Automatic Labeling Machine Market by Type (Self-Adhesive/Pressure-Sensitive Labelers, Shrink Sleeve Labelers and Glue-Based Labelers), Industry (Food & Beverages, Pharmaceuticals, Consumer Products, Personal Care), Geography - Global Forecast to 2025-2035

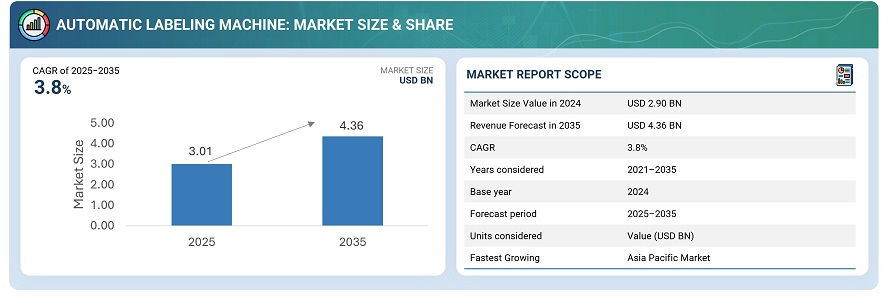

The global automatic labeling machine market was valued at USD 2.90 billion in 2025 and is projected to reach USD 4.36 billion by 2035, growing at a CAGR of 3.8% between 2025 and 2035.

Market growth is driven by increasing demand for efficient, high-speed, and accurate labeling solutions across food & beverage, pharmaceuticals, cosmetics, logistics, and consumer goods sectors. Advancements in automation technologies, vision inspection systems, and IoT-enabled labeling solutions are enhancing operational efficiency, reducing errors, and supporting compliance with stringent regulatory standards. Furthermore, the growing emphasis on product traceability, sustainable packaging, and customization of labels is creating additional opportunities for market expansion. Overall, the market is becoming increasingly competitive, with manufacturers focusing on modular designs, integration with production lines, and smart labeling systems to cater to the evolving needs of diverse industrial applications worldwide.

Automatic Labeling Machines are advanced automated systems designed to apply labels accurately and efficiently on a wide variety of products and packaging types, enabling consistent branding, traceability, and regulatory compliance. They are widely used in food & beverage, pharmaceuticals, cosmetics, logistics, and consumer goods industries, where high-speed, precision labeling is critical. Automatic labeling machines operate using mechanisms such as rotary, linear, or tamp-blow systems, often integrated with sensors, vision inspection systems, and conveyor automation to ensure precise label placement and alignment. Key features include high throughput, minimal downtime, adaptability to different package shapes and sizes, and compact design, ensuring reliable performance in demanding production environments. Modern machines incorporate IoT connectivity, smart control interfaces, and modular designs, improving operational efficiency, energy usage, and compatibility with existing production lines across industrial and commercial applications.

Market by Type

Self-Adhesive/Pressure-Sensitive Labelers

Self-Adhesive/Pressure-Sensitive Labelers are expected to hold a significant share of the global automatic labeling machine market due to their versatility, high efficiency, and precision in label application. These machines are widely used across food & beverage, pharmaceuticals, cosmetics, and consumer goods industries, where consistent labeling, brand visibility, and regulatory compliance are critical. They operate by applying pressure-sensitive labels directly onto product surfaces without the need for additional adhesives, ensuring clean, accurate, and fast labeling. Key advantages include adaptability to various container shapes and sizes, minimal maintenance requirements, and seamless integration with production lines. Increasing demand for automation, product traceability, and high-speed packaging processes is driving widespread adoption of self-adhesive labeling solutions across global manufacturing sectors.

Shrink Sleeve Labelers

Shrink Sleeve Labelers are projected to grow with a significant CAGR, driven by rising demand for visually appealing, tamper-evident, and 360-degree product labeling solutions. These machines apply heat-shrinkable sleeves that conform precisely to container shapes, offering superior design flexibility and brand differentiation. Their adoption is increasing across food & beverage, personal care, and pharmaceutical sectors, where premium packaging and product authentication are essential. Shrink sleeve labelers enable high-speed operations, compatibility with diverse materials, and excellent resistance to moisture and abrasion, making them ideal for modern packaging lines. Growing consumer preference for attractive, durable packaging and advancements in shrink film materials are expected to further accelerate market growth for these labeling systems worldwide.

Market by Industry

Food & Beverage

The Food & Beverage industry accounted for a significant share of the global automatic labeling machine market, driven by the rising demand for efficient, high-speed labeling solutions that ensure product traceability, regulatory compliance, and brand consistency. Automatic labeling machines are extensively used for applying ingredient information, barcodes, and promotional labels on bottles, cans, pouches, and cartons. Increasing production volumes, growing preference for packaged and ready-to-eat foods, and stringent labeling regulations are propelling market demand. Moreover, manufacturers are adopting smart, automated labeling systems integrated with vision inspection and IoT connectivity to minimize errors and enhance line efficiency. The industry’s focus on sustainable packaging and flexible labeling options further supports continued adoption of advanced labeling technologies.

Pharmaceuticals

The Pharmaceuticals industry is projected to grow with a significant CAGR in the automatic labeling machine market, driven by the increasing need for precision, traceability, and regulatory compliance in drug packaging. Labeling machines in this sector are used for applying variable data labels, barcodes, and tamper-evident seals on vials, ampoules, bottles, and blister packs. The growing emphasis on serialization, anti-counterfeiting measures, and patient safety is accelerating the adoption of advanced labeling technologies. Pharmaceutical manufacturers are increasingly investing in automated, vision-enabled systems to ensure labeling accuracy, reduce manual errors, and enhance production throughput. Additionally, the expansion of biologics, vaccines, and personalized medicines continues to create strong growth opportunities for high-speed, flexible labeling solutions worldwide.

Market by Geography

Asia Pacific is expected to hold a significant share of the global automatic labeling machine market and register the highest CAGR over the forecast period. The region’s growth is driven by rapid industrialization, expanding manufacturing sectors, and rising adoption of automation across food & beverage, pharmaceuticals, and consumer goods industries. Increasing investments in packaging modernization, coupled with stringent labeling regulations in countries such as China, Japan, India, and South Korea, are boosting market demand. Moreover, the growth of e-commerce and logistics sectors is driving the need for efficient labeling solutions to ensure product traceability and compliance. The presence of key equipment manufacturers and growing exports of packaged goods further strengthen the region’s market position.

Market Dynamics

Driver: Demand for Automation in the Food & Beverage Industry

The food & beverage industry is increasingly embracing automation to enhance production efficiency, maintain consistent quality, and meet growing consumer demand for packaged products. Automatic labeling machines are a key component of this trend, enabling high-speed, precise, and reliable labeling of bottles, cans, cartons, and pouches. Automation reduces manual errors, minimizes downtime, and ensures compliance with strict labeling regulations, including ingredient disclosure, nutritional information, and barcode standards. Additionally, with expanding product lines, seasonal promotions, and increasing e-commerce packaging requirements, manufacturers require flexible labeling systems that can handle varying container sizes and label designs. This rising emphasis on automated, efficient, and adaptable labeling solutions is a significant driver of market growth in the food & beverage sector.

Restraint: High Initial Investment and Maintenance Complexity

Despite operational benefits, automatic labeling machines require substantial capital investment, particularly for high-speed, multi-format, or smart labeling systems. Smaller manufacturers may find the cost of procurement, installation, and maintenance prohibitive. Additionally, sophisticated machines often require specialized technical expertise for setup, calibration, and software updates. Variability in label types, container sizes, and packaging formats can further complicate integration, leading to downtime and increased operational costs. These financial and technical barriers may restrict adoption among small and medium enterprises, particularly in emerging markets, moderating overall market growth.

Opportunity: Expansion of Smart and Traceable Labeling Solutions in Pharmaceuticals and Logistics

The growing need for product traceability, anti-counterfeiting measures, and regulatory compliance in pharmaceuticals and logistics presents a significant opportunity for automatic labeling machine manufacturers. Advanced labeling solutions—such as serialization-ready systems, RFID-enabled labels, and AI-powered vision inspection—allow companies to track products throughout the supply chain, ensure accurate labeling, and prevent tampering. The rising global pharmaceutical production, increased exports, and stringent government regulations on serialization and product safety are driving demand for sophisticated labeling machines. Similarly, logistics and e-commerce companies are investing in automated labeling systems to manage high-volume shipments efficiently, reduce errors, and improve delivery accuracy. These trends create strong growth potential for intelligent, high-precision labeling technologies.

Challenge: Trade-Off Between Machine Speed, Complexity, and Performance

One of the key challenges in the automatic labeling machine market is balancing high-speed operations with machine complexity and labeling accuracy. High-speed labeling machines are essential for industries such as pharmaceuticals, consumer goods, and logistics to meet large-volume production demands. However, increasing speed often requires more complex mechanisms, advanced sensors, and precision controls, which can raise maintenance needs and operational costs. Moreover, excessive complexity may increase the risk of downtime, setup errors, or misaligned labels, especially when handling diverse container shapes and label types. Manufacturers must carefully optimize machine design to achieve maximum throughput without compromising accuracy, reliability, or ease of operation, making this trade-off a persistent market challenge.

Future Outlook

Between 2025 and 2035, the automatic labeling machine market is expected to grow significantly as demand for high-speed, precise, and automated labeling solutions rises across pharmaceuticals, consumer goods, logistics, and industrial manufacturing. Advances in automation technologies, IoT-enabled monitoring, and vision inspection systems will enhance labeling accuracy, operational efficiency, and production line reliability, while modular and flexible designs will enable seamless integration with diverse packaging formats. Increasing investments in serialization, product traceability, and compliance with global labeling regulations will further drive adoption. As the market evolves, automatic labeling machines will play a critical role in improving production efficiency, ensuring regulatory compliance, and supporting smart packaging initiatives across both industrial and commercial applications.

Key Market Players

Top automatic labeling machine companies Krones AG (Germany), SACMI (Italy), Sidel (France), KHS Group (Germany) and HERMA (Germany).

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 6 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From the Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data Points From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 30)

4.1 Opportunities in Automatic Labeling Machine Market, 2019–2024

4.2 Automatic Labeling Machine Market for Food & Beverage Industry, By Type (2019–2024)

4.3 Automatic Labeling Machine Market, Exports & Imports

4.4 RoW Automatic Labeling Machine Market, By Region

4.5 APAC Automatic Labeling Machine Market, By Type and Industry

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Demand for Automation in the Food & Beverage Industry

5.2.1.2 Benefits Tendered By Automatic Labelers

5.2.2 Restraints

5.2.2.1 High Price of Automatic Labeling Machines and Consumables

5.2.3 Opportunities

5.2.3.1 Shrink-Sleeve Labels Expected to Exhibit Huge Demand

5.2.3.2 Growth Opportunities in the APAC Region

5.2.4 Challenges

5.2.4.1 Trade-Off Between Machine Speed, Complexity, and Performance

5.3 Classification of Automatic Labeling Machines

5.3.1 High-End Machines

5.3.2 Standard Machines

5.4 Classification of Material of Construction for Primary and Secondary Packaging

5.4.1 Glass

5.4.1.1 Increasing Demand for Shrink-Sleeve Labeling for Glass Products

5.4.2 Plastic

5.4.2.1 Improvement in Drug Safety Through Low-Migration Labeling

5.4.3 Metal

5.4.3.1 High Surface Energy of Metallic Surfaces Leading to the Chemistry of Surface Adhesion

5.4.4 Paper/Cardboard

5.4.4.1 Usage of High-Resolution Inkjet Printer for Cardboard Box Marking and Coding

5.5 Key Methods of Label Placements

5.5.1 Front & Back/Double–Sided

5.5.2 Top & Bottom

5.5.3 Wrap Around

5.5.4 Side

6 Automatic Labeling Machine Market, By Type (Page No. - 41)

6.1 Introduction

6.2 Self-Adhesive/Pressure-Sensitive Labelers

6.2.1 Apply Only

6.2.1.1 Apply Only Labeling Machines Used as A Decorative Labeling Solution

6.2.2 Print & Apply

6.2.2.1 Print & Apply Evolves to Meet the Demands of E-Commerce

6.3 Shrink-Sleeve/Stretch-Sleeve Labelers

6.3.1 Factors Affecting the Cost of Shrink-Sleeve Labeling Machines

6.4 Glue-Based Labelers

6.4.1 Innovative Roll-Fed Labelers Using Adhesleeve Technology

7 Automatic Labeling Machine Market, By Industry (Page No. - 52)

7.1 Introduction

7.2 Food & Beverage

7.2.1 Food

7.2.1.1 Traffic Light Labeling Measure for Packaged Food in India

7.2.2 Beverages

7.2.2.1 Common Labeling Challenges in the Beverage Industry

7.3 Pharmaceuticals

7.3.1 Legal Requirements of Manufacturer Label

7.4 Consumer Products, Cosmetics, & Personal Care

7.4.1 Regulations for Labeling of Personal Care Products

7.5 Others

7.5.1 Color Labeling Technology in Warehousing & Logistics

8 Automatic Labeling Machine Market, By Geography (Page No. - 59)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 Growing Demand for Secondary and Mailing/Shipping Labels Aids the Growth of the Automatic Labeling Machine Market

8.2.2 Rest of North America

8.2.2.1 Food Industry is A Major Sector for Packaging Machinery in Canada

8.3 Europe

8.3.1 UK

8.3.1.1 UK Automatic Labeling Machine Industry Driven By Exports

8.3.2 Germany

8.3.2.1 Demand for Food Labeling Machinery Keeps the German Market in Good Shape

8.3.3 France

8.3.3.1 Adoption of Nutri-Score Labeling Scheme in France

8.3.4 Italy

8.3.4.1 Key Suppliers of Automatic Labeling Machines in Italy

8.3.5 Rest of Europe

8.4 Asia Pacific

8.4.1 China

8.4.1.1 Key Market Dynamics and Trends of Packaging Machinery Industry in China

8.4.2 Japan

8.4.2.1 Major Suppliers of Automatic Labeling Machines in Japan

8.4.3 Rest of APAC

8.5 Rest of the World (RoW)

8.5.1 South America

8.5.1.1 Future Growth Opportunities for Automatic Labeling Machines in South America

8.5.2 Middle East & Africa

8.5.2.1 Significant Growth of Flexible Packaging in the Middle East & Africa

9 Competitive Landscape (Page No. - 76)

9.1 Overview

9.2 Competitive Analysis

9.3 Competitive Leadership Mapping

9.3.1 Visionary Leaders

9.3.2 Dynamic Differentiators

9.3.3 Innovators

9.3.4 Emerging Companies

9.4 Competitive Situation and Trends

9.4.1 Agreements, Collaborations, and Partnerships

9.4.2 Product Launches and Developments

9.4.3 Acquisitions and Expansions

10 Company Profiles (Page No. - 84)

(Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis)*

10.1 Key Players

10.1.1 Krones

10.1.2 Sacmi

10.1.3 Sidel

10.1.4 KHS

10.1.5 Herma

10.1.6 Promach

10.1.7 Marchesini Group

10.1.8 Etiquette

10.1.9 Pack Leader

10.1.10 Novexx Solutions

10.2 Other Players

10.2.1 Fuji Seal International

10.2.2 Sleever International

10.2.3 IMA Group

10.2.4 Tech-Long

10.2.5 Bausch+Ströbel

10.2.6 Accutek

10.2.7 Quadrel Labeling Systems

10.2.8 Logopak

10.2.9 Topjet

10.2.10 Videojet

10.2.11 Sinclair International

10.2.12 Maharshi Group

10.2.13 Heuft Systemtechnik

10.2.14 Barry-Wehmiller

10.2.15 Label-Aire

*Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 115)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (35 Tables)

Table 1 Key Companies and Their Offerings in the Automatic Labeling Machine Market

Table 2 Automatic Labeling Machine Market, By Type, 2015–2024 (USD Million)

Table 3 Automatic Labeling Machine Market for Self-Adhesive/Pressure-Sensitive Labelers, By Region, 2015–2024 (USD Million)

Table 4 Automatic Labeling Machine Market for Self-Adhesive/Pressure-Sensitive Labelers in RoW, By Region, 2015–2024 (USD Million)

Table 5 Automatic Labeling Machine Market for Self-Adhesive/Pressure-Sensitive Labelers, By Industry, 2015–2024 (USD Million)

Table 6 Automatic Labeling Machine Market for Shrink-Sleeve Labelers, By Region, 2015–2024 (USD Million)

Table 7 Automatic Labeling Machine Market for Shrink-Sleeve Labelers in RoW, By Region, 2015–2024 (USD Million)

Table 8 Automatic Labeling Machine Market for Shrink-Sleeve Labelers, By Industry, 2015–2024 (USD Million)

Table 9 Automatic Labeling Machine Market for Glue-Based Labelers, By Region, 2015–2024 (USD Million)

Table 10 Automatic Labeling Machine Market for Glue-Based Labelers in RoW, By Region, 2015–2024 (USD Million)

Table 11 Automatic Labeling Machine Market for Glue-Based Labelers, By Industry, 2015–2024 (USD Million)

Table 12 Automatic Labeling Machine Market, By Industry, 2015–2024 (USD Million)

Table 13 Automatic Labeling Machine Market for Food & Beverage Industry, By Type, 2015–2024 (USD Million)

Table 14 Automatic Labeling Machine Market for Pharmaceuticals Industry, By Type, 2015–2024 (USD Million)

Table 15 Automatic Labeling Machine Market for Consumer Products, Personal Care & Cosmetics Industry, By Type, 2015–2024 (USD Million)

Table 16 Automatic Labeling Machine Market for Other Industries, By Type, 2015–2024 (USD Million)

Table 17 Automatic Labeling Machine Market, By Region, 2015–2024 (USD Million)

Table 18 Automatic Labeling Machine Market in North America, By Country, 2015–2024 (USD Million)

Table 19 Automatic Labeling Machine Market in North America, By Type, 2015–2024 (USD Million)

Table 20 Automatic Labeling Machine Market in North America, By Industry, 2015–2024 (USD Million)

Table 21 Automatic Labeling Machine Market in Europe, By Country, 2015–2024 (USD Million)

Table 22 Automatic Labeling Machine Market in Europe, By Type, 2015–2024 (USD Million)

Table 23 Automatic Labeling Machine Market in Europe, By Industry, 2015–2024 (USD Million)

Table 24 Automatic Labeling Machine Market in APAC, By Country, 2015–2024 (USD Million)

Table 25 Automatic Labeling Machine Market in APAC, By Type, 2015–2024 (USD Million)

Table 26 Automatic Labeling Machine Market in APAC, By Industry, 2015–2024 (USD Million)

Table 27 Automatic Labeling Machine Market in RoW, By Region, 2015–2024 (USD Million)

Table 28 Automatic Labeling Machine Market in RoW, By Type, 2015–2024 (USD Million)

Table 29 Automatic Labeling Machine Market in RoW, By Industry, 2015–2024 (USD Million)

Table 30 Automatic Labeling Machine Market in South America, By Type, 2015–2024 (USD Million)

Table 31 Automatic Labeling Machine Market in Middle East & Africa, By Type, 2015–2024 (USD Million)

Table 32 Key Companies and Their Offerings in the Automatic Labeling Machine Market

Table 33 Agreements, Collaborations, and Partnerships, 2017–2018

Table 34 Product Launches and Developments 2017–2018

Table 35 Acquisitions and Expansions 2017-2018

List of Figures (37 Figures)

Figure 1 Automatic Labeling Machine Market Segmentation

Figure 2 Automatic Labeling Machine Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Breakdown & Data Triangulation

Figure 6 Assumptions of the Research Study

Figure 7 Limitations of the Research Study

Figure 8 Automatic Labeling Machine Market Segmentation

Figure 9 Europe is the World’s Largest Exporter of Packaging Machinery and Automatic Labeling Machines

Figure 10 Automatic Labeling Machine Market Snapshot (2018 vs 2024): Shrink-Sleeve Labelers Expected to Exhibit the Highest Growth Rate

Figure 11 Food & Beverage Industry is Expected to Lead the Growth in the Automatic Labeling Machine Market During the Forecast Period

Figure 12 Asia Pacific is Expected to Grow at the Highest Rate Between 2019 and 2024

Figure 13 Attractive Growth Opportunities in Automatic Labeling Machine Market Between 2019 and 2024

Figure 14 Shrink-Sleeve Labelers Expected to Grow at the Highest Rate Driven By the Beverage Industry

Figure 15 Europe is the Largest Exporter of Packaging Machinery and Automatic Labeling Machines

Figure 16 Middle East & Africa Accounted for A Larger Market Share Than South America in 2018

Figure 17 Food & Beverage Held the Largest Share of the APAC Automatic Labeling Machine Market in 2018

Figure 18 Automatic Labeling Machine Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 Salient Features of Automatic Labeling Machines

Figure 20 Benefits of Shrink-Sleeve Labeling

Figure 21 Upcoming Food & Beverage Plants in India

Figure 22 Classification of Materials

Figure 23 Types of Automatic Labeling Machines

Figure 24 Features of Apply Only Labeling System

Figure 25 Components of Print & Apply Labeling System

Figure 26 Automatic Labeling Machine Market, By Industry

Figure 27 Key Product Categories in the Beverage Industry

Figure 28 China to Dominate the Automatic Labeling Machine Market From 2019 to 2024

Figure 29 Snapshot of Automatic Labeling Machine Market in Europe

Figure 30 Snapshot of Automatic Labeling Machine Market in APAC

Figure 31 Market Ranking of the Top 3 Players in the Automatic Labeling Machine Market, 2017

Figure 32 Automatic Labeling Machine Market (Global) Competitive Leadership Mapping, 2017

Figure 33 Krones: Company Snapshot

Figure 34 Sacmi: Company Snapshot

Figure 35 Sidel: Company Snapshot

Figure 36 KHS: Company Snapshot

Figure 37 Herma: Company Snapshot

The study involved four major activities in estimating the current market size for the automatic labeling machine market. Exhaustive secondary research has been done to collect information on the current market, the peer market, and the parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the overall market size. After that, the market breakdown and data triangulation approaches have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories and databases; and SEC filings; among others.

Primary Research

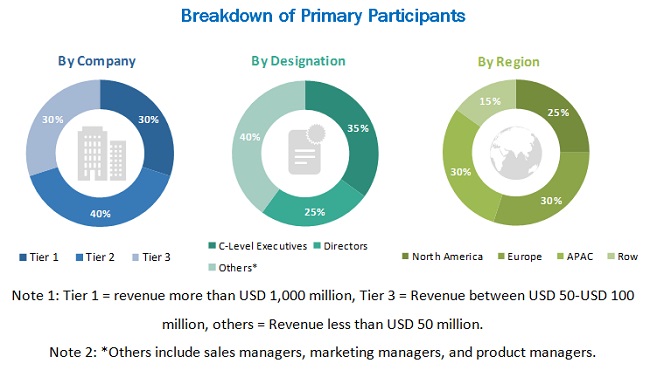

In the primary research process, various primary sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, product users, and related executives from major companies and organizations operating in the automatic labeling machine market. Following is the breakdown of primary respondents-

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the automatic labeling machine market, as well as that of the other dependent submarkets. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire research methodology includes the following:

- The study of annual and financial reports of top players, as well as interviews with experts for key insights

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through the primary research

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the global automatic labeling machine market by type, industry, and geography in terms of value

- To describe and forecast the market size for various segments by region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges pertaining to the Automatic labeling machine market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To strategically profile key players and comprehensively analyze their market ranking in terms of revenue and core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments such as expansions & investments, new product launches, mergers & acquisitions and agreements in the automatic labeling market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companies’ specific needs. The following customization options are available for the report:

Company Information:

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Automatic Labeling Machine Market