Gasoline Direct Injection Market by Engine (I3, I4, V6, V8), Component (Fuel Injector, Rail, Pump, Sensor, ECU), Vehicle Type (Hatchback, Sedan, SUV/MPV), Hybrid Vehicles, Technology (Gasoline Turbocharger, GPF) & Region - Global Forecast to 2027

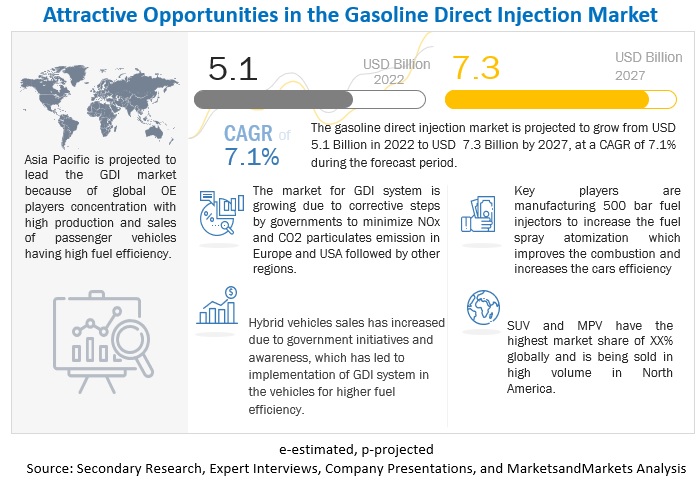

The global gasoline direct injection market size was valued at USD 5.1 billion in 2022 and is expected to reach USD 7.3 billion by 2027 at a CAGR of 7.1% during the forecast period 2022-2027. The market is driven by factors such as CO2 reduction targets, cost-effectiveness over diesel direct injection, and an increasing trend of engine downsizing. However, factors that can hinder the market growth are the high cost of gasoline direct injection and the increasing use of battery electric vehicles (BEV). Moreover, technological advancements such as turbo gasoline direct injection, gasoline direct injection for hybrid electric vehicles (HEV) and plug-in hybrid electric vehicles (PHEV), and emissions norms in various countries are anticipated to create immense opportunities for the growth of gasoline direct injection.

To know about the assumptions considered for the study, Request for Free Sample Report

Gasoline Direct Injection Market Dynamics

DRIVER: Growing trends of engine downsizing

Engine downsizing can be a reduction in engine size (cubic capacity) or the number of cylinders (for instance, downsizing from the V8 engine to V6) to achieve higher fuel economy and lower emissions. Many OEMs are downsizing their engines to increase fuel economy. As seen in the following table, downsizing has resulted in a significant increase in fuel economy for various models and drivetrains.

Reduction in engine size has increased fuel economy. Ford has also introduced a new 1.0-liter EcoBoost engine for its 2017 vehicle line-up. This 1-liter, 3-cylinder engine can deliver a fuel economy of 29–33 MPG. This is >30% increase over the 2.7-liter engine from 2015.

The engine uses a gasoline turbocharger, which helps to push more air into the engine, increasing the power and efficiency of the engine. Hence, using GDI technology in association with turbocharger would help achieve effective downsizing. This would be more effective in countries like the US, China, and Japan, where the percentage of gasoline cars is >90%.

As GDI is an essential system required for engine downsizing, the growth in the global engine downsizing trend would increase the demand for direct gasoline injections.

RESTRAINT: High Cost of GDI Engines as compared with port fuel injection

Gasoline direct injection systems are complex and costlier than the port fuel injection (PFI) systems they replace. Port fuel injection systems inject the fuel into the intake manifold. They do not require advanced components such as high-pressure pumps, high-pressure common rail, and related technologies like turbochargers and gasoline particulate filters. Due to the addition of these components, Gasoline direct injections are more expensive than port fuel injection systems.

Globally, 45–50% of cars run on gasoline fuel, which is higher in countries such as the US, China, and Japan. With light trucks equipped with gasoline engines, the US currently has one of the highest penetrations of Gasoline direct injections. However, the high cost of Gasoline direct injection engines may limit their growth in countries such as China and India. Hence, OEMs prefer PFI instead of Gasoline direct injection engines in developing countries. While GDI engines offer greater fuel economy, many buyers may ignore this technology due to its higher cost than PFI systems. This restraint would have a short-term impact on the gasoline direct injection market for 5–7 years. With the advancement of technology, the price of Gasoline direct injections is expected to reduce in the near future.

As a result of the high price of gasoline direct injection, many car buyers prefer to buy cars with port fuel injection. As a result, the high price of Gasoline direct injections is a restraint for the growth of the technology.

OPPORTUNITY High-pressure injectors

The current pressure limit for gasoline injectors is 200 bar. Manufacturers are trying to increase the pressure limit to 500 bar to provide cleaner combustion and increase fuel efficiency. As the pressure increases, the spray atomization of the fuel increases, which ultimately improves the combustion characteristics of the Gasoline direct injection. Finer the spray pattern, the more complete the combustion and fuel efficiency increase. Magneti Marelli is developing injectors to work pressure of 350 to 500 bar. Delphi already has a fuel injector with a pressure limit of 400 bar in its product portfolio. In 2021, Magneti Marelli (Italy) developed a new very-high-pressure gasoline direct injection fuel system capable of reaching a 1,000-bar pressure level. The company developed a complete system, including a pump, fuel rail, and an electronic control unit, to result in higher fuel efficiency and cleaner combustion. In December 2021, Stanadyne (US) developed a gasoline direct injection fuel injector that delivers 1,000 bar of pressure. According to industry experts, higher injection pressures can help engine designers reduce tailpipe emissions for upcoming EU7 and SULEV regulations. The injectors would result in higher combustion pressure and, as a result, would enable vehicles to reduce fuel consumption and reduce emissions.

From now on, injectors with pressures >200 bar will be the new norm. Hence, there will be an opportunity for Tier 1 manufacturers and OEMs to work in that direction.

CHALLENGE: High carbon deposits

GDI engines operate at higher temperatures and pressure, which results in high carbon deposits around the injectors and valves. Direct injectors are prone to carbon build-up and are affected by the hostile environment in the combustion chamber and ethanol, hydrocarbons, and additives, which form a part of today’s fuels.

Depending on the engine requirements, this injector style can have varying spray patterns. All direct injectors will atomize a much smaller fuel droplet size than a normal MPI injector. A conventional injector would have a fuel droplet size of +/- 165 microns, whereas some GDI injectors would produce a fuel droplet of only +/- 65 microns. Hence, carbon build-up will result in poor performance and, at times, the engine not starting.

As a result, inspecting and cleaning the fuel injectors at regular intervals becomes very important. This results in higher maintenance costs and an increase in the overall cost of ownership. The high maintenance cost of GDI engines is one of the major reasons consumers don’t prefer to own GDI-equipped cars.

Hence, the high carbon build-up and maintenance cost is expected to restrict the gasoline direct injection market growth.

The sensors segment is expected to grow at the highest growth rate during the forecast period

The number of sensors used depends on the engine size. For example, the I4 engine uses four basic sensors. In the case of V6 and V8 engines, the number of sensors goes up to six and seven, respectively. Again, in V10 and V12 engines, the average number of sensors is nine. As the engine size increases, the applications of advanced sensors also increase. Shortly, the number of sensors used in I3 and I4 engines will likely increase due to engine downsizing without compromising engine power. Bosch (Germany) introduced Lambda sensors in 1976. With timely modification and upgradation, it meets the demands of current emission standards set by many governing bodies. Bosch Lambda sensors cover 85% of UK car parc. On 1st November 2019, SST Zirconia (USA) launched its new oxygen sensor, OXY-02S-FR_T2-18BM-C, which controls the air-fuel ratio before injecting the gasoline into the IC engine.

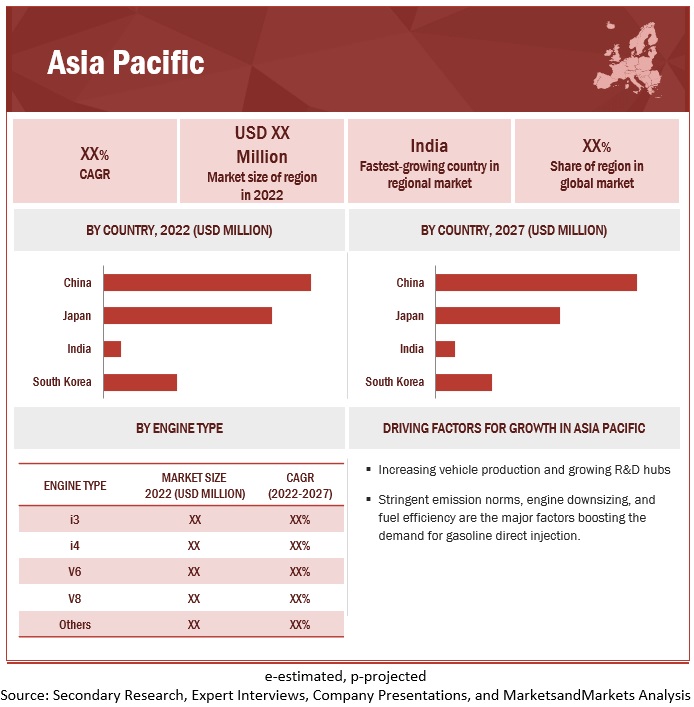

Asia Pacific is estimated to be the largest market in 2021

The study scope considers the Asia Pacific region comprising of countries - China, India, Japan, and South Korea. In 2022, the Asia Pacific region accounted for >45% share of the global gasoline direct injection market in value. Increased vehicle production in China, India, and Japan contributed to the market's growth. According to MarketsandMarkets analysis and validations from primary respondents, Asia Pacific is estimated to be the largest market for small passenger cars, backed by strong demand in the automotive industry. The growth of the vehicle type segment will positively influence the market in the region. The increasing demand for fuel-efficient vehicles to comply with stringent emission norms will drive the market.

China was also the major contributor to the overall gasoline direct injection sales (approximately 44%) in the Asia Pacific region in 2021.

China is estimated to dominate the Asia Pacific gasoline direct injection market during the forecast period. China is the world’s largest vehicle manufacturer. Thus, China's gasoline direct injections market is estimated to grow at a high rate. The upcoming emission regulations will increase the maintenance cost of diesel vehicles. Due to this, the preference for gasoline vehicles in the region would increase further. OEMs will adopt the GDI system to meet the BS 6/China 6 emission regulations, which will also help improve the engine performance. The government in China has taken steps to promote fuel economy and reduce CO2 emissions by incorporating TGDI technology in vehicles owing to the rising pollution in China. Automobile sales in China are expected to reach 24 million by 2024, with 54% of vehicles equipped with TGDI. Thus, the region is estimated to dominate the market with a 47% share in 2021.

To know about the assumptions considered for the study, download the pdf brochure

Scope of the Report

|

Report Metrics |

Details |

| Base year for estimation | 2022 |

| Forecast period | 2022–2027 |

| Market Growth and Revenue forecast | USD 5.1 Billion in 2022 to USD 7.3 Billion by 2027 and a CAGR of 7.1% during the forecast period 2022 to 2027 |

| Top Players | Robert Bosch GmbH (Germany), Denso (Japan), Hitachi (Japan), BorgWarner Inc. (US), and Magneti Marelli (Italy). |

| Fastest Growing Market | Asia Pacific |

| Segments covered | |

| By Component | ECUs, Fuel Injectors, Fuel Rail, Fuel Pumps, and Sensors |

| By Engine Type | I3, I4, V6, V8, and Other Engine Types |

| By Vehicle Type | Hatchback, Sedan, and SUV/MPV |

| By Hybrid Vehicles | HEV and PHEV |

| Gasoline Support Technologies market, by region | Asia Pacific, North America, Europe, and Rest of the World |

| By Region | Asia Pacific, North America, Europe, and Rest of the World |

| Additional Customization to be offered | Gasoline Direct Injection by Type, Gasoline Direct Injection by Passenger Car Type and Country |

The study segments the gasoline direct injection market:

By Vehicle Type

- Hatchback

- Sedan

- SUV/MPV

By Engine Type

- I3

- I4

- V6

- V8

- other engine types

By Component

- ECUs

- Fuel Injectors

- Fuel Rails

- Fuel Pumps

- Sensors

By Hybrid Vehicles

- Hybrid Electric Vehicle (HEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

Gasoline Support Technologies market

- Gasoline Turbocharger

- Gasoline Particulate Filter

By Region

- Asia Pacific

- Europe

- North America

- RoW

Key Market Players

The gasoline direct injection market is dominated by a few globally established companies such as Robert Bosch GmbH (Germany), Denso (Japan), Hitachi (Japan), BorgWarner Inc. (US), and Magneti Marelli (Italy). These companies adopted new product launches, partnerships, and joint ventures to gain traction in the gmarket.

Recent Developments

- In October 2022, Magneti Marelli showcased its new advanced technologies at the International Suppliers Fair (IZB) in Germany. The company showcased emission reduction solutions, integrating competencies from after-treatment and powertrain systems.

- In September 2022, Stanadyne developed its new alternative fuel injector for medium-duty and heavy-duty commercial vehicle powertrains. The company developed a multipurpose port injector for delivering hydrogen, compressed natural gas, and dimethyl ether (DME) fuels.

- In September 2022, Stanadyne developed its new Electrified GDI (Gasoline Direct Injection) fuel pump as part of its approach to fuel delivery system technology based on electrification. The new pump can be powered by 24- and 48-volt vehicle architectures and is decoupled from the internal combustion engine drivetrain.

- In February 2022, BorgWarner Inc. developed a new hydrogen injection system. The company is developing hydrogen components for low, medium, and high-pressure environments, including port fuel injection and direct injection solutions.

- In December 2021, Marelli Automotive Lighting Xiaogan., a subsidiary of Magneti Marelli, announced the signing of a partnership agreement with Chang’an to set up a joint innovation center to develop advanced technologies and strengthen the cooperation relationship between Chang’an and Marelli.

- In November 2021, Robert Bosch Gmbh announced a joint venture with the commercial vehicle manufacturer, Qingling Motors, to establish the Bosch Hydrogen Powertrain Systems in Chongqing, China.

- In January 2021, Hitachi Automotive Systems, Ltd., Keihin Corporation, Showa Corporation, and Nissin Kogyo Co., Ltd integrated to form Hitachi Astemo, Ltd., a leading provider of mobility solutions to the automotive industry. The word Astemo is derived from "Advanced Sustainable Technologies for Mobility" which provide a safe, sustainable, and comfortable mobility through technologies that contribute to an advanced and sustainable society.

- In October 2020, BorgWarner Inc. acquired Delphi Technologies, a leader in electronics and power electronics products for automotive applications. The acquisition helps the company to develop and enhance its product portfolio into propulsion products and systems across combustion, hybrid and electric vehicles.

Frequently Asked Questions (FAQ):

What is the current size of the global gasoline direct injection market?

The gasoline direct injection market is estimated to grow from USD 5.1 billion in 2022 to USD 7.3 billion by 2027 at a CAGR of 7.1% over the forecast period.

Which vehicle type is currently leading the global gasoline direct injection market?

The SUV/MPV segment is leading in the global gasoline direct injection market.

Many companies are operating in the global gasoline direct injection market space. Do you know who are the front leaders and what strategies have been adopted by them?

The gasoline direct injection market is dominated by a few globally established companies such as Robert Bosch GmbH (Germany), Denso (Japan), Hitachi (Japan), BorgWarner Inc. (US), and Magneti Marelli (Italy). These companies adopted new product launches, partnerships, and joint ventures to gain traction in the gasoline direct injection market

How does the global gasoline direct injection market demand vary by region?

With the high demand for fuel-efficient vehicles in developing countries and the rise in production and sales of passenger cars, the Asia Pacific region is predicted to lead the gasoline direct injection market with a CAGR of 7.3%. The stringent emission norms from this region and many sustainability initiatives by the government are some of the key reasons for this region to also have the largest market for gasoline direct injection, with USD XX million in 2027.

What are the growth opportunities for the global gasoline direct injection market supplier?

Growing demand for hybrid vehicles and high-pressure injectors would create growth opportunities for the gasoline direct injection market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 SUMMARY OF CHANGES

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 GASOLINE DIRECT INJECTION MARKET: RESEARCH DESIGN

FIGURE 2 RESEARCH METHODOLOGY

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources referred to for vehicle production

2.1.1.2 Key secondary sources referred to for market sizing

2.1.1.3 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

2.1.3 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.1.3.1 Primary participants

2.2 MNM KNOWLEDGESTORE

FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.3 MARKET: SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET:, BY VEHICLE TYPE & REGION

2.3.2 DEMAND- AND SUPPLY-SIDE ANALYSIS

2.4 MARKET: BREAKDOWN & DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 RESEARCH ASSUMPTIONS

TABLE 1 MARKET:: RESEARCH ASSUMPTIONS

2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 45)

3.1 REPORT SUMMARY

FIGURE 7 GASOLINE DIRECT INJECTION MARKET OVERVIEW

FIGURE 8 MARKET:, BY REGION, 2022 & 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN GASOLINE DIRECT INJECTION GASOLINE DIRECT INJECTION MARKET:

FIGURE 9 REGULATIONS ASSOCIATED WITH EMISSIONS AND FUEL ECONOMY TO RAISE DEMAND FOR GASOLINE DIRECT INJECTIONS

4.2 MARKET:, BY COMPONENT

FIGURE 10 IMPROVED FEATURES IN VEHICLES TO DRIVE DEMAND FOR SENSORS DURING FORECAST PERIOD

4.3 MARKET:, BY ENGINE TYPE

FIGURE 11 I4 ENGINE TO SURPASS OTHER ENGINES DUE TO INCREASED SALES OF SUV AND SEDAN CARS

4.4 MARKET:, BY VEHICLE TYPE

FIGURE 12 HATCHBACK TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.5 MARKET:, BY HYBRID VEHICLES

FIGURE 13 ASIA PACIFIC TO COMMAND HEV SEGMENT FROM 2022 TO 2027

4.6 GASOLINE SUPPORT TECHNOLOGIES MARKET, BY REGION

FIGURE 14 ASIA PACIFIC LEADS GASOLINE TURBOCHARGER MARKET DURING FORECAST PERIOD

4.7 MARKET:, BY REGION

FIGURE 15 ASIA PACIFIC IS ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

5 GASOLINE DIRECT INJECTION MARKET: OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

FIGURE 16 MARKET DYNAMICS

5.2 DRIVERS

5.2.1 STRINGENT REGULATIONS TO REDUCE C02 EMISSIONS

FIGURE 17 CAFE LIGHT-DUTY VEHICLE CO2 & FUEL ECONOMY TARGETS, 2016–2025

TABLE 2 CO2 REDUCTION TARGETS FOR KEY COUNTRIES

TABLE 3 IMPACT OF DIRECT FUEL INJECTION ON FUEL CONSUMPTION & CO2 EMISSIONS

5.2.2 COST-EFFECTIVENESS OF GDI OVER DIESEL DIRECT INJECTION

5.2.3 TREND OF ENGINE DOWNSIZING

TABLE 4 ENGINE DOWNSIZING, FORD F-150

5.3 RESTRAINTS

5.3.1 HIGH COST OF GASOLINE DIRECT INJECTIONS

5.4 OPPORTUNITIES

5.4.1 GROWING DEMAND FOR HYBRID VEHICLES

FIGURE 18 SALE OF HYBRID VEHICLES, 2020–2027

5.4.2 HIGH-PRESSURE INJECTORS

5.5 CHALLENGES

5.5.1 SYSTEM INTEGRATION

5.5.2 INCREASED PM/PN EMISSIONS

FIGURE 19 PARTICULATE EMISSION COMPARISON BETWEEN GDI & PFI

5.5.3 HIGH CARBON DEPOSITS

5.5.4 FUEL QUALITY

FIGURE 20 GASOLINE FUEL QUALITY, BY COUNTRY, 2021

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 IMPACT OF PORTER’S FIVE FORCES ANALYSIS

FIGURE 21 GASOLINE DIRECT INJECTION MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 TRADE ANALYSIS

5.7.1 EXPORT TRADE DATA

5.7.1.1 Germany

TABLE 6 GERMANY: GDI EXPORT, BY COUNTRY (VALUE %)

5.7.1.2 US

TABLE 7 US: GDI EXPORT, BY COUNTRY (VALUE %)

5.7.1.3 China

TABLE 8 CHINA: GDI EXPORT, BY COUNTRY (VALUE %)

5.7.2 IMPORT TRADE DATA

5.7.2.1 US

TABLE 9 US: GDI IMPORT, BY COUNTRY (VALUE %)

5.7.2.2 Germany

TABLE 10 GERMANY: GDI IMPORT, BY COUNTRY (VALUE %)

5.7.2.3 China

TABLE 11 CHINA: GDI IMPORT, BY COUNTRY (VALUE %)

5.8 GASOLINE DIRECT INJECTION: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.8.1 REVENUE SHIFT FOR GASOLINE DIRECT INJECTION MARKET

5.9 CASE STUDIES

5.9.1 SEA FOAM SPRAY PREVENTS CARBON BUILD-UP IN GDI ENGINES

5.9.2 BORGWARNER’S HYDROGEN INJECTION SYSTEM SUPPORTS CO2-FREE MOBILITY

5.9.3 ENGINE FUEL INJECTOR CHARACTERIZATION WITH LABVIEW

5.9.4 HIGH-PRECISION GRINDING OF FUEL INJECTION INDIGENIZED ON MGT’S CENTERLESS GRINDER

5.10 PATENT ANALYSIS

5.11 SUPPLY CHAIN ANALYSIS

FIGURE 22 SUPPLY CHAIN ANALYSIS

5.12 ECOSYSTEM MAP

FIGURE 23 MARKET: ECOSYSTEM

TABLE 12 ROLE OF COMPANIES IN GASOLINE DIRECT INJECTION ECOSYSTEM

5.13 REGULATORY ANALYSIS

5.13.1 EMISSION STANDARDS FOR PASSENGER CARS

5.13.1.1 European Union

TABLE 13 EUROPEAN UNION: GASOLINE ENGINE EMISSION STANDARDS FOR PASSENGER CARS (G/KM)

5.13.1.2 China

TABLE 14 CHINA: GASOLINE ENGINE EMISSION LIMITS

5.13.1.3 India

TABLE 15 INDIA: GASOLINE ENGINE EMISSION LIMITS

5.13.2 FUEL ECONOMY NORMS

5.13.2.1 US

TABLE 16 US: CAFE STANDARDS (MILES PER GALLON), 2019–2025

5.13.2.2 Europe

5.13.2.3 China

5.13.2.4 India

5.13.3 EUROPE: PETROL VS. DIESEL PASSENGER CARS SHARE (%)

FIGURE 24 TREND OF GASOLINE PASSENGER CARS IN EUROPE, 2018–2021

5.14 PRICING ANALYSIS

5.14.1 ASP ANALYSIS

TABLE 17 AVERAGE REGIONAL PRICE TREND: GASOLINE DIRECT INJECTION, BY ENGINE TYPE (USD/UNIT), 2021

5.15 TECHNOLOGY ANALYSIS

5.15.1 TURBOCHARGED DIRECT INJECTION HYDROGEN ENGINE

5.16 KEY CONFERENCES AND EVENTS, 2022–2023

5.17 KEY STAKEHOLDERS AND BUYING CRITERIA

5.17.1 KEY STAKEHOLDERS

TABLE 18 INFLUENCE OF STAKEHOLDERS ON PURCHASE OF GASOLINE DIRECT INJECTION (%)

5.17.2 BUYING CRITERIA

FIGURE 25 KEY BUYING CRITERIA FOR MARKET

TABLE 19 KEY BUYING CRITERIA FOR GASOLINE DIRECT INJECTION

6 GASOLINE DIRECT INJECTION MARKET, BY COMPONENT (Page No. - 80)

6.1 INTRODUCTION

6.1.1 RESEARCH METHODOLOGY

6.1.2 ASSUMPTIONS

FIGURE 26 GASOLINE DIRECT INJECTION MARKET, BY COMPONENT, 2022 VS. 2027

TABLE 20 MARKET, BY COMPONENT, 2018–2021 (MILLION UNITS)

TABLE 21 MARKET, BY COMPONENT, 2022–2027 (MILLION UNITS)

TABLE 22 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 23 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 FUEL INJECTORS

TABLE 24 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 25 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 26 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 27 MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 ENGINE CONTROL UNITS (ECUS)

TABLE 28 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 29 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 30 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 SENSORS

TABLE 32 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 33 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 34 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 35 MARKET, BY REGION, 2022–2027 (USD MILLION)

6.5 FUEL RAILS

TABLE 36 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 37 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 38 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 MARKET, BY REGION, 2022–2027 (USD MILLION)

6.6 FUEL PUMPS

TABLE 40 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 41 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 42 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 MARKET, BY REGION, 2022–2027 (USD MILLION)

7 MARKET, BY ENGINE TYPE (Page No. - 93)

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS

FIGURE 27 GASOLINE DIRECT INJECTION MARKET, BY ENGINE TYPE, 2022 VS. 2027

TABLE 44 MARKET, BY ENGINE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 45 MARKET, BY ENGINE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 46 MARKET, BY ENGINE TYPE, 2018–2021 (USD MILLION)

TABLE 47 MARKET, BY ENGINE TYPE, 2022–2027 (USD MILLION)

7.2 I3

TABLE 48 I3: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 49 I3: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 50 I3: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 I3: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 I4

TABLE 52 I4: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 53 I4: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 54 I4: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 I4: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 V6

TABLE 56 V6: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 57 V6: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 58 V6: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 V6: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 V8

TABLE 60 V8: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 61 V8: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 62 V8: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 V8: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 OTHER ENGINE TYPES

TABLE 64 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 65 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 66 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 67 MARKET, BY REGION, 2022–2027 (USD MILLION)

8 GASOLINE DIRECT INJECTION MARKET, BY VEHICLE TYPE (Page No. - 103)

8.1 INTRODUCTION

FIGURE 28 GASOLINE DIRECT INJECTION MARKET, BY VEHICLE TYPE, 2022 VS. 2027

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS

TABLE 68 MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 69 MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 70 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 71 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

8.2 HATCHBACK

TABLE 72 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 73 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 74 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 SEDAN

TABLE 76 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 77 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 78 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 79 MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 SUV/MPV

TABLE 80 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 81 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 82 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 83 SUV/MPV: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 MARKET, BY HYBRID VEHICLES (Page No. - 112)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS

FIGURE 29 GASOLINE DIRECT INJECTION MARKET FOR HYBRID VEHICLES, BY REGION, 2022 VS. 2027

TABLE 84 MARKET FOR HYBRID VEHICLES, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 85 MARKET FOR HYBRID VEHICLES, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 86 MARKET FOR HYBRID VEHICLES, BY REGION, 2018–2021 (USD MILLION)

TABLE 87 MARKET FOR HYBRID VEHICLES, BY REGION, 2022–2027 (USD MILLION)

9.2 HYBRID ELECTRIC VEHICLE (HEV)

TABLE 88 HEV: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 89 HEV: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 90 HEV: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 91 HEV: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 PLUG-IN ELECTRIC VEHICLE (PHEV)

TABLE 92 PHEV: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 93 PHEV: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 94 PHEV: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 95 PHEV: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 GASOLINE SUPPORT TECHNOLOGIES MARKET, BY REGION (Page No. - 120)

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS

FIGURE 30 GASOLINE DIRECT INJECTION MARKET, BY REGION, 2022 VS. 2027

TABLE 96 MARKET, BY TECHNOLOGY, 2018–2021 (THOUSAND UNITS)

TABLE 97 MARKET, BY TECHNOLOGY, 2022–2027 (THOUSAND UNITS)

TABLE 98 MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 99 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

10.2 GASOLINE TURBOCHARGER

TABLE 100 GASOLINE TURBOCHARGER MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 101 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 102 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 103 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 GASOLINE PARTICULATE FILTER (GPF)

TABLE 104 GASOLINE PARTICULATE FILTER MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 105 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 106 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 107 MARKET, BY REGION, 2022–2027 (USD MILLION)

11 MARKET, BY REGION (Page No. - 128)

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS

FIGURE 31 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

TABLE 108 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 109 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 110 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 111 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 ASIA PACIFIC

FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 112 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 113 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 114 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.1 CHINA

TABLE 116 CHINA: MARKET, BY ENGINE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 117 CHINA: MARKET, BY ENGINE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 118 CHINA: MARKET, BY ENGINE TYPE, 2018–2021 (USD MILLION)

TABLE 119 CHINA: MARKET, BY ENGINE TYPE, 2022–2027 (USD MILLION)

11.2.2 INDIA

TABLE 120 INDIA: MARKET, BY ENGINE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 121 INDIA: MARKET, BY ENGINE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 122 INDIA: MARKET, BY ENGINE TYPE, 2018–2021 (USD MILLION)

TABLE 123 INDIA: MARKET, BY ENGINE TYPE, 2022–2027 (USD MILLION)

11.2.3 JAPAN

TABLE 124 JAPAN: MARKET, BY ENGINE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 125 JAPAN: MARKET, BY ENGINE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 126 JAPAN: MARKET, BY ENGINE TYPE, 2018–2021 (USD MILLION)

TABLE 127 JAPAN: MARKET, BY ENGINE TYPE, 2022–2027 (USD MILLION)

11.2.4 SOUTH KOREA

TABLE 128 SOUTH KOREA: MARKET, BY ENGINE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 129 SOUTH KOREA: MARKET, BY ENGINE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 130 SOUTH KOREA: MARKET, BY ENGINE TYPE, 2018–2021 (USD MILLION)

TABLE 131 SOUTH KOREA: MARKET, BY ENGINE TYPE, 2022–2027 (USD MILLION)

11.3 NORTH AMERICA

FIGURE 33 NORTH AMERICA: MARKET SNAPSHOT

TABLE 132 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 133 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 134 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 135 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.1 US

TABLE 136 US: MARKET, BY ENGINE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 137 US: MARKET, BY ENGINE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 138 US: MARKET, BY ENGINE TYPE, 2018–2021 (USD MILLION)

TABLE 139 US: MARKET, BY ENGINE TYPE, 2022–2027 (USD MILLION)

11.3.2 CANADA

TABLE 140 CANADA: MARKET, BY ENGINE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 141 CANADA: MARKET, BY ENGINE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 142 CANADA: MARKET, BY ENGINE TYPE, 2018–2021 (USD MILLION)

TABLE 143 CANADA: MARKET, BY ENGINE TYPE, 2022–2027 (USD MILLION)

11.3.3 MEXICO

TABLE 144 MEXICO: MARKET, BY ENGINE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 145 MEXICO: MARKET, BY ENGINE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 146 MEXICO: MARKET, BY ENGINE TYPE, 2018–2021 (USD MILLION)

TABLE 147 MEXICO: MARKET, BY ENGINE TYPE, 2022–2027 (USD MILLION)

11.4 EUROPE

FIGURE 34 EUROPE: MARKET, BY COUNTRY, 2022 VS. 2027 (USD MILLION)

TABLE 148 EUROPE: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 149 EUROPE: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 150 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 151 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.1 GERMANY

TABLE 152 GERMANY: MARKET, BY ENGINE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 153 GERMANY: MARKET, BY ENGINE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 154 GERMANY: MARKET, BY ENGINE TYPE, 2018–2021 (USD MILLION)

TABLE 155 GERMANY: MARKET, BY ENGINE TYPE, 2022–2027 (USD MILLION)

11.4.2 UK

TABLE 156 UK: MARKET, BY ENGINE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 157 UK: MARKET, BY ENGINE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 158 UK: MARKET, BY ENGINE TYPE, 2018–2021 (USD MILLION)

TABLE 159 UK: MARKET, BY ENGINE TYPE, 2022–2027 (USD MILLION)

11.4.3 FRANCE

TABLE 160 FRANCE: MARKET, BY ENGINE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 161 FRANCE: MARKET, BY ENGINE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 162 FRANCE: MARKET, BY ENGINE TYPE, 2018–2021 (USD MILLION)

TABLE 163 FRANCE: MARKET, BY ENGINE TYPE, 2022–2027 (USD MILLION)

11.4.4 SPAIN

TABLE 164 SPAIN: MARKET, BY ENGINE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 165 SPAIN: MARKET, BY ENGINE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 166 SPAIN: MARKET, BY ENGINE TYPE, 2018–2021 (USD MILLION)

TABLE 167 SPAIN: MARKET, BY ENGINE TYPE, 2022–2027 (USD MILLION)

11.5 ROW

FIGURE 35 ROW: MARKET, BY COUNTRY, 2022 VS. 2027 (USD MILLION)

TABLE 168 ROW: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 169 ROW: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 170 ROW: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 171 ROW: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.5.1 BRAZIL

TABLE 172 BRAZIL: MARKET, BY ENGINE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 173 BRAZIL: MARKET, BY ENGINE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 174 BRAZIL: MARKET, BY ENGINE TYPE, 2018–2021 (USD MILLION)

TABLE 175 BRAZIL: MARKET, BY ENGINE TYPE, 2022–2027 (USD MILLION)

11.5.2 RUSSIA

TABLE 176 RUSSIA: MARKET, BY ENGINE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 177 RUSSIA: MARKET, BY ENGINE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 178 RUSSIA: MARKET, BY ENGINE TYPE, 2018–2021 (USD MILLION)

TABLE 179 RUSSIA: MARKET, BY ENGINE TYPE, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 163)

12.1 OVERVIEW

12.2 GASOLINE DIRECT INJECTION MARKET SHARE ANALYSIS, 2021

TABLE 180 MARKET SHARE ANALYSIS, 2021

FIGURE 36 MARKET SHARE, 2021

12.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

FIGURE 37 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2019–2021

12.4 COMPANY EVALUATION QUADRANT: GASOLINE DIRECT INJECTION MANUFACTURERS

12.4.1 STARS

12.4.2 EMERGING LEADERS

12.4.3 PERVASIVE PLAYERS

12.4.4 PARTICIPANTS

TABLE 181 MARKET: COMPANY PRODUCT FOOTPRINT, 2021

TABLE 182 MARKET: COMPANY PRODUCT FOOTPRINT, 2021

TABLE 183 MARKET: COMPANY REGION FOOTPRINT, 2021

FIGURE 38 COMPETITIVE EVALUATION MATRIX: GASOLINE DIRECT INJECTION MANUFACTURERS, 2021

FIGURE 39 DETAILS ON KEY DEVELOPMENTS BY LEADING PLAYERS

12.5 COMPETITIVE SCENARIO

12.5.1 NEW PRODUCT DEVELOPMENTS

TABLE 184 NEW PRODUCT DEVELOPMENTS, 2022

12.5.2 DEALS

TABLE 185 DEALS, 2020–2022

12.5.3 OTHERS

TABLE 186 OTHERS, 2019–2020

12.6 KEY PLAYER STRATEGIES

TABLE 187 KEY GROWTH STRATEGIES FROM 2019 TO 2022

12.7 COMPETITIVE BENCHMARKING

TABLE 188 MARKET: KEY STARTUPS/SMES

TABLE 189 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (STARTUPS/SMES)

13 COMPANY PROFILES (Page No. - 180)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

13.1 KEY PLAYERS

13.1.1 ROBERT BOSCH GMBH

TABLE 190 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

FIGURE 40 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

TABLE 191 ROBERT BOSCH GMBH: DEALS

13.1.2 DENSO

TABLE 192 DENSO: BUSINESS OVERVIEW

FIGURE 41 DENSO: COMPANY SNAPSHOT

13.1.3 BORGWARNER INC.

TABLE 193 BORGWARNER INC.: BUSINESS OVERVIEW

FIGURE 42 BORGWARNER INC.: COMPANY SNAPSHOT

TABLE 194 BORGWARNER INC.: OTHERS

13.1.4 MAGNETI MARELLI

TABLE 195 MAGNETI MARELLI: BUSINESS OVERVIEW

FIGURE 43 MAGNETI MARELLI: COMPANY SNAPSHOT

TABLE 196 MAGNETI MARELLI: OTHERS

13.1.5 HITACHI

TABLE 197 HITACHI: BUSINESS OVERVIEW

FIGURE 44 HITACHI: COMPANY SNAPSHOT

TABLE 198 HITACHI: NEW PRODUCT DEVELOPMENT

TABLE 199 HITACHI: DEALS

13.1.6 STANADYNE

TABLE 200 STANADYNE: BUSINESS OVERVIEW

TABLE 201 STANADYNE: NEW PRODUCT DEVELOPMENT

13.1.7 PARK-OHIO HOLDINGS CORP.

TABLE 202 PARK-OHIO HOLDINGS CORP.: BUSINESS OVERVIEW

FIGURE 45 PARK-OHIO HOLDINGS CORP.: COMPANY SNAPSHOT

13.1.8 RENESAS ELECTRONICS CORPORATION

TABLE 203 RENESAS ELECTRONICS CORPORATION: BUSINESS OVERVIEW

FIGURE 46 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

13.1.9 INFINEON TECHNOLOGIES AG

TABLE 204 INFINEON TECHNOLOGIES AG: BUSINESS OVERVIEW

FIGURE 47 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

13.1.10 VITESCO TECHNOLOGIES GMBH

TABLE 205 VITESCO TECHNOLOGIES GMBH: BUSINESS OVERVIEW

FIGURE 48 VITESCO TECHNOLOGIES GMBH: COMPANY SNAPSHOT

13.2 OTHER PLAYERS

13.2.1 STMICROELECTRONICS

TABLE 206 STMICROELECTRONICS: COMPANY OVERVIEW

13.2.2 MAHLE GMBH

TABLE 207 MAHLE GMBH: COMPANY OVERVIEW

13.2.3 VALEO

TABLE 208 VALEO: COMPANY OVERVIEW

13.2.4 GMB

TABLE 209 GMB: COMPANY OVERVIEW

13.2.5 UCAL FUEL SYSTEMS LTD.

TABLE 210 UCAL FUEL SYSTEMS LTD.: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 RECOMMENDATIONS FROM MARKETSANDMARKETS (Page No. - 214)

14.1 ASIA PACIFIC WILL BE MAJOR MARKET FOR GASOLINE DIRECT INJECTION

14.2 HIGH-PRESSURE DIRECT INJECTION IS SIGNIFICANT FOR OEMS

14.3 ELECTRIC TURBOCHARGER CAN BE PRIMARY FOCUS FOR MANUFACTURERS

14.4 CONCLUSION

15 APPENDIX (Page No. - 216)

15.1 INSIGHTS FROM INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 CUSTOMIZATION OPTIONS

15.4.1 GASOLINE DIRECT INJECTION MARKET, BY TYPE

15.4.1.1 Two stroke

15.4.1.2 Four stroke

15.4.2 GASOLINE DIRECT INJECTION MARKET, BY VEHICLE TYPE

15.4.2.1 Compact vehicle

15.4.2.2 Mid-Sized vehicle

15.4.2.3 Premium vehicle

15.4.2.4 Luxury vehicle

15.4.2.5 Others

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

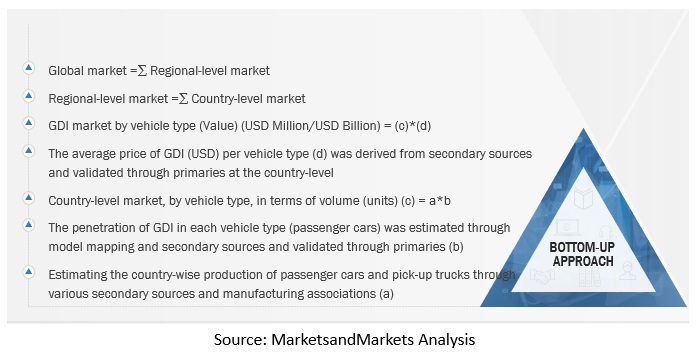

The study involves four main activities to estimate the current size of the gasoline direct injection market.

- Exhaustive secondary research was done to collect information on the market, such as market by engine type, component, vehicle type, hybrid vehicles, gasoline support technologies by region, and region.

- The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research.

- Bottom-up and top-down approaches were employed to estimate the complete market size for different segments considered under this study.

- Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study. The secondary sources included annual reports; press releases and investor presentations of companies; white papers, certified publications, articles from recognized authors, directories, and databases; and articles from recognized associations and government publishing sources.

Secondary research was used to obtain key information about the industry’s value chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

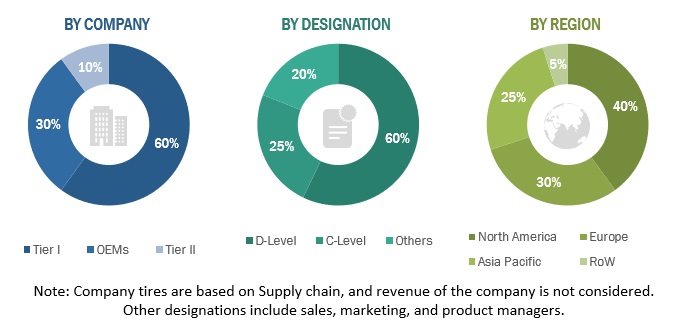

Extensive primary research was conducted after acquiring an understanding of the gasoline direct injection market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand- (automotive OEMs) and supply-side (gasoline fuel injection manufacturers, suppliers, and others) players across four major regions, namely, North America, Europe, Asia Pacific, and Rest of the World. Approximately 60%, 30%, and 10% of the primary interviews were conducted from the Tier I, OEMs, and Tier II, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. Various departments within organizations, including sales, operations, and administration were strived, to provide a holistic viewpoint in reports while canvassing primaries.

After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the opinions of in-house subject matter experts, has led to the findings delineated in the rest of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value and volume of the gasoline direct injection market and other dependent submarkets, as mentioned below:

- The bottom-up approach was used to estimate and validate the size of the global market and various other dependent sub-markets of the overall market. The research methodology used to estimate the market size includes the following details.

- The study employed the bottom-up method to estimate the market size of gasoline direct injection. In this approach, country-wise passenger car production, through secondary sources and different industry associations and organizations’ production statistics (units) was derived.

- Following this, secondary research was used to derive gasoline engine type penetration (%) present in each of the vehicle type per country, and this information was validated from primary respondents. After multiplying the country-level passenger car production statistics with gasoline engine type penetration, the country-level volume of gasoline direct injection units was derived.

- This resulted in the country-level volume of the market. The ASP by each engine type for each country was derived from secondary research and validated with primary sources. The ASP of gasoline direct injection for different engine types on the country level was multiplied with the volume figures to derive the country-level market in terms of value (USD million).

- The addition of country-level markets (volume and value) gave the regional and global market, and the addition of country-level value gave the regional and global gasoline direct injection market, which was validated by primary respondents.

- Extensive secondary and primary research was carried out to understand the global market scenario and penetration for engine type, component, vehicle type, hybrid vehicles, gasoline support technologies by region.

- While estimating the regional market for gasoline direct injection by component, the regional shares of fuel injectors, ECUs, sensors, fuel Rails, and fuel pumps were identified and multiplied with the regional market size, in terms of volume, of gasoline direct injection. The regional-level market size, in terms of volume, was then multiplied with the regional-level average selling price of the above-mentioned components. This resulted in regional-level market size, by components, in terms of value. This information was then validated through several primary interviews with OEMs and Tier I suppliers.

Gasoline Direct Injection Market Size: Bottom-Up Approach (Engine Type and Region)

To know about the assumptions considered for the study, Request for Free Sample Report

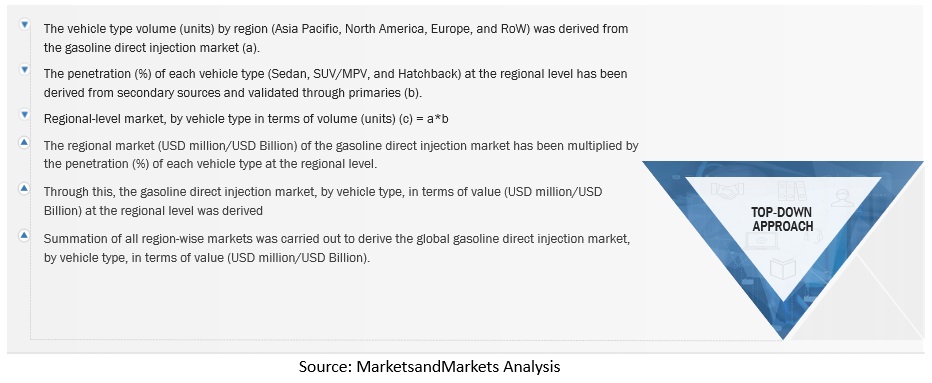

Gasoline Direct Injection Market Size: Top-Down Approach (Vehicle Type)

Report Objectives

-

To define, describe, and forecast the size of the gasoline direct injection market in terms of volume and value

- By component (ECUs, Fuel Injectors, Fuel Rails, Fuel Pumps, and Sensors)

- By vehicle type (Hatchback, Sedan, SUV/MPV)

- By engine type (I3, I4, V6, V8, Other Engine Types)

- By hybrid vehicles (HEV and PHEV)

- Gasoline support technologies market, by region (Asia Pacific, North America, Europe, and ROW)

- By region (Asia Pacific, North America, Europe, and ROW)

- To qualitatively analyze and assess the market, by region

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the share of leading players in the market and evaluate competitive leadership mapping

- To strategically analyze the key player strategies/right to win and company revenue analysis

- To strategically analyze the market with Porter’s Five Forces analysis, supply chain analysis, market ecosystem, trade analysis, case studies, ASP analysis, patent analysis, trends/disruptions impacting buyers, technology trend and regulatory analysis.

- To analyze recent developments, including new product launches, expansions, and other activities, undertaken by key industry participants in the market.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations in accordance with a company’s specific needs

Gasoline Direct Injection Market, By Type & Region

- Two Stroke

- Four Stroke

Gasoline Direct Injection Market, By Vehicle Type & Region

- Compact Vehicle

- Mid-Sized Vehicle

- Premium Vehicle

- Luxury Vehicle

- Others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Gasoline Direct Injection Market

Hello my company is an automotive injection decorative trim supplier and we are reviewing our current business technologies. We would like to find out what the current IMD (In-Mould Decorative) market - particularly which automotive brand and model uses IMD and what is the percentage?

Hi, Looking for market share by region for gasoline direct injection - wet systems and multi-fuel systems. Can you please URGENTLY let me know if this is available and if so, at what price?

Most interested in Section 11 - company profiles. Can you share a sample of one of these companies 11.1 CONTINENTAL AG 11.2 DELPHI AUTOMOTIVE PLC 11.3 DENSO CORPORATION 11.4 EDELBROCK LLC 11.5 FEDERAL-MOGUL CORPORATION