Insect Protein Market by Application (Food & Beverages, Animal Nutrition, Pharmaceutical & Cosmetics), Insect Type (Cricket, Grasshoppers, Ants, Mealworms, Black Soldier Flies, and Others),Distribution Channel and Region - Global Forecast to 2027

At a CAGR of 33.4% from 2022 to 2027, the global insect protein market is estimated to be worth $0.8 billion in 2022 and $3.3 billion by the end of 2027.

As the world becomes increasingly focused on sustainability and healthy living, the market is emerging as a unique and exciting alternative, one that is rapidly capturing the attention of investors and consumers alike. With its impressive growth potential and endless possibilities for innovation, it's clear that the insect protein is not just a flash in the pan, but a transformative trend with staying power.As the world seeks to address the pressing issues of food security and environmental sustainability, the insect protein market has emerged as a rapidly expanding industry with immense potential. With insects being rich in nutrients and having a low ecological impact, they offer a viable alternative to conventional protein sources. However, the industry is still in its nascent stages and faces hurdles such as regulatory challenges and consumer apprehension. Nonetheless, as the world becomes more aware of the environmental and health benefits of insect farming, the industry is poised for exponential growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Insect protein is a protein obtained from insects that can be utilized as a source of sustenance for people and animals. Insects are a very sustainable and environmentally beneficial source of protein since they require substantially less land, water, and feed to produce than traditional livestock such as cows or pigs. Insects are also high in protein, healthy fats, and critical vitamins and minerals. Insect protein is becoming increasingly popular as a culinary ingredient, with applications in a wide range of goods such as protein bars, energy drinks, and even burgers. Insects are also being investigated as a potential solution to global food crisis because they are readily available and can be grown on a huge scale.

The insect protein market is a veritable treasure trove of unique qualities that set it apart from traditional protein sources. These small but mighty creatures offer a highly nutritious protein source, with essential amino acids, vitamins, and minerals in abundance. What's more, they're a sustainable option, requiring minimal resources to farm and producing a smaller ecological footprint than conventional livestock. With a wide range of possible applications, from protein bars to pet food, insects offer remarkable versatility as a protein source. However, the market faces some hurdles, such as limited consumer acceptance and regulatory challenges. Despite these obstacles, the insect protein market is on track for remarkable growth, fueled by increasing demand for sustainable and alternative protein options, and growing recognition of the environmental benefits of insect farming. As the market continues to expand and evolve, it's clear that insects are much more than just a pest - they're a powerful force in the future of food production.

Insect Protein Market Dynamics

Increasing Investments in R&D and Start-ups

Various companies in the insect protein market are undertaking strategies to expand their business and gain the market share. Some of the key strategies adopted by the industry participants are new product launches, partnerships, and acquisitions. For instance, in March 2022, Global Bugs entered in partnership with Smart Vet Group to focus on formulating and production of pet food and supplemental products for pets that contain whole roasted crickets and cricket powder. In November 2021, Ÿnsect, an insect protein company launched the Bernie’s, an ultra-premium and luxury brand for dog feed in US market in collaboration with Pure Simple True LLC.

Microbial Risk and Allergic Reactions

Consumption of insect protein is highly prone to various allergic risks both for human and animal consumption. Use of insect protein is still in the early phase of research for use in various applications and thus have high risk of various unknown allergic and associated diseases, that cannot be treated on an immediate basis. Risks associated with eating insects could be caused by probable chemical (e.g., heavy metal accumulation) and microbiological contaminations. Additionally, several insects have been known to trigger allergic reactions by eating, inhalation, direct contact, stings, and bites. Cross-reactivity with other taxonomically related food allergens, such as crustaceans, as well as inhalant allergens, such as home dust mites, can contribute to the adverse reactions recorded after ingesting insects.

Adverse Effect of Vegan Trend on Insect Protein Market

Excessive consumption of animal-based protein has been proven to result in various diet-related diseases such as obesity, type-2 diabetes, heart diseases, and certain cancers. Whereas, on the other hand, the consumption of vegan products is observed not to accentuate such diseases; moreover, they help in building better immunity. Vegan products are replacing conventional processed meat products such as burgers, sausages, and nuggets. This is because vegetarian food contains lower levels of saturated fat, cholesterol, and calories than animal-based meat. It often contains higher levels of micronutrients such as zinc, iron, and calcium. Considering this rapid growth of the vegan population, various meat product manufacturers are shifting toward producing plant-based meat and soy-based products, which is anticipated to hamper the growth of the market.

Defined Regulations and Government Support

Consumption and acceptance of insect protein products is highly associated to the key sensory factors such as texture, taste, and appearance. Various regulatory bodies are conducting studies and research to help provide consumers with appropriate guidelines regarding the use of insect protein and its benefits. For instance, in 2021, European Commission recognized the key role of insect farming in its Farm to Fork strategy for sustainable food. in July 2021 European Union also approved and introduced the first novel insect protein, a yellow mealworm, in the European market. These regulatory acceptance and approvals are projected to provide lucrative growth opportunities to the participants in the market.

The offline distribution channel is most widely used and held the largest market share in 2021, primarily owing to its of ease of accessibility and convenience.

Offline distribution includes supermarkets, hypermarkets, convenience stores, and specialist retailers. Few consumers prefer online platform because of ease of accessibility and convenience. The dominance of offline distribution channel is primarily driven by the demand from developing countries. These countries are the large consumers of insect protein and do not have well established online distribution channel.

To know about the assumptions considered for the study, download the pdf brochure

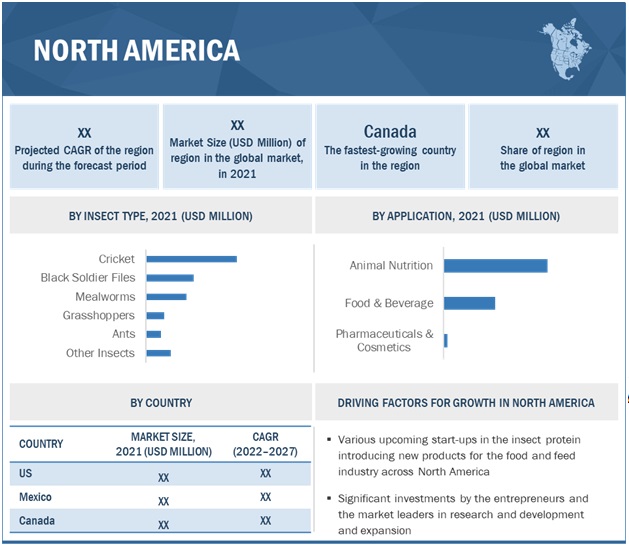

North America dominated the insect protein market and is projected to grow with a CAGR of 33.45% during the forecast period (2022 - 2027)

North America is anticipated to hold the largest market share in the insect protein market in 2022, followed by Europe, Asia Pacific, and RoW. The presence of key insect protein manufacturing companies in developed regions such as North America and Europe contributes to these regions' high market share. Many start-ups have been established in the region that provide both edible insects and insect protein-based products for food and feed applications. Enterra Feed Corporation (Canada), Entomo Farms (Canada), EnviroFlight LLC (US), and Aspire Food Group (US) are some of the leading companies providing insect protein-based products. The market for insect protein-based food products is projected to record the fastest growth during the forecast period due to the increasing awareness among people.

Insect Protein Market Key Players

The key players in insect protein market include EnviroFlight (US), InnovaFeed (France), HEXAFLY (Ireland), Protix (Netherlands), Global Bugs (Thailand), Entomo Farms (Canada), and Ynsect (France) among others.

Insect Protein Market Report Scope

|

Report Metric |

Details |

|

Market dimension in 2022 |

USD 0.8 billion |

|

Revenue forecast in 2027 |

USD 3.3 billion |

|

Progress rate |

CAGR of 33.4% |

|

Historical data |

2019-2027 |

|

Base year for estimation |

2021 |

|

Report Coverage |

company ranking, driving factors, Competitive benchmarking, and analysis, regional opportunities |

|

Segments covered |

Region, Insect Type, Application |

|

Regional Insight |

Europe, North America, South America, Asia Pacific |

|

Research coverage: |

The report segments the insect protein market based on insect type, application, distribution channel, and region. In terms of insights, this report has focused on various levels of analyses - the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global insect protein market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges. |

Target Audience

- Insect Protein manufacturers

- Insect Protein distributors

- Academicians and research organizations

- Consumers

Insect Protein Market Report Highlights

This research report categorizes the insect protein market. Based on insect type, application, distribution channel, and region.

|

Aspect |

Details |

|

By Insect Type |

|

|

By Application |

|

|

By Distribution Channel |

|

|

By Region |

|

Insect Protein Market Report Recent Developments

- April 2022, Global Bugs has made strategic partnership with Innovative Natural Solutions. The goal of Global Bugs Asia (GBA) and Innovative Natural Solutions (INS) is to collaboratively promote, support, and manufacture and distribute nutritious food items using a combination of plant-based components and crickets.

- October 2021, Aspire Food Group has expanded their automated production facility in London, to produce 10,000 tons of crickets/year.

- In January 2020, Darling Ingredients has acquired a 50% stake joint venture with EnviroFlight, one of the leading developers of proprietary technologies that help the scalable rearing of non-pathogenic Black Soldier Fly (BSF) larvae.

Frequently Asked Questions (FAQ):

What is the market for insect protein?

In the latest report published by MarketsandMarkets, The insect protein market is undergoing a major transformation, with projections indicating that it will grow from a modest US$ 0.8 billion in 2022 to an impressive US$ 3.3 billion by 2027.

What is the estimated growth rate (CAGR) of the global insect protein market for the next five years?

The global insect protein market is set for significant growth, with a projected surge at a CAGR of 33.4% during 2022-2027.

What are the major revenue pockets in the insect protein market currently?

North America and Europe are expected to hold the largest share of the insect protein market in 2022 due to the presence of established insect protein manufacturers. Insect protein-based food products are expected to experience the fastest growth, driven by growing consumer awareness.

What was the size of the global insect protein market in 2022?

In 2022, the insect protein market was valued at approximately US$ 0.8 billion, indicating a significant increase from previous years.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 INSECT PROTEIN MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 INSECT PROTEIN MARKET SEGMENTATION

TABLE 1 INCLUSIONS AND EXCLUSIONS

1.3.1 REGIONAL SEGMENTATION

FIGURE 2 INSECT PROTEIN: GEOGRAPHIC SCOPE

1.4 YEARS CONSIDERED

FIGURE 3 INSECT PROTEIN MARKET: YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 2 USD EXCHANGE RATES CONSIDERED

1.6 UNITS CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 4 RESEARCH DESIGN: INSECT PROTEIN MARKET

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

FIGURE 5 KEY DATA FROM SECONDARY SOURCES

2.1.2 PRIMARY DATA

2.1.2.1 Primary Interviews with Experts

TABLE 3 PRIMARY INTERVIEWS WITH EXPERTS

2.1.2.2 List of Key Primary Interview Participants

TABLE 4 PRIMARY INTERVIEW PARTICIPANTS

2.1.2.3 Key Industry Insights

FIGURE 6 KEY INDUSTRY INSIGHTS

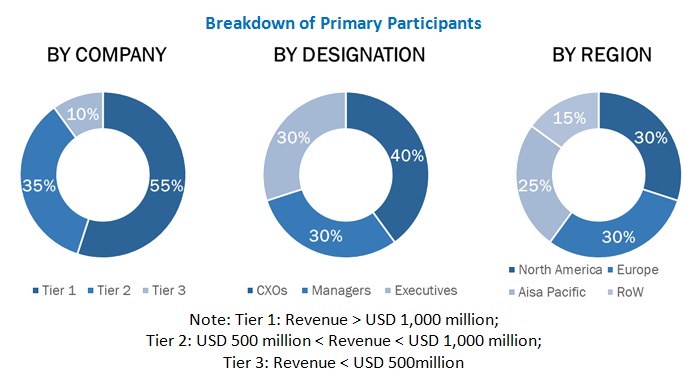

2.1.2.4 Breakdown of Primary Interviews

FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.5 Primary Sources

FIGURE 8 PRIMARY SOURCES

2.2 INSECT PROTEIN MARKET SIZE ESTIMATION

FIGURE 9 MARKET SIZE ESTIMATION (SUPPLY-SIDE)

FIGURE 10 DEMAND-SIDE ASPECTS OF MARKET SIZING

2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 11 INSECT PROTEIN MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 12 INSECT PROTEIN MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 13 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

FIGURE 14 ASSUMPTIONS CONSIDERED IN INSECT PROTEIN MARKET

2.5 LIMITATIONS

FIGURE 15 LIMITATION AND RISK ASSESSMENT OF STUDY

3 EXECUTIVE SUMMARY (Page No. - 46)

TABLE 5 INSECT PROTEIN MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 16 INSECT PROTEIN MARKET SIZE, BY INSECT TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 17 INSECT PROTEIN MARKET SIZE, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 18 INSECT PROTEIN MARKET SHARE, BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN THE INSECT PROTEIN MARKET

FIGURE 19 NEW PRODUCT DEVELOPMENTS AND FACILITY EXPANSION TO DRIVE INSECT PROTEIN MARKET GROWTH

4.2 INSECT PROTEIN MARKET: GROWTH RATE OF MAJOR REGIONAL SUBMARKETS

FIGURE 20 CANADA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

4.3 EUROPE: INSECT PROTEIN MARKET, BY KEY TYPE & COUNTRY

FIGURE 21 FRANCE TO ACCOUNT FOR LARGEST SHARE IN EUROPEAN INSECT PROTEIN MARKET IN 2022

4.4 INSECT PROTEIN MARKET, BY INSECT TYPE

FIGURE 22 CRICKET SEGMENT TO DOMINATE THE INSECT PROTEIN MARKET IN 2022

4.5 INSECT PROTEIN MARKET, BY APPLICATION

FIGURE 23 ANIMAL NUTRITION SEGMENT TO DOMINATE INSECT PROTEIN MARKET IN 2022

4.6 INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL

FIGURE 24 OFFLINE SEGMENT TO DOMINATE INSECT PROTEIN MARKET DURING FORECAST PERIOD

4.7 INSECT PROTEIN MARKET, BY REGION

FIGURE 25 EUROPE TO DOMINATE INSECT PROTEIN MARKET DURING FORECAST PERIOD

5 INSECT PROTEIN MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 INSECT PROTEIN MARKET DYNAMICS

FIGURE 26 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing Investments in R&D and Start-ups

TABLE 6 LIST OF INVESTMENTS IN THE INSECT PROTEIN MARKET (USD MILLION), 2019-2022

5.2.1.2 Increasing Demand for Alternate Protein

5.2.1.3 Food Security & Sustainability

FIGURE 27 GLOBAL MEAT CONSUMPTION, 1964–2030 (KG/CAPITA)

5.2.2 RESTRAINTS

5.2.2.1 Consumers’ Unacceptance of Insect-based Proteins

5.2.2.2 High Cost

TABLE 7 PRICE COMPARISON: CONVENTIONAL PROTEIN PRODUCTS VS. INSECT PROTEIN PRODUCTS

5.2.2.3 Microbial Risk and Allergic Reactions

5.2.3 OPPORTUNITIES

5.2.3.1 Defined Regulations and Government Support

5.2.3.2 Collaborations of Insect Protein-based Product Manufacturers with Retailers

5.2.3.3 Opportunities for Food Equipment Manufacturers in Insect Rearing

5.2.4 CHALLENGES

5.2.4.1 Adverse Effect of Vegan Trend on Insect Protein Market

FIGURE 28 VEGAN POPULATION IN THE UK, 2014–2020

6 INDUSTRY TREND (Page No. - 63)

6.1 PRICING ANALYSIS

TABLE 8 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP TWO APPLICATIONS (USD/KG)

6.2 VALUE CHAIN

6.2.1 RESEARCH AND PRODUCT DEVELOPMENT

6.2.2 REARING OF INSECTS

6.2.3 PRODUCTION & PROCESSING

6.2.4 DISTRIBUTION

6.2.5 MARKETING & SALES

FIGURE 29 VALUE CHAIN ANALYSIS OF INSECT PROTEIN MARKET

6.3 TARIFF AND REGULATORY LANDSCAPE

6.3.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.3.2 US

6.3.2.1 Feed Application

6.3.2.2 Food Application

6.3.3 CANADA

6.3.4 EUROPE

6.3.5 ASIA PACIFIC

6.4 PATENT ANALYSIS

TABLE 12 LIST OF IMPORTANT PATENTS FOR INSECT PROTEIN AND EDIBLE INSECTS, 2019–2022

6.5 PORTER’S FIVE FORCES ANALYSIS

TABLE 13 INSECT PROTEIN MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 30 INSECT PROTEIN MARKET: PORTER’S FIVE FORCES ANALYSIS

6.5.1 THREAT OF NEW ENTRANTS

6.5.2 THREAT OF SUBSTITUTES

6.5.3 BARGAINING POWER OF SUPPLIERS

6.5.4 BARGAINING POWER OF BUYERS

6.5.5 INTENSITY OF COMPETITIVE RIVALRY

7 INSECT PROTEIN MARKET, BY INSECT TYPE (Page No. - 74)

7.1 INTRODUCTION

FIGURE 31 INSECT PROTEIN MARKET, BY INSECT TYPE, 2022 VS 2027 (USD MILLION)

TABLE 14 INSECT PROTEIN MARKET, BY INSECT TYPE, 2019–2021 (USD MILLION)

TABLE 15 INSECT PROTEIN MARKET, BY INSECT TYPE, 2022–2027 (USD MILLION)

7.2 CRICKETS

7.2.1 HIGH ACCEPTANCE IN FOOD INDUSTRY DUE TO HIGH PROTEIN CONTENT

TABLE 16 CRICKETS: INSECT PROTEIN MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 17 CRICKETS: INSECT PROTEIN MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 BLACK SOLDIER FLIES

7.3.1 INCREASING USE OF BLACK SOLDIER FLY LARVAE FOR FEED APPLICATION

TABLE 18 BLACK SOLDIER FLIES: INSECT PROTEIN MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 19 BLACK SOLDIER FLIES: INSECT PROTEIN MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 MEALWORMS

7.4.1 ACCEPTANCE OF MEALWORMS GAINING PACE IN FEED INDUSTRY

TABLE 20 MEALWORMS: INSECT PROTEIN MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 21 MEALWORMS: INSECT PROTEIN MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 GRASSHOPPERS

7.5.1 PROTIFARM (FRANCE) COMMERCIALIZING FOOD PRODUCTS WITH GRASSHOPPER PROTEIN IN EUROPE

TABLE 22 GRASSHOPPERS: INSECT PROTEIN MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 23 GRASSHOPPERS: INSECT PROTEIN MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 ANTS

7.6.1 COMMERCIALIZATION OF INSECT PROTEIN FROM ANTS FOR FEED AND FOOD APPLICATIONS

TABLE 24 ANTS: INSECT PROTEIN MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 25 ANTS: INSECT PROTEIN MARKET, BY REGION, 2022–2027 (USD MILLION)

7.7 OTHER INSECTS

TABLE 26 OTHER INSECTS: INSECT PROTEIN MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 27 OTHER INSECTS: INSECT PROTEIN MARKET, BY REGION, 2022–2027 (USD MILLION)

8 INSECT PROTEIN MARKET, BY APPLICATION (Page No. - 82)

8.1 INTRODUCTION

FIGURE 32 ANIMAL NUTRITION SEGMENT PROJECTED TO DOMINATE INSECT PROTEIN MARKET THROUGHOUT FORECAST PERIOD

TABLE 28 INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 29 INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 30 INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (METRIC TONS)

TABLE 31INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (METRIC TONS)

8.2 FOOD & BEVERAGES

8.2.1 HIGH PROTEIN CONTENT HAS ENCOURAGED AMERICAN AND EUROPEAN POPULATION TO ACCEPT INSECT PROTEIN-BASED FOOD PRODUCTS

TABLE 32 FOOD & BEVERAGES: INSECT PROTEIN MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 33 FOOD & BEVERAGES: INSECT PROTEIN MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 34 FOOD & BEVERAGES: INSECT PROTEIN MARKET, BY REGION, 2019–2021 (METRIC TONS)

TABLE 35 FOOD & BEVERAGES: INSECT PROTEIN MARKET, BY REGION, 2022–2027 (METRIC TONS)

8.3 ANIMAL NUTRITION

TABLE 36 ANIMAL NUTRITION: INSECT PROTEIN MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 37 ANIMAL NUTRITION: INSECT PROTEIN MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 38 ANIMAL NUTRITION: INSECT PROTEIN MARKET, BY REGION, 2019–2021 (METRIC TONS)

TABLE 39 ANIMAL NUTRITION: INSECT PROTEIN MARKET, BY REGION, 2022–2027 (METRIC TONS)

TABLE 40 ANIMAL NUTRITION: INSECT PROTEIN MARKET, BY LIVESTOCK, 2019–2021 (USD MILLION)

TABLE 41 ANIMAL NUTRITION: INSECT PROTEIN MARKET, BY LIVESTOCK, 2022–2027 (USD MILLION)

8.3.1 AQUAFEED

8.3.1.1 Most feed insect protein products for aquafeed application

8.3.2 POULTRY FEED

8.3.2.1 Food security issue raised for soybean meal has led to the increasing demand for insect protein

8.3.3 PET FOOD

8.3.3.1 Dogs and cats are major pets fed with insect protein-based products

8.3.4 OTHER ANIMAL NUTRITION

8.4 PHARMACEUTICAL & COSMETICS

8.4.1 HIGH PRICES AND THE NEED FOR ADVANCED EXTRACTION AND PURIFICATION TECHNOLOGIES ARE INHIBITING THE GROWTH POTENTIAL OF THE INSECT PROTEIN MARKET

TABLE 42 PHARMACEUTICAL & COSMETICS: INSECT PROTEIN MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 43 PHARMACEUTICAL & COSMETICS: INSECT PROTEIN MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 44 PHARMACEUTICAL & COSMETICS: INSECT PROTEIN MARKET, BY REGION, 2019–2021 (METRIC TONS)

TABLE 45 PHARMACEUTICAL & COSMETICS: INSECT PROTEIN MARKET, BY REGION, 2022–2027 (METRIC TONS)

9 INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL (Page No. - 91)

9.1 INTRODUCTION

FIGURE 33 INSECT PROTEIN MARKET SIZE, BY DISTRIBUTION CHANNEL, 2022 VS 2027 (USD MILLION)

TABLE 46 INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 47 INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

9.2 OFFLINE

TABLE 48 OFFLINE: INSECT PROTEIN MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 49 OFFLINE: INSECT PROTEIN MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 ONLINE

TABLE 50 ONLINE: INSECT PROTEIN MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 51 ONLINE: INSECT PROTEIN MARKET, BY REGION, 2022–2027 (USD MILLION)

10 INSECT PROTEIN MARKET, BY REGION (Page No. - 95)

10.1 INTRODUCTION

FIGURE 34 NORTH AMERICA AND EUROPE TO HAVE SIGNIFICANT MARKET SHARES IN 2022

TABLE 52 INSECT PROTEIN MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 53 INSECT PROTEIN MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 54 INSECT PROTEIN MARKET, BY REGION, 2019–2021 (METRIC TONS)

TABLE 55 INSECT PROTEIN MARKET, BY REGION, 2022–2027 (METRIC TONS)

10.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA: INSECT PROTEIN MARKET SNAPSHOT

TABLE 56 NORTH AMERICA: INSECT PROTEIN MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 57 NORTH AMERICA: INSECT PROTEIN MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 58 NORTH AMERICA: INSECT PROTEIN MARKET, BY COUNTRY, 2019–2021 (METRIC TONS)

TABLE 59 NORTH AMERICA: INSECT PROTEIN MARKET, BY COUNTRY, 2022–2027 (METRIC TONS)

TABLE 60 NORTH AMERICA: INSECT PROTEIN MARKET, BY INSECT TYPE, 2019–2021 (USD MILLION)

TABLE 61 NORTH AMERICA: INSECT PROTEIN MARKET, BY INSECT TYPE, 2022–2027 (USD MILLION)

TABLE 62 NORTH AMERICA: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 63 NORTH AMERICA: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 64 NORTH AMERICA: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (METRIC TONS)

TABLE 65 NORTH AMERICA: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (METRIC TONS)

TABLE 66 NORTH AMERICA: INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 67 NORTH AMERICA: INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Government regulations help manufacturers to standardize the manufacturing process

TABLE 68 US: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 69 US: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 70 US: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (METRIC TONS)

TABLE 71 US: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (METRIC TONS)

10.2.2 CANADA

10.2.2.1 Increasing public and private support to drive insect protein market growth

TABLE 72 CANADA: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 73 CANADA: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 74 CANADA: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (METRIC TONS)

TABLE 75 CANADA: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (METRIC TONS)

10.2.3 MEXICO

10.2.3.1 Opportunity for insect protein manufacturers to set up insect rearing units

TABLE 76 MEXICO: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 77 MEXICO: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 78 MEXICO: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (METRIC TONS)

TABLE 79 MEXICO: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (METRIC TONS)

10.3 EUROPE

TABLE 80 EUROPE: INSECT PROTEIN MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 81 EUROPE: INSECT PROTEIN MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 82 EUROPE: INSECT PROTEIN MARKET, BY COUNTRY, 2019–2021 (METRIC TONS)

TABLE 83 EUROPE: INSECT PROTEIN MARKET, BY COUNTRY, 2022–2027 (METRIC TONS)

TABLE 84 EUROPE: INSECT PROTEIN MARKET, BY INSECT TYPE, 2019–2021 (USD MILLION)

TABLE 85 EUROPE: INSECT PROTEIN MARKET, BY INSECT TYPE, 2022–2027 (USD MILLION)

TABLE 86 EUROPE: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 87 EUROPE: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 88 EUROPE: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (METRIC TONS)

TABLE 89 EUROPE: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (METRIC TONS)

TABLE 90 EUROPE: INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 91 EUROPE: INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

10.3.1 FRANCE

10.3.1.1 Investments by private investors and support from government to drive the insect protein market

TABLE 92 FRANCE: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 93 FRANCE: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 94 FRANCE:INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (METRIC TONS)

TABLE 95 FRANCE: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (METRIC TONS)

10.3.2 GERMANY

10.3.2.1 Expansion of insect protein manufacturers to contribute to the growth of the insect protein market

TABLE 96 GERMANY: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 97 GERMANY: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 98 GERMANY: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (METRIC TONS)

TABLE 99 GERMANY: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (METRIC TONS)

10.3.3 ITALY

10.3.3.1 High aquafeed production to drive growth of the insect protein market

TABLE 100 ITALY: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 101 ITALY: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 102 ITALY: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (METRIC TONS)

TABLE 103 ITALY: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (METRIC TONS)

10.3.4 THE NETHERLANDS

10.3.4.1 Rising investments by industry players to propel demand for insect protein

TABLE 104 THE NETHERLANDS: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 105 THE NETHERLANDS: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 106 THE NETHERLANDS: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (METRIC TONS)

TABLE 107 THE NETHERLANDS: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (METRIC TONS)

10.3.5 UK

10.3.5.1 Rising collaboration of national supermarket chains with insect protein manufacturers to widen the opportunity in food industry

TABLE 108 UK: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 109 UK: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 110 UK: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (METRIC TONS)

TABLE 111 UK: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (METRIC TONS)

10.3.6 REST OF EUROPE

TABLE 112 REST OF EUROPE: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 113 REST OF EUROPE: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 114 REST OF EUROPE: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (METRIC TONS)

TABLE 115 REST OF EUROPE: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (METRIC TONS)

10.4 ASIA PACIFIC

TABLE 116 ASIA PACIFIC: INSECT PROTEIN MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 117 ASIA PACIFIC: INSECT PROTEIN MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 118 ASIA PACIFIC: INSECT PROTEIN MARKET, BY COUNTRY, 2019–2021 (METRIC TONS)

TABLE 119 ASIA PACIFIC: INSECT PROTEIN MARKET, BY COUNTRY, 2022–2027 (METRIC TONS)

TABLE 120 ASIA PACIFIC: INSECT PROTEIN MARKET, BY INSECT TYPE, 2019–2021 (USD MILLION)

TABLE 121 ASIA PACIFIC: INSECT PROTEIN MARKET, BY INSECT TYPE, 2022–2027 (USD MILLION)

TABLE 122 ASIA PACIFIC: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 123 ASIA PACIFIC: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 124 ASIA PACIFIC: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (METRIC TONS)

TABLE 125 ASIA PACIFIC: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (METRIC TONS)

TABLE 126 ASIA PACIFIC: INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 127 ASIA PACIFIC: INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

10.4.1 AUSTRALIA

10.4.1.1 Rise in number of start-ups investing in edible insects and insect protein products

TABLE 128 AUSTRALIA: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 129 AUSTRALIA: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 130 AUSTRALIA: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (METRIC TONS)

TABLE 131 AUSTRALIA: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (METRIC TONS)

10.4.2 CHINA

10.4.2.1 Insect rearing is one of the major sources of income

TABLE 132 CHINA: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 133 CHINA: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 134 CHINA: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (METRIC TONS)

TABLE 135 CHINA: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (METRIC TONS)

10.4.3 JAPAN

10.4.3.1 Entry of new insect protein product-based manufacturers

TABLE 136 JAPAN: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 137 JAPAN: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 138 JAPAN: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (METRIC TONS)

TABLE 139 JAPAN: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (METRIC TONS)

10.4.4 THAILAND

10.4.4.1 Opportunity for insect protein-based product manufacturers to establish their presence

TABLE 140 THAILAND: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 141 THAILAND: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 142 THAILAND: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (METRIC TONS)

TABLE 143 THAILAND: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (METRIC TONS)

10.4.5 MALAYSIA

10.4.5.1 Higher growth potential for insect protein market

TABLE 144 MALAYSIA: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 145 MALAYSIA: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 146 MALAYSIA: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (METRIC TONS)

TABLE 147 MALAYSIA: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (METRIC TONS)

10.4.6 REST OF ASIA PACIFIC

TABLE 148 REST OF ASIA PACIFIC: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 149 REST OF ASIA PACIFIC: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 150 REST OF ASIA PACIFIC: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (METRIC TONS)

TABLE 151 REST OF ASIA PACIFIC: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (METRIC TONS)

10.5 REST OF THE WORLD

TABLE 152 REST OF THE WORLD: INSECT PROTEIN MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 153 REST OF THE WORLD: INSECT PROTEIN MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 154 REST OF THE WORLD: INSECT PROTEIN MARKET, BY REGION, 2019–2021 (METRIC TONS)

TABLE 155 REST OF THE WORLD: INSECT PROTEIN MARKET, BY REGION, 2022–2027 (METRIC TONS)

TABLE 156 REST OF THE WORLD: INSECT PROTEIN MARKET, BY INSECT TYPE, 2019–2021 (USD MILLION)

TABLE 157 REST OF THE WORLD: INSECT PROTEIN MARKET, BY INSECT TYPE, 2022–2027 (USD MILLION)

TABLE 158 REST OF THE WORLD: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 159 REST OF THE WORLD: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 160 REST OF THE WORLD: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (METRIC TONS)

TABLE 161 REST OF THE WORLD: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (METRIC TONS)

TABLE 162 REST OF THE WORLD: INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

TABLE 163 REST OF THE WORLD: INSECT PROTEIN MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 Increasing adoption of black soldier fly insect protein in poultry feed

TABLE 164 SOUTH AMERICA: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 165 SOUTH AMERICA: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 166 SOUTH AMERICA: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (METRIC TONS)

TABLE 167 SOUTH AMERICA: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (METRIC TONS)

10.5.2 MIDDLE EAST AND AFRICA

TABLE 168 MIDDLE EAST & AFRICA: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 169 MIDDLE EAST & AFRICA: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: INSECT PROTEIN MARKET, BY APPLICATION, 2019–2021 (METRIC TONS)

TABLE 171 MIDDLE EAST & AFRICA: INSECT PROTEIN MARKET, BY APPLICATION, 2022–2027 (METRIC TONS)

11 COMPETITIVE LANDSCAPE (Page No. - 135)

11.1 OVERVIEW

11.2 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

11.2.1 STARS

11.2.2 EMERGING LEADERS

11.2.3 PERVASIVE PLAYERS

11.2.4 PARTICIPANTS

FIGURE 36 COMPANY EVALUATION QUADRANT

11.3 RANKING OF KEY PLAYERS, 2021

11.4 COMPETITIVE BENCHMARKING

TABLE 172 INSECT PROTEIN MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS BY INSECT TYPE

TABLE 173 INSECT PROTEIN MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY APPLICATION

TABLE 174 INSECT PROTEIN MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY REGION

11.5 COMPETITIVE BENCHMARKING

TABLE 175 INSECT PROTEIN MARKET: DETAILED LIST OF SMES

11.6 COMPETITIVE SCENARIO

11.6.1 PRODUCT LAUNCHES

TABLE 176 INSECT PROTEIN MARKET: PRODUCT LAUNCHES, (2019-2022)

11.6.2 DEALS

TABLE 177 INSECT PROTEIN MARKET: DEALS, 2019–2022

11.6.3 OTHER DEVELOPMENTS

TABLE 178 INSECT PROTEIN MARKET: OTHER DEVELOPMENTS, 2019–2022

12 COMPANY PROFILES (Page No. - 143)

12.1 KEY PLAYERS

(Business overview, Products/Solutions/Services offered, Recent developments, and MNM view)*

12.1.1 ENVIROFLIGHT

TABLE 179 ENVIROFLIGHT: BUSINESS OVERVIEW

TABLE 180 ENVIROFLIGHT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 181 ENVIROFLIGHT: DEALS

TABLE 182 ENVIROFLIGHT: OTHERS

12.1.2 INNOVAFEED

TABLE 183 INNOVAFEED: BUSINESS OVERVIEW

TABLE 184 INNOVAFEED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 185 INNOVAFEED: DEALS

TABLE 186 INNOVAFEED: OTHER DEVELOPMENTS

12.1.3 HEXAFLY

TABLE 187 HEXAFLY: BUSINESS OVERVIEW

TABLE 188 HEXAFLY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 189 HEXAFLY: OTHER DEVELOPMENTS

12.1.4 PROTIX

TABLE 190 PROTIX: BUSINESS OVERVIEW

TABLE 191 PROTIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 192 PROTIX: OTHER DEVELOPMENTS

12.1.5 GLOBAL BUGS

TABLE 193 GLOBAL BUGS: BUSINESS OVERVIEW

TABLE 194 GLOBAL BUGS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 195 GLOBAL BUGS: DEALS

12.1.6 ENTOMO FARMS

TABLE 196 ENTOMO FARMS: BUSINESS OVERVIEW

TABLE 197 ENTOMO FARMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.7 YNSECT

TABLE 198 YNSECT: BUSINESS OVERVIEW

TABLE 199 YNSECT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 200 YNSECT: DEALS

TABLE 201 YNSECT: OTHER DEVELOPMENTS

12.1.8 BETA BUGS

TABLE 202 BETA BUGS: BUSINESS OVERVIEW

TABLE 203 BETA BUGS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.9 ASPIRE FOOD GROUP

TABLE 204 ASPIRE FOOD GROUP: BUSINESS OVERVIEW

TABLE 205 ASPIRE FOOD GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 206 ASPIRE FOOD GROUP: OTHER DEVELOPMENTS

12.1.10 CHAPUL, LLC

TABLE 207 CHAPUL, LLC: BUSINESS OVERVIEW

TABLE 208 CHAPUL, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 209 CHAPUL, LLC: OTHER DEVELOPMENTS

12.1.11 BETA HATCH

TABLE 210 BETA HATCH: BUSINESS OVERVIEW

TABLE 211 BETA HATCH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 212 BETA HATCH: OTHER DEVELOPMENTS

12.1.12 NEXTPROTEIN

TABLE 213 NEXTPROTEIN: BUSINESS OVERVIEW

TABLE 214 NEXTPROTEIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.13 NUTRITION TECHNOLOGIES

TABLE 215 NUTRITION TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 216 NUTRITION TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 217 NUTRITION TECHNOLOGIES: DEALS

TABLE 218 NUTRITION TECHNOLOGIES: OTHER DEVELOPMENTS

12.1.14 GOTERRA

TABLE 219 GOTERRA: BUSINESS OVERVIEW

TABLE 220 GOTERRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 221 GOTERRA: OTHER DEVELOPMENTS

12.1.15 ALL THINGS BUGS, LLC.

TABLE 222 ALL THINGS BUGS, LLC.: BUSINESS OVERVIEW

TABLE 223 ALL THINGS BUGS, LLC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 224 ALL THINGS BUGS, LLC: OTHER DEVELOPMENTS

12.1.16 JR UNIQUE FOODS

TABLE 225 JR UNIQUE FOODS: BUSINESS OVERVIEW

12.1.17 PROTENGA

TABLE 226 PROTENGA: BUSINESS OVERVIEW

12.1.18 HIPROMINE S.A.

TABLE 227 HIPROMINE S.A.: BUSINESS OVERVIEW

12.1.19 BIOFLYTECH

TABLE 228 BIOFLYTECH: BUSINESS OVERVIEW

12.1.20 TEBRIO

TABLE 229 TEBRIO: BUSINESS OVERVIEW

*Details on Business overview, Products/Solutions/Services offered, Recent developments, and MNM view might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS (Page No. - 171)

13.1 INTRODUCTION

TABLE 230 ADJACENT MARKETS TO SEED COATING MARKET

13.2 LIMITATIONS

13.3 PROTEIN INGREDIENTS MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

TABLE 231 PROTEIN INGREDIENTS MARKET SIZE, BY SOURCE, 2016–2019 (USD MILLION)

TABLE 232 PROTEIN INGREDIENTS MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

TABLE 233 PROTEIN INGREDIENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 234 PROTEIN INGREDIENTS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

13.4 AQUA FEED MARKET

13.4.1 MARKET DEFINITION

TABLE 235 AQUAFEED MARKET SIZE, BY ADDITIVES, 2016–2019 (USD MILLION)

TABLE 236 AQUAFEED MARKET SIZE, BY ADDITIVES, 2020–2025 (USD MILLION)

14 APPENDIX (Page No. - 175)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

This research study involved extensive secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect valuable information for a technical, market-oriented, and commercial study of the insect protein market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information and assess prospects.

Secondary Research

In the secondary research process, sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both demand- and technology oriented perspectives.

Insect Protein Market Report Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market.

To know about the assumptions considered for the study, download the pdf brochure

Report Objectives

- To determine and project the size of the insect protein market based on insect type, application, distribution channel, and region ranging from 2022 to 2027

- To identify attractive opportunities in the insect protein market by determining the largest and fastest-growing segments across the regions

- To recognize the key drivers and restraints impacting the global insect protein market

- To profile the key players in the insect protein market supplying ingredients for both food and feed applications and comprehensively analyze their market positions and core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by the players across the key regions

- To provide insights on the key investments in product innovations and patent registrations

Impact of Insect-based Food on Insect Protein Market

The insect-based food market is closely connected to the insect protein market, as insect protein is a key ingredient in many insect-based food products. Insect-based foods are made from various parts of the insect, including the larvae, pupae, and adults. These insects are usually farmed specifically for food production, and they are often processed into a powder or a paste that can be used as an ingredient in a wide range of food products.

Insect-based food products are becoming increasingly popular as a sustainable and nutritious alternative to traditional meat products. They are a good source of protein, healthy fats, and micronutrients, and are also more environmentally friendly to produce than conventional meat. Some common examples of insect-based foods include cricket flour, mealworm burgers, and grasshopper snacks.

Therefore, the demand for insect-based food products is driving the growth of the insect protein market, as manufacturers need a reliable and cost-effective source of insect protein to produce these products. This, in turn, is leading to the development of new insect farming and processing technologies, as well as new applications for insect protein in the food industry.

Newer applications available in Insect-based Food Market

Newer applications available in Insect-based Food Market are Cricket Flours, EXO Protein Bars, Bitty Foods, Crunchy Critters, Hopper Foods, and Chapul. Additionally, there are other companies working to create new products and applications for insect-based food products, such as All Things Bugs, a company that produces powders, proteins, and oils derived from insects for use as ingredients in food products.

Facts and Operational details on Plant Protein Alternatives Market

- Plant protein alternatives are derived from sources such as peas, soy, sunflower seeds, and oats, among others. The growing demand for vegan and vegetarian protein sources has been driving the market for plant protein alternatives across the globe.

- Rising awareness among consumers about the benefits of consuming plant-based proteins is propelling the demand for these products. Furthermore, increasing health concerns among consumers about obesity and other metabolic disorders are further boosting the demand for these products.

- The increase in health consciousness among people due to the growing number of food-related health risks has also been driving the growth of this market.

- Furthermore, changes in consumer preference towards convenient and more nutritious food products is also driving market growth. For instance, incorporation of pea proteins into various food categories such as snacks bars, nutrition powders, and beverages will help in meeting consumer demand for convenient and healthier food products.

- Additionally, the increasing demand for convenience foods is also a major factor driving the growth of this market globally.

Sustainable Protein Market Size, Share, Growth Analysis trends in coming years

The future of the sustainable protein market is expected to be bright. This growth is mainly due to increasing consumer demand for plant-based proteins as an alternative to animal-based proteins and growing environmental concerns about food production. Additionally, the introduction of new plant-based proteins, such as pea protein, jackfruit protein, and mung bean protein, are expected to increase the popularity of sustainable proteins as they provide similar flavor and texture profiles as traditional animal-based proteins. Furthermore, increasing awareness about the environment and health benefits associated with sustainable proteins is projected to further drive their adoption in the global market.

Cricket Protein and Industrial Trends

Cricket protein is becoming increasingly popular and is becoming more widely available due to its sustainability, nutritionally rich health benefits, and neutral taste. Cricket protein powder is an excellent source of nutrition, as it is low in fat, high in iron and calcium, as well as being a complete protein – containing all the essential amino acids. It is also gluten-free and vegan friendly, so it can be a great option for those with dietary restrictions. With a growing awareness of the potential health, environmental and financial benefits of cricket protein, the industry is rapidly expanding, with farmers and producers making this novel food a viable option. There is increased investment and interest in the insect-protein market, which is currently valued at over $150 million and rising. As cricket protein becomes more commonplace, it will become a major part of the global food chain as well as bring about new innovative ideas for healthier eating.

Hypothetic growth opportunity, use cases, niche growth drivers, niche threats for Insect-based Food Market in coming years

The insect-based food market is a relatively new and growing industry that has the potential to address many of the sustainability and health concerns associated with traditional protein sources. Here are some hypothetical growth opportunities, future use cases, niche growth drivers, and niche threats for the insect-based food market:

- Increased Demand for Alternative Protein Sources: As the world population continues to grow, and traditional protein sources such as beef, pork, and chicken become more expensive and less sustainable, there is an increasing demand for alternative protein sources. Insects are a highly nutritious and sustainable source of protein that can be produced with minimal environmental impact.

- Expansion into New Markets: While the insect-based food market is still relatively small, it has the potential to expand into new markets such as pet food and animal feed. Insects are already being used in some pet foods, and their high protein content makes them an attractive option for livestock feed.

- Increased Interest in Sustainable Agriculture: As consumers become more interested in sustainable agriculture, the demand for insect-based food products is likely to increase. Insects require less water, land, and feed than traditional livestock, and produce fewer greenhouse gas emissions.

- Increased Use in Sports Nutrition: Insects are an excellent source of protein for athletes and fitness enthusiasts. Insect-based protein powders and energy bars are already available, and as the market for sports nutrition continues to grow, so too may the demand for insect-based products.

- Regulatory Hurdles: While the insect-based food market is growing, it is still subject to regulatory hurdles in many countries. Some countries do not allow the sale of insects as food, while others have strict regulations around insect production and processing.

- Consumer Acceptance: While insects are a common source of protein in many cultures, they are still relatively new to Western markets. Consumer acceptance of insect-based products will be a key driver of the industry's growth in the coming years.

- Competition from Plant-Based Proteins: Plant-based protein sources such as soy, pea, and rice are also growing in popularity as an alternative to traditional animal protein. As the plant-based protein market expands, it may compete with the insect-based food market for market share.

Overall, the insect-based food market has the potential to grow significantly in the coming years as consumers become more interested in sustainable and alternative protein sources. However, the industry will need to overcome regulatory hurdles and consumer acceptance issues and compete with other alternative protein sources to achieve its full potential.

Speak to our Analyst today to know more about "Insect-based Food Market".

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe into Ireland, Norway, Sweden, and Switzerland.

- Further analysis of the Rest of Asia Pacific into Indonesia, Vietnam, South Korea, and Singapore.

- The rest of the World (RoW) includes South America and Middle East & Africa

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Insect Protein Market