Automotive Interior Materials Market

Automotive Interior Materials Market by Type (Polymer, Genuine Leather, Fabric), Application (Seat, Dashboards, Safety Components), Vehicle Type (Passenger Cars, Buses & Coaches), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

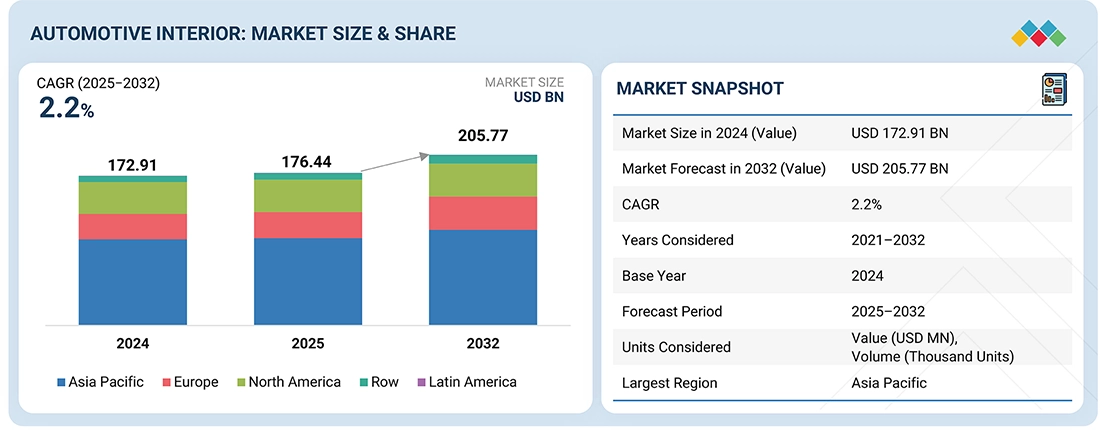

The global automotive interior market is estimated to be USD 176.44 billion in 2025 and is projected to reach USD 205.77 billion by 2032, at a CAGR of 2.2% during the same period. The integration of advanced technologies such as infotainment systems, touchscreens, voice control, augmented reality, and autonomous driving capabilities is driving significant advancements in automotive interiors. Automakers are prioritizing the incorporation of cutting-edge tech features to enhance the overall in-cabin experience. Increasing demand for connected vehicle ecosystems is encouraging the development of integrated digital interfaces and smart cockpit solutions, further advancing the automotive interior market.

KEY TAKEAWAYS

-

BY COMPONENT TYPEThe automotive interior market by component type is segmented into, automotive display, dome module, headliner, seat, interior lighting, door panel, center console, adhesives & tapes, upholstery, and others. With an increase in the use of connected technologies in vehicles, there is a growing demand for in-vehicle electronic systems such as head-up displays. Additionally, components such as rear seat entertainment systems, and adaptive interior lighting are gaining traction to enhance overall passenger experience.

-

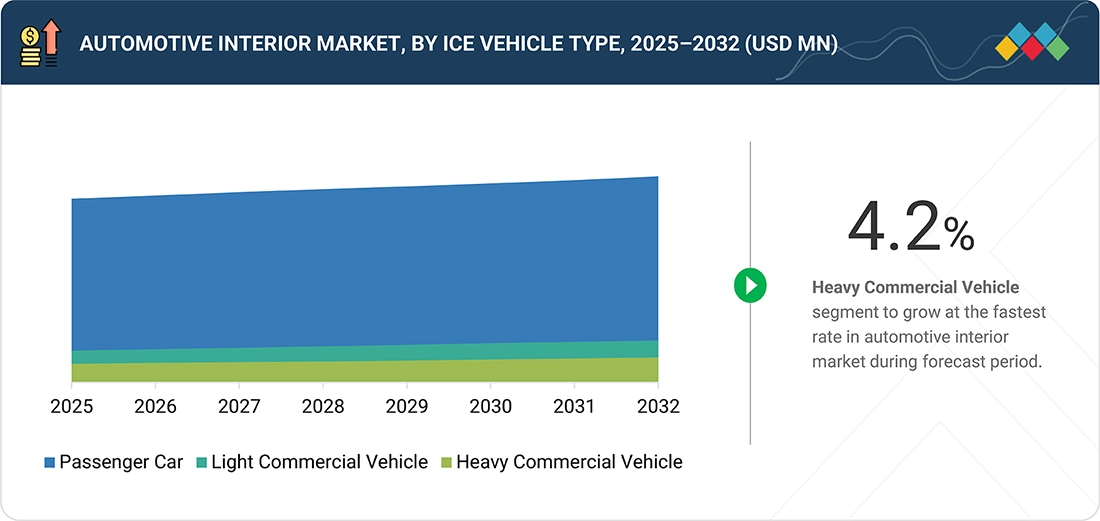

BY ICE VEHICLE TYPEThe expansion of infrastructure and construction sectors, growing industrial activity, and the rise of logistics and e-commerce are driving demand for commercial vehicles equipped with durable, ergonomic, and functional interiors. This growing focus on driver comfort, and cabin usability in commercial vehicles is further fueling the demand for advanced automotive interior systems and solutions. Additionally, the increasing focus on comfort in passenger cars is expected to further support the growth of automotive interior applications and technologies.

-

BY PASSENGER CAR CLASSLuxury car makers from the US, France, Germany, and the UK are increasingly offering advanced display systems such as infotainment, rear-seat entertainment, and fully digital instrument clusters. This trend is expected to boost the automobile interiors market in these countries. To some extent, OEMs are now extending these interior features to mass-market segment cars as well, further driving market growth.

-

BY MATERIAL TYPEOEMs can leverage the high strength and durability of metals for vehicle interiors. PVC synthetic leather is commonly used in affordable passenger and commercial vehicles because it offers a more cost-effective alternative to other synthetic leather materials.

-

BY REGIONAsia Pacific is expected to dominate the automotive interior market due to its large and growing vehicle production base, increasing preference for feature-rich vehicles, and strong manufacturing cost advantages that attract global OEMs and suppliers. The rapid adoption of electric vehicles is creating demand for redesigned interiors with integrated digital displays, ambient lighting, and multifunctional controls, while the localization of supply chains is enabling faster, cost-effective production of advanced interior components and technologies.

Consumers expect their vehicles to be an extension of their digital lives, leading to an increased demand for connectivity features. In addition, environmental consciousness has led to a growing demand for eco-friendly and sustainable interior materials. Manufacturers are exploring options for conventional materials, such as recycled plastics, natural fibers, and bio-based materials.

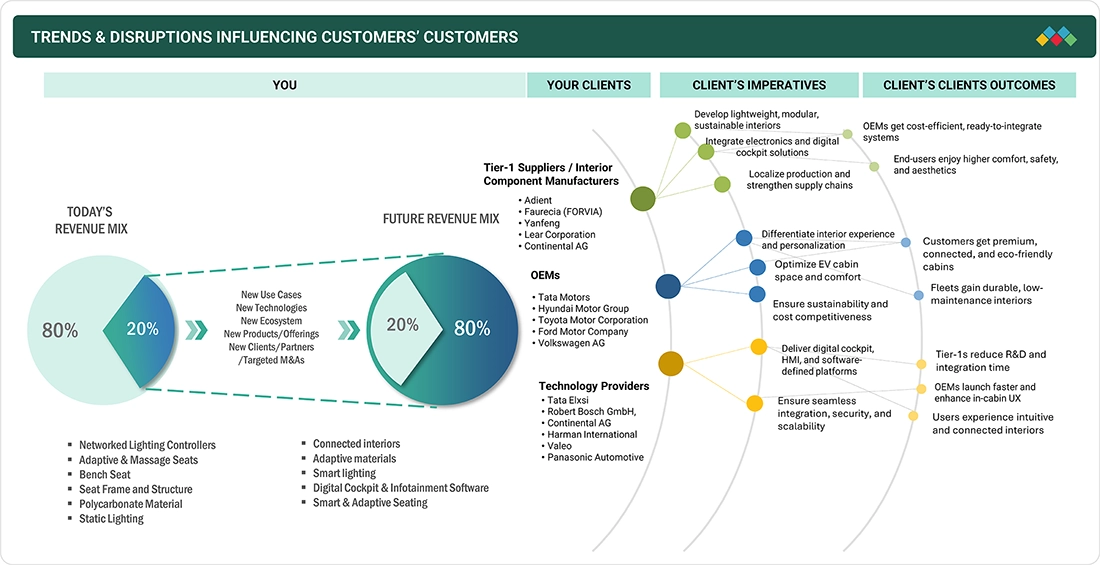

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Trends and disruptions in the automotive interior market reveal the current and future trends. The automotive interior market is being shaped by trends such as advanced seating technologies including powered, heated, ventilated, and memory/massage seats driven by the growing SUV segment and rising consumer income. Infotainment and display innovations, including smart, curved, and multi-display systems with Android Auto, Apple CarPlay, AR, and 5G connectivity, are transforming in-car experiences.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing consumer preference for high-end features, convenience, and advanced safety

-

Lightweight & sustainable material innovations

Level

-

High development cost and volatility in raw material prices

-

Significant power consumption in automotive interior electronics

Level

-

Growing trend of interior customization in premium vehicles

-

New entertainment and smart mirror applications

Level

-

Cybersecurity risks in connected interiors

-

Presence of unorganized aftermarket

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing consumer preference for high-end features, convenience, and advanced safety

Vehicle interiors are now a major factor in buyer decisions, with premium features increasingly offered in mid-segment cars. Economy segment vehicles are also coming with advanced comfort and interior features, driving wider adoption. Luxury vehicles continue to lead in advanced components such as smart seats, HUDs, and ambient lighting, fueling overall market growth.

Restraint: High development cost and volatility in raw material prices

Technological innovations have increased the cost of automotive interior systems, now accounting for 8–12% of vehicle costs, making advanced features mostly limited to luxury cars. High development costs and volatile raw material prices for plastics, leather, and upholstery pose barriers to wider adoption in lower-end vehicles.

Opportunity: Rising trend of semi-autonomous and autonomous vehicles

The rise of autonomous and semi-autonomous vehicles is boosting demand for advanced interior technologies, including voice controls, 360-degree cameras, and integrated display systems. Increasing consumer expectations for comfort, convenience, and personalized in-cabin experiences are further accelerating the adoption of these smart cabin solutions.

Challenge: Presence of unorganized aftermarket

OEMs often offer interior features as bundled packages, leading consumers to turn to the aftermarket for customized or standalone upgrades. However, the presence of unorganized aftermarket players with low-cost, substandard components results in quality inconsistencies, intense competition, and supply chain challenges.

Automotive Interior Materials Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Development of modular, lightweight seating systems adaptable for ride-sharing and electric vehicles. | Enhances cabin flexibility, reduces vehicle weight, and improves sustainability. |

|

Minimalist, touchscreen-based interior design integrated with over-the-air UI updates. | Reduces component complexity, enhances digital experience, and supports continuous feature upgrades. |

|

Cabin air purification and smart acoustic interiors for EVs and luxury cars. | Improves occupant health and comfort, reduces NVH (Noise, Vibration, Harshness) levels. |

|

Smart seating with integrated sensors for occupant monitoring and personalized comfort settings. | Enhances passenger comfort and provides health-related insights; designed to support autonomous vehicle interiors. |

|

Flexible interior configurations for commercial and autonomous shuttles. | Allows reconfigurable layouts, optimizing interior usage for cargo or passengers. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The automotive interior market ecosystem includes OEMs, Tier 1 & Tier 2 suppliers, raw material suppliers, and technology providers. The automotive interior market is dominated by key players such as Lear Corporation (US), Adient plc. (US), Yanfeng (China), FORVIA Faurecia (France), and Continental AG (Germany). These companies have a global distribution network across Asia Pacific, North America, Europe and Rest of the World. They are vital in their domestic markets and explore geographic diversification alternatives to grow their businesses.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Automoive Interior Market, By Component Type

The seat segment is expected to lead the automotive interior market, supported by growing demand for comfort, convenience, and advanced features in vehicles. Its growth is driven by the increasing use of powered, heated, and ventilated seats, which provide improved ergonomics, luxury, and personalized comfort for drivers and passengers.

Automoive Interior Market, Electric Vehicle Type

Battery electric vehicles (BEVs) dominate the market due to their higher integration of electronics and advanced systems. BEVs are equipped with more advanced electronics and premium features, including digital instrument clusters, infotainment systems, head-up displays (HUDs), and smart interiors, which drive strong consumer demand. This demand is expected to grow further during the forecast period.

Automoive Interior Market, ICE Vehicle Type

The passenger car segment is set to lead the automotive interior market, driven by the growing demand for luxury vehicles and advanced comfort and convenience features. The adoption of semi-autonomous vehicles with smarter displays and adaptive controls is further boosting market growth.

Automoive Interior Market, Level of Autonomy

Semi-autonomous cars lead the automotive interior market due to the need for advanced cabins with adaptive controls, 360-degree cameras, and multi-functional displays. Features like AR HUDs and personalized seating enhance safety and comfort, while Level 2 and 3 technologies drive demand for high-tech interior components.

Automoive Interior Market, By Material Type

The fabric segment is set to lead the automotive interior market due to its comfort, versatility in textures and colors, and compatibility with features such as heated, ventilated, and memory seats. These qualities enhance passenger experience, driving strong demand.

Automoive Interior Market, By Passenger Car Class

OEMs are improving vehicle interiors using cost-effective materials, while luxury vehicles focus on advanced, lightweight, and high-tech components to enhance comfort and performance. Economic cars are expected to drive market growth during the forecast period, providing affordable access to features such as basic infotainment, Bluetooth, and driver-assistance systems.

REGION

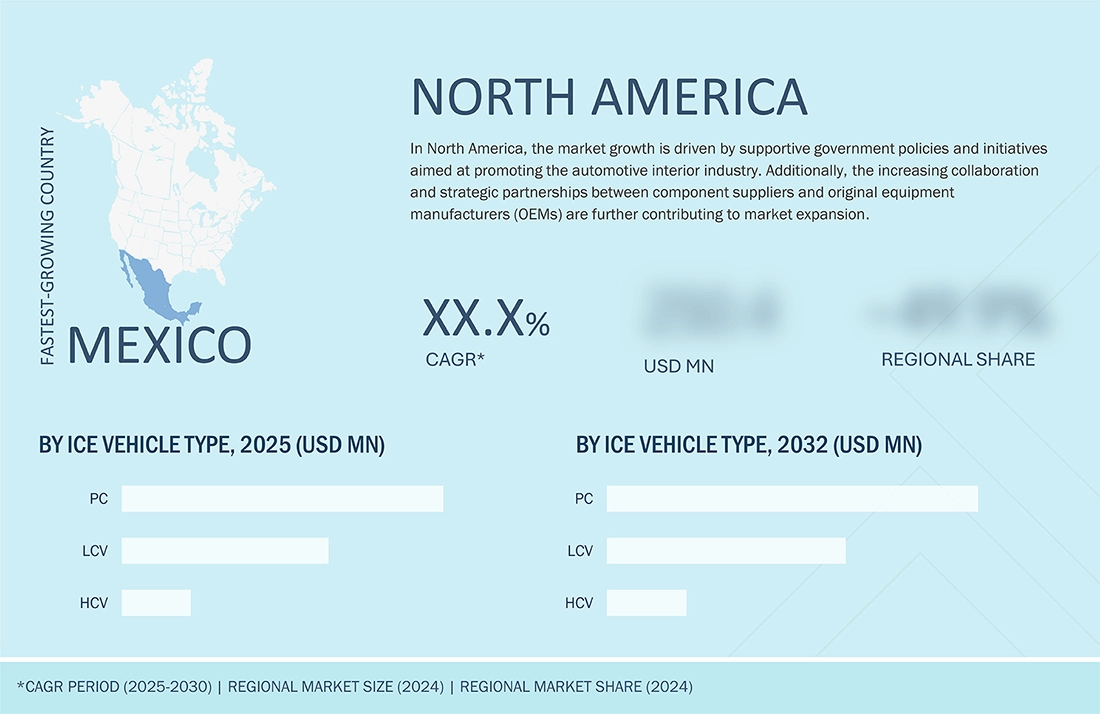

North America is second-largest automotive interior market during forecast period

Autonomous and electric vehicles in North America are driving demand for innovative, adaptive interior designs, including touchscreen infotainment, ADAS, connectivity, and personalized settings such as customized seat positions, climate control preferences, ambient lighting, infotainment profiles. Consumer preference for comfort features such as heated, ventilated, and massage seats is boosting luxury interior adoption. Simplified EV powertrains allow more spacious and creative layouts, while strong R&D in semi-autonomous technology continues to expand the market for advanced automotive interiors, with the US leading the region.

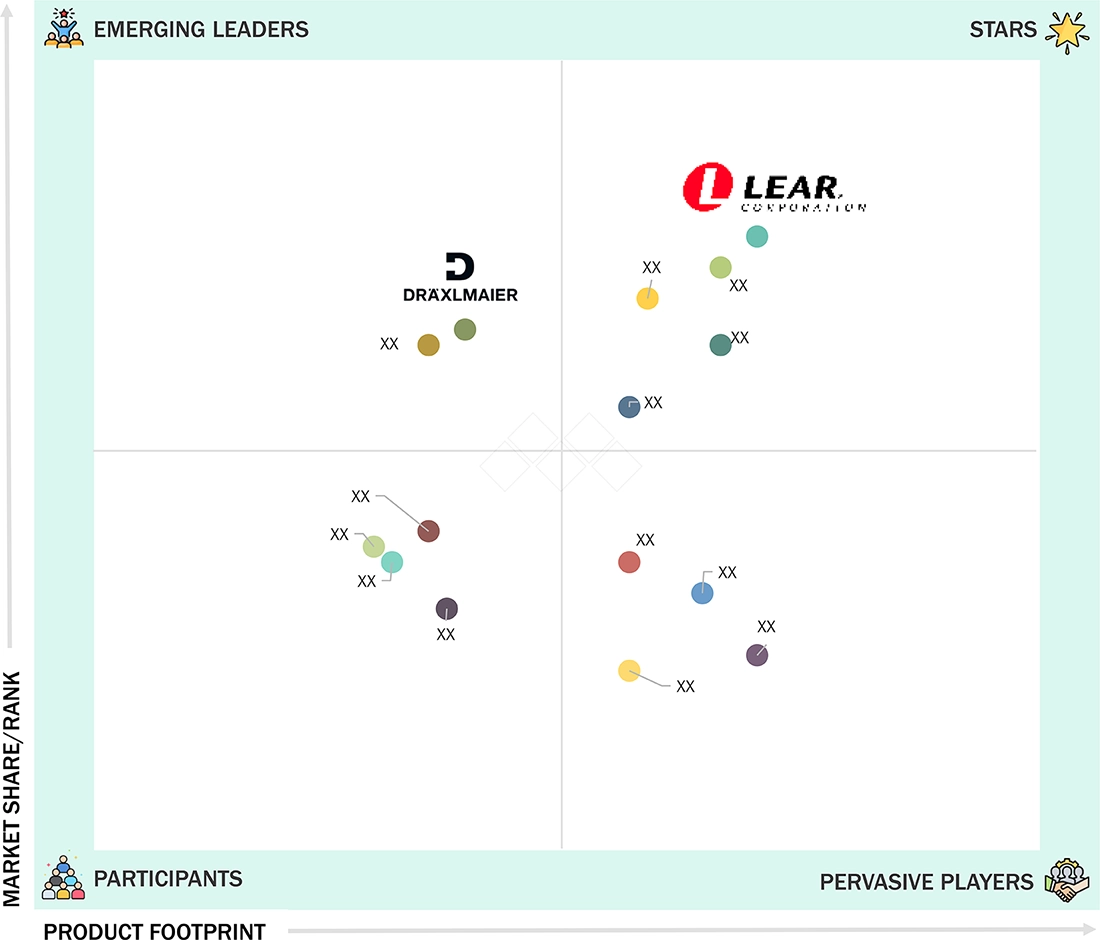

Automotive Interior Materials Market: COMPANY EVALUATION MATRIX

In the automotive interior market matrix, Lear Corporation Limited (Star) leads with a strong global presence and comprehensive automotive interior offerings, driving market expansion and revenue growth through innovative seating solutions, advanced electronics integration, and a diverse portfolio of premium and mid-segment interior components. DRÄXLMAIER GROUP (Emerging Leader) is gaining traction with customized interiors, advanced electronics, and lightweight, sustainable materials for premium vehicles. The company shows strong growth potential to advance toward the leaders' quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 172.91 Billion |

| Revenue Forecast in 2032 | USD 205.77 Billion |

| Growth Rate | CAGR of 2.2% from 2025-2032 |

| Actual data | 2021-2032 |

| Base year | 2024 |

| Forecast period | 2025-2032 |

| Units considered | Volume (Thousand Units) and Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific, Europe, North America, and the Rest of the World |

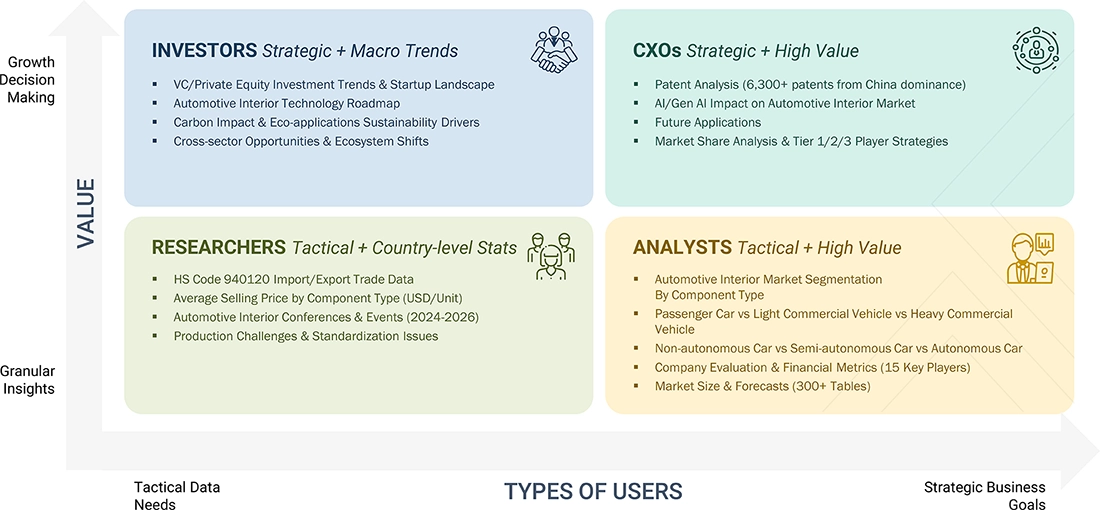

WHAT IS IN IT FOR YOU: Automotive Interior Materials Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Tier-1 Interior Supplier (Germany) |

|

|

| Luxury OEM (Japan) |

|

|

| EV Startup (US) |

|

|

| Component Manufacturer (India) |

|

|

| Infotainment System Supplier (South Korea) |

|

|

RECENT DEVELOPMENTS

- September 2025 : Adient plc (Ireland) introduced its Pure Ergonomics seating concept, designed to enhance comfort and space within the vehicle interior. Compared to similar models, it provides up to 60 mm of extra legroom in the foot and knee areas of the second row. The concept includes a manual adjustment system developed for mid- and lower-priced vehicle segments. Its cost-effectiveness comes from the optimized use of materials such as metal, foam, and trim. Additionally, the seat’s total weight has been reduced by 5–10%, helping lower vehicle energy consumption and emissions.

- September 2025 : Antolin (Spain) announced that its full ambient lighting system is featured in the all-new electric Mercedes-Benz GLC SUV, unveiled at the IAA Mobility 2025 in Munich, Germany. The lighting system enhances the floating appearance of the instrument panel and highlights the vehicle’s modern, futuristic interior design. Antolin also supplies the GLC with a complete modular headliner.

- September 2025 : Antolin (Spain) opened a new facility in Indonesia through a partnership with the local joint venture AAA, formed by APM and ARMADA AUTOPARTS. The plant will initially produce headliners and later expand to manufacture door panels, lighting systems, and integrated electronics.

- September 2025 : Samsung unveiled a conceptual interior design for future mobility at IAA Mobility 2025. The concept was developed in collaboration with French designer and automotive artist Alban Lerailler. It features an autonomous vehicle design with a V-shaped out-folding rooftop display visible from both sides, an extendable central information display (CID) using rollable OLED technology, and multiple L- and G-shaped curved displays.

- September 2025 : ZF Lifetec (Germany) unveiled a transformable steering wheel concept designed to support the development of future vehicle interiors. The concept retains the traditional steering wheel design with familiar controls and includes the driver’s airbag in the center hub. It features an electromechanical system that folds the wheel rim downward in about two seconds, allowing it to retract smoothly into the dashboard. This design creates extra space for work or relaxation during automated driving or when the vehicle is parked.

- August 2025 : Samvardhana Motherson International Limited (India) announced that its Integrated Assemblies division had secured new programs in Europe with several OEMs, including an electric vehicle manufacturer, across Germany, the Czech Republic, Spain, and Türkiye. These projects cover complete interior modules such as center consoles, instrument panels, and decorative trim systems. In the Americas, the company received contracts in the US and Mexico for integrated assemblies, including headliners, mirror components, and interior systems.

- February 2025 : Lear Corporation partnered with General Motors to integrate ComfortMax Seat technology, set for rollout in Q2 2025. The seats feature advanced thermal comfort solutions embedded in trim covers, enhancing occupant well-being and manufacturing efficiency. ComfortMax Seat improved heating and ventilation efficiency, reducing time-to-sensation by up to 40%, while its modular design streamlined assembly, cutting part count by up to 50%. As part of Lear’s Thermal Comfort Systems (TCS) portfolio, the partnership also introduced ComfortFlex, which integrates multiple thermal solutions, and FlexAir, a sustainable alternative to polyurethane foam.

Table of Contents

Methodology

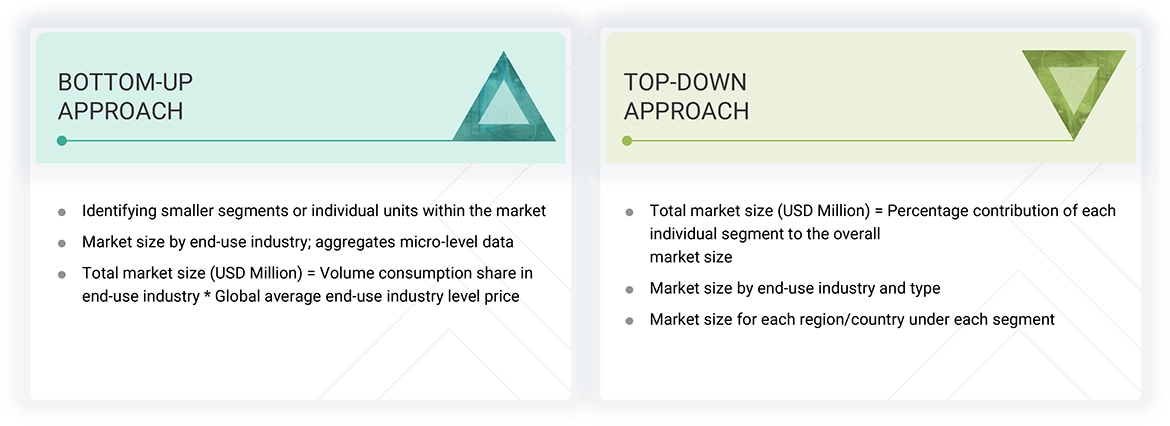

The study involved four major activities in estimating the market size for the automotive interior materials market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

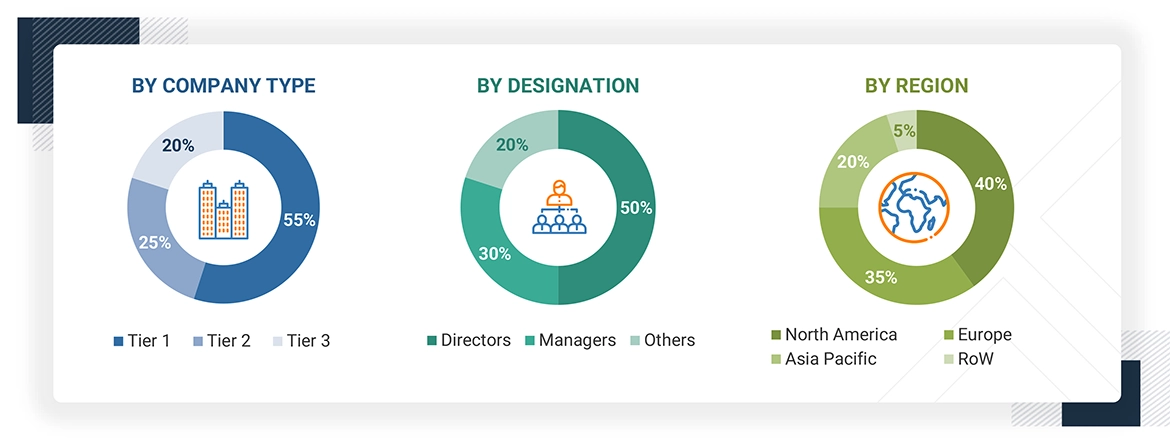

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The automotive interior materials market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by key opinion leaders in various applications for the automotive interior materials market. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| Toyoda Gosei Corporation | Senior Manager | |

| Grupo Antolín-Irausa, S.A.U. | Innovation Manager | |

| DK Leather Seats Sdn. Bhd. | Vice-President | |

| Asahi Kasei Corporation | Production Supervisor | |

| Yanfeng Automotive Interior | Sales Manager | |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the automotive interior materials market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Automotive Interior Materials Market: Bottom-Up and Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the automotive interior materials industry.

Market Definition

The automotive interior materials market encompasses the production, development, and application of various materials used in manufacturing interior components of vehicles. These materials include polymers, fabrics, leather (both genuine and synthetic), thermoplastic olefins (TPO), and others, which are utilized in components such as dashboards, door panels, seats, headliners, floor carpets, and interior trims. The market serves a broad spectrum of vehicle categories, including passenger cars, light commercial vehicles, and heavy commercial vehicles. Driven by growing consumer expectations for comfort, aesthetic appeal, safety, and sustainability, interior materials are critical in enhancing the overall driving experience. Key market trends include advancements in lightweight material technologies, adopting eco-friendly and recycled materials, and integrating smart surface technologies. These innovations are central to the market’s evolution, as manufacturers seek to meet regulatory requirements and address the shifting demands of next-generation mobility.

Stakeholders

- Automotive Interior Material Manufacturers

- Automotive Interior Material Distributors

- Raw Material Suppliers

- Service Providers

- automotive Manufacturers

- Government and Research Organizations

Report Objectives

- To analyze and forecast the size of the global automotive interior materials market in terms of value and volume

- To provide detailed information about the important drivers, restraints, challenges, and opportunities influencing market growth

- To define, describe, and segment the market based on type, application, vehicle type, and region

- To forecast the size of the market segments based on regions such as Asia Pacific, North America, Europe, the Middle East & Africa, and South America

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contributions to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as expansions, partnerships & collaborations, mergers & acquisitions, agreements, and product launches in the market

- To strategically profile the key companies and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Who are the major players in the automotive interior materials market?

Lear Corporation (US), Asahi Kasei Corporation (Japan), Toyota Boshoku Corporation (Japan), Forvia (France), Toyoda Gosei Co., Ltd. (Japan), Grupo Antolín-Irausa, S.A.U. (Spain), Yanfeng Automotive Interiors (China), SEIREN CO., LTD. (Japan), DK Leather Seats Sdn. Bhd. (Malaysia), DRÄXLMAIER Group (Germany), and others.

What are the drivers and opportunities for the automotive interior materials market?

Key drivers include increasing fuel efficiency by reducing weight, rising demand for customization and comfort, and the growth of interior fabrics. Opportunities include rising production of automotive fabrics, use of sustainable technologies for leather, and the trend of styling in vehicles.

Which strategies are the key players focusing upon in the automotive interior materials market?

Product launches, partnerships, mergers & acquisitions, agreements, and expansions are the primary strategies to enhance global presence.

What is the expected growth rate of the automotive interior materials market between 2025 and 2030?

The market is projected to grow at a CAGR of 3.52% in terms of value during the forecast period.

Which major factors are expected to restrain the growth of the automotive interior materials market during the forecast period?

Fluctuations in raw material prices and improper disposal of used products are expected to hinder market growth.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Automotive Interior Materials Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Automotive Interior Materials Market