Autonomous Data Platform Market by Component (Platform and Services), Organization Size (Large Enterprises and Small and Medium-Sized Enterprises), Deployment Type (On-Premises and Cloud), Vertical, and Region - Global Forecast to 2024

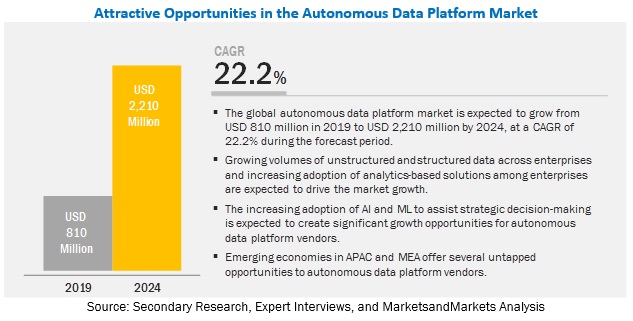

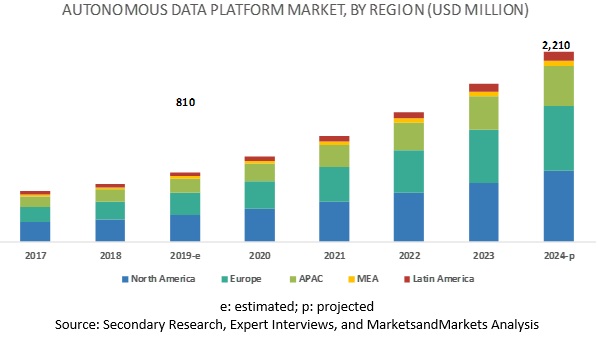

[126 Pages Report] The global autonomous data platform market size is projected to reach USD 2,210 million by 2024, at a CAGR of 22.2% during the forecast period. Rising adoption of cognitive computing technology and advanced analytics and increasing volume of unstructured data (due to the phenomenal growth of interconnected devices and social media) are major factors driving the market growth. The challenges for this market include lack of skilled workforce and managing data quality and safety.

The BFSI vertical to significantly contribute to the autonomous data platform market during the forecast period

There has been rapid adoption of autonomous data platforms in the BFSI vertical. The changing behavior of customers has made it difficult for financial marketers to deliver personalized services and maintain the privacy of their customers’ data. Financial marketers gather first-party-data generated by customers’ activities across different channels and integrate the data to create a unified customer profile. They then apply advanced analytics to extract insights to deliver personalized one-to-one customer interactions. The marketers make sure that the autonomous data platform is compliant with regulations governing privacy, risk, money laundering, and other requirements for ensuring the security of customers’ data. Many financial institutions require the on-premises delivery model for deploying their systems, especially those holding sensitive customers’ data. The autonomous data platforms are available for both on-premises and cloud environments to address the needs of all types of customers.

On-premises deployment segment to hold a larger market share than the cloud segment during the forecast period

An on-premises deployment mode is a traditional approach to implementing solutions at the premises of an enterprise. On-premise solutions are delivered on a one-time license fee, along with a service agreement. The approach is followed in enterprises where user credentials and security are critical aspects of business operations, as the on-premises deployment is considered safe as compared to the cloud deployment type. Moreover, the software deployed on-premises can easily be customized to meet the business requirements. The on-premises deployment model allows organizations to refrain from transferring data over the internet, removes the need for third-party vendors that provide separate maintenance and security of data, enables quick and easy access of data, and keeps the IP addresses and data private. This deployment model is preferred by data-sensitive organizations that hold consumers’ confidential information, which if leaked, may create a threat to organizations dealing with sensitive data, particularly in the BFSI, healthcare, and government verticals. Apart from its advantages such as control over the system, tailored software, and security, the on-premises deployment mode also has various downsides, such as high deployment cost and the requirement for a robust infrastructure, which are not affordable for many organizations.

The market in Europe to witness the highest CAGR during the forecast period

The autonomous data platform market in Europe is anticipated to grow at the highest rate during the forecast period. An increase in inconsistent data generated across organizations in different European countries has led to the increase in adoption of autonomous data platforms and services in the region. The UK, Germany, France, and the Rest of Europe are considered in the regional analysis of the autonomous data platform market in Europe. Enterprises in Europe face data-related challenges in meeting the demands of global businesses and simultaneously handling regulatory requirements. New technologies and business models are being rapidly introduced to the European market due to the dynamic business needs of enterprises. Constant technological innovation in the region resulted in changing customer preferences and the evolution of new technologies, which, in turn, change the business models in data-driven industries. Large enterprises in this region are deploying autonomous data platforms and services to extract valuable insights from data repositories.

Key Market Players

The major autonomous data platform vendors include Oracle (US), Teradata (US), IBM (US), AWS (US), MapR (US), Cloudera (US), Qubole (US), Ataccama (Canada), Gemini Data (US), DvSum (US), Denodo (US), Zaloni (US), Datrium (US), Paxata (US), and Alteryx (US).

Teradata is a leading analytics solutions company. It generates the majority of its revenue from the service business segment. The company is continuously focused on R&D activities to enhance its product offerings. For instance, it invested USD 0.3 billion in R&D activities in 2018. The company has adopted a mix of organic and inorganic growth strategies to enhance its position in the market. In January 2017, it announced the availability of the Teradata Database on Azure, for Q1 2007, providing customers with more choices of cloud options in Teradata software.

Scope of Report

|

Report Metrics |

Details |

|

Market size value in 2018 |

USD 810 Million |

|

Market size value in 2024 |

USD 2,210 Million |

|

Growth rate |

CAGR of 22.2% |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Component (Platform and Services), Organization Size, Deployment Type, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

Oracle (US), Teradata (US), IBM (US), AWS(US), MapR (US), Cloudera (US), Qubole (US), Ataccama (Canada), Gemini Data (US), DvSum (US), Denodo (US), Zaloni (US), Datrium (US), Paxata (US), Alteryx (US), and others. |

This research report categorizes the autonomous data platform market to forecast revenues and analyze trends in each of the following submarkets:

By Component, the Autonomous Data Platform Market has been segmented as follows:

- Platform

- Services

- Advisory

- Integration

- Support and Maintenance

By Organization size, the Market has been segmented as follows:

- Large Enterprises

- SMEs

By Deployment type, the Autonomous Data Platform Market has been segmented as follows:

- On-premises

- Cloud

By Vertical, the Market has been segmented as follows:

- BFSI

- Healthcare and Life Sciences

- Retail

- Manufacturing

- Telecommunication and Media

- Government

- Others (Travel and Hospitality, Transportation and Logistics, and Energy and Utilities)

By Region, the Autonomous Data Platform Market has been segmented as follows:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

APAC

- Australia and New Zealand (ANZ)

- China

- Rest of APAC

-

MEA

- South Africa

- UAE

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In June 2019, Qubole launched a self-service platform for data scientists and engineers to build their AI, machine learning, and analytics workflows on the public cloud of their choice.

- In April 2019, MapR announced innovations in the MapR Data Platform that accelerated the platform with new, deep integrations with Kubernetes core components for primary workloads on Spark and Drill. This enhancement enabled the platform to better manage highly elastic workloads.

Key Questions Addressed by the Report:

- Where would all these developments take the industry in the mid to long term?

- What are the upcoming industry solutions for the autonomous data platform market?

- Which are the major factors expected to drive the market?

- Which region would offer high growth opportunity for vendors in the market

Frequently Asked Questions (FAQ):

How big is the Autonomous Data Platform Market?

What is the Autonomous Data Platform Market growth?

What is autonomous data platform market?

Which region have the highest market share in autonomous data platform market?

What are the major factors that are anticipated to drive and challenge the autonomous data platform market?

What are the top companies providing autonomous data platforms?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

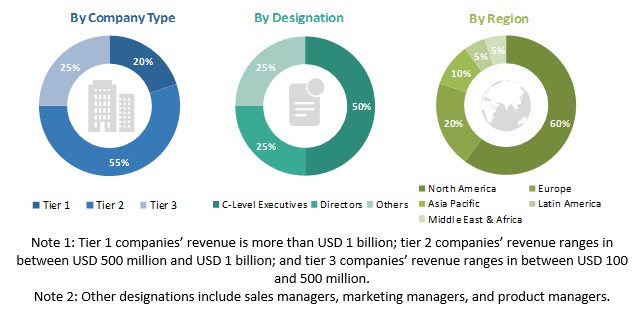

2.1.2.1 Breakup of Primary Participants’ Profiles

2.2 Market Breakup and Data Triangulation

2.3 Competitive Leadership Mapping Research Methodology

2.4 Market Size Estimation

2.4.1 Top-Down Approach

2.4.2 Bottom-Up Approach

2.5 Market Forecast

2.6 Assumptions for the Study

2.7 Limitations of the Study

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Autonomous Data Platform Market

4.2 Market in North America, By Vertical and Country

4.3 Market Major Countries

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Adoption of Cognitive Computing Technology and Advanced Analytics

5.2.1.2 Increasing Volume of Unstructured Data Due to the Phenomenal Growth of Interconnected Devices and Social Media

5.2.1.3 Increasing Volume of Complex Data

5.2.2 Restraints

5.2.2.1 Complex Analytical Process

5.2.3 Opportunities

5.2.3.1 Growing Demand From SMEs

5.2.3.2 Increasing Adoption of Cloud Technology

5.2.4 Challenges

5.2.4.1 Managing Data Quality and Safety

5.2.4.2 Lack of Skilled Workforce

5.2.4.3 Data Privacy Laws and Compliance

5.3 Use Cases

5.3.1 Introduction

5.3.1.1 Use Case 1

5.3.1.2 Use Case 2

5.3.1.3 Use Case 3

5.3.1.4 Use Case 4

5.4 Regulatory Implications

5.4.1 Introduction

5.4.2 General Data Protection Regulation (GDPr)

5.4.3 Health Insurance Portability and Accountability Act (HIPAA)

5.4.4 Federal Trade Commission (FTC)

5.4.5 ISO/IEC JTC 1/SC 42

6 Autonomous Data Platform Market By Component (Page No. - 41)

6.1 Introduction

6.2 Platform

6.2.1 Increasing Need From Enterprises to Handle Complex Data Formats is Expected to Draw the Demand for Autonomous Data Platforms

6.3 Services

6.3.1 Advisory

6.3.1.1 Increasing Adoption of Complex Data Management Platform is Expected to Drive the Demand for Advisory Services

6.3.2 Integration

6.3.2.1 Growing Demand Amongst Enterprises for Hassle-Free Installation and Integration of Autonomous Data Platforms is Expected to Drive the Market for Integration Services

6.3.3 Support and Maintenance

6.3.3.1 Growing Need to Increase the Uptime of Data Management Platform to Spur the Demand for Support and Maintenance Services

7 Autonomous Data Platform Market By Organization Size (Page No. - 48)

7.1 Introduction

7.2 Large Enterprises

7.2.1 Increasing Need to Analyze the Huge Volumes of Data Generated From Various Enterprise Systems to Drive the Demand for Autonomous Data Platforms Among Large Enterprises

7.3 Small and Medium-Sized Enterprises

7.3.1 Focus Amongst Enterprises to Improve the Quality of Data-Driven Insights to Boost the Adoption of Autonomous Data Platforms in Small and Medium-Sized Enterprises

8 Autonomous Data Platform Market By Deployment Type (Page No. - 52)

8.1 Introduction

8.2 On-Premises

8.2.1 Concerns Over the Security of Sensitive Data to Drive the Adoption of On-Premises Autonomous Data Platforms

8.3 Cloud

8.3.1 Scalability, Enhanced Collaboration, and Cost-Effectiveness Offed By the Cloud Platform are Expected to Boost the Demand for Cloud-Based Autonomous Data Platforms

9 Autonomous Data Platform Market By Vertical (Page No. - 56)

9.1 Introduction

9.2 BFSI

9.2.1 Growing Demand to Improves Customer Service and to Enhance Know Your Customer (KYC) Capabilities to Drive Demand for Autonomous Data Platform

9.3 Healthcare and Life Sciences

9.3.1 Growing Demand to Comply With Regulations in Healthcare Industry to Drive the Demand for Autonomous Data Platform and Services

9.4 Retail

9.4.1 Growing Demand to Manage Diverse Products and Items Across Multiple Departments and Portfolios is Expected to Drive the Demand for Autonomous Data Platform

9.5 Manufacturing

9.5.1 Autonomous Data Platform Enable Manufacturers to Manage Products, Inventories, and Assets Across All Channels

9.6 Telecommunication and Media

9.6.1 Growing Demand to Enables Consolidation of Information Into A Single Reference Frame and Centralization of Different Services is Expected to Drive Demand for Autonomous Data Platform

9.7 Government

9.7.1 Need to Manage Fragmented Critical Data From Heterogeneous Systems Propels Demand for Autonomous Data Platform

9.8 Others

10 Autonomous Data Platform Market By Region (Page No. - 65)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 Presence of Leading Global Technology Players is One of the Factors Driving the US Market

10.2.2 Canada

10.2.2.1 Rising Adoption of Data Compliance Practices is Driving the Growth of Market in Canada

10.3 Europe

10.3.1 UK

10.3.1.1 Strategic Partnerships and Supportive Government Initiatives to Drive the Demand for Autonomous Data Platform

10.3.2 Germany

10.3.2.1 Emergence of Industry 4.0 is Expected to Drive the Market in Germany

10.3.3 Rest of Europe

10.4 Asia Pacific

10.4.1 Australia and New Zealand (ANZ)

10.4.1.1 Rising Need to Handle Large Volumes of Data Supporting the Adoption of Autonomous Data Platform and Services in ANZ

10.4.2 China

10.4.2.1 Increasing Adoption of Advanced Enterprise Application Amongst Chinese Organizations is Expected to Drive the Autonomous Data Platform Market

10.4.3 Rest of Asia Pacific

10.5 Middle East and Africa (MEA)

10.5.1 UAE

10.5.1.1 Increasing Adoption of Emerging Technologies is Expected to Drive the Adoption of Autonomous Data Platform and Services

10.5.2 South Africa

10.5.2.1 Supportive Government Initiatives are Expected to Drive Market Growth in South Africa

10.5.3 Rest of Middle East and Africa

10.6 Latin America

10.6.1 Brazil

10.6.1.1 Supportive Government Initiatives are Expected to Drive Market Growth in South Africa

10.6.2 Mexico

10.6.2.1 Rising Awareness About Autonomous Data Platform is Expected to Drive Growth of the Market in Mexico

10.6.3 Rest of Latin America

11 Competitive Landscape (Page No. - 87)

11.1 Competitive Leadership Mapping

11.1.1 Visionary Leaders

11.1.2 Innovators

11.1.3 Dynamic Differentiators

11.1.4 Emerging Companies

11.2 Competitive Landscape Overview

11.3 Competitive Scenario

11.3.1 New Product Launches/Product Enhancements

11.3.2 Partnerships, Agreements, and Collaborations

11.3.3 Mergers and Acquisitions

12 Company Profiles (Page No. - 93)

(Business Overview, Products, Solutions & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.1 Oracle

12.2 AWS

12.3 Teradata

12.4 IBM

12.5 MAPR

12.6 Cloudera

12.7 Qubole, Inc.

12.8 Ataccama

12.9 Gemini Data

12.10 Denodo

12.11 Datrium

12.12 Dvsum

12.13 Alteryx

12.14 Zaloni

12.15 Paxata

*Details on Business Overview, Products, Solutions & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 118)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (57 Tables)

Table 1 USD Exchange Rate, 2015–2017

Table 2 Factor Analysis

Table 3 Autonomous Data Platform Market Size, By Component, 2017–2024 (USD Thousand)

Table 4 Platform: Market Size By Region, 2017–2024 (USD Thousand)

Table 5 Services: Market Size By Type, 2017–2024 (USD Thousand)

Table 6 Services: Market Size By Region, 2017–2024 (USD Thousand)

Table 7 Advisory Services Market Size, By Region, 2017–2024 (USD Thousand)

Table 8 Integration Services Market Size, By Region, 2017–2024 (USD Thousand)

Table 9 Support and Maintenance Services Market Size, By Region, 2017–2024 (USD Thousand)

Table 10 Autonomous Data Platform Market Size, By Organization Size, 2017–2024 (USD Thousand)

Table 11 Large Enterprises: Market Size By Region, 2017–2024 (USD Thousand)

Table 12 Small and Medium-Sized Enterprises: Market Size By Region, 2017–2024 (USD Thousand)

Table 13 Autonomous Data Platform Market Size, By Deployment Type, 2017–2024 (USD Thousand)

Table 14 On-Premises: Market Size By Region, 2017–2024 (USD Thousand)

Table 15 Cloud: Market Size By Region, 2017–2024 (USD Thousand)

Table 16 Autonomous Data Platform Market, By Vertical, 2017–2024 (USD Thousand)

Table 17 BFSI: Market Size By Region, 2017–2024 (USD Thousand)

Table 18 Healthcare and Life Sciences: Market Size By Region, 2017–2024 (USD Thousand)

Table 19 Retail: Market Size By Region, 2017–2024 (USD Thousand)

Table 20 Manufacturing: Market Size By Region, 2017–2024 (USD Thousand)

Table 21 Telecommunication and Media: Market Size By Region, 2017–2024 (USD Thousand)

Table 22 Government: Market Size By Region, 2017–2024 (USD Thousand)

Table 23 Others: Market Size By Region, 2017–2024 (USD Thousand)

Table 24 Autonomous Data Platform Market Size, By Region, 2017–2024 (USD Thousand)

Table 25 North America: Market Size By Component, 2017–2024 (USD Thousand)

Table 26 North America: Market Size By Services, 2017–2024 (USD Thousand)

Table 27 North America: Market Size By Organization Size, 2017–2024 (USD Thousand)

Table 28 North America: Market Size By Deployment Type, 2017–2024 (USD Thousand)

Table 29 North America: Market Size By Vertical, 2017–2024 (USD Thousand)

Table 30 North America: Market Size By Country, 2017–2024 (USD Thousand)

Table 31 Europe: Autonomous Data Platform Market Size, By Component, 2017–2024 (USD Thousand)

Table 32 Europe: Market Size By Services, 2017–2024 (USD Thousand)

Table 33 Europe: Market Size By Organization Size, 2017–2024 (USD Thousand)

Table 34 Europe: Market Size By Deployment Type, 2017–2024 (USD Thousand)

Table 35 Europe: Market Size By Vertical, 2017–2024 (USD Thousand)

Table 36 Europe: Market Size By Country, 2017–2024 (USD Thousand)

Table 37 Asia Pacific: Autonomous Data Platform Market Size, By Component, 2017–2024 (USD Thousand)

Table 38 Asia Pacific: Market Size By Services, 2017–2024 (USD Thousand)

Table 39 Asia Pacific: Market Size By Organization Size, 2017–2024 (USD Thousand)

Table 40 Asia Pacific: Market Size By Deployment Type, 2017–2024 (USD Thousand)

Table 41 Asia Pacific: Market Size By Vertical, 2017–2024 (USD Thousand)

Table 42 Asia Pacific: Market Size By Country, 2017–2024 (USD Thousand)

Table 43 Middle East and Africa: Autonomous Data Platform Market Size, By Component, 2017–2024 (USD Thousand)

Table 44 Middle East and Africa: Market Size By Services, 2017–2024 (USD Thousand)

Table 45 Middle East and Africa: Market Size By Organization Size, 2017–2024 (USD Thousand)

Table 46 Middle East and Africa: Market Size By Deployment Type, 2017–2024 (USD Thousand)

Table 47 Middle East and Africa: Market Size By Vertical, 2017–2024 (USD Thousand)

Table 48 Middle East and Africa: Market Size By Country, 2017–2024 (USD Thousand)

Table 49 Latin America: Autonomous Data Platform Market Size, By Component, 2017–2024 (USD Thousand)

Table 50 Latin America: Market Size By Services, 2017–2024 (USD Thousand)

Table 51 Latin America: Market Size By Organization Size, 2017–2024 (USD Thousand)

Table 52 Latin America: Market Size By Deployment Type, 2017–2024 (USD Thousand)

Table 53 Latin America: Market Size By Vertical, 2017–2024 (USD Thousand)

Table 54 Latin America: Market Size By Country, 2017–2024 (USD Thousand)

Table 55 New Product Launches/Product Enhancements

Table 56 Partnerships, Agreements, and Collaborations

Table 57 Mergers and Acquisitions

List of Figures (29 Figures)

Figure 1 Autonomous Data Platform Market: Research Design

Figure 2 Competitive Leadership Mapping: Criteria Weightage

Figure 3 Market Bottom-Up and Top-Down Approaches

Figure 4 Europe to Register the Highest CAGR During the Forecast Period

Figure 5 Support and Maintenance Segment Estimated to Hold the Largest Market Share in 2019

Figure 6 BFSI Vertical Estimated to Account for the Largest Market Share in 2019

Figure 7 Growing Need to Optimize Data Management and Improve Decision-Making Capabilities to Drive the Market During the Forecast Period

Figure 8 BFSI Vertical and the US Estimated to Dominate the Autonomous Data Platform Market in North America in 2019

Figure 9 Autonomous Data Platform Market in the UK to Grow at the Highest CAGR During the Forecast Period

Figure 10 Drivers, Restraints, Opportunities, and Challenges

Figure 11 Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 12 Small and Medium-Sized Enterprises Segment to Witness A Higher CAGR During the Forecast Period

Figure 13 Cloud Deployment Type to Grow at A Higher CAGR During the Forecast Period

Figure 14 Retail Vertical to Grow at the Highest CAGR During the Forecast Period

Figure 15 Europe to Witness the Highest Growth Rate During the Forecast Period

Figure 16 North America: Market Snapshot

Figure 17 Asia Pacific: Market Snapshot

Figure 18 Autonomous Data Platform Market (Global) Competitive Leadership Mapping

Figure 19 Key Developments in the Market During 2016–2019

Figure 20 Oracle: Company Snapshot

Figure 21 Oracle: SWOT Analysis

Figure 22 AWS: Company Snapshot

Figure 23 AWS: SWOT Analysis

Figure 24 Teradata: Company Snapshot

Figure 25 Teradata: SWOT Analysis

Figure 26 IBM: Company Snapshot

Figure 27 IBM: SWOT Analysis

Figure 28 MAPR: SWOT Analysis

Figure 29 Cloudera: Company Snapshot

The study involved 4 major activities in estimating the current market size for the autonomous data platform market. An exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the autonomous data platform market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, Factiva, and various journals for e-Learning, such as Current Issues in Emerging eLearning (CIEE), The Electronic Journal of e-Learning (EJEL), International Journal of Advanced Corporate Learning (iJAC), and Australasian Journal of Educational Technology (AJET) have been referred, to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, certified publications and articles by recognized authors, gold standard and silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The autonomous data platform market comprises several stakeholders, such as autonomous data platform vendors, cloud platform and service providers, cloud service brokers, system integrators, resellers and distributors, research organizations, government agencies, enterprise users, venture capitalists, private equity firms, and startup companies. The demand side of the autonomous data platform market consists of enterprises across industries, including retail; manufacturing and logistics; banking, financial services, and insurance (BFSI); telecom and IT; and healthcare and life sciences. The supply side includes autonomous data platform solution providers offering autonomous data platforms and services. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the autonomous data platform market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides across industries.

Report Objectives

- To define, describe, and forecast the autonomous data platform market by component (platform and services), deployment type, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the market with respect to individual growth trends, prospects, and contributions to the market

- To forecast the market size of 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze opportunities in the market for stakeholders, by identifying the high-growth segments of the autonomous data platform market

- To profile the key players in the market and comprehensively analyze their core competencies in each subsegment

- To analyze the competitive developments, such as new product launches and product enhancements, partnerships, collaborations, agreements, and mergers and acquisitions, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American market into the US and Canada

- Further breakup of the European market into the UK, Germany, and Rest of Europe

- Further breakup of the APAC market into ANZ, China and Rest of APAC

- Further breakup of the MEA market into South Africa, the UAE, and the Rest of MEA

- Further breakup of the Latin American market into Brazil, Mexico, and Rest of Latin America

Company information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Autonomous Data Platform Market