Automotive Specialty Coatings Market by Application (Engine Exhaust, Interior, Transmission, Wheels), Technology (Solvent-borne, Water-borne, Powder), Resin (PU, Epoxy, Acrylic), Substrate, ICE, Electric & Hybrid Vehicle & Region - Global Forecast to 2025

The automotive specialty coatings market was estimated to be $2.97 bn in 2017 & is projected to reach $3.75 bn by 2025 at a CAGR of 3.12%, during the forecast period.

The automotive specialty coatings industry has evolved along with the automotive industry. The demand for automotive specialty coatings and advancements in the coatings technology is largely influenced by the increase in vehicle production, increase in the number of applications that required coating, and increasing sales of premium vehicles.

Years considered for this report:

- 2017 – Base Year

- 2018 – Estimated Year

- 2018–2025 – Forecast Period

Objectives of the study

- To define, analyze, segment, and forecast the global market (2015–2025), in terms of volume (KT) and value (USD million)

- To segment and forecast the market size, by value and volume, by coating applications, technology, resin, and substrate

- To segment the market and forecast the market size, by value and volume, by vehicle type

- To segment the market and forecast the market size, by value and volume, by electric and hybrid vehicle type

- To segment the market and forecast the market size, by value and volume, by region

- To identify the market dynamics and analyze their impact on the global market

The research methodology used in the report involves various secondary sources, including paid databases and directories such as American Coatings Association (ACA), British Coatings Federation (BCF), and The International Council on Clean Transportation (ICCT) Factiva, and Hoovers. Experts from related industries have been interviewed to understand the future trends of this market.

A bottom-up approach was used to estimate and validate the size of the global market and to estimate the size of various other dependent submarkets in the overall market. The market size, by volume, of the market, has been derived by identifying the country-wise vehicle production and amount of coating required per application, by vehicle type. The total specialty coatings market is further segmented by technology, resin type, and substrate.

A top-down approach has been followed to estimate certain markets such as the market by technology, by resin, and by substrate. The global numbers were broken down into regional numbers by considering all the regional trends.

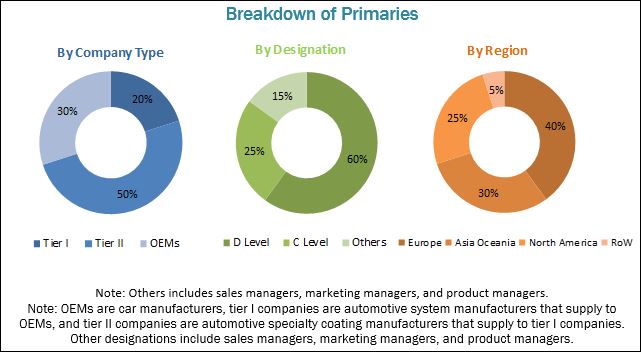

The figure given below shows the breakup of the profile of industry experts that participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The automotive specialty coatings market consists of manufacturers such as PPG (US), Axalta (US), AkzoNobel (Netherlands), BASF (Germany), Sherwin Williams (US), Kansai (Japan), Covestro (Germany), Solvay (Belgium), DOW Chemical (US), Nippon Paint (Japan), and KCC (South Korea).

Target Audience

- Manufacturers of Various Types of Automotive Coatings

- Raw Material Suppliers to Automotive Coating Manufacturers

- Manufacturers of Automotive Coating Technologies

- Dealers and Distributors of Automotive Coatings

- Automotive Original Equipment Manufacturers (OEMs)

- Regional Automotive Manufacturers’ Associations

Scope of the Report

By Application

By Technology Type

By Resin Type

By Substrate

By Electric & Hybrid Vehicle Type

By Vehicle Type

By Region

-

- Engine & exhaust

- Interior

- Transmission

- Wheel rims

- Others

- Solvent-borne

- Waterborne

- Powder Coating

- Polyurethane

- Epoxy

- Acrylic

- Other

- Metal

- Plastics & others

- HEV

- PHEV

- BEV

- Passenger Car

- LCV

- HCV

- North America

- Asia Oceania

- Europe

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to company-specific needs.

By Vehicle Type & Country

- Passenger car

- LCV

- Bus

- Truck

Electric & Hybrid Specialty Coatings Market, By Application & Country

- Engine & exhaust

- Motor

- Interior

- Transmission

- Wheels rims

- Battery and power electronics

- Others

By Application & Vehicle Type

- Engine & exhaust

- Interior

- Transmission

- Wheels rims

- Others

Note 1: Countries considered are China, Japan, South Korea, India, Thailand, Asia Others, Germany, UK, France, Spain, Turkey, Russia, Europe (Belgium, Sweden, Hungary, Poland, Romania, Slovakia, and Czech Republic), US, Canada, Mexico, Brazil, Iran, and ROW (Argentina and South Africa).

Note 2: The vehicle type considered are passenger cars, LCVs, trucks, buses.

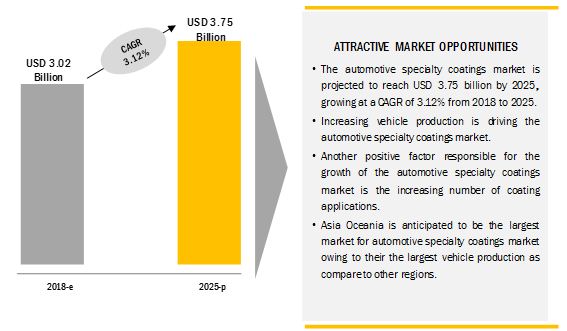

The increasing vehicle production, increasing number of coating application will drive the global market to USD 3.75 billion by 2025

Automotive specialty coatings are the coatings applied to various vehicle components or systems to protect them from corrosion and to provide high efficiency in high temperature and friction. Some of the components and systems include engine, exhaust, suspension system, steering system, brake system, and wheel rims, among others.

Increasing engine downsizing trend and sales of BEV are the major restraints for this market as these will reduce the consumption rate of specialty coatings in the vehicle.

The increasing demand of waterborne technology owing to strict VOC regulations in Europe and North America will create immense opportunity for the specialty coatings manufacturers. Coating manufactures can focus on new product development to cater the market of water borne technology and can increase their market share.

Ongoing bio-based product development by leading manufacturers for less VOC emission products are likely to drive the growth of this market for long-term forecast.

Market Dynamics

Drivers

- Increasing vehicle production to fuel the market

- Increasing number of coating applications to increase the demand for specialty coatings

Restraints

- Growing trends of engine downsizing

- Increasing sales of BEV & FCEV

Opportunities

- Increasing sales of premium vehicles

Challenges

- Stringency of volatile organic compound (VOC) regulations

Critical Questions:

- Why polyurethane resins are holding the largest market share in present scenario and will it be same in the future as well?

- Is the eco-friendly waterborne coating technology the ultimate way to move forward with strict VOC emission norms?

- How are the specialty coatings manufactures going to tackle the market challenge of engine downsizing ?

The automotive specialty coatings market is estimated to be USD 3.02 billion in 2018 and is projected to reach USD 3.75 billion by 2025, at a CAGR of 3.12%, from 2018 to 2025. The growing vehicle production, increasing application of coatings, and the increasing adoption rate of AMTs are projected to drive the automotive specialty coatings industry and the advancements in the coating technology.

Waterborne technology is expected to be the largest as well as the fastest growing market for automotive specialty coatings by 2025. Solvent-borne coating technology has the largest market share in 2018. Solvent-borne coatings were preferred due to their lower price and quick drying properties. However, with the growing stringency of VOC emission regulations monitoring the coating production, the industry stakeholders are preferring eco-friendly coating technologies, such as waterborne.

The polyurethane resin segment is expected to be the largest as well as the fastest growing market, by resin type. Polyurethane resins are mostly used to provide high gloss and scratch resistance to plastic parts that are mostly used in the interior applications of cars. Moreover, polyurethane resins are also used on metal for applications such as engine & exhaust, transmission, and wheel rims to make them corrosion-resistant. Advancement in technology such as “direct to metal” coating will have a huge positive impact on the polyurethane market as polyurethane is the only resin that can be used in the direct to metal coating technology.

Wheel rims market is expected to be the largest, by applications. The amount of coating required for wheel rims is dependent on two factors, namely, wheel rim size and the number of wheels required per vehicle. Passenger cars and LCVs in Europe and North America are mostly sedans, SUVs, and pick-up trucks, which use bigger rims. Whereas, passenger cars and LCVs that are produced in the Asia Oceania region mostly require less amount of coating. This difference will impact the market in these respective regions.

Plastics & others segment is estimated to be the fastest growing market by substrate. This growth is attributed to the adoption of plastic components to reduce the overall vehicle weights.

The HEV segment is estimated to hold the largest market share in the global market, by electric & hybrid vehicle type. The large market share is attributed to the higher sales of HEVs than BEVs and PHEVs in all the regions. The market is also estimated to grow with the HEV market. Asia Oceania and North America are the largest markets for HEV, in terms of vehicle sales. Hence, these markets are expected to be the largest markets for automotive specialty coatings for HEVs.

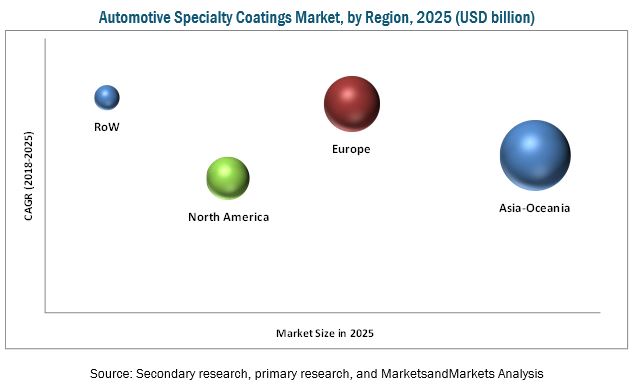

The Asia Oceania region is estimated to be the largest market for automotive specialty coatings during the forecast period. Asia Oceania region is estimated to be the largest producer of passenger cars and LCVs, which are the largest contributors in this market.

In Asia Oceania, China is the leading country in this market where passenger car & LCV are the leading vehicle types. Wheel rims coating is estimated to have the largest market share and transmission coating is estimated to be the fastest growing application area in the Asia Oceania region.

Increasing sales of BEV is acting as a hindering factor for the global market as BEVs are not equipped with engine & exhaust system, which is a major application area for specialty coatings.

Automotive specialty coatings market consists of manufacturers such as PPG (US), Axalta (US), AkzoNobel (Netherlands), BASF (Germany), Sherwin Williams (US), Kansai (Japan), Covestro (Germany), Solvay (Belgium), DOW Chemical (US), Nippon Paint (Japan), and KCC (South Korea).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources for Vehicle Production

2.2.2 Key Secondary Sources for Market Sizing

2.2.3 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Primary Participants

2.4 Market Size Estimation

2.5 Market Breakdown & Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Automotive Specialty Coatings Market

4.2 Market, By Region

4.3 Market, By Technology

4.4 Market, By Substrate Type

4.5 Market, By Ice Vehicle Type

4.6 Market, By Applications

4.7 Market, By Resin Type

4.8 Market, By Electric & Hybrid Vehicle Type

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Vehicle Production to Fuel the Global Market

5.2.1.2 Increasing Number of Coating Applications to Increase the Demand for Specialty Coatings

5.2.2 Restraints

5.2.2.1 Growing Trends of Engine Downsizing

5.2.2.2 Increasing Sales of BEV

5.2.3 Opportunities

5.2.3.1 Increasing Sales of Premium Vehicles

5.2.3.1.1 Premium Vehicles

5.2.3.1.2 HEV & PHEV

5.2.4 Challenges

5.2.4.1 Stringency of Volatile Organic Compound (VOC) Regulations

6 By Applications (Page No. - 49)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America, and RoW

6.1 Introduction

6.2 Engine & Exhaust

6.3 Interior

6.4 Transmission

6.5 Wheel Rims

6.6 Other Applications

7 By Technology (Page No. - 57)

Note - The Chapter is Further Segmented at Apllication Level and Considered Applications are Engine & Exhaust, Interior, Transmission, Wheel Rims and Other Applications

7.1 Introduction

7.2 Solvent-Borne

7.3 Waterborne

7.4 Powder Coatings

8 By Resin Type (Page No. - 64)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America, and RoW

8.1 Introduction

8.2 Polyurethane

8.3 Epoxy

8.4 Acrylic

8.5 Other Resin Types

9 By Substrate (Page No. - 71)

Note - The Chapter is Further Segmented at Apllication Level and Considered Applications are Engine & Exhaust, Interior, Transmission, Wheel Rims and Other Applications

9.1 Introduction

9.2 Metal

9.3 Plastic & Others

10 By Electric and Hybrid Vehicle (Page No. - 76)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America, and RoW

10.1 Introduction

10.2 Battery Electric Vehicle

10.3 Hybrid Electric Vehicle

10.4 Plug-In Hybrid Vehicle

11 By ICE Vehicle Type (Page No. - 82)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America, and RoW

11.1 Introduction

11.2 Passenger Car

11.3 Light Commercial Vehicle

11.4 Trucks

11.5 Buses

12 By Region (Page No. - 90)

Note - The Chapter is Further Segmented at Regional & Country Level By Apllications-Engine & Exhaust, Interior, Transmission, Wheel Rims and Other Applications

12.1 Introduction

12.2 Asia Oceania

12.2.1 China

12.2.2 Japan

12.2.3 South Korea

12.2.4 India

12.2.5 Thailand

12.2.6 Asia Oceania Others

12.3 North America

12.3.1 US

12.3.2 Canada

12.3.3 Mexico

12.4 Europe

12.4.1 Germany

12.4.2 France

12.4.3 UK

12.4.4 Spain

12.4.5 Turkey

12.4.6 Russia

12.4.7 Europe Others

12.5 Rest of the World (RoW)

12.5.1 Brazil

12.5.2 Iran

12.5.3 RoW Others

13 Competitive Landscape (Page No. - 122)

13.1 Overview

13.2 Automotive Specialty Coatings: Market Ranking Analysis

13.3 Competitive Scenario

13.3.1 Expansions

13.3.2 Mergers & Acquisitions

13.3.3 New Product Launches/New Product Developments

13.3.4 Partnerships/Joint Ventures

14 Company Profiles (Page No. - 129)

(Business Overview, Product Offerings, Recent Developments & SWOT Analysis)*

14.1 PPG

14.2 BASF

14.3 Axalta

14.4 Akzo Nobel

14.5 Sherwin-Williams

14.6 Kansai

14.7 Solvay

14.8 Covestro

14.9 DOW Chemical

14.10 KCC

14.11 Nippon Paint

*Details on Business Overview, Product Offerings, Recent Developments & SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

14.12 Additional Cps

14.12.1 Asia Oceania

14.12.1.1 Kangnam Jevisco

14.12.1.2 Chembond Chemicals

14.12.2 Europe

14.12.2.1 Clariant

14.12.2.2 Nsp Coatings

14.12.2.3 Oerlikon Metco

14.12.2.4 Berlac AG

14.12.3 North America

14.12.3.1 Decc Company

14.12.3.2 Hexion

14.12.3.3 Lord Corporation

14.12.3.4 Electro Tech Coatings

15 Appendix (Page No. - 155)

15.1 Key Industry Insights

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Introducing RT: Real-Time Market Intelligence

15.5 Available Customization

15.5.1 By Vehicle Type, By Country

15.5.1.1 PC

15.5.1.2 LCV

15.5.1.3 Truck

15.5.1.4 Bus

15.5.2 By Application Type, By Vehicle Type

15.5.2.1 Engine & Exhaust

15.5.2.2 Interior

15.5.2.3 Transmission

15.5.2.4 Wheel Rims

15.5.2.5 Others

15.5.3 By Electric & Hybrid Vehicle Type, By Application, By Country

15.5.3.1 Engine & Exhaust

15.5.3.2 Motor

15.5.3.3 Interior

15.5.3.4 Transmission

15.5.3.5 Wheel Rims

15.5.3.6 Battery & Power Electronics

15.5.3.7 Others

Note 1: Countries Considered are China, Japan, South Korea, India, Thailand, Asia Others, Germany, Uk, France, Spain, Turkey, Russia, Europe Others, Us, Canada, Mexico, Brazil, Iran and RoW Others

Note 2: Vehicle Type Considered are Passenger Car, LCV, Truck, Bus

15.6 Related Reports

15.7 Author Details

List of Tables (111 Tables)

Table 1 Currency Exchange Rates (W.R.T. USD)

Table 2 Ford-150: Engine Downsizing vs Fuel Economy

Table 3 Comparison of Old & New Car Engines

Table 4 Key Premium Vehicle Manufacturers & Their Vehicle Sales in China, Germany, the Us, & the Uk, 2015–2017 (Units)

Table 5 VOC Concentration Limit, By Product Category

Table 6 Global Market, By Application, 2016–2025 (KT)

Table 7 Global Market, By Application, 2016–2025 (USD Million)

Table 8 Engine & Exhaust: Market, By Region, 2016–2025 (KT)

Table 9 Engine & Exhaust: Market, By Region, 2016–2025 (USD Million)

Table 10 Interior: Coatings Market, By Region, 2016–2025 (KT)

Table 11 Interior: Market, By Region, 2016–2025 (USD Million)

Table 12 Transmission: Market, By Region, 2016–2025 (KT)

Table 13 Transmission: Market, By Region, 2016–2025 (USD Million)

Table 14 Wheel Rims: Market, By Region, 2016–2025 (KT)

Table 15 Wheel Rims: Market, By Region, 2016–2025 (USD Million)

Table 16 Other Applications: Market, By Region, 2016–2025 (KT)

Table 17 Other Applications: Market, By Region, 2016–2025 (USD Million)

Table 18 Market, By Technology, 2016–2025 (KT)

Table 19 Market, By Technology, 2016–2025 (USD Million)

Table 20 Solvent-Borne: Market, By Application, 2016–2025 (KT)

Table 21 Solvent-Borne: Market, By Application, 2016–2025 (USD Million)

Table 22 Waterborne: Market, By Application, 2016–2025 (KT)

Table 23 Waterborne: Market, By Application, 2016–2025 (USD Million)

Table 24 Powder Coating: Market, By Application, 2016–2025 (KT)

Table 25 Powder Coating: Market, By Application, 2016–2025 (USD Million)

Table 26 Global Market, By Resin Type, 2016–2025 (KT)

Table 27 Global Market, By Resin Type, 2016–2025 (USD Million)

Table 28 Polyurethane: Automotiive Specialty Coating Resin Market, By Region, 2016–2025 (KT)

Table 29 Polyurethane: Automotive Specialty Coatings Resin Market, By Region, 2016–2025 (USD Million)

Table 30 Epoxy: Automotiive Specialty Coating Resin Market, By Region, 2016–2025 (KT)

Table 31 Epoxy: Automotiive Specialty Coating Resin Market, By Region, 2016–2025 (USD Million)

Table 32 Acrylic: Automotive Specialty Coatings Resin Market, By Region, 2016–2025 (KT)

Table 33 Acrylic: Automotive Specialty Coatings Resin Market, By Region, 2016–2025 (USD Million)

Table 34 Others: Automotive Specialty Coatings Resin Market, By Region, 2016–2025 (KT)

Table 35 Others: Automotive Specialty Coatings Resin Market, By Region, 2016–2025 (USD Million)

Table 36 Global Market, By Substrate, 2016–2025 (KT)

Table 37 Global Market, By Substrate, 2016–2025 (USD Million)

Table 38 Metal: Market, By Application, 2016–2025 (KT)

Table 39 Metal: Market, By Application, 2016–2025 (USD Million)

Table 40 Plastic & Others: Market, By Application, 2016–2025 (KT)

Table 41 Plastic & Others: Market, By Application, 2016–2025 (USD Million)

Table 42 Market, By Electric and Hybrid Vehicle, 2016–2025 (Tons)

Table 43 Global Market, By Electric and Hybrid Vehicle, 2016–2025 (USD Million)

Table 44 BEV: Market, By Region, 2016–2025 (Tons)

Table 45 BEV: Market, By Region, 2016–2025 (USD Thousand)

Table 46 HEV: Market, By Region, 2016–2025 (Tons)

Table 47 HEV: Market, By Region, 2016–2025 (USD Thousand)

Table 48 PHEV: Market, By Region, 2016–2025 (Tons)

Table 49 PHEV: Market, By Region, 2016–2025 (USD Thousand)

Table 50 Market, By Ice Vehicle Type, 2016–2025 (KT)

Table 51 Global Market, By Ice Vehicle Type, 2016–2025 (USD Million)

Table 52 Passenger Car: Market, By Region, 2016–2025 (KT)

Table 53 Passenger Car: Market, By Region, 2016–2025 (USD Million)

Table 54 LCV: Market, By Region, 2016–2025 (KT)

Table 55 LCV: Market, By Region, 2016–2025 (USD Million)

Table 56 Truck: Market, By Region, 2016–2025 (KT)

Table 57 Truck: Market, By Region, 2016–2025 (USD Million)

Table 58 Bus: Market, By Region, 2016–2025 (KT)

Table 59 Bus: Market, By Region, 2016–2025 (USD Million)

Table 60 Global Market, By Region, 2016–2025 (KT)

Table 61 Global Market, By Region, 2016–2025 (USD Million)

Table 62 Asia Oceania: Market, By Country, 2016–2025 (KT)

Table 63 Asia Oceania: Market, By Country, 2016–2025 (USD Million)

Table 64 China: Market, By Applications, 2016–2025 (KT)

Table 65 China: Market, By Applications, 2016–2025 (USD Million)

Table 66 Japan: Market, By Applications, 2016–2025 (KT)

Table 67 Japan: Market, By Applications, 2016–2025 (USD Million)

Table 68 South Korea: Market, By Applications, 2016–2025 (KT)

Table 69 South Korea: Market, By Applications, 2016–2025 (USD Million)

Table 70 India: Market, By Applications, 2016–2025 (KT)

Table 71 India: Market, By Applications, 2016–2025 (USD Million)

Table 72 Thailand: Market, By Applications, 2016–2025 (KT)

Table 73 Thailand: Market, By Applications, 2016–2025 (USD Million)

Table 74 Asia Oceania Others: Market, By Applications, 2016–2025 (KT)

Table 75 Asia Oceania Others: Market, By Applications, 2016–2025 (USD Million)

Table 76 North America: Market, By Country, 2016–2025 (KT)

Table 77 North America: Market, By Country, 2016–2025 (USD Million)

Table 78 US: Market, By Applications, 2016–2025 (KT)

Table 79 US: Market, By Applications, 2016–2025 (USD Million)

Table 80 Canada: Market, By Applications, 2016–2025 (KT)

Table 81 Canada: Market, By Applications, 2016–2025 (USD Million)

Table 82 Mexico: Market, By Applications, 2016–2025 (KT)

Table 83 Mexico: Market, By Applications, 2016–2025 (USD Million)

Table 84 Europe: Market, By Country, 2016–2025 (KT)

Table 85 Europe: Market, By Country, 2016–2025 (USD Million)

Table 86 Germany: Market, By Applications, 2016–2025 (KT)

Table 87 Germany: Market, By Applications, 2016–2025 (USD Million)

Table 88 France: Market, By Applications, 2016–2025 (KT)

Table 89 France: Market, By Applications, 2016–2025 (USD Million)

Table 90 UK: Market, By Applications, 2016–2025 (KT)

Table 91 UK: Market, By Applications, 2016–2025 (USD Million)

Table 92 Spain: Market, By Applications, 2016–2025 (KT)

Table 93 Spain: Market, By Applications, 2016–2025 (USD Million)

Table 94 Turkey: Market, By Applications, 2016–2025 (KT)

Table 95 Turkey: Market, By Applications, 2016–2025 (USD Million)

Table 96 Russia: Market, By Applications, 2016–2025 (KT)

Table 97 Russia: Market, By Applications, 2016–2025 (USD Million)

Table 98 Europe Others: Market, By Applications, 2016–2025 (KT)

Table 99 Europe Others: Market, By Applications, 2016–2025 (USD Million)

Table 100 RoW: Market, By Country, 2016–2025 (KT)

Table 101 RoW: Market, By Country, 2016–2025 (USD Million)

Table 102 Brazil: Market, By Application, 2016–2025 (KT)

Table 103 Brazil: Market, By Application, 2016–2025 (USD Million)

Table 104 Iran: Market, By Application, 2016–2025 (KT)

Table 105 Iran: Market, By Application, 2016–2025 (USD Million)

Table 106 RoW Others: Market, By Application, 2016–2025 (KT)

Table 107 RoW Others: Market, By Application, 2016–2025 (USD Million)

Table 108 Expansions, 2015–2017

Table 109 Mergers & Acquisitions, 2016–2017

Table 110 New Product Launches/New Product Developments, 2017

Table 111 Partnerships/Joint Ventures, 2014–2018

List of Figures (50 Figures)

Figure 1 Global Market Segmentation

Figure 2 Market: Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Global Market: Bottom-Up Approach

Figure 6 Top-Down Approach: Technology & Resin Type

Figure 7 Data Triangulation

Figure 8 Market: Market Outlook

Figure 9 Market, By Region, 2018 vs 2025 (USD Million)

Figure 10 The Growing Vehicle Production and Increasing Coating Applications to Drive the Market, 2018–2025

Figure 11 Asia Oceania to Hold the Largest Share of the Market During the Forecast Period, By Value

Figure 12 Waterborne Technology to Be the Largest Segment in Market By 2025, By Value

Figure 13 Metal Coating Market to Be the Largest Market, 2018 vs 2025, By Value

Figure 14 Passenger Car Segment to Be the Largest Market and Truck Segment to Be the Fastest Growing Market for Automotive Specialty Coatings, 2018—2025, By Value

Figure 15 Wheel Rims Application to Be the Largest Market and Transmission Applications to Be the Fastest Growing Market for Automotive Specialty Coatings, 2018–2025, By Value

Figure 16 Polyurethane to Be the Largest and the Fastest Growing Market in Automotive Specialty Coatings, 2018—2025, By Value

Figure 17 Additional Applications and Higher Sales Figures Expected to Make HEV the Largest Segment of this Market, 2018 vs 2025, By Value

Figure 18 Market Dynamics: Market

Figure 19 Vehicle Production, 2012—2017 (Million Units)

Figure 20 Sales of BEV, 2017 vs 2022 vs 2025

Figure 21 HEV & PHEV Sales, 2017 vs 2022 vs 2025 (’000 Units)

Figure 22 Global Market, By Application, 2018 vs 2022 vs 2025 (USD Million)

Figure 23 Global Market, By Technology, 2018 vs 2025 (USD Million)

Figure 24 Global Market, By Resin Type, 2018 vs 2022 vs 2025 (USD Million)

Figure 25 Global Market, By Substrate, 2018 vs 2022 vs 2025 (USD Million)

Figure 26 Global Market, By Electric & Hybrid Vehicle, 2018 vs 2022 vs 2025 (USD Thousand)

Figure 27 Global Market, By Ice Vehicle Type, 2018 vs 2022 vs 2025 (USD Million)

Figure 28 Global Market, By Region, 2018 vs 2022 vs 2025 (USD Million)

Figure 29 Asia Oceania: Market Snapshot

Figure 30 North America: Market, By Country, 2018 vs 2022 vs 2025 (USD Million)

Figure 31 Europe: Market Snapshot

Figure 32 RoW: Market, By Country (USD Million)

Figure 33 Companies Adopted Expansions as the Key Growth Strategy From January 2014 to April 2018

Figure 34 Global Market Ranking Analysis in 2017

Figure 35 PPG: Company Snapshot

Figure 36 PPG: SWOT Analysis

Figure 37 BASF: Company Snapshot

Figure 38 BASF: SWOT Analysis

Figure 39 Axalta: Company Snapshot

Figure 40 Axalta: SWOT Analysis

Figure 41 Akzo Nobel: Company Snapshot

Figure 42 Akzo Nobel: SWOT Analysis

Figure 43 Sherwin-Williams: Company Snapshot

Figure 44 Sherwin-Williams: SWOT Analysis

Figure 45 Kansai: Company Snapshot

Figure 46 Solvay: Company Snapshot

Figure 47 Covestro: Company Snapshot

Figure 48 DOW Chemical: Company Snapshot

Figure 49 KCC: Company Snapshot

Figure 50 Nippon Paint: Company Snapshot

Growth opportunities and latent adjacency in Automotive Specialty Coatings Market

Hello, the topic of my Ph.D is the atomization of waterborne basecoats. In my thesis I want to show how important this type of automotive coats is. This is why I need data of the volume or the number of cars which are coated by basecoats in comparision to solventborne basecoats.