Metaverse Market for Automotive by Products (Software, Hardware), Technology (Virtual Reality (VR), Augmented Reality (AR), Mixed Reality (MR), Non-fungible Token (NFT), Blockchain), Function, Application & Region - Global Forecast to 2030

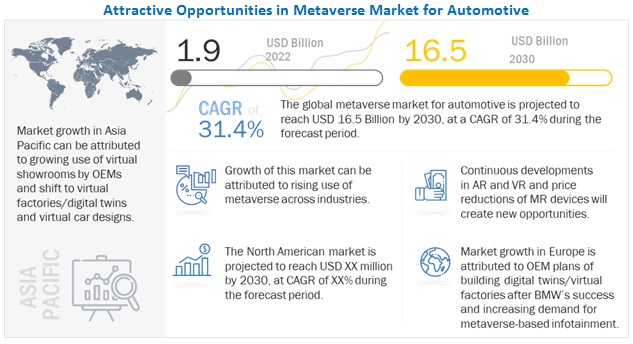

The global metaverse market for automotive size was valued at USD 1.9 billion in 2022 and is expected to reach USD 6.5 billion by 2030 at a CAGR of 31.4% during the forecast period 2022-2030. Automotive OEMs, Hardware and Software providers have shown their keenness towards leveraging metaverse related solutions in their industrial pipeline from designing to showcasing products on the metaverse space. Many automotive manufacturers and dealers are providing immersive experiences to the users and customers through virtual showrooms and various XR based technologies like VR simulation. Users and customers are showing their interest in the NFTs and crypto to be used in the asset market place in the virtual space. Metaverse technologies has made the things much more convenient in the field of simulation and testing the vehicle.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Brand promotions for automotive OEMs using gamification

Many companies in the automobile industry are taking advantage of the gaming part of the metaverse to increase brand awareness. They are strategically using metaverse for engaging in metaverse-based promotions and sponsorships. These companies capitalize by gamifying their brands through immersive online experiences and virtual world simulators. Some metaverse projects that gamify brand awareness include Mobility Adventure by Hyundai Motor Company and Roblox and Moving Platform by Volkswagen AG and Microsoft, among others. People engage in these 3D worlds to play mini-games, connect with other gamers, socialize, make friends, and get product information through salespeople, chatbots, or virtual AI agents. Metaverse makes brand promotion interesting and engaging for young customers.

The metaverse vendors are witnessing new revenue prospects from the opportunities in segments such as VR, AR, XR, cloud gaming, AI in social media, e-sports, virtual fitting rooms, and AR/VR hardware and peripherals. The following table includes metaverse in automotuve market sizes and CAGRs of such adjacent markets.

Restraint: Installation and maintenance cost of high-end components

Metaverse hardware includes devices for extended reality (AR, VR, and MR), along with semiconductor components, sensors, trackers, and other state-of-the-art equipment. These devices used in metaverse also use 3D and other advanced technologies to create a realistic-looking virtual environment, which increases their costs. The enterprise-grade metaverse software such as engines, 3D modelling software, and rendering tools are expensive. In addition to that, the installation of XR devices and solutions requires additional costs. Their maintenance costs further increase the overall investments required to adopt this technology. Therefore, such high installation and maintenance costs are expected to hinder the growth of the metaverse market globally. According to a report by NFT Studios, the cost of a project on metaverse can cost around USD 10,000 to USD 300,000, with around USD 1-4 million cost for a team of developers. Bigger projects, like Facebook’s metaverse, cost the company around USD 2.7 billion in just the first 3 months since its launch for upkeep and maintenance.

Opportunity: Incorporation of metaverse in automotive infotainment

AR, VR, and MR are expected to find applications in the automotive infotainment space in the coming years. OEMs have already started developing or partnering with other companies to provide AR/VR-based infotainment using metaverse. For instance, in CES 2019, Nissan announced the development of its invisible-to-visible (i2V) technology that can connect the driver and the passengers to the metaverse. People can appear as 3D AR avatars inside the cars. It also tracks the vehicle's immediate surroundings and anticipates what lies ahead. Similarly, In March 2022, Audi collaborated with start-up Holoride. The collaboration will bring VR in-car entertainment to Audi cars. The passengers in the back seat of the Audi car can use VR glasses and can have an immersive VR experience of games, videos, and other interactive entertainment content. The Holoride technology also synchronizes the real-time driving motions of the car.

Challenge: Cybersecurity and privacy challenges

Security and privacy issues are major challenges that VR, AR, and MR adoption face. These issues have emerged due to the inconsistencies in programming and negligence and oversight of both developers and end users of apps and devices. Many consumer AR applications available on the Play Store and App Store do not have the capabilities to secure user identity and privacy, thereby raising cybersecurity concerns. If the metaverse platforms and apps are not infused with top-notch cybersecurity protocols, it will lead to a malicious intent to misuse users’ personal information. For instance, the try-before-you-buy concept for clothing retailers can be misused if not secured well. The hacker can capture the nude or semi-exposed body of the user behind the overlaid virtual layer of clothes, which can lead to cyberbullying and harassment, thereby harming the user’s privacy and reputation.

Metaverse based infotainment to grow at a fast pace during the forecast period

The adoption of AR and VR in automotive infotainment will be growing in the coming future. Companies like Holoride, Mercedes-Benz, Huawei, Panasonic, and Continental AG, among others, have already started developing prototypes and AR-based HUD devices. Nissan and Audi have also announced plans to bring in-car infotainment using AR/VR technology. Audi, for instance, in March 2022, collaborated with Holoride to bring VR in-car entertainment to Audi cars. The passengers in the back seat of an Audi car can use VR glasses and have an immersive VR experience of games, videos, and other interactive entertainment content. The Holoride technology also synchronizes the real-time driving motions of the car. Metaverse in automotive infotainment systems is a much-awaited application with companies like Nissan, Audi, WayRay, Here Technologies, etc., working on developing their AR/VR/MR-based metaverse infotainment systems. These are expected to find applications in in-car infotainment, automobile safety systems, navigation functions as well as other functions connecting automobiles to the metaverse. This application is expected to come by 2023, with Audi launching its VR headsets for in-car infotainment. Europe is expected to be the largest metaverse market for automotive for this application by the end of the forecast period.

Mixed Reality (MR) will be the fastest-growing segment during the forecast period

MR is a blend of physical and digital worlds or a combination of both AR and VR. HoloLens 2 is an example of MR smart glasses developed by Microsoft. It leverages multiple sensors, advanced optics, and holographic processing to display information, blend with the real world, or even simulate a virtual world. MR headsets are in the early stages of deployment in enterprises, with the rise in the number of devices, such as the sensor-equipped HMD of Apple, currently being patented for future deployments. Other companies and start-ups are also planning to enter the field of MR devices. This will lead to MR finding greater applicability in the automotive industry.

Microsoft HoloLens was the first MR headset running on Windows mixed reality (WMR) platform under Windows 10 OS. Its successor, HoloLens 2, is the latest Microsoft smart glass device, an untethered MR headset worn like a baseball cap. Its built-in sensors map out users’ physical environments for interaction with holographic displays. HoloLens 2 also includes improved hand- and eye-tracking sensors, a new display system, an increased field of view, and improved resolution, thereby enhancing user experience.

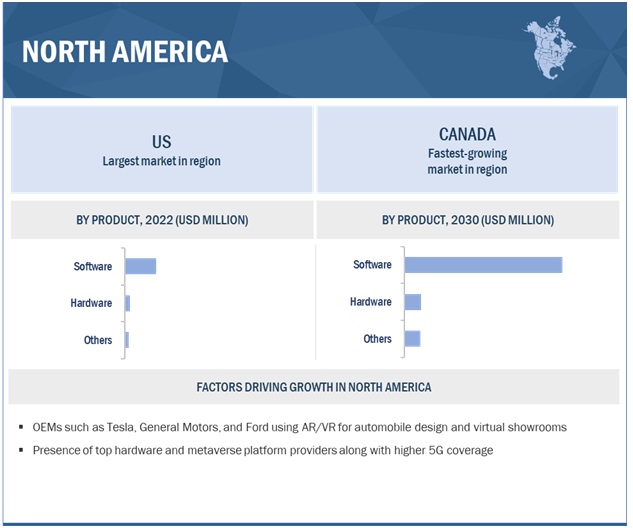

North America is expected to be the largest-growing market in the forecast period.

North America is expected to be the largest market for metaverse in automotive industry due to the presence big giants in software and hardware sector such as Microsoft, Meta, Unity Technologies, among others. Automotive OEMs like General Motors and Ford have been using this technology for designing cars, providing immersive experiences to users (through virtual showrooms). Many tech-oriented start-ups in the region are also emerging as major providers of metaverse related solutions to many businesses around the globe. Companies like Roblox Corporation, The Sandbox, InfiniteWorld and Upland are providing open world experiences to tech savvy users. Users can now sell, buy and monetize their assets in the virtual space through digital money i.e., NFTs without using actual money.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The metaverse market for automotive is dominated by established players such as NVIDIA (US), Roblox Corporation (US), Unity Technologies (US), Meta Platforms Inc. (US), and WayRay (Switzerland). They develop products and provide service offerings for the automotive metaverse ecosystem. They have initiated partnerships to develop their metaverse technology and provide finished products and services to their respective customers in the market. They have initiated partnerships to develop their metaverse technology and provide finished products and services to their respective customers in the market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2030 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2030 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

Product, Technology, Function, Application and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

|

Companies Covered |

NVIDIA (US), Roblox Corporation (US), Meta Platforms Inc. (US), Unity Technologies (US), WayRay (Switzerland), others. |

This research report categorizes the metaverse market for automotive based on Product, Technology, Function, Application and Region

Based on Product:

- Hardware

- Software

- Others

Based on Function:

- Virtual Platforms/Spaces

- Avatars

- Asset Marketplace

- Financial Services

Based on Technology:

- Virtual Reality (VR)

- Augmented Reality (AR)

- Mixed Reality (MR)

- Non-fungible Token (NFT)

- Blockchain

Based on Application:

- Advertising

- Online Car Purchase

- Infotainment

- Car Design

- Autonomous Car Testing

- Training & Simulation Public

Based on Region:

-

Asia Pacific (APAC)

- China

- Japan

- South Korea

- Rest of Asia Pacific

-

North America (NA)

- US

- Canada

-

Europe (EU)

- Germany

- UK

- Rest of Europe

- Middle East & Africa

- Latin America

Recent Developments

- In February 2022, Cupra, a subsidiary of the Volkswagen group, announced Metahype, which will serve as a collaborative space where brands, startups and content creators can collaborate and host a vast variety of events and experiences for the people.

- In January 2022, Unity Technologies and Hyundai Motor Company announced plans to develop a digital twin setup for Hyundai’s factories in the coming years. This will enable faster process time for Hyundai’s factories and a reduction in operational errors due to tests in simulated environments.

- In January 2022, Mercedes-Benz launched its first ever NFT in collaboration with Art2People. The company’s first non-fungible token (NFT) will be based on its G-Class car line.

- In October 2021, Meta (Oculus) Quest 2 is a VR headset created by Facebook Technologies, LLC doing business as Oculus, a brand of Facebook Inc. (now Meta Platforms) is the successor to the company’s previous headset, the Oculus Quest. Quest 2 supports all games and software made for the first-generation model, and existing titles can be updated to support higher graphical quality on Quest 2. It also supports Oculus Link, which allows the headset to be used with Oculus Rift-compatible software on a PC. It is not compatible with Oculus Go apps and games.

- In September 2021, Hyundai announced its Hyundai Mobility Adventure, which is based on a metaverse adventure on Roblox under which various users can communicate and meet each other in the form of avatars.

- In September 2021, BMW launched its streaming platform i.e., JOYTOPIA. It is a metaverse that takes corporate and brand communication to a new level. It is a whole new virtual world for the users to create immersive experiences in digital space with their personalized avatar.

Frequently Asked Questions (FAQ):

How big is the metaverse market for automotive?

The global metaverse market for automotive is projected to grow from USD 1.9 billion in 2022 to USD 16.5 billion by 2030, at a CAGR of 31.4%.

Who are the winners in the metaverse market for automotive?

The metaverse market for automotive is dominated by NVIDIA (US), Roblox Corporation (US), Unity Technologies (US), Meta Platforms Inc. (US), and WayRay (Switzerland). They develop hardware and software. They have initiated partnerships to develop their metaverse technology.

Which region will have the fastest-growing market for metaverse market for automotive?

The Middle East and Africa will the fastest growing market for metaverse market for automotive due to the huge volume of investments in the region. Asia Pacific will also have a high demand for metaverse in automotive industry due to the presence of Automotive OEMs and software start-ups.

What are the key technologies affecting this metaverse market in automotive?

The key technologies affecting the automotive metaverse are 5G Network Internet of Things (IoT), Cloud Computing, Edge Computing, Blockchain, 3D Modelling, Real-Time Rendering, Artificial Intelligence, Machine Learning, Natural Language Processing and Computer vision. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

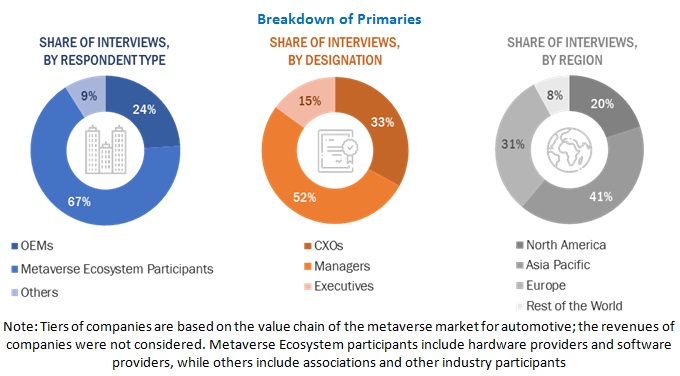

The study involved 4 major activities in estimating the current size of the metaverse market for automotive. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down approach was employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used in estimating the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, publications of automobile OEMs, Publications of XR Companies, automotive component associations, American Automobile Association (AAA), European Alternative Fuels Observatory (EAFO), International Energy Agency (IEA), country-level automotive associations, automobile magazines, articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases (for example, Marklines, and Factiva) have been used to identify and collect information useful for an extensive commercial study of the global metaverse market for automotive.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the metaverse market for automotive scenarios through secondary research. Several primary interviews were conducted with market experts from both the demand (country-level government associations, and trade associations, institutes, R&D centers, OEMs/vehicle manufacturers) and supply (component manufacturers, software providers) side across five major regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, Latin America. 21% of the experts involved in primary interviews were from the demand side, and 79% were from the supply side of the industry. Primary data was collected through questionnaires, emails, and telephonic interviews. Several primary interviews were conducted from various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in the report.

After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, has led to the findings delineated in the rest of this report. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach were used to estimate and validate the total size of the metaverse market for automotive. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s future supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall metaverse market for automotive size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the supply side.

Report Objectives

- To segment and forecast the metaverse market size for automotive in terms of value (USD Million/Billion)

- To define, describe, and forecast the metaverse market for automotive based on offering, product, technology, application, and region

- To segment the market and forecast its size, by value, based on region (Asia Pacific, Europe, North America, Middle East & Africa, Latin America)

- To segment and forecast the market based on offering (virtual platforms/spaces, avatars, asset marketplaces, financial services)

- To segment and forecast the market based on products (hardware, software, others)

- To segment and forecast the market based on technology (virtual reality, augmented reality, mixed reality, NFT, Blockchain)

- To segment and forecast the market based on application (advertising, online car purchase, infotainment, car design, autonomous car testing, training & simulation)

- To analyze the technological developments impacting the market

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze markets with respect to individual growth trends, future prospects, and contribution to the total market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), new product development, and other activities carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- Further (estimated) breakdown for the metaverse market for automotive at the country-level (for countries covered in the report)

- Further breakdown of the metaverse market for automotive by hardware type (as part of the Hardware segment in the Product category)

Company Information

- Profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Metaverse Market