Barrier Films Market by Materials (Polyethylene (PE), Polypropylene (PP), Polyester (PET), Polyamide, Organic Coatings, Inorganic Oxide Coatings), Packaging Type (Pouches, Bags, Blister Packs), End-use, Type and Region - Global Forecast to 2028

Updated on : July 17, 2025

Barrier Films Market

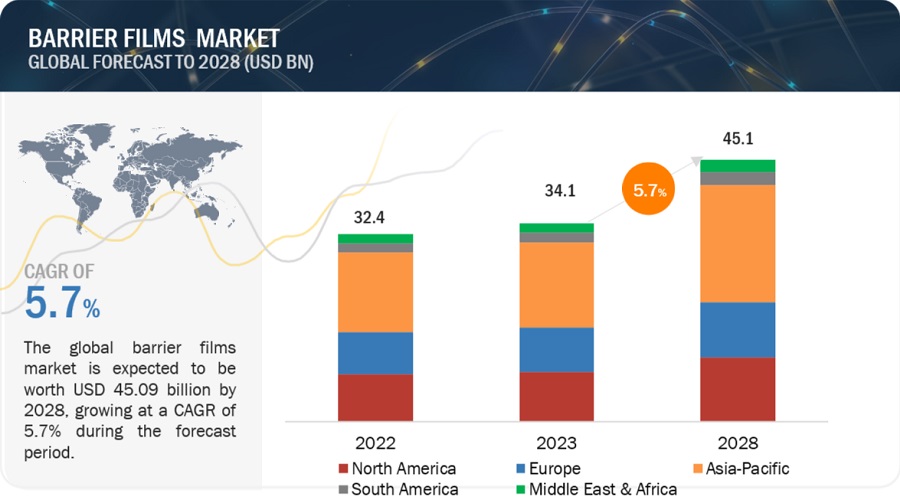

The global barrier films market was valued at USD 34.1 billion in 2023 and is projected to reach USD 45.1 billion by 2028, growing at 5.7% cagr from 2023 to 2028. Barrier films are specialized packaging materials designed to provide a barrier against the permeation of gases, moisture, and other external substances. They are used to protect sensitive products, such as food, pharmaceuticals, electronics, and industrial goods, from degradation caused by exposure to air, moisture, light, or other environmental factors. The global barrier films market has been growing steadily in recent years and is expected to continue to grow in the coming years. The market is segmented on the basis of materials such as Polyethylene (PE), Polypropylene (PP), Polyester (PET), polyamide, organic coatings, inorganic oxide coatings, and others. Barrier films market by packaging type are pouches, bags, blister packs, and others. The barrier films market is segmented on the basis of type such as metalized, transparent, and white. The barrier films are used in several end-use industries such as food & beverage packaging, Pharmaceutical packaging, agriculture, and others.

Attractive Opportunities in the Barrier Films Market

To know about the assumptions considered for the study, Request for Free Sample Report

Barrier Films Market Dynamics

Driver: Rising number of retail chains in developing countries

Retail chains have dominated the food & beverage market in advanced countries for many years. Food & beverage retailing has been traditionally dominated by local, small, and independent artisan stores offering unpacked food in developing regions, such as Central and Eastern Europe, South America, and Asia. This trend is changing, and the number of domestic hypermarkets and supermarkets is increasing in many of the major cities in developing countries. This change in trend has helped these supermarkets to increase their shares in the food & beverages market. The demand for barrier packaging films is benefitting from the growing market share of large retail chains as these retail chains provide packed food products with convenient and user-friendly packaging. Furthermore, these chains have extended the market for packaged food with a strong focus on cost reduction and shelf life extension. There has also been growth in the number of discount stores and private label products, which enable lower-income groups to purchase packaged food and drinks at more affordable prices.

Restraint: Susceptibility to degradation

Barrier films can be susceptible to degradation under certain conditions. The susceptibility to degradation depends on various factors, including the specific material used, the environmental conditions, and the duration of exposure. Many barrier films, especially those made from polymers, can absorb moisture over time. Moisture absorption can lead to dimensional changes, loss of mechanical strength, and increased permeability to gases and other substances. It is essential to store barrier films in a controlled environment with low humidity to minimize moisture absorption.

Opportunities: Biodegradable barrier films

Biodegradable barrier films are a type of packaging material designed to provide the necessary barrier properties while also being environmentally friendly and capable of breaking down naturally over time. These films are engineered to degrade through biological processes, such as microbial activity or enzymatic action, into simpler, non-toxic substances, such as water, carbon dioxide, and biomass. The rate of biodegradation for these films can vary depending on factors such as film thickness, composition, environmental conditions, and the presence of specific microorganisms or enzymes. It is important to note that the biodegradability of these films is often optimized in industrial composting facilities or specific environmental conditions that provide the necessary microorganisms, temperature, and humidity for degradation to occur.

Challenges: Issue related to recycling of multilayer films

Multilayer barrier films pose challenges when it comes to recycling due to their complex structure and combination of different materials. Multilayer barrier films often consist of layers made from different types of polymers, additives, and coatings. These materials may have different melting points, chemical compositions, and recycling compatibilities. Separating and recycling each layer individually becomes challenging because they require specialized processes. The recycling of multilayer barrier films can be more expensive compared to the recycling of single-material films. The costs associated with collection, sorting, and processing of multilayer films may outweigh the economic benefits of recycling, especially when the market demand for recycled materials is uncertain.

Ecosystem

By material, organic coatings segment is projected to register the highest CAGR during the forecast period.

Organic coating barrier films refer to packaging films that incorporate organic coatings or surface treatments to enhance their barrier properties. These coatings are typically applied to a base film made from materials like polyethylene (PE), polypropylene (PP), or polyethylene terephthalate (PET) to provide additional barriers against gases, moisture, and other external factors. Organic coatings can improve the barrier properties of the base film by reducing the permeability of gases and moisture. These coatings are typically applied using techniques such as extrusion coating, lamination, or surface coating. The coating thickness can vary depending on the desired level of barrier protection.

By End-Use Industry, the Agriculture segment projected to register the highest CAGR during the forecast period.

Barrier films play a significant role in agriculture by providing protection and enhancing the quality and shelf life of agricultural products. Silage films are used to cover and protect silage, which is fermented and stored livestock feed. Barrier silage films, usually made from multi-layered co-extruded plastics, provide an airtight seal that prevents oxygen penetration and inhibits spoilage. These films preserve the nutritional value and freshness of silage, enabling farmers to store feed for extended periods without quality deterioration. Barrier films are widely used as greenhouse covers to create an optimal growing environment for crops. These films provide a physical barrier against pests, insects, and adverse weather conditions, while also allowing light transmission for photosynthesis. They regulate temperature and humidity inside the greenhouse, promoting optimal plant growth and higher yields. Barrier films in agriculture offer numerous benefits, including improved crop yield, enhanced product quality, reduced waste, and increased profitability for farmers and growers. They contribute to sustainable agricultural practices by minimizing resource wastage and improving the efficiency of production and post-harvest processes.

Asia Pacific is projected to account for the highest CAGR in the barrier films market during the forecast period.

The Asia Pacific region is currently experiencing significant market drivers that are influencing the demand for barrier films. The Asia Pacific region is witnessing a substantial increase in population, coupled with rapid urbanization. This demographic trend has resulted in higher consumption of packaged goods, including food, beverages, personal care products, and pharmaceuticals. Consequently, there is an increased demand for barrier films to protect and preserve these products during storage and transportation. There is a significant surge in demand for packaged food and beverages in the Asia Pacific region. Packaged products offer convenience, safety, and extended shelf life, driving the use of barrier films. Moreover, the growth of e-commerce and online grocery platforms has further fueled the demand for effective barrier packaging solutions, as they require robust protective films to withstand various handling and shipping processes. The pharmaceutical and healthcare sectors in the Asia Pacific region are experiencing rapid growth. Barrier films are indispensable in pharmaceutical packaging to protect products from moisture, oxygen, UV light, and other external factors that could compromise their quality and efficacy. Factors such as population growth, rising healthcare expenditure, and the expansion of generic drug manufacturing contribute to the increasing demand for barrier films in the pharmaceutical industry. Asia Pacific region is witnessing a shift in the retail landscape, with the growth of modern retail formats such as supermarkets, hypermarkets, and convenience stores. These formats require efficient packaging solutions to extend the shelf life of products and ensure their quality and safety. Barrier films play a vital role in meeting these requirements.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Barrier films market comprises major manufacturers such as Berry Global Inc. (US), Amcor Plc (Australia), Sealed Air (US), Toppan Printing Co., Ltd. (Japan), Cosmo Films Ltd. (India), Jindal Poly Films Ltd. (India), Dupont Teijin Films (US) and Uflex Ltd. (India) among others were the leading players in the barrier films market. Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the barrier films market.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2020–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) |

|

Segments Covered |

application, type, and Region |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

Royal Dutch Shell (Netherlands), Chevron Phillips Chemical Company (Texas), INEOS Group Limited (UK), SABIC (Saudi Arabia), Evonik Industries AG (Germany), Dow Chemical Company (Michigan), Sasol Limited (South Africa), ExxonMobil (US), Qatar Chemical Company (Qatar), PJSC Nizhnekamskneftekhim (Russia). |

|

|

This research report categorizes the barrier films market by fuel, applications, product type, power rating, end user, and region

Based on type, the Alpha olefins market has been segmented as follows:

- 1-Hexene

- 1-Octene

- 1-Butene

- Others

Based on application, the Alpha olefins market has been segmented as follows:

- Polyolefins comonomer

- Surfactants and intermediates

- Lubricants

- Fine chemicals

- Plasticizer

- Oil field chemicals

- Others

Based on region, the Alpha olefins market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In May 2023, The Amcor a leader in developing and producing responsible packaging solutions, announced that it has signed a definitive agreement to acquire Moda Systems, a leading manufacturer of state-of-the-art, automated protein packaging machines.

- In April 2023, Sealed Air and Koenig & Bauer AG announced they have signed a non-binding letter of intent to expand their strategic partnership for digital printing machines. The partnership aims to significantly improve packaging design capabilities by developing state-of-the art digital printing technology, equipment, and services.

- In July 2021, Toppan has acquired the InterFlex Group (InterFlex), a global flexible packaging converter with bases in the United States and the United Kingdom on July 23, 2021.

- Interflex is a provider of various packaging solutions to a wide range of consumer goods markets. With five production facilities located in the United States and the United Kingdom, Interflex offers a diverse product portfolio. Their offerings include printed shrink films, stand-up pouches, pre-formed bags, wax coated papers, surface print and laminate roll stocks, as well as barrier and non-barrier film laminations. By providing these packaging options, Interflex caters to the specific needs of different industries and ensures effective protection and presentation of their customers' products.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the Barrier films market?

The major driver influencing the growth of the Barrier films market are Growing Demand for Packaged Food and Beverages and Increasing Focus on Product Protection and Shelf Life Extension.

What are the major challenges in the Barrier films market?

The major challenge in the Barrier films market is Issue related to recycling of multilayer films.

What are the restraining factors in the Barrier films market?

The major restraining factor faced by the Barrier films market is Susceptibility to degradation.

What is the key opportunity in the Barrier films Market?

The policy changes regarding the use of Barrier films have a new opportunity for the Barrier films market and Biodegradable barrier films.

What are the end-uses of Barrier films?

Barrier films play a significant role in agriculture by providing protection and enhancing the quality and shelf life of agricultural products. It is also primarily used in food and beverages industry. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Demand for food products with long shelf life- Increasing demand for customer-friendly packaging- Rising number of retail chains in developing countries- Downsizing of packagingRESTRAINTS- Susceptibility to degradationOPPORTUNITIES- Biodegradable barrier films- Increasing use of agricultural films- Growing applications of barrier films in electronics industryCHALLENGES- Issues related to recycling of multilayer films

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 TARIFF AND REGULATORY LANDSCAPE

- 5.6 REGULATIONS

-

5.7 MACROECONOMIC OVERVIEWINTRODUCTIONTRENDS AND GDP FORECAST

-

5.8 ECOSYSTEM MAPPING

- 5.9 TECHNOLOGY ANALYSIS

-

5.10 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPEPATENT PUBLICATION TRENDSINSIGHTSJURISDICTION ANALYSISTOP PATENT APPLICANTSTRENDS AND DISRUPTIONS IMPACTING MARKET GROWTH

-

5.11 CASE STUDYENHANCING MEDICATION INTEGRITY: CASE STUDY ON IMPLEMENTING BARRIER FILMS FOR PHARMACEUTICAL PACKAGING

- 5.12 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.14 TRADE ANALYSIS

- 5.15 PRICING ANALYSIS

-

5.16 PRICING ANALYSIS BASED ON REGIONPRICING ANALYSIS BASED ON TYPECHANGES IN BARRIER FILMS PRICING IN 2022

- 6.1 INTRODUCTION

-

6.2 PEHIGH DEMAND FOR LDPE FOR TRANSPARENT BARRIER FILMS TO DRIVE MARKET

-

6.3 PPHIGH MELTING POINT OF PP-BASED FILMS TO INCREASE DEMAND

-

6.4 PET/BOPETRECYCLABILITY TO INCREASE DEMAND IN END-USE INDUSTRIES

-

6.5 POLYAMIDEEXCELLENT PERFORMANCE IN LOW AND HIGH TEMPERATURES TO DRIVE MARKET

-

6.6 ORGANIC COATINGSOXYGEN BARRIER PROPERTIES TO DRIVE MARKET

-

6.7 INORGANIC OXIDE COATINGSFOOD PACKAGING APPLICATION TO DRIVE SEGMENT

- 6.8 OTHERS

- 7.1 INTRODUCTION

-

7.2 TRANSPARENT BARRIER FILMSOPTIMAL VISIBILITY APPLICATION TO DRIVE MARKET

-

7.3 METALLIZED BARRIER FILMSELEVATING PACKAGING PERFORMANCE TO INCREASE USAGE

-

7.4 WHITE BARRIER FILMSGROWING TRENDS OF BAKERY PACKAGED FOODS AND MILK-BASED BEVERAGES TO DRIVE DEMAND

- 8.1 INTRODUCTION

-

8.2 POUCHESPOUCH PACKAGING WITH PROTECTIVE BARRIER FILMS TO DRIVE MARKET

- 8.3 BAGS

-

8.4 BLISTER PACKSENHANCED PHARMACEUTICAL PROTECTION TO INCREASE DEMAND

- 8.5 OTHERS

- 9.1 INTRODUCTION

-

9.2 FOOD & BEVERAGE PACKAGINGGROWING DEMAND FOR FOOD PRODUCTS WITH LONG SHELF LIFE OF TO DRIVE DEMAND

-

9.3 PHARMACEUTICAL PACKAGINGBARRIER FILMS OFFER SECURITY & PROTECTION WITH EASY AND SAFE OPENING FEATURES

-

9.4 AGRICULTUREIMPROVED FOOD QUALITY, CROP PROTECTION, AND INCREASED CROP PRODUCTIVITY TO DRIVE MARKET

- 9.5 OTHERS

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFIC (APAC)RECESSION IMPACTCHINA- Growing demand for processed & semi-processed food to drive marketINDIA- Growth in demand for FMCG and convenience products to increase demandJAPAN- Increasing use of plastic films in food & beverage packaging and agriculture to support market growthSOUTH KOREA- Increasing demand for packaged food and blister packaging in pharmaceutical industry to drive demandINDONESIA- Rising consumer spending and growing food & beverage industry to drive marketREST OF APAC

-

10.3 NORTH AMERICARECESSION IMPACTUS- Established end-use industries to increase consumptionCANADA- Increasing food production to favor market growthMEXICO- Demand for packaging to influence growth

-

10.4 EUROPERECESSION IMPACTGERMANY- Plastics industry to increase consumptionFRANCE- Net exporter of agri-food and seafood products to drive marketUK- Huge plastic film production to increase demandITALY- Agricultural films market to support market growthRUSSIA- Packaging demand in major end-use industries to govern market growthTURKEY- Largest producer and exporter of agricultural products to drive marketREST OF EUROPE

-

10.5 SOUTH AMERICARECESSION IMPACTBRAZIL- Large export of food raw materials to support market growthARGENTINA- Expansion of end-use industries to drive marketREST OF SOUTH AMERICA

-

10.6 MIDDLE EAST & AFRICA (MEA)RECESSION IMPACTUAE- Demand for FMCG to drive market growthSAUDI ARABIA- Shift toward flexible plastic packaging to support market growthSOUTH AFRICA- Shift toward small packs or single-portion packs to drive marketREST OF MEA

- 11.1 INTRODUCTION

- 11.2 MARKET SHARE ANALYSIS

- 11.3 KEY PLAYER STRATEGIES

- 11.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

-

11.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.7 COMPETITIVE BENCHMARKING

-

11.8 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESOTHERSDEALS

-

12.1 KEY PLAYERSBERRY GLOBAL, INC.- Business overview- Products/Solutions/Services offered- Recent developments- Others- MnM viewAMCOR PLC- Business overview- Products/Solutions/Services offered- Recent developments- Product launches- MnM viewSEALED AIR CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTOPPAN, INC.- Business overview- Products/Solutions/Services offered- Recent developments- Product launches- MnM viewJINDAL POLY FILMS LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPOLYPLEX CORP. LTD.- Business overview- Products/Solutions/Services offered- MnM viewCOSMO FIRST LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDUO PLAST AG- Business overview- Products/Solutions/Services offeredMONDI PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDUPONT TEIJIN FILMS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewUFLEX LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCONSTANTIA FLEXIBLES GROUP GMBH- Business overview- Products/Solutions/Services offered- Recent developments- Others- MnM view

-

12.2 OTHER PLAYERSMITSUBISHI CHEMICAL GROUP CORPORATIONTICINOPLAST SPAPLASTCHIM-TPOLYSACK FLEXIBLE PACKAGING LTDCAMVAC LIMITEDFUTAMURA CHEMICAL CO. LTD.POLIVOUGA - INDÚSTRIA DE PLÁSTICOS S.A.PROAMPAC HOLDINGS INC.DAIBOCHI PLASTIC AND PACKAGING INDUSTRY BHD.CHIRIPAL POLY FILMSWINPAK LTD.PLASTISSIMO FILM COMPANY LIMITEDHONEYWELL INTERNATIONAL, INC.GLENROY INC.TORAY INDUSTRIESAEGIS PACKAGING PTE. LTD.

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 BOPP FILMS MARKET

- 13.4 BOPP FILMS MARKET, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 GDP GROWTH RATE FOR MAJOR REGIONS

- TABLE 2 COUNTRY-WISE CERTIFICATION OR APPROVING AUTHORITIES FOR FOOD PACKAGING

- TABLE 3 WORLDWIDE GDP GROWTH PROJECTION

- TABLE 4 BARRIER FILMS MARKET: REGISTERED PATENTS

- TABLE 5 BARRIER FILMS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 6 KEY BUYING CRITERIA FOR BARRIER FILMS INDUSTRY

- TABLE 7 MAJOR IMPORT PARTNERS –FOOD AND BEVERAGES PACKAGING FILMS

- TABLE 8 BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 9 BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 10 PE-BASED BARRIER FILMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 11 PE-BASED BARRIER FILMS MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 12 PP-BASED BARRIER FILMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 13 PP-BASED BARRIER FILMS MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 14 PET/BOPET-BASED BARRIER FILMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 15 PET/BOPET-BASED BARRIER FILMS MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 16 POLYAMIDE-BASED BARRIER FILMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 17 POLYAMIDE-BASED BARRIER FILMS MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 18 ORGANIC COATING-BASED BARRIER FILMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 19 ORGANIC COATING-BASED BARRIER FILMS MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 20 INORGANIC OXIDE COATINGS-BASED BARRIER FILMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 INORGANIC OXIDE COATINGS-BASED BARRIER FILMS MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 22 OTHER MATERIAL-BASED BARRIER FILMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 OTHER MATERIAL-BASED BARRIER FILMS MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 24 BARRIER FILMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 25 BARRIER FILMS MARKET, BY TYPE, 2021–2028 (KILOTON)

- TABLE 26 TRANSPARENT BARRIER FILMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 TRANSPARENT BARRIER FILMS MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 28 METALLIZED BARRIER FILMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 29 METALLIZED BARRIER FILMS MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 30 WHITE BARRIER FILMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 WHITE BARRIER FILMS MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 32 BARRIER FILMS MARKET, BY PACKAGING TYPE, 2021–2028 (USD MILLION)

- TABLE 33 BARRIER FILMS MARKET, BY PACKAGING TYPE, 2021–2028 (KILOTON)

- TABLE 34 POUCHES: BARRIER FILMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 POUCHES: BARRIER FILMS MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 36 BAGS: BARRIER FILMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 37 BAGS: BARRIER FILMS MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 38 BLISTER PACKS: BARRIER FILMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 39 BLISTER PACKS: BARRIER FILMS MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 40 OTHERS: BARRIER FILMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 41 OTHERS: BARRIER FILMS MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 42 BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 43 BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 44 BARRIER FILMS MARKET IN FOOD & BEVERAGE PACKAGING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 45 BARRIER FILMS MARKET IN FOOD & BEVERAGE PACKAGING, BY REGION, 2021–2028 (KILOTON)

- TABLE 46 BARRIER FILMS MARKET IN PHARMACEUTICAL PACKAGING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 47 BARRIER FILMS MARKET IN PHARMACEUTICAL PACKAGING, BY REGION, 2021–2028 (KILOTON)

- TABLE 48 BARRIER FILMS MARKET IN AGRICULTURE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 49 BARRIER FILMS MARKET IN AGRICULTURE, BY REGION, 2021–2028 (KILOTON)

- TABLE 50 BARRIER FILMS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 51 BARRIER FILMS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2021–2028 (KILOTON)

- TABLE 52 BARRIER FILMS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 53 BARRIER FILMS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 54 BARRIER FILMS MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 55 APAC: BARRIER FILMS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 56 APAC: BARRIER FILMS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 57 APAC: BARRIER FILMS MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 58 APAC: BARRIER FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 59 APAC: BARRIER FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 60 APAC: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 61 APAC: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 62 APAC: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 63 APAC: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 64 APAC: BARRIER FILMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 65 APAC: BARRIER FILMS MARKET, BY TYPE, 2021–2028 (KILOTON)

- TABLE 66 APAC: BARRIER FILMS MARKET, BY PACKAGING TYPE, 2021–2028 (USD MILLION)

- TABLE 67 APAC: BARRIER FILMS MARKET, BY PACKAGING TYPE, 2021–2028 (KILOTON)

- TABLE 68 CHINA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 69 CHINA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 70 CHINA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 71 CHINA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 72 CHINA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 73 INDIA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 74 INDIA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 75 INDIA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 76 INDIA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 77 INDIA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 78 JAPAN: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 79 JAPAN: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 80 JAPAN: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 81 JAPAN: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 82 JAPAN: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 83 SOUTH KOREA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 84 SOUTH KOREA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 85 SOUTH KOREA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 86 SOUTH KOREA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 87 SOUTH KOREA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 88 INDONESIA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 89 INDONESIA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 90 INDONESIA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 91 INDONESIA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 92 INDONESIA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 93 REST OF APAC: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 94 REST OF APAC: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 95 REST OF APAC: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 96 REST OF APAC: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 97 REST OF APAC: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 98 NORTH AMERICA: BARRIER FILMS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 99 NORTH AMERICA: BARRIER FILMS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 100 NORTH AMERICA: BARRIER FILMS MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 101 NORTH AMERICA: BARRIER FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 102 NORTH AMERICA: BARRIER FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 104 NORTH AMERICA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 105 NORTH AMERICA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 106 NORTH AMERICA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 107 NORTH AMERICA: BARRIER FILMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 108 NORTH AMERICA: BARRIER FILMS MARKET, BY TYPE, 2021–2028 (KILOTON)

- TABLE 109 NORTH AMERICA: BARRIER FILMS MARKET, BY PACKAGING TYPE, 2021–2028 (USD MILLION)

- TABLE 110 NORTH AMERICA: BARRIER FILMS MARKET, BY PACKAGING TYPE, 2021–2028 (KILOTON)

- TABLE 111 US: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 112 US: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 113 US: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 114 US: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 115 US: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 116 CANADA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 117 CANADA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 118 CANADA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 119 CANADA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 120 CANADA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 121 MEXICO: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 122 MEXICO: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 123 MEXICO: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 124 MEXICO: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 125 MEXICO: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 126 EUROPE: BARRIER FILMS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 127 EUROPE: BARRIER FILMS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 128 EUROPE: BARRIER FILMS MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 129 EUROPE: BARRIER FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 130 EUROPE: BARRIER FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 131 EUROPE: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 132 EUROPE: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 133 EUROPE: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 134 EUROPE: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 135 EUROPE: BARRIER FILMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 136 EUROPE: BARRIER FILMS MARKET, BY TYPE, 2021–2028 (KILOTON)

- TABLE 137 EUROPE: BARRIER FILMS MARKET, BY PACKAGING TYPE, 2021–2028 (USD MILLION)

- TABLE 138 EUROPE: BARRIER FILMS MARKET, BY PACKAGING TYPE, 2021–2028 (KILOTON)

- TABLE 139 GERMANY: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 140 GERMANY: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 141 GERMANY: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 142 GERMANY: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 143 GERMANY: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 144 FRANCE: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 145 FRANCE: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 146 FRANCE: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 147 FRANCE: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 148 FRANCE: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 149 UK: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 150 UK: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 151 UK: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 152 UK: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 153 UK: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 154 ITALY: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 155 ITALY: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 156 ITALY: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 157 ITALY: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 158 ITALY: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 159 RUSSIA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 160 RUSSIA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 161 RUSSIA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 162 RUSSIA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 163 RUSSIA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 164 TURKEY: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 165 TURKEY: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 166 TURKEY: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 167 TURKEY: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 168 TURKEY: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 169 REST OF EUROPE: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 170 REST OF EUROPE: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 171 REST OF EUROPE: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 172 REST OF EUROPE: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 173 REST OF EUROPE: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 174 SOUTH AMERICA: BARRIER FILMS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 175 SOUTH AMERICA: BARRIER FILMS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 176 SOUTH AMERICA: BARRIER FILMS MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 177 SOUTH AMERICA: BARRIER FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 178 SOUTH AMERICA: BARRIER FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 179 SOUTH AMERICA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 180 SOUTH AMERICA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 181 SOUTH AMERICA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 182 SOUTH AMERICA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 183 SOUTH AMERICA: BARRIER FILMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 184 SOUTH AMERICA: BARRIER FILMS MARKET, BY TYPE, 2021–2028 (KILOTON)

- TABLE 185 SOUTH AMERICA: BARRIER FILMS MARKET, BY PACKAGING TYPE, 2021–2028 (USD MILLION)

- TABLE 186 SOUTH AMERICA: BARRIER FILMS MARKET, BY PACKAGING TYPE, 2021–2028 (KILOTON)

- TABLE 187 BRAZIL: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 188 BRAZIL: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 189 BRAZIL: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 190 BRAZIL: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 191 BRAZIL: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 192 ARGENTINA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 193 ARGENTINA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 194 ARGENTINA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 195 ARGENTINA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 196 ARGENTINA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 197 REST OF SOUTH AMERICA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 198 REST OF SOUTH AMERICA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 199 REST OF SOUTH AMERICA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 200 REST OF SOUTH AMERICA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 201 REST OF SOUTH AMERICA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 202 MEA: BARRIER FILMS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 203 MEA: BARRIER FILMS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 204 MEA: BARRIER FILMS MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 205 MEA: BARRIER FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 206 MEA: BARRIER FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 207 MEA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 208 MEA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 209 MEA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 210 MEA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 211 MEA: BARRIER FILMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 212 MEA: BARRIER FILMS MARKET, BY TYPE, 2021–2028 (KILOTON)

- TABLE 213 MEA: BARRIER FILMS MARKET, BY PACKAGING TYPE, 2021–2028 (USD MILLION)

- TABLE 214 MEA: BARRIER FILMS MARKET, BY PACKAGING TYPE, 2021–2028 (KILOTON)

- TABLE 215 UAE: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 216 UAE: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 217 UAE: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 218 UAE: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 219 UAE: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 220 SAUDI ARABIA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 221 SAUDI ARABIA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 222 SAUDI ARABIA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 223 SAUDI ARABIA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 224 SAUDI ARABIA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 225 SOUTH AFRICA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 226 SOUTH AFRICA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 227 SOUTH AFRICA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 228 SOUTH AFRICA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 229 SOUTH AFRICA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 230 REST OF MEA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 231 REST OF MEA: BARRIER FILMS MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 232 REST OF MEA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 233 REST OF MEA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 234 REST OF MEA: BARRIER FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 235 STRATEGIC POSITIONING OF KEY PLAYERS

- TABLE 236 BARRIER FILMS MARKET: DETAILED LIST OF KEY PLAYERS

- TABLE 237 BARRIER FILMS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 238 BARRIER FILMS MARKET: PRODUCT LAUNCHES, 2019–2023

- TABLE 239 BARRIER FILMS MARKET: OTHERS, 2019–2023

- TABLE 240 BARRIER FILMS MARKET: DEALS, 2019–2023

- TABLE 241 BERRY GLOBAL, INC.: COMPANY OVERVIEW

- TABLE 242 BERRY GLOBAL, INC.: DEALS

- TABLE 243 BERRY GLOBAL, INC.: OTHERS

- TABLE 244 AMCOR PLC.: COMPANY OVERVIEW

- TABLE 245 AMCOR PLC.: DEALS

- TABLE 246 AMCOR PLC.: OTHERS

- TABLE 247 AMCOR PLC.: PRODUCT LAUNCHES

- TABLE 248 SEALED AIR CORPORATION: COMPANY OVERVIEW

- TABLE 249 SEALED AIR CORPORATION.: DEALS

- TABLE 250 SEALED AIR CORPORATION.: OTHERS

- TABLE 251 TOPPAN, INC. COMPANY OVERVIEW

- TABLE 252 TOPPAN, INC.: DEALS

- TABLE 253 TOPPAN, INC: OTHERS

- TABLE 254 TOPPAN, INC.: PRODUCT LAUNCHES

- TABLE 255 JINDAL POLY FILMS LTD.: COMPANY OVERVIEW

- TABLE 256 JINDAL POLY FILMS LTD.: DEALS

- TABLE 257 JINDAL POLY FILMS LTD.: OTHERS

- TABLE 258 POLYPLEX CORP. LTD.: COMPANY OVERVIEW

- TABLE 259 COSMO FIRST LTD.: COMPANY OVERVIEW

- TABLE 260 COSMO FIRST LTD.: OTHERS

- TABLE 261 COSMO FIRST LTD.: PRODUCT LAUNCHES

- TABLE 262 DUO PLAST AG.: COMPANY OVERVIEW

- TABLE 263 MONDI PLC: COMPANY OVERVIEW

- TABLE 264 MONDI PLC: DEALS

- TABLE 265 MONDI PLC: OTHERS

- TABLE 266 DUPONT TEIJIN FILMS: COMPANY OVERVIEW

- TABLE 267 DUPONT TEIJIN FILMS: OTHERS

- TABLE 268 DUPONT TEIJIN FILMS.: PRODUCT LAUNCHES

- TABLE 269 UFLEX LTD.: COMPANY OVERVIEW

- TABLE 270 UFLEX LTD.: DEALS

- TABLE 271 UFLEX LTD.: OTHERS

- TABLE 272 CONSTANTIA FLEXIBLES GROUP GMBH: COMPANY OVERVIEW

- TABLE 273 CONSTANTIA FLEXIBLES GROUP GMBH: DEALS

- TABLE 274 CONSTANTIA FLEXIBLES GROUP GMBH: OTHERS

- TABLE 275 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 276 TICINOPLAST SPA: COMPANY OVERVIEW

- TABLE 277 PLASTCHIM-T.: COMPANY OVERVIEW

- TABLE 278 POLYSACK FLEXIBLE PACKAGING LTD.: COMPANY OVERVIEW

- TABLE 279 CAMVAC LIMITED: COMPANY OVERVIEW

- TABLE 280 FUTAMURA CHEMICAL CO. LTD.: COMPANY OVERVIEW

- TABLE 281 POLIVOUGA - INDÚSTRIA DE PLÁSTICOS S.A.: COMPANY OVERVIEW

- TABLE 282 PROAMPAC HOLDINGS INC.: COMPANY OVERVIEW

- TABLE 283 DAIBOCHI PLASTIC AND PACKAGING INDUSTRY BHD.: COMPANY OVERVIEW

- TABLE 284 CHIRIPAL POLY FILMS.: COMPANY OVERVIEW

- TABLE 285 WINPAK LTD.: COMPANY OVERVIEW

- TABLE 286 PLASTISSIMO FILM COMPANY LIMITED.: COMPANY OVERVIEW

- TABLE 287 HONEYWELL INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 288 GLENROY INC.: COMPANY OVERVIEW

- TABLE 289 TORAY INDUSTRIES.: COMPANY OVERVIEW

- TABLE 290 AEGIS PACKAGING PTE. LTD.: COMPANY OVERVIEW

- TABLE 291 BOPP FILMS MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 292 BOPP FILMS MARKET, BY REGION, 2018–2025 (KILOTON)

- FIGURE 1 BARRIER FILMS MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 3 BARRIER FILMS MARKET: SUPPLY-SIDE APPROACH – 1

- FIGURE 4 BARRIER FILMS MARKET: SUPPLY-SIDE APPROACH – 2

- FIGURE 5 BARRIER FILMS MARKET: DEMAND-SIDE APPROACH – 1

- FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 8 BARRIER FILMS MARKET: DATA TRIANGULATION

- FIGURE 9 PE TO LEAD BARRIER FILMS MARKET DURING FORECAST PERIOD

- FIGURE 10 FOOD & BEVERAGE PACKAGING INDUSTRY TO LEAD BARRIER FILMS MARKET DURING FORECAST PERIOD

- FIGURE 11 APAC LED BARRIER FILMS MARKET IN 2022

- FIGURE 12 GROWING DEMAND FROM FOOD & BEVERAGE PACKAGING SECTOR TO DRIVE MARKET BETWEEN 2023 AND 2028

- FIGURE 13 CHINA AND FOOD & BEVERAGE PACKAGING SEGMENT ACCOUNTED FOR LARGEST SHARES

- FIGURE 14 PE TO BE LARGEST SEGMENT

- FIGURE 15 ASIA PACIFIC AND NORTH AMERICA TO WITNESS SIGNIFICANT GROWTH BETWEEN2023 AND 2028

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN BARRIER FILMS MARKET

- FIGURE 17 BARRIERS FILMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 BARRIER FILMS: VALUE CHAIN ANALYSIS

- FIGURE 19 COMPLIANCE TESTING OF FOOD PACKAGING MATERIALS

- FIGURE 20 BARRIER FILMS MARKET: REGISTERED PATENTS

- FIGURE 21 BARRIER FILMS MARKET: PATENT PUBLICATION TRENDS, 2015–2023

- FIGURE 22 BARRIER FILMS MARKET: JURISDICTION ANALYSIS

- FIGURE 23 BARRIER FILMS MARKET: TOP PATENT APPLICANTS

- FIGURE 24 BARRIER FILMS FUTURE REVENUE MIX

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 26 KEY BUYING CRITERIA OF BARRIER FILMS INDUSTRY

- FIGURE 27 AVERAGE PRICING ANALYSIS, BY REGION

- FIGURE 28 PE FILMS TO DOMINATE BARRIER FILMS MARKET, 2023–2028

- FIGURE 29 TRANSPARENT BARRIER FILMS TO WITNESS HIGHEST GROWTH RATE

- FIGURE 30 POUCHES SEGMENT TO DRIVE BARRIER FILMS MARKET FROM 2023 TO 2028

- FIGURE 31 FOOD & BEVERAGE PACKAGING TO BE LARGEST END-USE INDUSTRY OF BARRIER FILMS

- FIGURE 32 REGIONAL SNAPSHOT: INDIA TO BE FASTEST-GROWING BARRIER FILMS MARKET, 2023–2028

- FIGURE 33 APAC: BARRIER FILMS MARKET SNAPSHOT

- FIGURE 34 NORTH AMERICA: BARRIER FILMS MARKET SNAPSHOT

- FIGURE 35 EUROPE: BARRIER FILMS MARKET SNAPSHOT

- FIGURE 36 COMPANIES ADOPTED EXPANSION AS KEY GROWTH STRATEGY BETWEEN 2019 AND 2023

- FIGURE 37 RANKING OF KEY PLAYERS IN BARRIER FILMS MARKET, 2022

- FIGURE 38 TOP FIVE PLAYERS DOMINATED MARKET IN LAST FIVE YEARS

- FIGURE 39 COMPETITIVE LEADERSHIP MAPPING: BARRIER FILMS MARKET, 2022

- FIGURE 40 SME MATRIX: BARRIER FILMS MARKET, 2022

- FIGURE 41 BERRY GLOBAL, INC.: COMPANY SNAPSHOT

- FIGURE 42 AMCOR PLC.: COMPANY SNAPSHOT

- FIGURE 43 SEALED AIR CORPORATION: COMPANY SNAPSHOT

- FIGURE 44 TOPPAN, INC.: COMPANY SNAPSHOT

- FIGURE 45 JINDAL POLY FILMS LTD.: COMPANY SNAPSHOT

- FIGURE 46 POLYPLEX CORP. LTD.: COMPANY SNAPSHOT

- FIGURE 47 COSMO FIRST LTD.: COMPANY SNAPSHOT

- FIGURE 48 MONDI PLC: COMPANY SNAPSHOT

- FIGURE 49 UFLEX LTD.: COMPANY SNAPSHOT

- FIGURE 50 BAGS & POUCHES TO BE LARGEST SEGMENT OF BOPP FILMS MARKET

- FIGURE 51 15-30 MICRONS SEGMENT TO BE FASTEST-GROWING SEGMENT OF BOPP FILMS MARKET

- FIGURE 52 TENTER TO BE LARGER AND FASTER-GROWING SEGMENT OF BOPP FILMS MARKET

- FIGURE 53 FOOD TO BE LEADING APPLICATION SEGMENT OF BOPP FILMS MARKET

- FIGURE 54 ASIA PACIFIC DOMINATED BOPP FILMS MARKET IN 2019

- FIGURE 55 INDIA TO BE FASTEST-GROWING MARKET DURING 2020–2025

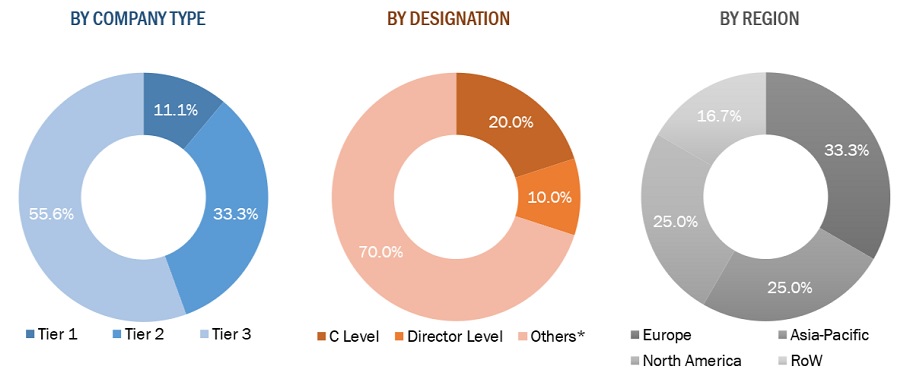

The study involved major activities in estimating the current size of the barrier films market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various sources, such as annual reports, press releases, investor presentations of companies, white papers, certified publications, articles from recognized authors, and databases, were considered for identifying and collecting information for this study. Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the monetary chain of the market, the total number of market players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, consultants, and related key executives from major companies and organizations operating in the market. Primary sources from the demand side include lab technicians, technologists, and sales/purchase managers in the industry. Following is the breakdown of primary respondents:

Note: Others include product engineers and product specialists.

The tier of the companies is defined on the basis of their total revenue; as of 2018: Tier 1 = > USD 1 billion, Tier 2 = From USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Alpha Olefins market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions has been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Alpha olefins Market Size: Bottom-up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Alpha Olefins Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

The Alpha Olefins market encompasses the utilization of continuous Alpha Olefins principles and technologies, including various types, applications across industries, and regional market dynamics. The alpha olefins market refers to the global marketplace for the group of chemical compounds known as alpha olefins. Alpha olefins are unsaturated hydrocarbons containing a double bond at the primary carbon atom, which is the carbon atom directly adjacent to the end of the carbon chain. These compounds are versatile and are used to manufacture a variety of products in industries, such as plastics, chemicals, lubricants, and surfactants.

Key Stakeholders

Objectives of the Study

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

Asia (China, Japan, South Korea, India, Singapore, and the Rest of Asia-Pacific), Europe (Germany, Italy, Belgium, France, Netherlands, Russia, and rest of Europe), North America (US, Canada, and Mexico), South America (Brazil, Venezuela, Argentina, Columbia, rest of South America), Middle East & Africa (Qatar, Saudi Arabia, UAE, Iran, rest of Middle East).

-

- Alpha Olefins Manufacturers

- End-Use Industries

- Distributors and Suppliers

- Research and Development (R&D) Organizations

- Consumers and Consumer Advocacy Groups

- To define, describe, segment, and forecast the Alpha olefins market size by technology, meter type, component, and application

- To provide detailed information on the major drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the Alpha olefins market

- To strategically analyze the Alpha olefins market with respect to individual growth trends, prospects, and contributions of each segment to the market

- To analyze market opportunities for stakeholders and provide a detailed competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to five main regions (along with countries), namely, North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To track and analyze competitive developments such as new product developments, contracts & agreements, investments & expansions, and mergers & acquisitions in the Alpha Olefins market

Growth opportunities and latent adjacency in Barrier Films Market