Hi-Fi System Market by System (Product, Device), Connectivity Technology (Wired, Wireless (Bluetooth, Wi-Fi, Airplay, Others)), Application (Residential, Automotive, Commercial, Others), and Geography

Hi-Fi System Market Size and Growth

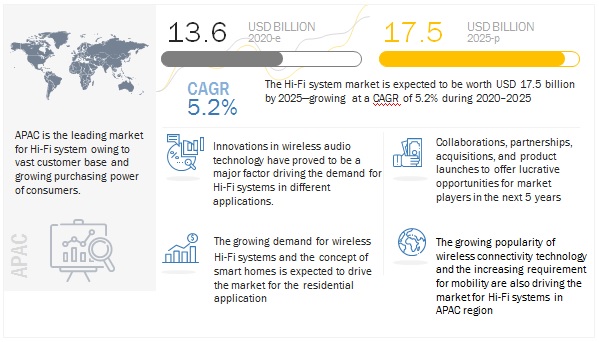

The global Hi-Fi system market is expected to grow from USD 13.6 billion in 2020 to USD 17.5 billion by 2025, at a CAGR of 5.2%, driven by rising consumer demand for premium audio experiences, advancements in wireless and smart audio technologies, and the growing popularity of portable devices such as smartphones and tablets. Hi-Fi systems, known for delivering high-fidelity sound, are increasingly integrated with modern features like voice assistants and smart home connectivity, further enhancing their appeal among tech-savvy consumers. The Asia-Pacific region is anticipated to dominate the market during the forecast period, fueled by a vast consumer base, increasing disposable incomes, and rapid urbanization.

The Hi-Fi System Market is experiencing growing demand due to the rising popularity of high-quality audio systems among consumers, especially with the increasing trend toward home entertainment. Key trends driving market growth include advancements in wireless audio technology, the integration of smart features, and the demand for premium sound quality. As more consumers seek immersive audio experiences for music, movies, and gaming, manufacturers are focusing on innovations such as voice control and multi-room audio setups, positioning the market for steady growth.

Impact of AI in Hi-Fi System Market

Artificial Intelligence (AI) is significantly transforming the Hi-Fi system market by enhancing personalization, audio quality, and user interaction. AI-powered Hi-Fi systems can analyze user preferences to deliver customized sound experiences, utilize advanced digital signal processing for real-time audio upscaling, and integrate with voice assistants for seamless, hands-free control. Additionally, AI enables adaptive sound based on room acoustics and listener location, while predictive maintenance features help extend the life of high-end audio equipment. As consumer demand grows for intelligent and immersive audio solutions, AI is driving innovation and opening new opportunities for manufacturers, although challenges such as data privacy and maintaining analog audio purity remain key considerations.

The Hi-Fi system market growth can be attributed to several factors, such as a rise in demand for infotainment services, high spending on R&D by OEMs, innovations in wireless audio technology, and increasing adoption of portable devices.

Attractive Opportunities in Hi-Fi System Market

Hi-Fi System Market Dynamics

Driver: Innovations in wireless audio technology

The wireless technology has made successful inroads across all the product segments of consumer electronics, and the audio technology industry has benefitted from this. Throughout this shift toward wireless, demand for advanced sound quality continues to be the crucial parameter among audio consumers globally.

Restraint: Health issues pertaining to prolonged use of audio devices

The use of headphones for listening to music or talking over the phone affects the listening power of users. Studies have revealed that continuous exposure to loud noise via loudspeakers, headphones, etc., can damage the delicate inner ear cells and result in hearing impairment or complete hearing loss. Children and youngsters are more prone to such damages. Additionally, Wi-Fi signals can create chronic sleep problems. Some implanted medical devices use radio frequency communication for reporting the status as well as making changes in device behavior. Emissions from wireless electronic devices can interfere with the functioning of these medical devices, thereby adversely affecting the health of the user.

Opportunity: Newer, non-conventional applications of headphones

Headsets are expected to help in the measurement of vitals of the body of users and track them during their workouts. Wireless headphones can also be paired with Amazon’s Alexa voice assistant to allow wearers to control connected home electrical appliances, such as thermostats and lights, remotely through verbal commands. Companies are making efforts to offer an engaging on-the-go Alexa experience to customers by making their headphones, headsets, or earbuds compatible with Alexa.

Challenge: Delivering high-quality and synchronized audio through wireless Hi-Fi systems

Wireless audio engineers are facing the challenge of not being able to deliver high-quality and synchronized audio streams in real-time using the wireless technology. Bandwidth constraints, delays in coding, and bit errors affect the wireless audio transfer. Innovations in wireless technologies, such as Bluetooth and Wi-Fi, have provided advantages such as receiving digital audio wherever and whenever required. However, the convergence of audio with video in the spectrum of consumer devices poses quality challenges for manufacturers. The availability of full bandwidth is impractical, and the required bandwidth cannot be made available for every application.

The market for the product segment is expected to hold the largest share during the forecast period

Based on the system, the Hi-Fi system market has been divided into products and devices. The product segment, which includes speaker & soundbar, CD player, DVD player, Blu-ray player, network media player, turntable, headphone & earphone, and microphone products, has a higher market share currently and expected to grow at the higher rate during the forecast period. Of these, the speaker & soundbar segment holds the largest share of the Hi-Fi system market. Speakers and soundbars are compatible with TV sets, smartphones, music systems, gaming consoles, etc., and can be connected to them through different media sources such as High-Definition Multimedia Interface (HDMI), Bluetooth, Wi-Fi, and Universal Serial Bus (USB). Due to their portability and ease of use, wireless speakers and soundbars are getting immensely popular.

Market for automotive application is expected to register the highest CAGR during the forecast period

The Hi-Fi system market based on application is segmented into residential, automotive, commercial, and others. The automotive application is expected to register the highest CAGR during the forecast period. The growing popularity of in-car infotainment systems is expected to drive the market for Hi-Fi systems in the automotive application.

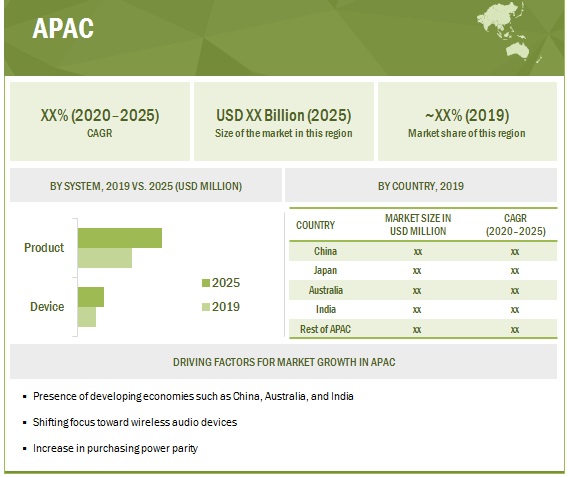

APAC expected to account for largest market share from 2020 to 2025

APAC is expected to hold the largest size of the Hi-Fi system market during the forecast period owing to large customer base and growing purchasing power of consumers. The growing popularity of wireless connectivity technology and the increasing requirement for mobility are also driving the market for Hi-Fi systems in this region. The region is witnessing increased demand for consumer electronics, such as smartphones and tablets, thereby leading to the growth of the Hi-Fi system market in the region.

Hi-Fi System Market Key Players

Some of the major players operating in the market are Samsung Electronics Co. (South Korea), Sony Corporation (Japan), Apple Inc. (US), Bose Corporation (US), Sennheiser Electronic GmbH & Co. KG (Germany), LG Electronics (South Korea), Panasonic Corporation (Japan), DEI Holdings, Inc. (US), Yamaha Corporation (Japan), Koninklijke Philips N.V. (Netherlands), Onkyo Corporation (Japan), and Sonos, Inc. (US). These players adopted various strategies such as product launches and developments, acquisitions, and partnerships to cater to the needs of the Hi-Fi system market.

Hi-Fi System Market Report Scope:

|

Report Metric |

Details |

| Market Size Value in 2020 | USD 13.6 Billion |

| Revenue Forecast in 2025 | USD 17.5 Billion |

| Growth Rate | 5.2% |

|

Market size available for years |

2017-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

In this research report, the Hi-Fi system market has been segmented on the basis of system, connectivity technology, application, and geography.

Hi-Fi System Market, by System

-

Product

- Speaker & Soundbar

- CD player

- DVD player

- Blu-ray player

- Network media player

- Turntable

- Headphone & Earphone

- Microphone

-

Device

- DAC

- Amplifier

- Preamplifier

- Receiver

Hi-Fi System Market, by Connectivity Technology

-

Wired

- Ethernet Cable

- Audio Cable

-

Wireless

- Bluetooth

- Wi-Fi

- AirPlay

- Others

Hi-Fi System Market, by Application

- Residential

- Automotive

- Commercial

- Others

Hi-Fi System Market, by Geography

- North America

- Europe

- APAC

- RoW

Recent Developments

- In August 2019, HARMAN, subsidiary of Samsung Electronics, launched a lifestyle audio brand in the Indian market - Infinity by HARMAN. As part of the brand launch, the company launched 11 new audio products, including six Infinity headphones, four portable Bluetooth speakers, and a multimedia 2.1 Bluetooth system.

- In May 2019, Bose Corporation launched the Headphones 700 noise-canceling headphone that redefines voice-control and mobile communication. It introduces a revolutionary new voice interface that redefines mobile communication the way Bose noise cancellation redefined mobile audio. It is built off the legendary performance of QCs to transform the most demanding environments into private sanctuaries for listening. With its exclusive innovation, the 700 isolates a user’s voice from unwanted ambient sounds.

- In January 2019, Sennheiser launched the latest members of its family of professional in-ear headphones—IE 400 PRO and IE 500 PRO. These headphones offer natural, high-resolution sound, with a secure and comfortable fit that can be custom-molded in-ears. They have a break-proof, patent-pending cable connection.

Frequently Asked Questions (FAQ):

Where will all the developments take the industry in the long term?

Technological progressions in wireless technologies have changed the way people communicate as well as listen to music. High-end audio has become a symbol of class for consumer home audio equipment. Owing to the increasing demand for portable devices such as smartphones, growing proliferation of connected devices, and rising global adoption of Wi-Fi networks, the Hi-Fi system market is expected to flourish in the coming years.

What are the drivers and opportunities for the Hi-Fi system market?

The market growth can be attributed to several driving factors, such as rise in demand for infotainment services, high spending on R&D by OEMs, innovations in wireless audio technology, and increasing adoption of portable devices. Growth of speakers and soundbars market in emerging regions and newer, nonconventional applications of headphones are providing opportunities in the market.

Which segment provides the most opportunity for growth?

The product segment, which includes speaker & soundbar, CD player, DVD player, Blu-ray player, network media player, turntable, headphone & earphone, and microphone products, has a higher market share currently and expected to grow at the higher rate during the forecast period. Speakers and soundbars are compatible with TV sets, smartphones, music systems, gaming consoles, etc., and can be connected to them through different media sources such as High-Definition Multimedia Interface (HDMI), Bluetooth, Wi-Fi, and Universal Serial Bus (USB). Due to their portability and ease of use, wireless speakers and soundbars are getting immensely popular.

Who are the leading vendors operating in the hi-fi system market?

Key players operating in the Hi-Fi system market are Samsung Electronics Co. (South Korea), Sony Corporation (Japan), Apple Inc. (US), Bose Corporation (US), Sennheiser Electronic GmbH & Co. KG (Germany), LG Electronics (South Korea), Panasonic Corporation (Japan), DEI Holdings, Inc. (US), Yamaha Corporation (Japan), Koninklijke Philips N.V. (Netherlands), Onkyo Corporation (Japan), and Sonos, Inc. (US), Linn Products (Scotland), Bowers & Wilkins (UK), Tannoy Ltd. (UK), VOXX International Corp. (US), VIZIO, Inc. (US), Bang & Olufsen (Denmark), Plantronics, Inc. (US), DALI A/S (Denmark), Human Inc. (US), Cambridge Audio (UK). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 20)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key data from primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for estimating the market size by bottom-up analysis (demand side)

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for estimating the market size by top-down approach (supply side)

2.3 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 29)

4 PREMIUM INSIGHTS (Page No. - 33)

4.1 MAJOR OPPORTUNITIES IN HI-FI SYSTEM MARKET

4.2 MARKET, BY CONNECTIVITY TECHNOLOGY

4.3 MARKET IN APAC, BY SYSTEM AND COUNTRY

4.4 MARKET, BY COUNTRY

4.5 MARKET, BY APPLICATION

5 HI-FI SYSTEM MARKET OVERVIEW (Page No. - 36)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rise in demand for infotainment services

5.2.1.2 High spending on R&D by OEMs

5.2.1.3 Innovations in wireless audio technology

5.2.1.4 Increasing adoption of portable devices

5.2.2 RESTRAINTS

5.2.2.1 Issues related to operating frequency compliance for wireless Hi-Fi systems

5.2.2.2 Health issues pertaining to prolonged use of audio devices

5.2.3 OPPORTUNITIES

5.2.3.1 Growth of speakers and soundbars market in emerging regions

5.2.3.2 Newer, nonconventional applications of headphones

5.2.4 CHALLENGES

5.2.4.1 Delivering high-quality and synchronized audio through wireless Hi-Fi systems

5.3 VALUE CHAIN ANALYSIS

5.4 IMPACT OF COVID-19 ON MARKET

6 HI-FI SYSTEM MARKET, BY SYSTEM (Page No. - 42)

6.1 INTRODUCTION

6.2 PRODUCT

6.2.1 SPEAKER & SOUNDBAR

6.2.1.1 Increasing popularity of wireless speakers and soundbars among consumers is expected to drive this segment

6.2.2 CD PLAYER

6.2.2.1 Hi-Fi CD player market is currently witnessing stagnant growth

6.2.3 DVD PLAYER

6.2.3.1 Hi-Fi DVD player market is expected to decline during forecast period

6.2.4 BLU-RAY PLAYER

6.2.4.1 Market for Blu-ray player is expected to witness sluggish growth

6.2.5 NETWORK MEDIA PLAYER

6.2.5.1 Market for network media players to witness significant growth during forecast period

6.2.6 TURNTABLE

6.2.6.1 Turntable is having negligible share in market

6.2.7 HEADPHONE & EARPHONE

6.2.7.1 Over-ear

6.2.7.1.1 Over-ear headphones are considered to be the best headphones among all categories

6.2.7.2 On-ear

6.2.7.2.1 On-ear headphones provide high portability

6.2.7.3 In-ear

6.2.7.3.1 In-ear headphones are generally tiny and provide high portability

6.2.8 MICROPHONE

6.2.8.1 Continuous technological advancements in output sound quality of wireless microphones are expected to fuel growth of this segment

6.3 DEVICE

6.3.1 DAC (DIGITAL-TO-ANALOG CONVERTER)

6.3.1.1 DAC converts digital data streams into analog audio signals

6.3.2 AMPLIFIER

6.3.2.1 Standalone amplifiers allow users to add more speakers to a Hi-Fi stereo system

6.3.3 PREAMPLIFIER

6.3.3.1 Preamps are used along with sound equipment to improve overall quality of sound

6.3.4 RECEIVER

6.3.4.1 Receiver is used to capture signal from different sources

7 HI-FI SYSTEM MARKET, BY CONNECTIVITY TECHNOLOGY (Page No. - 65)

7.1 INTRODUCTION

7.2 WIRED

7.2.1 ETHERNET CABLE

7.2.1.1 Ethernet cable is one of the popular forms of wired audio technology

7.2.2 AUDIO CABLE

7.2.2.1 Audio cables transfer analog or digital signals from an audio source to an amplifier or powered speaker

7.3 WIRELESS

7.3.1 BLUETOOTH

7.3.1.1 Cost-effectiveness and compatibility associated with this technology is driving market of audio devices equipped with Bluetooth

7.3.2 WI-FI

7.3.2.1 Secured operation carried out by Wi-Fi-enabled audio devices leading to growth of this technology

7.3.3 AIRPLAY

7.3.3.1 Increased use of AirPlay technology for wireless streaming on devices supported by Apple 7.3.4 OTHERS

7.3.4.1 SKAA

7.3.4.2 Sonos

7.3.4.3 Play-Fi

7.3.4.4 RF and IR

8 HI-FI SYSTEM MARKET, BY APPLICATION (Page No. - 76)

8.1 INTRODUCTION

8.2 RESIDENTIAL

8.2.1 INCREASED USE OF WIRELESS AUDIO SYSTEMS FOR IN-HOME APPLICATION IS FUELING GROWTH OF MARKET IN RESIDENTIAL APPLICATION

8.3 AUTOMOTIVE

8.3.1 RISING DEMAND FOR PREMIUM AUDIO SYSTEMS IN LUXURY AUTOMOBILES TO SPUR GROWTH MARKET

8.4 COMMERCIAL

8.4.1 PREFERENCE FOR HIGH-END AUDIO IN COMMERCIAL PLACES IS DRIVING GROWTH OF HI-FI SYSTEMS IN THIS APPLICATION

8.5 OTHERS

8.5.1 INCREASING DEMAND FOR HI-FI HEADPHONES AND MICROPHONES IN SECURITY AND MILITARY APPLICATIONS IS DRIVING GROWTH OF OTHERS SEGMENT

9 GEOGRAPHIC ANALYSIS (Page No. - 85)

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 US

9.2.1.1 Presence of majority of wireless audio device manufacturers in the country is fueling growth of market in US

9.2.2 CANADA

9.2.2.1 Preference of Canadian population to adopt innovative products contributing to growth of market

9.2.3 MEXICO

9.2.3.1 Growing investments in consumer electronics industry of Mexico lead to growth of market

9.3 EUROPE

9.3.1 GERMANY

9.3.1.1 Popularity of wireless streaming speakers and premium soundbars to boost market in Germany

9.3.2 UK

9.3.2.1 Willingness of users to invest in wireless audio devices to fuel growth of market in UK

9.3.3 FRANCE

9.3.3.1 Rising demand for audio devices in home entertainment application to spur growth of market in France

9.3.4 SPAIN

9.3.4.1 Growing demand for Hi-Fi speakers will lead to growth of market in Spain

9.3.5 REST OF EUROPE

9.4 APAC

9.4.1 CHINA

9.4.1.1 Geographical expansion by international wireless audio device manufacturers is expected to lead to growth of market in China

9.4.2 JAPAN

9.4.2.1 Rise in demand for consumer electronics equipped with wireless audio technology to spur growth of market in Japan

9.4.3 AUSTRALIA

9.4.3.1 Adoption of innovative audio technologies among consumer groups to boost growth of market in Australia

9.4.4 INDIA

9.4.4.1 Government initiatives such as Make in India are fueling demand for consumer durables in India

9.4.5 REST OF APAC

9.5 REST OF THE WORLD (ROW)

9.5.1 SOUTH AMERICA

9.5.1.1 Brazil and Argentina are potential markets for Hi-Fi systems in

South America 104

9.5.2 MIDDLE EAST

9.5.2.1 Surge in demand for wireless speakers and wireless headphones to fuel growth of market in Middle East

9.5.3 AFRICA

9.5.3.1 South Africa holds significant share in market

10 COMPETITIVE LANDSCAPE (Page No. - 106)

10.1 INTRODUCTION

10.2 RANKING ANALYSIS OF KEY PLAYERS IN MARKET

10.3 COMPETITIVE SITUATIONS AND TRENDS

10.3.1 PRODUCT LAUNCHES

10.3.2 PARTNERSHIP

10.3.3 ACQUISITION

10.4 COMPETITIVE LEADERSHIP MAPPING, 2019

10.4.1 VISIONARY LEADERS

10.4.2 INNOVATORS

10.4.3 DYNAMIC DIFFERENTIATORS

10.4.4 EMERGING COMPANIES

11 COMPANY PROFILES (Page No. - 112)

11.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1.1 SAMSUNG ELECTRONICS CO., LTD.

11.1.2 SONY CORPORATION

11.1.3 APPLE INC.

11.1.4 BOSE CORPORATION

11.1.5 SENNHEISER ELECTRONIC GMBH & CO. KG

11.1.6 LG ELECTRONICS

11.1.7 PANASONIC CORPORATION

11.1.8 DEI HOLDINGS, INC.

11.1.9 YAMAHA CORPORATION

11.1.10 KONINKLIJKE PHILIPS N.V.

* Business Overview, Products/Solutions/Services Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

11.2 RIGHT TO WIN

11.3 OTHER IMPORTANT PLAYERS

11.3.1 BOWERS & WILKINS

11.3.2 TANNOY LTD.

11.3.3 VOXX INTERNATIONAL CORPORATION

11.3.4 SONOS, INC.

11.3.5 VIZIO INC.

11.3.6 ONKYO CORPORATION

11.3.7 BANG & OLUFSEN

11.3.8 PLANTRONICS, INC.

11.3.9 DALI A/S

11.3.10 HUMAN INC.

11.3.11 LINN PRODUCTS

11.3.12 CAMBRIDGE AUDIO

12 APPENDIX (Page No. - 145)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

LIST OF TABLES (108 Tables)

TABLE 1 HI-FI SYSTEM MARKET, BY SYSTEM, 2017–2025 (USD BILLION)

TABLE 2 MARKET FOR PRODUCT, BY TYPE, 2017–2025 (USD MILLION)

TABLE 3 MARKET FOR PRODUCT, BY TYPE, 2017–2025 (MILLION UNITS)

TABLE 4 MARKET FOR PRODUCT, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 5 MARKET FOR PRODUCT, BY REGION, 2017–2025 (USD MILLION)

TABLE 6 MARKET FOR SPEAKER & SOUNDBAR, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 7 MARKET FOR SPEAKER & SOUNDBAR, BY REGION, 2017–2025 (USD MILLION)

TABLE 8 MARKET FOR SPEAKER & SOUNDBAR, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 9 MARKET FOR CD PLAYER, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 10 MARKET FOR CD PLAYER, BY REGION, 2017–2025 (USD MILLION)

TABLE 11 MARKET FOR CD PLAYER, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 12 MARKET FOR DVD PLAYER, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 13 MARKET FOR DVD PLAYER, BY REGION, 2017–2025 (USD MILLION)

TABLE 14 MARKET FOR DVD PLAYER, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 15 MARKET FOR BLU-RAY PLAYER, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 16 MARKET FOR BLU-RAY PLAYER, BY REGION, 2017–2025 (USD MILLION)

TABLE 17 MARKET FOR BLU-RAY PLAYER, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 18 MARKET FOR NETWORK MEDIA PLAYER, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 19 MARKET FOR NETWORK MEDIA PLAYER, BY REGION, 2017–2025 (USD MILLION)

TABLE 20 MARKET FOR NETWORK MEDIA PLAYER, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 21 MARKET FOR TURNTABLE, BY APPLICATION, 2017–2025 (USD THOUSAND)

TABLE 22 HI-FI SYSTEM MARKET FOR TURNTABLE, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 23 MARKET FOR TURNTABLE, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2017–2025 (USD THOUSAND)

TABLE 24 MARKET FOR HEADPHONE & EARPHONE, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 25 MARKET FOR HEADPHONE & EARPHONE, BY REGION, 2017–2025 (USD MILLION)

TABLE 26 MARKET FOR HEADPHONE & EARPHONE, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 27 MARKET FOR MICROPHONE, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 28 MARKET FOR MICROPHONE, BY REGION, 2017–2025 (USD MILLION)

TABLE 29 MARKET FOR MICROPHONE, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 30 MARKET FOR DEVICE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 31 MARKET FOR DEVICE, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 32 HI-FI SYSTEM MARKET FOR DEVICE, BY REGION, 2017–2025 (USD MILLION)

TABLE 33 MARKET FOR DAC, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 34 MARKET FOR DAC, BY REGION, 2017–2025 (USD MILLION)

TABLE 35 MARKET FOR DAC, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 36 MARKET FOR AMPLIFIER, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 37 MARKET FOR AMPLIFIER, BY REGION, 2017–2025 (USD MILLION)

TABLE 38 MARKET FOR AMPLIFIER, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 39 MARKET FOR PREAMPLIFIER, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 40 MARKET FOR PREAMPLIFIER, BY REGION, 2017–2025 (USD MILLION)

TABLE 41 MARKET FOR PREAMPLIFIER, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 42 MARKET FOR RECEIVER, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 43 MARKET FOR RECEIVER, BY REGION, 2017–2025 (USD MILLION)

TABLE 44 MARKET FOR RECEIVER, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 45 HI-FI SYSTEM MARKET, BY CONNECTIVITY TECHNOLOGY, 2017–2025 (USD BILLION)

TABLE 46 MARKET FOR WIRED CONNECTIVITY TECHNOLOGY FOR PRODUCT, BY TYPE, 2017–2025 (USD MILLION)

TABLE 47 MARKET FOR WIRED CONNECTIVITY TECHNOLOGY FOR DEVICE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 48 MARKET FOR PRODUCT, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 49 MARKET FOR DEVICE, BY WIRELESS CONNECTIVITY TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 50 MARKET FOR WIRELESS CONNECTIVITY TECHNOLOGY FOR PRODUCT, BY TYPE, 2017–2025 (USD MILLION)

TABLE 51 MARKET FOR WIRELESS CONNECTIVITY TECHNOLOGY FOR DEVICE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 52 MARKET FOR BLUETOOTH TECHNOLOGY, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 53 MARKET FOR BLUETOOTH TECHNOLOGY, BY DEVICE, 2017–2025 (USD MILLION)

TABLE 54 MARKET FOR WI-FI TECHNOLOGY, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 55 MARKET FOR WI-FI TECHNOLOGY, BY DEVICE, 2017–2025 (USD MILLION)

TABLE 56 MARKET FOR AIRPLAY TECHNOLOGY, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 57 MARKET FOR AIRPLAY TECHNOLOGY, BY DEVICE, 2017–2025 (USD MILLION)

TABLE 58 MARKET FOR OTHER TECHNOLOGIES, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 59 MARKET FOR OTHER TECHNOLOGIES, BY DEVICE, 2017–2025 (USD MILLION)

TABLE 60 HI-FI SYSTEM MARKET, BY APPLICATION, 2017–2025 (USD BILLION)

TABLE 61 MARKET IN RESIDENTIAL APPLICATION, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 62 MARKET FOR PRODUCT IN RESIDENTIAL APPLICATION, BY TYPE, 2017–2025 (USD MILLION)

TABLE 63 MARKET FOR DEVICE IN RESIDENTIAL APPLICATION, BY TYPE, 2017–2025 (USD MILLION)

TABLE 64 MARKET IN AUTOMOTIVE APPLICATION, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 65 MARKET FOR PRODUCT IN AUTOMOTIVE APPLICATION, BY TYPE, 2017–2025 (USD MILLION)

TABLE 66 MARKET FOR DEVICE IN AUTOMOTIVE APPLICATION, BY TYPE, 2017–2025 (USD MILLION)

TABLE 67 MARKET IN COMMERCIAL APPLICATION, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 68 MARKET FOR PRODUCT IN COMMERCIAL APPLICATION, BY TYPE, 2017–2025 (USD MILLION)

TABLE 69 MARKET FOR DEVICE IN COMMERCIAL APPLICATION, BY TYPE, 2017–2025 (USD MILLION)

TABLE 70 MARKET IN OTHER APPLICATIONS, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 71 MARKET FOR PRODUCT IN OTHER APPLICATIONS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 72 MARKET FOR DEVICE IN OTHER APPLICATIONS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 73 HI-FI SYSTEM MARKET, BY REGION, 2017–2025 (USD BILLION)

TABLE 74 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 75 MARKET IN NORTH AMERICA, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 76 MARKET FOR PRODUCT IN NORTH AMERICA, BY TYPE, 2017–2025 (USD MILLION)

TABLE 77 MARKET FOR DEVICE IN NORTH AMERICA, BY TYPE, 2017–2025 (USD MILLION)

TABLE 78 MARKET IN THE US, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 79 MARKET IN CANADA, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 80 MARKET IN MEXICO, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 81 MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 82 MARKET IN EUROPE, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 83 MARKET FOR PRODUCT IN EUROPE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 84 MARKET FOR DEVICE IN EUROPE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 85 MARKET IN GERMANY, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 86 MARKET IN UK, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 87 MARKET IN FRANCE, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 88 MARKET IN SPAIN, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 89 MARKET IN REST OF EUROPE, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 90 MARKET IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 91 MARKET IN APAC, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 92 HI-FI SYSTEM MARKET FOR PRODUCT IN APAC, BY TYPE, 2017–2025 (USD MILLION)

TABLE 93 MARKET FOR DEVICE IN APAC, BY TYPE, 2017–2025 (USD MILLION)

TABLE 94 MARKET IN CHINA, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 95 MARKET IN JAPAN, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 96 MARKET IN AUSTRALIA, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 97 MARKET IN INDIA, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 98 MARKET IN REST OF APAC, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 99 MARKET IN ROW, BY REGION, 2017–2025 (USD MILLION)

TABLE 100 MARKET IN ROW, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 101 MARKET FOR PRODUCT IN ROW, BY TYPE, 2017–2025 (USD MILLION)

TABLE 102 MARKET FOR DEVICE IN ROW, BY TYPE, 2017–2025 (USD MILLION)

TABLE 103 MARKET IN SOUTH AMERICA, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 104 HI-FI SYSTEM MARKET IN MIDDLE EAST, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 105 MARKET IN AFRICA, BY SYSTEM, 2017–2025 (USD MILLION)

TABLE 106 PRODUCT LAUNCHES, 2019

TABLE 107 PARTNERSHIP, 2018

TABLE 108 ACQUISITION, 2018

LIST OF FIGURES (55 Figures)

FIGURE 1 MARKET SEGMENTATION

FIGURE 2 HI-FI SYSTEM MARKET: RESEARCH DESIGN

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE OF MARKET PLAYERS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2 (DEMAND SIZE): BOTTOM-UP MARKET ESTIMATION FOR HI-FI SYSTEMS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 7 DATA TRIANGULATION

FIGURE 8 ASSUMPTIONS FOR THE RESEARCH STUDY

FIGURE 9 HI-FI SYSTEM MARKET, 2017–2025

FIGURE 10 PRODUCT SEGMENT EXPECTED TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 11 WIRELESS CONNECTIVITY TECHNOLOGY EXPECTED TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

FIGURE 12 RESIDENTIAL APPLICATION EXPECTED TO HOLD LARGEST SHARE IN MARKET DURING FORECAST PERIOD

FIGURE 13 APAC HELD LARGEST SHARE OF MARKET IN 2019

FIGURE 14 MARKET EXPECTED TO REGISTER HIGHEST CAGR IN APAC DURING FORECAST PERIOD

FIGURE 15 MARKET FOR WIRELESS TECHNOLOGY EXPECTED TO WITNESS HIGHER GROWTH RATE DURING FORECAST PERIOD

FIGURE 16 PRODUCT SEGMENT HELD LARGER SHARE OF MARKET IN APAC IN 2019

FIGURE 17 US DOMINATED GLOBAL MARKET IN 2019

FIGURE 18 AUTOMOTIVE APPLICATION TO WITNESS HIGHEST GROWTH IN MARKET DURING FORECAST PERIOD

FIGURE 19 INNOVATIONS IN WIRELESS AUDIO TECHNOLOGIES BOOST GROWTH OF MARKET

FIGURE 20 IMPACT ANALYSIS: DRIVERS

FIGURE 21 IMPACT ANALYSIS: RESTRAINTS

FIGURE 22 IMPACT ANALYSIS: OPPORTUNITIES

FIGURE 23 IMPACT ANALYSIS: CHALLENGE

FIGURE 24 MAJOR VALUE IS ADDED DURING MANUFACTURING AND ASSEMBLY STAGES

FIGURE 25 MARKET, BY SYSTEM

FIGURE 26 PRODUCT SEGMENT EXPECTED TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 27 MARKET, BY PRODUCT

FIGURE 28 HI-FI SYSTEM MARKET, BY DEVICE

FIGURE 29 MARKET, BY CONNECTIVITY TECHNOLOGY

FIGURE 30 WIRELESS TECHNOLOGY EXPECTED TO SURPASS WIRED TECHNOLOGY IN MARKET BY 2025

FIGURE 31 MARKET, BY WIRED TECHNOLOGY

FIGURE 32 MARKET, BY WIRELESS TECHNOLOGY

FIGURE 33 MARKET, BY APPLICATION

FIGURE 34 RESIDENTIAL APPLICATION EXPECTED TO HOLD LARGEST SIZE OF MARKET DURING FORECAST PERIOD

FIGURE 35 MARKET, BY REGION

FIGURE 36 MARKET IN NORTH AMERICA

FIGURE 37 HI-FI SYSTEM MARKET SNAPSHOT: NORTH AMERICA

FIGURE 38 MARKET IN EUROPE

FIGURE 39 MARKET SNAPSHOT: EUROPE

FIGURE 40 MARKET IN APAC

FIGURE 41 MARKET SNAPSHOT: APAC

FIGURE 42 MARKET IN ROW

FIGURE 43 MARKET SNAPSHOT: ROW

FIGURE 44 MARKET: KEY GROWTH STRATEGY ADOPTED BY COMPANIES FROM 2017 T0 2019

FIGURE 45 HI-FI SYSTEM MARKET: RANKING OF KEY COMPANIES

FIGURE 46 MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 47 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

FIGURE 48 SONY CORPORATION: COMPANY SNAPSHOT

FIGURE 49 APPLE INC.: COMPANY SNAPSHOT

FIGURE 50 BOSE CORPORATION: COMPANY SNAPSHOT

FIGURE 51 SENNHEISER ELECTRONIC GMBH & CO. KG: COMPANY SNAPSHOT

FIGURE 52 LG ELECTRONICS: COMPANY SNAPSHOT

FIGURE 53 PANASONIC CORPORATION: COMPANY SNAPSHOT

FIGURE 54 YAMAHA CORPORATION: COMPANY SNAPSHOT

FIGURE 55 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT

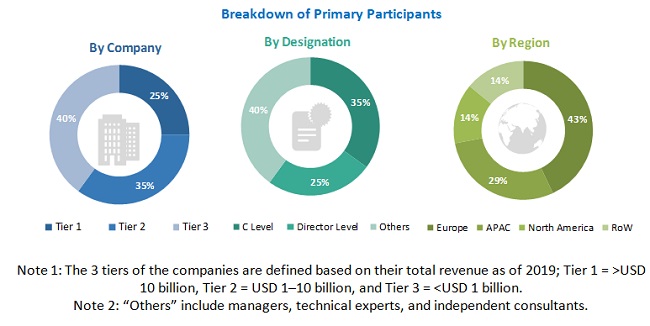

The study involved four major activities in estimating the size of the Hi-Fi system market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market’s size. After that, market breakdown and data triangulation were used to determine the market sizes of segments and sub-segments.

Secondary Research

In the Hi-Fi system market, both top-down and bottom-up approaches have been used to estimate and validate the size of the Hi-Fi system market, along with other dependent submarkets. Key players in the Hi-Fi system market have been identified through secondary research, and their revenue has been determined through primary and secondary research activities. This entire research methodology involved studying annual and financial reports of the top players and interviewing experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative). All percentage shares split, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that may affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

>

Primary Research

The Hi-Fi system market supply chain comprises several stakeholders, such as key technology providers, manufacturers, system integrators, distribution channels, marketing & sales, and end-users. The demand side of this market is characterized by applications such as residential, automotive, commercial, and others; the supply side is characterized by technology and product/associated device suppliers and software providers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Hi-Fi system market. These methods were also extensively used to estimate the sizes of various market sub-segments. The research methodology used to estimate the market sizes includes the following:

- The key players in the market were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

The main objectives of this study are:

- To define, describe, segment, and forecast the Hi-Fi system market, in terms of value, based on system, connectivity technology, and application

- To describe and forecast the size of the market, for four regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)—in terms of value

- To forecast the market size, in terms of volume, for the market segmented on the basis of product under system segment

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information regarding the major factors such as drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed value chain for the Hi-Fi system market

- To analyze the opportunities in the market for stakeholders and details of the competitive landscape of the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies, along with the competitive leadership mapping chart

- To analyze the competitive developments such as partnerships, mergers and acquisitions, and product launches in the Hi-Fi system market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Hi-Fi System Market