Amniocentesis Needle Market by Type (Smaller Than 100 mm, 100 - 150 mm, Larger Than 150 mm), Procedure (Amniocentesis, Amnioreduction, Fetal Blood Transfusion, Amnioinfusion), End User (Hospitals, Diagnostic Centers, Clinics) - Global Forecast to 2022

[132 Pages Report] The amniocentesis Needles market is expected to reach USD 172.8 million by 2022 from USD 146.4 million in 2016 at a CAGR of 2.8%. The base year for this study is 2016 and the forecast period is 20172022. 100150 mm needles are the most commonly used amniocentesis needles and are expected to account for the largest share of the global market in 2017. The large share of this segment can be attributed to the fact that these needles are suitable for most patients on account of their optimal length.

Market Dynamics

Drivers

- High reliability of amniocentesis

- Growth in the median age of first-time motherhood

- Heavy burden of congenital disorders

Restraints

- Availability of alternative methods

Challenges

- Shortage of skilled proffessionals

Use of amniocentesis needles in amniocentesis procedures drives the global 100150 mm needles market

This type of needle is suitable for use in females with a normal body-mass index (BMI) of 18.5024.99 kg/m2. There is an increase in the proportion of women who are overweight, this proportion will still be lesser than the proportion of women with normal BMI. This is one of the major factors responsible for the large share of 100150 mm needles in the amniocentesis needles market. Amniocentesis procedure is the most commonly recommended invasive prenatal diagnostic test to detect chromosomal disorders, infections, or birth defects. In spite of a small proportion of risks associated with this procedure, amniocentesis is carried out to diagnose the abnormalities in the developing fetus. These are the major factors responsible for the large share of this procedure segment in the amniocentesis needles market.

The following are the major objectives of the study:

- To define, describe, segment, and forecast the amniocentesis needles market on the basis of type, procedure, end user, and region

- To forecast revenue of the market segments with respect to four main regional segments, namely, North America, Europe, Asia, and the Rest of the World (RoW)

- To identify the micromarkets with respect to drivers, restraints, industry-specific challenges, opportunities, and trends affecting the growth of the market

- To strategically analyze market segments and subsegments with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their market position and core competencies in terms of market developments and growth strategies

- To track and analyze competitive developments such as partnerships, agreements, collaborations, and joint ventures; mergers and acquisitions; product launches; and research and development activities in the amniocentesis needles market

Research Methodology

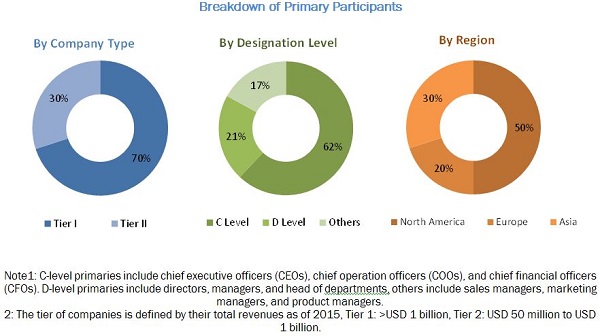

Top-down and bottom-up approaches were used to estimate and validate the size of the market and to estimate the size of various other dependent submarkets. The overall market size was used in the top-down approach to estimate the sizes of other individual submarkets (mentioned in the market segmentationby type, procedure, end user, and region) through percentage splits from secondary and primary research. The bottom-up approach was also implemented (wherever applicable) for data extracted from secondary research to validate the market segment revenues obtained. Various secondary sources such as World Health Organization, National Institutes of Health, Eurostat, U.S. Food and Drug Administration, Centers for Disease Control and Prevention, European Diagnostic Manufacturers Association, World Bank, International Society for Prenatal Diagnosis, Centers for Disease Control and Prevention, Society for Maternal-Fetal Medicine, American Congress of Obstetricians and Gynecologists, European Commission, and European Centre for Disease Prevention and Control have been used to identify and collect information useful for this extensive commercial study of the amniocentesis needles market. Primary sources such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess prospects of the amniocentesis needles market. The breakdown of profiles of primaries is shown in the figure below:

The key players in the amniocentesis needles market include Medtronic (Ireland), BD (US), CooperSurgical (US), Integra LifeSciences (US), Smiths Medical (US), Medline (US), Cook Medical (US), Laboratoire CCD (France), Biopsybell (Italy), RI.MOS. (Italy), TSUNAMI MEDICAL (Italy), and Rocket Medical (UK).

Major Market Developments

- In 2018, Medline Industries, Inc. (US) completed the acquisition of Centurion Medical Products (US) to provide a complete set of offerings that complement its minor procedure tray kits and its growing infection prevention focus

- In 2016, CooperSurgical (US) completed the acquisition of Wallace, the in-vitro fertilization (IVF) segment of Smiths Medical, a division of Smiths Group plc, to strengthen product portfolio and takeover premier products for womens health

- In 2017, Medtronic established an innovation center in Chengdu, China to provide advanced training to medical workers in Central and Western China

- In 2016, Medline shifted its corporate headquarters to a new, state-of-the-art facility which is more than double the size of its current space with a view to adapt to the needs of the rapidly changing healthcare.

Target Audience for this Report:

- Manufacturers and vendors of amniocentesis needles

- Hospitals

- Diagnostic centers

- Private clinics

- Research associations related to amniocentesis needles

- Various research and consulting firms

- Distributors of amniocentesis needles

- Contract research manufacturers of amniocentesis needles

- Research institutes

- Government bodies

- Amniocentesis needles database and software providers

- Venture capitalists

Scope of the Report:

This report categorizes the amniocentesis needles market into the following segments:

By Type

- 100150 mm

- Larger than 150 mm

- Smaller than 100 mm

By Procedure

- Amniocentesis

- Amnioreduction

- Fetal Blood Transfusion

- Amnioinfusion

- Cordocentesis

By End User

- Hospitals

- Diagnostic Centers

- Clinics

- Other End Users

By Region

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Rest of Europe

- Asia

- Rest of the World

Critical questions which the report answers

- What are new application areas which the amniocentesis needles companies are exploring?

- Which are the key players in the market and how intense is the competition?

Customization Options:

- Company Information: Detailed company profiles of five or more market players

- Opportunities Assessment: A detailed report underlining the various growth opportunities presented in the market

The global amniocentesis needles market is expected to reach USD 172.8 million by 2022 from USD 150.6 million in 2017, at a CAGR of 2.8%. The high reliability of the amniocentesis technique, rise in the median age of first-time motherhood, and increasing burden of congenital disorders are key factors driving the growth of this market.

The global amniocentesis needles market is segmented by type, procedure, end user, and regions. By type, the amniocentesis needles market is segmented into needles of length 100150 mm, larger than 150 mm, and smaller than 100 mm. The 100150 mm segment is estimated to account for the largest market share of the global amniocentesis needles market in 2017. Factors driving the growth of this segment include the widespread use of these needles on account of their optimal length and suitability of use for most patients.

By procedure, the market is classified into amniocentesis, amnioreduction, fetal blood transfusion, amnioinfusion, and cordocentesis. The amniocentesis segment is estimated to account for the largest share of the global amniocentesis needles market during the next five years. High reliability of the amniocentesis technique and the extensive use of this procedure to diagnose the abnormalities in the developing fetus are driving the growth of this market.

On the basis of end user, the amniocentesis needles market is segmented into hospitals, diagnostic centers, clinics, and other end users. The hospitals segment is estimated to account for the largest share of the global amniocentesis needles market during the forecast period. Growth in the number of hospitals coupled with better accessibility and availability of test results in hospitals are major factors driving the growth of this end-user segment.

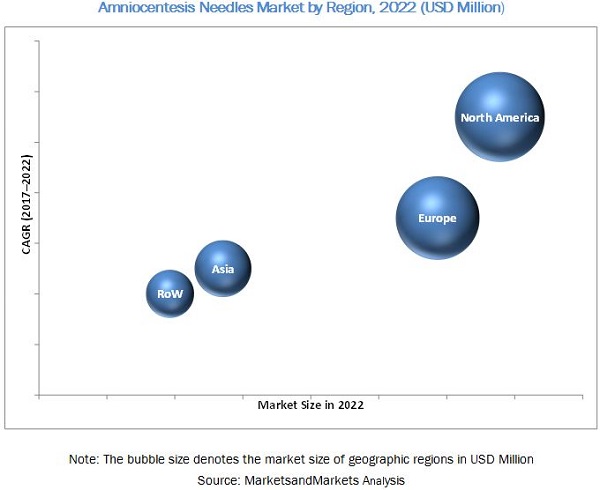

The global amniocentesis needles market is dominated by North America, followed by Europe. North America will continue to dominate the global amniocentesis needles market during the forecast period. Factors such as the rising government initiatives and increasing healthcare expenditure are driving the growth of the amniocentesis needles market in this region.

The availability of alternate methods for prenatal diagnosis may restrain market growth to a certain extent.

Amniocentesis procedures and amniodreduction procedures will drive the overall growth of amiocentesis needles market

Amniocentesis Procedures

Amniocentesis is an invasive procedure in which a portion of the amniotic fluid is withdrawn from the uterus using an amniocentesis needle. This fluid contains the cells shed by the fetus and certain chemicals produced by the baby, which can be used as a sample to detect chromosomal disorders, infections, or birth defects. Globally, maternal age is increasing on account of changing lifestyles, which is expected to lead to an increase in the burden of chromosomal abnormalities. Furthermore, there is an average increase in the body mass index of women, which may decrease the specificity of the non-invasive screening methods. Thus, the increasing burden of chromosomal disorders, increasing maternal age and BMI, and high reliability of amniocentesis technique are the major factors contributing to the growth of this market.

Amnioreduction Procedures

Amnioreduction is a procedure performed to remove the excess amount of amniotic fluid from the gestational sac. In this procedure, the fluid is withdrawn by inserting an amniocentesis needle under Ultrasound guidance and withdrawing the fluid manually or with the help of vacuum tubing and vacuum bottles.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for amniocentesis needles?

The availability of alternate methods is expected to limit market growth to a certain extent. Apart from amniocentesis, there are invasive as well as non-invasive techniques for screening and diagnosing fetal disorders or diseases. Invasive tests include chorionic villus sampling (CVS) and cordocentesis. CVS is preferred over amniocentesis as it is performed at an earlier stage of pregnancy and there is more time available to consider the results and take a final decision. However, there is a low probability of miscarriage associated with invasive tests, which may result in the reduced adoption of these tests. Non-invasive tests include blood tests, ultrasound measurements, and genomics-based non-invasive prenatal testing. These tests are preferred as there is no risk of miscarriage associated with them.

Major industry players acquired companies and business units from other companies to maintain and improve their position in the Amniocentesis Needles Market. Medtronic (Ireland), BD (US), CooperSurgical (US), Integra LifeSciences (US), Smiths Medical (US), Medline (US), and Cook Medical (US) have been identified as the key players in this market. These companies have a broad product portfolio with comprehensive features. These leaders have products for all end users in this market, and have a strong geographical presence.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Sources

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 28)

4.1 Amniocentesis Needle Market: Overview

4.2 Global Market in Europe, By Country/Region and End User

4.3 Global Market, By Procedure

4.4 Geographical Snapshot of the Global Market

4.5 Geographical Snapshot of the Global Market, By Country

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Reliability of Amniocentesis

5.2.1.2 Growth in the Median Age of First-Time Motherhood

5.2.1.3 Heavy Burden of Congenital Disorders

5.2.2 Restraints

5.2.2.1 Availability of Alternate Methods

5.2.3 Challenges

5.2.3.1 Shortage of Skilled Professionals

6 Amniocentesis Needle Market, By Type (Page No. - 37)

6.1 Introduction

6.2 100150 mm Needles

6.3 Larger Than 150 mm Needles

6.4 Smaller Than 100 mm Needles

7 Amniocentesis Needle Market, By Procedure (Page No. - 45)

7.1 Introduction

7.2 Amniocentesis Procedures

7.3 Amnioreduction Procedures

7.4 Fetal Blood Transfusion Procedures

7.5 Amnioinfusion Procedures

7.6 Cordocentesis Procedures

8 Amniocentesis Needle Market, By End User (Page No. - 58)

8.1 Introduction

8.2 Hospitals

8.3 Diagnostic Centers

8.4 Clinics

8.5 Other End Users

9 Amniocentesis Needle Market, By Region (Page No. - 67)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.3 Europe

9.3.1 France

9.3.2 UK

9.3.3 Germany

9.3.4 RoE

9.4 Asia

9.5 Rest of the World (RoW)

10 Competitive Landscape (Page No. - 98)

10.1 Introduction

10.2 Ranking of Key Players

10.3 Competitive Scenario

10.3.1 Acquisitions

10.3.2 Expansions

10.3.3 Other Developments

11 Company Profiles (Page No. - 102)

(Overview, Products and Services, Financials, Strategy & Development)*

11.1 Medtronic

11.2 Becton, Dickinson and Company

11.3 Coopersurgical

11.4 Integra Lifesciences

11.5 Smiths Medical

11.6 Medline

11.7 Cook Medical

11.8 Laboratoire Ccd

11.9 Biopsybell

11.10 Ri.Mos.

11.11 Tsunami Medical

11.12 Rocket Medical

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 122)

12.1 Industry Insights

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (74 Tables)

Table 1 Amniocentesis Needle: Market Snapshot

Table 2 Amniocentesis Needle Market, By Type, 20152022 (USD Million)

Table 3 Amniocentesis Needles Market for 100150 mm Needles, By Region, 20152022 (USD Million)

Table 4 North America: Market for 100150 mm Needles, By Country, 20152022 (USD Million)

Table 5 Europe: Market for 100150 mm Needles, By Country, 20152022 (USD Million)

Table 6 Amniocentesis Needle Market for Larger Than 150 mm Needles, By Region, 20152022 (USD Million)

Table 7 North America: Market for Larger Than 150 mm Needles, By Country, 20152022 (USD Million)

Table 8 Europe: Market for Larger Than 150 mm Needles, By Country, 20152022 (USD Million)

Table 9 Amniocentesis Needles Market for Smaller Than 100 mm Needles, By Region, 20152022 (USD Million)

Table 10 North America: Market for Smaller Than 100 mm Needles, By Country, 20152022 (USD Million)

Table 11 Europe: Market for Smaller Than 100 mm Needles, By Country, 20152022 (USD Million)

Table 12 Amniocentesis Needle Market, By Procedure, 20152022 (USD Million)

Table 13 Global Market for Amniocentesis Procedures, By Region, 20152022 (USD Million)

Table 14 North America: Market for Amniocentesis Procedures, By Country, 20152022 (USD Million)

Table 15 Europe: Market for Amniocentesis Procedures, By Country, 20152022 (USD Million)

Table 16 Amniocentesis Needles Market for Amnioreduction Procedures, By Region, 20152022 (USD Million)

Table 17 North America: Market for Amnioreduction Procedures, By Country, 20152022 (USD Million)

Table 18 Europe: Market for Amnioreduction Procedures, By Country, 20152022 (USD Million)

Table 19 Amniocentesis Needle Market for Fetal Blood Transfusion Procedures, By Region, 20152022 (USD Million)

Table 20 North America: Market for Fetal Blood Transfusion Procedures, By Country, 20152022 (USD Million)

Table 21 Europe: Market for Fetal Blood Transfusion Procedures, By Country, 20152022 (USD Million)

Table 22 Global Market for Amnioinfusion Procedures, By Region, 20152022 (USD Million)

Table 23 North America: Amniocentesis Needle Market for Amnioinfusion Procedures, By Country, 20152022 (USD Million)

Table 24 Europe: Market for Amnioinfusion Procedures, By Country, 20152022 (USD Million)

Table 25 Global Market for Cordocentesis Procedures, By Region, 20152022 (USD Million)

Table 26 North America: Market for Cordocentesis Procedures, By Country, 20152022 (USD Million)

Table 27 Europe: Market for Cordocentesis Procedures, By Country, 20152022 (USD Million)

Table 28 Amniocentesis Needle Market, By End User, 20152022 (USD Million)

Table 29 Amniocentesis Needles Market for Hospitals, By Region, 20152022 (USD Million)

Table 30 North America: Market for Hospitals, By Country, 20152022 (USD Million)

Table 31 Europe: Market for Hospitals, By Country, 20152022 (USD Million)

Table 32 Global Market for Diagnostic Centers, By Region, 20152022 (USD Million)

Table 33 North America: Amniocentesis Needle Market for Diagnostic Centers, By Country, 20152022 (USD Million)

Table 34 Europe: Market for Diagnostic Centers, By Country, 20152022 (USD Million)

Table 35 Global Market for Clinics, By Region, 20152022 (USD Million)

Table 36 North America: Market for Clinics, By Country, 20152022 (USD Million)

Table 37 Europe: Market for Clinics, By Country, 20152022 (USD Million)

Table 38 Amniocentesis Needle Market for Other End Users, By Region, 20152022 (USD Million)

Table 39 North America: Market for Other End Users, By Country, 20152022 (USD Million)

Table 40 Europe: Market for Other End Users, By Country, 20152022 (USD Million)

Table 41 Amniocentesis Needle Market, By Region, 20152022 (USD Million)

Table 42 North America: Amniocentesis Needle Market, By Country, 20152022 (USD Million)

Table 43 North America: Market, By Type, 20152022 (USD Million)

Table 44 North America: Market, By Procedure, 20152022 (USD Million)

Table 45 North America: Market, By End User, 20152022 (USD Million)

Table 46 US: Amniocentesis Needle Market, By Type, 20152022 (USD Million)

Table 47 US: Market, By Procedure, 20152022 (USD Million)

Table 48 US: Market, By End User, 20152022 (USD Million)

Table 49 Canada: Amniocentesis Needle Market, By Type, 20152022 (USD Million)

Table 50 Canada: Market, By Procedure, 20152022 (USD Million)

Table 51 Canada: Market, By End User, 20152022 (USD Million)

Table 52 Europe: Amniocentesis Needle Market, By Country, 20152022 (USD Million)

Table 53 Europe: Market, By Type, 20152022 (USD Million)

Table 54 Europe: Market, By Procedure, 20152022 (USD Million)

Table 55 Europe: Market, By End User, 20152022 (USD Million)

Table 56 France: Amniocentesis Needle Market, By Type, 20152022 (USD Million)

Table 57 France: Market, By Procedure, 20152022 (USD Million)

Table 58 France: Market, By End User, 20152022 (USD Million)

Table 59 UK: Amniocentesis Needle Market, By Type, 20152022 (USD Million)

Table 60 UK: Market, By Procedure, 20152022 (USD Million)

Table 61 UK: Market, By End User, 20152022 (USD Million)

Table 62 Germany: Amniocentesis Needle Market, By Type, 20152022 (USD Million)

Table 63 Germany: Market, By Procedure, 20152022 (USD Million)

Table 64 Germany: Market, By End User, 20152022 (USD Million)

Table 65 RoE: Amniocentesis Needle Market, By Type, 20152022 (USD Million)

Table 66 RoE: Market, By Procedure, 20152022 (USD Million)

Table 67 RoE: Market, By End User, 20152022 (USD Million)

Table 68 Asia: Amniocentesis Needle Market, By Type, 20152022 (USD Million)

Table 69 Asia: Market, By Procedure, 20152022 (USD Million)

Table 70 Asia: Market, By End User, 20152022 (USD Million)

Table 71 RoW: Amniocentesis Needle Market, By Type, 20152022 (USD Million)

Table 72 RoW: Market, By Procedure, 20152022 (USD Million)

Table 73 RoW: Market, By End User, 20152022 (USD Million)

Table 74 Rank of Companies in the Global Amniocentesis Needles Market 2016

List of Figures (34 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Amniocentesis Needle Market, By Type, 20172022 (USD Million)

Figure 7 Amniocentesis Needle Market, By Procedure, 20172022 (USD Million)

Figure 8 Amniocentesis Needle Market, By End User, 20172022 (USD Million)

Figure 9 Amniocentesis Needles Market, By Region, 20172022 (USD Million)

Figure 10 Growth in the Median Age of First-Time Motherhood and Heavy Burden of Congenital Disorders to Drive the Growth of the Amniocentesis Needle Market During the Forecast Period

Figure 11 Hospitals to Dominate the Amniocentesis Needle Market in Europe in 2017

Figure 12 Amniocentesis Will Register the Highest CAGR During the Forecast Period

Figure 13 North America to Account for the Largest Market Share During the Forecast Period

Figure 14 US to Register the Highest CAGR During the Forecast Period

Figure 15 Amniocentesis Needles Market: Drivers, Restraints, and Challenges

Figure 16 Global Increase in the Median Age of Motherhood, 19952050

Figure 17 Increase in Fertility Rate for Women Above 35 Years, 2010-2015

Figure 18 100150 mm Amniocentesis Needles to Dominate the Market During the Forecast Period

Figure 19 Amniocentesis Procedures Segment to Account for the Largest Share of the Global Market in 2017

Figure 20 Hospitals to Command the Largest Share of the Amniocentesis Needle Market During the Forecast Period

Figure 21 North America to Witness the Highest Growth Rate in the Amniocentesis Needles Market During the Forecast Period

Figure 22 North America: Market Snapshot

Figure 23 100150 mm Needles to Command the Largest Share of the Global Market in North America in 2022

Figure 24 Europe: Amniocentesis Needle Market Snapshot

Figure 25 Amniocentesis Procedures to Dominate the Amniocentesis Needle Market in Europe in 2017

Figure 26 Asia: Amniocentesis Needle Market Snapshot

Figure 27 Hospitals to Register the Highest Growth Rate in the Asian Amniocentesis Needle Market During the Forecast Period

Figure 28 RoW: Amniocentesis Needle Market Snapshot

Figure 29 Acquisitions is the Most Adopted Growth Strategy From 2014 to 2017

Figure 30 Medtronic: Company Snapshot

Figure 31 BD: Company Snapshot

Figure 32 Coopersurgical: Company Snapshot

Figure 33 Integra Lifesciences: Company Snapshot

Figure 34 Smiths Medical: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Amniocentesis Needle Market