Audio Amplifier Market by Channel Type (Mono, Two, Four, Six), Device (Smartphones, Television Sets, Desktops & Laptops, Home Audio Systems, Professional Audio Systems, Automotive Infotainment Systems), End-user Industry, Region - Global Forecast to 2025-2033

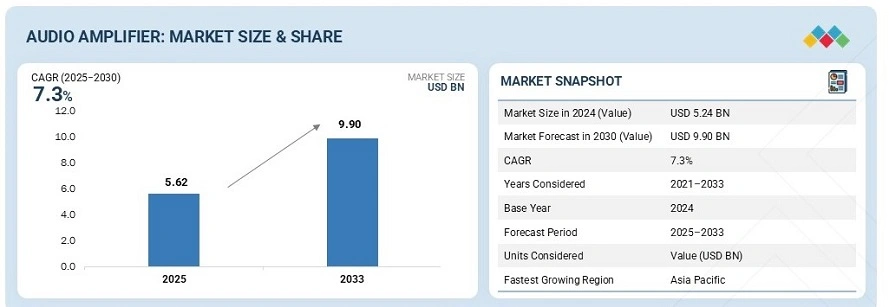

The global audio amplifier market was valued at USD 5.24 billion in 2024 and is estimated to reach USD 9.90 billion by 2033, at a CAGR of 7.3% between 2025 and 2033.

The global audio amplifier market is driven by the rising demand for high-quality audio in consumer electronics, the growth of the automotive industry, and advancements in audio technology. Increasing consumer expectations for better sound performance in devices such as smartphones, televisions, laptops, and portable speakers are pushing manufacturers to integrate efficient and compact amplifier solutions. The automotive sector is another major driver, with modern vehicles—especially electric and luxury models—featuring premium in-car entertainment systems that rely on advanced audio amplifiers.

An audio amplifier is an electronic device that increases the strength of audio signals, allowing them to drive speakers or headphones and produce louder sound. It takes weak audio inputs from sources like smartphones, microphones, or music players and amplifies them without significantly distorting the sound quality. Audio amplifiers are essential in various applications, including home theaters, car audio systems, headphones, and professional sound equipment.

Market by Channel Type

Two Channel

Two-channel audio amplifiers dominate the market because they offer a balanced and straightforward solution for delivering high-quality stereo sound, which is the most common listening format. They efficiently power left and right speakers, providing clear, immersive audio for music, movies, and gaming. Compared to multi-channel systems, two-channel amplifiers are simpler, more affordable, and easier to integrate into various devices like home audio setups and car stereos. Their versatility and cost-effectiveness make them popular among consumers who want excellent sound quality without the complexity or expense of surround sound systems, driving their strong market presence.

Six Channel

Six-channel audio amplifiers are the fastest-growing segment because they cater to the increasing demand for immersive surround sound experiences in home theaters, gaming setups, and automotive audio systems. With more consumers investing in multi-speaker setups to enjoy richer, more dynamic audio, six-channel amplifiers provide the necessary power and control to drive multiple speakers simultaneously. Advances in technology have also made these amplifiers more compact and affordable, encouraging wider adoption.

Mono Channel

Mono-channel audio amplifiers are gaining adoption mainly because of their simplicity, compact size, and cost-effectiveness, making them ideal for portable and single-speaker applications. They are widely used in devices like Bluetooth speakers, smartphones, and public address systems where only one audio channel is needed. Mono amplifiers also consume less power, which is crucial for battery-operated gadgets. Additionally, with the rise of smart home devices and IoT products, many small audio solutions require mono amplification to deliver clear sound without the complexity of multi-channel setups.

Market by End User Industry

Consumer Electronics

Consumer electronics is leading the audio amplifier market because of the widespread use and continuous innovation in devices like smartphones, smart TVs, laptops, wireless speakers, and headphones. These products require efficient, high-quality audio amplification to meet consumer expectations for better sound experiences. The rapid growth of portable and smart devices, along with increasing multimedia consumption, drives demand for compact and energy-efficient amplifiers. Additionally, consumers are willing to invest in enhanced audio quality for entertainment, gaming, and communication, making consumer electronics the largest and fastest-growing segment in the audio amplifier market.

Entertainment

The entertainment end-user industry is growing fastest because of the rising demand for immersive audio experiences in movies, music, gaming, and streaming platforms. As consumers increasingly consume digital content at home or on the go, there is a strong need for high-quality sound systems, including surround sound setups and wireless audio devices. Advances in technology, such as virtual reality and 3D audio, are also driving this growth by enhancing how audiences experience entertainment. Moreover, the popularity of home theaters, gaming consoles, and portable speakers is expanding rapidly, fueling the need for advanced audio amplifiers in the entertainment sector.

Market by Geography

Geographically, the audio amplifier market is witnessing strong growth across Asia Pacific, North America, Europe, and the Rest of the World (RoW). Asia Pacific leads the market, driven by rapid urbanization, increasing disposable incomes, and the growing penetration of consumer electronics such as smartphones, smart TVs, and portable speakers. The presence of a large manufacturing base and intense competition in the region contributes to lower average selling prices (ASP), further fueling adoption. North America follows, supported by high demand for premium audio systems in home entertainment, automotive, and personal devices. In Europe, market growth is driven by rising consumer preference for high-fidelity audio, increasing investments in smart home technologies, and the expansion of the automotive sector. Meanwhile, the Rest of the World is showing promising growth due to rising demand for affordable audio solutions, infrastructure development, and growing interest in wireless and smart audio products across emerging economies.

Market Dynamics

Driver: Growing traction of in-vehicle infotainment systems

The growing traction of in-vehicle infotainment systems is a significant driver for the audio amplifier market. Modern consumers expect high-quality audio experiences in their vehicles, leading automakers to integrate advanced infotainment systems that rely on powerful, multi-channel amplifiers. These systems support music, navigation, voice control, and entertainment features, all requiring clear and dynamic sound output. As electric and connected vehicles become more popular, the demand for efficient, compact, and high-performance amplifiers increases. Additionally, luxury and mid-range vehicles are increasingly equipped with branded audio systems, further boosting the need for sophisticated amplifier technologies to deliver immersive in-car audio experiences.

Restraint: Interface integration issues of audio amplifiers in various audio devices

Interface integration issues of audio amplifiers in various audio devices act as a key restraint in the market. Integrating amplifiers into complex systems like smartphones, smart speakers, automotive infotainment units, and wireless headphones often requires compatibility with multiple components, signal formats, and power requirements. Mismatches in signal levels, impedance, or communication protocols can lead to performance degradation, distortion, or increased power consumption. Additionally, miniaturization and space constraints in modern devices make it challenging to fit and optimize amplifier circuitry without affecting thermal performance or audio quality. These technical challenges can delay product development and limit broader adoption across diverse applications.

Opportunity: Growing penetration of Internet of Things across the globe

The growing penetration of the Internet of Things (IoT) across the globe presents a significant opportunity for the audio amplifier market. As IoT-enabled devices such as smart speakers, voice-controlled assistants, home automation systems, and connected appliances become more widespread, the demand for high-quality, compact, and energy-efficient audio amplification solutions is rising. Audio amplifiers play a critical role in enabling voice interaction, alerts, and media playback in these smart devices. With IoT adoption expanding rapidly in both consumer and industrial segments, manufacturers have the opportunity to develop innovative amplifier solutions tailored for low-power, space-constrained, and always-connected environments.

Challenge: High costs of integrating LC filters with audio amplifiers

The high costs of integrating LC (inductor-capacitor) filters with audio amplifiers present a significant challenge for manufacturers. LC filters are essential in Class-D amplifiers to reduce electromagnetic interference and deliver clean, high-quality audio. However, these components can be expensive, bulky, and difficult to fit into compact, modern electronic devices. Their integration adds complexity to circuit design, increases production costs, and limits miniaturization, particularly in space-constrained applications like smartphones, earbuds, and IoT devices. As demand grows for smaller, more efficient audio solutions, overcoming the challenge of cost-effective and compact LC filter integration remains a key hurdle for amplifier designers and OEMs.

Future Outlook

Between 2025 and 2030, the audio amplifier market is expected to expand significantly due to rapid growth of consumer electronics—including smart TVs, wireless speakers, and wearable audio devices. Additionally, the widespread adoption of electric and connected vehicles will boost the need for high-performance audio systems, especially with advanced infotainment features becoming standard. The expansion of smart homes and IoT devices will further fuel amplifier integration for voice interaction and audio feedback. Technological advancements in Class-D amplifiers and miniaturized components will also make high-quality sound more accessible, supporting broader market growth.

Key Market Players

Top audio amplifier companies STMicroelectronics (Switzerland), Texas Instruments (US), NXP Semiconductors (Netherlands), Analog Devices, Inc. (US), and Infineon Technologies AG (Germany)

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 6 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 15)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumption

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in Market

4.2 Market, By Device

4.3 Market, By Channel Type

4.4 Market for Consumer Electronics, By Device

4.5 Market in Asia Pacific

4.6 Market, By Geography

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Value Chain Analysis

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Popularity of Consumer Electronic Devices Across the Globe

5.3.1.2 Growing Traction of In-Vehicle Infotainment Systems

5.3.1.3 Rising Demand for Energy-Efficient Technologies in Portable Audio Devices

5.3.1.4 Growing Demand for High-Quality Audio Output

5.3.2 Restraints

5.3.2.1 Interface Integration Issues of Audio Amplifiers in Various Audio Devices

5.3.2.2 Reduced Price Margins Due for Manufacturers of Audio Amplifiers

5.3.3 Opportunities

5.3.3.1 Integrating Increased Number of Functionalities With Audio Systems of Vehicles

5.3.3.2 Growing Penetration of the Internet of Things (Iot) Across the Globe

5.3.4 Challenges

5.3.4.1 Design and Complexity Challenges for the Development of High-Efficiency Audio Amplifiers

5.3.4.2 High Costs of Integrating Lc Filters With Audio Amplifiers

6 Audio Amplifier Market, By Channel Type (Page No. - 41)

6.1 Introduction

6.2 Mono Channel

6.2.1 Increasing use in Smartphones

6.3 Two Channel

6.3.1 Increasing use of 2-Channel in Automotive Infotainment Systems, Consumer Electronics & Professional Audio Systems

6.4 Four Channel

6.4.1 Professional Audio Systems to Grow at the Highest Rate During the Forecast Period

6.5 Six Channel

6.5.1 Home Audio Systems to Hold a Larger Size During the Forecast Period

6.6 Others

7 Audio Amplifier Market, By Device (Page No. - 50)

7.1 Introduction

7.2 Smartphones

7.2.1 Technological Developments in Consumer Electronic Products are Boosting the Growth of Smartphone Market

7.3 Television Sets

7.3.1 Increased Demand for Large Screen Television Sets With Superior Audio Quality is Expected to Fuel Growth of Market

7.4 Home Audio Systems

7.4.1 Rise in Popularity of Smart Speakers for use in Home Audio Systems

7.5 DesKTops & Laptops

7.5.1 Decreasing Shipments of Tablets

7.6 Tablets

7.6.1 Decreasing Shipments of DesKTops and Laptops

7.7 Automotive Infotainment Systems

7.7.1 Increased Demand for Navigation, Vehicle Diagnostics, and Entertainment Services in Passenger Cars and Commercial Vehicles

7.8 Professional Audio Systems

7.8.1 Increased Spending on Music Concerts, Festivals, and Sports Events is Leading to Growth of Professional Audio Systems Segment of Market

8 Audio Amplifier Market, By End-User Industry (Page No. - 64)

8.1 Introduction

8.2 Consumer Electronics

8.2.1 Increasing Popularity of Smart Electronic Devices to Propel Growth of Market for Consumer Electronics

8.3 Automotive

8.3.1 Growing Traction of In-Vehicle Infotainment Systems to Contribute to Demand for Audio Amplifiers in Automotive Vertical

8.4 Entertainment

8.4.1 Rising Expenditure on Global Festivals and Music Concerts to Augment Demand for Audio Amplifiers in Entertainment Vertical

9 Audio Amplifier Market, By Region (Page No. - 74)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Presence of Prominent Audio Amplifier Manufacturers in the US is Fueling Growth of Market in the Country

9.2.2 Canada

9.2.2.1 Growing Popularity of Consumer Electronic Products in Canada to Lead to Growth of Market in the Country

9.2.3 Mexico

9.2.3.1 Flourishing and Well-Positioned Automotive Industry of the Country Leading to Growth of Market in Mexico

9.3 Europe

9.3.1 Germany

9.3.1.1 Flourishing Automotive Industry of the Country Leading to Rise in Demand for Audio Amplifiers in Germany

9.3.2 UK

9.3.2.1 Increasing Adoption of Smart Television Sets Leading to Growth of Market in the UK

9.3.3 France

9.3.3.1 Increasing Adoption of Audio Systems in Automobile Industry of France Fueling Growth of Market in Country

9.3.4 Rest of Europe (RoE)

9.4 Asia Pacific (APAC)

9.4.1 China

9.4.1.1 Increasing Demand for Consumer Electronics and Flourishing Automotive Industry in China are Fueling Growth of Market in the Country

9.4.2 Japan

9.4.2.1 Increasing Vehicle Production in Japan to Fuel Growth of Market in the Country

9.4.3 Korea

9.4.3.1 Increasing Penetration of Smart Speakers in Korea is Contributing to the Growth of Market in the Country

9.4.4 Rest of Asia Pacific

9.5 Rest of the World (RoW)

9.5.1 Middle East and Africa (MEA)

9.5.1.1 Increasing Investments in the Automotive Sector of the Middle East and North Africa are Fueling Growth of Market in the Middle East and Africa

9.5.2 South America

9.5.2.1 Increasing Demand for Consumer Electronic Products is Fueling Growth of Market in South America

10 Competitive Landscape (Page No. - 90)

10.1 Introduction

10.2 Market Ranking Analysis of Market for 2018

10.3 Competitive Leadership Mapping

10.3.1 Visionary Leaders

10.3.2 Dynamic Differentiators

10.3.3 Innovators

10.3.4 Emerging Companies

10.4 Strength of Product Portfolio

10.5 Business Strategy Excellence

10.6 Competitive Situations and Trends

10.6.1 Product Launches

10.6.2 Partnerships and Collaborations

10.6.3 Acquisitions

11 Company Profiles (Page No. - 100)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1 Key Players

11.1.1 STMicroelectronics

11.1.2 Texas Instruments

11.1.3 NXP Semiconductors

11.1.4 Analog Devices

11.1.5 Infineon Technologies

11.1.6 Maxim Integrated Product Inc.

11.1.7 Cirrus Logic Inc.

11.1.8 Toshiba Corporation

11.1.9 on Semiconductor Corp.

11.1.10 Qualcomm Incorporated

11.2 Other Ecosystem Players

11.2.1 ROHM Semiconductor

11.2.2 Monolithic Power Systems Inc.

11.2.3 Silicon Laboratories, Inc. (Silicon Labs)

11.2.4 ICEPower A/S

11.2.5 Nuvoton Technology Corporation

11.2.6 Tempo Semiconductor Inc.

11.2.7 Renesas Electronics

11.2.8 Dialog Semiconductors

11.2.9 Integrated Silicon Solutions Inc. (ISSI)

11.2.10 DIOO Microcircuits Co., Ltd.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 132)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (72 Tables)

Table 1 Audio Amplifier Market, By Channel Type, 2016–2024 (USD Million)

Table 2 Mono Channel Audio Amplifier, By Device, 2016–2024 (USD Million)

Table 3 Mono Channel Audio Amplifier, By Device, 2016–2024 (Million Units)

Table 4 Two Channel Audio Amplifier , By Device, 2016–2024 (USD Million)

Table 5 Two Channel Audio Amplifier , By Device, 2016–2024 (Million Units)

Table 6 Four Channel Audio Amplifier , By Device, 2016–2024 (USD Million)

Table 7 Four Channel Audio Amplifier , By Device, 2016–2024 (Million Units)

Table 8 Six Channel Audio Amplifier , By Device, 2016–2024 (USD Million)

Table 9 Six Channel Audio Amplifier , By Device, 2016–2024 (Million Units)

Table 10 Other Channels Audio Amplifier , By Device, 2016–2024 (USD Million)

Table 11 Other Channels Audio Amplifier , By Device, 2016–2024 (Million Units)

Table 12 Market, By Device, 2016–2024 (USD Million)

Table 13 Market, By Device, 2016–2024 (Million Units)

Table 14 Market for Smartphones, By Channel Type, 2016–2024 (USD Million)

Table 15 Market for Smartphones, By Region, 2016–2024 (USD Million)

Table 16 Market for Smartphones, By Region, 2016–2024 (Million Units)

Table 17 Market for Television Sets, By Channel Type, 2016–2024 (USD Million)

Table 18 Market for Television Sets, By Region, 2016–2024 (USD Million)

Table 19 Market for Television Sets, By Region, 2016–2024 (Million Units)

Table 20 Market for Home Audio Systems, By Channel Type, 2016–2024 (USD Million)

Table 21 Market for Home Audio Systems, By Region, 2016–2024 (USD Million)

Table 22 Market for Home Audio Systems, By Region, 2016–2024 (Million Units)

Table 23 Market for Desktops & Laptops, By Channel Type, 2016–2024 (USD Million)

Table 24 Market for Desktops & Laptops, By Region, 2016–2024 (USD Million)

Table 25 Market for Desktops & Laptops, By Region, 2016–2024 (Million Units)

Table 26 Market for Tablets, By Channel Type, 2016–2024 (USD Million)

Table 27 Market for Tablets, By Region, 2016–2024 (USD Million)

Table 28 Market for Tablets, By Region, 2016–2024 (Million Units)

Table 29 Market for Automotive Infotainment Systems, By Channel Type, 2016–2024 (USD Million)

Table 30 Market for Automotive Infotainment Systems, By Region, 2016–2024 (USD Million)

Table 31 Market for Automotive Infotainment Systems, By Region, 2016–2024 (Million Units)

Table 32 Market for Professional Audio Systems, By Channel Type, 2016–2024 (USD Million)

Table 33 Market for Professional Audio Systems, By Region, 2016–2024 (USD Million)

Table 34 Market for Professional Audio Systems, By Region, 2016–2024 (Million Units)

Table 35 Market, By End-User Industry, 2016–2024 (USD Million)

Table 36 Market for Consumer Electronics, By Device, 2016–2024 (USD Million)

Table 37 Market for Consumer Electronics, By Device, 2016–2024 (Million Units)

Table 38 Market for Consumer Electronics, By Region, 2016–2024 (USD Million)

Table 39 Market for Consumer Electronics in North America, By Country, 2016–2024 (USD Million)

Table 40 Market for Consumer Electronics in Europe, By Country, 2016–2024 (USD Million)

Table 41 Market for Consumer Electronics in Asia Pacific, By Country, 2016–2024 (USD Million)

Table 42 Market for Consumer Electronics in RoW, By Region, 2016–2024 (USD Million)

Table 43 Market for Automotive, By Region, 2016–2024 (USD Million)

Table 44 Market for Automotive in North America, By Country, 2016–2024 (USD Million)

Table 45 Market for Automotive in Europe, By Country, 2016–2024 (USD Million)

Table 46 Market for Automotive in Asia Pacific, By Country, 2016–2024 (USD Million)

Table 47 Market for Automotive in RoW, By Region, 2016–2024 (USD Million)

Table 48 Market for Entertainment, By Region, 2016–2024 (USD Million)

Table 49 Market for Entertainment in North America, By Country, 2016–2024 (USD Million)

Table 50 Market for Entertainment in Europe, By Country, 2016–2024 (USD Million)

Table 51 Market for Entertainment in Asia Pacific, By Country, 2016–2024 (USD Million)

Table 52 Market for Entertainment in RoW, By Region, 2016–2024 (USD Million)

Table 53 Market, By Region, 2016–2024 (USD Million)

Table 54 North America Audio Amplifier , By Country, 2016–2024 (USD Million)

Table 55 North America Audio Amplifier , By End-User Industry, 2016–2024 (USD Million)

Table 56 North America Audio Amplifier , By Device, 2016–2024 (USD Million)

Table 57 North America Audio Amplifier , By Device, 2016–2024 (Million Units)

Table 58 Europe Audio Amplifier , By Country, 2016–2024 (USD Million)

Table 59 Europe Audio Amplifier , By End-User Industry, 2016–2024 (USD Million)

Table 60 Europe Audio Amplifier , By Device, 2016–2024 (USD Million)

Table 61 Europe Audio Amplifier , By Device, 2016–2024 (Million Units)

Table 62 Asia Pacific Audio Amplifier , By Country, 2016–2024 (USD Million)

Table 63 Asia Pacific Audio Amplifier , By End-User Industry, 2016–2024 (USD Million)

Table 64 Asia Pacific Audio Amplifier , By Device, 2016–2024 (USD Million)

Table 65 Asia Pacific Audio Amplifier , By Device, 2016–2024 (Million Units)

Table 66 RoW Audio Amplifier , By Region, 2016–2024 (USD Million)

Table 67 RoW Audio Amplifier , By End-User Industry, 2016–2024 (USD Million)

Table 68 RoW Audio Amplifier , By Device, 2016–2024 (USD Million)

Table 69 RoW Audio Amplifier , By Device 2016–2024 (Million Units)

Table 70 Product Launches, January 2016–April 2019

Table 71 Partnerships and Collaborations, January 2016–April 2019

Table 72 Acquisitions, January 2016–April 2019

List of Figures (39 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 Process Flow of Market Size Estimation

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Market Growth in Terms of Value and Volume (2016–2024)

Figure 8 Six Channel Segment of Market Projected to Grow at the Highest CAGR From 2019 to 2024

Figure 9 Home Audio Systems Segment Projected to Lead Audio Amplifier Market From 2019 to 2024

Figure 10 Entertainment Segment of Market Projected to Grow at the Highest CAGR From 2019 to 2024

Figure 11 Market in Asia Pacific Projected to Grow at the Highest CAGR From 2019 to 2024

Figure 12 Market in APAC is Projected to Grow at the Highest CAGR From 2019 to 2024

Figure 13 Home Audio Systems Segment of Market is Projected to Grow at the Highest CAGR From 2019 to 2024 in Terms of Value

Figure 14 Two Channel Market Holds the Largest Market Size in 2019

Figure 15 Home Audio Systems is Projected to Lead the Market From 2019 to 2024

Figure 16 China Accounted for the Largest Share of Market in Asia Pacific in 2018

Figure 17 Market in Rest of Asia Pacific is Projected to Grow at the Highest CAGR From 2019 to 2024

Figure 18 Value Chain Analysis

Figure 19 Market Dynamics

Figure 20 Market, By Channel Type

Figure 21 Home Audio Systems Segment to Growth With the Highest Rate Mono Channel Audio Amplifier Market From 2019 to 2024

Figure 22 Professional Audio Systems Segment of Four Channel Market is Projected to Grow at the Highest CAGR From 2019 to 2024

Figure 23 Market, By Region

Figure 24 North America Audio Amplifier Snapshot

Figure 25 Europe Audio Amplifier Snapshot

Figure 26 Asia Pacific Audio Amplifier Snapshot

Figure 27 Key Growth Strategies Adopted By Top Companies From January 2016 to April 2019

Figure 28 Market Ranking of Top 5 Players in Market, 2018

Figure 29 Market (Global) Competitive Leadership Mapping, 2018

Figure 30 STMicroelectronics: Company Snapshot

Figure 31 Texas Instruments: Company Snapshot

Figure 32 NXP Semiconductors: Company Snapshot

Figure 33 Analog Devices: Company Snapshot

Figure 34 Infineon Technologies: Company Snapshot

Figure 35 Maxim Integrated Product Inc.: Company Snapshot

Figure 36 Cirrus Logic: Company Snapshot

Figure 37 Toshiba Corporation: Company Snapshot

Figure 38 ON Semiconductor Corp.: Company Snapshot

Figure 39 Qualcomm Incorporated: Company Snapshot

The study involves four major activities to estimate the size of the audio amplifier market from 2019 to 2024. Exhaustive secondary research was conducted to collect information about the market, its peer markets, and its parent market. It was followed by primary research carried out to validate these findings, assumptions, and sizing with industry experts across the value chain. Both top-down and bottom-up approaches were employed to estimate the overall size of the market. It was followed by the market breakdown and data triangulation methods to estimate sizes of different segments and subsegments of the market.

Secondary Research

In the secondary research process, secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to for the identification and collection of information for this study on the audio amplifier market. The other secondary sources used during the study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles by recognized authors; gold-standard and silver-standard websites; regulatory bodies; trade directories; and databases.

Primary Research

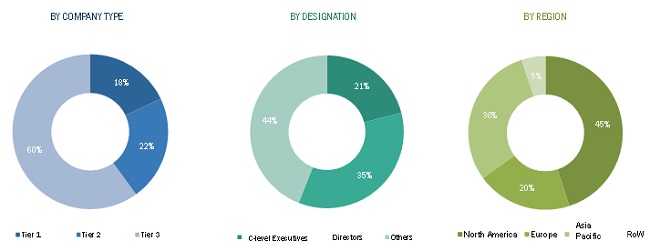

The audio amplifier market comprises stakeholders such as raw material suppliers, processors, end product manufacturers, and regulatory organizations. The supply-side market segmentation included channel types of audio amplifiers while the demand-side segmentation included various devices, end-user industries, and regions. Primary sources from both supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the overall size of the audio amplifier market. These methods were used extensively to estimate sizes of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and markets were identified through extensive secondary research

- The industry’s supply chain and the market size, in terms of value, were determined through primary and secondary research

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall size of the audio amplifier market through the market estimation process explained above, the total market was split into several segments. Market breakdown and data triangulation procedures were employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the size of the audio amplifier market based on channel type, device, end-user industry, and region

- To describe and forecast the size of the market in North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of audio amplifier market

- To strategically analyze micromarkets with respect to their individual growth trends, prospects, and contributions to the overall market

- To provide a detailed overview of the value chain of audio amplifiers

- To strategically profile key players and comprehensively analyze their market ranking in terms of revenues and core competencies, along with a detailed competitive landscape of the market for players operating in the audio amplifier market

- To analyze strategies such as product launches, partnerships, agreements, and collaborations adopted by leading players to strengthen their position in the audio amplifier market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players based on various blocks of the value chain of the audio amplifier market.

Regional Analysis

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Audio Amplifier Market