AR VR Software Market by Technology Type (AR Software and VR Software), Software Type (Software Development Kit, Game Engine), Vertical (Media & Entertainment, Retail & eCommerce, Manufacturing, Healthcare) and Region - Global Forecast to 2028

AR VR Software Market Share, Forecast & Growth Report

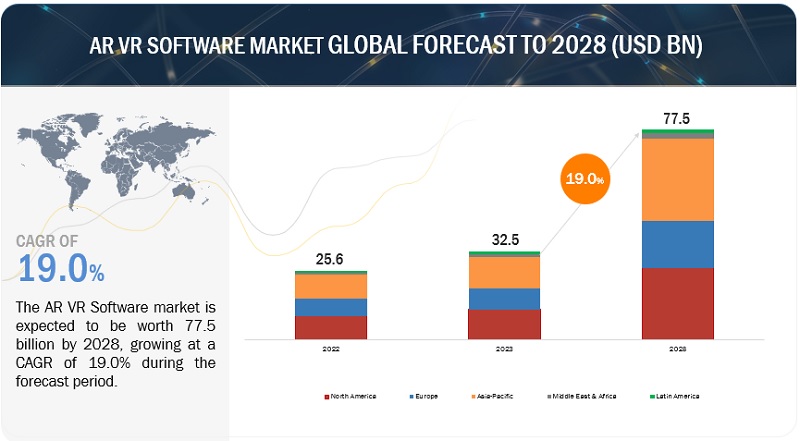

[244 Pages Report] The global AR VR Software Market size worth approximately $32.5 billion in 2023. It is expected to grow at an effective Compound Annual Growth Rate (CAGR) of 19.0% from 2023 to 2028. The revenue forecast for 2028 is anticipated to reach over $77.5 billion. The base year considered for estimation is 2022 and the historical data span ranges from 2023 to 2028.

AR VR Software, In the aviation and aerospace sectors, AR and VR technologies are instrumental for pilot training, aircraft maintenance, and cockpit design. These immersive technologies provide trainee pilots with true-to-life flight simulations, improving their skills and decision-making abilities. Additionally, maintenance procedures are streamlined as technicians can access augmented repair instructions and visualize complex systems in 3D, reducing downtime. Furthermore, AR and VR facilitate cockpit design by allowing engineers to test and refine layouts virtually, optimizing ergonomics and enhancing safety. Consequently, the development of specialized software solutions for these industries is driven by the practicality and efficiency that AR and VR bring to aviation and aerospace operations.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

AR VR Software Market Growth Dynamics

Driver: Growing popularity of gaming

The gaming sector's enthusiasm for immersive experiences, its thirst for authenticity, and its welcoming stance towards innovation are propelling the acceptance of AR/VR software. Gamers, renowned for their early adoption of tech, actively pursue immersive gameplay and inventive features, rendering AR/VR software exceptionally appealing. Leading gaming companies are seamlessly integrating AR/VR software with their existing gaming ecosystems. Furthermore, multiplayer, and social gaming experiences, as well as heightened developer involvement, are flourishing within the AR/VR software realm. Gaming communities magnify the positive impact of AR/VR software, while esports amplify spectator engagement. Collectively, gamers play a pivotal role in expanding the influence of AR/VR software in the realm of entertainment and gaming.

Restraint: Diverse use cases of AR VR in multiple industries

AR/VR software serves as a driving force in various industries, including aviation, healthcare, and military training, by offering realistic simulations for safe skill development. It enables remote collaboration in fields like architecture and engineering, fosters therapy and rehabilitation in healthcare, enhances education through interactive learning experiences, and transforms marketing campaigns by engaging customers with virtual try-ons and product visualizations. In real estate, it facilitates virtual property tours, saving time for both buyers and sellers. Additionally, AR/VR software promotes tourism and cultural preservation by providing immersive virtual tours of historical and cultural sites, thereby driving innovation and growth in the AR/VR industry.

Opportunity: Enhancing remote work and collaboration through AR/VR software

The ascent of remote work and collaboration has propelled AR/VR software into a transformative role in redefining the way teams interact and collaborate. AR/VR-enabled virtual meetings transcend the limitations of traditional video conferencing, allowing colleagues to gather in lifelike virtual environments, fostering a stronger sense of presence and connection. Design collaboration takes on a new dimension, as teams can visualize and interact with 3D models in real time, enhancing creativity and productivity. Moreover, AR/VR facilitates immersive team-building experiences, enabling remote teams to engage in team-building activities and training exercises as if they were physically present, ultimately strengthening bonds and collaboration.

Challenge: Limited amount of content available for AR/VR

Content development is a pivotal challenge in the AR/VR ecosystem due to the relatively limited availability of diverse and compelling experiences. Attracting users and sustaining their interest hinges on having a rich array of content. Insufficient content diversity can deter users from adopting AR/VR technology, as they seek engaging applications and experiences that cater to their diverse preferences. This scarcity necessitates a concerted effort from developers to create innovative, high-quality content across various genres, from gaming and entertainment to education and training, to drive user adoption and establish AR/VR as a mainstream platform.

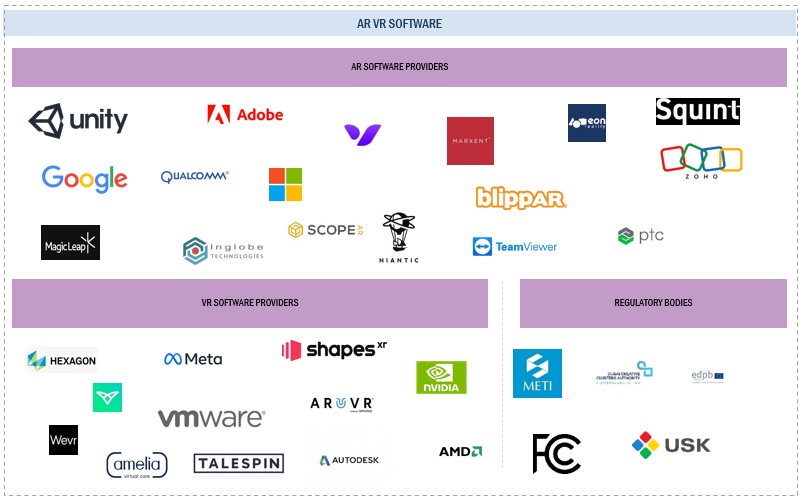

AR VR Software Market Ecosystem

Prominent players in this market include well-established, financially stable AR and VR Software solutions, services providers, and regulatory bodies. These companies have been operating in the market for several years and possess a diversified product portfolio and state-of-the-art technologies. Prominent companies in this market include Microsoft (US), Google (US), and Unity Technologies (US) and so on.

The Media & Entertainment segment to hold the largest market size during the forecast period

Virtual cinemas revolutionize movie-watching by transporting viewers into virtual theaters. Within these immersive environments, users can enjoy films on a virtual big screen, complete with theater ambiance and seating, all from the comfort of their own space. This innovative cinematic experience not only adds novelty to movie consumption but also opens new possibilities for social interactions, allowing friends and family to watch movies together in a shared virtual space, regardless of physical distance. The growth of virtual cinemas propels the advancement of software solutions tailored to this unique form of cinematic entertainment, enriching the overall landscape of modern film experiences.

The VR Software segment is expected to register the second fastest growth rate during the forecast period.

In the real estate sector, VR has ushered in a transformative era by providing virtual property tours, immersive 3D property visualizations, and augmented property information. These innovations have significantly elevated the property marketing and sales landscape, offering prospective buyers an unparalleled opportunity to explore and evaluate properties from the comfort of their own spaces. This immersive experience not only saves time and resources but also enhances decision-making by allowing buyers to interact with properties as if they were physically present. As a result, the adoption of VR software in property marketing and sales has surged, becoming an integral tool for real estate professionals, and redefining the way properties are showcased and sold in the market.

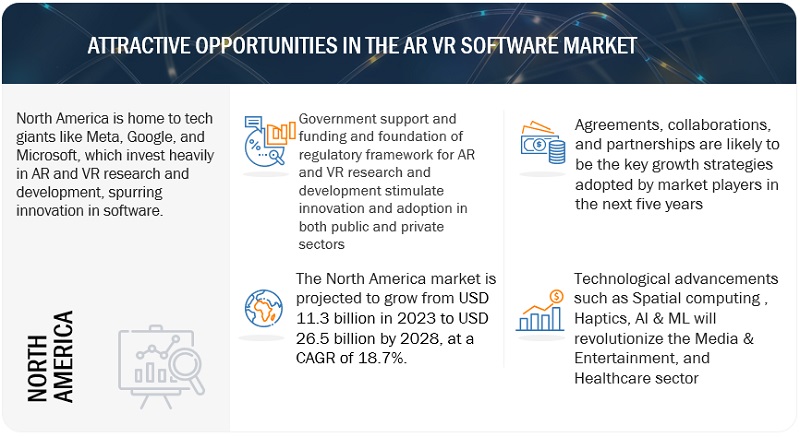

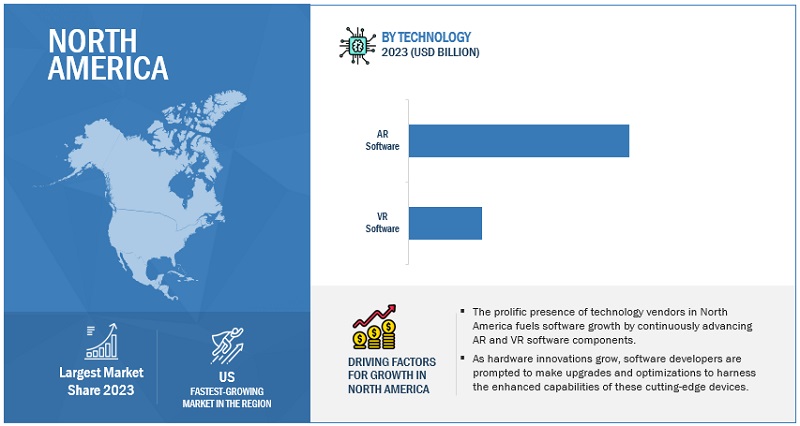

North America is expected to hold the second largest market size during the forecast period

Prominent North American technology giants, such as Meta, Google, and Microsoft, allocate substantial resources to AR and VR research and development initiatives. These investments drive forward groundbreaking innovations in AR and VR software. By pushing the boundaries of what's possible in terms of hardware capabilities, user experiences, and immersive content, these industry leaders set the pace for the entire AR and VR ecosystem. Their contributions range from cutting-edge VR headsets and AR glasses to software development kits (SDKs) that empower developers worldwide to create the next generation of immersive applications and experiences. This commitment to advancing AR and VR technologies continues to shape the industry's trajectory, propelling it into new frontiers of possibility.

AR VR Software Companies:

The major companies in the AR VR Software market are include Microsoft (US), Google (US), Unity Technologies (US), Adobe (US), Autodesk (US), Meta (US), PTC (US), TeamViewer (Germany), NVIDIA Corporation (US), Advanced Micro Devices (US), Qualcomm (US), Zoho Corporation (India), Hexagon AB (Sweden), Magic Leap (US), VMware (US), Blippar (UK), Augment (France), ShapesXR (US), ARuVR (UK), Scope AR (US), Vectary (US), Eon Reality (US), Wevr (US), Talespin Reality Labs (US), Squint (US), Niantic (US), Marxent Labs (US), Inglobe Technologies (Italy), Ultraleap (US), Amelia (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and enhancements, and acquisitions to expand their AR VR Software market footprint.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Billion |

|

Segments covered |

Technology Type (AR Software and VR Software), Software Type, Vertical, and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. |

|

Companies covered |

Microsoft (US), Google (US), Unity Technologies (US), Adobe (US), Autodesk (US), Meta (US), PTC (US), TeamViewer (Germany), NVIDIA Corporation (US), Advanced Micro Devices (US), Qualcomm (US), Zoho Corporation (India), Hexagon AB (Sweden), Magic Leap (US), VMware (US), Blippar (UK), Augment (France), ShapesXR (US), ARuVR (UK), Scope AR (US), Vectary (US), Eon Reality (US), Wevr (US), Talespin Reality Labs (US), Squint (US), Niantic (US), Marxent Labs (US), Inglobe Technologies (Italy), Ultraleap (US), Amelia (US) |

This research report categorizes the AR VR Software market to forecast revenues and analyze trends in each of the following submarkets:

Based on Technology Type:

- AR Software

- VR Software

Based on Software Type:

- Software Development Kit

- Game Engine

- Modeling & Visualization Software

- Content Management System

- Training Simulation Software

- Other Software (remote collaboration, geospatial mapping, and industrial platforms)

Based on Vertical:

- Media & Entertainment

- Retail & E-commerce

- Training & Education

- Travel & Hospitality

- Aerospace & Defense

- Real Estate

- Manufacturing

- Healthcare

- Aerospace & Defense

- Automotive

- Other Verticals (IT & Telecom, Transportation & Logistics, and Energy & Utilities)

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Italy

- Spain

- Nordics

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Southeast Asia

- Rest of Asia Pacific

-

Middle East & Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In February 2023, Samsung, Google, and Qualcomm collaborated to deliver a mixed-reality platform. This collaboration will enable the companies to deliver the next-gen technology through cutting-edge advanced hardware and software.

- In November 2022, Microsoft and Microsoft partnered to integrate Microsoft 365, Teams, Intune, and Azure Active Directory into Meta Quest devices.

- In March 2022, Autodesk acquired The Wild cloud-connected Metaverse and virtual reality platform technology firm.

Frequently Asked Questions (FAQ):

What is mean by AR VR Software?

AR and VR software refers to computer programs and applications that create immersive digital environments or enhance real-world experiences. AR overlays digital information onto the physical world, enhancing it with interactive elements, while VR immerses users in entirely computer-generated environments. These software types are used across various industries, including gaming, education, healthcare, and more, to provide interactive and immersive experiences.

What is the future for AR VR Software market?

The AR VR Software Market is anticipated to be valued at USD 32.5 billion in 2023 and poised to reach USD 77.5 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 19.0% during anticipated period from 2023 to 2028.

What are the major drivers in the AR VR Software market?

The major drivers in the AR VR Software market are the growing popularity of gaming and diverse use cases of AR VR in multiple industries.

Which are the leading AR VR Software companies included in the report?

The leading AR VR Software companies included in this report are Microsoft (US), Google (US), Unity Technologies (US), Adobe (US), Autodesk (US), Meta (US), PTC (US), TeamViewer (Germany), NVIDIA Corporation (US), Advanced Micro Devices (US), Qualcomm (US), Zoho Corporation (India), Hexagon AB (Sweden), Magic Leap (US), VMware (US), Blippar (UK), Augment (France), ShapesXR (US), ARuVR (UK), Scope AR (US), Vectary (US), Eon Reality (US), Wevr (US), Talespin Reality Labs (US), Squint (US), Niantic (US), Marxent Labs (US), Inglobe Technologies (Italy), Ultraleap (US), Amelia (US).

What is the total CAGR expected to be recorded for the wireless charging market for electric vehicles during 2023-2030?

The key technology trends in AR VR Software include Spatial Computing, Haptics, and AI & ML.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

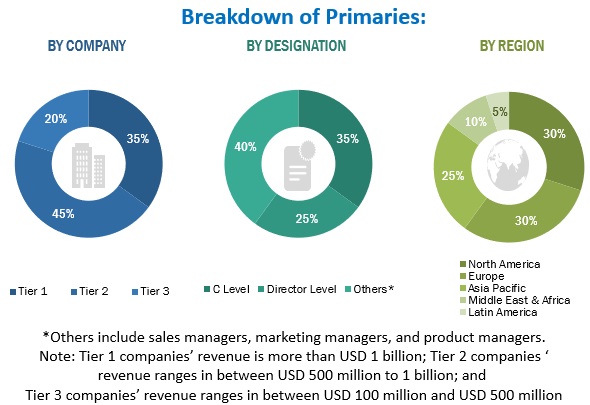

This research study involved the extensive use of secondary sources, directories, and databases, such as Dun & Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for a technical, market-oriented, and commercial study of the AR VR Software market. The primary sources have been mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market for companies offering AR VR Software solutions and services to different verticals has been estimated and projected based on the secondary data made available through paid and unpaid sources, as well as by analyzing their product portfolios in the ecosystem of the AR VR Software market. It also involved rating company products based on their performance and quality. In the secondary research process, various sources such as the Immersive Technology Alliance (ITA), International Virtual Reality and Healthcare Association (IVHA), VR/AR Association (VRARA), Augmented Reality for Enterprise Alliance (AREA), have been referred to for identifying and collecting information for this study on the AR VR Software market. The secondary sources included annual reports, press releases and investor presentations of companies, white papers, journals, and certified publications and articles by recognized authors, directories, and databases. Secondary research has been mainly used to obtain key information about the supply chain of the market, the total pool of key players, market classification, segmentation according to industry trends to the bottommost level, regional markets, and key developments from both market- and technology-oriented perspectives that have been further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from AR VR Software solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using AR VR Software solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of AR VR Software solutions which would impact the overall AR VR Software market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the AR VR Software market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of AR and VR Software offerings.

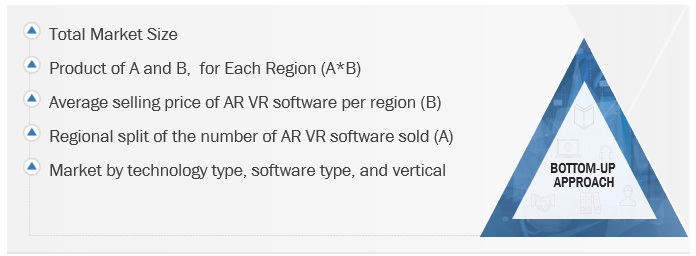

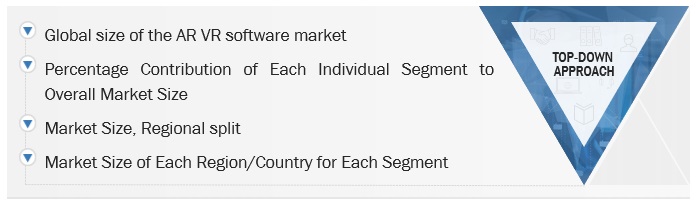

Both top-down and bottom-up approaches were used to estimate and validate the total size of the AR VR Software market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

AR VR Software Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

AR VR Software Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the AR VR Software market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

AR and VR software refer to computer programs and applications designed to create interactive, immersive, and often sensory-rich digital experiences. AR software overlays digital information onto the real world, enhancing it with digital elements, while VR software completely immerses users in a computer-generated environment, typically through headsets or other devices. These software technologies find applications in gaming, education, training, simulations, entertainment, and various industries, transforming how users interact with digital content and their surroundings.

Key Stakeholders

- AR VR Software providers

- Government organizations, forums, alliances, and associations

- Consulting service providers

- Value-added resellers (VARs)

- End users

- System integrators

- Research organizations

- Consulting companies

Report Objectives

- To determine and forecast the global AR VR Software market by technology (AR software, VR software), software type, vertical, and region from 2023 to 2038, and analyze the various macroeconomic and microeconomic factors affecting market growth.

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the AR VR Software market.

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market's competitive landscape.

- Track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and research and development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Country-wise information

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in AR VR Software Market