Automotive Acoustic Engineering Services Market by Process (Design, Development, Test), Software (Calibration, Signal Analysis, Simulation, Vibration), Offering (Physical, Virtual), Application, Vehicle Type (ICE, Electric) & Region-Global Forecast to 2025

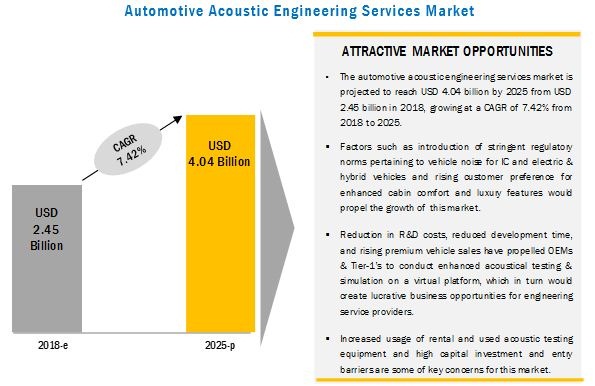

[141 Pages Report] The global automotive acoustic engineering services market size was valued at USD 2.26 billion in 2017 and is estimated to reach USD 4.04 billion by 2025, registering a CAGR of 7.42%. Factors such as the increasing demand for mid-sized & premium vehicles, growing stringency in vehicular noise regulation, rising demand for interior cabin comfort & luxury features, and need to reduce R&D expenses have resulted in the growth of automotive acoustic engineering services.

Years considered for this report:

- 2017 – Base Year

- 2018 – Estimated Year

- 2018–2025 – Forecast Period

Strict noise regulations for ICE, electric & hybrid vehicles and rising sales of premium & sport utility vehicles (SUV)/multi utility vehicles (MUV) have fueled the demand for acoustic engineering services and boosted the global acoustic engineering services market for automotive application.

The automotive acoustic engineering services include processes such as designing, development, testing, and simulation of sound originating from the engine, transmission, other auto components, and overall vehicle to bring the interior cabin noise within the permissible range. These processes usually measure the pass-by noise and stationary noise to achieve a satisfactory result for the vehicle. Acoustic engineering and testing services are carried out for different applications such as the powertrain, drivetrain, body interior, and exterior to control and minimize the noise level of the vehicle.

Ongoing expansions, collaborations, joint ventures, partnerships, and acquisitions by leading engineering service providers are likely to propel the growth of this market, especially in the developing and untapped markets. On the other hand, high capital investment and entry barriers make it difficult for a new player to enter the market and gain business opportunities from OEMs and Tier 1 suppliers that have already partnered with established engineering services providers.

Market Dynamics

Drivers

- Government regulations pertaining to vehicle noise

-

Rising customer preference for enhanced cabin comfort and luxury features

- Increase in the sales of premium vehicles

- Rising sales of Sport Utility Vehicles (SUV)/Multi Utility Vehicles (MUV)

Restraints

- Increased usage of rental and used acoustic testing equipment

- High capital investment and entry barriers

Opportunities

- Rising trend of engine downsizing

Challenges

- Acoustical challenge for electric vehicles

Objectives of the study

- To define, describe, and forecast the automotive acoustic engineering services market with respect to individual growth trends and prospects and segment the total market into further sub-segments

- To analyze and forecast the country-level market size, by value, of the automotive acoustic engineering services based on process

- To analyze and forecast the regional market size, by value, of the automotive acoustic engineering services based on offering

- To analyze and forecast the regional market size, by value, of the market based on software

- To analyze and forecast the regional market size, by value, of the market based on application

- To analyze and forecast the country-level market size, by value, of the market based on vehicle type

- To identify the market dynamics and analyze their impact on the global market

A top- down approach has been used to estimate and validate the size of this market. The global automotive acoustic engineering services market size is estimated with the help of secondary research and then validated through primary interviews with the key market players. The market is further segmented into processes such as designing, development, and testing. The percentage penetration of each process is derived by using the primary and secondary data research. Further, the regional and country-level penetrations for each process are derived from secondary research and validated through multiple primary interviews to get the regional and country level market, by process. Alternatively, a certain percentage of segmental revenue for key market players such as Schaeffler, AVL, Siemens, EDAG Engineering, Bertrandt, FEV, and Continental has been taken into consideration to triangulate this market.

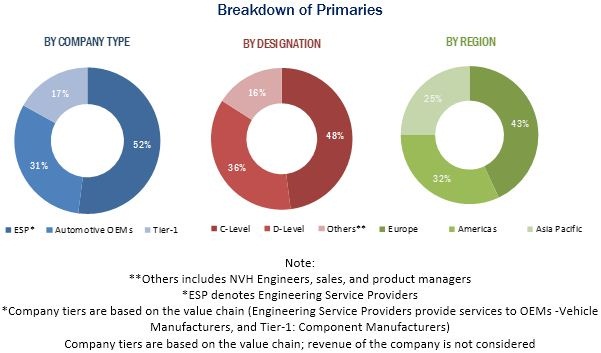

The figure given below shows the breakup of the profile of industry experts that participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

Critical Questions which the report answers:

- Designing process is estimated to hold the largest share as it ensures vehicle system acoustical accuracy and helps to go ahead with the development of the actual product. What are the other factors that would drive the market during the next 7 years?

- What are the future trends and market share of different software such as calibration, signal analysis, simulation, and vibration during the forecast period?

- How are the industry players addressing the challenge of minimum sound requirement for electric & hybrid vehicles?

Target AudiencE

- Automotive acoustic simulation service providers

- Automotive acoustic testing & engineering services providers

- Acoustic testing equipment suppliers

- Automotive Original Equipment Manufacturers (OEMs)

- Regional manufacturing associations and automobile associations

- Regional vehicle noise regulatory authorities

- Tier-I component/system manufacturers

Scope of the Report

Automotive Acoustic Engineering Services Market, By Process

- Designing

- Development

- Testing

Automotive Acoustic Engineering Services Market, By Offering

- Physical

- Virtual

Automotive Acoustic Engineering Services Market, By Software

- Calibration

- Signal Analysis

- Simulation

- Vibration

- Others

Automotive Acoustic Engineering Services Market, By Application

- Drivetrain

- Powertrain

- Body & Structure

- Interior

- Others

Automotive Acoustic Engineering Services Market, By Vehicle type

- Light-Duty Vehicle

- Heavy-Duty Vehicle

- Electric & Hybrid Vehicle

Automotive Acoustic Engineering Services Market, By Region & Country

- Asia Pacific

- EMEA

- Americas

Available customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Automotive Acoustic Engineering Services Application Market, By Vehicle Type

- Light Duty Vehicles

- Heavy Duty Vehicles

- Electric & Hybrid Vehicles

Note: The market can be offered for vehicle type- Light Duty vehicles, Heavy Duty vehicle, and Electric & Hybrid vehicles by application (drivetrain, powertrain, body & structure, interior, and other) at regional level- Americas, EMEA, and Asia Pacific.

Automotive Acoustic Engineering Services Offering Market, By Vehicle Type

- Light Duty Vehicles

- Heavy Duty Vehicles

- Electric & Hybrid Vehicles

Note: The market can be offered for vehicle type- Light Duty vehicles, Heavy Duty vehicle, and Electric & Hybrid vehicles by offering (physical & virtual) at regional level- Americas, EMEA, and Asia Pacific.

Detailed Analysis and Profiling of Additional Market Players (Up to 3)

The automotive acoustic engineering services market is projected to reach USD 4.04 billion by 2025 from USD 2.45 billion in 2018, at a CAGR of 7.42% during the forecast period. Increasing demand for optimum acoustical performance in passenger cars and SUV/MPV segments and rising sales of premium vehicles equipped with luxury & comfort features are expected to drive this market during the forecast period.

Simulation software is projected to be the largest and fastest growing market during the review period. Main advantages associated with simulation are enhanced acoustical testing & measurement, reduced R&D cost, multiple testing options, and reduced development time. Also, the introduction of artificial intelligence in simulation helps to understand the actual behavior of a component in the most appropriate manner. Engineering service providers such as Siemens, AVL, Schaeffler, Bertrandt, and IAV provide simulation services for automotive components and vehicle assembly. Thus, continuous increase in R&D activities and rising need of process optimization have led to improvements in simulation. Improved simulation software has become a prime requirement that would drive the demand for simulation software in the coming years.

The automotive engineering services market for the interior application is anticipated to grow at the fastest rate during the forecast period. The growth of this segment can be attributed to the increased demand for enhanced comfort and silent cabin among customers. Dashboard, HVAC system, gearbox, trunk panel, and infotainment are various sources of acoustic disturbances that can originate inside the cabin. Other secondary noise sources such as tires, door interiors, roof & floor, and trunk panels also add to the interior cabin noise. The vehicle acoustic engineering service providers offer virtual and physical testing & simulation of all components/systems in the cabin and improve the interior cabin acoustical performance. Hence, the increasing stringency of norms for vehicle and passenger safety and deployment of advanced features would prompt the addition of new components in the cabin, which in turn will make the interior cabin more complex and accentuate the need to improve acoustic performance of interior components.

The acoustic engineering services market for electric & hybrid vehicles is expected to grow at the fastest rate from 2018 to 2025. The presence of an alternate powertrain brings new sources of noise such as the motor, HVAC, battery, tires, and several other low decibel (dB(A)) noise from brake, acoustics, wind, squeaks, and rattle sounds from the vehicle that need to be addressed to improve the acoustical performance. Further, new legislative guidelines for electric and hybrid vehicles with respect to minimum noise requirement have changed the dynamics of acoustic engineering of these vehicles. As defined by NHTSA laws published in January 2013, electric & hybrid vehicles must have a minimum exterior sound requirement of 63.8 to 68.9 dB(A) while running at a speed of 30 kmph. This sound should be loud enough to be audible to a visually impaired person when the vehicle passes nearby. Hence, the vehicular noise refinement and the minimum sound requirement by the legal authorities would drive the electric and hybrid vehicle acoustic engineering services market.

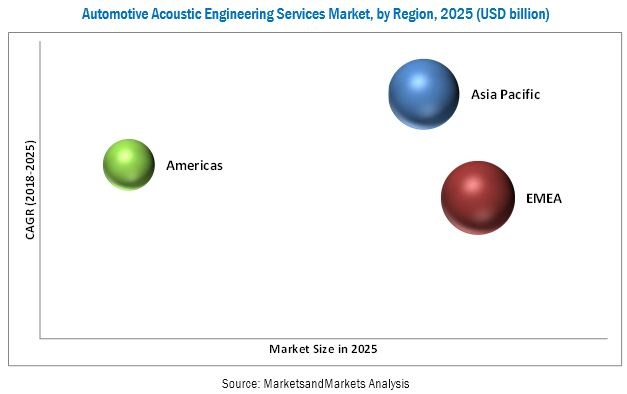

EMEA is estimated to be the largest market for automotive acoustic engineering services. A majority of engineering services providers, which are based in Europe, provide physical as well as virtual acoustic testing and engineering of automotive components and vehicle assembly to meet the requirement of regional and foreign OEMs and tier-1 suppliers. Also, premium vehicle manufacturers in Europe such as Volkswagen, BMW, Volvo, Mercedes-Benz, and Porsche are increasingly focusing on acoustic engineering of their vehicle models. Therefore, ESPs are expanding their network within Europe in proximity to these OEMs. In September 2016, EDAG opened a new development center with an area of ~25,000 m2 at Warmenau facility in Wolfsburg, Germany. This facility is located in the vicinity of Volkswagen and can accommodate up to 1,100 engineering experts. More such expansions are expected to happen in the future to meet the rising demand for automotive acoustic engineering services in the region.

The high capital investment and entry barriers & increased usage of rental and used acoustic testing equipment are the key restraints for this market. Also, new regulations for electric vehicles regarding minimum sound requirement and keeping the noise from other auxiliary sources within the permissible range pose a challenge for the market. These factors may affect the growth of the automotive acoustic engineering services market in the near future.

Some of the key players in the automotive engineering services market are AVL (Austria), Siemens PLM (US), Bertrandt (Germany), EDAG Engineering (Germany), Schaeffler (Germany), FEV (Germany), Continental (Germany), IAV (Germany), and Autoneum (Switzerland). AVL adopted collaboration as a key strategy to retain its market position, while Siemens PLM followed the expansion and new product launch strategies to remain a prominent player in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources for Vehicle Production

2.2.2 Key Secondary Sources for Market Sizing

2.2.3 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Size Estimation

2.4.1 Top-Down Approach

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 32)

4.1 Automotive Acoustic Engineering Services – Global Market & Forecast

4.2 Market, By Region

4.3 Market, By Process

4.4 Market, By Offering

4.5 Market, By Software

4.6 Market, By Application

4.7 Market, By Vehicle Type

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Government Regulations Pertaining to Vehicle Noise

5.2.1.2 Rising Customer Preference for Enhanced Cabin Comfort and Luxury Features

5.2.1.2.1 Increase in the Sales of Premium Vehicles

5.2.1.2.2 Rising Sales of Sport Utility Vehicles (Suv)/Multi Utility Vehicles (Muv)

5.2.2 Restraints

5.2.2.1 Increased Usage of Rental and Used Acoustic Testing Equipment

5.2.2.2 High Capital Investment and Entry Barriers

5.2.3 Opportunities

5.2.3.1 Rising Trend of Engine Downsizing

5.2.4 Challenges

5.2.4.1 Acoustical Challenge for Electric Vehicles

6 Automotive Acoustic Engineering Services Market, By Process (Page No. - 45)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, EMEA, and Americas.

6.1 Introduction

6.2 Designing

6.3 Development

6.4 Testing

7 Automotive Acoustic Engineering Services Market, By Offering (Page No. - 50)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, EMEA, and Americas.

7.1 Introduction

7.2 Physical Acoustic Testing

7.3 Virtual Acoustic Testing

8 Automotive Acoustic Engineering Services Market, By Software (Page No. - 54)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, EMEA, and Americas.

8.1 Introduction

8.2 Calibration

8.3 Signal Analysis

8.4 Simulation

8.5 Vibration

8.6 Others

9 Automotive Acoustic Engineering Service Market, By Application (Page No. - 60)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, EMEA, and Americas.

9.1 Introduction

9.2 Drivetrain

9.3 Powertrain

9.4 Body & Structure

9.5 Interior

9.6 Others

10 Automotive Acoustic Engineering Services Market, By Vehicle Type (Page No. - 67)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, EMEA, and Americas.

10.1 Introduction

10.2 Light-Duty Vehicles (LDV)

10.3 Heavy-Duty Vehicles (HDV)

10.4 Electric & Hybrid Vehicles

11 Automotive Acoustic Engineering Services Market, By Region (Page No. - 73)

Note - The Chapter is Further Segmented By Process (Designing, Development & Testing), and By Vehicle Type (LDV, HDV & Electric & Hybrid Vehicle) at Country and Regional Level.

11.1 Introduction

11.2 Asia Pacific

11.2.1 China

11.2.2 India

11.2.3 Japan

11.2.4 South Korea

11.2.5 Thailand

11.2.6 Asia Pacific Others

11.3 Europe, Middle East & Africa

11.3.1 France

11.3.2 Germany

11.3.3 Spain

11.3.4 Russia

11.3.5 Sweden

11.3.6 UK

11.3.7 EMEA Others

11.4 Americas

11.4.1 Brazil

11.4.2 Canada

11.4.3 Mexico

11.4.4 US

11.4.5 Americas Others

12 Competitive Landscape (Page No. - 99)

12.1 Overview

12.2 Automotive Acoustic Engineering Services Market: Market Ranking Analysis

12.3 Competitive Scenario

12.3.1 Expansions

12.3.2 Joint Ventures/Collaborations/Partnerships

12.3.3 New Product Developments

12.3.4 Mergers & Acquisitions

13 Company Profile (Page No. - 105)

(Overview, Products & Services, Recent Developments, Swot Analysis)* (Page No. - )

13.1 AVL GmbH

13.2 Siemens PLM Software

13.3 Bertrandt

13.4 EDAG Engineering

13.5 Schaeffler

13.6 FEV

13.7 Continental

13.8 IAV

13.9 Autoneum

13.10 STS Group

13.11 Head Acoustics

13.12 Brüel & Kjær

13.13 Additional Company Profiling

13.13.1 Europe

13.13.1.1 Iac Acoustics

13.13.1.2 AZL

13.13.1.3 M+P International

13.13.1.4 Adler Pelzer

13.13.1.5 Quiet Acoustic Engineering

13.13.1.6 Vibratec

13.13.2 Asia Pacific

13.13.2.1 Tata Consultancy Services

13.13.2.2 Infosys

13.13.3 Americas

13.13.3.1 Data Physics Corporation

13.13.3.2 Signal.X Technologies

*Details on Overview, Products Offerings, Recent Developments & Swot Analysis are Captured in Case of Listed Companies Only. (Page No. - )

14 Appendix (Page No. - 133)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customizations

14.4.1 Automotive Acoustic Engineering Services Application Market,

By Vehicle Type 139

Note: The Market Can Be Offered for Vehicle Type- Light Duty Vehicles, Heavy Duty Vehicle, and Electric & Hybrid Vehicles By Application (Drivetrain, Powertrain, Body & Structure, Interior, and Other) at Regional Level- Americas, EMEA, and Asia Pacific.

14.4.1.1 Light Duty Vehicles

14.4.1.2 Heavy Duty Vehicles

14.4.1.3 Electric & Hybrid Vehicles

14.4.2 Automotive Acoustic Engineering Services Offering Market,

By Vehicle Type 139

Note: The Market Can Be Offered for Vehicle Type- Light Duty Vehicles, Heavy Duty Vehicle, and Electric & Hybrid Vehicles By Offering (Physical & Virtual) at Regional Level- Americas, EMEA, and Asia Pacific.

14.4.2.1 Light Duty Vehicles

14.4.2.2 Heavy Duty Vehicles

14.4.2.3 Electric & Hybrid Vehicles

14.4.3 Detailed Analysis and Profiling of Additional Market Players (Upto 3)

14.5 Related Reports

14.6 Author Details

List of Tables (72 Tables)

Table 1 Currency Exchange Rates (W.R.T. Per USD)

Table 2 Different Government Associations Responsible for Vehicle Noise Limits

Table 3 Average Rental Cost of Acoustic Testing Equipment, 2016–2017

Table 4 Automotive Acoustic Engineering Services Market, By Process, 2016–2025 (USD Million)

Table 5 Designing: Market, By Region, 2016–2025 (USD Million)

Table 6 Development: Market, By Region, 2016–2025 (USD Million)

Table 7 Testing: Market, By Region, 2016–2025 (USD Million)

Table 8 Market, By Offering, 2016–2025 (USD Million)

Table 9 Physical Acoustic Testing: Market, By Region, 2016–2025 (USD Million)

Table 10 Virtual Acoustic Testing: Market, By Region, 2016-2025 (USD Million)

Table 11 Market, By Software, 2016–2025 (USD Million)

Table 12 Calibration: Market, By Region, 2016–2025 (USD Million)

Table 13 Signal Analysis: Market, By Region, 2016–2025 (USD Million)

Table 14 Simulation: Market, By Region, 2016–2025 (USD Million)

Table 15 Vibration: Market, By Region, 2016–2025 (USD Million)

Table 16 Others: Market, By Region, 2016–2025 (USD Million)

Table 17 Percent Noise Contribution of Different Vehicle Systems Into Total Noise

Table 18 Market, By Application, 2016–2025 (USD Million)

Table 19 Drivetrain: Market, By Region, 2016–2025 (USD Million)

Table 20 Powertrain: Market, By Region, 2016–2025 (USD Million)

Table 21 Body & Structure: Market, By Region, 2016–2025 (USD Million)

Table 22 Interior: Market, By Region, 2016–2025 (USD Million)

Table 23 Others: Market, By Region, 2016–2025 (USD Million)

Table 24 Market, By Vehicle Type, 2016–2025 (USD Million)

Table 25 LDV: Market, By Region, 2016–2025 (USD Million)

Table 26 HDV: Market, By Region, 2016–2025 (USD Million)

Table 27 Electric & Hybrid Vehicles: Market, By Region, 2016–2025 (USD Million)

Table 28 Market, By Region, 2016–2025 (USD Million)

Table 29 Asia Pacific: Market, By Country, 2016–2025 (USD Million)

Table 30 China: Market, By Process, 2016–2025 (USD Million)

Table 31 China: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 32 India: Market, By Process, 2016–2025 (USD Million)

Table 33 India: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 34 Japan: Market, By Process, 2016–2025 (USD Million)

Table 35 Japan: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 36 South Korea: Market, By Process, 2016–2025 (USD Million)

Table 37 South Korea: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 38 Thailand: Market, By Process, 2016–2025 (USD Million)

Table 39 Thailand: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 40 Asia Pacific Others: Automotive Acoustic Engineering Services Market, By Process, 2016–2025 (USD Million)

Table 41 Asia Pacific Others: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 42 EMEA: Market, By Country, 2016–2025 (USD Million)

Table 43 France: Market, By Process, 2016–2025 (USD Million)

Table 44 France: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 45 Germany: Market, By Process, 2016–2025 (USD Million)

Table 46 Germany: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 47 Spain: Market, By Process, 2016–2025 (USD Million)

Table 48 Spain: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 49 Russia: Market, By Process, 2016–2025 (USD Million)

Table 50 Russia: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 51 Sweden: Market, By Process, 2016–2025 (USD Million)

Table 52 Sweden: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 53 UK: Market,By Process, 2016–2025 (USD Million)

Table 54 UK: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 55 EMEA Others: Market, By Process, 2016–2025 (USD Million)

Table 56 EMEA Others: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 57 Americas: Market, By Country, 2016–2025 (USD Million)

Table 58 Brazil: Market, By Process, 2016–2025 (USD Million)

Table 59 Brazil: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 60 Canada: Market, By Process, 2016–2025 (USD Million)

Table 61 Canada: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 62 Mexico: Market, By Process, 2016–2025 (USD Million)

Table 63 Mexico: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 64 US: Market, By Process, 2016–2025 (USD Million)

Table 65 US: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 66 Americas Others: Market, By Process, 2016–2025 (USD Million)

Table 67 Americas Others: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 68 Market: Market Ranking Analysis, 2017

Table 69 Expansions, 2017–2018

Table 70 Joint Ventures/Collaborations Partnerships, 2015–2017

Table 71 New Product Developments, 2015–2017

Table 72 Merger & Acquisitions, 2016

List of Figures (35 Figures)

Figure 1 Automotive Acoustic Engineering Services: Market Segmentation

Figure 2 Automotive Acoustic Engineering Services Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Top-Down Approach: Market

Figure 6 Data Triangulation

Figure 7 Market: Market Outlook

Figure 8 Market, By Process & Region, 2018 (USD Million)

Figure 9 Stringent Norms and Rising Preference for Cabin Comfort are Expected to Drive The Acoustic Engineering Services Market

Figure 10 EMEA is Estimated to Be The Leading Market, Whereas Designing is Estimated to Be The Largest Process Segment OfServices Market, 2018 33

Figure 11 Designing Process is Anticipated to Be The Largest and Fastest Growing Market During The Forecast Period, 2018 vs. 2025 (USD Billion)

Figure 12 Virtual Acoustic Testing is Estimated to Dominate The Market, 2017 vs. 2025 (USD Billion)

Figure 13 Simulation Holds The Largest Share of Market, 2018 vs. 2025 (USD Billion)

Figure 14 Body & Structure Holds The Largest Share of The Market, 2018 vs. 2025 (USD Billion)

Figure 15 Light-Duty Vehicles Segment Constitutes The Largest Share of The Market, 2018 vs. 2025 (USD 36

Figure 16 Automotive Acoustic Engineering Services: Market Dynamics

Figure 17 Premium Car Sales, By Region, 2012–2016 (‘000 Units)

Figure 18 Global Suv Production, By Region, 2015–2020 (‘000 Units)

Figure 19 Global Electric Vehicle Sales, 2016–2025 (‘000 Units)

Figure 20 Market, By Process, 2018–2025 (USD Million)

Figure 21 Market, By Offering, 2018–2025 (USD Million)

Figure 22 Market, By Software, 2018–2025 (USD Million)

Figure 23 Market Share, By Application, 2018 (USD Million)

Figure 24 Market, By Vehicle Type, 2016–2025 (USD Million)

Figure 25 Market, By Region, 2018–2025 (USD Million)

Figure 26 Asia Pacific: Market Snapshot

Figure 27 EMEA: Market Snapshot

Figure 28 Companies Adopted New Product Developments as The Key Growth Strategy, 2014–2018

Figure 29 Siemens PLM Software: Company Snapshot

Figure 30 Bertrandt: Company Snapshot

Figure 31 EDAG Engineering: Company Snapshot

Figure 32 Schaeffler: Company Snapshot

Figure 33 Company Snapshot: Continental

Figure 34 Autoneum: Company Snapshot

Figure 35 STS Group: Company Snapshot

Growth opportunities and latent adjacency in Automotive Acoustic Engineering Services Market

I am a student at Cattolica University and I am writing my degree thesis, but I am struggling finding some general recent data about the market of acoustic components in the automotive industry. I hope you can help me.

I am most interested in learning about engineering consulting services and the impact of electrification.