B2B Digital Payment Market by Offering (Solutions, Services), Payment Method (Credit Cards/Debit Cards/Virtual Cards, Digital Wallet), Transaction Type (Domestic, Cross-Border), Vertical and Region - Global Forecast to 2028

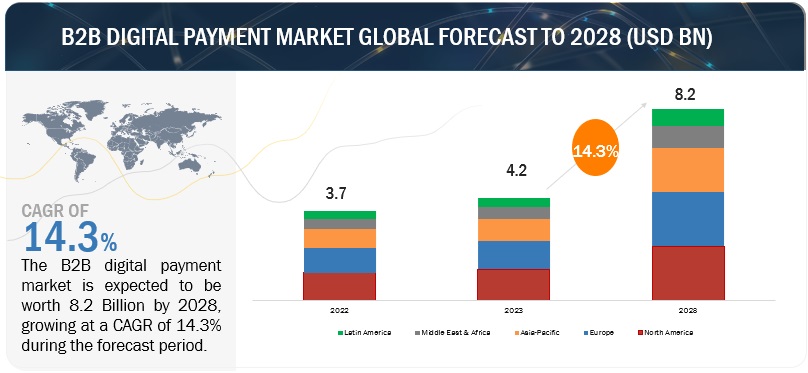

The global B2B Digital Payment Market size was estimated at $4.2 billion in 2023 and is projected to reach over $8.2 billion by 2028, growing at a CAGR of 14.3% from 2023 to 2028. The growth of the fintech sector has introduced innovative payment solutions, such as digital wallets, blockchain-based payments, and peer-to-peer platforms. These innovations have contributed to the diversification of B2B digital payment options. Evolving regulations around financial transactions and data security have encouraged businesses to adopt secure and compliant payment methods. B2B digital payment platforms often incorporate features that help businesses adhere to these regulations. These factors are driving the demand for management decisions.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

B2B Digital Payment Market Dynamics

Driver: Increased in the adoption of real-time payments.

Countries across the world implement ICT technologies to promote digital economies. Governments are taking various initiatives to accelerate the adoption of RTP solutions by digitizing the payment process. The Federal Reserve Bank and National Automated Clearing House Association (NACHA) are working on a roadmap and incentives for accelerating real-time payments in the US. In India, the Government of India (GoI) has launched various initiatives, including Digital India and Immediate Payment Service (IMPS), which act as catalysts for the adoption of real-time payments. These initiatives help promote digitalization and increase awareness about the advantages of using new technologies. Other countries such as Singapore and Australia have also launched their real-time payment schemes, named FAST and NPP, respectively, to increase the adoption of RTP solutions. Thus, worldwide government initiatives are expected to increase the demand for RTP solutions and services in the coming years. Mobile wallet usage has also grown significantly, with adoption among adults up nearly threefold in the past five years. Mobile wallets now play an important part in the payments ecosystem, and with UPI integration in some of the most popular wallets, they are another factor fueling real-time payments growth in India.

Restraint: Complexity of processes

B2B transactions often involve complex processes, such as invoicing, purchase orders, and reconciliation. These complexities can lead to delays and errors in payments, impacting operational efficiency. B2B digital payment domain pertains to the intricate and multifaceted nature of payment procedures within business-to-business transactions. Such transactions encompass a series of intricate steps, documentation requisites, and approval protocols, often resulting in delays, inaccuracies, and operational inefficiencies. This intricacy arises from diverse factors, including the wide spectrum of businesses, industries, and regulatory frameworks involved. For instance, generating and exchanging precise invoices, purchase orders, and pertinent documents is paramount for accuracy, yet the manual handling of these documents can prove time-intensive and susceptible to errors. Additionally, larger organizations may necessitate multi-tiered approval mechanisms, leading to bottlenecks and prolonged processing times. The diverse payment methods and channels utilized, including checks, electronic fund transfers, ACH payments, and credit cards, further complicate matters. Moreover, the complexities of cross-border transactions, involving currency conversions, regulatory compliance, and varying payment practices across different countries, amplify the intricacy of the process.

Opportunity: Rise in cross-border payments

In the B2B digital payment market, the realm of cross-border payments presents a spectrum of opportunities for innovation and growth. As businesses increasingly engage in global trade and collaborations, there is a pressing demand for streamlined cross-border payment solutions. Fintech companies have a chance to revolutionize this landscape by developing technologically advanced platforms that offer real-time, cost-effective, and transparent cross-border transactions. Leveraging blockchain technology and cryptocurrencies can minimize intermediary fees and expedite settlement times, enhancing efficiency and financial control for B2B transactions across borders. Additionally, API integration services can empower businesses to seamlessly integrate cross-border payment capabilities into their existing systems, catering to the specific needs of their international clientele. As regulatory advancements shape the cross-border payment ecosystem, there's an opportunity for B2B digital payment providers to offer compliance-oriented solutions that ensure adherence to international financial regulations. In essence, the B2B cross-border payment sector invites innovative players to simplify processes, optimize costs, and deliver unparalleled value to businesses navigating the complexities of global commerce.

Challenge: Fraud and security concerns

Fraud and security concerns pose significant challenges in the B2B digital payment market, threatening the integrity of financial transactions. These concerns encompass a range of malicious activities, from payment fraud like invoice manipulation and CEO impersonation to data breaches that expose sensitive financial information. Cybersecurity threats, such as malware, phishing, and ransomware attacks, further exacerbate the risk landscape. Insider threats, payment method vulnerabilities, and inadequate authentication methods also contribute to the complexity. Regulatory compliance and data protection laws, such as GDPR and PCI DSS, add another layer of urgency to secure payment processes. To counter these challenges, businesses must adopt multi-layered security measures, encryption protocols, and employee training programs. Regular audits, vendor due diligence, and strong authentication practices are crucial in maintaining a robust defense against evolving cyber threats. Vigilance and adaptability are key, as fraud prevention remains an ongoing endeavor to safeguard B2B transactions effectively.

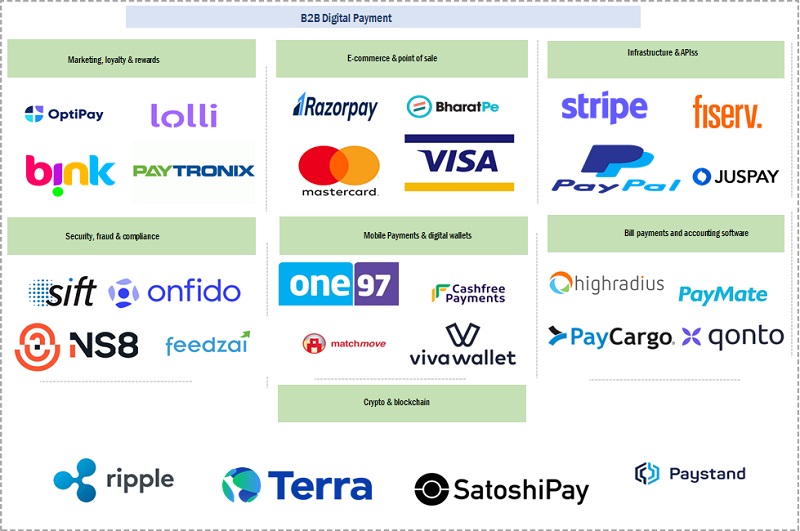

B2B Digital Payment Market Ecosystem

Prominent companies in this market include a well-established, financially stable provider of the B2B digital payment market. These companies have innovated their offerings and possess a diversified product portfolio, state-of-the-art technologies, and marketing networks. Prominent companies in this market include PayPal (US), Fiserv (US), FIS (US), Global Payments (US), ACI Worldwide (US), Block (US), MasterCard (US), Visa (US), Payoneer (US), Stripe (US).

By payment method, the credit/debit/virtual cards segment to hold the largest market size during the forecast period

A credit card enables consumers to build a continuing balance of debt, subject to interest being charged. A credit card typically involves a third-party entity that pays the seller and is reimbursed by the buyer. Issuing banks and other financial institutes offer various credit cards, such as business, secured, prepaid, and digital cards. A debit card is a plastic payment card that can be used instead of cash when making purchases. It is similar to a credit card, but unlike a credit card, the money is immediately transferred directly from the cardholder's bank account when performing a transaction. In several countries, the use of debit cards has become so widespread that their volume has overtaken or entirely replaced checks and, in some instances, cash transactions. . Virtual cards generate unique details for each transaction, bolstering security by minimizing the risk of fraud. This is especially crucial in the B2B space where trust and confidentiality are paramount. Additionally, the convenience of virtual cards extends to supplier relationships, enabling swift and controlled payments. Their integration with accounting systems simplifies reconciliation and reporting, offering enhanced financial oversight.

By transaction type, the cross-border segment is expected to grow with the highest CAGR during the forecast period

Cross-border transactions in the B2B digital payment market are essential components of global trade, enabling businesses to exchange money and goods/services across international borders. These transactions have historically faced challenges such as high fees, currency conversion costs, and slow settlement times. However, the rise of digital payment solutions has transformed this landscape by providing cost-effective, efficient, and secure alternatives. Through technologies like electronic funds transfers, digital wallets, and blockchain-based systems, businesses can now execute cross-border transactions with reduced fees, quicker processing times, and enhanced transparency. Nonetheless, regulatory compliance, security, and the competitive nature of the market remain critical considerations as businesses navigate this evolving terrain.

By vertical, the IT & ITES segment to hold the largest market size during the forecast period

The IT & ITES sector has been a driving force in the growth of the B2B digital payment market. Through technological innovation, IT companies have developed secure payment gateways, advanced APIs, and software solutions that enable seamless and secure transactions between businesses. These developments have given rise to dedicated B2B payment platforms offering features like real-time tracking, automated invoicing, and integration with accounting software. Additionally, the sector's involvement in digital wallet solutions, blockchain technology, and cryptocurrencies has expanded the realm of possibilities for B2B payments.

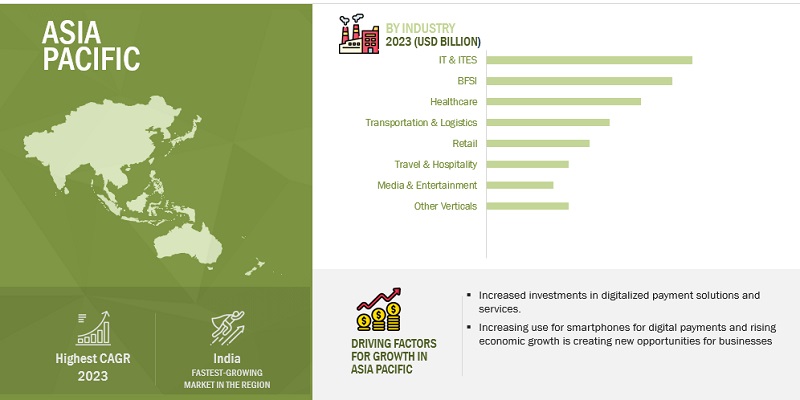

Based on region, Asia Pacific is expected to grow with the highest CAGR during the forecast period

Asia Pacific exhibits a notable propensity for technology adoption and is poised to achieve the highest CAGR in the B2B digital payment market in the coming years. The B2B digital payment market in Asia Pacific includes China, Japan, India, ANZ and the rest of Asia Pacific. Cross-border payment solutions have been developed to accommodate the rising trade between countries in the region. Governments have responded by implementing regulations to foster trust and security in digital payments. Mobile payment adoption has surged due to widespread smartphone usage, while traditional banks have adapted by offering online banking tailored for businesses. Despite progress, challenges such as interoperability and cybersecurity remain, underscoring the need for continued evolution in the B2B payment landscape.

Market Players:

The major players in the B2B digital payment market are PayPal (US), Fiserv (US), FIS (US), Visa (US), MasterCard (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, product enhancements, and acquisitions to expand their footprint in the B2B digital payment market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

Offering (Solutions and Services), Transaction Type (Domestic and Cross Border), Payment Method (Credit Cards/Debit Cards/Virtual Cards, Digital Wallet and Other Payment Methods), Vertical, and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

|

Companies covered |

PayPal (US), Fiserv (US), FIS (US), Global Payments (US), ACI Worldwide (US), Block (US), MasterCard (US), Visa (US), Payoneer (US), Stripe (US), Helcim (Canada), Payset (UK), Paytm (India), Razorpay (India), Rapyd (UK), Stax (US), EBANX (Brazil), Ramp (US), HighRadius (US), MatchMove (US), BharatPe (India), Juspay (India), Ripple (US), Terra (South Korea), Lolli (US), Paystand (US) |

This research report categorizes the B2B digital payment market based on offering, functions, deployment model, organization size, vertical, and region.

Based on the Offering:

-

Solutions

-

Payment Infrastructure

- Payment Gateways

- Payment Processors

- Mobile payment Applications

- Other Solutions

-

Billing and Accounting Management

- Recurring Billing and Subscription Management

- Account Payables (AP) & Account Receivable (AR)

- Others

- Security, Compliance, & Fraud Prevention Management

-

Payment Infrastructure

-

Services

- Professional

- Managed

Based on the Transaction Type:

- Domestic

- Cross Border

Based on Payment Method:

- Credit Cards/Debit Cards/Virtual Cards

- Digital Wallet

- Other Payment Methods

Based on the vertical:

- BFSI

- IT & ITES

- Retail and E-commerce

- Travel and Hospitality

- Healthcare

- Media and Entertainment

- Transportation and Logistics

- Other Verticals

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Italy

- Spain

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia and New Zealand (ANZ)

- Rest of Asia Pacific

-

Middle East & Africa

- Kingdom of Saudi Arabia

- UAE

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In April 2023, a new version of PayPal Payment Solution provided acceptance of PayPal payments with Apple Pay, save payment methods with PayPal Vault, real-time account updater for small and medium-sized businesses.

- In April 2023, FIS announced the launch of Worldpay. Worldpay obtained a category II payment services license, enabling card acquisition and disbursements in the UAE. This domestic license empowered Worldpay to provide its top-tier payment services to local companies with global aspirations and fast-growing enterprises seeking market expansion opportunities.

- In August 2023, Payoneer acquired Spott. Spott’s technology will enable Payoneer to better understand and serve customers, which supports our mission to make it easier for SMBs to operate and grow their business around the world.

- In April 2023, Payoneer collaborated with Zoho, to provide innovative payment solutions to businesses using Zoho Books. The collaboration will benefit small and medium-sized businesses (SMBs) and freelancers working globally in India, Australia, New Zealand, the UK, and the Philippines, with plans to expand the offering into new markets in the future.

- In January 2023, Amazon and Stripe have signed an expanded global agreement under which Amazon will significantly expand its use of Stripe’s core payments platform and Amazon Web Services (AWS) will provide crucial compute infrastructure to help Stripe serve millions of businesses around the world.

Frequently Asked Questions (FAQ):

What is the definition of the B2B digital payment market?

B2B digital payments are the exchange of currency for goods or services between two businesses. The business-to-business digital payments is the transfer of value denominated in currency from buyer to supplier for goods or services supplied. B2B payments can be a one-time or recurring transaction depending on the contractual agreement made between the buyer and supplier.

What is the market size of the B2B digital payment market?

The B2B digital payment market size is projected to grow from USD 4.2 billion in 2023 to USD 8.2 billion by 2028, at a CAGR of 14.3% during the forecast period.

What are the major drivers in the B2B digital payment market?

The major drivers of the B2B digital payment market are the increasing digital transformation across industries, high proliferation of smartphones enabling mCommerce growth, rise of eCommerce and adoption of embedded payment system, rise in the adoption of contactless payments, increase in the adoption of real-time payments..

Who are the key players operating in the B2B digital payment market?

The major players in the B2B digital payment market are PayPal (US), Fiserv (US), FIS (US), Global Payments (US), ACI Worldwide (US), Block (US), MasterCard (US), Visa (US), Payoneer (US), Stripe (US), Helcim (Canada), Payset (UK), Paytm (India), Razorpay (India), Rapyd (UK), Stax (US), EBANX (Brazil), Ramp (US), HighRadius (US), MatchMove (US), BharatPe (India), Juspay (India), Ripple (US), Terra (South Korea), Lolli (US), Paystand (US).

What are the opportunities for new market entrants in the B2B digital payment market?

The major opportunities of the B2B digital payment market are the rapid decline in unbanked population across the globe, gradual adoption of open-banking APIs, progressive changes in regulatory frameworks, rise in cross-border payments, collaboration between banks and fintech institutions to leverage customer experience.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 MARKET OVERVIEW

-

5.2 MARKET DYNAMICSDRIVERS- Aggressive promotion and adoption of digital ecosystem by governments worldwide- High proliferation of smartphones enabling m-commerce growth- Exponential expansion of e-commerce and high adoption of embedded payment systems- Increased consumer preference for contactless payments- Extensive use of real-time payment systemsRESTRAINTS- Lack of global standards for cross-border payments- Complexities associated with B2B payment transactionsOPPORTUNITIES- Rapid decline in unbanked population globally- Gradual adoption of open-banking APIs- Progressive changes in regulatory frameworks pertaining to B2B digital payments- Rise in cross-border payments- Collaboration between banks and FinTech institutions to enhance customer experienceCHALLENGES- Fragmented regional regulatory landscape- Risk of fraud and security concerns

-

5.3 INDUSTRY TRENDSBEST PRACTICES IN B2B DIGITAL PAYMENT MARKETREGULATORY LANDSCAPESUPPLY CHAIN ANALYSISBRIEF HISTORY OF B2B DIGITAL PAYMENT TECHNOLOGY- 2000–2010- 2010–2020- 2020–PresentECOSYSTEM MAPPINGPATENT ANALYSIS- Methodology- Document type- Innovations and patent applications- Top applicantsCASE STUDY ANALYSIS- Case study 1: Implementation of PayPal products by Tradera to streamline operations and scale business- Case study 2: Adoption of FIS Exemption Engine solution by Zalando to ensure fast and frictionless checkout process- Case study 3: Deployment of Braintree payment gateway by Animoto to increase renewal rates and build customer base- Case study 4: Execution of Stripe platform by Mindbody to provide hybrid fitness experience to customers- Case study 5: Integration of Square platform with Brushfire’s dashboard to offer omnichannel tool to manage ticketing and event paymentsPRICING ANALYSIS- Average selling price of B2B digital payment solutions provided by key players- Average selling price trendIMPACT OF B2B DIGITAL PAYMENTS ON ADJACENT TECHNOLOGIESTECHNOLOGY ANALYSIS- Adjacent technologies- Related technologiesPORTER’S FIVE FORCES ANALYSIS- Threat of new entrants- Threat of substitutes- Bargaining power of buyers- Bargaining power of suppliers- Intensity of competitive rivalryDISRUPTIONS/TRENDS IMPACTING CUSTOMER’S BUSINESS- Buy Now Pay Later (BNPL)- Real-time cross-border paymentsKEY CONFERENCES AND EVENTS, 2023–2024KEY STAKEHOLDERS AND BUYING CRITERIA- Key stakeholders in buying process- Buying criteriaFUTURE OF B2B DIGITAL PAYMENT TECHNOLOGY

-

6.1 INTRODUCTIONOFFERINGS: B2B DIGITAL PAYMENT MARKET DRIVERS

-

6.2 SOLUTIONSPAYMENT INFRASTRUCTURE- Growing demand for payment gateways and processors by merchants to drive segmental growth- Payment gateways- Payment processors- Mobile payment applications- Other solutionsBILLING & ACCOUNTING MANAGEMENT- Increasing use of billing & accounting management solutions to track invoice and payment status to drive market- Recurring billing & subscription management- Account payables & account receivables- OthersSECURITY, COMPLIANCE, & FRAUD PREVENTION- Rising focus on securing end-to-end payment transactions to drive segmental growth

-

6.3 SERVICESSURGING ADOPTION OF DIGITAL PAYMENT SOLUTIONS TO DRIVE DEMAND FOR SERVICESPROFESSIONAL SERVICESMANAGED SERVICES

-

7.1 INTRODUCTIONTRANSACTION TYPES: B2B DIGITAL PAYMENT MARKET DRIVERS

-

7.2 DOMESTICSIMPLICITY, HIGH SPEED, AND LOW COST OF DOMESTIC TRANSACTIONS TO DRIVE SEGMENTAL GROWTH

-

7.3 CROSS-BORDERCOMPLEX REGULATORY FRAMEWORK AND RISKS ASSOCIATED WITH CURRENCY EXCHANGE RATES TO PRESENT DISTINCT CHALLENGES

-

8.1 INTRODUCTIONPAYMENT METHODS: B2B DIGITAL PAYMENT MARKET DRIVERS

-

8.2 CREDIT/DEBIT/VIRTUAL CARDSINCREASING NUMBER OF CARD USERS TO BOOST MARKET GROWTH

-

8.3 DIGITAL WALLETSROBUST SECURITY MEASURES, SUCH AS ENCRYPTION AND MULTI-FACTOR AUTHENTICATION, OFFERED BY DIGITAL WALLETS TO DRIVE SEGMENTAL GROWTH

- 8.4 OTHER PAYMENT METHODS

-

9.1 INTRODUCTIONVERTICALS: B2B DIGITAL PAYMENT MARKET DRIVERS

-

9.2 BANKING, FINANCIAL SERVICES & INSURANCE (BFSI)GROWING FOCUS OF BFSI COMPANIES ON REDUCING CUSTOMER ATTRITION BY OFFERING DIGITAL FINANCIAL SERVICES TO DRIVE MARKETCASE STUDY- Fundraise Up and Stripe partnered to provide seamless payment experience to donors- FIS helped River City Bank to strengthen business continuity, regulatory compliance, and resilience

-

9.3 TRANSPORTATION & LOGISTICSRISING ADOPTION OF DIGITAL PAYMENT SOLUTIONS TO BUILD TRUST AND ACCOUNTABILITY AMONG PARTNERS TO FUEL MARKET GROWTHCASE STUDY- Maersk adopted intuitive platform from Stripe to accept payments through credit cards- Brightwell provided Mastercard cross-border services to tourists on ships to remit money internationally

-

9.4 IT & ITESINTEGRATION OF BLOCKCHAIN AND AI TECHNOLOGIES INTO B2B PAYMENT PLATFORMS TO SUPPORT SEAMLESS AND SECURE PAYMENT TRANSACTIONSCASE STUDY- Atlassian selected Stripe to create single payment and billing platform for global transactions- Linear partnered with Stripe to grow its business globally

-

9.5 HEALTHCAREPRESSING NEED TO SIMPLIFY BILLING AND INSURANCE CLAIM PROCESSES TO BOOST ADOPTION OF DIGITAL PAYMENT METHODSCASE STUDY- Doctolib utilized Stripe Connect to scale telemedicine services during pandemic- ACI helped leading healthcare service provider to launch new electronic payment system

-

9.6 RETAIL & E-COMMERCEINCREASING EFFORTS OF RETAILERS TOWARD ELIMINATING PAPER CHECKS TO BOOST ADOPTION OF DIGITAL PAYMENTSCASE STUDY- Tradera implemented PayPal products to streamline operations and scale business- Amazon partnered with Stripe to simply cross-border payments- Decathlon partnered with Stripe to support payments for new coaches and sports classes

-

9.7 TRAVEL & HOSPITALITYGROWING EMPHASIS ON PROTECTING SENSITIVE CUSTOMER AND FINANCIAL DATA TO FUEL SEGMENTAL GROWTHCASE STUDY- Mount Errigal Hotel switched to Worldpay to make seamless payment improvements- Aegean Airlines partnered with ACI Worldwide to resolve issue of e-commerce payment fraud

-

9.8 MEDIA & ENTERTAINMENTINCREASING POPULARITY OF STREAMING SERVICES AND OTT PLATFORMS TO BOOST DEMAND FOR DIGITAL PAYMENT SOLUTIONSCASE STUDY- Mindbody partnered with Stripe to build customer trust and simplify onboarding experience for customers- Agua Bendita expanded internationally with B2B digital payment solutions from Stripe and VTEX

- 9.9 OTHER VERTICALS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: B2B DIGITAL PAYMENT MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Presence of eminent companies offering digital payment solutions to drive marketCANADA- Technological advancements in digital payment solutions to support market growth

-

10.3 EUROPEEUROPE: B2B DIGITAL PAYMENT MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Rising demand for contactless payment solutions and card acceptance devices to drive marketGERMANY- High adoption of mobile-friendly payment solutions to contribute to market growthFRANCE- Significant investments by government to improve digital infrastructure to boost demand for digital payment solutionsSPAIN- Increasing use of digital and mobile wallets to reshape landscape of digital paymentsITALY- Thriving e-commerce sector to create opportunities for payment gateway providersREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: B2B DIGITAL PAYMENT MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Increasing installation of PoS terminals to support market growthINDIA- Revolution in digital payments and banking services through BHIM and YONO apps to accelerate marketJAPAN- Rising number of card-based payment transactions to drive marketAUSTRALIA & NEW ZEALAND- Increasing popularity of contactless payment technologies to fuel market growthREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTUAE- Innovations in financial technology to drive marketKINGDOM OF SAUDI ARABIA- Saudi Vision 2030 program by government to create opportunities for digital banking service providersSOUTH AFRICA- Government’s focus on modernizing payment methods to support market growthREST OF MIDDLE EAST & AFRICA

-

10.6 LATIN AMERICALATIN AMERICA: B2B DIGITAL PAYMENT MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Increasing penetration of mobiles and other payment devices in Brazil to drive marketMEXICO- Growing digital innovations and technological advancements to drive marketREST OF LATIN AMERICA

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS, 2019–2023

- 11.3 MARKET SHARE ANALYSIS OF KEY PLAYERS

- 11.4 REVENUE ANALYSIS, 2020–2022

- 11.5 RANKING OF KEY PLAYERS IN B2B DIGITAL PAYMENT MARKET, 2023

-

11.6 COMPANY EVALUATION MATRIX, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.7 STARTUP/SME EVALUATION MATRIX, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.8 COMPANY FOOTPRINT

- 11.9 COMPETITIVE BENCHMARKING

-

11.10 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHES/ENHANCEMENTSDEALS

-

11.11 B2B DIGITAL PAYMENT PRODUCT BENCHMARKINGPROMINENT B2B DIGITAL PAYMENT SOLUTIONS- Razorpay- Stripe- Mastercard- Visa- PayPal

- 11.12 VALUATION AND FINANCIAL METRICS FOR KEY B2B DIGITAL PAYMENT SOLUTION AND SERVICE VENDORS

-

12.1 KEY PLAYERSPAYPAL- Business overview- Products/Solutions/Services offered- Recent developments- MNM viewFIS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFISERV, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVISA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMASTERCARD- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGLOBAL PAYMENTS INC.- Business overview- Products/Solutions/Services offered- Recent developmentsACI WORLDWIDE- Business overview- Products/Solutions/Services offered- Recent developmentsBLOCK, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsPAYONEER INC.- Business overview- Products/Solutions/Services offered- Recent developmentsSTRIPE, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsHELCIM INC.PAY SET LIMITEDPAYTMRAZORPAYRAPYD FINANCIAL NETWORK LTD.

-

12.2 OTHER PLAYERSSTAX LLCEBANXRAMP BUSINESS CORPORATIONHIGHRADIUSMATCHMOVE PAY PTE LTDBHARATPEJUSPAYRIPPLETERRALOLLIPAYSTAND, INC.

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 DIGITAL PAYMENT MARKET

- 13.4 PAYMENT PROCESSING SOLUTIONS MARKET

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 AVAILABLE CUSTOMIZATIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2020–2022

- TABLE 2 RISK ASSESSMENT

- TABLE 3 ROLE OF COMPANIES IN B2B DIGITAL PAYMENT ECOSYSTEM

- TABLE 4 PATENTS FILED, 2020–2023

- TABLE 5 PRICING ANALYSIS

- TABLE 6 TECHNOLOGY ENABLERS IN B2B DIGITAL PAYMENTS

- TABLE 7 B2B DIGITAL PAYMENT MARKET: PORTER’S FIVE FORCES MODEL

- TABLE 8 B2B DIGITAL PAYMENT MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 VERTICALS (%)

- TABLE 10 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- TABLE 11 OFFERING: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 12 OFFERING: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 13 SOLUTIONS: B2B DIGITAL PAYMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 14 SOLUTIONS: B2B DIGITAL PAYMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 15 SOLUTIONS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 16 SOLUTIONS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 17 PAYMENT INFRASTRUCTURE: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 18 PAYMENT INFRASTRUCTURE: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 BILLING & ACCOUNTING MANAGEMENT: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 20 BILLING & ACCOUNTING MANAGEMENT: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 SECURITY, COMPLIANCE, & FRAUD PREVENTION: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 22 SECURITY, COMPLIANCE, & FRAUD PREVENTION: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 SERVICES: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 24 SERVICES: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 26 B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 27 DOMESTIC: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 28 DOMESTIC: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 CROSS-BORDER: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 CROSS-BORDER: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 32 B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 33 CREDIT/DEBIT/VIRTUAL CARDS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 CREDIT/DEBIT/VIRTUAL CARDS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 DIGITAL WALLETS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 36 DIGITAL WALLETS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 OTHER PAYMENT METHODS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 OTHER PAYMENT METHODS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 40 B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 41 BFSI: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 BFSI: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 TRANSPORTATION & LOGISTICS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 44 TRANSPORTATION & LOGISTICS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 IT & ITES: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 46 IT & ITES: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 HEALTHCARE: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 48 HEALTHCARE: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 RETAIL & E-COMMERCE: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 RETAIL & E-COMMERCE: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 TRAVEL & HOSPITALITY: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 52 TRAVEL & HOSPITALITY: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 MEDIA & ENTERTAINMENT: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 MEDIA & ENTERTAINMENT: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 OTHER VERTICALS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 56 OTHER VERTICALS: B2B DIGITAL PAYMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 B2B DIGITAL PAYMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 58 B2B DIGITAL PAYMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 60 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 68 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 71 US: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 72 US: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 73 US: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 74 US: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 75 US: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 76 US: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 77 US: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 78 US: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 79 US: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 80 US: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 81 CANADA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 82 CANADA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 83 CANADA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 84 CANADA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 85 CANADA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 86 CANADA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 87 CANADA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 88 CANADA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 89 CANADA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 90 CANADA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 91 EUROPE: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 92 EUROPE: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 93 EUROPE: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 94 EUROPE: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 95 EUROPE: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 96 EUROPE: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 97 EUROPE: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 98 EUROPE: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 99 EUROPE: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 100 EUROPE: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 101 EUROPE: B2B DIGITAL PAYMENT MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 102 EUROPE: B2B DIGITAL PAYMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 103 UK: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 104 UK: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 105 UK: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 106 UK: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 107 UK: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 108 UK: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 109 UK: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 110 UK: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 111 UK: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 112 UK: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 113 GERMANY: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 114 GERMANY: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 115 GERMANY: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 116 GERMANY: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 117 GERMANY: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 118 GERMANY: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 119 GERMANY: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 120 GERMANY: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 121 GERMANY: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 122 GERMANY: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 123 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 124 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 125 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 126 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 127 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 128 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 129 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 130 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 131 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 132 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 134 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 135 CHINA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 136 CHINA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 137 CHINA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 138 CHINA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 139 CHINA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 140 CHINA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 141 CHINA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 142 CHINA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 143 CHINA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 144 CHINA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 145 INDIA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 146 INDIA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 147 INDIA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 148 INDIA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 149 INDIA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 150 INDIA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 151 INDIA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 152 INDIA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 153 INDIA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 154 INDIA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: B2B DIGITAL PAYMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 167 UAE: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 168 UAE: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 169 UAE: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 170 UAE: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 171 UAE: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 172 UAE: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 173 UAE: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 174 UAE: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 175 UAE: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 176 UAE: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 177 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 178 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 179 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 180 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 181 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 182 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 183 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 184 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 185 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 186 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 187 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 188 LATIN AMERICA: B2B DIGITAL PAYMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 189 BRAZIL: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 190 BRAZIL: B2B DIGITAL PAYMENT MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 191 BRAZIL: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 192 BRAZIL: B2B DIGITAL PAYMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 193 BRAZIL: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 194 BRAZIL: B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 195 BRAZIL: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2018–2022 (USD MILLION)

- TABLE 196 BRAZIL: B2B DIGITAL PAYMENT MARKET, BY TRANSACTION TYPE, 2023–2028 (USD MILLION)

- TABLE 197 BRAZIL: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 198 BRAZIL: B2B DIGITAL PAYMENT MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 199 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN B2B DIGITAL PAYMENT MARKET, 2019–2023

- TABLE 200 MARKET SHARE ANALYSIS OF TOP PLAYERS

- TABLE 201 B2B DIGITAL PAYMENT MARKET: OVERALL COMPANY FOOTPRINT

- TABLE 202 B2B DIGITAL PAYMENT MARKET: LIST OF STARTUPS/SMES

- TABLE 203 B2B DIGITAL PAYMENT MARKET: COMPANY FOOTPRINT FOR STARTUPS/SMES

- TABLE 204 B2B DIGITAL PAYMENT MARKET: COMPANY FOOTPRINT FOR KEY PLAYERS

- TABLE 205 B2B DIGITAL PAYMENT MARKET: PRODUCT LAUNCHES/ENHANCEMENTS, 2020–2023

- TABLE 206 B2B DIGITAL PAYMENT MARKET: DEALS, 2020–2023

- TABLE 207 COMPARISON OF BRANDS IN B2B DIGITAL PAYMENT ECOSYSTEM

- TABLE 208 PAYPAL: COMPANY OVERVIEW

- TABLE 209 PAYPAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 PAYPAL: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 211 PAYPAL: DEALS

- TABLE 212 FIS: COMPANY OVERVIEW

- TABLE 213 FIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 FIS: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 215 FIS: DEALS

- TABLE 216 FISERV, INC.: COMPANY OVERVIEW

- TABLE 217 FISERV, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 FISERV, INC.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 219 FISERV, INC.: DEALS

- TABLE 220 VISA: COMPANY OVERVIEW

- TABLE 221 VISA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 VISA: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 223 VISA: DEALS

- TABLE 224 MASTERCARD: COMPANY OVERVIEW

- TABLE 225 MASTERCARD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 MASTERCARD: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 227 MASTERCARD: DEALS

- TABLE 228 GLOBAL PAYMENTS INC.: COMPANY OVERVIEW

- TABLE 229 GLOBAL PAYMENTS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 GLOBAL PAYMENTS INC.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 231 GLOBAL PAYMENTS INC.: DEALS

- TABLE 232 ACI WORLDWIDE: COMPANY OVERVIEW

- TABLE 233 ACI WORLDWIDE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 ACI WORLDWIDE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 235 ACI WORLDWIDE: DEALS

- TABLE 236 BLOCK, INC.: COMPANY OVERVIEW

- TABLE 237 BLOCK, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 BLOCK, INC.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 239 BLOCK, INC.: DEALS

- TABLE 240 PAYONEER INC.: COMPANY OVERVIEW

- TABLE 241 PAYONEER INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 PAYONEER INC.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 243 PAYONEER INC.: DEALS

- TABLE 244 STRIPE, INC.: COMPANY OVERVIEW

- TABLE 245 STRIPE, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 STRIPE, INC.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 247 STRIPE, INC.: DEALS

- TABLE 248 ADJACENT MARKETS AND FORECASTS

- TABLE 249 BFSI: DIGITAL PAYMENT MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 250 BFSI: DIGITAL PAYMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 251 RETAIL & E-COMMERCE: DIGITAL PAYMENT MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 252 RETAIL & E-COMMERCE: DIGITAL PAYMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 253 HEALTHCARE: DIGITAL PAYMENT MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 254 HEALTHCARE: DIGITAL PAYMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 255 TRAVEL & HOSPITALITY: DIGITAL PAYMENT MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 256 TRAVEL & HOSPITALITY: DIGITAL PAYMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 257 TRANSPORTATION & LOGISTICS: DIGITAL PAYMENT MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 258 TRANSPORTATION & LOGISTICS: DIGITAL PAYMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 259 MEDIA & ENTERTAINMENT: DIGITAL PAYMENT MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 260 MEDIA & ENTERTAINMENT: DIGITAL PAYMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 261 OTHER VERTICALS: DIGITAL PAYMENT MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 262 OTHER VERTICALS: DIGITAL PAYMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 263 PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018–2022 (USD MILLION)

- TABLE 264 PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023–2028 (USD MILLION)

- TABLE 265 PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 266 PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 267 PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 268 PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

- FIGURE 1 B2B DIGITAL PAYMENT MARKET: RESEARCH DESIGN

- FIGURE 2 KEY STEPS FOLLOWED TO ESTIMATE MARKET SIZE

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1: SUPPLY-SIDE ANALYSIS OF REVENUE GENERATED THROUGH SALES OF DIGITAL PAYMENT PLATFORMS AND SERVICES

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF B2B DIGITAL PAYMENT VENDORS

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 B2B DIGITAL PAYMENT MARKET SIZE, 2021–2028 (USD MILLION)

- FIGURE 10 REGION-WISE MARKET SUMMARY (SIZE, SHARE, AND CAGR)

- FIGURE 11 ASIA PACIFIC TO BE LUCRATIVE MARKET FOR B2B DIGITAL PAYMENT SOLUTIONS AND SERVICES DURING FORECAST PERIOD

- FIGURE 12 RISE IN CROSS-BORDER PAYMENTS TO CREATE OPPORTUNITIES FOR PLAYERS IN B2B DIGITAL PAYMENT MARKET

- FIGURE 13 CROSS-BORDER SEGMENT TO WITNESS HIGHER CAGR FROM 2023 TO 2028

- FIGURE 14 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SHARE IN 2023

- FIGURE 15 CREDIT/DEBIT/VIRTUAL CARDS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 16 CREDIT/DEBIT/VIRTUAL CARDS AND IT & ITES SEGMENTS TO ACCOUNT FOR MAJORITY OF NORTH AMERICAN MARKET SHARE, BY PAYMENT METHOD AND VERTICAL, RESPECTIVELY, IN 2023

- FIGURE 17 IT & ITES AND CHINA TO CAPTURE LARGEST SHARE OF ASIA PACIFIC MARKET, BY VERTICAL AND COUNTRY, RESPECTIVELY, IN 2023

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: B2B DIGITAL PAYMENT MARKET

- FIGURE 19 B2B DIGITAL PAYMENT SUPPLY CHAIN ANALYSIS

- FIGURE 20 EVOLUTION OF B2B DIGITAL PAYMENT

- FIGURE 21 B2B DIGITAL PAYMENT ECOSYSTEM ANALYSIS

- FIGURE 22 TOTAL NUMBER OF PATENTS GRANTED, 2020–2023

- FIGURE 23 TOP 10 PATENT APPLICANTS, 2020–2023

- FIGURE 24 REVENUE SHIFT FOR B2B DIGITAL PAYMENT MARKET

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 VERTICALS

- FIGURE 26 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- FIGURE 27 SERVICES SEGMENT TO EXHIBIT HIGHEST CAGR IN B2B DIGITAL PAYMENT MARKET DURING FORECAST PERIOD

- FIGURE 28 CROSS-BORDER TRANSACTIONS TO EXHIBIT HIGHER CAGR IN B2B DIGITAL PAYMENT MARKET DURING FORECAST PERIOD

- FIGURE 29 DIGITAL WALLETS TO RECORD HIGHEST CAGR IN B2B DIGITAL PAYMENT MARKET, BY PAYMENT METHOD, DURING FORECAST PERIOD

- FIGURE 30 HEALTHCARE VERTICAL TO RECORD HIGHEST CAGR IN B2B DIGITAL PAYMENT MARKET DURING FORECAST PERIOD

- FIGURE 31 B2B DIGITAL PAYMENT MARKET: REGIONAL SNAPSHOT, 2023

- FIGURE 32 B2B DIGITAL PAYMENT MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

- FIGURE 33 NORTH AMERICA: B2B DIGITAL PAYMENT MARKET SNAPSHOT

- FIGURE 34 ASIA PACIFIC: B2B DIGITAL PAYMENT MARKET SNAPSHOT

- FIGURE 35 THREE-YEAR REVENUE ANALYSIS OF KEY PLAYERS, 2020–2022 (USD MILLION)

- FIGURE 36 MARKET RANKING OF KEY PLAYERS IN B2B DIGITAL PAYMENT MARKET, 2023

- FIGURE 37 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

- FIGURE 38 B2B DIGITAL PAYMENT MARKET: COMPANY EVALUATION MATRIX, 2023

- FIGURE 39 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- FIGURE 40 B2B DIGITAL PAYMENT MARKET: STARTUP/SME EVALUATION MATRIX, 2023

- FIGURE 41 VALUATION AND FINANCIAL METRICS FOR MAJOR VENDORS OF B2B DIGITAL PAYMENT SOLUTIONS AND SERVICES

- FIGURE 42 PAYPAL: COMPANY SNAPSHOT

- FIGURE 43 FIS: COMPANY SNAPSHOT

- FIGURE 44 FISERV, INC.: COMPANY SNAPSHOT

- FIGURE 45 VISA: COMPANY SNAPSHOT

- FIGURE 46 MASTERCARD: COMPANY SNAPSHOT

- FIGURE 47 GLOBAL PAYMENTS INC.: COMPANY SNAPSHOT

- FIGURE 48 ACI WORLDWIDE: COMPANY SNAPSHOT

- FIGURE 49 BLOCK, INC.: COMPANY SNAPSHOT

- FIGURE 50 PAYONEER INC.: COMPANY SNAPSHOT

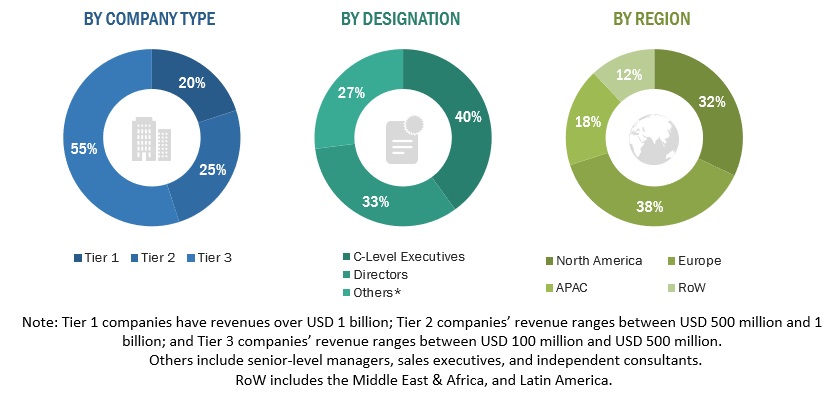

The study involved four major activities in estimating the current size of the global B2B digital payment market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total B2B digital payment market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; and journals, such as Linux Journal and Container Journal, and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the B2B digital payment market along with the associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

PayPal |

Senior Manager |

|

Rapyd |

VP |

|

Visa |

Business Executive |

Market Size Estimation

For making market estimates and forecasting the B2B digital payment market, and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global B2B digital payment market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the B2B digital payment market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

B2B digital payment market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

B2B digital payment market Size: Top-Down Approach

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

B2B digital payments are the exchange of currency for goods or services between two businesses. Business-to-business digital payment is the transfer of value denominated in currency from buyer to supplier for goods or services supplied through various payment methods such as credit cards, debit cards, virtual cards, digital wallets, and others. B2B payments can be a one-time or recurring transaction depending on the contractual agreement made between the buyer and supplier.

Key Stakeholders

- Payment solution and service providers

- Smart card vendors

- Financial institutions

- Merchants and merchant acquirers

- Mobile network operators

- Credit/Debit card providers

- Contactless payment solution providers

- Cloud payment solution providers

- PoS device manufacturers

- Payment security service providers

- Professional and managed service providers

- System integrators

- Technology consultants

Report Objectives

- To determine, segment, and forecast the global B2B digital payment market by offering, application, vertical, and region in terms of value.

- To forecast the size of the market segments to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape.

- To strategically analyze the macro and micro markets to individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market.

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the B2B digital payment market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies.

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and Research & Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of an additional two market players

Growth opportunities and latent adjacency in B2B Digital Payment Market