Automotive Glass Market by Type (Laminated, Tempered), Application (Windshield, Sidelite & Backlite, Side & Rearview Mirror), Smart Glass (Technology, Application), Vehicle Type (ICE & Electric), Material, Aftermarket and Region - Global Forecast to 2027

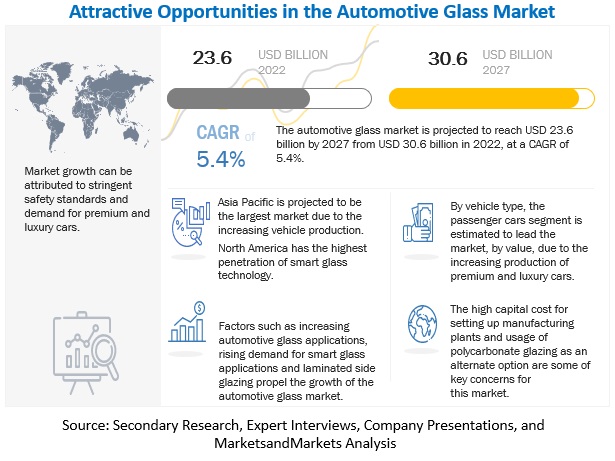

The automotive glass market size was valued at USD 23.6 billion in 2022 and is expected to reach USD 30.6 billion by 2027, at a CAGR of 5.4% during the forecast period 2022-2027. Growing vehicle production globally, especially the SUV segment, and increasing penetration of premium luxury cars with smart glass technology are key factors boosting the glass demand in the automotive industry. Additionally, implementation of safety glass regulations, demand for lightweight glass, and advanced smart glass technologies with enhanced visibility and protection are a few other factors influencing the demand for automotive glass industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive Glass Market Dynamics

Opportunities: OE-fitted laminated side glazing

European carmakers have pioneered the installation of laminated side glass in the premium car segment. As compared to tempered glass, laminated side glass provides more safety to passengers in case of vehicle rollovers. Some European OEMs have standardized side glazing in a few of their top-selling vehicles. For instance, models such as the Citroën C6, Peugeot 407 and 607, Jaguar XJ, and Mercedes-Benz S-class have laminated side glazing as a standard feature.

Owing to its benefits, the use of laminated side glazing in automobiles has increased significantly during the last five years. According to an industry expert from ITC glass company, around ~25-30% of all vehicles sold in North America in 2021 had laminated sidelites on the front doors. In 2012, laminated sidelites were installed in only 5% of passenger cars in North America. Examples of passenger cars in North America with standard laminated side glazing are the Bentley Arnage, Buick Enclave, Cadillac ATS, Chevrolet Equinox, and others. A few pickup trucks, such as the Dodge Ram, have laminated side glazing as a standard feature.

Restraints: High initial capital and set-up cost of automotive glass plant, which restricts geographic expansion

Automotive glass for windshields is manufactured from flat glass. According to Pilkington Glass insights, an investment of USD 90–250 million is required to set up a new glass plant. Such a plant is designed to operate 365 days a year and has an average life of 15–18 years. After this period, it may require a major upgrade or repair, which costs USD 40–50 million. Over the last few years, major glass manufacturers such as Saint-Gobain (France), Fuyao Glass (China), Asahi Glass (Japan), Magna (Canada), and Webasto (Germany) have preferred to expand their existing plants instead of establishing new ones. This also indicates that manufacturers prefer to build a customer base for existing plants over establishing entirely new ones. Such expansions in existing plants might restrict the technology transfer over regions, and a company is restricted to serving clients from limited regions. This can eventually act as a restraint for companies that have a limited presence in high-growth automotive windshield market. Thus, the large breakeven points restrain the establishment of new glass plants and limit them to a few locations.

Opportunities: Use of smart glass

New technologies and applications in the automotive glass market, such as smart glass and gorilla glass, are aimed at enhancing comfort and efficiency. Smart glass, such as thermos chromic glass, is used to regulate the amount of light entering the vehicle with its auto dimmable property. It reduces heat build-up in the cabin, thus reducing the load on air-conditioning, which in turn reduces carbon emissions and improves fuel efficiency. Electrochromic glass allows passengers to adjust the transparency of the glass as per their requirements. Suspended particle device glass uses electricity to switch between dark and light shades and is generally used in sunroofs. In 2021, Jeep (US), to reduce the weight of its offroad wrangler, decided to replace conventional automotive glass with gorilla glass. The replacement was able to reduce the gross vehicle weight by 7 kg. The advantage has prompted Jeep to offer its newer Wrangler SUV with OE-fitted gorilla glass, which will be supplied by Corning Incorporated. Vehicle manufacturers are focusing on manufacturing lighter vehicles to increase fuel efficiency and reduce emissions. Governments across the world are introducing new mandates to reduce emissions from automobiles. Smart glass and gorilla glass provide an excellent opportunity for glass manufacturers to not only reduce emissions but also increase their revenue.

BEV segment is estimated to be the largest growing market during the forecast period

According to the Enhanced Protective Glass Automotive Association (EPGAA), solar glass can be used in BEVs to capture sunlight to increase their range. With factors such as reduced energy consumption on air conditioning and reduced overall exposure of battery packs to external heat, the automotive glass market for BEVs is projected to grow due to growing sales in Asia Pacific and Europe. This, coupled with increasing consumer preference for SUVs in Asia Pacific, makes it the fastest-growing glass market for electric vehicles.

According to the IEA, the sales of BEV stood at ~9-10% of the total car market in 2021. China emerged as the largest BEV market in 2021. Companies such as BYD (China) and Toyota (Japan) have reiterated their commitment to increase the production of BEVs in the region. Toyota rolled out 30 new EV models in 2021, while BYD has shifted from ICE vehicles and announced that it would only manufacture BEV and PHEV vehicles from April 2022. Various governments around the world support the sales of BEVs with high subsidy and tax rebate structures in comparison to that of HEVs and PHEVs. Due to the continuously improving charging infrastructure and reducing charging time, BEVs are estimated to register a higher growth rate than other propulsion systems of EVs, such as PHEVs and HEVs. Thus, the increasing sales of BEVs will translate into the growth of the market during the forecast period.

Commercial Buses segment is estimated to be the fastest growing market during the forecast period

Commercial buses are expected to be the fastest growing market during the forecast period. Stringent emission standards, government efforts to electrify public transport and launches of various electric trucks models to boost automotive glass demand in the future. Asia Pacific leads the electric bus segment in the electric commercial vehicles market due to the high adoption rate in China. Shenzhen is the world's first city to have a fully electric public transport fleet. China alone accounts for more than 95% of the global electric bus market. As of February 2021, the Chinese city of Shenzhen was the first to have a fully electrified public transport fleet of over 16,000 electric buses. Half of the cost of these electric buses is subsidized by the government, and to keep the fleet going, more than 40,000 charging points have been built in the city. This growth in the production volume of electric buses globally is expected to drive the automotive glass market.

Other Asian countries such as India and Japan have also introduced electric buses in their public transportation fleets. For instance, In January 2019, India's Tata Motors received an order to supply 255 e-buses for public transport entities, including WBTC (West Bengal), LCTSL (Lucknow), AICTSL (Indore), ASTC (Guwahati), J&KSRTC (Jammu), and JCTSL (Jaipur). 25 electric buses from BYD were put into operation in Pune, India, in 2018. Thus, the glass market for electric buses is likely to grow significantly in the coming years.

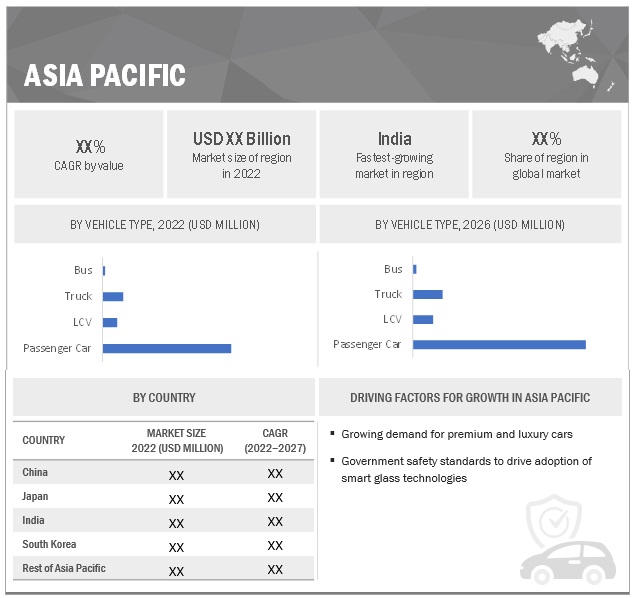

Asia Pacific segment is estimated to be the largest growing market during the forecast period

Asia Pacific is estimated to be largest automotive glass market and is projected to grow at the highest CAGR during the forecast period. This growth can be attributed to the improving socio-economic conditions in emerging countries such as China and India. China, Japan, and India are among the top five passenger vehicle manufacturers in the world.

Asia Pacific is expected to be a major automotive glass OE market and aftermarket. China, Japan and India are the major markets, holding the majority of vehicle production market share. Aftermarket is expected to be significantly larger than automotive glass OE market. The passenger car fleet is estimated to be around 850 million units globally, with Asia Pacific holding the largest share (~72%) in 2022. This fleet is expected to grow at a CAGR of 1.9% from 2022 to 2027. Also, the growing demand for enhanced safety and comfort is expected to drive the replacement rate of automotive glass in the coming years. This is expected to drive the demand for automotive glass in the aftermarket in Asia Pacific.

Market Ecosystem

The market ecosystem comprises raw materials suppliers, automotive glass manufacturers, and OEMs. Raw materials include silica, sodium oxide, calcium oxide, potassium oxide, etc. Automotive glass manufacturers/system integrators then procure these materials from suppliers and design automotive glass according to OEM requirements, and OEMs directly deploy these systems and install them in their vehicle models.

Automotive Glass Market: Ecosystem

|

COMPANY |

ROLE IN ECOSYSTEM |

|

Saint-Gobain Quartz |

Raw Material Supplier |

|

NLC Ltd |

Raw Material Supplier |

|

Eastman Chemical Company |

Raw Material Supplier |

|

Strategic Materials Inc |

Raw Material Supplier |

|

Andela Products |

Raw Material Supplier |

|

Shark Solutions |

Raw Material Supplier |

|

DIVELIME |

Raw Material Supplier |

|

Renes Glastechniek BV |

Raw Material Supplier |

|

Muby Chemicals |

Raw Material Supplier |

|

Drägerwerk AG & Co. |

Raw Material Supplier |

|

Compagnie de Saint-Gobain S. A |

OEM |

|

AGC Inc. |

OEM |

|

Fuyao Glass Industry Group Co., Ltd. |

OEM |

|

Motherson Sumi Systems Limited |

OEM |

|

Central Glass Co., Ltd. |

OEM |

|

Gentex Corporation |

OEM |

|

Magna International Inc. |

OEM |

|

Webasto Group |

OEM |

|

Nippon Sheet Glass Co., Ltd |

OEM |

|

Corning Incorporated |

OEM |

|

Xinyai Glass Co ltd |

OEM |

|

VITRO |

OEM |

|

ªiºecam |

OEM |

|

Gavista |

OEM |

|

AGP Group |

OEM |

|

Compagnie de Saint-Gobain S. A |

OEM |

Source: Company Websites and MarketsandMarkets Analysis

Asia Pacific: Automotive Glass Market

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The automotive glass market is dominated by a few global players and comprises several regional players. Some of the key manufacturers operating in the market are Saint-Gobain (France), Asahi Glass (Japan), Fuyao Glass (China), Samvardhana Motherson (India), Webasto (Germany) and Nippon Sheet Glass (Japan).

Scope of the Report

|

Report Attributes |

Details |

|

Market size value in 2022: |

USD 23.6 Billion |

|

Projected to reach 2027: |

USD 30.6 Billion |

|

CAGR: |

5.4% |

|

Base Year Considered: |

2021 |

|

Forecast Period: |

2022-2027 |

|

Largest Market: |

Asia Pacific |

|

Region Covered: |

Asia Pacific, North America, Europe, and RoW |

|

Segments Covered: |

By Glass, By Smart Glass Technology, By Component, By Application, By Vehicle Type, EV Type, By Material Type, By Smart Glass Application, By Device Embedded Application, Aftermarket, By Windscreen Application and By Region |

|

Companies Covered: |

Compagnie de Saint-Gobain S.A.(France), AGC Inc. (Japan), Fuyao Glass Industry Group Co., Ltd. (China), Motherson Sumi Systems Limited (Japan), Central Glass Co., Ltd. (Japan) |

Recent Developments

- In July 2022, Compagnie de Saint-Gobain S.A. expanded its building products with technology transfer from Kaycan Ltd. (Canada) through Kaycan Ltd’s acquisition. The acquisition is also expected to improve Compagnie de Saint-Gobain S.A.’s market presence in North America.

- In January 2022, AGC Inc. improved its Infoverre Paper-like Screen Series, ultra-thin glass signage that applies AGC's glass processing technology to OLEDs. The signage finds its application in buses, trains, and commercial vehicles.

- In October 2021, Motherson Sumi Systems Limited (India) acquired Nanchang JMCG Mekra Lang Vehicle Mirror Co., Ltd (China). The acquisition of Nanchang JMCG Mekra Lang Vehicle Mirror Co., Ltd (China) is projected to improve access to the booming Chinese automobile market and the company's market share.

- In September 2021, Webasto demonstrated its roof sensor module, which has sensors, cameras, and related features that leverages Lidar technology in a visually appealing way.

Frequently Asked Questions (FAQ):

How big is the automotive glass market?

The automotive glass market is estimated to be USD 23.6 billion in 2022 and is projected to reach USD 30.6 billion by 2027 at a CAGR of 5.4%.

What are the key trends in automotive glass market?

SPD smart glass technology is gaining popularity and various OEMs such as BMW, Audi, Mercedes-Benz are adopting the technology in their models.

Tinted glass holds the largest market share, however, IR-PVB will experience faster growth

Who are the major players in the automotive glass ecosystem.

Saint-Gobain (France), Asahi Glass (Japan), Fuyao Glass (China), Webasto Group (Germany), Gentex Corporation (US) and Nippon Sheet Glass (NSG) (Japan) are the key players in this market.

Players are focusing on smart glass smart technologies owing to the growing demand for premium and luxury vehicles

What are the growth prospects of automotive glass in electric vehicle industry?

Electric vehicles have witnessed exponential growth during the last 2-3 years. Countries such as China, Germany, Netherlands, Norway are major EV markets.

Stringent emission standards, affordable EV models, developments in Li-ion battery ranges, attractive government incentive to boost EV production and sales, driving automotive glass market .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 AUTOMOTIVE GLASS MARKET SEGMENTATION

FIGURE 2 MARKET, BY REGION

1.3.1 YEARS CONSIDERED

1.4 CURRENCY AND PRICING

TABLE 1 CURRENCY EXCHANGE RATES (WRT PER USD)

1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN

FIGURE 4 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY STAKEHOLDER, DESIGNATION, AND REGION

2.1.2.1 List of primary participants

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 BOTTOM-UP APPROACH

FIGURE 7 AUTOMOTIVE GLASS MARKET SIZE: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE: TOP-DOWN APPROACH (BY APPLICATION, TYPE, AND VEHICLE TYPE)

2.3 DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.4.1 GLOBAL ASSUMPTIONS

2.4.2 MARKET ASSUMPTIONS

2.4.3 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND- AND SUPPLY-SIDES

2.5 FACTOR ANALYSIS

2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 10 MARKET OUTLOOK

FIGURE 11 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MARKET

FIGURE 12 GROWING SALES OF SUVS AND INCREASE IN DEMAND FOR ELECTRIC VEHICLES TO DRIVE MARKET

4.2 MARKET, BY APPLICATION

FIGURE 13 SIDELITES TO BE LARGEST APPLICATION, 2022–2027 (USD MILLION)

4.3 MARKET, BY MATERIAL

FIGURE 14 TINTED GLASS TO DOMINATE MARKET, 2022 VS. 2027 (‘000 SQUARE METERS)

4.4 MARKET, BY VEHICLE TYPE

FIGURE 15 PASSENGER CARS TO LEAD AUTOMOTIVE GLASS OE MARKET, 2022 VS. 2027 (USD MILLION)

4.5 AUTOMOTIVE SMART GLASS MARKET, BY TECHNOLOGY

FIGURE 16 SPD SEGMENT TO HOLD MAJOR SHARE OF AUTOMOTIVE SMART GLASS MARKET, 2022 VS. 2027 (‘000 SQUARE METERS)

4.6 AUTOMOTIVE SMART GLASS MARKET, BY APPLICATION

FIGURE 17 SUNROOFS TO BE LARGEST APPLICATION FOR AUTOMOTIVE SMART GLASS, 2022 VS. 2027 (‘000 SQUARE METERS)

4.7 AUTOMOTIVE DEVICE EMBEDDED GLASS MARKET, BY APPLICATION

FIGURE 18 REARVIEW MIRRORS TO HOLD SIGNIFICANT SHARE OF AUTOMOTIVE DEVICE EMBEDDED GLASS MARKET, 2022 VS. 2027 (USD MILLION)

4.8 MARKET, BY ELECTRIC VEHICLE TYPE

FIGURE 19 BEV TO DOMINATE MARKET, 2022 VS. 2027 (USD MILLION)

4.9 AUTOMOTIVE GLASS AFTERMARKET, BY VEHICLE TYPE

FIGURE 20 COMMERCIAL VEHICLES TO HOLD LARGEST MARKET SHARE, 2022 VS. 2027 (USD MILLION)

4.10 ELECTRIC COMMERCIAL MARKET, BY VEHICLE TYPE

FIGURE 21 ELECTRIC BUSES TO BE LARGEST SEGMENT, 2022 VS. 2027 (USD MILLION)

4.11 AUTOMOTIVE WINDSCREEN GLASS MARKET, BY APPLICATION

FIGURE 22 HEAD-UP DISPLAYS TO BE FASTEST-GROWING MARKET, 2022 VS. 2027 (USD MILLION)

4.12 MARKET, BY REGION

FIGURE 23 ASIA PACIFIC TO BE DOMINANT MARKET, 2022 VS. 2027 (USD MILLION)

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 24 AUTOMOTIVE GLASS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing applications of glass in SUVs & penetration of smart glass and sunroofs

5.2.1.1.1 Growing demand for SUVs with increased glass applications

FIGURE 25 SUV PRODUCTION, BY TYPE, 2022 VS. 2027 (‘000 UNITS)

5.2.1.1.2 Increase in Sunroof Penetration

5.2.1.2 OE-fitted laminated side glazing

5.2.2 RESTRAINTS

5.2.2.1 High initial capital and set-up cost of automotive glass plant restricts geographic expansion

TABLE 2 FACTORS INVOLVED IN GLASS PLANT SET-UP

5.2.2.2 Polycarbonate glazing emerging as alternative to automotive glass

FIGURE 26 AUTOMOTIVE GLAZING MARKET, BY REGION (USD MILLION)

5.2.3 OPPORTUNITIES

5.2.3.1 Use of smart glass

5.2.3.2 Device embedded glass

5.2.4 CHALLENGES

5.2.4.1 Low cost of glass in independent aftermarket (IAM)

5.2.4.2 Safety concerns regarding laminated glass

TABLE 3 LIST OF MODELS WITH LAMINATED NON-WINDSHIELD OEM GLAZING

5.2.4.3 Need for optimum thickness and strength

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 27 REVENUE SHIFT FOR BRAKE SYSTEM MARKET

5.4 MARKET SCENARIOS (2018–2027)

FIGURE 28 MARKET SCENARIOS, 2018–2027 (USD MILLION)

5.4.1 MOST LIKELY SCENARIO

TABLE 4 MARKET (REALISTIC SCENARIO), BY REGION, 2021–2027 (USD MILLION)

5.4.2 LOW-IMPACT SCENARIO

TABLE 5 MARKET (LOW-IMPACT SCENARIO), BY REGION, 2021–2027 (USD MILLION)

5.4.3 HIGH-IMPACT SCENARIO

TABLE 6 MARKET (HIGH-IMPACT SCENARIO), BY REGION, 2021–2027 (USD MILLION)

5.5 MARKET ECOSYSTEM

TABLE 7 MARKET: ECOSYSTEM

5.6 TECHNOLOGY ANALYSIS

5.7 CASE STUDY ANALYSIS

5.7.1 CASE STUDY 1

5.7.2 CASE STUDY 2

5.8 PATENT ANALYSIS

TABLE 8 AUTOMOTIVE GLASS: PATENT ANALYSIS, 2018–2022

5.9 PRICING ANALYSIS

5.9.1 BY TYPE

TABLE 9 AVERAGE SELLING PRICE ACROSS REGIONS, BY TYPE, 2022 (USD)

5.10 SUPPLY CHAIN ANALYSIS

FIGURE 29 SUPPLY CHAIN ANALYSIS: MARKET

5.11 PORTER'S FIVE FORCES ANALYSIS

FIGURE 30 PORTER'S FIVE FORCES ANALYSIS: MARKET

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

5.12 TRADE ANALYSIS

5.12.1 HS CODE – 700721 GLASS: LAMINATED SAFETY GLASS OF SIZE AND SHAPE SUITABLE FOR INCORPORATION IN AIRCRAFT, SPACECRAFT, VESSELS OR OTHER VEHICLES

TABLE 10 MARKET - IMPORTS, BY REGION

TABLE 11 MARKET - EXPORTS, BY REGION

5.12.2 HS CODE – 700711 GLASS: SAFETY GLASS, CONSISTING OF TOUGHENED (TEMPERED) OR LAMINATED GLASS OF SIZE AND SHAPE SUITABLE FOR INCORPORATION IN VEHICLES, AIRCRAFT, SPACECRAFT, OR VESSELS

TABLE 12 MARKET, REGION-WISE IMPORTS

TABLE 13 MARKET, REGION-WISE EXPORTS

5.13 REGULATORY LANDSCAPE

5.13.1 SAFETY GLASS STANDARDS, BY COUNTRY

TABLE 14 SAFETY GLASS STANDARDS, MAJOR COUNTRIES AND REGIONS

5.14 KEY STAKEHOLDERS IN BUYING PROCESS & BUYING CRITERIA

FIGURE 31 KEY BUYING CRITERIA FOR TOP TWO AUTOMOTIVE GLASS TYPES

TABLE 15 KEY BUYING CRITERIA FOR TOP TWO AUTOMOTIVE GLASS TYPES

5.15 KEY CONFERENCES

TABLE 16 MARKET: UPCOMING CONFERENCES AND EVENTS, 2022–2023

6 AUTOMOTIVE GLASS MARKET, BY GLASS TYPE (Page No. - 80)

6.1 INTRODUCTION

6.1.1 RESEARCH METHODOLOGY

6.1.2 ASSUMPTIONS/LIMITATIONS

6.1.3 INDUSTRY INSIGHTS

FIGURE 32 MARKET, BY GLASS TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 17 MARKET, BY GLASS TYPE, 2018–2021 (‘000 SQUARE METERS)

TABLE 18 MARKET, BY GLASS TYPE, 2022–2027 (‘000 SQUARE METERS)

TABLE 19 MARKET, BY GLASS TYPE, 2018–2021 (USD MILLION)

TABLE 20 MARKET, BY GLASS TYPE, 2022–2027 (USD MILLION)

6.2 LAMINATED GLASS

6.2.1 GROWTH IN APPLICATIONS DRIVEN BY GOVERNMENT REGULATIONS

TABLE 21 LAMINATED GLASS MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 22 MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

TABLE 23 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 TEMPERED GLASS

6.3.1 HIGHER PENETRATION IN ASIA PACIFIC AND ROW TO RESULT IN SUSTAINED GROWTH

TABLE 25 TEMPERED GLASS MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 26 MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

TABLE 27 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 OTHERS

6.4.1 INCREASE IN VEHICLE PRODUCTION TO BE INSTRUMENTAL IN SEGMENT GROWTH

TABLE 29 OTHER MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 30 OTHER MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

TABLE 31 OTHER MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 OTHER MARKET, BY REGION, 2022–2027 (USD MILLION)

7 AUTOMOTIVE GLASS MARKET, BY APPLICATION (Page No. - 89)

7.1 INTRODUCTION

FIGURE 33 MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 33 MARKET, BY APPLICATION, 2018–2021 (‘000 SQUARE METERS)

TABLE 34 MARKET, BY APPLICATION, 2022–2027 (‘000 SQUARE METERS)

TABLE 35 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 36 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.2 WINDSHIELDS

7.2.1 INCREASING POPULARITY OF ADVANCED GLASS SUCH AS GORILLA GLASS TO BOOST DEMAND

TABLE 37 WINDSHIELD GLASS MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 38 MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

TABLE 39 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 SIDELITES

7.3.1 INCREASE IN AVERAGE GLASS AREA TO DRIVE DEMAND

TABLE 41 SIDELITE GLASS MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 42 MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

TABLE 43 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 BACKLITES

7.4.1 TREND OF USING LAMINATED GLASS IN BACKLITE TO BOOST MARKET VALUE

TABLE 45 BACKLITE GLASS MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 46 MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

TABLE 47 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 SIDEVIEW MIRRORS

7.5.1 INNOVATIONS IN SIDEVIEW MIRRORS TO BOOST DEVELOPMENTS

TABLE 49 SIDEVIEW GLASS MIRROR MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 50 MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

TABLE 51 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 52 MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 REARVIEW MIRROR

7.6.1 DEVELOPMENTS IN REARVIEW MIRRORS FOR ENHANCED VISIBILITY AND PERFORMANCE TO INCREASE MARKET SHARE

TABLE 53 REARVIEW MIRROR GLASS MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 54 MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

TABLE 55 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 MARKET, BY REGION, 2022–2027 (USD MILLION)

8 AUTOMOTIVE GLASS MARKET, BY VEHICLE TYPE (Page No. - 100)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS/LIMITATIONS

8.1.3 INDUSTRY INSIGHTS

FIGURE 34 MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 57 MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 SQUARE METERS)

TABLE 58 MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 SQUARE METERS)

TABLE 59 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 60 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

8.2 PASSENGER CARS

8.2.1 HIGHER PENETRATION OF SUVS AND LUXURY CARS TO CONTRIBUTE TO GROWTH OF SEGMENT

TABLE 61 PASSENGER CAR GLASS MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 62 MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

TABLE 63 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 LIGHT COMMERCIAL VEHICLES

8.3.1 GROWTH IN E-COMMERCE AND LOGISTICS INDUSTRY TO INCREASE LCV PRODUCTION AND DRIVE DEMAND FOR AUTOMOTIVE GLASS

TABLE 65 LCV GLASS MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 66 MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

TABLE 67 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 TRUCKS

8.4.1 INCREASED GLASS AREA FOR ENHANCED SAFETY AND COMFORT TO BOOST DEMAND FOR AUTOMOTIVE GLASS

TABLE 69 TRUCK GLASS MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 70 MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

TABLE 71 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 BUSES

8.5.1 INCREASING DEMAND FOR SIDELITES IN BUSES TO BOOST DEMAND

TABLE 73 BUS GLASS MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 74 MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

TABLE 75 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 76 MARKET, BY REGION, 2022–2027 (USD MILLION)

9 AUTOMOTIVE GLASS MARKET, BY MATERIAL (Page No. - 111)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS/LIMITATIONS

9.1.3 INDUSTRY INSIGHTS

FIGURE 35 MARKET, BY MATERIAL, 2022 VS. 2027 (‘000 SQUARE METERS)

TABLE 77 MARKET, BY MATERIAL, 2018–2021 (‘000 SQUARE METERS)

TABLE 78 MARKET, BY MATERIAL, 2022–2027 (‘000 SQUARE METERS)

9.2 IR-PVB

9.2.1 REDUCED HEAT TRANSMISSION AND TEMPERATURE CONTROL TO BOOST PENETRATION

TABLE 79 IR-PVB: MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 80 IR-PVB: MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

9.3 METAL-COATED GLASS

9.3.1 GROWING VEHICLE PRODUCTION AND AVAILABILITY OF MODELS TO DRIVE DEMAND

TABLE 81 METAL-COATED: MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 82 METAL-COATED: MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

9.4 TINTED GLASS

9.4.1 SEGMENT TO GROW WITH RISE IN DEMAND FOR PREMIUM AND LUXURY CARS

TABLE 83 TINTED: MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 84 TINTED: MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

9.5 OTHERS

9.5.1 GROWING DEMAND FOR HEAVY-DUTY VEHICLES TO BOOST DEMAND

TABLE 85 OTHER MATERIALS: MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 86 OTHER MATERIALS: MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

10 AUTOMOTIVE SMART GLASS MARKET, BY TECHNOLOGY (Page No. - 119)

10.1 INTRODUCTION

TABLE 87 SMART GLASS CHARACTERISTICS, BY TECHNOLOGY

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS/LIMITATIONS

10.1.3 INDUSTRY INSIGHTS

FIGURE 36 AUTOMOTIVE SMART GLASS MARKET, BY TECHNOLOGY, 2022 VS. 2027 (‘000 SQUARE METERS)

TABLE 88 MARKET, BY TECHNOLOGY, 2018–2021 (‘000 SQUARE METERS)

TABLE 89 MARKET, BY TECHNOLOGY, 2022–2027 (‘000 SQUARE METERS)

10.2 ACTIVE SMART GLASS

10.2.1 SUSPENDED PARTICLE DEVICE (SPD) GLASS

10.2.1.1 Increasing adoption by various automakers to contribute to segment growth

TABLE 90 SPD GLASS MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 91 SPD GLASS MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

10.2.2 ELECTROCHROMIC (EC) GLASS

10.2.2.1 Good visibility in variety of conditions to drive penetration

TABLE 92 EC GLASS MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 93 EC GLASS MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

10.2.3 LIQUID CRYSTAL (LC)/POLYMER DISPERSED LIQUID CRYSTAL (PDLC) GLASS

10.2.3.1 Growing sunroof applications in luxury cars to boost revenue

TABLE 94 LC/PDLC GLASS MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 95 LC/PDLC GLASS MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

10.3 PASSIVE GLASS

10.3.1 PHOTOCHROMIC GLASS

10.3.1.1 Safety regulations to boost demand FOR pc glass

TABLE 96 PHOTOCHROMIC GLASS MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 97 PHOTOCHROMIC GLASS MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

10.3.2 THERMOCHROMIC GLASS

10.3.2.1 Asia Pacific to be largest market

TABLE 98 THERMOCHROMIC GLASS MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 99 THERMOCHROMIC GLASS MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

11 AUTOMOTIVE SMART GLASS MARKET, BY APPLICATION (Page No. - 129)

11.1 INTRODUCTION

TABLE 100 AUTOMOTIVE SMART GLASS APPLICATION VS. PREFERRED TECHNOLOGY

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS/LIMITATIONS

11.1.3 INDUSTRY INSIGHTS

FIGURE 37 AUTOMOTIVE SMART GLASS MARKET, BY APPLICATION, 2022 VS. 2027 (‘000 SQUARE METERS)

TABLE 101 MARKET, BY APPLICATION, 2018–2021 (‘000 SQUARE METERS)

TABLE 102 MARKET, BY APPLICATION, 2022–2027 (‘000 SQUARE METERS)

11.2 DIMMABLE MIRRORS

11.2.1 ELIMINATION OF GLARE AND ENHANCED VISIBILITY TO DRIVE PENETRATION

TABLE 103 DIMMABLE MIRRORS: AUTOMOTIVE SMART GLASS MARKET, BY TECHNOLOGY, 2018–2021 (‘000 SQUARE METERS)

TABLE 104 DIMMABLE MIRRORS: AUTOMOTIVE SMART GLASS MARKET, BY TECHNOLOGY, 2022–2027 (‘000 SQUARE METERS)

11.3 WINDSHIELDS

11.3.1 ADOPTION IN PREMIUM AND LUXURY MODELS TO DRIVE MARKET

TABLE 105 WINDSHIELDS: AUTOMOTIVE SMART GLASS MARKET, BY TECHNOLOGY, 2018–2021 (‘000 SQUARE METERS)

TABLE 106 WINDSHIELDS: AUTOMOTIVE SMART GLASS MARKET, BY TECHNOLOGY, 2022–2027 (‘000 SQUARE METERS)

11.4 SUNROOFS

11.4.1 LOW POWER CONSUMPTION FOR APPLICATIONS SUCH AS AC TO DRIVE POPULARITY

TABLE 107 SUNROOFS: AUTOMOTIVE SMART GLASS MARKET, BY TECHNOLOGY, 2018–2021 (‘000 SQUARE METERS)

TABLE 108 SUNROOFS: AUTOMOTIVE SMART GLASS MARKET, BY TECHNOLOGY, 2022–2027 (‘000 SQUARE METERS)

11.5 SIDELITES/BACKLITES

11.5.1 ADVANCEMENTS AND DEVELOPMENTS IN SMART GLASS TECHNOLOGY TO BOOST POPULARITY

TABLE 109 SIDELITES/BACKLITES: AUTOMOTIVE SMART GLASS MARKET, BY TECHNOLOGY, 2018–2021 (‘000 SQUARE METERS)

TABLE 110 SIDELITES/BACKLITES: AUTOMOTIVE SMART GLASS MARKET, BY TECHNOLOGY, 2022–2027 (‘000 SQUARE METERS)

12 AUTOMOTIVE GLASS MARKET, BY ELECTRIC VEHICLE TYPE (Page No. - 138)

12.1 INTRODUCTION

12.1.1 RESEARCH METHODOLOGY

12.1.2 ASSUMPTIONS/LIMITATIONS

12.1.3 INDUSTRY INSIGHTS

FIGURE 38 ELECTRIC & HYBRID VEHICLES GLASS MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 111 MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 SQUARE METERS)

TABLE 112 MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 SQUARE METERS)

TABLE 113 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 114 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.2 BATTERY ELECTRIC VEHICLES (BEV)

12.2.1 AVAILABILITY OF NEWER GLASS TECHNOLOGY TO POPULARIZE BEV AND DRIVE SEGMENT

TABLE 115 BEV GLASS MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 116 MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

TABLE 117 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 118 MARKET, BY REGION, 2022–2027 (USD MILLION)

12.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEV)

12.3.1 EUROPE AND ASIA PACIFIC TO REMAIN LARGEST MARKETS DUE TO LOCAL AUTOMAKERS

TABLE 119 PHEV GLASS MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 120 MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

TABLE 121 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 122 PHEV GLASS MARKET, BY REGION, 2022–2027 (USD MILLION)

12.4 FUEL CELL ELECTRIC VEHICLES (FCEV)

12.4.1 GOVERNMENT INITIATIVES TO DRIVE PRODUCTION OF FCEV AND FCEV GLASS MARKET

TABLE 123 FCEV GLASS MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 124 MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

TABLE 125 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 126 MARKET, BY REGION, 2022–2027 (USD MILLION)

13 AUTOMOTIVE GLASS MARKET, BY ELECTRIC COMMERCIAL VEHICLE TYPE (Page No. - 147)

13.1 INTRODUCTION

13.1.1 RESEARCH METHODOLOGY

13.1.2 ASSUMPTIONS/LIMITATIONS

13.1.3 INDUSTRY INSIGHTS

FIGURE 39 ELECTRIC COMMERCIAL VEHICLES GLASS MARKET, BY VEHICLE TYPE, 2022 VS 2027 (USD MILLION)

TABLE 127 MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 SQUARE METERS)

TABLE 128 MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 SQUARE METERS)

TABLE 129 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 130 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

13.2 ELECTRIC COMMERCIAL VEHICLE OEMS AND THEIR MODELS

TABLE 131 ELECTRIC COMMERCIAL VEHICLE DATA, BY VEHICLE TYPE

13.3 ELECTRIC BUSES

13.3.1 GROWING ELECTRIC BUS PRODUCTION BY KEY OEMS

TABLE 132 ELECTRIC BUSES GLASS MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 133 MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

TABLE 134 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 135 MARKET, BY REGION, 2022–2027 (USD MILLION)

13.4 ELECTRIC TRUCKS

13.4.1 ADVANCEMENTS IN LITHIUM-ION BATTERY TECHNOLOGY

TABLE 136 ELECTRIC TRUCKS GLASS MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 137 MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

TABLE 138 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 139 MARKET, BY REGION, 2022–2027 (USD MILLION)

14 AUTOMOTIVE GLASS AFTERMARKET, BY VEHICLE TYPE (Page No. - 155)

14.1 INTRODUCTION

14.1.1 RESEARCH METHODOLOGY

14.1.2 ASSUMPTIONS/LIMITATIONS

14.1.3 INDUSTRY INSIGHTS

FIGURE 40 AUTOMOTIVE GLASS AFTERMARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 140 AFTERMARKET, BY VEHICLE TYPE, 2018–2021 (‘000 SQUARE METERS)

TABLE 141 AFTERMARKET, BY VEHICLE TYPE, 2022–2027 (‘000 SQUARE METERS)

TABLE 142 AFTERMARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 143 AFTERMARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

14.2 PASSENGER CARS

14.2.1 GROWING DEMAND FOR PREMIUM FEATURES IN PASSENGER CAR PARC

TABLE 144 PASSENGER CAR GLASS AFTERMARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 145 AFTERMARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

TABLE 146 AFTERMARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 147 AFTERMARKET, BY REGION, 2022–2027 (USD MILLION)

14.3 COMMERCIAL VEHICLES

14.3.1 INCREASE IN AVERAGE LIFE OF BUSES AND TRUCKS

TABLE 148 COMMERCIAL VEHICLE GLASS AFTERMARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 149 AFTERMARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

TABLE 150 AFTERMARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 151 COMMERCIAL VEHICLE GLASS AFTERMARKET, BY REGION, 2022–2027 (USD MILLION)

15 DEVICE EMBEDDED GLASS MARKET, BY APPLICATION (Page No. - 162)

15.1 INTRODUCTION

15.1.1 RESEARCH METHODOLOGY

15.1.2 ASSUMPTIONS/LIMITATIONS

15.1.3 INDUSTRY INSIGHTS

FIGURE 41 AUTOMOTIVE DEVICE EMBEDDED GLASS MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 152 MARKET, BY APPLICATION, 2018–2021 (‘000 SQUARE METERS)

TABLE 153 MARKET, BY APPLICATION, 2022–2027 (‘000 SQUARE METERS)

TABLE 154 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 155 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

15.2 DEVICE EMBEDDED REARVIEW MIRRORS

15.2.1 ACCURATE VISIBILITY AND ENHANCED SAFETY TO BOOST ADOPTION

TABLE 156 DEVICE EMBEDDED REARVIEW MIRROR GLASS MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 157 MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

TABLE 158 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 159 MARKET, BY REGION, 2022–2027 (USD MILLION)

15.3 DEVICE EMBEDDED WINDSHIELDS

15.3.1 DEVELOPMENTS IN EYE-TRACKING SENSORS EMBEDDED IN WINDSHIELDS TO DRIVE DEMAND

TABLE 160 DEVICE EMBEDDED WINDSHIELD GLASS MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

TABLE 161 DEVICE EMBEDDED WINDSHIELD GLASS MARKET, BY REGION, 2022–2027 (USD MILLION)

16 AUTOMOTIVE WINDSCREEN MARKET, BY APPLICATION (Page No. - 169)

16.1 INTRODUCTION

16.1.1 RESEARCH METHODOLOGY

16.1.2 ASSUMPTIONS/LIMITATIONS

16.1.3 INDUSTRY INSIGHTS

FIGURE 42 AUTOMOTIVE WINDSCREEN GLASS MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 162 MARKET, BY APPLICATION, 2018–2021 (‘000 SQUARE METERS)

TABLE 163 MARKET, BY APPLICATION, 2022–2027 (‘000 SQUARE METERS)

TABLE 164 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 165 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

16.2 WINDSCREENS WITH ADAS

16.3 HEAD-UP DISPLAY WINDSCREENS

16.4 RAIN SENSOR WINDSCREENS

16.5 HEATED WINDSCREENS

16.6 WATER-REPELLENT WINDSCREENS

17 AUTOMOTIVE GLASS MARKET, BY REGION (Page No. - 174)

17.1 INTRODUCTION

TABLE 166 FEDERAL MOTOR VEHICLE SAFETY STANDARDS FOR AUTOMOTIVE GLASS

TABLE 167 EUROPEAN AUTOMOTIVE SAFETY REGULATION FOR GLASS

17.1.1 RESEARCH METHODOLOGY

17.1.2 ASSUMPTIONS/LIMITATIONS

17.1.3 INDUSTRY INSIGHTS

FIGURE 43 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

TABLE 168 MARKET, BY REGION, 2018–2021 (‘000 SQUARE METERS)

TABLE 169 MARKET, BY REGION, 2022–2027 (‘000 SQUARE METERS)

TABLE 170 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 171 MARKET, BY REGION, 2022–2027 (USD MILLION)

17.2 ASIA PACIFIC

FIGURE 44 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 172 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (‘000 SQUARE METERS)

TABLE 173 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (‘000 SQUARE METERS)

TABLE 174 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 175 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

17.2.1 CHINA

17.2.1.1 Increasing market share of premium and luxury cars along with vehicle production to drive demand

TABLE 176 CHINA: MARKET, BY GLASS TYPE, 2018–2021 (‘000 SQUARE METERS)

TABLE 177 CHINA: MARKET, BY GLASS TYPE, 2022–2027 (‘000 SQUARE METERS)

TABLE 178 CHINA: MARKET, BY GLASS TYPE, 2018–2021 (USD MILLION)

TABLE 179 CHINA: MARKET, BY GLASS TYPE, 2022–2027 (USD MILLION)

17.2.2 INDIA

17.2.2.1 Growing demand for SUVs and MUVs

TABLE 180 INDIA: MARKET, BY GLASS TYPE, 2018–2021 (‘000 SQUARE METERS)

TABLE 181 INDIA: MARKET, BY GLASS TYPE, 2022–2027 (‘000 SQUARE METERS)

TABLE 182 INDIA: MARKET, BY GLASS TYPE, 2018–2021 (USD MILLION)

TABLE 183 INDIA: MARKET, BY GLASS TYPE, 2022–2027 (USD MILLION)

17.2.3 JAPAN

17.2.3.1 Growing production of sedans and luxury cars

TABLE 184 JAPAN: MARKET, BY GLASS TYPE, 2018–2021 (‘000 SQUARE METERS)

TABLE 185 JAPAN: MARKET, BY GLASS TYPE, 2022–2027 (‘000 SQUARE METERS)

TABLE 186 JAPAN: MARKET, BY GLASS TYPE, 2018–2021 (USD MILLION)

TABLE 187 JAPAN: MARKET, BY GLASS TYPE, 2022–2027 (USD MILLION)

17.2.4 SOUTH KOREA

17.2.4.1 Developments in autonomous vehicles to boost demand for smart windshields and rearview mirrors

TABLE 188 SOUTH KOREA: MARKET, BY GLASS TYPE, 2018–2021 (‘000 SQUARE METERS)

TABLE 189 SOUTH KOREA: MARKET, BY GLASS TYPE, 2022–2027 (‘000 SQUARE METERS)

TABLE 190 SOUTH KOREA: MARKET, BY GLASS TYPE, 2018–2021 (USD MILLION)

TABLE 191 SOUTH KOREA: MARKET, BY GLASS TYPE, 2022–2027 (USD MILLION)

17.2.5 REST OF ASIA PACIFIC

17.2.5.1 Localization of vehicle production to boost market

TABLE 192 REST OF ASIA PACIFIC: MARKET, BY GLASS TYPE, 2018–2021 (‘000 SQUARE METERS)

TABLE 193 REST OF ASIA PACIFIC: MARKET, BY GLASS TYPE, 2022–2027 (‘000 SQUARE METERS)

TABLE 194 REST OF ASIA PACIFIC: MARKET, BY GLASS TYPE, 2018–2021 (USD MILLION)

TABLE 195 REST OF ASIA PACIFIC: MARKET, BY GLASS TYPE, 2022–2027 (USD MILLION)

17.3 EUROPE

FIGURE 45 EUROPE: MARKET, 2022 VS. 2027 (USD MILLION)

TABLE 196 EUROPE: MARKET, BY COUNTRY, 2018–2021 (‘000 SQUARE METERS)

TABLE 197 EUROPE: MARKET, BY COUNTRY, 2022–2027 (‘000 SQUARE METERS)

TABLE 198 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 199 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

17.3.1 FRANCE

17.3.1.1 Presence of premium and luxury vehicles

TABLE 200 FRANCE: MARKET, BY GLASS TYPE, 2018–2021 (‘000 SQUARE METERS)

TABLE 201 FRANCE: MARKET, BY GLASS TYPE, 2022–2027 (‘000 SQUARE METERS)

TABLE 202 FRANCE: MARKET, BY GLASS TYPE, 2018–2021 (USD MILLION)

TABLE 203 FRANCE: MARKET, BY GLASS TYPE, 2022–2027 (USD MILLION)

17.3.2 GERMANY

17.3.2.1 Government mandates for safety standards

TABLE 204 GERMANY: MARKET, BY GLASS TYPE, 2018–2021 (‘000 SQUARE METERS)

TABLE 205 GERMANY: MARKET, BY GLASS TYPE, 2022–2027 (‘000 SQUARE METERS)

TABLE 206 GERMANY: MARKET, BY GLASS TYPE, 2018–2021 (USD MILLION)

TABLE 207 GERMANY: MARKET, BY GLASS TYPE, 2022–2027 (USD MILLION)

17.3.3 ITALY

17.3.3.1 Government mandates for safety standards

TABLE 208 ITALY: MARKET, BY GLASS TYPE, 2018–2021 (‘000 SQUARE METERS)

TABLE 209 ITALY: MARKET, BY GLASS TYPE, 2022–2027 (‘000 SQUARE METERS)

TABLE 210 ITALY: MARKET, BY GLASS TYPE, 2018–2021 (USD MILLION)

TABLE 211 ITALY: MARKET, BY GLASS TYPE, 2022–2027 (USD MILLION)

17.3.4 SPAIN

17.3.4.1 Increasing production of passenger cars and LCVs

TABLE 212 SPAIN: MARKET, BY GLASS TYPE, 2018–2021 (‘000 SQUARE METERS)

TABLE 213 SPAIN: MARKET, BY GLASS TYPE, 2022–2027 (‘000 SQUARE METERS)

TABLE 214 SPAIN: MARKET, BY GLASS TYPE, 2018–2021 (USD MILLION)

TABLE 215 SPAIN: MARKET, BY GLASS TYPE, 2022–2027 (USD MILLION)

17.3.5 UK

17.3.5.1 Localization of automobile industry and demand for premium and luxury cars

TABLE 216 UK: MARKET, BY GLASS TYPE, 2018–2021 (‘000 SQUARE METERS)

TABLE 217 UK: MARKET, BY GLASS TYPE, 2022–2027 (‘000 SQUARE METERS)

TABLE 218 UK: MARKET, BY GLASS TYPE, 2018–2021 (USD MILLION)

TABLE 219 UK: MARKET, BY GLASS TYPE, 2022–2027 (USD MILLION)

17.3.6 REST OF EUROPE

17.3.6.1 Increasing demand for vehicles

TABLE 220 REST OF EUROPE: MARKET, BY GLASS TYPE, 2018–2021 (‘000 SQUARE METERS)

TABLE 221 REST OF EUROPE: MARKET, BY GLASS TYPE, 2022–2027 (‘000 SQUARE METERS)

TABLE 222 REST OF EUROPE: MARKET, BY GLASS TYPE, 2018–2021 (USD MILLION)

TABLE 223 REST OF EUROPE: MARKET, BY GLASS TYPE, 2022–2027 (USD MILLION)

17.4 NORTH AMERICA

FIGURE 46 NORTH AMERICA: MARKET SNAPSHOT

TABLE 224 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (‘000 SQUARE METERS)

TABLE 225 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (‘000 SQUARE METERS)

TABLE 226 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 227 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

17.4.1 CANADA

17.4.1.1 Demand for advanced vehicles and premium cars

TABLE 228 CANADA: MARKET, BY GLASS TYPE, 2018–2021 (‘000 SQUARE METERS)

TABLE 229 CANADA: MARKET, BY GLASS TYPE, 2022–2027 (‘000 SQUARE METERS)

TABLE 230 CANADA: MARKET, BY GLASS TYPE, 2018–2021 (USD MILLION)

TABLE 231 CANADA: MARKET, BY GLASS TYPE, 2022–2027 (USD MILLION)

17.4.2 MEXICO

17.4.2.1 Government regulations to increase domestic production

TABLE 232 MEXICO: MARKET, BY GLASS TYPE, 2018–2021 (‘000 SQUARE METERS)

TABLE 233 MEXICO: MARKET, BY GLASS TYPE, 2022–2027 (‘000 SQUARE METERS)

TABLE 234 MEXICO: MARKET, BY GLASS TYPE, 2018–2021 (USD MILLION)

TABLE 235 MEXICO: MARKET, BY GLASS TYPE, 2022–2027 (USD MILLION)

17.4.3 US

17.4.3.1 Production of SUVs and pickup trucks to boost market

TABLE 236 US: MARKET, BY GLASS TYPE, 2018–2021 (‘000 SQUARE METERS)

TABLE 237 US: MARKET, BY GLASS TYPE, 2022–2027 (‘000 SQUARE METERS)

TABLE 238 US: MARKET, BY GLASS TYPE, 2018–2021 (USD MILLION)

TABLE 239 US: MARKET, BY GLASS TYPE, 2022–2027 (USD MILLION)

17.5 REST OF THE WORLD

FIGURE 47 ROW: MARKET, 2022 VS. 2027 (USD MILLION)

TABLE 240 ROW: MARKET, BY COUNTRY, 2018–2021 (‘000 SQUARE METERS)

TABLE 241 ROW: MARKET, BY COUNTRY, 2022–2027 (‘000 SQUARE METERS)

TABLE 242 ROW: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 243 ROW: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

17.5.1 BRAZIL

17.5.1.1 Trade agreements with US boost Brazil’s automobile production

TABLE 244 BRAZIL: MARKET, BY GLASS TYPE, 2018–2021 (‘000 SQUARE METERS)

TABLE 245 BRAZIL: MARKET, BY GLASS TYPE, 2022–2027 (‘000 SQUARE METERS)

TABLE 246 BRAZIL: MARKET, BY GLASS TYPE, 2018–2021 (USD MILLION)

TABLE 247 BRAZIL: MARKET, BY GLASS TYPE, 2022–2027 (USD MILLION)

17.5.2 RUSSIA

17.5.2.1 Increasing adoption of safety features by OEMs in Russia propels automotive glass demand

TABLE 248 RUSSIA: MARKET, BY GLASS TYPE, 2018–2021 (‘000 SQUARE METERS)

TABLE 249 RUSSIA: MARKET, BY GLASS TYPE, 2022–2027 (‘000 SQUARE METERS)

TABLE 250 RUSSIA: MARKET, BY GLASS TYPE, 2018–2021 (USD MILLION)

TABLE 251 RUSSIA: MARKET, BY GLASS TYPE, 2022–2027 (USD MILLION)

17.5.3 TURKEY

17.5.3.1 Set up of manufacturing facilities by luxury automakers

TABLE 252 TURKEY: MARKET, BY GLASS TYPE, 2018–2021 (‘000 SQUARE METERS)

TABLE 253 TURKEY: MARKET, BY GLASS TYPE, 2022–2027 (‘000 SQUARE METERS)

TABLE 254 TURKEY: MARKET, BY GLASS TYPE, 2018–2021 (USD MILLION)

TABLE 255 TURKEY: MARKET, BY GLASS TYPE, 2022–2027 (USD MILLION)

17.5.4 OTHERS IN ROW

17.5.4.1 Increasing market share of high-end cars to propel demand

TABLE 256 OTHERS IN ROW: MARKET, BY GLASS TYPE, 2018–2021 (‘000 SQUARE METERS)

TABLE 257 OTHER IN ROW: MARKET, BY GLASS TYPE, 2022–2027 (‘000 SQUARE METERS)

TABLE 258 OTHERS IN ROW: MARKET, BY GLASS TYPE, 2018–2021 (USD MILLION)

TABLE 259 OTHERS IN ROW: MARKET, BY GLASS TYPE, 2022–2027 (USD MILLION)

18 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 217)

18.1 ASIA PACIFIC TO BE MAJOR MARKET FOR GLASS SOLUTIONS

18.2 TEMPERED GLASS ESTIMATED TO BE LARGEST MARKET IN TERMS OF VALUE

18.3 CONCLUSION

19 COMPETITIVE LANDSCAPE (Page No. - 219)

19.1 OVERVIEW

19.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 260 COMPANIES ADOPTED ACQUISITION AS KEY GROWTH STRATEGY,

2019–2021 219

19.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2019–2021

19.4 MARKET SHARE ANALYSIS

TABLE 261 MARKET STRUCTURE, 2022

FIGURE 48 MARKET SHARE ANALYSIS, 2021

19.5 COMPETITIVE LEADERSHIP MAPPING

19.5.1 STARS

19.5.2 EMERGING LEADERS

19.5.3 PERVASIVE PLAYERS

19.5.4 PARTICIPANTS

FIGURE 49 COMPETITIVE LEADERSHIP MAPPING: AUTOMOTIVE GLASS MANUFACTURERS

TABLE 262 AUTOMOTIVE GLASS MARKET: COMPANY FOOTPRINT

TABLE 263 COMPANY TECHNOLOGY FOOTPRINT

TABLE 264 COMPANY REGION FOOTPRINT (19 COMPANIES)

19.6 COMPETITIVE LEADERSHIP MAPPING: SMART GLASS MANUFACTURERS

19.6.1 STARS

19.6.2 EMERGING LEADERS

19.6.3 PERVASIVE PLAYERS

19.6.4 PARTICIPANTS

FIGURE 50 COMPETITIVE LEADERSHIP MAPPING: SMART GLASS MANUFACTURERS

TABLE 265 SMART GLASS MANUFACTURERS: COMPANY FOOTPRINT

TABLE 266 COMPANY INDUSTRY FOOTPRINT (SMART GLASS) (12 COMPANIES)

TABLE 267 COMPANY REGION FOOTPRINT (OFF-HIGHWAY) (12 COMPANIES)

19.7 COMPETITIVE SCENARIO

19.8 NEW PRODUCT LAUNCHES

TABLE 268 NEW PRODUCT DEVELOPMENTS, 2020–2022

19.9 AGREEMENTS, PARTNERSHIPS, COLLABORATIONS, AND JOINT VENTURES

TABLE 269 AGREEMENTS, PARTNERSHIPS, COLLABORATIONS, AND JOINT VENTURES, 2020–2022

20 COMPANY PROFILES (Page No. - 236)

(Business overview, Products/Solutions offered, Recent developments & MnM View)*

20.1 KEY PLAYERS

20.1.1 COMPAGNIE DE SAINT-GOBAIN S.A.

TABLE 270 COMPAGNIE DE SAINT-GOBAIN S.A.: BUSINESS OVERVIEW

FIGURE 51 COMPAGNIE DE SAINT-GOBAIN S.A.: COMPANY SNAPSHOT

TABLE 271 COMPAGNIE DE SAINT-GOBAIN S.A.: PRODUCTS OFFERED

TABLE 272 COMPAGNIE DE SAINT-GOBAIN S.A.: DEALS

20.1.2 AGC INC.

TABLE 273 AGC INC.: BUSINESS OVERVIEW

FIGURE 52 AGC INC.: COMPANY SNAPSHOT

TABLE 274 AGC INC.: PRODUCTS OFFERED

TABLE 275 AGC INC.: NEW PRODUCT DEVELOPMENTS

20.1.3 FUYAO GLASS INDUSTRY GROUP CO., LTD.

TABLE 276 FUYAO GLASS INDUSTRY GROUP CO., LTD.: BUSINESS OVERVIEW

FIGURE 53 FUYAO GLASS INDUSTRY GROUP CO., LTD.: COMPANY SNAPSHOT

TABLE 277 FUYAO GLASS INDUSTRY GROUP CO., LTD.: PRODUCTS OFFERED

20.1.4 MOTHERSON SUMI SYSTEMS LIMITED

TABLE 278 MOTHERSON SUMI SYSTEMS LIMITED: BUSINESS OVERVIEW

FIGURE 54 MOTHERSON SUMI SYSTEMS LIMITED: COMPANY SNAPSHOT

TABLE 279 MOTHERSON SUMI SYSTEMS LIMITED: PRODUCTS OFFERED

TABLE 280 MOTHERSON SUMI SYSTEMS LIMITED: EXPANSION

20.1.5 WEBASTO GROUP

TABLE 281 WEBASTO GROUP: BUSINESS OVERVIEW

FIGURE 55 WEBASTO GROUP: COMPANY SNAPSHOT

TABLE 282 WEBASTO GROUP: PRODUCTS OFFERED

TABLE 283 WEBASTO GROUP: NEW PRODUCT DEVELOPMENTS

TABLE 284 WEBASTO GROUP: EXPANSION

20.1.6 NIPPON SHEET GLASS CO., LTD.

TABLE 285 NIPPON SHEET GLASS CO., LTD: BUSINESS OVERVIEW

FIGURE 56 NIPPON SHEET GLASS CO., LTD.: COMPANY SNAPSHOT

TABLE 286 NIPPON SHEET GLASS CO., LTD.: PRODUCTS OFFERED

TABLE 287 NIPPON SHEET GLASS CO., LTD.: EXPANSION

20.1.7 GENTEX CORPORATION

TABLE 288 GENTEX CORPORATION: BUSINESS OVERVIEW

FIGURE 57 GENTEX CORPORATION: COMPANY SNAPSHOT

TABLE 289 GENTEX CORPORATION: PRODUCTS OFFERED

TABLE 290 GENTEX CORPORATION: DEALS

20.1.8 MAGNA INTERNATIONAL INC.

TABLE 291 MAGNA INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 58 MAGNA INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 292 MAGNA INTERNATIONAL INC.: EXPANSION

TABLE 293 MAGNA INTERNATIONAL INC.: DEALS

20.1.9 CORNING INCORPORATED

TABLE 294 CORNING INCORPORATED: BUSINESS OVERVIEW

FIGURE 59 CORNING INCORPORATED: COMPANY SNAPSHOT

TABLE 295 CORNING INCORPORATED: PRODUCTS OFFERED

20.1.10 CENTRAL GLASS CO., LTD.

TABLE 296 CENTRAL GLASS CO., LTD.: BUSINESS OVERVIEW

FIGURE 60 CENTRAL GLASS CO., LTD.: COMPANY SNAPSHOT

TABLE 297 CENTRAL GLASS CO., LTD.: PRODUCTS OFFERED

*Details on Business overview, Products/Solutions offered, Recent developments & MnM View might not be captured in case of unlisted companies.

20.2 OTHER PLAYERS

20.2.1 VITRO

TABLE 298 VITRO: BUSINESS OVERVIEW

20.2.2 XINYI GLASS HOLDINGS LIMITED

TABLE 299 XINYI GLASS HOLDINGS LIMITED: BUSINESS OVERVIEW

20.2.3 ÞIÞECAM

TABLE 300 ÞIÞECAM: BUSINESS OVERVIEW

20.2.4 GAVISTA

TABLE 301 GAVISTA: BUSINESS OVERVIEW

20.2.5 AGP GROUP

TABLE 302 AGP GROUP: BUSINESS OVERVIEW

20.2.6 LTI SMART GLASS INC.

TABLE 303 LTI SMART GLASS INC.: BUSINESS OVERVIEW

20.2.7 VISION SYSTEMS - ARCHITECT OF INNOVATIONS

TABLE 304 VISION SYSTEMS - ARCHITECT OF INNOVATIONS: BUSINESS OVERVIEW

20.2.8 GAUZY LTD

TABLE 305 GAUZY LTD: BUSINESS OVERVIEW

20.2.9 KOCHHAR GLASS (INDIA) PVT. LTD

TABLE 306 KOCHHAR GLASS (INDIA) PVT. LTD: BUSINESS OVERVIEW

20.2.10 SOLIVER NV

TABLE 307 SOLIVER NV: BUSINESS OVERVIEW

21 APPENDIX (Page No. - 270)

21.1 INSIGHTS OF INDUSTRY EXPERTS

21.2 DISCUSSION GUIDE

21.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

21.4 CUSTOMIZATION OPTIONS

21.4.1 AUTOMOTIVE GLASS MARKET, BY MATERIAL AT REGIONAL LEVEL

21.4.1.1 North America

21.4.1.2 Europe

21.4.1.3 Asia Pacific

21.4.1.4 RoW

21.4.2 ELECTRIC VEHICLE GLASS MARKET, BY VEHICLE TYPE & APPLICATION

21.4.2.1 Windshield

21.4.2.2 Sidelite/Backlite

21.4.2.3 Rear Quarter Glass

21.4.2.4 Sideview Mirror

21.4.2.5 Rearview mirror

21.4.3 ELECTRIC COMMERCIAL VEHICLE GLASS MARKET, BY VEHICLE TYPE & APPLICATION

21.4.3.1 Windshield

21.4.3.2 Sidelite/Backlite

21.4.3.3 Rear Quarter Glass

21.4.3.4 Sideview Mirror

21.4.3.5 Rearview Mirror

21.4.4 AUTOMOTIVE GLASS AFTERMARKET, BY APPLICATION

21.4.4.1 Windshield

21.4.4.2 Sidelite/Backlite

21.4.4.3 Rear Quarter Glass

21.4.4.4 Sideview mirror

21.4.4.5 Rearview mirror

21.4.5 AUTOMOTIVE GLASS AFTERMARKET, BY VEHICLE TYPE & GLASS TYPE

21.4.5.1 Laminated

21.4.5.2 Tempered

21.4.5.3 Others

21.5 RELATED REPORTS

21.6 AUTHOR DETAILS

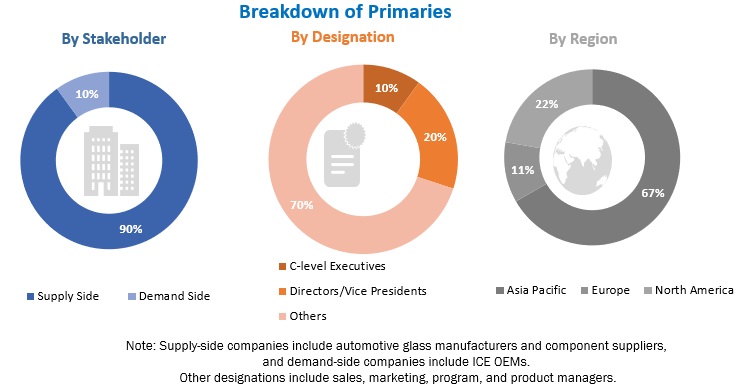

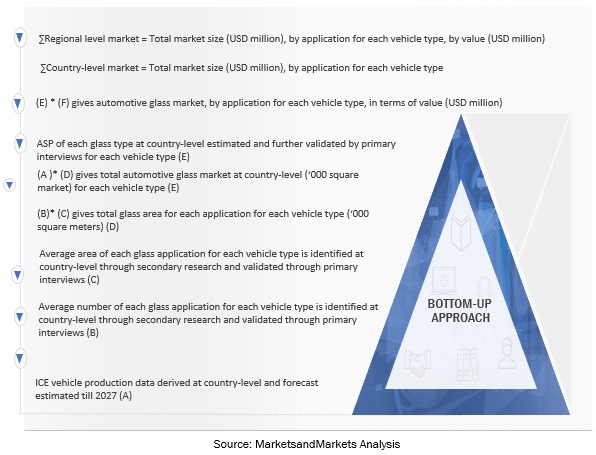

The study involved four major activities in estimating the current size of the automotive glass market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [such as publications of vehicle sales’ OEMs, Canadian Automobile Association (CAA), country-level automotive associations and trade organizations, and the US Department of Transportation (DOT)], automotive glass magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, and technical reports have been used to identify and collect information useful for an extensive commercial study of the automotive gass market.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from different key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews have been conducted to gather insights such as vehicle production forecast, glass production forecast, future technology trends, and upcoming technologies in the automotive glass glass industry. Data triangulation of all these points was done with the information gathered from secondary research as well as model mapping. Stakeholders from demand as well as supply-side have been interviewed to understand their views on the points mentioned above.

Primary interviews have been conducted with market experts from both the demand- (OEMs) and supply-side (raw material suppliers) players across four major regions, namely, North America, Europe, Asia Pacific, and Rest of the World. Approximately 10% and 90% of primary interviews have been conducted from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales and operations, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the automotive glass market and other dependent submarkets, as mentioned below:

- Key players in the automotive glass market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology included study of annual and quarterly financial reports and regulatory filings of major market players (public) as well as interviews with industry experts for detailed market insights.

- All industry-level penetration rates, percentage shares, splits, and breakdowns for the automotive glass were determined using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Automotive Glass Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive Glass Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and project the automotive glass market in terms of volume ('000 Units) and value (USD Million) based on:

- Glass type [laminated glass, tempered glass, and others]

- Technology [active smart glass (suspended particle device (SPD), electrochromic (EC), liquid crystal (LC)/polymer dispersed liquid crystal (PDLC) and passive glass (photochromic, thermochromic)]

- Application [windshields, sidelites, backlites, rear quarter glass, sideview mirrors, and rearview mirrors]

- Vehicle type [passenger cars, LCVs, trucks, and buses]

- Electric & hybrid vehicle glass, by region [BEV, HEV, PHEV, and FCEV)

- Material [IR-PVB, metal-coated glass, tinted glass, others]

- Smart glass market, by application [dimmable mirrors, windshields, sunroofs, and sidelites/backlites]

- Device embedded glass, by application [rearview mirrors and windshields]

- Windshield by application (head-up displays, windscreens with ADAS, windscreens with rain sensors, heated windscreens, water-repellent windscreens)

- Aftermarket [passenger cars and commercial vehicles]

- Region [Asia Pacific, Europe, North America, and RoW]

- To provide detailed information regarding major factors (drivers, restraints, opportunities, and challenges) influencing the automotive glass market

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and expansions in the market

- To conduct a case study analysis, technology analysis, supply chain analysis, trade analysis, market ecosystem analysis, tariff and regulatory landscape analysis, Porter’s Five Forces analysis, and average selling price analysis

- To analyze the market share of key players in the automotive glass market and conduct a revenue analysis of the top five players

- To formulate the competitive leadership mapping of key players in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

Automotive Glass Market, By Material & Region

Note: The segment covers the automotive glass market by material type, which includes IR-PVB, Metal Coated Glass, and Tinted Glass for below mentioned countries.

- North America

- Europe

- Asia Pacific

- RoW

Electric & Hybrid Vehicle Glass Market, By Application

Note: The segment covers the electric and hybrid vehicle glass market for the below-mentioned applications at the regional level – Asia Pacific, Europe, North America, and RoW.

- Windshield

- Sidelite/Backlite

- Rear Quarter Glass

- Sideview mirror

- Rearview mirror

Automotive Glass Aftermarket, By Application

Note: The segment covers the automotive glass aftermarket for the below-mentioned applications at the regional level – Asia Pacific, Europe, North America, and RoW.

- Windshield

- Sidelite/Backlite

- Rear Quarter Glass

- Sideview mirror

- Rearview mirror

Automotive Glass Market, By Vehicle Type & Glass Type

Note: The segment covers the automotive glass market for vehicle type at by glass type.

- Laminated

- Temepered

- Others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Glass Market

Does the report cover the view on the regulation against Polycarbonate for windscreen due to safety reason (egress in case of an accident)