Integrated Bridge Systems Market by Sub-System (Integrated Navigation System, Automatic Weather Observation System, Voyage Data Recorder and Automatic Identification Systems), End User (OEM, Aftermarket), Ship Type, Component, Region - Global Forecast to 2027

Updated on : Oct 22, 2024

The Integrated Bridge Systems Market is projected to grow from USD 6.1 Billion in 2022 to USD 7.9 Billion by 2027, growing at a CAGR of 5.4% from 2022 to 2027.

An integrated bridge system (IBS) is a combination of systems that are interconnected in order to allow the centralized access to sensor information or command/control from workstations, with the aim of increasing the safe and efficient management of ships by suitably qualified personnel. Navigation systems are integrated with other components, such as multifunctional consoles, radars, motion sensors, and GPS, to enable the control and maneuvering of the vessels in a certain direction as well as to aid in surveillance. The main advantage of IBS is the seamless integration of various sensors on a common platform. Integrated bridge systems used in commercial and defense ships, along with OEM and aftermarket of the systems for different ships, have been covered in this report.

Integrated Bridge Systems Market to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Integrated bridge systems Market Dynamics:

Driver: Rising preference for maritime tourism

Growth in maritime tourism eventually increases the use of cruise ships, ferries, and other passenger transport vessels. As tourism is an important source of revenue for nations, there are several regulations laid down for this maritime tourism sector.

The marine industry has been witnessing a steady growth in tourism. This industry is the fastest-growing sector in the leisure travel market. Cruise Lines International Association Inc. has projected the number of cruise passengers for FY2019 to be 29.7 million, with more than 50% of the travellers being from the US, followed by China and Germany. However, in 2020 cruise passenger has dropped to 5.8 million due to travel restriction during the COVID-19. Decline is expected to recover by 2023.

Passenger ships are adopting advanced systems for not only navigation and communication purposes but to serve customers and ensure their safety also better. Key market players in integrated bridge systems, for instance, Northrop Grumman and Wärtsilä, supply these advanced systems for recreational applications. Growth in the maritime tourism industry is expected to increase growth opportunities for shipbuilders as well as the manufacturers of integrated bridge systems.

Restraint: Digitalization leading to cyber threats

Digitalization in the maritime industry is growing continuously. The digitalization of ships worldwide results in new cyber threats. The integration of navigational equipment and vessel to shore connectivity can lead to cyber threats due to the use of satellites in a vessel to shore connectivity. To maintain a safe vessel operation, more emphasis should be given on cyber risk management. Cyber incidences like data corruption in an ECDIS and the loss of external sensor data can happen in ships because of navigational satellites. According to the International Chamber of Shipping, bridge systems that are not connected with other networks are equally vulnerable, as removable media are often used to update such systems from other networks. A cyber threat may deny the service and affect the components related to integrated bridge systems like ECDIS, AIS, VDR, and radar. The Maritime Safety Committee (MSC) of the International Maritime Organization has introduced temporary guidelines to prevent cyberattacks on ship systems as online threats and attacks are on the rise.

Opportunity: Precise navigational safety standards & regulations

Countries such as the US, the UK, and India are revising and enforcing regulations pertaining to marine safety as per the International Maritime Organization (IMO) guidelines. Thus, regulations related to safety are becoming homogeneous all over the world. This has enabled the integrated bridge system manufacturers to gain contracts from various companies, thus increasing their presence and ensuring the quality of their product. The IMO is working on finalizing a standard on E–Navigation systems, which connect onshore and offshore operations to bring about greater coordination. As these standards are introduced, small and big players in the integrated bridge systems markets can develop suitable products and market them in an efficient way. Products manufactured in compliance with IMO standards have more credibility in the market.

Challenge: Lack of skilled IBS operators

The construction of new and technologically advanced vessels and port systems (to meet the increasing demand of seaborne trade) and IMO regulating various aspects of maritime transportation (such as safety, security, and environmental protection) will demand a skilled workforce.

Integrated bridge systems are complex in nature with several components, such as radar, ECDIS, and Gyrocompass, working together. In order to successfully operate these systems, the ship crew must be thoroughly trained. The training cost is considerably high as it involves an investment in simulators, which are expensive.

Maritime accidents may also occur due to over-dependence on e–Navigation and lack of proper training of personnel. Meeting the least minimum criteria of training is not enough; robust and rigorous training should be made available for officers to avoid such instances. Therefore, adopting these new technologies is a challenge for shipping companies.

Based on Component, the hardware segment registered largest share in 2022

Based on component, the integrated bridge systems (IBSS) market has been segmented into hardware and software. Hardware components, such as displays, controls, data storage devices, sensors, and alarms, are essential parts of the subsystems, such as INS, AWOS, and AIS, that are integrated with the IBS. The increasing necessity of IBS on each ship type will drive the demand for hardware components over the forecast period.

Based on Subsystem, AWOS is anticipated to grow at the highest CAGR during 2022-2027

Based on sub-system, the integrated bridge systems (IBSS) market has been segmented into INS, Automatic Weather Observation System (AWOS), Voyage Data Recorder (VDR), and Automatic Identification System (AIS). Among these AWOS witness strong growth during the forecast period.

Ships operate in all types of weather conditions, and weather monitoring is an important factor for the safety of ships. An automatic weather observation system (AWOS) usually has a thermometer for temperature measurement, a rain gauge for the measurement of the total rainfall of a particular place, and sensors for the measurement of various parameters, such as atmospheric pressure, wind, and precipitation level. Measurements from different sensors are collected in the data logger in the weather system, which is then processed and analyzed by the software. The AWOS software suite collects data from these sensors in the control unit and provides real-time information about weather conditions to an authorized network of meteorological organizations and ships. AWOS is increasingly used in ships for improved safety, operational efficiency, reduced risks of collision, and grounding.

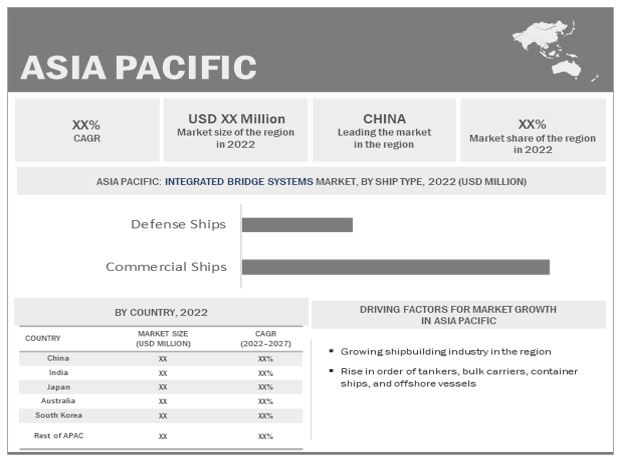

The Asia Pacific region is projected to Grow at highest CAGR during the forecast period

Asia Pacific is anticipated to witness the highest compound annual growth rate during 2022-2027. For the market analysis, Asia Pacific includes China, South Korea, Japan, Philippines, Singapore, and the Rest of Asia Pacific. Among these China registered largest share in IBS’s market in base year.

Labor costs are a significant component of vessel costs, and low cost in China, which is estimated to be between 10th and 15th of the Organization for the Economic Co-operation and Development (OECD) countries. China is the world’s largest exporter of raw material and consumer goods and the world’s largest trading nation. China is also expected to experience the highest growth in fleet ownership among all countries of the world owing to its increasing export, which has led to the growth of the commercial integrated bridge systems industry in China. The presence of key shipbuilding companies, such as the China Shipbuilding Industry, Jiangnan Shipyard, Dalian Shipbuilding Industry, and COMEC, has driven the OEM market for integrated bridge systems in China. Market players in this region are setting up new manufacturing facilities to increase their production capacities and launch new products.

Integrated Bridge Systems Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Integrated Bridge Systems Companies - Key Market Players

The integrated bridge systems companies are dominated by a few globally established players such as Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), Wärtsilä Corporation (Finland), Kongsberg (Norway), and Furuno Electric Co. Ltd. (Japan). These players have adopted various growth strategies such as contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches to further expand their presence in the integrated bridge systems market.

Scope of the Integrated Bridge Systems Market Report

|

Report Metric |

Details |

|

Market size available for years |

2019-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

By Ship Type, By End User, By Sub-System, By Component, and By Region |

|

Geographies covered |

North America, Asia Pacific, Europe, the Middle East, and Rest of the World |

|

Companies covered |

Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), Wärtsilä Corporation (Finland), Kongsberg (Norway), and Furuno Electric Co. Ltd. (Japan) |

|

Companies covered (IBSS start-ups and Integrated bridge systems ecosystem) |

PC Maritime Ltd (UK), Prime Mover Controls Inc. (Canada), HENSOLDT UK (UK), Praxis Automation & Technology B.V. (Netherland), Denelec Marine A/S (Denmark), Naudeq (France) |

This research report categorizes the integrated bridge systems market based on platform, application, component, type, frequency, and region

|

Aspect |

Details |

|

By Ship Type |

|

|

By End User |

|

|

By Sub-system |

|

|

By Component |

|

|

By Region |

|

Recent Developments

- In October 2022, Wärtsilä received a contract from the German’s Federal Ministry of Education and Research to integrate the electrical system package for a new German research vessel

- In September 2022, Raytheon Anschütz, a Raytheon Technologies company introduced its newly developed electronic chart display and information systems. ECDIS NX helps end user to make right decision by providing intuitive workflows and assistance functions support navigators and clearly structured displays and menus.

- In September 2022, Raytheon Anschütz, a Raytheon Technologies company has added the new radar video merge function in research and offshore vessels-based radar NX software application. This new function has been added to meet environmental, operational, and navigational requirement of offshore and research vessel.

- In June 2022, Raytheon Anschütz, a subsidiary of Raytheon Technologies corporation has delivered its advanced Synapsis NX IBS system for new Vox Ariane, an LNG hopper dredger. This new dredger is owned by marine contractor Van Oord. The contract has been completed in partnership with Thales Canada.

Frequently Asked Questions (FAQ):

What is the current size of the integrated bridge systems market?

The integrated bridge systems market is projected to grow from USD 6.1 Billion in 2022 to USD 7.9 Billion by 2027, at a CAGR of 5.4% from 2022 to 2027.

Who are the winners in the integrated bridge systems market?

Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), Wärtsilä Corporation (Finland), Kongsberg (Norway), and Furuno Electric Co. Ltd. (Japan)

What are some of the technological advancements in the market?

The digital marine automation system, which integrates different navigational and ship management functions to enhance the safety of vessels, is expected to be the next advancement in the field of connected ships.

Control Algorithm: Navigation and collision avoidance systems are particularly important in autonomous ships as these systems allow control algorithms to decide the action that needs to be carried out in accordance with the information received from different sensors.

What are the factors driving the growth of the market?

Continuously growing world seaborne trade and rising preference for maritime tourism are some factors that supporting the market growth.

What region holds the largest share of the market in 2021?

Asia Pacific registered the largest share of 38.82% in global integrated bridge systems market in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 INTEGRATED BRIDGE SYSTEMS MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.3.3 REGIONAL SCOPE

1.4 INCLUSIONS AND EXCLUSIONS

TABLE 1 INTEGRATED BRIDGE SYSTEMS MARKET: INCLUSIONS AND EXCLUSIONS

1.5 CURRENCY CONSIDERED

TABLE 2 USD EXCHANGE RATES

1.6 STAKEHOLDERS

1.7 LIMITATIONS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH PROCESS FLOW

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

TABLE 3 KEY PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

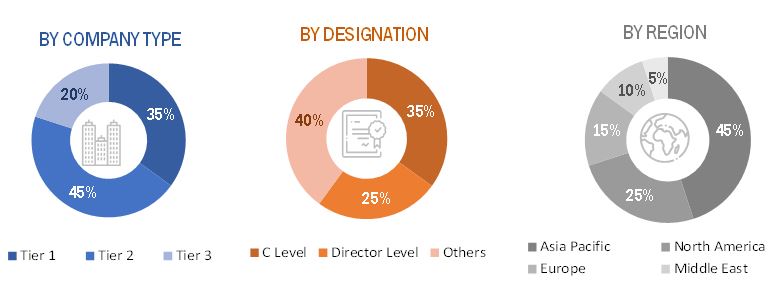

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.3 MARKET DEFINITION AND SCOPE

2.1.3.1 Exclusions

2.1.4 SEGMENT DEFINITIONS

2.1.4.1 Component

2.1.4.2 End user

2.1.4.3 Ship type

2.1.4.4 Subsystem

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.3 SUPPLY-SIDE INDICATORS

2.3 MARKET SIZE ESTIMATION

2.4 RESEARCH APPROACH AND METHODOLOGY

2.4.1 BOTTOM-UP APPROACH

2.4.1.1 OEM market

2.4.1.1.1 OEM market research methodology sample

FIGURE 5 RESEARCH METHODOLOGY SAMPLE

2.4.1.2 Aftermarket

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH BOTTOM-UP

2.4.2 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

2.5.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

FIGURE 8 DATA TRIANGULATION

2.6 GROWTH RATE ASSUMPTIONS

2.7 RESEARCH ASSUMPTIONS

FIGURE 9 ASSUMPTIONS FOR RESEARCH STUDY ON INTEGRATED BRIDGE SYSTEMS MARKET

2.7.1 MARKET SIZING AND MARKET FORECASTING

2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 54)

FIGURE 10 COMMERCIAL SHIP SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE

FIGURE 11 OEM SEGMENT ESTIMATED TO HAVE LARGER MARKET SHARE THAN AFTERMARKET

FIGURE 12 INTEGRATED NAVIGATION SYSTEM (INS) SEGMENT LIKELY TO LEAD MARKET

FIGURE 13 ASIA PACIFIC PROJECTED TO COMMAND MAJOR MARKET SHARE FROM 2022 TO 2027

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN INTEGRATED BRIDGE SYSTEMS MARKET

FIGURE 14 INCREASING SEABORNE TRADE AND MARITIME TOURISM TO DRIVE IBS MARKET FROM 2022 TO 2027

4.2 INTEGRATED BRIDGE SYSTEMS MARKET, BY COMMERCIAL SHIP TYPE

FIGURE 15 COMMERCIAL SHIPS SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.3 INTEGRATED BRIDGE SYSTEMS MARKET, BY OEM END USERS

FIGURE 16 COMMERCIAL OEM SEGMENT LIKELY TO FUEL MARKET DURING FORECAST PERIOD

4.4 INTEGRATED BRIDGE SYSTEMS MARKET, BY INS SUBSYSTEM

FIGURE 17 NAVIGATION RADAR ESTIMATED TO DRIVE MARKET FROM 2022–2027

4.5 INTEGRATED BRIDGE SYSTEMS MARKET, BY HARDWARE COMPONENT

FIGURE 18 DISPLAY HARDWARE SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 61)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 INTEGRATED BRIDGE SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Continuously growing world seaborne trade

FIGURE 20 GLOBAL MARITIME TRADE (2010–2020)

FIGURE 21 WORLD MARITIME TRADE BY REGION (2020)

5.2.1.2 Rising preference for maritime tourism

FIGURE 22 GLOBAL OCEAN CRUISE PASSENGERS (USD MILLION), 2009–2021

5.2.2 RESTRAINTS

5.2.2.1 Digitalization leading to cyber threats

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in port modernization and new port development programs in Asian countries

FIGURE 23 WORLD CONTAINER PORTS THROUGHPUT SHARE, BY REGION, 2020

5.2.3.2 Precise navigational safety standards and regulations

5.2.4 CHALLENGES

5.2.4.1 Lack of skilled IBS operators

5.3 TRENDS IMPACTING CUSTOMER BUSINESS

FIGURE 24 REVENUE SHIFT IN INTEGRATED BRIDGE SYSTEMS MARKET

5.4 INTEGRATED BRIDGE SYSTEMS MARKET ECOSYSTEM

FIGURE 25 MARKET ECOSYSTEM MAP: INTEGRATED BRIDGE SYSTEMS

5.4.1 PROMINENT COMPANIES

5.4.2 PRIVATE AND SMALL ENTERPRISES

5.4.3 END USERS

TABLE 4 INTEGRATED BRIDGE SYSTEMS MARKET ECOSYSTEM

5.5 VALUE CHAIN ANALYSIS

FIGURE 26 VALUE CHAIN ANALYSIS

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 INTEGRATED BRIDGE SYSTEMS MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 INTEGRATED BRIDGE SYSTEM MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 TARIFF AND REGULATORY LANDSCAPE

TABLE 6 NORTH AMERICA: REGULATORY BODIES AND GOVERNMENT AGENCIES

TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND DECENTRALIZED AGENCY

TABLE 8 ASIA PACIFIC: REGULATORY BODIES AND GOVERNMENT AGENCIES

TABLE 9 MIDDLE EAST: REGULATORY BODIES AND GOVERNMENT AGENCIES

TABLE 10 REST OF THE WORLD: REGULATORY BODIES AND GOVERNMENT AGENCIES

5.8 SELLING PRICE ANALYSIS

TABLE 11 AVERAGE SELLING PRICE BY VESSEL TYPE: INTEGRATED BRIDGE SYSTEMS

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING INTEGRATED BRIDGE SYSTEMS, BY SHIP TYPE

TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING INTEGRATED BRIDGE SYSTEMS, BY SHIP TYPE (%)

5.9.2 BUYING CRITERIA

FIGURE 29 KEY BUYING CRITERIA FOR INTEGRATED BRIDGE SYSTEMS, BY SHIP TYPE

TABLE 13 KEY BUYING CRITERIA FOR INTEGRATED BRIDGE SYSTEMS, BY SHIP TYPE

5.10 OPERATIONAL DATA

TABLE 14 NEW COMMERCIAL SHIP DELIVERIES, BY SHIP TYPE, 2017–2020

6 INDUSTRY TRENDS (Page No. - 79)

6.1 INTRODUCTION

6.1.1 EVOLUTION: INTEGRATED BRIDGE SYSTEMS

FIGURE 30 TECHNOLOGY ROADMAP FROM 2013 TO 2030

6.1.2 E-LORAN

6.1.3 CASCADE ADAPTIVE BRIDGE SYSTEM

6.1.4 MOBILE NAVIGATION APPS

6.1.5 HICASS

6.1.6 BRIDGE ALERT MANAGEMENT

6.1.7 ALPHABRIDGE

6.1.8 E-NAVIGATION

6.1.9 WARTSILA CONTROL SYSTEMS

6.1.10 3D PRINTING

6.1.11 MARITIME CONNECT

6.1.12 ROBOTICS

6.1.13 3D SONAR

6.1.14 ROLLS-ROYCE UNMANNED SHIPS

6.1.15 WIRELESS MONITORING

6.1.16 5G CONNECTIVITY

6.2 TECHNOLOGY TRENDS

FIGURE 31 TECHNOLOGICAL ADVANCEMENT TRENDING IN INTEGRATED BRIDGE SYSTEMS MARKET

6.2.1 DIGITAL MARINE AUTOMATION SYSTEMS

6.2.2 SENSOR FUSION SOLUTIONS

6.2.2.1 Control algorithms

6.2.2.2 Conning systems

6.2.2.3 Connectivity solutions

6.2.3 MULTIFUNCTIONAL WORKSTATIONS

6.2.4 INTEGRATED CLOSED-CIRCUIT TELEVISION SYSTEMS

6.2.5 INTEGRATED ONBOARD TRAINING SYSTEMS

6.2.6 INTEGRATED FIREFIGHTING CONTROL SYSTEMS

6.3 IMPACT OF MEGATRENDS

6.3.1 ARTIFICIAL INTELLIGENCE

6.3.2 BIG DATA ANALYTICS

6.3.3 INTERNET OF THINGS

6.4 USE CASE ANALYSIS: INTEGRATED BRIDGE SYSTEMS MARKET

6.4.1 ROYAL VAN OORD SELECTS RAYTHEON ANSCHÜTZ’S INTEGRATED BRIDGE SYSTEM FOR ITS NEW DREDGER

6.4.2 INSTALLATION OF IBS FOR FIVE ICE-BREAKING LNG-FUELED TANKERS

6.5 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 15 INNOVATIONS AND PATENT REGISTRATIONS (2019–2020)

6.6 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 16 INTEGRATED BRIDGE SYSTEMS MARKET: KEY CONFERENCES AND EVENTS, 2022–2023

7 INTEGRATED BRIDGE SYSTEMS MARKET, BY SHIP TYPE (Page No. - 86)

7.1 INTRODUCTION

FIGURE 32 COMMERCIAL SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 17 INTEGRATED BRIDGE SYSTEM MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 18 INTEGRATED BRIDGE SYSTEM MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

7.2 COMMERCIAL

7.2.1 GROWING MARITIME TRADE TO DRIVE DEMAND FOR CARGO VESSELS

TABLE 19 COMMERCIAL SHIPS: INTEGRATED BRIDGE SYSTEM MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 20 COMMERCIAL SHIPS: INTEGRATED BRIDGE SYSTEMS MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.2.2 BULK CARRIERS

7.2.3 GAS TANKERS

7.2.4 TANKERS

7.2.5 CRUISE SHIPS

7.2.6 OFFSHORE SUPPLY & PASSENGER FERRIES

7.2.7 DRY CARGO SHIPS

7.2.8 FISHING VESSELS

7.2.9 RESEARCH VESSELS

7.2.10 DREDGERS

7.3 DEFENSE

7.3.1 INCREASE IN DEMAND FOR SMALL WARSHIPS TO ENHANCE NAVAL FORCE STRENGTH

TABLE 21 DEFENSE SHIPS: INTEGRATED BRIDGE SYSTEMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 22 DEFENSE SHIPS: INTEGRATED BRIDGE SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.3.2 AIRCRAFT CARRIERS

7.3.3 AMPHIBIOUS SHIPS

7.3.4 DESTROYERS

7.3.5 FRIGATES

7.3.6 CORVETTES

7.3.7 SUBMARINES

7.3.8 MINESWEEPERS

7.3.9 OFFSHORE PATROL VESSELS

7.3.10 MISSILE-CARRYING BOATS & SUPPLY BOATS

8 INTEGRATED BRIDGE SYSTEMS MARKET, BY END USER (Page No. - 94)

8.1 INTRODUCTION

FIGURE 33 OEM SEGMENT PROJECTED TO DOMINATE DURING FORECAST PERIOD

TABLE 23 INTEGRATED BRIDGE SYSTEMS MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 24 INTEGRATED BRIDGE SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

8.2 OEM

8.2.1 INCREASE IN DEMAND FOR SHIPS EQUIPPED WITH ADVANCED INTEGRATED BRIDGE SYSTEMS

TABLE 25 OEM: INTEGRATED BRIDGE SYSTEMS MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 26 OEM: INTEGRATED BRIDGE SYSTEM MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

8.2.1.1 Commercial ships

8.2.1.2 Defense ships

8.3 AFTERMARKET

8.3.1 MAINTENANCE OF IBS COMPONENTS TO DRIVE GROWTH OF AFTERMARKET

TABLE 27 INTEGRATED BRIDGE SYSTEMS AFTERMARKET, BY SERVICE TYPE, 2019–2021 (USD MILLION)

TABLE 28 INTEGRATED BRIDGE SYSTEMS AFTERMARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

8.3.2 PARTS

8.3.3 MAINTENANCE

9 INTEGRATED BRIDGE SYSTEMS MARKET, BY SUBSYSTEM (Page No. - 98)

9.1 INTRODUCTION

FIGURE 34 AUTOMATIC WEATHER OBSERVATION SYSTEM SEGMENT PROJECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 29 INTEGRATED BRIDGE SYSTEMS MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 30 INTEGRATED BRIDGE SYSTEM MARKET, BY SUBSYSTEM 2022–2027 (USD MILLION)

9.2 INTEGRATED NAVIGATION SYSTEM

9.2.1 INCREASING FOCUS ON DEPLOYMENT OF ADVANCED SENSE AND AVOID SYSTEMS TO INCREASE DEMAND FOR INS

TABLE 31 INTEGRATED NAVIGATION SYSTEMS MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 32 INTEGRATED BRIDGE SYSTEMS MARKET, BY COMPONENT 2022–2027 (USD MILLION)

9.2.1.1 Navigation radar

9.2.1.2 ARPA radar

9.2.1.3 Gyro

9.2.1.4 Echo sounder

9.2.1.5 Electromagnetic log

9.2.1.6 Electronic chart display and information system

9.2.1.7 Differential global positioning system

9.2.1.8 Bridge communication console

9.2.1.9 Autopilot

9.2.1.10 Transmitting magnetic compass

9.2.1.11 Bridge navigation watch and alarm system

9.3 AUTOMATIC WEATHER OBSERVATION SYSTEM

9.3.1 INSTALLED WITH IBS TO ENHANCE METEOROLOGICAL OBSERVATIONS IN OCEANS

9.4 VOYAGE DATA RECORDER

9.4.1 HELPS IMPROVE SAFETY OF SHIPS DURING OPERATIONS

9.5 AUTOMATIC IDENTIFICATION SYSTEM

9.5.1 RISING DEMAND FOR AIS IN COMMERCIAL AND PASSENGER SHIPS

10 INTEGRATED BRIDGE SYSTEMS MARKET, BY COMPONENT (Page No. - 104)

10.1 INTRODUCTION

FIGURE 35 HARDWARE SEGMENT TO LEAD INTEGRATED BRIDGE SYSTEMS MARKET FROM 2022 TO 2027

TABLE 33 INTEGRATED BRIDGE SYSTEM MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 34 INTEGRATED BRIDGE SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

10.2 HARDWARE

10.2.1 INCREASING DEMAND FOR IBS HARDWARE COMPONENTS OVER FORECAST PERIOD

TABLE 35 HARDWARE: INTEGRATED BRIDGE SYSTEM MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 36 INTEGRATED BRIDGE SYSTEMS MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.2.1.1 Displays

10.2.1.2 Control units

10.2.1.3 Data storage devices

10.2.1.4 Sensors

10.2.1.5 Alarms

10.2.1.6 Others

10.3 SOFTWARE

10.3.1 RISE IN DEMAND FOR SOFTWARE APPLICATIONS FROM SHIPBUILDERS

TABLE 37 TOP FIVE INTEGRATED BRIDGE SYSTEM SOFTWARE PROVIDERS

10.3.1.1 Synapsis NX

10.3.1.2 K-Bridge Sensor Integrator (SINT)

10.3.1.3 VisionMaster FT

10.3.1.4 NAPA Logbook

10.3.1.5 Navi-Planner 4000

11 REGIONAL ANALYSIS (Page No. - 110)

11.1 INTRODUCTION

FIGURE 36 ASIA PACIFIC PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 38 INTEGRATED BRIDGE SYSTEMS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 39 INTEGRATED BRIDGE SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 37 NORTH AMERICA: INTEGRATED BRIDGE SYSTEMS MARKET SNAPSHOT

TABLE 40 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.2.2 US

11.2.2.1 Increasing naval defense budget to fuel demand for IBS

TABLE 48 US: INTEGRATED BRIDGE SYSTEMS MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 49 US: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 50 US: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 51 US: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 52 US: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 53 US: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.2.3 CANADA

11.2.3.1 Increasing trade activities to drive demand for IBS

TABLE 54 CANADA: INTEGRATED BRIDGE SYSTEM MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 55 CANADA: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 56 CANADA: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 57 CANADA: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 58 CANADA: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 59 CANADA: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.2.4 MEXICO

11.2.4.1 Rising export and economic development to increase IBS demand

TABLE 60 MEXICO: INTEGRATED BRIDGE SYSTEM MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 61 MEXICO: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 62 MEXICO: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 63 MEXICO: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 64 MEXICO: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 65 MEXICO: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.3 EUROPE

11.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 38 EUROPE: INTEGRATED BRIDGE SYSTEMS MARKET SNAPSHOT

TABLE 66 EUROPE: INTEGRATED BRIDGE SYSTEM MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 67 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 68 EUROPE: MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 69 EUROPE: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 70 EUROPE: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 71 EUROPE: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 72 EUROPE: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 73 EUROPE: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.3.2 GREECE

11.3.2.1 Large merchant ship fleet to propel IBS demand

TABLE 74 GREECE: INTEGRATED BRIDGE SYSTEMS MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 75 GREECE: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 76 GREECE: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 77 GREECE: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 78 GREECE: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 79 GREECE: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.3.3 GERMANY

11.3.3.1 Government reforms to strengthen technology adoption

TABLE 80 GERMANY: INTEGRATED BRIDGE SYSTEM MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 81 GERMANY: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 82 GERMANY: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 83 GERMANY: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 84 GERMANY: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 85 GERMANY: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.3.4 NORWAY

11.3.4.1 Programs such as green maritime transport to drive adoption of IBS

TABLE 86 NORWAY: INTEGRATED BRIDGE SYSTEM MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 87 NORWAY: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 88 NORWAY: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 89 NORWAY: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 90 NORWAY: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 91 NORWAY: INTEGRATED BRIDGE SYSTEMS MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.3.5 UK

11.3.5.1 Defense shipbuilding industry to boost IBS requirement

TABLE 92 UK: INTEGRATED BRIDGE SYSTEM MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 93 UK: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 94 UK: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 95 UK: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 96 UK: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 97 UK: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.3.6 NETHERLANDS

11.3.6.1 Maritime-related operations on coastal and inland waterways to fuel IBS demand

TABLE 98 NETHERLANDS: INTEGRATED BRIDGE SYSTEMS MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 99 NETHERLANDS: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 100 NETHERLANDS: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 101 NETHERLANDS: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 102 NETHERLANDS: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 103 NETHERLANDS: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.3.7 DENMARK

11.3.7.1 Digitalized parts and new technologies in shipping industry to drive IBS market

TABLE 104 DENMARK: INTEGRATED BRIDGE SYSTEMS MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 105 DENMARK: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 106 DENMARK: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 107 DENMARK: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 108 DENMARK: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 109 DENMARK: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.3.8 ITALY

11.3.8.1 Growing cruise and fishing industries to boost IBS market

TABLE 110 ITALY: INTEGRATED BRIDGE SYSTEM MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 111 ITALY: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 112 ITALY: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 113 ITALY: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 114 ITALY: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 115 ITALY: INTEGRATED BRIDGE SYSTEMS MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.3.9 REST OF EUROPE

TABLE 116 REST OF EUROPE: MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 117 REST OF EUROPE: INTEGRATED BRIDGE SYSTEM MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 118 REST OF EUROPE: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 119 REST OF EUROPE: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 120 REST OF EUROPE: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 121 REST OF EUROPE: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 39 ASIA PACIFIC: INTEGRATED BRIDGE SYSTEMS MARKET SNAPSHOT

TABLE 122 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.4.2 CHINA

11.4.2.1 Increasing cruise, fishing activities, and rising demand for merchant ships to fuel IBS market

TABLE 130 CHINA: INTEGRATED BRIDGE SYSTEM MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 131 CHINA: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 132 CHINA: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 133 CHINA: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 134 CHINA: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 135 CHINA: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.4.3 SOUTH KOREA

11.4.3.1 Increasing shipbuilding activities to boost IBS demand

TABLE 136 SOUTH KOREA: INTEGRATED BRIDGE SYSTEMS MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 137 SOUTH KOREA: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 138 SOUTH KOREA: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 139 SOUTH KOREA: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 140 SOUTH KOREA: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 141 SOUTH KOREA: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.4.4 JAPAN

11.4.4.1 Increasing global trade and shipbuilding to drive IBS market

TABLE 142 JAPAN: INTEGRATED BRIDGE SYSTEMS MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 143 JAPAN: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 144 JAPAN: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 145 JAPAN: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 146 JAPAN: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 147 JAPAN: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.4.5 PHILIPPINES

11.4.5.1 Steady development of economy to drive demand for shipbuilding activities

TABLE 148 PHILIPPINES: INTEGRATED BRIDGE SYSTEMS MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 149 PHILIPPINES: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 150 PHILIPPINES: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 151 PHILIPPINES: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 152 PHILIPPINES: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 153 PHILIPPINES: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.4.6 SINGAPORE

11.4.6.1 Increasing global sea trade to boost demand for IBS

TABLE 154 SINGAPORE: INTEGRATED BRIDGE SYSTEM MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 155 SINGAPORE: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 156 SINGAPORE: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 157 SINGAPORE: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 158 SINGAPORE: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 159 SINGAPORE: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.4.7 REST OF ASIA PACIFIC

TABLE 160 REST OF ASIA PACIFIC: INTEGRATED BRIDGE SYSTEMS MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 161 REST OF ASIA PACIFIC: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 162 REST OF ASIA PACIFIC: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 163 REST OF ASIA PACIFIC: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 164 REST OF ASIA PACIFIC: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 165 REST OF ASIA PACIFIC: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.5 MIDDLE EAST

11.5.1 PESTLE ANALYSIS: MIDDLE EAST

TABLE 166 MIDDLE EAST: INTEGRATED BRIDGE SYSTEMS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 167 MIDDLE EAST: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 168 MIDDLE EAST: MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 169 MIDDLE EAST: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 170 MIDDLE EAST: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 171 MIDDLE EAST: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 172 MIDDLE EAST: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 173 MIDDLE EAST: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.5.2 TURKEY

11.5.2.1 Increasing export and growing number of shipyards to boost IBS demand

TABLE 174 TURKEY: INTEGRATED BRIDGE SYSTEM MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 175 TURKEY: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 176 TURKEY: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 177 TURKEY: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 178 TURKEY: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 179 TURKEY: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.5.3 ISRAEL

11.5.3.1 Increasing deliveries of ships in defense and commercial sectors to boost IBS market

TABLE 180 ISRAEL: INTEGRATED BRIDGE SYSTEM MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 181 ISRAEL: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 182 ISRAEL: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 183 ISRAEL: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 184 ISRAEL: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 185 ISRAEL: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.5.4 REST OF MIDDLE EAST

TABLE 186 REST OF MIDDLE EAST: INTEGRATED BRIDGE SYSTEM MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 187 REST OF MIDDLE EAST: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 188 REST OF MIDDLE EAST: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 189 REST OF MIDDLE EAST: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 190 REST OF MIDDLE EAST: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.6 REST OF THE WORLD

11.6.1 PESTLE ANALYSIS: REST OF THE WORLD

TABLE 192 REST OF THE WORLD: INTEGRATED BRIDGE SYSTEM MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 193 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 194 REST OF THE WORLD: MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 195 REST OF THE WORLD: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 196 REST OF THE WORLD: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 197 REST OF THE WORLD: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 198 REST OF THE WORLD: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 199 REST OF THE WORLD: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.6.2 LATIN AMERICA

11.6.2.1 Increasing oil & gas production and growing global trade to boost IBS market

TABLE 200 LATIN AMERICA: INTEGRATED BRIDGE SYSTEMS MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

11.6.3 AFRICA

11.6.3.1 Growing economy and increasing trade activities to fuel IBS demand

TABLE 206 AFRICA: INTEGRATED BRIDGE SYSTEM MARKET, BY SHIP TYPE, 2019–2021 (USD MILLION)

TABLE 207 AFRICA: MARKET, BY SHIP TYPE, 2022–2027 (USD MILLION)

TABLE 208 AFRICA: MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 209 AFRICA: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 210 AFRICA: MARKET, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 211 AFRICA: MARKET, BY SUBSYSTEM, 2022–2027 (USD MILLION)

This research study on the integrated bridge systems (IBSS) market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. The primary sources considered included industry experts as well as service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the integrated bridge systems market as well as assess its growth prospects.

Secondary Research

The secondary sources referred for this research study on the integrated bridge systems market included financial statements of companies offering IBSs, INS and associated components, automatic weather observation system (AWOS), voyage data recorder (VDR), and automatic identification system (AIS) along with various trade, business, and professional associations, among others. The secondary data was collected and analyzed to arrive at the overall size of the integrated bridge systems market, which was validated by primary respondents.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included industry experts such as chief X officers (CXOs), vice presidents (VPs), directors, regional managers, and business development and product development teams, distributors, and vendors.

Extensive primary research was conducted to obtain qualitative and quantitative information such as market statistics, average selling price, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to platform, application, type, and regions. Stakeholders from the demand side include armed forces, telecommunication companies, space companies, and ship-building companies who are willing to adopt integrated bridge systems to enhance communication speed, quality, and security. These interviews were conducted to gather insights such as market statistics, data of revenue collected from the hardware systems and software solutions, market breakdowns, market size estimations, market size forecasting, and data triangulation. These interviews also helped analyze the solution adoption by ship type, end user,, sub-system, and component, segments of the market for six key regions.

To know about the assumptions considered for the study, download the pdf brochure

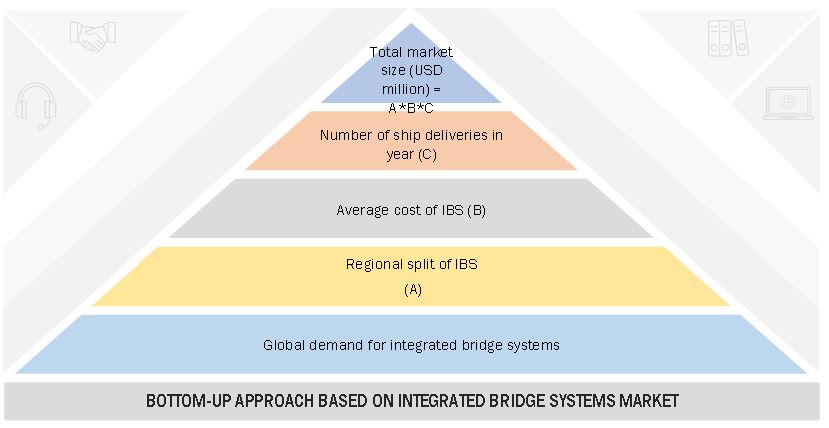

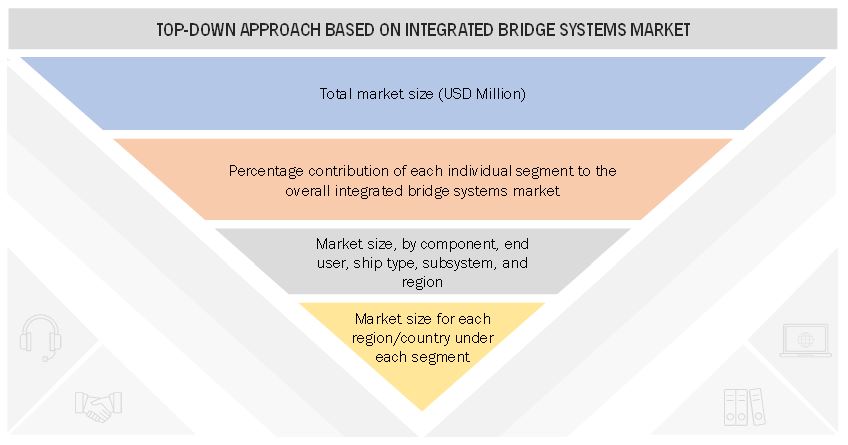

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the integrated bridge system market. The figure in the section below is a representation of the overall market size estimation process employed for the purpose of this study. The research methodology used to estimate the market size also includes the following details.

- Key players in the industry and markets were identified through secondary research, and their market share was determined through primary and secondary research. This included an extensive study of annual and financial reports of top market players and interviews of CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up approach

Market size estimation methodology: Top- Down approach

Data Triangulation

After arriving at the overall size of the integrated bridge systems market from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments, data triangulation and market breakdown procedures explained below were implemented, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the integrated bridge systems market based on ship type, end user, sub-system, component, and region

- To forecast sizes of various segments of the integrated bridge systems market with respect to 5 major regions, namely, North America, Europe, Asia Pacific, the Middle East, and Rest of the World, along with major countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the integrated bridge systems market across the globe

- To identify industry trends, market trends, and technology trends that are currently prevailing in the integrated bridge systems market

- To analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies2

- To analyze the degree of competition in the market by identifying key growth strategies, such as acquisitions, new product launches, new software launches, contracts, and partnerships, adopted by leading market players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the integrated bridge systems market, along with a ranking analysis, market share analysis, and revenue analysis of key players

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Integrated Bridge Systems Market