Antifreeze Proteins Market by Type (Type I, Type III, Antifreeze Glycoproteins), End-use (Medical, Cosmetics, Food), Source (Fish, Plants, Insects), Form, and Region(North America, Europe, Asia Pacific, South America, RoW) - Global Forecast to 2028

Antifreeze Protein Market Size, Share & Analysis Report, 2028

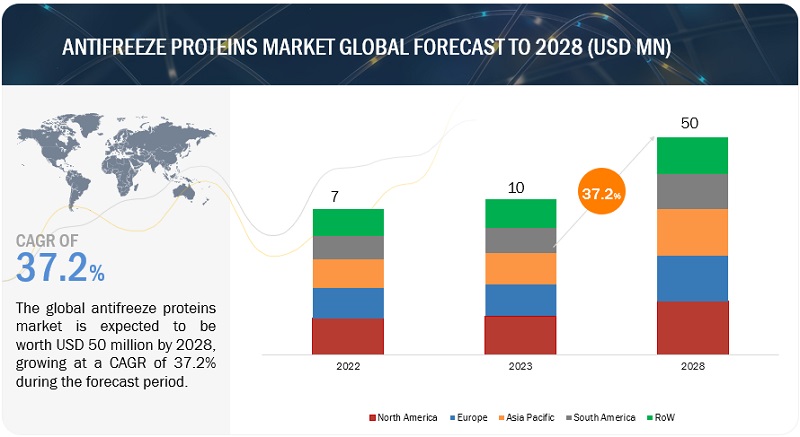

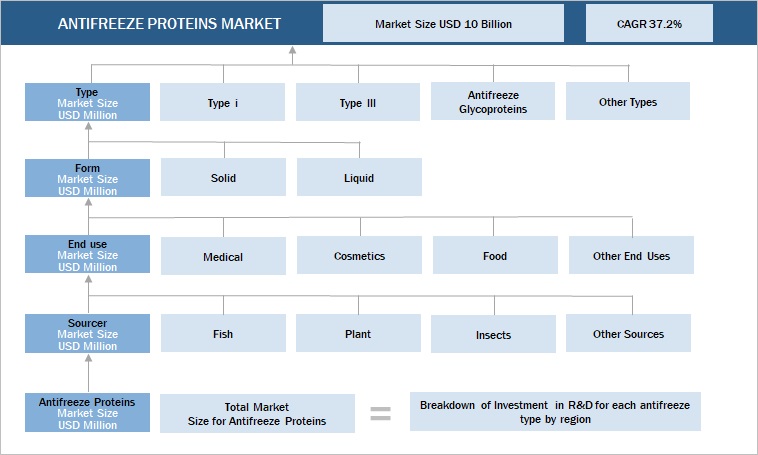

[199 Pages Report] The global antifreeze proteins market is estimated to be valued at USD 10 million in 2023 and it is projected to reach USD 50 million in 2028, growing at a CAGR of 37.2%. The factors driving the growth are the increasing demand for skin products, frozen foods, medicinal products, and the shift in focus of health-conscious consumers, and rising awareness of food nutrition supports the adoption of antifreeze proteins. The antifreeze protein market is driven by their rising usage in frozen food products globally. They also facilitate the cold storage of fresh food for trade which ensures the maintenance of food quality till the food reaches the end users thus their usage is growing.

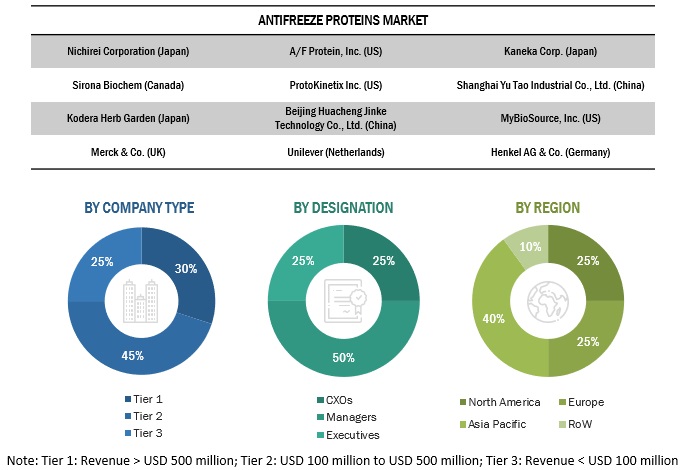

The expanding business has offered lucrative business opportunities to the players who are operating in the market segments. For instance, Unilever expanded its R&D capability by opening with a Foods Innovation Centre on the Wageningen University campus, with an investment of USD 96.92 million in the new center. It will lead its global foods innovation program for its brands. The overall antifreeze proteins market is classified as a consolidates market, with the top 5 key players namely Nichirei Corporation (Japan), A/F Protein Inc. (US), Kaneka Corporation (Japan), Unilever (Netherlands), Sirona Biochem (Canada), occupying >50% of the market share.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Antifreeze Proteins Market Dynamics

Driver: Rising awareness of benefits associated with antifreeze proteins

Antifreeze proteins are also known as ice structuring proteins which are produced by different fish, plants, insects, bacteria, and fungi to survive in sub-zero conditions. These work by binding to ice crystals in order to inhibit their growth. AFPs can block forming of ice crystals in fish and insects by lowering the freezing temperature in the body. Due to this mechanism, antifreeze proteins find a wide range of applications in the medical, cosmetics, and food industries.

Restraint: High cost of production and R&D expenditure

Any company involved in the extraction and manufacturing of antifreeze proteins incurs the high cost of research and development. The extraction of these antifreeze proteins from different sources requires complex instruments and research methods, which increases the overall production cost and price of the antifreeze proteins. Additionally, it also requires complex instruments and hence there are a lot of collaboration seen by key players with research institutes.

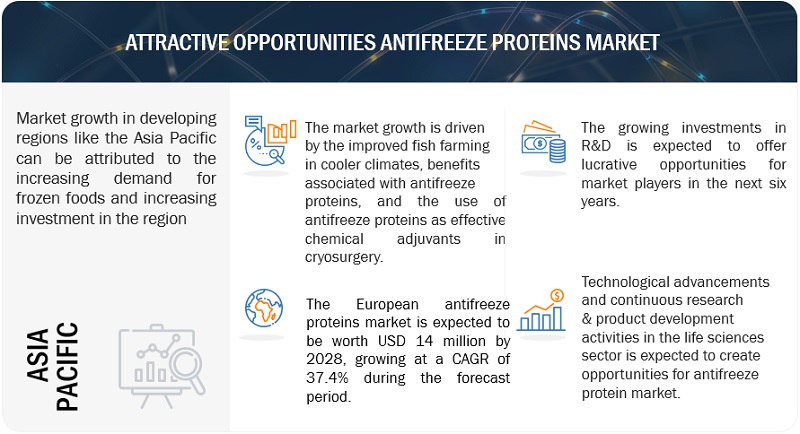

Opportunity: Emerging markets in developing regions presenting growth opportunities in the antifreeze protein market

The new generations always opt for convenience, due to its ease of availability. Technology innovation has provided engaging experiences for consumers. There has been a gradual shift in consumer choice towards conventional and sustainable products. Additionally, there has been a spike in demand for cosmetics and vaccines in developing countries like Brazil, India, etc., To fulfill the growing demand for these products which require antifreeze proteins, the market is set to expand in emerging economies.

Challenge: Adverse effects of vegan trends on antifreeze proteins from animal sources

Fish is the most prominent and accepted source of antifreeze proteins, however, due to the growing vegan population around the globe consumers are opting for animal-free ingredients. There are other sources from where antifreeze proteins can be obtained like bacteria, fungi, plants, insects, etc. However, extraction from these sources are very new or at a nascent stage due to which the acceptability of fish antifreeze proteins among vegan population is less and can be a challenging factor in the market growth.

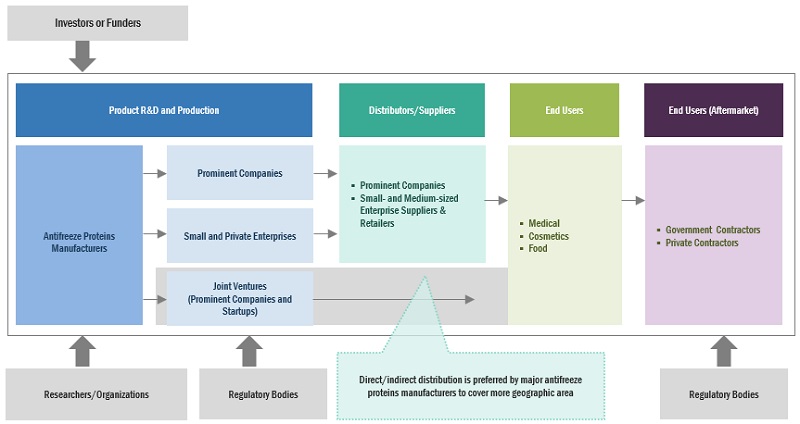

Antifreeze Proteins Market Ecosystem

Based on Type, Type III is anticipated to grow at a significant CAGR in the market

Type III marine collagen is mainly extracted from fish and is the second most important and viable source of antifreeze proteins. It works effectively in combination with type I and the medical and cosmetic industries create the highest demand for type III antifreeze proteins, owing to its diversified usage across multiple applications.

The liquid form segment is projected to occupy the second-largest market share in antifreeze protein market during the forecast period.

Liquid form occupies the second-largest market share in the antifreeze proteins market, due to its increasing application in cryopreservation. Though the liquid form has very less application as compared to the solid form, it finds its wider application in the cosmetics and cryopreservation in the pharmaceutical sectors.

Based on end use, the medical segment is projected to occupy the largest market share during the forecast period.

The medical segment largely demands antifreeze proteins due to its anti-infectant properties against viruses, bacteria, fungi. Food safety authorities have approved the use of antifreeze proteins in pharmaceutical products due to its multiple health benefits. It is relatively easily absorbed into the human body as a result, it provides better healing and repair opportunities.

Based on source, the insects segment is projected to grow at the highest CAGR during the study period

Insect antifreeze proteins is a high-quality protein extracted from various types of insects such as crickets, black soldier flies, mealworms, ants, and grasshoppers. Insects such as grasshoppers and beetles are also used as medicines to treat zoonotic diseases as well as human diseases. Although the acceptance of the use of grasshoppers in the pharmaceutical application is at a preliminary stage.

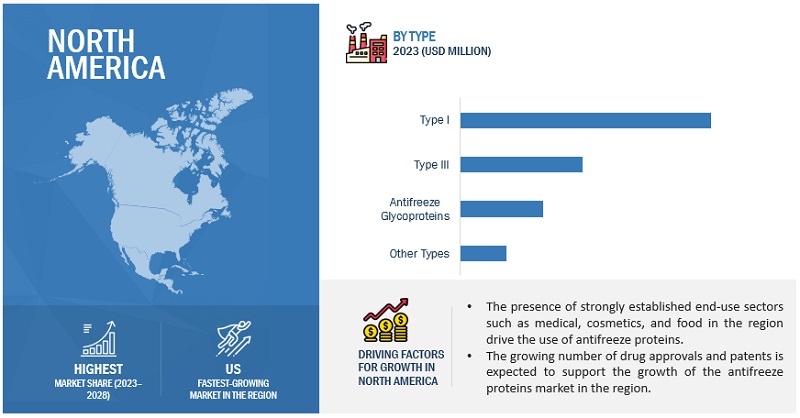

North America: Antifreeze Proteins Market Snapshot

North America holds the highest market share during the forecast period.

North America accounted for the largest antifreeze proteins market share in 2022. The antifreeze protein market in the North American region is largely driven by growing consumer awareness toward environmental sustainability. The region offers an excellent growth opportunity for the manufacturers of antifreeze proteins. Most of the players operating in the antifreeze proteins market are operating in the region and have a strong global presence. Moreover, North America is among the biggest consumer of packed and frozen foods. The region also offers increasing demand for different cosmetics and medicinal products, which are major end-user applications of antifreeze proteins. The region is mainly dominated by a large number of consumers and strong investment in R&D and technological advancements are expected to have a positive impact on the domestic production of antifreeze proteins in North America. These factors drive the market for antifreeze proteins in the North American region.

Key Market Players

Key players in this market include Nichirei Corporation (Japan), A/F Protein Inc. (US), Kaneka Corporation (Japan), Unilever (Netherlands), Sirona Biochem (Canada), ProtoKinetix, Inc. (US), Shanghai Yu Tao Industrial Co., Ltd. (China), Kodera Herb Garden Co., Ltd (Japan), Beijing Huacheng Jinke Technology Co., Ltd. (China), Rishon Biochem Co., Ltd (China), and MyBioSource, Inc. (US).

Antifreeze Protein Market Scope

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD), Volume (Grams) |

|

Segments Covered |

Type, Form, End use, Source, and Region |

|

Regions covered |

North America, Europe, South America, Asia Pacific, and RoW |

|

Companies studied |

|

Target Audience:

- Supply-side: antifreeze proteins producers, suppliers, distributors, importers, and exporters

- Demand-side: Large-scale cosmetics manufacturers, medicinal product manufacturers, food ingredient manufacturers, and research organizations

- Regulatory side: Related government authorities, commercial Research & Development (R&D) institutions, and other regulatory bodies

- Other related associations, research organizations, and industry bodies:

Antifreeze Protein Market Segmentation:

This research report categorizes the antifreeze proteins market, type, form, end use, source, and region.

By Type

- Type I

- Type III

- Antifreeze Glycoproteins

- Other Types

By Form

- Solid

- Liquid

By End use

- Medical

- Cosmetics

- Food

- Other end uses

By Source

- Fish

- Plants

- Insects

- Other sources

By Region

- North America

- Europe

- Asia Pacific

- South America

- RoW

Recent Developments in Antifreeze Protein Market

- In August 2022, Beijing Huacheng Jinke Technology launched 2 different type I antifreeze membranes which are specific glycopeptides, and peptides made by different organisms to allow cells to survive in sub-zero conditions.

- In December 2021, Kaneka Corporation launched a series of type I antifreeze proteins for different food applications like noodles and rice. With the launch of these products, the company expanded its footprint in the food industry to cater to its different applications.

- In May 2021, Unilever announced that it would partner with ENOUGH, a food tech company, to bring new plant-based frozen food products. ENOUGH’s technology uses a unique zero-waste fermentation process to grow a high-quality frozen food product. This unique product will be apt for Unilever’s fast-growing food segments.

Frequently Asked Questions (FAQ):

Which are the major companies in the antifreeze proteins market? What are their major strategies to strengthen their presence?

Some of the key companies operating in the Nichirei Corporation (Japan), A/F Protein Inc. (US), Kaneka Corporation (Japan), Unilever (Netherlands), Sirona Biochem (Canada), ProtoKinetix, Inc. (US), Shanghai Yu Tao Industrial Co., Ltd. (China), Kodera Herb Garden Co., Ltd (Japan), Beijing Huacheng Jinke Technology Co., Ltd. (China), Rishon Biochem Co., Ltd (China), and MyBioSource, Inc. (US) and many more. In the past few years, the companies have adopted strategies such as joint ventures, partnerships, agreements, etc., to strengthen their market presence.

What are the drivers and opportunities for the antifreeze protein market?

Advancement in technology to enhance fish farming in cooler climate: There has been different techniques and technology which enables the production of antifreeze proteins on the laboratory scale. Additionally, increase in investment in R&D and innovations to strengthen demand for antifreeze proteins. These are the drivers and opportunities of the antifreeze proteins market.

Which is the biggest regional market for fish antifreeze proteins market?

The market for fish antifreeze proteins will be dominated by the North American market in 2022, showcasing strong demand from companies manufacturing antifreeze proteins. The region is growing drastically by companies investing in manufacturing facilities, which further fuels the demand.

What is the total CAGR projected to be recorded for the medical segment market from 2023 to 2028?

The CAGR is expected to be 37.2% from 2023 – 2028

What kind of information is provided in the competitive landscape section?

For the list of players mentioned, company profiles provide insights such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix and key developments associated with the company.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising awareness of benefits associated with antifreeze proteins- Advancements in technology to enhance fish farming in cooler climates- Uses of antifreeze proteins as effective chemical adjuvants in cryosurgeryRESTRAINTS- High cost of production and R&D expenditure- Market consolidation limiting free entry for new playersOPPORTUNITIES- Increase in investments in R&D and innovations to strengthen demand for antifreeze proteins- Emerging markets in developing regions presenting growth opportunitiesCHALLENGES- Limited use in food applications- Adverse effects of vegan trend on antifreeze proteins from animal sources

- 6.1 INTRODUCTION

- 6.2 TRENDS IMPACTING CUSTOMERS’ BUSINESSES

-

6.3 PRICING ANALYSISAVERAGE SELLING PRICE TREND ANALYSIS

-

6.4 VALUE CHAINRESEARCH & PRODUCT DEVELOPMENTRAW MATERIAL SOURCINGPRODUCTION AND PROCESSINGDISTRIBUTIONMARKETING & SALES

-

6.5 MARKET MAPPING AND ECOSYSTEM OF ANTIFREEZE PROTEINSDEMAND SIDESUPPLY SIDE

- 6.6 TRADE DATA: ANTIFREEZE PROTEINS MARKET

-

6.7 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.8 TECHNOLOGY ANALYSISCRYOPRESERVATION OF FISH EMBRYOS AND GAMETESTRANSGENESIS FOR FROST-RESISTANT CROPS

-

6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES & EVENTS IN 2023–2024

-

6.11 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSANTIFREEZE PROTEINS MARKET REGULATIONS IN NORTH AMERICA- US- CanadaANTIFREEZE PROTEINS MARKET REGULATIONS IN EUROPEANTIFREEZE PROTEINS MARKET REGULATIONS IN ASIA PACIFIC- Australia & New Zealand

-

6.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS AND BUYING CRITERIABUYING CRITERIA

-

6.13 CASE STUDIES

- 7.1 INTRODUCTION

-

7.2 TYPE IHIGH ADOPTION OF TYPE I ANTIFREEZE PROTEINS IN COMMERCIAL MANUFACTURING TO DRIVE GROWTH

-

7.3 TYPE IIIBENEFITS OF TYPE III ANTIFREEZE PROTEINS IN GENETIC RESEARCH AND TRANSGENESIS TECHNIQUES TO FUEL MARKET GROWTH

-

7.4 ANTIFREEZE GLYCOPROTEINSUSAGE OF ANTIFREEZE GLYCOPROTEINS IN WIDE RANGE OF END-USE APPLICATIONS TO DRIVE MARKET

- 7.5 OTHER TYPES

- 8.1 INTRODUCTION

-

8.2 SOLIDHIGH USE OF SOLID ANTIFREEZE PROTEINS IN COSMETICS AND FOOD PRODUCTS TO PROPEL DEMAND

-

8.3 LIQUIDUSE OF LIQUID ANTIFREEZE PROTEINS AS ADDITIVES IN CRYOPRESERVATION REAGENTS TO DRIVE MARKET GROWTH

- 9.1 INTRODUCTION

-

9.2 MEDICALNEED FOR COLD STORAGE FOR MEDICINAL PRODUCTS AND ADVANCEMENTS IN CRYOPRESERVATION TECHNIQUES TO FUEL GROWTH

-

9.3 COSMETICSHIGH DEMAND FOR ORGANIC COSMETICS TO DRIVE DEMAND FOR SUSTAINABLE ANTIFREEZE PROTEINS

-

9.4 FOODGLOBAL RISE IN FROZEN FOOD CONSUMPTION TO DRIVE MARKET GROWTH

- 9.5 OTHER END USES

- 10.1 INTRODUCTION

-

10.2 FISHBENEFITS OF ANTIFREEZE PROTEINS DERIVED FROM FISH IN COSMETICS AND FOOD TO DRIVE MARKET GROWTH

-

10.3 PLANTSRISING DEMAND FOR VEGAN & PLANT-BASED COSMETIC PRODUCTS TO FUEL DEMAND

-

10.4 INSECTSINCREASING RESEARCH TO DEVELOP NEWER SOURCES FOR ANTIFREEZE PROTEINS TO DRIVE MARKET GROWTH

- 10.5 OTHER SOURCES

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAPRESENCE OF KEY PLAYERS AND WELL-ESTABLISHED END-USE SECTORS SUCH AS COSMETICS, MEDICAL, AND FOOD TO DRIVE GROWTHNORTH AMERICA: RECESSION IMPACT ANALYSIS

-

11.3 EUROPERISING AWARENESS AND ADOPTION OF ANTIFREEZE PROTEINS IN FOOD SECTOR TO FUEL MARKET GROWTHEUROPE: RECESSION IMPACT ANALYSIS

-

11.4 ASIA PACIFICSTRENGTHENING RESEARCH INITIATIVES AND INCREASING MANUFACTURING OPERATIONS IN DEVELOPING COUNTRIES TO DRIVE GROWTHASIA PACIFIC: RECESSION IMPACT ANALYSIS

-

11.5 SOUTH AMERICASLOW RISE IN CONSUMPTION OF FROZEN FOODS IN SOUTH AMERICA TO DRIVE MARKET GROWTHSOUTH AMERICA: RECESSION IMPACT ANALYSIS

-

11.6 ROWFOCUS ON IMPROVING PHARMACEUTICAL SECTOR AND BIOTECH RESEARCH TO CONTRIBUTE TO MARKET GROWTHROW: RECESSION IMPACT ANALYSIS

- 12.1 OVERVIEW

- 12.2 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

- 12.3 KEY PLAYERS’ ANNUAL REVENUE VS. GROWTH

- 12.4 KEY PLAYERS’ EBITDA

- 12.5 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.6 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- 12.7 MARKET SHARE ANALYSIS

-

12.8 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTSANTIFREEZE PROTEINS MARKET: PRODUCT FOOTPRINT (KEY PLAYERS)

-

12.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

13.1 KEY PLAYERSNICHIREI CORPORATION- Business overview- Products/Services/Solutions offered- MnM viewA/F PROTEIN INC.- Business overview- Products/Services/Solutions offered- MnM viewKANEKA CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewUNILEVER- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSIRONA BIOCHEM- Business overview- Products/Services/Solutions offered- MnM viewPROTOKINETIX, INC.- Business overview- Products/Services/Solutions offered- MnM viewSHANGHAI YU TAO INDUSTRIAL CO., LTD.- Business overview- Products/Services/Solutions offered- MnM viewKODERA HERB GARDEN CO., LTD- Business overview- Products/Services/Solutions offered- MnM viewBEIJING HUACHENG JINKE TECHNOLOGY CO., LTD- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewRISHON BIOCHEM CO., LTD- Business overview- Products/Services/Solutions offered- MnM viewMYBIOSOURCE, INC.- Business overview- Products/Services/Solutions offered- MnM view

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

-

14.3 INSECT PROTEIN MARKETMARKET DEFINITIONMARKET OVERVIEW

-

14.4 MARINE COLLAGEN MARKETMARKET DEFINITIONMARKET OVERVIEW

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019–2022

- TABLE 2 ANTIFREEZE PROTEINS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 BENEFITS OF ANTIFREEZE PROTEINS IN KEY FOOD PRODUCTS

- TABLE 4 TYPE I ANTIFREEZE PROTEINS MARKET: AVERAGE SELLING PRICE, BY REGION, 2020–2023 (USD/MG)

- TABLE 5 TYPE III ANTIFREEZE PROTEINS MARKET: AVERAGE SELLING PRICE, BY REGION, 2020–2023 (USD/MG)

- TABLE 6 ANTIFREEZE GLYCOPROTEINS: ANTIFREEZE PROTEINS MARKET AVERAGE SELLING PRICE, BY REGION, 2020–2023 (USD/ MG)

- TABLE 7 ANTIFREEZE PROTEINS MARKET: SUPPLY CHAIN (ECOSYSTEM)

- TABLE 8 EXPORT DATA OF FRESH AND FROZEN FISH, BY COUNTRY, 2022 (USD)

- TABLE 9 ANTIFREEZE PROTEINS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 10 PATENTS PERTAINING TO ANTIFREEZE PROTEINS, 2020–2023

- TABLE 11 KEY CONFERENCES & EVENTS IN ANTIFREEZE PROTEINS MARKET, 2023–2024

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 PROPOSED MODIFICATION TO LIST OF PERMITTED FOOD ADDITIVES WITH OTHER GENERALLY ACCEPTED USES

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR ANTIFREEZE PROTEINS

- TABLE 17 KEY BUYING CRITERIA FOR KEY ANTIFREEZE PROTEINS END USES

- TABLE 18 CASE STUDY: AQUACULTURE FOR SALMON IN ATLANTIC OCEAN

- TABLE 19 CASE STUDY: INCREASING SHELF LIFE IN FOOD

- TABLE 20 CHARACTERISTICS OF AFP, BY TYPE

- TABLE 21 ANTIFREEZE PROTEINS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 22 ANTIFREEZE PROTEINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 23 ANTIFREEZE PROTEINS MARKET, BY TYPE, 2018–2022 (GRAMS)

- TABLE 24 ANTIFREEZE PROTEINS MARKET, BY TYPE, 2023–2028 (GRAMS)

- TABLE 25 ANTIFREEZE TYPE I PROTEINS AND SOURCES

- TABLE 26 TYPE I: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 27 TYPE I: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 TYPE I: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (GRAMS)

- TABLE 29 TYPE I: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (GRAMS)

- TABLE 30 TYPE III: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 31 TYPE III: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 TYPE III: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (GRAMS)

- TABLE 33 TYPE III: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (GRAMS)

- TABLE 34 ANTIFREEZE GLYCOPROTEINS: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 35 ANTIFREEZE GLYCOPROTEINS: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 ANTIFREEZE GLYCOPROTEINS: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (GRAMS)

- TABLE 37 ANTIFREEZE GLYCOPROTEINS: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (GRAMS)

- TABLE 38 OTHER TYPES: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 39 OTHER TYPES: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 OTHER TYPES: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (GRAMS)

- TABLE 41 OTHER TYPES: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (GRAMS)

- TABLE 42 ANTIFREEZE PROTEINS MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 43 ANTIFREEZE PROTEINS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 44 ANTIFREEZE PROTEINS MARKET, BY FORM, 2018–2022 (GRAMS)

- TABLE 45 ANTIFREEZE PROTEINS MARKET, BY FORM, 2023–2028 (GRAMS)

- TABLE 46 SOLID: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 47 SOLID: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 SOLID: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (GRAMS)

- TABLE 49 SOLID: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (GRAMS)

- TABLE 50 LIQUID: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 51 LIQUID: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 LIQUID: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (GRAMS)

- TABLE 53 LIQUID: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (GRAMS)

- TABLE 54 ANTIFREEZE PROTEINS MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 55 ANTIFREEZE PROTEINS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 56 ANTIFREEZE PROTEINS MARKET, BY END USE, 2018–2022 (GRAMS)

- TABLE 57 ANTIFREEZE PROTEINS MARKET, BY END USE, 2023–2028 (GRAMS)

- TABLE 58 MEDICAL: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 59 MEDICAL: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 MEDICAL: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (GRAMS)

- TABLE 61 MEDICAL: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (GRAMS)

- TABLE 62 COSMETICS: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 63 COSMETICS: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 COSMETICS: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (GRAMS)

- TABLE 65 COSMETICS: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (GRAMS)

- TABLE 66 FOOD: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 67 FOOD: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 FOOD: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (GRAMS)

- TABLE 69 FOOD: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (GRAMS)

- TABLE 70 OTHER END USES: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 71 OTHER END USES: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 OTHER END USES: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (GRAMS)

- TABLE 73 OTHER END USES: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (GRAMS)

- TABLE 74 ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 75 ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 76 ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2018–2022 (GRAMS)

- TABLE 77 ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2023–2028 (GRAMS)

- TABLE 78 MAJOR FISH TYPES PRODUCING AFP

- TABLE 79 FISH: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 80 FISH: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 FISH: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (GRAMS)

- TABLE 82 FISH: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (GRAMS)

- TABLE 83 PLANTS: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 84 PLANTS: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 PLANTS: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (GRAMS)

- TABLE 86 PLANTS: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (GRAMS)

- TABLE 87 INSECTS: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 88 INSECTS: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 INSECTS: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (GRAMS)

- TABLE 90 INSECTS: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (GRAMS)

- TABLE 91 OTHER SOURCES: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 92 OTHER SOURCES: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 93 OTHER SOURCES: ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (GRAMS)

- TABLE 94 OTHER SOURCES: ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (GRAMS)

- TABLE 95 ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 96 ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 97 ANTIFREEZE PROTEINS MARKET, BY REGION, 2018–2022 (GRAMS)

- TABLE 98 ANTIFREEZE PROTEINS MARKET, BY REGION, 2023–2028 (GRAMS)

- TABLE 99 NORTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 100 NORTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 101 NORTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY TYPE, 2018–2022 (GRAMS)

- TABLE 102 NORTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY TYPE, 2023–2028 (GRAMS)

- TABLE 103 NORTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 104 NORTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 105 NORTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY FORM, 2018–2022 (GRAMS)

- TABLE 106 NORTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY FORM, 2023–2028 (GRAMS)

- TABLE 107 NORTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 108 NORTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 109 NORTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY END USE, 2018–2022 (GRAMS)

- TABLE 110 NORTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY END USE, 2023–2028 (GRAMS)

- TABLE 111 NORTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 112 NORTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 113 NORTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2018–2022 (GRAMS)

- TABLE 114 NORTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2023–2028 (GRAMS)

- TABLE 115 EUROPE: ANTIFREEZE PROTEINS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 116 EUROPE: ANTIFREEZE PROTEINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 117 EUROPE: ANTIFREEZE PROTEINS MARKET, BY TYPE, 2018–2022 (GRAMS)

- TABLE 118 EUROPE: ANTIFREEZE PROTEINS MARKET, BY TYPE, 2023–2028 (GRAMS)

- TABLE 119 EUROPE: ANTIFREEZE PROTEINS MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 120 EUROPE: ANTIFREEZE PROTEINS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 121 EUROPE: ANTIFREEZE PROTEINS MARKET, BY FORM, 2018–2022 (GRAMS)

- TABLE 122 EUROPE: ANTIFREEZE PROTEINS MARKET, BY FORM, 2023–2028 (GRAMS)

- TABLE 123 EUROPE: ANTIFREEZE PROTEINS MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 124 EUROPE: ANTIFREEZE PROTEINS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 125 EUROPE: ANTIFREEZE PROTEINS MARKET, BY END USE, 2018–2022 (GRAMS)

- TABLE 126 EUROPE: ANTIFREEZE PROTEINS MARKET, BY END USE, 2023–2028 (GRAMS)

- TABLE 127 EUROPE: ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 128 EUROPE: ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 129 EUROPE: ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2018–2022 (GRAMS)

- TABLE 130 EUROPE: ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2023–2028 (GRAMS)

- TABLE 131 ASIA PACIFIC: ANTIFREEZE PROTEINS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 132 ASIA PACIFIC: ANTIFREEZE PROTEINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: ANTIFREEZE PROTEINS MARKET, BY TYPE, 2018–2022 (GRAMS)

- TABLE 134 ASIA PACIFIC: ANTIFREEZE PROTEINS MARKET, BY TYPE, 2023–2028 (GRAMS)

- TABLE 135 ASIA PACIFIC: ANTIFREEZE PROTEINS MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 136 ASIA PACIFIC: ANTIFREEZE PROTEINS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 137 ASIA PACIFIC: ANTIFREEZE PROTEINS MARKET, BY FORM, 2018–2022 (GRAMS)

- TABLE 138 ASIA PACIFIC: ANTIFREEZE PROTEINS MARKET, BY FORM, 2023–2028 (GRAMS)

- TABLE 139 ASIA PACIFIC: ANTIFREEZE PROTEINS MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 140 ASIA PACIFIC: ANTIFREEZE PROTEINS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 141 ASIA PACIFIC: ANTIFREEZE PROTEINS MARKET, BY END USE, 2018–2022 (GRAMS)

- TABLE 142 ASIA PACIFIC: ANTIFREEZE PROTEINS MARKET, BY END USE, 2023–2028 (GRAMS)

- TABLE 143 ASIA PACIFIC: ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 144 ASIA PACIFIC: ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 145 ASIA PACIFIC: ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2018–2022 (GRAMS)

- TABLE 146 ASIA PACIFIC: ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2023–2028 (GRAMS)

- TABLE 147 SOUTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 148 SOUTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 149 SOUTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY TYPE, 2018–2022 (GRAMS)

- TABLE 150 SOUTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY TYPE, 2023–2028 (GRAMS)

- TABLE 151 SOUTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 152 SOUTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 153 SOUTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY FORM, 2018–2022 (GRAMS)

- TABLE 154 SOUTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY FORM, 2023–2028 (GRAMS)

- TABLE 155 SOUTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 156 SOUTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 157 SOUTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY END USE, 2018–2022 (GRAMS)

- TABLE 158 SOUTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY END USE, 2023–2028 (GRAMS)

- TABLE 159 SOUTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 160 SOUTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 161 SOUTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2018–2022 (GRAMS)

- TABLE 162 SOUTH AMERICA: ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2023–2028 (GRAMS)

- TABLE 163 ROW: ANTIFREEZE PROTEINS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 164 ROW: ANTIFREEZE PROTEINS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 165 ROW: ANTIFREEZE PROTEINS MARKET, BY TYPE, 2018–2022 (GRAMS)

- TABLE 166 ROW: ANTIFREEZE PROTEINS MARKET, BY TYPE, 2023–2028 (GRAMS)

- TABLE 167 ROW: ANTIFREEZE PROTEINS MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 168 ROW: ANTIFREEZE PROTEINS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 169 ROW: ANTIFREEZE PROTEINS MARKET, BY FORM, 2018–2022 (GRAMS)

- TABLE 170 ROW: ANTIFREEZE PROTEINS MARKET, BY FORM, 2023–2028 (GRAMS)

- TABLE 171 ROW: ANTIFREEZE PROTEINS MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 172 ROW: ANTIFREEZE PROTEINS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 173 ROW: ANTIFREEZE PROTEINS MARKET, BY END USE, 2018–2022 (GRAMS)

- TABLE 174 ROW: ANTIFREEZE PROTEINS MARKET, BY END USE, 2023–2028 (GRAMS)

- TABLE 175 ROW: ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 176 ROW: ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 177 ROW: ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2018–2022 (GRAMS)

- TABLE 178 ROW: ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2023–2028 (GRAMS)

- TABLE 179 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 180 MARKET SHARE ANALYSIS OF ANTIFREEZE PROTEINS, 2022

- TABLE 181 COMPANY FOOTPRINT, BY TYPE (KEY PLAYERS)

- TABLE 182 COMPANY FOOTPRINT, BY FORM (KEY PLAYERS)

- TABLE 183 COMPANY FOOTPRINT, BY END USE (KEY PLAYERS)

- TABLE 184 COMPANY FOOTPRINT, BY SOURCE (KEY PLAYERS)

- TABLE 185 COMPANY FOOTPRINT, BY REGION (KEY PLAYERS)

- TABLE 186 COMPETITIVE BENCHMARKING (KEY PLAYERS)

- TABLE 187 ANTIFREEZE PROTEINS MARKET: PRODUCT LAUNCHES, 2019–2023

- TABLE 188 ANTIFREEZE PROTEINS MARKET: DEALS, 2019–2023

- TABLE 189 ANTIFREEZE PROTEINS MARKET: OTHERS, 2019–2023

- TABLE 190 NICHIREI CORPORATION: BUSINESS OVERVIEW

- TABLE 191 NICHIREI CORPORATION: PRODUCTS OFFERED

- TABLE 192 A/F PROTEIN INC.: BUSINESS OVERVIEW

- TABLE 193 A/F PROTEIN INC.: PRODUCTS OFFERED

- TABLE 194 KANEKA CORPORATION: BUSINESS OVERVIEW

- TABLE 195 KANEKA CORPORATION: PRODUCTS OFFERED

- TABLE 196 KANEKA CORPORATION: PRODUCT LAUNCHES

- TABLE 197 KANEKA CORPORATION: OTHERS

- TABLE 198 UNILEVER: BUSINESS OVERVIEW

- TABLE 199 UNILEVER: PRODUCTS OFFERED

- TABLE 200 UNILEVER: DEALS

- TABLE 201 UNILEVER: OTHERS

- TABLE 202 SIRONA BIOCHEM: BUSINESS OVERVIEW

- TABLE 203 SIRONA BIOCHEM: PRODUCTS OFFERED

- TABLE 204 PROTOKINETIX, INC.: BUSINESS OVERVIEW

- TABLE 205 PROTOKINETIX, INC.: PRODUCTS OFFERED

- TABLE 206 SHANGHAI YU TAO INDUSTRIAL CO., LTD.: BUSINESS OVERVIEW

- TABLE 207 SHANGHAI YU TAO INDUSTRIAL CO., LTD.: PRODUCTS OFFERED

- TABLE 208 KODERA HERB GARDEN CO., LTD: BUSINESS OVERVIEW

- TABLE 209 KODERA HERB GARDEN CO., LTD: PRODUCTS OFFERED

- TABLE 210 BEIJING HUACHENG JINKE TECHNOLOGY CO., LTD: BUSINESS OVERVIEW

- TABLE 211 BEIJING HUACHENG JINKE TECHNOLOGY CO., LTD: PRODUCTS OFFERED

- TABLE 212 BEIJING HUACHENG JINKE TECHNOLOGY CO., LTD: PRODUCT LAUNCHES

- TABLE 213 RISHON BIOCHEM CO., LTD: BUSINESS OVERVIEW

- TABLE 214 RISHON BIOCHEM CO., LTD: PRODUCTS OFFERED

- TABLE 215 MYBIOSOURCE, INC.: BUSINESS OVERVIEW

- TABLE 216 MYBIOSOURCE, INC.: PRODUCTS OFFERED

- TABLE 217 ADJACENT MARKETS TO ANTIFREEZE PROTEINS MARKET

- TABLE 218 INSECT PROTEIN MARKET, BY INSECT TYPE, 2019–2021 (USD MILLION)

- TABLE 219 INSECT PROTEIN MARKET, BY INSECT TYPE, 2022–2027 (USD MILLION)

- TABLE 220 MARINE COLLAGEN MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 221 MARINE COLLAGEN MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 ANTIFREEZE PROTEINS MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 ANTIFREEZE PROTEINS MARKET: APPROACH ONE (BOTTOM-UP APPROACH)

- FIGURE 5 ANTIFREEZE PROTEINS MARKET: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- FIGURE 7 ASSUMPTIONS

- FIGURE 8 STUDY LIMITATIONS AND RISK ASSESSMENT

- FIGURE 9 INDICATORS OF RECESSION

- FIGURE 10 GLOBAL INFLATION RATE, 2011–2021

- FIGURE 11 GLOBAL GDP, 2011–2021 (USD TRILLION)

- FIGURE 12 RECESSION INDICATORS AND THEIR IMPACT ON ANTIFREEZE PROTEINS MARKET

- FIGURE 13 GLOBAL ANTIFREEZE PROTEINS MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 14 ANTIFREEZE PROTEINS MARKET SIZE, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 ANTIFREEZE PROTEINS MARKET SIZE, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 ANTIFREEZE PROTEINS MARKET SIZE, BY END USE, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 ANTIFREEZE PROTEINS MARKET SIZE, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 REGIONAL SNAPSHOT OF ANTIFREEZE PROTEINS MARKET

- FIGURE 19 BENEFITS ASSOCIATED WITH ANTIFREEZE PROTEINS FOR MEDICAL USE TO FUEL DEMAND

- FIGURE 20 NORTH AMERICA TO BE LARGEST MARKET FOR ANTIFREEZE PROTEINS IN 2023

- FIGURE 21 TYPE I AND MEDICAL SEGMENTS TO ACCOUNT FOR LARGEST SHARES IN ASIA PACIFIC ANTIFREEZE PROTEINS MARKET

- FIGURE 22 ASIA PACIFIC AND SOLID FORM PROJECTED TO GROW AT HIGHEST RATES

- FIGURE 23 TYPE I PROJECTED TO DOMINATE DURING FORECAST PERIOD

- FIGURE 24 MEDICAL SEGMENT PROJECTED TO DOMINATE ANTIFREEZE PROTEINS MARKET

- FIGURE 25 FISH SEGMENT PROJECTED TO HOLD LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 26 MARKET DYNAMICS: ANTIFREEZE PROTEINS MARKET

- FIGURE 27 INCREASE IN R&D EXPENDITURE BY NICHIREI CORPORATION, 2017–2022 (USD BILLION)

- FIGURE 28 VEGAN POPULATION IN UK, 2019–2021

- FIGURE 29 REVENUE SHIFT FOR ANTIFREEZE PROTEINS MARKET

- FIGURE 30 VALUE CHAIN ANALYSIS OF ANTIFREEZE PROTEINS MARKET

- FIGURE 31 ANTIFREEZE PROTEINS MARKET MAP

- FIGURE 32 NUMBER OF PATENTS GRANTED BETWEEN 2013 AND 2023

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING ANTIFREEZE PROTEINS FOR DIFFERENT END USES

- FIGURE 34 KEY BUYING CRITERIA FOR TOP ANTIFREEZE PROTEINS END USES

- FIGURE 35 ANTIFREEZE PROTEINS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 36 ANTIFREEZE PROTEINS MARKET, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 37 ANTIFREEZE PROTEINS MARKET, BY END USE, 2023 VS. 2028 (USD MILLION)

- FIGURE 38 GROWTH OF COSMETICS MARKET, 2012–2022

- FIGURE 39 ANTIFREEZE PROTEINS MARKET, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 40 ASIA PACIFIC EMERGING AS NEW HOTSPOT FOR ANTIFREEZE PROTEIN MANUFACTURERS DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: ANTIFREEZE PROTEINS MARKET SNAPSHOT

- FIGURE 42 NORTH AMERICAN ANTIFREEZE PROTEINS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 43 ASIA PACIFIC: ANTIFREEZE PROTEINS MARKET SNAPSHOT

- FIGURE 44 REVENUE ANALYSIS OF KEY PLAYERS, 2020–2022 (USD BILLION)

- FIGURE 45 ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020–2022 (%)

- FIGURE 46 EBITDA, 2022 (USD BILLION)

- FIGURE 47 ANTIFREEZE PROTEINS MARKET: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- FIGURE 48 ANTIFREEZE PROTEINS MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 49 NICHIREI CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 KANEKA CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 UNILEVER: COMPANY SNAPSHOT

This research involves the extensive use of secondary sources; directories; and databases (Bloomberg and Factiva) to identify and collect information useful for a technical, market-oriented, and commercial study of the antifreeze proteins market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the Food and Agricultural Organization (FAO), United States Department of Agriculture (USDA), U.S. Food and Drug Administration (FDA) U.S. Food and Drug Administration (FDA), European Food Safety Authority (EFSA), World Health Organization (WHO), were referred to identify and collect information for this study. The secondary sources also include journals, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases. Secondary research was mainly conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The antifreeze proteins market encompasses various stakeholders involved in the supply chain, including antifreeze proteins manufacturers and suppliers, raw material suppliers, regulatory organizations, and research institutions. To gather comprehensive information, primary sources from both the supply and demand sides were engaged. Primary interviewees from the supply side consisted of manufacturers, distributors, importers, and technology providers involved in the production and distribution of antifreeze proteins. On the demand side, key opinion leaders, executives, and CEOs of companies in the antifreeze proteins industry were approached through questionnaires, emails, and telephonic interviews. This approach ensured a comprehensive and well-rounded understanding of the antifreeze protein market from various perspectives.

To know about the assumptions considered for the study, download the pdf brochure

Antifreeze Protein Market Size Estimation

The research methodology used to estimate the size of the antifreeze proteins market includes the following details. The top-down and bottom-up approaches were used to estimate and validate the market’s and various dependent submarkets’ size. The research methodology used to estimate the market size includes extensive secondary research of key players, reports, reviews, and newsletters of top market players, along with extensive interviews from leaders, such as CEOs, directors, and marketing executives.

Global antifreeze proteins market size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global antifreeze proteins market size: Top-Down Approach

Data Triangulation

The data triangulation and market breakdown procedures explained above were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Antifreeze Protein Market Definition

According to Food Standards Australia New Zealand (FSANZ), “Various naturally occurring proteins and peptides have been extracted and identified from the blood of fish living in very cold waters. These proteins and peptides protect the fish from the damage that would be caused by freezing and allow them to survive. Such proteins were subsequently also found in many other organisms that survive in very cold environments, such as plants, insects, fungi, and bacteria. A number of these proteins are already consumed in foods that have been significant parts of the human diet, such as fish and carrots. These proteins have been known as thermal hysteresis proteins or antifreeze proteins

Stakeholders

- Raw material suppliers

- Importers and exporters of antifreeze proteins

- R&D laboratories

- Intermediary suppliers such as traders and distributors of food, medical, and cosmetics product

- Government and research organizations

- Venture capitalists and investors

- Association and industry bodies:

- Food and Agriculture Organization (FAO)

- Trade statistics for international business development

- European Food Safety Authority (EFSA)

- Food Safety Council (FSC)

- Commercial research & development (R&D) institutions and financial institutions:

- Importers and exporters of antifreeze proteins

Antifreeze Protein Market Report Objectives

- To define, segment, and project the global market for antifreeze proteins market on the basis of type, form, end use, source, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micro markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze competitive developments in the antifreeze proteins market, including joint ventures, mergers & acquisitions, new product developments, and research & development activities

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Antifreeze Proteins Market