Automotive DC-DC Converters Market Size, Share, Trends & Growth Analysis by Vehicle Type (Commercial, Passenger), Propulsion Type (BEV, FCEV, PHEV), Product Type (Isolated, Non-Isolated), Input Voltage, Output Voltage, Output Power, Region - Global Forecast to 2025

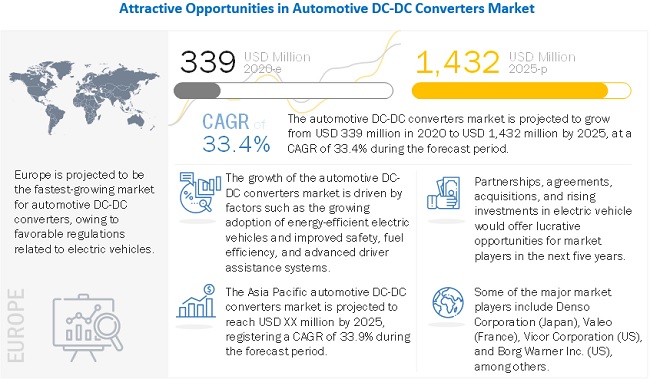

The Global Automotive DC-DC Converters Market size is projected to grow from an estimated USD 339 million in 2020 to USD 1,432 million by 2025, at a CAGR of 33.4% during the forecast period. Automotive DC-DC converters are devices that transform input DC that has a range of voltages into regulated DC with a stable output voltage. These converters are designed to operate at high switching frequencies to reduce the size of output capacitors and inductors to save the onboard space of power equipment. Electronic component manufacturers require advanced and miniaturized DC-DC converters for use in their electronic devices to reduce the overall space occupied by device circuits as well as improve their performance. This has also led to the development of technologically advanced DC-DC converters to cater to the power supply requirements of various automotive vehicles such as battery electric vehicles, plug-in hybrid electric vehicles, and fuel cell electric vehicles, among others. The growing adoption of energy-efficient electric vehicles to curb GHG emissions from the automotive industry; the requirement of improved safety, fuel efficiency, and advanced driver assistance systems; and the growing demand for safety and connectivity features in passenger vehicles are driving the demand for DC-DC converters across the automotive industry.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Automotive DC-DC Converters Market

The COVID-19 pandemic has had a severe impact on the globally integrated automotive industry. Symptoms include a disruption in Chinese parts exports, large-scale manufacturing interruptions across Europe, and the closure of assembly plants in the US. This is placing intense pressure on an industry already coping with a downshift in global demand and likely leading to increased merger & acquisition activity. According to industry experts, automotive sales are most likely to decrease 14-22% among the Chinese, US, and European markets in 2020. The automotive industry in the US continued to remain fragile in the month of August and September, while China automotive sales continue their fast recovery. Vehicle shipments reached close to 2.2 million units in August, up 11.6% on a YoY basis. The easing of lockdowns in many countries of Europe coupled with stimulus packages to support economic revival seems to have started benefitting the region’s automotive industry. The COVID-19 pandemic has led to many changes in car-buyer behavior and attitude. Digital services and features are being readily accepted by people as a way to stay connected, trackable, and safe. Increasing penetration of in-vehicle screens will lead to the easy integration of many of these digital features. Thus, the rise in technology trends of digitalization in vehicles, connectivity, and advanced safety features will drive the demand for DC-DC converters.

Automotive DC-DC Converters Market Dynamics:

Driver: Growing adoption of energy-efficient electric vehicles

The demand for electric vehicles is growing significantly across the globe, owing to the ambitious plans and initiatives of governments of different countries such as India, China, France, Germany, the US, the UK, etc., to reduce emissions from vehicles by promoting the use of eco-friendly vehicles, and are helping develop infrastructure for these vehicles as well. For instance, the government of France has introduced an environmental bonus to promote low CO2 emission models; the German government gives a grant of USD 2,370 for BEVs & FCEVs and USD 1,780 for PHEVs; and the Chinese government provides subsidies for the electrification of vehicles. DC-DC converters in electric vehicles are used to increase or decrease voltage levels from attached batteries based on the power requirements of different systems used in vehicles. They enhance efficiency and reduce fuel consumption of vehicles as well as increase the vehicle output power per unit of volume.

Restraint: Varying regional/country-wise regulatory compliance and safety standards

A number of international and domestic regulations and standards have been formulated for DC-DC converters with an aim to prevent injury or damage to people and property due to potential dangers such as electric shock, energy hazards, fire, mechanical & heat hazards, radiation hazards, and chemical hazards. Manufacturers of DC-DC converters must adhere to these regulations and standards, which include various categories of insulation such as functional, basic, supplementary, double, and reinforced insulation. As these standards vary from country to country, adherence to them acts as a restraint for manufacturers. These standards are, on occasion, technically complex and hence, require experts to interpret them. With continuous evolution and amendments in these standards, it becomes challenging for manufacturers of DC-DC converters to adhere to them.

Opportunity: Development of miniaturized DC-DC converters

Miniaturization of different electrical and electronic systems has led to the requirement for compact and lightweight DC-DC converters as well. These compact converters are suitable for analog circuit applications, which require galvanic isolated output power with reduced noise. Miniaturized DC-DC converters offer low output noise and extended operating temperatures. This results in high switching frequencies of DC-DC converters. Denso Corporation (South Korea), a global automotive component manufacturer, has worked on an invention related to a switching power supply which includes a technique to achieve higher efficiency and miniaturization of an insulating switching DC-DC converter. Also, the semiconductor company of Panasonic Corporation has developed the LSI series DC-DC converters with a voltage step-down type hysteretic control system to achieve high-efficiency, high-speed response for miniaturized power supply circuits.

Challenge: Low-quality products on grey market

The grey market refers to the trade of commodities or components through distributed channels that are not authorized by the original component manufacturers or trade mark proprietors. In the electronics grey market, retailers import merchandise from regions where prices are lower or where regional design differences are more favorable to consumers and subsequently sell merchandise in regions where the manufacturer's selling price is higher. According to Information Handling Services (IHS), there have been reported incidents of counterfeit electronic components such as analog integrated circuits, microprocessors, memory chips, programmable logic devices, and transistors.

For instance, in February 2016, Importer AMG Trade & Distribution battled with Nissan and US Customs Department for a 10,778-part shipment, which was initially declared as fake with respect to the cost of shipping legitimate parts from Oman and suspicious features such as incorrect packaging, security features, and altered markings. However, when the US Customs Department asked Nissan to inspect every part, it was identified that 217 units of the total 10,778 parts were counterfeit.

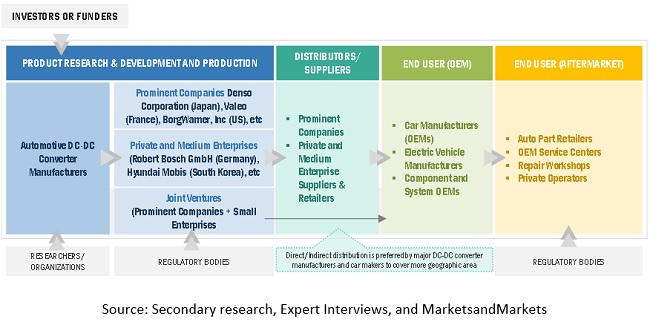

AUTOMOTIVE DC-DC CONVERTERS MARKET ECOSYSTEM

Prominent companies that provide automotive DC-DC converters, private and medium enterprises, joint ventures, distributors/suppliers/retailers, and end customers (OEMs and MROs) are the key stakeholders in the automotive DC-DC converters market ecosystem. Investors, funders, academic researchers, distributors, service providers, and automotive regulating authorities serve as the major influencers in the automotive DC-DC converters market.

To know about the assumptions considered for the study, download the pdf brochure

The passenger vehicle segment is estimated to lead the automotive DC-DC converters market in 2020

Based on vehicle type, the automotive DC-DC converters market is segmented into a commercial vehicle and passenger vehicle. The passenger vehicle segment of the automotive DC-DC converters market is accounted for the largest share during the forecast period. Car manufacturers such as Tesla, Honda, Hyundai, and Ford, among others, are manufacturing passenger electric vehicles in order to combat GHG emissions from the automotive industry. Also, government initiatives in the form of tax exemptions on using electric vehicles are increasing the demand from consumers to opt for environment-friendly vehicles for private and shared mobility purposes, in turn, driving the demand for passenger vehicles.

The battery-electric vehicle segment is expected to grow at the highest CAGR during the forecast period

Based on propulsion type, the automotive DC-DC converters market has been segmented into battery electric vehicles (BEV), fuel cell electric vehicles (FCEV), and plug-in hybrid electric vehicles (PHEV).. The BEV segment is estimated to account for the largest share and grow at the highest CAGR during the forecast period. This is due to the rise in demand for electrification in the automobile sector. Moreover, increasing environmental awareness, government subsidies, and tax exemptions are expected to lead to a surge in demand for DC-DC converters in this segment. Industry experts has states that, globally, countries are making the switch from gasoline and diesel vehicles to electric vehicles (EVs). Due to an accelerated shift to EVs, some estimates suggest that by 2040, EVs will account for more than 50% of global new car sales. Furthermore, in parallel with the shift to EVs, the development of autonomous vehicles is being accelerated. To meet the surging demand for BEVs, various players are developing advanced, compact DC-DC converters.

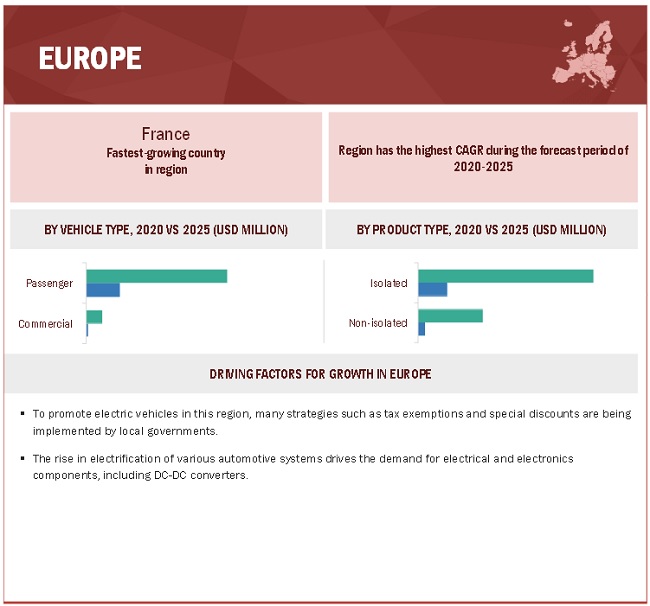

Europe is expected to grow at the highest CAGR during the forecast period

Europe is expected to grow at the highest CAGR during the forecast period. The European market is estimated to exhibit growth in the coming years, resulting from an increase in demand for electric vehicles. It is home to major automobile manufacturers such as Volkswagen AG, BMW AG, and Daimler AG. According to CleanTechnica, the European passenger plug-in vehicle market witnessed over 33,000 registrations in January 2018. In the first month of 2019, all-electrics jumped 67% Year over Year (YoY), to approximately 21,000 deliveries. These are now 62% of all plug-in vehicle (PEV) sales, leading to a record 1.7% share for electric vehicles (EVs). In Europe, almost all vehicles are equipped with EPS and start stop systems. The rise in electrification of these components contributes to significant demand for electrical and electronics components, including DC-DC converters.

Key Market Players

Major players operating in the automotive DC-DC converters market include BorgWarner Inc. (US), Denso Corporation (Japan), Valeo (France), Vicor Corporation (US), TDK-Lambda Corporation (Japan), Delta Electronics (Taiwan), Continental AG (Germany), Toyota Industries Corporation (Japan), Hyundai Mobis (South Korea), and Robert Bosch GmbH (Germany), among others. These key players offer various products and services in order to cater the increasing demand of electrification of vehicles in automotive industry.

Scope of the Automotive DC-DC Converters Market Report

|

Report Metric |

Details |

| Estimated Market Size |

USD 339 million by 2020 |

| Projected Market Size |

USD 1,432 million by 2025 |

| CAGR |

33.4% |

|

Market size available for years |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

By Vehicle Type, Propulsion Type, Input Voltage, Output Voltage, Output Power, Product Type, and Region |

|

Geographies covered |

North America, Europe, and Asia Pacific |

|

Companies covered |

BorgWarner Inc. (US), Denso Corporation (Japan), Valeo (France), Vicor Corporation (US), TDK-Lambda Corporation (Japan), Delta Electronics (Taiwan), Continental AG (Germany), Toyota Industries Corporation (Japan), Hyundai Mobis (South Korea), Robert Bosch GmbH (Germany), Infineon Technologies AG (Germany), Hella GmbH & Co. KGaA (Germany), and Mornsun (China), among others |

This research report categorizes the automotive DC-DC converters based on vehicle type, propulsion type, input voltage, output voltage, output power, product type, and region.

By Vehicle Type

- Commercial Vehicle

- Passenger Vehicle

By Propulsion Type

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicle (FCEV)

- Plug-in Hybrid Vehicle (PHEV)

By Input Voltage

- <40V

- 40–70V

- >70V

By Output Voltage

- 3.3V

- 5V

- 12V

- 15V

- 24V and Above

By Output Power

- <1kW

- 1–10kW

- 10–20kW

- >20kW

By Product Type

- Isolated

- Non-isolated

By Region

- North America

- Europe

- Asia Pacific

Recent Developments

- In October 2020, BorgWarner Inc. completed the acquisition of Delphi Technologies. This acquisition was expected to strengthen BorgWarner’s electronics and power electronics products, capabilities, and scale.

- In September 2020, Vicor Corporation entered into a global distribution agreement with Arrow Electronics. Inc. This agreement will help the company expand in Europe, the Middle East, and Africa to fullfill customer demand for smaller and more efficient solutions for power-delivery networks.

- In July 2020, Denso Corporation established Global R&D Tokyo, Haneda, as a new base for R&D on automated driving and related technologies.

- In January 2020, Valeo launched its autonomous, electric delivery droid, developed in partnership with Meituan Dianping, China’s leading e-commerce platform for services.

- In January 2020, Delta Electronics and GKN Automotive collaborated to enable the rapid acceleration of next-generation integrated 3-in-1 eDrive systems of power classes from 80kW to 155kW.

- In March 2019, TDK-Lambda Corporation introduced its smallest DC-DC converter µPOL power solutions with a dimension of 3.3*3.3*1.5mm. It is a compact and highest power density point of load solution for various applications.

Frequently Asked Questions (FAQ):

What is the current size of the automotive DC-DC converters market?

The automotive DC-DC converters market size is projected to grow from USD 339 million in 2020 to USD 1,432 million by 2025, at a CAGR of 33.4% from 2020 to 2025.

Who are the leading players in the automotive DC-DC converters market?

BorgWarner Inc. (US), Denso Corporation (Japan), Valeo (France), Vicor Corporation (US), TDK-Lambda Corporation (Japan), Delta Electronics (Taiwan), Continental AG (Germany), Toyota Industries Corporation (Japan), Hyundai Mobis (South Korea), Robert Bosch GmbH (Germany), are some of the winners in the market.

What is the COVID-19 impact on automotive DC-DC converters manufacturers?

The COVID-19 pandemic has had a severe impact on the globally integrated automotive industry. A prolonged decline in consumer demand as countries work through various lockdown scenarios may spark a global recession, leading to widespread loss of consumer confidence, significantly impacting automaker revenues and profitability. This will, in turn, negatively impact component manufacturers and auto parts manufacturers.

What are some of the technological advancements in the market?

Minaturization of DC-DC converters and other power electronic devices, implementation of low power devices, new arcitectures in DC-DC converters, use of thermal potting materials in DC_DC converters, shift from analog to digital power management in DC-DC power modules, emerging modeling and control techniques are some of the technological advancements happening in the market.

What are the factors driving the growth of the market?

The growing adoption of energy-efficient electric vehicles such as battery electric vehicles, plug-in hybrid vehicles, and fuel cell vehicles to curb GHG emissions from the automotive industry; improved safety, fuel efficiency, and advanced driver assistance systems; and the growing demand for safety and connectivity features in passenger vehicles are driving the demand for DC-DC converters across the automotive industry. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY & PRICING

TABLE 1 USD EXCHANGE RATES

1.5 UNIT CONSIDERED

1.6 INCLUSIONS AND EXCLUSIONS

TABLE 2 AUTOMOTIVE DC-DC CONVERTERS MARKET: INCLUSIONS AND EXCLUSIONS

1.7 LIMITATIONS

1.8 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

2.1.1 RESEARCH FLOW

FIGURE 1 RESEARCH DESIGN

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES

2.2.2 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

2.3.1 PRIMARY SOURCES

2.3.2 BREAKDOWN OF PRIMARY INTERVIEWS

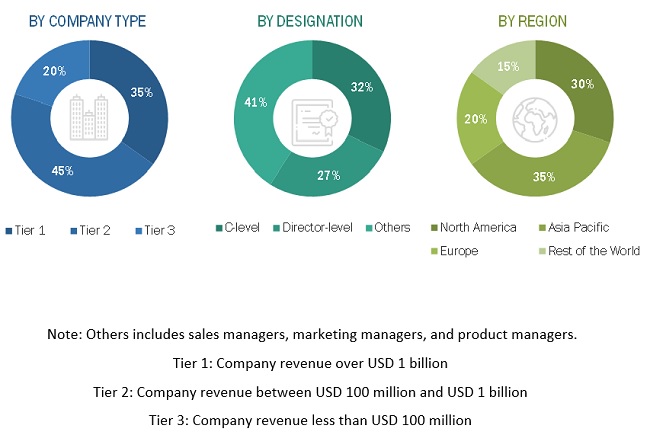

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.4 MARKET DEFINITION & SCOPE

2.4.1 SEGMENT DEFINITIONS

2.4.1.1 Automotive DC-DC converters market, by vehicle type

2.4.1.2 Automotive DC-DC converter market, by propulsion type

2.4.1.3 Automotive DC-DC converter market, by input voltage

2.4.1.4 Automotive DC-DC converter market, by output voltage

2.4.1.5 Automotive DC-DC converter market, by output power

2.4.1.6 Automotive DC-DC converter market, by product type

2.4.2 EXCLUSIONS

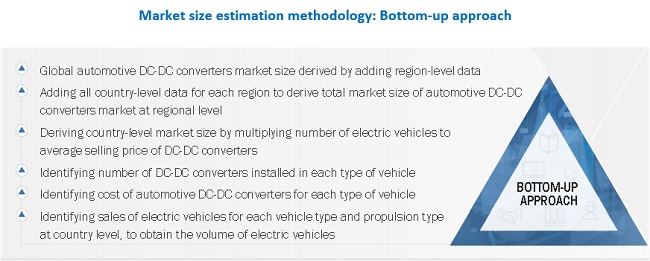

2.5 MARKET SIZE ESTIMATION & METHODOLOGY

2.5.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP

2.5.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN

2.6 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.7 RESEARCH ASSUMPTIONS

2.8 RISKS

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 6 PASSENGER VEHICLE TO COMMAND LARGEST SHARE OF AUTOMOTIVE DC-DC CONVERTERS MARKET FROM 2020 TO 2025

FIGURE 7 BEV PROPULSION SEGMENT TO LEAD AUTOMOTIVE DC-DC CONVERTER MARKET IN 2020 & 2025

FIGURE 8 10-20KW OUTPUT POWER SEGMENT TO DOMINATE AUTOMOTIVE DC-DC CONVERTER MARKET (2020-2025)

FIGURE 9 ASIA PACIFIC TO HOLD DOMINANT SHARE OF DC-DC CONVERTERS MARKET FROM 2020 TO 2025

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE OPPORTUNITIES IN AUTOMOTIVE DC-DC CONVERTERS MARKET

FIGURE 10 GROWING ADOPTION OF ENERGY-EFFICIENT ELECTRIC VEHICLES TO DRIVE MARKET DURING FORECAST PERIOD

4.2 AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE

FIGURE 11 PASSENGER VEHICLE TO BE LEADING SEGMENT IN MARKET

4.3 AUTOMOTIVE DC-DC CONVERTER MARKET, BY PRODUCT TYPE

FIGURE 12 ISOLATED CONVERTERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.4 AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE

FIGURE 13 BEV SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.5 ASIA PACIFIC AUTOMOTIVE DC-DC CONVERTERS MARKET, BY COUNTRY

FIGURE 14 CHINA TO BE LARGEST AUTOMOTIVE DC-DC CONVERTER MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

4.6 AUTOMOTIVE DC-DC CONVERTERS, BY COUNTRY

FIGURE 15 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DC-DC CONVERTERS: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing adoption of energy-efficient electric vehicles

FIGURE 17 PROJECTED GLOBAL SALES OF ELECTRIC PASSENGER VEHICLES (BEV/PHEV/FCEV) 2017-2025

5.2.1.2 Improved safety, fuel efficiency, and advanced driver assistance systems

5.2.1.3 Growing demand for safety and connectivity features in passenger vehicles

5.2.2 RESTRAINTS

5.2.2.1 Varying regional/country-wise regulatory compliance and safety standards

5.2.3 OPPORTUNITIES

5.2.3.1 Development of miniaturized DC-DC converters

5.2.3.2 DC-DC converters with high switching frequencies

5.2.3.3 Increased demand for digital power-based DC-DC converters

5.2.3.4 Increasing use of SiC and GaN products in vehicle applications

5.2.4 CHALLENGES

5.2.4.1 Heating issues in DC-DC converters

5.2.4.2 Inability of DC-DC converters to switch off during no-load situations

5.2.4.3 Low-quality products on grey market

5.2.4.4 Complexities in testing and validation of DC-DC converters

5.3 TECHNOLOGY ANALYSIS

5.3.1 POWER CONVERSION TECHNIQUES

TABLE 3 FUNCTIONS AND APPLICATIONS OF CONVERTERS IN ELECTRIC VEHICLES

5.3.2 ULTRALOW QUIESCENT CURRENT DC/DC CONVERTERS FOR LIGHT LOAD APPLICATIONS

5.3.3 CONDUCTED EMISSIONS

5.4 USE CASES

5.4.1 INNOVATIVE DIGITAL CONTROL ARCHITECTURE FOR LOW-VOLTAGE, HIGH-CURRENT DC–DC CONVERTERS WITH TIGHT VOLTAGE REGULATION

5.4.2 HEAT DISSIPATION FOR HYBRID VEHICLE DC/DC CONVERTER

5.5 3 GLOBAL SCENARIOS OF COVID-19 IMPACT

FIGURE 18 IMPACT OF COVID-19 ON AUTOMOTIVE DC-DC CONVERTERS MARKET: 3 GLOBAL SCENARIOS

5.6 COVID-19 IMPACT ON AUTOMOTIVE DC-DC CONVERTER MARKET

TABLE 4 COVID-19 IMPACT ON VEHICLE SALES OF VARIOUS REGIONS

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.7.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AUTOMOTIVE DC-DC CONVERTER MANUFACTURERS

FIGURE 19 REVENUE SHIFT IN AUTOMOTIVE DC-DC CONVERTER MARKET

5.8 TARIFF AND REGULATORY LANDSCAPE

5.8.1 ELECTROMAGNETIC COMPATIBILITY COMPLIANCE

5.8.2 TARIFF IMPOSED BY US ON PRODUCTS IMPORTED FROM CHINA

5.9 AVERAGE SELLING PRICE TREND

TABLE 5 AVERAGE SELLING PRICE: DC-DC CONVERTERS

5.10 MARKET ECOSYSTEM

5.10.1 PROMINENT COMPANIES

5.10.2 PRIVATE AND MEDIUM ENTERPRISES

5.10.3 END USERS

FIGURE 20 MARKET ECOSYSTEM MAP: AUTOMOTIVE DC-DC CONVERTERS

5.11 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING OEM STAGE

6 INDUSTRY TRENDS (Page No. - 67)

6.1 INTRODUCTION

6.2 EVOLUTION OF AUTOMOTIVE DC-DC CONVERTERS

FIGURE 22 EVOLUTION OF DC-DC CONVERTERS

6.3 KEY TRENDS IN DC-DC CONVERTERS MARKET

6.3.1 LOW POWER DEVICES

6.3.2 MINIATURIZATION OF DC-DC CONVERTERS

6.3.3 NEW ARCHITECTURE IN DC-DC CONVERTERS

6.3.4 INCREASED DEMAND FOR NON–ISOLATED POL CONVERTERS

6.3.5 USE OF THERMAL POTTING MATERIALS IN DC-DC CONVERTERS

6.3.6 SHIFT FROM ANALOG TO DIGITAL POWER MANAGEMENT IN DC-DC POWER MODULES

6.3.7 WIDE BAND GAP SEMICONDUCTORS (WBGS)

6.3.8 EMERGING MODELING AND CONTROL TECHNIQUES

6.4 TECHNOLOGICAL ADVANCEMENTS IN DC-DC CONVERTERS

6.5 IMPACT OF MEGATRENDS

6.5.1 ELECTRIFICATION

6.5.2 AUTONOMOUS

6.5.3 SHARED

6.5.4 CONNECTED

6.5.5 YEARLY UPDATES

6.5.6 CLIMATE CHANGE

6.5.7 DEMOGRAPHIC SHIFTS

6.6 PATENT ANALYSIS

TABLE 6 PATENTS GRANTED FROM 2011 TO 2016

7 AUTOMOTIVE DC-DC CONVERTERS MARKET, BY VEHICLE TYPE (Page No. - 78)

7.1 INTRODUCTION

7.2 COVID-19 IMPACT ON VEHICLE TYPES

FIGURE 23 PASSENGER VEHICLE SEGMENT TO DOMINATE DURING FORECAST PERIOD (USD MILLION)

TABLE 7 AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

7.3 COMMERCIAL VEHICLE

TABLE 8 AUTOMOTIVE DC-DC CONVERTERS MARKET SIZE FOR COMMERCIAL VEHICLES, BY REGION, 2018–2025 (USD MILLION)

7.3.1 LIGHT COMMERCIAL VEHICLES (LCV)

7.3.1.1 Increasing demand from logistics sector will drive demand for LCV

7.3.2 HEAVY COMMERCIAL VEHICLES (HCV)

7.3.2.1 Advancements in battery technology to boost heavy commercial vehicles market

7.4 PASSENGER VEHICLE

TABLE 9 AUTOMOTIVE DC-DC CONVERTERS MARKET SIZE FOR PASSENGER VEHICLES, BY REGION, 2018–2025 (USD MILLION)

7.4.1 SPORTS UTILITY VEHICLE (SUV)

7.4.1.1 Rapid development and production of small and compact SUVs will fuel market growth

7.4.2 MULTI-UTILITY VEHICLE (MUV)

7.4.2.1 Increase in electrification of MUVs will boost demand

7.4.3 SEDAN

7.4.3.1 Rise in shared mobility will fuel demand for electric sedans to curb GHG emissions

7.4.4 HATCHBACK

7.4.4.1 Efforts to reduce carbon footprint leading to electrification in hatchbacks

7.5 OPERATIONAL DATA

TABLE 10 ELECTRIC VEHICLES MARKET SIZE, 2018–2020 (UNITS)

8 AUTOMOTIVE DC-DC CONVERTERS MARKET, BY PROPULSION TYPE (Page No. - 85)

8.1 INTRODUCTION

FIGURE 24 BEV SEGMENT TO DOMINATE DURING FORECAST PERIOD (USD MILLION)

TABLE 11 AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY PROPULSION TYPE, 2018–2025 (USD MILLION)

8.2 BATTERY ELECTRIC VEHICLES (BEV)

8.2.1 RISING ENVIRONMENTAL CONCERNS DRIVE BEV MARKET

TABLE 12 AUTOMOTIVE DC-DC CONVERTER MARKET SIZE FOR BEV, BY REGION 2018–2025 (USD MILLION)

8.3 FUEL CELL ELECTRIC VEHICLE (FCEV)

8.3.1 DEMAND FOR ZERO EMISSION VEHICLES WILL BOOST FCEV MARKET

TABLE 13 AUTOMOTIVE DC-DC CONVERTER MARKET SIZE FOR FCEV, BY REGION 2018–2025 (USD MILLION)

8.4 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

8.4.1 PHEV SEGMENT BENEFITS FROM TAX BENEFITS AND INCENTIVES

TABLE 14 AUTOMOTIVE DC-DC CONVERTER MARKET SIZE FOR PHEV, BY REGION 2018–2025 (USD MILLION)

8.5 OPERATIONAL DATA

TABLE 15 BEV, FCEV, AND PHEV, MARKET SIZE, 2018–2025 (UNITS)

9 AUTOMOTIVE DC-DC CONVERTERS MARKET, BY INPUT VOLTAGE (Page No. - 90)

9.1 INTRODUCTION

FIGURE 25 >70V INPUT VOLTAGE SEGMENT TO HAVE HIGHEST CAGR DURING FORECAST PERIOD (USD MILLION)

TABLE 16 AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY INPUT VOLTAGE, 2018–2025 (USD MILLION)

9.2 <40V

9.2.1 COST-EFFECTIVENESS CONTRIBUTES TO GROWTH OF <40 V SEGMENT

TABLE 17 <40V INPUT AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.3 40-70V

9.3.1 SAFETY FEATURES FOR VARIOUS POWER ELECTRONICS IN CIRCUIT DRIVES 40-70V SEGMENT

TABLE 18 40-70V INPUT AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.4 >70V

9.4.1 >70V RANGE SIMPLIFIES DESIGN REQUIREMENTS IN DEMANDING AUTOMOTIVE APPLICATIONS

TABLE 19 >70V INPUT AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10 AUTOMOTIVE DC-DC CONVERTERS MARKET, BY OUTPUT VOLTAGE (Page No. - 94)

10.1 INTRODUCTION

FIGURE 26 12V SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

TABLE 20 AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY OUTPUT VOLTAGE, 2018–2025 (USD MILLION)

10.2 3.3V

10.2.1 NEED FOR MULTIPLE LOW OUTPUT VOLTAGES IN ELECTRIC VEHICLES DRIVES MARKET FOR 3.3V CONVERTERS

TABLE21 3.3V OUTPUT AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.3 5V

10.3.1 PROTECTION AGAINST OUTPUT SHORT CIRCUIT FAULTS DRIVES 5V MARKET

TABLE22 5V OUTPUT AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.4 12V

10.4.1 HIGH DEMAND OBSERVED FOR 12V OUTPUT IN ELECTRIC VEHICLE SYSTEMS

TABLE23 12V OUTPUT AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.5 15V

10.5.1 RISE IN ADOPTION OF BATTERY AND HYBRID ELECTRIC VEHICLES WILL DRIVE 15V SEGMENT

TABLE24 15V OUTPUT AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.6 24V AND ABOVE

10.6.1 HIGH VOLTAGE OUTPUT FOR HEAVY COMMERCIAL VEHICLES BOOSTS 24V AND ABOVE OUTPUT SEGMENT

TABLE25 24V AND ABOVE OUTPUT AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11 AUTOMOTIVE DC-DC CONVERTERS MARKET, BY OUTPUT POWER (Page No. - 100)

11.1 INTRODUCTION

FIGURE 27 10-20KW SEGMENT PROJECTED TO LEAD OUTPUT POWER MARKET DURING FORECAST PERIOD

TABLE 26 AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY OUTPUT POWER, 2018–2025 (USD MILLION)

11.2 <1KW

11.2.1 INCREASING R&D IN POWER ELECTRONICS OF ELECTRIC VEHICLES TO DRIVE <1KW SEGMENT

TABLE27 <1KW OUTPUT AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11.3 1-10KW

11.3.1 RISING ADOPTION OF BEV AND PHEV BOOSTS MARKET FOR 1-10KW OUTPUT POWER CONVERTERS

TABLE28 1-10KW OUTPUT AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11.4 10-20KW

11.4.1 HIGH EFFICIENCY AND POWER DENSITY KEY TO GROWTH OF 10-20KW SEGMENT

TABLE 29 10-20KW OUTPUT AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11.5 >20KW

11.5.1 >20KW SEGMENT GROWTH DRIVEN BY RISE IN ELECTRIFICATION OF VEHICLES

TABLE 30 >20KW OUTPUT AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

12 AUTOMOTIVE DC-DC CONVERTERS MARKET, BY PRODUCT TYPE (Page No. - 105)

12.1 INTRODUCTION

FIGURE 28 ISOLATED DC-DC CONVERTERS TO HOLD DOMINANT SHARE DURING FORECAST PERIOD (USD MILLION)

TABLE 31 AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

12.2 ISOLATED

12.2.1 RISE IN ELECTRIFICATION IN AUTOMOBILES TO BOOST ISOLATED CONVERTERS MARKET

TABLE 32 ISOLATED AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

12.3 NON-ISOLATED

12.3.1 DEMAND FOR NON-ISOLATED CONVERTERS DRIVEN BY THEIR HIGH EFFICIENCY AND LOW COST

TABLE 33 NON-ISOLATED AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

13 REGIONAL ANALYSIS (Page No. - 109)

13.1 INTRODUCTION

FIGURE 29 AUTOMOTIVE DC-DC CONVERTERS MARKET: REGIONAL SNAPSHOT (2020)

TABLE 34 AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

13.2 NORTH AMERICA

13.2.1 NORTH AMERICA: PESTLE ANALYSIS

13.2.2 NORTH AMERICA: COVID-19 IMPACT

FIGURE 30 NORTH AMERICA: AUTOMOTIVE DC-DC CONVERTER MARKET SNAPSHOT

TABLE35 NORTH AMERICA: ELECTRIC COMMERCIAL AND PASSENGER VEHICLE VOLUME, BY COUNTRY, 2018–2025 (UNITS)

TABLE36 NORTH AMERICA: AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY VEHICLE TYPE, 2018–2025 (UNITS)

TABLE37 NORTH AMERICA: MARKET SIZE, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE38 NORTH AMERICA: MARKET SIZE FOR PASSENGER VEHICLES, BY PROPULSION TYPE, 2018–2025 (UNITS)

TABLE39 NORTH AMERICA: MARKET SIZE FOR PASSENGER VEHICLES, BY PROPULSION TYPE, 2018–2025 (USD MILLION)

TABLE40 NORTH AMERICA: MARKET SIZE, BY INPUT VOLTAGE, 2018–2025 (USD MILLION)

TABLE41 NORTH AMERICA: MARKET SIZE, BY OUTPUT VOLTAGE, 2018–2025 (USD MILLION)

TABLE42 NORTH AMERICA: MARKET SIZE, BY OUTPUT POWER, 2018–2025 (USD MILLION)

TABLE43 NORTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE44 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

13.2.3 US

13.2.3.1 Increasing adoption of electric vehicles will boost demand for DC-DC converters in the US

TABLE45 US: AUTOMOTIVE DC-DC CONVERTERS MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE46 US: AUTOMOTIVE DC-DC CONVERTER MARKET SIZE FOR PASSENGER VEHICLES, BY PROPULSION TYPE, 2018–2025 (USD MILLION)

TABLE47 US: AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY INPUT VOLTAGE, 2018–2025 (USD MILLION)

13.2.4 CANADA

13.2.4.1 Subsidies and tax exemptions from Canadian government will drive market

TABLE48 CANADA: AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE49 CANADA: AUTOMOTIVE DC-DC CONVERTER MARKET SIZE FOR PASSENGER VEHICLES, BY PROPULSION TYPE, 2018–2025 (USD MILLION)

TABLE50 CANADA: AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY INPUT VOLTAGE, 2018–2025 (USD MILLION)

13.3 EUROPE

13.3.1 EUROPE: PESTLE ANALYSIS

13.3.1.1 POLITICAL

13.3.2 EUROPE: COVID-19 IMPACT

FIGURE 31 EUROPE: AUTOMOTIVE DC-DC CONVERTERS MARKET SNAPSHOT

TABLE51 EUROPE: ELECTRIC COMMERCIAL AND PASSENGER VEHICLE VOLUME, BY COUNTRY, 2018–2025 (UNITS)

TABLE52 EUROPE: MARKET SIZE, BY VEHICLE TYPE, 2018–2025 (UNITS)

TABLE53 EUROPE: MARKET SIZE, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE54 EUROPE: MARKET SIZE FOR PASSENGER VEHICLES, BY PROPULSION TYPE, 2018–2025 (UNITS)

TABLE55 EUROPE: MARKET SIZE FOR PASSENGER VEHICLES, BY PROPULSION TYPE, 2018–2025 (USD MILLION)

TABLE56 EUROPE: MARKET SIZE, BY INPUT VOLTAGE, 2018–2025 (USD MILLION)

TABLE57 EUROPE: MARKET SIZE, BY OUTPUT VOLTAGE, 2018–2025 (USD MILLION)

TABLE58 EUROPE: MARKET SIZE, BY OUTPUT POWER, 2018–2025 (USD MILLION)

TABLE59 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE60 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

13.3.3 UK

13.3.3.1 Increasing demand for energy-efficient solutions results in demand for DC-DC converters in the UK

TABLE61 UK: AUTOMOTIVE DC-DC CONVERTERS MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE62 UK: MARKET SIZE FOR PASSENGER VEHICLES, BY PROPULSION TYPE, 2018–2025 (USD MILLION)

TABLE63 UK: MARKET SIZE, BY INPUT VOLTAGE, 2018–2025 (USD MILLION)

13.3.4 FRANCE

13.3.4.1 Government purchase grants will boost DC-DC converter demand in France

TABLE64 FRANCE: AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE65 FRANCE: MARKET SIZE FOR PASSENGER VEHICLES, BY PROPULSION TYPE, 2018–2025 (USD MILLION)

TABLE66 FRANCE: MARKET SIZE, BY INPUT VOLTAGE, 2018–2025 (USD MILLION)

13.3.5 GERMANY

13.3.5.1 Rising sales of battery electric vehicles by domestic players will boost demand in Germany

TABLE67 GERMANY: AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE68 GERMANY: AUTOMOTIVE DC-DC CONVERTERS MARKET SIZE FOR PASSENGER VEHICLES, BY PROPULSION TYPE, 2018–2025 (USD MILLION)

TABLE69 GERMANY: MARKET SIZE, BY INPUT VOLTAGE, 2018–2025 (USD MILLION)

13.3.6 NORWAY

13.3.6.1 Emergence of e-mobility will boost demand for DC-DC converters in Norway

TABLE70 NORWAY: AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE71 NORWAY: MARKET SIZE FOR PASSENGER VEHICLES, BY PROPULSION TYPE, 2018–2025 (USD MILLION)

TABLE72 NORWAY: MARKET SIZE, BY INPUT VOLTAGE, 2018–2025 (USD MILLION)

13.3.7 SWEDEN

13.3.7.1 Strong existing charging infrastructure will increase adoption of electric vehicles in Sweden

TABLE73 SWEDEN: AUTOMOTIVE DC-DC CONVERTERS MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE74 SWEDEN: MARKET SIZE FOR PASSENGER VEHICLES, BY PROPULSION TYPE, 2018–2025 (USD MILLION)

TABLE75 SWEDEN: MARKET SIZE, BY INPUT VOLTAGE, 2018–2025 (USD MILLION)

13.3.8 REST OF EUROPE

13.3.8.1 Government focus on greener vehicles will boost demand for DC-DC converters in Rest of Europe

TABLE76 REST OF EUROPE: AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE77 REST OF EUROPE: MARKET SIZE FOR PASSENGER VEHICLES, BY PROPULSION TYPE, 2018–2025 (USD MILLION)

TABLE78 REST OF EUROPE: MARKET SIZE, BY INPUT VOLTAGE, 2018–2025 (USD MILLION)

13.4 ASIA PACIFIC

13.4.1 ASIA PACIFIC: PESTLE ANALYSIS

13.4.1.1 Environment

13.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 32 ASIA PACIFIC: AUTOMOTIVE DC-DC CONVERTERS MARKET SNAPSHOT

TABLE79 ASIA PACIFIC: ELECTRIC COMMERCIAL AND PASSENGER VEHICLE VOLUME, BY COUNTRY, 2018–2025 (UNITS)

TABLE80 ASIA PACIFIC: MARKET SIZE, BY VEHICLE TYPE, 2018–2025 (UNITS)

TABLE81 ASIA PACIFIC: MARKET SIZE, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE82 ASIA PACIFIC: MARKET SIZE FOR PASSENGER VEHICLES, BY PROPULSION TYPE, 2018–2025 (UNITS)

TABLE83 ASIA PACIFIC: MARKET SIZE FOR PASSENGER VEHICLES, BY PROPULSION TYPE, 2018–2025 (USD MILLION)

TABLE84 ASIA PACIFIC: MARKET SIZE, BY INPUT VOLTAGE, 2018–2025 (USD MILLION)

TABLE85 ASIA PACIFIC: MARKET SIZE, BY OUTPUT VOLTAGE, 2018–2025 (USD MILLION)

TABLE86 ASIA PACIFIC: MARKET SIZE, BY OUTPUT POWER, 2018–2025 (USD MILLION)

TABLE87 ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE88 ASIA PACIFIC: AMARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

13.4.3 CHINA

13.4.3.1 China’s automotive and electronic goods sectors expected to increase demand for DC-DC converters

TABLE89 CHINA: AUTOMOTIVE DC-DC CONVERTERS MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE90 CHINA: MARKET SIZE FOR PASSENGER VEHICLES, BY PROPULSION TYPE, 2018–2025 (USD MILLION)

TABLE91 CHINA: AUTOMOTIVE DC-DC CONVERTER MARKET SIZE, BY INPUT VOLTAGE, 2018–2025 (USD MILLION)

13.4.4 INDIA

13.4.4.1 Growing concerns to curb GHG emissions propel demand for electric vehicles in India

TABLE92 INDIA: AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE93 INDIA: MARKET SIZE FOR PASSENGER VEHICLES, BY PROPULSION TYPE, 2018–2025 (USD MILLION)

TABLE94 INDIA: MARKET SIZE, BY INPUT VOLTAGE, 2018–2025 (USD MILLION)

13.4.5 JAPAN

13.4.5.1 Market in Japan to grow due to rising adoption of electric vehicles

TABLE95 JAPAN: AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE96 JAPAN: MARKET SIZE FOR PASSENGER VEHICLES, BY PROPULSION TYPE, 2018–2025 (USD MILLION)

TABLE97 JAPAN: MARKET SIZE, BY INPUT VOLTAGE, 2018–2025 (USD MILLION)

13.4.6 SOUTH KOREA

13.4.6.1 Development of electric vehicle infrastructure to boost DC-DC converters market in South Korea

TABLE98 SOUTH KOREA: AUTOMOTIVE DC-DC CONVERTERS MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE99 SOUTH KOREA: MARKET SIZE FOR PASSENGER VEHICLES, BY PROPULSION TYPE, 2018–2025 (USD MILLION)

TABLE100 SOUTH KOREA: MARKET SIZE, BY INPUT VOLTAGE, 2018–2025 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 142)

14.1 OVERVIEW

TABLE 101 KEY DEVELOPMENTS BY LEADING PLAYERS IN AUTOMOTIVE DC-DC CONVERTERS MARKET 2015-2020

14.2 COMPANY EVALUATION QUADRANT

14.2.1 STAR

14.2.2 EMERGING LEADERS

14.2.3 PERVASIVE

14.2.4 PARTICIPANT

FIGURE 33 AUTOMOTIVE DC-DC CONVERTERS MARKET COMPETITIVE LEADERSHIP MAPPING, 2019

14.3 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 34 STRENGTH OF PRODUCT PORTFOLIO OF MAJOR PLAYERS IN AUTOMOTIVE DC-DC CONVERTERS MARKET

14.4 BUSINESS STRATEGY EXCELLENCE

FIGURE 35 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN AUTOMOTIVE DC-DC CONVERTER MARKET

14.5 MARKET RANKING ANALYSIS

FIGURE 36 RANK ANALYSIS OF LEADING PLAYERS IN DC-DC CONVERTERS MARKET, 2019

14.6 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2019

FIGURE 37 MARKET SHARE ANALYSIS OF LEADING PLAYERS IN AUTOMOTIVE DC-DC CONVERTER MARKET, 2019

14.7 REVENUE ANALYSIS OF LEADING PLAYERS, 2017-2019

FIGURE 38 REVENUE ANALYSIS OF LEADING PLAYERS IN AUTOMOTIVE DC-DC CONVERTER MARKET, 2017-2019

14.8 COMPETITIVE SCENARIO

14.8.1 MERGERS & ACQUISITIONS IN AUTOMOTIVE DC-DC CONVERTERS MARKET

TABLE102 MERGERS & ACQUISITIONS, 2015-2020

14.8.2 NEW PRODUCT LAUNCHES AND CERTIFICATIONS IN AUTOMOTIVE DC-DC CONVERTER MARKET

TABLE103 NEW PRODUCT LAUNCHES AND CERTIFICATIONS, 2015-2020

14.8.3 CONTRACTS, PARTNERSHIPS, AND AGREEMENTS IN AUTOMOTIVE DC-DC CONVERTER MARKET

TABLE104 CONTRACTS, PARTNERSHIPS, AND AGREEMENTS, 2015-2020

14.8.4 EXPANSIONS, COLLABORATIONS, AND JOINT VENTURES IN AUTOMOTIVE DC-DC CONVERTERS MARKET

TABLE105 EXPANSIONS, COLLABORATIONS, AND JOINT VENTURES, 2015-2020

15 COMPANY PROFILES (Page No. - 162)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

15.1 VICOR CORPORATION

FIGURE 39 VICOR CORPORATION: COMPANY SNAPSHOT

15.2 DENSO CORPORATION

FIGURE 40 DENSO CORPORATION: COMPANY SNAPSHOT

15.3 BORGWARNER INC.

FIGURE 41 BORGWARNER, INC.: COMPANY SNAPSHOT

15.4 TDK-LAMBDA CORPORATION

15.5 VALEO

FIGURE 42 VALEO: COMPANY SNAPSHOT

15.6 ROBERT BOSCH GMBH

15.7 STMICROELECTRONICS

FIGURE 44 STMICROELECTRONICS: COMPANY SNAPSHOT

15.8 BEL FUSE INC.

FIGURE 45 BEL FUSE INC.: COMPANY SNAPSHOT

15.9 RECOM POWER GMBH

15.1 MORNSUN GUANGZHOU SCIENCE & TECHNOLOGY CO., LTD.

15.11 MARELLI CORPORATION

15.12 TOSHIBA CORPORATION

FIGURE 46 TOSHIBA CORPORATION: COMPANY SNAPSHOT

15.13 HELLA GMBH & CO. KGAA

FIGURE 47 HELLA GMBH & CO. KGAA: COMPANY SNAPSHOT

15.14 TOYOTA INDUSTRIES CORPORATION

FIGURE 48 TOYOTA INDUSTRIES CORPORATION: COMPANY SNAPSHOT

15.15 CONTINENTAL AG

FIGURE 49 CONTINENTAL AG: COMPANY SNAPSHOT

15.16 LG INNOTEK

FIGURE 50 LG INNOTEK: COMPANY SNAPSHOT

15.17 HYUNDAI MOBIS

FIGURE 51 HYUNDAI MOBIS: COMPANY SNAPSHOT

15.18 ANALOG DEVICES, INC.

FIGURE 52 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

15.19 DELTA ELECTRONICS, INC.

FIGURE 53 DELTA ELECTRONICS, INC.: COMPANY SNAPSHOT

15.20 INFINEON TECHNOLOGIES AG

FIGURE 54 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

15.21 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC (ON SEMICONDUCTOR)

FIGURE 55 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: COMPANY SNAPSHOT

15.22 SHENZHEN XINRUI TECHNOLOGY CO., LTD

15.23 SHINDENGEN ELECTRIC MANUFACTURING CO., LTD

FIGURE 56 SHINDENGEN ELECTRIC MANUFACTURING CO., LTD: COMPANY SNAPSHOT

15.24 CINCON ELECTRONICS CORPORATION

15.25 PANASONIC CORPORATION

FIGURE 57 PANASONIC CORPORATION: COMPANY SNAPSHOT

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

16 AUTOMOTIVE DC-DC CONVERTERS ADJACENT MARKETS (Page No. - 226)

16.1 INTRODUCTION

16.2 ELECTRIC VEHICLE CHARGING MARKET, BY CHARGING POINT

FIGURE 58 SUPERCHARGING SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD, 2019–2027 (UNITS)

TABLE 106 ELECTRIC VEHICLE CHARGING MARKET, BY CHARGING POINT TYPE, 2017–2027 (UNITS)

16.2.1 NORMAL CHARGING

16.2.1.1 Increase adoption of electric vehicles will boost the demand

TABLE 107 NORMAL CHARGING: ELECTRIC VEHICLE CHARGING MARKET, BY REGION, 2017–2027 (UNITS)

16.2.2 SUPER CHARGING

16.2.2.1 Demand for fast charging will boost demand for super charging

TABLE 108 SUPER CHARGING: ELECTRIC VEHICLE CHARGING MARKET, BY REGION, 2017–2027 (UNITS)

16.3 ELECTRIC COMMERCIAL VEHICLES MARKET, BY BATTERY CAPACITY

FIGURE 59 <50KWH SEGMENT TO BE FASTEST-GROWING DURING FORECAST PERIOD (UNITS)

TABLE 109 ELECTRIC COMMERCIAL VEHICLE MARKET SIZE, BY BATTERY CAPACITY, 2017-2027 (UNITS)

16.3.1 LESS THAN 50 KWH

16.3.1.1 High adoption rate of electric vans to boost less than 50kWh segment

TABLE 110 LESS THAN 50 KWH ELECTRIC COMMERCIAL VEHICLE MARKET SIZE, BY REGION, 2017-2027 (UNITS)

16.3.2 50–200 KWH

16.3.2.1 Affordable electric buses and pick-up trucks offered by OEMs in Asia Pacific to fuel 50-250 kWh market

TABLE 111 50-200 KWH ELECTRIC COMMERCIAL VEHICLE MARKET SIZE, BY REGION, 2017-2027 (UNITS)

16.3.3 ABOVE 250 KWH

16.3.3.1 Chinese electric bus fleet dominated by buses with more than 250 kWh battery capacity

TABLE 112 ABOVE 250 KWH ELECTRIC COMMERCIAL VEHICLE MARKET SIZE, BY REGION, 2017-2027 (UNITS)

17 APPENDIX (Page No. - 234)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 AVAILABLE CUSTOMIZATIONS

17.4 RELATED REPORTS

The research study conducted on the automotive DC-DC converters market involved extensive use of secondary sources, directories, and databases such as company annual reports/presentations, industry association publications, automotive magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the automotive DC-DC converters market. The primary sources—experts from related industries, automobile OEMs, and suppliers—were interviewed to obtain and verify critical information and assess the growth prospects and market estimations. In-depth interviews with various primary respondents, including key industry participants, Subject Matter Experts (SMEs), industry consultants, and C-level executives have been conducted to obtain and verify critical qualitative and quantitative information pertaining to the automotive DC-DC converters market as well as to assess the growth prospects of the market.

Secondary Research

The secondary sources referred for this research study include automotive industry organizations such as the Organisation Internationale des Constructeurs d'Automobiles (OICA), the Alternative Fuels Data Center (AFDC), Canadian Automobile Association (CAA), Country-level Automotive Associations and Trade Organizations, Environmental Protection Agency (EPA), International Council on Clean Transportation (ICCT), European Automobile Manufacturers Association (ACEA), corporate filings (such as annual reports, investor presentations, and financial statements) of trade, business, and automotive associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary research. This entire procedure included studying annual and financial reports of top market players and in-depth interviews for key insights from industry leaders such as CEOs, VPs, directors, and marketing executives. Both top-down and bottom-up approaches were used to estimate and validate the size of the automotive DC-DC converters market. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size through the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments. The data was triangulated by studying various factors and trends from both, the demand and supply sides. Along with this, the market size was validated using both, the top-down and bottom-up approaches.

Report Objectives

- To define and forecast the size of the automotive DC-DC converters market based on vehicle type, propulsion type, input voltage, output voltage, output power, and product type

- To forecast the market size in three main regions, namely, North America, Europe, and Asia Pacific

- To segment and forecast the market size, in terms of value and volume, on the basis of vehicle type, and propulsion type

- To identify, analyze, describe, and evaluate the key drivers, restraints, opportunities, and challenges in the market

- To analyze and provide a view of the tariff and regulatory landscape in various countries in terms of initiatives for electric vehicles

- To strategically analyze emerging technological trends and prospects in the automotive DC-DC converters market

- To analyze the adjacent and connected markets to provide valuable insights for manufacturers and suppliers of automotive DC-DC converters

- To analyze the degree of competition in the market by identifying key market players

- To provide company profiles of key stakeholders in the market, along with their product portfolios, market share, and key growth strategies

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze competitive developments, such as mergers & acquisitions, new product launches & certifications, contracts, partnerships & agreements, expansions, collaborations, and joint ventures of key market players

- To identify the market rank, key products, and key developments of leading companies in the market

- To strategically profile key players and comprehensively analyze their market share and core competencies1

- To analyze the impact of the COVID-19 pandemic on various stakeholders of the automotive DC-DC converters market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Automotive DC-DC Converters Market