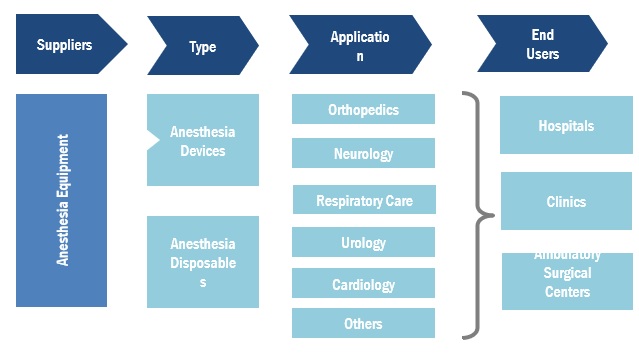

Anesthesia Equipment Market by Type (Anesthesia Devices (Workstation, Ventilators, Monitors), Disposables (Circuits, Endotraceal Tubes)), Application (Orthopedics, Neurology, Urology), End User (Hospitals, Clinics, ASC) & Region - Global Forecast to 2028

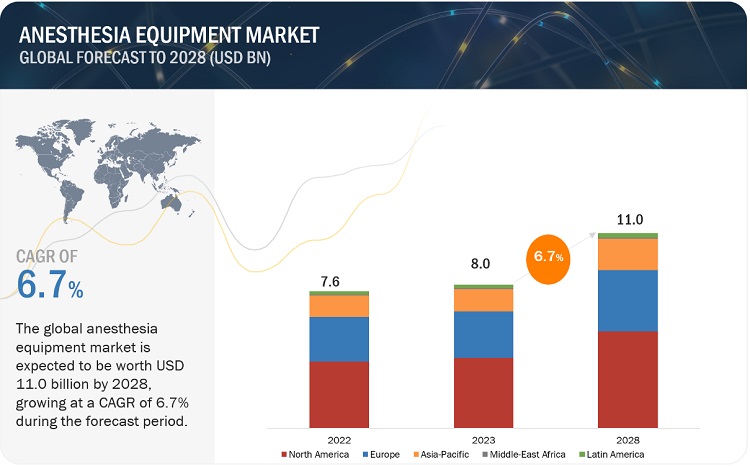

The global anesthesia equipment market, valued at US$7.6 billion in 2022, stood at US$8.0 billion in 2023 and is projected to advance at a resilient CAGR of 6.7% from 2023 to 2028, culminating in a forecasted valuation of US$11.0 billion by the end of the period. Growth in this market can primarily be attributed to the growing geriatric population on a global level. Common age-related diseases and conditions include arthritis, osteoporosis, lumbar spinal stenosis (LSS), gastroesophageal reflux disease (GERD), and benign prostatic hypertrophy. LSS is extremely common among people aged 50 years and above, with most patients in this age group undergoing surgical procedures for its treatment. As per the American Academy of Orthopaedic Surgeons (AAOS), around 2.4 million Americans are expected to be affected by this condition by 2021. The growth in the geriatric population is thus expected to result in a surge in the total number of surgeries performed in the US.

Attractive Opportunities in Anesthesia equipment Market

To know about the assumptions considered for the study, Request for Free Sample Report

Anesthesia Equipment Market Dynamics

Driver: Rising prevalence of chronic disorders

According to the WHO, cancer is the leading cause of death globally and was responsible for an estimated 10 million deaths in 2020. According to Cancer Research UK, an estimated 27.5 million new cancer cases will be reported in 2040, an increase of 61.7% compared to 2018. About 62.6% of the new cancer cases occurred in Africa, Asia, Latin America, and the Caribbean region in 2020; 72.6% of global cancer deaths also occurred in these regions in 2020. The increasing burden of cancer can be attributed to several factors, including population growth and aging, as well as the changing prevalence of certain causes of cancer linked to social and economic development. Based on these statistics, basic and translational cancer research continues to be of utmost importance. This is resulting in the growing demand for surgeries, hence boosting the anesthesia equipment industry growth.

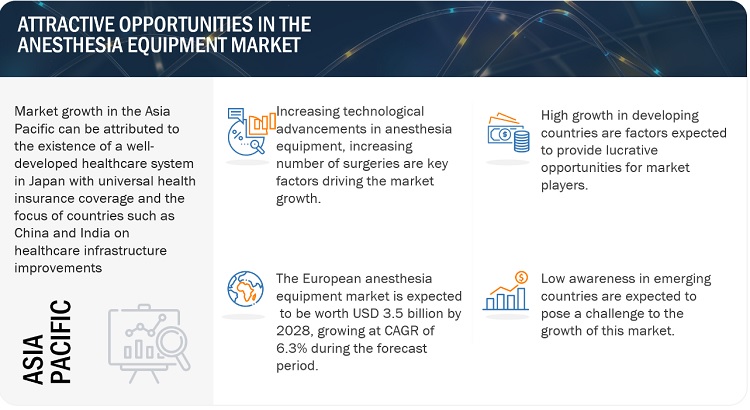

Restraint: Unfavorable reimbursement scenario

Currently, the healthcare system in developing countries faces many challenges due to rising healthcare costs, increasing incidence of chronic diseases, and the growing geriatric population (coupled with the growth in age-related disorders). To counter these challenges, governments in a number of countries are focusing on redesigning their healthcare reimbursement systems. In Asian countries, there is very limited or no reimbursement available (except in Japan). Thus, limited or decreasing reimbursement rates in developed countries and undefined reimbursement policies in emerging countries restrict the adoption of surgical procedures globally. This, in turn, is restraining the demand for anesthesia equipment during the forecast period.

Opportunity: High growth in developing countries

An increase in the per capita income and healthcare expenses in developing markets across APAC and Latin America has increased patient access to advanced healthcare treatments. However, some countries in the APAC and Latin America rely heavily on purchasing medical devices from developed countries such as the US, Japan, Germany, and Ireland. This represents significant growth opportunities for players operating in the anesthesia equipment industry. According to the World Bank, Asia accounts for more than half of the world’s population. Authorities in various developing countries in this region are planning to establish new healthcare delivery models, such as day-care centers, single-specialty hospitals, and long-term care centers, to serve larger population sections. Many private enterprises are also taking steps to cater to the needs of modern and well-equipped state-run healthcare facilities in these countries. In China, the private hospital sector is expected to maintain double-digit growth over the coming years owing to regulatory changes, market demand, and capital investments. In the private hospitals segment, specialty hospitals are witnessing high growth.

Challenge: Hospital budget cuts

In recent years, changes in regulatory policies in major markets such as the US have significantly affected hospital budgets. The Affordable Care Act (ACA), implemented in the US in 2010, has brought tighter federal regulations, forcing many hospitals to curtail their capital expenditure budgets. Similar budgetary cuts are observed in hospitals in the European region, mainly due to the economic slowdown in the past few years. Owing to such budget cuts, many hospitals cannot afford costly medical devices and prefer lower-priced alternatives (such as refurbished devices) or undertake upgradation of existing medical equipment and devices. The rising cost of prescription drugs and a sharp decline in the proposed budget allocations for Health and Human Services in the US have significantly reduced hospital budgets. A study by the American Hospital Association estimates that federal payment cuts to hospitals would amount to USD 218 billion by 2028, forcing hospitals to allocate smaller budgets annually.

Anesthesia Equipment Market Ecosystem

Leading players in this market include well-established and financially stable manufacturers of anesthesia equipment. These companies have been operating in the market for several years and possess a diversified product portfolio, advanced technologies, and strong global presence. Prominent companies in this market include GE Healthcare (US), Dragerwerk Ag & Co. KGAA (Germany), Koninklijke Philips N.V. (Netherlands), Ambu AS (Denmark), Medline Industries Inc. (US).

The anesthesia circuits (breathing circuits) segment of the anesthesia equipment industry is expected to register the highest CAGR during the forecast period.

Based on type, the anesthesia equipment market is segmented into anesthesia circuits (breathing circuits), anesthesia masks, endotracheal tubes (ETTS), laryngeal mask airways (LMAS), and other accessories. In 2022, the anesthesia circuits (breathing circuits) segment is expected to register the highest CAGR during the forecast period. These anesthesia disposables are essential for maintaining a sterile environment, preventing infections, and ensuring patient safety during anesthesia procedures. They are designed to be convenient, cost-effective, and eliminate the need for cleaning and sterilization which is fueling the demand for these products.

The cardiology segment of anesthesia equipment industry is estimated to grow at a higher CAGR during the forecast period.

Based on application, the anesthesia equipment market is segmented into orthopedics, neurology, respiratory care, urology, cardiology, and others. The cardiology segment is estimated to grow at a higher CAGR during the forecast period. Growth in this segment can be attributed to the the aging population, which is more susceptible to cardiac conditions, and the rising adoption of minimally invasive cardiac interventions.

The ambulatory surgical centers segment of the anesthesia equipment industry is expected to grow at the highest CAGR during the forecast period.

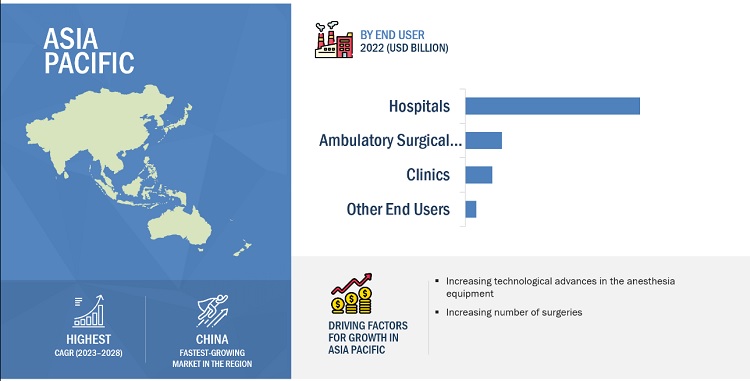

Based on the end user, the anesthesia equipment market is segmented into hospitals, clinics, ambulatory surgical centers, and other end users. In 2022, ambulatory surgical centers segment is expected to grow at the highest CAGR during the forecast period. the growing number of outpatient visits. Ambulatory surgical centers are well-equipped with critical care devices and instruments. Moreover, these outpatient settings are associated with reduced patient stays.

APAC is estimated to be the fastest-growing region for anesthesia equipment industry.

The global anesthesia equipment market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2022, APAC is estimated to be the fastest-growing regional market for anesthesia equipment. The high growth in this market can majorly be attributed to the rising number of hospitals and increasing healthcare expenditure, the significant growth in patient volume, and the demand for healthcare services.

To know about the assumptions considered for the study, download the pdf brochure

The anesthesia equipment market is dominated by a few globally established players such as GE Healthcare (US), Drägerwerk AG & Co. KGaA (Germany), Koninklijke Philips N.V. (Netherlands), Ambu A/S (Denmark), Medline Industries Inc. (US). Major players adopt growth strategies to expand their geographical presence and garner higher shares in the global market, such as product launches and approvals, expansions, collaborations, and acquisitions.

Scope of the Anesthesia Equipment Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$8.0 billion |

|

Projected Revenue by 2028 |

$11.0 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 6.7% |

|

Market Driver |

Rising prevalence of chronic disorders |

|

Market Opportunity |

High growth in developing countries |

The study categorizes the anesthesia equipment market to forecast revenue and analyze trends in each of the following submarkets:

By Type

-

Anesthesia Devices

- Anesthesia Workstation

- Anesthesia Delivery Machines

- Anesthesia Ventilators

- Anesthesia Monitors

- Other Devices

-

Anesthesia Disposables

- Anesthesia Circuits (Breathing Circuits)

- Anesthesia Masks

- Endotracheal Tubes (ETTS)

- Laryngeal Mask Airways (LMAS)

- Other Accessories

By Application

- Orthopedics

- Neurology

- Respiratory Care

- Urology

- Cardiology

- Others

By End User

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments of Anesthesia Equipment Industry

- In April 2022, GE Healthcare received the FDA pre-market approval (PMA) for its End-tidal (Et) Control software for general anesthesia delivery on its Aisys CS2Anesthesia Delivery System.

- In May 2022, Fisher & Paykel Healthcare expands offering in anesthesia with the release of the Optiflow Switch and Optiflow Trace.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global anesthesia equipment market?

The global anesthesia equipment market boasts a total revenue value of $11.0 billion by 2028.

What is the estimated growth rate (CAGR) of the global anesthesia equipment market?

The global anesthesia equipment market has an estimated compound annual growth rate (CAGR) of 6.7% and a revenue size in the region of $8.0 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising technological advancements in anesthesia equipment- Increasing number of surgical procedures- High prevalence of chronic diseasesRESTRAINTS- Unfavorable reimbursements across healthcare systemsOPPORTUNITIES- Growth opportunities in emerging economiesCHALLENGES- Budgetary constraints in hospitals- Shortage of skilled medical professionals

-

5.3 INDUSTRY TRENDSTECHNOLOGICAL ADVANCEMENTS FOR IMPROVED PATIENT SAFETYGROWING PREFERENCE FOR PORTABLE AND LIGHTWEIGHT ANESTHESIA DEVICES

-

5.4 REGULATORY ANALYSISNORTH AMERICA- US- CanadaEUROPEREST OF THE WORLD

- 5.5 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

-

5.8 ECOSYSTEM MARKET MAP

-

5.9 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.10 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR ANESTHESIA EQUIPMENTANESTHESIA EQUIPMENT MARKET: TOP APPLICANTSJURISDICTION ANALYSIS: TOP APPLICANTS (COUNTRIES) FOR PATENTS

- 5.11 TECHNOLOGY ANALYSIS

- 5.12 PRICING MODEL ANALYSIS

-

5.13 KEY CONFERENCES AND EVENTSLIST OF KEY CONFERENCES AND EVENTS (2023-2025)

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 ANESTHESIA DEVICESANESTHESIA WORKSTATIONS- Increasing number of surgical procedures to drive marketANESTHESIA DELIVERY MACHINES- Rising need for patient safety and efficient administration to drive marketANESTHESIA VENTILATORS- Advanced monitoring capabilities and adaptive ventilation modes to support market growthANESTHESIA MONITORS- Ability to provide continuous monitoring and real-time information to drive marketOTHER DEVICES

-

6.3 ANESTHESIA DISPOSABLESANESTHESIA CIRCUITS- Ability to deliver gases and anesthetic agents during surgery to propel marketANESTHESIA MASKS- Advancements in mask design to support market growthENDOTRACHEAL TUBES- Reduced risk of HAIs to fuel uptakeLARYNGEAL MASK AIRWAYS- Less invasive method for delivery of anesthetic gases to support market growthOTHER ACCESSORIES

- 7.1 INTRODUCTION

-

7.2 ORTHOPEDICSRISING NEED FOR PATIENT COMFORT DURING SURGICAL PROCEDURES TO DRIVE MARKET

-

7.3 NEUROLOGYINCREASING UPTAKE OF ANESTHESIA DELIVERY MACHINES TO SUPPORT MARKET GROWTH

-

7.4 RESPIRATORY CARERISING DEMAND FOR ADVANCED RESPIRATORY SUPPORT AND VENTILATION SYSTEMS TO PROPEL MARKET

-

7.5 UROLOGYINCREASING PREVALENCE OF UROLOGICAL CONDITIONS TO SUPPORT MARKET GROWTH

-

7.6 CARDIOLOGYGROWING PREFERENCE FOR MINIMALLY INVASIVE CARDIAC INTERVENTIONS TO DRIVE MARKET

- 7.7 OTHER APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 HOSPITALSGROWING PREFERENCE FOR MINIMALLY INVASIVE SURGERIES TO PROPEL MARKET

-

8.3 CLINICSRISING PREVALENCE OF TARGET CONDITIONS TO SUPPORT MARKET GROWTH

-

8.4 AMBULATORY SURGERY CENTERSINCREASING NUMBER OF OUTPATIENT VISITS AND REDUCED COSTS TO DRIVE MARKET

- 8.5 OTHER END USERS

- 9.1 INTRODUCTION

-

9.2 EUROPEGERMANY- High healthcare spending for innovative medical technologies to drive marketFRANCE- Favorable reimbursements and advanced healthcare infrastructure to fuel marketUK- Rising investments by hospitals in medical equipment to propel marketITALY- High growth in medical device industry to fuel uptakeSPAIN- Rising prevalence of cancer to drive marketREST OF EUROPEEUROPE: RECESSION IMPACT

-

9.3 NORTH AMERICAUS- Favorable reimbursement policies for surgical procedures to drive marketCANADA- Rising prevalence of target conditions to drive marketNORTH AMERICA: RECESSION IMPACT

-

9.4 ASIA PACIFICJAPAN- Supportive medical device reimbursement policies to drive marketCHINA- Large target patient pool and rise in age-associated surgeries to fuel marketINDIA- Government initiatives for improvements in healthcare infrastructure to support market growthAUSTRALIA- Growing awareness campaigns for novel technologies to drive marketSOUTH KOREA- Significant uptake of anesthesia equipment technology to support market growthREST OF ASIA PACIFICASIA PACIFIC: RECESSION IMPACT

-

9.5 LATIN AMERICABRAZIL- Universal public health coverage system to support market growthMEXICO- Rising initiatives on import of medical devices to support market growthREST OF LATIN AMERICALATIN AMERICA: RECESSION IMPACT

-

9.6 MIDDLE EAST & AFRICAIMPROVEMENTS IN HEALTHCARE INFRASTRUCTURE TO SUPPORT MARKET GROWTHMIDDLE EAST & AFRICA: RECESSION IMPACT

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 REVENUE SHARE ANALYSIS OF KEY MARKET PLAYERS

- 10.4 MARKET SHARE ANALYSIS

-

10.5 COMPANY FOOTPRINTTYPE FOOTPRINT (25 COMPANIES)END-USER FOOTPRINT (25 COMPANIES)REGIONAL FOOTPRINT (25 COMPANIES)

-

10.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.7 COMPETITIVE BENCHMARKING

-

10.8 COMPETITIVE SCENARIOPRODUCT LAUNCHES & APPROVALS

-

11.1 KEY PLAYERSKONINKLIJKE PHILIPS N.V.- Business overview- Products offered- MnM viewAMBU A/S- Business overview- Products offered- MnM viewDRÄGERWERK AG & CO. KGAA- Business overview- Products offered- MnM viewGE HEALTHCARE- Business overview- Products offered- Recent developmentsBEIJING AEONMED CO., LTD.- Business overview- Products offeredMEDTRONIC PLC- Business overview- Products offeredGETINGE AB- Business overview- Products offeredBECTON, DICKINSON AND COMPANY- Business overview- Products offeredSHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.- Business overview- Products offeredFISHER & PAYKEL HEALTHCARE CO. LTD.- Business overview- Products offered- Recent developmentsMEDLINE INDUSTRIES, INC.- Business overview- Products offeredSHENZHEN COMEN MEDICAL INSTRUMENTS CO., LTD.- Business overview- Products offeredALLIED MEDICAL LIMITED- Business overview- Products offeredBPL MEDICAL TECHNOLOGIES- Business overview- Products offeredMEDEC INTERNATIONAL BV- Business overview- Products offeredSKANRAY TECHNOLOGIES LTD.- Business overview- Products offered

-

11.2 OTHER COMPANIESMEDITEC INTERNATIONAL ENGLAND LTD.PENLON LIMITEDSPACELABS HEALTHCARETELEFLEX INCORPORATEDSUNMEDINFINIUM MEDICALINTERSURGICAL, LTD.NIHON KOHDEN CORPORATIONAVASARALA TECHNOLOGIES LIMITEDAXCENT MEDICAL GMBH

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- TABLE 2 ANESTHESIA EQUIPMENT MARKET: RISK ASSESSMENT ANALYSIS

- TABLE 3 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 PORTER’S FIVE FORCES ANALYSIS

- TABLE 7 AVERAGE SELLING PRICE OF ANESTHESIA EQUIPMENT OFFERED BY LEADING PLAYERS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR ANESTHESIA EQUIPMENT

- TABLE 9 KEY BUYING CRITERIA FOR ANESTHESIA EQUIPMENT

- TABLE 10 ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 11 ANESTHESIA DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 12 ANESTHESIA DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 13 ANESTHESIA DEVICES MARKET FOR ANESTHESIA WORKSTATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 14 ANESTHESIA DEVICES MARKET FOR ANESTHESIA DELIVERY MACHINES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 15 ANESTHESIA DEVICES MARKET FOR ANESTHESIA VENTILATORS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 16 ANESTHESIA DEVICES MARKET FOR ANESTHESIA MONITORS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 17 ANESTHESIA DEVICES MARKET FOR OTHER DEVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 18 ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 19 ANESTHESIA DISPOSABLES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 ANESTHESIA DISPOSABLES MARKET FOR ANESTHESIA CIRCUITS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 ANESTHESIA DISPOSABLES MARKET FOR ANESTHESIA MASKS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 ANESTHESIA DISPOSABLES MARKET FOR ENDOTRACHEAL TUBES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 23 ANESTHESIA DISPOSABLES MARKET FOR LARYNGEAL MASK AIRWAYS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 ANESTHESIA DISPOSABLES MARKET FOR OTHER ACCESSORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 26 ANESTHESIA EQUIPMENT MARKET FOR ORTHOPEDICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 27 ANESTHESIA EQUIPMENT MARKET FOR NEUROLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 ANESTHESIA EQUIPMENT MARKET FOR RESPIRATORY CARE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 ANESTHESIA EQUIPMENT MARKET FOR UROLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 ANESTHESIA EQUIPMENT MARKET FOR CARDIOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 ANESTHESIA EQUIPMENT MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 33 ANESTHESIA EQUIPMENT MARKET FOR HOSPITALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 ANESTHESIA EQUIPMENT MARKET FOR CLINICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 35 ANESTHESIA EQUIPMENT MARKET FOR AMBULATORY SURGERY CENTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 36 ANESTHESIA EQUIPMENT MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 ANESTHESIA EQUIPMENT MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 38 EUROPE: ANESTHESIA EQUIPMENT MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 39 EUROPE: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 40 EUROPE: ANESTHESIA DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 41 EUROPE: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 42 EUROPE: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 43 EUROPE: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 44 GERMANY: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 45 GERMANY: ANESTHESIA DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 46 GERMANY: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 47 GERMANY: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 48 GERMANY: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 49 FRANCE: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 50 FRANCE: ANESTHESIA DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 51 FRANCE: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 52 FRANCE: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 53 FRANCE: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 54 UK: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 55 UK: ANESTHESIA DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 56 UK: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 57 UK: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 58 UK: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 59 ITALY: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 60 ITALY: ANESTHESIA DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 61 ITALY: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 62 ITALY: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 63 ITALY: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 64 SPAIN: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 65 SPAIN: ANESTHESIA DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 66 SPAIN: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 67 SPAIN: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 68 SPAIN: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 69 REST OF EUROPE: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 70 REST OF EUROPE: ANESTHESIA DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 71 REST OF EUROPE: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 72 REST OF EUROPE: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 73 REST OF EUROPE: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: ANESTHESIA EQUIPMENT MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: ANESTHESIA DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 80 US: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 81 US: ANESTHESIA DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 82 US: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 83 US: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 84 US: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 85 AGE-STANDARDIZED INCIDENCE RATES (ASIR) FOR SELECTED CANCERS IN MEN AND WOMEN, CANADA, 2020 VS. 2040

- TABLE 86 CANADA: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 87 CANADA: ANESTHESIA DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 88 CANADA: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 89 CANADA: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 90 CANADA: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: ANESTHESIA EQUIPMENT MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 92 ASIA PACIFIC: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: ANESTHESIA DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 96 ASIA PACIFIC: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 97 JAPAN: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 98 JAPAN: ANESTHESIA DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 99 JAPAN: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 100 JAPAN: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 101 JAPAN: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 102 CHINA: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 103 CHINA: ANESTHESIA DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 104 CHINA: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 105 CHINA: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 106 CHINA: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 107 INDIA: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 108 INDIA: ANESTHESIA DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 109 INDIA: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 110 INDIA: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 111 INDIA: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 112 AUSTRALIA: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 113 AUSTRALIA: ANESTHESIA DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 114 AUSTRALIA: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 115 AUSTRALIA: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 116 AUSTRALIA: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 117 SOUTH KOREA: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 118 SOUTH KOREA: ANESTHESIA DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 119 SOUTH KOREA: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 120 SOUTH KOREA: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 121 SOUTH KOREA: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 122 REST OF ASIA PACIFIC: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 123 REST OF ASIA PACIFIC: ANESTHESIA DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 124 REST OF ASIA PACIFIC: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 125 REST OF ASIA PACIFIC: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 126 REST OF ASIA PACIFIC: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 127 LATIN AMERICA: ANESTHESIA EQUIPMENT MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 128 LATIN AMERICA: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 129 LATIN AMERICA: ANESTHESIA DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 130 LATIN AMERICA: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 131 LATIN AMERICA: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 132 LATIN AMERICA: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 133 BRAZIL: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 134 BRAZIL: ANESTHESIA DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 135 BRAZIL: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 136 BRAZIL: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 137 BRAZIL: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 138 MEXICO: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 139 MEXICO: ANESTHESIA DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 140 MEXICO: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 141 MEXICO: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 142 MEXICO: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 143 REST OF LATIN AMERICA: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 144 REST OF LATIN AMERICA: ANESTHESIA DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 145 REST OF LATIN AMERICA: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 146 REST OF LATIN AMERICA: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 147 REST OF LATIN AMERICA: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: ANESTHESIA DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: ANESTHESIA DISPOSABLES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: ANESTHESIA EQUIPMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 153 ANESTHESIA EQUIPMENT MARKET: COMPETITIVE BENCHMARKING FOR KEY STARTUPS/SMES (2022)

- TABLE 154 ANESTHESIA EQUIPMENT MARKET: PRODUCT LAUNCHES & APPROVALS (JANUARY 2019–JUNE 2023)

- TABLE 155 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

- TABLE 156 AMBU A/S: BUSINESS OVERVIEW

- TABLE 157 DRAGERWERK AG & CO. KGAA: BUSINESS OVERVIEW

- TABLE 158 GE HEALTHCARE: BUSINESS OVERVIEW

- TABLE 159 BEIJING AEONMED CO., LTD.: BUSINESS OVERVIEW

- TABLE 160 MEDTRONIC PLC: BUSINESS OVERVIEW

- TABLE 161 GETINGE AB: BUSINESS OVERVIEW

- TABLE 162 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

- TABLE 163 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.: BUSINESS OVERVIEW

- TABLE 164 FISHER & PAYKEL HEALTHCARE CO. LTD.: BUSINESS OVERVIEW

- TABLE 165 MEDLINE INDUSTRIES INC.: BUSINESS OVERVIEW

- TABLE 166 SHENZHEN COMEN MEDICAL INSTRUMENTS CO., LTD.: BUSINESS OVERVIEW

- TABLE 167 ALLIED MEDICAL LIMITED: BUSINESS OVERVIEW

- TABLE 168 BPL MEDICAL TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 169 MEDEC INTERNATIONAL BV: BUSINESS OVERVIEW

- TABLE 170 SKANRAY TECHNOLOGIES LTD.: BUSINESS OVERVIEW

- FIGURE 1 ANESTHESIA EQUIPMENT MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

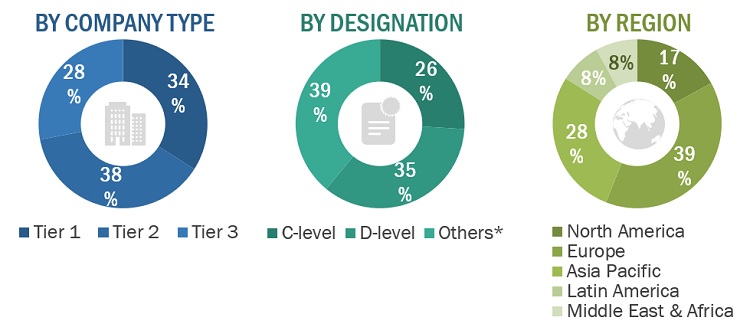

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

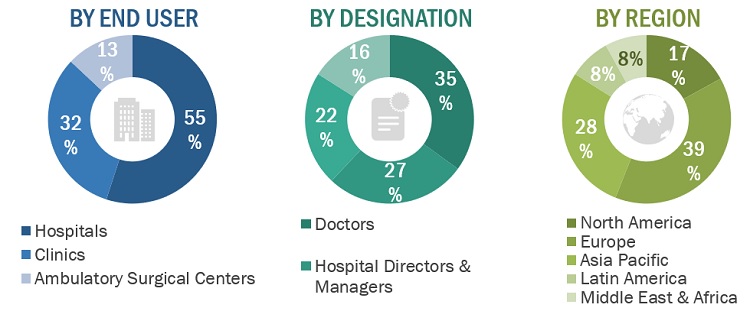

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION: KONINKLIJKE PHILIPS N.V.

- FIGURE 9 ANESTHESIA EQUIPMENT MARKET: SUPPLY-SIDE MARKET ESTIMATION

- FIGURE 10 ANESTHESIA EQUIPMENT MARKET: DEMAND-SIDE MARKET ESTIMATION

- FIGURE 11 ANESTHESIA EQUIPMENT MARKET: CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 12 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 13 TOP-DOWN APPROACH

- FIGURE 14 DATA TRIANGULATION METHODOLOGY

- FIGURE 15 ANESTHESIA EQUIPMENT MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 ANESTHESIA EQUIPMENT MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 GEOGRAPHICAL SNAPSHOT OF ANESTHESIA EQUIPMENT MARKET

- FIGURE 19 RISING NUMBER OF SURGICAL PROCEDURES TO DRIVE MARKET

- FIGURE 20 ANESTHESIA DEVICES SEGMENT IN JAPAN ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 21 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 22 EUROPE ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 23 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

- FIGURE 24 ANESTHESIA EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 ANESTHESIA EQUIPMENT MARKET: GDP GROWTH FORECAST COMPARISON (2020 VS. 2040)

- FIGURE 26 ANESTHESIA EQUIPMENT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 ANESTHESIA EQUIPMENT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 28 ANESTHESIA EQUIPMENT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 ANESTHESIA EQUIPMENT MARKET: GLOBAL PATENT PUBLICATION TRENDS (2015–2023)

- FIGURE 30 TOP APPLICANTS FOR ANESTHESIA EQUIPMENT PATENTS (2015–2023)

- FIGURE 31 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR ANESTHESIA EQUIPMENT PATENTS (2015–2023)

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR ANESTHESIA EQUIPMENT

- FIGURE 33 KEY BUYING CRITERIA FOR ANESTHESIA EQUIPMENT

- FIGURE 34 ANESTHESIA EQUIPMENT MARKET: GEOGRAPHICAL GROWTH OPPORTUNITIES

- FIGURE 35 EUROPE: ANESTHESIA EQUIPMENT MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: ANESTHESIA EQUIPMENT MARKET SNAPSHOT

- FIGURE 37 ANESTHESIA EQUIPMENT MARKET: REVENUE SHARE ANALYSIS OF KEY PLAYERS

- FIGURE 38 ANESTHESIA EQUIPMENT MARKET: MARKET SHARE ANALYSIS, BY KEY PLAYER (2022)

- FIGURE 39 ANESTHESIA EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (2022)

- FIGURE 40 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2022)

- FIGURE 41 AMBU A/S: COMPANY SNAPSHOT (2022)

- FIGURE 42 DRAGERWERK AG & CO. KGAA: COMPANY SNAPSHOT (2022)

- FIGURE 43 GE HEALTHCARE: COMPANY SNAPSHOT (2022)

- FIGURE 44 MEDTRONIC PLC: COMPANY SNAPSHOT (2022)

- FIGURE 45 GETINGE AB: COMPANY SNAPSHOT (2022)

- FIGURE 46 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2022)

- FIGURE 47 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.: COMPANY SNAPSHOT (2022)

- FIGURE 48 FISHER & PAYKEL HEALTHCARE CO. LTD.: COMPANY SNAPSHOT (2022)

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the usage of comprehensive secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the anesthesia equipment market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottommost level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Extensive primary research was conducted after obtaining information regarding the anesthesia equipment market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from anesthesia equipment vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. The primary sources from the supply side and demand side are detailed below.

A breakdown of the primary respondents is provided below:

Breakdown of Primary Interviews: Supply-Side Participants, by Company Type, Designation, and Region

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Breakdown of Primary Interviews: Demand-Side Participants, by End User, Designation, and Region

Note: Others include department heads, research scientists, and professors.

Market Size Estimation

The total size of the anesthesia equipment market was arrived at after data triangulation from two different approaches, as mentioned below. After each approach, the weighted average of all approaches was taken based on the level of assumptions used in each approach.

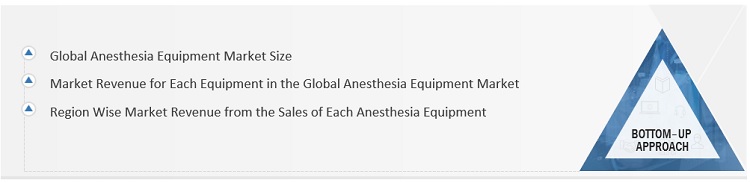

Global Anesthesia Equipment Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

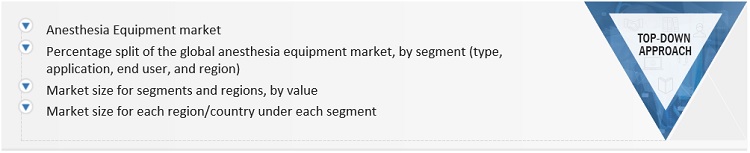

Global Anesthesia Equipment Market Size: Top-Down Approach

Data Triangulation

After arriving at the market size, the total market was divided into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures were employed, wherever applicable. The following figure shows the market validation, source structure, and data triangulation methodology implemented in this report’s market engineering process.

Market Definition

Anesthesia equipment refers to a collection of medical devices and instruments used during the administration and monitoring of anesthesia to ensure the safety and comfort of patients undergoing surgical procedures or other medical interventions. These devices are designed to deliver anesthetic agents, control the patient's airway, monitor vital signs, and provide respiratory support as needed.

Key Stakeholders

- Manufacturers of anesthesia equipment and related devices

- Suppliers and distributors of anesthesia equipment

- Hospitals, clinics, and medical colleges

- Independent surgeons and private offices of physicians

- Ambulatory surgery centers (ASCs)

- Teaching hospitals and academic medical centers

- Government bodies/municipal corporations

- Business research and consulting service providers

- Venture capitalists

- US Food and Drug Administration (US FDA)

- European Union (EU)

Objectives of the Study

- To describe, analyze, and forecast the anesthesia equipment industry, by type, application, end user, and region.

- To describe and forecast the anesthesia equipment market for key regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the anesthesia equipment market

- To strategically analyze the ecosystem, regulations, patenting trend, value chain, Porter’s five forces, and prices pertaining to the market under study

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market players.

- To profile key players and comprehensively analyze their market shares and core competencies2 in the anesthesia equipment market.

- To analyze competitive developments such as collaborations, acquisitions, product launches, expansions, and R&D activities in the anesthesia equipment market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the RoE anesthesia equipment market into Austria, Finland, and others

- Further breakdown of the RoLATAM anesthesia equipment market into Argentina, Colombia, Chile, and others

Competitive Landscape Assessment

- Market share analysis for the North America and Europe region, which provides market shares of the top 3–5 key players in the anesthesia equipment market

- Competitive leadership mapping for established players in the US

Growth opportunities and latent adjacency in Anesthesia Equipment Market