Data Science Platform Market by Component (Platform & Services), Business Function (Marketing, Sales, Logistics, & Customer Support), Deployment Mode, Organization Size, Industry Vertical & Region - Global Forecast to 2026

Data Science Platform Market Size, Global Industry Share Forecast

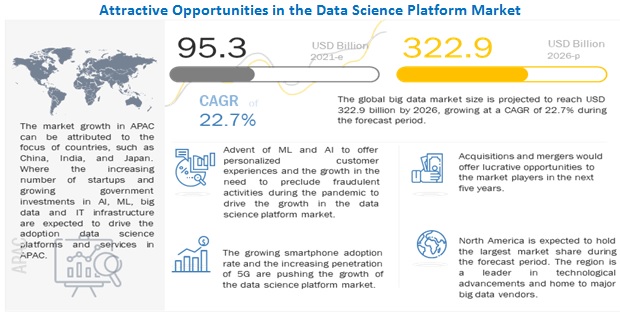

[ 349 Pages Report] The global Data Science Platform Market size was valued $95.3 billion in 2021. The revenue forecast for 2026 is set for the valuation of $322.9 billion. It is projected to grow at a CAGR of 27.7% during the forecast period (2021-2026). The base year for estimation is 2020 and the market size available for the years of 2018 to 2026.

The data science platform industry is driven by astonishing growth of big data, however, rising in adoption of cloud-based solutions, rising application of the data science platform in various industries and growing need to extract in-depth insights from voluminous data to gain competitive advantage.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Astonishing growth of Big Data

The volume of data captured by organizations is continuously increasing due to the rise of social media, IoT, and multimedia, which have produced an overwhelming flow of data in either structured or unstructured format. For instance, almost 90% of the world’s data has been created in the past two years alone. Machine-based as well as human-generated data are witnessing an overall growth rate of 10 times faster than the conventional business data. For instance, machine data is experiencing an exponential 50 times faster growth rate. Data is largely consumer driven and consumer oriented. Most of the data in the world is generated by consumers, who are nowadays ‘always-on.’ Most people now spend 4–6 hours per day consuming and generating data through a variety of devices and (social) applications. With every click, swipe, or message, new data is created in a database somewhere around the world. Because everyone now has a smartphone in their pocket, the data creation sums to incomprehensible amounts.

The increasing volume of business data, rapid technological changes, and declining average selling prices of smart devices eventually contribute to the generation of massive amount of structured and unstructured data. More than 80% of all data collected by organizations is not in a standard relational database. Instead, it is trapped in unstructured documents, social media posts, machine logs, images, and other sources. The massive increase in data creates opportunities for organizations to gain new insights, for which the demand for new techniques and methods has also increased. This, in turn, plays a crucial role to drive the data science platform market.

Restraint: Lack of clarity on business problem

Companies should study the business challenges for which they want to implement the data science platform. Opting for the mechanical approach of identifying datasets and performing data analysis before getting a clear picture of what business issue to solve, proves to be less effective. This is especially unsupportive when the companies are applying the data science platform for effective decision-making. Even with a clear purpose in mind if companies’ expectations from the data science platform implementation is not aligned with the end-goals, the efforts are futile.

Opportunity: Higher inclination of enterprises toward data-intensive business strategies

Organizations are quickly adopting the data-intensive approach and are taking great measures to ensure that they are able to compete in this digital era, where their consumers are most informed, and competitors are leaving no stone unturned to attract their clients. They are utilizing different data science tools, technologies, and best practices from the industry to determine optimal solutions for their complex business problems, to have better insights into their customers’ behavior as well as their requirements and invent creative solutions to cater to their diverse business requirements. Data science allows organizations to make better informed decisions based on real scenarios and accurately predict possible future outcomes. With massive amounts of data generated from customers through mobile applications and other handy solutions, businesses can track their customers in real time, their behavior patterns, their purchasing habits and preferences, and their social network. This crucial data can be analyzed through advanced data science tools available today, allowing organizations to bend their business strategies toward success. According to a recent study, 33% of companies that adopted data-driven decisions were six percent more profitable than their counterparts. With the advent of advanced technologies such as big data, ML, IoT, and cloud, organizations are more inclined toward making decisions based on historical and real-time data analysis instead of relying on expert opinions.

Challenge: Lack of adequately skilled workforce

Organizations are nowadays using advanced analytics techniques, such as streaming analytics, ML, and predictive analytics, which are complex in nature and require in-depth analytical knowledge. The skills required to build an ML model are technical skills, and analysis and critical thinking skills. Various end users do not have people with the required skills and knowledge.

Organizations spend most of their time in capturing and correcting data generated from various sources. It is not necessary that all employees working with data have skills in data science. Business knowledge is also required along with appropriate training to build a data-driven, decision-making culture. Thus, the lack of skilled personnel is one of the biggest challenges that could be faced by a majority of business end users.

Based on Component, the service segment is expected to grow at a higher CAGR during the forecast period

The service segment of the Data Science Platform market is further segmented into professional services (support and maintenance, and deployment and integration) and managed services. This section discusses each service subsegment's market size and growth rate based on type (for selected subsegments) and region.

Based on deployment mode, on-premises segment is segmented to account for a larger market size during the forecast period Most

Cloud computing refers to the storage, management, and processing of data via networks of remote servers, which are typically accessed via the Internet. Enterprises mostly in heavily regulated industry verticals, such as BFSI, healthcare and life sciences, and manufacturing, opt for the on-premises deployment model of Data Science Platform. Furthermore, large enterprises with sufficient IT resources are expected to opt for the on-premises deployment model. On-premises is the most reliable deployment mode, which an enterprise can rely on for a high level of control and security. Enterprises need to purchase a license or a copy to deploy cloud-based solutions.

Based on organization size, large enterprise segment to account for a larger market size during the forecast period

Most Large enterprises considered in the report are organizations with an employee size of more than or equal to 1,000. The adoption of the data science platform among large enterprises is high due to the ever-increasing adoption of the cloud, and the trend is expected to continue during the forecast period. Large enterprises accumulate huge chunks of data that can be attributed to the widespread client base. In large enterprises, data plays a major role in evaluating the overall performance of organizations. Large enterprises are leveraging the data science platform coming from various sources, for instance, social media feeds or sensors and cameras, each record needs to be processed in a way that preserves its relation to other data and sequence in time.

Based on vertical, the BFSI segment is expected to account for a larger market size during the forecast period

Data Science Platform are gaining acceptance among all verticals to improve profitability and reduce overall costs. The major verticals adopting Data Science Platform software are BFSI, Retail and eCommerce, Telecom and IT, Media and Entertainment, Healthcare and Life Sciences, Government and Defense, Manufacturing, Transportation and Logistics, Energy and Utilities, Other Verticals ( travel and hospitality, and education and research). BFSI segment is expected to account for a larger market size during the forecast period

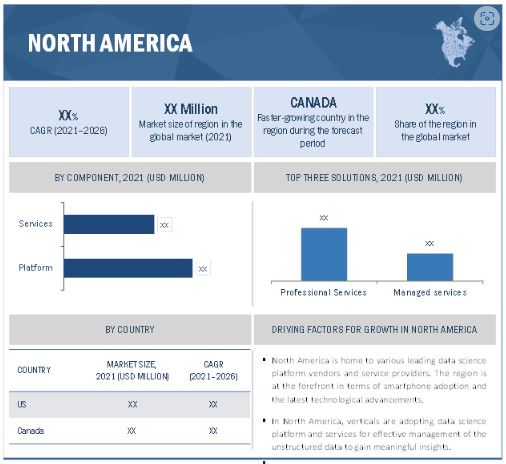

North America to hold the largest market size during the forecast period

North America is estimated to account for the largest market share during the forecast period. In North America, data discovery and Data Science Platform are considered highly effective by most organizations and verticals. On the other hand, Europe is gradually incorporating these advanced solutions within its enterprises. APAC is witnessing a substantial rise in the adoption of Data Science Platform owing to the increasing digitalization and rising demand for centrally managed systems.

To know about the assumptions considered for the study, download the pdf brochure

Market Interconnection

Market Players

Major Data Science Platform Market vendors include IBM(US), Google(US), Microsoft(US), SAS(US), AWS(US), MathWorks (US), Cloudera (US), Teradata (US), TIBCO (US), Alteryx (US), RapidMiner (US), Databricks (US), Snowflake (US), H2O.ai (US), Altair (US), Anaconda (US), SAP (US), Domino Data Lab (US), Dataiku (US), DataRobot (US), Apheris (Germany), Comet (US), Databand (US), dotData (US), Explorium (US), Noogata (US), Tecton (US), Spell (US), Arrikto (US), and Iterative (US). These market players have adopted various growth strategies, such as partnerships, collaborations, and new product launches, to expand have been the most adopted strategies by major players from 2018 to 2022, which helped companies innovate their offerings and broaden their customer base.

Scope of the Report

|

Report Metrics |

Details |

|

Data Science Platform Market Size in 2020 |

USD 4.89 Billion |

|

Revenue forecast in 2026 |

USD 25.94 Billion |

|

Growth Rate |

CAGR of 26.9% from 2020 to 2026 |

|

Market size available for years |

2016–2026 |

|

Base year considered |

2021 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Component (Platform & Services), Business Function (Marketing, Sales, Logistics, & Customer Support), Deployment Mode, Organization Size, Industry Vertical, and Region - Global Forecast to 2026. |

|

Regions covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

IBM(US), Google(US), Microsoft(US), SAS(US), AWS(US), MathWorks (US), Cloudera (US), Teradata (US), TIBCO (US), Alteryx (US), RapidMiner (US), Databricks (US), Snowflake (US), H2O.ai (US), Altair (US), Anaconda (US), SAP (US), Domino Data Lab (US), Dataiku (US), DataRobot (US), Apheris (Germany), Comet (US), Databand (US), dotData (US), Explorium (US), Noogata (US), Tecton (US), Spell (US), Arrikto (US), and Iterative (US). |

This research report categorizes the Data Science Platform Market to forecast revenues and analyze trends in each of the following submarkets:

Based on Component, the market has the following segments:

- Platform

-

Services

- Professional Services

- Support and maintenance

- Consulting

-

Deployment and Integration

- Managed Services

Based on Deployment Mode, the market has the following segments:

- Cloud

- On-premises

Based on Organization Size, the Data Science Platform market has the following segments:

- Small and Medium-Sized Enterprises

- Large Enterprises

Based on Business Function, the market has the following segments:

- Marketing

- Sales

- Logistics

- Finance and Accounting

- Customer Support

- Other Business Functions (HR and operations)

Based on Vertical, the Data Science Platform market has the following segment

- BFSI

- Retail and eCommerce

- Telecom and IT

- Media and Entertainment

- Healthcare and Life Sciences

- Government and Defense

- Manufacturing

- Transportation and Logistics

- Energy and Utilities

- Other Verticals (travel and hospitality, and education and research).

Based on regions, the Data Science Platform market has the following segments:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- Middle East

- Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In November 2021 IBM updates IBM SPSS Modeler 18.2.2 the new update comes with a sophisticated, versatile data mining workbench that allows the user to easily and easily develop accurate prediction models without programming..

- In May 2021, Google updates Google Vertex AI, a new managed ML platform from Google Cloud, is designed to make it easier for developers to deploy and maintain AI models. It is an unusual announcement at Google I/O, which usually focuses on mobile and web developers and does not usually include much Google Cloud news, but the fact that Google chose today to unveil Vertex shows how vital it feels this new service is for a wide spectrum of developers.

- In September 2021, Microsoft updates Microsoft Machine Learning Studio the new update adds a new PyTorch extension library for agile deep learning experimentation.

- In September 2021, MathWorks updates The MATLAB and Simulink product families release 2021b from MathWorks. MATLAB and Simulink have hundreds of new and updated features and functions in Release 2021b (R2021b), major improvements, Code refactoring and block editing, as well as the ability to run Python commands and scripts from MATLAB, are all new features in MATLAB. Users can now run several simulations for different scenarios from the Simulink Editor and create unique tabs in the Simulink Toolstrip thanks to Simulink upgrades.

- In December 2021, Amazon updates AWS Amazon SageMaker with the new update Amazon SageMaker technology can speed up deep learning (DL) model training by up to 50%.

Frequently Asked Questions (FAQ):

How big is the Data Science Platform Market?

What is the Data Science Platform Market Growth?

Which region have the highest Data Science Platform market share?

Which component segment is expected to witness a higher adoption rate in the coming years?

Who are the major vendors in the Data Science Platform market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATE, 2018–2021

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 6 GLOBAL DATA SCIENCE PLATFORM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF THE MARKET

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS/SERVICES OF THE MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 3 TOP-DOWN (DEMAND SIDE): SHARE OF DATA SCIENCE PLATFORM THROUGH THE OVERALL DATA SCIENCE PLATFORM SPENDING

FIGURE 11 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

2.4 COMPANY EVALUATION MATRIX

FIGURE 12 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.5 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 13 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 52)

TABLE 2 GLOBAL DATA SCIENCE PLATFORM MARKET SIZE AND GROWTH RATE, 2016–2020 (USD MILLION, Y-O-Y%)

TABLE 3 GLOBAL MARKET SIZE AND GROWTH RATE, 2021–2026 (USD MILLION, Y-O-Y%)

FIGURE 14 DATA SCIENCE PLATFORM COMPONENT SEGMENT TO ACCOUNT FOR A LARGER MARKET SIZE IN 2021

FIGURE 15 PROFESSIONAL SERVICES SEGMENT TO ACCOUNT FOR A LARGER MARKET SHARE IN 2021

FIGURE 16 DEPLOYMENT AND INTEGRATION SEGMENT TO HOLD THE LARGEST MARKET SIZE IN 2021

FIGURE 17 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR A LARGER MARKET SHARE IN 2021

FIGURE 18 ON-PREMISES SEGMENT TO ACCOUNT FOR A LARGER MARKET SIZE IN 2021

FIGURE 19 MARKETING SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2021

FIGURE 20 HEALTHCARE AND LIFE SCIENCES INDUSTRY VERTICAL CONTRIBUTES TO THE HIGHEST MARKET REVENUE IN 2021

FIGURE 21 NORTH AMERICA TO BE AN EMERGING DOMINANT REGION IN TERMS OF MARKET SIZE IN 2021

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 22 INCREASED DIGITALIZATION AND EMERGING TECHNOLOGIES, SUCH AS BIG DATA, ML, ANALYTICS, IOT, AND AI, TO DRIVE THE MARKET GROWTH

4.2 MARKET: TOP THREE INDUSTRY VERTICALS

FIGURE 23 BFSI VERTICAL TO ACCOUNT FOR THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

4.3 MARKET, BY REGION

FIGURE 24 NORTH AMERICA TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2021

4.4 NORTH AMERICA: MARKET, BY BUSINESS FUNCTION AND INDUSTRY VERTICAL

FIGURE 25 MARKETING BUSINESS FUNCTION AND BFSI INDUSTRY VERTICAL TO ACCOUNT FOR THE LARGEST SHARES IN THE DATA SCIENCE PLATFORM MARKET IN 2021

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 61)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 26 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DATA SCIENCE PLATFORM MARKET

5.2.1 DRIVERS

5.2.1.1 Astonishing growth of big data

5.2.1.2 Rising adoption of cloud-based solutions

5.2.1.3 Rising application of the data science platform in various industries

5.2.1.4 Growing need to extract in-depth insights from voluminous data to gain competitive advantage

5.2.2 RESTRAINTS

5.2.2.1 Lack of clarity on business problem

5.2.2.2 Stringent government rules and regulations

5.2.3 OPPORTUNITIES

5.2.3.1 Higher inclination of enterprises toward data-intensive business strategies

5.2.3.2 Rising adoption of advanced technologies

5.2.4 CHALLENGES

5.2.4.1 Lack of adequately skilled workforce

5.2.4.2 Data privacy, security, and reliability concerns

5.3 USE CASES

5.3.1 BANKING, FINANCIAL SERVICES AND INSURANCE

5.3.1.1 Use Case 1: CBA uses H2O AI Cloud capabilities to generate better customer and community outcomes at a greater pace and scale

5.3.2 TELECOMMUNICATION AND INFORMATION TECHNOLOGY

5.3.2.1 Use Case 2: AT&T uses H2O.AI to address a broad range of use cases, from marketing and sales to network availability and maintenance

5.3.3 RETAIL AND CONSUMER GOODS

5.3.3.1 Use Case 3: Azure Databricks offers a Unified Data Analytics Platform for Reckitt to improve cost optimization

5.3.4 GOVERNMENT AND DEFENSE

5.3.4.1 Use Case 4: Project Odyssey uses SAS software for data integration and intelligent data mining of large sets of ballistics and crime information data

5.3.5 MEDIA AND ENTERTAINMENT

5.3.5.1 Use Case 5: Comcast uses H2O AI CLOUD to enhance customer experience

5.3.6 MANUFACTURING

5.3.6.1 Use Case 6: ENGIE Digital uses Amazon SageMaker for predictive maintenance at power plants

5.3.7 HEALTHCARE AND LIFE SCIENCES

5.3.7.1 Use Case 7: Department of Nursing uses TIBCO Data Science Software to strengthen the training process

5.3.8 TRANSPORT AND LOGISTICS

5.3.8.1 Use Case 8: Transport for London uses RapidMiner to aid the performance of the road network

5.3.9 ENERGY AND UTILITIES

5.3.9.1 Use Case 9: Blue River Analytics uses TIBCO Data Science to save time, reduce costs, and increase productivity

5.4 PATENT ANALYSIS

5.4.1 METHODOLOGY

5.4.2 DOCUMENT TYPE

TABLE 4 PATENTS FILED, 2019–2022

5.4.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 27 ANNUAL NUMBER OF PATENTS GRANTED, 2018–2021

5.4.3.1 Top applicants

FIGURE 28 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2019–2022

5.5 KEY COMPONENTS AND CHARACTERISTICS OF THE DATA SCIENCE PLATFORM

FIGURE 29 DATA SCIENCE PLATFORM

5.6 DATA SCIENCE PLATFORM ECOSYSTEM

TABLE 5 DATA SCIENCE PLATFORM MARKET: ECOSYSTEM

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 30 SUPPLY CHAIN ANALYSIS

5.8 PRICING MODEL ANALYSIS

TABLE 6 PRICING MODEL

5.9 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS IN THE MARKET

FIGURE 31 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.10 PORTER’S FIVE FORCES ANALYSIS

FIGURE 32 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 7 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF SUPPLIERS

5.10.4 BARGAINING POWER OF BUYERS

5.10.5 INTENSITY OF COMPETITIVE RIVALRY

5.11 TECHNOLOGICAL ANALYSIS

5.11.1 ARTIFICIAL INTELLIGENCE

5.11.2 MACHINE LEARNING

5.11.3 DEEP LEARNING

5.11.4 NATURAL LANGUAGE PROCESSING

5.11.5 INTERNET OF THINGS

5.11.6 CLOUD COMPUTING

5.12 REGULATORY IMPLICATIONS

5.12.1 GENERAL DATA PROTECTION REGULATION

5.12.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.12.3 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.12.4 SARBANES-OXLEY ACT OF 2002

5.12.5 SOC 2 TYPE II COMPLIANCE

5.12.6 ISO/IEC 27001

5.12.7 THE GRAMM–LEACH–BLILEY ACT

5.13 MARKET: COVID-19 IMPACT

6 DATA SCIENCE PLATFORM MARKET, BY COMPONENT (Page No. - 84)

6.1 INTRODUCTION

6.1.1 COVID-19 IMPACT ON THE MARKET, BY COMPONENT

FIGURE 33 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 8 MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 9 MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

6.1.2 COMPONENTS: MARKET DRIVERS

6.2 PLATFORM

TABLE 10 PLATFORM: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 11 PLATFORM: MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3 SERVICES

FIGURE 34 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 12 MARKET, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 13 MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 14 SERVICES: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 15 SERVICES: MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.1 MANAGED SERVICES

TABLE 16 MANAGED SERVICES: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 17 MANAGED SERVICES: MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.2 PROFESSIONAL SERVICES

TABLE 18 PROFESSIONAL SERVICES: DATA SCIENCE PLATFORM MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 19 PROFESSIONAL SERVICES: MARKET, BY REGION, 2021–2026 (USD MILLION)

FIGURE 35 SUPPORT AND MAINTENANCE SERVICES SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 20 PROFESSIONAL SERVICES: MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 21 PROFESSIONAL SERVICES: MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.3.3 CONSULTING

TABLE 22 CONSULTING DATA SCIENCE PLATFORM SERVICES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 23 CONSULTING DATA SCIENCE PLATFORM SERVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.4 DEPLOYMENT AND INTEGRATION

TABLE 24 DEPLOYMENT AND INTEGRATION: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 25 DEPLOYMENT AND INTEGRATION: MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.5 SUPPORT AND MAINTENANCE

TABLE 26 SUPPORT AND MAINTENANCE: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 27 SUPPORT AND MAINTENANCE: MARKET, BY REGION, 2021–2026 (USD MILLION)

7 DATA SCIENCE PLATFORM MARKET, BY BUSINESS FUNCTION (Page No. - 97)

7.1 INTRODUCTION

7.1.1 COVID-19 IMPACT ON THE MARKET, BY BUSINESS FUNCTION

FIGURE 36 FINANCE AND ACCOUNTING SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 28 MARKET, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 29 MARKET, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

7.1.2 BUSINESS FUNCTIONS: MARKET DRIVERS

7.2 MARKETING

TABLE 30 MARKETING: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 31 MARKETING: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.3 SALES

TABLE 32 SALES: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 33 SALES: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.4 LOGISTICS

TABLE 34 LOGISTICS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 35 LOGISTICS: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.5 FINANCE AND ACCOUNTING

TABLE 36 FINANCE AND ACCOUNTING: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 37 FINANCE AND ACCOUNTING: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.6 CUSTOMER SUPPORT

TABLE 38 CUSTOMER SUPPORT: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 39 CUSTOMER SUPPORT: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.7 OTHER BUSINESS FUNCTIONS

TABLE 40 OTHER BUSINESS FUNCTIONS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 41 OTHER BUSINESS FUNCTIONS: MARKET, BY REGION, 2021–2026 (USD MILLION)

8 DATA SCIENCE PLATFORM MARKET, BY DEPLOYMENT MODE (Page No. - 107)

8.1 INTRODUCTION

8.1.1 COVID-19 IMPACT ON THE MARKET, BY DEPLOYMENT MODE

FIGURE 37 CLOUD SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 42 MARKET, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 43 MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

8.1.2 DEPLOYMENT MODES: MARKET DRIVERS

8.2 ON-PREMISES

TABLE 44 ON-PREMISES: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 45 ON-PREMISES: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.3 CLOUD

TABLE 46 CLOUD: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 47 CLOUD: MARKET, BY REGION, 2021–2026 (USD MILLION)

9 DATA SCIENCE PLATFORM MARKET, BY ORGANIZATION SIZE (Page No. - 113)

9.1 INTRODUCTION

9.1.1 COVID-19 IMPACT ON THE MARKET, BY ORGANIZATION SIZE

FIGURE 38 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 48 MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 49 MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

9.1.2 ORGANIZATION SIZE: MARKET DRIVERS

9.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 50 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 51 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2021–2026 (USD MILLION)

9.3 LARGE ENTERPRISES

TABLE 52 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 53 LARGE ENTERPRISES: MARKET, BY REGION, 2021–2026 (USD MILLION)

10 DATA SCIENCE PLATFORM MARKET, BY INDUSTRY VERTICAL (Page No. - 119)

10.1 INTRODUCTION

10.1.1 COVID-19 IMPACT ON THE MARKET, BY INDUSTRY VERTICAL

FIGURE 39 HEALTHCARE AND LIFE SCIENCES INDUSTRY VERTICAL TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 54 MARKET, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 55 MARKET, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

10.1.2 INDUSTRY VERTICALS: MARKET DRIVERS

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 56 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 57 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.3 TELECOMMUNICATIONS AND IT

TABLE 58 TELECOMMUNICATIONS AND IT: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 59 TELECOMMUNICATIONS AND IT: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.4 RETAIL AND ECOMMERCE

TABLE 60 RETAIL AND ECOMMERCE: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 61 RETAIL AND ECOMMERCE: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.5 HEALTHCARE AND LIFE SCIENCES

TABLE 62 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 63 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.6 GOVERNMENT AND DEFENSE

TABLE 64 GOVERNMENT AND DEFENSE: DATA SCIENCE PLATFORM MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 65 GOVERNMENT AND DEFENSE: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.7 MEDIA AND ENTERTAINMENT

TABLE 66 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 67 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.8 MANUFACTURING

TABLE 68 MANUFACTURING: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 69 MANUFACTURING: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.9 TRANSPORTATION AND LOGISTICS

TABLE 70 TRANSPORTATION AND LOGISTICS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 71 TRANSPORTATION AND LOGISTICS: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.10 ENERGY AND UTILITIES

TABLE 72 ENERGY AND UTILITIES: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 73 ENERGY AND UTILITIES: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.11 OTHER INDUSTRY VERTICALS

TABLE 74 OTHER INDUSTRY VERTICALS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 75 OTHER INDUSTRY VERTICALS: MARKET, BY REGION, 2021–2026 (USD MILLION)

11 DATA SCIENCE PLATFORM MARKET, BY REGION (Page No. - 136)

11.1 INTRODUCTION

FIGURE 40 ASIA PACIFIC TO ACHIEVE THE HIGHEST GROWTH IN THE MARKET DURING THE FORECAST PERIOD

FIGURE 41 INDIA TO ACHIEVE THE HIGHEST GROWTH IN THE MARKET DURING THE FORECAST PERIOD

TABLE 76 MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 77 MARKET, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

11.2.2 NORTH AMERICA: COVID-19 IMPACT

11.2.3 NORTH AMERICA: REGULATIONS

11.2.3.1 Personal Information Protection and Electronic Documents Act (PIPEDA)

11.2.3.2 Gramm-Leach-Bliley (GLB) Act

11.2.3.3 Health Insurance Portability and Accountability Act (HIPAA) of 1996

11.2.3.4 Federal Information Security Management Act (FISMA)

11.2.3.5 Federal Information Processing Standards (FIPS)

11.2.3.6 California Consumer Privacy Act (CSPA)

FIGURE 42 NORTH AMERICA: MARKET SNAPSHOT

TABLE 78 NORTH AMERICA: DATA SCIENCE PLATFORM, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 79 NORTH AMERICA: DATA SCIENCE PLATFORM, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 80 NORTH AMERICA: DATA SCIENCE PLATFORM, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 81 NORTH AMERICA: DATA SCIENCE PLATFORM, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 82 NORTH AMERICA: DATA SCIENCE PLATFORM, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 83 NORTH AMERICA: DATA SCIENCE PLATFORM, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 84 NORTH AMERICA: DATA SCIENCE PLATFORM, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 85 NORTH AMERICA: DATA SCIENCE PLATFORM, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 86 NORTH AMERICA: DATA SCIENCE PLATFORM, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 87 NORTH AMERICA: DATA SCIENCE PLATFORM, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 88 NORTH AMERICA: DATA SCIENCE PLATFORM, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 89 NORTH AMERICA: DATA SCIENCE PLATFORM, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 90 NORTH AMERICA: DATA SCIENCE PLATFORM, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 91 NORTH AMERICA: DATA SCIENCE PLATFORM, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

TABLE 92 NORTH AMERICA: DATA SCIENCE PLATFORM, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 93 NORTH AMERICA: DATA SCIENCE PLATFORM, BY COUNTRY, 2021–2026 (USD MILLION)

11.2.4 UNITED STATES

TABLE 94 UNITED STATES: DATA SCIENCE PLATFORM MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 95 UNITED STATES: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 96 UNITED STATES: MARKET, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 97 UNITED STATES: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

11.2.5 CANADA

TABLE 98 CANADA: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 99 CANADA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 100 CANADA: MARKET, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 101 CANADA: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: DATA SCIENCE PLATFORM MARKET DRIVERS

11.3.2 EUROPE: COVID-19 IMPACT

11.3.3 EUROPE: TARIFFS AND REGULATIONS

11.3.3.1 GDPR 2016/679 is a regulation in the EU

11.3.3.2 General Data Protection Regulation

11.3.3.3 European Committee for Standardization

11.3.3.4 European Technical Standards Institute

TABLE 102 EUROPE: DATA SCIENCE PLATFORM, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 103 EUROPE: DATA SCIENCE PLATFORM, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 104 EUROPE: DATA SCIENCE PLATFORM, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 105 EUROPE: DATA SCIENCE PLATFORM, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 106 EUROPE: DATA SCIENCE PLATFORM, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 107 EUROPE: DATA SCIENCE PLATFORM, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 108 EUROPE: DATA SCIENCE PLATFORM, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 109 EUROPE: DATA SCIENCE PLATFORM, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 110 EUROPE: DATA SCIENCE PLATFORM, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 111 EUROPE: DATA SCIENCE PLATFORM, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 112 EUROPE: DATA SCIENCE PLATFORM, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 113 EUROPE: DATA SCIENCE PLATFORM, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 114 EUROPE: DATA SCIENCE PLATFORM, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 115 EUROPE: DATA SCIENCE PLATFORM, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

TABLE 116 EUROPE: DATA SCIENCE PLATFORM MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 117 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

11.3.4 UNITED KINGDOM

TABLE 118 UNITED KINGDOM: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 119 UNITED KINGDOM: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.3.5 GERMANY

TABLE 120 GERMANY: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 121 GERMANY: DATA SCIENCE PLATFORM MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.3.6 FRANCE

TABLE 122 FRANCE: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 123 FRANCE: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.3.7 REST OF EUROPE

TABLE 124 REST OF EUROPE: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 125 REST OF EUROPE: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: DATA SCIENCE PLATFORM MARKET DRIVERS

11.4.2 ASIA PACIFIC: COVID-19 IMPACT

11.4.3 ASIA PACIFIC: REGULATIONS

11.4.3.1 Privacy Commissioner for Personal Data

11.4.3.2 Act on the Protection of Personal Information

11.4.3.3 Critical Information Infrastructure

11.4.3.4 International Organization for Standardization 27001

11.4.3.5 Personal Data Protection Act

FIGURE 43 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 126 ASIA PACIFIC: DATA SCIENCE PLATFORM, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 127 ASIA PACIFIC: DATA SCIENCE PLATFORM, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 128 ASIA PACIFIC: DATA SCIENCE PLATFORM, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 129 ASIA PACIFIC: DATA SCIENCE PLATFORM, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 130 ASIA PACIFIC: DATA SCIENCE PLATFORM, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 131 ASIA PACIFIC: DATA SCIENCE PLATFORM, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 132 ASIA PACIFIC: DATA SCIENCE PLATFORM, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 133 ASIA PACIFIC: DATA SCIENCE PLATFORM, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 134 ASIA PACIFIC: DATA SCIENCE PLATFORM, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 135 ASIA PACIFIC: DATA SCIENCE PLATFORM, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 136 ASIA PACIFIC: DATA SCIENCE PLATFORM, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 137 ASIA PACIFIC: DATA SCIENCE PLATFORM, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 138 ASIA PACIFIC: DATA SCIENCE PLATFORM, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 139 ASIA PACIFIC: DATA SCIENCE PLATFORM, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

TABLE 140 ASIA PACIFIC: DATA SCIENCE PLATFORM MARKET, BY COUNTRY/REGION, 2016–2020 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET, BY COUNTRY/REGION, 2021–2026 (USD MILLION)

11.4.4 CHINA

TABLE 142 CHINA: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 143 CHINA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.4.5 JAPAN

TABLE 144 JAPAN: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 145 JAPAN: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.4.6 INDIA

TABLE 146 INDIA: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 147 INDIA: DATA SCIENCE PLATFORM MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.4.7 REST OF ASIA PACIFIC

TABLE 148 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 149 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

11.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

11.5.3 MIDDLE EAST AND AFRICA: REGULATIONS

11.5.3.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

11.5.3.2 GDPR Applicability in KSA

11.5.3.3 Protection of Personal Information Act (POPIA)

TABLE 150 MIDDLE EAST AND AFRICA: DATA SCIENCE PLATFORM, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 151 MIDDLE EAST AND AFRICA: DATA SCIENCE PLATFORM, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 152 MIDDLE EAST AND AFRICA: DATA SCIENCE PLATFORM, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 153 MIDDLE EAST AND AFRICA: DATA SCIENCE PLATFORM, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 154 MIDDLE EAST AND AFRICA: DATA SCIENCE PLATFORM, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 155 MIDDLE EAST AND AFRICA: DATA SCIENCE PLATFORM, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 156 MIDDLE EAST AND AFRICA: DATA SCIENCE PLATFORM, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 157 MIDDLE EAST AND AFRICA: DATA SCIENCE PLATFORM, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 158 MIDDLE EAST AND AFRICA: DATA SCIENCE PLATFORM, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 159 MIDDLE EAST AND AFRICA: DATA SCIENCE PLATFORM, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 160 MIDDLE EAST AND AFRICA: DATA SCIENCE PLATFORM, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 161 MIDDLE EAST AND AFRICA: DATA SCIENCE PLATFORM, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 162 MIDDLE EAST AND AFRICA: DATA SCIENCE PLATFORM, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 163 MIDDLE EAST AND AFRICA: DATA SCIENCE PLATFORM, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

TABLE 164 MIDDLE EAST AND AFRICA: DATA SCIENCE PLATFORM MARKET, BY COUNTRY/REGION, 2016–2020 (USD MILLION)

TABLE 165 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY/REGION, 2021–2026 (USD MILLION)

11.5.4 MIDDLE EAST

TABLE 166 MIDDLE EAST: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 167 MIDDLE EAST: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.5.5 AFRICA

TABLE 168 AFRICA: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 169 AFRICA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.5.6 REST OF THE MIDDLE EAST AND AFRICA

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: DATA SCIENCE PLATFORM MARKET DRIVERS

11.6.2 LATIN AMERICA: COVID-19 IMPACT

11.6.3 LATIN AMERICA: REGULATIONS

11.6.3.1 Brazil Data Protection Law

11.6.3.2 Argentina Personal Data Protection Law No. 25.326

TABLE 170 LATIN AMERICA: DATA SCIENCE PLATFORM, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 171 LATIN AMERICA: DATA SCIENCE PLATFORM, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 172 LATIN AMERICA: DATA SCIENCE PLATFORM, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 173 LATIN AMERICA: DATA SCIENCE PLATFORM, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 174 LATIN AMERICA: DATA SCIENCE PLATFORM, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 175 LATIN AMERICA: DATA SCIENCE PLATFORM, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 176 LATIN AMERICA: DATA SCIENCE PLATFORM, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 177 LATIN AMERICA: DATA SCIENCE PLATFORM, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 178 LATIN AMERICA: DATA SCIENCE PLATFORM, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 179 LATIN AMERICA: DATA SCIENCE PLATFORM, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 180 LATIN AMERICA: DATA SCIENCE PLATFORM, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 181 LATIN AMERICA: DATA SCIENCE PLATFORM, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 182 LATIN AMERICA: DATA SCIENCE PLATFORM, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 183 LATIN AMERICA: DATA SCIENCE PLATFORM, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

TABLE 184 LATIN AMERICA: DATA SCIENCE PLATFORM MARKET, BY COUNTRY/REGION, 2016–2020 (USD MILLION)

TABLE 185 LATIN AMERICA: MARKET, BY COUNTRY/REGION, 2021–2026 (USD MILLION)

11.6.4 BRAZIL

TABLE 186 BRAZIL: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 187 BRAZIL: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.6.5 MEXICO

TABLE 188 MEXICO: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 189 MEXICO: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

11.6.6 REST OF LATIN AMERICA

TABLE 190 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 191 REST OF LATIN AMERICA: DATA SCIENCE PLATFORM MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 197)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES

12.3 REVENUE ANALYSIS

FIGURE 44 REVENUE ANALYSIS FOR KEY COMPANIES IN THE PAST FIVE YEARS

12.4 MARKET SHARE ANALYSIS

FIGURE 45 MARKET SHARE ANALYSIS FOR KEY COMPANIES

TABLE 192 DATA SCIENCE PLATFORM MARKET: DEGREE OF COMPETITION

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE

12.5.4 PARTICIPANT

FIGURE 46 KEY MARKET PLAYERS, COMPANY EVALUATION QUADRANT, 2021

12.6 COMPETITIVE BENCHMARKING

12.6.1 COMPANY PRODUCT FOOTPRINT

TABLE 193 COMPANY PRODUCT FOOTPRINT

12.6.2 COMPANY REGION FOOTPRINT

TABLE 194 COMPANY REGION FOOTPRINT

TABLE 195 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

TABLE 196 DATA SCIENCE PLATFORM MARKET: DETAILED LIST OF KEY PLAYERS

12.7 STARTUP/SME EVALUATION QUADRANT

12.7.1 PROGRESSIVE COMPANIES

12.7.2 RESPONSIVE COMPANIES

12.7.3 DYNAMIC COMPANIES

12.7.4 STARTING BLOCKS

FIGURE 47 STARTUP/SME MARKET EVALUATION QUADRANT, 2021

12.8 STARTUP/SME COMPETITIVE BENCHMARKING

12.8.1 COMPANY PRODUCT FOOTPRINT

TABLE 197 STARTUP/SME COMPANY OFFERING FOOTPRINT

12.8.2 COMPANY REGION FOOTPRINT

TABLE 198 STARTUP/SME COMPANY REGION FOOTPRINT

TABLE 199 MARKET: DETAILED LIST OF KEYS STARTUP/SMES

TABLE 200 MARKET COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

12.9 COMPETITIVE SCENARIO AND TRENDS

12.9.1 PRODUCT LAUNCHES

TABLE 201 MARKET: PRODUCT LAUNCHES, APRIL 2020– FEBRUARY 2022

12.9.2 DEALS

TABLE 202 DATA SCIENCE PLATFORM MARKET: DEALS, FEBRUARY 2019–FEBRUARY 2022

13 COMPANY PROFILES (Page No. - 242)

13.1 INTRODUCTION

13.2 MAJOR PLAYERS

(Business Overview, Products & Services, Key Insights, Recent Developments, COVID-19 Related Developmets, MnM View)*

13.2.1 IBM

TABLE 203 IBM: BUSINESS OVERVIEW

FIGURE 48 IBM: COMPANY SNAPSHOT

TABLE 204 IBM: PRODUCTS OFFERED

TABLE 205 IBM: SERVICES OFFERED

TABLE 206 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 207 IBM: DEALS

13.2.2 GOOGLE

TABLE 208 GOOGLE: BUSINESS OVERVIEW

FIGURE 49 GOOGLE: COMPANY SNAPSHOT

TABLE 209 GOOGLE: PRODUCTS OFFERED

TABLE 210 GOOGLE: SERVICES OFFERED

TABLE 211 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 212 GOOGLE: DEALS

13.2.3 MICROSOFT

TABLE 213 MICROSOFT: BUSINESS OVERVIEW

FIGURE 50 MICROSOFT: COMPANY SNAPSHOT

TABLE 214 MICROSOFT: PRODUCTS OFFERED

TABLE 215 MICROSOFT: SERVICES OFFERED

TABLE 216 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 217 MICROSOFT: DEALS

13.2.4 MATHWORKS

TABLE 218 MATHWORKS: BUSINESS OVERVIEW

TABLE 219 MATHWORKS: PRODUCTS OFFERED

TABLE 220 MATHWORKS: SERVICES OFFERED

TABLE 221 MATHWORKS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 222 MATHWORKS: DEALS

13.2.5 SAS

TABLE 223 SAS: BUSINESS OVERVIEW

FIGURE 51 SAS: COMPANY SNAPSHOT

TABLE 224 SAS: PRODUCTS OFFERED

TABLE 225 SAS: SERVICES OFFERED

TABLE 226 SAS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 227 SAS: DEALS

13.2.6 CLOUDERA

TABLE 228 CLOUDERA: BUSINESS OVERVIEW

FIGURE 52 CLOUDERA: COMPANY SNAPSHOT

TABLE 229 CLOUDERA: PRODUCTS OFFERED

TABLE 230 CLOUDERA: SERVICES OFFERED

TABLE 231 CLOUDERA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 232 CLOUDERA: DEALS

13.2.7 TERADATA

TABLE 233 TERADATA: BUSINESS OVERVIEW

FIGURE 53 TERADATA: COMPANY SNAPSHOT

TABLE 234 TERADATA: PRODUCTS OFFERED

TABLE 235 TERADATA: SERVICES OFFERED

TABLE 236 TERADATA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 237 TERADATA: DEALS

13.2.8 TIBCO

TABLE 238 TIBCO: BUSINESS OVERVIEW

TABLE 239 TIBCO: PRODUCTS OFFERED

TABLE 240 TIBCO: SERVICES OFFERED

TABLE 241 TIBCO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 242 TIBCO: DEALS

13.2.9 AWS

TABLE 243 AWS: BUSINESS OVERVIEW

FIGURE 54 AWS: COMPANY SNAPSHOT

TABLE 244 AWS: PRODUCTS OFFERED

TABLE 245 AWS: SERVICES OFFERED

TABLE 246 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 247 AWS: DEALS

13.2.10 ALTERYX

TABLE 248 ALTERYX: BUSINESS OVERVIEW

FIGURE 55 ALTERYX: COMPANY SNAPSHOT

TABLE 249 ALTERYX: PRODUCTS OFFERED

TABLE 250 ALTERYX: SERVICES OFFERED

TABLE 251 ALTERYX: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 252 ALTERYX: DEALS

13.2.11 RAPIDMINER

TABLE 253 RAPIDMINER: BUSINESS OVERVIEW

TABLE 254 RAPIDMINER: PRODUCTS OFFERED

TABLE 255 RAPIDMINER: SERVICES OFFERED

TABLE 256 RAPIDMINER: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 257 RAPIDMINER: DEALS

13.2.12 DATABRICKS

TABLE 258 DATABRICKS: BUSINESS OVERVIEW

TABLE 259 DATABRICKS: PRODUCTS OFFERED

TABLE 260 DATABRICKS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 261 DATABRICKS: DEALS

13.2.13 SNOWFLAKE

TABLE 262 SNOWFLAKE: BUSINESS OVERVIEW

FIGURE 56 SNOWFLAKE: COMPANY SNAPSHOT

TABLE 263 SNOWFLAKE: SOLUTIONS OFFERED

TABLE 264 SNOWFLAKE: SERVICES OFFERED

TABLE 265 SNOWFLAKE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 266 SNOWFLAKE: DEALS

13.2.14 H2O.AI

TABLE 267 H2O.AI: BUSINESS OVERVIEW

TABLE 268 H2O.AI: PRODUCTS OFFERED

TABLE 269 H2O.AI: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 270 H2O.AI: DEALS

13.2.15 ANACONDA

TABLE 271 ANACONDA: BUSINESS OVERVIEW

TABLE 272 ANACONDA: PRODUCTS OFFERED

TABLE 273 ANACONDA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 274 ANACONDA: DEALS

13.2.16 ALTAIR

TABLE 275 ALTAIR: BUSINESS OVERVIEW

FIGURE 57 ALTAIR: COMPANY SNAPSHOT

TABLE 276 ALTAIR: PRODUCTS OFFERED

TABLE 277 ALTAIR: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 278 ALTAIR: DEALS

*Details on Business Overview, Products & Services, Recent Developments, COVID-19 Related Developments, MnM View might not be captured in case of unlisted companies.

13.3 SMES/START-UPS

13.3.1 SAP

13.3.2 DOMINO DATA LAB

13.3.3 DATAIKU

13.3.4 DATAROBOT

13.3.5 APHERIS

13.3.6 COMET

13.3.7 DATABAND

13.3.8 DOTDATA

13.3.9 EXPLORIUM

13.3.10 NOOGATA

13.3.11 TECTON

13.3.12 SPELL

13.3.13 ARRIKTO

13.3.14 ITERATIVE

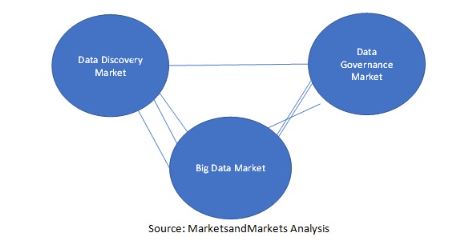

14 ADJACENT AND RELATED MARKETS (Page No. - 324)

14.1 DATA GOVERNANCE MARKET—GLOBAL FORECAST TO 2025

14.1.1 MARKET DEFINITION

14.1.2 MARKETS OVERVIEW

14.1.2.1 Data governance market, by application

TABLE 279 DATA GOVERNANCE MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 280 DATA GOVERNANCE MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

14.1.2.2 Data governance market, by component

TABLE 281 DATA GOVERNANCE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 282 DATA GOVERNANCE MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

14.1.2.3 Data governance market, by deployment model

TABLE 283 DATA GOVERNANCE MARKET SIZE, BY DEPLOYMENT MODEL, 2014–2019 (USD MILLION)

TABLE 284 DATA GOVERNANCE MARKET SIZE, BY DEPLOYMENT MODEL, 2019–2025 (USD MILLION)

14.1.2.4 Data governance market, by organization size

TABLE 285 DATA GOVERNANCE MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 286 DATA GOVERNANCE MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

14.1.2.5 Data governance market, by vertical

TABLE 287 DATA GOVERNANCE MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 288 DATA GOVERNANCE MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

14.1.2.6 Data governance market, by region

TABLE 289 DATA GOVERNANCE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 290 DATA GOVERNANCE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

14.1.3 DATA DISCOVERY MARKET—GLOBAL FORECAST TO 2025

14.1.3.1 Market definition

14.1.3.2 Market overview

14.1.3.3 Data discovery market, by component

TABLE 291 DATA DISCOVERY MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 292 DATA DISCOVERY MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 293 DATA DISCOVERY MARKET SIZE, BY SERVICE,2014–2019 (USD MILLION)

TABLE 294 DATA DISCOVERY MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 295 PROFESSIONAL SERVICES: DATA DISCOVERY MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 296 PROFESSIONAL SERVICES: DATA DISCOVERY MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

14.1.3.4 Data discovery market, by organization size

TABLE 297 DATA DISCOVERY MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 298 DATA DISCOVERY MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

14.1.3.5 Data discovery market, by deployment mode

TABLE 299 DATA DISCOVERY MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 300 DATA DISCOVERY MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 301 CLOUD: DATA DISCOVERY MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 302 CLOUD: DATA DISCOVERY MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

14.1.3.6 Data discovery market, by functionality

TABLE 303 DATA DISCOVERY MARKET SIZE, BY FUNCTIONALITY, 2014–2019 (USD MILLION)

TABLE 304 DATA DISCOVERY MARKET SIZE, BY FUNCTIONALITY, 2019–2025 (USD MILLION)

14.1.3.7 Data discovery market, by application

TABLE 305 DATA DISCOVERY MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 306 DATA DISCOVERY MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

14.1.3.8 Data discovery market, by vertical

TABLE 307 DATA DISCOVERY MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 308 DATA DISCOVERY MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

14.1.3.9 Data discovery market, by region

TABLE 309 DATA DISCOVERY MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 310 DATA DISCOVERY MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

15 APPENDIX (Page No. - 339)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

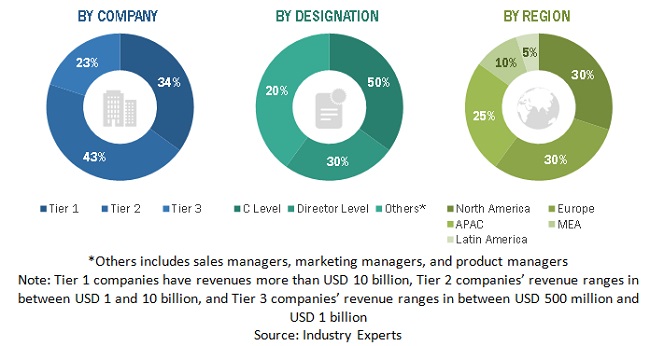

The research study for the Data Science Platform market report involved the use of extensive secondary sources, directories, as well as several journals and magazines, to identify and collect information that is useful for this technical and market-oriented study. During the production cycle of the report, in-depth interviews were conducted with various primary respondents, including key opinion leaders, subject-matter experts, high-level executives of various companies offering Data Science Platform and services, and industry consultants, to obtain and verify critical qualitative and quantitative information, as well as assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various secondary sources were referred to, for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of Data Science Platform vendors; white papers, certified publications, and articles from recognized industry associations; statistics bureaus; and government publishing sources. The secondary research was carried out to obtain key information about the industry’s value and supply chain, the total pool of key players, market classifications, and segmentations from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides of the Data Science Platform market ecosystem were interviewed to obtain qualitative and quantitative information for the study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives of various vendors providing Data Science Platform, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global Data Science Platform market and estimate the size of various other dependent subsegments. The research methodology used to estimate the market size included the following details: the key players in the market were identified through secondary research and their revenue contributions in the respective regions were determined through primary and secondary research. The entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources. All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data was consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global Data Science Platform Market with COVID-19 Impact Analysis by Component (Platform & Services), Business Function (Marketing, Sales, Logistics, & Customer Support), Deployment Mode, Organization Size, Industry Vertical, and Region - Global Forecast to 2026 and analyze the various macroeconomic and microeconomic factors that affect market growth

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the Data Science Platform market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall Data Science Platform market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the Data Science Platform market

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze the competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolios of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Data Science Platform Market