Automotive Robotics Market by Type (Articulated, Cartesian, SCARA, Cylindrical), Component (Controller, Robotic Arm, End Effector, Sensors, Drive), Application (Welding, Painting, Cutting, Material Handling), and Region - Global Forecast to 2021

The global automotive robotics market size was valued at USD 5.13 billion in 2016 and is expected to reach USD 8.53 billion by 2021 at a CAGR of 10.69 % during the forecast period 2016-2021. The increasing reliance on articulated robots to ensure efficiency in the production process, is expected to be the prime factor enhancing the growth of the automotive robotics industry. The intelligent manufacturing industry of the future, has a special focus on process automation and industrial robotics. The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2021.

Market Dynamics

Drivers

- Rising Vehicle Production

- Enhancing cost competitiveness

- Wage Inflation

Restraints

- High penetration in automotive industry

- Perception: automation pushes unemployment

Opportunities

- Productivity Optimization

- Industrie 4.0 and Made in China 2025 Industrial Plans

- Low robot density in Chinese automotive industry

Challenges

- Significant initial investment

- Sluggish growth in the US automotive industry

Robotic sensors expected to drive the global automotive robotics market

Robotic Sensors segment is estimated to be the fastest growing segment in the market, by component. The major reason for this, is the additional capabilities that are brought into the automotive robots due to these sensors. These sensor-enabled robots can take smarter decisions related to the manufacturing process, and hence make the process much more easier and less time consuming. Some of the key sensory systems used in automotive robotics are vision perception sensors and force sensing.

The following are the major objectives of the study.

- To define, describe, and forecast the automotive robotics market on the basis of product type, component, application, and region, in terms of volume (thousand/million units) and value (USD million/billion)

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, industry-specific challenges, and burning issues)

- To analyze opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To strategically analyze subsegments (product type and component) with respect to individual growth trends, future prospects, and contribution to the total market

- To forecast the size of market segments with respect to four main regions (along with key countries)— namely, Asia-Pacific, North America, Europe, and the Rest of the World (RoW)

- To strategically profile key players and comprehensively analyze their strategies and core competencies

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product development, and research and development (R&D) in the market

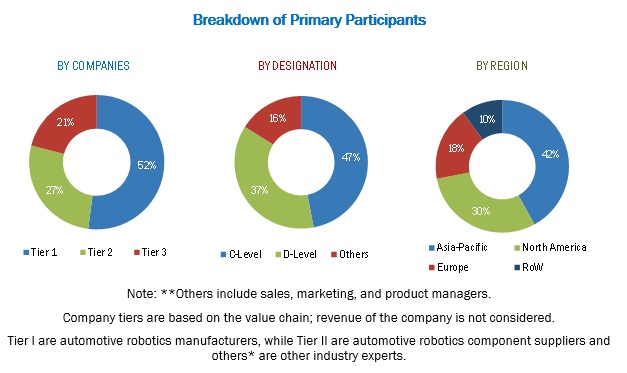

During this research study, major players operating in the automotive robotics market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The automotive robotics market comprises a network of players involved in the research and product development; raw material supply; component manufacturing; distribution and sale; and post-sales services. Key players considered in the analysis of the market are ABB (Switzerland), FANUC Corporation (Japan), Yaskawa Electric Corporation (Japan), KUKA AG (Germany) and Kawasaki Heavy Industries (Japan).

Major Market Developments

- In October 2016, NVIDIA and FANUC Corporation had announced a collaboration for implementation of artificial intelligence on the FANUC Intelligent Edge Link and Drive (FIELD) system. This would lead to a growth in productivity of robots and enhance capabilities of automated factories worldwide.

- In November 2016, KUKA Robotics System launched 3D Metal Printing robotics technology at FABTECH 2016. This process uses 3D design data to build components in layers by depositing material.

- In May 2016, ABB acquired SVIA automation solutions (Sweden) to expand its robotics operations. As of now, this collaborative operation will be limited to ABB’s Discrete Automation and Motion division, later it will make its global application center for machine-tending.

Target Audience

- Manufacturers of automotive robotics

- Integrators of automotive robotics

- Industry associations

- Automotive OEM’s

- Tier 1 and Tier 2 Suppliers

- Private equity firms

Report Scope:

Market, by Product Type

- Articulated Robots

- Cartesian Robots

- Cylindrical Robots

- SCARA Robots

- Others

Market, by Component

- Controller

- Robotics Arm

- End Effector

- Drive

- Sensor

Market, by Application

-

Primary Manufacturing Process Robots

- Welding

- Painting

- Cutting

-

Secondary Manufacturing Process Robots

- Material Handling, Palletizing & Packaging

- Assembly/Disassembly

Market, by Region

- Asia Pacific

- Europe

- North America

- Rest of the World

Critical questions which the report answers

- What are new application areas which the automotive robotics companies are exploring?

- Which are the key players in the market and how intense is the competition?

- What are the upcoming disrupting technologies in the automotive robotics market?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

- Detailed analysis and profiling of additional regions (up to 3)

- Detailed analysis and profiling of additional market players (up to 3)

The global automotive robotics market is estimated to be USD 6.59 billion in 2016, and is projected to reach USD 9.57 billion by 2021. The market, in terms of value, is projected to grow at a CAGR of 10.69% from 2016 to 2021. Factors such as wage inflation, automotive OEM’s and component suppliers focus on enhancing overall competitiveness as well as growing vehicle production is expected to drive the market. However, high initial capital expenditure associated with robotics as well as maintenance costs would pose challenge to the growth of overall market in years to come.

The market has been segment according to product type such as Articulated, Cartesian, SCARA, Cylindrical, and Others. The components identified in the report include Controller, Robotic Arm, End Effector, Drive, and Sensors. Additionally, the report covers the market on application basis such as Welding, Painting, Cutting, Material Handling, Palletizing & Packaging, and Assembly/Disassembly. The articulated robotics segment is estimated to account for the largest market share, in terms of value, in 2016.

The automotive robotics market has been segmented by component into Controller, Robotic Arm, End Effector, Drive, and Sensors. The controller segment is expected to hold the largest market share, by value, in 2016. A key factor driving the market is the rising sales of all types of robots where the controller is used.

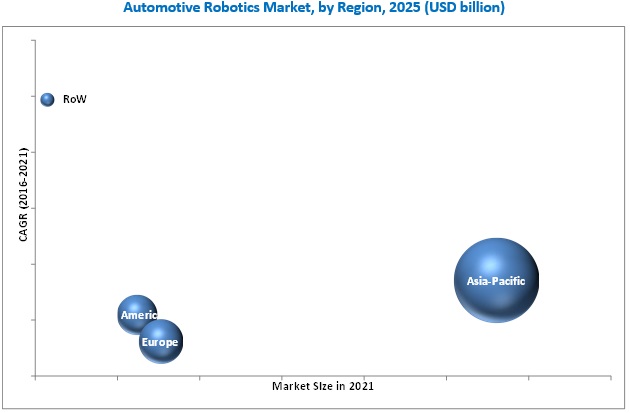

Asia-Pacific is estimated to be the largest market for automotive robotics. The Asia-Pacific automotive robotics market, in terms of value, is projected to post highest CAGR from 2016 to 2021. This can be mainly attributed to the rising labor cost particularly in China and continuous increase in vehicle production in the region.

Automotive robotics applications namely, primary process and secondary process to drive the growth of automotive robotics market

Primary Process

The primary application type includes welding, painting, and cutting applications. The welding application market is estimated to account for the largest share, in terms of value, of the global market.

Secondary Process

The secondary application type includes material handling, palletizing and packaging assembly/disassembly applications.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications of automotive robotics?

High penetration rate of industrial robotics in the global automotive industry would result in relatively lower growth rates compare to other industries. Electrical/electronic and metal and machinery industry posted a higher growth rates than automotive industry in terms of volume during 2015. As of 2015, around 40% of total installed base of industrial robots are in the automotive industry. Such high concentration of robotics in automotive industry would limit growth potential for robot manufacturers serving primarily to automotive industry.

Key players in the market include ABB (Switzerland), FANUC Corporation (Japan), Yaskawa Electric Corporation (Japan), KUKA AG (Germany) and Kawasaki Heavy Industries (Japan). These players are increasingly undertaking mergers and acquisitions, and product launches to develop and introduce new technologies and products in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Automotive Robotics Market Segmentation

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.3 Data From Secondary Sources

2.4 Primary Data

2.4.1 Sampling Techniques & Data Collection Methods

2.4.2 Primary Participants

2.5 Factor Analysis

2.5.1 Introduction

2.5.2 Demand Side Analysis

2.5.2.1 Vehicle Production Increasing in Developing Countries

2.5.2.2 Wage Inflation

2.5.3 Supply Side Analysis

2.5.4 Influence of Other Factors

2.6 Market Size Estimation

2.7 Data Triangulation

2.8 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Opportunities in the Global Market

4.2 Global Automotive Robotics Market, By Region, 2016-2021

4.3 Global Market, By Type, 2016-2021

4.4 Global Market, By Component, 2016-2021

4.5 Global Market, By Application 2016-2021

4.6 Automotive Robots Lifecycle Analysis: Rise in Demand for Automotive Robots in Emerging Economies Such as Asia-Pacific

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Global Automotive Robotics Market Segmentation: By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Rising Vehicle Production

5.3.1.2 Enhancing Cost Competitiveness Through Automation in Developed Countries

5.3.1.3 Wage Inflation

5.3.2 Restraints

5.3.2.1 High Penetration of Robotics in Automotive Industry

5.3.2.2 Perception: Automation Pushes Unemployment

5.3.3 Opportunities

5.3.3.1 Productivity Optimization

5.3.3.2 Industrie 4.0 and Made in China 2025 Industrial Plans

5.3.3.3 Low Robot Density in Chinese Automotive Industry

5.3.4 Challenges

5.3.4.1 Significant Initial Investment

5.3.4.2 Sluggish Growth in the Us Automotive Industry

5.4 Porter’s Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.1.1 Capital Intensive

5.4.1.2 Technical Sophistication

5.4.2 Threat of Substitutes

5.4.2.1 Skilled Labor

5.4.3 Bargaining Power of Buyers

5.4.3.1 Large Orders

5.4.4 Bargaining Power of Suppliers

5.4.4.1 Technological Offering

5.4.4.2 Innovation

5.4.5 Intensity of Competitive Rivalry

5.4.5.1 Highly Competitive

5.4.5.2 Domestic Players

5.5 Artificial Intelligence in Automotive Robotics

5.6 Impact of Industry 4.0

6 Global Automotive Robotics Market, By Type (Page No. - 45)

6.1 Introduction

6.2 Articulated Robots

6.3 Cartesian Robots

6.4 Cylindrical Robots

6.5 Scara Robots

6.6 Other Type of Robots

7 Automotive Robotics Market, By Component (Page No. - 56)

7.1 Introduction

7.1.1 Controllers

7.1.2 Robotics Arm

7.1.3 End Effector

7.1.4 Automotive Robotics Drive

7.1.5 Automotive Robotic Sensor

8 Global Market, By Application (Page No. - 64)

8.1 Introduction

8.2 Global Automotive Robotics Market, By Application

8.2.1 Global Primary Application Type Market

8.2.1.1 Global Welding Application Market

8.2.1.2 Global Painting Application Market

8.2.1.3 Global Cutting Application Market

8.2.2 Global Secondary Application Type Market

8.2.2.1 Global Material Handling, Palletizing & Packaging Application Market

8.2.2.2 Global Assembly/Disassembly Application Market

9 Global Market, By Region (Page No. - 74)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 By Country

9.2.2 China

9.2.3 Japan

9.2.4 South Korea

9.2.5 India

9.2.6 Others (Asia-Pacific)

9.3 Europe

9.3.1 By Country

9.3.2 Germany

9.3.3 U.K.

9.3.4 France

9.3.5 Italy

9.3.6 Others (Europe)

9.4 North America

9.4.1 By Country

9.4.2 U.S.

9.4.3 Mexico

9.4.4 Canada

9.5 RoW

9.5.1 By Country

9.5.2 Brazil

9.5.3 Others

10 Competitive Landscape (Page No. - 98)

10.1 Overview

10.2 Market Ranking Analysis: Automotive Robotics Market

10.3 Supply Contracts/Agreements/Partnerships

10.4 New Product Launches

10.5 Expansions and Merges/Acquisitions

11 Company Profiles (Page No. - 105)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

11.1 ABB Ltd.

11.2 Kuka AG

11.3 Fanuc Corporation

11.4 Yaskawa Electric Corporation

11.5 Kawasaki Heavy Industries

11.6 Denso Wave Incorporated

11.7 Comau SPA

11.8 Nachi-Fujikoshi Corp.

11.9 Rockwell Automation, Inc.

11.10 Seiko Epson Corporation

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 131)

12.1 Key Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.4.1 Company Information

12.5 Related Reports

12.6 Author Details

List of Tables (86 Tables)

Table 1 Global Automotive Robotics Market Size, By Type, 2014–2021 (‘000 Units)

Table 2 Market Size, By Type, 2014–2021 (USD Million)

Table 3 Articulated Type: Market Size, By Region, 2014–2021 (‘000 Units)

Table 4 Articulated Type: Market Size, By Region, 2014–2021 (USD Million)

Table 5 Cartesian Type: Market Size, By Region, 2014–2021 (‘000 Units)

Table 6 Cartesian Type: Market Size, By Region, 2014–2021 (USD Million)

Table 7 Cylindrical Type: Market Size, By Region, 2014–2021 (‘000 Units)

Table 8 Cylindrical Type: Market Size, By Region, 2014–2021 (USD Million)

Table 9 Scara Type: Market Size, By Region, 2014–2021 (‘000 Units)

Table 10 Scara Type: Market Size, By Region, 2014–2021 (USD Million)

Table 11 Other Robot Type: Market Size, By Region, 2014–2021 (‘000 Units)

Table 12 Other Robot Type: Market Size, By Region, 2014–2021 (USD Million)

Table 13 Automotive Robotics Market Size, By Component, 2014–2021 (‘000 Units)

Table 14 Market Size, By Component, 2014–2021 (USD Million)

Table 15 Automotive Robotics Controller: Market Size, By Region, 2014–2021 (‘000 Units)

Table 16 Controller: Market Size, By Region, 2014–2021 (USD Million)

Table 17 Robotics Arm: Market Size, By Region, 2014–2021 (‘000 Units)

Table 18 Robotic Arms: Market Size, By Region, 2014–2021 (USD Million)

Table 19 End Effector : Market Size, By Region, 2014–2021 (‘000 Units)

Table 20 End Effector: Automotive Robotic Market Size, By Region, 2014–2021 (USD Million)

Table 21 Automotive Robotics Drive: Market Size, By Region, 2014–2021 (‘000 Units)

Table 22 Automotive Robotics Drive: Automotive Robotic Market Size, By Region, 2014–2021 (USD Million)

Table 23 Automotive Robotic Sensor : Automotive Robotic Market Size, By Region, 2014–2021 (‘000 Units)

Table 24 Automotive Robotic Sensor: Automotive Robotic Market Size, By Region, 2014–2021 (USD Million)

Table 25 Global Market, By Application: 2014-2021 (USD Million)

Table 26 Global Automotive Robotic Market, By Application: 2014-2021 (‘000 Units)

Table 27 Global Primary Application Type Market, By Region: 2014-2021 (USD Million)

Table 28 Global Primary Application Type Market, By Region: 2014-2021 (‘000 Units)

Table 29 Global Primary Application Type Market Size, By Application: 2016-2021 (USD Million)

Table 30 Global Primary Process Robots Market: By Application Type, 2014-2021, (‘000 Units)

Table 31 Global Welding Application Market: By Region, 2014-2021, (USD Million)

Table 32 Global Welding Application Market: By Region, 2014-2021, (‘000 Units)

Table 33 Global Painting Robots Market: By Region, 2014-2021, (USD Million)

Table 34 Global Painting Application Market: By Region, 2014-2021, (‘000 Units)

Table 35 Global Cutting Application Market: By Region, 2014-2021, (USD Million)

Table 36 Global Cutting Application Market: By Region, 2014-2021, (‘000 Units)

Table 37 Global Secondary Processes Market: By Application Type, 2014-2021, (USD Million)

Table 38 Global Secondary Processes Market: By Application Type, 2014-2021, (‘000 Units)

Table 39 Global Material Handling, Palletizing & Packaging Application Market: By Region, 2014-2021, (USD Million)

Table 40 Global Material Handling, Palletizing & Packaging Application Market: By Region, 2014-2021, (‘000 Units)

Table 41 Global Assembly/Disassembly Application Market: By Region, 2014-2021, (USD Million)

Table 42 Global Assembly/Disassembly Application Market: By Region Type, 2014-2021, (‘000 Units)

Table 43 Automotive Robotics Market, By Region, 2014–2021 (‘000 Units)

Table 44 Automotive Robotic Market, By Region, 2014–2021 (USD Million)

Table 45 Asia-Pacific: Market, By Country, 2014–2021 (‘000 Units)

Table 46 Asia-Pacific: Market, By Country, 2014–2021 (USD Million)

Table 47 China: Market, By Robot Type, 2014–2021 (‘000 Units)

Table 48 China: Market, By Robot Type, 2014–2021 (USD Million)

Table 49 Japan: Market, By Robot Type, 2014–2021 (‘000 Units)

Table 50 Japan: Market, By Robot Type, 2014–2021 (USD Million)

Table 51 South Korea: Market, By Robot Type, 2014–2021 (‘000 Units)

Table 52 South Korea: Market, By Robot Type, 2014–2021 (USD Million)

Table 53 India: Market, By Robot Type, 2014–2021 (‘000 Units)

Table 54 India: Market, By Robot Type, 2014–2021 (USD Million)

Table 55 Others (Asia-Pacific): Market, By Robot Type, 2014–2021 (‘000 Units)

Table 56 Others (Asia-Pacific): Market, By Robot Type, 2014–2021 (USD Million)

Table 57 Europe: Market, By Country, 2014–2021 (‘000 Units)

Table 58 Europe: Market, By Country, 2014–2021 (USD Million)

Table 59 Germany: Market, By Robot Type, 2014–2021 (‘000 Units)

Table 60 Germany: Market, By Robot Type, 2014–2021 (USD Million)

Table 61 U.K.: Market, By Robot Type, 2014–2021 (‘000 Units)

Table 62 U.K.: Market, By Robot Type, 2014–2021 (USD Million)

Table 63 France: Market, By Robot Type, 2014–2021 (‘000 Units)

Table 64 France: Market, By Robot Type, 2014–2021 (USD Million)

Table 65 Italy: Market, By Robot Type, 2014–2021 (‘000 Units)

Table 66 Italy.: Market, By Robot Type, 2014–2021 (USD Million)

Table 67 Others: Market, By Robot Type, 2014–2021 (‘000 Units)

Table 68 Others.: Market, By Robot Type, 2014–2021 (USD Million)

Table 69 North America: Market, By Country, 2014–2021 (‘000 Units)

Table 70 North America: Market, By Country, 2014–2021 (USD Million)

Table 71 U.S.: Market, By Robot Type, 2014–2021 (‘000 Units)

Table 72 U.S.: Market, By Robot Type, 2014–2021 (USD Million)

Table 73 Mexico: Market, By Robot Type, 2014–2021 (‘000 Units)

Table 74 Mexico: Market, By Robot Type, 2014–2021 (USD Million)

Table 75 Canada: Market, By Robot Type, 2014–2021 (‘000 Units)

Table 76 Canada: Market, By Robot Type, 2014–2021 (USD Million)

Table 77 RoW: Market, By Country, 2014–2021 (‘000 Units)

Table 78 RoW: Market, By Country, 2014–2021 (USD Million)

Table 79 Brazil: Market, By Robot Type, 2014–2021 (‘000 Units)

Table 80 Brazil: Market, By Robot Type, 2014–2021 (USD Million)

Table 81 Others: Market, By Robot Type, 2014–2021 (‘000 Units)

Table 82 Others:Market, By Robot Type, 2014–2021 (USD Million)

Table 83 Market Ranking: 2016

Table 84 Supply Contracts, 2013–2016

Table 85 New Product Launch/ Product Development, 2013–2016

Table 86 Expansions and Mergers/Acquisitions, 2013–2016

List of Figures (49 Figures)

Figure 1 Research Design

Figure 2 Research Methodology Model

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Vehicle Production, 2010 & 2015

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Articulated Robots to Be the Largest Contributor to the Global Automotive Robotics Market, (2016-2021)

Figure 7 Welding Application to Be the Largest Contributor to the Global Automotive Robotic Market, By Application Type (2016-2021

Figure 8 Global Market, By Component (2016-2021)

Figure 9 Asia-Pacific Expected to Hold the Largest Share in the Global Market, 2021

Figure 10 Rising Vehicle Production & Wage Inflation is Expected to Drive the Global Automotive Robotic Market

Figure 11 Asia-Pacific to Hold the Largest Market for Market, 2016-2021

Figure 12 Articulated Robots to Hold the Largest Share in the Global Market, By Value

Figure 13 Robotic Controllers is Estimated to Dominate the Market During the Forecast Period, By Value, in the Global Market

Figure 14 Primary Application Robots to Hold the Largest Share in the Global Market, By Value

Figure 15 Rise in Demand for Automotive Robotics in Emerging Regions, 2016

Figure 16 Global Market Segmentation

Figure 17 Rising Vehicle Production is Expected to Drive the Market

Figure 18 Porter’s Five Forces Analysis

Figure 19 Articulated Robots are Expected to Hold the Highest Market Share in Terms of Value, 2016 - 2021

Figure 20 Asia-Pacific to Hold the Largest Share (Value) in the Articulated Robotics Market From 2016 - 2021

Figure 21 Cartesian Type: Global Market Size, By Region, 2016 - 2021

Figure 22 Asia-Pacific is Expected to Hold the Largest Market Share in Cylindrical Robotic Market, 2016 - 2021

Figure 23 Scara Type: Global Market Size, By Region, 2016 - 2021

Figure 24 Other Robot Type: Global Automotive Robotic Market Size, By Region, 2016 - 2021

Figure 25 Market, By Component, 2016–2021 (USD Million)

Figure 26 Primary Manufacturing Process Robots: Estimated to Be the Larger Segment in Market

Figure 27 Asia-Pacific to Be the Largest Region for Automotive Robotics Market During the Forecast Period

Figure 28 China Estimated to Lead the Asia-Pacific Automotive Robotic Market During the Forecast Period

Figure 29 Germany to Grow at the Fastest Rate in the European Region

Figure 30 U.S. Expected to Dominate the North American Market During the Forecast Period

Figure 31 Brazil to Account for the Largest Market Share in the RoW Region, 2016 - 2021

Figure 32 Companies Adopted New Product Launches as Key Growth Strategies From 2013 to 2016

Figure 33 Market Evaluation Framework: New Product Launches Fueled Market Growth From 2013 to 2016

Figure 34 Battle for Market Share: Joint Ventures and Supply Contracts Were the Key Strategy

Figure 35 ABB Ltd. : Company Snapshot

Figure 36 ABB Ltd.: SWOT Analysis

Figure 37 Kuka AG PLC: Company Snapshot

Figure 38 Kuka AG: SWOT Analysis

Figure 39 Fanuc: Company Snapshot

Figure 40 Fanuc Corporation : SWOT Analysis

Figure 41 Yaskawa Electric Corporation: Company Snapshot

Figure 42 Yaskawa Electric : SWOT Analysis

Figure 43 Kawasaki Heavy Industries: Company Snapshot

Figure 44 Kawasaki Heavy Industries : SWOT Analysis

Figure 45 Denso Wave Incorporated: Company Snapshot

Figure 46 Comau SPA : Company Snapshot

Figure 47 Nachi-Fujikoshi Corp.: Company Snapshot

Figure 48 Rockwelll Automation, Inc. : Company Snapshot

Figure 49 Seiko Epson Corporation: Company Snapshot

Growth opportunities and latent adjacency in Automotive Robotics Market