Thermal Printing Market by Offering (Printer, Supplies), Printer Type (Barcode, POS, Kiosk & Ticket, RFID, and Card), Format Type (Industrial, Desktop, Mobile), Printing Technology (DT, TT, D2T2), Application and Geography - Global Forecast to 2025

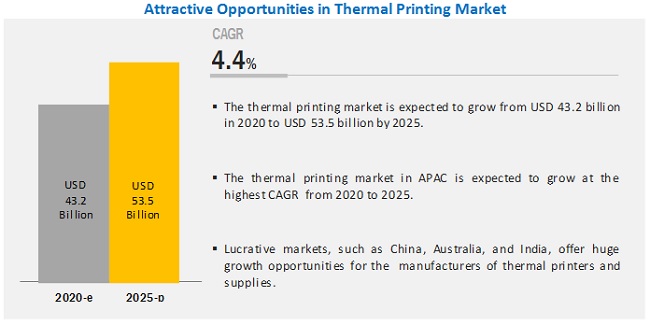

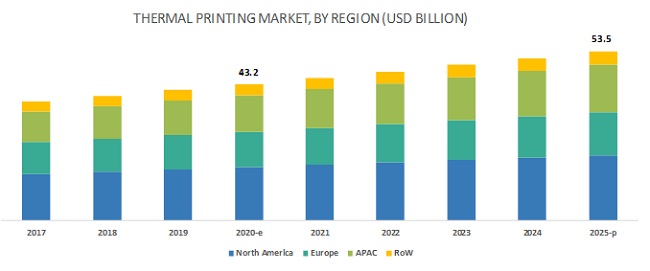

The thermal printing market is expected to grow from USD 43.2 billion in 2020 to USD 53.5 billion by 2025; it is expected to grow at a CAGR of 4.4% during the forecast period. Rising utilization of automatic identification and data capture technologies for improving productivity, increasing concerns regarding product safety and anti-counterfeiting, increasing use of thermal printing technology in latest on-demand printing applications, rising penetration of wireless technologies in mobile printers, and growing use of RFID and barcode thermal printers in the fast-growing e-commerce industry are the key driving factors for the thermal printing market.

Thermal printing market for healthcare & hospitality application to grow at highest CAGR during the forecast period

The healthcare & hospitality application is expected to witness the highest CAGR in the thermal printing market during the forecast period. The use of smart labels helps in the instant tracking of patients and medical equipment, whenever required, especially in emergencies. Thermal printers are widely used for printing labels and tags that are compatible with various processes in the healthcare application and help to improve patient flow, bed utilization, and asset allocation.

Barcode printers for thermal printer market to account for largest market share during the forecast period

The thermal printing market, by printer type, is segmented into barcode printers, POS printers, kiosk & ticket Printers, RFID printers, and card printers. Barcode printers segment is expected to lead the thermal printer market, in terms of size, during the forecast period. Thermal barcode printers are extensively used in small, medium, and large businesses to label and subsequently track the products to be shipped. This is one of the significant factors that has led to the leading position of barcode printers in the thermal printer market

North America in thermal printing market to account for the largest market share during the forecast period

North America is expected to account for the largest share of the thermal printing market during the forecast period. Among all applications, retail, transportation & logistics, manufacturing & industrial, and healthcare & hospitality are the major application areas in which thermal printers are used in the region. Several companies offering thermal printers and supplies have their presence in this region, which further adds to the growth of the market in North America. Zebra Technologies (US), Honeywell International (US), NCR Corporation (US), and Avery Dennison (US) are among a few of the providers of thermal printers having a presence in North America.

Key Market Players

Key players in the thermal printing market include Zebra Technologies (US), SATO Holdings (Japan), Seiko Epson (Japan), Star Micronics (Japan), and Honeywell International (US). Zebra Technologies is one of the leading players in the market and has over 35 years of experience and expertise in the field of printers. Strong brand name and broad product portfolio are two key factors resulting in the leading position of Zebra Technologies in the market. Apart from the strong brand name and product portfolio, the company also has strong R&D capabilities and geographic presence.

Scope of the Report

|

Report Attributes |

Details |

|

Market Size Value in 2020 |

USD 43.2 Billion |

| Revenue Forecast in 2025 | USD 53.5 Billion |

| Growth Rate | 4.4% |

| Base Year Considered | 2019 |

| Historical Data Available for Years | 2017–2025 |

|

Forecast Period |

2020–2025 |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Top Companies in North America |

|

| Largest Growing Region | North America |

| Largest Market Share Segment | Barcode Printers Segment |

| Highest CAGR Segment | Healthcare & Hospitality |

| Largest Application Market Share | Healthcare & Hospitality |

This research report categorizes the market based on offering, printer type, format type, printing technology, application, and region.

Thermal Printing Market, by Offering

- Printer

- Supplies

Thermal Printing Market, by Printer Type

- Barcode Printers

- POS Printers

- Kiosk & Ticket Printers

- RFID Printers

- Card Printers

Thermal Printing Market, by Format Type

- Industrial Format

- Desktop Format

- Mobile Format

Thermal Printing Market, by Printing Technology

- Direct Thermal (DT)

- Thermal Transfer (TT)

- Dye Diffusion Thermal Transfer (D2T2)

Thermal Printing Market, by Application

- Retail

- Transportation & Logistics

- Manufacturing & Industrial

- Healthcare & Hospitality

- Government

- Others

Thermal Printing Market, by Geography

- North America (US, Canada, and Mexico)

- Europe (UK, Germany, France, Italy, and Rest of Europe)

- APAC (China, Japan, Australia, India, and Rest of APAC)

- RoW (South America, and Middle East & Africa)

Recent Developments

- In January 2020, SATO Holdings (Japan) launched CL4NX Plus, a thermal industrial printer designed for durability and dependability in business-critical track and trace applications across the world.

- In September 2019, Toshiba America Business Solutions (US) launched its premium thermal barcode printer, which delivers high-resolution labels with precision and speed. Toshiba’s B-EX4T3HS prints 600 dots per inch at speeds up to six inches per second, and can print labels as small as 0.51 inches wide by 0.12 inches high.

- In January 2019, TSC Auto ID Technology (Taiwan) announced the acquisition of persified Labeling Solutions, Inc. (DLS, US), one of the leading labeling solutions providers. Under this acquisition, DLS will remain a separate entity, retain its name and brand, and maintain all of its current employees and executive leadership.

Critical questions answered by this report:

- Where will all these developments take the industry in the mid to long term?

- What are the emerging applications of thermal printers?

- How are advancements in retail, transportation & logistics, manufacturing & industrial, healthcare & hospitality, government, and other industries influencing the market?

- Which type of thermal printers is expected to penetrate significantly in the market?

- Which countries are expected to witness significant growth in the market?

Frequently Asked Questions (FAQ):

Which type of technology will be widely used in the thermal printer market?

In thermal printer market direct thermal printing technology is most widely used technology. Direct thermal printing technology is ideal for high-volume printing applications. This method is the easiest and most cost-effective solution for short-term applications and for labels meant for temporary use, such as shipping labels and food packaging labels. This is one of the major factors that has led to the leading position of the direct thermal printing technology in the thermal printer market.

Which region is expected to witness significant demand for thermal printers in the coming years?

North America currently accounts for the largest share of the thermal printing market, and a similar trend is likely to be observed in the coming years. Among all applications, retail, transportation & logistics, manufacturing & industrial, and healthcare & hospitality are the major application areas in which thermal printers are used in the region. Several companies offering thermal printers and supplies have their presence in this region, which further adds to the growth of the thermal printing market in North America.

Which are the major companies in the thermal printing market? What are their major strategies to strengthen their market presence?

Zebra Technologies (US), SATO Holdings (Japan), Seiko Epson (Japan), Star Micronics (Japan), and Honeywell International (US) are among the key players operating in the thermal printing market. The product launch strategy is one of the major strategies adopted by these players to grow in the thermal printing market.

Which type of thermal printers dominates in the thermal printer market?

Currently, barcode thermal printers dominates the thermal printer market, in terms of market size. Thermal barcode printers are extensively used in small, medium, and large businesses to label and subsequently track the products to be shipped. This is one of the major factors that has led to the leading position of barcode printers in the thermal printer market.

Which are the major applications of thermal printers?

Retail, transportation & logistics, manufacturing & industrial, and healthcare & hospitality are the major applications of thermal printers.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 16)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 19)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size by bottom-up analysis (demand side)

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis (supply side)

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 ASSUMPTIONS FOR RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 28)

4 PREMIUM INSIGHTS (Page No. - 32)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN THERMAL PRINTING MARKET

4.2 MARKET, BY OFFERING

4.3 MARKET IN APAC, BY COUNTRY AND APPLICATION

4.4 MARKET, BY APPLICATION

4.5 MARKET, BY COUNTRY (2019)

5 MARKET OVERVIEW (Page No. - 35)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rising utilization of automatic identification and data capture technologies for improving productivity

5.2.1.2 Growing concerns regarding product safety and anti-counterfeiting

5.2.1.3 Increasing use of thermal printing technology in latest on-demand printing applications

5.2.1.4 Rising penetration of wireless technologies in mobile printers

5.2.1.5 Growing use of RFID and barcode thermal printers in fast-growing e-commerce industry

5.2.2 RESTRAINTS

5.2.2.1 Poor image quality of barcode labels

5.2.2.2 Stringent printing regulations

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing adoption of thermal printers in healthcare industry

5.2.3.2 Growing use of thermal barcode printers in supply chain industry to accelerate market growth

5.2.4 CHALLENGES

5.2.4.1 Heat settings of thermal barcode printers

5.2.5 WINNING IMPERATIVE

5.2.5.1 Emergence of IoT technology for printing applications

5.3 VALUE CHAIN ANALYSIS

5.4 IMPACT OF COVID-19 ON THERMAL PRINTING MARKET

6 THERMAL PRINTING MARKET, BY OFFERING (Page No. - 42)

6.1 INTRODUCTION

6.2 PRINTERS

6.2.1 COMPONENTS OF THERMAL PRINTERS

6.2.1.1 Thermal heads

6.2.1.1.1 Printhead is vital printer component that creates image on face of media

6.2.1.2 Platens

6.2.1.2.1 Platen is key component of thermal printer, which is responsible for feeding paper into device

6.2.1.3 Springs

6.2.1.3.1 Spring presses thermal head to paper, causing chemical reaction in paper to print image

6.2.1.4 Controller boards

6.2.1.4.1 Controller board plays vital role of collaborating overall working of all components in thermal printer

6.3 SUPPLIES

6.3.1 DIRECT THERMAL SUPPLIES

6.3.1.1 Direct thermal supplies to continue to hold largest share of thermal printing supplies market during 2020–2025

6.3.2 THERMAL TRANSFER SUPPLIES

6.3.2.1 High durability, long shelf life, and protection against environmental conditions are key features of thermal transfer labels

6.3.3 DYE DIFFUSION THERMAL TRANSFER SUPPLIES

6.3.3.1 Dye diffusion thermal transfer method of thermal printing finds major uses in security, medical, and scientific, applications

7 THERMAL PRINTING MARKET, BY PRINTER TYPE (Page No. - 48)

7.1 INTRODUCTION

7.2 BARCODE PRINTERS

7.2.1 THERMAL BARCODE PRINTERS ARE WIDELY USED IN MANUFACTURING APPLICATIONS, AS THEY BENEFIT EVERY PROCESS OF MANUFACTURING, FROM DISTRIBUTION AND LOGISTICS TO INVENTORY TRACKING AND SHIPPING

7.3 POS PRINTERS

7.3.1 PRINTING CUSTOMER RECEIPTS AT RETAIL POS COUNTERS IS AMONG MAJOR APPLICATIONS OF POS PRINTERS

7.4 KIOSK AND TICKET PRINTERS

7.4.1 GROWING DEMAND FROM GOVERNMENT AND HEALTHCARE & HOSPITALITY APPLICATIONS TO DRIVE THERMAL KIOSK AND TICKET PRINTER MARKET

7.5 RFID PRINTERS

7.5.1 THERMAL RFID PRINTERS TO WITNESS HIGHEST GROWTH IN THERMAL PRINTER MARKET DURING FORECAST PERIOD

7.6 CARD PRINTERS

7.6.1 NORTH AMERICA TO DOMINATE IN THERMAL CARD PRINTER MARKET DURING FORECAST PERIOD

8 THERMAL PRINTING MARKET, BY FORMAT TYPE (Page No. - 61)

8.1 INTRODUCTION

8.2 INDUSTRIAL FORMAT PRINTERS

8.2.1 INDUSTRIAL FORMAT PRINTERS TO CONTINUE TO ACCOUNT FOR LARGEST SHARE OF THERMAL PRINTER MARKET DURING 2020–2025

8.3 DESKTOP FORMAT PRINTERS

8.3.1 RETAIL, HEALTHCARE, AND HOSPITALITY ARE AMONG KEY APPLICATION AREAS OF DESKTOP FORMAT THERMAL PRINTERS

8.4 MOBILE FORMAT PRINTERS

8.4.1 MOBILE FORMAT THERMAL PRINTERS ARE LIGHT IN WEIGHT, EASY TO USE, DURABLE, AND DELIVER RICH PRINT QUALITY

9 THERMAL PRINTING MARKET, BY PRINTING TECHNOLOGY (Page No. - 66)

9.1 INTRODUCTION

9.2 DIRECT THERMAL

9.2.1 POS PRINTERS ACCOUNTED FOR LARGEST SHARE OF THERMAL PRINTER MARKET FOR DIRECT THERMAL TECHNOLOGY IN 2019

9.3 THERMAL TRANSFER

9.3.1 BARCODE PRINTERS, POS PRINTERS, AND KIOSK & TICKET PRINTERS ARE MAJOR TYPES OF PRINTERS IN WHICH THERMAL TRANSFER TECHNOLOGY IS BEING USED

9.4 DYE DIFFUSION THERMAL TRANSFER

9.4.1 CARD PRINTERS TO ACCOUNT FOR LARGEST SIZE OF THERMAL PRINTER MARKET FOR DYE DIFFUSION THERMAL TRANSFER TECHNOLOGY DURING FORECAST PERIOD

10 THERMAL PRINTING MARKET, BY APPLICATION (Page No. - 73)

10.1 INTRODUCTION

10.2 RETAIL

10.2.1 GROWING DEMAND FOR RFID PRINTERS TO DRIVE THE MARKET FOR RETAIL APPLICATION

10.3 TRANSPORTATION AND LOGISTICS

10.3.1 ENHANCING YARD MANAGEMENT AND FLEET MANAGEMENT PROCESSES AND TRACKING ASSETS ARE A FEW KEY APPLICATIONS OF RFID THERMAL PRINTERS

10.4 MANUFACTURING AND INDUSTRIAL

10.4.1 THERMAL-PRINTED BARCODE SOLUTIONS HELP IN END-TO-END TRACEABILITY AND QUALITY CONTROL IN MANUFACTURING & INDUSTRIAL ENVIRONMENT

10.5 HEALTHCARE AND HOSPITALITY

10.5.1 PATIENT ID TRACKING, SPECIMEN/BLOOD LABELLING, MEDICATION TRACKING, STAFF ID AND ACCESS CONTROL, HEALTHCARE MATERIALS MANAGEMENT, AND WORKFLOW AUTOMATION ARE A FEW KEY APPLICATIONS OF THERMAL PRINTERS IN HEALTHCARE INDUSTRY

10.6 GOVERNMENT

10.6.1 INITIATIVES TAKEN BY US GOVERNMENT TO INCREASE SAFETY AND SECURITY IS AMONG KEY FACTORS LEADING TO HIGH DEMAND FOR THERMAL PRINTERS IN NORTH AMERICA

10.7 OTHERS

11 GEOGRAPHIC ANALYSIS (Page No. - 85)

11.1 INTRODUCTION

11.2 NORTH AMERICA

11.2.1 US

11.2.1.1 US to continue to account for largest share of North American market during 2020–2025

11.2.2 CANADA

11.2.2.1 Rapid growth of E-Commerce, IT, retail, and manufacturing industries is expected to propel market in Canada

11.2.3 MEXICO

11.2.3.1 Mexico to witness highest growth in market in North America during forecast period

11.3 EUROPE

11.3.1 UK

11.3.1.1 Increasing adoption of thermal printing solutions in healthcare and manufacturing sectors in

UK is among major factors driving growth of market in UK

11.3.2 GERMANY

11.3.2.1 Increasing demand from automotive industry positively impacts market in Germany

11.3.3 FRANCE

11.3.3.1 France to witness highest growth in market in Europe during forecast period

11.3.4 ITALY

11.3.4.1 Barcode printers and POS printers are major printer types in thermal printer market in Italy

11.3.5 REST OF EUROPE

11.4 APAC

11.4.1 CHINA

11.4.1.1 China to continue to account for largest share of APAC market in 2025

11.4.2 JAPAN

11.4.2.1 Healthcare, hospitality, retail, automobile, and transportation are key industries in Japanese market

11.4.3 AUSTRALIA

11.4.3.1 Australia to witness significant growth in the market in APAC

11.4.4 INDIA

11.4.4.1 Increasing demand for thermal printers from retail and manufacturing & industrial segments is boosting growth of market in India

11.4.5 REST OF APAC

11.5 ROW

11.5.1 MIDDLE EAST AND AFRICA

11.5.1.1 Retail and manufacturing industries are boosting demand for thermal printers in Middle East and Africa

11.5.2 SOUTH AMERICA

11.5.2.1 Increasing industrialization and rising penetration of retail, entertainment, and government applications are expected to drive demand for thermal printers in South America

12 COMPETITIVE LANDSCAPE (Page No. - 102)

12.1 OVERVIEW

12.2 MARKET RANKING ANALYSIS: THERMAL PRINTER MARKET

12.3 COMPETITIVE LEADERSHIP MAPPING

12.3.1 VISIONARY LEADERS

12.3.2 INNOVATORS

12.3.3 DYNAMIC DIFFERENTIATORS

12.3.4 EMERGING COMPANIES

12.4 STRENGTH OF PRODUCT PORTFOLIO

12.5 BUSINESS STRATEGY EXCELLENCE

12.6 COMPETITIVE SITUATIONS AND TRENDS

12.6.1 PRODUCT LAUNCHES

12.6.2 EXPANSIONS AND ACQUISITIONS

12.6.3 PARTNERSHIPS AND COLLABORATIONS

13 COMPANY PROFILES (Page No. - 109)

13.1 KEY PLAYERS

13.1.1 ZEBRA TECHNOLOGIES

(Business overview, Products offered, Recent developments, SWOT analysis, and MnM view)*

13.1.2 SATO HOLDINGS

13.1.3 SEIKO EPSON

13.1.4 STAR MICRONICS

13.1.5 HONEYWELL INTERNATIONAL

13.1.6 BIXOLON

13.1.7 FUJITSU

13.1.8 BROTHER INDUSTRIES

13.1.9 TOSHIBA TEC

13.1.10 TSC AUTO ID TECHNOLOGY

13.2 OTHER COMPANIES

13.2.1 NCR CORPORATION

13.2.2 AVERY DENNISON

13.2.3 CITIZEN SYSTEMS

13.2.4 JADAK

13.2.5 RONGTA TECHNOLOGY (XIAMEN) GROUP

13.2.6 PROMACH

13.2.7 COGNITIVETPG

13.2.8 SHINMEI

13.2.9 SEIKO INSTRUMENTS

13.2.10 AXIOHM

*Details on Business overview, Products offered, Recent developments, SWOT analysis, and MnM view might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 139)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

LIST OF TABLES (64 Tables)

TABLE 1 THERMAL PRINTING MARKET, BY OFFERING, 2017–2025 (USD BILLION)

TABLE 2 THERMAL PRINTING MARKET FOR SUPPLIES, BY TYPE, 2017–2025 (USD BILLION)

TABLE 3 THERMAL PRINTER MARKET, BY PRINTER TYPE, 2017–2025 (USD MILLION)

TABLE 4 THERMAL PRINTER MARKET, BY PRINTER TYPE, 2017–2025 (THOUSAND UNITS)

TABLE 5 THERMAL PRINTER MARKET FOR BARCODE PRINTERS, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 6 THERMAL PRINTER MARKET FOR BARCODE PRINTERS, BY PRINTING TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 7 THERMAL PRINTER MARKET FOR BARCODE PRINTERS, BY REGION, 2017–2025 (USD MILLION)

TABLE 8 THERMAL PRINTER MARKET FOR POS PRINTERS, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 9 THERMAL PRINTER MARKET FOR POS PRINTERS, BY PRINTING TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 10 THERMAL PRINTER MARKET FOR POS PRINTERS, BY REGION, 2017–2025 (USD MILLION)

TABLE 11 THERMAL PRINTER MARKET FOR KIOSK AND TICKET PRINTERS, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 12 THERMAL PRINTER MARKET FOR KIOSK AND TICKET PRINTERS, BY PRINTING TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 13 THERMAL PRINTER MARKET FOR KIOSK AND TICKET PRINTERS, BY REGION, 2017–2025 (USD MILLION)

TABLE 14 THERMAL PRINTER MARKET FOR RFID PRINTERS, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 15 THERMAL PRINTER MARKET FOR RFID PRINTERS, BY PRINTING TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 16 THERMAL PRINTER MARKET FOR RFID PRINTERS, BY REGION, 2017–2025 (USD MILLION)

TABLE 17 THERMAL PRINTER MARKET FOR CARD PRINTERS, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 18 THERMAL PRINTER MARKET FOR CARD PRINTERS, BY PRINTING TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 19 THERMAL PRINTER MARKET FOR CARD PRINTERS, BY REGION, 2017–2025 (USD MILLION)

TABLE 20 THERMAL PRINTER MARKET, BY FORMAT TYPE, 2017–2025 (USD BILLION)

TABLE 21 INDUSTRIAL FORMAT THERMAL PRINTER MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 22 DESKTOP FORMAT THERMAL PRINTER MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 23 MOBILE FORMAT THERMAL PRINTER MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 24 ADVANTAGES AND DISADVANTAGES OF THERMAL PRINTING TECHNOLOGIES

TABLE 25 THERMAL PRINTER MARKET, BY PRINTING TECHNOLOGY, 2017–2025 (USD BILLION)

TABLE 26 THERMAL PRINTER MARKET FOR DIRECT THERMAL TECHNOLOGY, BY PRINTER TYPE, 2017–2025 (USD MILLION)

TABLE 27 THERMAL PRINTER MARKET FOR THERMAL TRANSFER, BY PRINTER TYPE, 2017–2025 (USD MILLION)

TABLE 28 THERMAL PRINTER MARKET FOR DYE DIFFUSION THERMAL TRANSFER, BY PRINTER TYPE, 2017–2025 (USD MILLION)

TABLE 29 THERMAL PRINTING MARKET, BY APPLICATION, 2017–2025 (USD BILLION)

TABLE 30 THERMAL PRINTING MARKET FOR RETAIL, BY REGION, 2017–2025 (USD BILLION)

TABLE 31 THERMAL PRINTER MARKET FOR RETAIL, BY PRINTER TYPE, 2017–2025 (USD MILLION)

TABLE 32 MARKET FOR TRANSPORTATION AND LOGISTICS, BY REGION, 2017–2025 (USD BILLION)

TABLE 33 THERMAL PRINTER MARKET FOR TRANSPORTATION AND LOGISTICS, BY PRINTER TYPE, 2017–2025 (USD MILLION)

TABLE 34 MARKET FOR MANUFACTURING AND INDUSTRIAL, BY REGION, 2017–2025 (USD BILLION)

TABLE 35 THERMAL PRINTER MARKET FOR MANUFACTURING AND INDUSTRIAL, BY PRINTER TYPE, 2017–2025 (USD MILLION)

TABLE 36 MARKET FOR HEALTHCARE & HOSPITALITY, BY REGION, 2017–2025 (USD BILLION)

TABLE 37 THERMAL PRINTER MARKET FOR HEALTHCARE & HOSPITALITY, BY PRINTER TYPE, 2017–2025 (USD MILLION)

TABLE 38 MARKET FOR GOVERNMENT APPLICATION, BY REGION, 2017–2025 (USD MILLION)

TABLE 39 THERMAL PRINTER MARKET FOR GOVERNMENT APPLICATION, BY PRINTER TYPE, 2017–2025 (USD MILLION)

TABLE 40 MARKET FOR OTHER APPLICATIONS, BY REGION, 2017–2025 (USD MILLION)

TABLE 41 THERMAL PRINTER MARKET FOR OTHER APPLICATIONS, BY PRINTER TYPE, 2017–2025 (USD MILLION)

TABLE 42 THERMAL PRINTING MARKET, BY REGION, 2017–2025 (USD BILLION)

TABLE 43 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD BILLION)

TABLE 44 MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2025 (USD BILLION)

TABLE 45 MARKET IN NORTH AMERICA, BY OFFERING, 2017–2025 (USD BILLION)

TABLE 46 THERMAL PRINTER MARKET IN NORTH AMERICA, BY PRINTER TYPE, 2017–2025 (USD MILLION)

TABLE 47 THERMAL PRINTER MARKET IN NORTH AMERICA, BY FORMAT TYPE, 2017–2025 (USD MILLION)

TABLE 48 MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD BILLION)

TABLE 49 MARKET IN EUROPE, BY APPLICATION, 2017–2025 (USD BILLION)

TABLE 50 MARKET IN EUROPE, BY OFFERING, 2017–2025 (USD BILLION)

TABLE 51 THERMAL PRINTER MARKET IN EUROPE, BY PRINTER TYPE, 2017–2025 (USD MILLION)

TABLE 52 THERMAL PRINTER MARKET IN EUROPE, BY FORMAT TYPE, 2017–2025 (USD MILLION)

TABLE 53 MARKET IN APAC, BY COUNTRY, 2017–2025 (USD BILLION)

TABLE 54 MARKET IN APAC, BY APPLICATION, 2017–2025 (USD BILLION)

TABLE 55 MARKET IN APAC, BY OFFERING, 2017–2025 (USD BILLION)

TABLE 56 THERMAL PRINTER MARKET IN APAC, BY PRINTER TYPE, 2017–2025 (USD MILLION)

TABLE 57 THERMAL PRINTER MARKET IN APAC, BY FORMAT TYPE, 2017–2025 (USD MILLION)

TABLE 58 MARKET IN ROW, BY REGION, 2017–2025 (USD BILLION)

TABLE 59 MARKET IN ROW, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 60 THERMAL PRINTER MARKET IN ROW, BY PRINTER TYPE, 2017–2025 (USD MILLION)

TABLE 61 THERMAL PRINTER MARKET IN ROW, BY FORMAT TYPE, 2017–2025 (USD MILLION)

TABLE 62 PRODUCT LAUNCHES, 2019–2020

TABLE 63 EXPANSIONS AND ACQUISITIONS, 2018–2019

TABLE 64 PARTNERSHIPS AND COLLABORATION, 2019–2020

LIST OF FIGURES (53 Figures)

FIGURE 1 THERMAL PRINTING MARKET SEGMENTATION

FIGURE 2 PROCESS FLOW: MARKET SIZE ESTIMATION

FIGURE 3 THERMAL PRINTER MARKET: RESEARCH DESIGN

FIGURE 4 THERMAL PRINTER MARKET: BOTTOM-UP APPROACH

FIGURE 5 THERMAL PRINTER MARKET: TOP-DOWN APPROACH

FIGURE 6 DATA TRIANGULATION

FIGURE 7 THERMAL PRINTING MARKET, 2017–2025 (USD BILLION)

FIGURE 8 BARCODE PRINTERS TO ACCOUNT FOR SIGNIFICANT MARKET SIZE DURING FORECAST PERIOD

FIGURE 9 DIRECT THERMAL SEGMENT TO HOLD LARGEST SIZE OF THERMAL PRINTER MARKET, BY PRINTING TECHNOLOGY, IN 2025

FIGURE 10 HEALTHCARE & HOSPITALITY IS EXPECTED TO BE FASTEST-GROWING APPLICATION IN MARKET DURING FORECAST PERIOD

FIGURE 11 NORTH AMERICA CAPTURED LARGEST SHARE OF MARKET IN 2019

FIGURE 12 INCREASING ADOPTION OF THERMAL PRINTING TECHNOLOGY IN APAC DRIVING MARKET GROWTH

FIGURE 13 MARKET FOR SUPPLIES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 14 RETAIL APPLICATION AND CHINA TO BE LARGEST SHAREHOLDERS IN MARKET IN APAC IN 2025

FIGURE 15 MARKET FOR HEALTHCARE AND HOSPITALITY APPLICATION TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 16 US HELD LARGEST SHARE OF MARKET IN 2019

FIGURE 17 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 18 E-COMMERCE SALES WORLDWIDE (2017–2023)

FIGURE 19 VALUE CHAIN ANALYSIS: MANUFACTURING AND ASSEMBLY PHASE CONTRIBUTES MAJOR VALUE

FIGURE 20 MARKET SEGMENTATION, BY OFFERING

FIGURE 21 SUPPLIES SEGMENT TO HOLD LARGER SIZE OF MARKET IN 2025

FIGURE 22 DIRECT THERMAL SUPPLIES SEGMENT TO WITNESS HIGHEST CAGR IN THERMAL PRINTING SUPPLIES MARKET DURING FORECAST PERIOD

FIGURE 23 THERMAL PRINTER MARKET SEGMENTATION, BY PRINTER TYPE

FIGURE 24 BARDCODE PRINTERS TO HOLD LARGEST SIZE OF THERMAL PRINTER MARKET IN 2025

FIGURE 25 MANUFACTURING & INDUSTRIAL APPLICATION TO WITNESS HIGHEST CAGR IN THERMAL POS PRINTER MARKET DURING FORECAST PERIOD

FIGURE 26 DIRECT THERMAL (DT) TECHNOLOGY TO HOLD LARGEST SIZE OF THERMAL RFID PRINTER MARKET IN 2025

FIGURE 27 THERMAL PRINTER MARKET SEGMENTATION, BY FORMAT TYPE

FIGURE 28 INDUSTRIAL FORMAT SEGMENT TO HOLD LARGEST SIZE OF THERMAL PRINTER MARKET IN 2025

FIGURE 29 THERMAL PRINTER MARKET SEGMENTATION, BY PRINTING TECHNOLOGY

FIGURE 30 DIRECT THERMAL SEGMENT TO WITNESS HIGHEST GROWTH IN THERMAL PRINTER MARKET DURING FORECAST PERIOD

FIGURE 31 RFID PRINTERS TO WITNESS HIGHEST GROWTH IN THERMAL PRINTER MARKET FOR THERMAL TRANSFER DURING FORECAST PERIOD

FIGURE 32 MARKET SEGMENTATION, BY APPLICATION

FIGURE 33 RETAIL APPLICATION TO HOLD LARGEST SIZE OF MARKET IN 2025

FIGURE 34 APAC TO WITNESS HIGHEST GROWTH IN MARKET FOR MANUFACTURING & INDUSTRIAL APPLICATION DURING FORECAST PERIOD

FIGURE 35 NORTH AMERICA TO DOMINATE THE MARKET FOR GOVERNMENT APPLICATION IN 2025

FIGURE 36 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL MARKET DURING FORECAST PERIOD

FIGURE 37 SNAPSHOT OF MARKET IN NORTH AMERICA

FIGURE 38 SNAPSHOT OF MARKET IN EUROPE

FIGURE 39 SNAPSHOT OF MARKET IN APAC

FIGURE 40 MARKET RANKING OF KEY PLAYERS IN MARKET, 2019

FIGURE 41 THERMAL PRINTING MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 42 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET

FIGURE 43 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MARKET

FIGURE 44 ZEBRA TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 45 SATO HOLDINGS: COMPANY SNAPSHOT

FIGURE 46 SEIKO EPSON: COMPANY SNAPSHOT

FIGURE 47 STAR MICRONICS: COMPANY SNAPSHOT

FIGURE 48 HONEYWELL INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 49 BIXOLON: COMPANY SNAPSHOT

FIGURE 50 FUJITSU: COMPANY SNAPSHOT

FIGURE 51 BROTHER INDUSTRIES: COMPANY SNAPSHOT

FIGURE 52 TOSHIBA TEC: COMPANY SNAPSHOT

FIGURE 53 TSC AUTO ID TECHNOLOGY: COMPANY SNAPSHOT

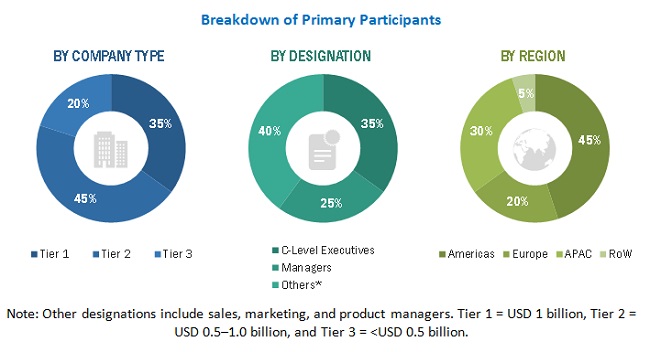

The study involved four major activities in estimating the current size of the thermal printing market. Exhaustive secondary research was done to collect information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were employed to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include thermal printing technology journals and magazines, IEEE journals; annual reports, press releases, and investor presentations of companies; white papers; certified publications and articles from recognized authors; and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the thermal printing market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as to verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the thermal printing market and other dependent submarkets listed in this report.

- Key players in the industry and markets have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends identified from both demand and supply sides in retail, transportation & logistics, manufacturing & industrial, healthcare & hospitality, and government applications among others.

Report Objectives

The following are the primary objectives of the study.

- To describe and forecast the thermal printing market, in terms of value, by offering and application

- To describe and forecast the thermal printing market, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To describe and forecast the thermal printer market, in terms of value, by printer type, format type, printing technology, application

- To forecast the thermal printer market based on printer type, in terms of volume

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges that influence the market growth

- To provide a detailed overview of the thermal printing value chain

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To profile key players and comprehensively analyze their ranking based on their revenues and core competencies, along with detailed competitive landscape for the market leaders

- To analyze competitive developments such as product launches, expansions, acquisitions, collaborations, partnerships, and research and development (R&D) in the thermal printing market

- To benchmark players within the market using competitive leadership mapping, which analyzes market players on various parameters within the broad categories of business strategies and product offerings

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Country-Wise Information:

- Detailed analysis of various printer types, format types, and applications for each country

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Thermal Printing Market