TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 43)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

TABLE 1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 ARMORED VEHICLES MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 2 USD EXCHANGE RATES

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

1.6.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY (Page No. - 49)

2.1 RESEARCH DATA

FIGURE 2 REPORT PROCESS FLOW

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

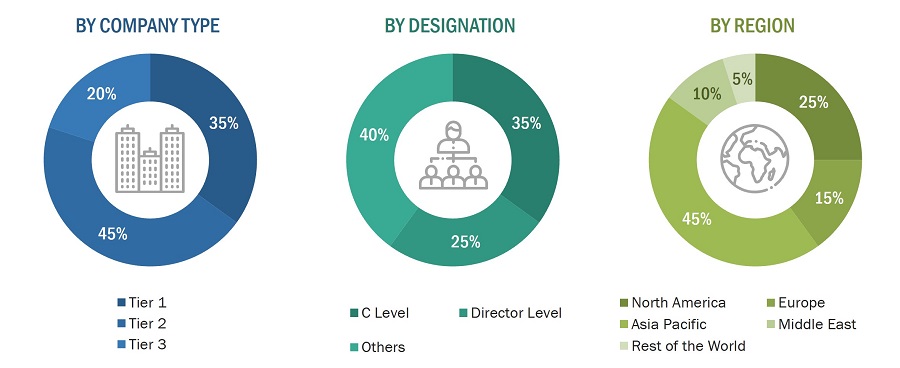

2.1.2.2 Breakdown of primary interviews

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.3 SUPPLY-SIDE INDICATORS

2.2.3.1 Impact of Russia-Ukraine war

2.2.3.1.1 Impact of Russia-Ukraine war on macro factors of armored vehicles market

FIGURE 4 IMPACT OF RUSSIA-UKRAINE WAR ON MACRO FACTORS OF ARMORED VEHICLES MARKET

2.2.3.1.2 Impact of Russia-Ukraine war on micro factors of armored vehicles market

TABLE 3 IMPACT OF RUSSIA-UKRAINE WAR ON MICRO FACTORS OF ARMORED VEHICLES MARKET

FIGURE 5 IMPACT OF RUSSIA-UKRAINE WAR ON MICRO FACTORS OF ARMORED VEHICLES MARKET

2.2.4 RECESSION IMPACT ANALYSIS

2.3 MARKET SIZE ESTIMATION

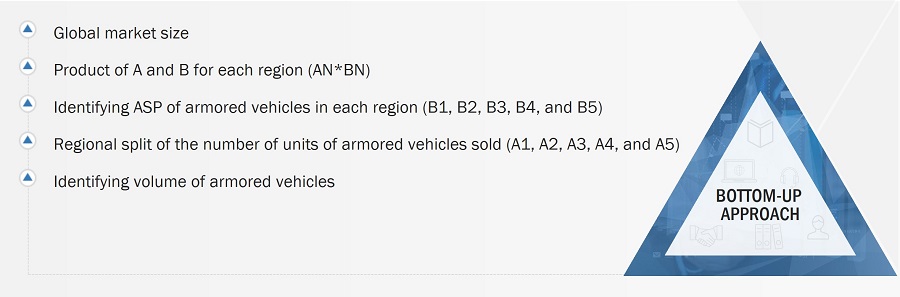

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Market size estimation methodology (demand-side)

FIGURE 6 BOTTOM-UP APPROACH

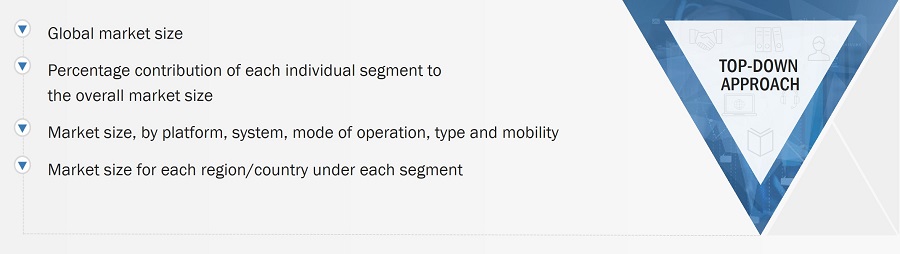

2.3.2 TOP-DOWN APPROACH

FIGURE 7 TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

2.6 RESEARCH LIMITATIONS

2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 62)

FIGURE 9 COMBAT VEHICLES TO BE LARGEST SEGMENT DURING FORECAST PERIOD

FIGURE 10 WHEELED SEGMENT TO HOLD HIGHER MARKET SHARE DURING FORECAST PERIOD

FIGURE 11 UNMANNED TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

FIGURE 12 ELECTRIC ARMORED VEHICLES TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

FIGURE 13 ASIA PACIFIC TO BE LARGEST MARKET FOR ARMORED VEHICLES DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 66)

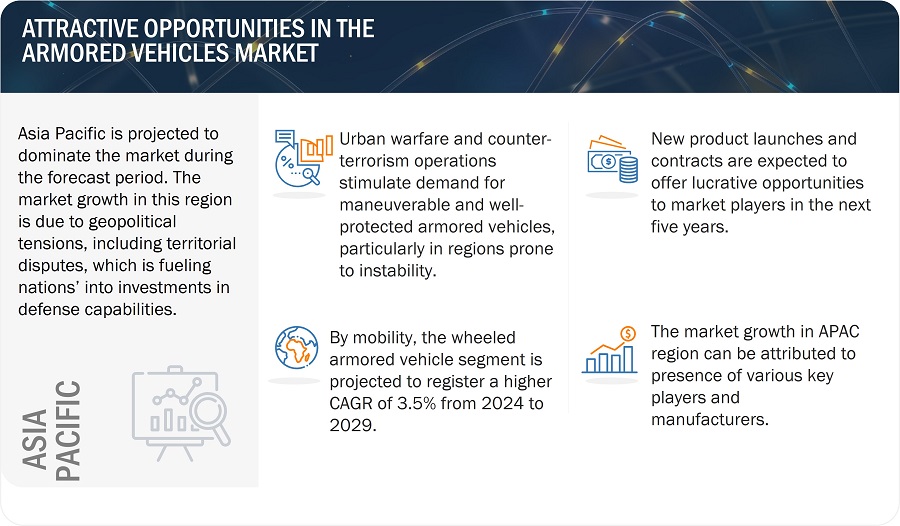

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ARMORED VEHICLES MARKET

FIGURE 14 NEED FOR BORDER SECURITY AND MARITIME PATROLLING TO DRIVE GROWTH

4.2 ARMORED VEHICLES MARKET, BY REGION

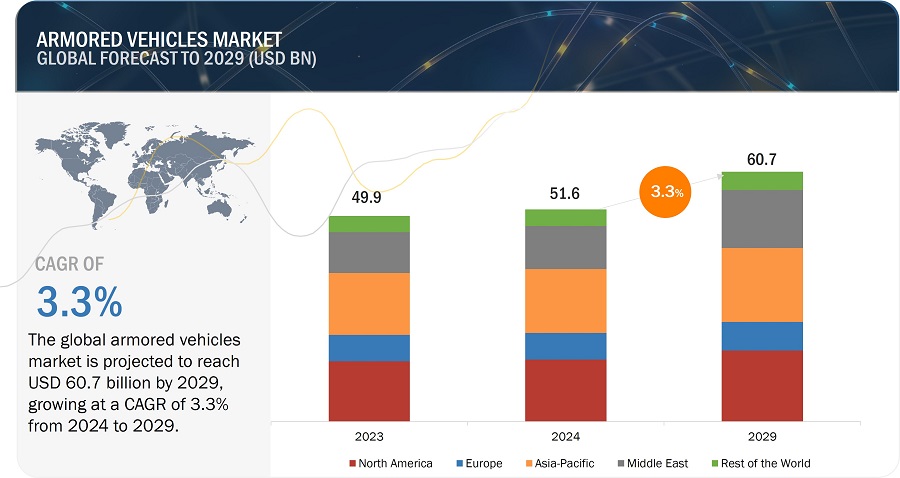

FIGURE 15 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

4.3 ARMORED VEHICLES MARKET, BY PLATFORM

FIGURE 16 COMBAT VEHICLES TO SECURE LEADING MARKET POSITION DURING FORECAST PERIOD

4.4 ARMORED VEHICLES MARKET, BY MOBILITY

FIGURE 17 WHEELED SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.5 ARMORED VEHICLES MARKET, BY MODE OF OPERATION

FIGURE 18 MANNED SEGMENT TO ACQUIRE MAXIMUM MARKET SHARE IN 2029

4.6 ARMORED VEHICLES MARKET, BY TYPE

FIGURE 19 CONVENTIONAL ARMORED VEHICLES TO SURPASS ELECTRIC ARMORED VEHICLES DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 70)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 ARMORED VEHICLES MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Need for improved intelligence, surveillance, and reconnaissance (ISR) and target acquisition capabilities by defense forces

5.2.1.2 Growing demand for armored vehicles to tackle cross-border conflicts

TABLE 4 NEW DELIVERIES OF COMBAT SUPPORT VEHICLES, BY COUNTRY, 2021–2023 (UNITS)

5.2.1.3 Rising incidences of asymmetric warfare

5.2.1.4 Increased global defense spending

FIGURE 21 TOP 10 DEFENSE SPENDERS, 2020–2030

5.2.2 RESTRAINTS

5.2.2.1 Susceptibility to mechanical and electrical failures

5.2.2.2 Survivability risks for personnel onboard armored vehicles

5.2.3 OPPORTUNITIES

5.2.3.1 Rising technology integration and upgrades in military vehicles

5.2.3.2 Adoption of lifecycle optimization strategies for sustainment

5.2.3.3 Global military modernization plans

5.2.3.4 Increasing procurement of unmanned systems by defense forces

5.2.3.5 Development of modular and scalable armored vehicles

5.2.4 CHALLENGES

5.2.4.1 Hardware and software malfunctions

5.2.4.2 High costs of main battle tanks

5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 22 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

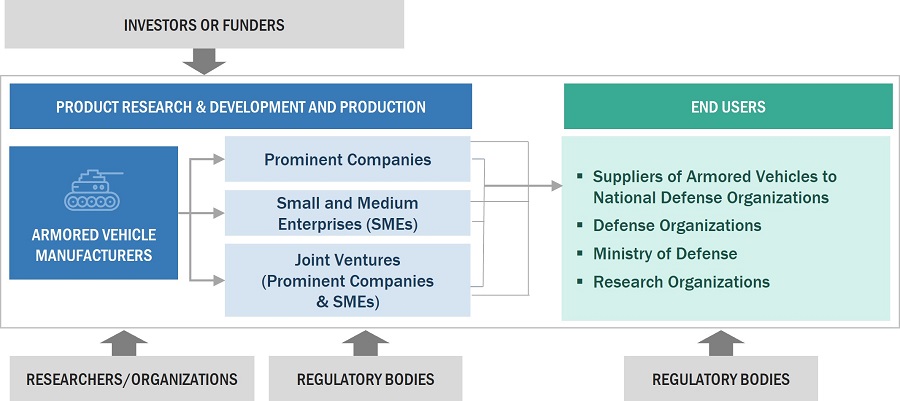

5.4 ECOSYSTEM ANALYSIS

5.4.1 PROMINENT COMPANIES

5.4.2 PRIVATE AND SMALL ENTERPRISES

5.4.3 END USERS

FIGURE 23 ECOSYSTEM ANALYSIS

TABLE 5 ROLE OF COMPANIES IN ECOSYSTEM

5.5 VOLUME DATA

TABLE 6 ACTIVE FLEET VOLUME OF MAIN BATTLE TANKS, BY COUNTRY, 2020–2030 (UNITS)

TABLE 7 ACTIVE FLEET VOLUME OF COMBAT SUPPORT VEHICLES, BY COUNTRY, 2020–2030 (UNITS)

TABLE 8 ACTIVE FLEET VOLUME OF COMBAT VEHICLES, BY COUNTRY, 2020–2030 (UNITS)

5.6 PRICING ANALYSIS

TABLE 9 INDICATIVE PRICING ANALYSIS OF ARMORED VEHICLES, BY PLATFORM, 2023

FIGURE 24 INDICATIVE PRICING ANALYSIS OF ARMORED VEHICLES, BY PLATFORM, 2023

TABLE 10 AVERAGE SELLING PRICE RANGE OF MAIN BATTLE TANKS, 2023

TABLE 11 AVERAGE SELLING PRICE RANGE OF INFANTRY FIGHTING VEHICLES, 2023

TABLE 12 AVERAGE SELLING PRICE RANGE OF ARMORED PERSONNEL CARRIERS, 2023

TABLE 13 AVERAGE SELLING PRICE RANGE OF MINE-RESISTANT AMBUSH- PROTECTED VEHICLES, 2023

TABLE 14 AVERAGE SELLING PRICE RANGE OF LIGHT-PROTECTED VEHICLES, 2023

TABLE 15 AVERAGE SELLING PRICE RANGE OF SELF-PROPELLED HOWITZERS, 2023

5.7 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS

5.8 TECHNOLOGY ROADMAP

FIGURE 26 EVOLUTION OF KEY TECHNOLOGIES

FIGURE 27 EMERGING TRENDS RELATED TO ARMORED VEHICLES

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF ARMORED VEHICLES, BY MODE OF OPERATION

TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF ARMORED VEHICLES, BY MODE OF OPERATION (%)

5.9.2 BUYING CRITERIA

FIGURE 29 KEY BUYING CRITERIA FOR ARMORED VEHICLES, BY PLATFORM

TABLE 17 KEY BUYING CRITERIA FOR ARMORED VEHICLES, BY PLATFORM

5.10 USE CASE ANALYSIS

5.10.1 VEHICLE INTEGRATION FOR C4ISR/EW INTEROPERABILITY (VICTORY) INITIATIVE

5.10.2 ELECTRIC FORCE FIELD FOR ARMORED VEHICLES

5.10.3 SEE-THROUGH ARMOR

5.10.4 OSHKOSH PROPULSION HYBRID DIESEL-ELECTRIC SYSTEM

5.10.5 ADAPTIVE CAMOUFLAGE SYSTEM

5.11 KEY CONFERENCES AND EVENTS, 2024–2025

TABLE 18 KEY CONFERENCES AND EVENTS, 2024–2025

5.12 TRADE ANALYSIS

5.12.1 EXPORT DATA

TABLE 19 EXPORT DATA, BY REGION, 2020–2022

FIGURE 30 EXPORT DATA, BY REGION, 2020–2022

5.12.2 IMPORT DATA

TABLE 20 IMPORT DATA, BY REGION, 2020–2022

FIGURE 31 IMPORT DATA, BY REGION, 2020–2022

5.13 TECHNOLOGY ANALYSIS

5.13.1 KEY TECHNOLOGY

5.13.1.1 Design and implementation of solar-powered armored vehicles

5.13.1.2 Development of multi-payload unmanned armored vehicles

5.13.2 COMPLEMENTARY TECHNOLOGY

5.13.2.1 Electro-optical and radar sensor payloads for unmanned armored vehicles

5.14 BILL OF MATERIALS

FIGURE 32 BILL OF MATERIALS FOR ARMORED VEHICLES

FIGURE 33 BILL OF MATERIALS FOR MAIN BATTLE TANKS

FIGURE 34 BILL OF MATERIALS FOR ARMORED PERSONNEL CARRIERS

FIGURE 35 BILL OF MATERIALS FOR INFANTRY FIGHTING VEHICLES

5.15 TOTAL COST OF OWNERSHIP

FIGURE 36 TOTAL COST OF OWNERSHIP OF ARMORED VEHICLES

FIGURE 37 PERCENTAGE BREAKDOWN OF TOTAL COST OF OWNERSHIP

TABLE 21 TOTAL COST OF OWNERSHIP OF MAIN BATTLE TANKS

5.16 BUSINESS MODELS

FIGURE 38 BUSINESS MODELS OF ARMORED VEHICLES MARKET

TABLE 22 BUSINESS MODELS OF ARMORED VEHICLES MARKET

5.17 REGULATORY LANDSCAPE

TABLE 23 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 24 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 25 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 26 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 27 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.18 INVESTMENT AND FUNDING SCENARIO

TABLE 28 VENTURE CAPITAL FOR UNMANNED GROUND VEHICLES, 2021–2023 (USD MILLION)

FIGURE 39 VENTURE CAPITAL FOR UNMANNED GROUND VEHICLES

6 INDUSTRY TRENDS (Page No. - 107)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

FIGURE 40 TECHNOLOGY TRENDS

6.2.1 ACTIVE PROTECTION SYSTEM

6.2.1.1 Soft-kill technology

6.2.1.2 Electro-optical jammer

6.2.1.3 Hard-kill technology

6.2.2 REACTIVE ARMOR TECHNOLOGY

6.2.3 PROGRAMMABLE AMMUNITION

6.2.4 LINKLESS FEED SYSTEM

6.2.5 AMMUNITION FEED CHUTE

6.2.6 SENSOR FUSION TECHNOLOGY

6.3 IMPACT OF MEGATRENDS

6.3.1 IMPROVED AMMUNITION CARRYING CAPABILITY

6.3.2 INNOVATIONS IN MICRO-ELECTROMECHANICAL SYSTEM AND NANOTECHNOLOGY

6.3.3 INTEROPERABLE COMMUNICATION SYSTEM

6.3.4 ADVANCED AUTOLOADER

6.4 SUPPLY CHAIN ANALYSIS

FIGURE 41 SUPPLY CHAIN ANALYSIS

6.5 PATENT ANALYSIS

FIGURE 42 PATENT ANALYSIS

TABLE 29 PATENT ANALYSIS

7 ARMORED VEHICLES MARKET, BY PLATFORM (Page No. - 116)

7.1 INTRODUCTION

FIGURE 43 ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029

TABLE 30 ARMORED VEHICLES MARKET, BY PLATFORM, 2021–2023 (USD MILLION)

TABLE 31 ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029 (USD MILLION)

7.2 COMBAT VEHICLES

TABLE 32 NEW DELIVERIES OF COMBAT VEHICLES, BY REGION, 2021–2029 (UNITS)

7.2.1 MAIN BATTLE TANKS

7.2.1.1 Surge in upgrade and procurement programs to drive growth

TABLE 33 NEW DELIVERIES OF MAIN BATTLE TANKS, BY REGION, 2021–2029 (UNITS)

7.2.2 INFANTRY FIGHTING VEHICLES

7.2.2.1 Ongoing developments by prominent defense companies and governments to drive growth

7.2.3 ARMORED PERSONNEL CARRIERS

7.2.3.1 Significant investments in defense armored vehicles to drive growth

7.2.4 ARMORED AMPHIBIOUS VEHICLES

7.2.4.1 Innovations in propulsion technology and hull design to drive growth

7.2.5 MINE-RESISTANT AMBUSH-PROTECTED VEHICLES

7.2.5.1 Need for protection against rocket-propelled grenades and small arms to drive growth

7.2.6 LIGHT ARMORED VEHICLES

7.2.6.1 Need for rapid response in fluid combat situations to drive growth

7.2.7 SELF-PROPELLED HOWITZERS

7.2.7.1 Advanced targeting technologies and powerful munitions to drive growth

7.2.8 AIR DEFENSE VEHICLES

7.2.8.1 Trend toward fully automated air defense systems to drive growth

7.2.9 ARMORED MORTAR CARRIERS

7.2.9.1 Ability to provide increased firepower and mobility to drive growth

7.3 COMBAT SUPPORT VEHICLES

TABLE 34 NEW DELIVERIES OF COMBAT SUPPORT VEHICLES, BY REGION, 2021–2029 (UNITS)

7.3.1 ARMORED SUPPLY TRUCKS

7.3.1.1 Focus on ensuring secure delivery of vital supplies to frontline units to drive growth

7.3.1.2 Armored fuel trucks

7.3.1.3 Armored ammunition replenishment vehicles

7.3.1.4 Armored ambulances

7.3.2 ARMORED COMMAND & CONTROL VEHICLES

7.3.2.1 Seamless integration with existing military systems to drive growth

7.3.3 REPAIR & RECOVERY VEHICLES

7.3.3.1 Need for towing or repairing combat vehicles on battlefields to drive growth

7.3.4 BRIDGE-LAYING TANKS

7.3.4.1 Operational readiness to drive growth

7.3.5 MINE CLEARANCE VEHICLES

7.3.5.1 High demand for prevention of mine blasts and other battlefield hazards to drive growth

7.4 UNMANNED ARMORED GROUND VEHICLES

7.4.1 INCREASING DEMAND FOR AUTONOMIC DECISION-MAKING CAPABILITIES IN COMPLEX REMOTE OPERATIONS TO DRIVE GROWTH

8 ARMORED VEHICLES MARKET, BY TYPE (Page No. - 125)

8.1 INTRODUCTION

FIGURE 44 ARMORED VEHICLES MARKET, BY TYPE, 2024–2029

TABLE 35 ARMORED VEHICLES MARKET, BY TYPE, 2021–2023 (USD MILLION)

TABLE 36 ARMORED VEHICLES MARKET, BY TYPE, 2024–2029 (USD MILLION)

8.2 ELECTRIC ARMORED VEHICLES

8.2.1 EMPHASIS ON REDUCING DEPENDENCE ON FOSSIL FUELS TO DRIVE GROWTH

8.3 CONVENTIONAL ARMORED VEHICLES

8.3.1 HIGHER POWER OUTPUT AND PERFORMANCE TO DRIVE GROWTH

9 ARMORED VEHICLES MARKET, BY MOBILITY (Page No. - 128)

9.1 INTRODUCTION

FIGURE 45 ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029

TABLE 37 ARMORED VEHICLES MARKET, BY MOBILITY, 2021–2023 (USD MILLION)

TABLE 38 ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029 (USD MILLION)

9.2 WHEELED

9.2.1 NEED FOR IMPROVED MOBILITY DURING CRITICAL COMBAT OPERATIONS TO DRIVE GROWTH

9.2.2 4X4

9.2.3 6X6

9.2.4 8X8

9.2.5 10X10

9.2.6 12X12

9.3 TRACKED

9.3.1 ONGOING MILITARY MODERNIZATION EFFORTS TO DRIVE GROWTH

10 ARMORED VEHICLES MARKET, BY MODE OF OPERATION (Page No. - 132)

10.1 INTRODUCTION

FIGURE 46 ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029

TABLE 39 ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2021–2023 (USD MILLION)

TABLE 40 ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

10.2 MANNED

10.2.1 NEED FOR ROBUST LAND COMBAT PLATFORMS TO DRIVE GROWTH

10.3 UNMANNED

TABLE 41 TYPES OF UNMANNED ARMORED VEHICLES

11 ARMORED VEHICLES MARKET, BY SYSTEM (Page No. - 136)

11.1 INTRODUCTION

FIGURE 47 ARMORED VEHICLES MARKET, BY SYSTEM, 2024–2029

TABLE 42 ARMORED VEHICLES MARKET, BY SYSTEM, 2021–2023 (USD MILLION)

TABLE 43 ARMORED VEHICLES MARKET, BY SYSTEM, 2024–2029 (USD MILLION)

11.2 ENGINES

11.2.1 DIESEL ENGINES

11.2.2 TURBINE ENGINES

11.3 DRIVE SYSTEMS

11.3.1 POWER TRANSMISSION DRIVES

11.3.2 SUSPENSION & BRAKING SYSTEMS

11.3.3 TRACKS & WHEELS

11.4 BALLISTIC ARMORS

11.4.1 COMPOSITE ARMORS

11.4.2 EXPLOSIVE REACTIVE ARMORS

11.4.3 ELECTRIC ARMORS

11.4.4 HOMOGENOUS ARMORS

11.4.5 DEPLETED URANIUM ARMORS

11.4.6 ADD-ON ARMORS

11.5 TURRET DRIVES

11.6 AMMUNITION HANDLING SYSTEMS

11.7 FIRE CONTROL SYSTEMS

11.8 ARMAMENTS

11.9 COUNTERMEASURE SYSTEMS

11.1 COMMAND & CONTROL SYSTEMS

11.11 POWER SYSTEMS

11.12 NAVIGATION SYSTEMS

11.13 OBSERVATION & DISPLAY SYSTEMS

11.14 HULLS/FRAMES

12 ARMORED VEHICLES MARKET, BY POINT OF SALE (Page No. - 143)

12.1 INTRODUCTION

12.2 OEM

12.3 RETROFIT

13 ARMORED VEHICLES MARKET, BY REGION (Page No. - 144)

13.1 INTRODUCTION

FIGURE 48 ARMORED VEHICLES MARKET, BY REGION, 2024–2029

13.1.1 REGIONAL RECESSION IMPACT ANALYSIS

TABLE 44 REGIONAL RECESSION IMPACT ANALYSIS

TABLE 45 ARMORED VEHICLES MARKET, BY REGION, 2021–2023 (USD MILLION)

TABLE 46 ARMORED VEHICLES MARKET, BY REGION, 2024–2029 (USD MILLION)

13.2 NORTH AMERICA

13.2.1 PESTLE ANALYSIS

13.2.2 RECESSION IMPACT ANALYSIS

FIGURE 49 NORTH AMERICA: ARMORED VEHICLES MARKET SNAPSHOT

TABLE 47 NORTH AMERICA: ARMORED VEHICLES MARKET, BY COUNTRY, 2021–2023 (USD MILLION)

TABLE 48 NORTH AMERICA: ARMORED VEHICLES MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 49 NORTH AMERICA: ARMORED VEHICLES MARKET, BY PLATFORM, 2021–2023 (USD MILLION)

TABLE 50 NORTH AMERICA: ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029 (USD MILLION)

TABLE 51 NORTH AMERICA: ARMORED VEHICLES MARKET, BY MOBILITY, 2021–2023 (USD MILLION)

TABLE 52 NORTH AMERICA: ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029 (USD MILLION)

TABLE 53 NORTH AMERICA: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2021–2023 (USD MILLION)

TABLE 54 NORTH AMERICA: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

TABLE 55 NORTH AMERICA: ARMORED VEHICLES MARKET, BY TYPE, 2021–2023 (USD MILLION)

TABLE 56 NORTH AMERICA: ARMORED VEHICLES MARKET, BY TYPE, 2024–2029 (USD MILLION)

13.2.3 US

13.2.3.1 Collaborations and joint ventures between key players to drive growth

TABLE 57 US: ARMORED VEHICLES MARKET, BY PLATFORM, 2021–2023 (USD MILLION)

TABLE 58 US: ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029 (USD MILLION)

TABLE 59 US: ARMORED VEHICLES MARKET, BY MOBILITY, 2021–2023 (USD MILLION)

TABLE 60 US: ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029 (USD MILLION)

TABLE 61 US: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2021–2023 (USD MILLION)

TABLE 62 US: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

TABLE 63 US: ARMORED VEHICLES MARKET, BY TYPE, 2021–2023 (USD MILLION)

TABLE 64 US: ARMORED VEHICLES MARKET, BY TYPE, 2024–2029 (USD MILLION)

13.2.4 CANADA

13.2.4.1 Military modernization programs to drive growth

TABLE 65 CANADA: ARMORED VEHICLES MARKET, BY PLATFORM, 2021–2023 (USD MILLION)

TABLE 66 CANADA: ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029 (USD MILLION)

TABLE 67 CANADA: ARMORED VEHICLES MARKET, BY MOBILITY, 2021–2023 (USD MILLION)

TABLE 68 CANADA: ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029 (USD MILLION)

TABLE 69 CANADA: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2021–2023 (USD MILLION)

TABLE 70 CANADA: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

TABLE 71 CANADA: ARMORED VEHICLES MARKET, BY TYPE, 2021–2023 (USD MILLION)

TABLE 72 CANADA: ARMORED VEHICLES MARKET, BY TYPE, 2024–2029 (USD MILLION)

13.3 EUROPE

13.3.1 PESTLE ANALYSIS

13.3.2 RECESSION IMPACT ANALYSIS

FIGURE 50 EUROPE: ARMORED VEHICLES MARKET SNAPSHOT

TABLE 73 EUROPE: ARMORED VEHICLES MARKET, BY COUNTRY, 2021–2023 (USD MILLION)

TABLE 74 EUROPE: ARMORED VEHICLES MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 75 EUROPE: ARMORED VEHICLES MARKET, BY PLATFORM, 2021–2023 (USD MILLION)

TABLE 76 EUROPE: ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029 (USD MILLION)

TABLE 77 EUROPE: ARMORED VEHICLES MARKET, BY MOBILITY, 2021–2023 (USD MILLION)

TABLE 78 EUROPE: ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029 (USD MILLION)

TABLE 79 EUROPE: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2021–2023 (USD MILLION)

TABLE 80 EUROPE: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

TABLE 81 EUROPE: ARMORED VEHICLES MARKET, BY TYPE, 2021–2023 (USD MILLION)

TABLE 82 EUROPE: ARMORED VEHICLES MARKET, BY TYPE, 2024–2029 (USD MILLION)

13.3.3 UK

13.3.3.1 Surge in armored vehicle upgrade programs to drive growth

TABLE 83 UK: ARMORED VEHICLES MARKET, BY PLATFORM, 2021–2023 (USD MILLION)

TABLE 84 UK: ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029 (USD MILLION)

TABLE 85 UK: ARMORED VEHICLES MARKET, BY MOBILITY, 2021–2023 (USD MILLION)

TABLE 86 UK: ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029 (USD MILLION)

TABLE 87 UK: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2021–2023 (USD MILLION)

TABLE 88 UK: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

TABLE 89 UK: ARMORED VEHICLES MARKET, BY TYPE, 2021–2023 (USD MILLION)

TABLE 90 UK: ARMORED VEHICLES MARKET, BY TYPE, 2024–2029 (USD MILLION)

13.3.4 GERMANY

13.3.4.1 Focus on modernizing domestic armored personnel carrier fleets to drive growth

TABLE 91 GERMANY: ARMORED VEHICLES MARKET, BY PLATFORM, 2021–2023 (USD MILLION)

TABLE 92 GERMANY: ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029 (USD MILLION)

TABLE 93 GERMANY: ARMORED VEHICLES MARKET, BY MOBILITY, 2021–2023 (USD MILLION)

TABLE 94 GERMANY: ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029 (USD MILLION)

TABLE 95 GERMANY: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2021–2023 (USD MILLION)

TABLE 96 GERMANY: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

TABLE 97 GERMANY: ARMORED VEHICLES MARKET, BY TYPE, 2021–2023 (USD MILLION)

TABLE 98 GERMANY: ARMORED VEHICLES MARKET, BY TYPE, 2024–2029 (USD MILLION)

13.3.5 FRANCE

13.3.5.1 Procurement of new-generation combat vehicles to drive growth

TABLE 99 FRANCE: ARMORED VEHICLES MARKET, BY PLATFORM, 2021–2023 (USD MILLION)

TABLE 100 FRANCE: ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029 (USD MILLION)

TABLE 101 FRANCE: ARMORED VEHICLES MARKET, BY MOBILITY, 2021–2023 (USD MILLION)

TABLE 102 FRANCE: ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029 (USD MILLION)

TABLE 103 FRANCE: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2021–2023 (USD MILLION)

TABLE 104 FRANCE: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

TABLE 105 FRANCE: ARMORED VEHICLES MARKET, BY TYPE, 2021–2023 (USD MILLION)

TABLE 106 FRANCE: ARMORED VEHICLES MARKET, BY TYPE, 2024–2029 (USD MILLION)

13.3.6 POLAND

13.3.6.1 Increase in domestic defense spending to drive growth

TABLE 107 POLAND: ARMORED VEHICLES MARKET, BY PLATFORM, 2021–2023 (USD MILLION)

TABLE 108 POLAND: ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029 (USD MILLION)

TABLE 109 POLAND: ARMORED VEHICLES MARKET, BY MOBILITY, 2021–2023 (USD MILLION)

TABLE 110 POLAND: ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029 (USD MILLION)

TABLE 111 POLAND: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2021–2023 (USD MILLION)

TABLE 112 POLAND: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

TABLE 113 POLAND: ARMORED VEHICLES MARKET, BY TYPE, 2021–2023 (USD MILLION)

TABLE 114 POLAND: ARMORED VEHICLES MARKET, BY TYPE, 2024–2029 (USD MILLION)

13.3.7 REST OF EUROPE

TABLE 115 REST OF EUROPE: ARMORED VEHICLES MARKET, BY PLATFORM, 2021–2023 (USD MILLION)

TABLE 116 REST OF EUROPE: ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029 (USD MILLION)

TABLE 117 REST OF EUROPE: ARMORED VEHICLES MARKET, BY MOBILITY, 2021–2023 (USD MILLION)

TABLE 118 REST OF EUROPE: ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029 (USD MILLION)

TABLE 119 REST OF EUROPE: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2021–2023 (USD MILLION)

TABLE 120 REST OF EUROPE: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

TABLE 121 REST OF EUROPE: ARMORED VEHICLES MARKET, BY TYPE, 2021–2023 (USD MILLION)

TABLE 122 REST OF EUROPE: ARMORED VEHICLES MARKET, BY TYPE, 2024–2029 (USD MILLION)

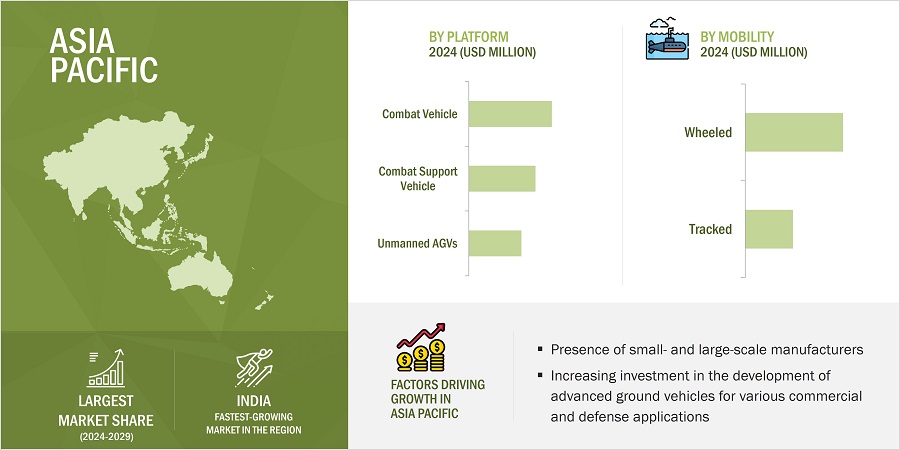

13.4 ASIA PACIFIC

13.4.1 PESTLE ANALYSIS

13.4.2 RECESSION IMPACT ANALYSIS

FIGURE 51 ASIA PACIFIC: ARMORED VEHICLES MARKET SNAPSHOT

TABLE 123 ASIA PACIFIC: ARMORED VEHICLES MARKET, BY COUNTRY, 2021–2023 (USD MILLION)

TABLE 124 ASIA PACIFIC: ARMORED VEHICLES MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 125 ASIA PACIFIC: ARMORED VEHICLES MARKET, BY PLATFORM, 2021–2023 (USD MILLION)

TABLE 126 ASIA PACIFIC: ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029 (USD MILLION)

TABLE 127 ASIA PACIFIC: ARMORED VEHICLES MARKET, BY MOBILITY, 2021–2023 (USD MILLION)

TABLE 128 ASIA PACIFIC: ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029 (USD MILLION)

TABLE 129 ASIA PACIFIC: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2021–2023 (USD MILLION)

TABLE 130 ASIA PACIFIC: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

TABLE 131 ASIA PACIFIC: ARMORED VEHICLES MARKET, BY TYPE, 2021–2023 (USD MILLION)

TABLE 132 ASIA PACIFIC: ARMORED VEHICLES MARKET, BY TYPE, 2024–2029 (USD MILLION)

13.4.3 INDIA

13.4.3.1 Indigenous manufacturing of electric military vehicles to drive growth

TABLE 133 INDIA: ARMORED VEHICLES MARKET, BY PLATFORM, 2021–2023 (USD MILLION)

TABLE 134 INDIA: ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029 (USD MILLION)

TABLE 135 INDIA: ARMORED VEHICLES MARKET, BY MOBILITY, 2021–2023 (USD MILLION)

TABLE 136 INDIA: ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029 (USD MILLION)

TABLE 137 INDIA: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2021–2023 (USD MILLION)

TABLE 138 INDIA: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

TABLE 139 INDIA: ARMORED VEHICLES MARKET, BY TYPE, 2021–2023 (USD MILLION)

TABLE 140 INDIA: ARMORED VEHICLES MARKET, BY TYPE, 2024–2029 (USD MILLION)

13.4.4 JAPAN

13.4.4.1 Development of high-end military technologies to drive growth

TABLE 141 JAPAN: ARMORED VEHICLES MARKET, BY PLATFORM, 2021–2023 (USD MILLION)

TABLE 142 JAPAN: ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029 (USD MILLION)

TABLE 143 JAPAN: ARMORED VEHICLES MARKET, BY MOBILITY, 2021–2023 (USD MILLION)

TABLE 144 JAPAN: ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029 (USD MILLION)

TABLE 145 JAPAN: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2021–2023 (USD MILLION)

TABLE 146 JAPAN: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

TABLE 147 JAPAN: ARMORED VEHICLES MARKET, BY TYPE, 2021–2023 (USD MILLION)

TABLE 148 JAPAN: ARMORED VEHICLES MARKET, BY TYPE, 2024–2029 (USD MILLION)

13.4.5 AUSTRALIA

13.4.5.1 Rise in manufacturing of combat fleets to drive growth

TABLE 149 AUSTRALIA: ARMORED VEHICLES MARKET, BY PLATFORM, 2021–2023 (USD MILLION)

TABLE 150 AUSTRALIA: ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029 (USD MILLION)

TABLE 151 AUSTRALIA: ARMORED VEHICLES MARKET, BY MOBILITY, 2021–2023 (USD MILLION)

TABLE 152 AUSTRALIA: ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029 (USD MILLION)

TABLE 153 AUSTRALIA: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2021–2023 (USD MILLION)

TABLE 154 AUSTRALIA: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

TABLE 155 AUSTRALIA: ARMORED VEHICLES MARKET, BY TYPE, 2021–2023 (USD MILLION)

TABLE 156 AUSTRALIA: ARMORED VEHICLES MARKET, BY TYPE, 2024–2029 (USD MILLION)

13.4.6 SOUTH KOREA

13.4.6.1 High investments in robotics technologies to drive growth

TABLE 157 SOUTH KOREA: ARMORED VEHICLES MARKET, BY PLATFORM, 2021–2023 (USD MILLION)

TABLE 158 SOUTH KOREA: ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029 (USD MILLION)

TABLE 159 SOUTH KOREA: ARMORED VEHICLES MARKET, BY MOBILITY, 2021–2023 (USD MILLION)

TABLE 160 SOUTH KOREA: ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029 (USD MILLION)

TABLE 161 SOUTH KOREA: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2021–2023 (USD MILLION)

TABLE 162 SOUTH KOREA: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

TABLE 163 SOUTH KOREA: ARMORED VEHICLES MARKET, BY TYPE, 2021–2023 (USD MILLION)

TABLE 164 SOUTH KOREA: ARMORED VEHICLES MARKET, BY TYPE, 2024–2029 (USD MILLION)

13.4.7 REST OF ASIA PACIFIC

TABLE 165 REST OF ASIA PACIFIC: ARMORED VEHICLES MARKET, BY PLATFORM, 2021–2023 (USD MILLION)

TABLE 166 REST OF ASIA PACIFIC: ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029 (USD MILLION)

TABLE 167 REST OF ASIA PACIFIC: ARMORED VEHICLES MARKET, BY MOBILITY, 2021–2023 (USD MILLION)

TABLE 168 REST OF ASIA PACIFIC: ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029 (USD MILLION)

TABLE 169 REST OF ASIA PACIFIC: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2021–2023 (USD MILLION)

TABLE 170 REST OF ASIA PACIFIC: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

TABLE 171 REST OF ASIA PACIFIC: ARMORED VEHICLES MARKET, BY TYPE, 2021–2023 (USD MILLION)

TABLE 172 REST OF ASIA PACIFIC: ARMORED VEHICLES MARKET, BY TYPE, 2024–2029 (USD MILLION)

13.5 MIDDLE EAST

13.5.1 PESTLE ANALYSIS

13.5.2 RECESSION IMPACT ANALYSIS

FIGURE 52 MIDDLE EAST: ARMORED VEHICLES MARKET SNAPSHOT

TABLE 173 MIDDLE EAST: ARMORED VEHICLES MARKET, BY COUNTRY, 2021–2023 (USD MILLION)

TABLE 174 MIDDLE EAST: ARMORED VEHICLES MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 175 MIDDLE EAST: ARMORED VEHICLES MARKET, BY PLATFORM, 2021–2023 (USD MILLION)

TABLE 176 MIDDLE EAST: ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029 (USD MILLION)

TABLE 177 MIDDLE EAST: ARMORED VEHICLES MARKET, BY MOBILITY, 2021–2023 (USD MILLION)

TABLE 178 MIDDLE EAST: ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029 (USD MILLION)

TABLE 179 MIDDLE EAST: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2021–2023 (USD MILLION)

TABLE 180 MIDDLE EAST: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

TABLE 181 MIDDLE EAST: ARMORED VEHICLES MARKET, BY TYPE, 2021–2023 (USD MILLION)

TABLE 182 MIDDLE EAST: ARMORED VEHICLES MARKET, BY TYPE, 2024–2029 (USD MILLION)

13.5.3 GULF COOPERATION COUNCIL (GCC)

13.5.3.1 Saudi Arabia

13.5.3.1.1 Rising concerns over regional security to drive growth

TABLE 183 SAUDI ARABIA: ARMORED VEHICLES MARKET, BY PLATFORM, 2021–2023 (USD MILLION)

TABLE 184 SAUDI ARABIA: ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029 (USD MILLION)

TABLE 185 SAUDI ARABIA: ARMORED VEHICLES MARKET, BY MOBILITY, 2021–2023 (USD MILLION)

TABLE 186 SAUDI ARABIA: ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029 (USD MILLION)

TABLE 187 SAUDI ARABIA: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2021–2023 (USD MILLION)

TABLE 188 SAUDI ARABIA: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

TABLE 189 SAUDI ARABIA: ARMORED VEHICLES MARKET, BY TYPE, 2021–2023 (USD MILLION)

TABLE 190 SAUDI ARABIA: ARMORED VEHICLES MARKET, BY TYPE, 2024–2029 (USD MILLION)

13.5.3.2 UAE

13.5.3.2.1 Significant presence of prominent players to drive growth

TABLE 191 UAE: ARMORED VEHICLES MARKET, BY PLATFORM, 2021–2023 (USD MILLION)

TABLE 192 UAE: ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029 (USD MILLION)

TABLE 193 UAE: ARMORED VEHICLES MARKET, BY MOBILITY, 2021–2023 (USD MILLION)

TABLE 194 UAE: ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029 (USD MILLION)

TABLE 195 UAE: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2021–2023 (USD MILLION)

TABLE 196 UAE: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

TABLE 197 UAE: ARMORED VEHICLES MARKET, BY TYPE, 2021–2023 (USD MILLION)

TABLE 198 UAE: ARMORED VEHICLES MARKET, BY TYPE, 2024–2029 (USD MILLION)

13.5.4 REST OF MIDDLE EAST

TABLE 199 REST OF MIDDLE EAST: ARMORED VEHICLES MARKET, BY PLATFORM, 2021–2023 (USD MILLION)

TABLE 200 REST OF MIDDLE EAST: ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029 (USD MILLION)

TABLE 201 REST OF MIDDLE EAST: ARMORED VEHICLES MARKET, BY MOBILITY, 2021–2023 (USD MILLION)

TABLE 202 REST OF MIDDLE EAST: ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029 (USD MILLION)

TABLE 203 REST OF MIDDLE EAST: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2021–2023 (USD MILLION)

TABLE 204 REST OF MIDDLE EAST: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

TABLE 205 REST OF MIDDLE EAST: ARMORED VEHICLES MARKET, BY TYPE, 2021–2023 (USD MILLION)

TABLE 206 REST OF MIDDLE EAST: ARMORED VEHICLES MARKET, BY TYPE, 2024–2029 (USD MILLION)

13.6 REST OF THE WORLD

FIGURE 53 REST OF THE WORLD: ARMORED VEHICLES MARKET SNAPSHOT

TABLE 207 REST OF THE WORLD: ARMORED VEHICLES MARKET, BY COUNTRY, 2021–2023 (USD MILLION)

TABLE 208 REST OF THE WORLD: ARMORED VEHICLES MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 209 REST OF THE WORLD: ARMORED VEHICLES MARKET, BY PLATFORM, 2021–2023 (USD MILLION)

TABLE 210 REST OF THE WORLD: ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029 (USD MILLION)

TABLE 211 REST OF THE WORLD: ARMORED VEHICLES MARKET, BY MOBILITY, 2021–2023 (USD MILLION)

TABLE 212 REST OF THE WORLD: ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029 (USD MILLION)

TABLE 213 REST OF THE WORLD: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2021–2023 (USD MILLION)

TABLE 214 REST OF THE WORLD: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

TABLE 215 REST OF THE WORLD: ARMORED VEHICLES MARKET, BY TYPE, 2021–2023 (USD MILLION)

TABLE 216 REST OF THE WORLD: ARMORED VEHICLES MARKET, BY TYPE, 2024–2029 (USD MILLION)

13.6.1 LATIN AMERICA

13.6.1.1 Increasing acquisition of modern armored vehicles to drive growth

TABLE 217 LATIN AMERICA: ARMORED VEHICLES MARKET, BY PLATFORM, 2021–2023 (USD MILLION)

TABLE 218 LATIN AMERICA: ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029 (USD MILLION)

TABLE 219 LATIN AMERICA: ARMORED VEHICLES MARKET, BY MOBILITY, 2021–2023 (USD MILLION)

TABLE 220 LATIN AMERICA: ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029 (USD MILLION)

TABLE 221 LATIN AMERICA: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2021–2023 (USD MILLION)

TABLE 222 LATIN AMERICA: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

TABLE 223 LATIN AMERICA: ARMORED VEHICLES MARKET, BY TYPE, 2021–2023 (USD MILLION)

TABLE 224 LATIN AMERICA: ARMORED VEHICLES MARKET, BY TYPE, 2024–2029 (USD MILLION)

13.6.2 AFRICA

13.6.2.1 Rising demand for unmanned military ground vehicles to drive growth

TABLE 225 AFRICA: ARMORED VEHICLES MARKET, BY PLATFORM, 2021–2023 (USD MILLION)

TABLE 226 AFRICA: ARMORED VEHICLES MARKET, BY PLATFORM, 2024–2029 (USD MILLION)

TABLE 227 AFRICA: ARMORED VEHICLES MARKET, BY MOBILITY, 2021–2023 (USD MILLION)

TABLE 228 AFRICA: ARMORED VEHICLES MARKET, BY MOBILITY, 2024–2029 (USD MILLION)

TABLE 229 AFRICA: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2021–2023 (USD MILLION)

TABLE 230 AFRICA: ARMORED VEHICLES MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

TABLE 231 AFRICA: ARMORED VEHICLES MARKET, BY TYPE, 2021–2023 (USD MILLION)

TABLE 232 AFRICA: ARMORED VEHICLES MARKET, BY TYPE, 2024–2029 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 207)

14.1 INTRODUCTION

14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2023

TABLE 233 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2023

14.3 RANKING ANALYSIS, 2023

FIGURE 54 MARKET RANKING OF KEY PLAYERS, 2023

14.4 MARKET SHARE ANALYSIS, 2023

FIGURE 55 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

14.5 REVENUE ANALYSIS, 2019–2023

FIGURE 56 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2019–2023

TABLE 234 ARMORED VEHICLES MARKET: DEGREE OF COMPETITION

14.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

14.6.1 STARS

14.6.2 EMERGING LEADERS

14.6.3 PERVASIVE PLAYERS

14.6.4 PARTICIPANTS

FIGURE 57 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

14.6.5 COMPANY FOOTPRINT

14.6.5.1 Company footprint

FIGURE 58 COMPANY FOOTPRINT

14.6.5.2 Mobility footprint

TABLE 235 MOBILITY FOOTPRINT

14.6.5.3 Platform footprint

TABLE 236 PLATFORM FOOTPRINT

14.6.5.4 Region footprint

TABLE 237 REGION FOOTPRINT

14.7 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

14.7.1 PROGRESSIVE COMPANIES

14.7.2 RESPONSIVE COMPANIES

14.7.3 DYNAMIC COMPANIES

14.7.4 STARTING BLOCKS

FIGURE 59 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

14.7.5 COMPETITIVE BENCHMARKING

14.7.5.1 Key start-ups/SMEs

TABLE 238 KEY START-UPS/SMES

14.7.5.2 Competitive benchmarking of key start-ups/SMEs

TABLE 239 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

14.8 COMPANY VALUATION AND FINANCIAL METRICS

FIGURE 60 FINANCIAL METRICS OF PROMINENT PLAYERS, 2023

FIGURE 61 COMPANY VALUATION OF PROMINENT PLAYERS, 2023

14.9 BRAND/PRODUCT COMPARISON

FIGURE 62 BRAND/PRODUCT COMPARISON

14.1 COMPETITIVE SCENARIO AND TRENDS

14.10.1 MARKET EVALUATION FRAMEWORK

14.10.2 PRODUCT LAUNCHES

TABLE 240 ARMORED VEHICLES MARKET: PRODUCT LAUNCHES, 2020–2024

14.10.3 DEALS

TABLE 241 ARMORED VEHICLES MARKET: DEALS, 2020–2024

14.10.4 OTHERS

TABLE 242 ARMORED VEHICLES MARKET: OTHERS, 2020–2024

15 COMPANY PROFILES (Page No. - 235)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

15.1 KEY PLAYERS

15.1.1 RHEINMETALL AG

TABLE 243 RHEINMETALL AG: COMPANY OVERVIEW

FIGURE 63 RHEINMETALL AG: COMPANY SNAPSHOT

TABLE 244 RHEINMETALL AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 245 RHEINMETALL AG: PRODUCT LAUNCHES

TABLE 246 RHEINMETALL AG: DEALS

TABLE 247 RHEINMETALL AG: OTHERS

15.1.2 GENERAL DYNAMICS CORPORATION

TABLE 248 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

FIGURE 64 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

TABLE 249 GENERAL DYNAMICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 250 GENERAL DYNAMICS CORPORATION: OTHERS

15.1.3 OSHKOSH CORPORATION

TABLE 251 OSHKOSH CORPORATION: COMPANY OVERVIEW

FIGURE 65 OSHKOSH CORPORATION: COMPANY SNAPSHOT

TABLE 252 OSHKOSH CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 253 OSHKOSH CORPORATION: OTHERS

15.1.4 BAE SYSTEMS

TABLE 254 BAE SYSTEMS: COMPANY OVERVIEW

FIGURE 66 BAE SYSTEMS: COMPANY SNAPSHOT

TABLE 255 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 256 BAE SYSTEMS: OTHERS

15.1.5 HANWHA GROUP

TABLE 257 HANWHA GROUP: COMPANY OVERVIEW

FIGURE 67 HANWHA GROUP: COMPANY SNAPSHOT

TABLE 258 HANWHA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 259 HANWHA GROUP: OTHERS

15.1.6 NORTHROP GRUMMAN

TABLE 260 NORTHROP GRUMMAN: COMPANY OVERVIEW

FIGURE 68 NORTHROP GRUMMAN: COMPANY SNAPSHOT

TABLE 261 NORTHROP GRUMMAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 262 NORTHROP GRUMMAN: OTHERS

15.1.7 LOCKHEED MARTIN CORPORATION

TABLE 263 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

FIGURE 69 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

TABLE 264 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 265 LOCKHEED MARTIN CORPORATION: OTHERS

15.1.8 THALES

TABLE 266 THALES: COMPANY OVERVIEW

FIGURE 70 THALES: COMPANY SNAPSHOT

TABLE 267 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 268 THALES: OTHERS

15.1.9 L3HARRIS TECHNOLOGIES, INC.

TABLE 269 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

FIGURE 71 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

TABLE 270 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 271 L3HARRIS TECHNOLOGIES, INC.: DEALS

TABLE 272 L3HARRIS TECHNOLOGIES, INC.: OTHERS

15.1.10 ST ENGINEERING

TABLE 273 ST ENGINEERING: COMPANY OVERVIEW

FIGURE 72 ST ENGINEERING: COMPANY SNAPSHOT

TABLE 274 ST ENGINEERING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 275 ST ENGINEERING: PRODUCT LAUNCHES

TABLE 276 ST ENGINEERING: DEALS

15.1.11 ELBIT SYSTEMS LTD.

TABLE 277 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

FIGURE 73 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

TABLE 278 ELBIT SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 279 ELBIT SYSTEMS LTD.: OTHERS

15.1.12 MITSUBISHI HEAVY INDUSTRIES, LTD.

TABLE 280 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

FIGURE 74 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

TABLE 281 MITSUBISHI HEAVY INDUSTRIES, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

15.1.13 HYUNDAI ROTEM COMPANY

TABLE 282 HYUNDAI ROTEM COMPANY: COMPANY OVERVIEW

FIGURE 75 HYUNDAI ROTEM COMPANY: COMPANY SNAPSHOT

TABLE 283 HYUNDAI ROTEM COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 284 HYUNDAI ROTEM COMPANY: PRODUCT LAUNCHES

TABLE 285 HYUNDAI ROTEM COMPANY: OTHERS

15.1.14 TEXTRON INC.

TABLE 286 TEXTRON INC.: COMPANY OVERVIEW

FIGURE 76 TEXTRON INC.: COMPANY SNAPSHOT

TABLE 287 TEXTRON INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

15.1.15 OTOKAR OTOMOTIV VE SAVUNMA SANAYI

TABLE 288 OTOKAR OTOMOTIV VE SAVUNMA SANAYI: COMPANY OVERVIEW

FIGURE 77 OTOKAR OTOMOTIV VE SAVUNMA SANAYI: COMPANY SNAPSHOT

TABLE 289 OTOKAR OTOMOTIV VE SAVUNMA SANAYI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 290 OTOKAR OTOMOTIV VE SAVUNMA SANAYI: OTHERS

15.1.16 DENEL SOC LTD.

TABLE 291 DENEL SOC LTD.: COMPANY OVERVIEW

TABLE 292 DENEL SOC LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 293 DENEL SOC LTD.: DEALS

15.1.17 KNDS

TABLE 294 KNDS: COMPANY OVERVIEW

TABLE 295 KNDS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 296 KNDS: DEALS

TABLE 297 KNDS: OTHERS

15.1.18 FNSS

TABLE 298 FNSS: COMPANY OVERVIEW

TABLE 299 FNSS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 300 FNSS: PRODUCT LAUNCHES

TABLE 301 FNSS: OTHERS

15.1.19 CHINA NORTH INDUSTRIES CORPORATION (NORINCO)

TABLE 302 CHINA NORTH INDUSTRIES CORPORATION (NORINCO): COMPANY OVERVIEW

TABLE 303 CHINA NORTH INDUSTRIES CORPORATION (NORINCO): PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 304 CHINA NORTH INDUSTRIES CORPORATION (NORINCO): PRODUCT LAUNCHES

15.1.20 RTX

TABLE 305 RTX: COMPANY OVERVIEW

FIGURE 78 RTX: COMPANY SNAPSHOT

TABLE 306 RTX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 307 RTX: OTHERS

15.1.21 IVECO DEFENCE VEHICLES

TABLE 308 IVECO DEFENCE VEHICLES: COMPANY OVERVIEW

TABLE 309 IVECO DEFENCE VEHICLES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 310 IVECO DEFENCE VEHICLES: PRODUCT LAUNCHES

TABLE 311 IVECO DEFENCE VEHICLES: DEALS

TABLE 312 IVECO DEFENCE VEHICLES: OTHERS

15.1.22 PARAMOUNT GROUP

TABLE 313 PARAMOUNT GROUP: COMPANY OVERVIEW

TABLE 314 PARAMOUNT GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 315 PARAMOUNT GROUP: PRODUCT LAUNCHES

TABLE 316 PARAMOUNT GROUP: DEALS

TABLE 317 PARAMOUNT GROUP: OTHERS

15.2 OTHER PLAYERS

15.2.1 ARQUUS

TABLE 318 ARQUUS: COMPANY OVERVIEW

15.2.2 TATRA TRUCKS A.S.

TABLE 319 TATRA TRUCKS A.S.: COMPANY OVERVIEW

15.2.3 KALYANI STRATEGIC SYSTEMS LTD.

TABLE 320 KALYANI STRATEGIC SYSTEMS LTD.: COMPANY OVERVIEW

15.2.4 AM GENERAL

TABLE 321 AM GENERAL: COMPANY OVERVIEW

15.2.5 MAHINDRA EMIRATES VEHICLE ARMOURING FZ LLC

TABLE 322 MAHINDRA EMIRATES VEHICLE ARMOURING FZ LLC: COMPANY OVERVIEW

15.2.6 TATA ADVANCED SYSTEMS LIMITED

TABLE 323 TATA ADVANCED SYSTEMS LIMITED: COMPANY OVERVIEW

15.2.7 INKAS ARMORED VEHICLE MANUFACTURING

TABLE 324 INKAS ARMORED VEHICLE MANUFACTURING: COMPANY OVERVIEW

15.2.8 STREIT GROUP

TABLE 325 STREIT GROUP: COMPANY OVERVIEW

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

16 APPENDIX (Page No. - 315)

16.1 DISCUSSION GUIDE

16.2 ANNEXURE A: DEFENSE PROGRAM MAPPING

16.3 ANNEXURE B: COMPANY LISTED

16.4 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.5 CUSTOMIZATION OPTIONS

16.6 RELATED REPORTS

16.7 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Armored Vehicles Market

We are trying to understand the armored vehicles requirement, subsegment categorization, and the Indian customers for such products.

Hi. I'm particularity interested in the sections of the market report which covers advancements and new innovations in ballistic armor as well as projections regarding the value and anticipated growth of the US market over the period covered. Many thanks.

Hi. I am after data for the following: 1. Global market size split by region (top 10 markets) 2. Top 5 suppliers 3. Top 10 buyers 4. Best selling model and specs Many Thanks

Would they have information for Colombia?