Tappet Market for Automotive by Type (Flat, and Roller), End User (Economic, Mid-priced, and Luxury passenger cars), Engine Capacity (<4 cylinders, 4-6 cylinders, and >6 cylinders), Vehicle Type, and Region - Global Forecast to 2025

[121 Pages Report] The tappet market for automotive was valued at USD 6.90 Billion in 2016 and is projected to reach USD 10.11 Billion by 2025, growing at a CAGR of 3.36% during the forecast period. The base year for the report is 2016 and the forecast period is 2017 to 2025.

Objectives of the Report

- To define, describe, and project (2017–2025) the market , by volume (million units) and value (USD million)

- To provide detailed information regarding the major factors such as drivers, restraints, opportunities, and industry-specific challenges impacting the growth of the tappet market market

- To analyze the market for automotive tappet and forecast the market size, by volume and value, based on type (flat and roller)

- To analyze the market for automotive tappet and forecast the market size, by volume and value, based on number of cylinders (<4 cylinders, 4–6 cylinders, >6 cylinders)

- To analyze the market for automotive tappet and forecast the market size, by volume and value, based on end-user (economic passenger cars, mid-priced passenger cars, and luxury passenger cars)

- To analyze the tappet market for automotive tappet and forecast the market size, by volume and value, based on vehicle type (Light duty vehicles and Heavy commercial vehicles)

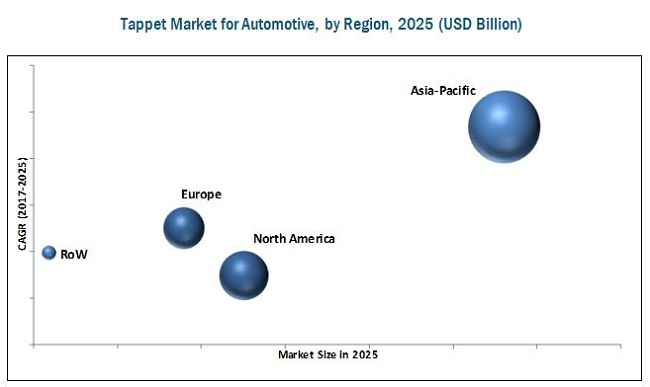

- To forecast the market size, by volume and value, of the market with respect to four regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

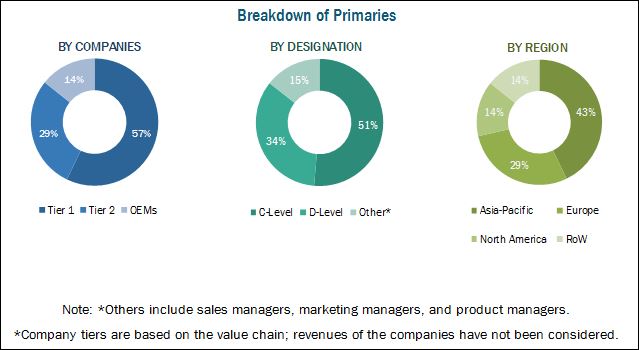

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

The research methodology used in the report involves primary and secondary sources and follows a bottom-up approach for the purpose of data triangulation. The study involves the country-level OEM and model-wise analysis of tappet market. This analysis involves historical trends as well as existing penetrations by country as well as vehicle type. The analysis is projected based on various factors such as growth trends in vehicle production and adoption rate by OEMs, among others. The analysis has been discussed and validated by primary respondents, which include experts from the automotive industry, manufacturers, and suppliers. Secondary sources include associations such as China Association of Automobile Manufacturers (CAAM), International Organization of Motor Vehicle Manufacturers (OICA), European Automobile Manufacturers Association (ACEA), Environmental Protection Agency (EPA), Society of Indian Automobile Manufacturers (SIAM), SAE International, and paid databases and directories such as Factiva.

The figure below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the tappet market for automotive consists of automotive tappet manufacturers such as Schaeffler (Germany), SKF (Sweden), Eaton (Ireland), Federal-Mogul (US), Otics Corporation (Japan), and NSK (Japan). These manufacturers supply tappets to automotive OEMs such as Nissan (Japan), General Motors (US), Daimler AG (Germany), and others.

Target Audience

- Automotive Tappet Manufacturers

- Automotive Engine Manufacturers

- Automotive Camshaft Manufacturers

- Automotive Valve Manufacturers

- Industry Associations

- Raw Material Suppliers for Automotive Tappet Manufacturers

- The Automobile Industry as an End User, Traders, Distributors, and Suppliers of Automotive Tappets

Scope of the Report

Market, by Type

Market, by Engine Capacity

Market, by End User

Market, by Vehicle Type

Market, by Region

-

- Flat Tappet

- Roller Tappet

- <4 Cylinders engine

- 4–6 Cylinders engine

- >6 Cylinders Engine

- Economic passenger cars

- Luxury passenger cars

- Mid-priced passenger cars

- Heavy Commercial Vehicles

- Light Duty Vehicles

- Asia Pacific (China, India, Japan, South Korea, and Rest of Asia Pacific)

- Europe (Germany, France, Italy, UK, and Rest of Europe)

- North America (US, Mexico, and Canada)

- Rest of the World (Brazil, Russia, and South Africa)

Available Customizations

Roller Tappets Market, by Region

-

(Region include Asia-Pacific, Europe, North America, Rest of the World)

Market, By Engine Capacity, by Country

The tappet market is projected to grow at a CAGR of 3.36% from 2017 to 2025, to reach a market size of USD 10.11 Billion by 2025. The market growth is primarily driven by an increase in passenger vehicles production. Also, the growth of the commercial vehicles segment, which can be attributed to the improving business environment for fleet operators and a rise in demand from the construction and mining sectors, drives the growth of the market.

Roller tappets are estimated to be the fastest growing segment of the global market. The growing trend of engine downsizing without compromising the performance of the engine is driving the market for roller tappets.

The 4–6 cylinder segment is estimated to be the largest segment of the tappet market for automotive, by engine capacity. Stringent emission regulations in several regions and the demand for high-performance vehicles with the smaller engine are the major factors driving the growth of the 4–6 cylinders segment.

Luxury passenger cars are estimated to be the fastest growing segment of the market, by end user type. The growth of this segment can be attributed to a significant number of luxury vehicles in Europe and North America and increasing demand for these vehicles in Asia Pacific owing to increasing purchasing power and demand for more powerful vehicles.

Asia Pacific is estimated to dominate the tappet market by volume as well as value. The region comprises countries such as China and India, which are witnessing a huge demand for passenger and commercial vehicles. The demand for automotive tappets is directly linked to the vehicle production and consumer demand in this region. Also, favorable government policies for the manufacturers and infrastructural developments have boosted the demand for passenger cars and commercial vehicles, which is further expected to boost the growth of the automotive market in this region.

A key factor restraining the growth of the tappet market market is the increasing adoption of electric vehicles. Unlike ICE, an electric engine does not require the automotive tappet, as there are no inlet and outlet valves. Several OEMs are focusing on the development of alternative fuel type powertrain technologies to meet the stringent emission regulations set by the government and, more importantly, hold a competitive advantage in the market. Some of the key market players in the market are Schaeffler (Germany), SKF (Sweden), Eaton (Ireland), Federal-Mogul (US), Otics Corporation (Japan), and NSK (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Tappet Market Definition

1.3 Market Scope

1.3.1 Years Considered in the Study

1.4 Currency and Pricing

1.5 Units Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand-Side Analysis

2.4.2.1 Growing Vehicle Production

2.4.3 Supply-Side Analysis

2.4.3.1 Significant Focus By OEMS on Improving Engine Performance

2.5 Tappet Market Size Estimation

2.6 Data Triangulation

2.7 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Market

4.2 Tappet Market, By Region

4.3 Market, By Country

4.4 Market, By End-User

4.5 Market, By Engine Capacity

4.6 Market, By Type

4.7 Market, By Vehicle Type

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Tappet Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for High-Performance Vehicles

5.2.2 Restraints

5.2.2.1 Increasing Popularity of Electric and Hybrid Vehicles

5.2.2.2 Growing Demand for Camless Actuation

5.2.3 Opportunities

5.2.3.1 Growing Market for Machined Tappets

5.2.4 Challenges

5.2.4.1 Environmental Awareness has Led OEMS to Make Smaller and Cleaner Internal Combustion Engines

5.2.4.2 Increasing Share of Alternative Fuel Type Engine

6 Technological Overview (Page No. - 44)

6.1 Introduction

6.2 Types and Mechanisms of Tappet, 2017

6.2.1 Types of Tappets

6.2.2 Tappet Mechanism

6.2.2.1 Mechanical Flat Tappet

6.2.2.2 Hydraulic Flat Tappet

6.2.2.3 Mechanical Roller Tappet

6.2.2.4 Hydraulic Roller Tappet

6.3 Product Lifecycle Curve, Automotive Tappet,

6.3.1 The Tappet Market Product Lifecycle, 2017

6.3.2 The Market Product Lifecycle, 2025

7 Market, By Type (Page No. - 49)

7.1 Introduction

7.2 Flat Tappets

7.3 Roller Tappets

8 Market, By Engine Capacity (Page No. - 55)

8.1 Introduction

8.2 <4 Cylinders

8.3 4–6 Cylinders

8.4 >6 Cylinders

9 Market, By End User (Page No. - 61)

9.1 Introduction

9.2 Economic Passenger Cars

9.3 Luxury Passenger Cars

9.4 Mid-Priced Passenger Cars

10 Market, By Region (Page No. - 66)

10.1 Introduction

10.1.1 Asia Pacific

10.1.1.1 China

10.1.1.2 India

10.1.1.3 Japan

10.1.1.4 South Korea

10.1.1.5 Rest of Asia Pacific

10.1.2 Europe

10.1.2.1 France

10.1.2.2 Germany

10.1.2.3 Italy

10.1.2.4 UK

10.1.2.5 Rest of Europe

10.1.3 North America

10.1.3.1 Canada

10.1.3.2 Mexico

10.1.3.3 US

10.1.4 Rest of the World

10.1.4.1 Brazil

10.1.4.2 Russia

10.1.4.3 South Africa

11 Competitive Landscape (Page No. - 89)

11.1 Introduction

11.2 Tappet Market Ranking Analysis

11.3 Business Strategy Landscape

11.3.1 Introduction

12 Company Profiles (Page No. - 93)

(Business Overview, Product Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Schaeffler

12.2 Eaton

12.3 Federal-Mogul

12.4 Rane Engine Valve

12.5 NSK

12.6 SKF

12.7 Otics Corporation

12.8 Riken

12.9 Comp Cams

12.10 SM Motorenteile

12.11 Lunati

12.12 Jinan Worldwide Auto-Accessory

*Details on Business Overview, Product Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 112)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.5.1 Roller Tappet Market, By Region

13.5.1.1 Asia Pacific

13.5.1.2 Europe

13.5.1.3 North America

13.5.1.4 Rest of the World

13.5.2 Market By Engine Capacity, By Country

13.6 Related Reports

13.7 Author Details

List of Tables (64 Tables)

Table 1 Currency Exchange Rates (W.R.T. USD)

Table 2 Tappet Market By Type, 2015–2025 (Million Units)

Table 3 Market By Type, 2015–2025 (USD Million)

Table 4 Flat Tappet: Market By Region, 2015–2025 (Million Units)

Table 5 Flat Tappet: Market By Region, 2015–2025 (USD Million)

Table 6 Roller Tappet: Market By Region, 2015–2025 (Million Units)

Table 7 Roller Tappet: Market By Region, 2015–2025 (USD Million)

Table 8 Market By Engine Capacity, 2015–2025 (Million Units)

Table 9 Market By Engine Capacity, 2015–2025 (USD Million)

Table 10 <4 Cylinders: Market By Region, 2015–2025 (Million Units)

Table 11 <4 Cylinders: Market By Region, 2015-2025 (USD Million)

Table 12 4–6 Cylinders: Market By Region, 2015–2025 (Million Units)

Table 13 4–6 Cylinders: Market By Region, 2015–2025 (USD Million)

Table 14 > 6 Cylinders: Market By Region, 2015–2025 (Million Units)

Table 15 > 6 Cylinders: Market By Region, 2015–2025 (USD Million)

Table 16 Market By End-User, for Passenger Cars, 2015–2025 (Million Units)

Table 17 Economic Passenger Cars: Tappet Market By Region, 2015–2025 (Million Units)

Table 18 Luxury Passenger Cars: Market By Region, 2015–2025 (Million Units)

Table 19 Mid-Segment Vehicles: Market By Region, 2015–2025 (Million Units)

Table 20 Market By Vehicle Type, 2015–2025 (Million Units)

Table 21 Market By Vehicle Type, 2015–2025 (USD Million)

Table 22 Market By Region, 2015–2025 (Million Units)

Table 23 Market By Region, 2015–2025 (USD Million)

Table 24 Asia Pacific: Market By Country, 2015–2025 (Million Units)

Table 25 Asia Pacific: Market By Country, 2015–2025 (USD Million)

Table 26 China: Market By Vehicle Type, 2015–2025 (Million Units)

Table 27 China: Market By Vehicle Type, 2015–2025 (USD Million)

Table 28 India: Market By Vehicle Type, 2015–2025 (Million Units)

Table 29 India:Market By Vehicle Type, 2015–2025 (USD Million)

Table 30 Japan: Tappet Market By Vehicle Type, 2015–2025 (Million Units)

Table 31 Japan: Market By Vehicle Type, 2015–2025 (USD Million)

Table 32 South Korea: Market By Vehicle Type, 2015–2025 (Million Units)

Table 33 South Korea: Market By Vehicle Type, 2015–2025 (USD Million)

Table 34 Rest of Asia Pacific: Market By Vehicle Type, 2015–2025 (Million Units)

Table 35 Rest of Asia Pacific: Market By Vehicle Type, 2015–2025 (USD Million)

Table 36 Europe: Market By Country, 2015–2025 (Million Units)

Table 37 Europe: Market By Country, 2015–2025 (USD Million)

Table 38 France: Market By Vehicle Type, 2015–2025 (Million Units)

Table 39 France: Market By Vehicle Type, 2015–2025 (USD Million)

Table 40 Germany: Market By Vehicle Type, 2015–2025 (Million Units)

Table 41 Germany: Market By Vehicle Type, 2015–2025 (USD Million)

Table 42 Italy: Tappet Market By Vehicle Type, 2015–2025 (Million Units)

Table 43 Italy: Market By Vehicle Type, 2015–2025 (USD Million)

Table 44 UK: Market By Vehicle Type, 2015–2025 (Million Units)

Table 45 UK: Market By Vehicle Type, 2015–2025 (USD Million)

Table 46 Rest of Europe: Market By Vehicle Type, 2015–2025 (Million Units)

Table 47 Rest of Europe: Market By Vehicle Type, 2015–2025 (USD Million)

Table 48 North America: Market By Country, 2015–2025 (Million Units)

Table 49 North America: Market By Country, 2015–2025 (USD Million)

Table 50 Canada: Market By Vehicle Type, 2015–2025 (Million Units)

Table 51 Canada: Market By Vehicle Type, 2015–2025 (USD Million)

Table 52 Mexico: Market By Vehicle Type, 2015–2025 (Million Units)

Table 53 Mexico: Market By Vehicle Type, 2015–2025 (USD Million)

Table 54 US: Market By Vehicle Type, 2015–2025 (Million Units)

Table 55 US:Market By Vehicle Type, 2015–2025 (USD Million)

Table 56 Rest of the World (RoW): Market By Country, 2015–2025 (Million Units)

Table 57 Rest of the World (RoW): Market By Country, 2015–2025 (USD Million)

Table 58 Brazil: Market By Vehicle Type, 2015–2025 (Million Units)

Table 59 Brazil: Market By Vehicle Type, 2015–2025 (USD Million)

Table 60 Russia: Market By Vehicle Type, 2015–2025 (Million Units)

Table 61 Russia: Market By Vehicle Type, 2015–2025 (USD Million)

Table 62 South Africa: Tappet Market By Vehicle Type, 2015–2025 (Million Units)

Table 63 South Africa: Market By Vehicle Type, 2015–2025 (USD Million)

Table 64 Competitive Business Strategy Landscape

List of Figures (45 Figures)

Figure 1 Tappet Market : Markets Covered

Figure 2 Market : Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Growing Vehicle Production & Sales to Drive the Market , 2010–2021

Figure 6 Market : Bottom-Up Approach

Figure 7 Market : Top-Down Approach

Figure 8 Data Triangulation

Figure 9 Asia Pacific Region to Hold the Largest Share in the Market , 2017–2025 (USD Million)

Figure 10 Flat Tappet Market is the Largest Segment of Market, 2017–2025 (USD Million)

Figure 11 4–6 Cylinders to Hold the Largest Share of the Market, 2017 vs 2025 (Value)

Figure 12 Mid-Priced Passenger Cars to Dominate the Market, 2017 vs 2025 (Volume)

Figure 13 Light Duty Vehicles Segment is Expected to Lead the Market, 2017 vs 2025 (Value)

Figure 14 Rising Vehicle Demand and Production to Drive the Market

Figure 15 Asia Pacific Holds the Largest Share of the Market in 2017 (Value)

Figure 16 Indian Market for Tappet to Grow at the Highest CAGR During the Forecast Period (Value)

Figure 17 Mid-Priced Passenger Car is Estimated to Hold the Largest Market Share During the Forecast Period, 2017 vs 2025 (Volume)

Figure 18 Tappet Market for 4–6 Cylinder Engine Capacity is Expected to Have the Largest Market Size During the Forecast Period, 2017 vs 2025 (Value)

Figure 19 Flat Tappet Segment is Expected to Lead the Market During the Forecast Period, 2017 vs 2025 (Value)

Figure 20 Light Duty Vehicles Segment is Expected to Hold the Largest Market Size, 2017 vs 2025 (Value)

Figure 21 Increase in Demand for Bevs, 2017 – 2022

Figure 22 on Road Light and Heavy-Duty Vehicle Emission Regulation Outlook

Figure 23 Market By Type, 2017 vs 2025 (Million Units)

Figure 24 Market By Engine Capacity, 2017 vs 2025 (Million Units)

Figure 25 Market By End-User, 2017 vs 2025 (Million Units)

Figure 26 Market By Region, 2017 vs 2025

Figure 27 Asia Pacific: Market Snapshot

Figure 28 Europe: Market By Country, 2017 vs 2025 (Million Units)

Figure 29 North America: Market Snapshot

Figure 30 Rest of the World (RoW): Tappet, By Country, 2017 vs 2025 (Million Units)

Figure 31 Key Developments By Leading Players in Market 2013 to 2017

Figure 32 Tappet Market Ranking: 2016

Figure 33 Schaeffler: Company Snapshot (2016)

Figure 34 Schaeffler: SWOT Analysis

Figure 35 Eaton: Company Snapshot (2016)

Figure 36 Eaton: SWOT Analysis

Figure 37 Federal-Mogul: Company Snapshot (2016)

Figure 38 Federal-Mogul: SWOT Analysis

Figure 39 Rane Engine Valve: Company Snapshot (2016)

Figure 40 Rane Engine Valve: SWOT Analysis

Figure 41 NSK: Company Snapshot (2016)

Figure 42 NSK: SWOT Analysis

Figure 43 SKF: Company Snapshot (2016)

Figure 44 Otics Corporation: Company Snapshot (2016)

Figure 45 Riken: Company Snapshot (2016)

Growth opportunities and latent adjacency in Tappet Market