Animal Parasiticides Market Size, Growth, Share & Trends Analysis

Animal Parasiticides Market by Type (Ectoparasiticides, Endoparasiticides, Endectocides), Animal Type (Dogs, Cats, Horses, Cattle, Pigs, Poultry), End User (Veterinary Hospitals, Animal Farms, Home Care Settings), & Region - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

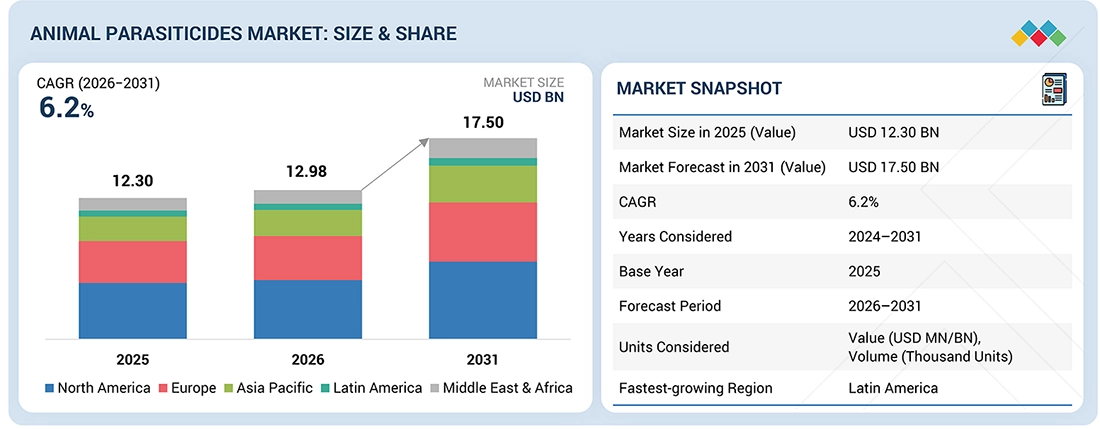

The global animal parasiticides market, valued at USD 12.30 billion in 2025, stood at USD 12.98 billion in 2026 and is projected to advance at a resilient CAGR of 6.2% from 2026 to 2031, culminating in a forecasted valuation of USD 17.50 billion by the end of the period. The market is fueled by the increasing cases of ecto- and endoparasites in companion and food-producing animals, growing focus on the preventive management of parasites, and the rising number of pet owners worldwide. Advances in the development of parasiticides, such as combination therapies and long-acting treatments, along with the growing awareness of the transmission of zoonotic diseases, are also fueling the adoption of effective parasite control measures.

KEY TAKEAWAYS

-

By RegionLatin America is expected to register the highest CAGR of 7.7% during the forecast period (2026-2031).

-

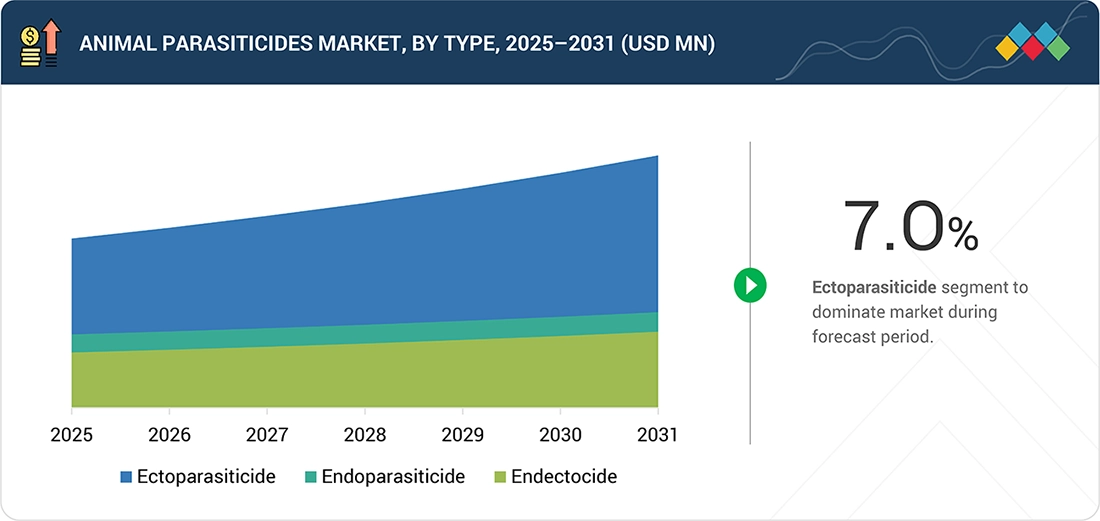

By TypeBy type, the ectoparasiticides segment is expected to register the highest CAGR of 7.0% during the forecast period.

-

By Animal TypeBy animal type, the companion animals segment accounted for the largest market share (57.8%) in 2025.

-

By End UserBy end user, the veterinary hospitals & clinics segment dominated the market with a share of 61.1% in 2025.

-

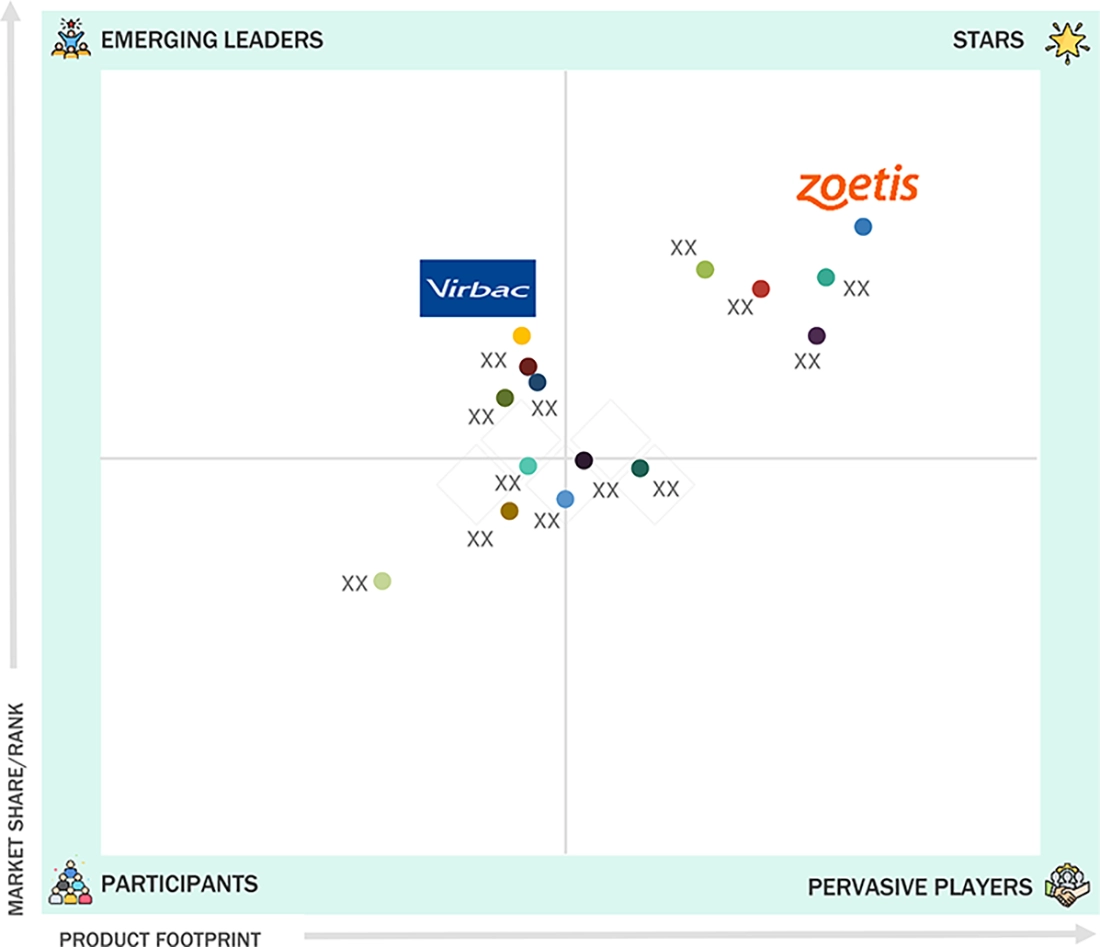

Competitive Landscape - Key PlayersZoetis Services LLC, Merck & Co., Inc., and Elanco were identified as some of the star players in the animal parasiticides market, given their extensive global reach and comprehensive product portfolios.

-

Competitive Landscape - StartupsECO - Animal Health Ltd., Biogénesis Bagó, and Chanelle Pharma, among others, have distinguished themselves among startups and SMEs due to their specialized veterinary expertise and focused product capabilities.

The animal parasiticides market is expanding rapidly. The major factors contributing to this growth are increased expenditure on pet healthcare, the rising awareness of the need for parasite prevention throughout the year, and the strong market receptivity to novel, easy-to-administer treatment solutions. Some new technologies defining the market are the long-acting and extended-release formulations, combination endectocide products that provide broad-spectrum parasite control in a single dose, and advanced topical and oral delivery mechanisms that not only increase drug efficacy but also make it easier for patients to follow the treatment regimen. Besides that, the increasing use of digital health tools and data analytics for preventive care and ensuring treatment adherence is making it easier for people to adopt products. Moreover, pharmaceutical companies, veterinary networks, and technology providers' widening partnerships are indications of the accelerated product development and commercialization activities resulting in the animal parasiticides market's continued growth.

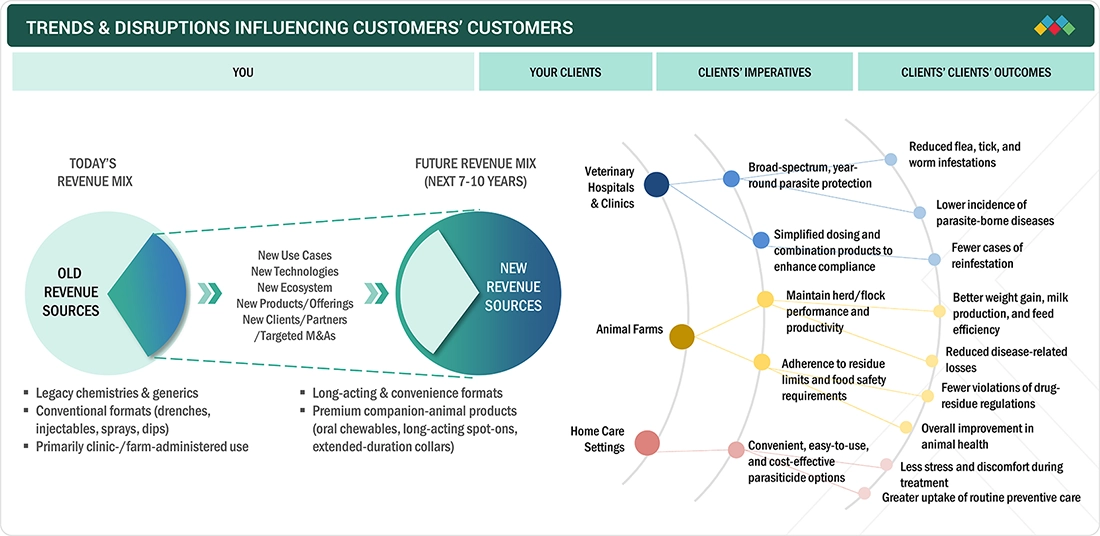

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The effect on the consumer businesses in the animal parasiticides market is due to the rising focus on preventive pet care, the prevalence of parasitic infections, and the concerns about resistance and zoonotic transmission. Veterinary practices, animal healthcare firms, and pet care operators are becoming more and more reliant on safe, broad-spectrum, and long-acting parasiticide solutions that provide year-round protection, improve owner compliance, and provide better outcomes. The need to provide convenient, fast-acting, and comprehensive parasite control while adjusting to the changing patterns of parasites and treatment modalities based on lifestyle trends is fueling the adoption of innovative parasiticide solutions. The rising need for effective and reliable parasitic protection is fueling the reliance on innovative parasiticide solution providers, which has a significant influence on the market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising pet ownership and increased focus on preventive animal healthcare

-

Growing prevalence of ecto- and endoparasites

Level

-

Strict regulations on parasiticide residues in food-producing animals

-

High cost of premium and combination parasiticide products

Level

-

Development of long-acting, combination, and novel-delivery parasiticides

-

Expansion of parasiticide adoption in emerging markets

Level

-

Increasing parasite resistance to existing active ingredients

-

Stringent regulatory approval processes and varying regional compliance requirements

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising pet ownership and increased focus on preventive animal healthcare

The increasing number of pet owners across the globe, especially in urban and developing countries, along with the rising awareness of preventive animal healthcare, is a major driving factor for the animal parasiticides market. Pet owners and animal farmers are now focusing on the regular prevention of parasites to prevent costly treatments, losses, and zoonoses. This is further fueled by the development of veterinary care, rising disposable income, and the humanization of pets.

Restraint: Strict regulations on parasiticide residues in food-producing animals

Market expansion in the livestock sector remains constrained because strict regulations that control parasiticide levels in food-producing animals create obstacles for market development. Regulatory bodies enforce maximum residue limits (MRLs) to ensure consumer food safety, which results in increased development costs and extended product approval periods, and limits the availability of specific active ingredients. Product launches become more challenging for manufacturers operating in multiple regions because they must deal with different regional regulations, which create additional compliance requirements, in turn limiting market growth for their products.

Opportunity: Development of long-acting, combination, and novel-delivery parasiticides

The market shows substantial potential to expand through the introduction of long-acting parasiticides, combination products, and upcoming delivery systems. Products that provide extended protection, target multiple parasites, and reduce dosing frequency improve compliance among animal owners and veterinarians. Premiumization and product differentiation in the parasiticides market will experience growth because of ongoing formulation technology advancements, which include sustained-release injectables and palatable oral formulations, along with the rising market presence of emerging economies.

Challenge: Increasing parasite resistance to existing active ingredients

The animal parasiticides market faces its main obstacle because parasites develop resistance against all current active ingredients. The repeated use of chemical classes has led to their decreased effectiveness against specific parasite populations, which are found in intensive livestock systems. The challenge requires higher R&D expenses while it delays product development, and the market requires integrated parasite management with active ingredient rotation and better surveillance systems to achieve sustainable growth.

ANIMAL PARASITICIDES MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides a wide parasiticide portfolio for companion animals (e.g., Simparica, Revolution/Stronghold) and livestock, along with vaccines, diagnostics, and other animal health solutions marketed globally. | Enables broad, cross-species parasite control and improves preventive care and herd/clinic productivity through well-known and trusted brands. |

|

Develops and commercializes parasiticides such as the BRAVECTO range, including long-acting formulations for fleas, ticks, and internal parasites in pets and livestock worldwide. | Increases treatment adherence with extended-duration protection and reduces parasite load, supporting better outcomes for veterinarians and owners. |

|

Offers parasiticides for both companion and production animals, supported by strong global R&D capabilities and extensive distribution networks. | Delivers effective, preventive, and therapeutic parasite control across species and helps meet the everyday needs of veterinary practices in Asia Pacific. |

|

Supplies parasiticides as part of a broader veterinary pharmaceutical portfolio for pets and livestock, targeting fleas, ticks, mites, internal worms, and related conditions. | Improves animal health and farm efficiency by providing veterinarians and farmers with dependable parasite management options. |

|

Provides a diverse range of external and internal parasiticides for companion animals and livestock, backed by localized subsidiaries and regional R&D. | Offers region-tailored parasite control solutions that strengthen veterinary care and support consistent prevention and treatment. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem in the animal parasiticides market consists of different players, each of whom is crucial to the development, distribution, and use of solutions for controlling parasites. At the top of the list are animal health firms that are developing and producing parasiticides for companion animals and farm animals. These are followed by veterinary distributors and practices like veterinary hospitals & clinics and animal farms, which are the main end users of these products. Emerging players include technology firms that are providing online platforms for monitoring treatment compliance and resistance.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Animal Parasiticides Market, By Type

In?????? 2025, ectoparasiticides held the largest share of the animal parasiticides market because external parasites like fleas, ticks, and mites infest both companion animals and livestock. The ongoing need for preventive treatment solutions exists because these parasites remain present in the environment. The segment experienced growth because people widely adopted topical treatments, collars, and oral formulations to treat fleas and ticks. The market dominance of ectoparasiticides receives support from their common application in preventive care routines.

Animal Parasiticides Market, By Animal Type

In 2025, the companion animal segment held the largest share of the animal parasiticides market because of the increased adoption of pets, which led to higher spending on preventive health treatments. The ongoing requirement for parasiticides results from companion animals receiving continuous flea and tick and internal parasite treatment throughout the year. The segment remains dominant because customers maintain high veterinarian contact while premium long-lasting products stay on the market and awareness about parasite diseases increases.

Animal Parasiticides Market, By End User

By end user, the animal parasiticides market is estimated to be dominated by veterinary hospitals and clinics, because these facilities serve as the main location for diagnosing parasites and prescribing their treatment. Veterinary doctors help pet owners and livestock farmers choose the right products and preventive treatments, resulting in them using more prescription-based and high-priced parasiticides through veterinary clinics. The combination of long-acting products and combination products, as well as the increase in preventive veterinary visits, has established veterinary hospitals and clinics as the leading centers for distributing and using parasiticide products.

REGION

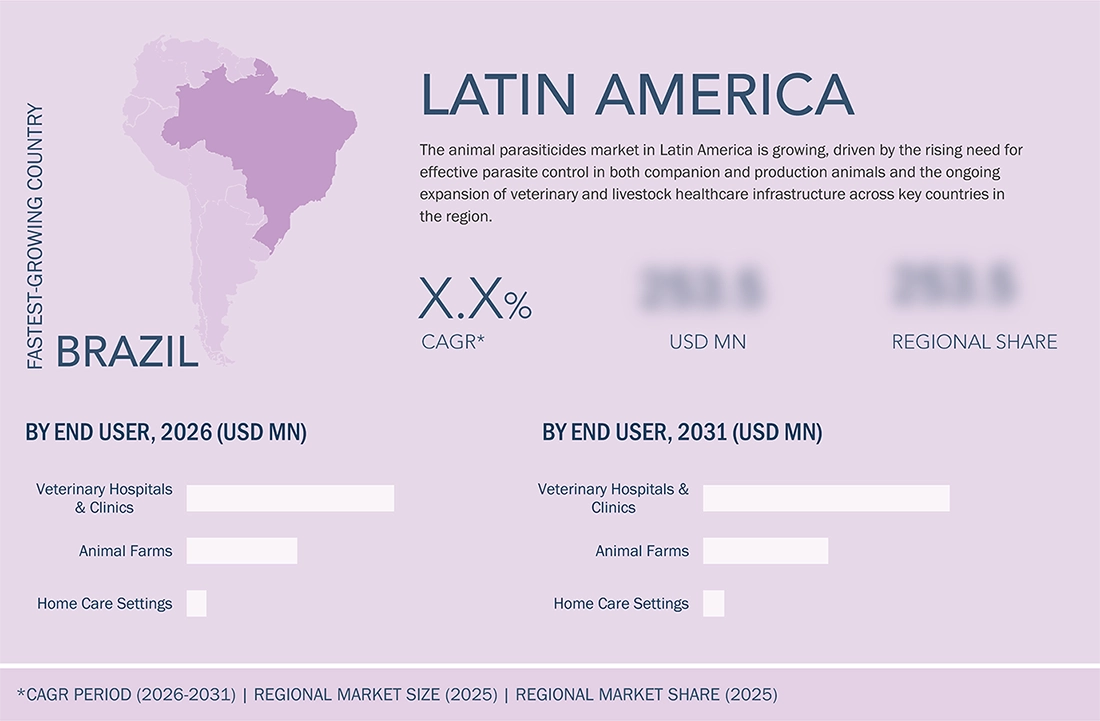

Latin America to be fastest-growing region in global parasiticides market during forecast period

Latin America is projected to be the fastest-growing regional market for animal parasiticides, owing to livestock production intensification, rise in pet ownership, and consumer awareness regarding the significance of parasite control as well as preventive animal healthcare. Due to the region's warm climate, parasites proliferate throughout the year, which is why there is constant demand for both ecto and endoparasiticides. Better veterinary services, the use of sophisticated animal health products, and the coming together of global and regional animal health companies for increased investments also contribute to the acceleration of market growth in Latin America.

ANIMAL PARASITICIDES MARKET: COMPANY EVALUATION MATRIX

In the animal parasiticides market, Zoetis (Star) is supported by a wide range of ectoparasiticides, endoparasiticides, and endectocides for both companion and production animals in its portfolio. It is supported with the leadership of the company from the continued investment in R&D, product innovations, a global distribution and veterinary network that facilitates deep market penetration and brand loyalty. Meanwhile, Virbac (Emerging Leader) is turning out to be a great challenger, especially in the field of companion animal parasiticides, carrying the torch of a veterinary-led approach through the offerings of the company, differentiated formulations, and a progressive move to the new regional markets.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Zoetis Services LLC (US)

- Merck & Co., Inc. (US)

- Elanco (US)

- Boehringer Ingelheim International GmbH (Germany)

- Virbac (France)

- Vetoquinol (France)

- Dechra Pharmaceuticals PLC (UK)

- Phibro Animal Health Corporation (US)

- Norbrook (UK)

- Bimeda Corporate (Ireland)

- krka (Slovenia)

- Ourofino Saúde Animal (Brazil)

- Sequent (India)

- PetIQ, LLC (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 12.30 BN |

| Market Forecast in 2031 (Value) | USD 17.50 BN |

| Growth Rate | CAGR of 6.2% from 2026 to 2031 |

| Years Considered | 2024-2031 |

| Base Year | 2025 |

| Forecast Period | 2026-2031 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Related Segment & Geographic Reports | APAC Animal Parasiticides Market |

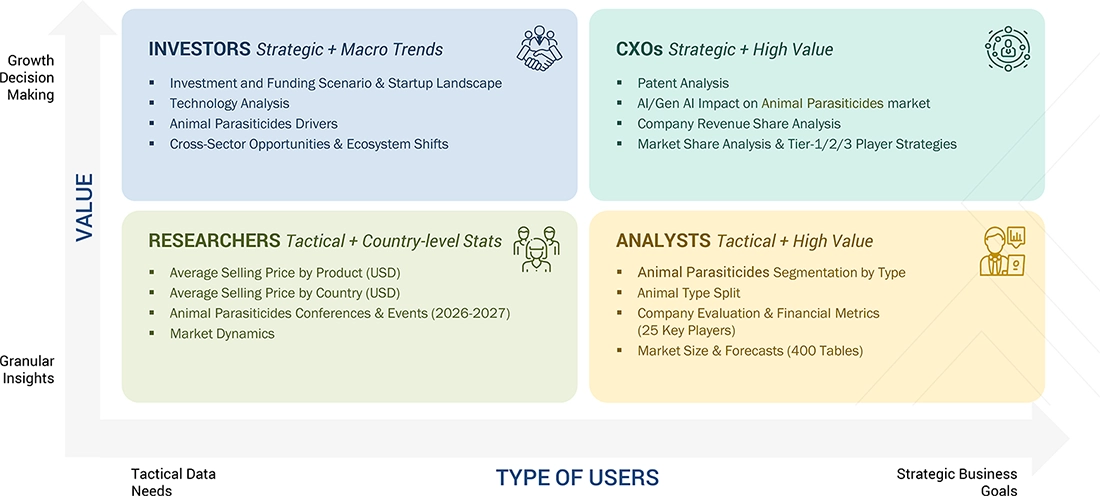

WHAT IS IN IT FOR YOU: ANIMAL PARASITICIDES MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Compared different key parasiticide types for animals, such as ectoparasiticides, endoparasiticides, and endectocides. Evaluated whether used for prevention or treatment, by animal type (pets versus livestock), and product differentiation among major companies. | Facilitated clarity into product maturity, usage dynamics, and demand gaps, thereby aiding in portfolio optimization, pricing decisions, and prioritized focus on high-growth parasiticide markets. |

| Company Information | Profiled major animal health firms such as Zoetis, MSD Animal Health, Boehringer Ingelheim, Elanco, Virbac, and major local players. | Assessed their product portfolios, R&D investments, manufacturing, and distribution networks. |

| Geographic Analysis | Carried out in-depth regional analysis in China, India, Japan, Australia, and Rest of APAC regarding the prevalence of parasitic diseases, farm animal density, and companion animal market trends. | Assisted in the development of regional strategies for finding the fastest-growing countries, the level of complexity for regulations, opportunities for localizations, and markets to pursue in the APAC region. |

RECENT DEVELOPMENTS

- July 2025 : Merck & Co., Inc. announced that the US FDA approved BRAVECTO QUANTUM, an extended-release injectable suspension administered once annually to provide treatment and protection for dogs against fleas and ticks.

- April 2025 : Zoetis Services LLC reported that the US FDA approved an expanded indication for Simparica Trio, a combination canine parasiticide that also prevents flea-transmitted tapeworm infections.

- April 2024 : Zoetis Services LLC and Phibro Animal Health Corporation entered into a definitive agreement under which Phibro acquired Zoetis’ medicated feed additive portfolio, including selected water-soluble products and related assets, for USD 350 million.

Table of Contents

Methodology

This research study extensively utilized both primary and secondary sources. It involved analyzing various factors influencing the industry to identify segmentation types, industry trends, key players, the competitive landscape, key market dynamics, and strategies employed by key players.

Secondary Research

This research study utilized a variety of comprehensive secondary sources, including directories, databases such as Bloomberg Business, Factiva, and Dun & Bradstreet, white papers, annual reports, company house documents, investor presentations, and SEC filings from various companies. Secondary research was employed to gather information crucial for an in-depth, technical, market-oriented, and commercial analysis of the animal parasiticides market. This approach also helped identify key players in the industry and allowed for classification and segmentation based on emerging trends at the most detailed level. Furthermore, significant developments pertaining to both market and technological perspectives were documented. A database of primary industry leaders was created as part of this secondary research.

Primary Research

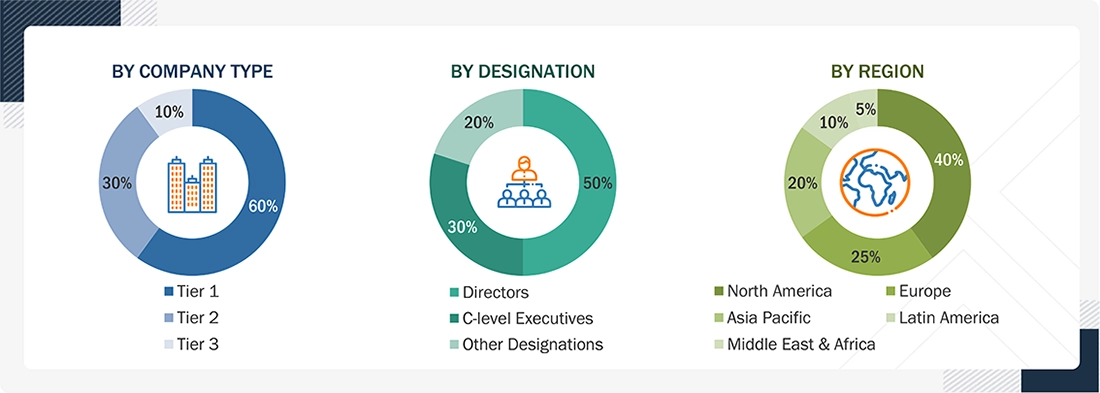

In the primary research process, a range of sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information for this report. Primary sources from the supply side included project/sales/marketing/business development managers, presidents, CEOs, vice presidents, chairpersons, chief operating officers, chief strategy officers, directors, chief information officers, and chief medical information officers related to the animal parasiticides market. Primary sources from the demand side included R&D and product development teams at animal health companies, veterinary clinicians, procurement managers at veterinary hospitals and clinics, and purchasing heads across livestock farms and animal health distribution networks.

A breakdown of the primary respondents is provided below:

Note: Tiers are defined based on a company’s total revenue. As of 2025: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million. C-level executives include CEOs, COOs, CTOs, and VPs. Other designations include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

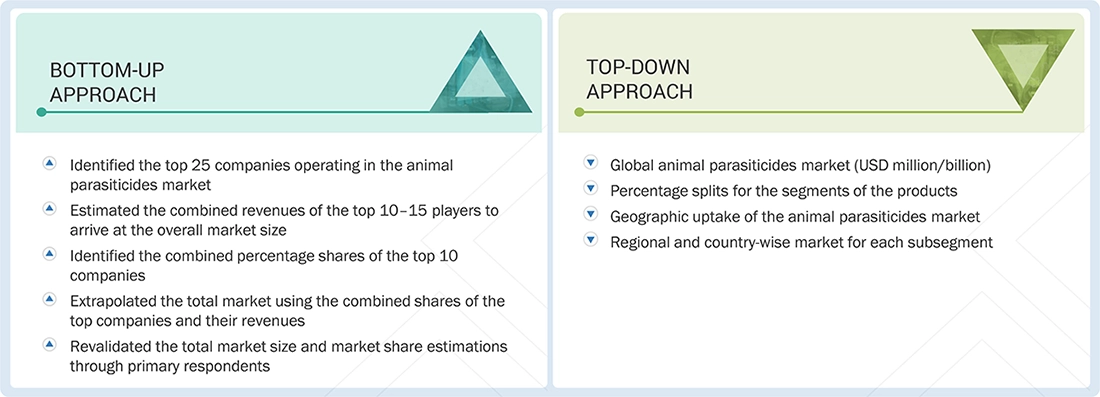

Market Size Estimation

The total size of the animal parasiticides market was determined after data triangulation from three approaches, as mentioned below. After each approach, the weighted average of the three approaches was taken based on the level of assumptions used in each approach.

Animal Parasiticides Market: Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Market Definition

Animal parasiticides or antiparasitics are medications used to prevent, mitigate, and treat internal and external parasitic infestations in companion and livestock animals. Parasiticides are usually categorized as endoparasiticides, ectoparasiticides, and endectocides. They are available in various formulations, such as oral liquids, tablets, injectables, pour-ons, spot-ons, drenches, ear tags, collars, and sprays. A parasiticide is selected depending on the type of parasite, type of animal, and the number of animals to be treated.

Key Stakeholders

- Animal Parasiticide Manufacturers

- Animal Parasiticide Distributors

- Animal Health R&D Companies

- Veterinary Clinics and Hospitals

- Veterinary Pharmaceutical Associations

- Veterinary Research Institutes and Universities

- Venture Capitalists and Investors

- Market Research and Consulting Firms

- Government Associations

Report Objectives

- To define, describe, segment, and forecast the animal parasiticides market by type, animal type, end user, and region

- To provide detailed information about the factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market in five main regions (along with their respective key countries): North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as acquisitions, product launches, expansions, collaborations, agreements, and partnerships

Available customizations:

With the given market data, MarketsandMarkets offers customizations to meet your company’s specific needs. The following customization options are available for the report:

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Regional Analysis

-

Further breakdown of the Rest of Europe animal parasiticides market into Austria, Finland, Switzerland, and other countries

-

Further breakdown of the Rest of Latin America animal parasiticides market into Colombia, Chile, and other countries

Competitive Landscape

-

Market share analysis for North America and Europe, which provides market shares of the top 3–5 key players in the animal parasiticides market

Competitive leadership mapping for established players in the US

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Animal Parasiticides Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Animal Parasiticides Market