Electric Bus Market Size, Share & Analysis

Electric Bus Market by Propulsion (BEV, FCEV), Battery (LFP, NMC, NCA), Length (<9, 9-14, >14m), Battery Capacity (=400 & >400kWh), Application, Seating Capacity, Range, Power Output, Autonomy Level, Component, Consumer and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The electric bus market is projected to grow from USD 23.80 billion in 2025 to USD 59.60 billion by 2032, at a CAGR of 14.0%. Government subsidies and funding from local and national transit agencies make large-scale electric bus adoption financially sustainable worldwide. This shift is further boosted by progress in advanced battery chemistries and faster charging technology, which have extended driving ranges and reduced dependence on mid-route charging breaks. Although there are still a few challenges, a significant challenge is the need to upgrade power grids and bus depots to handle fast charging. Also, constant stop-and-go driving wears out batteries faster and creates heating issues, which can raise long-term costs for bus operators.

KEY TAKEAWAYS

-

BY PROPULSIONBattery electric buses continue to dominate globally, accounting for the vast majority of electric bus sales due to lower initial and operating costs and improving charging infrastructure. Ongoing efforts to reduce the cost of hydrogen and improve refueling infrastructure will drive the demand for Fuel cell electric buses. However, the higher upfront cost still poses a significant challenge for market adoption.

-

BY RANGEThe intracity electric buses are more popular due to the limited charging range offered and the lack of charging infrastructure outside cities. Hence, the dominance of the up to 300-mile segment. Growing demand for inter-city buses and coaches in Europe and North America will drive the > 300 miles segment.

-

BY CONSUMERGovernments, as the consumers for electric buses, dominate the market with more than 90% share across regions. This is driven by large-scale subsidies, fleet mandates, and public transit electrification programs that prioritize municipal and state-run operators.

-

BY BATTERY CAPACITYThe demand for intercity travel and the future growth potential for electric coaches will drive the market for the above 400 kWh segment.

-

BY BATTERY TYPELFP batteries currently dominate the global electric bus market by battery type. NMC batteries have seen decent demand in the European region, but their demand is decreasing as Chinese players enter European markets. Solid-state batteries are under development in the European region, where players such as Daimler are planning to integrate them into their buses.

-

BY APPLICATIONSIncreased government initiatives for the adoption of electric buses for urban mobility will drive the electric city/transit bus market. The electric school buses market will be dominated by North America.

-

BY POWER OUTPUTThe growing demand for high-performance electric buses in challenging regions will drive the market for buses with a power output above 250 kW. Buses with up to 250 kW power output are mainly used for intracity public transport globally.

-

BY LENGTHThe 9–14 meter long electric buses are set to account for the largest portion of the market, as these buses are a perfect balance between required length and seats. These buses also suit intra-city mobility, which increases their application areas.

-

BY SEATING CAPACITYElectric buses with a seating capacity of 40–70 are increasingly incorporated into public transportation in cities. Increasing popularity of trolley buses and articulated buses is the key driving factor for the growth of electric buses with more than 70 seating capacity.

-

BY GVWElectric buses with a GVW of 10–20 tonnes dominate the electric bus market. Electric bus OEMs are planning to reduce the vehicle weight up to 1 tonne per meter of length.

-

BY COMPONENTAdvancements in battery technologies and the falling prices of LFP batteries will significantly drive the growth of the batteries segment.

-

BY REGIONAsia Pacific is projected to be largest region in global electric bus market during forecast period.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships and investments. Daimler Buses acquired a 49% stake in SINOS GmbH, a software company specializing in intelligent charging management systems for electrified city bus fleets.

The electric bus market is growing due to strong government support, with subsidies and funding from local and national agencies making them more affordable for large-scale use. New battery technologies have improved driving range, need not stop as often for charging, and faster charging systems help reduce waiting times and keep operations running smoothly. At the same time, investments in upgrading power grids and bus depots make it easier to handle large-scale charging needs. While challenges like battery wear and heating from constant stop-and-go driving still exist, improvements in battery management and cooling systems are expected to make batteries last longer and reduce costs over time, further boosting adoption.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Trends and disruptions in the electric bus market indicate the latest and upcoming market trends. It also indicates those trends that were responsible for the past revenue generation, along with upcoming trends that will impact the future revenue of the market. This section also highlights those factors that will be responsible for the market growth of electric buses.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Rising GHG Emissions (Government incentives and policies, target to reduce fleet-level emissions)

-

Increasing demand for emission-free vehicles and decline in battery prices

Level

-

CNG and biofuel buses slowing adoption of electric buses

-

Safety concerns in EV batteries and high development costs

Level

-

Development of advanced battery technologies

-

Transition toward hydrogen fuel cell electric mobility

Level

-

High cost of developing charging infrastructure

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand for green vehicles to lower fleet-level emissions

The push for greener public transport is driving strong demand for electric buses, as governments and cities prioritize fleet-level emission reductions. Strict emission targets in the EU, funding programs in the US and LATAM, and large-scale initiatives in Asia and Africa are accelerating the adoption of green vehicles. OEMs such as BYD and Yutong are supporting this shift by offering cost-competitive, localized solutions. By enabling measurable reductions in CO2 and NOx per passenger-kilometer compared to diesel and CNG fleets, eBuses are helping agencies meet climate action goals. Additionally, various government incentives/subsidies cover up to 85% of the upfront costs. This policy-driven momentum positions electric buses as the most effective pathway to achieving zero-emission transit while maintaining favorable operating economics.

Restraint: CNG and bio-fuel buses slowing adoption of electric buses

CNG buses are slowing the adoption of eBuses because they are around 30–40% cheaper upfront and already supported by widespread refueling infrastructure in markets like India and parts of the US. Their total cost of ownership (TCO) is competitive, owing to the lower purchase price and stable fuel costs, while eBuses still carry higher risks of costly battery replacements and the need for depot charging setups. For high-utilization fleets, CNG buses often reach payback 2–3 years faster than eBuses when subsidies are limited, making many operators cautious about fully shifting to electric.

Opportunity: Advancements in Battery Technologies

Advancements in battery technology are creating significant opportunities for the electric bus market by making vehicles more practical, cost-effective, and widely adoptable. Breakthroughs in sodium-ion batteries, such as CATL’s upcoming Naxtra in 2025, offer a sustainable and affordable alternative to lithium-ion, with comparable energy density, longer lifespan, and higher safety, ideal for urban and entry-level transit systems. At the same time, solid-state batteries are being developed, which promise safer operations, faster charging, and nearly double the energy density, with leading manufacturers like Mercedes-Benz (Germany) already preparing for road trials with their eCitaro electric bus equipped with solid-state batteries. Additionally, the newest generation of NMC4 batteries enhances range and efficiency through higher energy density and prismatic cell designs, supporting new models and retrofitting.

Challenge: High cost of developing charging infrastructure

Developing charging infrastructure for electric buses poses significant challenges for the market because of high costs. Investing in charging stations, grid upgrades, and maintenance facilities is essential for setting up the infrastructure needed for electric buses. Electric buses face a dilemma with their extended charging time and limited driving range per charge, making it difficult to function at maximum capacity. Also, unlike developed countries, most of the emerging economies in the Asia Pacific lack the necessary charging facilities. An extensive and comprehensive charging infrastructure network is required to ensure the smooth operation of electric buses. Bus companies must consider strategic decisions about investing in electric bus fleets, setting up charging infrastructures, and determining where to place those infrastructures in the city network.

MARKET ECOSYSTEM

This diagram highlights the role of electric buses within the broader electric vehicle industry. It outlines their growing importance in sustainable mobility and captures the key aspects influencing adoption, such as vehicle size, range, seating capacity, battery type, and charging capability. The electric bus market is further segmented by consumer type, applications, power output, propulsion technologies, and critical components, providing a clear view of how the market is structured and analyzed. BYD Company (China), Zhejiang Geely Holding Group (China), Yutong Bus Co., Ltd. (China), Fuqi Group (China) and Daimler Truck AG (Germany) are the leading electric bus manufacturers in the market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Electric Bus Market, By Range

The market for long-range electric buses and coaches is expanding as transit operators seek vehicles capable of covering extended routes with fewer charging stops. Falling battery costs, along with advances in high-energy-density LFP batteries (500–600 kWh packs), are enabling ranges above 300 miles. These buses reduce downtime by up to 30%, making them attractive for high-frequency urban routes in China, intercity travel in Europe, and rural services in India.

Electric Bus Market, By Length

The 9–14-meter bus segment is emerging as the backbone of the electric bus market, driven by its versatility for urban, suburban, and select intercity routes. With seating for 40–70 passengers and a range of 240–400 km, these buses meet the needs of full-day city operations without frequent charging. Their popularity is reinforced by government-funded clean bus programs, such as the UK’s ZEBRA scheme, which prioritizes this category for large-scale fleet deployment.

Electric Bus Market, By Consumer

The government sector is driving the growth of electric buses, with large-scale subsidies, mandates, and fleet replacement programs making them the backbone of public transit electrification. China leads with Shenzhen’s 16,000+ municipal eBuses, while India’s FAME-II scheme is enabling thousands of state-run fleet additions toward a 50,000-bus target by 2027. In the US, federal funding of USD 1.7 billion has supported over 1,300 zero-emission transit buses, and the EU’s Clean Bus Deployment Initiative registered nearly 8,000 units in 2024, pushing operators toward 100% electrification by 2030.

Electric Bus Market, By Propulsion

BEVs are estimated to dominate the electric bus market by propulsion during the forecast period. Their lower initial cost and lower operating costs compared to FCEV buses are driving their adoption. Moreover, the developing charging infrastructure has supported growth of BEV buses. FCEV buses on the other hand are priced 2–3x compared to BEVs and have higher operating costs due to high cost of hydrogen.

Electric Bus Market, By Battery Type

LFP batteries are projected to dominate the electric bus market by battery type during the forecast period. NMC batteries have seen decent demand in the European region, but their demand is decreasing, as Chinese players have entered European markets with their inhouse production of LFP batteries. Solid-state batteries are under development in the European region, where players such as Daimler AG are planning to integrate them into their electric buses.

Electric Bus Market, By Battery Capacity

Electric buses with battery capacities of up to 400 kWh are dominating the electric bus market. These batteries provide sufficient range to run intracity throughout the day without frequent recharging, whereas the demand for intercity travel and the future growth potential for electric coaches are estimated to drive the market for the above 400 kWh segment.

Electric Bus Market, By Application

City/Transit buses are leading the electric bus market by application. Increased government initiatives for the adoption of electric buses for urban mobility is the driving factor for this adoption. Electric school buses are becoming popular in North America, while electric coaches are in demand in Europe.

Electric Bus Market, By GVW

The 10–20 tonne segment is estimated to account for the largest share in the electric bus market by GVW. Electric bus OEMs across the globe are focusing on reducing the weight of the buses to improve efficiency. OEMs are targeting to reach 1-tonne per meter of length but currently have achieved around 1.3–1.5 tonne per meter.

Electric Bus Market, By Power Output

Up to 250 kW power output buses are currently leading the market. According to industry experts, this power is sufficient for intercity as well as intracity operations. However, when it comes to harsh and mountainous terrains, higher power output electric buses are preferred. As of 2025, more than 98% of buses have power outputs of up to 250 kW.

Electric Bus Market, By Seating Capacity

The 40–70 seater electric buses dominate the electric bus market in terms of length. These buses serve various applications, including intracity and intercity. Governments are focusing on these buses to be included for public transport. Also, these are a preferred alternative when it comes to long-distance travel, supporting the growth of the segment.

REGION

Asia Pacific to be largest region in global electric bus market during forecast period

Asia Pacific is set to remain the largest electric bus market, driven by large-scale manufacturing, integrated supply chains, and strong government support. China dominates with nearly 65% of global production, led by BYD and Yutong, and has already achieved near-100% electrification of city buses. Chinese OEMs also export to over 40 countries using CATL and BYD batteries. India is rapidly scaling with the PM eBus Sewa program (10,000 buses across 169 cities) and FAME-II, which has sanctioned nearly 7,000 buses. South Korea and Japan are expanding steadily, with Tokyo operating over 100 fuel-cell buses. Other markets like Singapore, Indonesia, and Australia together sold about 500 electric buses in 2024.

Electric Bus Market: COMPANY EVALUATION MATRIX

The figure illustrates the competitive landscape of the global electric bus market, positioning key players based on their market share and product footprint. In the market matrix, Yutong Bus Co., Ltd (China) (Star) leads with a strong market presence and a broad product portfolio, driving large-scale adoption across all major regions. Daimler Truck AG (Germany) (Emerging Leader) is gaining traction in the market through its strong focus on advanced battery development, and the company’s collaborations in charging infrastructure and hydrogen technologies further strengthen its long-term competitiveness in zero-emission buses.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2025 (Value) | USD 23.80 Billion |

| Revenue Forecast, 2032 (Value) | USD 59.60 Billion |

| Growth Rate | 14% |

| Actual Data | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Volume (Units), Value (USD Million) |

| Report Coverage | Revenue Forecast, Company Market Shares, Competitive Landscape, Growth Factors, Trends & Disruption, OEM Analysis, Bill of Materials, Total Cost of Ownership, and OE-wise sales |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

WHAT IS IN IT FOR YOU: Electric Bus Market REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- July 2025 : BYD commenced an expansion of its electric bus and truck manufacturing plant in Komárom, Hungary. The new 29,000-square-meter facility is expected to triple production capacity to over 1,000 vehicles annually. This plant will create more than 600 jobs and enhance Europe's supply of zero-emission public transport solutions.

- July 2025 : Yutong launched its new-generation battery electric intercity bus, the IC12E, at the UITP Summit 2025 in Hamburg, Germany, highlighting its commitment to eco-friendly transportation. The IC12E is explicitly designed for the European market, offering a maximum 610-kilometer range under SORT2 conditions.

- July 2025 : Yutong delivered 110 customized C13PRO premium coaches to Aramco in Saudi Arabia. These coaches were specially engineered to perform reliably in the region’s extreme desert climate. They feature advanced cooling systems, intelligent safety technologies, and luxurious, business-class interiors designed for comfort and connectivity.

- June 2025 : Zhejiang Geely Holding Group launched the U12M at the Hong Kong Auto Expo. This would be Geely’s first methanol hybrid city bus, targeting public transport in Hong Kong with sustainable powertrain technology.

- March 2025 : Volvo secured a major order for 106 electric buses from Svealandstrafiken in Sweden in 2024. This included 60 Volvo 8900 Electric intercity buses and 46 Volvo 7900 Electric articulated city buses, with deliveries starting in 2025–2026 and operations expected by early 2027.

- February 2025 : Volvo Buses secured its first electric bus order from Go Ahead (UK), the largest operator of bus services in London. The company will add 25 Volvo BZL Electric single-deck buses to its fleet later this year.

- January 2025 : Thomas Built Buses, a subsidiary of Daimler Trucks, launched the second-generation Saf-T-Liner C2 Jouley battery-electric school bus. The bus featured a new 219-inch wheelbase that accommodated up to 60 passengers. It would be powered by the advanced 14Xe eAxle from Accelera, with a 246 kWh battery enabling a range of up to 150 miles and acceleration from 0-60 mph in 49 seconds.

Table of Contents

Methodology

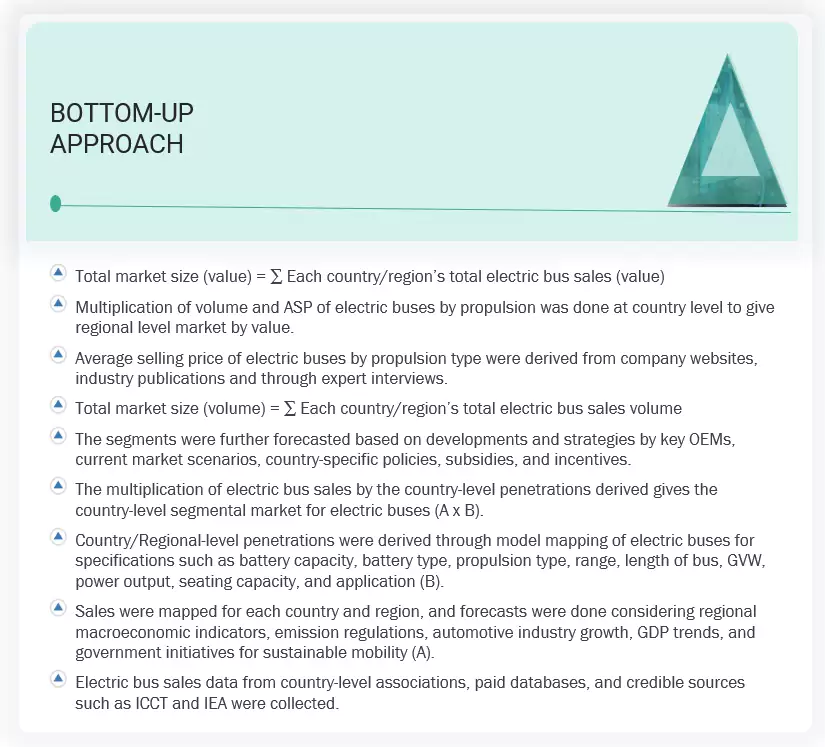

The study encompassed four primary tasks to determine the present and future scope of the electric bus market. Initially, extensive secondary research was conducted to gather data on the market, its related sectors, and overarching industries. Subsequently, primary research involving industry experts across the supply chain corroborated and validated these findings and assumptions. The complete market size was estimated by using the bottom-up methodology. Following this, a market breakdown and data triangulation approach were utilized to determine the size of specific segments and subsegments within the market.

Secondary Research

Secondary sources for this research study included electric vehicle industry organizations such as the World Electric Vehicle Association and corporate filings such as annual reports, investor presentations, and financial statements. Secondary data was collected and analyzed to determine the total market size, further validated by primary research.

Primary Research

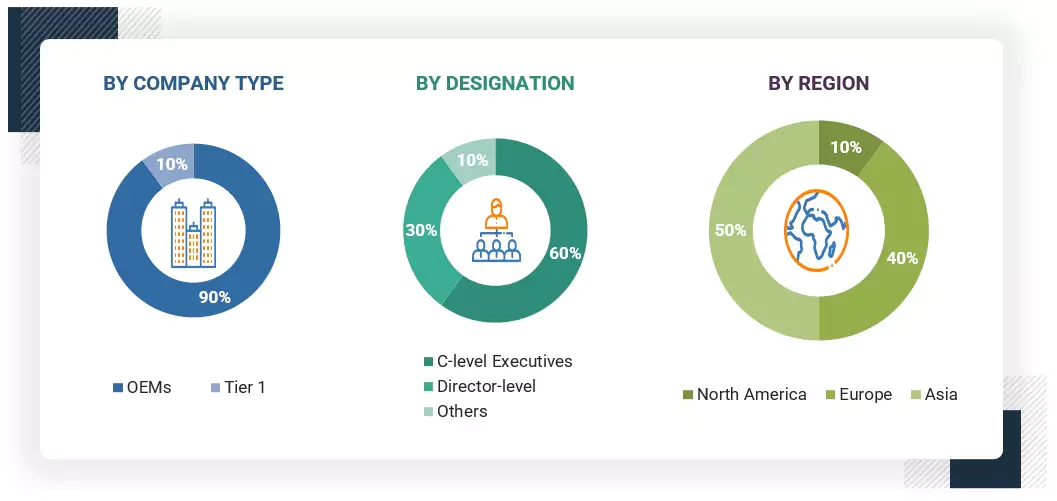

Extensive primary research was conducted through secondary research after understanding the electric bus market scenario. Several primary interviews were conducted with market experts from both the demand (OEMs) and supply (electric bus and component manufacturers) sides across major regions, namely Asia Pacific, Europe, Latin America, the Middle East & Africa, and North America. Approximately 90% and 10% of primary interviews were conducted with the OEM and Tier I players, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, were covered to provide a holistic viewpoint in the report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from the primaries. This and the in-house subject matter experts’ opinions led to the findings described in the remainder of this report.

Note: Company tiers are based on the supply chain; company revenue is not considered. Tier 1 includes component

manufacturers and suppliers to OEMs, and Tier 2 includes component suppliers to Tier 1.

*Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the electric bus market and other dependent submarkets.

- The bottom-up approach was used to estimate and validate the size of the market. Firstly, the country-wise sales of electric buses were mapped from country-level associations, paid databases, and sources such as ICCT and IEA. The sales forecast for electric buses by country and region was based on macroeconomic indicators, emission regulations, automotive industry growth, GDP growth, and government initiatives for sustainable mobility.

- Secondly, all segments of the market were derived by mapping different electric buses, by different regions for their technical specifications such as battery capacity, propulsion, range, length, GVW, power output, seating capacity, and application.

- The market forecasts were estimated on factors such as developments by key OEMs, current market scenarios, country-wise initiatives and incentives for electric buses, and based on insights shared by industry experts.

- Each country/region’s total volume was later summed up to reveal the total volume of the global market. The data was validated through primary interviews with industry experts.

Electric Bus Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the vehicles complying with the electric bus market through the methodology mentioned above, the market was split into several segments and subsegments. Data triangulation is a research technique used to increase the validity and reliability of findings by cross-validating data from multiple sources or methods. This technique involves the use of multiple sources of data, such as surveys, interviews, observations, and secondary data, to confirm and corroborate the findings obtained from each source. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the supply and demand sides.

Market Definition

An electric bus is a type of bus powered by electricity rather than fossil fuels such as gasoline or diesel. It uses electric motors for propulsion, with energy generally stored in onboard batteries that can be charged through electrical outlets or charging stations. Electric buses produce zero emissions while driving, making them a cleaner and quieter alternative to conventional buses, and are often used in public transit, school, and shuttle services. They are more energy-efficient, offer lower operating costs, and typically feature regenerative braking systems that help recharge their batteries during operation.

Stakeholders

- Associations, Forums, and Alliances Related to Electric Vehicles

- Automotive Industry Investors

- Automotive Software Manufacturers and Providers

- Companies Operating in Autonomous Vehicle Ecosystem

- Electric Bus Manufacturers

- EV Charging Equipment Manufacturers

- EV Charging Infrastructure Service Providers

- EV Component Suppliers

- EV Distributors and Retailers

- Government Agencies and Policy Makers

Report Objectives

-

To segment and forecast the electric bus market size in terms of volume & value:

- By propulsion (BEVs and FCEVs)

- By length of the bus (less than 9 m, 9–14 m, more than 14 m)

- By component (batteries, motors, fuel cell stacks, battery management systems, battery cooling systems, DC-DC converters, inverters, AC/DC chargers, and EV connectors)

- By range (up to 300 miles and above 300 miles)

- By power output (up to 250 kW and above 250 kW)

- By battery capacity (up to 400 kWh and above 400 kWh)

- By application (transit buses, coaches, school buses, and other applications)

- By battery type (LFP batteries, NMC batteries, NCA batteries, and other batteries)

- By seating capacity (up to 40 seats, 40–70 seats, and above 70 seats)

- By consumers (government and private)

- By GVW (Up to 10 tonnes, 10 to 20 tonnes, and above 20 tonnes)

- By level of autonomy (semi-autonomous and autonomous)

- By region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa)

- To provide detailed information about the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To track and analyze competitive developments, such as product launches, deals, and other activities by key industry participants.

- To strategically analyze the market with value chain analysis, bill of materials, revenue analysis, and regulatory analysis in the electric bus market

- To examine the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Electric bus market, by range at the country-level (for countries covered in the report)

- Up to 200 miles

- Above 200 miles

Electric bus market, by battery type at the country level (for countries covered in the report)

- LFP

- NMC

- NCA

- Others

Company Information

- Profiles of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Electric Bus Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Electric Bus Market

Maria

Jul, 2022

MnM while conducting the given research on “Electric Bus Market” have contacted and conducted primary interviews from all major players from the Electric Vehicle eco-system consisting of Bus manufacturers, bus components manufacturers, EV charging infrastructure service and equipment providers, EV experts, country level government associations and agencies etc. All major market numbers, penetration rates and growth rates have been discussed and validated through primary interviews..