Automotive Temperature Sensor Market by Application (Engine, Exhaust, Seats), Product (Thermocouple, MEMS, IC Sensor), Usage, Technology, EV Application (Battery, Motor), EV Charging Tech (Wired, Wireless), Vehicle, and Region - Global Forecast to 2025

The automotive temperature sensor market size was valued at USD 7.21 Billion in 2016 and is estimated to grow at a CAGR of 5.58% during the forecast period, to reach USD 1.89 Billion by 2025.In this study, 2016 has been considered as the base year, and 2017 to 2025 as the forecast period, for estimating the global market size. The report segments the market and forecasts its size, by volume and value, based on application, product, usage, technology, EV application, EV charging technology, vehicle, and region.

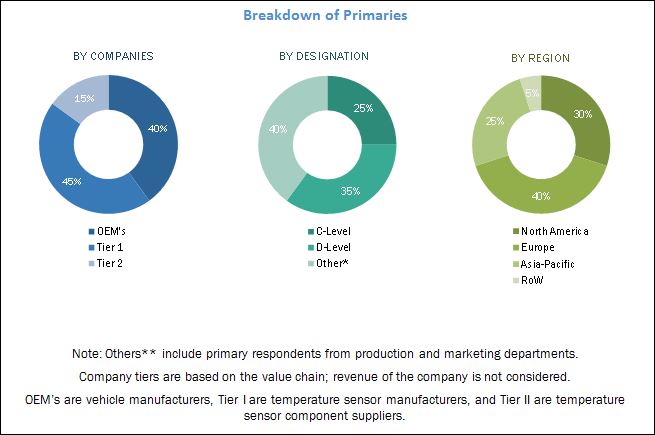

The figure given below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The research methodology used in the report involves various secondary sources such as Automotive Component Manufacturers Association (ACMA), Automotive Electronics Council (AEC), International Organization of Motor Vehicle Manufacturers (OICA), and others. Experts from related industries and suppliers have been interviewed to understand the future trends of this market. Both, bottom-up and top-down approaches have been used to estimate and validate the size of the global market. The market size, by volume, is derived by identifying the region-wise production volume of vehicles and, by value, is derived by multiplying the average selling price of temperature sensor by the number of temperature sensors installed in the automobiles of that region.

The ecosystem of the automotive temperature sensor market consists of manufacturers such as Robert Bosch (Germany), Continental (Germany), Panasonic (Japan), Delphi (UK), TDK Corporation (Japan), and research institutes such as the Automotive Component Manufacturers Association (ACMA), Automotive Electronics Council (AEC), and others.

By EV charging technology, the market for wireless charging technology is expected to grow at the highest rate during the forecast period. Technology in the automotive industry is constantly evolving. Wireless charging systems for electric vehicles are gaining popularity as they can efficiently charge electric vehicles without the need to plug in wires or cords. Manufacturers are therefore developing this technology to improve efficiency and provide a more convenient way to charge vehicles. For instance, in 2016, Mercedes announced the availability of wireless charging in early 2018 for its S550e plug-in hybrid luxury sedan.

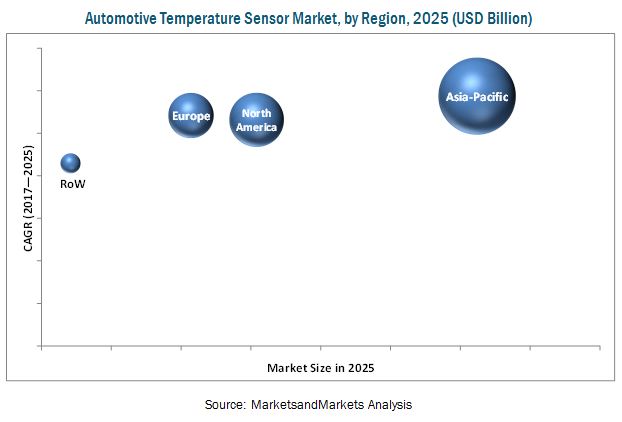

Asia Pacific is estimated to lead the market during the forecast period, followed by North America and Europe. The market in North America is expected to witness a slower growth rate as compared to the Asia Pacific and Europe. Due to stringent government regulations, the majority of the vehicles in North America are equipped with safety features. Hence, there is a limited scope of growth for temperature sensor applications in the region. The North American market for automotive temperature sensor is set to mature in the near future.

Target Audience

- Automotive OEMs

- Electronic component manufacturers

- Electric vehicle manufacturers

- Industry associations and experts

- Raw material manufacturers

- Raw material suppliers

Scope of the Report

-

Market, By Application Type

- Engine

- Transmission

- HVAC

- Exhaust

-

Thermal Seats

-

Market, By Product Type

- Thermistor

- Resistance Temperature Detector

- Thermocouple

- IC Temperature Sensor

- MEMS Temperature Sensor

-

Infrared Sensor

-

Market, By Technology

- Contact

-

Non-Contact

-

Market, By Usage

- Gas

- Liquid

-

Air

-

Market, By Vehicle

- Passenger Cars

-

Commercial Vehicle

-

Market, By Electric Vehicle Application

- Engine

- HVAC

- Battery

-

Motor

-

Market, By EV Charging Technology

- Wired

-

Wireless

-

Market, By Region

- Asia Pacific

- Europe

- North America

- Rest of the World

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Detailed analysis and profiling of additional countries (up to 3)

- Detailed analysis and profiling of additional market players (up to 3)

- Detailed analysis of additional automotive temperature sensors application (only 1)

The global automotive temperature sensor market size was valued at USD 7.70 Billion in 2017 and is estimated to grow to USD 11.89 Billion by 2025, at a CAGR of 5.58%.

The automotive temperature sensors are used for sensing the temperature of liquid and gases in a vehicle. Hence, they are used in various components of a vehicle to sense and monitor the temperature. The global market is segmented by application into the engine, transmission, engine, HVAC, exhaust, and thermal seats. The engine is estimated to hold the largest share of the market, by application. Automotive temperature sensors for the engine are used in the engine air intake and cooling fluid.

By product, the market for MEMS temperature sensors is estimated to experience the highest growth during the forecast period. With the development of advanced technologies, the use of advanced MEMS temperature sensors has increased. MEMS, IC sensors, and infrared temperature sensors are expected to be future technologies, due to increasing luxury vehicles around the globe and reduction of the wiring harness. The MEMS temperature sensors are widely used in all major advanced applications of electric as well as conventional vehicles.

Automotive temperature sensors are mainly custom-made and are designed according to the requirements of automotive manufacturers or system suppliers. Depending on the application, the specification for a temperature sensor varies, which increases the cost of a sensor. Automotive temperature sensor manufacturers cannot reduce the cost due to a lack of mass production.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Sampling Techniques & Data Collection Methods

2.1.2.2 Primary Participants

2.2 Factor Analysis

2.2.1 Demand-Side Analysis

2.2.1.1 Impact of GDP on Total Vehicle Sales

2.2.1.2 Rising Demand for Temperature Sensor From Oems

2.2.2 Supply Side Analysis

2.2.2.1 Government Regulations and Norms for Safety & Emission

2.3 Market Breakdown & Data Triangulation

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Research Assumptions

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 41)

4.1 Attractive Opportunities in the Automotive Temperature Sensor Market

4.2 Global Market By Application, 2017 vs 2025

4.3 Global Market By Product, 2017 vs 2025

4.4 Global Market By Technology, 2017 vs 2025

4.5 Global Market By Usage, 2017 vs 2025

4.6 Global Market By EV Charging Technology, 2017 vs 2025

4.7 Global Market By EV Application, 2017 vs 2025

4.8 Global Market By Vehicle Type, 2017 vs 2025

4.9 Global Market By Region, 2017 vs 2025

5 Market Overview (Page No. - 46)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Stringent Emission Norms for Automobiles

5.2.1.2 Increasing Application of Automotive Temperature Sensor

5.2.2 Restraints

5.2.2.1 Cost Pressure on Automotive Oems

5.2.2.2 Limitations of Temperature Sensors

5.2.3 Opportunities

5.2.3.1 Sensor Fusion Technology

5.2.3.2 Aggressive Development in Autonomous Vehicle

5.2.3.3 Increasing Penetration of Electric Vehicle Globally

5.2.4 Challenges

5.2.4.1 Compatibility Issue Between Sensor Manufacturers and Oems

5.2.4.2 Price Competition Among Sensor Manufacturers

5.3 Macro-Indicator Analysis

5.3.1 Introduction

5.3.2 China

5.3.3 Us

5.3.4 Japan

6 Global Market, By Application (Page No. - 54)

6.1 Introduction

6.2 Engine

6.3 Exhaust

6.4 HVAC

6.5 Transmission

6.6 Thermal Seats

7 Global Market, By Product (Page No. - 64)

7.1 Introduction

7.2 Thermistor

7.3 Resistance Temperature Detectors (RTD)

7.4 Thermocouple

7.5 IC Temperature Sensor

7.6 MEMS

7.7 Infrared Temperature Sensor

8 Global Market, By Technology (Page No. - 77)

8.1 Introduction

8.2 Contact

8.3 Non-Contact

9 Global Market, By Usage (Page No. - 83)

9.1 Introduction

9.2 Gas

9.3 Liquid

9.4 Air

10 Global Market, By EV Application (Page No. - 89)

10.1 Introduction

10.2 HVAC

10.3 Battery

10.4 Engine

10.5 Electric Motor

11 Global Market, By EV Charging Technology (Page No. - 98)

11.1 Introduction

11.2 Wired

11.3 Wireless

12 Global Market, By Vehicle (Page No. - 105)

12.1 Introduction

12.2 Passenger Cars

12.3 Commercial Vehicles

13 Global Market, By Region (Page No. - 112)

13.1 Introduction

13.2 Asia Pacific

13.2.1 China

13.2.2 India

13.2.3 Japan

13.2.4 South Korea

13.3 Europe

13.3.1 France

13.3.2 Germany

13.3.3 Italy

13.3.4 Spain

13.3.5 UK

13.4 North America

13.4.1 Canada

13.4.2 Mexico

13.4.3 US

13.5 Rest of the World

13.5.1 Brazil

13.5.2 Russia

14 Competitive Landscape (Page No. - 140)

14.1 Overview

14.2 Market Ranking Analysis

14.3 Competitive Scenario & Trends

14.3.1 Expansions

14.3.2 Mergers and Acquisitions

14.3.3 New Product Launches/Developments

14.3.4 Partnerships/Agreements/Collaborations/Supply Contracts

15 Company Profiles (Page No. - 145)

(Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

15.1 Continental

15.2 Robert Bosch

15.3 Delphi

15.4 Sensata Technologies

15.5 TE Connectivity

15.6 NXP Semiconductors

15.7 Microchip

15.8 Analog Devices

15.9 Texas Instruments

15.10 Panasonic Corporation

15.11 Murata

15.12 TDK Corporation

*Details on Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

16 Appendix (Page No. - 175)

16.1 Key Industry Insights

16.2 Discussion Guide

16.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

16.4 Introducing RT: Real Time Market Intelligence

16.5 Available Customizations

16.6 Related Reports

16.7 Author Details

List of Tables (108 Tables)

Table 1 Currency Exchange Rates (W.R.T. USD)

Table 2 Overview of Emission and Fuel Economy Norms for Passenger Cars

Table 3 Few Expected Autonomous Vehicle Release

Table 4 News Related to Vehicle Sensor Recall

Table 5 Global Market Size, By Application, 2015–2025 (Million Units)

Table 6 Global Market Size By Application, 2015–2025 (USD Million)

Table 7 Engine: Market Size By Region, 2015–2025 (Million Units)

Table 8 Engine: Market Size By Region, 2015–2025 (USD Million)

Table 9 Exhaust: Market Size By Region, 2015–2025 (Million Units)

Table 10 Exhaust: Market Size By Region, 2015–2025 (USD Million)

Table 11 HVAC: Market Size By Region, 2015–2025 (Million Units)

Table 12 HVAC: Market Size By Region, 2015–2025 (USD Million)

Table 13 Transmission: Market Size, By Region, 2015–2025 (Million Units)

Table 14 Transmission: Market Size By Region, 2015–2025 (USD Million)

Table 15 Thermal Seats: Market Size By Region, 2015–2025 (Million Units)

Table 16 Thermal Seats: Market Size By Region, 2015–2025 (USD Million)

Table 17 Market Size By Product, 2015–2025 (Million Units)

Table 18 Market Size By Product, 2015–2025 (USD Million)

Table 19 Thermistor: Market Size By Region, 2015–2025 (Million Units)

Table 20 Thermistor: Market Size By Region, 2015–2025 (USD Million)

Table 21 RTD: Market Size, By Region, 2015–2025 (Million Units)

Table 22 RTD: Market Size By Region, 2015–2025 (USD Million)

Table 23 Thermocouple: Market Size By Region, 2015–2025 (Million Units)

Table 24 Thermocouple: Market Size By Region, 2015–2025 (USD Million)

Table 25 IC Temperature Sensor: Market Size By Region, 2015–2025 (Million Units)

Table 26 IC Temperature Sensor: Market Size By Region, 2015–2025 (USD Million)

Table 27 MEMS: Market Size, By Region, 2015–2025 (Million Units)

Table 28 MEMS: Market Size By Region, 2015–2025 (USD Million)

Table 29 Infrared Temperature Sensor: Market Size By Region, 2015–2025 (Million Units)

Table 30 Infrared Temperature Sensor: Market Size By Region, 2015–2025 (USD Million)

Table 31 Market By Technology, 2015–2025 (Million Units)

Table 32 Market By Technology, 2015–2025 (USD Billion)

Table 33 Contact: Market Size By Product, 2015–2025 (Million Units)

Table 34 Contact: Market Size By Product, 2015–2025 (USD Million)

Table 35 Non-Contact: Market Size By Product, 2015–2025 (Million Units)

Table 36 Non-Contact: Market Size By Product, 2015–2025 (USD Million)

Table 37 Global Market Size, By Usage, 2015–2025 (Million Units)

Table 38 Global Market Size By Usage, 2015–2025 (USD Million)

Table 39 Gas: Market Size 2015–2025 (Million Units)

Table 40 Gas: Market Size 2015–2025 (USD Million)

Table 41 Liquid: Market Size 2015–2025 (Million Units)

Table 42 Liquid: Market Size 2015–2025 (USD Million)

Table 43 Air: Market Size 2015–2025 (Million Units)

Table 44 Air: Market Size 2015–2025 (USD Million)

Table 45 Global Market Size By EV Application, 2015–2025 (Million Units)

Table 46 Global Market Size By EV Application, 2015–2025 (USD Million)

Table 47 HVAC: Market Size, By Region, 2015–2025 (Thousand Units)

Table 48 HVAC: Market Size By Region, 2015–2025 (USD Million)

Table 49 Battery: Market Size By Region, 2015–2025 (Thousand Units)

Table 50 Battery: Market Size By Region, 2015–2025 (USD Million)

Table 51 Engine: Market Size By Region, 2015–2025 (Thousand Units)

Table 52 Engine: Market Size By Region, 2015–2025 (USD Million)

Table 53 Electric Motor: Market Size By Region, 2015–2025 (Thousand Units)

Table 54 Electric Motor: Market Size By Region, 2015–2025 (USD Million)

Table 55 Global Market Size By EV Charging Technology, 2015–2025 (Thousand Units)

Table 56 Global Market Size By EV Charging Technology, 2015–2025 (USD Thousand)

Table 57 Wired: Market Size, By Region, 2015–2025 (Thousand Units)

Table 58 Wired: Market Size By Region, 2015–2025 (USD Thousand)

Table 59 Wireless: Market Size By Region, 2015–2025 (Thousand Units)

Table 60 Wireless: Market Size By Region, 2015–2025 (USD Thousand)

Table 61 Global Market Size By Vehicle Type, 2015–2025 (Million Units)

Table 62 Global Market Size By Vehicle Type, 2015–2025 (USD Billion)

Table 63 Passenger Cars: Market Size By Region, 2015–2025 (Million Units)

Table 64 Passenger Cars: Market Size By Region, 2015–2025 (USD Million)

Table 65 Commercial Vehicles: Market Size By Region, 2015–2025 (Million Units)

Table 66 Commercial Vehicles: Market Size By Region, 2015–2025 (USD Million)

Table 67 Global Market, By Region, 2015–2025 (Million Units)

Table 68 Global Market By Region, 2015–2025 (USD Million)

Table 69 Asia Pacific: Market By Country, 2015–2025 (Million Units)

Table 70 Asia Pacific: Market By Country, 2015–2025 (USD Million)

Table 71 China: Market By Application, 2015–2025 (Million Units)

Table 72 China: Market By Application, 2015–2025 (USD Million)

Table 73 India: Market By Application, 2015–2025 (Million Units)

Table 74 India: Market By Application, 2015–2025 (USD Million)

Table 75 Japan: Market By Application, 2015–2025 (Million Units)

Table 76 Japan: Market By Application, 2015–2025 (USD Million)

Table 77 South Korea: Market By Application, 2015–2025 (Million Units)

Table 78 South Korea: Market, By Application, 2015–2025 (USD Million)

Table 79 Europe: Market By Country, 2015–2025 (Million Units)

Table 80 Europe: Market By Country, 2015–2025 (USD Million)

Table 81 France: Market By Application, 2015–2025 (Million Units)

Table 82 France: Market By Application, 2015–2025 (USD Million)

Table 83 Germany: Market By Application, 2015–2025 (Million Units)

Table 84 Germany: Market By Application, 2015–2025 (USD Million)

Table 85 Italy: Market By Application, 2015–2025 (Million Units)

Table 86 Italy: Market By Application, 2015–2025 (USD Million)

Table 87 Spain: Market By Application, 2015–2025 (Million Units)

Table 88 Spain: Market, By Application, 2015–2025 (USD Million)

Table 89 UK: Market By Application, 2015–2025 (Million Units)

Table 90 UK: Market By Application, 2015–2025 (USD Million)

Table 91 North America: Market By Country, 2015–2025 (Million Units)

Table 92 North America: Market By Country, 2015–2025 (USD Million)

Table 93 Canada: Market By Application, 2015–2025 (Million Units)

Table 94 Canada: Market By Application, 2015–2025 (USD Million)

Table 95 Mexico: Market By Application, 2015–2025 (Million Units)

Table 96 Mexico: Market By Application, 2015–2025 (USD Million)

Table 97 US: Market By Application, 2015–2025 (Million Units)

Table 98 US: Market, By Application, 2015–2025 (USD Million)

Table 99 RoW: Market By Country, 2015–2025 (Million Units)

Table 100 RoW: Market By Country, 2015–2025 (USD Million)

Table 101 Brazil: Market By Application, 2015–2025 (Million Units)

Table 102 Brazil: Market By Application, 2015–2025 (USD Million)

Table 103 Russia: Market By Application, 2015–2025 (Million Units)

Table 104 Russia: Market By Application, 2015–2025 (USD Million)

Table 105 Expansions, 2014—2016

Table 106 Mergers and Acquisitions, 2016–2017

Table 107 New Product Launches/Developments, 2016–2017

Table 108 Partnerships/Agreements/Collaborations/Supply Contracts, 2015–2017

List of Figures (78 Figures)

Figure 1 Automotive Temperature Sensor Market: Research Design

Figure 2 Breakdown of Primary Interviews

Figure 3 Gross Domestic Product vs Total Vehicle Sales

Figure 4 Data Triangulation

Figure 5 Market Bottom-Up Approach

Figure 6 Market Top-Down Approach

Figure 7 Market China to Be the Fastest-Growing and Largest Market

Figure 8 Market By Application Type, 2017 vs 2025 (USD Million)

Figure 9 Market By Product, 2017 vs 2025 (USD Million)

Figure 10 Market By Technology, 2017 vs 2025 (USD Million)

Figure 11 Market By Usage, 2017 vs 2025 (USD Million)

Figure 12 Market By EV Charging Technology, 2017 vs 2025 (USD Million)

Figure 13 Market, By Electric Vehicle Application, 2017 vs 2025 (USD Million)

Figure 14 Market By Vehicle Type, 2017 vs 2025 (USD Billion)

Figure 15 Market 2017 vs 2025

Figure 16 Engine Segment is Expected to Lead the Market During the Forecast Period

Figure 17 Thermistor Temperature Sensor Segment is Expected to Lead the AMarket During the Forecast Period

Figure 18 Contact Segment is Expected to Lead the Market During the Forecast Period

Figure 19 Air Segment is Expected to Lead the Market During the Forecast Period

Figure 20 Wired Segment is Expected to Lead the Market During the Forecast Period

Figure 21 HVAC Segment is Expected to Lead the Electric Vehicle Market During the Forecast Period

Figure 22 Passenger Car to Hold the Largest Market in Market in 2017

Figure 23 Asia Pacific is Expected to Lead the Market During the Forecast Period

Figure 24 Automotive Temperature Sensor: Market Dynamics

Figure 25 Battery Electric Vehicle Sales (Thousand Units)

Figure 26 Macro Indicators Affecting Market

Figure 27 Macro Indicators Affecting Market

Figure 28 Macro Indicators Affecting Market

Figure 29 Global Market, By Application, 2017 vs 2025 (USD Million)

Figure 30 Engine: Market By Region, 2017 vs 2025 (USD Million)

Figure 31 Exhaust: Market By Region, 2017 vs 2025 (USD Million)

Figure 32 HVAC: Market By Region, 2017 vs 2025 (USD Million)

Figure 33 Transmission: Market By Region, 2017 vs 2025 (USD Million)

Figure 34 Market By Product, 2017 vs 2025 (USD Million)

Figure 35 Thermistor: Market By Region, 2017 vs 2025 (USD Million)

Figure 36 RTD: Market By Region, 2017 vs 2025 (USD Million)

Figure 37 Thermocouple: Market By Region, 2017 vs 2025 (USD Million)

Figure 38 IC Temperature Sensor: Market By Region, 2017 vs 2025 (USD Million)

Figure 39 MEMS: Market By Region, 2017 vs 2025 (USD Million)

Figure 40 Infrared Temperature Sensor: Market By Region, 2017 vs 2025 (USD Million)

Figure 41 Global Market, By Technology, 2017 vs 2025 (USD Million)

Figure 42 Contact: the Thermistor Segment to Hold the Largest Market Share, By Value, 2017 vs 2025 (USD Million)

Figure 43 Market By Usage, 2017 vs 2025 (USD Million)

Figure 44 Market By EV Application, 2017 vs 2025 (USD Million)

Figure 45 HVAC: Market By EV Application, 2017 vs 2025 (USD Million)

Figure 46 Battery: Market By EV Application, 2017 vs 2025 (USD Million)

Figure 47 Engine: Market By EV Application, 2017 vs 2025 (USD Million)

Figure 48 Electric Motor: Market By EV Application, 2017 vs 2025 (USD Million)

Figure 49 Market, By EV Charging Technology, 2017 vs 2025 (USD Thousand)

Figure 50 Wired: Global Market, By Region, 2017 vs 2025 (USD Thousand)

Figure 51 Wireless: Market By Region, 2017 vs 2025 (USD Thousand)

Figure 52 Market By Vehicle Type, 2017 vs 2025 (USD Billion)

Figure 53 Pc: Asia Pacific to Hold the Largest Market Share, By Value, 2017 vs 2025 (USD Million)

Figure 54 Cv: North America to Hold the Largest Market Share, By Value, 2017 vs 2025

Figure 55 China is Estimated to Be the Fastest-Growing Market for Automotive Temperature Sensor During the Forecast Period (2017–2025)

Figure 56 Asia Pacific: Market Snapshot

Figure 57 Europe: Market Snapshot

Figure 58 North America: Market Snapshot

Figure 59 RoW: Market 2017 vs 2025 (USD Million)

Figure 60 Companies Adopted Expansions as the Key Growth Strategy, 2014–2017

Figure 61 Automotive Temperature Sensor Market Ranking, 2016

Figure 62 Continental: Company Snapshot

Figure 63 Continental: SWOT Analysis

Figure 64 Robert Bosch: Company Snapshot

Figure 65 Robert Bosch: SWOT Analysis

Figure 66 Delphi: Company Snapshot

Figure 67 Delphi: SWOT Analysis

Figure 68 Sensata Technologies: Company Snapshot

Figure 69 Sensata Technologies: SWOT Analysis

Figure 70 TE Connectivity: Company Snapshot

Figure 71 TE Connectivity: SWOT Analysis

Figure 72 NXP Semiconductors: Company Snapshot

Figure 73 Microchip: Company Snapshot

Figure 74 Analog Devices: Company Snapshot

Figure 75 Texas Instruments: Company Snapshot

Figure 76 Panasonic Corporation: Company Snapshot

Figure 77 Murata: Company Snapshot

Figure 78 TDK Corporation: Company Snapshot

Growth opportunities and latent adjacency in Automotive Temperature Sensor Market

As you said, MEMS, IC sensors, and infrared temperature sensors are expected to be future technologies, but when this sensor can be use.