Automotive Diagnostic Scan Tools Market by Workshop Equipment, Vehicle, Handheld Scan Tools (Scanner, Code Reader, Digital Pressure Tester, TPMS Tool, Battery Analyzer), Offering, Connectivity (wi-Fi, Bluetooth), Type and Region - Global Forecast to 2026

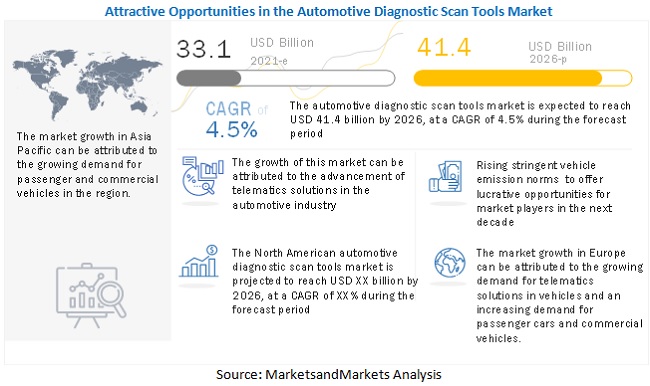

[246 Pages Report] The global automotive diagnostic scan tools market size was valued at USD 33.1 billion in 2021 and is expected to reach USD 41.4 billion by 2026, at a CAGR of 4.5% during the forecast period 2021-2026. The key growth drivers for the market are the rise in vehicle production and sales, an increase in automotive workshops, and the trend of integrating advanced features in the vehicles.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on Automotive Diagnostic Scan Tools Market:

The outbreak of the COVID-19 pandemic is not expected to affect the extraction of materials such as steel, copper, and aluminum. With trade restrictions in place during the first six months of 2020, raw material extraction was continued by major extractors in China. However, the prices of raw materials such as copper will continue to rise, with copper price hitting USD 10,000 per ton for the first time in 10 years in May 2021. The automotive diagnostic scan tools market, however, is expected to witness a significant boost in 2022 owing to the rise in awareness for timely vehicle repair and maintenance, stringent emission norms by different countries. The COVID-19 pandemic has had a severe impact on the global automotive industry. This is witnessed in terms of the supply chain disruptions of part exports from China, large-scale manufacturing interruptions across Europe, and closure of assembly plants in the US and other major countries, such as India and Brazil, where the automotive sector highly contributes to the GDP

Market Dynamics:

Automotive Diagnostic Scan Tools Market Driver: Increasing sales of passenger cars

The market for automotive diagnostic scan tools is expected to grow with the increase in sales of passenger vehicles. Passenger vehicle sales have surged, with growth in all three top auto markets: China, the US, and Europe. Factors such as growing demand for low emission commuting and governments supporting vehicle inspection mandates have compelled the manufacturers to provide automotive diagnostic scan tools around the world. Passenger car is the fast-growing segment in the automotive market and is expected to witness significant growth during the forecast period. According to Business Insider, the total number of passenger cars on the road will double by 2040 as passenger cars are projected to reach 2 billion by 2040. The global passenger car sales is estimated to reach 72.5 million units in 2025 from 64.1 million units in 2021. This has led to a growing demand for automotive diagnostic tools in the market. The Passenger Cars market is generally influenced by the distribution of wealth within a country or region and serves as a good indicator when it comes to financial stability. The growth of automotive diagnostic scan tools market is driven by rapid urbanization in emerging economies that have led to the increase in demand for personal motor vehicles.

Automotive Diagnostic Scan Tools Market Restraint: High initial cost of advanced diagnostic tools

With constant advancements in vehicle computer technology, workshops require more sophisticated scan tools to keep up, but most workshops cannot afford them all. Diagnostic scan tools have witnessed a decline in their overall price levels. However, newer technologies are more expensive than conventional OBD-I systems. This can reduce the demand for newer and innovative technologies. Diagnostic scan tool manufacturers are under constant pressure from OEMs to curtail the prices of diagnostic scan tool equipment. Many manufacturers are also hesitant to invest in R&D activities due to high costs, particularly in emerging countries, wherein OEMs are still launching new models with basic diagnostic scanning systems. Since automobiles must successfully meet stringent safety regulations, automotive diagnosis requires highly sophisticated instruments and equipment, which add to the overall cost. The equipment also needs to be updated whenever there are changes in regulations.

Automotive Diagnostic Scan Tools Market Opportunity: Consumer preference for high-end cars

The ongoing trend in developed countries across the globe is inclined more toward purchasing premium segment cars, featuring accurate, improved, and quick diagnosis tools. A significant growth of tangible luxury offerings in vehicles, shifting consumer preferences from sedans to SUVs, and increasing disposable incomes of consumers have been propelling the demand for luxury cars worldwide. The demand for OBD solutions continues to be high in personal and commercial vehicles, as there is the adoption of newer technologies in vehicles to make them more efficient and sustainable. Automotive trends such as connected cars and electric vehicles demand advanced diagnostic tools for managing and controlling high-tech vehicle components. The high-end car market accounted for 6% of automobile sales in the US in 2020, resulting in a small but highly lucrative segment. According to Statista, the global market for high-end cars is grew from USD 327.1 billion (245 billion euros) in 2010 to USD 593.5 billion (503 billion euros) in 2020. The growth can be attributed to the increasing consuming power of emerging markets such as China. Germany, Italy, France, and Spain are leading the path of adopting newer and modern scan tools. The demand for high-end passenger vehicles is expected to grow at a substantial rate in the coming years, with major demand from the Asia Pacific region.

Automotive Diagnostic Scan Tools Market Challenges: Lack of awareness

Lack of awareness to deal up with the latest technologies act as major challenges in growth of the automotive diagnostic scan tools market. The cost of the technology is immensely high, which may not be easily affordable to many consumers. Moreover, the complexities involved in the functioning of such diagnostic scan tools may limit the growth of market. Some OBD2 scanners are more budget-friendly and generalized in their capabilities, designed to appeal to the average car owner. Advanced OBD2 scanners are equipped with much more extensive and detailed diagnostic capabilities, clearly designed with serious DIYers and pro mechanics. Higher quality OBD2 scanners, on the other hand, come equipped with a much greater range of capabilities.

By vehicle type: Passenger cars segment is estimated to hold the largest share of the overall Automotive Diagnostic Scan Tools Market

Passenger cars are major contributors to the amount of pollution caused due to vehicular emissions. The diagnostic scan tools monitor and detect faults in the emission control system. The dashboard light is illuminated, indicating ‘check engine’ whenever a fault is dedicated. Earlier, vehicle faults where diagnosed by trained technicians certified with ASE A6, A8, and L1 standards. However, with the introduction of handheld tools for diagnostics, DIY for minor defects has gained momentum in passenger cars. The standard of living of consumers has improved in the recent decade due to the rapid globalization and economic growth of emerging countries such as Brazil, Mexico, and India. The increase in disposable income of consumers has fueled the demand for passenger cars, which, in turn, has driven the passenger car market. OEMs such as General Motors, Ford, and Honda have launched their new passenger car models by employing a customer-focused strategy.

By Offering: Diagnostic equipment/hardware segment is expected to dominate the Automotive Diagnostic Scan Tools Market

The growth of this segment can be attributed to the increasing vehicle population in both developed and emerging countries and the growing complexity in vehicle electronics. Automotive diagnostic equipment/hardware tools are generally physical devices that are designed to determine the conditions of various automotive hardware components. The increase in complexity of vehicles has increased the requirement of automotive diagnostic equipment/hardware in automobile workshops hence leading to the growth of the automotive diagnostics equipment/hardware market. Over the years, there has been an exceptional surge in the production and sales of vehicles along with a steady increase in the number of automotive workshops, which has simultaneously bolstered the automotive diagnostic scan tools market across the globe.

By Connectivity: USB is estimated to be the largest market during the forecast period

The USB connectivity is widely used in all vehicles equipped with OBD-II. OBD-II is an on-board computer that monitors emissions, mileage, speed, and other data about a vehicle. It is connected to the Check Engine light, which illuminates when the computer detects a problem. USB is cost-effective, and user friendly. It is an adapter that turns tablet, laptop, or netbook into a sophisticated diagnostic scan tool, and real-time performance monitor. However, with higher demand for wireless diagnostic scan tools, the USB connectivity is expected to be replaced by Bluetooth and Wi-Fi.

Asia Pacific is expected to account for the largest automotive diagnostic scan tools market size during the forecast period

In recent years, Asia Pacific has emerged as a hub for automobile production. Infrastructural developments and industrialization activities in emerging economies have opened new avenues, creating several opportunities for automotive OEMs. In addition, the increased purchasing capability of the population has triggered the demand for automobiles. Global OEMs such as Volkswagen and General Motors cater to this market through joint ventures with domestic manufacturers. The implementation of new technologies, establishment of additional manufacturing plants, and creation of value-added supply chains between manufacturers and material providers have made Asia Pacific a market with high growth potential. China is the largest market in Asia Pacific and is witnessing significant growth in the sales and the demand for premium vehicles. China is a major market for premium vehicles, given the rising disposable income in the country. Nearly all major OEMs have invested in the Chinese market, which is inclined toward small and affordable passenger vehicles. A surge in demand is expected, as the current vehicle penetration is low as compared to developed countries. The growing automotive production levels in China have driven the demand for automotive diagnostic scan tools.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major automotive diagnostic scan tool market players include Robert Bosch GmbH (Germany), Siemens (Germany), Continental AG(Germany), Denso (Japan), Snap-on (US)

These companies have strong distribution networks at a global level. In addition, these companies offer an extensive product range. The key strategies adopted by these companies to sustain their market position are new product developments, collaborations, and contracts & agreements. Some instances are provided below.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2021–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD Million/Billion) and Volume (Thousand Units) |

|

Segments covered |

By offering, Workshop Equipment Type, By Vehicle Type, Connectivity, Handheld Scan tools and Type |

|

Geographies covered |

Asia Pacific, Europe, North America and Rest of the World |

|

Companies covered |

Robert Bosch GmbH (Germany), Siemens (Germany), Denso (Japan), Continental AG (Germany) and Snap-on (US) |

This research report categorizes the automotive diagnostic scan tools market based on offering, workshop equipment, vehicle type, connectivity, handheld scan tool and tool type

Based on Offering type:

- Diagnostic Equipment/Hardware

- Diagnostic Software

Based on Workshop Equipment:

- Exhaust gas analyzer

- Wheel alignment equipment

- Paint scan equipment

- Dynamometer

- Headlight Tester

- Fuel Injection Diagnostic

- Pressure Leak Detection

- Engine Analyzer

Based on connectivity:

- USB

- Wi-Fi

- Bluetooth

Based on vehicle type:

- Passenger Cars

- Commercial Vehicles

Based on Handheld Scan Tools:

- Scanners

- Code readers

- TPMS tools

- Digital pressure tester

- Battery analyzer

Based on type:

- OEMs Diagnostic

- Professional Diagnostics

- DIY Diagnostics

Based on region:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Rest of Asia Pacific

-

Europe

- France

- Germany

- UK

- Spain

- Russia

- Turkey

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

Rest of the World

- Brazil

- Iran

Recent Developments

- In March 2021, Robert Bosch GmbHintroduced ADS 625 X that performs all system DTC scans under 60 seconds on average, with complete scans taking 30 seconds or less. The scan tool provides technicians advanced vehicle coverage across a broad range of domestic, Asian and European vehicles.

- In August 2021, Continental AG launched the Autodiagnos Drive, an innovative, remote vehicle data solution designed to deliver advanced diagnostic information that service providers, fleet managers, and repair facilities can use to maximize their data-driven services.

- In November 2019, Denso launched the vehicle MRI Inspection tool, which is compatible with android smartphones and tablets allowing technicians to inspect vehicles and identify underperforming parts to prescribe their customers a predictive maintenance plan quickly and accurately.

- In December-2020, Snap-on launched a new diagnostic website to provide even more relevant information to help customers learn about diagnostic products and services quickly. The website is presented in a user-friendly, easy-to-navigate manner, whether on a desk-top computer or mobile device.

Frequently Asked Questions (FAQ):

Does this report cover various connectivity of Automotive Diagnostic Scan Tools?

Yes, Automotive Diagnostic Scan Tool connectivity such as USB, Wi-Fi and Bluetooth as a segment is provided in the report.

Which countries are considered in the Asian region?

The report includes Asia Pacific countries such as:

- China

- India

- Japan

- South Korea

- Thailand

- Rest of Asia Pacific

Does this report include impact of COVID-19 on Automotive Diagnostic Scan Tools Market?

Yes, the report includes qualitative insights for COVID-19 impact on the Automotive Diagnostic Scan Tools Market and Impact of COVID-19 is considered for market sizing.

Does this report provide insights on Automotive Diagnostic Scan by offering?

Yes, Automotive Diagnostic Scan by offering is covered for both Hardware equipment and software diagnosis.

Does this report provide insights on Automotive Diagnostic Scan tools Market for handheld scan tools?

Yes, Automotive Diagnostic Scan Tool type is covered for handheld scan tools such as scanners, code readers, digital pressure tester, TPMS tool and battery analyzer. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 STUDY OBJECTIVES

1.2 AUTOMOTIVE DIAGNOSTIC SCAN TOOLS MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSION

TABLE 1 INCLUSIONS & EXCLUSIONS FOR MARKET

1.3 MARKET SCOPE

FIGURE 1 MARKET: SEGMENTATION COVERED

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY & PRICING

TABLE 2 CURRENCY & PRICING

1.5 PACKAGE SIZE

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.1.2.1 Primary participants

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 6 AUTOMOTIVE DIAGNOSTIC SCAN TOOLS MARKET SIZE: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 7 AUTOMOTIVE DIAGNOSTIC SCAN TOOLSMARKET: TOP-DOWN APPROACH

FIGURE 8 AUTOMOTIVE DIAGNOSTIC SCAN TOOLSMARKET: RESEARCH DESIGN AND METHODOLOGY

FIGURE 9 RESEARCH APPROACH: MARKET

FIGURE 10 AUTOMOTIVE DIAGNOSTIC SCAN TOOLSMARKET: RESEARCH METHODOLOGY ILLUSTRATION OF COMPANY-BASED REVENUE ESTIMATION

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 11 DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.5.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY-SIDE

2.6 ASSUMPTIONS

2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 12 AUTOMOTIVE DIAGNOSTIC SCAN TOOLS MARKET OVERVIEW

FIGURE 13 AUTOMOTIVE DIAGNOSTIC SCAN TOOLSMARKET, BY REGION, 2021–2026 (USD MILLION)

FIGURE 14 PASSENGER CARS SEGMENT EXPECTED TO GROW AT A HIGHER CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN THE AUTOMOTIVE DIAGNOSTIC SCAN TOOLS MARKET

FIGURE 15 INCREASING DEMAND FOR ADVANCED TECHNOLOGY VEHICLES TO DRIVE THE MARKET FOR AUTOMOTIVE DIAGNOSTIC SCAN TOOLS

4.2 AUTOMOTIVE DIAGNOSTIC SCAN TOOLSMARKET, BY OFFERING

FIGURE 16 DIAGNOSTIC SOFTWARE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET, BY CONNECTIVITY

FIGURE 17 WI-FI SEGMENT EXPECTED TO GROW AT HIGHEST RATE FROM 2021–2026

4.4 MARKET, BY WORKSHOP EQUIPMENT

FIGURE 18 DYNAMOMETER SEGMENT TO LEAD MARKET FROM 2021–2026

4.5 AUTOMOTIVE DIAGNOSTIC HANDHELD SCAN TOOLS MARKET, BY TYPE

FIGURE 19 DIGITAL PRESSURE TESTER EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

4.6 MARKET, BY VEHICLE TYPE

FIGURE 20 PASSENGER CARS SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

4.7 MARKET, BY TYPE

FIGURE 21 DIY DIAGNOSTIC IS EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

4.8 MARKET GROWTH RATE, BY REGION

FIGURE 22 ASIA PACIFIC PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

5 AUTOMOTIVE DIAGNOSTIC SCAN TOOLS MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

TABLE 3 IMPACT OF MARKET DYNAMICS

5.2 AUTOMOTIVE DIAGNOSTIC SCAN TOOLSMARKET DYNAMICS

FIGURE 23 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing sales of passenger cars

FIGURE 24 GLOBAL PASSENGER CAR SALES

5.2.1.2 Increasing technological advancements in automobiles

FIGURE 25 TECHNOLOGICAL ADVANCEMENTS IN PASSENGER CARS

5.2.1.3 Rise in stringent emission norm to prevent environmental impact

FIGURE 26 GLOBAL EMISSION LEGISLATION

TABLE 4 EMISSION REGULATIONS IN MAJOR COUNTRIES

FIGURE 27 EMISSION NORMS AND FUTURE OUTLOOK FOR ASIAN COUNTRIES

FIGURE 28 GOVERNMENT MEASURES FOR EMISSION REDUCTION

5.2.2 RESTRAINTS

5.2.2.1 High initial cost of advanced diagnostic tools

TABLE 5 PRICES OF AUTOMOTIVE DIAGNOSTICS SCAN TOOLS, 2021

5.2.2.2 Lack of skilled workforce

5.2.3 OPPORTUNITIES

5.2.3.1 Consumer preference for high-end cars

FIGURE 29 PREFERENCE FOR HIGH-END CAR FEATURES

5.2.3.2 Vehicle inspection mandates

TABLE 6 US EMISSION INSPECTION MANDATES

5.2.4 CHALLENGES

5.2.4.1 Lack of awareness towards vehicle technologies updates

5.2.4.2 Outdated automotive diagnostic scan tools

TABLE 7 PERFORMANCE COMPARISON: BASIC VS ADVANCED AUTOMOTIVE DIAGNOSTIC SCAN TOOLS

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 30 VALUE CHAIN ANALYSIS

5.4 PORTERS FIVE FORCES

FIGURE 31 MARKET: PORTER’S FIVE FORCES

TABLE 8 MAUTOMOTIVE DIAGNOSTIC SCAN TOOLS ARKET: IMPACT OF PORTERS FIVE FORCES

5.4.1 THREAT OF SUBSTITUTES

5.4.2 THREAT OF NEW ENTRANTS

5.4.3 BARGAINING POWER OF BUYERS

5.4.4 BARGAINING POWER OF SUPPLIERS

5.4.5 RIVALRY AMONG EXISTING COMPETITORS

5.5 MARKET ECOSYSTEM

FIGURE 32 MARKET: ECOSYSTEM ANALYSIS

5.5.1 MANUFACTURERS OF AUTOMOTIVE DIAGNOSTIC SCAN TOOLS

5.5.2 PROFESSIONAL DIAGNOSTICS

5.5.3 OEMS

5.5.4 END USERS

TABLE 9 MARKET: ROLE OF COMPANIES IN ECOSYSTEM

5.6 TRENDS AND DISRUPTIONS IN MARKET

FIGURE 33 TRENDS AND DISRUPTIONS IN MARKET

5.7 PRICING ANALYSIS

TABLE 10 AUTOMOTIVE DIAGNOSTICS SCAN TOOLS MARKET: AVERAGE PRICING (USD), 2021

5.8 PATENT ANALYSIS

5.9 CASE STUDY

5.9.1 MAN PARTNERED WITH INDIGO TO REDUCE TIME-CONSUMING SAFETY CHECKS OF VEHICLES

5.10 REGULATORY FRAMEWORK

5.10.1 CALIFORNIA

TABLE 11 CALIFORNIA: OBD REGULATIONS

5.10.2 JAPAN

TABLE 12 JAPAN: OBD REGULATIONS

5.10.3 OBD SYSTEM STANDARDIZATION REQUIREMENTS

5.11 MARKET: COVID-19 IMPACT

5.11.1 IMPACT ON RAW MATERIAL SUPPLY

5.11.2 COVID-19 IMPACT ON AUTOMOTIVE INDUSTRY

5.11.3 OEMS/MANUFACTURERS ANNOUNCEMENTS

TABLE 13 ANNOUNCEMENTS

5.11.4 IMPACT ON AUTOMOTIVE PRODUCTION

5.12 MARKET SCENARIO ANALYSIS

FIGURE 34 MARKET– FUTURE TRENDS & SCENARIO, 2021–2026 (USD MILLION)

5.12.1 MOST LIKELY SCENARIO

TABLE 14 MARKET (MOST LIKELY SCENARIO), BY REGION, 2021–2026 (USD MILLION)

5.12.2 OPTIMISTIC SCENARIO

TABLE 15 MARKET (OPTIMISTIC), BY REGION, 2021–2026 (USD MILLION)

5.12.3 PESSIMISTIC SCENARIO

TABLE 16 MARKET (PESSIMISTIC), BY REGION, 2021–2026 (USD MILLION)

6 TECHNOLOGICAL OVERVIEW (Page No. - 80)

6.1 INTRODUCTION

FIGURE 35 PASSENGER CAR ON-BOARD DIAGNOSTICS

6.2 OBD FOR ELECTRIC VEHICLES

6.3 OBD-I VS. OBD-II

FIGURE 36 OBD-I VS OBD-II

6.3.1 MISFIRE MONITORING

6.3.2 CATALYST MONITORING

6.3.3 EGR MONITORING

6.3.4 EVAPORATIVE PURGE SYSTEM MONITORING

6.3.5 MIL ILLUMINATION

FIGURE 37 MALFUNCTION INDICATOR LAMP

6.3.6 SECONDARY AIR SYSTEM MONITORING

6.3.7 STORED ENGINE FREEZE FRAME DATA

6.3.8 DTC & SERVICE INFORMATION STANDARDIZATION

6.3.9 FUEL SYSTEM MONITOR

6.3.10 OXYGEN SENSOR MONITOR

6.3.11 COMPREHENSIVE COMPONENT MONITOR

6.4 TELEMATICS CONNECTIVITY

6.5 SCANNING TOOLS SERVICE PROVIDER

6.6 TRENDS FOR EV DIAGNOSIS

6.6.1 ELECTRIC SYSTEM ANALYZER TOOLS

7 AUTOMOTIVE DIAGNOSTIC SCAN TOOLS MARKET, BY OFFERING (Page No. - 88)

7.1 INTRODUCTION

FIGURE 38 AUTOMOTIVE DIAGNOSTIC EQUIPMENT/HARDWARE TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 17 MARKET, BY OFFERING, 2018–2020 (USD MILLION)

TABLE 18 MARKET, BY OFFERING, 2021–2026 (USD MILLION)

7.2 OPERATIONAL DATA

TABLE 19 AUTOMOTIVE DIAGNOSTIC SCAN TOOLS, BY OFFERING

7.2.1 ASSUMPTIONS

TABLE 20 ASSUMPTIONS: BY OFFERING

7.3 RESEARCH METHODOLOGY

7.4 DIAGNOSTIC EQUIPMENT/HARDWARE

7.4.1 INCREASING NUMBER OF SERVICE STATIONS TO DRIVE MARKET GROWTH

TABLE 21 AUTOMOTIVE DIAGNOSTIC EQUIPMENT/HARDWARE MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 22 AUTOMOTIVE DIAGNOSTIC EQUIPMENT/HARDWARE MARKET, BY REGION, 2021–2026 (USD MILLION)

7.5 DIAGNOSTIC SOFTWARE

7.5.1 TRENDS SUCH AS REMOTE AND PREDICTIVE DIAGNOSTICS TO DRIVE THE MARKET

TABLE 23 AUTOMOTIVE DIAGNOSTIC SOFTWARE MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 24 AUTOMOTIVE DIAGNOSTIC SOFTWARE MARKET, BY REGION, 2021–2026 (USD MILLION)

7.6 KEY INDUSTRY INSIGHTS

8 AUTOMOTIVE DIAGNOSTICS SCAN TOOLS MARKET, BY CONNECTIVITY (Page No. - 96)

8.1 INTRODUCTION

FIGURE 39 USB CONNECTIVITY TO DOMINATE AUTOMOTIVE DIAGNOSTIC SCAN TOOLS MARKET DURING FORECAST PERIOD

TABLE 25 MARKET, BY CONNECTIVITY, 2018–2020 (USD MILLION)

TABLE 26 MARKET, BY CONNECTIVITY, 2021–2026 (USD MILLION)

8.2 OPERATIONAL DATA

TABLE 27 AUTOMOTIVE DIAGNOSTIC SCAN TOOLS, BY CONNECTIVITY

8.2.1 ASSUMPTIONS

TABLE 28 ASSUMPTIONS: BY CONNECTIVITY

8.3 RESEARCH METHODOLOGY

8.4 USB

8.4.1 LOW INSTALLATION COST TO DRIVE MARKET GROWTH

TABLE 29 USB: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 30 USB: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.5 WI-FI

8.5.1 INCREASING DEMAND FOR WIRELESS DIAGNOSTICS TO DRIVE MARKET GROWTH

TABLE 31 WI-FI: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 32 WI-FI: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.6 BLUETOOTH

8.6.1 HIGH COMPATIBILITY WITH VARIOUS OPERATING SYSTEMS TO DRIVE MARKET GROWTH

TABLE 33 BLUETOOTH: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 34 BLUETOOTH: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.7 KEY INDUSTRY INSIGHTS

9 AUTOMOTIVE DIAGNOSTICS SCAN TOOLS MARKET, BY WORKSHOP EQUIPMENT (Page No. - 104)

9.1 INTRODUCTION

FIGURE 40 MARKET, BY WORKSHOP EQUIPMENT, 2021–2026 (USD MILLION)

TABLE 35 MARKET, BY WORKSHOP EQUIPMENT, 2018–2020 (‘000 UNITS)

TABLE 36 MARKET, BY WORKSHOP EQUIPMENT, 2021–2026 (‘000 UNITS)

TABLE 37 MARKET, BY WORKSHOP EQUIPMENT, 2018–2020 (USD MILLION)

TABLE 38 MARKET, BY WORKSHOP EQUIPMENT, 2021–2026 (USD MILLION)

9.2 OPERATIONAL DATA

TABLE 39 WORKSHOP EQUIPMENT OFFERINGS, BY MANUFACTURER

9.2.1 ASSUMPTIONS

TABLE 40 ASSUMPTIONS: BY WORKSHOP EQUIPMENT

9.3 RESEARCH METHODOLOGY

9.4 EXHAUST GAS ANALYZER

9.4.1 STRINGENT EMISSION NORMS TO DRIVE MARKET GROWTH

TABLE 41 EXHAUST GAS ANALYZER MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 42 MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 43 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 44 MARKET, BY REGION, 2021–2026 (USD MILLION)

9.5 PAINT SCAN EQUIPMENT

9.5.1 ADVANCEMENTS IN SCANNING TECHNOLOGY TO DRIVE MARKET GROWTH

TABLE 45 PAINT SCAN EQUIPMENT MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 46 MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 47 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 48 MARKET, BY REGION, 2021–2026 (USD MILLION)

9.6 WHEEL ALIGNMENT EQUIPMENT

9.6.1 WHEEL ALIGNMENT TESTING ENSURES MAXIMUM TIRE LIFE AND OPTIMAL VEHICLE HANDLING

TABLE 49 WHEEL ALIGNMENT EQUIPMENT MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 50 MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 51 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 52 MARKET, BY REGION, 2021–2026 (USD MILLION)

9.7 DYNAMOMETER

9.7.1 ADVANCEMENTS IN AUTOMOTIVE TECHNOLOGIES TO DRIVE MARKET GROWTH

TABLE 53 DYNAMOMETER MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 54 MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 55 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 56 DYNAMOMETER MARKET, BY REGION, 2021–2026 (USD MILLION)

9.8 HEADLIGHT TESTER

9.8.1 INCREASING DEMAND FOR SAFETY FEATURES TO DRIVE MARKET GROWTH

TABLE 57 HEADLIGHT TESTERS MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 58 MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 59 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 60 MARKET, BY REGION, 2021–2026 (USD MILLION)

9.9 FUEL INJECTION DIAGNOSTIC

9.9.1 INCREASING AWARENESS REGARDING VEHICLE MAINTENANCE TO FUEL MARKET GROWTH

TABLE 61 FUEL INJECTION DIAGNOSTIC MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 62 MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 63 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 64 MARKET, BY REGION, 2021–2026 (USD MILLION)

9.10 PRESSURE LEAK DETECTION

9.10.1 EASE OF DETECTION TO DRIVE MARKET GROWTH

TABLE 65 PRESSURE LEAK DETECTION MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 66 MARKET SIZE, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 67 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 68 MARKET, BY REGION, 2021–2026 (USD MILLION)

9.11 ENGINE ANALYZER

9.11.1 ENGINER ANALYZERS PLAY SIGNIFICANT ROLE IN MEASURING ENGINE SPEED AND MONITORING DWELL ANGLE

TABLE 69 ENGINE ANALYZERS MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 70 MARKET SIZE, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 71 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 72 MARKET, BY REGION, 2021–2026 (USD MILLION)

9.12 KEY INDUSTRY INSIGHTS

10 AUTOMOTIVE DIAGNOSTICS HANDHELD SCAN TOOLS MARKET, BY TYPE (Page No. - 123)

10.1 INTRODUCTION

FIGURE 41 AUTOMOTIVE DIAGNOSTIC HANDHELD SCAN TOOLS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 73 MARKET, BY TYPE, 2018–2020 (‘000 UNITS)

TABLE 74 MARKET, BY TYPE, 2021–2026 (‘000 UNITS)

TABLE 75 MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 76 MARKET, BY TYPE, 2021–2026 (USD MILLION)

10.2 OPERATIONAL DATA

TABLE 77 AUTOMOTIVE DIAGNOSTIC HANDHELD SCAN TOOLS AND THEIR PROVIDERS

10.2.1 ASSUMPTIONS

TABLE 78 ASSUMPTIONS: HANDHELD SCAN TOOLS, BY TYPE

10.3 RESEARCH METHODOLOGY

10.4 SCANNERS

10.4.1 ADVANCEMENTS IN AUTOMOTIVE ELECTRONICS TO FUEL GROWTH IN THIS SEGMENT

TABLE 79 SCANNERS MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 80 MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 81 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 82 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.5 CODE READERS

10.5.1 INCREASING TREND OF DIY DIAGNOSTICS TO FUEL GROWTH OF THIS SEGMENT

TABLE 83 CODE READERS MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 84 MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 85 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 86 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.6 DIGITAL PRESSURE TESTER

10.6.1 INCREASE IN DEMAND FOR FUEL-EFFICIENT VEHICLES TO DRIVE THIS SEGMENT

TABLE 87 DIGITAL PRESSURE TESTER MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 88 MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 89 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 90 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.7 TPMS TOOL

10.7.1 ADVANCEMENTS IN PRESSURE MONITORING TECHNOLOGY TO DRIVE MARKET GROWTH

TABLE 91 TPMS TOOLS MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 92 MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 93 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 94 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.8 BATTERY ANALYZER

10.8.1 INCREASE IN VEHICLE ELECTRIFICATION TO DRIVE MARKET

TABLE 95 BATTERY ANALYZERS MARKET, BY REGION, 2018–2020 (‘000 UNITS)

TABLE 96 MARKET, BY REGION, 2021–2026 (‘000 UNITS)

TABLE 97 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 98 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.9 KEY INDUSTRY INSIGHTS

11 AUTOMOTIVE DIAGNOSTICS SCAN TOOLS MARKET, BY VEHICLE TYPE (Page No. - 137)

11.1 INTRODUCTION

FIGURE 42 PASSENGER CARS SEGMENT TO DOMINATE AUTOMOTIVE DIAGNOSTIC SCAN TOOLS MARKET DURING FORECAST PERIOD

TABLE 99 MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 100 MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

11.2 OPERATIONAL DATA

TABLE 101 DIAGNOSTIC SCAN TOOLS, BY COMPANY & VEHICLE TYPE

11.2.1 ASSUMPTIONS

TABLE 102 ASSUMPTIONS: BY VEHICLE TYPE

11.3 RESEARCH METHODOLOGY

11.4 PASSENGER CARS

11.4.1 INCREASING DEMAND FOR ADVANCED FEATURES IN PASSENGER CARS TO FUEL MARKET GROWTH

TABLE 103 MARKET FOR PASSENGER CARS, BY REGION, 2018–2020 (USD MILLION)

TABLE 104 MARKET FOR PASSENGER CARS, BY REGION, 2021–2026 (USD MILLION)

11.5 COMMERCIAL VEHICLES

11.5.1 STRINGENT EMISSION NORMS TO DRIVE MARKET GROWTH

TABLE 105 MARKET FOR COMMERCIAL VEHICLES, BY REGION, 2018–2020 (USD MILLION)

TABLE 106 MARKET FOR COMMERCIAL VEHICLES, BY REGION, 2021–2026 (USD MILLION)

11.6 KEY INDUSTRY INSIGHTS

12 AUTOMOTIVE DIAGNOSTICS SCAN TOOLS MARKET, BY TYPE (Page No. - 145)

12.1 INTRODUCTION

FIGURE 43 OEM DIAGNOSTIC SEGMENT EXPECTED TO DOMINATE AUTOMOTIVE DIAGNOSTIC SCAN TOOLS MARKET DURING FORECAST PERIOD

TABLE 107 MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 108 MARKET, BY TYPE, 2021–2026 (USD MILLION)

12.2 OPERATIONAL DATA

TABLE 109 AUTOMOTIVE DIAGNOSTIC SCAN TOOLS, BY TYPE

12.2.1 ASSUMPTIONS

TABLE 110 ASSUMPTIONS: BY TYPE

12.3 RESEARCH METHODOLOGY

12.4 PROFESSIONAL DIAGNOSTIC

12.4.1 INCREASING PASSENGER CAR SALES IS DRIVING THIS SEGMENT

12.5 DIY DIAGNOSTIC

12.5.1 FREQUENT DEMAND FOR VEHICLE DIAGNOSIS IS DRIVING MARKET FOR DIY DIAGNOSTIC

12.6 OEM DIAGNOSTIC

12.6.1 HIGH COMPATIBILITY WITH VARIOUS OPERATING SYSTEMS TO DRIVE MARKET GROWTH

12.7 KEY INDUSTRY INSIGHTS

13 AUTOMOTIVE DIAGNOSTIC SCAN TOOLS MARKET, BY REGION (Page No. - 151)

13.1 INTRODUCTION

FIGURE 44 ASIA PACIFIC EXPECTED TO LEAD MARKET FOR AUTOMOTIVE DIAGNOSTIC SCAN TOOLS DURING FORECAST PERIOD

TABLE 111 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 112 MARKET, BY REGION, 2021–2026 (USD MILLION)

13.2 ASIA PACIFIC

FIGURE 45 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 113 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

13.2.1 CHINA

13.2.1.1 Technological advancements in automotive electronics to drive the Chinese market

TABLE 115 CHINA VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 116 CHINA: MARKET, BY OFFERING, 2018–2020 (USD MILLION)

TABLE 117 CHINA: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

13.2.2 INDIA

13.2.2.1 Strong presence of prominent players to drive Indian market

TABLE 118 INDIA VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 119 INDIA: MARKET, BY OFFERING, 2018–2020 (USD MILLION)

TABLE 120 INDIA: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

13.2.3 JAPAN

13.2.3.1 R&D in automotive technology to drive Japanese market

TABLE 121 JAPAN: VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 122 JAPAN: MARKET, BY OFFERING, 2018–2020 (USD MILLION)

TABLE 123 JAPAN: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

13.2.4 SOUTH KOREA

13.2.4.1 Rapid technological advancements drive South Korean market

TABLE 124 SOUTH KOREA VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 125 SOUTH KOREA: MARKET, BY OFFERING, 2018–2020 (USD MILLION)

TABLE 126 SOUTH KOREA: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

13.2.5 THAILAND

13.2.5.1 Strong growth in vehicle production to drive market

TABLE 127 THAILAND VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 128 THAILAND: MARKET, BY OFFERING, 2018–2020 (USD MILLION)

TABLE 129 THAILAND: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

13.2.6 REST OF ASIA PACIFIC

13.2.6.1 Growth of automotive industry will fuel market in this region

TABLE 130 REST OF ASIA PACIFIC: VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 131 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2018–2020 (USD MILLION)

TABLE 132 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

13.3 EUROPE

TABLE 133 EUROPE: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 134 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

13.3.1 GERMANY

13.3.1.1 Stringent emission norms to drive German market

TABLE 135 GERMANY VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 136 GERMANY: MARKET, BY OFFERING, 2018–2020 (USD MILLION)

TABLE 137 GERMANY: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

13.3.2 FRANCE

13.3.2.1 Presence of established OEMs to drive market

TABLE 138 FRANCE VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 139 FRANCE: MARKET, BY OFFERING, 2018–2020 (USD MILLION)

TABLE 140 FRANCE: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

13.3.3 UK

13.3.3.1 Increasing demand for electric vehicles to drive market

TABLE 141 UK VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 142 UK: MARKET, BY OFFERING, 2018–2020 (USD MILLION)

TABLE 143 UK: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

13.3.4 SPAIN

13.3.4.1 Growing vehicle sales to drive the market

TABLE 144 SPAIN VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 145 SPAIN: MARKET, BY OFFERING, 2018–2020 (USD MILLION)

TABLE 146 SPAIN: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

13.3.5 RUSSIA

13.3.5.1 Favorable government policies to drive market

TABLE 147 RUSSIA VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 148 RUSSIA: MARKET, BY OFFERING, 2018–2020 (USD MILLION)

TABLE 149 RUSSIA: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

13.3.6 TURKEY

13.3.6.1 Increasing investments in automotive industry to drive market

TABLE 150 TURKEY VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 151 TURKEY: MARKET, BY OFFERING, 2018–2020 (USD MILLION)

TABLE 152 TURKEY: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

13.3.7 REST OF EUROPE

13.3.7.1 Increasing demand for passenger cars to drive market in this region

TABLE 153 REST OF EUROPE: MARKET, BY OFFERING, 2018–2020 (USD MILLION)

TABLE 154 REST OF EUROPE: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

13.4 NORTH AMERICA

FIGURE 46 NORTH AMERICA: MARKET SNAPSHOT

TABLE 155 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 156 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

13.4.1 CANADA

13.4.1.1 Increased demand for advanced features to drive market

TABLE 157 CANADA VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 158 CANADA: MARKET, BY OFFERING, 2018–2020 (USD MILLION)

TABLE 159 CANADA: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

13.4.2 MEXICO

13.4.2.1 Increasing demand for upgraded diagnostic features to drive Mexican market

TABLE 160 MEXICO VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 161 MEXICO: MARKET, BY OFFERING, 2018–2020 (USD MILLION)

TABLE 162 MEXICO: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

13.4.3 US

13.4.3.1 Increasing demand for wireless diagnostics to drive US market

TABLE 163 US VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 164 US: MARKET, BY OFFERING, 2018–2020 (USD MILLION)

TABLE 165 US: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

13.5 REST OF THE WORLD

FIGURE 47 REST OF THE WORLD: MARKET SNAPSHOT

TABLE 166 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 167 REST OF THE WORLD: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

13.5.1 BRAZIL

13.5.1.1 Growing investments in automotive industry to drive market

TABLE 168 BRAZIL VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 169 BRAZIL: MARKET, BY OFFERING, 2018–2020 (USD MILLION)

TABLE 170 BRAZIL: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

13.5.2 IRAN

13.5.2.1 Strong presence of local players to fuel Iranian market

TABLE 171 IRAN VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 172 IRAN: MARKET, BY OFFERING, 2018–2020 (USD MILLION)

TABLE 173 IRAN: MARKET, BY OFFERING, 2021–2026 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 180)

14.1 OVERVIEW

14.2 MARKET SHARE ANALYSIS

TABLE 174 MARKET SHARE ANALYSIS, 2020

FIGURE 48 MARKET SHARE ANALYSIS, 2020

14.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

FIGURE 49 TOP PUBLIC/LISTED PLAYERS DOMINATING AUTOMOTIVE DIAGNOSTIC SCAN TOOLS MARKET DURING LAST FIVE YEARS

14.4 COMPETITIVE SCENARIO

14.4.1 NEW PRODUCT LAUNCHES

TABLE 175 NEW PRODUCT LAUNCHES, 2018–2021

14.4.2 DEALS

TABLE 176 DEALS, 2018–2021

14.5 COMPANY EVALUATION QUADRANT

14.5.1 STARS

14.5.2 EMERGING LEADERS

14.5.3 PERVASIVE

14.5.4 PARTICIPANTS

FIGURE 50 AUTOMOTIVE DIAGNOSTICS SCAN TOOLS MARKET: COMPANY EVALUATION QUADRANT, 2021

TABLE 177 MARKET: COMPANY FOOTPRINT, 2021

TABLE 178 MARKET: PRODUCT FOOTPRINT, 2021

TABLE 179 MARKET: REGIONAL FOOTPRINT, 2021

14.6 STARTUP/SME EVALUATION QUADRANT

14.6.1 PROGRESSIVE COMPANIES

14.6.2 RESPONSIVE COMPANIES

14.6.3 DYNAMIC COMPANIES

14.6.4 STARTING BLOCKS

FIGURE 51 MARKET: STARTUP/SME EVALUATION QUADRANTS, 2021

14.7 RIGHT TO WIN, 2018-2021

TABLE 180 WINNERS VS. TAIL-ENDERS

15 COMPANY PROFILES (Page No. - 192)

(Business overview, Products offered, Recent developments & MnM View)*

15.1 KEY PLAYERS

15.1.1 ROBERT BOSCH GMBH

TABLE 181 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

FIGURE 52 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

FIGURE 53 ROBERT BOSCH GMBH: EMPLOYEES, BY REGION

TABLE 182 ROBERT BOSCH GMBH: PRODUCTS OFFERED

TABLE 183 ROBERT BOSCH GMBH: NEW PRODUCT DEVELOPMENTS

TABLE 184 ROBERT BOSCH GMBH: DEALS

15.1.2 SIEMENS

TABLE 185 SIEMENS: BUSINESS OVERVIEW

FIGURE 54 SIEMENS: COMPANY SNAPSHOT

TABLE 186 SIEMENS: PRODUCTS OFFERED

TABLE 187 SIEMENS: NEW PRODUCT DEVELOPMENTS

TABLE 188 SIEMENS: DEALS

15.1.3 CONTINENTAL AG

TABLE 189 CONTINENTAL AG: BUSINESS OVERVIEW

FIGURE 55 CONTINENTAL AG: COMPANY SNAPSHOT

FIGURE 56 CONTINENTAL AG: EMPLOYEES WORLDWIDE

TABLE 190 CONTINENTAL AG: PRODUCTS OFFERED

TABLE 191 CONTINENTAL AG: NEW PRODUCT DEVELOPMENTS

TABLE 192 CONTINENTAL AG: DEALS

15.1.4 DENSO

TABLE 193 DENSO: BUSINESS OVERVIEW

FIGURE 57 DENSO: COMPANY SNAPSHOT

TABLE 194 DENSO: PRODUCTS OFFERED

TABLE 195 DENSO: NEW PRODUCT DEVELOPMENTS

TABLE 196 DENSO: DEALS

TABLE 197 DENSO: OTHERS

15.1.5 SNAP-ON

TABLE 198 SNAP-ON: BUSINESS OVERVIEW

FIGURE 58 SNAP-ON: COMPANY SNAPSHOT

TABLE 199 SNAP-ON: PRODUCTS OFFERED

TABLE 200 SNAP-ON: NEW PRODUCT DEVELOPMENTS

TABLE 201 SNAP-ON: DEALS

15.1.6 HORIBA

TABLE 202 HORIBA: BUSINESS OVERVIEW

FIGURE 59 HORIBA: COMPANY SNAPSHOT

TABLE 203 HORIBA: PRODUCTS OFFERED

TABLE 204 HORIBA: NEW PRODUCT DEVELOPMENTS

TABLE 205 HORIBA: DEALS

TABLE 206 HORIBA: OTHERS

15.1.7 ACTIA

TABLE 207 ACTIA: BUSINESS OVERVIEW

FIGURE 60 ACTIA: COMPANY SNAPSHOT

TABLE 208 ACTIA: PRODUCTS OFFERED

TABLE 209 ACTIA: NEW PRODUCT DEVELOPMENTS

TABLE 210 ACTIA: DEALS

TABLE 211 ACTIA: OTHERS

15.1.8 SOFTING

TABLE 212 SOFTING: BUSINESS OVERVIEW

FIGURE 61 SOFTING: COMPANY SNAPSHOT

TABLE 213 SOFTING: PRODUCTS OFFERED

TABLE 214 SOFTING: NEW PRODUCT DEVELOPMENTS

TABLE 215 SOFTING: OTHERS

15.1.9 CRAWFORD UNITED CORPORATION

TABLE 216 CRAWFORD UNITED CORPORATION: BUSINESS OVERVIEW

FIGURE 62 CRAWFORD UNITED CORPORATION: COMPANY SNAPSHOT

TABLE 217 CRAWFORD UNITED CORPORATION: PRODUCTS OFFERED

15.1.10 SGS

TABLE 218 SGS: BUSINESS OVERVIEW

FIGURE 63 SGS: COMPANY SNAPSHOT

FIGURE 64 SGS REVENUE: BY REGION

TABLE 219 SGS: PRODUCTS OFFERED

TABLE 220 SGS: DEALS

15.1.11 DG TECHNOLOGIES

TABLE 221 DG TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 222 DG TECHNOLOGIES: PRODUCTS OFFERED

TABLE 223 DG TECHNOLOGIES: NEW PRODUCT DEVELOPMENTS

TABLE 224 DG TECHNOLOGIES: DEALS

15.1.12 NOREGON

TABLE 225 NOREGON: BUSINESS OVERVIEW

TABLE 226 NOREGON: PRODUCTS OFFERED

TABLE 227 NOREGON: NEW PRODUCT DEVELOPMENTS

TABLE 228 NOREGON: DEALS

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

15.2 OTHER KEY PLAYERS

15.2.1 KPIT

15.2.2 AMPRO TESTING MACHINES

15.2.3 MBL IMPEX

15.2.4 AUTEL INTELLIGENT TECHNOLOGY CORPORATION

15.2.5 AVL

15.2.6 VECTOR INFORMATIK

15.2.7 DSA DATEN-UND SYSTEMTECHNIK GMBH

15.2.8 VOGELSANG & BENNING

15.2.9 DSPACE GMBH

15.2.10 FLUKE CORPORATION

15.2.11 HUNTER

15.2.12 ALLDATA

16 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 238)

16.1 ASIA PACIFIC: KEY FOCUS MARKET FOR AUTOMOTIVE DIAGNOSTIC SCAN TOOLS

16.2 INCREASED ADOPTION OF AUTOMOTIVE DIAGNOSTIC SCAN TOOLS WITH BLUETOOTH CONNECTIVITY

16.3 CONCLUSION

17 APPENDIX (Page No. - 240)

17.1 KEY INSIGHTS OF INDUSTRY EXPERTS

17.2 DISCUSSION GUIDE

17.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.4 AVAILABLE CUSTOMIZATIONS

17.5 RELATED REPORTS

17.6 AUTHOR DETAILS

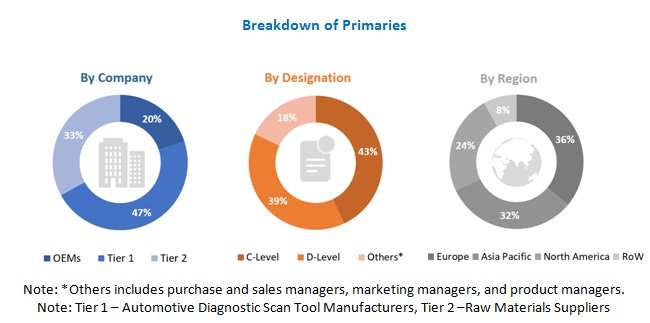

The study involved 4 major activities in estimating the market size for Automotive Diagnostic Scan Tools. Exhaustive secondary research was done to collect information on the market, peer automotive diagnostic scan tools market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been used in the secondary research process to identify and collect information useful for an extensive commercial study of the global automotive diagnostic scan tools market. Secondary sources include company annual reports/presentations, press releases, industry association publications, India Electronics & Semiconductor Association, ARTEMIS Industry Association, European Automotive Research Partners Association (EARPA), International Organization of Motor Vehicle Manufacturers (OICA), American Association of Motor Vehicle Administrators (AAMVA), Automotive Component Manufacturers Association of India (ACMA), China Association Of Automoblie Manufacturers (CAAM), automotive magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases (Marklines and Factiva).

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the automotive diagnostic scan tools market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs [(in terms of component supply), country-level government associations, and trade associations] and component manufacturers across 4 major regions, namely, Asia Pacific, Europe, North America and Rest of the World. Approximately 23% and 77% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter expert’s opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the automotive diagnostic scan tools market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the automotive diagnostic scan tools market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply sides.

Report Objectives

- To analyze and forecast the automotive diagnostic scan tools market in terms of volume (‘000 units) and value (USD million/billion) from 2021 to 2026

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall market

- To segment and forecast the market, by value, based on region (Asia Pacific, Europe, North America and Rest of the World)

- To segment and forecast the market size, by value, based on offering type (diagnostic equipment/hardwares and diagnostic softwares)

- To segment the market for market and forecast the market size, by value and volume, based on workshop equipment (exhaust gas analyzer, paint scan equipment, dynamometer, headlight tester, wheel alignment equipment, pressure leak detector, engine analyzer, and fuel injection diagnostic)

- To segment the market for Automotive Diagnostic Scan tools and forecast the market size, by value, based on vehicle type (passenger cars and commercial vehicles)

- To segment the market for Automotive Diagnostic Scan tools and forecast the market size, by value and volume, based on handheld scan tools (scanners, code readers, digital pressure testers, Tire Pressure Monitoring System (TPMS) devices, and battery analyzers)

- To segment the market for Automotive Diagnostic Scan tools and forecast the market size, by value, based on connectivity (Bluetooth, Wi-Fi, and USB)

- To segment and forecast the Automotive Diagnostic Scan tools Market size, by value, based on tool type (OEMs Diagnostic, Professional Diagnostics and DIY Diagnostics)

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their respective market share and core competencies

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities undertaken by the key industry participants

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country level analysis of automotive diagnostic scan tools market

- Profiling of additional market players (up to 3)

-

Country level analysis of workshop equipment and handheld diagnostic scan tools

- Profiling of Additional Market Players (Up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Diagnostic Scan Tools Market