Thermal Interface Materials Market

Thermal Interface Materials Market by Material (Silicone, Epoxy,Polymide), Type (Greases & Adhesives, Tapes & Films, Gap Fillers, Phase Change Materials), Application (Computers, Telecom, Consumer Durables) & Region - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global thermal interface materials market is projected to grow from USD 3.56 billion in 2024 to USD 5.64 billion by 2029, at a CAGR of 9.7% during the forecast period. The increased prevalence of electric vehicles, 5G infrastructure, renewable energy systems, and high-performing computers require appropriate thermal management for device stability and longevity. Thermal Interface Materials (TIMs) have excellent thermal conductivity, good mechanical stability, and can be applied easily to distribute heat away from semiconductors, batteries, and power electronics. Moreover, innovations in nano-filled, phase-change, and graphite-based thermal interface materials, along with sustainability-focused formulations, are transforming the sector towards enhanced efficiency and environmentally friendly performance.

KEY TAKEAWAYS

-

BY MATERIALThe thermal interface materials market includes silicone, epoxy, polyimide, and other materials, with silicone-based TIMs leading due to flexibility and high thermal performance, while epoxy, polyimide, and others serve specialized high-performance and industrial applications.

-

BY APPLICATIONThermal interface materials are used in computers & data centers, automotive, telecommunications, industrial applications, healthcare & medical devices, consumer durables, and other applications, driven by rising heat dissipation needs and device miniaturization, with healthcare & medical devices being the fastest-growing segment.

-

BY TYPEThe market comprises greases & adhesives, tapes & films, gap fillers, metal-based TIMs, phase-change materials, and other types, each catering to specific thermal management requirements based on conductivity, mechanical compliance, and application environment, driven by increasing adoption of electric vehicles, high-performance electronics, 5G infrastructure, and renewable energy systems.

-

BY REGIONThe thermal interface materials market is segmented regionally into Asia Pacific, North America, Europe, South America, and the Middle East & Africa. Asia Pacific is the fastest-growing region, driven by due to rapid industrialization, increasing electronics manufacturing, growing adoption of electric vehicles and renewable energy systems, and rising demand for high-performance thermal management solutions.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Dow, 3M, Honeywell International Inc., Henkel AG & Co. KGaA, and Parker Hannifin Corporation entered into a number of agreements, partnerships, product launches, and expansions to cater to the growing demand for thermal interface materials across innovative applications.

The growth in this market can be attributed to the increasing use of thermal interface materials in computers. The demand for computer components is increasing due to an increase in computer purchases. Other industries, such as telecommunications, are also growing, particularly in 5G setups.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The influence on customers' businesses in the Thermal Interface Materials market stems from rising device performance requirements, miniaturization, and evolving industrial and consumer electronics trends. Key industries encompass computers and data centers, automobiles, telecommunications, industrial applications, healthcare and medical devices, and consumer durables, while targeted applications pertain to heat dissipation, insulation, and thermal management of electronic and power components. Variations in end-user demand directly influence revenues for manufacturers and suppliers of Thermal Interface Materials, hence defining overall market growth and sales dynamics.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for consumer electroni

-

Rise in EV adoption

Level

-

Physical properties limiting performance

-

High cost of advanced thermal interface materials

Level

-

Adoption of 5G technology

-

Increasing adoption of nanodiamonds

Level

-

Finding optimum operating costs for end users

-

Maintaining the optimal granule size and amount of TIM applied

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for consumer electronics

The increasing focus on effective thermal management solutions is a result of the expanding consumer market for high-performance mobile electronics, such as smartphones, tablets, laptops, gaming consoles, and wearables. As consumer electronics evolve and manufacturers incorporate advanced processing technology, higher density batteries, and power-consuming components, there is a trend toward compact and multifunctional designs. Improved performance and added functionality, however, come with increased heat, which can lead to performance degradation, component failure, and reduced device life without proper management. To address these issues, thermal interface materials have been designed as thermally conductive mediums that reduce thermal resistance and enhance heat dissipation, so ensuring reliable and efficient operation of electronic devices.

Restraint: Physical properties limiting the performance of thermal interface materials

In microprocessor chips, power densities have been escalating in the past few decades. As a result of the continuing trend of reduction in device dimensions, thermal issues in electronic circuits have become increasingly dramatic. A thermal management system may use all modes of heat transfer to keep temperatures within their acceptable limits and to operate at optimum performance and reliability, but conductive heat transfer is generally the mode of heat transfer used to spread the heat away from its point of generation into the extended surface area of a heat sink. Although the use of thermal interface materials increases heat transfer across an interface, thermal interface materials are responsible for most of the systems' thermal resistance.

Opportunity: Adoption of 5G technology

The emergence of 5G technology is markedly enhancing global connectivity, characterized by accelerated speeds, reduced latency, and the capacity to simultaneously link millions of devices. As companies embrace digital transformation, 5G is emerging as a crucial facilitator in sectors including manufacturing, healthcare, automotive, and smart cities. Companies are utilizing 5G to enable applications such as the Internet of Things (IoT), autonomous vehicles, remote healthcare, augmented reality (AR), and Industry 4.0 initiatives. As the use of 5G technology is increasing, there is an emerging need to evaluate the need for thermal interface materials to help facilitate the performance of 5G technology-enabled devices.

Challenge: Finding optimum operating costs for end users

Determining optimal operating costs with Thermal Interface Materials (TIMs) is complex due to the interrelated variables. Enhanced thermal conductivity facilitates heat transfer but often affects conformability and workability, hence influencing assembly and performance. Key variables encompass phase transition temperature, viscosity, pressure, outgassing, and surface polish. Outgassing presents a significant challenge in aerospace and sealed applications; yet, materials with decreased outgassing characteristics tend to be more costly. Furthermore, it is crucial to equilibrate wetting and gap-filling properties, as high-wetting thermal interface materials enhance conductivity but degrade more swiftly, thereby reducing long-term effectiveness. Manufacturers must navigate these trade-offs to improve performance, reliability, and cost-effectiveness across diverse applications.

Thermal Interface Materials Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Developed THERM-A-GAP GEL 40NS, a non-silicone, urethane-based TIM for automotive infotainment and camera modules, addressing ADAS and AVNT thermal challenges. | Provides high thermal conductivity, faster assembly, and long-term reliability without silicone-related failures. |

|

Developed 3M Thermally Conductive Adhesive Transfer Tapes for consumer electronics to manage heat in compact devices like smartphones and tablets. | Enables thinner designs, strong adhesion, and consistent heat dissipation for improved device performance. |

|

Utilizes BERGQUIST GAP PAD TGP 1000 in data center servers and power electronics for enhanced heat dissipation between components. | Ensures efficient thermal transfer, improved reliability, and extended component life in high-power computing systems. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of thermal interface materials involves raw material suppliers, manufacturers, distributors, and end users. The different materials considered in this report include silicone, epoxy, and polyimide. They are manufactured in the form of grease, tapes, films, pads, and phase change materials. Further, it is either sold directly to end users or to distributors for further sale to customers.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Thermal Interface Market, By Material

In 2023, silicone-based materials dominated the global Thermal Interface Materials market due to their adaptability and superior performance. Silicone thermal interface materials are easy to apply, adept at filling minute gaps that other substances cannot, and offer exceptional thermal conductivity for effective heat dissipation from heated components. Their robustness and adaptability make them suitable for diverse applications, ensuring lasting performance and reliable temperature control.

Thermal Interface Market, By Type

In 2023, the thermal interface materials market is dominated by grease and adhesive types. This results from their ease of use and adaptability across multiple applications. Grease is simple to apply, compatible with automated dispensing systems, and appropriate for large-scale manufacturing. Adhesives serve as thermal interface materials and fastening agents, facilitating assembly and ensuring uniformity in bonding materials. They are widely used because of their ease of application, sustainability, and efficiency across various applications.

Thermal Interface Market, By Application

In 2023, the Thermal Interface Materials market is largely driven by the computer and data center industry, which remains the largest application segment. Rising investments in electronic devices and high-performance computing have surged demand for TIMs to manage heat dissipation, ensure even thermal distribution, and maintain optimal efficiency of components. As computer technology advances, the need for reliable thermal management continues to grow.

REGION

Asia Pacific to be the fastest-growing region in the global thermal interface material market during the forecast period

The Thermal Interface Materials (TIMs) market in the Asia Pacific region is expected to experience the fastest growth due to increased electronic-device usage, along with government policies promoting local production. A higher degree of domestic manufacturing will lead to less reliance on imported products and consequently lower production costs and higher demand, for example for TIMs. As the prices of smartphones, tablets, laptops, and electronics continue to decline and disposable incomes expand, the need for TIMs for efficient thermal dissipation, performance, and longevity remains clear. Demand will continue to grow in several key sectors, including data centers, automotive, and renewable energy solutions, to ensure reliable operation of critical electronic components throughout the region.

Thermal Interface Materials Market: COMPANY EVALUATION MATRIX

Honeywell International Inc. (Star) dominates the Thermal Interface Materials market with a robust global presence, an extensive product portfolio, and a commitment to research and development, enabling substantial infiltration into computer, datacenter, automotive, telecommunications, and industrial sectors. Momentive (Emerging Leader) is securing a portion of the TIM market by creating innovative high-performance and specialized thermal solutions, emphasizing customer-specific materials for electronics, automotive, and industrial applications, while simultaneously enhancing its standing in the leader quadrant through reliability, quality, and customer service.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 3.25 BN |

| Market Forecast in 2029 (Value) | USD 5.64 BN |

| CAGR | 9.7% |

| Years Considered | 2020–2029 |

| Base Year | 2023 |

| Forecast Period | 2024–2029 |

| Units Considered | Value (USD MN) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Thermal Interface Materials Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based thermal interface material manufacturer |

|

|

| Silicone-based thermal interface material manufacturers |

|

|

| Epoxy-based thermal interface material manufacturers |

|

|

RECENT DEVELOPMENTS

- November 2024 : Parker Hannifin Corp. launched a new range of thermal grease made from silicone and ceramic filler materials ideal for use in heat dissipation in CPUs and GPUs, memory modules, power supplies, power conversion equipment, lighting, and automotive control modules.

- October 2024 : Dow and Carbice announced a strategic partnership to enhance thermal management solutions by combining Dow’s expertise in material science with Carbice’s proprietary nanotechnology. The collaboration aims to create next-generation thermal interface materials that improve heat dissipation in electronics, enhancing device performance and reliability.

- June 2023 : Henkel AG & Co. KGaA launched its new manufacturing facility for the production of high-impact adhesive products. This has helped the company enhance its supply in international and domestic markets, catering to demand from electronics, automotive, medical, equipment manufacturing, and aerospace.

- February 2023 : Momentive opened a new manufacturing facility in Rayong, Thailand, to meet the increasing demand for specialty silicones in industries such as beauty and personal care, automotive, energy, healthcare, and agriculture.

- April 2022 : 3M company partnered with Innovative Automation Inc., a high-quality automation systems manufacturer, to develop an automated system for tape in industrial applications.

Table of Contents

Methodology

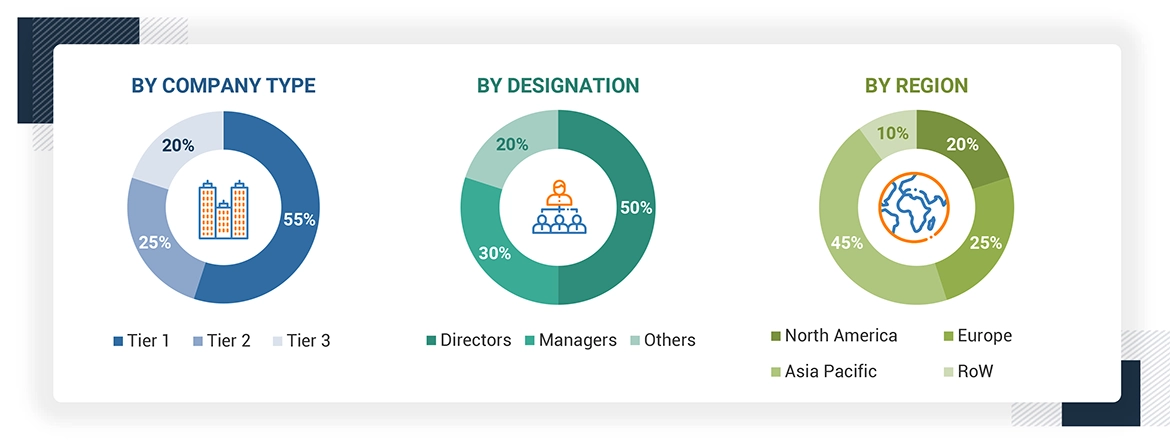

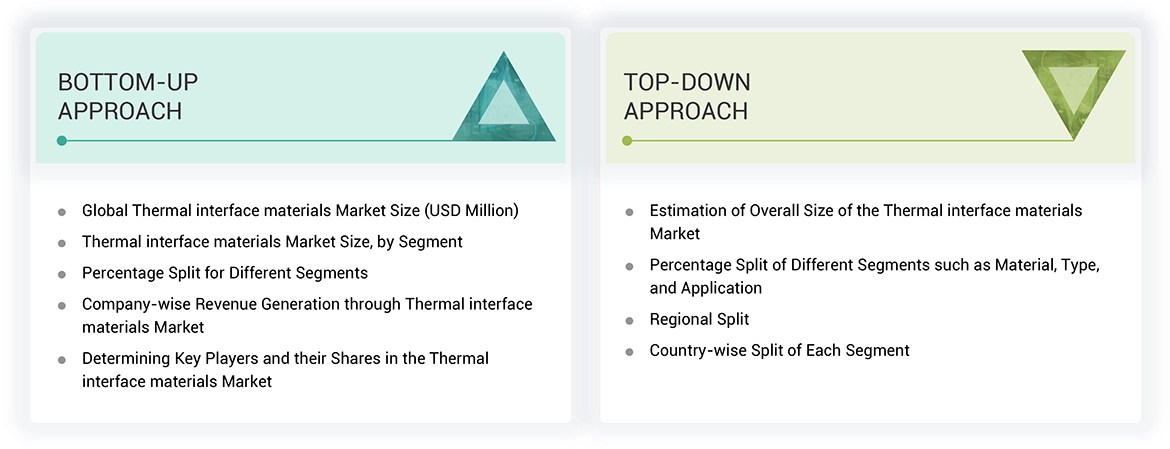

The study involved four major activities for estimating the current global size of the Thermal interface materials market. Exhaustive secondary research was conducted to gather information on the market, the peer and parent market. Both the top-down and bottom-up approaches were employed to estimate the overall size of the Thermal interface materials market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

The market for the companies offering Thermal interface materials is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of Thermal interface materials vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Thermal interface materials market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of Thermal interface materials offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the Thermal interface materials market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following:

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Thermal interface materials are used as a heat dissipating tool majorly made from silicone and epoxy.. It comes in the form of greases, adhesives, tapes,films, pads, fillers or liquids. The product has many applications like computers, telecom, industrial machinery, medical devices, automotive electronics. It is majorly used in computer components such as CPU and GPU. Another developing application can be seen in the developing electric vehicles market.

Stakeholders

- Thermal interface materials Manufacturers

- Thermal interface materials Suppliers

- Raw Material Suppliers

- Electric vehicle companies

- Small and Medium-Sized Enterprises (SMEs) and Large Enterprises

- Government Agencies

- Distributors

- Semiconductor companies

Report Objectives

- To estimate and forecast the Thermal interface materials market, in terms of value and volume

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To define, describe, and forecast the market size, based on type, application, and region

- To forecast the market size along with segments and submarkets, in key regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South America along with their key countries

- To strategically analyze micro markets, for individual growth trends, prospects, and their contribution to the total market

- To analyze growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as merger & acquisition, expansion & investment, and agreements in the Thermal interface materials market

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Thermal Interface Materials Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Thermal Interface Materials Market