Unmanned Ground Vehicles Market by Mobility (Wheeled, Tracked, Hybrid), Application (Military, Commercial, Law Enforcement, Federal Law Enforcement), Size (10-200lbs, 200-500lbs, Others), Mode of Operation, System, and Region-Global Forecast to 2027

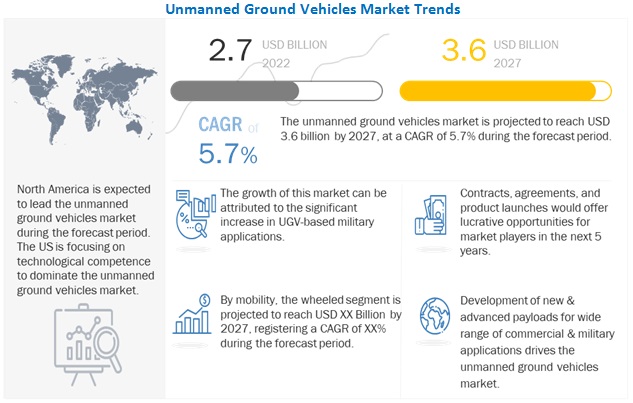

The Unmanned Ground Vehicles Market size is estimated to be USD 2.7 billion in 2022 and is projected to reach USD 3.6 billion by 2027, at a CAGR of 5.7% from 2022 to 2027. The market is driven by factors such as innovations in Unmanned ground vehicles used in navigation and communication satellites across the world.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 has disturbed supply chains of several products and services in several industries. The impact of COVID-19 on the supply chain of unmanned systems was no different. As several countries in the world reduced their defense budgets, it badly impacted the research & development (r&d), contracts and hence production og UGVs. The pandemic has also disturbed the trading of those systems, affected the development of Unmanned Ground Vehicles Industry.

Unmanned Ground Vehicles Market Dynamics

Development of UGV payloads for combat operations

The use of UGVs in combat situations can be crutial. UGVs in cobat can be used for several tasks like providing a medical aid, weapons, surveillance, tracking, and actual combat by attaching a weapon system as a payload. This application area of UGV has wide scope and a rapid developments are taking place in this field. This application area holds fairly large amount of total UGV market as it covers few of the most important military operations. Hence, the rapid development in this application area is expected to drive the market for Unmanned Ground Vehicles.

Opportunity : Development of fully autonomous UGVs

Fully Autonomous UGVs is the latest innovation in the Unmanned ground vehicles market. Using AI & ML techniques, the fully autonomous UGVs are developed which are designed to operate without any human interference. Autonomous UGVs are designed accomplish any assigned task without any human help. Currently, these UGVs are used for applications like Intelligence, Surveillance & Reconnaissance (ISR) and security operations. With the advanced research being carried away, the widening of the application areas of fully autonomous UGVs will push the market upwards.

Challenges : Requirement for continuous and uninterrupted power supply in UGVs

UGVs are used for mission critical operations like Explosive Ordinance Disposal (EOD), Intelligence, Surveillance, & Reconnaissance (ISR), where the timely operation is crutial. These operations require uninterrupted and reliable power supply because of the high dependency of the whole operation on one UGV. So, there arises challenge for developing a highly reliable power supply solution with compact size.

Small unmanned ground vehicles segment Projected to Grow at Highest CAGR During Forecast Period

Small UGVs weigh more than 10 lbs to 200 lbs but less than 200 lbs. These UGVs are for applications like Explosive Ordnance Disposal (EOD), counter IED, Intelligence, Surveillance, and Reconnaissance (ISR) missions, Firefighting, Toxic Industrial Chemicals (TIC), and Toxic Industrial Materials (TIM) reconnaissance operations. Small UGVs can be equipped with various payloads like night-vision cameras, Chemical, Biological, Radioactive, and Nuclear (CBRN) sensors, motion detectors, manipulator arms, and grippers.

Payload systems segment Projected To Grow at Highest Cagr During Forecast Period

The UGV payloads market includes payloads like sensors, Lasers, cameras, motor encoders, articulated arms, radars, GPS antennas, and other payloads, which covers payloads like ammunition mount, power supplies, etc.

The North America market is projected to contribute the largest share from 2022 to 2027

To know about the assumptions considered for the study, download the pdf brochure

Emerging Industry Trends

Unmanned Ground Vehicles for SWARM operations

Technological advancements in robotics have enabled the development of varied sizes of unmanned ground vehicles to support different kinds of disaster-relief and combat missions. These UGVs are presently used in few numbers with no coordination among each other in most cases. However, some applications are expected to benefit from the utilization of smaller or even miniaturized UGVs in considerable quantities, featuring a swarming behavior. Among the possible applications are operations in urban areas, which are considered to be extremely complex. It is a challenging task due to multi-story structures, new engagement conditions, and the consideration of civilian-military relations.

The US Army UGV campaign plan identifies that unmanned ground vehicles still require further technological advancements to meet their future capabilities. Swarm intelligence is an artificial intelligence discipline that consists of a multi-agent system that takes inspiration from the behavior of colonies of social insects and animal societies. The 3 key special characteristics of a swarm are decentralized control, lack of synchronicity, and the simplicity and homogeneity of the swarm. Additionally, the swarm’s algorithms run in an asynchronous and decentralized fashion. For swarming, miniaturization (micro and nano-bots) is considered one of the most promising capabilities that need to be developed. It also requires proper software development, programming, and integration.

Key Players

The Unmanned ground vehicles Companies are dominated by a few globally established players such as BAE Systems (UK), QinetiQ (UK), Rheinmetall AG (Germany), Teledyne FLIR (US), General Dynamics (US), ECA Group (France), and Lockheed Martin (US). The report covers various industry trends and new technological innovations in the Unmanned ground vehicles market for the period, 2018-2027.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 2.7 billion

|

|

Projected Market Size |

USD 3.6 billion |

|

Growth Rate |

5.7% |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Application, By Mobility, By Size, By Mode of Operation, By System |

|

Geographies covered |

North America, Europe, Asia Pacific, the Middle East, and Rest of the World |

|

Companies covered |

Raytheon Technologies Corporation (US), Thales Group (France), Northrop Grumman Corp. (US), L3harris Technologies (US), HEXAGON AB (Sweden), and Furuno Electric (Japan) |

The study categorizes the unmanned ground vehicles market based on Application, Mobility, Size, Mode of Operation, System, and Region.

Based on Application, the unmanned ground vehicles market has been segmented as follows:

- Commercial

- Military

- Law Enforcement

- Federal Law Enforcement

Based on Mobility, the unmanned ground vehicles market has been segmented as follows:

- Wheeled

- Tracked

- Legged

- Hybrid

Based on the Size, the unmanned ground vehicles market has been segmented as follows:

- Small

- Medium

- Large

- Very Large

- Extremely Large

Based on the Mode of Operation, unmanned ground vehicles market has been segmented as follows:

- Autonomous

- Teleoperated

- Tethered

Based on the System, unmanned ground vehicles market has been segmented as follows:

- Payloads

- Navigation System

- Controller System

- Power System

- Others

Based on the region, unmanned ground vehicles market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- The Middle East

- Rest of the World (RoW)

Rest of the World includes Latin America, and Africa

Recent Developments

- North America: In 2020, Dragon Runner 10 – A multi-mission UGV equipped with day-night cameras and transceivers

- Europe: In 2020, Viking (HORIBA MIRA Ltd) and Titan (QinetiQ) - UGVs that operate in hybrid mode and can carry payloads up to 600 kg and 750 kg, respectively

- Asia Pacific: In 2020, Sharp Claw-1 –UGV has been deployed with the People’s Liberation Army Ground Force (PLAGF) for tracking and reconnaissance operations

- Middle East: In 2019, The Carmel - armored fighting vehicle for the Israel Defense Force IAF to improve military ground maneuvering capabilities with extensive use of AI to manage battlefield decisions autonomously

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the Unmanned ground vehicles market?

The Unmanned ground vehicles market is expected to grow substantially owing to the technological development in designing of the Unmanned ground vehicles based systems for several military & commercial applications.

What are the key sustainability strategies adopted by leading players operating in the Unmanned ground vehicles market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the Unmanned ground vehicles market. Major players including BAE Systems (UK), L3harris Technologies (US), Lockheed Martin Corporation (US), Honeywell International Inc. (US), Northrop Grumman Corp. (US), Thales Group (France), and Lockheed Martin (US). have adopted various strategies, such as contracts and agreements, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the Unmanned ground vehicles market?

Some of the major emerging technologies and use cases disrupting the market include the use of COTS components in satellite manufacturing.

Who are the key players and innovators in the ecosystem of the Unmanned ground vehicles market?

Major players in the Unmanned ground vehicles market include BAE Systems (UK), QinetiQ (UK), Rheinmetall AG (Germany), Teledyne FLIR (US), General Dynamics (US), ECA Group (France), and Lockheed Martin (US).

Which region is expected to hold the highest market share in the Unmanned ground vehicles market?

Unmanned ground vehicles market in The North America region is estimated to account for the largest share of 34.2% of the market in 2022 and is expected to grow at the highest CAGR of 6.4% during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

| USD 2.7 billion |

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 44)

1.1 OBJECTIVES OF STUDY

1.2 MARKET DEFINITION

1.3 MARKETS SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 UNMANNED GROUND VEHICLE MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR STUDY

1.4 INCLUSIONS & EXCLUSIONS

1.5 CURRENCY & PRICING

1.6 USD EXCHANGE RATES

1.7 LIMITATIONS

1.8 MARKET STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 49)

2.1 RESEARCH DATA

FIGURE 2 REPORT PROCESS FLOW

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key primary sources

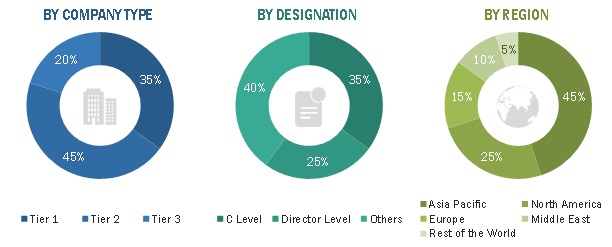

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION & REGION

2.1.3 DEMAND-SIDE INDICATORS

2.1.4 SUPPLY-SIDE ANALYSIS

2.2 MARKET SIZE ESTIMATION

2.2.1 SEGMENTS AND SUBSEGMENTS

2.3 RESEARCH APPROACH & METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

TABLE 1 UNMANNED GROUND VEHICLES MARKET ESTIMATION PROCEDURE

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.5 GROWTH RATE ASSUMPTIONS

2.6 ASSUMPTIONS FOR RESEARCH STUDY

2.7 RISKS

3 EXECUTIVE SUMMARY (Page No. - 58)

FIGURE 8 MILITARY APPLICATIONS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 9 PAYLOAD SYSTEMS TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 10 AUTONOMOUS UGVS TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 11 SMALL UGVS SEGMENT TO ACCOUNT FOR HIGHEST MARKET GROWTH DURING FORECAST PERIOD

FIGURE 12 WHEELED UGV TO HOLD LARGEST SHARE IN MARKET IN 2022

FIGURE 13 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF UNMANNED GROUND VEHICLES MARKET IN 2022

4 PREMIUM INSIGHTS (Page No. - 62)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN UNMANNED GROUND VEHICLES MARKET

FIGURE 14 INCREASING DEMAND FOR UGVS IN MILITARY OPERATIONS RESPONSIBLE FOR MARKET GROWTH

4.2 UNMANNED GROUND VEHICLES MARKET, BY APPLICATION

FIGURE 15 MILITARY SEGMENT TO COMMAND HIGHEST MARKET SHARE FROM 2018 TO 2027

4.3 UNMANNED GROUND VEHICLES MARKET, BY SYSTEM

FIGURE 16 PAYLOAD SYSTEMS SEGMENT EXPECTED TO DOMINATE MARKET FROM 2018 TO 2027

4.4 UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION

FIGURE 17 AUTONOMOUS UGVS TO LEAD MARKET FROM 2018 TO 2027

4.5 UNMANNED GROUND VEHICLES MARKET, BY SIZE

FIGURE 18 SMALL UGVS TO WITNESS UPWARD TREND FROM 2018 TO 2027

4.6 UNMANNED GROUND VEHICLES MARKET, BY MOBILITY

FIGURE 19 WHEELED UGVS TO SHOWCASE HIGHEST MARKET SHARE FROM 2018 TO 2027

4.7 UNMANNED GROUND VEHICLES MARKET, BY COUNTRY

FIGURE 20 JAPAN PROJECTED TO BE FASTEST-GROWING MARKET FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 66)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 UNMANNED GROUND VEHICLES MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing use of robots in areas affected by chemical, biological, radiological, and nuclear (CBRN) attacks

5.2.1.2 Growing demand for autonomous systems in defense and commercial sectors

5.2.1.3 Rising adoption of UGVs for counter-insurgency operations

5.2.1.4 Development of smart robots for combat operations

5.2.1.5 Improving ISR and target acquisition capabilities of defense forces

5.2.2 RESTRAINTS

5.2.2.1 Requirement for developing sophisticated and highly reliable UGVs

5.2.2.2 Lack of advanced visual capabilities in UGVs

5.2.3 OPPORTUNITIES

5.2.3.1 Development of fully autonomous UGVs

5.2.3.2 Increased defense budgets of different countries for unmanned systems

5.2.4 CHALLENGES

5.2.4.1 Requirement for continuous and uninterrupted power supply in UGVs

5.2.4.2 Hardware and software malfunctions

5.2.5 DEMAND-SIDE IMPACT

5.2.5.1 Key developments from January 2019 to May 2022

TABLE 2 KEY DEVELOPMENTS IN UNMANNED GROUND VEHICLES MARKET, 2019-2022

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

FIGURE 22 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.4 MARKET ECOSYSTEM

FIGURE 23 UNMANNED GROUND VEHICLES, MARKET ECOSYSTEM

5.4.1 PROMINENT COMPANIES

5.4.2 PRIVATE AND SMALL ENTERPRISES

5.4.3 END USERS

TABLE 3 UNMANNED GROUND VEHICLES MARKET ECOSYSTEM

5.5 PRICING ANALYSIS

5.5.1 AVERAGE SELLING PRICE ANALYSIS OF UNMANNED GROUND VEHICLES IN 2021

FIGURE 24 AVERAGE SELLING PRICE OF UNMANNED GROUND VEHICLES OFFERED BY TOP PLAYERS

5.6 TARIFF REGULATORY LANDSCAPE

5.6.1 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES & OTHER AGENCIES

5.6.2 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES & OTHER AGENCIES

5.6.3 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES & OTHER AGENCIES

5.6.4 MIDDLE EAST: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES & OTHER AGENCIES

5.6.5 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES & OTHER AGENCIES

5.7 TRADE DATA

5.7.1 TRADE ANALYSIS

TABLE 4 COUNTRY-WISE IMPORTS, 2019-2021 (USD THOUSAND)

TABLE 5 COUNTRY-WISE EXPORTS, 2019-2021 (USD THOUSAND)

5.8 PATENT ANALYSIS

FIGURE 25 LIST OF MAJOR PATENTS FOR UNMANNED GROUND VEHICLES

TABLE 6 LIST OF MAJOR PATENTS FOR UNMANNED GROUND VEHICLES

5.9 VALUE CHAIN ANALYSIS OF UNMANNED GROUND VEHICLES MARKET

FIGURE 26 VALUE CHAIN ANALYSIS

5.10 TECHNOLOGY ANALYSIS

5.10.1 KEY TECHNOLOGY

5.10.1.1 Design and implementation of solar-powered UGVs

5.10.1.2 Development of multi-payload UGVs

5.10.2 COMPLIMENTARY TECHNOLOGY

5.10.2.1 Electro-optical and radar sensor payloads for unmanned vehicles

5.11 PORTER’S FIVE FORCES MODEL

5.11.1 UNMANNED GROUND VEHICLES MARKET: PORTER’S FIVE FORCE ANALYSIS

FIGURE 27 UNMANNED GROUND VEHICLES MARKET: PORTER’S FIVE FORCE ANALYSIS

5.11.2 THREAT OF NEW ENTRANTS

5.11.3 THREAT OF SUBSTITUTES

5.11.4 BARGAINING POWER OF SUPPLIERS

5.11.5 BARGAINING POWER OF BUYERS

5.11.6 INTENSITY OF COMPETITIVE RIVALRY

5.12 KEY STAKEHOLDERS & BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 28 INFLUENCE OF STAKEHOLDERS IN BUYING UNMANNED GROUND VEHICLES, BY APPLICATION

TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING UNMANNED GROUND VEHICLES, BY APPLICATION (%)

5.12.2 BUYING CRITERIA

FIGURE 29 KEY BUYING CRITERIA FOR UNMANNED GROUND VEHICLES, BY MOBILITY

TABLE 8 KEY BUYING CRITERIA FOR UNMANNED GROUND VEHICLES, BY MOBILITY

5.13 USE CASES

5.13.1 VIKING MULTIROLE UNMANNED GROUND VEHICLE DEVELOPED BY HORIBA MIRA FOR UK MINISTRY OF DEFENCE

5.14 KEY CONFERENCES & EVENTS, 2022-23

TABLE 9 UNMANNED GROUND VEHICLES MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6 INDUSTRY TRENDS (Page No. - 87)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 30 SUPPLY CHAIN ANALYSIS

6.2.1 MAJOR COMPANIES

6.2.2 SMALL AND MEDIUM ENTERPRISES

6.2.3 END USERS/CUSTOMERS

6.3 EMERGING INDUSTRY TRENDS

TABLE 10 ADVANCEMENTS IN UNMANNED GROUND VEHICLES IN KEY NATIONS

6.3.1 UNMANNED GROUND VEHICLES FOR SWARM OPERATIONS

6.3.2 CROSS-PLATFORM COMMUNICATION

6.3.2.1 SwarmDiver by Aquabotix (Australia)

6.3.2.2 Lockheed Martin (US) launched UAV on command from AUV

6.3.3 REMOTE CONTROL STATION

6.3.4 ROBOTIC FOLLOWER ADVANCED TECHNOLOGY DEMONSTRATION

6.3.5 SEMI-AUTONOMOUS ROBOTICS FOR FUTURE COMBAT SYSTEMS

6.3.6 M160 ANTI-PERSONNEL MINE-CLEARING SYSTEM

6.3.7 PACKBOT AND TALON FAMILY OF SYSTEMS

6.3.8 ROUTE RECONNAISSANCE AND CLEARANCE ROBOT PROGRAM

6.3.9 APPLIQUE KITS

6.3.10 SUPERVISED AUTONOMY TO NEUTRALIZE AND DETECT IEDS

6.3.11 SQUAD MISSION SUPPORT SYSTEM

6.3.12 BRAIN COMPUTER INTERACTION TECHNOLOGIES

6.4 IMPACT OF MEGATRENDS

6.4.1 ROBOT CONSTRUCTION USING 3D PRINTING TECHNOLOGY

6.4.1.1 UGV prototype developed by MITRE Corporation (US)

6.4.2 MULTI-MISSION UNMANNED GROUND VEHICLES

6.4.2.1 MMUGV developed by Rheinmetall AG (Germany)

6.4.2.2 Viking Multirole unmanned ground vehicle developed by Horiba Mira for UK Ministry of Defence

6.5 INNOVATIONS AND PATENT REGISTRATIONS (2012–2022)

TABLE 11 INNOVATIONS AND PATENT REGISTRATIONS

7 UNMANNED GROUND VEHICLES MARKET, BY MOBILITY (Page No. - 97)

7.1 INTRODUCTION

FIGURE 31 WHEELED UNMANNED GROUND VEHICLES SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 12 UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 13 UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

7.2 WHEELED

7.2.1 INCREASING DEMAND FOR WHEELED ROBOTS FOR SURVEILLANCE APPLICATIONS TO PROPEL MARKET GROWTH

7.3 TRACKED

7.3.1 USE OF TRACKED ROBOTS FOR ROUGH, OFF-ROAD, AND UNPREDICTABLE TERRAINS TO RAISE MARKET DEMAND

7.4 HYBRID

7.4.1 DYNAMIC, FAST, AND ENERGY-EFFICIENT FEATURES OF HYBRID ROBOTS TO BE KEY FACTORS DRIVING MARKET GROWTH

7.5 LEGGED

7.5.1 HIGH ADAPTABILITY OF LEGGED ROBOTS FOR LARGE NUMBER OF APPLICATIONS TO BOOST THEIR DEMAND

8 UNMANNED GROUND VEHICLES MARKET, BY SIZE (Page No. - 100)

8.1 INTRODUCTION

FIGURE 32 SMALL UNMANNED GROUND VEHICLES SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 14 UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 15 UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

8.2 SMALL (10–200 LBS)

8.2.1 DEMAND FOR SMALL UGVS ON RISE DUE TO COMPACT SIZE AND MANEUVERABILITY

8.3 MEDIUM (200–500 LBS)

8.3.1 MEDIUM UGVS CARRYING CRITICAL MISSIONS TO DRIVE SEGMENT GROWTH

8.4 LARGE (500–1,000 LBS)

8.4.1 LARGE UGVS TO HAVE HIGH DEMAND FOR MILITARY APPLICATIONS

8.5 VERY LARGE (1,000–2,000 LBS)

8.5.1 VERY LARGE ROBOTS TO BE USED FOR LONG-RANGE OPERATIONS DUE TO HIGH ENDURANCE

8.6 EXTREMELY LARGE (>2,000 LBS)

8.6.1 EXTREMELY LARGE ROBOTS MAINLY USED IN MILITARY AND COMMERCIAL APPLICATIONS TO BOOST SEGMENT DEMAND

9 UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION (Page No. - 103)

9.1 INTRODUCTION

FIGURE 33 AUTONOMOUS UNMANNED GROUND VEHICLES SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 16 UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2018–2021 (USD MILLION)

TABLE 17 UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

9.2 TETHERED

9.2.1 ASSISTANCE FOR HUMANS FOR LINE-OF-SITE MISSION BY TETHERED OPERATIONS TO DRIVE MARKET GROWTH

9.3 TELEOPERATED

9.3.1 TELEOPERATED UGVS DEPLOYED FOR MINE DETECTION AND CLEARING OPERATIONS TO BOOST MARKET DEMAND

9.4 AUTONOMOUS

FIGURE 34 SEMI-AUTONOMOUS UNMANNED GROUND VEHICLES SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 18 AUTONOMOUS UNMANNED GROUND VEHICLES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 19 AUTONOMOUS UNMANNED GROUND VEHICLES MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.4.1 FULLY AUTONOMOUS

9.4.1.1 Fully autonomous UGVs to assist soldiers in target tracking, surveillance, and reconnaissance missions

9.4.2 SEMI-AUTONOMOUS

9.4.2.1 Semi-autonomous UGVs to have greater adoption as weapon platform

10 UNMANNED GROUND VEHICLES MARKET, BY SYSTEM (Page No. - 107)

10.1 INTRODUCTION

FIGURE 35 PAYLOAD SYSTEMS SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 20 UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 21 UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

10.2 PAYLOADS

10.2.1 INCREASING DEMAND FOR SENSOR PAYLOADS FOR MILITARY UGVS TO DRIVE MARKET

FIGURE 36 SENSOR PAYLOADS PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 22 UNMANNED GROUND VEHICLE PAYLOADS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 23 UNMANNED GROUND VEHICLE PAYLOADS MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.2.2 SENSORS

10.2.2.1 Growth of UGVs in advanced military applications to increase demand for smaller, lighter, and less-expensive payloads

10.2.3 RADARS

10.2.3.1 Radars on land used as defense and surveillance tool to drive segment growth

10.2.4 LASERS

10.2.4.1 Robots equipped with laser designators to provide immediate targeting of assets by smart munitions

10.2.5 CAMERAS

10.2.5.1 UGVs equipped with different cameras to be used for specific applications

10.2.6 MOTOR ENCODERS

10.2.6.1 Availability of configurations of motor encoder payloads to drive market segment

10.2.7 ARTICULATED ARMS

10.2.7.1 Articulated arms to be widely used for surveillance activities

10.2.8 GPS ANTENNAS

10.2.8.1 Market for GPS antennas projected to grow at highest CAGR during forecast period

10.2.9 OTHER PAYLOADS

10.3 CONTROLLER SYSTEMS

10.3.1 GROWING DEMAND FOR UGVS TO ENABLE DEVELOPMENT OF COMPACT AND LIGHTWEIGHT CONTROL UNITS

10.4 NAVIGATION SYSTEMS

10.4.1 NAVIGATION SYSTEMS TO PLAY IMPORTANT ROLE IN MOBILITY OF UGVS

10.5 POWER SYSTEMS

10.5.1 DEVELOPMENT OF SOLAR RECHARGEABLE BATTERIES TO DRIVE MARKET DURING FORECAST PERIOD

FIGURE 37 SOLAR RECHARGEABLE BATTERIES PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 24 UNMANNED GROUND VEHICLE POWER SYSTEMS MARKET, BY BATTERY TYPE, 2018–2021 (USD MILLION)

TABLE 25 UNMANNED GROUND VEHICLE POWER SYSTEMS MARKET, BY BATTERY TYPE, 2022–2027 (USD MILLION)

10.5.2 SOLAR RECHARGEABLE BATTERY

10.5.2.1 Technological advancements in solar-based power systems to raise market demand

10.5.3 ELECTRIC NON-SOLAR RECHARGEABLE BATTERY

10.5.3.1 Increasing use of efficient & long-lasting lithium-ion batteries in UGVs to amplify market

10.5.3.1.1 Lithium-ion battery

10.5.3.1.2 Sealed lead-acid battery

10.5.3.1.3 Nickel cadmium

10.5.3.1.4 Nickel metal hydride battery

10.6 OTHER SYSTEMS

11 UNMANNED GROUND VEHICLES MARKET, BY APPLICATION (Page No. - 116)

11.1 INTRODUCTION

FIGURE 38 MILITARY SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 26 UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 27 UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.2 MILITARY

FIGURE 39 EXPLOSIVE ORDINANCE DISPOSAL (EOD) SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 28 UNMANNED GROUND VEHICLES MARKET FOR MILITARY APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 29 UNMANNED GROUND VEHICLES MARKET FOR MILITARY APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

11.2.1 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE (ISR)

11.2.1.1 UGVs in military sector to provide battlefield intelligence

11.2.2 SEARCH & RESCUE

11.2.2.1 UGVs for search & rescue applications to witness high adoption during forecast period

11.2.3 COMBAT SUPPORT

11.2.3.1 Combat support applications to grow at highest CAGR during forecast period

11.2.4 TRANSPORTATION

11.2.4.1 Increase in operation by reducing ratio of support personnel to combat troops enabled by transportation robots

TABLE 30 MILITARY TRANSPORTATION ROBOTS, BY COMPANY

11.2.5 EXPLOSIVE ORDNANCE DISPOSAL (EOD)

11.2.5.1 Explosive Ordnance Disposal (EOD) robots to identify and neutralize dangerous objects

FIGURE 40 EOD ROBOT PAYLOADS

TABLE 31 EOD ROBOTS, BY COMPANY

11.2.6 MINE CLEARANCE

11.2.6.1 Mine reconnaissance and area clearance operations expanded by UGVs

11.2.7 FIREFIGHTING

11.2.7.1 Increase in use of firefighting robots to address fire situations to avoid casualties

11.2.8 OTHER MILITARY APPLICATIONS

11.3 LAW ENFORCEMENT

11.3.1 UGVS FOR LAW ENFORCEMENT APPLICATIONS SURGED DUE TO TERRORIST ACTIVITIES

11.4 FEDERAL LAW ENFORCEMENT

11.4.1 UGVS EXTENSIVELY USED BY FEDERAL LAW ENFORCEMENT AGENCIES FOR DANGEROUS MISSIONS

11.5 COMMERCIAL

FIGURE 41 AUTONOMOUS DELIVERY SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 32 UNMANNED GROUND VEHICLES MARKET FOR COMMERCIAL APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 33 UNMANNED GROUND VEHICLES MARKET FOR COMMERCIAL APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

11.5.1 FIREFIGHTING

11.5.1.1 Rise in use of robots to address accidents caused by fires and prevent casualties

11.5.2 OIL & GAS

11.5.2.1 Oil & gas industry to be major sector to use UGVs for more productivity and safety

11.5.3 AGRICULTURE

11.5.3.1 Use of UGVs in agriculture sector to boost productivity

11.5.4 CBRN

11.5.4.1 Protective action taken to prevent interaction, mitigation, and containment of CBRN agents using UGVs

11.5.5 AUTONOMOUS DELIVERY

11.5.5.1 Autonomous feature of UGVs to promote usage of UGVs for delivery services

11.5.6 PHYSICAL SECURITY

11.5.6.1 Autonomous robots to be used in physical security activities

12 UNMANNED GROUND VEHICLES MARKET, BY REGION (Page No. - 126)

12.1 INTRODUCTION

FIGURE 42 NORTH AMERICA HELD LARGEST SHARE OF UNMANNED GROUND VEHICLES MARKET IN 2022

TABLE 34 UNMANNED GROUND VEHICLES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 35 UNMANNED GROUND VEHICLES MARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 43 NORTH AMERICA: NUMBER OF UGVS DELIVERED IN 2021

12.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 44 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET SNAPSHOT

TABLE 36 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 37 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 38 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 39 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 40 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2018–2021 (USD MILLION)

TABLE 41 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 42 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 43 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 44 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 45 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 46 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 47 NORTH AMERICA: UNMANNED GROUND VEHICLES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.2.2 US

12.2.2.1 Increasing R&D and venture capitalist activities in robotics aid market growth in US

TABLE 48 US: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 49 US: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 50 US: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 51 US: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 52 US: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 53 US: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.2.3 CANADA

12.2.3.1 Technological developments in UGVs to fuel growth in unmanned ground vehicles market in Canada

TABLE 54 CANADA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 55 CANADA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 56 CANADA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 57 CANADA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 58 CANADA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 59 CANADA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3 EUROPE

FIGURE 45 EUROPE: NUMBER OF UGVS DELIVERED IN 2021

12.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 46 EUROPE: UNMANNED GROUND VEHICLES MARKET SNAPSHOT

TABLE 60 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 61 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 62 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 63 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 64 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2018–2021 (USD MILLION)

TABLE 65 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 66 EUROPE: AUTONOMOUS UNMANNED GROUND VEHICLES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 67 EUROPE: AUTONOMOUS UNMANNED GROUND VEHICLES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 68 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 69 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 70 EUROPE: UNMANNED GROUND VEHICLES MARKET FOR MILITARY APPLICATIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 71 EUROPE: UNMANNED GROUND VEHICLES MARKET FOR MILITARY APPLICATIONS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 72 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 73 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 74 EUROPE: UNMANNED GROUND VEHICLE PAYLOADS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 75 EUROPE: UNMANNED GROUND VEHICLE PAYLOADS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 76 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 77 EUROPE: UNMANNED GROUND VEHICLES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.3.2 GERMANY

12.3.2.1 Investments to develop multi-functional and technologically advanced land robots to drive market growth in Germany

TABLE 78 GERMANY: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 79 GERMANY: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 80 GERMANY: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 81 GERMANY: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 82 GERMANY: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 83 GERMANY: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3.3 FRANCE

12.3.3.1 Increasing deployment of UGVs for security and surveillance missions to uplift market growth in France

TABLE 84 FRANCE: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 85 FRANCE: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 86 FRANCE: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 87 FRANCE: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 88 FRANCE: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 89 FRANCE: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3.4 UK

12.3.4.1 Increasing procurement of military UGVs resulting in growth of unmanned ground vehicles market in UK

TABLE 90 UK: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 91 UK: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 92 UK: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 93 UK: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 94 UK: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 95 UK: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3.5 POLAND

12.3.5.1 Development of UGVs equipped with advanced payloads resulting in increasing demand for UGVs in Poland

TABLE 96 POLAND: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 97 POLAND: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 98 POLAND: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 99 POLAND: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 100 POLAND: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 101 POLAND: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3.6 RUSSIA

12.3.6.1 Development and integration of autonomous and robotic systems in military force by Russian MoD to push market growth

TABLE 102 RUSSIA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 103 RUSSIA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 104 RUSSIA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 105 RUSSIA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 106 RUSSIA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 107 RUSSIA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3.7 REST OF EUROPE

12.3.7.1 Presence of major military robot manufacturing companies to contribute to market growth in Rest of Europe

TABLE 108 REST OF EUROPE: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 109 REST OF EUROPE: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 110 REST OF EUROPE: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 111 REST OF EUROPE: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 112 REST OF EUROPE: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 113 REST OF EUROPE: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.4 ASIA PACIFIC

FIGURE 47 ASIA PACIFIC: NUMBER OF UGVS DELIVERED IN 2021

12.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 48 ASIA PACIFIC: REGIONAL SNAPSHOT

TABLE 114 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 115 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 116 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 117 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 118 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2018–2021 (USD MILLION)

TABLE 119 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 120 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 121 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 122 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 123 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 124 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 125 ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.4.2 JAPAN

12.4.2.1 Technologically advanced and significant defense budget for development of UGV technologies to drive Japanese market

TABLE 126 JAPAN: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 127 JAPAN: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 128 JAPAN: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 129 JAPAN: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 130 JAPAN: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 131 JAPAN: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.4.3 AUSTRALIA

12.4.3.1 UGVs for search and track operation to boost market in Australia

TABLE 132 AUSTRALIA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 133 AUSTRALIA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 134 AUSTRALIA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 135 AUSTRALIA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 136 AUSTRALIA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 137 AUSTRALIA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.4.4 CHINA

12.4.4.1 Patroling and RSTA operations by UGVs to fuel market in China

TABLE 138 CHINA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 139 CHINA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 140 CHINA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 141 CHINA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 142 CHINA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 143 CHINA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.4.5 INDIA

12.4.5.1 Enhanced border surveillance by UGVs to combat increased cross-border terrorism to upscale market in India

TABLE 144 INDIA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 145 INDIA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 146 INDIA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 147 INDIA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 148 INDIA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 149 INDIA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.4.6 SOUTH KOREA

12.4.6.1 Large investments in robotics technologies to raise demand for unmanned ground vehicles in South Korea

TABLE 150 SOUTH KOREA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 151 SOUTH KOREA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 152 SOUTH KOREA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 153 SOUTH KOREA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 154 SOUTH KOREA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 155 SOUTH KOREA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.4.7 REST OF ASIA PACIFIC

12.4.7.1 Growing demand for UGVs for security purposes to increase growth of UGVs market in Rest of Asia Pacific

TABLE 156 REST OF ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 157 REST OF ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 158 REST OF ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 159 REST OF ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 160 REST OF ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 161 REST OF ASIA PACIFIC: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.5 MIDDLE EAST

FIGURE 49 MIDDLE EAST: NUMBER OF UGVS DELIVERED IN 2021

12.5.1 PESTLE ANALYSIS: MIDDLE EAST

FIGURE 50 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET SNAPSHOT

TABLE 162 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 163 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 164 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 165 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 166 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2018–2021 (USD MILLION)

TABLE 167 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 168 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 169 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 170 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 171 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 172 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 173 MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.5.2 ISRAEL

12.5.2.1 Patrolling and RSTA purposes fulfilled by UGVs to boost market in Israel

TABLE 174 ISRAEL: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 175 ISRAEL: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 176 ISRAEL: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 177 ISRAEL: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 178 ISRAEL: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 179 ISRAEL: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.5.3 SAUDI ARABIA

12.5.3.1 Investments in expanding military and security to fuel the growth of UGVs market in Arabia

TABLE 180 SAUDI ARABIA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 181 SAUDI ARABIA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 182 SAUDI ARABIA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 183 SAUDI ARABIA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 184 SAUDI ARABIA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 185 SAUDI ARABIA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.5.4 UAE

12.5.4.1 Increased procurement of UGVs for firefighting to expand market in UAE

TABLE 186 UAE: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 187 UAE: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 188 UAE: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 189 UAE: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 190 UAE: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 191 UAE: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.5.5 TURKEY

12.5.5.1 Increased procurement of UGVs for military operations to develop unmanned ground vehicles market in Turkey

TABLE 192 TURKEY: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 193 TURKEY: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 194 TURKEY: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 195 TURKEY: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 196 TURKEY: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 197 TURKEY: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.5.6 REST OF MIDDLE EAST

12.5.6.1 Increasing requirement for unmanned systems for military operations to raise market demand in Rest of Middle East

TABLE 198 REST OF MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 199 REST OF MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 200 REST OF MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 201 REST OF MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 202 REST OF MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 203 REST OF MIDDLE EAST: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.6 REST OF THE WORLD

FIGURE 51 REST OF THE WORLD: NUMBER OF UGVS DELIVERED IN 2021

12.6.1 PESTLE ANALYSIS: REST OF THE WORLD

FIGURE 52 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET SNAPSHOT

TABLE 204 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 205 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 206 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 207 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 208 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2018–2021 (USD MILLION)

TABLE 209 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 210 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 211 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 212 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 213 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 214 REST OF THE WORLD: UNMANNED GROUND VEHICLE PAYLOADS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 215 REST OF THE WORLD: UNMANNED GROUND VEHICLE PAYLOADS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 216 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 217 REST OF THE WORLD: UNMANNED GROUND VEHICLES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.6.2 LATIN AMERICA

TABLE 218 LATIN AMERICA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 219 LATIN AMERICA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 220 LATIN AMERICA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 221 LATIN AMERICA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 222 LATIN AMERICA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 223 LATIN AMERICA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.6.3 AFRICA

TABLE 224 AFRICA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 225 AFRICA: UNMANNED GROUND VEHICLES MARKET, BY MOBILITY, 2022–2027 (USD MILLION)

TABLE 226 AFRICA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 227 AFRICA: UNMANNED GROUND VEHICLES MARKET, BY SIZE, 2022–2027 (USD MILLION)

TABLE 228 AFRICA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 229 AFRICA: UNMANNED GROUND VEHICLES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

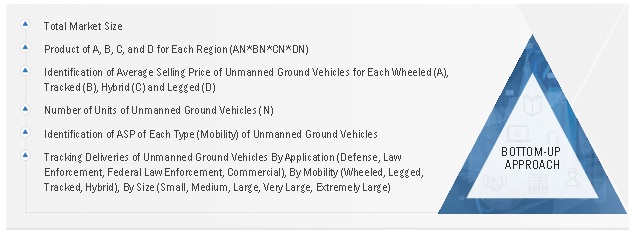

The study involved four major activities in estimating the current size of the unmanned ground vehicles market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included government sources, such as SIPRI; corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from unmanned ground vehicles vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using unmanned ground vehicles were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of unmanned ground vehicles and future outlook of their business which will affect the overall market.

The breakup of Primary Research :

|

Unmanned Ground Vehicles OEM |

Others |

|

Rheinmetall AG |

Teledyne FLIR |

|

QinetiQ |

Thales Group |

|

BAE Systems |

SAAB AB |

|

Lockheed Martin |

Elbit Systems |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the unmanned ground vehicles market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global Unmanned Ground Vehicles Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, download the pdf brochure

Data Triangulation

After arriving at the overall size of the unmanned ground vehicles market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the unmanned ground vehicles market.

Revolutionizing Transportation: The Growing Market for Unmanned Ground Vehicles (UGVs)

The unmanned ground vehicles market, also known as the UGV market, is an ever-growing industry that is set to revolutionize the way we move and transport goods. These vehicles are commonly referred to as uncrewed ground vehicles (UGV) or autonomous ground vehicles (AGV), and they are essentially ground-based robots that can operate without a human driver.

UGVs have been used in various industries, including the military, agriculture, logistics, and healthcare. The demand for these vehicles has been driven by several factors, including the need for more efficient and safer transportation, the rising demand for automation, and advancements in technology.

One of the primary benefits of UGVs is that they can operate in environments that are too hazardous or difficult for human drivers. For example, in the military, UGVs are used for tasks such as surveillance, reconnaissance, and bomb disposal. They are also used in agriculture to automate tasks such as planting, spraying, and harvesting.

In the logistics industry, UGVs are used for material handling, inventory management, and transportation. These vehicles can operate around the clock, increasing efficiency and reducing the need for human labor. In addition, UGVs can also reduce the risk of accidents, as they can be programmed to avoid obstacles and other hazards.

The healthcare industry is also starting to embrace UGVs, with applications such as telemedicine and patient transportation. These vehicles can be used to transport patients between hospital departments, reducing the need for human staff and potentially decreasing the spread of infectious diseases.

Niche Threats to Ensure the Safe and Responsible Growth of the UGV Industry:

The UGV industry is rapidly growing and innovating, but it also faces several niche threats that could impact its development and adoption. These include the potential for UGVs to be hacked or controlled by malicious actors, job loss in industries such as logistics and agriculture, safety and reliability concerns, and ethical issues in military applications. To address these threats, the industry must prioritize safety and security, invest in robust cybersecurity measures and testing protocols, and work with policymakers to address concerns about job loss and ethical implications. By doing so, the UGV industry can continue to grow and innovate while minimizing potential risks.

Report Objectives

- To define, describe, and forecast the unmanned ground vehicles market by Application, Mobility, Size, Mode of Operation, System, and region

- To analyze the demand- and supply-side indicators influencing the growth of the unmanned ground vehicles market

- To provide in-depth market intelligence regarding key market dynamics, such as drivers, restraints, opportunities, and industry-specific challenges, which influence the growth of the unmanned ground vehicles market

- To forecast the size of various segments of the unmanned ground vehicles market across five main regions, namely, North America, Europe, Asia Pacific, the Middle East, and Rest of the World.

- To analyze micromarkets 1 with respect to individual growth trends, prospects, and their contribution to the unmanned ground vehicles market

- To analyze technological advancements and new product launches in the unmanned ground vehicles market

- To strategically profile key players in the unmanned ground vehicles market and comprehensively analyze their core competencies 2

- To identify products and key developments of leading companies operating in the unmanned ground vehicles market

- To provide a comprehensive analysis of business and corporate strategies adopted by key players operating in the unmanned ground vehicles market

- To provide a detailed competitive landscape of the unmanned ground vehicles market, along with market share ranking of leading players in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Unmanned Ground Vehicles Market

I would like to find out what is the projected growth % in Asia Pacific UGVs market between 2018 and 2025; and the growth % in North America, Europe, ME, and RoW.