Tank Level Monitoring System Market Size, Share & Trends

Tank Level Monitoring System Market by Technology (Float & Tape Gauging, Conductivity, Ultrasonic, Capacitance, Radar-based Level Monitoring), Product (Invasive, Non-invasive), Fluid Type (Fuel, Oil, Water, Chemical), Component - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global tank level monitoring system market is projected to grow from USD 1.07 billion in 2025 to USD 1.45 billion by 2030, registering a CAGR of 6.4%. Tank level monitoring systems are used to measure and track liquid levels in storage tanks, enabling accurate inventory management, leakage detection, and process optimization across industries. Market growth is driven by the increasing demand for automation in oil & fuel, chemicals, mining, energy & power, automotive, and agriculture & husbandry sectors, alongside the need to improve safety and reduce operational downtime. Furthermore, the integration of wireless communication, IoT-based sensors, and cloud-enabled analytics is enhancing real-time monitoring capabilities, supporting data-driven decision-making and boosting the adoption of smart monitoring solutions worldwide.

KEY TAKEAWAYS

-

BY COMPONENTThe tank level monitoring system market includes sensors, tracking devices, power supply units, and monitoring systems. Sensors provide accurate measurement, tracking devices ensure real-time visibility, and power supply units support reliable operation. Monitoring systems with IoT and cloud integration deliver predictive insights, enhancing efficiency, accuracy, and reducing manual intervention.

-

BY TECHNOLOGYThe tank level monitoring system market, by technology, includes float & gauge, radar-based, ultrasonic, conductivity, and capacitance segments. Float & gauge technology-based systems offer simplicity, radar ensures precision, ultrasonic provides non-contact measurement, conductivity enables reliable detection, and capacitance delivers high sensitivity. These technologies collectively support accurate, efficient, and adaptable monitoring solutions.

-

BY TYPEInvasive systems directly contact the fluid, offering accuracy and cost-effectiveness for simple applications. Non-invasive systems use radar, ultrasonic, or capacitance, ensuring safety and suitability for hazardous environments.Together, they provide flexible solutions balancing cost, precision, and safety.

-

BY FLUID TYPEThe tank level monitoring system market by fluid type includes fuel, oil, water, chemical and other fluid types. Fuel monitoring enables safe storage, leak prevention, and regulatory compliance. Oil applications focus on optimizing processes and minimizing wastage in industrial and energy operations. Water monitoring supports efficient supply, watter & wastewater treatment, and sustainability efforts. Chemical monitoring ensures safe handling of hazardous substances with high precision, protecting both equipment and the environment.

-

BY END USERAdoption is led by oil & fuel, energy & power, chemicals, mining, automotive, agriculture & husbandry, and pharmaceuticals industries; however, other industries such as pulp & paper and discrete manufacturing, also contribute to market expansion.

-

BY REGIONAsia Pacific is projected to record the highest CAGR of 7.4%, supported by rapid industrialization, strong demand from automotive and energy sectors, and the increasing adoption of predictive maintenance technologies in countries such as China, Japan, and India.

-

COMPETITIVE LANDSCAPELeading players such as Emerson Electric CO., Honeywell International Inc. Siemens are adopting both organic and inorganic growth strategies, including product innovation, partnerships, and investments to expand their footprint and meet rising demand for tank level monitoring systems across industries.

Tank level monitoring systems are critical solutions across a wide range of industries, enabling accurate measurement, tracking, and management of liquid or solid materials stored in tanks and reservoirs. These systems play a vital role in sectors such as oil & fuel, water & wastewater management, chemicals, food & beverages, and pharmaceuticals, where safe storage, process optimization, and inventory control are essential. By providing real-time data and alerts, they help prevent overflows, shortages, and equipment damage while supporting compliance with safety and environmental regulations. As industries increasingly focus on digitalization, automation, and operational efficiency, the tank level monitoring system market is projected to witness steady growth, fueled by the integration of IoT, wireless connectivity, and advanced sensor technologies that expand the scope of applications and improve accuracy and reliability.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The tank level monitoring system market is projected to grow steadily over the next decade, driven by the rising need for accurate level measurement and efficient resource management. The adoption of IoT sensors, cloud-based platforms, and real-time monitoring is enhancing accuracy, improving reliability, and reducing operational costs across applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Rising importance of predictive maintenance in enhancing monitoring efficiency

-

•Increasing adoption of remote & wireless monitoring

Level

-

•Complex fluid conditions causing measurement limitations

-

•Ongoing operational costs associated with regular calibration in sensitive industries

Level

-

•Growing demand for AI-integrated systems to streamline replenishment and strengthen supply chain reliability

-

•Revolutionizing flexibility with decentralized monitoring-as-a-service (MaaS)

Level

-

•Ensuring reliable and stable communication between devices

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising importance of predictive maintenance in enhancing monitoring efficiency

In the tank level monitoring system market, predictive maintenance is becoming a key driver for efficiency and reliability. By integrating IoT sensors, smart analytics, and AI-powered insights, these systems enable operators to detect anomalies early and prevent unexpected failures. This proactive approach reduces downtime, lowers maintenance costs, and extends equipment life. As industries demand smarter operations and sustainability, predictive maintenance is shaping the future of advanced tank level monitoring solutions.

Restraint: Complex fluid conditions causing measurement limitations

Complex fluid conditions present a significant restraint for tank level monitoring systems, often leading to measurement inconsistencies and reduced accuracy. Variations such as foam formation, turbulence, high viscosity, or fluctuating temperatures can interfere with sensor performance, limiting reliability in critical applications. These complexities make it difficult to achieve consistent readings, increasing the need for advanced technologies. Overcoming such limitations remains essential to ensure dependable monitoring across diverse industrial environments.

Opportunity: Revolutionizing flexibility with decentralized monitoring-as-a-service (MaaS)

Decentralized Monitoring-as-a-Service (MaaS) is creating new opportunities by offering industries greater flexibility and scalability in tank-level monitoring. By shifting from traditional hardware-heavy setups to cloud-based, service-oriented models, businesses can optimize costs, simplify deployment, and seamlessly scale monitoring across multiple sites. This approach enables real-time visibility, remote access, and faster decision-making, making it an attractive option for industries seeking efficient, adaptable, and future-ready monitoring solutions.

Challenge: Ensuring reliable and stable communication between devices

Ensuring stable and reliable communication between devices remains a critical challenge in tank level monitoring systems. Dependence on wireless networks and connected platforms makes these systems vulnerable to signal interference, physical obstructions, and bandwidth limitations, especially in large facilities or remote installations. Such issues can disrupt data flow, impacting real-time visibility and operational decision-making. Addressing these connectivity challenges is vital to maintain accuracy, efficiency, and trust in modern monitoring solutions.

Tank Level Monitoring System Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Upgraded tank inventory system at Bayway Refinery using Varec’s N2920 Float and Tape Transmitter to improve measurement accuracy | Reduced capital costs | Enhanced safety compliance | Improved data accuracy | Enabled real-time monitoring | Minimized manual checks | Avoided extensive infrastructure changes. |

|

Replaced manual chemical tank monitoring with TankScan’s battery-powered radar sensors and cloud-based platform for real-time inventory visibility | Improved safety | Eliminated manual errors | Enabled real-time monitoring | Avoided stockouts | Enhanced vendor coordination | Saved time | Boosted efficiency | Supported additional sales opportunities |

|

Provided OverWatch remote monitoring with Digi XBee 3 LTE, integrating tank monitoring, motor control, and real-time mobile dashboards | Reduced site visits | Lowered costs | Enabled frequent updates | Improved safety | Minimized environmental risks | Enhanced reliability | Simple installation | Affordable daily pricing |

|

Implemented tank monitoring to replace manual inspections, ensuring reliable measurement, real-time visibility, and enhanced operational efficiency | Improved accuracy | Reduced manual checks | Enhanced safety | Enabled automated data flow | Cut operational costs | Supported predictive inventory management |

|

Adopted advanced tank monitoring solution to enhance terminal safety, optimize storage utilization, and strengthen environmental compliance | Enhanced worker safety | Minimized spill risks | Ensured regulatory compliance | Improved operational efficiency | Reduced downtime | Provided accurate real-time inventory management |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The tank level monitoring system ecosystem involves identifying and analyzing interconnected relationships among various stakeholders, including manufacturers, sensor and component suppliers, regulatory bodies, distributors, and end-use industries. Distributors establish contact between the manufacturing companies and end users to concentrate on the supply chain, increasing operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Tank Level Monitoring System Market, by Component

Sensors represented a key component share in 2024, as they deliver real-time accuracy and reliability in monitoring diverse fluids. Their integration with radar, ultrasonic, and IoT-enabled systems enhances performance, enabling predictive insights and supporting automation across industries such as oil & gas, chemicals, and water management.

Tank Level Monitoring System Market, by End User

The oil & fuel segment accounted for the largest share in 2024, with tank level monitoring enabling precise measurement, leakage detection, and inventory optimization. These capabilities are vital to enhance operational safety, comply with regulations, and ensure uninterrupted supply. Rising adoption across oil depots, fuel stations, refineries, and mining operations is reinforcing this segment’s dominance in driving demand for tank level monitoring solutions.

Tank Level Monitoring System Market, by Fluid Type

The fuel segment held the dominant market share in 2024, as tank level monitoring ensures accurate measurement, loss prevention, and compliance in fuel storage. With growing demand from oil & gas, mining, transportation, and power sectors, fuel monitoring is critical to operational efficiency and safety. This dominance highlights fuel’s pivotal role in strengthening the fluid-type segment of the tank level monitoring system market.

Tank Level Monitoring System Market, by Product

The invasive segment held the dominant market share in 2024, as direct-contact measurement methods such as probes and floats provide high accuracy and cost-effectiveness. Widely adopted in water treatment, storage facilities, and industrial applications, invasive systems remain a reliable choice for routine monitoring needs. This dominance underscores the segment’s pivotal role in driving growth within the product-based classification of the tank level monitoring system market.

REGION

Asia Pacific to be fastest-growing region in global tank level monitoring system market during forecast period

Asia Pacific is expected to be the fastest-growing market for tank level monitoring systems during the forecast period, fueled by rapid industrialization, rising fuel demand, and large-scale investments in oil & gas, chemical processing, and water infrastructure projects. Widespread adoption of radar and IoT-enabled monitoring solutions across major economies such as China, India, and Southeast Asia is further boosting regional growth. Supportive government initiatives and stricter safety and environmental regulations are accelerating the deployment of advanced tank level monitoring technologies.

Tank Level Monitoring System Market: COMPANY EVALUATION MATRIX

In the tank level monitoring system market matrix, Emerson Electric CO. (Star) holds a strong position with its advanced radar, ultrasonic, and wireless monitoring technologies, delivering precise measurements and seamless integration across diverse industries. Honeywell International Inc. (Star) also leads with its robust digital monitoring platforms and software-driven solutions, enabling real-time visibility, regulatory compliance, and operational efficiency for large-scale storage facilities. Together, these companies are driving widespread adoption of tank level monitoring systems by offering end-to-end solutions that enhance safety, optimize inventory, and lower overall costs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.00 Billion |

| Market Forecast in 2030 (Value) | USD 1.45 Billion |

| Growth Rate | CAGR of 6.4% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | • Component: Sensors, Tracking Device, Power Supply, Monitoring Stations • End User: Oil & Fuel, Chemicals, Energy & Power, Mining, Automotive, Agriculture & Husbandry, Other End Users • Fluid Type: Flue, Oil, Water, Chemical, Other Fluids • Technology: Float & Tape Gauging, Conductivity Level Monitoring, Ultrasonic Level Monitoring, Capacitance-level Monitoring, Radar-based Level Monitoring, Other Technologies • Product: Invasive type, Non-invasive type |

| Regional Scope | North America, Asia Pacific, Europe, and RoW |

WHAT IS IN IT FOR YOU: Tank Level Monitoring System Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Oil & Gas Operator | • Comparative evaluation of radar, ultrasonic, and capacitive tank level monitoring solutions • Vendor benchmarking across accuracy, installation cost, and serviceability • Assessment of regulatory compliance for hazardous & explosive environments | • Strengthened vendor selection and contract negotiation • Ensured compliance with API, OSHA, and ATEX standards • Reduced operational downtime with best-fit monitoring technology |

| Chemical Manufacturer (EU-based) | • Mapping of tank level monitoring adoption across corrosive and high-pressure storage tanks • Forecast of demand for wireless vs wired monitoring systems • Case study analysis of chemical spill prevention using real-time monitoring | • Improved safety and environmental compliance strategy • Identified high-ROI wireless system upgrades • Strengthened positioning in sustainability & risk mitigation |

RECENT DEVELOPMENTS

- July 2025 : Mopeka Products, LLC launched Cathodic Sentinel Plus, the industry’s first all-in-one solution combining cathodic protection monitoring with integrated tank level measurement. The device enables remote tracking of fuel levels and cathodic health indicators via cellular, satellite, and cloud platforms. Built in response to customer demand, it delivers unmatched visibility, control, and reliability in a single rugged unit.

- May 2025 : Otodata Wireless Network (Canada) acquired Dunraven Systems’ (Ireland) delta software platform, strengthening its position in remote tank monitoring solutions. The move is likely to expand Otodata’s portfolio with advanced telemetry and software capabilities, supporting industries such as heating oil, diesel, AdBlue, lubricants, and water. With Dunraven’s expertise in ultrasonic and radar monitoring, the acquisition is likely to enhance Otodata’s ability to deliver affordable, reliable, and scalable monitoring technologies to a global customer base.

- January 2025 : Mopeka Products, LLC partnered with METSA INC. (Mexico) to integrate the Cathodic Sentinel into Metsa’s underground propane tanks. The collaboration offers propane marketers a one-stop solution for tank longevity, safety, and compliance by combining durable tanks with continuous cathodic protection monitoring. The system comes factory-mounted, enabling easy installation and real-time reporting of moisture, current, and voltage levels.

- October 2023 : Endress+Hauser Group Services AG (Switzerland) and SICK AG (Germany) signed a memorandum of understanding agreement for a strategic partnership. Under the agreement, Endress+Hauser will handle global sales and service of SICK’s process analyzers and gas flowmeters, while a joint venture will manage production and development. The collaboration aims to enhance customer efficiency and sustainability.

- May 2023 : Rochester Sensors (US) acquired Tekelek (Ireland) as part of its multi-year strategy to expand its global liquid level sensor portfolio. Tekelek, known for ultrasound and radar-based sensor technologies along with cellular and LoRa remote monitoring solutions, strengthens Rochester’s capabilities in wireless sensing and logistics efficiency. The acquisition enabled Rochester to broaden its technical expertise and customer base, positioning it as a diversified leader in liquid level measurement solutions.

Table of Contents

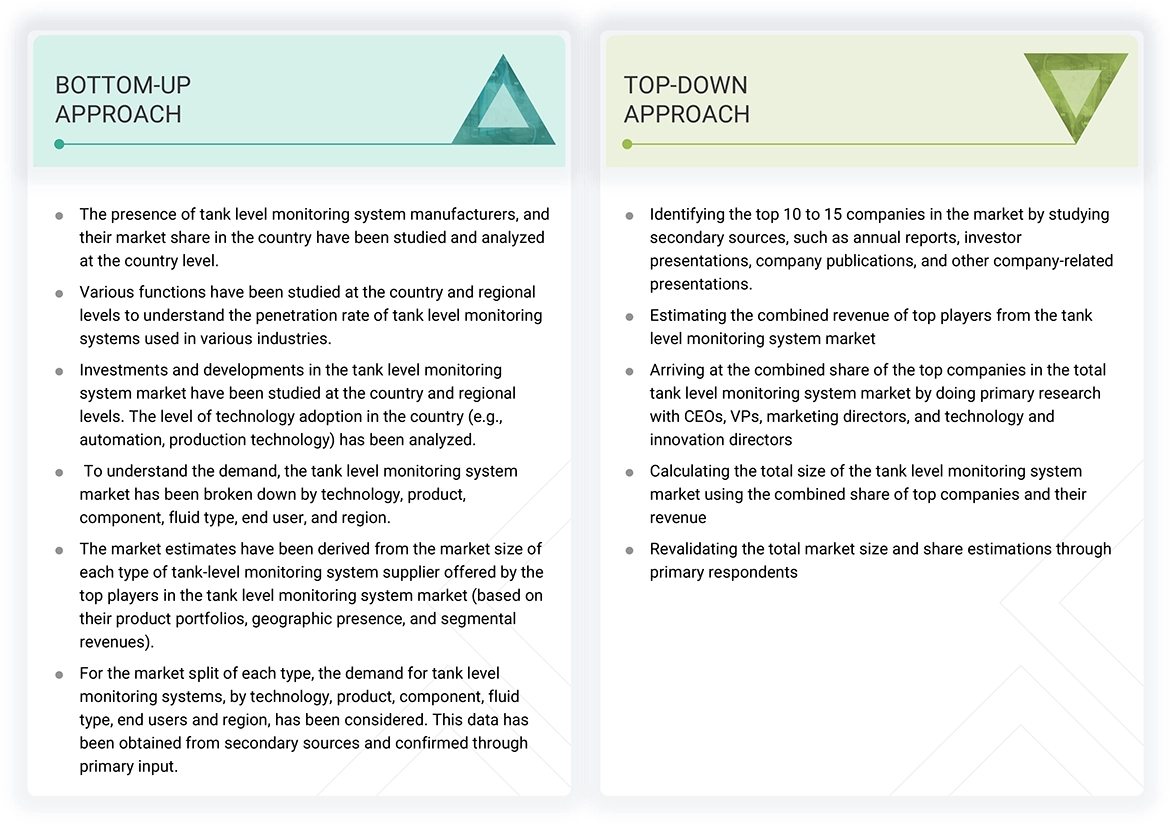

Methodology

The research study involved four major steps in estimating the size of the tank level monitoring market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. After this, the market breakdown and data triangulation approaches have been adopted to estimate the market sizes of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect the information required for this study. These sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from market and technology perspectives.

In the tank level monitoring system report, the global market size has been estimated using the top-down and bottom-up approaches, along with several other dependent submarkets. The major players in the market have been identified using extensive secondary research, and their presence in the market has been determined using secondary and primary research. All the percentage splits and breakdowns have been determined using secondary sources and verified through primary sources.

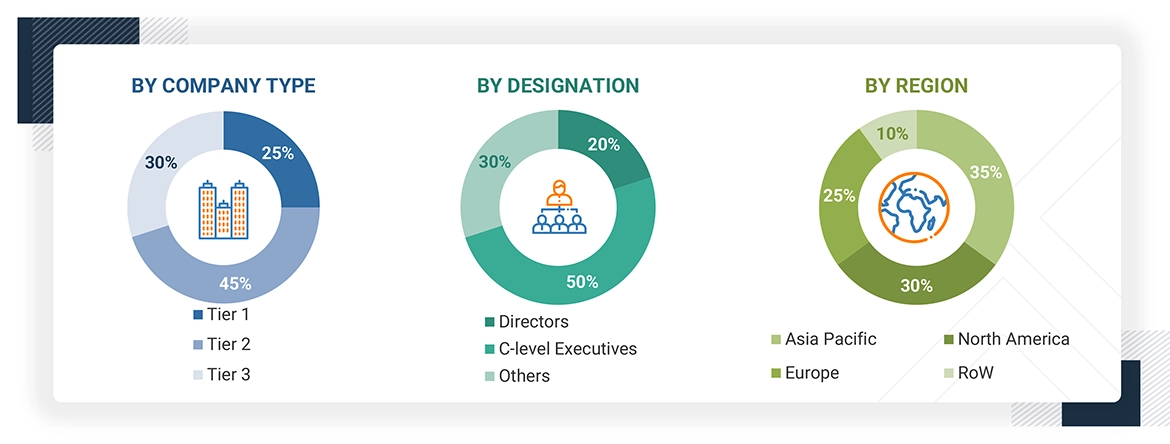

Primary Research

Extensive primary research has been conducted after understanding the tank level monitoring system market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions have been conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject-matter experts’ opinions, has led us to the findings described in the report. The breakdown of primary respondents is as follows:

Note: Other designations include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been used to estimate and forecast the market size for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been performed on the complete market engineering process to list the key information/insights throughout the report. The following table explains the process flow of the market size estimation.

The key players in the tank level monitoring system market have been identified through secondary research, and their rankings in the respective regions were determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, and interviews with industry experts, such as chief executive officers, vice presidents, directors, and marketing executives, for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets, and it is presented in this report.

Tank Level Monitoring System Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the tank level monitoring system market from the market size estimation processes explained above, the total market has been split into several segments and subsegments. Where applicable, the market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends. Additionally, the market size has been validated using top-down and bottom-up approaches.

Market Definition

The tank level monitoring system is an automated solution for accurately measuring and managing liquid levels in bulk storage tanks using advanced sensor technologies. Modern systems leverage ultrasonic, radar, and IoT-enabled sensors, ensuring high precision, real-time data visibility, and seamless integration with digital platforms. With applications spanning oil & fuel, chemicals, mining, agriculture, automotive, power generation, and water management, these systems have become integral to efficient fluid handling and operational safety.

By connectivity type, these appliances leverage Wi-Fi and Bluetooth to enable remote control, automation, and integration into broader smart home ecosystems. Through online and offline sales channels, smart appliances are accessible to both residential and commercial consumers, supporting daily operations, convenience, and energy efficiency. Smart appliances contribute to sustainable living, smarter energy usage, and more connected, intuitive environments, driving adoption across urban and emerging markets globally.

Key Stakeholders

- Raw material and component suppliers

- Tank level technology providers

- Manufacturers and distributors of tank level monitoring systems

- Device suppliers and distributors

- Software application providers

- Manufacturers of ancillary components

- System integrators

- Middleware providers

- Assembly, testing, and packaging vendors

- Research institutes and organizations

- Technology standards organizations, forums, alliances, and associations

- Governments, financial institutions, and regulatory bodies

Report Objectives

- To define, describe, and forecast the tank level monitoring system market, in terms of value, by technology, product, component, fluid type, end user, and region

- To forecast the market size, in terms of value, for various segments, about four main regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges that influence the growth of the tank level monitoring system market

- To analyze the micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To provide a detailed overview of the tank level monitoring system value chain

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To profile the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape of the market

- To analyze competitive developments such as partnerships, mergers and acquisitions, product launches, expansions, and research and development (R&D) activities in the tank level monitoring system market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Key Questions Addressed by the Report

What was the tank level monitoring market size in 2024?

The tank level monitoring market was valued at USD 1.00 billion in 2024.

Who are the key players in the tank level monitoring market, and how intense is the competition?

Key players include Emerson Electric Co. (US), Honeywell International Inc. (US), Schneider Electric (France), Siemens (Germany), and Endress+Hauser Group Services AG (Switzerland). The market competition is intense, with continuous R&D investments and technological innovations.

What are the growth prospects for the tank level monitoring market players in the next five years?

The tank level monitoring market is set for robust growth in the coming years, driven by the increasing demand for accurate, reliable, and connected monitoring solutions across industries. As sectors such as oil & gas, chemicals, water & wastewater, and food & beverages prioritize efficiency, safety, and sustainability, adopting smart monitoring systems is accelerating. Advances in IoT, cloud connectivity, and wireless communication technologies are enabling real-time visibility, predictive maintenance, and automated inventory management, making these systems essential for modern operations. The shift toward digitalized supply chains, stricter regulatory compliance, and the growing use of eco-friendly, durable devices also create fresh opportunities for manufacturers. With rising investments in automation and remote asset management, the market is positioned for sustained innovation and expansion.

What kind of information is provided in the company profiles section?

The company profiles offer valuable information, such as a comprehensive business overview, including details on the company's various business segments, financial performance, geographic reach, revenue composition, and the breakdown of their business revenue. Additionally, these profiles offer insights into the company's product offerings, significant milestones, and expert analyst perspectives to further explain the company's potential.

What is the contribution of the Asia Pacific region to market growth?

The Asia Pacific region is emerging as a key growth engine for the tank level monitoring market, propelled by rapid industrial expansion, infrastructure development, and robust demand across sectors such as oil and gas, chemicals, water and wastewater, and food and beverages. Nations including China, India, Japan, and South Korea are investing significantly in smart manufacturing and digital infrastructure, stimulating demand for advanced monitoring solutions. Furthermore, escalating energy requirements and the widespread presence of extensive oil and chemical storage facilities have intensified the need for dependable tank monitoring systems. These solutions are critical in ensuring operational safety, regulatory adherence, and efficient inventory control. Government initiatives to foster digital transformation, smart city development, and environmental sustainability are also accelerating the adoption of IoT-enabled and cloud-based monitoring technologies.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Tank Level Monitoring System Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Tank Level Monitoring System Market

catherine

Sep, 2015

On the market and market shares for the different companies. More interest in private household monitoring..

Surya

Mar, 2017

Tank Level Monitor Floating & Tape Gauge With Transmitter Application (Varec's 2920 FTT). Please send me Inquiry..

Ron

Dec, 2018

I can introduce this product to the China oil producers with whom we are interconnected. Is this of interest to you..

Patrick

Nov, 2015

I am interested in the accuracy of the report, particularly relative to the industry players. I would like a sample of the report on TANKLINK to compare validity of data. If the data and analysis looks good, I will buy the report. .

HARRY

May, 2019

I am interested to know how your people think this market will evolve since it is part of the bigger "process management industry of which I was very much a supporter..

NIAMH

Feb, 2015

Ultrasonic tank monitoring systems, local & remote telemetry, QUESTION: Is it possible to purchase individual sections of the report rather than all of it?.