Augmented Reality (AR) Shopping Market Size, Share, Statistics and Industry Growth Analysis Report by Device Type (HMD, Smart Mirror, Handheld Device), Application (Try-on Solution, Planning & Designing, Information System), Market Type (Apparel, Jewelry, Groceries), Offering and Region - Global Forecast to 2028

Updated on : March 06, 2025

Augmented Reality (AR) Shopping Market Size & Share

The global Augmented Reality (AR) shopping market size is projected to reach USD 11.6 billion by 2028 from USD 3.4 billion in 2023 at a CAGR of 28.0% during the forecast period. Growing adoption of online shopping and e-commerce platforms, rising competition in market driving the need for brand differentiation, growing demand for personalized shopping experience are some of the major factors driving the market growth globally.

Augmented Reality (AR) Shopping Market Statistics Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Augmented Reality (AR) Shopping Market Trends :

Driver: Growing demand for personalized shopping experience

Augmented reality (AR) is revolutionizing the shopping experience by offering personalized interactions. Unlike traditional online shopping, AR allows us to use our phones or devices to preview products in our own homes before making a purchase. This reduces the chances of disappointment and returns, enabling better decision-making. Retailers from various industries are utilizing AR to enhance personalization. Furniture stores like IKEA provide AR experiences to visualize furniture in our homes. Makeup brands such as NYX Professional Makeup and Sally Hansen offer virtual makeup try-ons. Nike even utilizes AR to measure our feet accurately for the right shoe size. Moreover, AR significantly impacts purchase behavior. Products with AR content have a higher chance of being bought compared to those without AR. When we can digitally interact and virtually try on products, we gain confidence in our purchases and reduce the likelihood of returns. AR creates a sense of being present in the store, making shopping enjoyable and leading to smarter choices.

Restraint: High cost of AR technology

AR technology requires specialized hardware, such as advanced cameras, sensors, and processors, to deliver immersive and interactive experiences. These hardware components can be expensive, making it challenging for retailers and brands to adopt AR shopping solutions on a large scale. In addition, developing AR applications and content requires specialized skills and expertise, which can also be costly. Businesses need to invest in hiring or training professionals who are proficient in AR development, adding to the overall cost.

The implementation costs associated with integrating AR infrastructure into existing e-commerce platforms or developing dedicated AR shopping apps can be a significant barrier. This encompasses the development of backend systems, ongoing maintenance, and continuous updates to ensure a seamless and high-quality AR shopping experience. Additionally, the high cost of AR hardware, such as headsets and smart glasses, presents a challenge for consumer adoption, as the investment required may deter potential users.

Opportunity: Lower costs of storage and efficient inventory management

The lower cost of storage and efficient inventory management present significant opportunities for the AR shopping industry . Augmented reality technology enables virtual shopping experiences, allowing consumers to explore and interact with virtual products in a realistic way. By integrating AR into the shopping experience, retailers can overcome traditional limitations of physical store space and inventory management.

The lower cost of storage becomes an opportunity as AR shopping eliminates the need for retailers to stock large quantities of physical inventory. Instead, retailers can maintain a virtual inventory of products, reducing the costs associated with warehousing, logistics, and physical store space. AR allows customers to virtually try on or test products, browse through virtual shelves, and make purchase decisions without the need for physical stock on hand. This streamlined approach to inventory management lowers costs and increases efficiency for retailers.

Challenge: Consumer Acceptance

Consumer acceptance poses a significant challenge for the AR shopping industry . While augmented reality (AR) technology holds immense potential for enhancing shopping experiences, it relies on consumer adoption and acceptance to achieve widespread success. There are several factors which contribute to the challenge of gaining consumer acceptance.

Firstly, AR shopping requires users to embrace and adopt new technology. Not all consumers are familiar with AR or comfortable using it in their shopping routines. There may be a learning curve associated with understanding how to interact with AR interfaces and navigate virtual shopping experiences. This lack of familiarity can create a barrier to entry, hindering the adoption of AR shopping platforms.

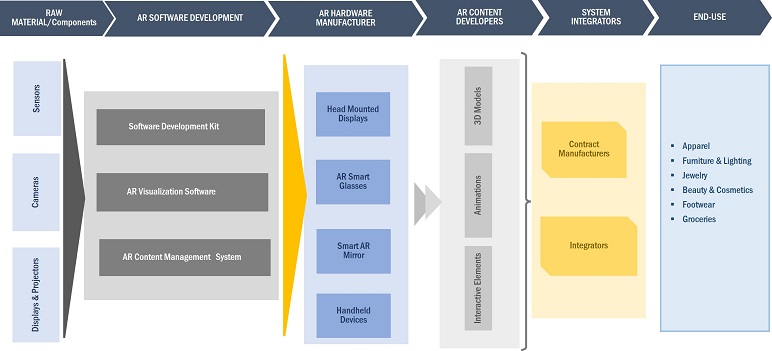

Augmented Reality (AR) Shopping Market Ecosystem

The major players in the Augmented Reality (AR) shopping market with a significant global presence include PTC (US), Alphabet Inc., (US), Microsoft (US), Apple (US), Meta (US). These companies not only boast a comprehensive product portfolio but also have a strong geographic footprint.

Augmented Reality (AR) Shopping Market Segmentation

Information System to register highest CAGR during the forecast period

The integration of information systems in AR Shopping apps and devices enhances transparency and empowers customers with relevant and accurate information. For instance, a customer using an AR Shopping app on their smartphone can scan a product's barcode and instantly retrieve detailed information about it, including specifications, pricing, and customer reviews. This allows customers to evaluate the product's features and quality, compare prices, and make well-informed decisions. Additionally, the app can provide real-time data on product availability, allowing customers to check if the item is in stock at nearby stores or online retailers is expected to drive the growth of AR shopping market.

AR Smart Mirror to account for the largest share of Augmented Reality (AR) shopping market during the forecast period

AR smart mirrors also benefit retailers by streamlining the fitting room process, reducing wait times, and enabling personalized recommendations. Beyond retail, AR smart mirrors have found applications in other industries, such as sports stadiums, where they provide fans with interactive experiences and opportunities to capture memorable moments. The increasing integration of AR technology in smart mirrors demonstrates its potential to revolutionize the way we shop and engage with our surroundings. Renowned brands like Ralph Lauren and H&M have successfully implemented smart mirrors in their stores, providing customers with convenient and customized try-on experiences. These are the major factor driving the growth of AR smart mirrors.

Augmented Reality (AR) Shopping Market Share

Software to account for the largest share of Augmented Reality (AR) shopping market during the forecast period

The software segment of augmented reality (AR) encompasses key components essential for AR development, visualization, and management. It includes Software Development Kits (SDKs) that provide developers with tools, libraries, and APIs to access AR functionalities like object tracking and spatial mapping. AR Visualization Software utilizes computer vision techniques and graphics rendering to seamlessly overlay virtual content onto the real-world environment, ensuring immersive experiences. AR Content Management Systems enable the organization, storage, and delivery of AR assets, allowing content creators to manage 3D models, animations, and videos. This comprehensive software ecosystem empowers developers and content creators to build and deploy engaging AR applications across different platforms and devices is expected to drive the growth of AR shopping market.

Augmented Reality (AR) Shopping Market Regional Analysis

Asia Pacific to register the highest growth during the forecast period

Asia Pacific is expected to register the highest CAGR in the Augmented Reality (AR) shopping market share from 2023 to 2028. The AR shopping market in Asia Pacific has witnessed numerous new developments and innovations. Companies like YouCam Makeup have pioneered such AR solutions in the region. Prominent retailers across the Asia Pacific region have embraced AR technology to enhance customer engagement and drive sales. For instance, Alibaba's e-commerce platform Taobao utilizes AR to enable virtual try-ons for cosmetic products, while JD.com has implemented AR features to visualize furniture and home decor items in customers' homes. These retailers provide immersive and interactive experiences, enhancing the shopping journey. The growth of the AR market in Asia Pacific can also be attributed to factors such as increasing usage of internet-based platforms, the continued rollout of high-speed 5G networks, and and advancements in technology.

Augmented Reality (AR) Shopping Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Augmented Reality (AR) Shopping Companies - Key Market Players:

The major players in the Augmented Reality (AR) shopping companies with a significant global presence include PTC (US), Alphabet Inc., (US), Microsoft (US), Apple (US), Meta (US). These players have adopted various organic and inorganic growth strategies such as product launches and developments, partnerships, collaborations, acquisitions, and joint ventures to strengthen their position in the Augmented Reality (AR) shopping market.

Augmented Reality (AR) Shopping Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 3.4 billion in 2023 |

| Projected Market Size | USD 11.6 billion by 2028 |

| Growth Rate | CAGR of 28.0% |

|

Augmented Reality (AR) shopping market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

The key players in the Augmented Reality (AR) shopping market with a significant global presence include PTC (US), Alphabet Inc., (US), Microsoft (US), Apple (US), Meta (US), Seiko Epson Corporation (Japan), Wikitude GmbH (Austria), Magic Leap, Inc. (US), 3D Cloud by Marxent (US), Vuzix (US), Blippar (UK). |

Augmented Reality (AR) Shopping Market Highlights

The study segments the Augmented Reality (AR) shopping market based on end use, AR technology, offering, device type, application, and market type at the regional and global level.

|

Segment |

Subsegment |

|

By End Use |

|

|

By AR Technology |

|

|

By Offering |

|

|

By Device Type |

|

|

By Application |

|

|

By Market Type |

|

|

By Region |

|

Recent Developments in Augmented Reality (AR) Shopping Industry

- In November 2022, Google released new AR shopping features for finding the perfect foundation match and trying on sneakers in AR, providing a realistic and immersive online shopping experience.

- In March 2021, PTC has launched Vuforia Engine Area Targets, the first offering in the market that supports the creation of immersive AR experiences for spaces up to 300,000 square feet. With the use of Area Targets, industrial organizations can create AR interfaces within their facilities.

- In March 2021, Seiko Epson announced the enhancement of the AR glasses – Moverio BT-40 and BT – 40S by using Si-OLED technology to expand the field of view with full HD 1080p display resolution, improved connectivity, and comfort.

- In September 2020, Microsoft partnershiped with Avatar Dimension, and selected it as the exclusive licensee for its volumetric capture technology in the Washington, D.C. area. Microsoft Mixed Reality Capture Studios certified the new studio after a rigorous testing process. The studio captures volumetric digital humans for business and governments, essential for powerful new virtual experiences across all categories.

- In October 2020, Meta launched Oculus Quest 2, which can run as both a standalone headset with the internal android-based operating system and with Oculus compatible VR software running on desktop computers.

- In March 2020, Apple released ARKi 3.5, which is an updated version of ARKi. The upgraded version has a new Scene Geometry application program interface (API) that uses the LiDAR scanner to create a 3D map of the space, differentiating between floors, walls, ceilings, windows, doors, and seats.

Frequently Asked Questions (FAQ):

What is the current size of the global Augmented Reality (AR) shopping market?

The Augmented Reality (AR) shopping market is projected to reach USD 11.6 billion by 2028 from USD 3.4 billion in 2023 at a CAGR of 28.0% from 2023 to 2028.

Who are the winners in the global Augmented Reality (AR) shopping market?

Companies such as PTC (US), Alphabet Inc., (US), Microsoft (US), Apple (US), Meta (US).

Which region is expected to hold the largest market share?

North America is expected to register the largest market share in the Augmented Reality (AR) shopping market during the forecast period. The high growth of the market in the region can be attributed to the increased government investments and initiatives in the retail sector and the presence of some of the technology giants, such as Apple and Google in the region.

What are the major drivers and opportunities related to Augmented Reality (AR) shopping market?

Growing adoption of online shopping and e-commerce platforms, rising competition in market driving the need for brand differentiation, growing demand for personalized shopping experience, increasing smartphone penetration & growth of AR apps are some of the major factors contributing to the market growth.

What are the major strategies adopted by market players?

The key players have adopted product launches, collaborations, acquisitions, and partnerships to strengthen their position in the Augmented Reality (AR) shopping market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing adoption of online shopping and e-commerce platforms- Need for brand differentiation- Growing demand for personalized shopping experience- Increasing use of smartphones and growth of AR appsRESTRAINTS- High cost of AR technology- Limited availability of AR devices- Lack of compatibility and interoperability- Privacy and security concernsOPPORTUNITIES- Lower cost of storage and efficient inventory management- Reduced labor costCHALLENGES- Need for skilled personnel- Technical limitations- Consumer acceptance

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 AR SHOPPING MARKET ECOSYSTEM ANALYSIS

-

5.5 KEY TECHNOLOGY TRENDSRELATED TECHNOLOGIES- Mixed Reality (MR)- Computer VisionUPCOMING TECHNOLOGIES- Extended Reality (XR)- Spatial ComputingADJACENT TECHNOLOGIES- Internet of Things (IoT)- Artificial Intelligence (AI)

-

5.6 PRICING ANALYSISAVERAGE SELLING PRICE OF KEY PLAYERS, BY DEVICE TYPEAVERAGE SELLING PRICE TREND

-

5.7 PATENT ANALYSIS

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 CASE STUDY ANALYSISENHANCED WINE SHOPPING EXPERIENCE BY IMPLEMENTING ARDEVELOPMENT OF APP TO CATER TO POTENTIAL HOMEBUYERS TO AVOID COSTS OF PHYSICAL STAGINGENHANCED SHOPPING EXPERIENCE FOR CUSTOMERS OF AUTA SUPEREFFECTIVE CUSTOMER SUPPORT FOR MERCEDES-BENZ

- 5.11 TRADE DATA

-

5.12 TARIFF AND REGULATIONSTARIFFSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America- Europe- Asia PacificSTANDARDS

-

5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.14 KEY CONFERENCES AND EVENTS IN 2022–2023

- 6.1 INTRODUCTION

-

6.2 MARKER-BASED ARPASSIVE MARKERSACTIVE MARKERS

-

6.3 MARKERLESS ARMARKERLESS AR, BY TECHNOLOGY- Model-based tracking- Image-based trackingMARKERLESS AR, BY TYPE- Projection-based AR- Superimposition-based AR- Location-based AR

- 7.1 INTRODUCTION

-

7.2 E-COMMERCE/OUT OF STOREINCREASING DEMAND FOR IMMERSIVE AND INTERACTIVE SHOPPING TO DRIVE GROWTH

-

7.3 RETAIL/IN-STOREBRAND DIFFERENTIATION AND SEAMLESS SHOPPING EXPERIENCE TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 HARDWAREDISPLAYS AND PROJECTORS- Growing demand in retail stores to drive marketCAMERAS- Need for object recognition and tracking to drive marketSENSORS- Immersive AR experience to drive market- Accelerometers- Gyroscopes- Magnetometers- Proximity sensors- Other hardware

-

8.3 SOFTWARE AND SERVICESSOFTWARE DEVELOPMENT KITS- Growing need for development of AR apps to drive marketAR VISUALIZATION SOFTWARE- Need to create lifelike models of products to drive marketAR CONTENT MANAGEMENT SYSTEMS- Increasing demand to create and manage 3D models, animation, and videos to drive marketSERVICES- Growing need for enhanced shopping experience in retail stores to drive market

- 9.1 INTRODUCTION

-

9.2 AR HEAD-MOUNTED DISPLAYSGROWING NEED FOR IMMERSIVE AND INTERACTIVE SHOPPING EXPERIENCES TO DRIVE GROWTH

-

9.3 SMART AR MIRRORSINCREASING ADOPTION BY RETAILERS TO DRIVE GROWTH

-

9.4 HANDHELD DEVICESINCREASED USE OF SMARTPHONES AND GROWTH OF AR APPS TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 TRY-ON SOLUTIONSINCREASED INTEGRATION OF AR FEATURES IN E-COMMERCE AND SMART AR MIRRORS TO DRIVE MARKET

-

10.3 PLANNING AND DESIGNINGGROWING ADOPTION OF E-COMMERCE PLATFORMS FOR SHOPPING TO DRIVE MARKET

-

10.4 ADVERTISING AND MARKETINGSHIFT IN FOCUS TOWARD EXPERIENTIAL MARKETING TO DRIVE MARKET

-

10.5 INFORMATION SYSTEMSGROWING NEED FOR INTERACTIVE AR SOLUTIONS TO DRIVE MARKET

- 11.1 INTRODUCTION

-

11.2 APPARELINCREASED INTEGRATION OF VIRTUAL TRY-ON FEATURES TO DRIVE MARKET

-

11.3 FURNITURE AND LIGHTINGDEVELOPMENT OF ADVANCED MARKERLESS TRACKING AND OBJECT RECOGNITION ALGORITHMS TO DRIVE MARKET

-

11.4 JEWELRYONLINE SHOPPING TO DRIVE MARKET

-

11.5 BEAUTY AND COSMETICSDEVELOPMENT OF ACCURATE VIRTUAL TRY-ON FEATURES TO DRIVE MARKET

-

11.6 FOOTWEARINCREASING ADOPTION OF 3D IMAGING TO DRIVE MARKET

-

11.7 GROCERIESWIDESPREAD ADOPTION OF AR-ENABLED SMARTPHONES TO DRIVE MARKET

- 11.8 OTHER MARKET TYPES

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICARECESSION IMPACT ANALYSISUS- Presence of established technology providers to drive marketCANADA- Increasing adoption of AR in retail and e-commerce to drive marketMEXICO- Strong economic growth and government initiatives to drive market

-

12.3 EUROPERECESSION IMPACT ANALYSISGERMANY- Thriving augmented reality ecosystem to drive marketUK- Adoption by major retailers to drive marketFRANCE- Growing advertising and marketing to drive marketREST OF EUROPE

-

12.4 ASIA PACIFICRECESSION IMPACT ANALYSISCHINA- Increasing economic growth and presence of advanced technology providers to drive marketINDIA- Massive e-commerce consumer base to drive marketJAPAN- Technological innovations and consumer acceptance to drive marketSOUTH KOREA- Technological advancements in AR hardware to drive marketREST OF ASIA PACIFIC

-

12.5 REST OF THE WORLDRECESSION IMPACTSOUTH AMERICA- Rapid urbanization and interest of global players to drive marketMIDDLE EAST & AFRICA- Growing luxury retail market and e-commerce to drive market

- 13.1 INTRODUCTION

-

13.2 MARKET EVALUATION FRAMEWORKORGANIC/INORGANIC GROWTH STRATEGIESPRODUCT PORTFOLIOGEOGRAPHIC PRESENCEMANUFACTURING AND DISTRIBUTION FOOTPRINT

- 13.3 MARKET SHARE ANALYSIS, 2022

- 13.4 HISTORICAL REVENUE ANALYSIS, 2018–2022

-

13.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.6 STARTUP/SME EVALUATION MATRIXCOMPETITIVE BENCHMARKINGPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 13.7 COMPANY FOOTPRINT

-

13.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

- 14.1 INTRODUCTION

-

14.2 KEY PLAYERSALPHABET INC. (GOOGLE)- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAPPLE INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMETA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPTC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSEIKO EPSON CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsWIKITUDE GMBH- Business overview- Products/Solutions/Services offeredMAGIC LEAP, INC.- Business overview- Products/Solutions/Services offered- Recent developments3D CLOUD BY MARXENT- Business overview- Products/Solutions/Services offered- Recent developmentsVUZIX CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsBLIPPAR- Business overview- Products/Solutions/Services offered- Recent developments

-

14.3 OTHER PLAYERSAUGMENTVIEWAR GMBHZUGARA, INC.GROOVE JONESSCIENCESOFT USA CORPORATION8TH WALL (NIANTIC)SKETCHFAB, INC.MAGIC MIRRORHOLITION LTD.OVERLYZAPPAR LTD.FINGENTKUDANINDEOBSESSORIIENT

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS

- TABLE 1 MARKET GROWTH ASSUMPTIONS

- TABLE 2 AR SHOPPING MARKET: RISK ASSESSMENT

- TABLE 3 AR SHOPPING MARKET: VALUE CHAIN ANALYSIS

- TABLE 4 PATENTS FILED FROM JANUARY 2012 TO DECEMBER 2022

- TABLE 5 TOP 20 PATENT OWNERS FROM JANUARY 2012 TO DECEMBER 2022

- TABLE 6 KEY PATENTS RELATED TO AR SHOPPING MARKET

- TABLE 7 AR SHOPPING MARKET: PORTER’S FIVE FORCES ANALYSIS– 2022

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR AR SHOPPING MARKET (%)

- TABLE 9 KEY BUYING CRITERIA IN AR SHOPPING MARKET

- TABLE 10 VUFORIA ENGINE ENHANCED WINE SHOPPING EXPERIENCE BY IMPLEMENTING AR IN VIVINO’S APP

- TABLE 11 ARCORE DEVELOPED CURATE APP TO CATER TO DIVERSE DESIGN TASTES AND NEEDS OF POTENTIAL BUYERS

- TABLE 12 AR APP ENHANCED SHOPPING EXPERIENCE FOR CUSTOMERS WITH COMPREHENSIVE PRODUCT CATALOG

- TABLE 13 VUFORIA ENGINE PROVIDED EFFICIENT AND EFFECTIVE CUSTOMER SUPPORT FOR MERCEDES-BENZ

- TABLE 14 HS CODE: 900490, EXPORT VALUES FOR MAJOR COUNTRIES, 2018–2022 (USD MILLION)

- TABLE 15 HS CODE: 900490, IMPORT VALUES FOR MAJOR COUNTRIES, 2018–2022 (USD MILLION)

- TABLE 16 MFN TARIFFS FOR PRODUCTS UNDER HS CODE: 900490 EXPORTED BY CHINA

- TABLE 17 AR SHOPPING MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 18 AR SHOPPING MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 19 AR SHOPPING MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 20 E-COMMERCE/OUT OF STORE: AR SHOPPING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 21 E-COMMERCE/OUT OF STORE: AR SHOPPING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 22 RETAIL/IN-STORE: AR SHOPPING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 23 RETAIL/IN-STORE: AR SHOPPING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 24 AR SHOPPING MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 25 AR SHOPPING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 26 HARDWARE: AR SHOPPING MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 27 HARDWARE: AR SHOPPING MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 28 SOFTWARE: AR SHOPPING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 29 SOFTWARE: AR SHOPPING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 30 AR SHOPPING MARKET, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 31 AR SHOPPING MARKET, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 32 AR HEAD-MOUNTED DISPLAYS: AR SHOPPING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 33 AR HEAD-MOUNTED DISPLAYS: AR SHOPPING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 34 AR HEAD-MOUNTED DISPLAYS: AR SHOPPING MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 35 AR HEAD-MOUNTED DISPLAYS: AR SHOPPING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 36 AR HEAD-MOUNTED DISPLAYS: AR SHOPPING MARKET, BY TYPE, 2019–2022 (THOUSAND UNITS)

- TABLE 37 AR HEAD-MOUNTED DISPLAYS: AR SHOPPING MARKET, BY TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 38 SMART AR MIRRORS: AR SHOPPING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 39 SMART AR MIRRORS: AR SHOPPING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 40 HANDHELD DEVICES: AR SHOPPING MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 41 HANDHELD DEVICES: AR SHOPPING MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 42 AR SHOPPING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 43 AR SHOPPING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 44 TRY-ON SOLUTIONS: AR SHOPPING MARKET, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 45 TRY-ON SOLUTIONS: AR SHOPPING MARKET, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 46 TRY-ON SOLUTIONS: AR SHOPPING MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 47 TRY-ON SOLUTIONS: AR SHOPPING MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 48 TRY-ON SOLUTIONS: AR SHOPPING MARKET, BY MARKET TYPE, 2019–2022 (USD MILLION)

- TABLE 49 TRY-ON SOLUTIONS: AR SHOPPING MARKET, BY MARKET TYPE, 2023–2028 (USD MILLION)

- TABLE 50 PLANNING AND DESIGNING: AR SHOPPING MARKET, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 51 PLANNING AND DESIGNING: AR SHOPPING MARKET, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 52 PLANNING AND DESIGNING: AR SHOPPING MARKET, BY MARKET TYPE, 2019–2022 (USD MILLION)

- TABLE 53 PLANNING AND DESIGNING: AR SHOPPING MARKET, BY MARKET TYPE, 2023–2028 (USD MILLION)

- TABLE 54 ADVERTISING AND MARKETING: AR SHOPPING MARKET, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 55 ADVERTISING AND MARKETING: AR SHOPPING MARKET, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 56 ADVERTISING AND MARKETING: AR SHOPPING MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 57 ADVERTISING AND MARKETING: AR SHOPPING MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 58 ADVERTISING AND MARKETING: AR SHOPPING MARKET, BY MARKET TYPE, 2019–2022 (USD MILLION)

- TABLE 59 ADVERTISING AND MARKETING: AR SHOPPING MARKET, BY MARKET TYPE, 2023–2028 (USD MILLION)

- TABLE 60 INFORMATION SYSTEMS: AR SHOPPING MARKET, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 61 INFORMATION SYSTEMS: AR SHOPPING MARKET, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 62 INFORMATION SYSTEMS: AR SHOPPING MARKET, BY MARKET TYPE, 2019–2022 (USD MILLION)

- TABLE 63 INFORMATION SYSTEMS: AR SHOPPING MARKET, BY MARKET TYPE, 2023–2028 (USD MILLION)

- TABLE 64 AR SHOPPING MARKET, BY MARKET TYPE, 2019–2022 (USD MILLION)

- TABLE 65 AR SHOPPING MARKET, BY MARKET TYPE, 2023–2028 (USD MILLION)

- TABLE 66 APPAREL: AR SHOPPING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 67 APPAREL: AR SHOPPING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 68 APPAREL: AR SHOPPING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 69 APPAREL: AR SHOPPING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: AR SHOPPING APPAREL MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: AR SHOPPING APPAREL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 72 EUROPE: AR SHOPPING APPAREL MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 73 EUROPE: AR SHOPPING APPAREL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 74 ASIA PACIFIC: AR SHOPPING APPAREL MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 75 ASIA PACIFIC: AR SHOPPING APPAREL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 76 REST OF THE WORLD: AR SHOPPING APPAREL MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 77 REST OF THE WORLD: AR SHOPPING APPAREL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 FURNITURE AND LIGHTING: AR SHOPPING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 79 FURNITURE AND LIGHTING: AR SHOPPING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 80 FURNITURE AND LIGHTING: AR SHOPPING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 81 FURNITURE AND LIGHTING: AR SHOPPING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: AR SHOPPING FURNITURE AND LIGHTING MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: AR SHOPPING FURNITURE AND LIGHTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 84 EUROPE: AR SHOPPING FURNITURE AND LIGHTING MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 85 EUROPE: AR SHOPPING FURNITURE AND LIGHTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 86 ASIA PACIFIC: AR SHOPPING FURNITURE AND LIGHTING MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 87 ASIA PACIFIC: AR SHOPPING FURNITURE AND LIGHTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 88 REST OF THE WORLD: AR SHOPPING FURNITURE AND LIGHTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 89 REST OF THE WORLD: AR SHOPPING FURNITURE AND LIGHTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 JEWELRY: AR SHOPPING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 91 JEWELRY: AR SHOPPING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 92 JEWELRY: AR SHOPPING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 93 JEWELRY: AR SHOPPING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: AR SHOPPING JEWELRY MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 95 NORTH AMERICA: AR SHOPPING JEWELRY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 96 EUROPE: AR SHOPPING JEWELRY MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 97 EUROPE: AR SHOPPING JEWELRY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: AR SHOPPING JEWELRY MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 99 ASIA PACIFIC: AR SHOPPING JEWELRY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 100 REST OF THE WORLD: AR SHOPPING JEWELRY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 101 REST OF THE WORLD: AR SHOPPING JEWELRY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 102 BEAUTY AND COSMETICS: AR SHOPPING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 103 BEAUTY AND COSMETICS: AR SHOPPING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 104 BEAUTY AND COSMETICS: AR SHOPPING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 105 BEAUTY AND COSMETICS: AR SHOPPING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 106 NORTH AMERICA: AR SHOPPING BEAUTY AND COSMETICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 107 NORTH AMERICA: AR SHOPPING BEAUTY AND COSMETICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 108 EUROPE: AR SHOPPING BEAUTY AND COSMETICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 109 EUROPE: AR SHOPPING BEAUTY AND COSMETICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: AR SHOPPING BEAUTY AND COSMETICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: AR SHOPPING BEAUTY AND COSMETICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 112 REST OF THE WORLD: AR SHOPPING BEAUTY AND COSMETICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 113 REST OF THE WORLD: AR SHOPPING BEAUTY AND COSMETICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 114 FOOTWEAR: AR SHOPPING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 115 FOOTWEAR: AR SHOPPING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 116 FOOTWEAR: AR SHOPPING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 117 FOOTWEAR: AR SHOPPING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 118 NORTH AMERICA: AR SHOPPING FOOTWEAR MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 119 NORTH AMERICA: AR SHOPPING FOOTWEAR MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 120 EUROPE: AR SHOPPING FOOTWEAR MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 121 EUROPE: AR SHOPPING FOOTWEAR MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: AR SHOPPING FOOTWEAR MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 123 ASIA PACIFIC: AR SHOPPING FOOTWEAR MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 124 REST OF THE WORLD: AR SHOPPING FOOTWEAR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 125 REST OF THE WORLD: AR SHOPPING FOOTWEAR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 126 GROCERIES: AR SHOPPING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 127 GROCERIES: AR SHOPPING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 128 GROCERIES: AR SHOPPING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 129 GROCERIES: AR SHOPPING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 130 NORTH AMERICA: AR SHOPPING GROCERIES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 131 NORTH AMERICA: AR SHOPPING GROCERIES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 132 EUROPE: AR SHOPPING GROCERIES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 133 EUROPE: AR SHOPPING GROCERIES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: AR SHOPPING GROCERIES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 135 ASIA PACIFIC: AR SHOPPING GROCERIES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 136 REST OF THE WORLD: AR SHOPPING GROCERIES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 137 REST OF THE WORLD: AR SHOPPING GROCERIES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 138 OTHER MARKET TYPES: AR SHOPPING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 139 OTHER MARKET TYPES: AR SHOPPING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 140 OTHER MARKET TYPES: AR SHOPPING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 141 OTHER MARKET TYPES: AR SHOPPING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 142 NORTH AMERICA: AR SHOPPING OTHER MARKET TYPES, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 143 NORTH AMERICA: AR SHOPPING OTHER MARKET TYPES, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 144 EUROPE: AR SHOPPING OTHER MARKET TYPES, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 145 EUROPE: AR SHOPPING OTHER MARKET TYPES, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: AR SHOPPING OTHER MARKET TYPES, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 147 ASIA PACIFIC: AR SHOPPING OTHER MARKET TYPES, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 148 REST OF THE WORLD: AR SHOPPING OTHER MARKET TYPES, BY REGION, 2019–2022 (USD MILLION)

- TABLE 149 REST OF THE WORLD: AR SHOPPING OTHER MARKET TYPES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 150 AR SHOPPING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 151 AR SHOPPING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 152 NORTH AMERICA: AR SHOPPING MARKET, BY MARKET TYPE, 2019–2022 (USD MILLION)

- TABLE 153 NORTH AMERICA: AR SHOPPING MARKET, BY MARKET TYPE, 2023–2028 (USD MILLION)

- TABLE 154 NORTH AMERICA: AR SHOPPING MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 155 NORTH AMERICA: AR SHOPPING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 156 EUROPE: AR SHOPPING MARKET, BY MARKET TYPE, 2019–2022 (USD MILLION)

- TABLE 157 EUROPE: AR SHOPPING MARKET, BY MARKET TYPE, 2023–2028 (USD MILLION)

- TABLE 158 EUROPE: AR SHOPPING MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 159 EUROPE: AR SHOPPING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 160 ASIA PACIFIC: AR SHOPPING MARKET, BY MARKET TYPE, 2019–2022 (USD MILLION)

- TABLE 161 ASIA PACIFIC: AR SHOPPING MARKET, BY MARKET TYPE, 2023–2028 (USD MILLION)

- TABLE 162 ASIA PACIFIC: AR SHOPPING MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 163 ASIA PACIFIC: AR SHOPPING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 164 REST OF THE WORLD: AR SHOPPING MARKET, BY MARKET TYPE, 2019–2022 (USD MILLION)

- TABLE 165 REST OF THE WORLD: AR SHOPPING MARKET, BY MARKET TYPE, 2023–2028 (USD MILLION)

- TABLE 166 REST OF THE WORLD: AR SHOPPING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 167 REST OF THE WORLD: AR SHOPPING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 168 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 169 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS IN AR SHOPPING MARKET, 2022

- TABLE 170 AR SHOPPING MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 171 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES: AR APPLICATIONS

- TABLE 172 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES: OFFERING

- TABLE 173 COMPETITIVE BENCHMARKING OF STARTUPS/SMES: REGION

- TABLE 174 AR SHOPPING MARKET: COMPANY FOOTPRINT

- TABLE 175 AR SHOPPING MARKET: COMPANY APPLICATION FOOTPRINT

- TABLE 176 AR SHOPPING MARKET: COMPANY OFFERING TYPE FOOTPRINT

- TABLE 177 AR SHOPPING MARKET: COMPANY REGION FOOTPRINT

- TABLE 178 AR SHOPPING MARKET: PRODUCT LAUNCHES, 2019–2023

- TABLE 179 AR SHOPPING MARKET: DEALS, 2019–2023

- TABLE 180 AR SHOPPING MARKET: OTHER STRATEGIES, 2019–2023

- TABLE 181 ALPHABET INC. (GOOGLE): COMPANY OVERVIEW

- TABLE 182 ALPHABET INC. (GOOGLE): PRODUCT LAUNCHES

- TABLE 183 ALPHABET INC. (GOOGLE): DEALS

- TABLE 184 APPLE INC.: COMPANY OVERVIEW

- TABLE 185 APPLE INC.: PRODUCT LAUNCHES

- TABLE 186 APPLE INC.: DEALS

- TABLE 187 MICROSOFT: COMPANY OVERVIEW

- TABLE 188 MICROSOFT: PRODUCT LAUNCHES

- TABLE 189 MICROSOFT: DEALS

- TABLE 190 META: COMPANY OVERVIEW

- TABLE 191 META: PRODUCT LAUNCHES

- TABLE 192 PTC: COMPANY OVERVIEW

- TABLE 193 PTC: PRODUCT LAUNCHES

- TABLE 194 PTC: DEALS

- TABLE 195 SEIKO EPSON CORPORATION: COMPANY OVERVIEW

- TABLE 196 SEIKO EPSON CORPORATION: PRODUCT LAUNCHES

- TABLE 197 SEIKO EPSON CORPORATION: DEALS

- TABLE 198 WIKITUDE GMBH: COMPANY OVERVIEW

- TABLE 199 MAGIC LEAP, INC.: COMPANY OVERVIEW

- TABLE 200 MAGIC LEAP, INC.: PRODUCT LAUNCHES

- TABLE 201 MAGIC LEAP, INC.: DEALS

- TABLE 202 3D CLOUD BY MARXENT: COMPANY OVERVIEW

- TABLE 203 3D CLOUD BY MARXENT: PRODUCT LAUNCHES

- TABLE 204 3D CLOUD BY MARXENT: DEALS

- TABLE 205 VUZIX CORPORATION: COMPANY OVERVIEW

- TABLE 206 VUZIX CORPORATION: PRODUCT LAUNCHES

- TABLE 207 VUZIX CORPORATION: DEALS

- TABLE 208 VUZIX CORPORATION: OTHERS

- TABLE 209 BLIPPAR: COMPANY OVERVIEW

- TABLE 210 BLIPPAR: PRODUCT LAUNCHES

- TABLE 211 BLIPPAR: DEALS

- FIGURE 1 AUGMENTED REALITY (AR) SHOPPING MARKET SEGMENTATION

- FIGURE 2 AUGMENTED REALITY (AR) SHOPPING MARKET: RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 AR SHOPPING MARKET: GLOBAL SNAPSHOT

- FIGURE 9 SOFTWARE AND SERVICES SEGMENT TO ACQUIRE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 AR HMDS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF AR SHOPPING MARKET DURING FORECAST PERIOD

- FIGURE 11 FURNITURE AND LIGHTING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 TRY-ON SOLUTIONS SEGMENT TO HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 NORTH AMERICA TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 14 PRESENCE OF ESTABLISHED TECHNOLOGY PLAYERS TO DRIVE MARKET

- FIGURE 15 SOFTWARE AND SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 FURNITURE AND LIGHTING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 17 AR HMDS SEGMENT TO HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 TRY-ON SOLUTIONS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 19 FURNITURE AND LIGHTING HELD LARGEST MARKET SHARE IN NORTH AMERICA (2022)

- FIGURE 20 AR SHOPPING MARKET DYNAMICS

- FIGURE 21 GLOBAL SMARTPHONE SHIPMENTS, 2014–2022 (MILLION UNITS)

- FIGURE 22 IMPACT ANALYSIS OF DRIVERS IN AR SHOPPING MARKET

- FIGURE 23 IMPACT ANALYSIS OF RESTRAINTS IN AR SHOPPING MARKET

- FIGURE 24 IMPACT ANALYSIS OF OPPORTUNITIES IN AR SHOPPING MARKET

- FIGURE 25 IMPACT ANALYSIS OF CHALLENGES IN AR SHOPPING MARKET

- FIGURE 26 AR SHOPPING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 AR SHOPPING MARKET ECOSYSTEM ANALYSIS

- FIGURE 28 AVERAGE SELLING PRICE OF KEY PLAYERS, BY DEVICE TYPE

- FIGURE 29 AVERAGE SELLING PRICE TREND IN AR SHOPPING MARKET

- FIGURE 30 NUMBER OF PATENTS GRANTED FOR AR SHOPPING MARKET

- FIGURE 31 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS (JANUARY 2012–DECEMBER 2022)

- FIGURE 32 AR SHOPPING MARKET: PORTER’S FIVE FORCES ANALYSIS, 2022

- FIGURE 33 IMPACT OF PORTER’S FIVE FORCES ON AR SHOPPING MARKET, 2022

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR AR DEVICES

- FIGURE 35 KEY BUYING CRITERIA FOR DEVICE TYPES IN AR SHOPPING MARKET

- FIGURE 36 HS CODE: 900490, EXPORT VALUES FOR MAJOR COUNTRIES, 2018–2022

- FIGURE 37 HS CODE: 8537, IMPORT VALUES FOR MAJOR COUNTRIES, 2018–2022

- FIGURE 38 REVENUE SHIFT IN AR SHOPPING MARKET

- FIGURE 39 E-COMMERCE/OUT OF STORE TO DOMINATE AR SHOPPING MARKET DURING FORECAST PERIOD

- FIGURE 40 TRY-ON SOLUTIONS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 41 INFORMATION SYSTEMS TO HAVE HIGHEST GROWTH IN AR SHOPPING MARKET

- FIGURE 42 SOFTWARE AND SERVICES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 43 DISPLAYS AND PROJECTORS TO HAVE HIGHEST GROWTH IN HARDWARE SEGMENT DURING FORECAST PERIOD

- FIGURE 44 TRY-ON SOLUTIONS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 45 AR HMDS TO HOLD DOMINANT MARKET POSITION DURING FORECAST PERIOD

- FIGURE 46 INFORMATION SYSTEMS TO HAVE HIGHEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 47 TRY-ON SOLUTIONS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 48 TRY-ON SOLUTIONS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 49 SMART AR MIRRORS TO DOMINATE TRY-ON SOLUTIONS MARKET DURING FORECAST PERIOD

- FIGURE 50 HANDHELD DEVICES TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 51 FURNITURE AND LIGHTING TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 52 TRY-ON SOLUTIONS TO DOMINATE APPAREL MARKET DURING FORECAST PERIOD

- FIGURE 53 PLANNING AND DESIGNING TO DOMINATE FURNITURE AND LIGHTING MARKET DURING FORECAST PERIOD

- FIGURE 54 ADVERTISING AND MARKETING TO GROW AT FASTEST PACE DURING FORECAST PERIOD

- FIGURE 55 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 56 NORTH AMERICA: AR SHOPPING MARKET SNAPSHOT

- FIGURE 57 EUROPE: AR SHOPPING MARKET SNAPSHOT

- FIGURE 58 ASIA PACIFIC: AR SHOPPING MARKET SNAPSHOT

- FIGURE 59 COMPANIES ADOPTED PARTNERSHIP AS KEY GROWTH STRATEGY (2019–2022)

- FIGURE 60 HISTORICAL REVENUE ANALYSIS OF MAJOR COMPANIES IN AR SHOPPING MARKET, 2018–2022 (USD BILLION)

- FIGURE 61 AR SHOPPING MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 62 AR SHOPPING MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 63 ALPHABET INC. (GOOGLE): COMPANY SNAPSHOT

- FIGURE 64 APPLE INC.: COMPANY SNAPSHOT

- FIGURE 65 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 66 META: COMPANY SNAPSHOT

- FIGURE 67 PTC: COMPANY SNAPSHOT

- FIGURE 68 SEIKO EPSON CORPORATION: COMPANY SNAPSHOT

- FIGURE 69 VUZIX CORPORATION: COMPANY SNAPSHOT

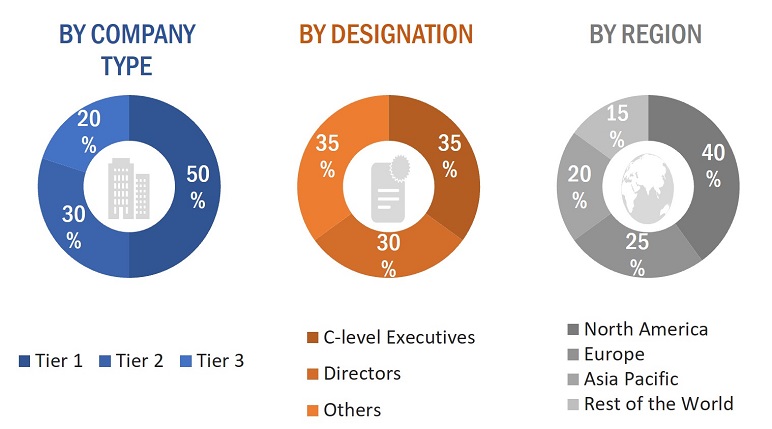

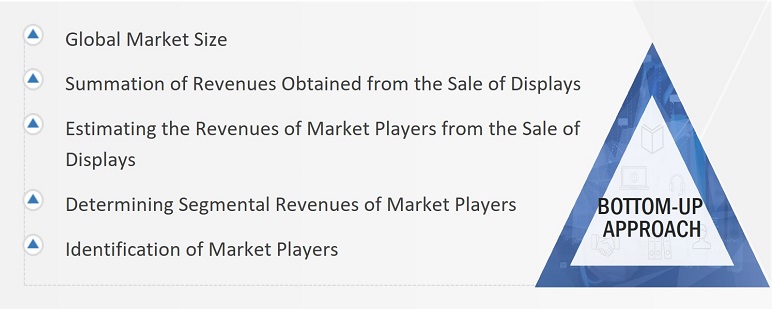

The research study involved 4 major activities in estimating the size of the Augmented Reality (AR) shopping market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In secondary research, various secondary sources have been referred to for obtaining the information that was needed for the study. Various secondary sources that were used for the research include, corporate filings such as annual reports, press releases, investor presentations, and financial statements, trade, business, and professional associations, whitepapers, journals, certified publications, and articles from recognized authors and databases.

In the AR Shopping Market report, the top-down as well as the bottom-up approaches have been used for the estimation of the global market size, along with several other dependent submarkets. The major players in the market were identified with the help of extensive secondary research and their presence in the market was determined using secondary and primary research. All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

Extensive primary research has been conducted after understanding the Augmented Reality (AR) shopping market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 major regions— North America, Europe, Asia Pacific, and the Rest of the World. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches along with data triangulation methods have been used to estimate and validate the size of the Augmented Reality (AR) shopping market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Initially, the focus was on top line investments and spending in the ecosystem. Further the segment level splits and major developments in the market have been considered.

- Identifying different stakeholders in the Augmented Reality (AR) shopping market that influence the entire market, along with participants across the supply chain

- Analyzing major manufacturers and solution provider of AR as well as studying their product portfolios

- Analyzing trends related to the adoption of AR devices

- Tracking the recent and upcoming developments in the market that include investments, R&D activities, product launches, collaborations, mergers & acquisitions, and partnerships, as well as forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to identify the adoption trends of AR in the shopping market

- Segmenting the overall market into various other market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-Up Approach

Data Triangulation

After arriving at the overall market size through the market size estimation process explained in the earlier section, the overall Augmented Reality (AR) shopping market has been divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply side perspectives. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches

Market Definition

AR shopping, also referred to as augmented reality shopping, revolutionizes the shopping experience by merging virtual elements with the physical retail environment. Through the utilization of smartphones or AR glasses, individuals can experiment with clothing, position furniture in their living spaces, and even visualize how a new vehicle would complement their driveway. An appealing aspect of AR shopping is its virtual try-on feature, especially sought-after within the fashion and beauty sectors. Users have the opportunity to virtually try on apparel or experiment with various makeup looks without the need for physical trials. This not only enhances convenience but also diminishes the necessity for product returns or exchanges.

Key Stakeholders

- Raw Material Suppliers

- AR Device Manufacturers

- AR Software Providers

- AR Service Providers

- Retailers

- E-Commerce Service Providers

- Research Organizations

- Industry Associations

- Technology Investors

- Governments

- Financial Institutions

The main objectives of this study are as follows:

- To define, analyze, and forecast the Augmented Reality (AR) shopping market size, by end use, offering, device type, application, market type, and region in terms of value

- To define, analyze, and forecast the Augmented Reality (AR) shopping market size, by device type, in terms of volume

- To forecast the market size for various segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and Rest of the World

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the Augmented Reality (AR) shopping market

- To study the complete value chain and related industry segments for the Augmented Reality (AR) shopping market

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze trends and disruptions; pricing trends; patents and innovations; trade data (export and import data); regulatory environment; Porter’s five forces analysis; case studies; key stakeholders & buying criteria; technology trends; the market ecosystem; and key conferences and events related to the Augmented Reality (AR) shopping market

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments such as product launches/developments, expansions, acquisitions, partnerships, collaborations, agreements, and research and development (R&D) activities carried out by players in the Augmented Reality (AR) shopping market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for North America, Europe, Asia Pacific, and Rest of the World

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Augmented Reality (AR) Shopping Market