Ballistic Protection Market by Material (Metals & Alloys, Ceramics, Composites, Others), Product (PPE, Weapon Stations and Optronics, Engine Protection, Others), Threat Level, Platform, Application, Technology, and Region - Global Forecast to 2027

Updated on : Oct 22, 2024

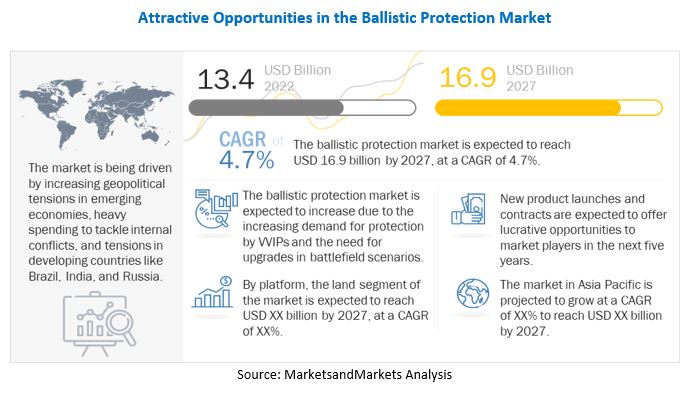

Increasing procurement of armored vehicles are also aiding the growth of the ballistic protection market in the US. Key manufacturers in the US are increasingly investing in R&D activities for the development of new and advanced armored vehicles. . In March 2022, it announced that it had increased its defense spending by 7.1% to reach USD 229 billion, continuing years of robust spending on its increasingly powerful military that is challenging the dominance of US armed forces in the Indo-Pacific region. The growth of the ballistic protection industry in China can be attributed to the procurement of vehicle armor protection systems such as Kevlar glass and fibers. India is the second-fastest-growing market for ballistic protection after China. The growth of the market in this country can be attributed to the increase in the defense budget and the overall development of the homeland security forces, such as the police, the first responders, and the VIP security personnel. With the rise in inter-border conflicts with Pakistan and China, the country also focuses on strengthening its military capabilities as well as safeguarding them.

Various players such as BAE Systems (UK), Avon Protection (US), Rheinmetall AG (US), Tencate Advanced Armor (Netherlands), Point Blank Enterprises (US), SAAB AB (Sweden) among others, are prominent players operating in the ballistic protection market.

To know about the assumptions considered for the study, Request for Free Sample Report

Ballistic Protection Market Dynamics:

Driver: Rising political unrest in emerging economies

An increase in political instability and unrest, as well as increasing terrorist activities, have prompted law enforcement agencies and the material science community to develop and provide effective solutions that can help the safe movement of troops and vehicles. In the present scenario, the political conflicts in Syria, Libya, Iraq, and Afghanistan, along with Russia & Ukraine, India & Pakistan, India & China, and Russia & Turkey are increasing the need for combat armor. Domestic conflicts in many countries are also boosting the need for ammunition. This drives the demand for protective equipment.

Developing countries, such as Brazil, India, and Russia, are spending heavily on defense owing to internal conflicts and tensions with their neighboring countries. The Middle East & Africa region suffers from severe political unrest, boosting the need for advanced armor materials.

Unstable political conditions and terrorism across the world are adversely affecting the economies of many countries. Therefore, these countries are channeling their resources to invest in defense systems to counter these issues, which is a long-term driver for the global ballistic protection market

Restraint: Failure to provide complete protection

Regardless of technological advances, present ballistic composite technologies and products are unable to provide complete protection, especially on the battlefield. Fiber vests and composite helmets are good against shrapnel from artillery or grenades, which accounts for 70% to 85% of battlefield casualties. However, ballistic composites fail to provide 100% protection against other casualties, such as those caused by high-powered rifle fire. Therefore, companies in the industry are looking for better hard-facing inserts to counter existing threats

Opportunity: Rising demand for multipurpose equipment

The current market for personal protective equipment (PPE) is focused on high-performance and reasonably priced products. Many customers prefer protective equipment that serves more than one function. In general, PPE is designed for protection against a hazard—for instance, fire-resistant (FR) clothing is resistant to fire damage but may not provide adequate protection against mechanical hazards. However, workers in industries such as oil & gas and chemical may be exposed to multiple hazards at once. In such situations, workers need multifunctional protective clothing for protection against multiple hazards.

Challenges: High production cost of armor materials

The production process of armor materials varies based on their application. The technology used in manufacturing these materials is one of the most vital parts of the value chain. Production is governed by various agencies as well as by military forces, as it is a sensitive market. Various initiatives have been undertaken by these agencies and forces to ensure the secrecy and security of the technology used in the production of armor materials. The production process also needs to undergo several control methodologies to ensure intellectual property theft is minimized. These factors increase the production cost of armor materials. Manufacturers also invest heavily in R&D to enhance the efficiency of armor, thus increasing the overall cost of the material

Ballistic Protection Market Ecosystem:

The key stakeholders in the ballistic protection market ecosystem include companies which provide platforms and ballistic protection products. The major influencers in this market are investors, funders, academic researchers, integrators, service providers, and licencing agencies.

Marine segment held largest market share in terms of value in ballistic protection market

On the basis of platform, the ballistic protection market has been segmented into land, airborne and marine. Mairne accounted for 49.2% of the overall ballistic protection market. Defense naval vessels are specifically designed and used by coastguards and naval forces. They differ from commercial ships in terms of their applications, design, construction methods, and technologies applied. The hull of a ship is the major area in which ballistic materials are used. Apart from the hull, ballistic protection systems are installed on windows, weapon mounts, and optronics, among others.

The marine segment includes destroyers, frigates, corvettes, aircraft carriers, offshore support vehicles, and unmanned surface vehicles. The increase in demand for maritime security has resulted in the growth of the unmanned surface vehicles market.

Homeland Security is anticipated to grow at highest CAGR during forecast period

The homeland security application segment is expected to grow at the highest CAGR of 7.4% during the forecast period. Ballistic-resistant body armor is worn by homeland security officers while in the field to protect against specific ballistic threats. Homeland security officers use personal protective equipment, including body vests, ballistic helmets, and gloves to ensure safety during missions. Ballistic helmets are intended to protect the wearer against small arms fire and fragmentation threats. The combat systems used by homeland security officers are ballistic-resistant as they are reinforced with ceramics and thermoplastics.

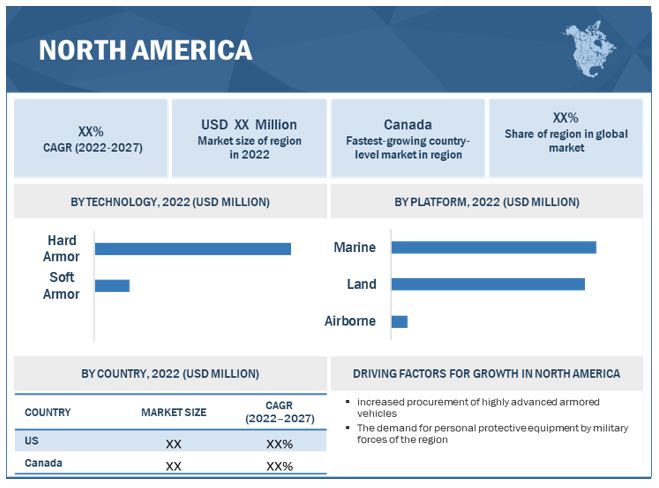

In terms of value, North America led the ballistic protection market

The US and Canada are considered under North America for market analysis. Market growth in the North American region can be attributed to the increased procurement of highly advanced armored vehicles and the demand for personal protective equipment by military forces of the region. The increase in terror threats is the main reason for the procurement of ballistic protection systems for land, airborne, and marine platforms. The global defense industry investment in R&D has led to the development of new soldier modernization technologies that enhance survivability and sustainability capabilities, including advanced combat clothing, boots, hard armors, eyewear, and helmets.

To know about the assumptions considered for the study, download the pdf brochure

Top Ballistic Protection Companies - Key Market Players

The ballistic protection companies are dominated by a few globally established players such as BAE Systems (UK), Avon Protection (US), Rheinmetall AG (US), Tencate Advanced Armor (Netherlands), Point Blank Enterprises (US), SAAB AB (Sweden) among others, are prominent players operating in the ballistic protection market.

Scope of the report

|

Report Metric |

Details |

|

Estimated Market Size

|

USD 13.4 Billion |

|

Projected Market Size

|

USD 16.9 Billion |

|

Growth Rate |

4.7% |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

By platform, application, technology, material, product, threat level |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East, Rest of the World |

|

Companies covered |

BAE Systems (UK), Avon Protection (US), Rheinmetall AG (US), Tencate Advanced Armor (Netherlands), Point Blank Enterprises (US) and SAAB AB (Sweden), among others |

This research report categorizes the Ballistic Protection Market based on Platform, Application, Technology, Material, Product, Threat Level and Region.

By Platform

-

Land

- Combat Armored Vehicles

- Combat Support Vehicles

- Unmanned Armored Ground Vehicles

- Soldiers & Security Personnel

- Base Stations

-

Airborne

- Fixed-Wing Aircraft

- Helicopters

- Unmanned Aerial Vehicles (UAV)

- Base Stations

-

Marine

- Destroyers

- Frigates

- Coverettes

- Offshore Support Vessels (OSVS)

- Aircraft Carriers

- Submarines

- Unmanned Surface Vehicles

By Application

- Military

-

Homeland Security

- Paramilitary Forces

- Police Forces

- Special Forces

By Technology

-

Hard Armor

- Land

- Airborne

- Marine

-

Soft Armor

- Land

- Airbrone

- Marine

By Material

-

Metals & Alloys

- High-density steel

- Aluminium

- Titanium

-

Ceramics

- Aluminum Oxide

- Silicon Carbide

-

Composites

- Aramid Composites

- Carbon Composites

- Hybrid Composites

- 3D Composites

-

By Bulletproof Glass

- Acrylic

- Polycarbonate

-

By Fabric

- Organic Cotton

- Synthetic Nylon & Ployester

By Product

-

Personal Protective Equipment

- Body Armor Clothing

- Ballistic Helmets

- Vests

- Ballistic Boots

- Ballistic Gloves

- Ballistic Containers & Portable Shelters

- Ballistic Blocks

- Ballistic Barrier Systems

- Hull & Body

- Weapon Stations & Optronics

- Fuel Drop Tanks & Ammunition Storage

- Cockpit Ballistic Protection

- Pilot Seat Protection

- Ballistic Floors

- Ballistic Windows

- Ballistic Doors

- Engine Protection

By Threat Level

- Level II & Level IIA

- Level III & Level IIIA

- Level IV & Above

By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Africa

- Rest of the World

Recent Developments

- In May 2022, TenCate Advanced Armor received a contract from the Naval Surface Warfare Center to provide maritime buoyant plates to support the Antiterrorism Afloat Equipage Program

- In March 2022, BAE Systems received a contract from the US Marine Corps to provide an Amphibious Combat Vehicle Recovery variant. The new variant provides direct field support and maintenance to the ACV family of vehicles.

- In March 2022, BAE Systems received a contract from the US Contracting Command for providing M109A7 and M992A3 combat vehicles.

- In March 2022, BAE Systems received a contract from the US Marine Corps to provide amphibious combat vehicles.

- In February 2022, Tencate Advanced Armor received a contract for providing a force protection system for Mack Granite-based M917A3 Heavy Dump Truck (HDT) and other Mack Defense vehicle platforms.

- In February 2022, Avon Protection received a contract to provide the second generation advanced combat helmet (ACH).

- In February 2022, Avon Protection received a contract from the United States Department of Defense for providing second-generation advanced combat helmets.

- In February 2022, Point Blank Enterprises received a contract from the US Marine Corps CH-53K for providing ballistic armor systems.

Frequently Asked Questions (FAQs):

What is the current size of the ballistic protection market?

The global ballistic protection market size is projected to grow from USD 13.4 billion in 2022 to USD 16.9 billion by 2027, at a CAGR of 4.7% from 2022 to 2027.

Who are the winners in the ballistic protection market?

BAE Systems (UK), Avon Protection (US), Rheinmetall AG (US), Tencate Advanced Armor (Netherlands), Point Blank Enterprises (US), SAAB AB (Sweden) among others are some of the winners in the market.

What are some of the technological advancements in the market?

Electronic textiles, electric armor, defcon armor technology, double-sided combat uniform fabric, modular ballistic protection systems are some of the technological advancements in the ballistic protection market.

What are the factors driving the growth of the market?

The ballistic protection market is being driven by factors such as rising political unrest in emerging economies, need for upgrades in battlefield scenarios, demand for protection by VVIPs and development of lightweight, comfortable, and high-strength materials

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

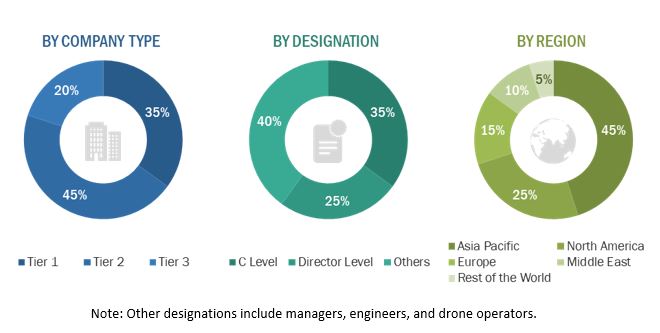

This research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the ballistic protection market. Primary sources included industry experts from the core and related industries as well as preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all the segments of this industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information as well as to assess prospects for the growth of the market during the forecast period.

Secondary Research

The share of companies in the ballistic protection market was determined using secondary data made available through paid and unpaid sources and by analyzing their product portfolios. The companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources that were referred to for this research study on the ballistic protection market included financial statements of companies offering and developing ballistic protection products and solutions and information from various trade, business, and professional associations, among others. Secondary data was collected and analyzed to arrive at the overall size of the ballistic protection market, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the ballistic protection market through secondary research. Several primary interviews were conducted with market experts from both, the demand- and supply-side across 5 major regions, namely, North America, Europe, Asia Pacific, the Middle East and Africa and Latin America. This primary data was collected through questionnaires, mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

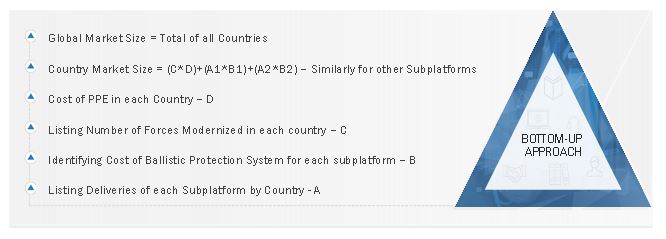

Market Size Estimation

Both, the top-down and bottom-up approaches were used to estimate and validate the size of the ballistic protection market.

The research methodology that was used to estimate the size of the target drones market includes the following details.

Key players in the ballistic protection market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders such as chief executive officers, directors, and marketing executives of the leading companies operating in the target drones market.

All percentage shares, splits, and breakdowns were determined using secondary sources and were verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the ballistic protection market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up approach

Data Triangulation

After arriving at the overall size of the ballistic protection market from the market size estimation process explained above, the total market has been split into several segments and subsegments. The data triangulation and market breakdown procedures explained below have been implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both, top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, segment, and forecast the size of the ballistic protection market based on platform, application, technology, material, product, threat level and region for the forecast period from 2022 to 2027

- To forecast the size of various segments of the market with respect to five major regions, namely, North America, Europe, Asia Pacific, the Middle East, Africa and Latin America , along with the major countries in each of these regions

- To identify and analyze the key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify opportunities for stakeholders in the market by studying key market and technology trends

- To analyze competitive developments such as contracts, agreements, acquisitions & partnerships, new product launches & developments, and R&D activities in the market

- To estimate the procurement of ballistic protection products by different countries to track the market size of ballistic protection

- To provide a comprehensive competitive landscape of the market along with an overview of the different strategies adopted by key players to strengthen their position in the market

- To identify industry trends, market trends, and technology trends currently prevailing in the market

- To analyze micromarkets1 with respect to individual technological trends and their contribution to the total market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies2

- To provide a detailed competitive landscape of the market, along with an analysis of business and strategies such as mergers & acquisitions, partnerships, agreements, and product developments in the ballistic protection market

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

Available Customizations:

Along with market data, MarketsandMarkets offers customizations as per the specific needs of a company. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

- Market analysis of additional countries (subject to the data availability)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ballistic Protection Market

I am looking for market intel on manufactures and customers involved with ballistic helmets, vehicles, and personal protection products.