Smart Mirror Market by Offering (Hardware (Displays, Sensors, Cameras), Software, Services), Application (Automotive (Interior, Exterior), Hospitality, Retail), Technology, Installation Type, Sales Channel and Region - Global Growth Driver and Industry Forecast to 2027

Smart Mirror Market Size & Growth

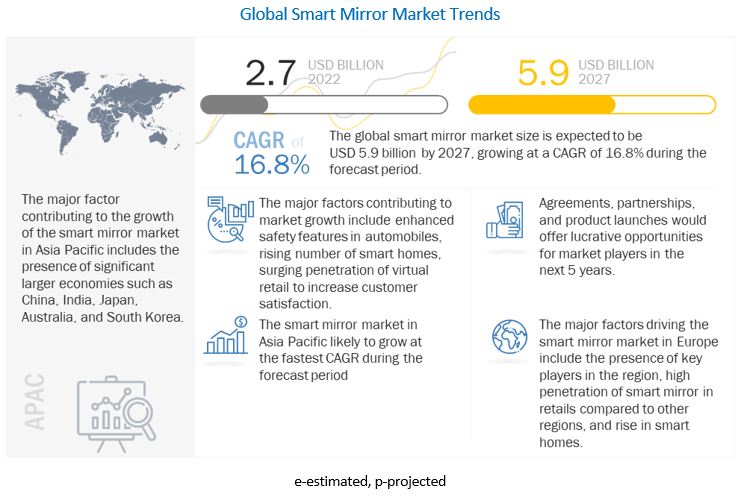

The global smart mirror market size is estimated to be USD 2.7 billion in 2022 and is projected to reach USD 5.9 billion by 2027, growing at a CAGR of 16.8% during the forecast period from 2022 to 2027.

The growing adoption of advanced smart mirrors in various verticals, especially automotive and retail, is driving the growth of market. Some of the other key factors fueling the growth of smart mirror market include rising adoption of smart mirrors as alternative to convex mirrors for enhanced safety features in automobiles, increasing demand of smart homes, presence of large number of startups, and innovative features of electric mirrors.

Impact of AI Smart Mirror Market

The impact of artificial intelligence (AI) on the smart mirror market is reshaping user interaction and personalization across sectors such as retail, healthcare, automotive, and hospitality. AI-powered smart mirrors can analyze facial features, monitor health metrics, offer personalized beauty and fitness recommendations, and even enable virtual try-ons in retail environments. In automobiles, they enhance safety with driver monitoring and real-time alerts. By leveraging AI for real-time data analysis, voice recognition, and augmented reality integration, smart mirrors are becoming multifunctional, intelligent hubs that deliver immersive, adaptive experiences—driving consumer engagement and accelerating market adoption.

To know about the assumptions considered for the study, Request for Free Sample Report

Smart Mirror Market Trends and Dynamics:

Drivers: Alternative to convex mirrors for enhanced safety features in automobiles/h3>

Smart mirrors equipped in automobiles play a key role in ensuring driving comfort and safety. The smart mirrors integrated into high-end vehicles are equipped with electro chromatic auto dimming mirror, which improves visibility in low light and decreases eye strain and tiredness in drivers. These mirrors ensure safety by displaying improved rear-view images, which help the drivers make correct decisions while driving. Additionally, these smart mirrors save time by displaying all the necessary information for drivers on the mirror screen. Smart mirrors can automatically correct camera distortion with added ability to detect and warn of moving objects. The increasing focus on improved road safety is driving the demand for integrated new electronic functionalities, including electric mirrors in automobiles.

Restraints: Security breach of confidential and personal data/h3>

Security breach is one of the major restraining factors due to tracking of personal data of users through smart mirrors. For instance, smart mirrors deployed in retail stores can easily track shoppers buying experiences, and its spending habits in the store. The smart mirrors also have ability to access other critical information of customers such as previous purchase history, frequent interactions with retail stores representatives, and hundreds of other data points with respect to customer behavior and its buying interest. The data gathered by retailers can be used to target appropriate customers for selling items in future by running sales and marketing campaign based on their previous buying interest.

Opportunities: Transition from traditional stores to digital stores in retail industry/h3>

The retail industry is undergoing a transformation with digital retailers merging with physical stores. Companies are embracing new ways of managing businesses and re-engineering their ways of connecting with customers. The retailers are integrating various technologies such as smart carts, smart mirrors, smart shelves, and retail robots. This industry is currently experiencing a rapid transition from traditional retail stores to advanced digital retail stores where technology plays a crucial role in customer engagement and increasing sales for retailers.

Challenges: Lack of awareness about smart mirrors

Smart mirrors are a new concept in the display segment and to the end users. With the increase in the use of these electric mirrors in the automobile and retail industries, the electric mirror companies are likely to witness a surge in popularity in the upcoming years. With the major companies worldwide working on offering more innovative smart mirrors and showcasing their products in a variety of tech events, these products are likely to witness growth in the future. Currently, the adoption of smart mirrors is limited to the high-end segment due to their high cost. For common people, it is still a concept that they might not be ready to invest in. Thus, the lack of awareness among customers and the high cost of electric mirrors poses a major challenge to the smart mirror market growth.

Smart Mirror Market Segment Overview

Smart mirror hardware segment likely to account for largest market share during the forecasting period

The hardware market is projected to account for the largest share during the forecast period as hardware components such as displays, cameras, and sensors, along with connectivity and audio components, form a major share of the cost of the complete smart mirror system. The smart mirror offers a platform for shoppers to try on new clothes, check the sizes or varieties of clothes in a store, and share information related to the tried clothes on social media platforms. Smart rear-view mirrors are being increasingly utilized to enhance safety in cars and reduce complications of camera systems. Smart rear-view mirrors for automotive applications can work normally even in the event of poor weather conditions with minimum obstructions to drivers. Unlike conventional mirrors, electric mirrors utilized in vehicles have the features of auto-adjusting their displays under different light intensities and thus provide better assistance to drivers under all weather conditions.

The smart mirror offers a platform for shoppers to try on new clothes, check the sizes or varieties of clothes in a store, and share information related to the tried clothes on social media platforms. Smart rear-view mirrors are being increasingly utilized to enhance safety in cars and reduce complications of camera systems. Smart rear-view mirrors for automotive applications can work normally even in the event of poor weather conditions with minimum obstructions to drivers. Unlike conventional mirrors, smart mirrors utilized in vehicles have the features of auto-adjusting their displays under different light intensities and thus provide better assistance to drivers under all weather conditions.

Electro-chromatic smart mirrors to dominate the market during the forecast period

Electro-chromatic segment held the largest market share in 2021 and is expected to continue this trend by 2027. Various advantages associated with digital rear-view smart mirrors compared to conventional mirrors are propelling the electro chromatic smart mirror market. Majority of digital rear-view mirrors are deployed as a combination of a camera mounted at the back of the car and the electro chromatic rear-view mirror, working together as a unit. The rear-view electric mirror also acts as a screen in most cars, whereas in others, there is a separate screen that broadcasts the image captured by the camera.

Majority of digital rear-view mirrors are deployed as a combination of a camera mounted at the back of the car and the electro chromatic rear-view mirror, working together as a unit. The rear-view mirror also acts as a screen in most cars, whereas in others, there is a separate screen that broadcasts the image captured by the camera.

Automotive segment likely to dominate the smart mirror market by 2027 due to the increasing deployment of digital rear-view mirrors in vehicles

The automotive segment dominated the market in 2021 and is expected to lead the market through 2027. The dominance of the segment is attributed to the increasing deployment of digital rear-view mirrors in vehicles. The rising number of mirrorless vehicles due to the rising trend in the adoption of smart camera-based display mirrors is propelling the growth of the market. Currently, approximately 30 percent high-end vehicles on roads have inside mirrors with inbuilt electrochromic technology while approximately 10 to 15 percent outside mirrors have inbuilt electrochromic features. The penetration of electrochromic mirrors with the auto-dimming feature is expected to witness significant rise in the years to come. Intelligent interior and exterior auto-dimming smart mirrors provide added value by enhancing the driving experience and increasing safety and driving comfort.

The dominance of the segment is attributed to the increasing deployment of digital rear-view mirrors in vehicles. The rising number of mirrorless vehicles due to the rising trend in the adoption of smart camera-based display mirrors is propelling the growth of the smart mirror market. Currently, approximately 30 percent high-end vehicles on roads have inside mirrors with inbuilt electrochromic technology while approximately 10 to 15 percent outside mirrors have inbuilt electrochromic features. The penetration of electrochromic mirrors with the auto-dimming feature is expected to witness significant rise in the years to come. Intelligent interior and exterior auto-dimming smart mirrors provide added value by enhancing the driving experience and increasing safety and driving comfort.

Smart Mirror Industry Regional Analysis

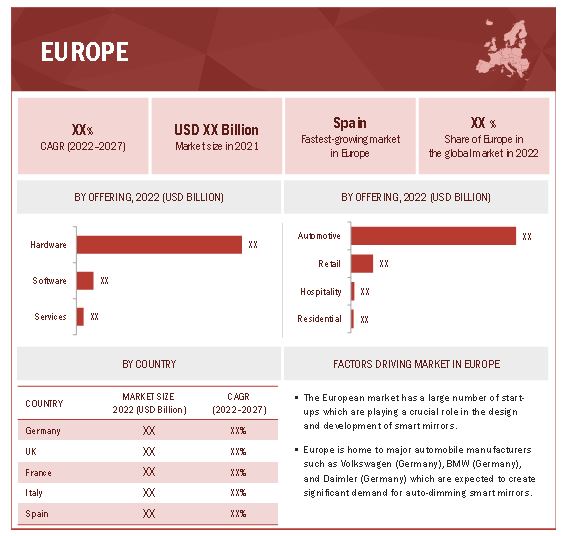

Europe likely to dominate the market during the forecast period due to increasing adoption of smart mirrors in the automotive, retail, and smart homes application

To know about the assumptions considered for the study, download the pdf brochure

Europe is expected to lead the smart mirror market between 2022 and 2027. Some of the major factors propelling market growth in Europe include increasing adoption of Electric Vehicles (EVs) in the region, and emphasis on automation of various end-use industries including automotive and retail. The presence of a significant number of automotive manufacturers leads to the high demand for rear-view electric mirrors in the region. Europe is home to major automobile manufacturers such as Volkswagen (Germany), BMW (Germany), and Daimler (Germany) which are expected to create significant demand for auto-dimming smart mirrors. The region is also known for its stringent safety regulations and advanced technologies. Automotive OEMs in Europe focus on developing new technologies to meet the increasing demand for advanced features and increasingly stringent safety norms.

The region has a considerable number of major retail brands which have started adopting smart mirrors in their stores to attract customers. The smart mirror market in Europe is also witnessing major adoption of smart mirrors in the smart homes segment. The sophisticated and innovative solutions offered by electric mirror companies have resonated well with consumers, contributing to the widespread adoption of smart mirrors in homes and commercial spaces across Europe. Moreover, the region's strong emphasis on sleek design, energy efficiency, and smart home integration aligns seamlessly with the offerings of electric mirrors, further solidifying Europe's dominance in this dynamic market segment.

The presence of a significant number of automotive manufacturers leads to the high demand for rear-view mirrors in the region. Europe is home to major automobile manufacturers such as Volkswagen (Germany), BMW (Germany), and Daimler (Germany) which are expected to create significant demand for auto-dimming smart mirrors. The region is also known for its stringent safety regulations and advanced technologies. Automotive OEMs in Europe focus on developing new technologies to meet the increasing demand for advanced features and increasingly stringent safety norms. The region has a considerable number of major retail brands which have started adopting smart mirrors in their stores to attract customers. The market in Europe is also witnessing major adoption of smart mirrors in the smart homes segment.

Top Smart Mirror Companies - Key Market Players

Smart Mirror Companies include:

-

Gentex Corporation (US),

-

Ficosa (Spain),

-

Seura Solutions (US),

-

Magna International (Canada),

-

Japan Display Inc. ("JDI") (Japan),

Smart Mirror Market Report Scope

|

Report Attributes |

Details |

|

Estimated Market Size |

USD 2.7 Billion in 2022 |

| Revenue Forecast in 2027 | USD 5.9 Billion by 2027 |

| Growth Rate | CAGR of 16.8% |

| Base Year Considered | 2021 |

| Historical Data Available for Years | 2018–2027 |

|

Forecast Period |

2022–2027 |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | Alternative to convex mirrors for enhanced safety features in automobiles |

| Key Market Opportunity | Transition from traditional stores to digital stores in retail industry |

| Largest Growing Region | Europe |

| Largest Market Share Segment | Technology Segment |

| Highest CAGR Segment | HVAC Control Sensors Segment |

| Largest Application Market Share | Automotive Application |

Smart Mirror Market Categorization

This research report categorizes the smart mirror market share, by offering, application, technology, installation type, sales channel, and Region

Based on Offering:

-

Hardware

- Displays

- Cameras

- Sensors

- Others

- Software

- Services

Based on Application:

- Automotive

- Retail

- Residential

- Hospitality

- Healthcare

- Others

Based on Technology :

- Electro Chromatic

- Others

Based on Sales Channel:

- Direct Sales

- Indirect Sales

Based on Installation Type:

- Fixed

- Free Style&

Based on the Region:

- Americas (North America, South America)

- Europe

- Asia Pacific

- RoW (Middle East & Africa)

Recent Developments in Smart Mirror Industry

- In January 2022, Seura Solutions launched vanity mirrors for every category to match every lifestyle. Séura vanity mirrors are tailor-made and expertly crafted for an entirely personalized reflection.

- In September 2021, Gentex Corporation (NASDAQ: GNTX) acquired the Israeli start-up Guardian Optical Technologies, a pioneer in multimodal sensor technology designed to provide a comprehensive suite of driver- and cabin-monitoring solutions for the automotive industry.

- In May 2021, Séura, a US-based designer technology company, released its latest developments in high-tech lighted mirrors for a broad range of applications from residential use to the hospitality industry.

- May 2021, Gentex Corporation (NASDAQ: GNTX) became a supplier to Volkswagen. The former supplies its Bluetooth-enabled automatic-dimming mirror with HomeLink integrated buttons capable of operating a wide range of radio frequency (RF) and cloud-based smart home devices.

- In March 2019, Electric Mirror launched Savvy Smart Mirror for high-end hotels and home customers.

Frequently Asked Questions (FAQs):

Who are the key players in the smart mirror market?

Major companies operating in the smart mirror market are Gentex Corporation (US), Ficosa (Spain), Seura Solutions (US), Magna International (Canada), Japan Display Inc. ("JDI") (Japan), Murakami Kaimeido (Japan), Harman International Industries (US). Product launches and developments, acquisitions, collaborations, contracts, and agreements were among the major strategies adopted by these players to compete in the market.

What are the new opportunities for emerging players in smart mirror value chain?

For existing players, there are several new opportunities in the value chain of smart mirror market. Some of the major opportunities in smart mirror market includes application such as virtual retail stores, smart home application, and hospitality sector.

Which end user of smart mirror market is expected to drive the growth of the market in the next five years?

The automotive segment likely to spur the growth of smart mirror market from 2022 to 2027. The auto-dimming feature is used to automatically reduce the glare imparted on rear-view mirrors by the headlights of other vehicles. This technology helps drivers clearly see the traffic at the rear at night.

Which Region to offer lucrative growth for smart mirror market share in future?

Europe is likely to lead the mirror market during the forecast period. Whereas the Asia Pacific region is expected to witness the highest growth rate between 2022 to 2027.

What are the key drivers of growth in the Smart Mirror market share?

The key drivers of growth in the Smart Mirror market include the increasing demand for innovative and connected devices, the rise in smart home adoption, and the integration of augmented reality (AR) and artificial intelligence (AI) technologies into smart mirrors.

How can businesses and consumers benefit from the growth in the Smart Mirror market share?

Businesses can benefit from this growth by offering innovative products that cater to the evolving needs and preferences of consumers. Smart mirror technology presents opportunities for improved customer engagement, increased sales, and brand differentiation. Consumers can benefit from enhanced convenience, personalized experiences, and improved lifestyle and wellness management through the adoption of smart mirrors.

What challenges does the Smart Mirror market face in its growth?

Challenges in the Smart Mirror market include concerns about data privacy and security, high initial costs, and the need for standardized interfaces and platforms to ensure interoperability among different smart mirror products.

What can we expect in the future of the Smart Mirror market

The future of the Smart Mirror market is likely to include even more advanced AI and AR integration, improved customization options, and broader applications in various industries. As technology continues to evolve, smart mirrors are expected to play a significant role in our daily lives, offering innovative solutions for personal and professional use.

How are Retail and Fashion Smart Mirrors contributing to the market's growth?

Retail and Fashion Smart Mirrors are transforming the shopping experience. They allow customers to virtually try on clothing and accessories, helping retailers increase sales and providing consumers with a more interactive and convenient shopping experience.

Why are Fitness and Healthcare Smart Mirrors witnessing significant growth?

Fitness and Healthcare Smart Mirrors are on the rise as they offer health and fitness tracking capabilities, including workout guidance and vital sign monitoring. They cater to the increasing demand for home-based fitness solutions and health management.

How can this report assist businesses and stakeholders in the Smart Mirror market?

This report can provide valuable insights and data to businesses and stakeholders, helping them make informed decisions about market entry, product development, and investment opportunities within the smart mirror industry.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONAL SCOPE

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 LIMITATIONS

1.7 SUMMARY OF CHANGES

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 1 SMART MIRROR MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Key data from secondary sources

2.1.2.2 List of key secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Key data from primary sources

2.1.3.2 Key industry insights

2.1.3.3 Breakdown of primary interviews

2.1.3.4 List of key primary interview participants

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 3 TOP-DOWN APPROACH

2.3 FACTOR ANALYSIS

2.3.1 SMART MIRROR MARKET: SUPPLY-SIDE ANALYSIS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE)—REVENUE GENERATED BY COMPANIES FROM PRODUCTS OFFERED IN MIRROR MARKET

2.3.2 MARKET: DEMAND-SIDE ANALYSIS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE) FOR MARKET

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.5 RISK ASSESSMENT

TABLE 1 MARKET: RISK ASSESSMENT

2.6 ASSUMPTIONS

TABLE 2 KEY ASSUMPTIONS: MACRO- AND MICRO-ECONOMIC ENVIRONMENT

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 7 SMART MIRROR MARKET: REALISTIC SCENARIO ANALYSIS, 2018–2027 (USD MILLION)

FIGURE 8 HARDWARE SEGMENT TO HOLD LARGEST SHARE OF MARKET

FIGURE 9 AUTOMOTIVE APPLICATION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE

FIGURE 10 FIXED INSTALLATION TO BE LARGER SEGMENT OF MARKET

FIGURE 11 INDIRECT SALES SEGMENT TO HOLD LARGER MARKET SHARE

FIGURE 12 ELECTRO CHROMATIC SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 13 EUROPE ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN SMART MIRROR MARKET

FIGURE 14 INCREASING ADOPTION OF SMART MIRRORS AS A SUBSTITUTE FOR CONVENTIONAL REAR-VIEW MIRRORS TO DRIVE MARKET

4.2 MARKET, BY OFFERING

FIGURE 15 HARDWARE TO BE LARGEST OFFERING SEGMENT OF MARKET

4.3 MARKET, BY INSTALLATION TYPE

FIGURE 16 FIXED INSTALLATION TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

4.4 MARKET, BY SALES CHANNEL

FIGURE 17 INDIRECT SALES TO ACCOUNT FOR LARGER MARKET SHARE

4.5 MARKET, BY TECHNOLOGY

FIGURE 18 ELECTRO CHROMATIC TECHNOLOGY TO BE LEADING SEGMENT

4.6 MARKET, BY APPLICATION

FIGURE 19 AUTOMOTIVE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SMART MIRROR MARKET

5.2.1 DRIVERS

5.2.1.1 Alternative to convex mirrors for enhanced safety features in automobiles

TABLE 3 COMPARISON OF ORDINARY REAR-VIEW MIRROR AND SMART REAR-VIEW MIRROR

5.2.1.2 Smart homes driven by IOT devices

FIGURE 21 SMART HOMES SEGMENT GROWTH, 2018-2021

5.2.1.3 Presence of large number of start-ups

5.2.1.4 Innovative features

FIGURE 22 IMPACT ANALYSIS OF DRIVERS IN MARKET

5.2.2 RESTRAINTS

5.2.2.1 Security breach of confidential and personal data

FIGURE 23 IMPACT ANALYSIS OF RESTRAINTS IN MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Transition from traditional stores to digital stores in retail industry

5.2.3.2 Industry 4.0 to provide growth opportunities

5.2.3.3 Untapped potential in Asia Pacific

FIGURE 24 IMPACT ANALYSIS OF OPPORTUNITIES IN MARKET

5.2.4 CHALLENGES

5.2.4.1 Lack of awareness about smart mirrors

5.2.4.2 Higher cost than ordinary mirrors

FIGURE 25 IMPACT ANALYSIS OF CHALLENGES IN MMARKET

5.3 VALUE CHAIN ANALYSIS

FIGURE 26 MARKET: VALUE CHAIN ANALYSIS

5.4 SMART MIRROR MARKET ECOSYSTEM

FIGURE 27 MARKET ECOSYSTEM

TABLE 4 MARKET: ECOSYSTEM

5.5 TECHNOLOGY ANALYSIS

5.5.1 DLP TECHNOLOGY

5.5.2 SCREEN MIRRORING

5.6 PRICING ANALYSIS: AVERAGE SELLING PRICE TRENDS

FIGURE 28 AVERAGE SELLING PRICE (ASP) OF SMART MIRRORS (IN USD)

TABLE 5 AVERAGE SELLING PRICE QUOTATION OF KEY SUPPLIERS FOR DIFFERENT APPLICATIONS (IN USD)

5.7 PATENT ANALYSIS

FIGURE 29 MARKET: NUMBER OF PATENTS GRANTED (2011–2021)

FIGURE 30 MARKET: REGIONAL ANALYSIS OF PATENTS GRANTED (2011–2021)

TABLE 6 MARKET: LIST OF PATENTS (2018–2020)

FIGURE 31 MARKET: PATENT ANALYSIS (2011–2021)

5.8 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 7 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.9 TARIFF AND REGULATORY LANDSCAPE

5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 CODES AND STANDARDS RELATED TO SMART MIRROR

5.10 CASE STUDY

5.10.1 THE SINCLAIR BECAME FIRST HOTEL IN US TO DEPLOY DIGITAL SIGNAGE AND SMART MIRRORS

5.10.2 BEHANCE PROVIDED PERSONALIZED INTERACTIVE DEVICE TO CUSTOMERS

5.11 TRADE ANALYSIS

TABLE 10 IMPORT DATA FOR GLASS MIRROR, HS CODE: 7009 (USD MILLION)

FIGURE 32 GLASS MIRROR IMPORT VALUE FOR MAJOR COUNTRIES, 2017–2021

TABLE 11 EXPORT DATA FOR GLASS MIRROR, HS CODE: 7009 (USD MILLION)

FIGURE 33 GLASS MIRROR, EXPORT VALUE FOR MAJOR COUNTRIES, 2017–2021

5.12 PORTERS FIVE FORCES ANALYSIS

FIGURE 34 MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 35 IMPACT OF PORTER’S FIVE FORCES ON MARKET

TABLE 12 PORTER’S FIVE FORCES IMPACT ON MARKET

5.12.1 THREAT OF NEW ENTRANTS

5.12.2 THREAT OF SUBSTITUTES

5.12.3 BARGAINING POWER OF SUPPLIERS

5.12.4 BARGAINING POWER OF BUYERS

5.12.5 INTENSITY OF COMPETITIVE RIVALRY

5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 36 REVENUE SHIFT FOR MARKET

5.14 KEY STAKEHOLDERS & BUYING CRITERIA

5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 37 MARKET: BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 13 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

5.14.2 BUYING CRITERIA

FIGURE 38 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 14 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

6 SMART MIRROR MARKET, BY OFFERING (Page No. - 76)

6.1 INTRODUCTION

TABLE 15 MARKET, BY OFFERING, 2018–2021 (USD MILLION)

FIGURE 39 SOFTWARE OFFERING PROJECTED TO GROW AT HIGHEST CAGR

TABLE 16 MARKET, BY OFFERING, 2022–2027 (USD MILLION)

6.2 HARDWARE

TABLE 17 HARDWARE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

FIGURE 40 SENSORS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 18 HARDWARE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 19 HARDWARE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 20 HARDWARE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 21 HARDWARE: SMART MIRROR MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 41 EUROPE TO ACCOUNT FOR LARGEST MARKET SHARE IN HARDWARE SEGMENT

TABLE 22 HARDWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1 DISPLAYS

6.2.1.1 Rising trend of deploying touchscreen interactive displays in retail applications to spur market growth

6.2.2 SENSORS

6.2.2.1 Temperature sensors

6.2.2.1.1 Thermocouples and resistance temperature detectors commonly utilized temperature sensors

6.2.2.2 Light sensors

6.2.2.2.1 Increasing demand for light sensors to assist auto on/off feature of smart mirrors

6.2.2.3 Humidity sensors

6.2.2.3.1 Mainly installed in smart mirrors for home automation and residential applications

6.2.3 CAMERAS

6.2.3.1 Features such as gestures and facial recognition to propel market

6.2.4 OTHER HARDWARE TYPES

6.2.4.1 Audio systems

6.2.4.2 Connectivity components

6.3 SOFTWARE

6.3.1 REFLEKTOS- AMONG MOST POPULAR OPEN-SOURCE OPERATING SYSTEMS FOR BUILDING SMART MIRRORS

TABLE 23 SOFTWARE: SMART MIRROR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 24 SOFTWARE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 25 SOFTWARE: MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 42 EUROPE TO ACCOUNT FOR LARGEST MARKET SHARE IN SOFTWARE SEGMENT

TABLE 26 SOFTWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 SERVICES

6.4.1 MAJOR COMPANIES OFFERING SUPPORT SERVICES FOR SPECIFIC PERIODS WITH FOCUS ON MAINTENANCE SERVICES

TABLE 27 SERVICES: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 28 SERVICES: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 29 SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 30 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 SMART MIRROR MARKET, BY TECHNOLOGY (Page No. - 88)

7.1 INTRODUCTION

TABLE 31 MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

FIGURE 43 ELECTRO CHROMATIC TECHNOLOGY TO DOMINATE GLOBAL MARKET

TABLE 32 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

7.2 ELECTRO CHROMATIC/AUTO DIMMING MIRRORS

7.2.1 SURGING DEMAND FOR EVS AND MIRRORLESS VEHICLES TO DRIVE AUTO DIMMING TECHNOLOGY

TABLE 33 ELECTRO CHROMATIC: MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 44 EUROPE TO BE LARGEST MARKET FOR ELECTRO CHROMATIC SMART MIRROR

TABLE 34 ELECTRO CHROMATIC: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 OTHERS

TABLE 35 OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 45 ASIA PACIFIC TO REGISTER HIGHEST CAGR FOR OTHER SMART MIRROR TECHNOLOGIES

TABLE 36 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 SMART MIRROR MARKET, BY APPLICATION (Page No. - 93)

8.1 INTRODUCTION

TABLE 37 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

FIGURE 46 MARKET FOR RETAIL APPLICATION TO GROW AT HIGHEST CAGR

TABLE 38 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 AUTOMOTIVE

TABLE 39 AUTOMOTIVE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 40 AUTOMOTIVE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 41 AUTOMOTIVE: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 42 AUTOMOTIVE: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 43 AUTOMOTIVE: MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 47 MARKET FOR AUTOMOTIVE APPLICATION IN ASIA PACIFIC TO GROW AT HIGHEST CAGR

TABLE 44 AUTOMOTIVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.2.1 INTERIOR MIRRORS

8.2.1.1 Integration of additional electronic features such as compass, microphones, lighting assist, and driver assist in interior mirrors to drive market

8.2.2 EXTERIOR MIRRORS

8.2.2.1 Increasing focus of major OEMs on integrating additional features in smart exterior mirrors with capabilities of advanced driver assistance systems (ADAS)

8.3 RETAIL

8.3.1 RISE IN ONLINE SHOPPING AND INCREASING VIRTUAL TRIAL ROOMS TO PROPEL MARKET

TABLE 45 RETAIL: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 46 RETAIL: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 47 RETAIL: MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 48 ASIA PACIFIC MARKET TO WITNESS HIGHEST GROWTH IN RETAIL APPLICATION

TABLE 48 RETAIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 RESIDENTIAL

8.4.1 SURGING ADOPTION OF IOT DEVICES FOR HOME AUTOMATION TO PROPEL DEPLOYMENT OF SMART MIRRORS IN RESIDENTIAL APPLICATIONS

TABLE 49 RESIDENTIAL: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 50 RESIDENTIAL: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 51 RESIDENTIAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 52 RESIDENTIAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 HOSPITALITY

8.5.1 HOSPITALITY SECTOR TO FOCUS ON ENHANCING GUEST EXPERIENCE BY DEPLOYING SMART MIRRORS

TABLE 53 HOSPITALITY: SMART MIRROR MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 54 HOSPITALITY: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 55 HOSPITALITY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 HOSPITALITY: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 HEALTHCARE

8.6.1 MEDICAL RESEARCH: MAJOR HEALTHCARE APPLICATION OF SMART MIRRORS

TABLE 57 HEALTHCARE: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 58 HEALTHCARE: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 59 HEALTHCARE: MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 49 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FOR SMART MIRROR HEALTHCARE APPLICATION FROM 2022 TO 2027

TABLE 60 HEALTHCARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.7 OTHERS

TABLE 61 OTHERS: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 62 OTHERS: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 63 OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 SMART MIRROR MARKET, BY INSTALLATION TYPE (Page No. - 108)

9.1 INTRODUCTION

TABLE 65 MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

FIGURE 50 FIXED INSTALLATION TO BE WIDELY ADOPTED DEPLOYMENT FOR SMART MIRROR

TABLE 66 MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

9.2 FIXED

9.2.1 INCREASING DEPLOYMENT OF INTERIOR AND EXTERIOR REAR-VIEW AUTOMATIC DIMMING MIRRORS TO SUPPORT MARKET GROWTH

9.3 FREE STYLE

9.3.1 INCREASING POPULARITY OF SMART HOMES AND HOME AUTOMATION DEVICES IN RESIDENTIAL BUILDINGS TO SPUR MARKET GROWTH

10 SMART MIRROR MARKET, BY SALES CHANNEL (Page No. - 111)

10.1 INTRODUCTION

TABLE 67 MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

FIGURE 51 INDIRECT SALES CHANNEL TO DOMINATE MARKET

TABLE 68 MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

10.2 INDIRECT SALES

10.2.1 TO ACCOUNT FOR MAJORITY OF SMART MIRROR SALES

10.3 DIRECT SALES

10.3.1 TO GROW AT HIGH RATE DRIVEN BY RETAIL, RESIDENTIAL, AND HEALTHCARE SEGMENTS

11 SMART MIRROR MARKET, BY REGION (Page No. - 114)

11.1 INTRODUCTION

FIGURE 52 EUROPE TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 53 MARKET IN SOUTH KOREA TO GROW AT HIGHEST CAGR

TABLE 69 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 70 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 71 MARKET FOR AUTOMOTIVE, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 72 MARKET FOR AUTOMOTIVE, BY REGION, 2022–2027 (THOUSAND UNITS)

11.2 AMERICAS

TABLE 73 AMERICAS: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 74 AMERICAS: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 75 AMERICAS: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 76 AMERICAS: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 77 AMERICAS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 78 AMERICAS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2.1 NORTH AMERICA

FIGURE 54 NORTH AMERICA: MARKET SNAPSHOT

TABLE 79 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.1.1 US

11.2.1.1.1 Market growth attributed to government support for adoption of electric cars

11.2.1.2 Canada

11.2.1.2.1 Self-dimming smart mirrors for hospitality and retail applications to boost market

11.2.1.3 Mexico

11.2.1.3.1 Presence of several automobile manufacturers to propel market

11.2.2 SOUTH AMERICA

FIGURE 55 SOUTH AMERICA: MARKET SNAPSHOT

TABLE 85 SOUTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 86 SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 87 SOUTH AMERICA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 88 SOUTH AMERICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 89 SOUTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 90 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.2.1 Brazil

11.2.2.1.1 Emphasis on providing better shopping experience by retail sector to boost market

11.2.2.2 Argentina

11.2.2.2.1 Economic recovery and technological advancements to boost adoption of smart mirrors

11.2.2.3 Rest of South America

11.3 EUROPE

FIGURE 56 EUROPE: SMART MIRROR MARKET SNAPSHOT

TABLE 91 EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 92 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 93 EUROPE: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 94 EUROPE: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 95 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 96 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.1 UK

11.3.1.1 Increasing investments in retail, hospitality, and smart homes segments to promote market growth

11.3.2 GERMANY

11.3.2.1 Start-ups partnering with retail stores to implement smart mirrors to enhance customer engagement

11.3.3 FRANCE

11.3.3.1 Presence of large retail brands to propel adoption of smart mirrors

11.3.4 ITALY

11.3.4.1 Increasing awareness about smart mirror technology contributing to market growth

11.3.5 SPAIN

11.3.5.1 Increasing adoption of advanced technologies in retail and home automation to boost market

11.3.6 REST OF EUROPE (ROE)

11.4 ASIA PACIFIC

FIGURE 57 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 97 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 100 ASIA PACIFIC: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 To retain dominance in automotive market in Asia Pacific

11.4.2 JAPAN

11.4.2.1 Large automobile manufacturing base and transformation of retail industry to drive market

11.4.3 INDIA

11.4.3.1 Government initiatives such as Make in India to positively impact demand for smart mirrors in automotive, hospitality, retail, and smart homes applications

11.4.4 SOUTH KOREA

11.4.4.1 Rapid technological developments in automotive and electronics industries boosting adoption of smart mirrors

11.4.5 AUSTRALIA

11.4.5.1 Rising demand for smart retail and EVS to propel market

11.4.6 REST OF ASIA PACIFIC

11.5 REST OF THE WORLD

TABLE 103 REST OF THE WORLD: SMART MIRROR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 104 REST OF THE WORLD: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 105 REST OF THE WORLD: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 106 REST OF THE WORLD: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 107 REST OF THE WORLD: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 108 REST OF THE WORLD: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.5.1 MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE (Page No. - 141)

12.1 INTRODUCTION

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 109 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN SMART MIRROR MARKET

12.2.1 PRODUCT PORTFOLIO

12.2.2 REGIONAL FOCUS

12.2.3 MANUFACTURING FOOTPRINT

12.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

12.3 MARKET SHARE ANALYSIS, 2021

TABLE 110 MARKET (AUTOMOTIVE APPLICATION): DEGREE OF COMPETITION

12.4 HISTORICAL REVENUE ANALYSIS (2017–2021)

FIGURE 58 5-YEAR REVENUE ANALYSIS OF KEY PLAYERS IN MARKET

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STARS

12.5.2 PERVASIVE PLAYERS

12.5.3 EMERGING LEADERS

12.5.4 PARTICIPANTS

FIGURE 59 MARKET (GLOBAL): COMPANY EVALUATION QUADRANT

12.6 MARKET: COMPETITIVE BENCHMARKING

TABLE 111 MARKET: DETAILED LIST OF START-UPS/SMES

TABLE 112 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [SMES]

TABLE 113 LIST OF KEY START-UPS IN MARKET

12.7 START-UP/SME EVALUATION QUADRANT

12.7.1 PROGRESSIVE COMPANIES

12.7.2 RESPONSIVE COMPANIES

12.7.3 DYNAMIC COMPANIES

12.7.4 STARTING BLOCKS

FIGURE 60 MARKET (GLOBAL): START-UP/SME EVALUATION QUADRANT, 2021

12.8 COMPANY FOOTPRINT

TABLE 114 COMPANY FOOTPRINT (OVERALL)

TABLE 115 COMPANY OFFERING FOOTPRINT

TABLE 116 COMPANY APPLICATION FOOTPRINT

TABLE 117 COMPANY REGION FOOTPRINT

12.9 COMPETITIVE SITUATION AND TRENDS

12.9.1 PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 118 MARKET: PRODUCT LAUNCHES & DEVELOPMENTS, JANUARY 2018– JANUARY 2022

12.9.2 DEALS

TABLE 119 MARKET: DEALS, JANUARY 2019–MAY 2022

13 COMPANY PROFILES (Page No. - 158)

13.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)*

13.1.1 JAPAN DISPLAY INC.

TABLE 120 JAPAN DISPLAY INC.: COMPANY OVERVIEW

FIGURE 61 JAPAN DISPLAY INC.: COMPANY SNAPSHOT

TABLE 121 JAPAN DISPLAY INC.: PRODUCTS OFFERED

TABLE 122 JAPAN DISPLAY INC.: PRODUCT LAUNCHES

TABLE 123 JAPAN DISPLAY INC.: DEALS

13.1.2 FICOSA INTERNATIONAL S.A.

TABLE 124 FICOSA INTERNATIONAL S.A.: COMPANY OVERVIEW

TABLE 125 FICOSA: PRODUCTS OFFERED

TABLE 126 FICOSA INTERNATIONAL S.A.: PRODUCT LAUNCHES

TABLE 127 FICOSA INTERNATIONAL S.A.: DEALS

13.1.3 GENTEX CORPORATION

TABLE 128 GENTEX CORPORATION: COMPANY OVERVIEW

FIGURE 62 GENTEX CORPORATION: COMPANY SNAPSHOT

TABLE 129 GENTEX CORPORATION: PRODUCTS OFFERED

TABLE 130 GENTEX CORPORATION: PRODUCT LAUNCHES

TABLE 131 GENTEX CORPORATION: DEALS

13.1.4 SEURA SOLUTIONS

TABLE 132 SEURA SOLUTIONS: COMPANY OVERVIEW

TABLE 133 SEURA SOLUTIONS: PRODUCTS OFFERED

TABLE 134 SEURA SOLUTIONS: PRODUCT LAUNCHES

13.1.5 MAGNA INTERNATIONAL

TABLE 135 MAGNA INTERNATIONAL: COMPANY OVERVIEW

FIGURE 63 MAGNA INTERNATIONAL: COMPANY SNAPSHOT

TABLE 136 MAGNA INTERNATIONAL: PRODUCTS OFFERED

TABLE 137 MAGNA INTERNATIONAL: PRODUCT LAUNCHES

TABLE 138 MAGNA INTERNATIONAL: DEALS

13.1.6 ELECTRIC MIRROR

TABLE 139 ELECTRIC MIRROR: COMPANY OVERVIEW

TABLE 140 ELECTRIC MIRROR: PRODUCTS OFFERED

TABLE 141 ELECTRIC MIRROR: PRODUCT LAUNCHES

13.1.7 HARMAN INTERNATIONAL INDUSTRIES (A SAMSUNG SUBSIDIARY)

TABLE 142 HARMAN INTERNATIONAL INDUSTRIES (A SAMSUNG SUBSIDIARY): COMPANY OVERVIEW

TABLE 143 HARMAN INTERNATIONAL INDUSTRIES (A SAMSUNG SUBSIDIARY): PRODUCTS OFFERED

13.1.8 MURAKAMI KAIMEIDO

TABLE 144 MURAKAMI KAIMEIDO: COMPANY OVERVIEW

FIGURE 64 MURAKAMI KAIMEIDO: COMPANY SNAPSHOT

TABLE 145 MURAKAMI KAIMEIDO: PRODUCTS OFFERED

13.1.9 KEONN TECHNOLOGIES

TABLE 146 KEONN TECHNOLOGIES: COMPANY OVERVIEW

TABLE 147 KEONN TECHNOLOGIES: PRODUCTS OFFERED

TABLE 148 KEONN: DEALS

13.1.10 DENSION

TABLE 149 DENSION: COMPANY OVERVIEW

TABLE 150 DENSION: PRODUCTS OFFERED

* Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

13.2 OTHER PLAYERS

13.2.1 ALKE

13.2.2 AD NOTAM

13.2.3 MIRROCOOL

13.2.4 SEYMOURPOWELL

13.2.5 DIRROR

13.2.6 PERSEUS MIRROR

13.2.7 OAKLABS

13.2.8 SMARTSPOT

13.2.9 PRO DISPLAY

13.2.10 GLANCE DISPLAYS

13.2.11 NEXSTGO COMPANY LIMITED

13.2.12 METROCLICK

13.2.13 PINGALA SOFTWARE INDIA PVT. LTD.

13.2.14 EYYES GMBH

13.2.15 HILO SMART MIRROR

14 APPENDIX (Page No. - 194)

14.1 INSIGHTS FROM INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 CUSTOMIZATION OPTIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

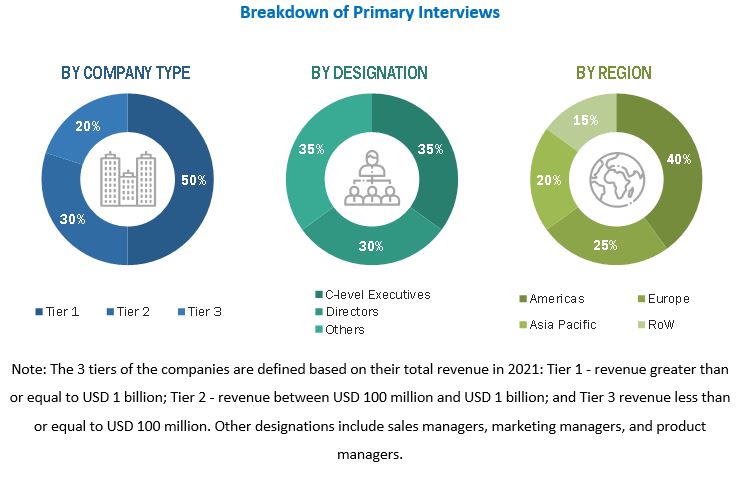

The study involved four major activities for estimating the size of the smart mirror market. Exhaustive secondary research has been carried out to collect information relevant to the market, its peer markets, and its child market. Primary research has been undertaken to validate key findings, assumptions, and sizing with the industry experts across the value chain of the smart mirror market. Both top-down and bottom-up approaches have been employed to estimate the complete market size. It has been followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

The research methodology that has been used to estimate and forecast the size of the smart mirror market began with the acquisition of data related to the revenues of key vendor in the market through secondary research. The secondary research referred to for the market research study involves Consumer Technology Association (CTA), Retail Technology Conclave, Global Retail Alliance, European Automobile Manufacturers Association (ACEA), International Organization of Motor Vehicle Manufacturers, and Federation of International Retail Associations (FIRA). Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the smart mirror market. Vendor offerings have been taken into consideration to determine the market segmentation. The entire research methodology included the study of annual reports, press releases, and investor presentations of companies; white papers; and certified publications and articles by recognized authors; directories; and databases.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the smart mirror market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand and supply-side players across key regions, namely, North America, Europe, APAC, and Middle East and Africa (MEA), and South America. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the smart mirror market has been estimated and validated using both top-down and bottom-up approaches. Furthermore, these methods have also been used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size is as follows:

- Identifying different entities influencing the value chain of the market

- Identifying major companies, system integrators, and service providers operating in the market

- Estimating the size of the smart mirror market for each region based on demand for smart mirrors

- Tracking the ongoing and upcoming smart mirror related development, and project deployment to forecast the market size based on these developments and other critical parameters

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Global Smart Mirror Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the smart mirror market from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the smart mirror market based on offering, application, technology, installation type, and sales channel in terms of value

- To describe and forecast the market for four main regions: the Americas, Asia Pacific, Europe, and Rest of the World (RoW), in terms of value and volume

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the value chain of the smart mirror ecosystem, along with the average selling prices of product types

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contributions to the overall market

- To strategically analyze the ecosystem, Porter’s Five Forces, regulations, patent landscape, trade landscape, and case studies pertaining to the market under study

- To analyze opportunities in the market for the stakeholders by identifying high-growth segments in the market

- To strategically profile the key players and provide a detailed competitive landscape of the market

- To analyze strategic approaches adopted by the leading players in the market, including product launches/developments/collaborations/partnerships/expansions, and mergers & acquisitions

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Mirror Market