Bio-Based Foam Market by Raw Material (Corn, Sugarcane, Soy), Type, End-Use Industry (Building & Construction; Packaging; Automotive; Furniture & Bedding; and Footwear, Sports & Recreational), and Region - Global Forecast to 2027

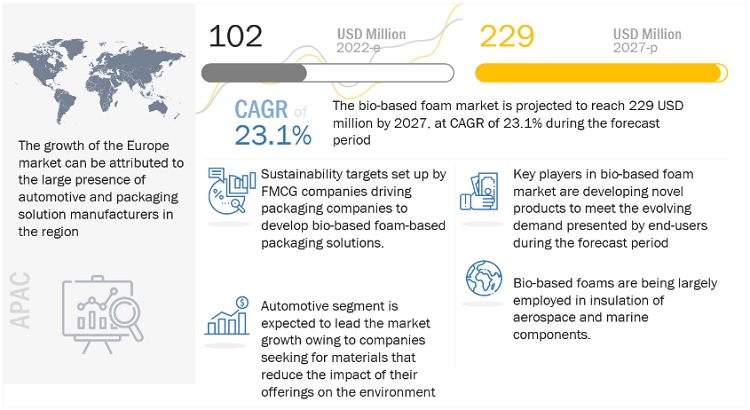

Bio-based foam market is projected to reach USD 229 million by 2027, at CAGR of 23.1%. The bio-based foam market has grown considerably in recent years and is expected to grow at a higher rate in the coming years. Key reason for increasing demand of bio-based foam is increasing adoption in automotive industry.

Attractive Opportunities in the Bio-Based Foam Market

To know about the assumptions considered for the study, Request for Free Sample Report

Bio-Based Foam Market Dynamics

Driver: Sustainability goals of product manufacturers persuading packaging companies to use eco-friendly products

Packaging companies are developing solutions using biomaterials, including bio-based foams to meet their sustainable goal. Many leading packaging companies are increasing the adoption of bio-based foam in their product manufacturing as they not only are sustainable but also have at-par performance with traditional foams manufactured from petroleum-based materials.

Restraint: Inconsistency and degradation of performance over time

As bio-based foams are manufactured from natural raw material such as soy-based, sugarcane based, among others which lead it to susceptible to degradation when exposed to air and moisture. Bio-based foam are not suitable for the applications wherein long life is required. Bio-based foam are used as an alternative to conventional foams in various applications including marine, defence, and aeronautics. However, their uptake is restricted by the inconsistent performance provided by these foams as compared to conventional alternatives.

Opportunity: FMCG companies developing novel products from bio-based foams

Many leading FMCG companies are using bio-based foam to improve their carbon footprint and reduce their impact on the environment. Footwear and bedding mattresses are two major products that have experienced a large shift in the use of bio-based foam as raw material. Some leading Footwear companies such as Kane Footwear are developing their products by using bio-based foam. Mattresses industries are developing new product by using bio-based foam, for example Natura, a mattresses manufacturing company has designed a bed mattress using palm oil-based polyols.

Challenges: Absence of standard testing procedures and fluctuating regulatory landscape

There is absence of proper testing standards for bio-based foam even though significant R&D activities. There is still a vast difference being observed in the testing standards for similar foam families. Due to this, an end-user gets are confused regarding the suitability of these foams for their product. Even though governments in various countries are trying to reduce their carbon footprint, stringent regulations against conventional foams are not enforced in many parts of the world, which creates a hurdle to the growth of the bio-based foams market.

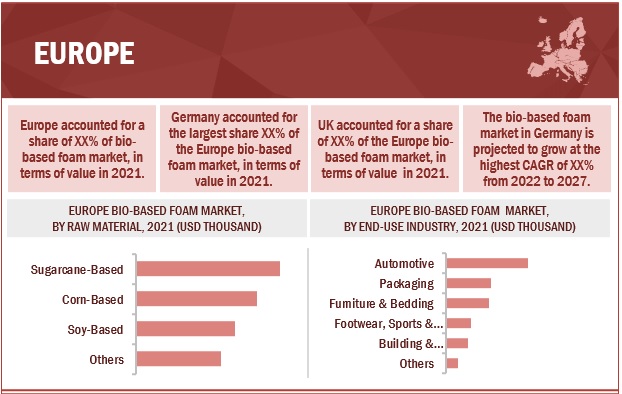

Based on raw material, the sugarcane-based segment is projected to grow at a significant CAGR during the forecast period.

The raw material segment of bio-based foam market covers soy-based, corn-based, sugarcane-based, and other material. Sugarcane-based bio-based foam are manufactured by various foam manufacturing companies. This type of foam is used in various end-use application majorly in the automotive industry.

Based on type, the flexible segment is expected to grow significantly during the forecast period

Flexible bio-based foam finds application in various end-use industry such as bedding & furniture, packaging and automotive. This type of foam is easy to mold and possess insulation and cushioning properties.

Based on end-use industry, the automotive segment is projected to grow at a significant CAGR during the forecast period

Bio-based foams are widely used in car interior such as rigid bio-based foam is used for headliners, suspension insulators, bumpers and other applications and flexible bio-based foam is used majorly for seat cushioning. As automotive sector is growing, the demand of bio-based foam is expected to increase in this end-use industry.

Europe region is projected to grow at a significant CAGR during the forecast period

By region, Europe is one of the fastest-growing markets of bio-based foam. There are various factors that has driven the market such as growing manufacturing industries and technological advancement. Increasing incomes and changing consumer spending are also contributing to the growth of this region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players in Bio-Based Foam Market

BASF SE (Germany), Huntsman Corporation (US), Cargill, Incorporated (US), Stora Enso (Finland), Braskem (US), Woodbridge Foam Corporation (Canada), Bewi Group (Sweden), INOAC Corporation (Japan), Trocellen GmBh (Germany), Sealed Air Corporation (US), RAMPF Group (Germany), Sinomax USA (US), DomFoam (Canada), Ecoglobal Manufacturing (US), and Nomaco (US) are among the key players leading the market through their innovative offerings, enhanced production capacities, and efficient distribution channels.

Bio-Based Foam Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2019,2020,2021,2022,2023,2024,2025,2026 and 2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022-2027 |

|

Forecast Units |

Value (USD Thousand/USD Million), Volume (Thousand Ton) |

|

Segments Covered |

By raw material, by type, by end-use industry and Region. |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

The major market players include BASF SE (Germany), Huntsman Corporation (US), Cargill, Incorporated (US), Stora Enso (Finland), Braskem (US), Woodbridge Foam Corporation (Canada), Bewi Group (Sweden), INOAC Corporation (Japan), Trocellen GmbH (Germany), Sealed Air Corporation (US), RAMPF Group (Germany), Sinomax USA (US), DomFoam (Canada), Ecoglobal Manufacturing (US), and Nomaco (US) |

This research report categorizes the bio-based foam Market based on raw material, type, end-use industry and region.

Based on type, the bio-based foam market has been segmented as follows:

- Soy-Based

- Corn-Based

- Sugarcane-Based

- Others

Based on type, the bio-based foam market has been segmented as follows:

- Rigid

- Flexible

Based on end-use industry, the bio-based foam market has been segmented as follows:

- Building & Construction

- Packaging

- Automotive

- Furniture & Bedding

- Footwear, Sports & Recreational

- Others

Based on regions, the bio-based foam market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments in Bio-Based Foam Market

- In February 2022, Huntsman Corporation has partnered with KEEN, Inc for the development of a line of shoes with plant-based soles.

- In February 2022, Sealed Air Corporation has acquired Foxpack Flexibles Limited.

- In September 2021, Cargill, Incorporated has entered into an agreement with Arkema to improve bio-based plasticizers and polyols.

Frequently Asked Questions (FAQ):

Which are the key companies operating in the bio-based foam market?

BASF SE (Germany), Huntsman Corporation (US), Cargill, Incorporated (US), Stora Enso (Finland), Braskem (US), Woodbridge Foam Corporation (Canada), Bewi Group (Sweden), INOAC Corporation (Japan), Trocellen GmBh (Germany), Sealed Air Corporation (US), RAMPF Group (Germany), Sinomax USA (US), DomFoam (Canada), Ecoglobal Manufacturing (US), and Nomaco (US) are some of the companies operating in the bio-based foam market.

What are the key strategies adopted by the market players?

The companies involved in the bio-based foam market have focused partnership, agreement, joint venture, expansion, divestment, and acquisitions as their key strategies to increase their geographical reach and business revenue.

How bio-based foam are classified?

Bio-based foam is classified based on raw material and type.

What are the major drivers of bio-based foam market?

Growth in food & beverage industry, increasing pharmaceutical R&D spending are some of the drivers of bio-based foam market.

What are the major raw materials used for manufacturing bio-based foam?

Generally, soy-based, corn-based, sugarcane-based material are used for manufacturing of bio-based foam. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 BIO-BASED FOAM MARKET, BY END-USE INDUSTRY: INCLUSIONS & EXCLUSIONS

TABLE 2 BIO-BASED FOAM MARKET, BY RAW MATERIAL: INCLUSIONS & EXCLUSIONS

TABLE 3 BIO-BASED FOAM MARKET, BY TYPE: INCLUSIONS & EXCLUSIONS

TABLE 4 BIO-BASED FOAM MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKET SEGMENTATION

FIGURE 1 BIO-BASED FOAM MARKET SEGMENTATION

1.4.2 REGIONS COVERED

1.4.3 YEARS CONSIDERED

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 BIO-BASED FOAM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

2.1.2.4 List of participating companies for primary research

2.2 BASE NUMBER CALCULATION

2.2.1 SUPPLY-SIDE APPROACH 1

2.2.2 SUPPLY-SIDE APPROACH 2

2.2.3 DEMAND-SIDE APPROACH

2.3 MARKET SIZE ESTIMATION

FIGURE 4 BOTTOM-UP APPROACH

FIGURE 5 TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 6 BIO-BASED FOAM MARKET: DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

2.6 LIMITATIONS & RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 7 AUTOMOTIVE TO BE LEADING END-USE INDUSTRY FOR BIO-BASED FOAMS

FIGURE 8 BIO-BASED FOAMS SOURCED FROM SUGARCANE TO LEAD OVERALL MARKET

FIGURE 9 FLEXIBLE FOAMS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE

FIGURE 10 EUROPE TO WITNESS HIGHEST CAGR IN BIO-BASED FOAM MARKET

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BIO-BASED FOAM MARKET

FIGURE 11 SUSTAINABILITY TARGETS OF LARGE CONGLOMERATES TO DRIVE MARKET

4.2 BIO-BASED FOAM MARKET, BY REGION

FIGURE 12 EUROPE TO BE LARGEST MARKET BETWEEN 2022 AND 2027

4.3 EUROPE BIO-BASED FOAM MARKET, BY COUNTRY AND END-USE INDUSTRY (2021)

FIGURE 13 GERMANY ACCOUNTED FOR LARGEST SHARE IN EUROPE

4.4 BIO-BASED FOAM MARKET: BY MAJOR COUNTRIES

FIGURE 14 GERMANY TO BE FASTEST-GROWING MARKET

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN BIO-BASED FOAM MARKET

5.2.1 DRIVERS

5.2.1.1 Sustainability goals of product manufacturers persuading packaging companies to use eco-friendly products

5.2.1.2 Easy degradability of bio-based foams of end-of-life vehicles

5.2.2 RESTRAINTS

5.2.2.1 Availability of low-cost alternatives

5.2.2.2 Inconsistency and degradation of performance over time

5.2.3 OPPORTUNITIES

5.2.3.1 FMCG companies developing novel products from bio-based foams

5.2.3.2 Development of novel bio-based foam for aeronautical and marine sectors

5.2.4 CHALLENGES

5.2.4.1 Absence of standard testing procedures and transitioning regulatory landscape

5.2.4.2 Low degradability of certain bio-based foams

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 16 BIO-BASED FOAM MARKET: PORTER'S FIVE FORCES ANALYSIS

TABLE 5 PORTER'S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

6 INDUSTRY TRENDS (Page No. - 59)

6.1 PATENT ANALYSIS

6.1.1 METHODOLOGY

6.1.2 PATENT PUBLICATION TRENDS

FIGURE 17 NUMBER OF PATENTS, 20122022

6.1.3 INSIGHTS

6.1.4 JURISDICTION ANALYSIS

FIGURE 18 CHINA ACCOUNTED FOR HIGHEST NUMBER OF PATENTS

6.1.5 TOP COMPANIES/APPLICANTS

FIGURE 19 TOP TEN COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

6.1.5.1 LIST OF MAJOR PATENTS

6.2 KEY CONFERENCES & EVENTS, 20222023

TABLE 6 BIO-BASED FOAM MARKET: LIST OF CONFERENCES & EVENTS

6.3 TECHNOLOGY ANALYSIS

6.3.1 BIO-BASED FOAM TECHNOLOGY THAT SHOWS 90% DEGRADATION

6.3.2 ALGAE-BASED PU FOAM TECHNOLOGY

6.4 CASE STUDY ANALYSIS

6.4.1 BIO-BASED PU FOAM FROM FOOD WASTE-DERIVED LIPID

6.4.1.1 Objective

6.4.1.2 Solution statement

6.4.2 SOY-BASED FOAM FOR AUTOMOTIVE INDUSTRY

6.4.2.1 Objective

6.4.2.2 Solution statement

6.5 REGULATORY LANDSCAPE

6.5.1 STANDARDS RELATED TO BIO-BASED FOAM

6.5.2 GLOBAL REGULATIONS

6.6 BIO-BASED FOAM MARKET: ECOSYSTEM

FIGURE 20 ECOSYSTEM MAPPING: BIO-BASED FOAM MARKET

TABLE 7 BIO-BASED FOAM MARKET: ECOSYSTEM

6.7 VALUE CHAIN ANALYSIS

FIGURE 21 BIO-BASED FOAM MARKET: VALUE CHAIN ANALYSIS

6.8 IMPACT OF TRENDS/DISRUPTIONS

FIGURE 22 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR BIO-BASED FOAM MARKET

7 BIO-BASED FOAM MARKET, BY RAW MATERIAL (Page No. - 70)

7.1 INTRODUCTION

FIGURE 23 BIO-BASED FOAM MARKET, BY RAW MATERIAL, 2022 & 2027 (USD THOUSAND)

TABLE 8 BIO-BASED FOAM MARKET, BY RAW MATERIAL, 20192021 (USD THOUSAND)

TABLE 9 BIO-BASED FOAM MARKET, BY RAW MATERIAL, 20222027 (USD THOUSAND)

7.2 SOY-BASED

7.2.1 SOY-BASED FOAMS PREFERRED IN MANY APPLICATIONS

TABLE 10 SOY-BASED FOAM MARKET, BY REGION, 20192021 (USD THOUSAND)

TABLE 11 SOY-BASED FOAM MARKET, BY REGION, 20222027 (USD THOUSAND)

7.3 CORN-BASED

7.3.1 CORN-BASED FOAMS OFFER EASY DISPOSABILITY

TABLE 12 CORN-BASED FOAM MARKET, BY REGION, 20192021 (USD THOUSAND)

TABLE 13 CORN-BASED FOAM MARKET, BY REGION, 20222027 (USD THOUSAND)

7.4 SUGARCANE-BASED

7.4.1 SUGARCANE-BASED FOAMS USED AS ALTERNATIVE TO EVA FOAM

TABLE 14 SUGARCANE-BASED FOAM MARKET, BY REGION, 20192021 (USD THOUSAND)

TABLE 15 SUGARCANE-BASED FOAM MARKET, BY REGION, 20222027 (USD THOUSAND)

7.5 OTHERS

TABLE 16 OTHER BIO-BASED RAW MATERIAL FOAM MARKET, BY REGION, 20192021 (USD THOUSAND)

TABLE 17 OTHER BIO-BASED RAW MATERIAL FOAM MARKET, BY REGION, 20222027 (USD THOUSAND)

8 BIO-BASED FOAM MARKET, BY TYPE (Page No. - 76)

8.1 INTRODUCTION

FIGURE 24 BIO-BASED FOAM MARKET, BY TYPE, 2022 & 2027 (KILOTON)

TABLE 18 BIO-BASED FOAM MARKET, BY TYPE, 20192021 (KILOTON)

TABLE 19 BIO-BASED FOAM MARKET, BY TYPE, 20222027 (KILOTON)

8.2 RIGID

8.2.1 RIGID BIO-FOAM WIDELY USED IN BUILDING & CONSTRUCTION APPLICATION

TABLE 20 RIGID BIO-BASED FOAM MARKET, BY REGION, 20192021 (KILOTON)

TABLE 21 RIGID BIO-BASED FOAM MARKET, BY REGION, 20222027 (KILOTON)

8.3 FLEXIBLE

8.3.1 FLEXIBLE BIO-FOAM WITNESSING SIGNIFICANT DEMAND IN VARIOUS APPLICATIONS

TABLE 22 FLEXIBLE BIO-BASED FOAM MARKET, BY REGION, 20192021 (KILOTON)

TABLE 23 FLEXIBLE BIO-BASED FOAM MARKET, BY REGION, 20222027 (KILOTON)

9 BIO-BASED FOAM MARKET, BY END-USE INDUSTRY (Page No. - 80)

9.1 INTRODUCTION

FIGURE 25 BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 2022 & 2027 (USD THOUSAND)

TABLE 24 BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (USD THOUSAND)

TABLE 25 BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (USD THOUSAND)

TABLE 26 BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (KILOTON)

TABLE 27 BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

9.2 BUILDING & CONSTRUCTION

9.2.1 DEMAND FOR BIO-BASED FOAMS INCREASING IN BUILDING & CONSTRUCTION INDUSTRY

TABLE 28 BIO-BASED FOAM MARKET IN BUILDING & CONSTRUCTION, BY REGION, 20192021 (USD THOUSAND)

TABLE 29 BIO-BASED FOAM MARKET IN BUILDING & CONSTRUCTION, BY REGION, 20222027 (USD THOUSAND)

TABLE 30 BIO-BASED FOAM MARKET IN BUILDING & CONSTRUCTION, BY REGION, 20192021 (KILOTON)

TABLE 31 BIO-BASED FOAM MARKET IN BUILDING & CONSTRUCTION, BY REGION, 20222027 (KILOTON)

9.3 PACKAGING

9.3.1 MANY INDUSTRIES SHIFTING TO BIO-BASED PACKAGING

TABLE 32 BIO-BASED FOAM MARKET IN PACKAGING, BY REGION, 20192021 (USD THOUSAND)

TABLE 33 BIO-BASED FOAM MARKET IN PACKAGING, BY REGION, 20222027 (USD THOUSAND)

TABLE 34 BIO-BASED FOAM MARKET IN PACKAGING, BY REGION, 20192021 (KILOTON)

TABLE 35 BIO-BASED FOAM MARKET IN PACKAGING, BY REGION, 20222027 (KILOTON)

9.4 AUTOMOTIVE

9.4.1 AUTOMOTIVE INDUSTRY TO BE LARGEST CONSUMER OF BIO-BASED FOAMS

TABLE 36 BIO-BASED FOAM MARKET IN AUTOMOTIVE, BY REGION, 20192021 (USD THOUSAND)

TABLE 37 BIO-BASED FOAM MARKET IN AUTOMOTIVE, BY REGION, 20222027 (USD THOUSAND)

TABLE 38 BIO-BASED FOAM MARKET IN AUTOMOTIVE, BY REGION, 20192021 (KILOTON)

TABLE 39 BIO-BASED FOAM MARKET IN AUTOMOTIVE, BY REGION, 20222027 (KILOTON)

9.5 FURNITURE & BEDDING

9.5.1 FLEXIBLE BIO-BASED FOAMS USED IN FURNITURE & BEDDING

TABLE 40 BIO-BASED FOAM MARKET IN FURNITURE & BEDDING, BY REGION, 20192021 (USD THOUSAND)

TABLE 41 BIO-BASED FOAM MARKET IN FURNITURE & BEDDING, BY REGION, 20222027 (USD THOUSAND)

TABLE 42 BIO-BASED FOAM MARKET IN FURNITURE & BEDDING, BY REGION, 20192021 (KILOTON)

TABLE 43 BIO-BASED FOAM MARKET IN FURNITURE & BEDDING, BY REGION, 20222027 (KILOTON)

9.6 FOOTWEAR, SPORTS & RECREATIONAL

9.6.1 LEADING SPORTS MANUFACTURERS INCREASINGLY ADOPTING BIO-BASED FOAMS

TABLE 44 BIO-BASED FOAM MARKET IN FOOTWEAR, SPORTS & RECREATIONAL, BY REGION, 20192021 (USD THOUSAND)

TABLE 45 BIO-BASED FOAM MARKET IN FOOTWEAR, SPORTS & RECREATIONAL, BY REGION, 20222027 (USD THOUSAND)

TABLE 46 BIO-BASED FOAM MARKET IN FOOTWEAR, SPORTS & RECREATIONAL, BY REGION, 20192021 (KILOTON)

TABLE 47 BIO-BASED FOAM MARKET IN FOOTWEAR, SPORTS & RECREATIONAL, BY REGION, 20222027 (KILOTON)

9.7 OTHERS

TABLE 48 BIO-BASED FOAM MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 20192021 (USD THOUSAND)

TABLE 49 BIO-BASED FOAM MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 20222027 (USD THOUSAND)

TABLE 50 BIO-BASED FOAM MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 20192021 (KILOTON)

TABLE 51 BIO-BASED FOAM MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 20222027 (KILOTON)

10 BIO-BASED FOAM MARKET, BY REGION (Page No. - 93)

10.1 INTRODUCTION

FIGURE 26 GERMANY, US, AND UK EMERGING AS NEW HOTSPOTS IN BIO-BASED FOAM MARKET

TABLE 52 BIO-BASED FOAM MARKET, BY REGION, 20192021 (USD THOUSAND)

TABLE 53 BIO-BASED FOAM MARKET, BY REGION, 20222027 (USD THOUSAND)

TABLE 54 BIO-BASED FOAM MARKET, BY REGION, 20192021 (KILOTON)

TABLE 55 BIO-BASED FOAM MARKET, BY REGION, 20222027 (KILOTON)

10.2 NORTH AMERICA

FIGURE 27 NORTH AMERICA: BIO-BASED FOAM MARKET SNAPSHOT

TABLE 56 NORTH AMERICA: BIO-BASED FOAM MARKET, BY COUNTRY, 20192021 (USD THOUSAND)

TABLE 57 NORTH AMERICA: BIO-BASED FOAM MARKET, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 58 NORTH AMERICA: BIO-BASED FOAM MARKET, BY COUNTRY, 20192021 (KILOTON)

TABLE 59 NORTH AMERICA: BIO-BASED FOAM MARKET, BY COUNTRY, 20222027 (KILOTON)

TABLE 60 NORTH AMERICA: BIO-BASED FOAM MARKET, BY RAW MATERIAL, 20192021 (USD THOUSAND)

TABLE 61 NORTH AMERICA: BIO-BASED FOAM MARKET, BY RAW MATERIAL, 20222027 (USD THOUSAND)

TABLE 62 NORTH AMERICA: BIO-BASED FOAM MARKET, BY TYPE, 20192021 (KILOTON)

TABLE 63 NORTH AMERICA: BIO-BASED FOAM MARKET, BY TYPE, 20222027 (KILOTON)

TABLE 64 NORTH AMERICA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (USD THOUSAND)

TABLE 65 NORTH AMERICA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (USD THOUSAND)

TABLE 66 NORTH AMERICA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (KILOTON)

TABLE 67 NORTH AMERICA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

10.2.1 US

10.2.1.1 Growth of packaging industry to boost demand for bio-based foam

TABLE 68 US: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (USD THOUSAND)

TABLE 69 US: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (USD THOUSAND)

TABLE 70 US: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (KILOTON)

TABLE 71 US: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

10.2.2 CANADA

10.2.2.1 Growth in automotive industry to fuel market for bio-based foam

TABLE 72 CANADA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (USD THOUSAND)

TABLE 73 CANADA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (USD THOUSAND)

TABLE 74 CANADA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (KILOTON)

TABLE 75 CANADA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

10.2.3 MEXICO

10.2.3.1 Bio-based foam market to witness significant growth in Mexico

TABLE 76 MEXICO: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (USD THOUSAND)

TABLE 77 MEXICO: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (USD THOUSAND)

TABLE 78 MEXICO: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (KILOTON)

TABLE 79 MEXICO: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

10.3 EUROPE

FIGURE 28 EUROPE: BIO-BASED FOAM MARKET SNAPSHOT

TABLE 80 EUROPE: BIO-BASED FOAM MARKET, BY COUNTRY, 20192021 (USD THOUSAND)

TABLE 81 EUROPE: BIO-BASED FOAM MARKET, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 82 EUROPE: BIO-BASED FOAM MARKET, BY COUNTRY, 20192021 (KILOTON)

TABLE 83 EUROPE: BIO-BASED FOAM MARKET, BY COUNTRY, 20222027 (KILOTON)

TABLE 84 EUROPE: BIO-BASED FOAM MARKET, BY RAW MATERIAL, 20192021 (USD THOUSAND)

TABLE 85 EUROPE: BIO-BASED FOAM MARKET, BY RAW MATERIAL, 20222027 (USD THOUSAND)

TABLE 86 EUROPE: BIO-BASED FOAM MARKET, BY TYPE, 20192021 (KILOTON)

TABLE 87 EUROPE: BIO-BASED FOAM MARKET, BY TYPE, 20222027 (KILOTON)

TABLE 88 EUROPE: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (USD THOUSAND)

TABLE 89 EUROPE: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (USD THOUSAND)

TABLE 90 EUROPE: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (KILOTON)

TABLE 91 EUROPE: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

10.3.1 GERMANY

10.3.1.1 R&D initiatives to boost bio-based foam market in Germany

TABLE 92 GERMANY: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (USD THOUSAND)

TABLE 93 GERMANY: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (USD THOUSAND)

TABLE 94 GERMANY: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (KILOTON)

TABLE 95 GERMANY: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

10.3.2 UK

10.3.2.1 Consumer inclination towards bio-based foam products increasing in UK

TABLE 96 UK: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (USD THOUSAND)

TABLE 97 UK: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (USD THOUSAND)

TABLE 98 UK: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (KILOTON)

TABLE 99 UK: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

10.3.3 FRANCE

10.3.3.1 Building & construction industry to boost bio-based foam market

TABLE 100 FRANCE: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (USD THOUSAND)

TABLE 101 FRANCE: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (USD THOUSAND)

TABLE 102 FRANCE: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (KILOTON)

TABLE 103 FRANCE: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

10.3.4 ITALY

10.3.4.1 Automobile industry to fuel demand for bio-based foam

TABLE 104 ITALY: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (USD THOUSAND)

TABLE 105 ITALY: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (USD THOUSAND)

TABLE 106 ITALY: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (KILOTON)

TABLE 107 ITALY: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

10.3.5 RUSSIA

10.3.5.1 Construction industry to drive demand for bio-based foam

TABLE 108 RUSSIA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (USD THOUSAND)

TABLE 109 RUSSIA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (USD THOUSAND)

TABLE 110 RUSSIA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (KILOTON)

TABLE 111 RUSSIA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

10.3.6 SPAIN

10.3.6.1 Automotive industry to fuel consumption of bio-based foams

TABLE 112 SPAIN: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (USD THOUSAND)

TABLE 113 SPAIN: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (USD THOUSAND)

TABLE 114 SPAIN: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (KILOTON)

TABLE 115 SPAIN: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

10.3.7 REST OF EUROPE

TABLE 116 REST OF EUROPE: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (USD THOUSAND)

TABLE 117 REST OF EUROPE: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (USD THOUSAND)

TABLE 118 REST OF EUROPE: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (KILOTON)

TABLE 119 REST OF EUROPE: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

10.4 ASIA PACIFIC

FIGURE 29 ASIA PACIFIC: BIO-BASED FOAM MARKET SNAPSHOT

TABLE 120 ASIA PACIFIC: BIO-BASED FOAM MARKET, BY COUNTRY, 20192021 (USD THOUSAND)

TABLE 121 ASIA PACIFIC: BIO-BASED FOAM MARKET, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 122 ASIA PACIFIC: BIO-BASED FOAM MARKET, BY COUNTRY, 20192021 (KILOTON)

TABLE 123 ASIA PACIFIC: BIO-BASED FOAM MARKET, BY COUNTRY, 20222027 (KILOTON)

TABLE 124 ASIA PACIFIC: BIO-BASED FOAM MARKET, BY RAW MATERIAL, 20192021 (USD THOUSAND)

TABLE 125 ASIA PACIFIC: BIO-BASED FOAM MARKET, BY RAW MATERIAL, 20222027 (USD THOUSAND)

TABLE 126 ASIA PACIFIC: BIO-BASED FOAM MARKET, BY TYPE, 20192021 (KILOTON)

TABLE 127 ASIA PACIFIC: BIO-BASED FOAM MARKET, BY TYPE, 20222027 (KILOTON)

TABLE 128 ASIA PACIFIC: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (USD THOUSAND)

TABLE 129 ASIA PACIFIC: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (USD THOUSAND)

TABLE 130 ASIA PACIFIC: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (KILOTON)

TABLE 131 ASIA PACIFIC: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

10.4.1 CHINA

10.4.1.1 Automotive sector to boost demand for bio-based foam

TABLE 132 CHINA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (USD THOUSAND)

TABLE 133 CHINA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (USD THOUSAND)

TABLE 134 CHINA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (KILOTON)

TABLE 135 CHINA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

10.4.2 SOUTH KOREA

10.4.2.1 Many leading manufacturers increasingly adopting bio-based foam

TABLE 136 SOUTH KOREA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (USD THOUSAND)

TABLE 137 SOUTH KOREA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (USD THOUSAND)

TABLE 138 SOUTH KOREA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (KILOTON)

TABLE 139 SOUTH KOREA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

10.4.3 JAPAN

10.4.3.1 Sustainable packaging increasingly becoming popular in Japan

TABLE 140 JAPAN: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (USD THOUSAND)

TABLE 141 JAPAN: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (USD THOUSAND)

TABLE 142 JAPAN: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (KILOTON)

TABLE 143 JAPAN: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

10.4.4 INDIA

10.4.4.1 Demand for bio-based foam to increase in building & construction industry

TABLE 144 INDIA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (USD THOUSAND)

TABLE 145 INDIA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (USD THOUSAND)

TABLE 146 INDIA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (KILOTON)

TABLE 147 INDIA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

10.4.5 THAILAND

10.4.5.1 Demand for bio-based foam to increase in automotive sector

TABLE 148 THAILAND: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (USD THOUSAND)

TABLE 149 THAILAND: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (USD THOUSAND)

TABLE 150 THAILAND: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (KILOTON)

TABLE 151 THAILAND: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

10.4.6 MALAYSIA

10.4.6.1 Growth of bedding & furniture industry to drive bio-based foam market

TABLE 152 MALAYSIA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (USD THOUSAND)

TABLE 153 MALAYSIA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (USD THOUSAND)

TABLE 154 MALAYSIA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (KILOTON)

TABLE 155 MALAYSIA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

10.4.7 REST OF ASIA PACIFIC

TABLE 156 REST OF ASIA PACIFIC: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (USD THOUSAND)

TABLE 157 REST OF ASIA PACIFIC: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (USD THOUSAND)

TABLE 158 REST OF ASIA PACIFIC: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (KILOTON)

TABLE 159 REST OF ASIA PACIFIC: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

10.5 MIDDLE EAST & AFRICA

TABLE 160 MIDDLE EAST & AFRICA: BIO-BASED FOAM MARKET, BY COUNTRY, 20192021 (USD THOUSAND)

TABLE 161 MIDDLE EAST & AFRICA: BIO-BASED FOAM MARKET, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 162 MIDDLE EAST & AFRICA: BIO-BASED FOAM MARKET, BY COUNTRY, 20192021 (KILOTON)

TABLE 163 MIDDLE EAST & AFRICA: BIO-BASED FOAM MARKET, BY COUNTRY, 20222027 (KILOTON)

TABLE 164 MIDDLE EAST & AFRICA: BIO-BASED FOAM MARKET, BY RAW MATERIAL, 20192021 (USD THOUSAND)

TABLE 165 MIDDLE EAST & AFRICA: BIO-BASED FOAM MARKET, BY RAW MATERIAL, 20222027 (USD THOUSAND)

TABLE 166 MIDDLE EAST & AFRICA: BIO-BASED FOAM MARKET, BY TYPE, 20192021 (KILOTON)

TABLE 167 MIDDLE EAST & AFRICA: BIO-BASED FOAM MARKET, BY TYPE, 20222027 (KILOTON)

TABLE 168 MIDDLE EAST & AFRICA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (USD THOUSAND)

TABLE 169 MIDDLE EAST & AFRICA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (USD THOUSAND)

TABLE 170 MIDDLE EAST & AFRICA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (KILOTON)

TABLE 171 MIDDLE EAST & AFRICA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

10.6 SOUTH AMERICA

TABLE 172 SOUTH AMERICA: BIO-BASED FOAM MARKET, BY COUNTRY, 20192021 (USD THOUSAND)

TABLE 173 SOUTH AMERICA: BIO-BASED FOAM MARKET, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 174 SOUTH AMERICA: BIO-BASED FOAM MARKET, BY COUNTRY, 20192021 (KILOTON)

TABLE 175 SOUTH AMERICA: BIO-BASED FOAM MARKET, BY COUNTRY, 20222027 (KILOTON)

TABLE 176 SOUTH AMERICA: BIO-BASED FOAM MARKET, BY RAW MATERIAL, 20192021 (USD THOUSAND)

TABLE 177 SOUTH AMERICA: BIO-BASED FOAM MARKET, BY RAW MATERIAL, 20222027 (USD THOUSAND)

TABLE 178 SOUTH AMERICA: BIO-BASED FOAM MARKET, BY TYPE, 20192021 (KILOTON)

TABLE 179 SOUTH AMERICA: BIO-BASED FOAM MARKET, BY TYPE, 20222027 (KILOTON)

TABLE 180 SOUTH AMERICA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (USD THOUSAND)

TABLE 181 SOUTH AMERICA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 (USD THOUSAND)

TABLE 182 SOUTH AMERICA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20192021 (KILOTON)

TABLE 183 SOUTH AMERICA: BIO-BASED FOAM MARKET, BY END-USE INDUSTRY, 20222027 ( KILOTON)

11 COMPETITIVE LANDSCAPE (Page No. - 146)

11.1 OVERVIEW

11.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 184 OVERVIEW OF STRATEGIES ADOPTED BY KEY BIO-BASED FOAM MANUFACTURERS

11.3 MARKET SHARE ANALYSIS

11.3.1 RANKING OF KEY MARKET PLAYERS, 2021

11.3.2 BASF SE

11.3.3 HUNTSMAN CORPORATION

11.3.4 CARGILL, INCORPORATED

11.3.5 BRASKEM

11.3.6 STORA ENSO

11.4 REVENUE ANALYSIS OF TOP THREE PLAYERS

FIGURE 30 REVENUE ANALYSIS OF KEY COMPANIES (20172021)

11.5 COMPETITIVE BENCHMARKING

11.5.1 COMPANY OVERALL FOOTPRINT

11.5.2 COMPANY PRODUCT TYPE FOOTPRINT

11.5.3 COMPANY END-USE INDUSTRY FOOTPRINT

11.5.4 COMPANY REGION FOOTPRINT

11.6 COMPANY EVALUATION QUADRANT (TIER 1)

11.6.1 STARS

11.6.2 EMERGING LEADERS

11.6.3 PARTICIPANTS

11.6.4 PERVASIVE PLAYERS

11.7 START-UP/SMES (SMALL AND MEDIUM-SIZED ENTERPRISES) EVALUATION QUADRANT

TABLE 185 BIO-BASED FOAM MARKET: DETAILED LIST OF KEY START-UP/SMES

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 STARTING BLOCKS

11.7.4 DYNAMIC COMPANIES

11.8 COMPETITIVE SITUATION AND TRENDS

11.8.1 DEALS

TABLE 186 BIO-BASED FOAM MARKET: DEALS (20182022)

11.8.2 OTHER DEVELOPMENTS

TABLE 187 BIO-BASED FOAM MARKET: EXPANSIONS, INVESTMENTS, AND INNOVATIONS (20182022)

12 COMPANY PROFILES (Page No. - 162)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)*

12.1 HUNTSMAN CORPORATION

TABLE 188 HUNTSMAN CORPORATION: COMPANY OVERVIEW

FIGURE 31 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

TABLE 189 HUNTSMAN CORPORATION: DEALS

12.2 BASF SE

TABLE 190 BASF SE: COMPANY OVERVIEW

FIGURE 32 BASF SE: COMPANY SNAPSHOT

TABLE 191 BASF SE: DEALS

12.3 WOODBRIDGE FOAM CORPORATION

TABLE 192 WOODBRIDGE FOAM CORPORATION: COMPANY OVERVIEW

TABLE 193 WOODBRIDGE FOAM CORPORATION: DEALS

TABLE 194 WOODBRIDGE FOAM CORPORATION: OTHERS

12.4 SEALED AIR CORPORATION

TABLE 195 SEALED AIR CORPORATION: COMPANY OVERVIEW

FIGURE 33 SEALED AIR CORPORATION: COMPANY SNAPSHOT

TABLE 196 SEALED AIR: DEALS

12.5 CARGILL, INCORPORATED

TABLE 197 CARGILL, INCORPORATED: COMPANY OVERVIEW

TABLE 198 CARGILL, INCORPORATED: DEALS

12.6 INOAC CORPORATION

TABLE 199 INOAC CORPORATION: COMPANY OVERVIEW

TABLE 200 INOAC CORPORATION: DEALS

12.7 BEWI GROUP

TABLE 201 BEWI GROUP: COMPANY OVERVIEW

FIGURE 34 BEWI GROUP: COMPANY SNAPSHOT

12.8 TROCELLEN GMBH

TABLE 202 TROCELLEN GMBH: COMPANY OVERVIEW

12.9 RAMPF GROUP

TABLE 203 RAMPF GROUP: COMPANY OVERVIEW

12.10 MCPU POLYMER ENGINEERING LLC

TABLE 204 MCPU POLYMER ENGINEERING LLC: COMPANY OVERVIEW

12.11 SINOMAX USA

TABLE 205 SINOMAX USA: COMPANY OVERVIEW

12.12 NAM LIONG GLOBAL CORPORATION

TABLE 206 NAM LIONG GLOBAL CORPORATION: COMPANY OVERVIEW

12.13 AMERISLEEP

TABLE 207 AMERISLEEP: COMPANY OVERVIEW

12.14 OSKAR PAHLKE GMBH

TABLE 208 OSKAR PAHLKE GMBH: COMPANY OVERVIEW

12.15 HWA CHING INDUSTRY

TABLE 209 HWA CHING INDUSTRY: COMPANY OVERVIEW

12.16 NOMACO

TABLE 210 NOMACO: COMPANY OVERVIEW

12.17 STORA ENSO

TABLE 211 STORA ENSO: COMPANY OVERVIEW

FIGURE 35 STORA ENSO: COMPANY SNAPSHOT

TABLE 212 STORA ENSO: DEALS

12.18 ECO GLOBAL MANUFACTURING

TABLE 213 ECO GLOBAL MANUFACTURING: COMPANY OVERVIEW

12.19 KODIAK INDUSTRIES

TABLE 214 KODIAK INDUSTRIES: COMPANY OVERVIEW

12.2 KTM INDUSTRIES

TABLE 215 KTM INDUSTRIES: COMPANY OVERVIEW

12.21 ALGENESIS MATERIALS

TABLE 216 ALGENESIS MATERIALS: COMPANY OVERVIEW

12.22 DOMFOAM

TABLE 217 DOM FOAM: COMPANY OVERVIEW

12.23 BRASKEM

TABLE 218 BRASKEM: COMPANY OVERVIEW

12.24 EVA GLORY

TABLE 219 EVA GLORY: COMPANY OVERVIEW

12.25 FOAMINDO INDUSTRI URETAN

TABLE 220 FOAMINDO INDUSTRI URETAN: COMPANY OVERVIEW

12.26 INTERPLASP

TABLE 221 INTERPLASP: COMPANY OVERVIEW

12.27 BIOPOLYMER NETWORK

TABLE 222 BIOPOLYMER NETWORK: COMPANY OVERVIEW

12.28 IPL PACKAGING

TABLE 223 IPL PACKAGING: COMPANY OVERVIEW

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)* might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 201)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

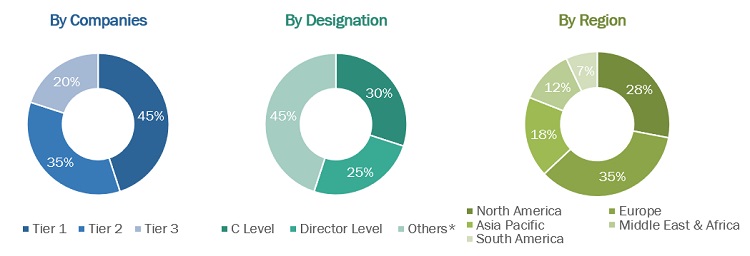

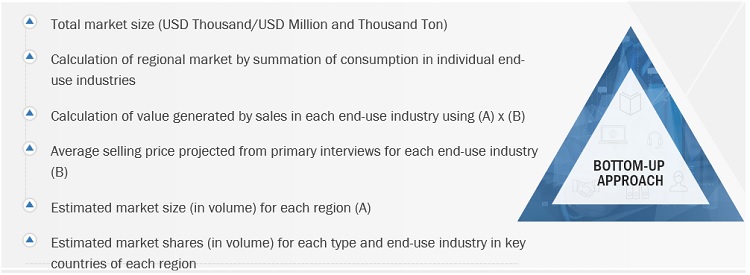

The study involved four major activities in estimating the current size of the bio-based foam market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the bio-based foam value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Bio-Based Foam Market Secondary Research

Secondary sources referred to for this study include Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet, were referred for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases. Secondary data has been collected and analysed to arrive at the overall market size, which is further validated by primary research.

Bio-Based Foam Market Primary Research

The bio-based foam market comprises several stakeholders, such as government & research organization, association & industrial bodies, raw material suppliers & distributors, polyol manufacturers, manufacturer & traders of bio-based foam, end-user, conventional foam manufacturer, polymer companies, and packaging companies in the supply chain.

As part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the bio-based foam market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, and related key executives from various key companies and organizations operating in the bio-based foam market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries.

Breakdown of the Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Bio-Based Foam Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the bio-based foam market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the bio-based foam market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

To know about the assumptions considered for the study, Request for Free Sample Report

Bio-Based Foam Market Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes as explained abovethe market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Bio-Based Foam Market Report Objectives

- To define, describe, and forecast the bio-based foam market based on raw material, type, end-use industry, and region

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the bio-based foam market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total bio-based foam market

- To analyze the opportunities in the bio-based foam market for the stakeholders and draw a competitive landscape of the market

- To forecast the market size, in terms of both volume and value, with respect to five main regions, namely, Asia Pacific, North America, Europe, the Middle East & Africa, and South America, along with their respective key countries

- To analyze competitive developments, such as partnerships & agreements, mergers & acquisitions, new product developments, and research & development (R&D) activities, in the bio-based foam market

- To strategically profile the key players in the bio-based foam market and comprehensively evaluate their current market shares

Bio-Based Foam Market Report Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- A further breakdown of product portfolio of each company in the bio-based foam market

- A further breakdown of a region of the bio-based foam market with respect to a particular country

- Details and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bio-Based Foam Market