Automotive Shielding Market by Shielding (Heat, EMI), Heat Application (Engine, Turbocharger, Battery Management, Fuel Tank), EMI Application (ACC, ECU, LDW, BSD, AEB, FCW, DMS), Material Type, Vehicle (PC, LCV, HCV), and Region - Global Forecast to 2025

Automotive Shielding Market

The automotive shielding market is divided into two parts—heat shields and EMI shields. The heat shield protects the vehicle body and other components from excessive heat generated by the internal combustion engine and the exhaust system of the vehicle. On the other hand, EMI shields are used in electronic devices to eliminate electromagnetic interference (EMI). Electromagnetic interference (EMI) is the disturbance created by external sources, such as electronic devices, which affects the electrical circuitry.

Key Drivers:

- Automotive EMC test standards

- Demand for EMI protection in advanced electronics

- Development of battery systems and electric powertrains

Key Restraints:

- Development of products to minimize EMI

- Design complexity and risk of failure of EMI shielding systems

Top Players

- Tenneco Inc (US)

- Laird PLC (UK)

- Henkel (Germany)

- Dana Incorporated (US)

- Morgan Advanced Materials (UK)

- 3M (US)

- Parker Hannifin (Chomerics) (US)

- KGS KITAGAWA INDUSTRIES CO (Japan)

- Autoneum (Switzerland)

- ElringKlinger AG (Germany)

- Parker Hannifin (Chomerics) (US): Chomerics designs, develops, and manufactures electromagnetic interference shielding solutions, thermal interface materials, integrated display solutions, and engineered plastics. The company designed PREMIER PBT-225, EMI shielding conductive plastic pellets. PREMIER PBT-225 is specially formulated to deliver excellent hydrolysis resistance, thereby improving long-term aging performance when exposed to typical heat and humidity conditions found on automotive applications. Its single pellet, Polybutylene Terephthalate (PBT)-based formula on electrically conductive plastic delivers superior reliability, making metal to plastic housing conversions possible for demanding automotive electronic applications. These conversions not only eliminate 35% of the housing weight (as compared to aluminum) but also provide up to a 65% cost reduction by eliminating secondary operations such as assembly and machining.

- Laird PLC (UK): Laird manufactures and sells components, devices, and systems for electromagnetic interference shielding. The company developed ET series thermoelectric coolers to protect critical electronic devices in emerging applications found in high temperature environments. The ET series shielding is designed for a range of automotive applications such as smart headlights, imaging sensors, and heads-up displays.

- Morgan Advanced Materials (UK): Morgan Advanced Materials specializes in specialist ceramics, carbon, and composites. Its principal products include high-temperature insulating fiber products, microporous products, firebricks, monolithic products, heat shields, fired refractory shapes, and structural block insulation products. The company designed its integrated technology heat shields using Superwool Plus, FireMaster, silica, glass fibre and completely encapsulated in stainless steel which provides excellent long life of insulators for automotive applications such as exhaust catalyst, exhaust manifold, and shielding for turbo chargers. This shielding material offers superior heat insulation while delivering design flexibility to the OEMs due to its custom shapes.

Automotive Shielding Market and Key EMI Application:

- Electric Motor - Electric motors are increasingly replacing belt-driven mechanical systems. Motors provides precise control over movements and these are more efficient than a mechanical system. In addition, motors are used in convenience features such as seat adjustment, cushion ventilation, lumber adjustment, side mirror folding, and sunroofs. The inclusion of convenience features would enhance the demand for EMI shielding for motors to avoid magnetic interference with other electronic components.

- Engine Control Module (ECM) - The ECU gathers data from sensors installed in a vehicle and uses this data to enhance the working of various operations such as timing of fuel injection, spark timing, stability control, and in-vehicle telematics. The EMI shielding for ECM is expected to increase due to the increased use of ECMs in a vehicle. The number of ECMs in a vehicle has increased due to factors such as rising demand for advanced electrical & electronic components, emission regulations, and safety & security concerns.

- Infotainment - The demand for infotainment has increased with the increase in consumer preference for premium and luxury cars. Additionally, the increasing penetration of infotainment systems in low and mid-segment cars and telematics mandates in different regions will boost the demand for in-vehicle infotainment systems, which in turn would require more EMI shielding protection.

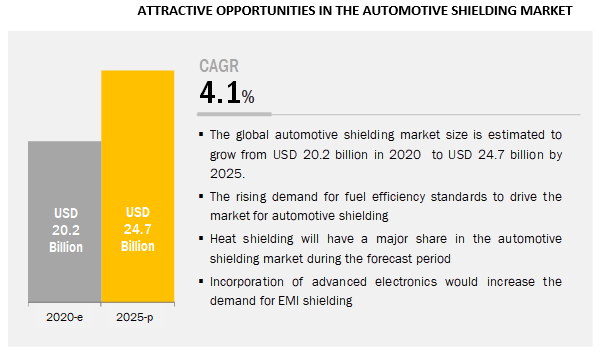

[184 Pages Report] The global automotive shielding market size was valued at USD 20.2 billion in 2020 and is projected to reach USD 4.7 billion by 2025, at a CAGR of 4.1%, during the forecast period 2020-2025. Compliance towards fuel efficiency standards and the adoption of electronics-based driving comfort & safety systems will drive the market for automotive shielding.

The passenger car segment is expected to be the largest automotive shielding market during the forecast period

The passenger car segment holds the largest market share, by vehicle type. The rising demand for fuel-efficient vehicles coupled with the increasing stringency of emission norms, has propelled the growth of the passenger car segment in the heat shield market. On the other hand, advanced technologies and increased use of electronic components in vehicles are driving the demand for EMI shielding.

High demand for personal mobility, increasing per capita income, and improved lifestyle has enhanced the sales of passenger cars. The adoption of advanced technologies continues to be high in this vehicle segment due to the higher production and sales of passenger cars worldwide in comparison to commercial vehicles. In particular, manufacturers are focusing on luxury passenger vehicles that are equipped with advanced features such as advanced driver assistance systems, advanced instrument cluster, and others. The increasing number of advanced features has boosted the demand for EMI shield to avoid interference among the electronic devices.

Heat shielding will have a major share in the automotive shielding market during the forecast period

Heat shields are used in the engine compartment, exhaust system, turbocharger, and many other applications in a vehicle. The increase in vehicle production worldwide is driving the growth of the heat shield segment. Although the electrification of vehicles can negatively impact the heat shield segment, the demand for heat shields will continue to grow in the commercial vehicle segment. The increasing demand for commercial vehicles in countries such as the US, China, India, Brazil, Japan, Germany, and others has contributed to the growth of heat shields. These vehicles have a high temperature in components such as the engine and exhaust, which drives the demand for heat shields.

Some of the leading manufacturers and suppliers of automotive heat shield are Autoneum (Switzerland), ElringKlinger (Germany), Tenneco Inc. (US), and others. These manufacturers have developed automotive heat shields for various applications, depending on the specific requirements of customers. Also, these players have expanded their regional presence through partnerships, joint ventures, and new establishments in high-growth regions. A comprehensive product portfolio, coupled with a strong regional presence, has helped market leaders strengthen their foothold in the global automotive shielding market.

“The Asia Pacific automotive shielding market is expected to hold the largest share during the forecast period.”

The key driver for the automotive market in this region is the rapid development of intelligent transport systems and connected mobility in countries such as China and Japan. The governments of these countries plan to incorporate active measures to counter increasing pollution levels in urban regions. For instance, members of the 5G Automotive Association—SAIC Motor, China Mobile, Huawei, and Shanghai International Automobile City have rolled out a roadmap for the world’s first 5G-based smart transportation demonstration project from 2020 onward.

The smart mobility project will be opened for the public, and vehicles would communicate through V2V (Vehicle-to-Vehicle), V2I (Vehicle-to-Infrastructure), and V2P (Vehicle-to-Pedestrian) technologies. Such connected systems and real communication systems are prone to interference or cross-talks. OEMs would require superior EMI shielding systems to avoid electromagnetic interference among electronics. In addition, emission norms in countries such as China, India, and Japan would foster the demand for heat shielding systems as well. Demand for fuel-efficient vehicles in this region also a major growth driver for the automotive shielding market. OEMs are incorporating lightweight measures to comply with fuel efficiency standards. Hence, they rely upon lighter heat shielding systems with a higher temperature dissipation rate. Such measures would propel the demand for heat shielding systems in the Asia Pacific region.

Key Market Players

The global automotive shielding market is dominated by major players such as Tenneco Inc (US), Laird (UK), Henkel (Germany), Dana Incorporated (US), and Morgan Advanced Materials (UK), 3M (US), Parker Hannifin (Chomerics) (US), and KGS KITAGAWA INDUSTRIES CO (Japan). These companies have secure distribution networks at a global level. Also, these manufacturers offer a wide range of heat and EMI shielding systems for various applications. The key strategies adopted by these companies to sustain their market position are new product developments, collaborations, and contracts & agreements.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Heat Application, EMI Application, Material Type, Shielding Type, Vehicle Type, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Latin America, and Rest of the World |

|

Companies Covered |

Tenneco Inc (US), Laird (UK), Henkel (Germany), Dana Incorporated (US), Morgan Advanced Materials (UK), 3M (US), Parker Hannifin (Chomerics) (US), and KGS KITAGAWA INDUSTRIES CO (Japan) |

This research report categorizes the automotive shielding market based on Heat Application, EMI Application, Material Type, Shielding Type, Vehicle Type, and Region

Based on Heat Application:

- Engine Compartment

- Exhaust System

- Turbocharger

- Under Bonnet

- Under Chassis

- Fuel Tank

- Battery Management

Based on EMI Application:

- Adaptive Cruise Control (ACC)

- Electric Motor

- Engine Control Module (ECM)

- Forward Collision Warning (FCW)

- Intelligent Park Assist (IPA)

- Lane Departure Warning (LDW)

- Infotainment

- Blind Spot Detection (BSD)

- Night Vision System (NVS)

- Driver Monitoring System (DMS)

- Automatic Emergency Braking (AEB)

Based on Material Type:

- Metallic

- Non-Metallic

Based on Shielding Type:

- EMI Shielding

- Heat Shielding

Based on Vehicle Type:

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Based on the Region:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Rest of Asia Pacific

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Russia

- Italy

- Spain

- Turkey

- UK

- Rest of Europe

-

Latin America

- Brazil

- Argentina

- Rest of LATAM

-

Rest of the World

- Iran

- South Africa

- Rest of RoW

Critical Questions:

- Where will the introduction of stringent emission regulations and fuel efficiency standards take the industry in the long term?

- How are increasing light weighting measures going to shape the automotive shielding market?

- What will be the impact on the market with respect to the increasing adoption of advanced electronics?

- What is the impact of developments in autonomous driving on the automotive shielding market?

- What are the upcoming trends in the automotive shielding market? What impact would they make post-2022?

- What are the key strategies adopted by top market players to increase their revenue?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

2.2 SECONDARY DATA

2.2.1 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

2.3.1 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.3.2 PRIMARY PARTICIPANTS

2.4 MARKET SIZE ESTIMATION

2.4.1 AUTOMOTIVE SHIELDING MARKET: BOTTOM-UP APPROACH

2.4.2 MARKET: TOP-DOWN APPROACH

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

2.6 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 34)

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 AUTOMOTIVE SHIELDING MARKET TO GROW AT A SIGNIFICANT RATE DURING THE FORECAST PERIOD (2020–2025)

4.2 ASIA PACIFIC IS ESTIMATED TO LEAD THE GLOBAL MARKET IN 2020

4.3 GLOBAL MARKET, BY SHIELDING AND VEHICLE TYPE

4.4 MARKET, BY HEAT APPLICATION

4.5 MARKET, BY EMI APPLICATION

4.6 MARKET, BY MATERIAL TYPE

4.7 MARKET, BY SHIELDING TYPE

4.8 MARKET, BY VEHICLE TYPE

5 MARKET OVERVIEW (Page No. - 41)

5.1 INTRODUCTION

5.2 OPERATIONAL DATA

5.2.1 COMPARISON OF EMI SHIELDING OPTIONS

5.3 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Automotive EMC test standards

5.3.1.2 Demand for EMI protection in advanced electronics

5.3.2 RESTRAINTS

5.3.2.1 Development of products to minimize EMI

5.3.3 OPPORTUNITIES

5.3.3.1 Emergence of autonomous vehicles

5.3.3.2 Development of battery systems and electric powertrains

5.3.3.3 Deployment of V2V, V2X, and connectivity services

5.3.4 CHALLENGES

5.3.4.1 Design complexity and risk of failure of EMI shielding systems

5.3.5 IMPACT OF MARKET DYNAMICS

5.4 REVENUE SHIFT DRIVING MARKET GROWTH

5.5 REVENUE MISSED: OPPORTUNITIES FOR SHIELDING MANUFACTURERS

5.6 AUTOMOTIVE SHIELDING MARKET, SCENARIOS (2018–2025)

5.6.1 MARKET, MOST LIKELY SCENARIO

5.6.2 OPTIMISTIC SCENARIO

5.6.3 PESSIMISTIC SCENARIO

6 COVID – 19 IMPACTS (Page No. - 53)

6.1 OEM ANNOUNCEMENTS

6.2 TIER 1 MANUFACTURERS ANNOUNCEMENTS

6.3 IMPACT ON GLOBAL AUTOMOTIVE INDUSTRY

6.4 IMPACT ON GLOBAL AUTOMOTIVE SHIELDING MARKET

7 INDUSTRY TRENDS (Page No. - 57)

7.1 INTRODUCTION

7.2 TECHNOLOGICAL OVERVIEW

7.2.1 EMI PROTECTION DESIGN TECHNIQUES: IC LEVEL

7.2.2 EMI PROTECTION DESIGN TECHNIQUES: BOARD LEVEL SHIELDING (BLS)

7.2.3 EMI PROTECTION DESIGN TECHNIQUES: MODULE LEVEL

7.2.4 EMI PROTECTION DESIGN TECHNIQUES: INTERCONNECT LEVEL

7.3 VALUE CHAIN ANALYSIS FOR AUTOMOTIVE EMI SHIELDING SYSTEMS

7.4 PORTERS FIVE FORCES

8 AUTOMOTIVE SHIELDING MARKET, BY HEAT APPLICATION (Page No. - 60)

8.1 INTRODUCTION

8.2 RESEARCH METHODOLOGY

8.3 ASSUMPTIONS

8.4 ENGINE COMPARTMENT

8.4.1 COMMERCIAL VEHICLES REQUIRE MORE ENGINE COMPARTMENT HEAT SHIELD

8.5 EXHAUST SYSTEM

8.5.1 INCREASING FUEL EFFICIENCY STANDARDS WOULD HAVE A POSITIVE IMPACT

8.5.1.1 Exhaust pipes

8.5.1.2 Exhaust manifold

8.5.1.3 Catalytic convertor

8.6 TURBOCHARGER

8.6.1 ENGINE DOWNSIZING WOULD BE A MAJOR GROWTH DRIVER

8.6.1.1 Intake manifold

8.6.1.2 Air intake

8.7 UNDER BONNET

8.7.1 FOCUS ON NVH LEVEL IS EXPECTED TO DRIVE THE MARKET

8.7.1.1 Electronic box/ECU

8.7.1.2 Battery

8.7.1.3 Firewall

8.8 UNDER CHASSIS

8.8.1 ENGINE ENCAPSULATION TO BOOST THE DEMAND FOR UNDER CHASSIS HEAT SHIELD

8.8.1.1 Transmission lines/cables

8.8.1.2 Transmission tunnel

8.8.1.3 Gearbox

8.9 FUEL TANK

8.9.1 ADOPTION OF PLASTIC FUEL TANKS WOULD BOOST DEMAND FOR SUPERIOR HEAT SHIELD

8.10 BATTERY MANAGEMENT

8.10.1 DEVELOPMENT OF HIGH VOLTAGE POWERTRAIN WITH ADVANCED BATTERY MANAGEMENT SYSTEMS WOULD DRIVE THE MARKET

8.11 MARKET LEADERS

9 AUTOMOTIVE SHIELDING MARKET, BY EMI APPLICATION (Page No. - 71)

9.1 INTRODUCTION

9.2 RESEARCH METHODOLOGY

9.3 ASSUMPTIONS

9.4 ADAPTIVE CRUISE CONTROL (ACC)

9.4.1 DEMAND FOR DRIVING COMFORT WILL BOOST THE DEMAND

9.5 ELECTRIC MOTOR

9.5.1 INCREASING USE OF MOTORS FOR CONVENIENCE FEATURES WOULD DRIVE THE MARKET

9.6 ENGINE CONTROL MODULE (ECM)

9.6.1 ADOPTION OF HIGH PERFORMANCE ENGINES WOULD BOOST DEMAND FOR ADVANCED ECM

9.7 FORWARD COLLISION WARNING (FCW)

9.7.1 DEMAND FOR ACTIVE SAFETY SYSTEMS WILL FUEL THE DEMAND FOR EMI SHIELDING

9.8 INFOTAINMENT

9.8.1 DEMAND FOR SMARTPHONE INTEGRATION AND REAR SEAT ENTERTAINMENT WOULD HAVE A POSITIVE IMPACT

9.9 INTELLIGENT PARK ASSIST (IPA)

9.9.1 AUTOMATED PARKING SYSTEMS WOULD FUEL THE DEMAND FOR EMI SHIELDING

9.10 LANE DEPARTURE WARNING (LDW)

9.10.1 SAFETY MANDATES WOULD INFLUENCE THE DEMAND FOR EMI SHIELDS FOR LDW

9.11 BLIND SPOT DETECTION (BSD)

9.11.1 GOVERNMENT REGULATIONS PERTAINING TO VEHICLE SAFETY WOULD BE INSTRUMENTAL

9.12 NIGHT VISION SYSTEM (NVS)

9.12.1 CAR ASSESSMENT PROGRAMS SUCH AS NCAP WOULD SURGE THE DEMAND FOR NVS SYSTEMS

9.13 DRIVER MONITORING SYSTEM (DMS)

9.13.1 EMPHASIS ON ACTIVE SAFETY SYSTEMS WOULD ESCALATE THE DEMAND FOR EMI SHIELDING FOR DMS

9.14 AUTOMATIC EMERGENCY BRAKING (AEB)

9.14.1 MANDATES FOR AEB IN MAJOR COUNTRIES TO DRIVE THE MARKET

9.15 MARKET LEADERS

10 AUTOMOTIVE SHIELDING MARKET, BY MATERIAL TYPE (Page No. - 86)

10.1 INTRODUCTION

10.2 OPERATIONAL DATA

10.2.1 RESEARCH METHODOLOGY

10.3 ASSUMPTIONS

10.4 METALLIC

10.4.1 ADVANCEMENTS IN AUTOMOTIVE DESIGN WILL FUEL THE DEMAND FOR FLEXIBLE METALLIC SHIELDS

10.5 NON-METALLIC

10.5.1 ADVANCED CONTROL MODULES ENHANCE THE DEMAND FOR NON-METALLIC EMI SHIELDING

10.6 MARKET LEADERS

11 AUTOMOTIVE SHIELDING MARKET, BY SHIELDING TYPE (Page No. - 92)

11.1 INTRODUCTION

11.2 RESEARCH METHODOLOGY

11.3 ASSUMPTIONS

11.4 EMI SHIELDING

11.4.1 INCREASING USE OF ELECTRONICS WOULD BOOST THE DEMAND FOR EMI SHIELD

11.5 HEAT SHIELDING

11.5.1 THERMAL PROTECTION FOR HIGH PERFORMANCE ENGINES WOULD FUEL THE MARKET

11.6 MARKET LEADERS

12 AUTOMOTIVE SHIELDING MARKET, BY VEHICLE TYPE (Page No. - 97)

12.1 INTRODUCTION

12.2 OPERATIONAL DATA

12.2.1 RESEARCH METHODOLOGY

12.3 ASSUMPTIONS

12.4 PASSENGER CAR

12.4.1 RISING DEMAND FOR PASSENGER CARS IN EMERGING ECONOMIES WOULD TRIGGER MARKET GROWTH

12.5 LIGHT COMMERCIAL VEHICLE (LCV)

12.5.1 RISING DEMAND FOR LCV IN TRANSPORT OF CARGO WOULD DRIVE THE MARKET

12.6 HEAVY COMMERCIAL VEHICLE (HCV)

12.6.1 HIGHER HEAT DISSIPATION DEMAND FOR HCV WOULD DRIVE THE MARKET

12.7 MARKET LEADERS

13 AUTOMOTIVE SHIELDING MARKET, BY REGION (Page No. - 103)

13.1 INTRODUCTION

13.2 ASIA PACIFIC

13.2.1 CHINA

13.2.1.1 Developments by domestic OEMs would drive the market in China

13.2.2 INDIA

13.2.2.1 Upcoming BS VI norms would have positive impact on the market

13.2.3 JAPAN

13.2.3.1 Innovations to enhance driving comfort are expected to drive the market

13.2.4 SOUTH KOREA

13.2.4.1 AEB and LDW regulations imposed by the South Korean government to drive demand

13.2.5 THAILAND

13.2.5.1 Government initiatives to localize production attract major OEMs and component manufacturers in the country

13.2.6 REST OF ASIA PACIFIC

13.2.6.1 Taiwan and Indonesia have become production hubs for major OEMs

13.3 EUROPE

13.3.1 GERMANY

13.3.1.1 Growing demand for vehicle performance will propel the demand

13.3.2 FRANCE

13.3.2.1 Incorporation of high performance engines by French OEMs will drive the market

13.3.3 ITALY

13.3.3.1 Government initiatives to increase production and export will impact the market positively

13.3.4 RUSSIA

13.3.4.1 Innovations in commercial vehicles will fuel the Russian market

13.3.5 UK

13.3.5.1 Focus on premium passenger car segment to fuel demand

13.3.6 TURKEY

13.3.6.1 Developments by component manufacturers will drive the market

13.3.7 SPAIN

13.3.7.1 Increasing vehicle production will boost demand

13.3.8 REST OF EUROPE

13.3.8.1 Advancements in electric drive systems will drive demand

13.4 NORTH AMERICA

13.4.1 US

13.4.1.1 Developments in autonomous driving will drive the market

13.4.2 CANADA

13.4.2.1 Focus on fuel efficiency standards will boost the demand

13.4.3 MEXICO

13.4.3.1 Light trucks production will drive demand

13.5 LATAM

13.5.1 BRAZIL

13.5.1.1 Increasing passenger car production will drive the Brazilian market

13.5.2 ARGENTINA

13.5.2.1 Stringent NVH norms for commercial vehicles will drive the Argentinian market

13.5.3 REST OF LATAM

13.5.3.1 Presence of leading automotive players will drive the Rest of LATAM market

13.6 REST OF THE WORLD (ROW)

13.6.1 IRAN

13.6.1.1 Focus on automotive R&D and design would fuel the demand in Iran

13.6.2 SOUTH AFRICA

13.6.2.1 Increasing production of commercial vehicles will drive the South African market

13.6.3 REST OF ROW

13.6.3.1 New investments and presence of major automotive players to drive the market

14 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 130)

14.1 ASIA PACIFIC WILL HOLD MAJOR MARKET FOR AUTOMOTIVE SHIELDING

14.2 THERMAL MANAGEMENT FOR BATTERY SYSTEMS AND FUEL TANKS CAN BE A KEY FOCUS FOR MANUFACTURERS

14.3 EMI PROTECTION FOR ADVANCED CONTROL MODULES WILL CREATE REVENUE OPPORTUNITY FOR EMI SHIELDING MANUFACTURERS

14.4 CONCLUSION

15 COMPETITIVE LANDSCAPE (Page No. - 132)

15.1 OVERVIEW

15.2 MARKET RANKING ANALYSIS

15.3 COMPETITIVE LEADERSHIP MAPPING

15.3.1 VISIONARY LEADERS

15.3.2 INNOVATORS

15.3.3 DYNAMIC DIFFERENTIATORS

15.3.4 EMERGING COMPANIES

15.4 STRENGTH OF PRODUCT PORTFOLIO: HEAT SHIELD MANUFACTURERS

15.5 BUSINESS STRATEGY EXCELLENCE: HEAT SHIELD MANUFACTURERS

15.6 STRENGTH OF PRODUCT PORTFOLIO: EMI SHIELD MANUFACTURERS

15.7 BUSINESS STRATEGY EXCELLENCE: EMI SHIELD MANUFACTURERS

15.8 WINNERS VS. TAIL-ENDERS

15.9 COMPETITIVE SCENARIO

15.9.1 NEW PRODUCT DEVELOPMENTS

15.9.2 COLLABORATIONS

15.9.3 MERGERS/ACQUISITIONS

15.9.4 EXPANSIONS

16 COMPANY PROFILES (Page No. - 144)

(Business overview, Products and services offered, Recent developments, SWOT analysis & MnM View)*

16.1 TENNECO INC

16.2 LAIRD PLC

16.3 HENKEL

16.4 MORGAN ADVANCED MATERIALS

16.5 DANA INCORPORATED

16.6 AUTONEUM

16.7 ELRINGKLINGER AG

16.8 KITAGAWA INDUSTRIES CO., LTD

16.9 3M

16.10 PARKER HANNIFIN CORP (CHOMERICS)

16.11 TECH-ETCH, INC.

16.12 MARIAN INC.

16.13 RTP COMPANY

*Details on Business overview, Products and services offered, Recent developments, SWOT analysis & MnM View might not be captured in case of unlisted companies.

16.14 OTHER KEY PLAYERS

16.14.1 ASIA PACIFIC

16.14.1.1 NICHIAS Corporation

16.14.1.2 Talbros

16.14.1.3 Kokusan Parts Industry Co., Ltd

16.14.1.4 Datsons Engineering Works Pvt. Ltd.

16.14.2 EUROPE

16.14.2.1 Röchling

16.14.2.2 HAPPICH Group

16.14.2.3 Zircotec

16.14.2.4 CARCOUSTICS

16.14.3 NORTH AMERICA

16.14.3.1 Lydall Inc.

16.14.3.2 Orion Industries

16.14.3.3 UGN Inc

16.14.3.4 Thermo-Tec Automotive Inc.

17 APPENDIX (Page No. - 177)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

17.3 AVAILABLE CUSTOMIZATIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

LIST OF TABLES (142 Tables)

TABLE 1 INCLUSIONS & EXCLUSIONS FOR AUTOMOTIVE SHIELDING MARKET

TABLE 2 COMPARISON OF EMI SHIELDING OPTIONS

TABLE 3 EMC STANDARDS FOR AUTOMOBILE

TABLE 4 MARKET: IMPACT OF MARKET DYNAMICS

TABLE 5 MARKET (MOST LIKELY), BY REGION, 2018–2025 (USD MILLION)

TABLE 6 MARKET (OPTIMISTIC), BY REGION, 2021–2025 (USD MILLION)

TABLE 7 MARKET (PESSIMISTIC), BY REGION, 2021–2025 (USD MILLION)

TABLE 8 OEM ANNOUNCEMENTS

TABLE 9 TIER 1 MANUFACTURERS ANNOUNCEMENTS

TABLE 10 MARKET, BY HEAT APPLICATION, 2018–2025 (USD MILLION)

TABLE 11 MAJOR ASSUMPTIONS, BY HEAT APPLICATION

TABLE 12 ENGINE COMPARTMENT: MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 13 EXHAUST SYSTEM: MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 14 TURBOCHARGER: MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 15 UNDER BONNET: AUTOMOTIVE SHIELDING MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 16 UNDER CHASSIS: MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 17 FUEL TANK: MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 18 BATTERY MANAGEMENT: MARKET, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 19 RECENT DEVELOPMENTS, BY HEAT APPLICATION

TABLE 20 MARKET, BY EMI APPLICATION, 2018–2025 (USD MILLION)

TABLE 21 MAJOR ASSUMPTIONS, BY EMI APPLICATION

TABLE 22 ACC: MARKET, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 23 ELECTRIC MOTOR: MARKET, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 24 ECM: MARKET, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 25 FCW: MARKET, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 26 INFOTAINMENT: MARKET, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 27 IPA: MARKET, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 28 LDW: MARKET, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 29 BSD: MARKET, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 30 NVS: MARKET, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 31 DMS: MARKET, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 32 AEB: MARKET, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 33 RECENT DEVELOPMENTS, BY EMI APPLICATION

TABLE 34 AUTOMOTIVE SHIELDING MARKET, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 35 COMPARISON OF AUTOMOTIVE LIGHTWEIGHT MATERIAL VS. CONVENTIONAL MATERIAL PRICING

TABLE 36 ASSUMPTIONS: BY MATERIAL TYPE

TABLE 37 METALLIC: MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 38 NON-METALLIC: MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 39 RECENT DEVELOPMENTS, BY MATERIAL TYPE

TABLE 40 MARKET, BY SHIELDING TYPE, 2018–2025 (USD MILLION)

TABLE 41 MAJOR ASSUMPTIONS: BY SHIELDING TYPE

TABLE 42 EMI SHIELDING: MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 43 HEAT SHIELDING: MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 44 RECENT DEVELOPMENT, BY SHIELDING TYPE

TABLE 45 MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 46 GLOBAL VEHICLE PRODUCTION, 2017 VS. 2018

TABLE 47 ASSUMPTIONS: BY VEHICLE TYPE

TABLE 48 PASSENGER CAR: MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 49 LIGHT COMMERCIAL VEHICLE: MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 50 HEAVY COMMERCIAL VEHICLE: MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 51 RECENT DEVELOPMENT, BY VEHICLE TYPE

TABLE 52 AUTOMOTIVE SHIELDING MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 53 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 54 CHINA: VEHICLE PRODUCTION DATA (UNITS)

TABLE 55 CHINA: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 56 INDIA: VEHICLE PRODUCTION DATA (UNITS)

TABLE 57 INDIA: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 58 JAPAN: VEHICLE PRODUCTION DATA (UNITS)

TABLE 59 JAPAN: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 60 SOUTH KOREA: VEHICLE PRODUCTION DATA (UNITS)

TABLE 61 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 62 THAILAND: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 63 REST OF ASIA PACIFIC: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 64 EUROPE: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 65 GERMANY: VEHICLE PRODUCTION DATA (UNITS)

TABLE 66 GERMANY: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 67 FRANCE: VEHICLE PRODUCTION DATA (UNITS)

TABLE 68 FRANCE: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 69 ITALY: VEHICLE PRODUCTION DATA (UNITS)

TABLE 70 ITALY: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 71 RUSSIA: VEHICLE PRODUCTION DATA (UNITS)

TABLE 72 RUSSIA: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 73 UK: VEHICLE PRODUCTION DATA (UNITS)

TABLE 74 UK: AUTOMOTIVE SHIELDING MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 75 TURKEY: VEHICLE PRODUCTION DATA (UNITS)

TABLE 76 TURKEY: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 77 SPAIN: VEHICLE PRODUCTION DATA (UNITS)

TABLE 78 SPAIN: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 79 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 81 US: VEHICLE PRODUCTION DATA (UNITS)

TABLE 82 US: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 83 CANADA: VEHICLE PRODUCTION DATA (UNITS)

TABLE 84 CANADA:MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 85 MEXICO: VEHICLE PRODUCTION DATA (UNITS)

TABLE 86 MEXICO: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 87 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 88 BRAZIL: VEHICLE PRODUCTION DATA (UNITS)

TABLE 89 BRAZIL: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 90 ARGENTINA: VEHICLE PRODUCTION DATA (UNITS)

TABLE 91 ARGENTINA: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 92 REST OF LATAM: AUTOMOTIVE SHIELDING MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 93 ROW: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 94 IRAN: VEHICLE PRODUCTION DATA (UNITS)

TABLE 95 IRAN: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 96 SOUTH AFRICA: VEHICLE PRODUCTION DATA (UNITS)

TABLE 97 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 98 EGYPT: VEHICLE PRODUCTION DATA (UNITS)

TABLE 99 REST OF ROW: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

TABLE 100 NEW PRODUCT DEVELOPMENTS, 2017–2018

TABLE 101 COLLABORATIONS, 2019

TABLE 102 MERGERS/ACQUISITIONS, 2018–2019

TABLE 103 EXPANSIONS, 2017

TABLE 104 TENNECO INC: PRODUCTS AND SERVICES OFFERED

TABLE 105 TENNECO INC: TOTAL SALES, 2014–2018 (USD BILLION)

TABLE 106 TENNECO INC: NET PROFIT, 2014–2018 (USD MILLION)

TABLE 107 LAIRD PLC: PRODUCTS AND SERVICES OFFERED

TABLE 108 LAIRD PLC: NEW PRODUCT DEVELOPMENT

TABLE 109 LAIRD PLC: TOTAL SALES, 2014–2017 (USD MILLION)

TABLE 110 HENKEL: PRODUCTS AND SERVICES OFFERED

TABLE 111 HENKEL: TOTAL SALES, 2014–2018 (USD BILLION)

TABLE 112 HENKEL: NET PROFIT, 2014–2018 (USD BILLION)

TABLE 113 MORGAN ADVANCED MATERIALS: PRODUCTS AND SERVICES OFFERED

TABLE 114 MORGAN ADVANCED MATERIALS: TOTAL SALES, 2014–2018 (USD BILLION)

TABLE 115 MORGAN ADVANCED MATERIALS: NET PROFIT, 2014–2018 (USD MILLION)

TABLE 116 DANA INCORPORATED: PRODUCTS AND SERVICES OFFERED

TABLE 117 DANA INCORPORATED: COLLABORATIONS

TABLE 118 DANA INCORPORATED: ACQUISITIONS

TABLE 119 DANA INCORPORATED: TOTAL SALES, 2015–2019 (USD BILLION)

TABLE 120 DANA INCORPORATED: NET PROFIT, 2015–2019 (USD MILLION)

TABLE 121 AUTONEUM: PRODUCTS AND SERVICES OFFERED

TABLE 122 AUTONEUM: TOTAL SALES, 2014–2018 (USD BILLION)

TABLE 123 AUTONEUM: NET PROFIT, 2014–2018 (USD MILLION)

TABLE 124 ELRINGKLINGER AG: PRODUCTS AND SERVICES OFFERED

TABLE 125 ELRINGKLINGER AG: TOTAL SALES, 2014–2018 (USD BILLION)

TABLE 126 ELRINGKLINGER AG: NET PROFIT, 2014–2018 (USD MILLION)

TABLE 127 KITAGAWA INDUSTRIES CO., LTD: PRODUCTS AND SERVICES OFFERED

TABLE 128 KITAGAWA INDUSTRIES CO., LTD: TOTAL SALES, 2014–2018 (USD MILLION)

TABLE 129 KITAGAWA INDUSTRIES CO., LTD: NET PROFIT, 2014–2018 (USD MILLION)

TABLE 130 3M: PRODUCTS AND SERVICES OFFERED

TABLE 131 3M: TOTAL SALES, 2014–2019 (USD BILLION)

TABLE 132 3M: NET PROFIT, 2014–2019 (USD BILLION)

TABLE 133 PARKER HANNIFIN CORP (CHOMERICS): PRODUCTS AND SERVICES OFFERED

TABLE 134 PARKER HANNIFIN CORP (CHOMERICS): NEW PRODUCT DEVELOPMENTS

TABLE 135 PARKER HANNIFIN CORP (CHOMERICS): TOTAL SALES, 2014–2019 (USD BILLION)

TABLE 136 PARKER HANNIFIN CORP (CHOMERICS): NET PROFIT, 2014–2019 (USD MILLION)

TABLE 137 TECH-ETCH, INC.: PRODUCTS AND SERVICES OFFERED

TABLE 138 TECH-ETCH, INC.: NEW PRODUCT DEVELOPMENTS

TABLE 139 MARIAN INC.: PRODUCTS AND SERVICES OFFERED

TABLE 140 MARIAN INC: EXPANSION

TABLE 141 RTP COMPANY: PRODUCTS AND SERVICES OFFERED

TABLE 142 CURRENCY EXCHANGE RATES (PER USD)

LIST OF FIGURES (64 Figures)

FIGURE 1 AUTOMOTIVE SHIELDING MARKET: MARKET SEGMENTATION

FIGURE 2 MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH DESIGN MODEL

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

FIGURE 5 MARKET: RESEARCH DESIGN & METHODOLOGY

FIGURE 6 MARKET: RESEARCH METHODOLOGY ILLUSTRATION OF 3M REVENUE ESTIMATION

FIGURE 7 DATA TRIANGULATION

FIGURE 8 AUTOMOTIVE SHIELDING: MARKET OUTLOOK

FIGURE 9 MARKET, BY VEHICLE TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 10 INCREASING DEMAND FOR ELECTRONICS IN VEHICLES IS LIKELY TO BOOST THE GROWTH OF AUTOMOTIVE SHIELDING

FIGURE 11 MARKET SHARE, BY REGION, 2020

FIGURE 12 HEAT SHIELDING AND PASSENGER CAR ACCOUNT FOR THE LARGEST SHARES OF THE AUTOMOTIVE SHIELDING MARKET IN 2020

FIGURE 13 EXHAUST SYSTEM HEAT SHIELD IS EXPECTED TO HOLD THE LARGEST MARKET SHARE, 2020 VS. 2025 (USD MILLION)

FIGURE 14 ENGINE CONTROL MODULE IS EXPECTED TO HOLD THE LARGEST MARKET SHARE, 2020 VS. 2025 (USD MILLION)

FIGURE 15 METALLIC IS ESTIMATED TO HOLD THE LARGEST MARKET SHARE, 2020 VS. 2025 (USD MILLION)

FIGURE 16 HEAT SHIELDING IS ESTIMATED TO HOLD THE LARGEST MARKET SHARE, 2020 VS. 2025 (USD MILLION)

FIGURE 17 PASSENGER CAR IS ESTIMATED TO HOLD THE LARGEST MARKET SHARE, 2020 VS. 2025 (USD MILLION)

FIGURE 18 MARKET: MARKET DYNAMICS

FIGURE 19 ADVANCED ELECTRONICS/CONTROL MODULES IN A CAR

FIGURE 20 VISION SYSTEM OF A FULLY AUTONOMOUS VEHICLE

FIGURE 21 KEY COMPONENTS OF A BATTERY SYSTEM

FIGURE 22 ELECTRIC VEHICLE ROADMAP: VOLKSWAGEN

FIGURE 23 AUTOMOTIVE SHIELDING MARKET– FUTURE TRENDS & SCENARIO, 2021–2025 (USD MILLION)

FIGURE 24 VOLKSWAGEN GROUP PERFORMANCE IN CHINA DURING JAN-FEB 2020

FIGURE 25 PASSENGER CAR SALES AND PRODUCTION IN CHINA

FIGURE 26 COMMERCIAL VEHICLE SALES AND PRODUCTION IN CHINA

FIGURE 27 VALUE CHAIN ANALYSIS: EMI SHIELDING SYSTEMS

FIGURE 28 PORTER’S FIVE FORCES: MARKET

FIGURE 29 MARKET, BY HEAT APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 30 KEY PRIMARY INSIGHTS

FIGURE 31 MARKET, BY EMI APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 32 KEY PRIMARY INSIGHTS

FIGURE 33 MARKET, BY MATERIAL TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 34 KEY PRIMARY INSIGHTS

FIGURE 35 AUTOMOTIVE SHIELDING MARKET: BY SHIELDING TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 36 KEY PRIMARY INSIGHTS

FIGURE 37 MARKET, BY VEHICLE TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 38 KEY PRIMARY INSIGHTS

FIGURE 39 MARKET, BY REGION, 2020 VS. 2025 (USD MILLION)

FIGURE 40 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 41 EUROPE: MARKET SNAPSHOT

FIGURE 42 MARKET – MARKET RANKING ANALYSIS,2019

FIGURE 43 MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING FOR HEAT SHIELD MANUFACTURERS, 2019

FIGURE 44 HEAT SHIELDING: PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET

FIGURE 45 HEAT SHIELDING: BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MARKET

FIGURE 46 MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING FOR EMI SHIELD MANUFACTURERS, 2019

FIGURE 47 EMI SHIELDING: PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET

FIGURE 48 EMI SHIELDING: BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MARKET

FIGURE 49 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE MARKET, 2017–2019

FIGURE 50 TENNECO INC: COMPANY SNAPSHOT

FIGURE 51 TENNECO INC: SWOT ANALYSIS

FIGURE 52 LAIRD PLC: COMPANY SNAPSHOT

FIGURE 53 LAIRD PLC: SWOT ANALYSIS

FIGURE 54 HENKEL: COMPANY SNAPSHOT

FIGURE 55 HENKEL: SWOT ANALYSIS

FIGURE 56 MORGAN ADVANCED MATERIALS: COMPANY SNAPSHOT

FIGURE 57 MORGAN ADVANCED MATERIALS: SWOT ANALYSIS

FIGURE 58 DANA INCORPORATED: COMPANY SNAPSHOT

FIGURE 59 DANA INCORPORATED: SWOT ANALYSIS

FIGURE 60 AUTONEUM: COMPANY SNAPSHOT

FIGURE 61 ELRINGKLINGER AG: COMPANY SNAPSHOT

FIGURE 62 KITAGAWA INDUSTRIES CO., LTD: COMPANY SNAPSHOT

FIGURE 63 3M: COMPANY SNAPSHOT

FIGURE 64 PARKER HANNIFIN CORP (CHOMERICS): COMPANY SNAPSHOT

The research study involved extensive use of secondary sources, such as company annual reports/presentations, industry association publications, magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the automotive shielding market. The primary sources—experts from related industries, automobile OEMs, and suppliers—have been interviewed to obtain and verify critical information, as well as assess the growth prospects and market estimations.

Secondary Research

The secondary sources referred to for this research study include corporate filings (such as annual reports, investor presentations, and financial statements), trade, business, and professional associations, whitepapers and automotive shielding-related journals, certified publications, articles from recognized authors, directories, and databases. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the automotive shielding market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand vehicle manufacturers [(in terms of component supply), country-level government associations, and trade associations] and supply-side OEMs and heat & EMI manufacturers across major regions, namely, North America, Europe, Asia Pacific, Latin America and the Rest of the World. Approximately 28% and 72% of primary interviews have been conducted from the demand- and supply-side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and marketing, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate and validate the size of the automotive shielding market. The market size, by vehicle type, in terms of value, is derived by identifying the value of each heat and EMI application for all vehicle type at the country level. The total market for each application is carried out by adding the total value of each application. Then the cost breakup percentage of each heat and EMI shield is applied each heat and EMI applications respectively at the country level for each vehicle type.

The top-down methodology has been followed to estimate the automotive shielding market by material type. To derive the market of automotive shielding, by material type, in terms of value, the cost breakup percentage of each material type is multiplied with the global value of the market. To derive the market, by material type at the regional level, the market share of each region is applied to the value of metallic and non-metallic shield.

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report.

Report Objectives

- To segment and forecast the global automotive shielding market, in terms of value (USD million)

- To define, describe, and forecast the global market based on heat application, EMI application, shielding type, material type, vehicle type, and region

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall market

- To segment and forecast the market size, by heat application (engine compartment, exhaust system, turbocharger, under the bonnet, under chassis, fuel tank, and battery management)

- To segment and forecast the market size, by EMI application (adaptive cruise control (ACC), electric motor, engine control module (ECM), forward collision warning (FCW), intelligent park assist (IPA), lane departure warning (LDW), infotainment, blind spot detection (BSD), night vision system (NVS), driver monitoring system (DMS), and automatic emergency braking (AEB))

- To segment and forecast the market size, by shielding type (EMI shielding and heat shielding)

- To segment and forecast the market size, by material type (metallic shield and non-metallic shield)

- To segment and forecast the market size, by vehicle type (passenger car, light commercial vehicle (LCV), and heavy commercial vehicle (HCV))

- To forecast the market size with respect to key regions, namely, North America, Europe, Asia Pacific, Latin America, and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze recent developments, alliances, joint ventures, product innovations, and mergers & acquisitions in the automotive shielding market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- Automotive shielding market, by EMI Application (for applications not covered in the report)

- Automotive shielding market, by the electric vehicle at the regional level

- Automotive shielding market, by vehicle type at country level (for countries not covered in the report)

- Company Information

- Profiling of Additional Market Players (Up to 3)

Growth opportunities and latent adjacency in Automotive Shielding Market