Automotive Fuse Market by Fuse Type (Blade, Glass Tube, Semiconductor, Limiter, Slow Blow/Multi Slow Blow Fuses), Electric Vehicle Application, Voltage, Amperage, ICE Vehicle Type, EV Type, Aftermarket and Region - Global Forecast to 2027

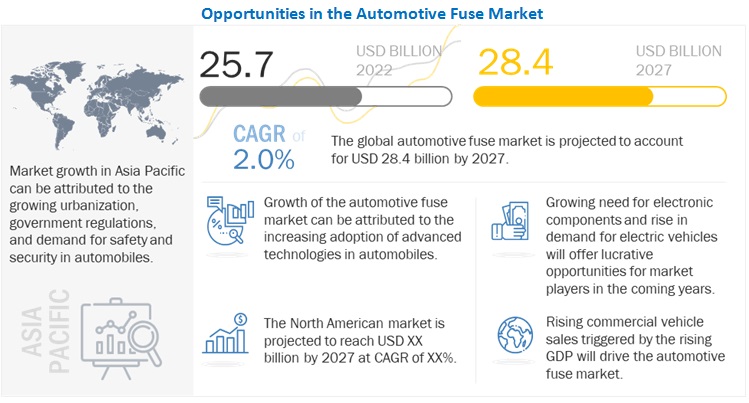

The global automotive fuse market size was valued at USD 25.7 billion in 2022 and is expected to reach USD 28.4 billion by 2027 at a CAGR of 2.0% during the forecast period 2022-2027. Developed economies such as the US, Japan, Germany, and the UK have a significant share of green vehicles due to rising concern of environment-friendly vehicles. However, in developing countries such as India, South Korea and Brazil, the use of green vehicles is at a beginning phase. The lack of charging stations and the high cost of electric vehicles can hinder the growth of the electric vehicle market in these countries. The global automotive fuse industry is significantly being aided by the rising demand from the Asia Pacific region. The market in the region is witnessing a rapid growth owing to the increased demand for passenger cars with comfort and protection, government safety rules and regulations, as well as high vehicle sales in the region.

Asia Pacific is projected to be the largest market for automotive fuse during the forecast period. Increasing demand for vehicle safety features and government mandates on safety technologies such as airbag are expected to drive the automotive fuse market in the Asia Pacific region. Increase in vehicle electronics and application of high voltage architecture to reduce vehicle emissions are key factors that would increase the application of fuse in a vehicle.

To know about the assumptions considered for the study, Request for Free Sample Report

Driver: Increasing application of high-voltage architecture in electric vehicles

The dated 12-V auto electrical systems are no longer viable in new vehicles, especially hybrid electrical vehicles (HEVs) and new all-electric vehicles (EVs). A higher voltages electrical system in vehicles results in increased efficiency. The dramatic increase in electronics designed into vehicles over the years has revealed the weaknesses of standard 12-V electrical systems. The advanced driver assistance systems (ADAS), now in most new vehicles, have added multiple processors and high-current sensors and actuators, in addition to other devices. Most new hybrid vehicles now include a 48-V system; standard vehicles with internal combustion engines are moving in that direction. In April 2020, the Government of India implemented the BS6 emission standard to control the outflow of air pollutants from vehicles. All these factors collectively escalate the demand for high-voltage electric vehicles in the near future. In terms of electric vehicles, a higher voltage system allows a lower current to be used when charging the battery, which reduces overheating and allows better power retention in the system. This power can be used for a longer driving range.

Restraint: Volatility in raw material prices

The procurement of raw materials has an important impact on the pricing of the end product. Any fluctuation in raw material pricing due to economic and political unrest can impact the prices of a component such as automotive fuses. The final products, such as vehicle components, are made of steel, plastic, copper, aluminum, or composition of multiple materials. The supply of basic raw materials like steel, copper, aluminum etc. has become unreliable and the prices are extremely volatile. These materials shortages inevitably lead to longer lead times, which the automotive supply chain is not well prepared to deal with which is likely to impact the automotive fuse market, especially for players having global presence, thus increasing challenges for them to be competitive. The high cost of materials such as steel, plastic, copper, aluminum prevents the extensive use of these materials in a vehicle.

Opportunity: Increasing sale of premium vehicles

With improving economic status globally, there is a change in the overall lifestyle of consumers. This change is noticeable, especially in developing countries, such as China, India, and Brazil. The increased sales of passenger cars globally, especially of premium passenger cars, which are more than USD 25,000, indicates improved lifestyle and financial status. With an increasing number of families having a high disposable income, the demands have changed in line with their new lifestyle, leading to a change in their preferences. Factors, such as increasing per capita income, improving infrastructure, and increasing competition between OEMs to offer improved features, have also positively impacted the sales of premium passenger vehicles across the globe. The purchasing power of consumers is high in developed countries, such as the US, the UK, and Germany. Hence, consumers can afford premium vehicles. The demand for automotive fuse is expected to grow in line with the increased demand for premium automobiles since the application of automotive fuse in premium vehicles is higher than in mid-segment or low-segment vehicles, owing to additional safety and luxury features.

Challenge: Connected smart junction box for autonomous vehicles

The junction box removes the need to run a wire from every outlet or switch back to the main service panel. Nowadays, junction box features with electronic module functionality. When a junction box is used for every electrical connection, it is much easier to locate and repair any electrical problems that appeared in the system. Every electrical connection should be inside a protective box that is easy to find and access, and a junction box is used for that. Also, the ongoing electrification of vehicles impacts all vehicle systems and provides an excellent reason for overhauling automotive power distribution architecture. With the advent of autonomous cars, the number of electronics in a vehicle is increasing. Hence, the demand for smart junction boxes will increase with the growing production of autonomous cars. Thus, it will act as a threat for Tier 1 manufacturers of automotive fuses, since the number of fuses will be reduced compared to today’s vehicles.

>300 V by voltage is expected to be the fastest growing segment during the forecast period

Automotive fuses play an important role in protecting electrical circuits, components, and switches in high-voltage vehicles since overvoltage can severely damage the circuits and components. The number of battery fuses used in BEVs, and most PHEVs, is higher due to the use of high-capacity batteries in these vehicles. Some models with >300 V architecture are the Tesla Model S, VW Golf PHEV, and Audi A3 PHEV. In October 2021, Eaton introduced the EVK Series, a new line of Bussmann series fuses. The new line of high-voltage fuses meets the requirements for use in the latest high-powered electrified vehicles (EVs) with ratings up to 1,000 volts of direct current (VDC) and 600 amps. An increase in the manufacturing and sales of BEVs and PHEVs will result in an increase in the charging management system, which will drive the market for >300 V automotive fuse market.

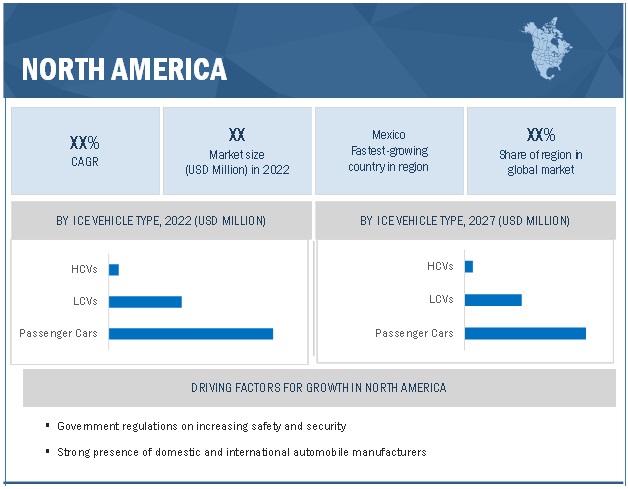

North America will be a major contributor for Automotive Fuse Market

The North American Free Trade Agreement (NAFTA) has fostered the growth of the automotive industry in the region, which is driving the market. The US, traditionally a global technological leader, is the largest automotive market in North America. It leads the region’s market, with the highest passenger car, LCV, and HCV sales. It also leads the market for EVs, in line with the highest EV sales in the North American region. A large customer base and high disposable incomes fuel the demand for vehicles in the country and result in increased manufacturing activities by local automotive OEMs. The sales statistics of North America indicate a promising growth potential, particularly for LCVs and HCVs, which dominate the market. The market in the region is expected to witness significant growth during the forecast period due to the higher penetration of advanced technology and safety features in most vehicles.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players considered in the analysis of the Automotive Fuse market are as Eaton (Ireland), Littelfuse (US), Sensata (US), Schurter Group (Switzerland), and Mersen (France). These companies offer extensive products for the automotive industry and have strong distribution networks, and they invest heavily in R&D to develop new products.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast Market Size |

Value & Volume |

|

Segments covered |

By Fuse type (blade fuse, semiconductor fuse, limiter fuse, glass tube fuse, slow blow/multi slow blow fuse), by voltage (12 & 24 V, 24-48 V, 49-150 V, 151-300 V, >300 V), by ampere, by ICE vehicle type, by electric vehicle type, (EV, by Application), by sales channel, by application |

|

Region covered |

Asia Pacific, Europe, North America and Rest of the World |

|

Companies Covered |

Eaton (Ireland), Schurter Group (Switzerland), Littelfuse (US), Sensata (US) and Mersen (France) are top players in the market |

This research report categorizes the Automotive Fuse market based on fuse type, voltage, ampere, ICE Vehicle type, electric vehicle type, (EV, by Application), sales channel, application and region

By fuse type

- Blade fuse

- Glass tube fuse

- Semiconductor fuse

- Limiter fuse

- Slow blow/multi slow blow fuse

- Others

By voltage

- 12 & 24V

- 24-48V

- 49-150V

- 151-300V

- >300V

By applications in EV

- Auxiliary Fuse

- Engine fuse

- Charge inlet fuse

- Battery fuse

- PCU fuse

- Onboard charger fuse

- Traction Motor fuse

By ampere

- <40A

- 40-100A

- >100A

By sales channel

- OEM

- Aftermarket

By application

- Engine Compartment

- Cabin Area/Under the Dashboard

By ICE vehicle type

- PC

- LCV

- HCV

By electric vehicle type

- BEV

- HEV

- PHEV

By region

- North America

- Asia Oceania

- Europe

- RoW

Recent Developments

- In March 2022, Littelfuse announced the new 828 Series High-Voltage Cartridge Fuse designed and tested to meet the circuit protection needs of compact automotive electronics, especially Electric Vehicle (EV) applications.

- In October 2021, Eaton introduced the EVK Series, a new line of Bussmann series fuses. The new line of high-voltage fuses meets the requirements for use in the latest high-powered electrified vehicles (EVs) with ratings up to 1,000 volts of direct current (VDC) and 600 amps.

- In May 2021, Eaton Corporation and Cooper Industries PLC entered into a definitive agreement to increase the capabilities and geographic breadth of the combined company’s power management portfolio and electrical business.

Frequently Asked Questions (FAQ):

What are different segment covered in report for Automotive Fuse market?

The Automotive Fuse market is covered for fuse type, by voltage, by ampere, by sales channel, by application, (EV, by application), by electric vehicle type, by ICE vehicle type and by region.

Who are the major players in Automotive Fuse market?

Eaton (Ireland), Littelfuse (US), Sensata (US), Schurter Group (Switzerland), and Mersen (France)are recognized as stars in the Automotive Fuse market. They have a strong portfolio of automotive fuses. These companies have been marking their presence in by offering advanced and innovative fuses, coupled with their robust business strategies, to achieve constant growth in the automotive fuse market. Moreover, these companies have a strong presence across the globe.

What are the new market trends impacting the growth of the Automotive Fuse market?

The automotive industry has witnessed rapid evolution with ongoing developments in engineering and technology. Technological advancements, such as battery swapping, use of high-performance battery, high motor power have boosted the demand for automotive fuses.

Which regions are considered in the Automotive Fuse market?

The report covers market sizing for regions such as Asia Pacific, Europe, North America and Rest of the World. Additionally, qualitative insights were covered for countries such as Netherlands and Norway. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 AUTOMOTIVE FUSE MARKET, BY FUSE TYPE

1.2.2 MARKET, BY ICE VEHICLE TYPE

1.2.3 MARKET, BY ELECTRIC VEHICLE TYPE

1.2.4 MARKET, BY SALES CHANNEL

1.2.5 MARKET, BY APPLICATION

1.2.6 MARKET: INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 CURRENCY EXCHANGE RATES, 2017-2021 (PER USD)

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 2 AUTOMOTIVE FUSE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.1.2 List of secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 List of companies participating in primary research

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET: TOP-DOWN APPROACH

2.3 FACTOR ANALYSIS

FIGURE 7 FACTORS IMPACTING THE MARKET

FIGURE 8 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

2.4 DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

2.6 LIMITATIONS AND RISK ASSESSMENT

2.6.1 RISK ASSESSMENT

2.6.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 10 AUTOMOTIVE FUSE MARKET: MARKET DYNAMICS

FIGURE 11 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET, BY AMPERE, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE FUSE MARKET

FIGURE 13 GROWING ELECTRIFICATION AND NEED FOR SAFETY FEATURES FOR PASSENGER VEHICLES DRIVING MARKET

4.2 MARKET, BY FUSE TYPE

FIGURE 14 BLADES SEGMENT EXPECTED TO DOMINATE MARKET BY 2027

4.3 MARKET, BY VOLTAGE

FIGURE 15 12 & 24 V SEGMENT EXPECTED TO ACCOUNT FOR LARGEST SIZE BY 2027

4.4 MARKET, BY AMPERE

FIGURE 16 40-100 A SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET BY 2027

4.5 MARKET, BY ICE VEHICLE TYPE

FIGURE 17 PASSENGER CARS SEGMENT EXPECTED TO DOMINATE MARKET DURING FORECAST PERIOD

4.6 MARKET, BY ELECTRIC VEHICLE TYPE

FIGURE 18 BEVS SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

4.7 ELECTRIC VEHICLE FUSE MARKET, BY APPLICATION

FIGURE 19 BATTERY FUSES SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET BY 2027

4.8 MARKET, BY SALES CHANNEL

FIGURE 20 OEMS SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET BY 2027

4.9 MARKET, BY APPLICATION

FIGURE 21 ENGINE COMPARTMENTS SEGMENT EXPECTED TO ACCOUNT FOR LARGER SHARE BY 2027

4.10 MARKET, BY REGION

FIGURE 22 ASIA PACIFIC EXPECTED TO ACCOUNT FOR LARGEST MARKET SHARE BY 2022

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

TABLE 2 AUTOMOTIVE FUSE MARKET: IMPACT OF MARKET DYNAMICS

5.2 MARKET DYNAMICS

FIGURE 23 AUTOMOTIVE FUSE: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing application of high-voltage architecture in electric vehicles

FIGURE 24 HIGH-VOLTAGE ARCHITECTURE IN ELECTRIC VEHICLES

5.2.1.2 Increasing vehicle safety and comfort features in mid-segment vehicles

FIGURE 25 POWER MANAGEMENT FOR ADVANCED DRIVER ASSISTANCE SYSTEMS

5.2.1.3 High battery capacity

TABLE 3 EV MODELS WITH BATTERY MODULES AND CELLS

5.2.2 RESTRAINTS

5.2.2.1 Limited development in low-voltage fuses

5.2.2.2 Volatility in raw material prices

FIGURE 26 TRENDS IN GLOBAL ALUMINUM PRICES PER METRIC TON, 2018-2021 (USD)

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing sale of premium vehicles

TABLE 4 KEY PREMIUM VEHICLE MANUFACTURERS AND THEIR VEHICLE SALES IN CHINA, US, AND UK, 2020–2021 (UNITS)

5.2.3.2 Introduction of semi-autonomous and autonomous vehicles

FIGURE 27 AUTONOMOUS CAR TECHNOLOGY

5.2.4 CHALLENGES

5.2.4.1 Unorganized aftermarket

TABLE 5 UNORGANIZED FUSE AFTERMARKET COMPANIES

5.2.4.2 Connected smart junction box for autonomous vehicles

FIGURE 28 SMART JUNCTION BOX ARCHITECTURE

5.3 PORTER’S FIVE FORCES

FIGURE 29 PORTER’S FIVE FORCES: MARKET

TABLE 6 MARKET: IMPACT OF PORTER’S FIVE FORCES

5.3.1 THREAT OF SUBSTITUTES

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 MACROECONOMIC INDICATORS

5.4.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

TABLE 7 GDP TRENDS AND FORECASTS, BY COUNTRY, 2018–2026 (USD BILLION)

5.5 PATENT ANALYSIS

TABLE 8 PATENT ANALYSIS: MARKET (ACTIVE PATENTS)

TABLE 9 MARKET: PATENTED DOCUMENTS PUBLISHED, FILED, AND GRANTED

5.6 CASE STUDIES

5.6.1 FUSE SELECTION FOR ELECTRIC VEHICLES

5.6.2 MULTI-ANGLE AUTOMOTIVE FUSE BOX DETECTION AND TWO-ASSEMBLY METHODS BASED ON MACHINE VISION

5.7 TRENDS AND DISRUPTIONS IMPACTING MARKET

FIGURE 30 INCREASING ELECTRONIC COMPONENTS IN AUTOMOBILES DRIVING MARKET

5.8 AVERAGE SELLING PRICE ANALYSIS: MARKET

TABLE 10 AUTOMOTIVE FUSE GLOBAL AVERAGE PRICE (USD), 2022

5.9 ECOSYSTEM ANALYSIS

FIGURE 31 MARKET: ECOSYSTEM ANALYSIS

5.9.1 OEMS

5.9.2 RAW MATERIAL SUPPLIERS

5.9.3 COMPONENT MANUFACTURERS

5.10 SUPPLY CHAIN ANALYSIS

TABLE 11 MARKET: SUPPLY CHAIN

FIGURE 32 MARKET: SUPPLY CHAIN ANALYSIS

5.10.1 RAW MATERIAL SUPPLIERS

5.10.2 COMPONENT MANUFACTURERS

5.10.3 OEMS

5.11 DETAILED LIST OF CONFERENCES AND EVENTS, 2022-2023

TABLE 12 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.12 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

TABLE 16 INFLUENCE OF INSTITUTIONAL BUYERS (COMMERCIAL USAGE) IN BUYING AUTOMOTIVE FUSES

5.13.2 BUYING CRITERIA

5.13.2.1 Blade Fuses

5.13.2.2 Glass Tube Fuses

5.13.2.3 Semiconductor Fuses

5.14 REGULATORY FRAMEWORK

FIGURE 33 EMISSION REDUCTION FRAMEWORK OF MAJOR COUNTRIES, 2021

TABLE 17 EURO VI STANDARDS 2021: EUROPEAN EMISSION NORMS

TABLE 18 US III STANDARDS 2021: US EMISSION NORMS

TABLE 19 CHINA 6A, 6B STANDARDS 2021: CHINA EMISSION NORMS

TABLE 20 JAPAN WLTC STANDARDS 2021: JAPAN EMISSION NORMS

TABLE 21 BRAZIL L-6 STANDARDS 2021: BRAZIL EMISSION NORMS

5.15 TECHNOLOGY OVERVIEW

5.15.1 ELECTRONIC FUSES COMPLIANT WITH ARCHITECTURE FOR AUTONOMOUS DRIVING

5.15.2 SMART FUSING

5.15.3 BLADE FUSES

5.16 SCENARIO ANALYSIS (2022–2027)

5.16.1 MOST LIKELY

TABLE 22 MARKET: MOST LIKELY SCENARIO, BY REGION, 2022–2027 (USD MILLION)

5.16.2 OPTIMISTIC

TABLE 23 MARKET: OPTIMISTIC SCENARIO, BY REGION, 2022–2027 (USD MILLION)

5.16.3 PESSIMISTIC

TABLE 24 MARKET: PESSIMISTIC SCENARIO, BY REGION, 2022–2027 (USD MILLION)

6 AUTOMOTIVE FUSE MARKET, BY FUSE TYPE (Page No. - 82)

6.1 INTRODUCTION

FIGURE 34 BLADE FUSES SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SHARE BY 2027

TABLE 25 MARKET, BY FUSE TYPE, 2018–2021 (MILLION UNITS)

TABLE 26 MARKET, BY FUSE TYPE, 2022–2027 (MILLION UNITS)

TABLE 27 MARKET, BY FUSE TYPE, 2018–2021 (USD MILLION)

TABLE 28 MARKET, BY FUSE TYPE, 2022–2027 (USD MILLION)

6.1.1 OPERATIONAL DATA

TABLE 29 AUTOMOTIVE FUSE OFFERINGS, BY TYPE

6.1.2 ASSUMPTIONS

6.1.3 RESEARCH METHODOLOGY

6.2 BLADE FUSES

6.2.1 GROWING COMPLEXITY OF AUTOMOTIVE ELECTRONICS TO DRIVE DEMAND

TABLE 30 BLADE FUSES: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 31 BLADE FUSES: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 32 BLADE FUSES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 BLADE FUSES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 GLASS TUBE FUSES

6.3.1 RAPID ADOPTION OF ELECTRONICS IN VEHICLES

TABLE 34 GLASS TUBE FUSES: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 35 GLASS TUBE FUSES: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 36 GLASS TUBE FUSES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 GLASS TUBE FUSES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 SEMICONDUCTOR FUSES

6.4.1 GROWTH IN PRODUCTION OF ENVIRONMENT FRIENDLY VEHICLES

TABLE 38 SEMICONDUCTOR FUSES: MARKET SIZE, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 39 SEMICONDUCTOR FUSES: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 40 SEMICONDUCTOR FUSES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 SEMICONDUCTOR FUSES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.5 LIMITERS

6.5.1 OPERATING ACCURACY TO DRIVE USE OF LIMITERS

TABLE 42 LIMITERS: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 43 LIMITERS: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 44 LIMITERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 45 LIMITERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.6 SLOW BLOW/MULTI-SLOW BLOW FUSES

6.6.1 RISING NEED FOR AUTOMOTIVE INFOTAINMENT PROTECTION

TABLE 46 SLOW BLOW/MULTI-SLOW BLOW FUSES: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 47 SLOW BLOW/MULTI-SLOW BLOW FUSES: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 48 SLOW BLOW/MULTI-SLOW BLOW FUSES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 SLOW BLOW/MULTI-SLOW BLOW FUSES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.7 OTHER FUSE TYPES

TABLE 50 OTHER FUSE TYPES: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 51 OTHER FUSE TYPES: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 52 OTHER FUSE TYPES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 OTHER FUSE TYPES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.8 KEY PRIMARY INSIGHTS

FIGURE 35 KEY PRIMARY INSIGHTS

7 AUTOMOTIVE FUSE MARKET, BY VOLTAGE (Page No. - 96)

7.1 INTRODUCTION

FIGURE 36 12 & 24 V SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE BY 2027

TABLE 54 MARKET, BY VOLTAGE, 2018–2021 (MILLION UNITS)

TABLE 55 MARKET, BY VOLTAGE, 2022–2027 (MILLION UNITS)

TABLE 56 MARKET, BY VOLTAGE, 2018–2021 (USD MILLION)

TABLE 57 MARKET, BY VOLTAGE, 2022–2027 (USD MILLION)

7.1.1 OPERATIONAL DATA

TABLE 58 AUTOMOTIVE FUSE OFFERINGS, BY VOLTAGE

7.1.2 ASSUMPTIONS

7.1.3 RESEARCH METHODOLOGY

7.2 12 & 24 V

7.2.1 INCREASING NEED FOR AUTOMOTIVE WIRING AND CABLES WITH LOW VOLTAGES

TABLE 59 12 & 24 V: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 60 12 & 24 V: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 61 12 & 24 V: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 12 & 24 V: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 >24–48 V

7.3.1 GROWING MARKET FOR BATTERY APPLICATIONS

TABLE 63 >24–48 V: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 64 >24–48 V: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 65 >24–48 V: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 >24–48 V: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 49–150 V

7.4.1 RISING DEMAND FOR HEAVY ELECTRIC VEHICLES

TABLE 67 49–150 V: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 68 49–150 V: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 69 49–150 V: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 70 49–150 V: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 151–300 V

7.5.1 INCREASING CHARGING MANAGEMENT FOR ELECTRIC VEHICLES

TABLE 71 151–300 V: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 72 151–300 V: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 73 151–300 V: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 74 151–300 V: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 >300 V

7.6.1 GROWING MARKET FOR PHEVS

TABLE 75 >300 V: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 76 >300 V: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 77 >300 V: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 78 >300 V: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.7 KEY PRIMARY INSIGHTS

FIGURE 37 KEY PRIMARY INSIGHTS

8 AUTOMOTIVE FUSE MARKET, BY AMPERE (Page No. - 108)

8.1 INTRODUCTION

FIGURE 38 40–100 A SEGMENT EXPECTED TO ACCOUNT FOR LARGEST SIZE BY 2027

TABLE 79 MARKET, BY AMPERE, 2018–2021 (MILLION UNITS)

TABLE 80 MARKET, BY AMPERE, 2022–2027 (MILLION UNITS)

TABLE 81 MARKET, BY AMPERE, 2018–2021 (USD MILLION)

TABLE 82 MARKET, BY AMPERE, 2022–2027 (USD MILLION)

8.1.1 OPERATIONAL DATA

TABLE 83 AUTOMOTIVE FUSE OFFERINGS, BY AMPERE

8.1.2 ASSUMPTIONS

8.1.3 RESEARCH METHODOLOGY

8.2 <40 A

8.2.1 INCREASING CABIN COMFORT IN VEHICLES TO DRIVE <40 A SEGMENT

TABLE 84 <40 A: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 85 <40 A: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 86 <40 A: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 87 <40 A: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 40–100 A

8.3.1 INCREASING ENGINE-RELATED ELECTRICAL CIRCUIT

TABLE 88 40–100 A: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 89 40–100 A: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 90 40–100 A: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 91 40–100 A: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 >100 A

8.4.1 GROWING ELECTRIC VEHICLE MARKET TO DRIVE >100 A SEGMENT

TABLE 92 >100 A: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 93 >100 A: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 94 >100 A: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 95 >100 A: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 KEY PRIMARY INSIGHTS

FIGURE 39 KEY PRIMARY INSIGHTS

9 AUTOMOTIVE FUSE MARKET, BY ICE VEHICLE TYPE (Page No. - 117)

9.1 INTRODUCTION

FIGURE 40 PASSENGER CARS SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE BY 2027

TABLE 96 MARKET, BY ICE VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 97 MARKET, BY ICE VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 98 MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 99 MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

9.1.1 OPERATIONAL DATA

TABLE 100 AUTOMOTIVE FUSE OFFERINGS, BY ICE VEHICLE TYPE

9.1.2 ASSUMPTIONS

9.1.3 RESEARCH METHODOLOGY

9.2 PASSENGER CARS

9.2.1 INCREASING NEED FOR CARS WITH ENHANCED SAFETY FEATURES

TABLE 101 PASSENGER CARS: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 102 PASSENGER CARS: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 103 PASSENGER CARS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 104 PASSENGER CARS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 LIGHT COMMERCIAL VEHICLES (LCVS)

9.3.1 ADOPTION OF ADVANCED TECHNOLOGIES IN COMMERCIAL VEHICLES

TABLE 105 LCVS: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 106 LCVS: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 107 LCVS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 108 LCVS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 HEAVY COMMERCIAL VEHICLES (HCVS)

9.4.1 INCREASING FLEET MANAGEMENT SERVICES

TABLE 109 HCVS: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 110 HCVS: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 111 HCVS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 112 HCVS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 KEY PRIMARY INSIGHTS

FIGURE 41 KEY PRIMARY INSIGHTS

10 AUTOMOTIVE FUSE MARKET, BY ELECTRIC VEHICLE TYPE (Page No. - 126)

10.1 INTRODUCTION

FIGURE 42 BEVS SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE BY 2027

TABLE 113 MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 114 MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 115 MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 116 MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2027 (USD MILLION)

10.1.1 OPERATIONAL DATA

TABLE 117 AUTOMOTIVE FUSE OFFERINGS, BY ELECTRIC VEHICLE TYPE

10.1.2 ASSUMPTIONS

10.1.3 RESEARCH METHODOLOGY

10.2 BATTERY ELECTRIC VEHICLES (BEVS)

10.2.1 INNOVATION IN BATTERY TECHNOLOGY

TABLE 118 BEVS: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 119 BEVS: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 120 BEVS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 121 BEVS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 HYBRID ELECTRIC VEHICLES (HEVS)

10.3.1 INCREASING ACTIVE AND PASSIVE SAFETY SYSTEMS

TABLE 122 HEVS: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 123 HEVS: MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 124 HEVS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 125 HEVS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

10.4.1 PRESENCE OF COMPONENTS WITH HIGH VOLTAGE

TABLE 126 PHEVS: MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 127 PHEVS: MARKET SIZE, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 128 PHEVS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 129 PHEVS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 KEY PRIMARY INSIGHTS

FIGURE 43 KEY PRIMARY INSIGHTS

11 AUTOMOTIVE FUSE MARKET, BY EV APPLICATION (Page No. - 136)

11.1 INTRODUCTION

FIGURE 44 BATTERY FUSES SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE BY 2027

11.1.1 OPERATIONAL DATA

TABLE 130 MARKET, BY APPLICATION

11.1.2 ASSUMPTIONS

11.1.3 RESEARCH METHODOLOGY

11.2 BEVS

TABLE 131 BEVS: MARKET SIZE, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 132 BEVS: MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 133 BEVS: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 134 BEVS: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.2.1 AUXILIARY FUSES

11.2.1.1 Growing market for ABS in electric vehicles

TABLE 135 AUXILIARY FUSES: BEV FUSE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 136 AUXILIARY FUSES: BEV FUSE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 137 AUXILIARY FUSES: BEV FUSE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 138 AUXILIARY FUSES: BEV FUSE MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2.2 CHARGE INLET FUSES

11.2.2.1 Increase in high-voltage charging stations for BEVs

TABLE 139 CHARGE INLET FUSES: BEV FUSE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 140 CHARGE INLET FUSES: BEV FUSE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 141 CHARGE INLET FUSES: BEV FUSE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 142 CHARGE INLET FUSES: BEV FUSE MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2.3 BATTERY FUSES

11.2.3.1 Need for BEV models with high battery capacity

TABLE 143 BATTERY FUSES: BEV FUSE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 144 BATTERY FUSES: BEV FUSE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 145 BATTERY FUSES: BEV FUSE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 146 BATTERY FUSES: BEV FUSE MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2.4 PCU FUSES

11.2.4.1 Increasing BEV sales with power control units

TABLE 147 PCU FUSES: BEV FUSE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 148 PCU FUSES: BEV FUSE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 149 PCU FUSES: BEV FUSE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 150 PCU FUSES: BEV FUSE MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2.5 ONBOARD CHARGER FUSES

11.2.5.1 Government efforts to support sales of BEVs

TABLE 151 ONBOARD CHARGER FUSES: BEV FUSE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 152 ONBOARD CHARGER FUSES: BEV FUSE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 153 ONBOARD CHARGER FUSES: BEV FUSE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 154 ONBOARD CHARGER FUSES: BEV FUSE MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2.6 TRACTION MOTOR FUSES

11.2.6.1 Growing demand for high-performance motors

TABLE 155 TRACTION MOTOR FUSES: BEV FUSE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 156 TRACTION MOTOR FUSES: BEV FUSE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 157 TRACTION MOTOR FUSES: BEV FUSE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 158 TRACTION MOTOR FUSES: BEV FUSE MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 HEVS

TABLE 159 HEVS: MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 160 HEVS: MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 161 HEVS: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 162 HEVS: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.3.1 AUXILIARY FUSES

11.3.1.1 Increasing sales of premium HEVs

TABLE 163 AUXILIARY FUSES: HEV FUSE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 164 AUXILIARY FUSES: HEV FUSE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 165 AUXILIARY FUSES: HEV FUSE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 166 AUXILIARY FUSES: HEV FUSE MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3.2 ENGINE FUSES

11.3.2.1 Market for PHEVs with high engine capacity

TABLE 167 ENGINE FUSES: HEV FUSE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 168 ENGINE FUSES: HEV FUSE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 169 ENGINE FUSES: HEV FUSE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 170 ENGINE FUSES: HEV FUSE MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3.3 CHARGE INLET FUSES

11.3.3.1 Use of electric vehicle charging stations

TABLE 171 CHARGE INLET FUSES: HEV FUSE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 172 CHARGE INLET FUSES: HEV FUSE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 173 CHARGE INLET FUSES: HEV FUSE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 174 CHARGE INLET FUSES: HEV FUSE MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3.4 BATTERY FUSES

11.3.4.1 High battery capacity of HEV models

TABLE 175 BATTERY FUSES: HEV FUSE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 176 BATTERY FUSES: HEV FUSE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 177 BATTERY FUSES: HEV FUSE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 178 BATTERY FUSES: HEV FUSE MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3.5 PCU FUSES

11.3.5.1 Technological advancements in HEVs

TABLE 179 PCU FUSES: HEV FUSE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 180 PCU FUSES: HEV FUSE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 181 PCU FUSES: HEV FUSE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 182 PCU FUSES: HEV FUSE MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3.6 ONBOARD CHARGER FUSES

11.3.6.1 Increasing application of onboard chargers in HEVs

TABLE 183 ONBOARD CHARGER FUSES: HEV FUSE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 184 ONBOARD CHARGER FUSES: HEV FUSE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 185 ONBOARD CHARGER FUSES: HEV FUSE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 186 ONBOARD CHARGER FUSES: HEV FUSE MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3.7 TRACTION MOTOR FUSES

11.3.7.1 Sale of HEVs and PHEVs with dual motors

TABLE 187 TRACTION MOTOR FUSES: HEV FUSE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 188 TRACTION MOTOR FUSES: HEV FUSE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 189 TRACTION MOTOR FUSES: HEV FUSE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 190 TRACTION MOTOR FUSES: HEV FUSE MARKET, BY REGION, 2022–2027 (USD MILLION)

11.4 KEY PRIMARY INSIGHTS

FIGURE 45 KEY PRIMARY INSIGHTS

12 AUTOMOTIVE FUSE MARKET, BY SALES CHANNEL (Page No. - 160)

12.1 INTRODUCTION

FIGURE 46 OEMS SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SIZE BY 2027

TABLE 191 MARKET, BY SALES CHANNEL, 2018–2021 (MILLION UNITS)

TABLE 192 MARKET, BY SALES CHANNEL, 2022–2027 (MILLION UNITS)

TABLE 193 MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

TABLE 194 MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

12.1.1 OPERATIONAL DATA

TABLE 195 AUTOMOTIVE FUSE SUPPLIERS LIST

12.1.2 ASSUMPTIONS

12.1.3 RESEARCH METHODOLOGY

12.2 OEMS

12.2.1 ASIA PACIFIC EXPECTED TO BE LARGEST AUTOMOTIVE FUSE OEM MARKET

12.3 AFTERMARKET

12.3.1 INCREASED VEHICLE PRODUCTION

12.4 KEY PRIMARY INSIGHTS

FIGURE 47 KEY PRIMARY INSIGHTS

13 AUTOMOTIVE FUSE MARKET, BY APPLICATION (Page No. - 165)

13.1 INTRODUCTION

FIGURE 48 ENGINE COMPARTMENTS SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SIZE BY 2027

TABLE 196 MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 197 MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 198 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 199 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.1.1 OPERATIONAL DATA

TABLE 200 AUTOMOTIVE FUSE OFFERINGS, BY APPLICATION

13.1.2 ASSUMPTIONS

13.1.3 RESEARCH METHODOLOGY

13.2 ENGINE COMPARTMENTS

13.2.1 INCREASING DEMAND FOR AUTONOMOUS AND SEMI-AUTONOMOUS VEHICLES

13.2.1.1 Cooling system

FIGURE 49 ENGINE COOLING SYSTEM

13.2.1.2 Anti-lock brake pump

FIGURE 50 ANTI-LOCK BRAKE SYSTEM

13.2.1.3 Engine control unit

13.3 CABIN AREA/UNDER THE DASHBOARD

13.3.1 GROWTH IN SALES OF PREMIUM VEHICLES

13.4 KEY PRIMARY INSIGHTS

FIGURE 51 KEY PRIMARY INSIGHTS

14 AUTOMOTIVE FUSE MARKET, BY REGION (Page No. - 172)

14.1 INTRODUCTION

FIGURE 52 ASIA PACIFIC EXPECTED TO ACCOUNT FOR LARGEST SIZE OF MARKET BY 2027

TABLE 201 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 202 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 203 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 204 MARKET, BY REGION, 2022–2027 (USD MILLION)

14.2 ASIA PACIFIC

TABLE 205 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 206 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 207 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 208 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

FIGURE 53 ASIA PACIFIC: MARKET SNAPSHOT

14.2.1 CHINA

14.2.1.1 High production of vehicles in China

TABLE 209 CHINA: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 210 CHINA: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 211 CHINA: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 212 CHINA: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.2.2 JAPAN

14.2.2.1 Increasing number of automotive production units

TABLE 213 JAPAN: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 214 JAPAN: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 215 JAPAN: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 216 JAPAN: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.2.3 SOUTH KOREA

14.2.3.1 Developments in autonomous vehicles

TABLE 217 SOUTH KOREA: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 218 SOUTH KOREA: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 219 SOUTH KOREA: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 220 SOUTH KOREA: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.2.4 INDIA

14.2.4.1 Government mandates to adopt ADAS features

TABLE 221 INDIA: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 222 INDIA: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 223 INDIA: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 224 INDIA: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.2.5 REST OF ASIA PACIFIC

TABLE 225 REST OF ASIA PACIFIC: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 226 REST OF ASIA PACIFIC: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 227 REST OF ASIA PACIFIC: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 228 REST OF ASIA PACIFIC: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.3 EUROPE

TABLE 229 EUROPE: MARKET, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 230 EUROPE: MARKET, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 231 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 232 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.3.1 GERMANY

14.3.1.1 Presence of major players

TABLE 233 GERMANY: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 234 GERMANY: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 235 GERMANY: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 236 GERMANY: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.3.2 UK

14.3.2.1 Heavy investments by OEMs to introduce high-end safety features

TABLE 237 UK: AUTOMOTIVE FUSE MARKET, BY ICE VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 238 UK: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 239 UK: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 240 UK: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.3.3 NETHERLANDS

14.3.3.1 Heavy investments by OEMs to increase production

14.3.4 NORWAY

14.3.4.1 Increasing sales of luxury cars

14.3.5 FRANCE

14.3.5.1 Rising safety concerns among consumers and government mandates for vehicle safety systems

TABLE 241 FRANCE: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 242 FRANCE: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 243 FRANCE: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 244 FRANCE: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.3.6 ITALY

14.3.6.1 Growth in number of automotive technological centers

TABLE 245 ITALY: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 246 ITALY: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 247 ITALY: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 248 ITALY: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.3.7 REST OF EUROPE

TABLE 249 REST OF EUROPE: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 250 REST OF EUROPE: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 251 REST OF EUROPE: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 252 REST OF EUROPE: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.4 NORTH AMERICA

TABLE 253 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 254 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 255 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 256 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

FIGURE 54 NORTH AMERICA: MARKET SNAPSHOT

14.4.1 US

14.4.1.1 Development of autonomous vehicle infrastructure

TABLE 257 US: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 258 US: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 259 US: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 260 US: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.4.2 CANADA

14.4.2.1 Increasing use of LCVs equipped with advanced safety features

TABLE 261 CANADA: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 262 CANADA: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 263 CANADA: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 264 CANADA: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.4.3 MEXICO

14.4.3.1 Growth of US-Mexico trade supporting development of technologically advanced vehicles

TABLE 265 MEXICO: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 266 MEXICO: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 267 MEXICO: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 268 MEXICO: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.5 REST OF THE WORLD (ROW)

TABLE 269 ROW: MARKET, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 270 ROW: MARKET, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 271 ROW: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 272 ROW: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.5.1 BRAZIL

14.5.1.1 Low cost of labor

TABLE 273 BRAZIL: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 274 BRAZIL: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 275 BRAZIL: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 276 BRAZIL: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.5.2 RUSSIA

14.5.2.1 Reduced growth due to ongoing Russia-Ukraine war

TABLE 277 RUSSIA: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 278 RUSSIA: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 279 RUSSIA: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 280 RUSSIA: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.5.3 SOUTH AFRICA

14.5.3.1 Demand for light commercial vehicles

TABLE 281 SOUTH AFRICA: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 282 SOUTH AFRICA: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 283 SOUTH AFRICA: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 284 SOUTH AFRICA: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.5.4 OTHER COUNTRIES

TABLE 285 OTHER COUNTRIES: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 286 OTHER COUNTRIES: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 287 OTHER COUNTRIES: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 288 OTHER COUNTRIES: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

15 COMPETITIVE LANDSCAPE (Page No. - 208)

15.1 OVERVIEW

15.2 MARKET SHARE ANALYSIS FOR AUTOMOTIVE FUSE MARKET

TABLE 289 MARKET SHARE ANALYSIS, 2021

FIGURE 55 MARKET SHARE ANALYSIS, 2021

15.2.1 EATON

15.2.2 LITTELFUSE

15.2.3 SENSATA

15.2.4 MERSEN

15.2.5 SCHURTER GROUP

15.3 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 290 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN MARKET

15.4 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

FIGURE 56 TOP PUBLIC/LISTED PLAYERS DOMINATING MARKET, 2017–2021

15.5 COMPETITIVE SCENARIO

15.5.1 NEW PRODUCT LAUNCHES

TABLE 291 NEW PRODUCT LAUNCHES, 2019–2022

15.5.2 DEALS

TABLE 292 DEALS, 2021

15.6 COMPANY EVALUATION QUADRANT

15.6.1 STARS

15.6.2 EMERGING LEADERS

15.6.3 PERVASIVE PLAYERS

15.6.4 PARTICIPANTS

FIGURE 57 AUTOMOTIVE FUSE MARKET: COMPANY EVALUATION QUADRANT, 2022

TABLE 293 MARKET: COMPANY FOOTPRINT, 2022

TABLE 294 MARKET: PRODUCT FOOTPRINT, 2022

TABLE 295 MARKET: REGIONAL FOOTPRINT, 2022

15.7 START-UP/SME EVALUATION QUADRANT,

15.7.1 PROGRESSIVE COMPANIES

15.7.2 RESPONSIVE COMPANIES

15.7.3 DYNAMIC COMPANIES

15.7.4 STARTING BLOCKS

FIGURE 58 MARKET: START-UP/SME EVALUATION QUADRANT, 2022

TABLE 296 MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 297 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

16 COMPANY PROFILES (Page No. - 221)

(Business overview, Products offered, Recent developments & MnM View)*

16.1 KEY PLAYERS

16.1.1 EATON

TABLE 298 EATON: BUSINESS OVERVIEW

FIGURE 59 EATON: COMPANY SNAPSHOT

TABLE 299 EATON: PRODUCTS OFFERED

TABLE 300 EATON: NEW PRODUCT DEVELOPMENT

TABLE 301 EATON: DEALS

16.1.2 LITTELFUSE

TABLE 302 LITTELFUSE: BUSINESS OVERVIEW

FIGURE 60 LITTELFUSE: COMPANY SNAPSHOT

TABLE 303 LITTELFUSE: PRODUCTS OFFERED

TABLE 304 LITTELFUSE: NEW PRODUCT DEVELOPMENT

TABLE 305 LITTELFUSE: OTHERS

16.1.3 SENSATA

TABLE 306 SENSATA: BUSINESS OVERVIEW

FIGURE 61 SENSATA: COMPANY SNAPSHOT

TABLE 307 SENSATA: PRODUCTS OFFERED

16.1.4 MERSEN

TABLE 308 MERSEN: BUSINESS OVERVIEW

TABLE 309 MERSEN: PRODUCTS OFFERED

TABLE 310 MERSEN: NEW PRODUCT DEVELOPMENT

TABLE 311 MERSEN: DEALS

16.1.5 SCHURTER GROUP

TABLE 312 SCHURTER GROUP: BUSINESS OVERVIEW

TABLE 313 SCHURTER GROUP: PRODUCTS OFFERED

TABLE 314 SCHURTER GROUP: NEW PRODUCT DEVELOPMENTS

16.1.6 OPTIFUSE

TABLE 315 OPTIFUSE: BUSINESS OVERVIEW

TABLE 316 OPTIFUSE: PRODUCTS OFFERED

16.1.7 PACIFIC ENGINEERING CORPORATION

TABLE 317 PACIFIC ENGINEERING CORPORATION: BUSINESS OVERVIEW

TABLE 318 PACIFIC ENGINEERING CORPORATION: PRODUCTS OFFERED

16.1.8 AEM COMPONENTS

TABLE 319 AEM COMPONENTS: BUSINESS OVERVIEW

TABLE 320 AEM COMPONENTS: PRODUCTS OFFERED

TABLE 321 AEM COMPONENTS: NEW PRODUCT DEVELOPMENTS

TABLE 322 AEM COMPONENTS: DEALS

16.1.9 E-T-A

TABLE 323 E-T-A: BUSINESS OVERVIEW

TABLE 324 E-T-A: PRODUCTS OFFERED

16.1.10 ON SEMICONDUCTOR

TABLE 325 ON SEMICONDUCTOR: BUSINESS OVERVIEW

FIGURE 62 ON SEMICONDUCTOR: COMPANY SNAPSHOT

TABLE 326 ON SEMICONDUCTOR: PRODUCTS OFFERED

16.1.11 FUZETEC

TABLE 327 FUZETEC: BUSINESS OVERVIEW

TABLE 328 FUZETEC: PRODUCTS OFFERED

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

16.2 OTHER KEY PLAYERS

16.2.1 GLOSO TECH

16.2.2 BLUE SEA SYSTEMS

16.2.3 SIBA

16.2.4 SHANGHAI SONGSHAN ELECTRONICS CO.

16.2.5 SKS ELECTRONICS

16.2.6 GUANGDONG UCHI ELECTRONICS CO., LTD.

16.2.7 DONGGUAN TIANRUI ELECTRONICS CO., LTD.

16.2.8 SLEEK CO., LTD.

16.2.9 CHE YEN INDUSTRIAL CO., LTD.

16.2.10 ZHEJIANG XINLI FUSE CO., LTD.

16.2.11 SHENZHEN DEER ELECTRONIC CO., LTD.

16.2.12 SOC FUSE TECHNOLOGY

17 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 255)

17.1 ASIA PACIFIC TO BE KEY FOCUS MARKET FOR AUTOMOTIVE FUSES

17.2 PASSENGER CARS SEGMENT EXPECTED TO BE LARGEST MARKET FOR AUTOMOTIVE FUSES

17.3 CONCLUSION

18 APPENDIX (Page No. - 256)

18.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

18.2 DISCUSSION GUIDE

18.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

18.4 CUSTOMIZATION OPTIONS

18.5 RELATED REPORTS

18.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the Automotive Fuse market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example International Council on Clean Transportation (ICCT), Society of Manufacturers of Electric Vehicles (SMEV), , corporate filings such as annual reports, investor presentations, and financial statements; and trade, business, and other automotive fuse manufacturers & associations] have been used to identify and collect information useful for an extensive commercial study of the Automotive Fuse market.

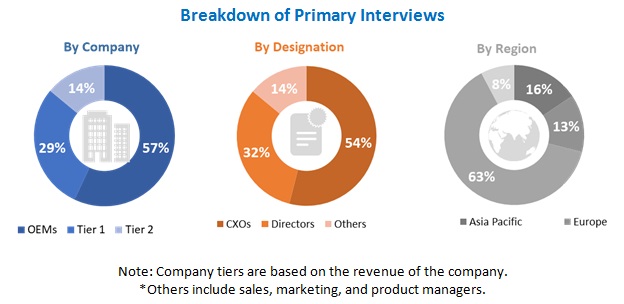

Primary Research

Extensive primary research was conducted after acquiring an understanding of the Automotive Fuse market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (automotive fuse manufacturers, country-level government associations, and trade associations) and supply (OEMs and component manufacturers) sides across major regions, namely, Asia Pacific, Europe, North America and Rest of the World, and primary interviews were conducted from the demand and supply sides, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in this report.<

After interacting with industry experts, brief sessions with highly experienced independent consultants were conducted to reinforce the findings from primaries. This, along with the in-house subject-matter experts’ opinions, has led to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value and volume of the Automotive Fuse and other dependent submarkets, as mentioned below:

- Key players in the automotive fuse market were identified through secondary research, and their market shares were determined through primary and secondary research

- The research methodology included the study of the annual and quarterly financial reports & regulatory filings of major market players, as well as interviews with industry experts for detailed market insights

- All major penetration rates, percentage shares, splits, and breakdowns for the Automotive Fuse market were determined using secondary sources and verified through primary sources

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze the Automotive Fuse market and forecast its size, in terms of value and volume (from 2018 to 2027

- To provide detailed information regarding major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To segment the market and forecast its size, by value and volume, based on fuse type

- To segment the market and forecast its size, by value and volume, based on voltage

- To segment the market and forecast its size, by value and volume, based on ampere

- To segment the market and forecast its size, by value and volume, based on ICE Vehicle type

- To segment the market and forecast its size, by value and volume, based on electric vehicle type

- To segment the market and forecast its size, by value and volume, based on (EV, by Application)

- To segment the market and forecast its size, by value and volume, based on sales channel

- To segment the market and forecast its size, by value and volume, based on application

- To segment the market and forecast its size, by value and volume, based on region (Asia Pacific, Europe, North America and Rest of the World)

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as new product developments, deals and other activities carried out by key industry participants.

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- Automotive fuse market, by ICE vehicle type, by country

- Automotive fuse market, by fuse type, by country

- Automotive fuse market, by application in BEV and hybrid vehicles, by country

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Fuse Market