Automotive Wheels Aftermarket by Aftermarket (New Wheel Replacement & Refurbished Wheel Fitment), Vehicle (PC, CV), Coating, Material, Rim Size (13-15 Inch, 16-18 Inch, 19-21 Inch, Above 21 Inch), Product, Distribution & Region - Global Forecast to 2027

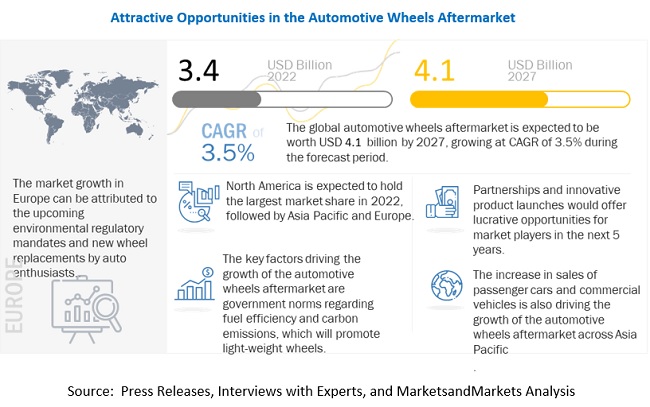

[235 Pages Report] The global automotive wheels aftermarket is projected to grow at a CAGR of 3.5% during the forecast period to reach USD 4.1 billion by 2027 from an estimated USD 3.4 billion in 2022. The automobile industry has witnessed a continuous increase in the average weight of the vehicle owing to the rising demand for safety and comfort features. This has led to huge innovations and R&D efforts from both the OEMs and aftermarket players in increasingly using lightweight materials to reduce the overall weight of the vehicle and comply with government regulations pertaining to vehicular fuel consumption and emissions which will boost the demand for aftermarket wheels. The growth for aftermarket wheels is expected to be higher in developed regions owing to the stringent focus on lightweight materials and fuel consumption. The growing demand from enthusiasts for style, performance, and ride boosts the demand for automotive wheels aftermarket.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of Covid-19 on Global Automotive Wheels Aftermarket

The COVID-19 pandemic has become a major concern for automotive stakeholders. Suspension of vehicle production and supply disruptions have brought the automotive industry to a halt. Lower vehicle sales post the pandemic will be a major concern for automotive OEMs for the next few quarters. The automotive wheels aftermarket, however, is expected to witness a significant boost in 2022 owing to the increase in adoption of new wheel replacement by enthusiast for luxury vehicles. Before that, lower vehicle sales and slow development for automotive wheels technologies will result in sluggish growth of the automotive wheels aftermarket in 2021.

Major automotive wheels manufacturers such as RONAL Group (Switzerland), Borbet Gmbh (Germany), Enkei Corporation (Japan), Superior Industries (US) had announced the suspension of Sales/distribution/production of wheels due to the lowered demand, supply chain bottlenecks, and to protect the safety of their employees in France, Germany, Italy, and Spain during the COVID-19 pandemic. Manufacturers are likely to adjust production/sales to prevent bottlenecks and plan production according to demand from OEMs and tier 1 manufacturers.

Driver: Improved vehicle dynamics and increased demand for lightweight materials to boost wheel aftermarket

Engine downsizing is the new trend in the automotive industry, which helps improve efficiency, mileage, and space utilization. However, despite several downsizing efforts, the weight of the car has been increasing in the past few decades due to the increasing adoption of electronic components in the form of ECUs relating to safety and comfort features. Wheel manufacturers have been trying to reduce the weight of the wheel as heavier wheels slow the vehicle speed. Lightweight wheels also offer higher torque to thrust the vehicle. Also, as turning a wheel requires torque, lighter wheels offer better vehicle control.

Restraint: Volatility in raw material prices

The procurement of raw materials has an important impact on the pricing of the end product. Any fluctuation in raw material pricing due to economic and political unrest can impact the prices of a component, affecting the prices of the final product. The final product, such as a wheel, vehicle components, and chassis, is made of steel, aluminum, magnesium, or a composition of multiple materials. The rise in raw steel prices would directly impact the price of the vehicle. The supply of basic raw materials like steel, aluminum, etc., has become unreliable and extremely volatile prices. Some of these problems are related to pandemic shutdowns, but global transportation woes, weather disruptions, and misguided tariffs have worsened the problem.

Opportunities: Advanced materials, use of lightweight alloys, and new compositions

The automotive industry has seen constant innovation in the development of lightweight materials. The average percentage of carbon fiber reinforced composites and aluminum used in automobiles has increased consistently over the years. Aftermarket players focus on developing light-weighting technologies due to lighter, faster, and better-performing vehicles and rising fuel costs. The use of lightweight materials will significantly grow across industries. The highest share (80%) of lightweight materials is in the aviation industry, but the automotive industry is massively increasing its share from 30 to 70%. All lightweight materials offer weight reduction potential at a higher cost. Carbon fiber has the highest weight reduction potential as it is 50% lighter than steel. So, the use of advanced materials offers significant opportunities for the automotive industry as they can play a vital role in reducing the overall weight of the vehicle, increasing fuel efficiency, and reducing harmful emissions.

Challenges: Engineering barriers in use of lightweight materials

Technological constraints such as difficulty in forging magnesium and its alloys to suit a specific need have also been hindering the market growth of these materials. In fact, magnesium offers better weight reduction than aluminum or high-strength steel. It is 33% lighter than aluminum and 75% lighter than steel. However, magnesium alloys are currently used in very small quantities in vehicles and are limited to die castings such as housings. The use of magnesium (Mg) is particularly appealing for automotive applications because it provides an attractive advantage over other structural metals such as aluminum and steel. The density of magnesium (0.06 pounds/inch3 or 1.74 gm/cm3) is two-thirds that of aluminum and a quarter that of steel. Magnesium’s combination of low density and reasonable strength leads to a specific strength that is far superior to either steel or aluminum.

Passenger cars estimated to account for the largest market size during the forecast period

The passenger cars segment is estimated to be the largest of the global automotive wheels aftermarket in 2022. The rising number of enthusiasts and growing demand for passenger vehicles in emerging and developed countries have contributed to the growth of the automotive wheels aftermarket for passenger vehicles. Carbon fiber wheels are widely used in high-performance vehicles and racing cars. These are now gaining popularity in the luxury vehicle segment because of their lightweight, strength, and rigidity, which helps enhance vehicle performance and fuel efficiency.

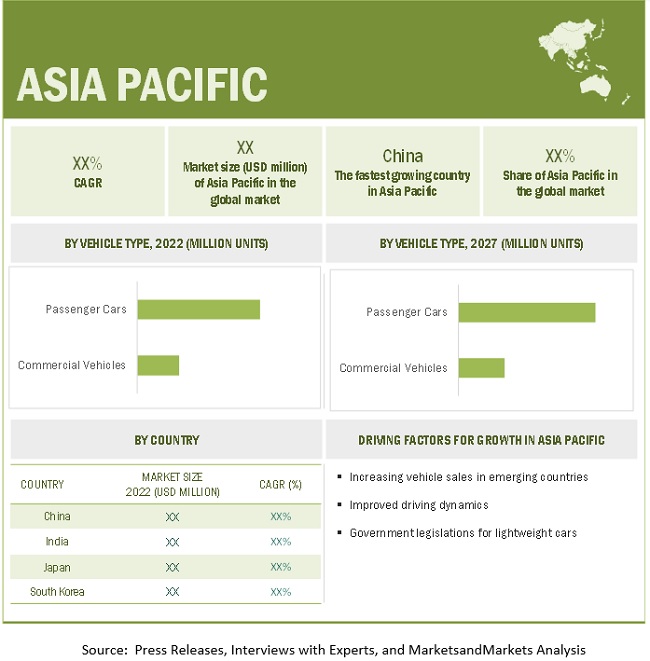

Asia Pacific is expected to grow with the highest CAGR during the forecast period

The Asia Pacific region comprises emerging economies such as China and India along with developed nations such as Japan. In recent years, the region has emerged as a hub for automobile production. The growing purchasing power of consumers in this region has triggered the demand for automobiles. Cost advantages for OEMs, low automobile penetration levels, and increased vehicle production in this region offers attractive market opportunities for automobile manufacturers and automotive component suppliers. The automotive industry in India is growing at a faster rate than most countries in the Asia Pacific region. The country had witnessed an increased demand for luxury and mid-priced vehicles in the past decade. However, the adoption rate of carbon fiber material is insignificant and limited to premium vehicles only. Also, as the country’s automotive market is highly driven by cost, most of the advanced wheel materials are only found in high-end vehicles.

To know about the assumptions considered for the study, download the pdf brochure

Key market players

The global automotive wheels aftermarket is dominated by major players such as RONAL Group (Switzerland), Borbet Gmbh (Germany), Enkei Corporation (Japan), Superior Industries (US), and Maxion Wheels (US). These companies have strong distribution networks at the global level. In addition, these companies offer an extensive product range in the aftermarket. The key strategies adopted by these companies to sustain their market position are new product developments, collaborations, and contracts & agreements.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million) and Volume (MILLION UNITS) |

|

Segments covered |

Aftermarket Type, Coating Type, Vehicle Type, Material Type, Product Type, Distribution Channel, Rim Size, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe and Rest of the World |

|

Companies covered |

RONAL Group (Switzerland), BORBET Gmbh (Germany), Enkei Corporation (Japan), Superior Industries (US), and Maxion Wheels (US). |

This research report categorizes the automotive wheels aftermarket based on aftermarket type, coating type, vehicle type, material type, rim size, and region.

On the basis of vehicle type, the wheels aftermarket has been segmented as follows:

- Passenger Cars

- Commercial Vehicles

On the basis of aftermarket type, the wheels aftermarket has been segmented as follows:

- New Wheel Replacement

- Refurbished Wheel Fitment

On the basis of material type, the wheels aftermarket has been segmented as follows:

- Alloy

- Steel

- Others (Carbon Fiber, Nickel)

On the basis of coating type, the wheels aftermarket has been segmented as follows:

- Liquid Coating

- Powdered Coating

On the basis of Product type, the wheels aftermarket has been segmented as follows:

- Regular Wheels

- High-Performance Wheels

On the basis of distribution channel, the wheels aftermarket has been segmented as follows:

- Retail

- Wholesalers and Distributors

On the basis of rim size, the wheels aftermarket has been segmented as follows:

- 13”–15” inch

- 16”–18” inch

- 19”–21” inch

- Above 21” inch

On the basis of region, the wheels aftermarket has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- Spain

- UK

-

Rest of the World

- Brazil

- Iran

Recent developments

- In November-2021, Maxion Wheels announced using Digital Twin technology to create a virtual duplicate of its light vehicle aluminum wheel production plant in Limeira, Brazil. The technology enables Maxion Wheels to predict and plan how the plant will operate under certain conditions to improve efficiency. It aims to expand the technology implementation to its other plants worldwide eventually.

- In February-2022, Ronal Group has signed a Memorandum of Understanding (MoU) with Eccomelt, which produces secondary aluminum from post-consumer wheels. By signing this MoU, the Ronal Group secured a preferential supply of Eccomelt’s post-consumer material, which has an extremely low carbon footprint.

- In September- 2021, Borbet launched a rim for light commercial vehicles and caravans. The Borbet CWZ design is a 5 double-spoke design suitable for vehicles with wheel loads of up to 1,250 kilograms such as the VW Crafter, Amarok, T5 and T6, Mercedes V-Class and the new EQV all-electric people carrier as well as the Citroën Jumper, Fiat. Ducato, Peugeot Boxer, and MAN TGE.

- In November-2019, Enkei Wheels (India) Limited (EWIL), the aluminum alloy wheels manufacturer, has signed a Joint Venture agreement to establish a Joint Venture Company with Nikkei MC Aluminium Co. Ltd Japan, Century Metal Recycling Limited, India, and Enkei Corporation, Japan. The purpose of the agreement is to incorporate a private limited company (Joint Venture Company) with the main objects of manufacturing, importing/ exporting, processing of primary and/ or secondary metal, metal scrap recycling, and selling of aluminum alloys in molten and ingot forms.

Frequently Asked Questions (FAQ):

What are different segment covered in report for automotive wheels aftermarket?

The automotive wheels aftermarket is covered for aftermarket type, coating type, by distribution channel, product type, rim size, vehicle type and by region.

Who are the major players in automotive wheels aftermarket?

The automotive wheels aftermarket is dominated by a few globally established players such as RONAL Group (Switzerland), Borbet Gmbh (Germany), Enkei Corporation (Japan), Superior Industries (US), and Maxion Wheels (US). These companies have been marking their presence in the automotive wheels aftermarket by offering advanced and innovative solutions, coupled with their robust business strategies, to achieve constant growth in the automotive wheels aftermarket. Moreover, these companies have a strong presence across the globe.

What are the key strategies adopted by top players to increase their revenue?

These companies adopted multiple strategies, including partnerships, collaborations, agreements, and mergers & acquisitions to stay ahead in this competitive market.

Which countries are considered in the European region?

The report covers market sizing for countries such as Germany, France, Italy, Spain, and UK. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS IN AUTOMOTIVE WHEELS AFTERMARKET

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 AFTERMARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR STUDY

1.4 CURRENCY & PRICING

TABLE 2 GLOBAL EXCHANGE RATE WRT USD

1.5 PACKAGE SIZE

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 AUTOMOTIVE WHEELS AFTERMARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES

2.2.2 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

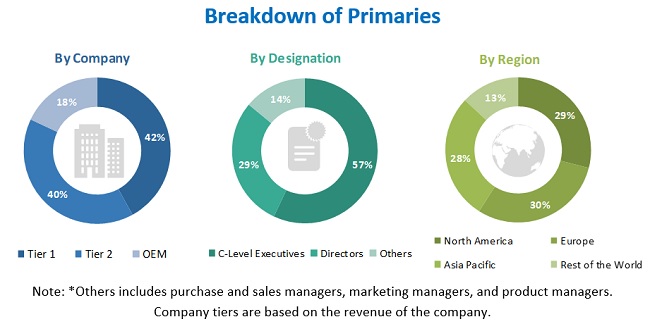

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.3.1 LIST OF PRIMARY PARTICIPANTS

2.4 MARKET ESTIMATION METHODOLOGY

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.5 MARKET SIZE ESTIMATION

2.5.1 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY FOR AUTOMOTIVE WHEELS AFTERMARKET: BOTTOM-UP APPROACH

FIGURE 7 AFTERMARKET: MARKET SIZE ESTIMATION DEMAND APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY FOR REFURBISHED WHEEL FITMENT MARKET: BOTTOM-UP APPROACH

FIGURE 9 AFTERMARKET: RESEARCH METHODOLOGY ILLUSTRATION OF SUPERIOR INDUSTRIES REVENUE ESTIMATION

FIGURE 10 AFTERMARKET: RESEARCH DESIGN & METHODOLOGY

2.6 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 11 DATA TRIANGULATION

2.7 FACTOR ANALYSIS

2.7.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY-SIDE

2.8 ASSUMPTIONS

2.9 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 52)

FIGURE 12 AUTOMOTIVE WHEELS AFTERMARKET: MARKET OVERVIEW

FIGURE 13 AFTERMARKET, BY REGION, 2022–2027 (USD MILLION)

FIGURE 14 AFTERMARKET BY MATERIAL TYPE, 2022–2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN AUTOMOTIVE WHEELS AFTERMARKET

FIGURE 15 INCREASED USE OF LIGHTWEIGHT MATERIALS TO DRIVE AFTERMARKET, 2022–2027 (USD BILLION)

4.2 NORTH AMERICA TO LEAD GLOBAL AFTERMARKET

FIGURE 16 AFTERMARKET SHARE, BY REGION (USD MILLION), 2027

4.3 AFTERMARKET, BY VEHICLE TYPE

FIGURE 17 PASSENGER CARS ACCOUNTED FOR LARGEST SHARES IN AFTERMARKET, 2022–2027 (USD MILLION)

4.4 AFTERMARKET, BY MATERIAL TYPE

FIGURE 18 ALLOY WHEELS TO HAVE HIGHEST MARKET SHARE BY MATERIAL TYPE, 2022–2027 (USD MILLION)

4.5 AFTERMARKET, BY COATING TYPE

FIGURE 19 POWDERED COATING SEGMENT TO DOMINATE MARKET, 2022 VS 2027 (USD MILLION)

4.6 AFTERMARKET, BY AFTERMARKET TYPE

FIGURE 20 NEW WHEEL REPLACEMENT MARKET TO REGISTER LARGEST MARKET SHARE, 2022 VS 2027 (USD MILLION)

4.7 AFTERMARKET, BY RIM SIZE

FIGURE 21 16”–18” MARKET TO ACCOUNT FOR LARGEST MARKET SHARE (MILLION UNITS), 2022 VS 2027

4.8 AFTERMARKET, BY PRODUCT TYPE

FIGURE 22 REGULAR WHEELS MARKET TO REPORT LARGEST MARKET SHARE (MILLION UNITS), 2022 VS 2027

5 MARKET OVERVIEW (Page No. - 61)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 AUTOMOTIVE WHEELS AFTERMARKET: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Improved vehicle dynamics and increased demand for lightweight materials to boost wheel aftermarket

5.2.1.2 Large organized and unorganized aftermarkets for wheels

TABLE 3 GLOBAL ORGANIZED AND UNORGANIZED MARKET PLAYERS

5.2.1.3 Rising number of car enthusiasts

TABLE 4 PASSENGER VEHICLE SALES DATA, BY COUNTRY (‘000 UNITS)

5.2.1.4 Gradual growth of average miles driven

FIGURE 24 YEARLY VEHICLE MILES TRAVELLED IN US 2021

5.2.2 RESTRAINTS

5.2.2.1 Volatility in raw material prices

FIGURE 25 TRENDS IN GLOBAL ALUMINUM PRICES PER METRIC TON (USD)

5.2.3 OPPORTUNITIES

5.2.3.1 Advanced materials, use of lightweight alloys, and new compositions

TABLE 5 KEY ALLOY WHEEL SUPPLIERS FOR SOME KEY CAR MODELS

5.2.3.2 Indirect impact on aftermarket with changing regulatory environment to reduce carbon footprint

5.2.4 CHALLENGES

5.2.4.1 Engineering barriers in use of lightweight materials

5.2.4.2 Balance between performance, cost, and weight

TABLE 6 GLOBAL WHEEL MATERIAL PRICES 2021 (USD)

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 26 PORTER’S FIVE FORCES: AFTERMARKET

TABLE 7 AFTERMARKET: IMPACT OF PORTERS FIVE FORCES

5.3.1 THREAT OF SUBSTITUTES

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN ANALYSIS

FIGURE 27 VALUE CHAIN ANALYSIS: AFTERMARKET

5.5 ECOSYSTEM ANALYSIS

TABLE 8 AFTERMARKET: ROLE OF COMPANIES IN ECOSYSTEM

5.6 PATENT ANALYSIS

5.7 CASE STUDY

5.7.1 CORROSION-RESISTANT STEEL ARMOR COATING TECHNOLOGY OF ACCURIDE

5.7.2 STEEL ARMOR COATING TECHNOLOGY

FIGURE 28 AFTERMARKET: STEEL ARMOR COATING TECHNOLOGY

5.7.3 SCOPE OF CARBON FIBER-REINFORCED POLYMER WHEEL RIMS FOR FORMULA STUDENT RACECARS

5.8 PRICING ANALYSIS

TABLE 9 AFTERMARKET: GLOBAL AVERAGE PRICING ANALYSIS, 2021

5.9 REGULATORY OVERVIEW

TABLE 10 REGULATORY STANDARD, BY COUNTRY

TABLE 11 STANDARD OF AFTERMARKET WHEELS

5.10 TECHNOLOGY ANALYSIS

TABLE 12 TECHNOLOGY USED FOR THE MANUFACTURING AUTOMOTIVE WHEELS

5.11 TRENDS AND DISRUPTIONS IN AFTERMARKET

FIGURE 29 TRENDS AND DISRUPTIONS IN AFTERMARKET

5.12 AFTERMARKET: COVID-19 IMPACT

5.12.1 IMPACT ON RAW MATERIAL SUPPLY

5.12.2 COVID-19 IMPACT ON AUTOMOTIVE INDUSTRY

5.12.3 IMPACT ON AUTOMOTIVE PRODUCTION

5.13 SCENARIO ANALYSIS

FIGURE 30 FUTURE TRENDS & SCENARIO, 2022–2027 (USD MILLION)

5.13.1 MOST LIKELY SCENARIO

TABLE 13 MOST LIKELY SCENARIO, BY REGION, 2022–2027 (USD MILLION)

5.13.2 OPTIMISTIC SCENARIO

TABLE 14 OPTIMISTIC SCENARIO, BY REGION, 2022–2027 (USD MILLION)

5.13.3 PESSIMISTIC SCENARIO

TABLE 15 PESSIMISTIC SCENARIO, BY REGION, 2022–2027 (USD MILLION)

5.14 LIST OF CONFERENCES & EVENTS

TABLE 16 DETAILED LIST OF CONFERENCES & EVENTS

5.15 LIST OF CONFERENCES & REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 AUTOMOTIVE WHEELS AFTERMARKET, BY AFTERMARKET TYPE (Page No. - 91)

6.1 INTRODUCTION

6.1.1 ASSUMPTIONS

TABLE 20 ASSUMPTIONS: AFTERMARKET TYPE

6.1.2 RESEARCH METHODOLOGY

TABLE 21 AFTERMARKET SIZE, BY AFTERMARKET TYPE, 2018–2021 (MILLION UNITS)

TABLE 22 AFTERMARKET SIZE, BY AFTERMARKET TYPE, 2022–2027 (MILLION UNITS)

TABLE 23 AFTERMARKET SIZE, BY AFTERMARKET TYPE, 2018–2021 (USD MILLION)

TABLE 24 AFTERMARKET SIZE, BY AFTERMARKET TYPE, 2022–2027 (USD MILLION)

FIGURE 31 REFURBISHED WHEEL FITMENT SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD (2022–2027)

6.2 NEW WHEEL REPLACEMENT

6.2.1 NORTH AMERICA TO LEAD NEW WHEEL REPLACEMENT MARKET

TABLE 25 NEW WHEEL REPLACEMENT: AFTERMARKET SIZE, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 26 NEW WHEEL REPLACEMENT: AFTERMARKET SIZE, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 27 NEW WHEEL REPLACEMENT: AFTERMARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 NEW WHEEL REPLACEMENT: AFTERMARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3 REFURBISHED WHEEL FITMENT

6.3.1 GROWING DEMAND FOR AESTHETICS TO BOOST DEMAND FOR REFURBISHED WHEEL FITMENT

TABLE 29 REFURBISHED WHEEL FITMENT: AFTERMARKET SIZE, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 30 REFURBISHED WHEEL FITMENT: AFTERMARKET SIZE, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 31 REFURBISHED WHEEL FITMENT: AFTERMARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 REFURBISHED WHEEL FITMENT: AFTERMARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.4 KEY PRIMARY INSIGHTS

7 AUTOMOTIVE WHEELS AFTERMARKET, BY COATING TYPE (Page No. - 99)

7.1 INTRODUCTION

7.1.1 OPERATIONAL DATA

TABLE 33 GLOBAL VEHICLE PRODUCTION (THOUSAND UNITS)

7.1.2 ASSUMPTIONS

TABLE 34 ASSUMPTIONS: COATING TYPE

7.1.3 RESEARCH METHODOLOGY

TABLE 35 AFTERMARKET, BY COATING TYPE, 2018–2021 (USD MILLION)

TABLE 36 AFTERMARKET, BY COATING TYPE, 2022–2027 (USD MILLION)

FIGURE 32 POWDERED COATING EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD (2022–2027)

7.2 LIQUID COATING

TABLE 37 LIQUID COATING: AFTERMARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 LIQUID COATING: AFTERMARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.2.1 WATERBORNE

7.2.2 SOLVENT-BORNE

7.3 POWDERED COATING

TABLE 39 POWDERED COATING: AFTERMARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 POWDERED COATING: AFTERMARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.3.1 LOW BAKE

7.3.2 HIGH BAKE

7.4 KEY PRIMARY INSIGHTS

8 AUTOMOTIVE WHEELS AFTERMARKET, BY MATERIAL TYPE (Page No. - 107)

8.1 INTRODUCTION

8.1.1 OPERATIONAL DATA

TABLE 41 GLOBAL MATERIAL PRICES (USD)

8.1.2 ASSUMPTIONS

TABLE 42 ASSUMPTIONS: MATERIAL TYPE

8.1.3 RESEARCH METHODOLOGY

TABLE 43 AFTERMARKET, BY MATERIAL TYPE, 2018–2021 (USD MILLION)

TABLE 44 AFTERMARKET, BY MATERIAL TYPE, 2022–2027 (USD MILLION)

FIGURE 33 ALLOY SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD (2022–2027)

8.2 ALLOY

8.2.1 HIGH DURABILITY AND TENSILE STRENGTH TO BOOST DEMAND FOR ALLOY

TABLE 45 ALLOY: AFTERMARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 ALLOY: AFTERMARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 STEEL

8.3.1 NORTH AMERICA TO LEAD STEEL SEGMENT BETWEEN 2022 AND 2027

TABLE 47 STEEL: AFTERMARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 STEEL: AFTERMARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 OTHERS

8.4.1 IMPROVED EFFICIENCY AND COMFORT TO FUEL DEMAND FOR CARBON FIBER DURING FORECAST PERIOD

TABLE 49 OTHERS: AFTERMARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 OTHERS: AFTERMARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 KEY PRIMARY INSIGHTS

9 AUTOMOTIVE WHEELS AFTERMARKET, BY RIM SIZE (Page No. - 115)

9.1 INTRODUCTION

9.1.1 OPERATIONAL DATA

TABLE 51 WHEEL SIZES IN INCHES

9.1.2 ASSUMPTIONS

TABLE 52 ASSUMPTIONS: BY RIM SIZE

9.1.3 RESEARCH METHODOLOGY

TABLE 53 AFTERMARKET, BY RIM SIZE, 2018–2021 (MILLION UNITS)

TABLE 54 AFTERMARKET, BY RIM SIZE, 2022–2027 (MILLION UNITS)

FIGURE 34 16–18 INCH SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD (2022–2027)

9.2 13–15 INCH

9.2.1 INCREASING FUEL EFFICIENCY TO BOOST DEMAND FOR 13–15 INCH WHEELS

TABLE 55 13–15 INCH: AUTOMOTIVE WHEELS AFTERMARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 56 13–15 INCH: AFTERMARKET, BY REGION, 2022–2027 (MILLION UNITS)

9.3 16–18 INCH

9.3.1 POWERFUL ACCELERATION TO DRIVE DEMAND FOR 16–18 INCH WHEELS

TABLE 57 16–18 INCH: AFTERMARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 58 16–18 INCH: AFTERMARKET, BY REGION, 2022–2027 (MILLION UNITS)

9.4 19–21 INCH

9.4.1 INCREASING PREFERENCE OF ENTHUSIASTS FOR LARGER WHEELS TO INCREASE DEMAND FOR 19–21 INCH WHEELS

TABLE 59 19–21 INCH: AFTERMARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 60 19–21 INCH: AFTERMARKET, BY REGION, 2022–2027 (MILLION UNITS)

9.5 ABOVE 21 INCH

9.5.1 HIGH TRACTION AND POWERFUL PERFORMANCE TO RAISE DEMAND FOR ABOVE 21 INCH WHEELS

TABLE 61 ABOVE 21 INCH: AFTERMARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 62 ABOVE 21 INCH: AFTERMARKET, BY REGION, 2022–2027 (MILLION UNITS)

9.6 KEY PRIMARY INSIGHTS

10 AUTOMOTIVE WHEELS AFTERMARKET, BY VEHICLE TYPE (Page No. - 124)

10.1 INTRODUCTION

10.1.1 OPERATIONAL DATA

TABLE 63 OEMS- SUPPLIERS DATA

10.1.2 ASSUMPTIONS

TABLE 64 ASSUMPTIONS: VEHICLE TYPE

10.1.3 RESEARCH METHODOLOGY

TABLE 65 AUTOMOTIVE WHEELS AFTERMARKET SIZE, BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 66 AFTERMARKET SIZE, BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 67 AFTERMARKET SIZE, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 68 AFTERMARKET SIZE, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

FIGURE 35 PASSENGER CAR SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD (2022-2027)

10.2 COMMERCIAL VEHICLES

10.2.1 INCREASING USE OF LIGHTWEIGHT WHEELS IN COMMERCIAL VEHICLES TO BOOST DEMAND

TABLE 69 COMMERCIAL VEHICLES: AFTERMARKET SIZE, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 70 COMMERCIAL VEHICLES: AFTERMARKET SIZE, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 71 COMMERCIAL VEHICLES: AFTERMARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 COMMERCIAL VEHICLES: AFTERMARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.3 PASSENGER CARS

10.3.1 GROWING DEMAND FOR FUEL EFFICIENCY AND GOVERNMENT LEGISLATIONS TO BOOST PASSENGER CAR WHEELS AFTERMARKET

TABLE 73 PASSENGER CARS: AFTERMARKET SIZE, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 74 PASSENGER CARS: AFTERMARKET SIZE, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 75 PASSENGER CARS: AFTERMARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 76 PASSENGER CARS: AFTERMARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.4 KEY PRIMARY INSIGHTS

11 AUTOMOTIVE WHEELS AFTERMARKET, BY PRODUCT TYPE (Page No. - 134)

11.1 INTRODUCTION

11.1.1 ASSUMPTIONS

TABLE 77 ASSUMPTIONS: PRODUCT TYPE

TABLE 78 AFTERMARKET SIZE, BY PRODUCT TYPE, 2018–2021 (MILLION UNITS)

TABLE 79 AFTERMARKET SIZE, BY PRODUCT TYPE, 2022–2027 (MILLION UNITS)

11.2 HIGH-PERFORMANCE WHEELS

11.3 REGULAR WHEELS

11.4 KEY PRIMARY INSIGHTS

12 AUTOMOTIVE WHEELS AFTERMARKET, BY DISTRIBUTION CHANNEL (Page No. - 138)

12.1 INTRODUCTION

12.2 RETAILERS

12.3 WHOLESALE AND DISTRIBUTION

12.4 KEY PRIMARY INSIGHTS

13 AUTOMOTIVE WHEELS AFTERMARKET, BY REGION (Page No. - 140)

13.1 INTRODUCTION

FIGURE 36 NORTH AMERICA TO DOMINATE AFTERMARKET DURING FORECAST PERIOD

TABLE 80 AFTERMARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 81 AFTERMARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 82 AFTERMARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 83 AFTERMARKET, BY REGION, 2022–2027 (USD MILLION)

13.2 ASIA PACIFIC

FIGURE 37 ASIA PACIFIC: AFTERMARKET SNAPSHOT

TABLE 84 ASIA PACIFIC: AFTERMARKET, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 85 ASIA PACIFIC: AFTERMARKET, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 86 ASIA PACIFIC: AFTERMARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 87 ASIA PACIFIC: AFTERMARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.2.1 CHINA

13.2.1.1 Rise in adoption of lightweight wheels in China expected to drive market

TABLE 88 CHINA: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 89 CHINA: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 90 CHINA: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 91 CHINA: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (USD MILLION)

13.2.2 INDIA

13.2.2.1 Rise in vehicle sales in India to fuel automotive wheels aftermarket

TABLE 92 INDIA: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 93 INDIA: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 94 INDIA: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 95 INDIA: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (USD MILLION)

13.2.3 JAPAN

13.2.3.1 Presence of major manufacturers in Japan to increase demand in automotive wheels aftermarket

TABLE 96 JAPAN: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 97 JAPAN: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 98 JAPAN: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 99 JAPAN: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (USD MILLION)

13.2.4 SOUTH KOREA

13.2.4.1 Government promoting ecofriendly vehicles in South Korea to propel automotive wheels aftermarket

TABLE 100 SOUTH KOREA: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 101 SOUTH KOREA: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 102 SOUTH KOREA: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 103 SOUTH KOREA: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (USD MILLION)

13.3 EUROPE

FIGURE 38 EUROPE: AFTERMARKET SNAPSHOT

TABLE 104 EUROPE: AFTERMARKET, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 105 EUROPE: AFTERMARKET, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 106 EUROPE: AFTERMARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 107 EUROPE: AFTERMARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.3.1 FRANCE

13.3.1.1 Government emission mandates to boost automotive wheels aftermarket in France

TABLE 108 FRANCE: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 109 FRANCE: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 110 FRANCE: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 111 FRANCE: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (USD MILLION)

13.3.2 GERMANY

13.3.2.1 Consumer preference toward alloy wheels and changing regulatory environment to push German automotive wheels aftermarket

TABLE 112 GERMANY: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 113 GERMANY: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 114 GERMANY: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 115 GERMANY: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (USD MILLION)

13.3.3 ITALY

13.3.3.1 Consumer preference toward passenger cars in Italy to lead automotive wheels aftermarket

TABLE 116 ITALY: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 117 ITALY: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 118 ITALY: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 119 ITALY: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (USD MILLION)

13.3.4 SPAIN

13.3.4.1 Increase in sales of passenger cars and commercial vehicles to drive demand in automotive wheels aftermarket in Spain

TABLE 120 SPAIN: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 121 SPAIN: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 122 SPAIN: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 123 SPAIN: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (USD MILLION)

13.3.5 UNITED KINGDOM

13.3.5.1 Government regulations to raise demand in UK automotive wheels aftermarket

TABLE 124 UK: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 125 UK: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 126 UK: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 127 UK: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (USD MILLION)

13.4 NORTH AMERICA

TABLE 128 NORTH AMERICA: AFTERMARKET, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 129 NORTH AMERICA: AFTERMARKET, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 130 NORTH AMERICA: AFTERMARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 131 NORTH AMERICA: AFTERMARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.4.1 CANADA

13.4.1.1 Increase in demand for wheel replacement in luxury vehicles would drive wheels aftermarket in future

TABLE 132 CANADA: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 133 CANADA: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 134 CANADA: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 135 CANADA: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (USD MILLION)

13.4.2 MEXICO

13.4.2.1 Cheap availability of labor and low manufacturing cost to aid growth of automotive wheels aftermarket in Mexico

TABLE 136 MEXICO: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 137 MEXICO: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 138 MEXICO: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 139 MEXICO: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (USD MILLION)

13.4.3 US

13.4.3.1 US accounted for largest market size in commercial vehicle wheels aftermarket in North America

TABLE 140 US: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 141 US: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 142 US: AFTERMARKET BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 143 US: AFTERMARKET BY VEHICLE TYPE, 2022–2027 (USD MILLION)

13.5 REST OF THE WORLD

FIGURE 39 BRAZIL ANTICIPATED TO BE LARGEST MARKET (2022-2027)

TABLE 144 REST OF THE WORLD: AFTERMARKET, BY COUNTRY, 2018–2021(MILLION UNITS)

TABLE 145 REST OF THE WORLD: AFTERMARKET, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 146 REST OF THE WORLD: AFTERMARKET, BY COUNTRY, 2018–2021(USD MILLION)

TABLE 147 REST OF THE WORLD: AFTERMARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.5.1 BRAZIL

13.5.1.1 Brazil estimated to dominate Rest of the World region

TABLE 148 BRAZIL: AFTERMARKET, BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 149 BRAZIL: AFTERMARKET, BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 150 BRAZIL: AFTERMARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 151 BRAZIL: AFTERMARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

13.5.2 IRAN

13.5.2.1 Iran expected to witness highest growth rate in Rest of the World

TABLE 152 IRAN: AFTERMARKET, BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 153 IRAN: AFTERMARKET, BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 154 IRAN: AFTERMARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 155 IRAN: AFTERMARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 174)

14.1 OVERVIEW

14.2 MARKET RANKING ANALYSIS

14.3 COMPETITIVE SCENARIO

14.3.1 NEW PRODUCT DEVELOPMENTS

TABLE 156 NEW PRODUCT DEVELOPMENTS, 2018–2021

14.3.2 DEALS

TABLE 157 DEALS, 2018–2021

14.3.3 OTHERS

TABLE 158 OTHERS, 2018–2021

14.4 COMPANY EVALUATION QUADRANT

14.4.1 STARS

14.4.2 EMERGING LEADERS

14.4.3 PERVASIVE COMPANIES

14.4.4 PARTICIPANTS

FIGURE 40 AUTOMOTIVE WHEELS AFTERMARKET: COMPANY EVALUATION QUADRANT, 2021

TABLE 159 AFTERMARKET: COMPANY FOOTPRINT, 2021

TABLE 160 AFTERMARKET: PRODUCT FOOTPRINT, 2021

TABLE 161 AFTERMARKET: REGIONAL FOOTPRINT,2021

14.5 STARTUP/SME EVALUATION QUADRANT

14.5.1 PROGRESSIVE COMPANIES

14.5.2 RESPONSIVE COMPANIES

14.5.3 DYNAMIC COMPANIES

14.5.4 STARTING BLOCKS

FIGURE 41 AUTOMOTIVE WHEELS AFTERMARKET: STARTUP/SME EVALUATION QUADRANT, 2021

14.6 AUTOMOTIVE WHEELS AFTERMARKET, STAKEHOLDERS MAP

FIGURE 42 AFTERMARKET: STAKEHOLDERS INFLUENCE VS INTEREST

TABLE 162 WINNERS VS. TAIL-ENDERS

14.7 WHO SUPPLIES WHOM DATA

TABLE 163 WHO SUPPLIES WHOM DATA

15 COMPANY PROFILES (Page No. - 189)

(Business overview, Products offered, Recent Developments, MNM view)*

15.1 MAXION WHEELS

FIGURE 43 MAXION WHEELS: GLOBAL FOOTPRINT,2021

TABLE 164 MAXION WHEELS: BUSINESS OVERVIEW

TABLE 165 MAXION WHEELS: SUPPLY AGREEMENTS

TABLE 166 MAXION WHEELS: PRODUCTS OFFERED

TABLE 167 MAXION WHEELS: NEW PRODUCT LAUNCHES

TABLE 168 MAXION WHEELS: DEALS

TABLE 169 MAXION WHEELS: OTHERS

15.2 RONAL GROUP

FIGURE 44 RONAL GROUP: CUSTOMER PORTFOLIO

TABLE 170 RONAL GROUP: BUSINESS OVERVIEW

TABLE 171 RONAL GROUP: PRODUCTS OFFERED

TABLE 172 RONAL GROUP: SUPPLY AGREEMENTS

TABLE 173 RONAL GROUP: NEW PRODUCT LAUNCHES

TABLE 174 RONAL GROUP: DEALS

15.3 BORBET GMBH

FIGURE 45 BORBET GMBH: PARTNERSHIPS

TABLE 175 BORBET GMBH: BUSINESS OVERVIEW

TABLE 176 BORBET GMBH: PRODUCTS OFFERED

TABLE 177 BORBET GMBH: SUPPLY AGREEMENTS

TABLE 178 BORBET GMBH: NEW PRODUCT LAUNCHES

TABLE 179 BORBET GMBH: OTHERS

15.4 ENKEI CORPORATION

TABLE 180 ENKEI CORPORATION: BUSINESS OVERVIEW

TABLE 181 ENKEI CORPORATION: PRODUCTS OFFERED

TABLE 182 ENKEI CORPORATION: DEALS

TABLE 183 ENKEI CORPORATION: OTHERS

15.5 SUPERIOR INDUSTRIES

TABLE 184 SUPERIOR INDUSTRIES: BUSINESS OVERVIEW

TABLE 185 SUPERIOR INDUSTRIES: PRODUCTS OFFERED

FIGURE 46 COMPANY SNAPSHOT: SUPERIOR INDUSTRIES

15.6 HOWMET AEROSPACE

TABLE 186 HOWMET AEROSPACE: BUSINESS OVERVIEW

TABLE 187 HOWMET AEROSPACE: PRODUCTS OFFERED

FIGURE 47 HOWMET AEROSPACE: COMPANY SNAPSHOT

TABLE 188 HOWMET AEROSPACE: NEW PRODUCT LAUNCHES

15.7 THE CARLSTAR GROUP

TABLE 189 CARLSTAR GROUP: BUSINESS OVERVIEW

FIGURE 48 CARSLTAR GROUP: GEOGRAPHIC PRESENCE

TABLE 190 CARLSTAR GROUP: PRODUCTS OFFERED

TABLE 191 CARLSTAR GROUP: NEW PRODUCT LAUNCHES

15.8 CM WHEELS

TABLE 192 CM WHEELS: BUSINESS OVERVIEW

TABLE 193 CM WHEELS: PRODUCTS OFFERED

15.9 CENTRAL MOTOR WHEEL OF AMERICA

TABLE 194 CENTRAL MOTOR WHEEL OF AMERICA: BUSINESS OVERVIEW

TABLE 195 CENTRAL MOTOR WHEELS OF AMERICA: PRODUCTS OFFERED

TABLE 196 CENTRAL MOTOR WHEELS OF AMERICA: SUPPLY AGREEMENTS

TABLE 197 CENTRAL MOTOR WHEEL OF AMERICA: OTHERS

15.10 ACCURIDE CORPORATION

TABLE 198 ACCURIDE CORPORATION: BUSINESS OVERVIEW

TABLE 199 ACCURIDE CORPORATION: PRODUCTS OFFERED

TABLE 200 ACCURIDE CORPORATION: NEW PRODUCT LAUNCHES

15.11 OTHER KEY PLAYERS

15.11.1 VOSSEN WHEELS

TABLE 201 VOSSEN WHEELS: COMPANY OVERVIEW

15.11.2 KONIG

TABLE 202 KONIG: COMPANY OVERVIEW

15.11.3 TSW ALLOY WHEELS

TABLE 203 TSW ALLOY WHEELS: COMPANY OVERVIEW

15.11.4 FORGIATO

TABLE 204 FORGIATO: COMPANY OVERVIEW

15.11.5 OZ GROUP

TABLE 205 OZ GROUP: COMPANY OVERVIEW

15.11.6 AEZ GROUP

TABLE 206 AEZ: COMPANY OVERVIEW

15.11.7 STATUS ALLOY WHEELS

TABLE 207 STATUS ALLOY WHEELS: COMPANY OVERVIEW

15.11.8 BEYERN WHEELS

TABLE 208 BEYERN WHEELS: COMPANY OVERVIEW

15.11.9 WORK WHEELS

TABLE 209 WORK WHEELS: COMPANY OVERVIEW

15.11.10 ZHENGXING WHEEL GROUP

TABLE 210 ZHENGXING WHEEL GROUP: COMPANY OVERVIEW

15.11.11 ZUMBO WHEELS

TABLE 211 ZUMBO WHEELS: COMPANY OVERVIEW

15.11.12 JIAN SIN INDUSTRIAL CO. LTDZHENGXING WHEEL GROUP

TABLE 212 JIAN SIN INDUSTRIAL CO. LTD: COMPANY OVERVIEW

15.11.13 BBS KRAFTFAHRZEUGTECHNIK

TABLE 213 BBS KRAFTFAHRZEUGTECHNIK: COMPANY OVERVIEW

15.11.14 RAYS ENGINEERING

TABLE 214 RAYS ENGINEERING: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

16 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 227)

16.1 NORTH AMERICA TO BE KEY MARKET FOR AUTOMOTIVE WHEELS AFTERMARKET

16.2 GROWING DEMAND FOR LIGHTWEIGHT ALLOYS TO BOOST AUTOMOTIVE WHEELS AFTERMARKET

16.3 CONCLUSION

17 APPENDIX (Page No. - 229)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 AVAILABLE CUSTOMIZATIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

The study involved 4 major activities in estimating the current market size of the automotive wheels aftermarket. Exhaustive secondary research was done to collect information on market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, automobile OEMs, Canadian Automobile Association (CAA), country-level automotive associations and trade organizations, and the Department of Transportation (DOT)], automotive magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases (for example, Marklines and Factiva) have been used to identify and collect information useful for an extensive commercial study of the global automotive wheels aftermarket.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the automotive wheels aftermarket scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across 4 major regions, namely, North America, Europe, Asia Pacific, and Rest of the World. Approximately 23% and 77% of primary interviews have been conducted from the demand- and supply-side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter expert’s opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the automotive wheels aftermarket. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Report Objectives

- To segment and forecast the global automotive wheels aftermarket size in terms of volume (million units) and value (USD Million)

- To define, describe, and forecast the global automotive wheels aftermarket based on aftermarket, vehicle, material, rim size, coating technology, and region

- To segment and forecast the market size by aftermarket type (new wheel replacement and refurbished wheel fitment)

- To segment and forecast the market size by vehicle type (passenger cars and commercial vehicles)

- To segment and forecast the market size by material type (steel, alloy, and others)

- To segment and forecast the market size by rim size (13”–15”, 16”–18”, 19”–21”, and above 21”)

- To segment and forecast the market size by coating technology type (liquid coating and powdered coating)

- To segment and forecast the market size by product type (high performance wheels and regular wheels)

- To segment and forecast the market size by distribution channel (Retail, wholesalers and distributors)

- To forecast the market size with respect to key regions, namely, North America, Europe, Asia Pacific, and Rest of the World.

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze markets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze opportunities for stakeholders and details of a competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze recent developments, alliances, joint ventures, product innovations, and mergers & acquisitions in the automotive wheels aftermarket

Refurbished wheels & Its impact on Automotive Wheels AfterMarket

Refurbished wheels are linked to the Automotive Wheels Aftermarket because they provide an alternative to purchasing brand new wheels. Refurbished wheels are used wheels that have been restored to their original condition, either through repairs or cosmetic enhancements, and are frequently sold at a lower price than brand new wheels. There is a high demand for refurbished wheels in the Automotive Wheels Aftermarket, which refers to the sale of wheels outside of the original equipment manufacturer (OEM) channels. This is due to the fact that refurbished wheels can provide a cost-effective solution for car owners looking to replace damaged or worn out wheels without having to pay the high cost of brand new wheels.

The Automotive Wheels Aftermarket is a large and rapidly growing industry, with many businesses specialising in the sale and distribution of aftermarket wheels, including refurbished wheels. These businesses frequently collaborate with auto repair shops, car dealerships, and individual customers to provide a variety of wheel options that meet their requirements and budget.

By extending the reach of Refurbished wheels companies are also creating new business opportunities. Companies are using these services to create new products and services and to drive their bottom line.

- Cost Savings: Refurbished wheels offer a cost-effective option for customers who want to replace their wheels without spending a lot of money.

- Increased Demand: As more people become aware of the cost-saving benefits of refurbished wheels, the demand for these products is likely to increase.

- Competition: The growing popularity of refurbished wheels is also likely to increase competition in the Automotive Wheels Aftermarket.

- Sustainability: Refurbished wheels also have the benefit of being environmentally sustainable. By refurbishing existing wheels instead of manufacturing new ones, this reduces waste and pollution associated with the production of new wheels.

The top players in the Refurbished wheels Market are Wheel Collision, Wheels America, Detroit Wheel and Tire, Midwest Wheel & Tire, Alloy Wheel Repair Specialists.

Several factors are driving the growth of the refurbished wheels market, including cost savings, environmental sustainability, and increased demand for high-quality refurbished products. Here are some potential future growth applications for refurbished wheels:

- Electric Vehicles: Refurbished wheels can provide a cost-effective and sustainable option for customers who want to upgrade their wheels without spending a lot of money.

- Autonomous Vehicles: The growth of autonomous vehicles could also drive demand for refurbished wheels. As autonomous vehicles become more prevalent, there will be a need for reliable and high-quality wheels that can withstand the demands of self-driving technology.

- Circular Economy: Refurbished wheels are an excellent example of the circular economy in action, as they extend the life of existing products and reduce the need for new products.

- Luxury Vehicles: Refurbished wheels are already popular among luxury vehicle owners, who appreciate the cost savings and environmental benefits of refurbished products.

Some of the key industries that are going to get impacted because in the future because of Refurbished wheels are,

- Auto Repair Industry: The auto repair industry may see an impact from the growing popularity of refurbished wheels.

- Manufacturing Industry: The manufacturing industry could be impacted by the increased demand for refurbished wheels.

- Recycling Industry: The recycling industry could benefit from the increased popularity of refurbished wheels.

- E-commerce Industry: The growing popularity of refurbished wheels could also impact the e-commerce industry.

Speak to our analyst today to know more about "Refurbished wheels Market"

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

Automotive Wheels Aftermarket, By Aftermarket Type at country level

Company Information

- Profiling of Additional Market Players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Wheels Aftermarket