Automotive Traction Motor Market by Motor Type (PMSM, AC Induction), Type (AC, DC), EV Type (BEV, HEV, PHEV), Power Output (less than 200 KW, 200-400 KW, and above 400 KW), Vehicle Type (PC, Pick-up Trucks, Trucks, Buses & Vans) & Region - Global Forecast to 2027

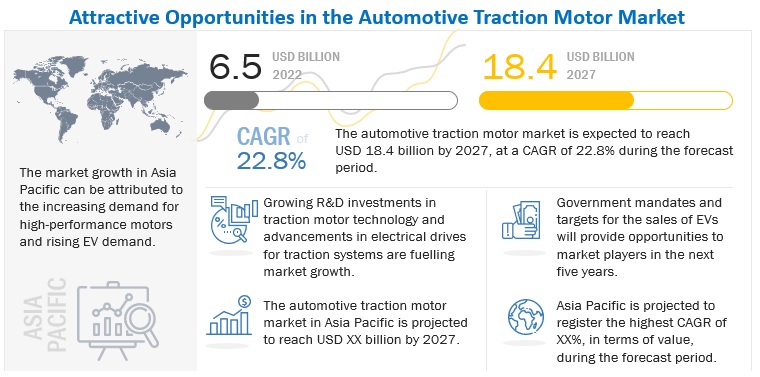

[277 Pages Report] The global automotive traction motor market size was valued at USD 6.5 billion in 2022 and is expected to reach USD 18.4 billion by 2027 at a CAGR of 22.8% during the forecast period 2022-2027. Increasing demand of EV’s, increasing manufacturing of high performance motors across the globe, and supporting government policies are factors responsible to drive the automotive traction motor market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Increased demand for electric vehicles

With increasing concerns raised over the environmental impact of conventional vehicles, governments around the world are encouraging the adoption of vehicles using alternative sources of fuel. EVs are zero-emission vehicles and are gaining preference for clean public transport across countries. Several national governments offer financial incentives, such as tax exemptions and rebates, subsidies, reduced parking/toll fees, and free charging, to encourage the adoption of EVs.

There is growing popularity of Smart Hybrid technology, wherein an integrated traction motor dualling as a starter motor is utilized for additional torque during acceleration with the aid of a dual battery setup

(Li-ion and lead-acid battery). The 48 V traction motors are in high demand from OEMs, especially in developing countries like India, Mexico, and Brazil, thanks to the high mileage being claimed by engines equipped with such technologies. All-wheel drive BEVs, PHEVs, and HEVs both in commercial and passenger segments are also witnessing high demand, further boosting the market for automotive traction motors, especially in developing countries.

Restraint: Limited availability of supporting infrastructure for EVs

The growth of the automotive traction motor market has been restrained due to the limited availability of supporting infrastructure for EVs. Traction motors support the working mechanism in EVs, but EVs need to recharge their batteries frequently.

Some developing countries have specifically targeted this problem statement to boost EV demand by providing incentives for charging station installation and operations. For instance, according to the federal government of Mexico, commercial buildings may be eligible for a tax credit of up to USD 1,500 for the purchase and installation of an EV charging station, or up to USD 3,000 if the infrastructure is located in an affordable housing building, thereby boosting EV infrastructure and inclining its population toward adopting EVs. In addition, the New Mexico Environment Department (NMED) may cover up to 100% of the cost of purchasing, installing, and maintaining qualified light-duty EV charging stations.

Opportunity: Unstable prices of fossil fuels

Fossil energy has been a fundamental driver of technological, social, and economic progress. Fossil fuels include coal, oil, and gas. All these fuel sources play a dominant role in global energy systems. But the negative impact of these fuels is the carbon dioxide (CO2) production after the fuels are burnt.

As gasoline is a petroleum-based product, any changes in crude oil price directly affect its price also. A decrease in the price of gasoline represents that automobile owners have more disposable income for other purchases. The effect of lower fuel prices on vehicle consumption will depend on different countries and their fuel prices. Consumers in a high fuel-tax country such as Norway, although experiencing the same price change as consumers in the lower fuel-tax US, will face a lower overall percentage change in the price. Hence, the price change does not appear as significant in Norway as it does in the US.

Prices of fossil fuels are also susceptible to fluctuations due to externalities such as trade barriers/sanctions, war, and the concentration of their supply to a few regions resulting in price manipulation by trade blocks as well as alternatives such as biofuels and shale gas. Thus, the economics of road transportation is moving significantly in favor of renewable fuel resources like electricity. EVs have gained advantages with the concept of renewable energy sources. OEMs and parts manufacturers are already considering partnerships to compete in the market. This creates a growth opportunity for manufacturers of traction motors that are implemented in all types of EVs.

Challenge: Reducing EV subsidies

The purchase subsidies on EVs were reduced in key markets, such as China and France. For example, the Chinese Ministry of Finance announced plans to cut down on subsidies associated with electric cars by about half in 2019, 20% in 2021, and 30% by 2022. However, vehicles for public transport and those costing below USD 42,000 would continue to receive subsidies, with the new ruling only hitting luxury car brands. As of 2021, the US government subsidized EV cars by providing a tax break of up to USD 7,500 to EV manufacturers for the first 200,000 electric cars they sell. After the tax break limit is met, the subsidy will be reduced by 50% for all EV cars sold over the next six months and by a further 50% for another six months before being discontinued. Germany has also planned to reduce financial incentives to buy electric cars from 2023. Under the plan, premiums for fully electric-powered vehicles priced below USD 40,000 will fall to USD 4,500 from USD 6,000 in 2023. In June 2022, the UK government announced the removal of subsidies for electric cars due to rising demand. In 2021, the government reduced the subsidies to USD 1,987.

The Buses segment is estimated to be the fastest growing in the vehicle type segment

There has been an increasing adoption of electric buses and coaches by public authorities, non-profit organizations, and private companies. Major electric bus manufacturers are BYD (China), Yutong (China), Proterra (US), VDL Group (Netherlands), Olectra Greentech (India), New Flyer (Canada), Foton Motors (China), and AB Volvo (Sweden). Magna, Continental, BorgWarner, and Meritor provide traction motors to various electric bus manufacturers, whereas some EV manufacturers like BYD, BAIC, Geely, etc., build their traction motors in-house. Thus, the rise in demand for buses will fuel the automotive traction motor market. Furthermore, with continuous advancements in battery technologies, OEMs have managed to increase the operating range of these buses. The increasing demand for emission-free public transport options in developed as well as emerging countries is projected to rapidly boost the electric buses segment in the near future, in turn driving the demand for traction motors.

The AC motor in the by type will be leading the automotive traction motor market during the forecast period

By type, the market is segmented into AC and DC. The AC segment is estimated to dominate the market during the forecast period. The larger share of this segment can be attributed to the high adoption of AC traction motors, as they offer higher efficiency, improved speed performance, and higher acceleration than DC electric traction motors.

One of the greatest advantages of electric vehicles is a quiet motor, that offers up to 100% torque at zero revolutions per minute (RPM). Either an AC or a DC motor is used in an EV, the difference between the two usually occurs in volts at which the motor can run. A DC motor will likely run between 96 and 192 V, while an AC motor is probably a three-phase motor that runs at 240 V. DC motor generally covers the 20 to 30 kW range.

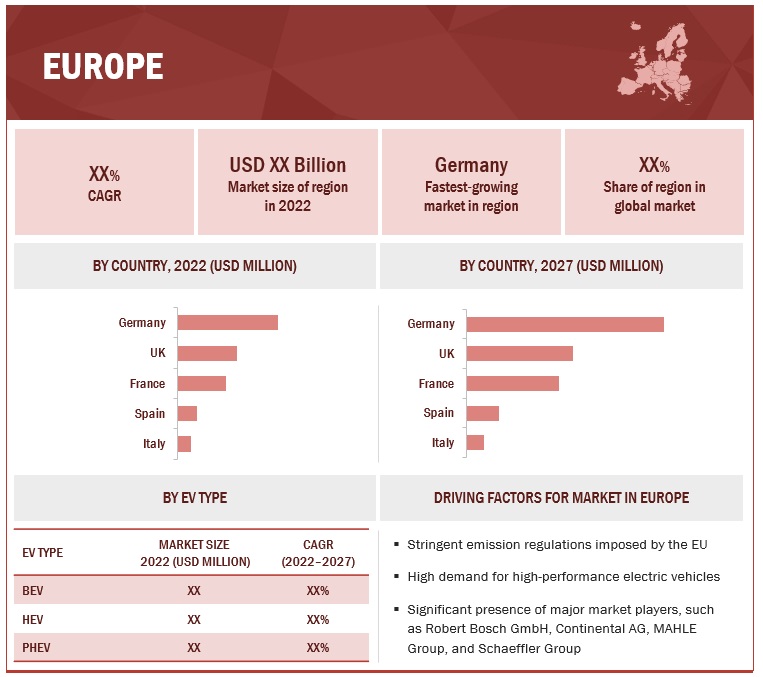

The European automotive traction motor market is projected to be the fastest by 2027

Europe is estimated to account for a share of 26.4% of the global market, in terms of value, in 2027. Germany is expected to be the largest market for automotive traction motors in Europe because of the increasing demand for the electrification of personal and public transport fleets and the growing use of electric vans in the logistics industry. Germany is home to many major traction motor manufacturers, such as Robert Bosch GmbH, Schaeffler Group, ZF Friedrichshafen AG, Continental AG, and MAHLE Group. These companies have developed new products and formed joint ventures and supply contracts with key OEMs, thereby significantly contributing to the growth of the market in Germany.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The global automotive traction motor market is dominated by major players BorgWarner Inc. (US), Schaeffler Group (Germany), Nidec Corporation (Japan), Robert Bosch GmbH (Germany), and ZF Friedrichshafen AG (Germany). The key strategies adopted by these companies to sustain their market position are new product developments, mergers & acquisitions, supply contracts, partnerships, expansions, collaborations, acquisitions, and contracts & agreements.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2022 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/USD Billion) and Volume (Thousand Units) |

|

Segments covered |

Vehicle Type, EV Type, Type, Motor Type, Power Output, and Region |

|

Geographies covered |

Asia Pacific, Europe, and North America |

|

Companies Covered |

BorgWarner Inc. (US), Schaeffler Group (Germany), Nidec Corporation (Japan), Robert Bosch GmbH (Germany), and ZF Friedrichshafen AG (Germany) |

This research report categorizes the Automotive Traction Motor Market based on vehicle type, EV type, motor type, type, power output, and region.

Based on the vehicle type:

- Passenger cars

- Trucks

- Buses

- Pickup Trucks

- Vans

Based on the EV type:

- BEV

- HEV

- PHEV

Based on the type:

- AC

- DC

Based on the motor type:

- PMSM

- AC induction

Based on the power output:

- Less than 200 kW

- 200-400 kW

- Above 400 kW

Based on the region:

-

Asia Pacific

- China

- India

- Japan

- South Korea

-

North America

- US

- Canada

-

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

Recent Developments

- In May 2022, BYD Co., Ltd. unveiled an intelligence Torque Adaption Control (iTAC) system that it created entirely. Changing wheel speeds can be predicted more than 50 ms ahead of time in terms of response speed. In terms of control strategy, the iTAC system enables many ways to manage the automobile, such as transferring torque, correctly lowering torque, and outputting negative torque, thanks to its faster motor reaction speed and more precise speed adjustment. The iTAC will be installed in BYD models built on the new e-platform 3.0.

- In May 2022, ZF Friedrichshafen AG unveiled new electric drive modules and systems, including its modular and scalable silicon carbide (SiC) inverter architecture, hairpin electric motor, electric powertrain, and accessories (eWorX). The SiC inverter architecture provides maximum output flexibility from 400 V to 800 V for e-motor operation. The ZF e-motor portfolio is modular, with a common electromagnetic design for the stator, an asynchronous motor (ASM) or permanent-magnet synchronous motor (PSM) design for the rotor, and power classes ranging from 75 kW to 400 kW and topologies ranging from 400 V to 800 V. eWorX, a newly developed product range from ZF, offers completely electric system solutions in a compact form with a common interface, reducing the integration necessary for electrifying work equipment and accessories.

- In May 2022 BorgWarner Inc. secured a contract to provide high-voltage hairpin (HVH) eMotors to a leading EV brand in China. The eMotors will be used in the company’s second-generation 800 V propulsion system platform and are expected to get installed in vehicles to be mass-produced from October 2023. The 800 V oil-cooled eMotors from BorgWarner are available as either motor assemblies or stator and rotor subassemblies. They incorporate built-in, permanent magnet rotor and proprietary stator insulation enhancement technologies, providing premium durability and reliability.

- In April 2022 BorgWarner Inc. completed its acquisition of Santroll Automotive Components. The acquisition is anticipated to boost BorgWarner's speed to market while strengthening its vertical integration, size, and portfolio breadth in light vehicle e-motors. Santroll, a Chinese company with almost 400 full-time workers based in Tianjin, creates and produces eMotors for light cars using concentrated-winding and hairpin technology, and it sells its proprietary technology to the Chinese OEM market.

- In March 2022, ZF Commercial Vehicle Control Systems India Ltd. (previously Wabco India Ltd.), a subsidiary of ZF Friedrichshafen AG, announced a USD 18.9 million capacity expansion investment through a greenfield venture in Chennai. The business plans to establish a new facility on a 44-acre plot of land in Chennai's manufacturing corridor Oragadam, with production set to begin in the first quarter of 2023. The firm intends to offer certain new items to the Indian market as a result of the worldwide combination of Wabco and ZF. The business will also place the new investment through the PLI scheme since it will localize some innovative technology in the electric car area as well as some advanced

- In September 2021, Robert Bosch GmbH unveiled its new 230 Electric Motor at Motor Bella 2021, for commercial and medium-duty vehicles, which has an 800-volt rated voltage and is intended for long service life. The constant power density was optimized in particular to allow for a compact design and easy integration into electric rigid axles. The new electric motor comes in power ratings ranging from 150 to 230 kilowatts continuous output. When paired with SiC inverter technology, the system efficiency may reach 97%. The Bosch e-axle is a single unit that houses the power electronics, electric motor, and gearbox.

Frequently Asked Questions (FAQ):

What is the current size of the global automotive traction motor market?

The global automotive traction motor market is projected to grow at CAGR 22.8% from USD 6.5 billion in 2022 to USD 18.4 billion by 2027

Who are the winners in the global automotive traction motor market?

The automotive traction motor market is dominated by established players such as BorgWarner Inc. (US), Schaeffler Group (Germany), Nidec Corporation (Japan), Robert Bosch GmbH (Germany), and ZF Friedrichshafen AG (Germany). These companies adopted various strategies such as new product developments, expansions, supply contracts, collaborations, and partnerships to gain traction in the automotive traction motor market.

What are the different types of motors types for electric vehicles?

PMSM, and AC induction motors.

What are the different EV types considered in the automotive traction motor market?

The EV types considered are battery electric vehicle (BEV), plug-in hybrid vehicle (PHEV), and hybrid electric vehicle (HEV). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 AUTOMOTIVE TRACTION MOTOR MARKET DEFINITION, BY MOTOR TYPE

1.2.2 MARKET DEFINITION, BY EV TYPE

1.2.3 MARKET DEFINITION, BY POWER OUTPUT

1.2.4 MARKET DEFINITION, BY TYPE

1.2.5 MARKET DEFINITION, BY VEHICLE TYPE

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS: MARKET

1.4 MARKET SCOPE

FIGURE 1 MARKET: MARKET SEGMENTATION

1.4.1 YEARS CONSIDERED

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primary interviews

2.1.2.2 Primary participants

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 5 AUTOMOTIVE TRACTION MOTOR MARKET SIZE: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET: TOP-DOWN APPROACH

FIGURE 7 MARKET: RESEARCH DESIGN & METHODOLOGY

2.3.3 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

2.4 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 RESEARCH ASSUMPTIONS

2.7 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 9 AUTOMOTIVE TRACTION MOTOR MARKET, BY REGION, 2022–2027

FIGURE 10 BY EV TYPE, BEV SEGMENT ESTIMATED TO LEAD MARKET FROM 2022 TO 2027

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE TRACTION MOTOR MARKET

FIGURE 11 INCREASING ADOPTION OF ELECTRIC VEHICLES AND GOVERNMENT INCENTIVES TO DRIVE MARKET IN NEXT FIVE YEARS

4.2 MARKET, BY VEHICLE TYPE

FIGURE 12 PASSENGER CARS SEGMENT EXPECTED TO DOMINATE MARKET FROM 2022 TO 2027

4.3 MARKET, BY EV TYPE

FIGURE 13 BEV SEGMENT PROJECTED TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

4.4 MARKET, BY TYPE

FIGURE 14 AC SEGMENT EXPECTED TO LEAD MARKET FROM 2022 TO 2027

4.5 MARKET, BY POWER OUTPUT

FIGURE 15 200-400 KW SEGMENT PROJECTED TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

4.6 MARKET, BY MOTOR TYPE

FIGURE 16 PMSM SEGMENT ESTIMATED TO LEAD MARKET IN 2022

4.7 MARKET, BY REGION

FIGURE 17 ASIA PACIFIC ESTIMATED TO DOMINATE MARKET IN 2022

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

TABLE 2 AUTOMOTIVE TRACTION MOTOR MARKET: IMPACT OF MARKET DYNAMICS

5.2 MARKET DYNAMICS

FIGURE 18 AUTOMOTIVE TRACTION MOTOR: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increased demand for high-performance motors

TABLE 3 AUTOMOTIVE TRACTION MOTOR KEY MODELS AND SUPPLIERS

5.2.1.2 Rising demand for electric vehicles

FIGURE 19 GLOBAL EV SALES, 2017–2021

TABLE 4 GOVERNMENT INCENTIVES, BY COUNTRY

FIGURE 20 AVERAGE FINANCIAL SUBSIDIES AT PURCHASE PROVIDED BY VARIOUS NATIONS (IN USD) IN 2021

5.2.1.3 Advancements in electrical drives for traction systems

5.2.2 RESTRAINTS

5.2.2.1 Less availability and price volatility of materials used in production

FIGURE 21 COPPER (LME) PRICE TREND (IN USD PER METRIC TON), 2019–2022

TABLE 5 MATERIALS USED IN ELECTRIC MOTORS

5.2.2.2 Lack of EV charging infrastructure

FIGURE 22 OVERVIEW OF PUBLICLY AVAILABLE FAST AND SLOW CHARGERS, BY COUNTRY (2017–2021)

5.2.3 OPPORTUNITIES

5.2.3.1 Implementation of stringent emission norms & environmental regulations

FIGURE 23 EV ADOPTION TARGETS BY COUNTRIES

5.2.3.2 Unstable prices of fossil fuels

FIGURE 24 FLUCTUATING CRUDE OIL PRICES (USD)

5.2.4 CHALLENGES

5.2.4.1 Overheating of traction motors

FIGURE 25 NUMBER OF PATENT APPLICATIONS FOR THERMAL MANAGEMENT TECHNOLOGY FOR VEHICLES WITH MOTOR COOLING

5.2.4.2 Reduced subsidies for EVs

TABLE 6 SUBSIDIES OFFERED FOR ELECTRIC VEHICLES IN CHINA

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 26 PORTER’S FIVE FORCES: AUTOMOTIVE TRACTION MOTOR MARKET

TABLE 7 MARKET: IMPACT OF PORTER’S FIVE FORCES

5.3.1 THREAT OF SUBSTITUTES

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 MACROECONOMIC INDICATORS

5.4.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

TABLE 8 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2018–2026 (USD BILLION)

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 27 MARKET: SUPPLY CHAIN ANALYSIS

5.6 ECOSYSTEM

FIGURE 28 ECOSYSTEM OF MARKET

TABLE 9 MARKET: ECOSYSTEM

5.7 PATENT ANALYSIS

5.7.1 INTRODUCTION

FIGURE 29 PUBLICATION TRENDS (2012–2021)

TABLE 10 IMPORTANT PATENT REGISTRATIONS RELATED TO MARKET

5.8 CASE STUDY

5.8.1 INTELLIGENT MOTORS EQUIPPED WITH MICROCOMPUTERS

5.8.2 DEVELOPMENT OF COMMERCIAL VEHICLE E-AXLE SYSTEMS BASED ON NVH PERFORMANCE OPTIMIZATION

5.9 AVERAGE SELLING PRICE OF TRACTION MOTORS

FIGURE 30 PRICE OF TRACTION MOTOR BY EV TYPE

FIGURE 31 AVERAGE COMPONENT COST PER EV POWERTRAIN, 2021

5.10 DETAILED LIST OF CONFERENCES AND EVENTS

TABLE 11 AUTOMOTIVE TRACTION MOTOR MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.11 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12 TECHNOLOGY ANALYSIS

5.12.1 INTRODUCTION

5.12.2 HYBRID AND ELECTRIC DRIVE MODULES

5.12.3 HIGH-POWER ELECTRIC MOTORS

FIGURE 32 48 VOLT ELECTRIFICATIONS

5.13 TRADE ANALYSIS

TABLE 15 COUNTRY WISE ELECTRIC VEHICLE SALES (UNITS)

TABLE 16 ELECTRIC VEHICLE MARKET: TRADE DATA FOR MOTOR VEHICLES IN 2021 (HS 8703)

5.14 REGULATORY OVERVIEW

TABLE 17 REGULATIONS FOR AUTOMOTIVE TRACTION MOTORS

5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

TABLE 18 INFLUENCE OF KEY STAKEHOLDERS IN BUYING AUTOMOTIVE TRACTION MOTORS (%)

5.14.2 BUYING CRITERIA

TABLE 19 KEY BUYING CRITERIA FOR TRACTION MOTORS

5.15 TRENDS AND DISRUPTIONS

FIGURE 33 TRENDS AND DISRUPTIONS IN AUTOMOTIVE TRACTION MOTOR MARKET

5.16 MARKET, MARKET SCENARIOS (2022–2027)

5.16.1 MOST LIKELY SCENARIO

TABLE 20 MARKET: MOST LIKELY SCENARIO, BY REGION, 2022–2027 (USD MILLION)

5.16.2 OPTIMISTIC SCENARIO

TABLE 21 MARKET: OPTIMISTIC SCENARIO, BY REGION, 2022–2027 (USD MILLION)

5.16.3 PESSIMISTIC SCENARIO

TABLE 22 MARKET: PESSIMISTIC SCENARIO, BY REGION, 2022–2027 (USD MILLION)

6 AUTOMOTIVE TRACTION MOTOR MARKET, BY VEHICLE TYPE (Page No. - 82)

6.1 INTRODUCTION

FIGURE 34 MARKET, BY VEHICLE TYPE, 2022 VS. 2027

TABLE 23 MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 24 MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 25 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 26 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

6.1.1 OPERATIONAL DATA

TABLE 27 LIST OF GLOBAL TRACTION MOTOR SUPPLIERS FOR PASSENGER CARS

6.1.2 ASSUMPTIONS

TABLE 28 ASSUMPTIONS: BY VEHICLE TYPE

6.1.3 RESEARCH METHODOLOGY

6.2 PASSENGER CARS

6.2.1 INCREASING NUMBER OF EMISSION NORMS FOR PASSENGER CARS TO BOOST DEMAND FOR TRACTION MOTORS

TABLE 29 HYBRID CAR SALES DATA (UNITS)

TABLE 30 PASSENGER CARS: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 31 PASSENGER CARS: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 32 PASSENGER CARS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 PASSENGER CARS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 TRUCKS

6.3.1 INCREASING SALES OF ELECTRIC MEDIUM AND HEAVY TRUCKS FOR SHORT AND LONG RANGES TO BOOST MARKET

TABLE 34 TRUCKS: MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 35 TRUCKS: MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 36 TRUCKS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 TRUCKS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 BUSES

6.4.1 HIGH DEMAND FROM MAJOR OEMS IN ASIA PACIFIC TO DRIVE MARKET SIGNIFICANTLY

TABLE 38 ELECTRIC BUS DATA BASED ON PROPULSION

TABLE 39 BUSES: MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 40 BUSES: MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 41 BUSES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 BUSES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.5 PICKUP TRUCKS

6.5.1 ELECTRIC PICKUP TRUCK SALES TO GROW WITH BEST-IN-CLASS OFFERINGS FROM OEMS

TABLE 43 PICKUP TRUCKS: MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 44 PICKUP TRUCKS: MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 45 PICKUP TRUCKS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 PICKUP TRUCKS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.6 VANS

6.6.1 INCREASING DEMAND FOR ELECTRIC VANS TO DRIVE MARKET

TABLE 47 ELECTRIC VAN MODELS

TABLE 48 VANS: MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 49 VANS: MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 50 VANS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 VANS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.7 KEY PRIMARY INSIGHTS

FIGURE 35 KEY PRIMARY INSIGHTS

7 AUTOMOTIVE TRACTION MOTOR MARKET, BY POWER OUTPUT (Page No. - 100)

7.1 INTRODUCTION

FIGURE 36 MARKET, BY POWER OUTPUT, 2022 VS. 2027

TABLE 52 MARKET, BY POWER OUTPUT, 2018–2021 (THOUSAND UNITS)

TABLE 53 MARKET, BY POWER OUTPUT, 2022–2027 (THOUSAND UNITS)

TABLE 54 MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 55 MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

7.1.1 OPERATIONAL DATA

TABLE 56 ELECTRIC VEHICLE AND ELECTRIC COMMERCIAL VEHICLE DATA BASED ON POWER OUTPUT

7.1.2 ASSUMPTIONS

TABLE 57 ASSUMPTIONS: BY POWER OUTPUT

7.1.3 RESEARCH METHODOLOGY

7.2 LESS THAN 200 KW

7.2.1 ELECTRIFICATION OF PASSENGER CARS TO DRIVE SEGMENT

TABLE 58 LESS THAN 200 KW: AUTOMOTIVE TRACTION MOTOR MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 59 LESS THAN 200 KW: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 60 LESS THAN 200 KW: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 LESS THAN 200 KW: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 200–400 KW

7.3.1 DEMAND FROM APPLICATIONS SUCH AS ELECTRIC BUSES AND TRUCKS TO DRIVE SEGMENT

TABLE 62 200−400 KW: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 63 200−400 KW: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 64 200−400 KW: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 65 200−400 KW: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 ABOVE 400 KW

7.4.1 INCREASING RATE OF URBANIZATION AND GROWING POPULATION TO DRIVE DEMAND FOR ABOVE 400 KW POWER MOTORS

TABLE 66 ABOVE 400 KW: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 67 ABOVE 400 KW: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 KEY PRIMARY INSIGHTS

FIGURE 37 KEY PRIMARY INSIGHTS

8 AUTOMOTIVE TRACTION MOTOR MARKET, BY MOTOR TYPE (Page No. - 111)

8.1 INTRODUCTION

FIGURE 38 MARKET, BY MOTOR TYPE, 2022 VS. 2027

TABLE 68 MARKET, BY MOTOR TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 69 MARKET, BY MOTOR TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 70 MARKET, BY MOTOR TYPE, 2018–2021 (USD MILLION)

TABLE 71 MARKET, BY MOTOR TYPE, 2022–2027 (USD MILLION)

8.1.1 OPERATIONAL DATA

TABLE 72 GOVERNMENT PROGRAMS FOR PROMOTION OF ELECTRIC COMMERCIAL VEHICLE SALES

8.1.2 RESEARCH METHODOLOGY

8.1.3 ASSUMPTIONS

TABLE 73 ASSUMPTIONS: BY MOTOR TYPE

8.2 PMSM

8.2.1 SUITED TO HIGH-PERFORMANCE APPLICATIONS

TABLE 74 PMSM: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 75 PMSM: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 76 PMSM: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 77 PMSM: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 AC INDUCTION MOTOR

8.3.1 LIMITED COMPLEXITY AND LOW COST TO DRIVE DEMAND

TABLE 78 AC INDUCTION MOTOR: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 79 AC INDUCTION MOTOR: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 80 AC INDUCTION MOTOR: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 81 AC INDUCTION MOTOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 KEY PRIMARY INSIGHTS

FIGURE 39 KEY PRIMARY INSIGHTS

9 AUTOMOTIVE TRACTION MOTOR MARKET, BY EV TYPE (Page No. - 119)

9.1 INTRODUCTION

FIGURE 40 MARKET, BY EV TYPE, 2022 VS. 2027

TABLE 82 MARKET, BY EV TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 83 MARKET, BY EV TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 84 MARKET, BY EV TYPE, 2018–2021 (USD MILLION)

TABLE 85 MARKET, BY EV TYPE, 2022–2027 (USD MILLION)

9.1.1 OPERATIONAL DATA

TABLE 86 ELECTRIC VEHICLE MODELS, BY PROPULSION TYPE

9.1.2 RESEARCH METHODOLOGY

9.1.3 ASSUMPTIONS

TABLE 87 ASSUMPTIONS: BY EV TYPE

9.2 BATTERY ELECTRIC VEHICLE (BEV)

9.2.1 INCREASE IN VEHICLE RANGE PER CHARGE TO RAISE DEMAND

TABLE 88 BEV: AUTOMOTIVE TRACTION MOTOR MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 89 BEV: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 90 BEV: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 91 BEV: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 HYBRID ELECTRIC VEHICLE (HEV)

9.3.1 LESSER REQUIREMENT FOR ELECTRIC POWER INCREASES DEMAND FOR HEVS

TABLE 92 HEV: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 93 HEV: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 94 HEV: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 95 HEV: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

9.4.1 HIGH ELECTRIC RANGE OF PHEVS TO DRIVE MARKET SIGNIFICANTLY

TABLE 96 PHEV: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 97 PHEV: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 98 PHEV: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 99 PHEV: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 KEY PRIMARY INSIGHTS

FIGURE 41 KEY PRIMARY INSIGHTS

10 AUTOMOTIVE TRACTION MOTOR MARKET, BY TYPE (Page No. - 129)

10.1 INTRODUCTION

FIGURE 42 MARKET, BY TYPE, 2022 VS. 2027

TABLE 100 MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 101 MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 102 MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 103 MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.1.1 OPERATIONAL DATA

TABLE 104 DIFFERENCE BETWEEN AC AND DC MOTORS

10.1.2 ASSUMPTIONS

TABLE 105 ASSUMPTIONS: BY MATERIAL TYPE

10.1.3 RESEARCH METHODOLOGY

10.2 DC

10.2.1 OPERATIONAL BENEFITS SUCH AS LOW NOISE AND LESS MAINTENANCE RAISE DEMAND FOR DC MOTORS

TABLE 106 DC: AUTOMOTIVE TRACTION MOTOR MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 107 DC: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 108 DC: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 109 DC: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 AC

10.3.1 HIGH EFFICIENCY AND LOW MANUFACTURING COST TO FUEL DEMAND FOR AC MOTORS

TABLE 110 AC: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 111 AC: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 112 AC: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 113 AC: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 KEY PRIMARY INSIGHTS

FIGURE 43 KEY PRIMARY INSIGHTS

11 AUTOMOTIVE TRACTION MOTOR MARKET, BY REGION (Page No. - 137)

11.1 INTRODUCTION

FIGURE 44 MARKET, BY REGION, 2022 VS. 2027

TABLE 114 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 115 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 116 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 117 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 ASIA PACIFIC

FIGURE 45 ASIA PACIFIC: AUTOMOTIVE TRACTION MOTOR MARKET SNAPSHOT

TABLE 118 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 119 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 120 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.1 CHINA

11.2.1.1 Heavy investments in EVs and stringent emission norms to boost market growth

TABLE 122 CHINA: MARKET, BY EV TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 123 CHINA: MARKET, BY EV TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 124 CHINA: MARKET, BY EV TYPE, 2018–2021 (USD MILLION)

TABLE 125 CHINA: MARKET, BY EV TYPE, 2022–2027 (USD MILLION)

11.2.2 JAPAN

11.2.2.1 Strong government support to reinforce transportation efficiency to offer lucrative opportunities to market players

TABLE 126 JAPAN: MARKET, BY EV TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 127 JAPAN: MARKET, BY EV TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 128 JAPAN: MARKET, BY EV TYPE, 2018–2021 (USD MILLION)

TABLE 129 JAPAN: MARKET, BY EV TYPE, 2022–2027 (USD MILLION)

11.2.3 INDIA

11.2.3.1 Major government initiatives to promote EV ecosystem to drive market

TABLE 130 INDIA: MARKET, BY EV TYPE, 2018–2021 (UNITS)

TABLE 131 INDIA: MARKET, BY EV TYPE, 2022–2027 (UNITS)

TABLE 132 INDIA: MARKET, BY EV TYPE, 2018–2021 (USD THOUSAND)

TABLE 133 INDIA: MARKET, BY EV TYPE, 2022–2027 (USD THOUSAND)

11.2.4 SOUTH KOREA

11.2.4.1 High investment in EV projects to drive demand for automotive traction motors

TABLE 134 SOUTH KOREA: MARKET, BY EV TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 135 SOUTH KOREA: MARKET, BY EV TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 136 SOUTH KOREA: MARKET, BY EV TYPE, 2018–2021 (USD MILLION)

TABLE 137 SOUTH KOREA: MARKET, BY EV TYPE, 2022–2027 (USD MILLION)

11.3 EUROPE

FIGURE 46 EUROPE: MARKET SNAPSHOT

TABLE 138 EUROPE: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 139 EUROPE: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 140 EUROPE: AUTOMOTIVE TRACTION MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 141 EUROPE: AUTOMOTIVE TRACTION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.1 FRANCE

11.3.1.1 Increasing adoption of electric vehicles to fuel market growth

TABLE 142 FRANCE: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

TABLE 143 FRANCE: AUTOMOTIVE TRACTION MOTOR MARKET, BY EV TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 144 FRANCE: MARKET, BY EV TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 145 FRANCE: MARKET, BY EV TYPE, 2018–2021 (USD MILLION)

TABLE 146 FRANCE: MARKET, BY EV TYPE, 2022–2027 (USD MILLION)

11.3.2 GERMANY

11.3.2.1 Increasing adoption of electric vehicles, growing focus on renewable energy capacity development programs, and presence of major automobile companies to fuel market growth

TABLE 147 GERMANY: MARKET, BY EV TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 148 GERMANY: MARKET, BY EV TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 149 GERMANY: MARKET, BY EV TYPE, 2018–2021 (USD MILLION)

TABLE 150 GERMANY: MARKET, BY EV TYPE, 2022–2027 (USD MILLION)

11.3.3 SPAIN

11.3.3.1 Rising adoption of EVs to increase demand for automotive traction motors

TABLE 151 SPAIN: MARKET, BY EV TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 152 SPAIN: MARKET, BY EV TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 153 SPAIN: MARKET, BY EV TYPE, 2018–2021 (USD MILLION)

TABLE 154 SPAIN: MARKET, BY EV TYPE, 2022–2027 (USD MILLION)

11.3.4 ITALY

11.3.4.1 Increasing adoption of EVs and focus on utilizing renewable energy sources to boost market

TABLE 155 ITALY: MARKET, BY EV TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 156 ITALY: MARKET, BY EV TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 157 ITALY: MARKET, BY EV TYPE, 2018–2021 (USD MILLION)

TABLE 158 ITALY: MARKET, BY EV TYPE, 2022–2027 (USD MILLION)

11.3.5 UK

11.3.5.1 Rising EV demand to push market growth

TABLE 159 UK: MARKET, BY EV TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 160 UK: MARKET, BY EV TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 161 UK: MARKET, BY EV TYPE, 2018–2021 (USD MILLION)

TABLE 162 UK: MARKET, BY EV TYPE, 2022–2027 (USD MILLION)

11.4 NORTH AMERICA

TABLE 163 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 164 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 165 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 166 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.1 US

11.4.1.1 Growth in electric cars segment to fuel demand for automotive traction motors

FIGURE 47 US EV MARKET

TABLE 167 US: MARKET, BY EV TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 168 US: MARKET, BY EV TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 169 US: MARKET, BY EV TYPE, 2018–2021 (USD MILLION)

TABLE 170 US: MARKET, BY EV TYPE, 2022–2027 (USD MILLION)

11.4.2 CANADA

11.4.2.1 Government support to promote EVs and rising investment in EV infrastructure to boost market

TABLE 171 CANADA: MARKET, BY EV TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 172 CANADA: MARKET, BY EV TYPE, 2022–2027 THOUSAND UNITS)

TABLE 173 CANADA: MARKET, BY EV TYPE, 2018–2021 (USD MILLION)

TABLE 174 CANADA: MARKET, BY EV TYPE, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 170)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS FOR AUTOMOTIVE TRACTION MOTOR MARKET

TABLE 175 MARKET SHARE ANALYSIS, 2021

FIGURE 48 MARKET SHARE ANALYSIS, 2021

12.2.1 BORGWARNER INC.

12.2.2 BYD CO., LTD.

12.2.3 SCHAEFFLER GROUP

12.2.4 ROBERT BOSCH GMBH

12.2.5 ZF FRIEDRICHSHAFEN AG

12.3 KEY PLAYER STRATEGIES

TABLE 176 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN AUTOMOTIVE TRACTION MOTOR MARKET

12.4 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

FIGURE 49 TOP PUBLIC/LISTED PLAYERS DOMINATING MARKET, 2017–2021

12.5 COMPETITIVE SCENARIO

12.5.1 NEW PRODUCT LAUNCHES

TABLE 177 NEW PRODUCT LAUNCHES, 2021–2022

12.5.2 DEALS

TABLE 178 DEALS, 2021–2022

12.5.3 OTHERS

TABLE 179 OTHERS, 2021–2022

12.6 COMPANY EVALUATION QUADRANT

12.6.1 STARS

12.6.2 EMERGING LEADERS

12.6.3 PERVASIVE PLAYERS

12.6.4 PARTICIPANTS

FIGURE 50 AUTOMOTIVE TRACTION MOTOR MARKET: COMPANY EVALUATION QUADRANT, 2022

TABLE 180 MARKET: COMPANY FOOTPRINT, 2022

TABLE 181 MARKET: PRODUCT FOOTPRINT, 2022

TABLE 182 MARKET: REGIONAL FOOTPRINT, 2022

12.7 START-UP/SME EVALUATION QUADRANT

12.7.1 PROGRESSIVE COMPANIES

12.7.2 RESPONSIVE COMPANIES

12.7.3 DYNAMIC COMPANIES

12.7.4 STARTING BLOCKS

FIGURE 51 MARKET: START-UP/SME EVALUATION QUADRANT, 2022

TABLE 183 MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 184 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UPS/SMES]

13 COMPANY PROFILES (Page No. - 190)

(Business overview, Products offered, Recent developments & MnM View)*

13.1 KEY PLAYERS

13.1.1 BORGWARNER INC.

TABLE 185 BORGWARNER INC.: BUSINESS OVERVIEW

FIGURE 52 BORGWARNER INC.: COMPANY SNAPSHOT

TABLE 186 BORGWARNER INC.: SUPPLY AGREEMENTS

TABLE 187 BORGWARNER INC.: PRODUCTS OFFERED

TABLE 188 BORGWARNER INC.: NEW PRODUCT DEVELOPMENTS

TABLE 189 BORGWARNER INC.: DEALS

TABLE 190 BORGWARNER INC.: OTHERS

13.1.2 BYD CO., LTD.

TABLE 191 BYD CO., LTD.: BUSINESS OVERVIEW

FIGURE 53 BYD CO., LTD.: COMPANY SNAPSHOT

TABLE 192 BYD CO., LTD.: SUPPLY AGREEMENTS

TABLE 193 BYD CO., LTD.: PRODUCTS OFFERED

TABLE 194 BYD CO., LTD.: NEW PRODUCT DEVELOPMENTS

TABLE 195 BYD CO., LTD.: DEALS

TABLE 196 BYD CO., LTD.: OTHERS

13.1.3 SCHAEFFLER GROUP

TABLE 197 SCHAEFFLER GROUP: BUSINESS OVERVIEW

FIGURE 54 SCHAEFFLER GROUP: COMPANY SNAPSHOT

TABLE 198 SCHAEFFLER GROUP: SUPPLY AGREEMENTS

TABLE 199 SCHAEFFLER GROUP: PRODUCTS OFFERED

TABLE 200 SCHAEFFLER GROUP: NEW PRODUCT DEVELOPMENTS

TABLE 201 SCHAEFFLER GROUP: DEALS

TABLE 202 SCHAEFFLER GROUP: OTHERS

13.1.4 ROBERT BOSCH GMBH

TABLE 203 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

FIGURE 55 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

TABLE 204 ROBERT BOSCH GMBH: SUPPLY AGREEMENTS

TABLE 205 ROBERT BOSCH GMBH: PRODUCTS OFFERED

TABLE 206 ROBERT BOSCH GMBH: NEW PRODUCT DEVELOPMENTS

TABLE 207 ROBERT BOSCH GMBH: DEALS

TABLE 208 ROBERT BOSCH GMBH: OTHERS

13.1.5 ZF FRIEDRICHSHAFEN AG

TABLE 209 ZF FRIEDRICHSHAFEN AG: BUSINESS OVERVIEW

FIGURE 56 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

TABLE 210 ZF FRIEDRICHSHAFEN AG: SUPPLY AGREEMENTS

TABLE 211 ZF FRIEDRICHSHAFEN AG: PRODUCTS OFFERED

TABLE 212 ZF FRIEDRICHSHAFEN AG: NEW PRODUCT DEVELOPMENTS

TABLE 213 ZF FRIEDRICHSHAFEN AG: DEALS

TABLE 214 ZF FRIEDRICHSHAFEN AG: OTHERS

13.1.6 JOHNSON ELECTRIC HOLDINGS LTD.

TABLE 215 JOHNSON ELECTRIC HOLDINGS LTD.: BUSINESS OVERVIEW

FIGURE 57 JOHNSON ELECTRIC HOLDINGS LTD.: COMPANY SNAPSHOT

TABLE 216 JOHNSON ELECTRIC HOLDINGS LTD.: PRODUCTS OFFERED

13.1.7 CONTINENTAL AG

TABLE 217 CONTINENTAL AG: BUSINESS OVERVIEW

FIGURE 58 CONTINENTAL AG: COMPANY SNAPSHOT

TABLE 218 CONTINENTAL AG: SUPPLY AGREEMENTS

TABLE 219 CONTINENTAL AG: PRODUCTS OFFERED

TABLE 220 CONTINENTAL AG: NEW PRODUCT DEVELOPMENTS

TABLE 221 CONTINENTAL AG: DEALS

TABLE 222 CONTINENTAL AG: OTHERS

13.1.8 VALEO S.A.

TABLE 223 VALEO S.A.: BUSINESS OVERVIEW

FIGURE 59 VALEO S.A.: COMPANY SNAPSHOT

TABLE 224 VALEO S.A.: SUPPLY AGREEMENTS

TABLE 225 VALEO S.A.: PRODUCTS OFFERED

TABLE 226 VALEO S.A.: NEW PRODUCT DEVELOPMENTS

TABLE 227 VALEO S.A.: DEALS

13.1.9 MAHLE GROUP

TABLE 228 MAHLE GROUP: BUSINESS OVERVIEW

FIGURE 60 MAHLE GROUP: COMPANY SNAPSHOT

TABLE 229 MAHLE GROUP: PRODUCTS OFFERED

TABLE 230 MAHLE GROUP: NEW PRODUCT DEVELOPMENTS

TABLE 231 MAHLE GROUP: DEALS

TABLE 232 MAHLE GROUP: OTHERS

13.1.10 NIDEC CORPORATION

TABLE 233 NIDEC CORPORATION: BUSINESS OVERVIEW

FIGURE 61 NIDEC CORPORATION: COMPANY SNAPSHOT

TABLE 234 NIDEC CORPORATION: SUPPLY AGREEMENTS

TABLE 235 NIDEC CORPORATION: PRODUCTS OFFERED

TABLE 236 NIDEC CORPORATION: NEW PRODUCT DEVELOPMENTS

TABLE 237 NIDEC CORPORATION: DEALS

TABLE 238 NIDEC CORPORATION: OTHERS

13.1.11 MITSUBA CORPORATION

TABLE 239 MITSUBA CORPORATION: BUSINESS OVERVIEW

FIGURE 62 MITSUBA CORPORATION: COMPANY SNAPSHOT

TABLE 240 MITSUBA CORPORATION: PRODUCTS OFFERED

13.1.12 ZHEJIANG FOUNDER MOTOR CO., LTD.

TABLE 241 ZHEJIANG FOUNDER MOTOR CO., LTD.: BUSINESS OVERVIEW

FIGURE 63 ZHEJIANG FOUNDER MOTOR CO., LTD.: COMPANY SNAPSHOT

TABLE 242 ZHEJIANG FOUNDER MOTOR CO., LTD.: SUPPLY AGREEMENTS

TABLE 243 ZHEJIANG FOUNDER MOTOR CO., LTD.: PRODUCTS OFFERED

TABLE 244 ZHEJIANG FOUNDER MOTOR CO., LTD.: DEALS

TABLE 245 ZHEJIANG FOUNDER MOTOR CO., LTD.: OTHERS

13.1.13 SHENZHEN INOVANCE TECHNOLOGY CO., LTD.

TABLE 246 SHENZHEN INOVANCE TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

FIGURE 64 SHENZHEN INOVANCE TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

TABLE 247 SHENZHEN INOVANCE TECHNOLOGY CO., LTD.: SUPPLY AGREEMENTS

TABLE 248 SHENZHEN INOVANCE TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

TABLE 249 SHENZHEN INOVANCE TECHNOLOGY CO., LTD.: DEALS

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

13.2 OTHER PLAYERS

13.2.1 DENSO CORPORATION

TABLE 250 DENSO CORPORATION: BUSINESS OVERVIEW

13.2.2 JING-JIN ELECTRIC

TABLE 251 JING-JIN ELECTRIC: BUSINESS OVERVIEW

13.2.3 SHANGHAI EDRIVE CO., LTD.

TABLE 252 SHANGHAI EDRIVE CO., LTD.: BUSINESS OVERVIEW

13.2.4 UNITED AUTOMOTIVE ELECTRONICS CO., LTD.

TABLE 253 UNITED AUTOMOTIVE ELECTRONICS CO., LTD.: BUSINESS OVERVIEW

13.2.5 ZHUHAI ENPOWER ELECTRIC CO., LTD.

TABLE 254 ZHUHAI ENPOWER ELECTRIC CO., LTD.: BUSINESS OVERVIEW

13.2.6 SHUANGLIN GROUP

TABLE 255 SHUANGLIN GROUP: BUSINESS OVERVIEW

13.2.7 ZHUZHOU CRRC TIMES ELECTRIC CO., LTD.

TABLE 256 ZHUZHOU CRRC TIMES ELECTRIC CO., LTD.: BUSINESS OVERVIEW

13.2.8 XPT DRIVE TECHNOLOGY

TABLE 257 XPT DRIVE TECHNOLOGY: BUSINESS OVERVIEW

13.2.9 AISIN CORPORATION

TABLE 258 AISIN CORPORATION: BUSINESS OVERVIEW

13.2.10 GKN AUTOMOTIVE LIMITED

TABLE 259 GKN AUTOMOTIVE LIMITED: BUSINESS OVERVIEW

13.2.11 ANAND MANDO EMOBILITY

TABLE 260 ANAND MANDO EMOBILITY: BUSINESS OVERVIEW

13.2.12 HYUNDAI TRANSYS INC.

TABLE 261 HYUNDAI TRANSYS INC.: BUSINESS OVERVIEW

14 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 269)

14.1 ASIA PACIFIC TO BE MAJOR MARKET FOR AUTOMOTIVE TRACTION MOTORS

14.2 RISING DEMAND FOR HEVS TO CREATE OPPORTUNITIES FOR MARKET GROWTH IN COMING YEARS

14.3 CONCLUSION

15 APPENDIX (Page No. - 271)

15.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 CUSTOMIZATION OPTIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

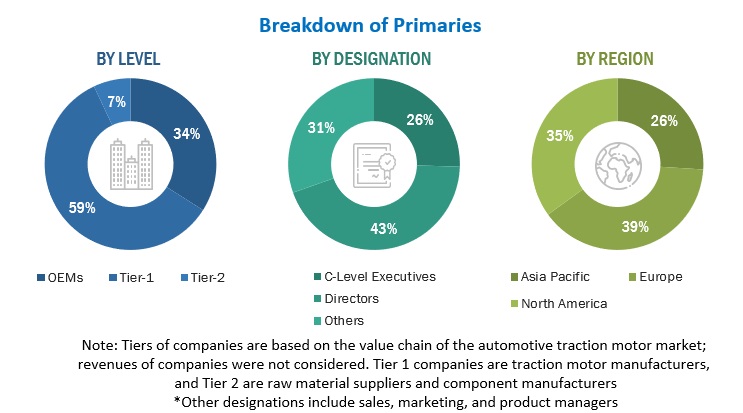

Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred for this research study included publications from government sources [such as country level automotive associations and organizations, Organisation for Economic Co-operation and Development (OECD), World Bank, CDC, and Eurostat]; corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; free and paid automotive databases such as The International Energy Agency, EV-volumes, Alternative Fuels Data Center (AFDC), the European Alternative Fuels Observatory (EAFO), Automotive Electronics Council (AEC) and other associations/organizations. Secondary data was collected and analyzed to arrive at the overall size of the global market, which was validated by primary research.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the global automotive traction motor market scenarios through secondary research. Several primary interviews were conducted with market experts from both the demand (country-level government associations, trade associations, institutes, R&D centers, and OEMs/vehicle manufacturers) and supply (traction motor manufacturers, traction motor component manufacturers, and raw material suppliers) sides across three major regions, namely, North America, Europe, and Asia Pacific. In this study, 21% of the experts involved in primary interviews were from the demand side, and 79% were from the supply side of the industry. Primary data was collected through questionnaires, emails, and telephonic interviews. Several primary interviews were conducted from various departments within organizations, such as sales, operations, administration, and so on, to provide a holistic viewpoint in the report.

After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, led to the findings delineated in the rest of this report.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations. The primary sources from the demand side included end-users, such as chief information officers (CIOs), consultants, service professionals, technicians and technologists, and managers at public and investor-owned utilities.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches were used to estimate and validate the size of the global automotive traction motor market. In these approaches, the electric vehicle sales statistics for each electric vehicle type (BEV, PHEV, and HEV) at a country level were considered.

In the bottom-up approach, the number of electric vehicle sales of each electric vehicle type at the country level was considered. The number of traction motors per vehicle was identified through model mapping and secondary research. The sale of electric vehicles at the country level was then multiplied with the number of traction motors in each EV type to determine the market size of the market in terms of volume. The country-level market size, in terms of volume, by EV type, was then multiplied with the country-level average traction motor selling price (ASP) of each electric vehicle type to determine the market size in terms of value for each EV type. The summation of the country-level market size for each EV type, by volume and value, would give the regional level market size. The summation of the regional markets provides the global market size. The market size for vehicle type was derived from the global market.

The top-down approach was used to estimate and validate the size of the automotive traction motor market by motor type, power output, and type. To derive the market size by type, the global market size in terms of volume and value was divided into AC and DC using the penetration and percentage split, respectively. The global market was further segmented at the regional level. A similar approach was used to derive the market size of motor type and power output segments in terms of volume and value.

Data Triangulation

After arriving at the overall market size of the global market through the abovementioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Report Objectives

-

To define, describe, and project the automotive traction motor market by volume

(thousand units) and value (USD million/USD Billion) - To define, describe, and forecast the market based on type, motor type, EV type, power output, vehicle type, and region.

- To analyze and forecast market size, in terms of volume and value, based on type (AC and DC)

- To analyze and forecast the market size, in terms of volume and value, based on motor type (PMSM and AC induction motor)

- To analyze and forecast the market size, in terms of volume and value, based on EV type {battery electric vehicle (BEV), hybrid electric vehicle (HEV), and plug-hybrid electric vehicle (PHEV).

- To analyze and forecast the market size, in terms of volume and value, based on vehicle type (passenger cars, buses, pickup trucks, trucks, and vans)

-

To analyze and forecast the market size, by volume and value, based on power output

(less than 200 kW, 200–400 kW, and above 400 kW) - To forecast the size of various segments of the market based on three regions—North America, Europe, and Asia Pacific, along with major countries in each region

- To analyze the technological developments impacting the automotive traction motors market

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze markets with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, and supply agreements), new product development, and other activities carried out by key industry participants

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in line with the company’s specific needs.

- Automotive Traction Motor Market, by vehicle type at country-level (for countries covered in the report)

- Automotive Traction Motor Market, by motor type at country-level (for countries covered in the report)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Traction Motor Market