Automotive Windshield Market by Glass Type (Laminated and Tempered), Material Type (Thermoset and Thermoplastic), Position (Front and Rear), Vehicle Type (PCs, LCVs, and HCVs), Electric Vehicle Type (HEVs, BEVs, and PHEVs), and Region - Global Forecast to 2025

The global automotive windshield market is estimated to be USD 13.47 Billion in 2016 and is projected to grow at a CAGR of 6.28% from 2017 to reach USD 23.24 Billion by 2025. In this study, 2016 has been considered the base year, and 2017–2025 the forecast period, for estimating the size of this market.

The report analyzes and forecasts the market size, by value (USD million), of the global automotive windshield market. The report segments the global market and forecasts its size, by region, windshield position, glass type, material type, vehicle type, and electric vehicle. The report also provides a detailed analysis of various forces acting in the market including drivers, restraints, opportunities, and challenges. It strategically profiles key players and comprehensively analyzes their market shares and core competencies. It also tracks and analyzes competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants.

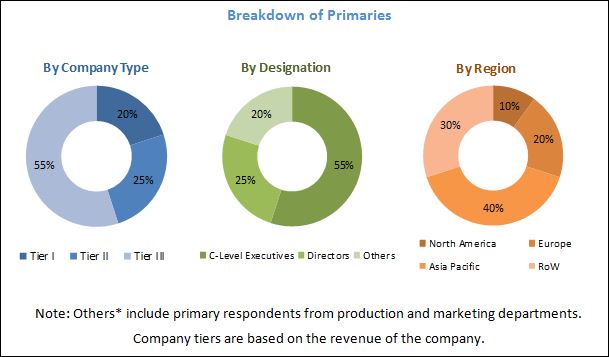

The research methodology used in the report involves various secondary sources such as National Highway Traffic Safety Administration (NHTSA), GENIVI Alliance, Japan Automobile Manufacturers Association (JAMA), European Automobile Manufacturers Association (EAMA), Canadian Automobile Association (CAA), and Korea Automobile Manufacturers Association (KAMA). Experts from related industries, automotive glass suppliers and manufacturers have been interviewed to understand the future trends in automotive windshield market. The market size of the individual segments was determined through various secondary sources: industry associations; white papers; and journals. The vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up approach has been used to estimate and validate the size of the global market. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments.

The figure given below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the automotive windshield market consists of manufacturers such as Saint-Gobain (France), Nippon Sheet Glass (Japan), Asahi Glass (Japan), and Fuyao Glass (China), and research institutes such as Japan Automobile Manufacturers Association (JAMA), European Automobile Manufacturers Association (EAMA), Canadian Automobile Association (CAA), and Korea Automobile Manufacturers Association (KAMA).

Target Audience

- Automobile manufacturers

- Automobile organizations/associations

- Compliance regulatory authorities

- Government agencies

- Information Technology (IT) companies & System integrators

- Investors and Venture Capitalists (VCs)

- Raw material suppliers for automotive windshield

- Traders, distributors, and suppliers of automotive windshield

Scope of the Report

Market, By Region

Market, By Glass Type

Market, By Windshield Position

Market, By Vehicle Type

Market, By Material Type

Market, By Electric Vehicle Type

-

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

- Laminated Glass

- Tempered Glass

- Front Windshield

- Rear Windshield

- Passenger Car

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

- Thermoset Material

- Thermoplastic Material

- Hybrid Electric Vehicle (HEV)

- Battery Electric Vehicle (BEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Detailed analysis and profiling of additional market players (up to 3)

- Detailed analysis of windshield services market for automotive

- Detailed analysis of windshield range market for automotive

The automotive industry is one of the key contributors to the overall GDP of the world and is growing significantly over the years. Growing economy and improving demographics have surged the demand for vehicles across the globe. As the demand for vehicles is growing, the demand for automotive components is also increasing significantly, especially in countries such as China and India. Also, new vehicle model launches and the increasing demand for premium and luxury segment cars have increased the demand for exterior components, such as a windshield. The automotive windshield provides an efficient aerodynamic design, clear visibility, and protection from debris, unwanted particles, ultraviolet (UV) rays, and harmful radiation.

The global automotive windshield market is estimated to be USD 14.27 Billion in 2017 and is projected to grow at a CAGR of 6.28% to reach USD 23.24 Billion by the end of 2025. Some of the major drivers identified are the growing vehicle production and the increasing use of windshield for the latest display technologies. The growth of the global automotive industry is expected to fuel the growth of the automotive windshield. Technologies, such as smart displays and driver assistance functions, are now getting incorporated in the mid-segment and economy vehicles. The market for these latest display technologies on the windshield is driven by the increased awareness of road and vehicle safety.

The global automotive windshield market is segmented by windshield position, glass type, material type, vehicle type, electric vehicle type, and region. The report discusses two windshield positions, namely, front windshield and rear windshield. The laminated glass market accounted for the largest market shares in this market and is estimated to grow with the highest CAGR during the forecast period. The growth of the laminated glass segment is expected to be driven by the increasing use of solar reflective windshields glazing on windshields and for the latest display technologies. Also, to understand the type of material, the report discusses the market for automotive windshield under two distinctive type of materials, namely, thermoset material and thermoplastic material. Further, to understand the market in different vehicle segments, the market is segmented into Passenger Car (PC), Light Commercial Vehicle (LCV), and Heavy Commercial Vehicle (HCV). The study also segments the global market by electric vehicle into Hybrid electric vehicle (HEV), Battery Electric Vehicle (BEV), and Plug-In Hybrid Electric Vehicle (PHEV). The extensive study has been done on four key regions, namely, Asia Pacific, Europe, North America, and the Rest of the World (RoW).

The global automotive windshield market for laminated glass is estimated to account for largest shares in the global market estimated in 2017. Tempered glass is estimated to be the second largest segment of this market. The global market for laminated glass segment is projected to grow at a higher CAGR during the forecast period due to the increasing use of laminated glass for protection against harmful ultraviolet (UV) rays. Various automotive glass manufacturers such as Asahi Glass (Japan), Nippon Sheet Glass (Japan), and Central Glass (Japan), especially in Asia Pacific, are offering customized windshields to vehicles manufacturers.

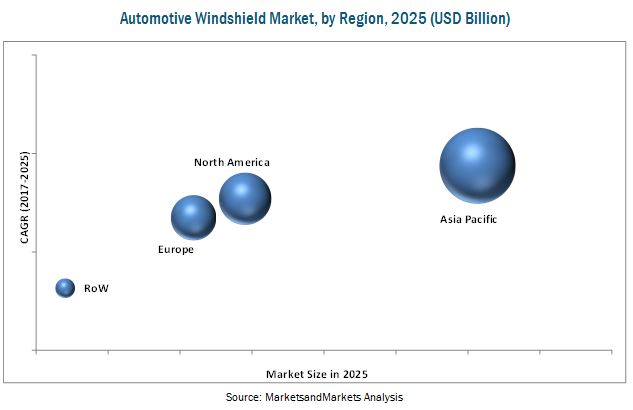

Asia Pacific is estimated to account for the largest market share followed by North America, Europe, and RoW, respectively. Asia Pacific is anticipated to remain predominant during the forecast period due to numerous factors such as increasing number of vehicle production, use of solar reflective glasses in vehicles, use of safety glasses, such as laminated and tempered glass. In terms of growth rate, Asia Pacific is estimated to exhibit the highest CAGR during the forecast period. The growth in Asia Pacific is anticipated to be driven by the increasing number of commercial vehicles production and the growing use of premium segment cars.

Restraint identified in the global automotive windshield market is the high cost of smart windshields. The automotive industry is slowly adopting newer technologies as the end-users are willing to pay a premium for enhanced comfort and luxury. Most end-users are still not aware of the benefits of the smart windshield, making this high cost unjustified for them. The rising prices of raw materials used for glass manufacturing, coupled with a reduction in the supply of fuel such as sodium carbonate and natural gas, have been haunting glass manufacturers and ultimately windshield manufacturers. These price fluctuations have been negatively influencing the automotive glass market. This factor may pose a challenge for the growth of this market to some extent.

Some of the major players in the global automotive windshield market are Asahi Glass (Japan), Saint-Gobain (France), Nippon Sheet Glass (Japan), Sisecam Group (Turkey), and Central Glass (Japan). The last chapter of this report covers a comprehensive study of the key vendors operating in the market. The evaluation of market players is done by taking various factors into account, such as new product development, R&D expenditure, business strategies, product revenue, and organic and inorganic growth.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Automotive Windshield Market Definition

1.3 Market Scope

1.3.1 Years Considered in the Report

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitation

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Demand-Side Analysis

2.4.1.1 Rising Safety Concerns of Vehicle Occupants

2.4.2 Supply-Side Analysis

2.4.2.1 Glass Type Superiority

2.5 Automotive Windshield Market Size Estimation

2.5.1 Bottom-Up Approach

2.6 Market Breakdown and Data Triangulation

2.7 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 33)

4.1 Automotive Windshield Market, 2017 vs 2025 (USD Billion)

4.2 Market, By Region

4.3 Market, By Windshield Position

4.4 Market, By Glass Type

4.5 Market, By Vehicle Type

4.6 Market, By Material Type

4.7 Market, By Electric Vehicle Type

5 Automotive Windshield Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Vehicle Production

5.2.1.2 Increasing Use of Windshield for Latest Display Technologies

5.2.2 Restraints

5.2.2.1 High Cost of Smart Windshield

5.2.3 Opportunities

5.2.3.1 Use of Solar Reflective Windshield

5.2.3.2 Use of Windshield for Augmented Reality Application

5.2.4 Challenges

5.2.4.1 Fluctuating Prices of Glass Raw Materials

5.3 Macro Indicator Analysis

5.3.1 Introduction

5.3.1.1 GDP (USD Billion)

5.3.1.2 Vehicle Sales as A Percentage of Total Sales

5.3.1.3 GDP Per Capita PPP (USD)

5.3.1.4 GNI Per Capita (Current USD)

5.3.2 Macro Indicators Influencing the Global Market for Top 3 Countries

5.3.2.1 Us

5.3.2.2 China

5.3.2.3 Japan

6 Automotive Windshield Market, By Position (Page No. - 46)

6.1 Introduction

6.1.1 Front Windshield

6.1.2 Rear Windshield

7 Global Market, By Vehicle Type (Page No. - 52)

7.1 Introduction

7.2 Passenger Cars (PC)

7.3 Light Commercial Vehicles (LCV)

7.4 Heavy Commercial Vehicle (HCV)

8 Automotive Windshield Market, By Electric Vehicle Type (Page No. - 60)

8.1 Introduction

8.2 Battery Electric Vehicles (BEV)

8.3 Hybrid Electric Vehicle (HEV)

8.4 Plug-In Hybrid Electric Vehicle (PHEV)

9 Global Market, By Glass Type (Page No. - 66)

9.1 Introduction

9.2 Laminated Glass

9.3 Tempered Glass

10 Automotive Windshield Market, By Material Type (Page No. - 72)

10.1 Introduction

10.2 Thermoset Material

10.3 Thermoplastic Material

11 Automotive Windshield Market, By Region (Page No. - 78)

11.1 Introduction

11.2 Asia Pacific

11.3 Europe

11.4 North America

11.5 RoW

12 Competitive Landscape (Page No. - 93)

12.1 Introduction

12.2 Market Ranking Analysis

12.3 Competitive Situation & Trends

12.3.1 Expansions

12.3.2 Partnerships/Supply Contracts/Collaborations/Jvs

12.3.3 Mergers & Acquisitions

12.3.4 New Product Developments

13 Company Profile (Page No. - 99)

(Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Asahi Glass

13.2 Saint-Gobain

13.3 Xinyi Glass

13.4 Fuyao Glass Industry

13.5 Nippon Sheet Glass

13.6 Vitro

13.7 Central Glass

13.8 Dura Automotive

13.9 Shenzhen Benson Automobile

13.10 Sisecam Group

13.11 Guardian Industries

13.12 Magna International

*Details on Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 128)

14.1 Discussion Guide

14.2 Introducing RT: Real Time Market Intelligence

14.3 Available Customizations

14.3.1 Additional Company Profiles

14.3.1.1 Business Overview

14.3.1.2 SWOT Analysis

14.3.1.3 Recent Developments

14.3.1.4 MnM View

14.3.2 Detaled Analysis of Windshield Glass Type

14.3.3 Detaled Analysis of Vehicle Segment

14.3.4 Detaled Analysis of Electric Vehicle Segment

14.4 Related Reports

14.5 Author Details

List of Tables (57 Tables)

Table 1 Currency Exchange Rates (W.R.T. USD)

Table 2 Global Automotive Windshield Market, By Position Type, 2015–2025 (‘000 Units)

Table 3 Global Market, By Position Type, 2015–2025 (USD Million)

Table 4 Front Windshield: Market, By Region, 2015–2025 (‘000 Units)

Table 5 Front Windshield: Market, By Region, 2015–2025 (USD Million)

Table 6 Rear Windshield: Market, By Region, 2015–2025 (‘000 Units)

Table 7 Rear Windshield: Market, By Region, 2015–2025 (USD Million)

Table 8 Global Market, By Vehicle Type, 2015–2025 (‘000 Units)

Table 9 Global Automotive Windshield Market, By Vehicle Type, 2015–2025 (USD Million)

Table 10 Passenger Cars: Market, By Region, 2015–2025 (‘000 Units)

Table 11 Passenger Cars: Market, By Region, 2015–2025 (USD Million)

Table 12 Light Commercial Vehicles: Market, By Region, 2015–2025 (‘000 Units)

Table 13 Light Commercial Vehicles: Market, By Region, 2015–2025 (USD Million)

Table 14 Heavy Commercial Vehicles: Automotive Windshieldmarket, By Region, 2015–2025 (‘000 Units)

Table 15 Heavy Commercial Vehicles: Market, By Region, 2015–2025 (USD Million)

Table 16 Global Market, By Electric Vehicle Type, 2015–2025 (‘000 Units)

Table 17 Global Market, By Electric Vehicle Type, 2015–2025 (USD Million)

Table 18 BEV: Market, By Region, 2015–2025 (‘000 Units)

Table 19 BEV: Market, By Region, 2015–2025 (USD Million)

Table 20 HEV: Market, By Region, 2015–2025 (‘000 Units)

Table 21 HEV: Market, By Region, 2015–2025 (USD Million)

Table 22 PHEV: Market, By Region, 2015–2025 (‘000 Units)

Table 23 PHEV: Market, By Region, 2015–2025 (USD Million)

Table 24 Global Market, By Glass Type, 2015–2025 (‘000 Units)

Table 25 Global Market, By Glass Type, 2015–2025 (USD Million)

Table 26 Market, By Laminated Glass Type, 2015–2025 (‘000 Units)

Table 27 Market, By Laminated Glass Type, 2015–2025 (USD Million)

Table 28 Market, By Tempered Glass Type, 2015–2025 (‘000 Units)

Table 29 Market, By Tempered Glass Type, 2015–2025 (USD Million)

Table 30 Market, By Material Type, 2015–2025 (‘000 Units)

Table 31 Market, By Material Type, 2015–2025 (USD Million)

Table 32 Thermoset Material: Market, By Region, 2015–2025 (‘000 Units)

Table 33 Thermoset Material: Market, By Region, 2015–2025 (USD Million)

Table 34 Thermoplastic Material: Market, By Region, 2015–2025 (‘000 Units)

Table 35 Thermoplastic Material: Market, By Region, 2015–2025 (USD Million)

Table 36 Global Automotive Windshield Market, By Region, 2015-2025 (‘000 Units)

Table 37 Global Market, By Region, 2015-2025 (USD Million)

Table 38 Asia Pacific: Market, By Country, 2015–2025 (’000 Units)

Table 39 Asia Pacific: Market, By Country, 2015-2025 (USD Million)

Table 40 Asia Pacific: Market, By Position, 2015–2025 (’000 Units)

Table 41 Asia Pacific: Market, By Position, 2015–2025 (USD Million)

Table 42 Europe: Market, By Country, 2015-2025 (‘000)

Table 43 Europe: Market, By Country, 2015-2025 (USD Million)

Table 44 Europe: Market, By Position, 2015–2025 (’000 Units)

Table 45 Europe: Market, By Position, 2015–2025 (USD Million)

Table 46 North America: Market, By Country, 2015-2025 (‘000 Units)

Table 47 North America: Market, By Country, 2015-2025 (USD Million)

Table 48 North America: Market, By Position, 2015–2025 (’000 Units)

Table 49 North America: Market, By Position, 2015–2025 (USD Million)

Table 50 RoW: Market, By Region, 2015-2025 (Units)

Table 51 RoW: Market, By Region, 2015-2025 (USD Million)

Table 52 RoW: Market, By Country, By Position, 2015–2025 (’000 Units)

Table 53 RoW: Market, By Country, By Position, 2015–2025 (USD Million)

Table 54 Expansions, 2016–2017

Table 55 Partnerships/Supply Contracts/Collaborations/Jvs, 2014–2017

Table 56 Mergers & Acquisitions, 2014–2017

Table 57 New Product Development, 2016

List of Figures (57 Figures)

Figure 1 Automotive Windshield Market Segmentation

Figure 2 Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Market: Bottom-Up Approach

Figure 6 Data Triangulation

Figure 7 Asia Pacific Holds the Largest Share of the global Market, 2017

Figure 8 Passenger Car is Estimated to Hold the Largest Share of this Market, 2017 vs 2025 (USD Billion)

Figure 9 Laminated Glass to Hold the Largest Share in the Global Automotive Windshield Market, 2017 vs 2025 (USD Billion)

Figure 10 Front Windshield to Hold the Largest Share in this Market, 2017 vs 2025 (USD Billion)

Figure 11 Thermoplastic Material to Hold the Largest Share in this Market, 2017 vs 2025 (USD Billion)

Figure 12 Attractive Opportunities in Market

Figure 13 Asia Pacific is Estimated to Lead the Global Market, 2017 vs 2025 (USD Billion)

Figure 14 Front Windshield is Estimated to Lead the Market, 2017 vs 2025 (USD Billion)

Figure 15 Laminated Glass is Estimated to Lead this Market, 2017 vs 2025 (USD Billion)

Figure 16 Passenger Car Segment Estimated to Lead this Market, 2017 vs 2025 (USD Billion)

Figure 17 Thermoplastic Material to Lead this Market, 2017 vs 2025 (USD Billion)

Figure 18 HEV Segment Estimated to Lead the global Market, 2017 vs 2025 (USD Million)

Figure 19 Automotive Windshield: Market Dynamics

Figure 20 Growing Vehicle Production to Drive the Global Automotive Windshield Market (2017-2025)

Figure 21 Increasing GNI Per Capita Expected to Drive global Market in the Us

Figure 22 Rising GDP is Expected to Drive the Domestic Demand in China During the Forecast Period

Figure 23 Rising Debt-GDP Ratio to Be the Most Crucial Indicator in Japan, Given Its Excessively Weak Performance in the Recent Past

Figure 24 Global Market, By Windshield Position, 2017 vs 2025 (USD Million)

Figure 25 Front Windshield Market, By Region, 2017 vs 2025 (USD Million)

Figure 26 Rear Windshield Market, By Region, 2017 vs 2025 (USD Million)

Figure 27 Global Market, By Vehicle Type, 2017 vs 2025 (USD Million)

Figure 28 Market, By Electric Vehicle Type, 2017 vs 2025 (USD Million)

Figure 29 Market, By Glass Type, 2017 vs 2025 (USD Million)

Figure 30 Laminated Glass Market, By Region, 2017 vs 2025 (USD Million)

Figure 31 Tempered Glass Market, By Region, 2017 vs 2025 (USD Million)

Figure 32 Global Automotive Windshield Market, By Material Type, 2017 vs 2025 (USD Million)

Figure 33 Thermoset Material: Market, By Region, 2017 vs 2025 (USD Million)

Figure 34 Thermoplastic Material: Market, By Region, 2017 vs 2025 (USD Million)

Figure 35 Global Market, By Region, 2017 (USD Million)

Figure 36 Aisa Pacific: Market Snapshot

Figure 37 Europe: Market, 2017 vs 2025 (USD Million)

Figure 38 North America: Market Snapshot

Figure 39 RoW: Market, 2017 vs 2015 (USD Million)

Figure 40 Key Developments By Leading Players in Market for 2014-2017

Figure 41 Market Ranking: 2016

Figure 42 Asahi Glass: Company Snapshot

Figure 43 Asahi Glass: SWOT Analysis

Figure 44 Saint-Gobain: Company Snapshot

Figure 45 Saint Gobain: SWOT Analysis

Figure 46 Xinyi Glass: Company Snapshot

Figure 47 Fuyao Glass Industry: Company Snapshot

Figure 48 Fuyao Glass Industry: SWOT Analysis

Figure 49 Nippon Sheet Glass: Company Snapshot

Figure 50 Nippon Sheet Glass: SWOT Analysis

Figure 51 Vitro: Comapany Snapshot

Figure 52 Central Glass: Company Snapshot

Figure 53 Central Glass: SWOT Analysis

Figure 54 Dura Automotive: Company Snapshot

Figure 55 Sisecam Group: Company Snapshot

Figure 56 Sisecam Group: SWOT Analysis

Figure 57 Magna International: Company Snapshot

Growth opportunities and latent adjacency in Automotive Windshield Market