Bakery Processing Equipment Market by Type, Application (Bread, Cookies & Biscuits, Cakes & Pastries), End User (Foodservice Industry and Bakery Processing Industry), Function, Mode of Operation and Region - Global Forecast to 2026

Bakery Processing Equipment Market Size & Trends

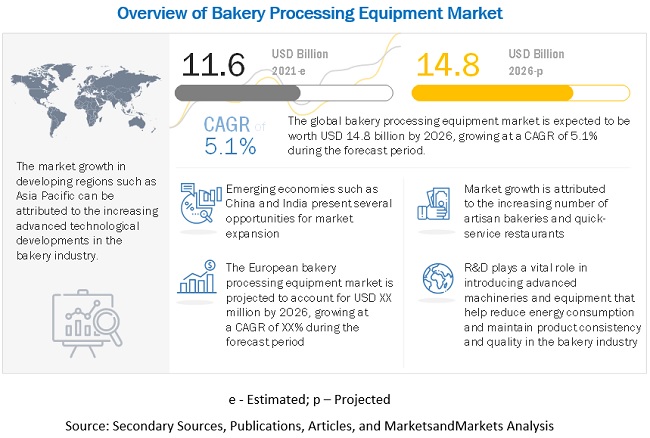

The global bakery processing equipment market is estimated to reach $14.8 billion by 2026, growing at a 5.1% compound annual growth rate (CAGR). The global market size was valued $11.6 billion in 2021.

The market is highly impacted by innovations, as manufacturers are always introducing new processing techniques to produce complex bakery products of different shapes and sizes, thereby focusing on catering to the increasing demand from the processed food industry and consumers. Development of new machinery and enhancement of the existing ones are the key strategies adopted by many players in the market. In addition, increasing focus on the expansion of facilities, marketing schemes, and information exchange programs to create awareness and enhance the applications of bakery processing equipment is projected to contribute to the growth of the market. The COVID-19 pandemic is projected to have a significant impact on the market, as it has highlighted the significance of safe, healthy, and nutritive eating. Food security, food safety, and food sustainability have been considerably affected during the COVID-19 pandemic. Consumer behaviour related to the food consumed saw sharp shifts, with a higher preference for safety and quality. These have further propelled the manufacturers to assess the safety parameters of their food products to be able to sustain their product values in the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Bakery Processing Equipment Market Insights

Drivers: Growth in the demand for convenience food products

The processed food market is driven by the increase in the need for convenience due to the busy customer lifestyles. Further, growth in per-capita income has resulted in greater demand for ready-to-eat and on-the-go food items. This, in turn, has led to an increase in demand for bakery products. The outlook on the growth of market is projected to remain positive due to the high growth in the bakery industry.

Consumers are also benefited by the purchase of bakery products, as it is easy for them to use, consume, and store for a longer period of time. Consumer preferences in developing countries, such as China, India, Brazil, and the Middle East, have witnessed a gradual transition from traditional home-made breakfasts and snacking meals to ready-to-eat products over the last couple of decades. The convenience in the preparation of these food products helps to easily preserve the quality of bread, pizza, cakes, pastries and pies. These equipment innovations enable easy handling, extend the shelf life of the products, and impart better aesthetic properties and flavor characteristics to the end products. This has been contributing to the growth of the bakery processing equipment market.

Restraints: Maintenance of wastewater in bakery production line

The bakery industry is one of the major food industries worldwide and varies widely in terms of production scale and process. The production by large plant bakers contributes more than 80% of the market’s supply, while other small scale bakers sell less than 5%. One of the important components in the maintenance of bakery processing equipments is water. During the manufacturing process, 40–508C hot water is mixed with detergents that is used to wash the baking plates, molds, and trays. It can be characterized as high loading, fluctuating flow and contains rich oil and grease. In addition, flour, oil, sugar, and yeast also form major components of waste.

Opportunities: Increasing demand for new products such as frozen bakery

Frozen bakery products have grown in popularity due to factors such as ease of preparation and time and cost efficiency that they provide to other institutional outlets. There is a rise in demand for different types of frozen bakery products, owing to their varying tastes and applicability in Quick Service Restaurants and food chains. The increasing variety of international specialties in domestic food markets is an emerging trend in the global frozen bread and bakery markets. Crossover bakery products are gaining popularity. Some of these products, such as frozen bread, are witnessing consumer preference over other frozen bakery products. The increasing popularity of frozen bakery products has also compelled manufacturers to boost production; it has also led to an increased demand for various types of bakery processing equipment market.

Challenges: Competition from local manufacturers offering low-cost products

Competition from Asia-based manufacturers offering cheaper products is affecting the profits of high-end equipment manufacturers from the developed parts of the world. They now need to either cut down their profits so as to offer their products at competitive prices; or increase their production and sales, together with providing increased functionality in a minimal price so that bakery product manufacturers would be able to buy their products and could cut down the cost involved in installing new equipment without sacrificing on quality.

The Bread segment is estimated to dominate the global bakery processing equipment market in 2021

By application, the bread segment is estimated to dominate the global market in 2021. The bread segment is projected to witness significant growth due to the increasing preference for healthy bread, such as multi-grain and gluten-free bread. As customers are becoming more health-conscious, they are encouraged to opt for bakery products that are gluten-free and are low in carbohydrates, unlike the traditional white bread. Bread is considered a staple food in many countries worldwide.

The mixers segment is estimated to account for the largest share in the market in 2021

By type, the mixers segment is estimated to account for the largest share in the market in 2021. Industrial bakery mixer is one of the key equipment, which is used for producing bakery products such as bread, cakes, pastries, and other bakery related products. Dough mixing is one of the important processes in the production of bakery products and bread, which homogenizes and hydrates the ingredients in the dough. This directly affects the product quality of bakery products. The baking mixer is used to add volume to the mixed product or dough and mixes all the ingredients such as wheat, sugar, and baking flour. The baking equipment companies are focusing on utilizing innovative and new technologies for mixing the bread and bakery products in the European region.

To know about the assumptions considered for the study, download the pdf brochure

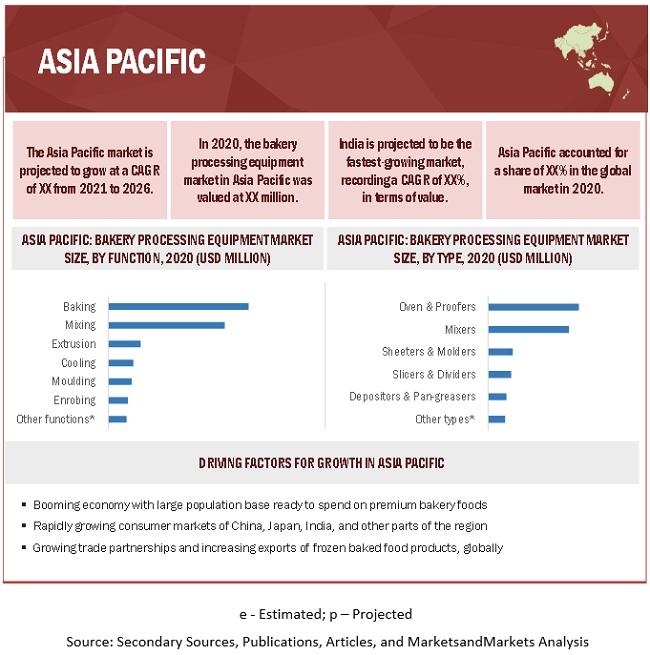

The Asia Pacific market is projected to grow at the highest CAGR during the forecast period

The bakery processing equipment market in the Asia Pacific region is projected to grow rapidly due to the enhanced economic growth in the last decade. The food industry has also played an important role in the region's economic development. Food consumption in the regions is also gradually increasing, owing to expanding population, rising income, and rapid urbanization. Students and professionals in metropolitan regions choose bakery products as snacks due to the hectic lifestyles of customers in countries such as China, India, Japan, Australia and New Zealand. Because of their superior quality and packaging, international bakery items have seen an increase in demand in China. These variables all contribute to the expansion of bread product markets.

Key Players in Bakery Processing Equipment Industry

Key players in this market include GEA Group (Germany), Bühler (Switzerland), JBT Corporation (US), The Middleby Corporation (US), Heat and Control, Inc. (US), Rheon Automatic Machinery Co., Ltd (Japan), Ali Group (Italy), Baker Perkins (UK), Makel Food Group (US), Anko Food Machine Co., Ltd. (Taiwan), Gemini Bakery Equipment Company (US), Allied Bakery Equipment (US), Global Bakery Solutions (UK), Erica Record LLC (US), and Koenig Maschinen - The Bakers Crown (Austria).

Bakery Processing Equipment Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

US $11.6 Billion |

|

Revenue Forecast in 2026 |

US $14.8 Billion |

|

Growth Rate |

CAGR of 5.1% |

|

Number of Pages |

285 Pages |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD) |

|

Segments covered |

Type, applications, end user, function, mode of operation and region |

|

Regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies studied |

|

Bakery Processing Equipment Market Segmentation

This research report categorizes the bakery processing equipment market based on type, application, end user, function, and region.

|

Segment |

Subsegment |

|

Market By Application |

|

|

Market By Type |

|

|

Market By End User |

|

|

Market By Mode of Operation |

|

|

Market By Function |

|

|

Market by Region |

|

Recent Developments in Bakery Processing Equipment Market

- In April 2021, Heat and Control, Inc. announced the construction of a new manufacturing facility in Mexico. This new site would be the largest of Heat & Control properties, aiding the company’s growth.

- In June 2021, AMF Tromp launched a smart applicator solution for pizza products. It deposits toppings such as cheese.

- In January 2021 Bühler and DIL Deutsches Institut für Lebensmitteltechnik e. V.research institute (Germany) teamed up to develop new production technologies for healthy and sustainable food products.

- In December 2020, the Middleby corporation company completed its acquisition of the properties and assets used to conduct the business of United Foodservice Equipment Limited (China), a business that purchased and sold foodservice equipment located in Hong Kong, and its affiliate, Zhuhai United Foodservice Equipment Limited.

- In November 2018, Rheon Automatic Machinery expanded its production facility center by opening a state-of-art manufacturing facility in New Jersey, US, with fully equipped large laboratory equipment.

Frequently Asked Questions (FAQ):

Which players are involved in manufacturing of bakery processing equipment market?

Key players in this market include GEA Group (Germany), Bühler (Switzerland), JBT Corporation (US), The Middleby Corporation (US), Heat and Control, Inc. (US), Rheon Automatic Machinery Co., Ltd (Japan), Ali Group (Italy), Baker Perkins (UK), Makel Food Group (US), Anko Food Machine Co., Ltd. (Taiwan), Gemini Bakery Equipment Company (US), Allied Bakery Equipment (US), Global Bakery Solutions (UK), Erica Record LLC (US), and Koenig Maschinen - The Bakers Crown (Austria).

Which are the key regions in the bakery processing equipment market?

Asia Pacific is the key region that is projected to witness significant growth with a CAGR of 5.8% in 2026, in the bakery processing equipment market. Asia Pacific dominated the bakery processing equipment for the bread segments in 2020. Countries such as India and China are the key producers of bread.

What are the major types of bakery processing equipment market?

Oven & Proofers segment with CAGR of 5.0% are the major types of bakery processing equipment market that are projected to gain maximum market revenue and share during the forecast period.

How big is the market for bakery processing equipment?

The global bakery processing equipment market size is estimated at USD 11,551.2 million in 2021 and its projected to grow at a CAGR of 5.1% to reach USD 14,824.1 million by 2026 .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

FIGURE 2 BAKERY PROCESSING EQUIPMENT MARKET: REGIONAL SCOPE

1.3.2 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2017–2020

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of Primaries

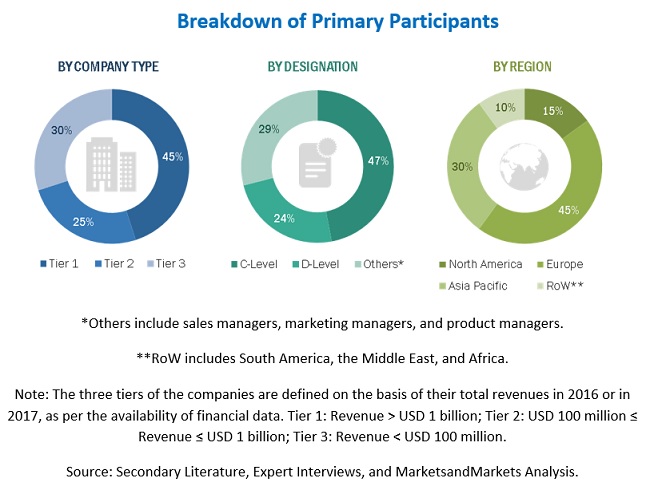

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.5 RESEARCH LIMITATIONS

2.6 BAKERY PROCESSING EQUIPMENT MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 SCENARIO-BASED MODELING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 8 COVID-19: GLOBAL PROPAGATION

FIGURE 9 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 10 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 11 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 12 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 13 MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 14 MARKET SIZE, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 15 MARKET SIZE, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 16 MARKET SIZE, BY MODE OF OPERATION, 2021 VS. 2026 (USD MILLION)

FIGURE 17 EUROPE DOMINATED THE MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 BRIEF OVERVIEW OF THE MARKET

FIGURE 18 EMERGING ECONOMIES PRESENT OPPORTUNITIES FOR MARKET GROWTH

4.2 EUROPE: MARKET, BY TYPE AND COUNTRY

FIGURE 19 MIXERS FORMED THE DOMINANT SEGMENT, IN TERMS OF VALUE, IN THE EUROPEAN MARKET

4.3 MARKET, BY END USER

FIGURE 20 BAKERY PROCESSING INDUSTRY SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.4 MARKET, BY APPLICATION AND REGION

FIGURE 21 EUROPE LED THE MARKET IN 2020

4.5 MARKET, BY REGION

FIGURE 22 THE US ACCOUNTED FOR THE LARGEST SHARE OF THE GLOBAL MARKET IN 2020

4.5.1 COVID-19 IMPACT ON MARKET

FIGURE 23 CHART OF PRE & POST COVID SCENARIO IN BAKERY PROCESSING EQUIPMENT MARKET

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 24 MARKET: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rising number of artisan bakeries and QSRs

FIGURE 25 NORTH AMERICA: PROCESSED FOOD CONSUMPTION SHARE IN DIETS, 2019

5.2.1.2 Growth in the demand for convenience food products

FIGURE 26 FOOD PROCESSING INDUSTRY SALES, 2019 (USD BILLION)

5.2.1.3 Automation and robotics in bakery processing

FIGURE 27 IMPORT VALUE OF BAKERY OVENS, BY COUNTRY, 2017 (USD MILLION)

5.2.1.4 Shift in food preferences to change the market dynamics

FIGURE 28 SHARE OF DIETS FOLLOWED BY CONSUMERS IN 2020

5.2.2 RESTRAINTS

5.2.2.1 High installation cost of equipment

5.2.2.2 Maintenance of wastewater in a bakery production line

TABLE 2 SUMMARY OF WASTE PRODUCTION FROM THE BAKERY INDUSTRY

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in demand for frozen bakery products

5.2.3.2 Expansion of production facilities to meet the rising demand

5.2.3.3 Government initiatives and investments to expand the processed food sector

5.2.3.4 Investments in technological upgradation

5.2.4 CHALLENGES

5.2.4.1 Competition from local manufacturers offering low-cost products

5.2.4.2 Lack of infrastructural support in emerging markets

5.2.4.3 Fluctuation in the prices of raw material and energy

6 INDUSTRY TRENDS (Page No. - 60)

6.1 INTRODUCTION

6.2 VALUE CHAIN

FIGURE 29 MARKET: VALUE CHAIN ANALYSIS

6.2.1 RESEARCH & DEVELOPMENT

6.2.2 INPUTS

6.2.3 PRODUCTION

6.2.4 LOGISTICS & DISTRIBUTION

6.2.5 MARKETING & SALES

6.2.6 END-USER INDUSTRY

6.3 MARKET ECOSYSTEM AND SUPPLY CHAIN

FIGURE 30 RAW MATERIAL SUPPLIERS ARE A VITAL COMPONENT OF THE SUPPLY CHAIN

TABLE 3 BAKERY PROCESSING EQUIPMENT MARKET: SUPPLY CHAIN (ECOSYSTEM)

6.3.1 BAKERY PROCESSING EQUIPMENT: MARKET MAP

6.4 TECHNOLOGY ANALYSIS

6.4.1 AUTOMATION AND ROBOTICS IN BAKERY PROCESSING

6.4.2 ARTIFICIAL INTELLIGENCE (AI) IN BAKERY PRODUCTION

6.4.3 CONTINUOUS MIXING TECHNOLOGY

6.4.4 OVEN TECHNOLOGY

6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 31 REVENUE SHIFT FOR THE MARKET

6.6 PORTER’S FIVE FORCES ANALYSIS

6.6.1 MARKET: PORTER’S FIVE FORCES ANALYSIS

6.6.2 THREAT OF NEW ENTRANTS

6.6.3 THREAT OF SUBSTITUTES

6.6.4 BARGAINING POWER OF SUPPLIERS

6.6.5 BARGAINING POWER OF BUYERS

6.6.6 INTENSITY OF COMPETITIVE RIVALRY

6.7 TRADE ANALYSIS

FIGURE 32 EXPORT VALUE OF BAKERY AND PASTA MAKING MACHINERY FOR TOP EXPORTERS, 2018–2019 (USD MILLION)

6.8 PATENT ANALYSIS

FIGURE 33 LIST OF TOP PATENTS IN THE MARKET, 2019–2021

TABLE 4 LIST OF IMPORTANT PATENTS FOR BAKERY PROCESSING EQUIPMENT, 2017–2019

6.9 REGULATORY FRAMEWORKS

6.9.1 ASIA PACIFIC

6.9.2 CHINA

6.9.3 INDIA

6.9.4 AUSTRALIA & NEW ZEALAND

6.9.5 EUROPE

6.9.6 NORTH AMERICA

6.9.7 US

6.9.8 CANADA

6.10 CASE STUDIES

6.10.1 EXPANSION OF ARTISAN BREAD PRODUCTION

6.10.2 BISCUIT MANUFACTURING WITH EFFICIENT, COMPACT PACKAGING EQUIPMENT

7 BAKERY PROCESSING EQUIPMENT MARKET, BY TYPE (Page No. - 77)

7.1 INTRODUCTION

FIGURE 34 MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 5 MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 6 MARKET BY TYPE, 2021–2026 (USD MILLION)

7.2 COVID-19 IMPACT ON THE MARKET, BY TYPE

TABLE 7 OPTIMISTIC SCENARIO: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 8 REALISTIC SCENARIO: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 9 PESSIMISTIC SCENARIO: MARKET , BY TYPE, 2018–2021 (USD MILLION)

7.3 MIXERS

7.3.1 GROWING NEED FOR INNOVATIVE AND TECHNOLOGICALLY ADVANCED DOUGH IS DRIVING THE DEMAND

TABLE 10 MIXERS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 11 MIXERS: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.4 OVENS & PROOFERS

7.4.1 GROWING NEED FOR OVENS AND PROOFERS WITH LOW FUEL CONSUMPTION IS DRIVING INNOVATION

TABLE 12 OVENS & PROOFERS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 13 OVENS & PROOFERS: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.5 SLICERS & DIVIDERS

7.5.1 SLICERS & DIVIDERS ARE WITNESSING AN INCREASE IN DEMAND AS THEY PROVIDE HIGH-QUALITY PERFORMANCE DURING THE PRODUCTION OF FINE AND SMALL BAKERY PRODUCTS

TABLE 14 SLICERS & DIVIDERS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 15 SLICERS & DIVIDERS: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.6 SHEETERS & MOLDERS

7.6.1 ADVANCEMENTS IN TECHNOLOGIES HAVE ENCOURAGED THE DEVELOPMENT OF ENHANCED SHEETERS & MOLDERS FOR THE PREPARATION OF LARGE QUANTITIES OF BAKERY PRODUCTS

TABLE 16 SHEETERS & MOLDERS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 17 SHEETERS & MOLDERS: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.7 DEPOSITORS & PAN-GREASERS

7.7.1 INCREASED AUTOMATION AND CONSISTENT PRODUCT DEMAND DRIVE THE MARKET FOR DEPOSITORS & PAN-GREASERS

TABLE 18 DEPOSITORS & PAN GREASERS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 19 DEPOSITORS & PAN GREASERS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.8 OTHER TYPES

TABLE 20 OTHER TYPES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 21 OTHER TYPES: MARKET, BY REGION, 2021–2026 (USD MILLION)

8 BAKERY PROCESSING EQUIPMENT MARKET, BY APPLICATION (Page No. - 89)

8.1 INTRODUCTION

FIGURE 35 MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

TABLE 22 MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 23 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

8.2 COVID-19 IMPACT ON THE MARKET, BY APPLICATION

TABLE 24 OPTIMISTIC SCENARIO: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 25 REALISTIC SCENARIO: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 26 PESSIMISTIC SCENARIO: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

8.3 BREAD

8.3.1 CHANGING LIFESTYLES OF CONSUMERS AND INCREASING DEMAND FOR BREAD AND RELATED BAKERY PRODUCTS IN ASIA PACIFIC ARE DRIVING THE MARKET

TABLE 27 BREAD: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 28 BREAD: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.4 COOKIES & BISCUITS

8.4.1 PRODUCT INNOVATIONS AND ENHANCEMENT OF EQUIPMENT ARE RESPONSIBLE FOR THE INCREASED MARKET SHARE OF COOKIES & BISCUITS

TABLE 29 COOKIES & BISCUITS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 30 COOKIES & BISCUITS: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.5 CAKES & PASTRIES

8.5.1 RISING DEMAND FOR CUSTOMIZED CAKES AND INCREASED PENETRATION OF KEY PLAYERS HAVE LED TO AN INCREASE IN DEMAND FROM DEVELOPING COUNTRIES

TABLE 31 CAKES & PASTRIES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 32 CAKES & PASTRIES: BAKERY PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.6 PIZZA CRUSTS

8.6.1 ADVANCEMENTS AND INNOVATIONS IN PIZZA CRUST EQUIPMENT CATER TO THE GROWING CONSUMER DEMAND FOR CUSTOMIZED AND DIFFERENT VARIETIES OF PIZZA CRUSTS

TABLE 33 PIZZA CRUSTS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 34 PIZZA CRUSTS: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.7 OTHER APPLICATIONS

TABLE 35 OTHER APPLICATIONS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 36 OTHER APPLICATIONS: MARKET, BY REGION, 2021–2026 (USD MILLION)

9 MARKET, BY FUNCTION (Page No. - 100)

9.1 INTRODUCTION

FIGURE 36 MARKET, BY FUNCTION, 2021 VS. 2026 (USD MILLION)

TABLE 37 MARKET, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 38 MARKET, BY FUNCTION, 2021–2026 (USD MILLION)

9.2 COVID-19 IMPACT ON THE MARKET, BY FUNCTION

TABLE 39 OPTIMISTIC SCENARIO: MARKET SIZE, BY FUNCTION, 2018–2021 (USD MILLION)

TABLE 40 REALISTIC SCENARIO: MARKET SIZE, BY FUNCTION, 2018–2021 (USD MILLION)

TABLE 41 PESSIMISTIC SCENARIO: MARKET SIZE, BY FUNCTION, 2018–2021 (USD MILLION)

9.3 MIXING

9.3.1 FAST-GROWING ECONOMIES PRESENT OPPORTUNITIES TO THE MARKET

TABLE 42 MIXING: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 43 MIXING: MARKET, BY REGION, 2021–2026 (USD MILLION)

9.4 EXTRUSION

9.4.1 INDUSTRY REQUIRES HIGH-QUALITY AND RELIABLE EQUIPMENT FOR EXTRUSION

TABLE 44 EXTRUSION: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 45 EXTRUSION: MARKET, BY REGION, 2021–2026 (USD MILLION)

9.5 MOLDING

9.5.1 ADVANCEMENTS IN TECHNOLOGIES HAVE ENCOURAGED THE DEVELOPMENT OF VARIOUS MOLDING TECHNIQUES

TABLE 46 MOLDING: BAKERY PROCESSING EQUIPMENT MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 47 MOLDING: MARKET, BY REGION, 2021–2026 (USD MILLION)

9.6 BAKING

9.6.1 BAKING HAS FUELED THE GROWTH OF OVENS WORLDWIDE

TABLE 48 BAKING: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 49 BAKING: MARKET, BY REGION, 2021–2026 (USD MILLION)

9.7 ENROBING

9.7.1 CONSUMPTION OF CHOCOLATE-BASED PRODUCTS TO CREATE A MARKET FOR ENROBING

TABLE 50 ENROBING: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 51 ENROBING: MARKET, BY REGION, 2021–2026 (USD MILLION)

9.8 COOLING

9.8.1 COOLING PLAYS A VITAL ROLE IN REDUCING THE WEIGHT OF BAKERY PRODUCTS

TABLE 52 COOLING: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 53 COOLING: MARKET, BY REGION, 2021–2026 (USD MILLION)

9.9 OTHER FUNCTIONS

9.9.1 WEIGHING BRINGS THE CONSISTENCY IN PRODUCTION, WHILE TEMPERATURE IS A KEY PARAMETER IN BAKING

TABLE 54 OTHER FUNCTIONS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 55 OTHER FUNCTIONS: MARKET, BY REGION, 2021–2026 (USD MILLION)

10 BAKERY PROCESSING EQUIPMENT MARKET, BY END USER (Page No. - 111)

10.1 INTRODUCTION

FIGURE 37 MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

TABLE 56 MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 57 MARKET, BY END USER, 2021–2026 (USD MILLION)

10.2 COVID-19 IMPACT ON THE GLOBAL MARKET, BY END USER

TABLE 58 OPTIMISTIC SCENARIO: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 59 REALISTIC SCENARIO: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 60 PESSIMISTIC SCENARIO: MARKET, BY END USER, 2018–2021 (USD MILLION)

10.3 FOODSERVICE INDUSTRY

10.3.1 FOODSERVICE INDUSTRY DOMINATED THE MARKET IN THE EUROPEAN AND ASIA PACIFIC REGIONS

TABLE 61 MARKET SIZE IN THE FOODSERVICE INDUSTRY, BY REGION, 2016–2020 (USD MILLION)

TABLE 62 MARKET SIZE IN THE FOODSERVICE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

10.4 BAKERY PROCESSING INDUSTRY

10.4.1 GROWING NEED FOR CUSTOMIZED BAKERY FOOD PRODUCTS IS EXPECTED TO PRESENT OPPORTUNITIES FOR INNOVATIVE BAKERY TECHNOLOGIES

TABLE 63 MARKET SIZE IN THE BAKERY PROCESSING INDUSTRY, BY REGION, 2016–2020 (USD MILLION)

TABLE 64 MARKET SIZE IN THE BAKERY PROCESSING INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

11 BAKERY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION (Page No. - 117)

11.1 INTRODUCTION

FIGURE 38 MARKET SIZE, BY MODE OF OPERATION, 2021 VS. 2026 (USD MILLION)

TABLE 65 MARKET, BY MODE OF OPERATION, 2016–2020 (USD MILLION)

TABLE 66 MARKET, BY MODE OF OPERATION, 2021–2026 (USD MILLION)

11.2 COVID-19 IMPACT ON THE GLOBAL MARKET, BY MODE OF OPERATION

TABLE 67 OPTIMISTIC SCENARIO: MARKET, BY MODE OF OPERATION, 2018–2021 (USD MILLION)

TABLE 68 REALISTIC SCENARIO: MARKET, BY MODE OF OPERATION, 2018–2021 (USD MILLION)

TABLE 69 PESSIMISTIC SCENARIO: MARKET, BY MODE OF OPERATION, 2018–2021 (USD MILLION)

11.3 SEMI-AUTOMATIC

11.3.1 HIGH INSTALLATION AND MAINTENANCE COST OF AUTOMATED EQUIPMENT FUELS THE MARKET FOR SEMI-AUTOMATIC EQUIPMENT IN DEVELOPING COUNTRIES

TABLE 70 SEMI-AUTOMATIC: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 71 SEMI-AUTOMATIC: MARKET, BY REGION, 2021–2026 (USD MILLION)

11.4 AUTOMATIC

11.4.1 TIME-SAVING AND EFFICIENCY DRIVE THE AUTOMATION MARKET

TABLE 72 AUTOMATIC: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 73 AUTOMATIC: MARKET, BY REGION, 2021–2026 (USD MILLION)

12 BAKERY PROCESSING EQUIPMENT MARKET, BY REGION (Page No. - 123)

12.1 INTRODUCTION

FIGURE 39 INDIA TO RECORD THE FASTEST GROWTH RATE DURING THE FORECAST PERIOD IN THE MARKET

TABLE 74 MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 75 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12.2 COVID-19 IMPACT ON THE MARKET, BY REGION

TABLE 76 OPTIMISTIC SCENARIO: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 77 REALISTIC SCENARIO: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 78 PESSIMISTIC SCENARIO: MARKET, BY REGION, 2018–2021 (USD MILLION)

12.3 NORTH AMERICA

TABLE 79 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET, BY MODE OF OPERATION, 2016–2020 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET, BY MODE OF OPERATION, 2021–2026 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET, BY FUNCTION, 2021–2026 (USD MILLION)

12.3.1 US

12.3.1.1 The US accounted for the largest market share in North America

TABLE 91 US: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 92 US: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 93 US: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 94 US: MARKET, BY TYPE, 2021–2026 (USD MILLION)

12.3.2 CANADA

12.3.2.1 Canada is projected to be the fastest-growing market in North America

TABLE 95 CANADA: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 96 CANADA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 97 CANADA: MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 98 CANADA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

12.3.3 MEXICO

12.3.3.1 market in Mexico is growing due to the increasing demand for frozen bakery products

TABLE 99 MEXICO: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 100 MEXICO: MARKET, 2021–2026 (USD MILLION)

TABLE 101 MEXICO: MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 102 MEXICO: MARKET, BY TYPE, 2021–2026 (USD MILLION)

12.4 EUROPE

FIGURE 40 NUMBER OF COMPANIES IN THE FOOD AND DRINK INDUSTRY SECTOR (2018, %)

FIGURE 41 EUROPE: MARKET SNAPSHOT

TABLE 103 EUROPE: BAKERY PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 105 EUROPE: MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 106 EUROPE: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 107 EUROPE: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 108 EUROPE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 109 EUROPE: MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 110 EUROPE: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 111 EUROPE: MARKET, BY MODE OF OPERATION, 2016–2020 (USD MILLION)

TABLE 112 EUROPE: MARKET, BY MODE OF OPERATION, 2021–2026 (USD MILLION)

TABLE 113 EUROPE: MARKET, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 114 EUROPE: MARKET, BY FUNCTION, 2021–2026 (USD MILLION)

12.4.1 GERMANY

12.4.1.1 Germany dominated the Asia Pacific market

FIGURE 42 EXPORT OF BAKERY EQUIPMENT FROM GERMANY, 2018 (USD THOUSAND)

TABLE 115 GERMANY: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 116 GERMANY: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 117 GERMANY: MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 118 GERMANY: MARKET, BY TYPE, 2021–2026 (USD MILLION)

12.4.2 UK

12.4.2.1 Trend of home bakeries has driven the sales of bakery equipment in the UK

FIGURE 43 MARKET SHARE OF UK BREAD PRODUCTION, 2020 (BY VOLUME %)

TABLE 119 UK: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 120 UK: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 121 UK: MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 122 UK: MARKET, BY TYPE, 2021–2026 (USD MILLION)

12.4.3 FRANCE

12.4.3.1 French bakery processing equipment market is projected to witness significant growth due to high investments

FIGURE 44 TURNOVER OF MAJOR EUROPEAN COUNTRIES FOR THE FOOD & DRINK SECTOR, 2019 (EUR BILLION)

TABLE 123 FRANCE: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 124 FRANCE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 125 FRANCE: MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 126 FRANCE: MARKET, BY TYPE, 2021–2026 (USD MILLION)

12.4.4 ITALY

12.4.4.1 market in Italy is driven by increasing sales of biscuits and crackers in the country

TABLE 127 ITALY: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 128 ITALY: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 129 ITALY: MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 130 ITALY: MARKET, BY TYPE, 2021–2026 (USD MILLION)

12.4.5 SPAIN

12.4.5.1 market in Spain is projected to grow at the highest CAGR in Europe

TABLE 131 SPAIN: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 132 SPAIN: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 133 SPAIN: MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 134 SPAIN: MARKET, BY TYPE, 2021–2026 (USD MILLION)

12.4.6 RUSSIA

12.4.6.1 Bakery processing market in Russia is driven by the growing retail sector

TABLE 135 RUSSIA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 136 RUSSIA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 137 RUSSIA: MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 138 RUSSIA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

12.4.7 REST OF EUROPE

TABLE 139 REST OF EUROPE: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 140 REST OF EUROPE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 141 REST OF EUROPE: MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 142 REST OF EUROPE: MARKET, BY TYPE, 2021–2026 (USD MILLION)

12.5 ASIA PACIFIC

FIGURE 45 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 143 ASIA PACIFIC: BAKERY PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET, BY MODE OF OPERATION, 2016–2020 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET, BY MODE OF OPERATION, 2021–2026 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET, BY FUNCTION, 2021–2026 (USD MILLION)

12.5.1 CHINA

12.5.1.1 China dominated the Asia Pacific market

TABLE 155 CHINA: MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 156 CHINA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 157 CHINA: MARKET APPLICATION, 2016–2020 (USD MILLION)

TABLE 158 CHINA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.5.2 INDIA

12.5.2.1 Growing consumer awareness regarding high-quality and premium bakery products drives the growth of the market in the country

TABLE 159 INDIA: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 160 INDIA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 161 INDIA: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 162 INDIA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.5.3 JAPAN

12.5.3.1 Increase in demand for premium bakery products and relatively low competition to drive the demand for bakery products in Japan

TABLE 163 JAPAN: MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 164 JAPAN: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 165 JAPAN: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 166 JAPAN: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.5.4 AUSTRALIA & NEW ZEALAND

12.5.4.1 Consumption of ready-to-eat foods is increasing in these regions

TABLE 167 AUSTRALIA & NEW ZEALAND: MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 168 AUSTRALIA & NEW ZEALAND: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 169 AUSTRALIA & NEW ZEALAND: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 170 AUSTRALIA & NEW ZEALAND: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.5.5 SOUTH KOREA

12.5.5.1 Evolving landscape in South Korea’s food culture is driving the market

TABLE 171 SOUTH KOREA: MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 172 SOUTH KOREA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 173 SOUTH KOREA: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 174 SOUTH KOREA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.5.6 REST OF ASIA PACIFIC

TABLE 175 REST OF ASIA PACIFIC: BAKERY PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 176 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 177 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 178 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.6 REST OF THE WORLD (ROW)

TABLE 179 ROW: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 180 ROW: MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 181 ROW: MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 182 ROW: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 183 ROW: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 184 ROW: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 185 ROW: MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 186 ROW: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 187 ROW: MARKET, BY MODE OF OPERATION, 2016–2020 (USD MILLION)

TABLE 188 ROW: MARKET, BY MODE OF OPERATION, 2021–2026 (USD MILLION)

TABLE 189 ROW: MARKET, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 190 ROW: MARKET, BY FUNCTION, 2021–2026 (USD MILLION)

12.6.1 SOUTH AMERICA

12.6.1.1 South America projected to dominate the RoW market

TABLE 191 SOUTH AMERICA: BAKERY PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 192 SOUTH AMERICA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 193 SOUTH AMERICA: MARKET, APPLICATION, 2016–2020 (USD MILLION)

TABLE 194 SOUTH AMERICA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.6.2 MIDDLE EAST

12.6.2.1 Increase in demand for customized bakery products to drive the growth of the market in the Middle East

TABLE 195 MIDDLE EAST: MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 196 MIDDLE EAST: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 197 MIDDLE EAST: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 198 MIDDLE EAST: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.6.3 AFRICA

12.6.3.1 Manufacture of baked goods is growing in African countries

TABLE 199 AFRICA: MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 200 AFRICA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 201 AFRICA: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 202 AFRICA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 195)

13.1 OVERVIEW

13.2 MARKET SHARE ANALYSIS, 2020

TABLE 203 MARKET: DEGREE OF COMPETITION (CONSOLIDATED)

13.3 KEY PLAYER STRATEGIES

13.4 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 46 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2018–2020 (USD BILLION)

13.5 COVID-19-SPECIFIC COMPANY RESPONSE

13.6 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

13.6.1 STARS

13.6.2 EMERGING LEADERS

13.6.3 PERVASIVE PLAYERS

13.6.4 PARTICIPANTS

FIGURE 47 BAKERY PROCESSING EQUIPMENT MARKET: COMPANY EVALUATION QUADRANT, 2020 (KEY PLAYERS)

13.6.5 PRODUCT FOOTPRINT

TABLE 204 COMPANY PRODUCT TYPE FOOTPRINT

TABLE 205 COMPANY APPLICATION FOOTPRINT

TABLE 206 COMPANY REGIONAL FOOTPRINT

TABLE 207 OVERALL COMPANY FOOTPRINT

13.7 BAKERY PROCESSING EQUIPMENT, START-UP/SME EVALUATION QUADRANT, 2020

13.7.1 PROGRESSIVE COMPANIES

13.7.2 STARTING BLOCKS

13.7.3 RESPONSIVE COMPANIES

13.7.4 DYNAMIC COMPANIES

FIGURE 48 MARKET: COMPANY EVALUATION QUADRANT, 2020 (START-UP/SME)

13.8 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

13.8.1 PRODUCT LAUNCHES

TABLE 208 PRODUCT LAUNCHES, AUGUST 2018–JUNE 2021

13.8.2 DEALS

TABLE 209 DEALS, FEBRUARY 2019–JANUARY 2021

13.8.3 OTHERS

TABLE 210 OTHERS, NOVEMBER 2018–AUGUST 2021

14 COMPANY PROFILES (Page No. - 210)

(Business overview, Products offered, Recent developments & MnM View)*

14.1 KEY PLAYERS

14.1.1 GEA GROUP

TABLE 211 GEA GROUP: BUSINESS OVERVIEW

FIGURE 49 GEA GROUP: COMPANY SNAPSHOT

TABLE 212 GEA GROUP: PRODUCTS OFFERED

14.1.2 BÜHLER

TABLE 213 BÜHLER: BUSINESS OVERVIEW

FIGURE 50 BÜHLER: COMPANY SNAPSHOT

TABLE 214 BÜHLER: PRODUCTS OFFERED

TABLE 215 BÜHLER: DEALS

TABLE 216 BÜHLER: OTHERS

14.1.3 THE MIDDLEBY CORPORATION

TABLE 217 THE MIDDLEBY CORPORATION: BUSINESS OVERVIEW

FIGURE 51 THE MIDDLEBY CORPORATION: COMPANY SNAPSHOT

TABLE 218 THE MIDDLEBY CORPORATION: PRODUCTS OFFERED

TABLE 219 THE MIDDLEBY CORPORATION: DEALS

14.1.4 JBT

TABLE 220 JBT: BUSINESS OVERVIEW

FIGURE 52 JBT: COMPANY SNAPSHOT

TABLE 221 JBT: PRODUCTS OFFERED

14.1.5 HEAT AND CONTROL INC.

TABLE 222 HEAT & CONTROL INC.: BAKERY PROCESSING EQUIPMENT MARKET BUSINESS OVERVIEW

TABLE 223 HEAT & CONTROL INC.: PRODUCTS OFFERED

TABLE 224 HEAT & CONTROL INC.: EXPANSION

14.1.6 RHEON AUTOMATIC MACHINERY CO., LTD

TABLE 225 RHEON AUTOMATIC MACHINERY CO., LTD: BUSINESS OVERVIEW

TABLE 226 RHEON AUTOMATIC MACHINERY CO., LTD: PRODUCTS OFFERED

TABLE 227 RHEON AUTOMATIC MACHINERY CO., LTD: EXPANSION

14.1.7 ALI GROUP

TABLE 228 ALI GROUP: BUSINESS OVERVIEW

TABLE 229 ALI GROUP: PRODUCTS OFFERED

14.1.8 BAKER PERKINS

TABLE 230 BAKER PERKINS: BUSINESS OVERVIEW

TABLE 231 BAKER PERKINS: PRODUCTS OFFERED

TABLE 232 BAKER PERKINS: PRODUCT LAUNCHES

14.1.9 MARKEL FOOD GROUP

TABLE 233 MARKEL FOOD GROUP: BUSINESS OVERVIEW

FIGURE 53 MARKEL FOOD GROUP: COMPANY SNAPSHOT

TABLE 234 MARKEL FOOD GROUP: PRODUCTS OFFERED

TABLE 235 MARKEL FOOD GROUP: DEAL

TABLE 236 MARKEL FOOD GROUP: NEW PRODUCT LAUNCHES

14.1.10 ANKO FOOD MACHINE CO., LTD

TABLE 237 ANKO FOOD MACHINE CO., LTD: BUSINESS OVERVIEW

TABLE 238 ANKO FOOD MACHINE CO., LTD: PRODUCTS OFFERED

14.1.11 GEMINI BAKERY EQUIPMENT COMPANY

TABLE 239 GEMINI BAKERY EQUIPMENT COMPANY: BUSINESS OVERVIEW

TABLE 240 GEMINI BAKERY EQUIPMENT COMPANY.: PRODUCTS OFFERED

14.1.12 ALLIED BAKERY EQUIPMENT

TABLE 241 ALLIED BAKERY EQUIPMENT: BUSINESS OVERVIEW

TABLE 242 ALLIED BAKERY EQUIPMENT: PRODUCTS OFFERED

14.1.13 GLOBAL BAKERY SOLUTIONS

TABLE 243 GLOBAL BAKERY SOLUTIONS: BUSINESS OVERVIEW

TABLE 244 GLOBAL BAKERY SOLUTIONS: PRODUCTS OFFERED

14.1.14 ERIKA RECORD LLC

TABLE 245 ERICA RECORD LLC: BUSINESS OVERVIEW

TABLE 246 ERICA RECORD LLC.: PRODUCTS OFFERED

14.1.15 KOENIG MASCHINEN – THE BAKER'S CROWN

TABLE 247 KOENING MASCHINEN – THE BAKER’S CROWN: BUSINESS OVERVIEW

TABLE 248 KOENING MASCHINEN: PRODUCTS OFFERED

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

14.2 OTHER PLAYERS/START-UPS

14.2.1 ZIBO TAIBO INDUSTRIAL CO., LTD

14.2.2 YASH FOOD EQUIPMENT

14.2.3 KAR BAKERY EQUIPMENT INDIA PVT LTD: KAROVENS

14.2.4 ALIGN INDUSTRY

14.2.5 FALCON FOOD EQUIPMENT

15 ADJACENT AND RELATED MARKETS (Page No. - 272)

15.1 INTRODUCTION

TABLE 249 ADJACENT MARKETS FOR BAKERY PROCESSING EQUIPMENT MARKET

15.2 LIMITATIONS

15.3 CONFECTIONERY PROCESSING EQUIPMENT MARKET

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

TABLE 250 CONFECTIONERY PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2016–2023 (USD MILLION)

15.4 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET

15.4.1 MARKET DEFINITION

15.4.2 MARKET OVERVIEW

TABLE 251 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2016–2023 (USD BILLION)

15.5 PREPARED FOOD EQUIPMENT MARKET

15.5.1 MARKET DEFINITION

15.5.2 MARKET OVERVIEW

TABLE 252 PRE-PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

16 APPENDIX (Page No. - 276)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

The study involves four major activities to estimate the current market size for the bakery processing equipment market. Exhaustive secondary research was done to collect information on the market as well as its peer and parent markets. The findings, assumptions, and market size were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to in order to identify and collect information. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, patent databases, gold & silver standard websites, food & beverage organizations, news articles, regulatory bodies, trade directories, and databases. The secondary research was used mainly to obtain key information about the industry’s supply chain, distribution channels, the total pool of key players, market classification, and segmentation, according to the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

The market comprises several stakeholders in the supply chain, which include manufacturers of bakery processing equipment, suppliers, foodservice companies, bakery manufacturing companies, and regulatory organizations. Extensive primary research was conducted after obtaining information about the bakery processing equipment market scenario through secondary research. Several primary interviews have been conducted with experts from the demand side (manufacturing companies, food processing companies, and government organizations) and supply side (suppliers and distributors, contractors, and supply chain vendors) across five major regions, namely, North America, Europe, Asia Pacific, South America, and the Middle East & Africa. Approximately 70% and 30% of the primary interviews were conducted from the demand and supply sides, respectively. This primary data was collected through questionnaires, e-mails, and telephonic interviews.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Bakery Processing Equipment Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology was used to estimate the market size, which includes the following:

- The key players in the bakery processing equipment market industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Bread Making Equipment Market Report Scope

The scope of the Bread Making Equipment Report will focus on equipment used in the bread making process. This includes but is not limited to mixers, ovens, dough dividers, proofing chambers, slicers, and packaging machines. The report will analyze the market trends, growth drivers, challenges, and opportunities for each type of equipment. It will also include information on the various materials used to manufacture bread making equipment, as well as the key players in the industry. Additionally, the report will provide an overview of the global bread making equipment market, including regional analysis and market segmentation. The target audience for this report includes manufacturers, distributors, suppliers, and investors in the bread making equipment industry, as well as researchers and analysts interested in the market.

Growing Demand in the Wheat Flour Processing Market

There has been a growing demand for wheat flour processing in recent years. This is due to a variety of factors, including increasing global population, rising consumer demand for baked goods and convenience foods, and the increasing use of wheat flour in various industries such as pharmaceuticals and cosmetics. To meet this growing demand, wheat flour processing companies have been investing in new technologies and expanding their production capacities. This includes the use of modern milling equipment and automation technologies to improve efficiency and reduce costs. However, the wheat flour processing industry also faces challenges such as fluctuating raw material prices, changing consumer preferences, and increasing competition from alternative flour sources such as rice flour and almond flour. To remain competitive, companies in this industry must stay up-to-date with the latest bakery processing equipment market trends and continuously innovate to meet evolving consumer demands.

Hypothetical Challenges that the Corn Processing Market may Face in the Future

- Climate change: Climate change may impact corn yields, which could lead to increased prices for corn and other agricultural commodities. The corn processing industry may need to adapt to changing weather patterns and potentially explore alternative sources of raw materials.

- Regulatory changes: There may be changes in government regulations related to food safety, environmental protection, or trade that could impact the corn processing industry. The industry may need to adjust its processes and practices to comply with new regulations.

- Competition: The corn processing industry may face increased competition from other crops or alternative sources of sweeteners and other products. Companies in the industry may need to focus on innovation and efficiency to stay competitive.

- Health concerns: There may be growing concerns about the health impacts of consuming processed corn products, such as high-fructose corn syrup. The industry may need to address these concerns through product development, marketing, or other means.

- Consumer preferences: Consumer preferences may shift towards more natural and organic foods, which could impact the demand for processed corn products. The industry may need to adapt its products and marketing to meet changing consumer preferences.

Overall, the corn processing industry will need to be flexible and adaptable to address these and other challenges that may arise in the future.

Target Audience:

- Government organizations

- Service providing company officials

- Government and research organizations

- Research officers

- CEOs and vice presidents

- Marketing directors

- Product innovation directors and related key executives from manufacturing companies and organizations operating in the bakery processing equipment market

- Manufacturing and marketing companies

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for each market segment and subsegment, data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the bakery processing industry. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

- To define, segment, and project the global market size for bakery processing equipment market

- To understand the structure of the market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the five regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by players across key regions

- To analyze competitive developments such as expansions & investments, new product launches, mergers & acquisitions, collaborations, and agreements

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Europe bakery processing equipment market

- Further breakdown of the Rest of Asia Pacific market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bakery Processing Equipment Market