To determine the current size of the sterilization equipment market, this study engaged in four main activities. A comprehensive study was conducted using secondary research methods to gather data about the market, its parent market, and its peer markets. The next stage involved conducting primary research to confirm these conclusions, assumptions, and sizing with industry experts throughout the value chain. A combination of top-down and bottom-up methods was used to assess the overall market size. The market sizes of segments and subsegments were then estimated using data triangulation techniques and market breakdown.

The four steps involved in estimating the market size are

Collecting Secondary Data

Within the secondary data collection process, a range of secondary sources were reviewed so as to identify and gather data for this study, including regulatory bodies, databases (like D&B Hoovers, Bloomberg Business, and Factiva), white papers, certified publications, articles by well-known authors, annual reports, press releases, and investor presentations of companies.

Collecting Primary Data

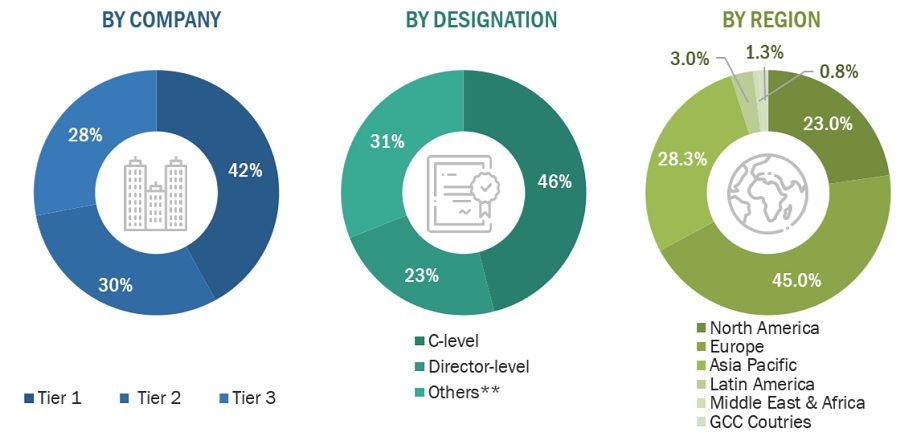

During the primary research phase, a comprehensive approach was adopted, involving interviews with a diverse array of sources from both the supply and demand sides. These interviews aimed to gather qualitative and quantitative data essential for compiling this report. Primary sources primarily comprised industry experts spanning core and related sectors, as well as favored suppliers, manufacturers, distributors, service providers, technology innovators, and entities associated with all facets of this industry's value chain. In-depth interviews were meticulously conducted with a range of primary respondents, including key industry stakeholders, subject-matter authorities, C-level executives representing pivotal market players, and industry advisors. The objective was to obtain and authenticate critical qualitative and quantitative insights and to evaluate future potentialities comprehensively.

A breakdown of the primary respondents is provided below:

Breakdown of Primary Participants:

Note 1: Others include sales, marketing, and product managers.

Note 2: Tiers of companies are defined based on their total revenue. As of 2023, Tier 1 = >USD 5 billion, Tier 2 = USD 500 million to USD 5 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME

|

DESIGNATION

|

|

Advanced Sterilization Products (ASP)

|

Area Business Manager

|

|

Getinge AB

|

Director of Research and Development

|

|

Steris

|

Sales Manager

|

|

3M

|

VP Marketing

|

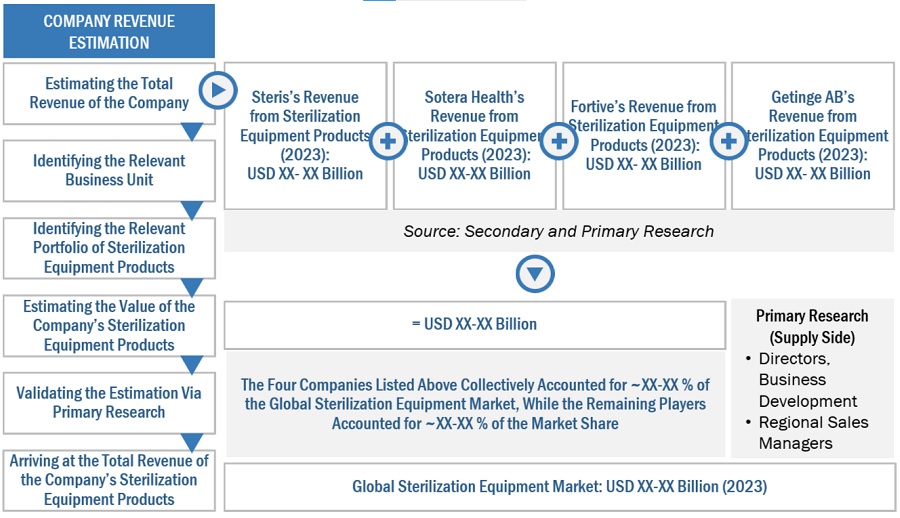

Market Size Estimation

All major product manufacturers offering various sterilization equipment market were identified at the global/regional level. Revenue mapping was done for the major players and was extrapolated to arrive at the global market value of each type of segment. The market value of in sterilization equipment market was also split into various segments and subsegments at the region and country level based on:

-

Product and services mapping of various manufacturers for each type of in sterilization equipment market at the regional and country-level

-

Relative adoption pattern of each sterilization equipment market among key application segments at the regional and/or country-level

-

Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country level.

-

Detailed secondary research to gauge the prevailing market trends at the regional and/or country level

Global Sterilization Equipment Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

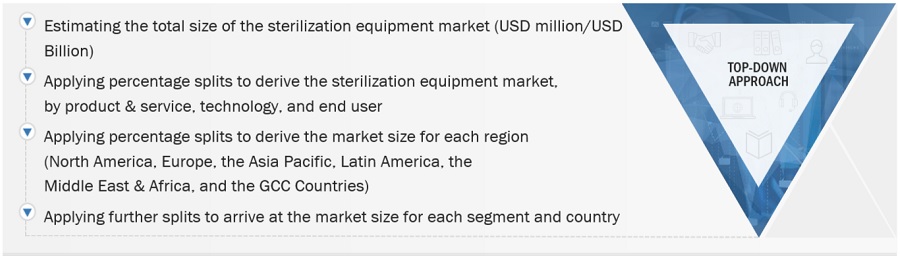

Global Sterilization Equipment Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Sterilization is a process that involves the removal of microorganisms and other pathogens from an object or surface by treating it with chemicals or subjecting it to high heat or radiation. Sterilization is an integral part of infection control procedures. Sterilization equipment are used to sterilize various products and supplies in end-user facilities, whereas consumables & accessories help monitor and simplify the sterilization process.

Key Stakeholders

-

Manufacturers of sterilization equipment, consumables, and accessories

-

Contract sterilization service providers

-

Pharmaceutical & biotechnology companies

-

Medical device manufacturers

-

Hospitals

-

Clinics

Report Objectives

-

To provide detailed information about the factors influencing the market growth (such as drivers, trends, opportunities, and challenges)

-

To define, describe, segment, and forecast the in sterilization equipment market by product & service, by technology, by end user, and by region

-

To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

-

To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall sterilization equipment market

-

To forecast the size of the sterilization equipment market in six main regions along with their respective key countries, namely, North America, Europe, the Asia Pacific, Latin America, Middle East & Africa, and GCC Countries.

-

To profile key players in the sterilization equipment market and comprehensively analyze their core competencies and market shares

-

To track and analyze competitive developments, such as product launches and approvals; expansions; and collaborations, of the leading players in the sterilization equipment market

-

To benchmark players within the sterilization equipment market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

MarketsandMarkets offers the following customizations for this market report

Country Information

-

Additional country-level analysis of the sterilization equipment market

Company profiles

-

Additional 3 company profiles of players operating in the sterilization equipment market.

Product Analysis

-

Product matrix, which provides a detailed comparison of the product portfolio of each company in the sterilization equipment market.

Growth opportunities and latent adjacency in Sterilization Equipment Market