Automatic Identification and Data Capture Market by Product (Barcodes, Smart Cards, OCR Systems, RFID Products, and Biometric Systems), Offering (Hardware, Software, and Services), Vertical, and Geography - Global Forecast to 2025-2033

Automatic Identification and Data Capture Market Forecast 2025 to 2033

The Automatic Identification and Data Capture Market is projected to experience strong growth from 2025 to 2033 as industries across the world increasingly adopt automation and digital transformation technologies. Automatic identification and data capture commonly referred to as AIDC refers to the technologies and systems that automatically identify objects collect data about them and enter that data directly into computer systems without human involvement. The growing need for accurate real time data collection and the expansion of e commerce logistics and manufacturing automation have been major factors driving the adoption of AIDC technologies. These systems help reduce errors enhance productivity improve operational efficiency and enable seamless tracking and management of goods across the supply chain.

The market encompasses various technologies including barcodes smart cards optical character recognition systems radio frequency identification products and biometric systems. These solutions are used across a wide range of industries such as retail healthcare logistics transportation manufacturing banking and government services. With the rising emphasis on digitalization the demand for AIDC systems has surged globally as organizations seek to enhance data accuracy traceability and workflow efficiency.

Market Segmentation by Product

The AIDC Market is divided into several key product categories including barcodes, smart cards, optical character recognition systems, radio frequency identification products, and biometric systems.

Barcodes are among the most widely used automatic identification technologies. They have been a cornerstone of retail and logistics operations for decades due to their simplicity low cost and reliability. Two dimensional barcodes such as QR codes have gained popularity as they can store more data and be easily read using smartphones and scanners. The increasing need for inventory management and product tracking across retail and warehouse operations continues to drive demand for barcode technology.

Smart cards are another key segment of the AIDC Market. These cards store information on embedded chips and are used for secure authentication and data exchange. They are extensively adopted in sectors such as banking transportation and healthcare. The increasing use of contactless payment systems and access control systems has further boosted the demand for smart cards. The growing shift toward secure and convenient payment and identity solutions continues to enhance market growth in this segment.

Optical character recognition systems are used to convert printed or handwritten text into digital form. OCR technology is widely used in banking postal services and document management. It helps reduce manual data entry errors and accelerates information processing. The rising adoption of digital documentation and automation in administrative workflows has contributed to the growing importance of OCR technology.

Radio frequency identification products are gaining traction due to their ability to provide real time tracking and data capture without direct line of sight. RFID tags and readers are increasingly used in supply chain management asset tracking and retail inventory control. The ability to read multiple tags simultaneously and from a distance gives RFID a distinct advantage over traditional barcoding systems. The integration of RFID technology with Internet of Things platforms has opened new opportunities for intelligent and connected tracking systems across industries.

Biometric systems represent one of the fastest growing segments within the AIDC Market. These systems identify individuals based on unique physiological or behavioral characteristics such as fingerprints facial recognition iris scans and voice recognition. The growing use of biometric authentication in government security financial services and consumer electronics has significantly contributed to the growth of this segment. Increasing concerns about data security and identity fraud have also accelerated the adoption of biometric systems worldwide.

Market Segmentation by Offering

The AIDC Market is categorized by offering into hardware, software, and services.

Hardware forms the foundation of the market and includes barcode scanners RFID readers biometric sensors smart card readers and OCR devices. Continuous advancements in sensor design wireless connectivity and miniaturization have improved device performance and cost efficiency. Hardware remains the largest segment owing to widespread deployment across industries for real time data collection and monitoring.

Software plays a critical role in managing and analyzing the data collected by AIDC hardware. It enables seamless integration with enterprise resource planning and warehouse management systems while offering data analytics capabilities. With the growing trend toward cloud-based platforms and artificial intelligence-driven analytics software solutions are increasingly being adopted to enhance visibility traceability and operational efficiency.

Services include system integration support maintenance and consulting. As AIDC solutions become more sophisticated and interconnected the demand for professional services to ensure seamless implementation and operation is rising. Managed services that offer continuous monitoring and optimization of AIDC systems are also gaining popularity particularly among large enterprises with complex logistics networks.

Market Segmentation by Vertical

The AIDC Market caters to multiple verticals including retail healthcare manufacturing transportation logistics banking and government.

Retail is one of the largest verticals for AIDC solutions driven by the growing need for efficient inventory management checkout automation and customer data analysis. Barcodes and RFID systems enable retailers to track inventory in real time reduce stockouts and improve supply chain visibility. The rise of omnichannel retailing has also boosted the use of AIDC for seamless integration of online and offline operations.

Healthcare is another key sector that relies heavily on automatic identification technologies to ensure patient safety and data accuracy. Barcodes and RFID tags are used for patient identification medication tracking and equipment management while biometric systems are being adopted for secure access control. The growing focus on digital health records and automated hospital management systems continues to support market growth in the healthcare sector.

Manufacturing is experiencing a rapid transformation with the advent of smart factories and industrial automation. AIDC technologies play a crucial role in asset tracking production monitoring and quality control. The integration of RFID and barcode systems within industrial Internet of Things frameworks enables real time visibility of manufacturing processes. This not only improves operational efficiency but also enhances traceability and compliance with industry standards.

Transportation and logistics form another major application area for AIDC technologies. RFID and barcode systems are widely used for cargo tracking fleet management and warehouse operations. The ability to automate data capture and ensure real time visibility across supply chains has made AIDC essential for logistics optimization. The continuous expansion of e commerce and global trade has further accelerated the deployment of AIDC systems in this vertical.

Banking and financial services have seen rapid adoption of AIDC technologies particularly smart cards and biometric systems. Contactless payment cards have become the global standard for secure transactions while biometric authentication enhances security for online banking and ATM access. Financial institutions are investing heavily in digital identity verification systems to combat fraud and comply with regulatory standards.

Government and public sector applications of AIDC technologies include national ID programs border control systems and public transportation ticketing. Governments around the world are implementing biometric identification systems to enhance security and streamline administrative processes. The use of smart cards for identity verification and access management continues to expand as countries modernize their public services.

Regional Insights

North America is expected to maintain a significant share of the global AIDC Market due to early adoption of digital and automation technologies. The United States and Canada are home to leading technology developers and early adopters in sectors such as retail logistics and healthcare. The growing implementation of RFID and biometric systems in both commercial and government sectors further strengthens the regional market.

Europe remains a key market driven by strong industrial infrastructure and data security regulations. The presence of advanced manufacturing industries and widespread use of smart cards and biometric systems contribute to market growth. European countries are also adopting AIDC technologies to support Industry 4.0 initiatives and digital identity programs.

Asia Pacific is projected to witness the highest growth rate during the forecast period. Rapid industrialization expansion of e commerce and increasing adoption of automation in manufacturing are driving market demand. Countries such as China Japan India and South Korea are heavily investing in RFID and biometric technologies to improve efficiency and security. The growing number of retail outlets logistics centers and digital payment platforms across the region also contributes to the strong growth outlook.

Regions such as Latin America the Middle East and Africa are gradually adopting AIDC technologies as part of their digital transformation efforts. The expansion of retail banking and government identity projects is creating new opportunities for market players in these regions.

Market Drivers

Several factors are driving the growth of the global AIDC Market. The increasing need for real time data accuracy and process automation across industries is a major driver. The expansion of e commerce and the demand for efficient logistics and supply chain management have accelerated the adoption of RFID and barcode systems. Rising concerns over data security and identity fraud have also fueled demand for biometric authentication and smart card systems. Furthermore advancements in cloud computing and artificial intelligence are enhancing the capabilities of AIDC software enabling smarter decision making and predictive analytics.

The growing focus on cost reduction and operational efficiency is another major factor supporting market growth. Organizations across all sectors are adopting AIDC technologies to reduce human errors streamline workflows and enhance transparency. Government regulations mandating traceability in industries such as pharmaceuticals and food have also boosted adoption rates.

Market Challenges

Despite strong growth potential the AIDC Market faces certain challenges. High implementation costs for advanced systems such as RFID and biometrics can limit adoption among small and medium sized enterprises. Data privacy concerns particularly related to biometric information remain a key issue in some regions. Interoperability between different systems and technologies can also pose challenges during integration. However ongoing technological advancements and increasing standardization efforts are expected to overcome these obstacles in the coming years.

Competitive Landscape

The global AIDC Market is highly competitive with several established players focusing on innovation product development and strategic partnerships. Companies are investing in next generation AIDC technologies that combine hardware sensors with cloud-based analytics platforms. Many firms are also expanding their presence in emerging markets through mergers and acquisitions and collaborations with regional distributors. The focus on developing compact energy efficient and cost effective solutions is further shaping the competitive landscape.

Future Outlook

The future of the Automatic Identification and Data Capture Market looks promising as industries continue to evolve toward connected intelligent and automated operations. The integration of AIDC systems with Internet of Things artificial intelligence and blockchain technologies will open new avenues for real time visibility and secure data sharing. The adoption of mobile scanning and cloud-based identification platforms will further enhance flexibility and scalability for businesses of all sizes.

The continued rise of digital commerce and smart manufacturing will ensure steady demand for AIDC technologies in the years ahead. As businesses and governments strive for greater transparency efficiency and security the role of automatic identification and data capture systems will become even more vital in shaping the future of global data-driven ecosystems.

Automatic Identification and Data Capture Market Key Players

Honeywell (US), Datalogic S.p.A. (Italy), Zebra Technologies (US), SICK AG (Germany), Cognex Corporation (US), Toshiba (Japan), Panasonic Corporation (Japan), Thales (France), and NXP Semiconductors N.V. (Netherlands) are a few major companies in the AIDC market. Organic growth strategies, such as product launches and developments, is a focus of many of the companies mentioned above.

Prominent players have adopted product launches and developments, followed by mergers and acquisitions, expansions, contracts, partnerships, agreements, and collaborations as the key business strategy to expand their share in the AIDC market. For instance, in December 2019, Cognex (US) its In-Sight Explorer software featuring support for the OPC Unified Architecture standard. As the premier data-exchange protocol for Industry 4.0, OPC UA enables streamlined communication and information sharing between In-Sight vision products and other industrial automation assets in smart factories.

Automatic Identification and Data Capture Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2020 |

USD 40.1 Billion in 2020 |

| Revenue Forecast in 2025 | USD 80.3 Billion by 2025 |

| Growth Rate | CAGR of 14.9% |

| Base Year Considered | 2019 |

| Historical Data Available for Years | 2016–2025 |

|

Forecast Period |

2020–2025 |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | Growing e-commerce industry globally |

| Key Market Opportunity | Imposing governments regulations for adoption of AIDC solutions |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Hardware Component |

| Highest CAGR Segment | Manufacturing |

This report categorizes the AIDC market based on product, offerings, vertical, and region.

By Product

- Smart cards

- RFID systems

- Barcoding solutions

- Biometric systems

- Magnetic stripe cards

- Optical character recognition (OCR) systems

- Voice-directed WMS

- Heads-up displays

- Wearables

- VR solutions

- Google Glass

By Offerings

- Hardware

- Software

- Services

By Vertical:

- Manufacturing

- Retail

- Transportation & Logistics

- Hospitality

- Banking & Finance

- Healthcare

- Government

- Commercial

- Energy & power

By Geography

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Italy

- Rest of Europe (Russia, Netherlands, Italy, Spain, Denmark, Austria, Slovenia, Sweden, Finland, Norway, Romania, Bulgaria, Switzerland, and Poland)

-

Asia Pacific (APAC)

- China

- Japan

- Taiwan

- Rest of APAC (Australia, India, Singapore, Malaysia, and Thailand)

-

Rest of the World (RoW)

- Middle East & Africa

- South America

Major market developments in Automatic Identification and Data Capture Industry

- In November 2019, Panasonic (Japan) launched an application programming interface (API) for facial recognition technology to be used in Japan. The API enables deep learning-powered facial recognition technology through a cloud-based service. The API allows facial recognition technology to be incorporated into customers’ smartphone applications, websites, and access management systems at buildings.

- In January 2019, SICK AG (Germany) acquired SICK SpA, its joint venture with E.i. Schädler y Cía Ltda, its product distributors in Chile, enabling SICK AG to strengthen its position in South America.

- In January 2019, Zebra Technologies (US) delivered its WT6000 wearable computer and RS4000 ring scanner to Mobis Parts Australia (MPAU), an Australian wholesale distributor of motor vehicle supplies, accessories, tools, and equipment. With Zebra’s offerings, MPAU aims to streamline its warehouse operations with a reduction in errors when compared to voice-only solutions.

Frequently Asked Questions (FAQ):

Which are the major industries of AIDC? How huge is the opportunity for their growth in the next five years?

The major verticals of AIDC include manufacturing, retail, banking & finance, and government. These are expected to open new revenue pockets for the AIDC market, which will lead to market opportunity of USD 80.3 billion.

Which are the major companies in the AIDC market? What are their major strategies to strengthen their market presence?

Honeywell (US), Datalogic (Italy), Zebra Technologies (US), SICK AG (Germany), and Cognex (US) are dominant players in the global AIDC market. Product launches is one of the key strategies adopted by these players. Apart from product launches and developments, these players extend their focus on partnerships, contracts, expansions, and acquisitions.

Which region is expected to witness significant demand for AIDC market in the coming years?

APAC is the highest growing region for this market. China, Japan, and Taiwan are the major contributors to the growth of the automatic identification and data capture market in APAC. Many retail and logistics companies are expanding their presence in the region to capitalize on the increased purchasing power of the middle-class people, which has led to the growth of the automatic identification and data capture market in the region.

Which are the major product types for AIDC? How huge is the opportunity for their growth in the next five years?

Smart card technology can be used in health cards, public transit cards, ATM cards, credit cards, fuel cards, security tokens, etc. Smart cards have been further segmented into contact and contactless smart cards.

What are the drivers and opportunities for the AIDC market?

The growing e-commerce industry across the world, the increasing use of smartphones for QR code scanning and image recognition, the rising adoption of AIDC solutions due to their ability to minimize queuing and transaction time and provide greater convenience to users in making small-value payments, and the surging implementation of AIDC solutions by banking and financial institutions to ensure customer safety and security, along with data privacy are the key factors driving the growth of the automatic identification and data capture market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 1 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.1.1 Key industry insights

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Breakdown of primaries

2.1.3.3 Primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for bottom-up analysis (Demand side)

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 4 PRIMARY & SECONDARY SOURCES: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 5 ASSUMPTIONS FOR RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 6 GLOBAL AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET, 2016–2025 (USD BILLION)

FIGURE 7 MANUFACTURING VERTICAL ACCOUNTED FOR LARGEST SHARE OF AUTOMATIC DATA CAPTURE MARKET IN 2019

FIGURE 8 HARDWARE OFFERINGS ACCOUNTED FOR LARGEST MARKET SHARE IN 2019

FIGURE 9 SMART CARDS HELD LARGEST SHARE OF AUTOMATIC DATA CAPTURE MARKET, BY PRODUCT, IN 2019

FIGURE 10 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET, BY REGION, 2019

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES IN AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET

FIGURE 11 GROWING E-COMMERCE INDUSTRY GLOBALLY DRIVES GROWTH OF AUTOMATIC DATA CAPTURE MARKET

4.2 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN APAC, BY COUNTRY AND VERTICAL

FIGURE 12 CHINA AND MANUFACTURING VERTICAL ACCOUNTED FOR LARGEST SHARE OF MARKET IN APAC, BY COUNTRY AND VERTICAL, RESPECTIVELY, IN 2019

4.3 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET, BY PRODUCT

FIGURE 13 SMART CARDS TO ACCOUNT FOR LARGEST MARKET SIZE IN 2025

4.4 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET, BY OFFERING

FIGURE 14 SERVICES EXPECTED TO EXHIBIT HIGHEST CAGR DURING 2020–2025

4.5 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET, BY VERTICAL

FIGURE 15 RETAIL VERTICAL TO CAPTURE LARGEST MARKET SHARE IN 2025

4.6 GLOBAL AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET, BY COUNTRY

FIGURE 16 US ACCOUNTED FOR LARGEST SHARE OF GLOBAL MARKET IN 2019

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 IMPACT OF DRIVERS AND OPPORTUNITIES ON GROWTH OF AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET

FIGURE 18 IMPACT OF CHALLENGES AND RESTRAINTS ON GROWTH OF AUTOMATIC DATA CAPTURE MARKET

5.2.1 DRIVERS

5.2.1.1 Growing e-commerce industry globally

FIGURE 19 E-COMMERCE SALES PERCENTAGE OF TOTAL RETAIL SALES FROM SECOND QUARTER OF 2019 TO FIRST QUARTER OF 2020

TABLE 1 TOP 10 COUNTRIES IN TERMS OF E-COMMERCE CONTRIBUTION TO GDP IN 2017

5.2.1.2 Increasing use of smartphones for QR code scanning and image recognition

FIGURE 20 GLOBAL MOBILE SUBSCRIPTIONS BETWEEN 2014 AND 2018 (BILLION)

5.2.1.3 Rising adoption of AIDC solutions due to their ability to minimize queuing and transaction time and provide greater convenience to users in making small-value payments

5.2.1.4 Surging adoption of AIDC solutions by banking and financial institutions to ensure customer safety and security, along with data privacy

5.2.2 RESTRAINTS

5.2.2.1 High installation cost of AIDC solutions

5.2.3 OPPORTUNITIES

5.2.3.1 Growing focus of enterprises to implement new and improved supply chain management tools, along with rising requirement for AIDC products from global healthcare centers

5.2.3.2 Imposing governments regulations for adoption of AIDC solutions

5.2.4 CHALLENGES

5.2.4.1 Malware attacks and security breaches

6 INDUSTRY TRENDS (Page No. - 66)

6.1 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING, ASSEMBLY, AND SYSTEM INTEGRATION PHASE

6.2 AIDC ECOSYSTEM

FIGURE 22 MAP OF AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET

6.3 KEY USE CASES

6.3.1 MCELROY MANUFACTURING HAS SELECTED GETAC’S ZX70 RUGGED TABLET FOR MEASURING ACCURACY AND EFFICIENCY IN PIPELINE FUSIONS

6.3.2 EUROSTAR HAS INITIATED BIOMETRIC-ENABLED BOARDING FOR UK PASSENGERS

6.3.3 SILK CONTRACT LOGISTICS HAS IMPLEMENTED ZEBRA TECHNOLOGIES’ VOICE-DIRECTED WAREHOUSING SOLUTION

6.4 AVERAGE SELLING PRICE

TABLE 2 AVERAGE SELLING PRICE OF SMART CARDS AND MAGNETIC CARDS, 2019

6.5 IMPACT OF COVID-19 ON AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET

7 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET, BY PRODUCT (Page No. - 71)

7.1 INTRODUCTION

FIGURE 23 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR VR SOLUTIONS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 3 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET, BY PRODUCT, 2016–2019 (USD BILLION)

TABLE 4 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET, BY PRODUCT, 2020–2025 (USD BILLION)

7.2 BARCODING SOLUTIONS

FIGURE 24 APAC TO CONTINUE TO COMMAND AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR BARCODING SOLUTIONS DURING FORECAST PERIOD

TABLE 5 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR BARCODING SOLUTIONS, BY REGION, 2016–2019 (USD BILLION)

TABLE 6 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR BARCODING SOLUTIONS, BY REGION, 2020–2025 (USD BILLION)

TABLE 7 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR BARCODING SOLUTIONS, BY TYPE, 2016–2019 (USD BILLION)

TABLE 8 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR BARCODING SOLUTIONS, BY TYPE, 2020–2025 (USD BILLION)

7.2.1 BARCODE SCANNERS

7.2.1.1 Barcode scanners help interpret single-dimensional and two-dimensional barcodes or QR codes

7.2.2 BARCODE PRINTERS

7.2.2.1 Barcode printers are used for printing barcode labels or tags that can be applied over packets, cartons, and objects

7.2.3 LASER SCANNERS

TABLE 9 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR LASER SCANNERS, BY RANGE, 2016–2019 (USD BILLION)

TABLE 10 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR LASER SCANNERS, BY RANGE, 2020–2025 (USD BILLION)

7.2.3.1 Short-range laser scanners

7.2.3.1.1 Short-range laser scanners are known for their high accuracy

7.2.3.2 Long-range laser scanners

7.2.3.2.1 Long-range laser scanners are useful in scanning large structures such as buildings, bridges, tunnels, and marine ships

TABLE 11 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR LONG-RANGE LASER SCANNERS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 12 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR LONG-RANGE LASER SCANNERS, BY TYPE, 2020–2025 (USD MILLION)

7.2.3.2.2 CMM based

7.2.3.2.2.1 CMM-based laser scanners offer high accuracy

7.2.3.2.3 Arm based

7.2.3.2.3.1 Arm-based laser scanners are portable and offer good accuracy for parts ranging from small to medium sizes

7.2.3.2.4 Single point

7.2.3.2.4.1 Single-point laser scanners are used to measure height, thickness, and surface roughness

7.2.3.2.5 Handheld terminal

7.2.3.2.5.1 Handheld terminal long-range laser scanners are used for capturing large objects

7.2.4 RUGGED TABLETS

TABLE 13 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR RUGGED TABLETS, BY TYPE, 2016–2019 (USD BILLION)

TABLE 14 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR RUGGED TABLETS, BY TYPE, 2020–2025 (USD BILLION)

7.2.4.1 HANDHELD

7.2.4.1.1 Handheld rugged tablets are ideal for outdoor applications due to their ability to withstand harsh weather conditions

7.2.4.2 VEHICLE MOUNTED

7.2.4.2.1 Advantages of vehicle-mounted rugged tablets include increased workforce productivity and ease of operation

7.3 SMART CARDS

FIGURE 25 APAC TO RECORD HIGHEST CAGR IN AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR SMART CARDS DURING FORECAST PERIOD

TABLE 15 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR SMART CARDS, BY REGION, 2016–2019 (USD BILLION)

TABLE 16 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR SMART CARDS, BY REGION, 2020–2025 (USD BILLION)

TABLE 17 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR SMART CARDS, BY TYPE, 2016–2019 (USD BILLION)

TABLE 18 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR SMART CARDS, BY TYPE, 2020–2025 (USD BILLION)

7.3.1 CONTACT-BASED SMART CARDS

7.3.1.1 Single-function smart cards are most cost-effective, while multiple-function smart cards are supported by added memory

7.3.2 CONTACTLESS SMART CARDS

7.3.2.1 Contactless smart cards are increasingly used in retail stores for faster payments

7.4 MAGNETIC STRIPE CARDS

7.4.1 CREDIT CARDS AND DEBIT CARDS ARE KEY EXAMPLES OF MAGNETIC STRIPE CARDS

TABLE 19 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR MAGNETIC CARDS, BY REGION, 2016–2019 (USD BILLION)

TABLE 20 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR MAGNETIC CARDS, BY REGION, 2020–2025 (USD BILLION)

TABLE 21 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR SMART CARDS AND MAGNETIC CARDS, 2016–2019 (BILLION UNITS)

TABLE 22 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR SMART CARDS AND MAGNETIC CARDS, 2020–2025 (BILLION UNITS)

7.5 OPTICAL CHARACTER RECOGNITION (OCR) SYSTEMS

7.5.1 OPTICAL CHARACTER RECOGNITION (OCR) TECHNOLOGY IS USED FOR VERIFICATION OF DOCUMENTS

TABLE 23 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR OCR SYSTEMS, BY REGION, 2016–2019 (USD BILLION)

TABLE 24 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR OCR SYSTEMS, BY REGION, 2020–2025 (USD BILLION)

7.6 RFID SYSTEMS

FIGURE 26 APAC TO CONTINUE TO LEAD AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR RFID SYSTEMS DURING FORECAST PERIOD

TABLE 25 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR RFID SYSTEMS, BY REGION, 2016–2019 (USD BILLION)

TABLE 26 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR RFID SYSTEMS, BY REGION, 2020–2025 (USD BILLION)

TABLE 27 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR RFID SYSTEMS, BY TYPE, 2016–2019 (USD BILLION)

TABLE 28 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR RFID SYSTEMS, BY TYPE, 2020–2025 (USD BILLION)

7.6.1 RFID SCANNERS

7.6.1.1 RFID readers do not require to be in line-of-sight with RFID tags and can read up to 300 feet

7.6.2 RFID TAGS

7.6.2.1 RFID tags are used in retail, logistics and supply chain, animal tracking, and access and security applications

7.6.3 RFID PRINTERS

7.6.3.1 RFID printers are used for printing RFID labels, alphanumeric characters, and barcodes

7.7 WEARABLES

7.7.1 INDUSTRIAL WEARABLES ARE DEVELOPED TO IMPROVE WORKPLACE PRODUCTIVITY, SAFETY, AND EFFICIENCY ACROSS INDUSTRIES

TABLE 29 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR WEARABLES, BY REGION, 2016–2019 (USD MILLION)

TABLE 30 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR WEARABLES, BY REGION, 2020–2025 (USD MILLION)

7.8 VR SOLUTIONS

7.8.1 MARKET FOR VR SOLUTIONS TO GROW AT HIGHEST CAGR DURING 2020–2025

TABLE 31 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR VR SOLUTIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 32 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR VR SOLUTIONS, BY REGION, 2020–2025 (USD MILLION)

7.9 BIOMETRIC SYSTEMS

FIGURE 27 APAC TO CONTINUE TO DOMINATE AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR BIOMETRIC SYSTEMS DURING FORECAST PERIOD

TABLE 33 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR BIOMETRIC SYSTEMS, BY REGION, 2016–2019 (USD BILLION)

TABLE 34 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR BIOMETRIC SYSTEMS, BY REGION, 2020–2025 (USD BILLION)

TABLE 35 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR BIOMETRIC SYSTEMS, BY TYPE, 2016–2019 (USD BILLION)

TABLE 36 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR BIOMETRIC SYSTEMS, BY TYPE, 2020–2025 (USD BILLION)

7.9.1 FACE RECOGNITION SYSTEMS

7.9.1.1 Face recognition technology is being implemented in smartphones for security purpose

7.9.2 IRIS RECOGNITION SYSTEMS

7.9.2.1 Iris recognition technology is well known for its accuracy and unique features

7.9.3 VOICE RECOGNITION SYSTEMS

7.9.3.1 Voice recognition solutions provide remote authentication

7.10 HEADS-UP DISPLAYS

7.10.1 TECHNOLOGICAL ADVANCEMENTS IN DISPLAY TECHNOLOGY HAVE ACCELERATED DEMAND FOR HEADS-UP DISPLAYS

TABLE 37 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR HEADS-UP DISPLAYS, BY REGION, 2016–2019 (USD BILLION)

TABLE 38 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR HEADS-UP DISPLAYS, BY REGION, 2020–2025 (USD BILLION)

7.11 GOOGLE GLASS

7.11.1 GOOGLE GLASS IS IDEAL FOR EMPLOYEES WORKING IN CONSTRUCTION SITES, FACTORY FLOORS, RETAIL & WAREHOUSING STORES, AND MEDICAL SITES

TABLE 39 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR GOOGLE GLASS, BY REGION, 2016–2019 (USD MILLION)

TABLE 40 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR GOOGLE GLASS, BY REGION, 2020–2025 (USD MILLION)

7.12 VOICE-DIRECTED WMS

7.12.1 VOICE-DIRECTED WMS OFFERS ADVANTAGES IN TERMS OF EASE OF USAGE AND REDUCED TRAINING COSTS

TABLE 41 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR VOICE-DIRECTED WMS, BY REGION, 2016–2019 (USD BILLION)

TABLE 42 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR VOICE-DIRECTED WMS, BY REGION, 2020–2025 (USD BILLION)

8 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET, BY OFFERING (Page No. - 98)

8.1 INTRODUCTION

FIGURE 28 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR SERVICES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 43 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 44 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET, BY OFFERING, 2020–2025 (USD BILLION)

8.2 HARDWARE

8.2.1 HARDWARE OFFERINGS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

FIGURE 29 APAC TO LEAD AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR HARDWARE OFFERINGS DURING FORECAST PERIOD

TABLE 45 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR HARDWARE, BY REGION, 2016–2019 (USD BILLION)

TABLE 46 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR HARDWARE, BY REGION, 2020–2025 (USD BILLION)

8.3 SOFTWARE

8.3.1 DEPLOYMENT OF SOFTWARE IN AIDC SOLUTIONS ENABLES THEIR USE IN TRACKING, IDENTIFICATION, AND VALIDATION APPLICATIONS

8.3.2 HONEYWELL

8.3.3 ZEBRA TECHNOLOGIES

8.3.4 LUCAS SYSTEMS

8.3.5 VOXWARE

8.3.6 IVANTI

TABLE 47 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR SOFTWARE, BY REGION, 2016–2019 (USD BILLION)

TABLE 48 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR SOFTWARE, BY REGION, 2020–2025 (USD BILLION)

8.4 SERVICES

8.4.1 MARKET FOR SERVICES TO GROW AT HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 49 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR SERVICES, BY REGION, 2016–2019 (USD BILLION)

TABLE 50 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR SERVICES, BY REGION, 2020–2025 (USD BILLION)

9 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET, BY VERTICAL (Page No. - 107)

9.1 INTRODUCTION

FIGURE 30 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR HOSPITALITY VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 51 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET, BY VERTICAL, 2016–2019 (USD BILLION)

TABLE 52 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET, BY VERTICAL, 2020–2025 (USD BILLION)

9.2 MANUFACTURING

FIGURE 31 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN APAC FOR MANUFACTURING VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 53 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR MANUFACTURING VERTICAL, BY REGION, 2016–2019 (USD BILLION)

TABLE 54 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR MANUFACTURING VERTICAL, BY REGION, 2020–2025 (USD BILLION)

9.2.1 SMARTPHONE MANUFACTURERS

9.2.1.1 Major smartphone manufacturers are using 2-dimensional barcode scanners for mobile payment solutions

9.2.2 AUTOMOBILE MANUFACTURERS

9.2.2.1 Automobile companies are using several AIDC solutions to streamline their supply chain and automation processes

9.2.3 FOOD & BEVERAGE COMPANIES

9.2.3.1 AIDC solutions help food & beverage companies for tracking food items

9.3 BANKING & FINANCE

9.3.1 BANKING AND FINANCIAL INSTITUTIONS INCREASINGLY RELY ON BIOMETRICS TO AUTHENTICATE THEIR CUSTOMERS WHILE USING SERVICES

TABLE 55 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR BANKING & FINANCE VERTICAL, BY REGION, 2016–2019 (USD BILLION)

TABLE 56 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR BANKING & FINANCE VERTICAL, BY REGION, 2020–2025 (USD BILLION)

9.4 HEALTHCARE

9.4.1 AIDC TECHNOLOGIES ARE COST-EFFECTIVE ALTERNATIVES USED TO ACCURATELY IDENTIFY AND TRACK PATIENTS

TABLE 57 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR HEALTHCARE VERTICAL, BY REGION, 2016–2019 (USD BILLION)

TABLE 58 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR HEALTHCARE VERTICAL, BY REGION, 2020–2025 (USD BILLION)

9.5 RETAIL

FIGURE 32 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN APAC FOR RETAIL VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 59 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR RETAIL VERTICAL, BY REGION, 2016–2019 (USD BILLION)

TABLE 60 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR RETAIL VERTICAL, BY REGION, 2020–2025 (USD BILLION)

TABLE 61 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR RETAIL VERTICAL, BY RETAILER TYPE, 2016–2019 (USD BILLION)

TABLE 62 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR RETAIL VERTICAL, BY RETAILER TYPE, 2020–2025 (USD BILLION)

9.5.1 WAREHOUSING AND DISTRIBUTION CENTERS

9.5.1.1 Warehousing and distribution centers adopt AIDC solutions owing to their ability to decrease operational costs and human errors

9.5.2 SUPERMARKETS

9.5.2.1 AIDC solutions are being used in supermarkets for efficient tracking of several items

9.5.3 HOME IMPROVEMENT STORES

9.5.3.1 laser scanners, barcode printers, and rugged tablets find applications in home improvement stores

9.5.4 DEPARTMENT STORES

9.5.4.1 Barcode scanners, RFID scanners, and OCR systems are deployed across several department stores to manage customers efficiently

9.5.5 APPAREL-FOOTWEAR-ACCESSORIES

9.5.5.1 Use of AIDC solutions in apparel and footwear stores has been proven to reduce theft and duplication

9.5.6 E-COMMERCE COMPANIES

9.5.6.1 E-commerce companies have witnessed increasing use of AIDC solutions for product identification and order tracking applications

9.6 GOVERNMENT

9.6.1 AIDC PRODUCTS ARE DEPLOYED IN GOVERNMENT SECTOR FOR EQUIPMENT MANAGEMENT AND INVENTORY MANAGEMENT APPLICATIONS

TABLE 63 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR GOVERNMENT VERTICAL, BY REGION, 2016–2019 (USD BILLION)

TABLE 64 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR GOVERNMENT VERTICAL, BY REGION, 2020–2025 (USD BILLION)

9.7 HOSPITALITY

9.7.1 AIDC TECHNOLOGIES ARE UTILIZED IN HOTELS AND RESTAURANTS FOR MOBILE PAYMENTS AND ORDERING AND INVENTORY MANAGEMENT APPLICATIONS

TABLE 65 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR GOVERNMENT VERTICAL, BY HOSPITALITY, 2016–2019 (USD BILLION)

TABLE 66 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR GOVERNMENT VERTICAL, BY HOSPITALITY, 2020–2025 (USD BILLION)

9.8 TRANSPORTATION & LOGISTICS

FIGURE 33 APAC TO CONTINUE TO DOMINATE AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR TRANSPORTATION & LOGISTICS VERTICAL DURING FORECAST PERIOD

TABLE 67 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR TRANSPORTATION & LOGISTICS VERTICAL, BY REGION, 2016–2019 (USD BILLION)

TABLE 68 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR TRANSPORTATION & LOGISTICS VERTICAL, BY REGION, 2020–2025 (USD BILLION)

TABLE 69 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR TRANSPORTATION & LOGISTICS VERTICAL, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 70 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR TRANSPORTATION & LOGISTICS VERTICAL, BY APPLICATION, 2020–2025 (USD BILLION)

9.8.1 PUBLIC TRANSPORT

9.8.1.1 Public transports such as metros, trains, and buses use magnetic stripes and smart cards for their ticketing systems

9.8.2 COURIER AND POSTAL SERVICES

9.8.2.1 AIDC solutions are used in courier and postal services for efficient and effective tracking of parcel items

9.8.3 FREIGHT FORWARDING

9.8.3.1 Freight forwarding companies use several AIDC technologies for effective order tracking and transport

9.8.4 LAST-MILE DELIVERY

9.8.4.1 All supply chain companies adopt AIDC technologies to streamline their processes

9.8.5 SAME-DAY DELIVERY

9.8.5.1 AIDC technologies, by providing more real-time access to warehouse management systems, help logistics companies to ensure same-day delivery

9.8.6 ENTERPRISE FIELD SERVICES

TABLE 71 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR ENTERPRISE FIELD SERVICES, BY TYPE, 2016–2019 (USD MILLION)

TABLE 72 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR ENTERPRISE FIELD SERVICES VERTICAL, BY TYPE, 2020–2025 (USD MILLION)

9.8.6.1 AC repair services

9.8.6.1.1 RFID tags are added to repair instruments, allowing them to be scanned when returned

9.8.6.2 Elevator repair services

9.8.6.2.1 RFID solutions are being used to achieve dynamic supervision by taking advantages of computers and networks

9.9 OTHERS

TABLE 73 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR OTHER VERTICALS, BY REGION, 2016–2019 (USD BILLION)

TABLE 74 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET FOR OTHER VERTICALS, BY REGION, 2020–2025 (USD BILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 127)

10.1 INTRODUCTION

FIGURE 34 GEOGRAPHIC SNAPSHOT: AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 35 APAC TO CONTINUE TO LEAD AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET DURING FORECAST PERIOD

TABLE 75 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET, BY REGION, 2016–2019 (USD BILLION)

TABLE 76 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET, BY REGION, 2020–2025 (USD BILLION)

10.2 NORTH AMERICA

FIGURE 36 SNAPSHOT OF AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN NORTH AMERICA

FIGURE 37 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN US TO GROW AT HIGHEST CAGR DURING 2020–2025

TABLE 77 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD BILLION)

TABLE 78 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD BILLION)

TABLE 79 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN NORTH AMERICA, BY PRODUCT, 2016–2019 (USD MILLION)

TABLE 80 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN NORTH AMERICA, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 81 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN NORTH AMERICA, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 82 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN NORTH AMERICA, BY OFFERING, 2020–2025 (USD BILLION)

FIGURE 38 HOSPITALITY VERTICAL TO EXHIBIT HIGHEST CAGR IN AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN NORTH AMERICA DURING FORECAST PERIOD

TABLE 83 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN NORTH AMERICA, BY VERTICAL, 2016–2019 (USD BILLION)

TABLE 84 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN NORTH AMERICA, BY VERTICAL, 2020–2025 (USD BILLION)

10.2.1 US

10.2.1.1 US held largest share of automatic identification and data capture market in North America in 2019

TABLE 85 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN US, BY PRODUCT, 2016–2019 (USD MILLION)

TABLE 86 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN US, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 87 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN US FOR BARCODING SOLUTIONS BY TYPE, 2016–2019 (USD MILLION)

TABLE 88 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN US FOR BARCODING SOLUTIONS, BY TYPE, 2020–2025 (USD MILLION)

FIGURE 39 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN US FOR VEHICLE-MOUNTED RUGGED TABLETS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 89 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN US FOR RUGGED TABLETS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 90 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN US FOR RUGGED TABLETS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 91 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN US FOR LASER SCANNERS, BY RANGE, 2016–2019 (USD MILLION)

TABLE 92 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN US FOR LASER SCANNERS, BY RANGE, 2020–2025 (USD MILLION)

TABLE 93 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN US FOR LONG-RANGE LASER SCANNERS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 94 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN US FOR LONG-RANGE LASER SCANNERS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 95 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN US, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 96 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN US, BY OFFERING, 2020–2025 (USD BILLION)

FIGURE 40 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN US FOR HOSPITALITY VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 97 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN US, BY VERTICAL, 2016–2019 (USD BILLION)

TABLE 98 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN US, BY VERTICAL, 2020–2025 (USD BILLION)

10.2.2 CANADA

10.2.2.1 Strengthening manufacturing sector in Canada to foster market growth

TABLE 99 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN CANADA, BY PRODUCT, 2016–2019 (USD MILLION)

TABLE 100 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN CANADA, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 101 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN CANADA, BY VERTICAL, 2016–2019 (USD BILLION)

TABLE 102 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN CANADA, BY VERTICAL, 2020–2025 (USD BILLION)

10.2.3 MEXICO

10.2.3.1 Emergence of Mexico as major industrial hub for North American companies fueling demand for AIDC solutions

TABLE 103 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN MEXICO, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 104 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN MEXICO, BY VERTICAL, 2020–2025 (USD MILLION)

10.3 EUROPE

FIGURE 41 SNAPSHOT OF AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN EUROPE

FIGURE 42 GERMANY TO CONTINUE TO COMMAND AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN EUROPE DURING FORECAST PERIOD

TABLE 105 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN EUROPE, BY COUNTRY, 2016–2019 (USD BILLION)

TABLE 106 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN EUROPE, BY COUNTRY, 2020–2025 (USD BILLION)

TABLE 107 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN EUROPE, BY PRODUCT, 2016–2019 (USD MILLION)

TABLE 108 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN EUROPE, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 109 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN EUROPE, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 110 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN EUROPE, BY OFFERING, 2020–2025 (USD BILLION)

FIGURE 43 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN EUROPE FOR RETAIL VERTICAL TO HOLD LARGEST MARKET SIZE IN 2025

TABLE 111 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN EUROPE, BY VERTICAL, 2016–2019 (USD BILLION)

TABLE 112 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN EUROPE, BY VERTICAL, 2020–2025 (USD BILLION)

10.3.1 GERMANY

10.3.1.1 Germany to lead automatic identification and data capture market in Europe from 2020 to 2025

TABLE 113 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN GERMANY, BY PRODUCT, 2016–2019 (USD MILLION)

TABLE 114 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN GERMANY, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 115 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN GERMANY, BY VERTICAL, 2016–2019 (USD BILLION)

TABLE 116 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN GERMANY, BY VERTICAL, 2020–2025 (USD BILLION)

10.3.2 FRANCE

10.3.2.1 Smart factory initiatives taken by manufacturers to automate supply chain processes would propel market growth in France

TABLE 117 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN FRANCE, BY PRODUCT, 2016–2019 (USD MILLION)

TABLE 118 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN FRANCE, BY PRODUCT, 2020–2025 (USD MILLION)

FIGURE 44 RETAIL VERTICAL TO ACCOUNT FOR LARGEST SIZE OF AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN FRANCE IN 2025

TABLE 119 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN FRANCE, BY VERTICAL, 2016–2019 (USD BILLION)

TABLE 120 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN FRANCE, BY VERTICAL, 2020–2025 (USD BILLION)

10.3.3 UK

10.3.3.1 Presence of solid state, liquid, and gas laser manufacturers harnesses growth of automatic identification and data capture market in UK

TABLE 121 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN UK, BY PRODUCT, 2016–2019 (USD MILLION)

TABLE 122 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN UK, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 123 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN UK, BY VERTICAL, 2016–2019 (USD BILLION)

TABLE 124 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN UK, BY VERTICAL, 2020–2025 (USD BILLION)

10.3.4 REST OF EUROPE

10.3.4.1 Presence of prominent players accelerates demand for AIDC solutions in RoE

TABLE 125 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN ROE, BY VERTICAL, 2016–2019 (USD BILLION)

TABLE 126 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN ROE, BY VERTICAL, 2020–2025 (USD BILLION)

10.4 APAC

FIGURE 45 SNAPSHOT OF AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN APAC

FIGURE 46 CHINA TO CONTINUE TO COMMAND AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN APAC DURING FORECAST PERIOD

TABLE 127 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN APAC, BY COUNTRY, 2016–2019 (USD BILLION)

TABLE 128 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN APAC, BY COUNTRY, 2020–2025 (USD BILLION)

TABLE 129 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN APAC, BY PRODUCT, 2016–2019 (USD MILLION)

TABLE 130 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN APAC, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 131 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN APAC, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 132 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN APAC, BY OFFERING, 2020–2025 (USD BILLION)

FIGURE 47 RETAIL TO ACCOUNT FOR LARGEST SIZE OF AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN APAC IN 2025

TABLE 133 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN APAC, BY VERTICAL, 2016–2019 (USD BILLION)

TABLE 134 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN APAC, BY VERTICAL, 2020–2025 (USD BILLION)

10.4.1 CHINA

10.4.1.1 China held largest share of automatic identification and data capture market in APAC in 2019

TABLE 135 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN CHINA, BY PRODUCT, 2016–2019 (USD MILLION)

TABLE 136 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN CHINA, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 137 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN CHINA, BY VERTICAL, 2016–2019 (USD BILLION)

TABLE 138 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN CHINA, BY VERTICAL, 2020–2025 (USD BILLION)

10.4.2 JAPAN

10.4.2.1 Presence of prominent manufacturing and logistics companies in country drives demand for AIDC solutions

TABLE 139 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN JAPAN, BY PRODUCT, 2016–2019 (USD MILLION)

TABLE 140 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN JAPAN, BY PRODUCT, 2020–2025 (USD MILLION)

FIGURE 48 HOSPITALITY VERTICAL TO REGISTER HIGHEST CAGR IN AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN JAPAN DURING FORECAST PERIOD

TABLE 141 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN JAPAN, BY VERTICAL, 2016–2019 (USD BILLION)

TABLE 142 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN JAPAN, BY VERTICAL, 2020–2025 (USD BILLION)

10.4.3 TAIWAN

10.4.3.1 Taiwan being hub for several companies that manufacture semiconductor and electronics components witness increasing demand for AIDC solutions

TABLE 143 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN TAIWAN, BY VERTICAL, 2016–2019 (USD BILLION)

TABLE 144 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN TAIWAN, BY VERTICAL, 2020–2025 (USD BILLION)

10.4.4 REST OF APAC

10.4.4.1 Growth of market in Rest of APAC is driven by expanding logistics and e-commerce companies

TABLE 145 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN REST OF APAC, BY VERTICAL, 2016–2019 (USD BILLION)

TABLE 146 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN REST OF APAC, BY VERTICAL, 2020–2025 (USD BILLION)

10.5 ROW

FIGURE 49 MIDDLE EAST & AFRICA TO WITNESS HIGHEST CAGR IN AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET DURING FORECAST PERIOD

TABLE 147 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN ROW, BY REGION, 2016–2019 (USD BILLION)

TABLE 148 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN ROW, BY REGION, 2020–2025 (USD BILLION)

TABLE 149 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN ROW, BY PRODUCT, 2016–2019 (USD MILLION)

TABLE 150 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN ROW, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 151 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN ROW, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 152 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN ROW, BY OFFERING, 2020–2025 (USD BILLION)

FIGURE 50 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN ROW FOR HOSPITALITY VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 153 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN ROW, BY VERTICAL, 2016–2019 (USD BILLION)

TABLE 154 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN ROW, BY VERTICAL, 2020–2025 (USD BILLION)

10.5.1 MIDDLE EAST & AFRICA

10.5.1.1 MEA held larger share of automatic identification and data capture market in RoW

TABLE 155 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN MEA, BY VERTICAL, 2016–2019 (USD BILLION)

TABLE 156 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN MEA, BY VERTICAL, 2020–2025 (USD BILLION)

10.5.2 SOUTH AMERICA

10.5.2.1 Rising number of manufacturing companies to contribute to growth of automatic identification and data capture market in South America

TABLE 157 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN SOUTH AMERICA, BY VERTICAL, 2016–2019 (USD BILLION)

TABLE 158 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET IN SOUTH AMERICA, BY VERTICAL, 2020–2025 (USD BILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 183)

11.1 INTRODUCTION

FIGURE 51 MAJOR PLAYERS IN AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET ADOPTED PRODUCT LAUNCHES AS KEY GROWTH STRATEGY FROM 2017 TO 2019

11.2 RANKING ANALYSIS OF PLAYERS IN AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET

FIGURE 52 TOP 5 COMPANIES IN AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET

11.3 COMPETITIVE LEADERSHIP MAPPING

FIGURE 53 AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

11.3.1 VISIONARY LEADERS

11.3.2 DYNAMIC DIFFERENTIATORS

11.3.3 INNOVATORS

11.3.4 EMERGING COMPANIES

11.4 COMPETITIVE BENCHMARKING

11.4.1 STRENGTH OF PRODUCT PORTFOLIO (25 COMPANIES)

FIGURE 54 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET

11.4.2 BUSINESS STRATEGY EXCELLENCE (25) COMPANIES

FIGURE 55 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET

11.5 COMPETITIVE SCENARIO

FIGURE 56 MARKET EVOLUTION FRAMEWORK: PRODUCT LAUNCHES, FOLLOWED BY CONTRACTS/PARTNERSHIPS/AGREEMENTS/COLLABORATIONS, FUELLED AUTOMATIC IDENTIFICATION AND DATA CAPTURE MARKET GROWTH (2017–2019)

11.5.1 EXPANSIONS

TABLE 159 EXPANSIONS, 2017–2019

11.5.2 PRODUCT LAUNCHES

TABLE 160 PRODUCT LAUNCHES, 2017–2019

11.5.3 MERGERS AND ACQUISITIONS

TABLE 161 MERGERS AND ACQUISITIONS, 2017–2019

11.5.4 CONTRACTS, PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS

TABLE 162 CONTRACTS, PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS, 2017–2019

12 COMPANY PROFILES (Page No. - 196)

(Overview, Products/solutions/services offered, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments, Key relationships)*

12.1 KEY PLAYERS

12.1.1 HONEYWELL

FIGURE 57 HONEYWELL: COMPANY SNAPSHOT

12.1.2 DATALOGIC

FIGURE 58 DATALOGIC: COMPANY SNAPSHOT

12.1.3 ZEBRA TECHNOLOGIES

FIGURE 59 ZEBRA TECHNOLOGIES: COMPANY SNAPSHOT

12.1.4 SICK AG

FIGURE 60 SICK AG: COMPANY SNAPSHOT

12.1.5 COGNEX

FIGURE 61 COGNEX: COMPANY SNAPSHOT

12.1.6 TOSHIBA

FIGURE 62 TOSHIBA: COMPANY SNAPSHOT

12.1.7 GETAC

FIGURE 63 GETAC: COMPANY SNAPSHOT

12.1.8 DELL

FIGURE 64 DELL: COMPANY SNAPSHOT

12.1.9 SAMSUNG

FIGURE 65 SAMSUNG: COMPANY SNAPSHOT

12.1.10 PANASONIC

FIGURE 66 PANASONIC: COMPANY SNAPSHOT

12.2 RIGHT TO WIN

12.2.1 HONEYWELL

12.2.2 DATALOGIC

12.2.3 ZEBRA TECHNOLOGIES

12.2.4 SICK AG

12.2.5 COGNEX

12.3 OTHER COMPANIES

12.3.1 AVERY DENNISON

12.3.2 EPSON

12.3.3 NCR

12.3.4 CASIO

12.3.5 DENSO WAVE

12.3.6 M3 MOBILE

12.3.7 SATO

12.3.8 SYNAPTICS

12.3.9 NXP

12.3.10 NEC

*Details on Overview, Products/solutions/services offered, Strength of Service Portfolio, Business Strategy Excellence, Recent Developments, Key relationships might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 246)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

The study involved four major activities in estimating the size of the AIDC market. Exhaustive secondary research has been done to collect information on the market, the peer market, and the parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the AIDC market begins with capturing data on revenues of key vendors in the market through secondary research. This study incorporates extensive use of secondary sources, directories, and databases (such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource) to identify and collect information useful for a technical, market-oriented, and commercial study of the AIDC market. Vendor offerings have also been taken into consideration to determine market segmentation. The entire research methodology includes studying annual reports, press releases, and investor presentations of companies; white papers; and certified publications and articles from recognized authors, directories, and databases.

Primary Research

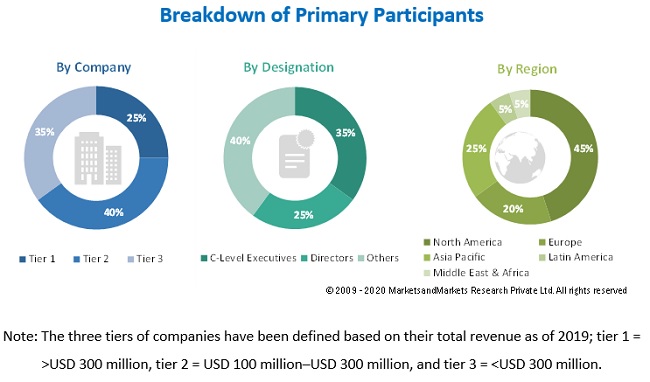

The AIDC market comprises several stakeholders, such as suppliers of components and original equipment manufacturers (OEMs). The demand side of this market is characterized by the development of manufacturing, retail, transportation & logistics, hospitality, banking & finance, healthcare, government, and others verticals. The supply side is characterized by advancements in types of AIDC solutions and services. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the AIDC market and its subsegments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes explained above—the market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends in both the demand and supply sides of the AIDC market.

Research Objective

- Describe and forecast the size of the global automatic identification and data capture market, in terms of value, by product, offering, vertical, and geography

- Provide the market size for different types of barcoding solutions, laser scanners, smart cards, rugged tablets, RFID systems, biometric systems

- Forecast the market size for laser scanners, by range

- Forecast the automatic identification and data capture market, in terms of volume

- Forecast the market size for various segments with respect to 4 main regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- Provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- Analyze the micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

- Profile the key players and comprehensively analyze their ranking in the market and core competencies2

- Analyze competitive developments such as joint ventures, mergers & acquisitions, product launches, and research & development (R&D) activities in the automatic identification and data capture market

- Provide competitive mapping based on company profiles and key player strategies such as product launches and developments, collaborations, expansions, and acquisitions

- Analyze opportunities in the market for stakeholders and provide a detailed competitive landscape for the market players

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Critical Questions

- What new application areas are AIDC providers exploring?

- Who are the key market players, and how intense is the competition?

- Which verticals and geographies would be the biggest markets for AIDC?

Growth opportunities and latent adjacency in Automatic Identification and Data Capture Market

Hello, I am a student at a renowned university in Germany and I am currently working on my Bachelor Thesis about the Technologies of Auto-ID. Through research, I have found your report and would like to know if there is any possibility for students to access the mentioned report?