Surgical Sutures Market Size, Growth, Share & Trends Analysis

Surgical Sutures Market by Product (Suture Thread (Natural, Synthetic (Absorbable, Non-absorbable)), Automated Suturing Device), Type (Monofilament, Multifilament), Application (Cardiovascular, General, Cosmetic), End User & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global surgical sutures market is projected to reach USD 6.65 billion by 2030 from USD 4.84 billion in 2025, at a CAGR of 6.5% during the forecast period. Sutures are surgical threads designed to approximate and secure tissue during operative procedures, facilitating effective wound closure and healing. These products are widely used by surgeons across specialties such as general surgery, gynecology, orthopedics, cardiovascular, and oral & maxillofacial surgery, where precise tissue management is critical. Absorbable sutures (such as polyglactin, polyglycolic acid, and polydioxanone) and non-absorbable sutures (such as polypropylene, polyester, and silk) remain the most widely adopted products. The surgical sutures market is witnessing steady growth, driven by the rising volume of surgical interventions globally. Increasing prevalence of trauma, chronic conditions requiring surgical management, and a growing preference for advanced, patient-friendly wound closure solutions are fueling demand. Reliable sutures are essential to optimize surgical outcomes, minimize infection risk, and promote faster recovery.

KEY TAKEAWAYS

-

BY PRODUCTBy product, the surgical sutures market can be categorized into 2 types: suture threads, and Automated Suturing Devices . Because suture thread is essential for wound closure in a wide range of surgical procedures, it commands a dominant market share in the surgical sutures industry. It is essential to both traditional open surgeries and minimally invasive procedures as the basic component of any suturing system. Its adaptability, wide range of material choices, and continuous advancements that improve its efficacy and performance are primarily responsible for its dominance.

-

BY TYPEBy type, the surgical sutures market can be categorized into 2 types: Monofilament Sutures and Multifilament Sutures. The market for surgical sutures is dominated by multifilament sutures because of their superior handling qualities, ability to knot securely, and versatility in a wide range of surgical specialties. These sutures, which are made from several braided or twisted strands, are stronger and more flexible than their monofilament counterparts, which makes them ideal for procedures requiring accurate tissue approximation.

-

BY END USERThe surgical sutures market can be divided by end user into three main categories: Hospitals, ambulatory surgical centers, and clinics & physician offices. The hospitals are the most significant portion of the hemostats market due to the increasing number of complex surgeries performed in hospitals, the rising geriatric population, favorable reimbursement policies for hospital treatments, and the growing number of new hospitals, especially in emerging countries..

-

BY REGIONThe surgical sutures market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Among these regions, Asia Pacific is anticipated to be the fastest-growing market with the CAGR of 8.9% for surgical sutures during the forecast period. This growth is due to the rapid increase in surgical procedures, rising healthcare expenditure, and expanding access to advanced surgical products.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including product launches, partnerships, and acquisitions. For example, in January 2023, Zimmer Biomet announced its agreement to acquire Embody, Inc., a privately held medical device company focused on soft tissue healing. This deal will strengthen Zimmer’s growing Sports and Medicine portfolio.

The surgical sutures market is experiencing consistent growth due to several key factors. The rising global surgical volume, driven by an aging population and the increasing prevalence of chronic and lifestyle-related diseases, is fueling demand for effective wound closure solutions. In addition, the growing adoption of absorbable sutures for enhanced patient comfort, along with ongoing innovations in suture materials and coatings, is expanding their clinical use

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The surgical sutures market is undergoing a transition from traditional sutures toward advanced solutions, with new revenue sources emerging around smart sutures, antibacterial sutures, and drug-delivering sutures. Trends such as minimally invasive surgery, electronic sensor-enabled sutures, and AI/robotic-assisted surgical procedures are disrupting conventional practices and driving innovation. End-user segments including hospitals, specialty clinics, ambulatory surgical centers, and long-term care settings are increasingly adopting these advanced sutures. This shift is fueled by rising surgical volumes, growing trauma cases, expanding medical tourism, and the demand for patient-friendly, technologically advanced wound closure products.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

§Increasing number of surgical procedures

-

§Growing number of trauma cases

Level

-

§Increasing preference for minimally invasive surgeries

-

§Presence of alternative wound care management products

Level

-

§Growth opportunities in low- and middle-income countries

Level

-

Market saturation and pricing pressure

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing number of surgical procedures

One of the major drivers propelling the growth of the surgical sutures market is the rising number of surgical procedures that are carried out across the world. This increase is primarily due to the rising incidence of chronic diseases like cardiovascular diseases, cancer, diabetes, and orthopedic diseases, which frequently need to be treated surgically. Furthermore, the elderly population of the world is playing a major role as older people are more prone to undergoing surgery because of age-related illnesses. Increasing healthcare infrastructure, especially in developing countries, and enhanced access to surgical treatment have also raised the number of procedures further. Additionally, the increased incidence of elective procedures, cosmetic interventions, and injury cases resulting from accidents and trauma is driving demand for dependable closure solutions such as sutures. With an increase in frequency and complexity of surgery, demand for high-performance sutures that provide best-in-class healing and minimize complications has increased, thus making the upsurge in the number of surgeries a key driver for the market's growth

Restraint: Increasing preference for minimally invasive surgeries

One significant constraint affecting the development of the surgical sutures market is the growing demand for minimally invasive surgeries (MIS). Such interventions, comprising laparoscopic, endoscopic, and robotic-assisted procedures, tend to have smaller cuts and cause less trauma to tissues, shorter recovery periods, and fewer complications than the conventional open surgeries. Thus, they tend to lessen or eliminate the need for a lot of sutures and depend on other devices like surgical clips, staples, adhesives, or energy-based sealer devices. Thus as the use of MIS rises in many various specialties gynecology, urology, cardiology, and orthopedics– they are restraining the total amount and size of sutures used per procedure. The increase in technology related to MIS and the desire of surgeons to perform quicker and less traumatic procedures will further reduce their reliance on sutures. This evolution poses a challenge for traditional suture companies; they have to either innovate and reinvent themselves, or risk becoming outdated in a transitional surgical landscape, where fewer traditional sutures are being used with increasing frequency in minimally invasive procedures

Opportunity: Growth opportunities in lowand middle income countries

One of the emerging opportunities for surgical sutures in the marketplace is increased demand in low- and middle-income countries (LMICs). These countries are experiencing slow increases in surgical volume from expanded infrastructure for surgical care, growth in healthcare investment, and a renewed governmental focus on improving access for surgical care of critical medical problems. Demand for better (safe and efficient) wound closure solutions is also being stimulated by rapid urbanization, a growing middle class (with additional incomes) and a better understanding of health and hygiene practices. Major global health organizations and non-government organizations are also financing and implementing surgical capacity building (training) programs in LMICs to continue to bolster market opportunity. While these nations have traditionally depended upon cheap and standard surgical equipment, there is increasingly a demand for inexpensive, high-quality sutures that provide improved healing and infection control. Suppliers can benefit from this trend by providing inexpensive product offerings, setting up local manufacturing or distribution alliances, and offering surgeon training programs to facilitate increased product use. As such economies continue to give importance to the development of healthcare, the market for surgical sutures would gain remarkably from higher penetration and sustained growth in these emerging markets.

Challenge: Market saturation and pricing pressure

Market saturation and price pressure are a major concern in the surgical sutures market, especially in advanced geographies like North America and Europe. These mature markets have many established competitors with similar product portfolios, and this causes high competition. Thus, companies end up competing on the price front instead of innovation, and this causes pressure on margins downwards. Also, healthcare professionals and buying organizations alike are more concerned with cost control, tending towards bulk buying and tenders that call for lower prices. Such a situation is also compounded by low-cost producers, especially from the Asian continent, providing alternative low-cost products at lower prices. In such a highly competitive marketplace, differentiation is not easy, and even superior or new products find it hard to sell at premium prices. Additionally, regulatory and reimbursement issues contribute to the cost load, which makes it difficult for firms to remain profitable. To better cope with this scenario, manufacturers will have to emphasize value-added services, product development, and strategic alliances, while balancing quality with affordability to remain competitive.

Surgical Sutures Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

|

Coated Vicryl Rapide – Synthetic absorbable suture made of polyglactin 910, designed for short-term wound support and rapid absorption. | Provides predictable absorption (within 42 days), minimizes need for suture removal, offers reliable wound support during early healing, reduces patient discomfort, and improves procedural efficiency. |

|

Velosorb Fast Suture – Synthetic absorbable braided suture made from glycolide/lactide copolymer, indicated for superficial soft tissue approximation. | Provides rapid tensile strength loss (within 7–10 days), fully absorbed by ~40–50 days, eliminates need for removal, reduces risk of suture-related complications, and enhances patient comfort. |

|

Novosyn – Braided, synthetic absorbable suture made of polyglactin 910, used for general soft tissue approximation and ligation. | Offers excellent handling and knot security, predictable absorption profile, biocompatible and fully resorbable, reduces risk of infection, and supports smooth tissue healing |

|

PGA Resorba – Synthetic absorbable suture made from polyglycolic acid, used in general surgery, gynecology, and oral/maxillofacial procedures. | Ensures reliable wound support, predictable absorption, easy handling, smooth passage through tissue, minimizes trauma, and lowers post-operative complications. |

|

TruMAS Suture – Absorbable synthetic suture designed for soft tissue approximation in various surgical procedures. | Provides controlled tensile strength retention, predictable absorption, user-friendly handling, and enhances safety by reducing operative risks and ensuring effective wound closure. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem map of the surgical sutures market outlines the key stakeholders and their interconnections within the value chain. It encompasses manufacturers, distributors, research and development entities, and end users. Manufacturers are responsible for the complete process of product innovation, from research and design to optimization and commercialization. Distributors include third-party providers and e-commerce platforms that collaborate with manufacturers to market and deliver sutures to end customers. Research and development players consist of in-house R&D teams, contract research organizations (CROs), and contract development and manufacturing organizations (CDMOs), all of which support innovation and product advancement through outsourcing partnerships. End users—comprising hospitals, specialty clinics, ambulatory centers, and other care settings—represent the primary points of application for surgical sutures

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Surgical Sutures Market, By Type

Based on type, multifilaments hold the dominating position for surgical sutures due to their superior handling power, knot security, and versatility to be used across a range of surgical procedures. Multifilaments are made of more than one braid or twist, which allows for greater strength and flexibly than that of a monofilament. Multifilament sutures are the suture of choice for surgeons performing procedures that require stable tissue approximation because of the superior knottability and ease of tying, which translates to reduced operation time. Additionally, the smooth texture of the knots minimizes manipulation caused tissue trauma, which makes them useful for delicate surgical procedures such as gastrointestinal, gynecological, and cardiovascular surgeries

Surgical Sutures Market, By Product

Based on product, suture thread is the largest segment in the market for surgical sutures based on its fundamental function of closing up wounds during a broad spectrum of surgical procedures. It is the central part of any suturing system and hence is absolutely necessary in both open traditional surgery and minimally invasive procedures. The relevance of suture thread is influenced by its broad material versatility, extensive range of materials, and ongoing development in design and performance. Innovations like absorbable, non-absorbable, antibacterial-coated, and barbed suture threads have broadened their indications in various specialties like cardiovascular, orthopedic, gynecological, and general surgeries. Physicians tend to use threads that have excellent tensile strength, minimal tissue reactivity, and consistent absorption patterns, all of which are being progressively improved by top manufacturers. In addition, the increase in surgical operations worldwide due to chronic diseases, aging population, and trauma cases has created more demand for quality suture threads. Their convenience, availability of different sizes and materials (e.g., polyglycolic acid, polypropylene, and catgut), and compatibility with a wide range of needles also make them widely used and leading in the market.

REGION

Asia Pacific to be fastest-growing region in global surgical sutures market during forecast period

The Asia Pacific surgical sutures market is projected to witness the highest growth during the forecast period. Rising awareness of advanced surgical procedures, increasing prevalence of chronic and lifestyle-related conditions requiring surgical intervention, expanding healthcare infrastructure, and growing access to modern hospitals and clinics are driving demand in the region. Additionally, a rapidly expanding middle-class population, increasing healthcare spending, and government initiatives to improve surgical care further support market growth. Countries such as China, India, and Japan are leading this surge due to high patient volumes and the adoption of advanced wound closure techniques. Moreover, the growing number of private hospitals and clinics, along with increased medical tourism, is expected to further fuel market expansion.

Surgical Sutures Market: COMPANY EVALUATION MATRIX

In the surgical sutures market matrix, Ethicon (Johnson & Johnson, US) leads with a broad and innovative product portfolio, strong global presence, and extensive distribution network, driving widespread adoption across hospitals and surgical centers. Medtronic (Ireland) leverages its expertise in absorbable and specialty sutures to strengthen its position, particularly in advanced surgical procedures and minimally invasive surgeries. B. Braun (Germany) focuses on high-quality suture solutions with strong emphasis on safety, biocompatibility, and surgeon-friendly handling, enhancing its reach in both hospital and clinical settings. While Ethicon maintains leadership through scale, innovation, and established networks, Medtronic and B. Braun demonstrate strong potential for growth through targeted product advancements and expanding regional footprints.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 4.56 Billion |

| Revenue Forecast in 2030 | USD 6.65 Billion |

| Growth Rate | CAGR of 6.5% from 2025-2030 |

| Actual data | 2023-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million), Volume (Thousands Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

WHAT IS IN IT FOR YOU: Surgical Sutures Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | ||

| Company Information | ||

| Geographic Analysis |

RECENT DEVELOPMENTS

- March 2024 : Johnson & Johnson MedTech working with NVIDIA to scale AI for surgery

- March 2024 : Advanced Medical Solutions announces the acquisition of Peters Surgical

- October 2024 : Corza Medical Launches Next-Generation Microsurgical Sutures at American Academy of Ophthalmology Conference

- August 2023 : Johnson & Johnson (J&J) finalized the separation of Kenvue, its consumer health business (includes brands like Tylenol, Band-Aid, etc.). J&J now owns just 9.5% of Kenvue, effectively making Kenvue a separate company.

- January 2023 : Zimmer Biomet announced its agreement to acquire Embody, Inc., a privately held medical device company focused on soft tissue healing. This deal will strengthen Zimmer’s growing Sports and Medicine portfolio.

Table of Contents

Methodology

This study involved four major activities to estimate the current surgical sutures market size. First, extensive secondary research was conducted to gather information on the market, including related and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the overall surgical sutures market size. After that, market breakdown and data triangulation were applied to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the surgical sutures market. It was also used to obtain important information about the key players, market classification, and segmentation according to industry trends to the bottom-most level, as well as key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various companies and organizations operating in the surgical sutures market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on key industry trends and key market dynamics.

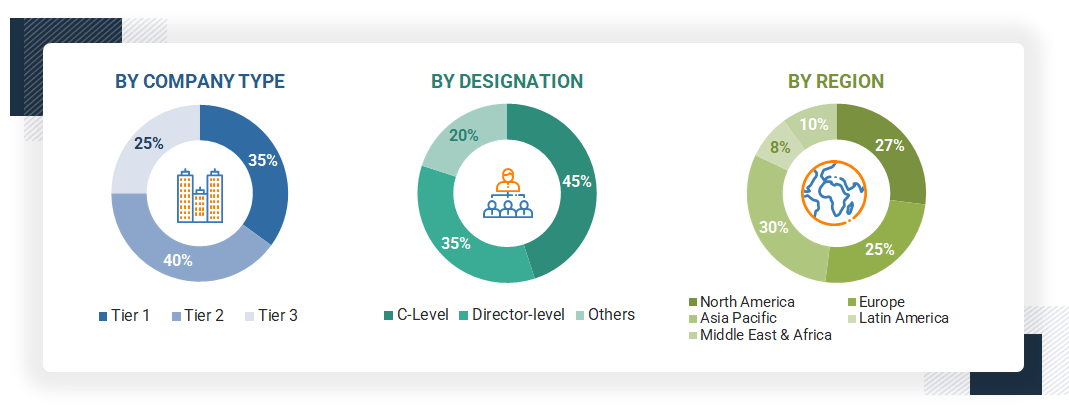

A breakdown of the primary respondents for the surgical sutures market is provided below:

Note 1: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 2: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = < USD 1.00 billion.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the global surgical sutures market. All the major product manufacturers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/sub-segments was done for the major players. Also, the global surgical sutures market was split into various segments and sub-segments based on:

- List of major players operating in the product market at the regional and/or country level

- Product mapping of various surgical sutures manufacturers at the regional and/or country level

- Mapping of annual revenue generated by listed major players from surgical sutures (or the nearest reported business unit/product category)

- Revenue mapping of major players is covered.

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global surgical sutures market

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Market Size Estimation (Bottom-up & Top-down Approach)

Data Triangulation

After arriving at the overall size of the global surgical sutures market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand- and supply-side participants.

Market Definition

Surgical sutures, often referred to as stitches, are sterile thread-like materials specifically designed for the closure and repair of skin and tissue lacerations. These sutures play a critical role in surgical procedures, facilitating the closure of incisions and the apposition of internal organs, dermal layers, and soft tissues post-operatively. Their applications extend to various types of wound management, ensuring hemostasis and promoting optimal healing processes through tensile strength and biocompatibility.

Stakeholders

- Medical device companies

- Vendors of surgical sutures

- Healthcare associations/institutes

- Hospitals and clinics

- Research and consulting firms

- Healthcare associations/institutes

- Venture capitalists

- Government agencies

Report Objectives

- To define, describe, and forecast the global surgical sutures market based on producttype, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the global surgical sutures market (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the surgical sutures market with respect to five main regions: North America (US and Canada), Europe (Germany, UK, France, Spain, Italy, and Rest of Europe), the Asia Pacific (Japan, China, India, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America) and the Middle East & Africa (GCC Countries and Rest of Middle East & Africa)

- To profile the key players in the global surgical sutures market and comprehensively analyze their core competencies2 and market shares

- To track and analyze competitive developments, such as acquisitions, product launches, collaborations, and partnerships, in the market

- To benchmark players within the market using the proprietary “Competitive Evaluation Matrix” framework, which analyzes market players on various parameters within the broad categories of business and product/service strategy

- To analyze the generative AI impact on the surgical sutures market

Frequently Asked Questions (FAQ)

What are the drivers of the surgical sutures market?

The drivers of the surgical sutures market include the increasing number of surgical procedures, a growing number of trauma cases, the expanding medical tourism industry, the rising incidence of chronic lifestyle-related diseases, and advancements in surgical sutures.

Which product dominates the surgical sutures market?

The suture threads segment, by product, is dominating the surgical sutures market.

Who are the surgical sutures market's end users? Which end user is leading the market?

The surgical sutures market is segmented into hospitals, ambulatory surgery centers, and clinics & physician offices. In 2024, the hospitals segment accounted for the largest share of the market.

Who are the key players in the surgical sutures market?

The key players in the surgical sutures market are Johnson & Johnson [Ethicon] (US), Medtronic (Ireland), B.Braun SE (Germany), Advanced Medical Solutions Group Plc (UK), Healthium MedTech Limited (India), Boston Scientific Corporation (US), Zimmer Biomet Holdings, Inc. (US), Stryker (US), Smith+Nephew (UK), Conmed Corporation (US), Internacional Farmacéutica S.A. de C.V. (Mexico), Corza Medical (US), and DemeTECH Corporation (US).

Which region is lucrative for the surgical sutures market?

The Asia Pacific market is expected to witness the highest growth rate of 8.9% during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Surgical Sutures Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Surgical Sutures Market

Ryan

Sep, 2023

For 2035 what are the market estimates of Surgical Sutures Market.

Jhonny

Sep, 2023

Need segment wise data of Surgical Sutures Market. .