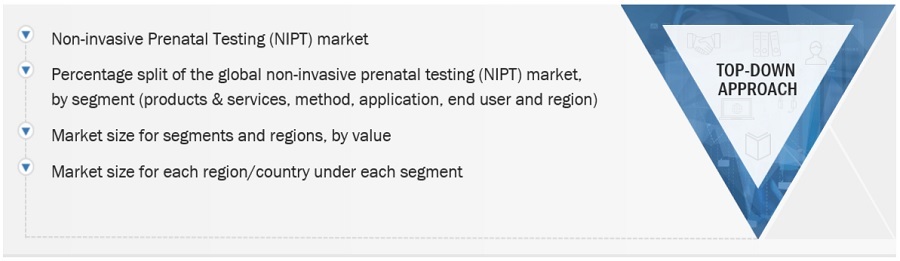

This study involved four major activities in estimating the current non-invasive prenatal testing (NIPT) market size. Extensive research was conducted to collect information on the market as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the value market. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Business, Factiva, and D&B Hoovers), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the non-invasive prenatal testing (NIPT) market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

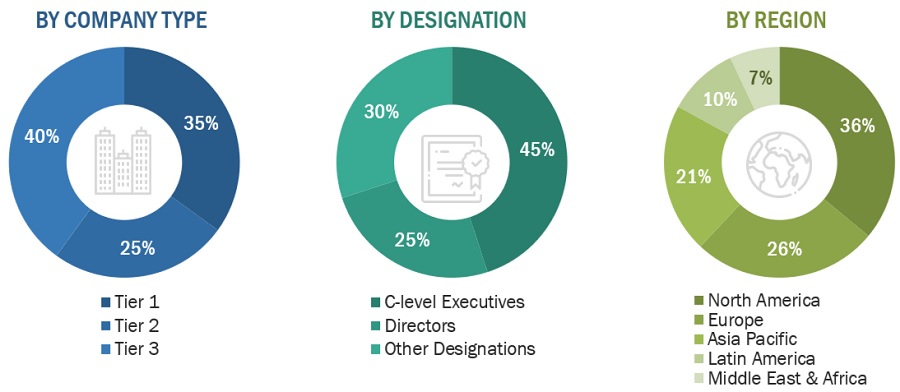

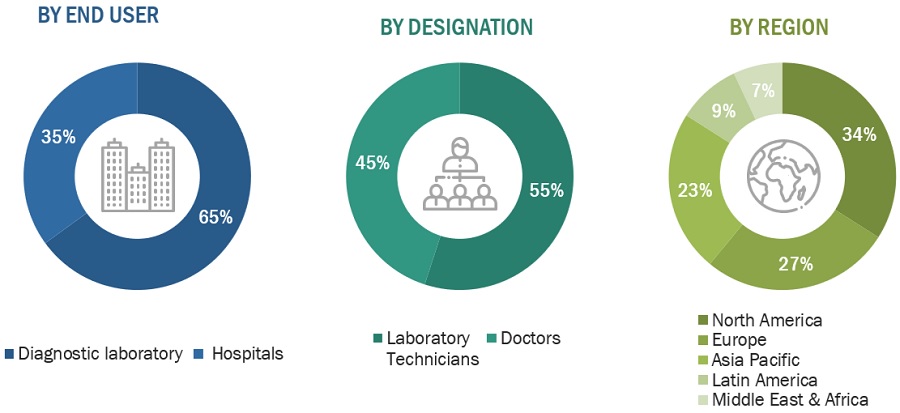

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include CEOs, consultants, subject-matter experts, directors, general managers, developers, and other key opinion leaders of the various companies that offer non-invasive prenatal testing (NIPT) product and service. Primary sources from the demand side include industry experts such as doctors, hospital directors and managers, and other medical professionals.

Primary research was conducted to identify segmentation types; industry trends; technology trends; key players; and key market dynamics such as drivers, restraints, opportunities, challenges, and key player strategies.

Note 1: Others include sales, marketing, and product managers.

Note 2: Their total revenues define the tiers of companies as of 2023, tier 1 = >USD 500 million, tier 2 = USD 200 million to USD 500 million, and tier 3 = <USD 200 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the non-invasive prenatal testing (NIPT) market was arrived at after data triangulation from four different approaches, as mentioned below.

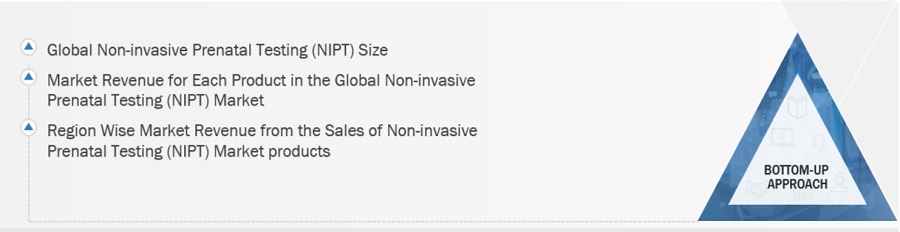

Bottom-up Approach: Revenues of individual companies were gathered from public sources and databases. Shares of the medical device cleaning businesses of leading players were gathered from secondary sources to the extent available. In certain cases, the share of the business unit was ascertained after a detailed analysis of various parameters, including product portfolio, market positioning, selling price, and geographic reach and strength. Individual shares or revenue estimates were validated through expert interviews.

Country level Analysis: The size of the non-invasive prenatal testing (NIPT) market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of non-invasive prenatal testing (NIPT) products in the overall non-invasive prenatal testing (NIPT) market was obtained from secondary data and validated by primary participants to arrive at the total non-invasive prenatal testing (NIPT) market. Primary participants further validated the numbers.

Primary Interviews: As a part of the primary research process, individual respondent insights on the market size and growth were taken during the interview (regional and global, as applicable). All the responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall non-invasive prenatal testing (NIPT) market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

After complete market engineering with calculations for market statistics, market size estimations, market forecasting, market breakdown, and data triangulation, extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. In the complete market engineering process, both top-down and bottom-up approaches were extensively used, along with several data triangulation methods to perform market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and further quantitative analysis was also done from all the numbers arrived at in the complete market engineering process to list key information throughout the report.

Global Non-invasive prenatal testing (NIPT) market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Non-invasive prenatal testing (NIPT) market Size: Bottom-Up Approach

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable.

Approach to derive the market size and estimate market growth

The market rankings for leading players were ascertained after a detailed assessment of their revenues from the non-invasive prenatal testing (NIPT) business using secondary data available through paid and unpaid sources. Owing to data limitations, in certain cases, the revenue share was arrived at after a detailed assessment of the product portfolios of major companies and their respective sales performance. At each point, this data was validated through primary interviews with industry experts.

Market Definition

Non-invasive prenatal testing (NIPT) is a method used to screen chromosomal abnormalities in a developing fetus by analyzing small fragments of fetal Cell-Free DNA circulating in a pregnant woman's blood. Non-invasive prenatal tests enable the detection of chromosomal abnormalities, such as trisomy 21 (Down Syndrome), trisomy 18 (Edwards' Syndrome), trisomy 13 (Patau Syndrome), microdeletion syndrome, and other genetic conditions. This market encompasses products such as assay kits and reagents, next generation sequencing systems, and diagnostic services offered by laboratories.

Key Stakeholders

-

Non-invasive prenatal testing product manufacturing companies

-

Hospitals and private clinics

-

Diagnostic laboratories

-

Medical research institutes

-

Market research and consulting firms

-

Suppliers and distributors of NIPT instruments

-

Venture capitalists and investors

-

Regulatory agencies and government bodies

Objectives of the Study

-

To define, describe, and forecast the global non-invasive prenatal testing (NIPT) market on the basis of product and service, method, application, end user, and region

-

To provide detailed information about the key factors influencing the market growth, such as drivers, restraints, opportunities, challenges, and industry trends

-

To strategically analyze the regulatory scenario, pricing trends, value chain, supply chain, ecosystem analysis, key stakeholders and buying criteria, technology scenario, patent scenario, and key conferences and events in the market

-

To analyze the micro markets with respect to individual growth trends, prospects, and contributions to the overall udder health market

-

To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

-

To strategically profile the key players in this market and comprehensively analyze their market shares and core competencies.

-

To strategically analyze the udder health market in five regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

-

To track and analyze competitive developments such as acquisitions, partnerships, and expansions in the udder health market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

-

Detailed analysis and profiling of additional market players

Geographic Analysis

-

Further breakdown of the Rest of Asia Pacific non-invasive prenatal testing (NIPT) market into China, Japan, India, South Korea, and other countries.

Growth opportunities and latent adjacency in Non Invasive Prenatal Testing Market