Anastomosis Devices Market by Product, Surgical Staplers (Manual, Powered), Surgical Sutures (Absorbable, Non-absorbable, Automated), and Surgical Sealants and Adhesives, Application (CVDs, GI Surgeries), End Users & Region - Global Forecast to 2027

The global anastomosis devices market in terms of revenue was estimated to be worth $3.0 billion in 2022 and is poised to reach $4.4 billion by 2027, growing at a CAGR of 8.3% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Growth in this market is mostly driven by the increasing incidence of target diseases and the subsequent growth in the number of surgical procedures, the growing demand for minimally invasive surgeries, and technological advancements.

To know about the assumptions considered for the study, Request for Free Sample Report

Anastomosis Devices Market Dynamics

Driver: Growing number of surgical procedures worldwide

Globally, a staggering 310 million major surgeries are performed annually—around 40 to 50 million in the US and 20 million in Europe. The growing number of surgeries can be attributed to the rapidly growing senior population worldwide and the increasing prevalence of chronic diseases. Apart from the rising geriatric population, the prevalence of lifestyle disorders such as cardiac diseases, diabetes, hypertension, obesity, and cancer is also increasing globally—not only among the elderly but also among younger people. With the rise in the overall number of such surgeries performed globally, the demand for anastomosis devices is also set to rise. These devices aid in faster recovery, minimal scarring, and reduced blood loss.

Opportunity: Growing healthcare markets in emerging economies

Emerging economies such as India, South Korea, Malaysia, Vietnam, Africa, and Middle Eastern countries such as Israel, Saudi Arabia, and the UAE offer significant growth opportunities to major market players. This can be attributed to their low regulatory barriers, improvements in healthcare infrastructure, a growing patient population, and rising healthcare expenditure. In addition, the regulatory policies in the Asia-Pacific region are more adaptive and business-friendly than those in developed countries. This, along with the increasing competition in mature markets, has drawn key players in the global market to focus on emerging countries.

Restraint: High cost of devices and extensive clinical data requirements for launching new products

Developing anastomosis devices like surgical sealants and adhesives is an extremely cost-intensive process. It takes significant investments in R&D to develop new products that effectively cater to market needs. Product development is characterised by an expensive production process (freeze-drying), refrigerated storage, and complicated device preparation. Additionally, surgical staplers are comparatively more expensive than sutures. The high prices of these devices further escalate the cost of surgical procedures. Since healthcare providers are increasingly focusing on curbing healthcare costs and reducing the burden on patients, the high cost of surgical staplers is expected to limit their demand to a certain extent, especially in developing countries.

Challenge: Requirement of skilled personnel for optimal utilization of products

The need for trained and skilled personnel is a key factor in this market that directly affects procedural outcomes. During wound closure, tissue compression and the integrity of staple lines are key factors for developing a stable anastomosis; the inappropriate use of surgical staplers due to a lack of training and knowledge increases the chance of potentially life-threatening damage to patients. Furthermore, effective tissue compression depends entirely on tissue thickness and tissue type, as tissues vary in thickness, making tissue compression and staple height an important consideration for surgeons. However, many surgeons are unaware of the correct size of staples to be used in various surgical procedures.

The anastomosis device market is highly consolidated. The top players in this market are Johnson & Johnson (US), Medtronic Plc (Ireland), B. Braun Melsungen (Germany), Intuitive Surgical Inc. (US), Boston Scientific Corporation (US), and Artivion, Inc. (US). These players lead the market because of their extensive product portfolios and wide geographic presence.

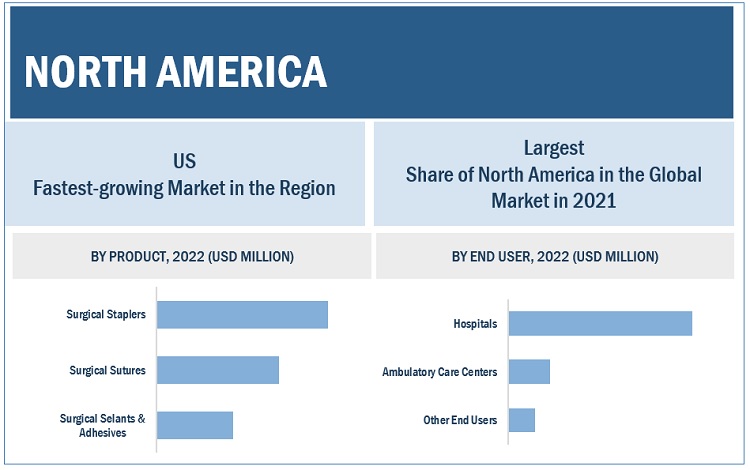

The surgical staplers segment accounted for the largest share of the anastomosis devices industry, by product.

The anastomosis devices market is segmented into surgical staplers, surgical sutures, and surgical sealants and adhesives. The surgical staplers segment accounted for the largest share of the global market. The large share of this segment can be attributed to the advantages associated with surgical staplers (ease of use, minimal risk of complications, reduced blood loss and leakage, and shorter operating time) compared with surgical sutures, sealants, and adhesives.

The cardiovascular and thoracic surgery segment accounted for the largest share in the anastomosis devices industry, by application.

The anastomosis devices market has been segmented into cardiovascular & thoracic surgery, gastrointestinal surgery, orthopaedic surgery, gynaecological surgery, and other applications. The cardiovascular & thoracic surgery segment accounted for the largest share of the anastomosis device market. Rising incidence of cardiovascular & thoracic diseases and the extensive usage of anastomosis devices in these surgical procedures is driving the growth of this segment.

The hospitals segment accounted for the largest share of the anastomosis devices industry by end users.

The anastomosis devices market has been segmented into hospitals, ambulatory surgery centers, and other end users. Hospitals are estimated to be the largest end users of the anastomosis device market. The large share of this segment can be attributed to the increasing number of intricate surgeries performed in hospitals, the growing prevalence of various diseases, and favourable compensation policies for hospital treatments.

North America is the largest region of the anastomosis devices industry.

The anastomosis devices market is segmented into five major regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of the anastomosis device market. The North American anastomosis device market growth can be attributed to the large volume of surgical procedures performed and favourable reimbursement scenario.

To know about the assumptions considered for the study, download the pdf brochure

Prominent key players in the anastomosis devices market are

- Johnson & Johnson (US)

- Medtronic Plc (Ireland)

- B. Braun Melsungen (Germany)

- Intuitive Surgical Inc. (US)

- Artivion, Inc. (US)

Scope of the Anastomosis Devices Industry

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$3.0 billion |

|

Projected Revenue by 2027 |

$4.4 billion |

|

Growth Rate |

poised to grow at a CAGR of 8.3% |

|

Market Driver |

Growing number of surgical procedures worldwide |

|

Market Opportunity |

Growing healthcare markets in emerging economies |

This report categorizes the global anastomosis devices market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Surgical Staplers

- Manual Surgical Staplers

- Powered Surgical Staplers

-

Surgical Sutures

- Absorbable Sutures

- Synthetic Sutures

- Polyglactin 910 Sutures

- Poliglecaprone 25 Sutures

- Polydioxanone Sutures

- Polyglycolic Acid Sutures

- Other Synthetic Sutures

- Natural Sutures

- Non-Absorbable Sutures

- Polypropylene Sutures

- Nylon Sutures

- Stainless Steel Sutures

- Other Non-Absorbable Sutures

- Automated Suturing Devices

- Disposable Automated Suturing Devices

- Reusable Automated Suturing Devices

-

Surgical Sealants and Adhesives

- Biological Surgical Sealants and Adhesives

- Fibrin-Based Sealants & Adhesives

- Collagen-Based Sealants and Adhesives

- Albumin-Based Sealants and Adhesives

- Synthetic and Semisynthetic Sealants and Adhesives

- PEG Hydrogel-Based Sealants and Adhesives

- Cyanoacrylate-Based Sealants and Adhesives

- Urethane-Based Sealants and Adhesives

- Other Synthetic and Semisynthetic Sealants and Adhesives

By Application

- Cardiovascular & Thoracic Surgery

- Gastrointestinal Surgery

- Orthopedic Surgery

- Gynecological Surgery

- Other Applications

By End User

- Hospitals

- Ambulatory Surgery Centers

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments of Anastomosis Devices Industry

- In June 2021, Intuitive Surgical Inc. launched the surgical stapler, SureForm, equipped with SmartFire technology, which is an integrated software.

- In March 2021, Johnson & Johnson (US) launched the ECHELON+ Stapler, a powered surgical stapler designed to reduce complications in surgery through more uniform tissue compression and better staple formation.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the anastomosis devices market?

The anastomosis devices market boasts a total revenue value of $4.4 billion by 2027.

What is the estimated growth rate (CAGR) of the anastomosis devices market?

The global anastomosis devices market has an estimated compound annual growth rate (CAGR) of 8.3% and a revenue size in the region of $3.0 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 STUDY OBJECTIVES

1.2 ANASTOMOSIS DEVICES INDUSTRY DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 ANASTOMOSIS DEVICES MARKET, BY REGION

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 1 ANASTOMOSIS DEVICES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary sources

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

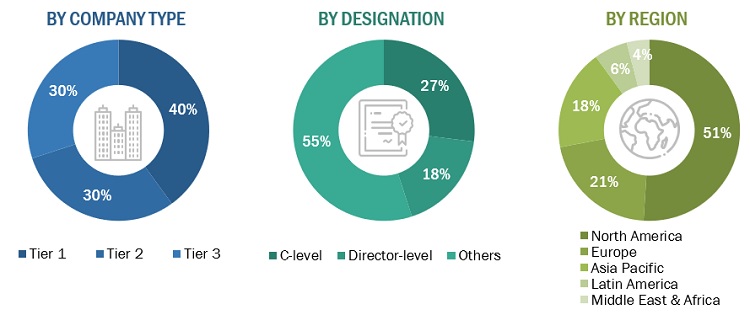

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach 1: Company revenue estimation approach

FIGURE 4 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

2.2.1.2 Approach 2: Presentations of companies and primary interviews

2.2.1.3 CAGR projections

FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.2.2 TOP-DOWN APPROACH

FIGURE 6 ANASTOMOSIS DEVICES INDUSTRY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ESTIMATION

2.5 STUDY ASSUMPTIONS

2.6 RISK ASSESSMENT

2.7 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 54)

FIGURE 8 ANASTOMOSIS DEVICES MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 9 GLOBAL MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 10 GLOBAL MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 11 GLOBAL MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ANASTOMOSIS DEVICES MARKET OVERVIEW

FIGURE 12 INCREASING NUMBER OF SURGICAL PROCEDURES TO DRIVE MARKET GROWTH

4.2 GLOBAL ANASTOMOSIS DEVICES INDUSTRY SHARE, BY PRODUCT, 2022 VS. 2027

FIGURE 13 SURGICAL STAPLERS TO DOMINATE MARKET DURING FORECAST PERIOD

4.3 GLOBAL MARKET SHARE, BY APPLICATION, 2022 VS. 2027

FIGURE 14 CARDIOVASCULAR & THORACIC SURGERY APPLICATIONS TO COMMAND LARGEST SHARE OF MARKET DURING FORECAST PERIOD

4.4 GLOBAL MARKET SHARE, BY END USER, 2022 VS. 2027

FIGURE 15 HOSPITALS TO CONTINUE TO DOMINATE MARKET IN 2027

4.5 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 16 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 ANASTOMOSIS DEVICES INDUSTRY DYNAMICS

FIGURE 17 ANASTOMOSIS DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing number of surgical procedures worldwide

TABLE 1 PERCENTAGE INCREASE IN NUMBER OF SURGERIES PERFORMED IN US, 2010 VS. 2021

5.2.1.2 Growing demand for minimally invasive surgeries

5.2.1.3 Technological advancements in anastomosis devices

5.2.2 RESTRAINTS

5.2.2.1 Rising healthcare costs and lack of reimbursements

5.2.2.2 High cost of devices and extensive clinical data requirements for launching new products

TABLE 2 COST OF ANASTOMOSIS DEVICES IN CANADA

5.2.3 OPPORTUNITIES

5.2.3.1 Growing healthcare markets in emerging economies

5.2.3.2 Low- and middle-income countries

5.2.4 CHALLENGES

5.2.4.1 Product recalls

TABLE 3 LIST OF MAJOR PRODUCT RECALLS

5.2.4.2 High degree of market consolidation

5.2.4.3 Requirement of skilled personnel for optimal utilization of products

5.3 PRICING ANALYSIS

5.3.1 INDICATIVE PRICING MODEL ANALYSIS

TABLE 4 AVERAGE SELLING PRICE OF ANASTOMOSIS DEVICES (2022)

5.4 PATENT ANALYSIS

FIGURE 18 PATENT ANALYSIS FOR ANASTOMOSIS DEVICES

5.4.1 LIST OF KEY PATENTS

5.5 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS: MAJOR VALUE-ADDED DURING MANUFACTURING AND DISTRIBUTION PHASES

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 20 GLOBAL MARKET: SUPPLY CHAIN ANALYSIS

5.7 ECOSYSTEM MAP ANALYSIS

FIGURE 21 GLOBAL MARKET: ECOSYSTEM MAP

TABLE 5 GLOBAL MARKET: ROLE IN ECOSYSTEM

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 GLOBAL MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT FROM NEW ENTRANTS

5.8.2 THREAT FROM SUBSTITUTES

5.8.3 BARGAINING POWER OF BUYERS

5.8.4 BARGAINING POWER OF SUPPLIERS

5.8.5 DEGREE OF COMPETITION

5.9 PESTLE ANALYSIS

5.10 REGULATORY LANDSCAPE

5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10.2 NORTH AMERICA

5.10.2.1 US

5.10.2.2 Canada

5.10.3 EUROPE

5.10.4 ASIA PACIFIC

5.10.4.1 China

5.10.4.2 Japan

5.10.4.3 India

5.10.5 LATIN AMERICA

5.10.5.1 Brazil

5.10.5.2 Mexico

5.10.6 MIDDLE EAST

5.10.7 AFRICA

5.11 TRADE ANALYSIS

5.11.1 TRADE ANALYSIS FOR ANASTOMOSIS DEVICES

TABLE 12 IMPORT DATA FOR ANASTOMOSIS DEVICES, BY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 13 EXPORT DATA FOR ANASTOMOSIS DEVICES, BY COUNTRY, 2017–2021 (USD THOUSAND)

5.12 TECHNOLOGY ANALYSIS

5.13 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 14 GLOBAL MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.14.1 REVENUE SOURCES TO SHIFT TOWARD TECHNOLOGICALLY ADVANCED ANASTOMOSIS DEVICES DUE TO COVID-19

FIGURE 22 REVENUE SHIFT IN GLOBAL MARKET

5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 23 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF ANASTOMOSIS DEVICES

TABLE 15 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF ANASTOMOSIS DEVICES

5.15.2 BUYING CRITERIA

FIGURE 24 KEY BUYING CRITERIA FOR ANASTOMOSIS DEVICES

TABLE 16 KEY BUYING CRITERIA FOR ANASTOMOSIS DEVICES

5.16 CASE STUDIES

5.16.1 CASE STUDY 1

5.16.2 CASE STUDY 2

6 ANASTOMOSIS DEVICES MARKET, BY PRODUCT (Page No. - 89)

6.1 INTRODUCTION

TABLE 17 GLOBAL ANASTOMOSIS DEVICES INDUSTRY, BY PRODUCT, 2020–2027 (USD MILLION)

6.2 SURGICAL STAPLERS

TABLE 18 SURGICAL STAPLERS AVAILABLE IN MARKET

TABLE 19 SURGICAL STAPLERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 20 SURGICAL STAPLERS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.1 MANUAL SURGICAL STAPLERS

6.2.1.1 Faster and better stapling lines offered by manual surgical staplers to drive market growth

TABLE 21 MANUAL SURGICAL STAPLERS AVAILABLE IN MARKET

TABLE 22 MANUAL SURGICAL STAPLERS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.2 POWERED SURGICAL STAPLERS

6.2.2.1 Growing preference for minimally invasive surgeries to drive market growth

TABLE 23 POWERED SURGICAL STAPLERS AVAILABLE IN MARKET

TABLE 24 POWERED SURGICAL STAPLERS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 SURGICAL SUTURES

TABLE 25 SURGICAL SUTURES AVAILABLE IN MARKET

TABLE 26 SURGICAL SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 27 SURGICAL SUTURES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.1 ABSORBABLE SUTURES

TABLE 28 ABSORBABLE SUTURES AVAILABLE IN MARKET

TABLE 29 ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 30 ABSORBABLE SUTURES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.1.1 Synthetic sutures

TABLE 31 SYNTHETIC SUTURES AVAILABLE IN MARKET

TABLE 32 SYNTHETIC SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 33 SYNTHETIC SUTURES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.1.1.1 Polyglactin 910 sutures

6.3.1.1.1.1 Polyglactin 910 sutures offer stability in alkaline environments and high rigidity—key factors driving growth

TABLE 34 POLYGLACTIN 910 SUTURES AVAILABLE IN MARKET

TABLE 35 POLYGLACTIN 910 SUTURES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.1.1.2 Poliglecaprone 25 sutures

6.3.1.1.2.1 Features like robust knot security and minimal tissue reaction to drive market growth

TABLE 36 POLIGLECAPRONE 25 SUTURES AVAILABLE IN MARKET

TABLE 37 POLIGLECAPRONE 25 SUTURES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.1.1.3 Polydioxanone sutures

6.3.1.1.3.1 Superior properties of polydioxanone sutures to fuel demand among end users

TABLE 38 POLYDIOXANONE SUTURES AVAILABLE IN MARKET

TABLE 39 POLYDIOXANONE SUTURES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.1.1.4 Polyglycolic acid sutures

6.3.1.1.4.1 Increasing number of gynecological and obstetric surgical procedures to drive market for PGA sutures

TABLE 40 POLYGLYCOLIC ACID SUTURES AVAILABLE IN MARKET

TABLE 41 POLYGLYCOLIC ACID SUTURES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.1.1.5 Other synthetic sutures

TABLE 42 OTHER SYNTHETIC SUTURES AVAILABLE IN MARKET

TABLE 43 OTHER SYNTHETIC SUTURES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.1.2 Natural sutures

6.3.1.2.1 Tissue reactions caused by natural sutures to hinder market growth

TABLE 44 NATURAL SUTURES AVAILABLE IN MARKET

TABLE 45 NATURAL SUTURES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.2 NON-ABSORBABLE SUTURES

TABLE 46 NON-ABSORBABLE SUTURES AVAILABLE IN MARKET

TABLE 47 NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 48 NON-ABSORBABLE SUTURES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.2.1 Polypropylene sutures

6.3.2.1.1 Advantages of polypropylene sutures to propel growth during forecast period

TABLE 49 POLYPROPYLENE SUTURES AVAILABLE IN MARKET

TABLE 50 POLYPROPYLENE SUTURES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.2.2 Nylon sutures

6.3.2.2.1 High preference for nylon sutures in surgeries to drive uptake in coming years

TABLE 51 NYLON SUTURES AVAILABLE IN MARKET

TABLE 52 NYLON SUTURES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.2.3 Stainless steel sutures

6.3.2.3.1 Risks associated with stainless steel sutures to limit demand among end users

TABLE 53 STAINLESS STEEL SUTURES AVAILABLE IN MARKET

TABLE 54 STAINLESS STEEL SUTURES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.2.4 Other non-absorbable sutures

TABLE 55 OTHER NON-ABSORBABLE SUTURES AVAILABLE IN MARKET

TABLE 56 OTHER NON-ABSORBABLE SUTURES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.3 AUTOMATED SUTURING DEVICES

TABLE 57 AUTOMATED SUTURING DEVICES AVAILABLE IN MARKET

TABLE 58 AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 59 AUTOMATED SUTURING DEVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.3.1 Disposable automated suturing devices

6.3.3.1.1 Cost-effectiveness of disposable automated suturing devices to drive demand

TABLE 60 DISPOSABLE AUTOMATED SUTURING DEVICES AVAILABLE IN MARKET

TABLE 61 DISPOSABLE AUTOMATED SUTURING DEVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.3.2 Reusable automated suturing devices

6.3.3.2.1 Reusability and cost-effectiveness of these sutures to drive uptake

TABLE 62 REUSABLE AUTOMATED SUTURING DEVICES AVAILABLE IN MARKET

TABLE 63 REUSABLE AUTOMATED SUTURING DEVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4 SURGICAL SEALANTS & ADHESIVES

TABLE 64 SURGICAL SEALANTS & ADHESIVES AVAILABLE IN MARKET

TABLE 65 SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 66 SURGICAL SEALANTS & ADHESIVES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4.1 BIOLOGICAL SEALANTS & ADHESIVES

TABLE 67 BIOLOGICAL SEALANTS & ADHESIVES AVAILABLE IN MARKET

TABLE 68 BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 69 BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4.1.1 Fibrin-based sealants & adhesives

6.4.1.1.1 Increasing number of surgical procedures to drive demand for fibrin-based sealants & adhesives

TABLE 70 FIBRIN-BASED SEALANTS & ADHESIVES AVAILABLE IN MARKET

TABLE 71 FIBRIN-BASED SEALANTS & ADHESIVES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4.1.2 Collagen-based sealants & adhesives

6.4.1.2.1 Swelling of tissues—a major risk associated with collagen-based sealants & adhesives

TABLE 72 COLLAGEN-BASED SEALANTS & ADHESIVES AVAILABLE IN MARKET

TABLE 73 COLLAGEN-BASED SEALANTS & ADHESIVES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4.1.3 Albumin-based sealants & adhesives

6.4.1.3.1 Biosafety concerns associated with albumin-based sealants & adhesives to hinder market growth

TABLE 74 ALBUMIN-BASED SEALANTS & ADHESIVES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4.2 SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES

TABLE 75 SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES AVAILABLE IN MARKET

TABLE 76 SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 77 SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4.2.1 PEG hydrogel-based sealants & adhesives

6.4.2.1.1 Non-toxic, non-immunogenic, and biocompatible functions to drive demand

TABLE 78 PEG HYDROGEL-BASED SEALANTS & ADHESIVES AVAILABLE IN MARKET

TABLE 79 PEG HYDROGEL-BASED SEALANTS & ADHESIVES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4.2.2 Cyanoacrylate-based sealants & adhesives

6.4.2.2.1 Risk of infection and complications associated with cyanoacrylate-based sealants & adhesives to limit adoption

TABLE 80 CYANOACRYLATE-BASED SEALANTS & ADHESIVES AVAILABLE IN MARKET

TABLE 81 CYANOACRYLATE-BASED SEALANTS & ADHESIVES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4.2.3 Urethane-based sealants & adhesives

6.4.2.3.1 Extensive ongoing research on urethane-based adhesives to further propel market growth

TABLE 82 URETHANE-BASED SEALANTS & ADHESIVES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4.2.4 Other synthetic and semi-synthetic sealants & adhesives

TABLE 83 OTHER SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES AVAILABLE IN MARKET

TABLE 84 OTHER SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY REGION, 2020–2027 (USD MILLION)

7 ANASTOMOSIS DEVICES MARKET, BY APPLICATION (Page No. - 131)

7.1 INTRODUCTION

TABLE 85 ANASTOMOSIS DEVICES INDUSTRY, BY APPLICATION, 2020–2027 (USD MILLION)

7.2 CARDIOVASCULAR & THORACIC SURGERY

7.2.1 GROWING BURDEN OF CARDIOVASCULAR DISEASE TO DRIVE MARKET GROWTH

TABLE 86 GLOBAL MARKET FOR CARDIOVASCULAR & THORACIC SURGERY, BY REGION, 2020–2027 (USD MILLION)

7.3 GASTROINTESTINAL SURGERY

7.3.1 DECLINING NUMBER OF GASTROENTEROLOGISTS TO AFFECT MARKET GROWTH

TABLE 87 GLOBAL MARKET FOR GASTROINTESTINAL SURGERY, BY REGION, 2020–2027 (USD MILLION)

7.4 ORTHOPEDIC SURGERY

7.4.1 GROWING DEMAND FOR SPORTS-RELATED INJURY TREATMENTS TO AID GROWTH

TABLE 88 GLOBAL MARKET FOR ORTHOPEDIC SURGERY, BY REGION, 2020–2027 (USD MILLION)

7.5 GYNECOLOGICAL SURGERY

7.5.1 GROWING NUMBER OF HYSTERECTOMIES PERFORMED TO SUPPORT MARKET

TABLE 89 GLOBAL MARKET FOR GYNECOLOGICAL SURGERY, BY REGION, 2020–2027 (USD MILLION)

7.6 OTHER APPLICATIONS

TABLE 90 MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

8 ANASTOMOSIS DEVICES MARKET, BY END USER (Page No. - 138)

8.1 INTRODUCTION

TABLE 91 ANASTOMOSIS DEVICES INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

8.2 HOSPITALS

8.2.1 INCREASING NUMBER OF SURGERIES AND TRAUMA CASES TO DRIVE ADOPTION OF ANASTOMOSIS DEVICES IN HOSPITALS

TABLE 92 GLOBAL MARKET FOR HOSPITALS, BY REGION, 2020–2027 (USD MILLION)

8.3 AMBULATORY SURGERY CENTERS

8.3.1 LOWER COSTS AND GROWING NUMBER OF SURGICAL PROCEDURES PERFORMED IN ASCS TO DRIVE DEMAND FOR ANASTOMOSIS DEVICES

TABLE 93 GLOBAL MARKET FOR AMBULATORY SURGERY CENTERS, BY REGION, 2020–2027 (USD MILLION)

8.4 OTHER END USERS

TABLE 94 GLOBAL MARKET FOR OTHER END USERS, BY REGION, 2020–2027 (USD MILLION)

9 ANASTOMOSIS DEVICES MARKET, BY REGION (Page No. - 143)

9.1 INTRODUCTION

TABLE 95 GLOBAL ANASTOMOSIS DEVICES INDUSTRY, BY REGION, 2020–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 25 NORTH AMERICA: ANASTOMOSIS DEVICES INDUSTRY SNAPSHOT

TABLE 96 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 99 NORTH AMERICA: ANASTOMOSIS DEVICES INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Presence of major players to make US largest market for anastomosis devices

TABLE 100 US: ANASTOMOSIS DEVICES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 101 US: SURGICAL STAPLERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 102 US: SURGICAL SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 103 US: ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 104 US: SYNTHETIC SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 105 US: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 106 US: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 107 US: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 108 US: BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 109 US: SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 110 US: ANASTOMOSIS DEVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 111 US: ANASTOMOSIS DEVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Growing number of organ transplants and cancer cases to drive anastomosis devices market in Canada

TABLE 112 CANADA: ANASTOMOSIS DEVICES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 113 CANADA: SURGICAL STAPLERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 114 CANADA: SURGICAL SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 115 CANADA: ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 116 CANADA: SYNTHETIC SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 117 CANADA: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 118 CANADA: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 119 CANADA: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 120 CANADA: BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 121 CANADA: SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 122 CANADA: ANASTOMOSIS DEVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 123 CANADA: ANASTOMOSIS DEVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3 EUROPE

TABLE 124 EUROPE: ANASTOMOSIS DEVICES INDUSTRY, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 125 EUROPE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 126 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 127 EUROPE: ANASTOMOSIS DEVICES INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Highly developed healthcare infrastructure to drive market growth

TABLE 128 GERMANY: ANASTOMOSIS DEVICES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 129 GERMANY: SURGICAL STAPLERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 130 GERMANY: SURGICAL SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 131 GERMANY: ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 132 GERMANY: SYNTHETIC SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 133 GERMANY: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 134 GERMANY: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 135 GERMANY: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 136 GERMANY: BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 137 GERMANY: SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 138 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 139 GERMANY: ANASTOMOSIS DEVICES INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.3.2 UK

9.3.2.1 Growing number of surgical procedures to drive growth

TABLE 140 ORGAN TRANSPLANTS PERFORMED IN UK

TABLE 141 UK: ANASTOMOSIS DEVICES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 142 UK: SURGICAL STAPLERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 143 UK: SURGICAL SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 144 UK: ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 145 UK: SYNTHETIC SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 146 UK: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 147 UK: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 148 UK: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 149 UK: BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 150 UK: SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 151 UK: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 152 UK: ANASTOMOSIS DEVICES INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Favorable health insurance system to drive demand for anastomosis devices in France

TABLE 153 FRANCE: ANASTOMOSIS DEVICES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 154 FRANCE: SURGICAL STAPLERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 155 FRANCE: SURGICAL SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 156 FRANCE: ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 157 FRANCE: SYNTHETIC SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 158 FRANCE: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 159 FRANCE: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 160 FRANCE: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 161 FRANCE: BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 162 FRANCE: SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 163 FRANCE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 164 FRANCE: ANASTOMOSIS DEVICES INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Improving quality and accessibility to medical care and technologies to fuel growth

TABLE 165 ITALY: ANASTOMOSIS DEVICES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 166 ITALY: SURGICAL STAPLERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 167 ITALY: SURGICAL SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 168 ITALY: ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 169 ITALY: SYNTHETIC SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 170 ITALY: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 171 ITALY: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 172 ITALY: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 173 ITALY: BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 174 ITALY: SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 175 ITALY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 176 ITALY: ANASTOMOSIS DEVICES INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Growing aging population to contribute to market growth

TABLE 177 SPAIN: ANASTOMOSIS DEVICES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 178 SPAIN: SURGICAL STAPLERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 179 SPAIN: SURGICAL SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 180 SPAIN: ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 181 SPAIN: SYNTHETIC SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 182 SPAIN: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 183 SPAIN: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 184 SPAIN: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 185 SPAIN: BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 186 SPAIN: SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 187 SPAIN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 188 SPAIN: ANASTOMOSIS DEVICES INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 189 REST OF EUROPE: ANASTOMOSIS DEVICES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 190 REST OF EUROPE: SURGICAL STAPLERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 191 REST OF EUROPE: SURGICAL SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 192 REST OF EUROPE: ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 193 REST OF EUROPE: SYNTHETIC SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 194 REST OF EUROPE: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 195 REST OF EUROPE: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 196 REST OF EUROPE: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 197 REST OF EUROPE: BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 198 REST OF EUROPE: SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 199 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 200 REST OF EUROPE: ANASTOMOSIS DEVICES INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 26 ASIA PACIFIC: ANASTOMOSIS DEVICES INDUSTRYS NAPSHOT

TABLE 201 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 202 ASIA PACIFIC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 203 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 204 ASIA PACIFIC: ANASTOMOSIS DEVICES INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Large population base and government support to drive market growth

TABLE 205 CHINA: ANASTOMOSIS DEVICES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 206 CHINA: SURGICAL STAPLERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 207 CHINA: SURGICAL SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 208 CHINA: ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 209 CHINA: SYNTHETIC SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 210 CHINA: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 211 CHINA: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 212 CHINA: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 213 CHINA: BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 214 CHINA: SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 215 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 216 CHINA: ANASTOMOSIS DEVICES INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Promising reimbursement scenario and well-developed healthcare system to support market

TABLE 217 JAPAN: ANASTOMOSIS DEVICES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 218 JAPAN: SURGICAL STAPLERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 219 JAPAN: SURGICAL SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 220 JAPAN: ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 221 JAPAN: SYNTHETIC SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 222 JAPAN: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 223 JAPAN: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 224 JAPAN: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 225 JAPAN: BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 226 JAPAN: SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 227 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 228 JAPAN: ANASTOMOSIS DEVICES INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Growing target patient population to drive market growth

TABLE 229 INDIA: ANASTOMOSIS DEVICES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 230 INDIA: SURGICAL STAPLERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 231 INDIA: SURGICAL SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 232 INDIA: ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 233 INDIA: SYNTHETIC SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 234 INDIA: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 235 INDIA: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 236 INDIA: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 237 INDIA: BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 238 INDIA: SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 239 INDIA: ANASTOMOSIS DEVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 240 INDIA: ANASTOMOSIS DEVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.4 AUSTRALIA

9.4.4.1 High prevalence of cancer to drive demand for anastomosis devices in Australia

TABLE 241 AUSTRALIA: ANASTOMOSIS DEVICES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 242 AUSTRALIA: SURGICAL STAPLERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 243 AUSTRALIA: SURGICAL SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 244 AUSTRALIA: ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 245 AUSTRALIA: SYNTHETIC SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 246 AUSTRALIA: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 247 AUSTRALIA: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 248 AUSTRALIA: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 249 AUSTRALIA: BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 250 AUSTRALIA: SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 251 AUSTRALIA: ANASTOMOSIS DEVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 252 AUSTRALIA: ANASTOMOSIS DEVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.5 REST OF ASIA PACIFIC

TABLE 253 REST OF ASIA PACIFIC: ANASTOMOSIS DEVICES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 254 REST OF ASIA PACIFIC: SURGICAL STAPLERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 255 REST OF ASIA PACIFIC: SURGICAL SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 256 REST OF ASIA PACIFIC: ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 257 REST OF ASIA PACIFIC: SYNTHETIC SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 258 REST OF ASIA PACIFIC: NON-ABSORBABLE SUTURES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 259 REST OF ASIA PACIFIC: AUTOMATED SUTURING DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 260 REST OF ASIA PACIFIC: SURGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 261 REST OF ASIA PACIFIC: BIOLOGICAL SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 262 REST OF ASIA PACIFIC: SYNTHETIC AND SEMI-SYNTHETIC SEALANTS & ADHESIVES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 263 REST OF ASIA PACIFIC: ANASTOMOSIS DEVICES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 264 REST OF ASIA PACIFIC: ANASTOMOSIS DEVICES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.5 LATIN AMERICA

9.5.1 GROWING NUMBER OF PLASTIC SURGERY PROCEDURES TO SUPPORT MARKET GROWTH

TABLE 265 LATIN AMERICA: ANASTOMOSIS DEVICES INDUSTRY, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 266 LATIN AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 267 LATIN AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 AWARENESS INITIATIVES TO DRIVE SEGMENT GROWTH

TABLE 268 MIDDLE EAST & AFRICA: ANASTOMOSIS DEVICES INDUSTRY, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 269 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 270 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 230)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

10.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY PLAYERS IN ANASTOMOSIS DEVICES MARKET

TABLE 271 OVERVIEW OF STRATEGIES DEPLOYED BY KEY ANASTOMOSIS DEVICE MANUFACTURING COMPANIES

10.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 27 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN ANASTOMOSIS DEVICES MARKET

10.4 MARKET SHARE ANALYSIS

FIGURE 28 ANASTOMOSIS DEVICES INDUSTRY SHARE, BY KEY PLAYER (2021)

TABLE 272 ANASTOMOSIS DEVICES INDUSTRY: DEGREE OF COMPETITION

10.5 COMPANY EVALUATION QUADRANT

10.5.1 LIST OF EVALUATED VENDORS

10.5.2 STARS

10.5.3 EMERGING LEADERS

10.5.4 PERVASIVE PLAYERS

10.5.5 PARTICIPANTS

FIGURE 29 ANASTOMOSIS DEVICES MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

10.6 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES (2021)

10.6.1 PROGRESSIVE COMPANIES

10.6.2 STARTING BLOCKS

10.6.3 RESPONSIVE COMPANIES

10.6.4 DYNAMIC COMPANIES

FIGURE 30 ANASTOMOSIS DEVICES MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES, 2021

10.7 COMPETITIVE BENCHMARKING

10.7.1 PRODUCT AND REGIONAL FOOTPRINT ANALYSIS

FIGURE 31 PRODUCT AND REGIONAL FOOTPRINT ANALYSIS OF TOP PLAYERS

TABLE 273 ANASTOMOSIS DEVICES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

TABLE 274 COMPANY PRODUCT FOOTPRINT

TABLE 275 COMPANY REGIONAL FOOTPRINT

TABLE 276 ANASTOMOSIS DEVICES MARKET: DETAILED LIST OF KEY START-UPS/SMES

10.8 COMPETITIVE SCENARIO

10.8.1 PRODUCT LAUNCHES

TABLE 277 KEY PRODUCT LAUNCHES & APPROVALS

10.8.2 DEALS

TABLE 278 KEY DEALS

11 COMPANY PROFILES (Page No. - 243)

11.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

11.1.1 JOHNSON & JOHNSON

TABLE 279 JOHNSON & JOHNSON: BUSINESS OVERVIEW

FIGURE 32 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2021)

11.1.2 MEDTRONIC PLC

TABLE 280 MEDTRONIC PLC: BUSINESS OVERVIEW

FIGURE 33 MEDTRONIC PLC: COMPANY SNAPSHOT (2021)

11.1.3 B. BRAUN MELSUNGEN AG

TABLE 281 B. BRAUN MELSUNGEN AG: BUSINESS OVERVIEW

FIGURE 34 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT (2021)

11.1.4 BOSTON SCIENTIFIC CORPORATION

TABLE 282 BOSTON SCIENTIFIC CORPORATION: BUSINESS OVERVIEW

FIGURE 35 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2021)

11.1.5 ARTIVION, INC.

TABLE 283 ARTIVION, INC.: BUSINESS OVERVIEW

FIGURE 36 ARTIVION, INC.: COMPANY SNAPSHOT (2021)

11.1.6 INTUITIVE SURGICAL, INC.

TABLE 284 INTUITIVE SURGICAL, INC.: BUSINESS OVERVIEW

FIGURE 37 INTUITIVE SURGICAL, INC: COMPANY SNAPSHOT (2021)

11.1.7 SMITH & NEPHEW PLC

TABLE 285 SMITH & NEPHEW PLC: BUSINESS OVERVIEW

FIGURE 38 SMITH & NEPHEW PLC: COMPANY SNAPSHOT (2021)

11.1.8 BECTON, DICKINSON AND COMPANY

TABLE 286 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

FIGURE 39 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2021)

11.1.9 CONMED CORPORATION

TABLE 287 CONMED CORPORATION: BUSINESS OVERVIEW

FIGURE 40 CONMED CORPORATION: COMPANY SNAPSHOT (2021)

11.1.10 BAXTER INTERNATIONAL INC.

TABLE 288 BAXTER INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 41 BAXTER INTERNATIONAL INC.: COMPANY SNAPSHOT (2021)

11.1.11 ADVANCED MEDICAL SOLUTIONS GROUP PLC (AMS GROUP)

TABLE 289 ADVANCED MEDICAL SOLUTIONS GROUP PLC: BUSINESS OVERVIEW

FIGURE 42 ADVANCED MEDICAL SOLUTIONS GROUP PLC: COMPANY SNAPSHOT (2021)

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 TELEFLEX

11.2.2 MERIL LIFE SCIENCES PVT. LTD.

11.2.3 SURGICAL SPECIALTIES CORPORATION

11.2.4 PÉTERS SURGICAL

11.2.5 DEMETECH CORPORATION

11.2.6 PURPLE SURGICAL

11.2.7 FRANKENMAN INTERNATIONAL LTD.

11.2.8 BIOSINTEX

11.2.9 LOTUS SURGICALS

11.2.10 ENDOEVOLUTION, LLC

11.2.11 MELLON MEDICAL B.V.

11.2.12 INTERNACIONAL FARMACÉUTICA S.A. DE C.V.

11.2.13 WELFARE MEDICAL LTD.

11.2.14 UNISUR LIFECARE PVT. LTD.

12 APPENDIX (Page No. - 298)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

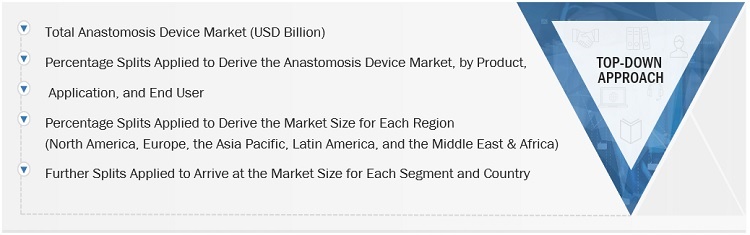

This study involved four major activities in estimating the current size of the anastomosis device market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate segments and subsegments' market size.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the anastomosis device market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the anastomosis device market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, segment, and forecast the global anastomosis device market by product, application, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall anastomosis device market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze company developments such as product launches, agreements, partnerships, and acquisitions in the anastomosis device market

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

Anastomosis device market size and growth rate estimates for countries in the Rest of Europe, the Rest of Asia Pacific, Latin America, and Middle East & Africa

Company profiles

Additional five company profiles of players operating in the anastomosis device market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Anastomosis Devices Market