Foam Market by Type (Polyurethane, Polystyrene (EPS & XPS), Polyolefin (PE, PP, EVA), Phenolic, PET), Type (Rigid, Flexible), End-Use Industry (Construction, Packaging, Automotive, Furniture & Bedding, Footwear), and Region - Global Forecast to 2026

Updated on : September 03, 2025

Foam Market

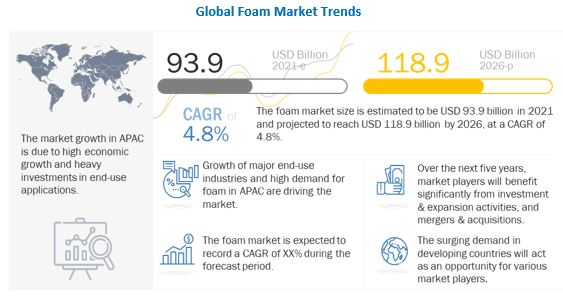

The global foam market was valued at USD 93.9 billion in 2021 and is projected to reach USD 118.9 billion by 2026, growing at 4.8% cagr from 2021 to 2026. The market is propelled by the growth of various end-use industries. Increasing investments in infrastructure, new housing projects, and renovation of non-residential buildings in China, India, and Brazil have also boosted market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Foam Market

The outbreak of COVID-19 has disrupted the production of raw materials used in paints and coatings manufacturing. Asian countries such as India, China, Japan, Singapore, and Thailand are the hubs for paints and coatings manufacturing and are major suppliers of these raw materials. The outbreak of the novel coronavirus in APAC has affected the supply of these raw materials. For instance, China is one of the major suppliers of resins and exports a million tons of resins in the global market. The break in the supplies of raw materials has reduced the production of paints and coatings products.

In April 2020, all private buildings and construction sites, government constructions, and refinish automotive businesses were hit drastically. Retailers are also canceling already placed bulk orders of paint and coatings products due to the shutdown of the market. End-use consumers are not buying expensive coating technologies such as polyurea and polyurethanes from distributors and retailers due to COVID-19. Overall, the sales of paints and coatings products are hampered at the distributors’ level due to the suspension of construction and building activities.

Foam Market Dynamics

Driver: Growing use of foam in major end-use industries

Major industries requiring foam include building & construction, packaging, automotive, and furniture & bedding,

Foam is used in the building & construction industry for forging, pipe-in-pipe, doors, roof board, and slabs. PU foam is widely used for interior insulation of walls or roofs in residential and commercial properties. Extruded polystyrene material is also used in crafts and architectural model building. EPS is an excellent material for building and construction, as it is light yet rigid with good thermal insulation and high impact resistance.

Packaging is necessary for the safety and insulation of all kinds of materials, especially in the food industry and the online shopping (shippable materials) business. With the growing awareness about the safety, quality, and maintenance of a product’s physical properties, the use of foam in packaging is increasing.

Restraint: Volatility in raw material prices

The price and availability of raw materials determine the cost structure of products. The key raw materials used to make foam are benzene, toluene, polyol, and phosgene. These are petroleum-based derivatives and are vulnerable to price fluctuations. Oil prices were highly volatile in 2018-2019 due to the rising global demand, and conflict, and foreign military intervention in the Middle East.

Over the last few years, the price fluctuation in petrochemical-based raw materials has affected the foam market. The consistent global demand, coupled with capacity constraints of primary chemicals and resins, has also tightened the supply and increased the raw material prices.

Opportunity: Growing demand for bio-based polyols

In view of the growing concerns over the dependence on fossil fuels and the impact of plastics on the environment, foam manufacturers are continuously striving for sustainability in business practices. The volatility in oil prices in recent years had a significant impact on the profitability of the foam industry. This led to the development of bio-based polyols that can be used to manufacture foam. Bio-derived materials such as soy-based polyols are far superior to conventional polyols, in terms of sustainability and cost. They are also more thermally stable and less sensitive to hydrolysis. The key producers of soy-based polyols include Urethane Soy Systems, Bio-Based Technologies, Dow Chemical Company, Cargill, Inc., and MCPU Polymer Engineering.

Challenge: High pricing pressure

The global polyols market has witnessed tremendous pricing pressure for the past few years due to fluctuations in crude oil prices. The rising cost of major raw materials such as propylene and propylene oxide, which are the derivatives of petroleum products, is primarily responsible for the rise in the manufacturing cost of polyols. Capital and raw material costs thus account for a major portion of foam production costs, leading to higher pricing pressure on manufacturers.

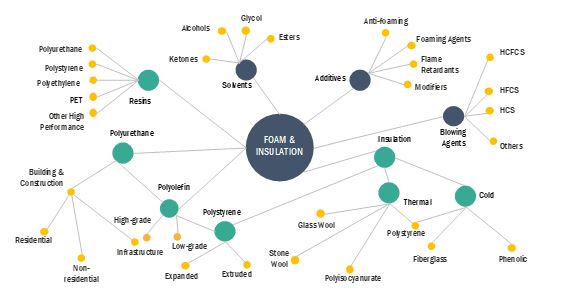

Foam Market Ecosystem

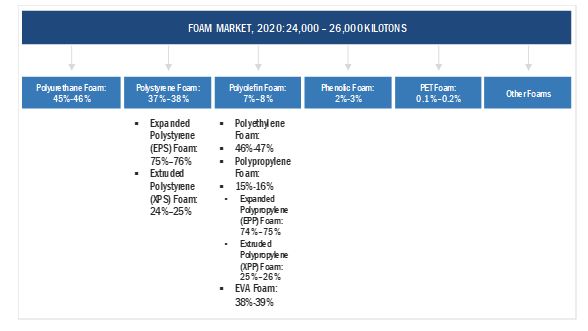

Polyurethane segment accounted for the largest share of the foam market in 2020.

Polyurethane segment accounts for the largest share in the foam market. It is mainly divided into flexible PU foam, rigid PU foam, and spray PU foam. Flexible PU foam is used in various applications such as cushioning, apparel padding, and filtration, whereas rigid PU foam is primarily used for board and laminate insulation and foam roofing in commercial and residential construction.

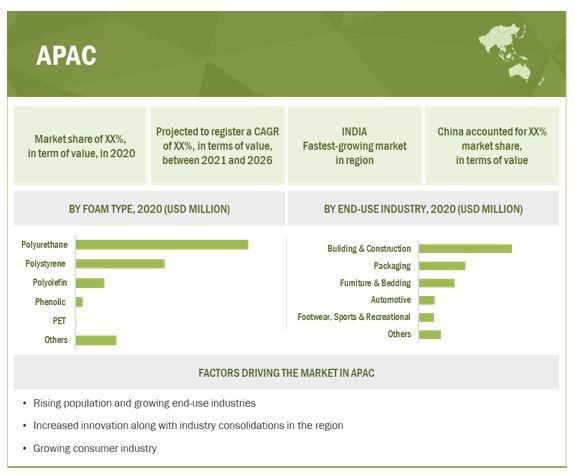

Building & Construction is projected to witness the fastest growth in APAC during the forecast period.

The building & construction industry in APAC is expected to witness the highest growth rate during the next five years, driven by huge investments in new infrastructure development, new housing projects, and renovation of non-residential buildings in major countries like China and India.

The high demand for online shopping is increasing the demand for packaging; this is expected to drive the protective packaging market during the forecast period. The use of foam in medical device packaging, orthopedic soft goods, and medical components is also projected to drive the market in the medical industry between 2021 and 2026.

APAC is the largest foam market in the forecast period

The foam market in APAC is segmented into China, India, Japan, South Korea, Malaysia, Indonesia, Thailand, and the Rest of APAC. The region is the fastest-growing in the foam market, driven by high economic growth and heavy investments in the automotive, marine, building & construction, and manufacturing industries. The growth of the APAC market is propelled by the increasing use of foam in the building & construction, automotive, footwear, sports & recreational, furniture & bedding, and packaging industries. The demand for high-quality products, rising population, and the growing end-use industries have led to innovation and development in the market. The continuous growth in the manufacturing of products for domestic use, as well as exports, drives the demand for foam in the region.

According to the latest S&P ratings, the COVID-19 outbreak has hampered APAC economies by more than USD 200 billion. The growth level in the region is the lowest it has been in the last decade. China might nose down to the growth of 3% with a recession looming in Japan, Hong Kong, and Australia.

Foam Market Players

BASF SE (Germany), Armacell International S.A. (Germany), JSP (Japan), Kaneka Corporation (Japan), Recticel (Belgium), Rogers Corporation (US), Sealed Air Corporation (US), Arkema (France), and Zotefoams Plc (UK) are some of the major players catering to the demand for foam, globally.

Foam Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 93.9 billion |

|

Revenue Forecast in 2026 |

USD 118.9 billion |

|

CAGR |

4.8% |

|

Years considered for the study |

2019-2026 |

|

Base year |

2020 |

|

Forecast period |

2021-2026 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

By Type, By Foam Type, By End-use Industry, By Region |

|

Regions covered |

APAC, Europe, North America, South America, and Middle East & Africa |

|

Companies profiled |

BASF SE (Germany), Armacell International S.A. (Germany), JSP (Japan), Kaneka Corporation (Japan), Recticel (Belgium), Rogers Corporation (US), Sealed Air Corporation (US), Arkema (France), and Zotefoams Plc (UK) are some of the major players catering to the demand for foam, globally. |

This research report categorizes the foam market based on type, foam type, end-use industry, and region.

Foam Market by Type:

- Flexible Foam

- Rigid Foam

Foam Market by Foam Type:

- Polyurethane

- Polystyrene

- Polyolefin

- Phenolic

- PET

- Others

Foam Market by End-use Industry:

- Building & Construction

- Packaging

- Automotive

- Furniture & Bedding

- Footwear, Sports, & Recreational

- Others

Foam Market by Region:

- APAC

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments in Foam Market

- In February 2020, Huntsman Corporation announced that it had completed the acquisition of Icynene-Lapolla, a leading North American manufacturer and distributor of spray polyurethane foam (SPF) insulation systems for residential and commercial applications. Huntsman acquired the business from an affiliate of FFL Partners, LLC, for USD 350 million, subject to customary closing adjustments, in an all-cash transaction funded from available liquidity.

- In May 2019, Sealed Air Corporation announced that it had signed a definitive agreement to acquire Automated Packaging Systems Inc. (APS), a leading manufacturer of high-reliability, automated bagging systems, for a purchase price of USD 510 million on a cash and debt-free basis.

Frequently Asked Questions (FAQ):

How big is the Foam Market?

Foam Market worth $118.9 billion by 2026.

What is the growth rate of Foam Market?

Foam Market grows at a CAGR of 4.8% during the forecast period.

What is the current size of the foam market?

The foam market is estimated to be USD 93.9 billion in 2021 and projected to reach USD 118.9 billion by 2026, at a CAGR of 4.8%

Who are the major players in the foam market?

BASF SE (Germany), Armacell International S.A. (Germany), JSP (Japan), Kaneka Corporation (Japan), Recticel (Belgium), Rogers Corporation (US), Sealed Air Corporation (US), Arkema (France), and Zotefoams Plc (UK) are some of the major players catering to the demand for foam, globally.

Where will all these developments take the industry in the mid-to-long term?

Continuous developments in the market, including new product launches, mergers & acquisitions, investments & expansions, and partnership and agreement are expected to help the market grow. New product launch and merger & acquisition are the key strategies adopted by companies operating in this market.

Which segment has the potential to register the highest market share for foam?

Building & Construction was the largest end-use industry of foam, in terms of both volume and value, in 2020. Foam is used in the building & construction industry for forging, pipe-in-pipe, doors, roof board, and slabs.

Which is the fastest-growing region in the market?

APAC is the largest market for foam globally. China is the largest market, and India is the fastest-growing market for foam in the region. Emerging economies such as India, Taiwan, Thailand, and Indonesia also supporting market growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET INCLUSIONS AND EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 FOAM MARKET SEGMENTATION

1.4.1 REGIONS COVERED

1.4.2 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 FOAM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key primary data sources

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 4 FOAM MARKET SIZE ESTIMATION, BY VALUE

2.2.2 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3 MARKET FORECAST APPROACH

2.3.1 DEMAND SIDE FORECAST PROJECTION

2.4 DATA TRIANGULATION

FIGURE 6 FOAM MARKET: DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 41)

TABLE 1 FOAM MARKET SNAPSHOT (2021 VS. 2026)

FIGURE 8 BUILDING & CONSTRUCTION SEGMENT LEADS FOAM MARKET IN 2020

FIGURE 9 APAC TO BE LARGEST AND FASTEST-GROWING REGION FOR FOAM MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE OPPORTUNITIES IN THE FOAM MARKET

FIGURE 10 FOAM MARKET TO WITNESS MODERATE GROWTH DURING FORECAST PERIOD

4.2 FOAM MARKET GROWTH, BY FOAM TYPE

FIGURE 11 POLYURETHANE FOAM TO BE LARGEST SEGMENT BETWEEN 2021 AND 2026

4.3 APAC: FOAM MARKET SHARE, BY END-USE INDUSTRY AND COUNTRY

FIGURE 12 CHINA ACCOUNTED FOR LARGEST SHARE OF APAC MARKET IN 2020

4.4 FOAM MARKET: MAJOR COUNTRIES

FIGURE 13 INDIA TO EMERGE AS LUCRATIVE MARKET DURING FORECAST PERIOD

4.5 FOAM MARKET: DEVELOPED VS. DEVELOPING COUNTRIES

FIGURE 14 FOAM MARKET TO WITNESS HIGHER GROWTH IN DEVELOPING COUNTRIES

FIGURE 15 INDIA AND CHINA TO REGISTER HIGHEST CAGR IN APAC DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 VALUE CHAIN ANALYSIS

FIGURE 16 FOAM MARKET: VALUE CHAIN ANALYSIS

5.2.1 FOAM MARKET: SUPPLY CHAIN ECOSYSTEM

5.2.2 COVID-19 IMPACT ON VALUE CHAIN

5.2.2.1 Action plan against such vulnerability

5.3 MARKET DYNAMICS

FIGURE 17 FACTORS GOVERNING THE FOAM MARKET

5.3.1 DRIVERS

5.3.1.1 Growing use of foam in major end-use industries

5.3.1.2 High demand for foam in APAC

5.3.1.3 Focus on energy sustainability and energy conservation

5.3.1.4 Growth of wind energy sector boosts PET foam market

5.3.2 RESTRAINTS

5.3.2.1 Volatility in raw material prices

5.3.3 OPPORTUNITIES

5.3.3.1 Growing demand for bio-based polyols

5.3.3.2 Increasing use of CO2-based polyols

5.3.4 CHALLENGES

5.3.4.1 High pricing pressure

5.3.4.2 Imposition of stringent regulations

5.3.4.3 Impact of COVID-19 on various end-use industries

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS: FOAM MARKET

TABLE 2 FOAM MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4.1 INTENSITY OF COMPETITIVE RIVALRY

5.4.2 BARGAINING POWER OF BUYERS

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 THREAT OF SUBSTITUTES

5.4.5 THREAT OF NEW ENTRANTS

5.5 AVERAGE PRICING ANALYSIS

FIGURE 19 AVERAGE PRICE COMPETITIVENESS IN FOAM MARKET

5.6 FOAM ECOSYSTEM

FIGURE 20 FOAM ECOSYSTEM

5.6.1 YC AND YCC SHIFT

5.7 MACROECONOMIC INDICATORS

5.7.1 INTRODUCTION

5.7.2 GDP TRENDS AND FORECAST

TABLE 3 GDP TRENDS AND FORECAST, PERCENTAGE CHANGE

5.8 OPERATIONAL DATA AND KEY INDUSTRY TRENDS

5.8.1 GLOBAL AUTOMOTIVE INDUSTRY TRENDS AND FORECAST

TABLE 4 AUTOMOTIVE INDUSTRY PRODUCTION (2019-2020)

5.8.2 GLOBAL CONSTRUCTION INDUSTRY TRENDS AND FORECAST

FIGURE 21 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2017–2025

5.8.3 WIND ENERGY INDUSTRY TRENDS

TABLE 5 WIND ENERGY INSTALLATION, BY COUNTRY, 2018–2019 (MW)

FIGURE 22 WIND ENERGY INSTALLED CAPACITY, BY REGION, 2018–2019

5.9 FOAM PATENT ANALYSIS

5.9.1 METHODOLOGY

5.9.2 PUBLICATION TRENDS

FIGURE 23 PUBLICATION TRENDS, 2017–2021

5.9.3 INSIGHT

5.9.4 JURISDICTION ANALYSIS

FIGURE 24 JURISDICTION ANALYSIS OF REGISTERED PATENTS, 2017–2021

5.9.5 TOP APPLICANTS

TABLE 6 POLYOLEFIN FOAM: NUMBER OF PATENTS, BY COMPANY, 2017–2021

TABLE 7 POLYSTYRENE FOAM: NUMBER OF PATENTS, BY COMPANY, 2017–2021

TABLE 8 POLYURETHANE FOAM: NUMBER OF PATENTS, BY COMPANY, 2017–2021

TABLE 9 PET FOAM: NUMBER OF PATENTS, BY COMPANY, 2017–2021

5.10 POLICY AND REGULATIONS

TABLE 10 GLOBAL REGULATIONS

5.11 TRADE ANALYSIS

5.11.1 TRADE SCENARIO FOR POLYETHYLENE FOAM

TABLE 11 US: IMPORT TRADE DATA, 2019

TABLE 12 MONTHLY IMPORT DATA FOR US, BY PARTNER, 2019

TABLE 13 MAJOR IMPORT PARTNERS OF US, 2019

TABLE 14 MONTHLY TRADE DATA FOR INDIA, 2019

TABLE 15 MONTHLY TRADE DATA FOR INDIA, BY PARTNER, 2019

TABLE 16 MAJOR TRADE PARTNERS OF INDIA, MONTHLY DATA, 2019

5.11.2 TRADE SCENARIO FOR POLYPROPYLENE FOAM

5.11.2.1 Polypropylene import-export trend impacting EPP and XPP foam production in foam market

TABLE 17 IMPORT TRADE DATA FOR TOP COUNTRIES, 2016–2020 (USD)

TABLE 18 EXPORT TRADE DATA FOR TOP COUNTRIES, 2016–2020 (USD)

5.11.3 POLYSTYRENE AND EPS IMPORT-EXPORT TREND IMPACTING EPS AND XPS FOAM PRODUCTION IN FOAM MARKET

TABLE 19 IMPORT TRADE DATA FOR TOP COUNTRIES, 2016–2020 (USD MILLION)

TABLE 20 EXPORT TRADE DATA FOR TOP COUNTRIES, 2016–2020 (USD MILLION)

5.12 CASE STUDY ANALYSIS

5.13 COVID-19 IMPACT ANALYSIS

5.13.1 COVID-19 ECONOMIC ASSESSMENT

5.13.2 MAJOR ECONOMIC EFFECTS OF COVID-19

5.13.3 EFFECTS ON GDP OF COUNTRIES

FIGURE 25 GDP FORECAST OF G20 COUNTRIES IN 2020

5.13.4 SCENARIO ASSESSMENT

FIGURE 26 FACTORS IMPACTING ECONOMY OF SELECT G20 COUNTRIES IN 2020

5.13.5 IMPACT ON CONSTRUCTION INDUSTRY

5.13.6 IMPACT ON AUTOMOTIVE INDUSTRY

5.14 TECHNOLOGY ANALYSIS

5.14.1 POLYSTYRENE

5.14.2 POLYETHYLENE FOAM

5.14.3 EPP FOAM

5.14.4 XPP FOAM

6 FOAM MARKET, BY TYPE (Page No. - 89)

6.1 INTRODUCTION

6.2 FLEXIBLE FOAM

6.3 RIGID FOAM

7 FOAM MARKET, BY FOAM TYPE (Page No. - 91)

7.1 INTRODUCTION

FIGURE 27 POLYURETHANE FOAM SEGMENT TO DOMINATE FOAM MARKET DURING FORECAST PERIOD

TABLE 21 MARKET SIZE, BY FOAM TYPE, 2019–2026 (USD MILLION)

TABLE 22 FOAM MARKET SIZE, BY FOAM TYPE, 2019–2026 (KILOTONS)

7.2 POLYURETHANE

7.2.1 EXPECTED TO LEAD FOAM MARKET

TABLE 23 PU FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 24 PU MARKET SIZE, BY REGION, 2019–2026 (KILOTONS)

7.3 POLYSTYRENE

7.3.1 HIGH DEMAND FROM BUILDING & CONSTRUCTION INDUSTRY

TABLE 25 POLYSTYRENE FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 26 POLYSTYRENE MARKET SIZE, BY REGION, 2019–2026 (KILOTONS)

TABLE 27 POLYSTYRENE MARKET SIZE, BY PS FOAM TYPE, 2019–2026 (USD MILLION)

TABLE 28 POLYSTYRENE FOAM MARKET SIZE, BY PS FOAM TYPE, 2019–2026 (KILOTONS)

7.3.2 EXPANDED POLYSTYRENE FOAM (EPS)

TABLE 29 EPS FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 30 EPS MARKET SIZE, BY REGION, 2019–2026 (KILOTONS)

7.3.3 EXTRUDED POLYSTYRENE FOAM (XPS)

TABLE 31 XPS FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 32 XPS MARKET SIZE, BY REGION, 2019–2026 (KILOTONS)

7.4 POLYOLEFIN

7.4.1 AUTOMOTIVE INDUSTRY TO DRIVE DEMAND FOR POLYOLEFIN FOAM

TABLE 33 PO FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 34 PO MARKET SIZE, BY REGION, 2019–2026 (KILOTONS)

TABLE 35 POLYOLEFIN FOAM MARKET SIZE, BY PO FOAM TYPE, 2019–2026 (USD MILLION)

TABLE 36 POLYOLEFIN FOAM MARKET SIZE, BY PO FOAM TYPE, 2019–2026 (KILOTONS)

7.4.2 POLYETHYLENE FOAM (PE)

TABLE 37 PE FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 38 PE MARKET SIZE, BY REGION, 2019–2026 (KILOTONS)

7.4.3 POLYPROPYLENE FOAM (PP)

TABLE 39 POLYPROPYLENE FOAM MARKET SIZE, BY PP FOAM TYPE, 2019–2026 (USD MILLION)

TABLE 40 POLYPROPYLENE MARKET SIZE, BY PP FOAM TYPE, 2019–2026 (KILOTONS)

TABLE 41 POLYPROPYLENE FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 42 POLYPROPYLENE MARKET SIZE, BY REGION, 2019–2026 (KILOTONS)

7.4.3.1 EPP Foam

TABLE 43 EPP FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 44 EPP MARKET SIZE, BY REGION, 2019–2026 (KILOTONS)

7.4.3.2 XPP Foam

TABLE 45 XPP FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 46 XPP MARKET SIZE, BY REGION, 2019–2026 (KILOTONS)

7.4.4 EVA FOAM

TABLE 47 EVA FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 48 EVA MARKET SIZE, BY REGION, 2019–2026 (KILOTONS)

7.5 PHENOLIC

7.5.1 USED IN HIGH-END APPLICATIONS

TABLE 49 PHENOLIC FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 50 PHENOLIC FOAM MARKET SIZE, BY REGION, 2019–2026 (KILOTONS)

7.6 PET FOAM

7.6.1 HIGH APPLICABILITY IN VARIED INDUSTRIES

TABLE 51 PET FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 52 PET FOAM MARKET SIZE, BY REGION, 2019–2026 (KILOTONS)

7.7 OTHERS

7.7.1 PVC FOAM

7.7.2 MELAMINE FOAM

7.7.3 SILICONE FOAM

7.7.4 PVDF FOAM

7.7.5 RUBBER

TABLE 53 OTHER FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 54 OTHER FOAM MARKET SIZE, BY REGION, 2019–2026 (KILOTONS)

8 FOAM MARKET, BY END-USE INDUSTRY (Page No. - 108)

8.1 INTRODUCTION

FIGURE 28 BUILDING & CONSTRUCTION TO LEAD FOAM MARKET BETWEEN 2021 AND 2026

TABLE 55 FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 56 FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTONS)

8.2 BUILDING & CONSTRUCTION

8.2.1 EXPECTED TO LEAD THE FOAM MARKET

TABLE 57 FOAM MARKET SIZE IN BUILDING & CONSTRUCTION INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

TABLE 58 MARKET SIZE IN BUILDING & CONSTRUCTION INDUSTRY, BY REGION, 2019–2026 (KILOTONS)

8.3 PACKAGING

8.3.1 WIDE USE OF PU, PS, AND PO FOAM

TABLE 59 FOAM MARKET SIZE IN PACKAGING INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

TABLE 60 MARKET SIZE IN PACKAGING INDUSTRY, BY REGION, 2019–2026 (KILOTONS)

8.4 AUTOMOTIVE

8.4.1 RAPIDLY INCREASING DEMAND FOR FOAM

TABLE 61 FOAM MARKET SIZE IN AUTOMOTIVE INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

TABLE 62 MARKET SIZE IN AUTOMOTIVE INDUSTRY, BY REGION, 2019–2026 (KILOTONS)

8.5 FURNITURE & BEDDING

8.5.1 HIGHEST AND FASTEST GROWING DEMAND FROM APAC

TABLE 63 FOAM MARKET SIZE IN FURNITURE & BEDDING INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

TABLE 64 MARKET SIZE IN FURNITURE & BEDDING INDUSTRY, BY REGION, 2019–2026 (KILOTONS)

8.6 FOOTWEAR, SPORTS & RECREATIONAL

8.6.1 INCREASING USE OF FOAM IN SPORTING EQUIPMENT

TABLE 65 FOAM MARKET SIZE IN FOOTWEAR, SPORTS & RECREATIONAL INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

TABLE 66 FOAM MARKET SIZE IN FOOTWEAR, SPORTS & RECREATIONAL, BY REGION, 2019–2026 (KILOTONS)

8.7 OTHERS

8.7.1 AVIATION & AEROSPACE

8.7.2 WIND ENERGY

8.7.3 MARINE

8.7.4 MEDICAL

8.7.5 REFRIGERATION

TABLE 67 FOAM MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 68 FOAM MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2026 (KILOTONS)

9 FOAM MARKET, BY REGION (Page No. - 119)

9.1 INTRODUCTION

FIGURE 29 REGIONAL SNAPSHOT: APAC TO EMERGE AS STRATEGIC LOCATION

TABLE 69 FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 70 MARKET SIZE, BY REGION, 2019–2026 (KILOTONS)

9.2 NORTH AMERICA

FIGURE 30 NORTH AMERICA SNAPSHOT: US TO DOMINATE FOAM MARKET

TABLE 71 NORTH AMERICA: FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTONS)

TABLE 73 NORTH AMERICA: MARKET SIZE, BY FOAM TYPE, 2019–2026 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET SIZE, BY FOAM TYPE, 2019–2026 (KILOTONS)

TABLE 75 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTONS)

9.2.1 US

9.2.1.1 Automotive industry driving demand for foam

9.2.2 CANADA

9.2.2.1 State-of-the-art manufacturing facilities to provide growth opportunities

9.2.3 MEXICO

9.2.3.1 Attractive destination for key market players

9.3 EUROPE

FIGURE 31 EUROPE SNAPSHOT: GERMANY TO LEAD FOAM MARKET IN EUROPE

TABLE 77 EUROPE: FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 78 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTONS)

TABLE 79 EUROPE: MARKET SIZE, BY FOAM TYPE, 2019–2026 (USD MILLION)

TABLE 80 EUROPE: MARKET SIZE, BY FOAM TYPE, 2019–2026 (KILOTONS)

TABLE 81 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTONS)

9.3.1 GERMANY

9.3.1.1 Presence of major automobile companies to boost demand

9.3.2 FRANCE

9.3.2.1 Growing demand for auto parts and packaging materials to drive market

9.3.3 ITALY

9.3.3.1 Increasing foreign investments to drive market

9.3.4 UK

9.3.4.1 Rising demand for polyolefin foam in automotive industry drives market

9.3.5 SPAIN

9.3.5.1 Growth of construction industry to propel demand for foam

9.3.6 RUSSIA

9.3.6.1 Government investments to modernize infrastructure to boost demand

9.3.7 TURKEY

9.3.7.1 Presence of key automotive players to positively influence market

9.3.8 REST OF EUROPE

9.4 APAC

FIGURE 32 APAC SNAPSHOT: CHINA TO LEAD APAC FOAM MARKET

TABLE 83 APAC: FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 84 APAC: MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTONS)

TABLE 85 APAC: MARKET SIZE, BY FOAM TYPE, 2019–2026 (USD MILLION)

TABLE 86 APAC: MARKET SIZE, BY FOAM TYPE, 2019–2026 (KILOTONS)

TABLE 87 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 88 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTONS)

9.4.1 CHINA

9.4.1.1 Automotive, public infrastructure, and construction sectors to boost demand

9.4.2 JAPAN

9.4.2.1 Moderate growth expected in mature market

9.4.3 INDIA

9.4.3.1 Construction and automotive industries to boost market

9.4.4 SOUTH KOREA

9.4.4.1 Growth in automotive industry to drive demand for foam

9.4.5 MALAYSIA

9.4.5.1 Increasing use of PU foam in construction sector to drive market

9.4.6 INDONESIA

9.4.6.1 High growth in building & construction and automotive industries to drive market

9.4.7 THAILAND

9.4.7.1 Strong automobile production to drive demand for foam

9.4.8 REST OF APAC

9.5 MIDDLE EAST & AFRICA

FIGURE 33 SAUDI ARABIA IS REGION’S KEY MARKET

TABLE 89 MIDDLE EAST & AFRICA: FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 90 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTONS)

TABLE 91 MIDDLE EAST & AFRICA: MARKET SIZE, BY FOAM TYPE, 2019–2026 (USD MILLION)

TABLE 92 MIDDLE EAST & AFRICA: MARKET SIZE, BY FOAM TYPE, 2019–2026 (KILOTONS)

TABLE 93 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2019-2026 (USD MILLION)

TABLE 94 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTONS)

9.5.1 SAUDI ARABIA

9.5.1.1 Increased local car sales to drive demand for global foam

9.5.2 SOUTH AFRICA

9.5.2.1 Growth of manufacturing industries to positively influence market growth

9.5.3 UAE

9.5.3.1 Construction projects to boost demand for foam

9.5.4 REST OF MIDDLE EAST & AFRICA

9.6 SOUTH AMERICA

FIGURE 34 BRAZIL IS REGION’S KEY MARKET

TABLE 95 SOUTH AMERICA: FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 96 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTONS)

TABLE 97 SOUTH AMERICA: MARKET SIZE, BY FOAM TYPE, 2019–2026 (USD MILLION)

TABLE 98 SOUTH AMERICA: MARKET SIZE, BY FOAM TYPE, 2019–2026 (KILOTONS)

TABLE 99 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 100 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTONS)

9.6.1 BRAZIL

9.6.1.1 Expansion of production capacity and well-established distribution channels to propel market

9.6.2 ARGENTINA

9.6.2.1 Growing automobile sector to drive foam market

9.6.3 CHILE

9.6.3.1 Government investment in infrastructure projects to drive market

9.6.4 REST OF SOUTH AMERICA

10 COMPETITIVE INSULATION MATERIALS (Page No. - 150)

10.1 INTRODUCTION

FIGURE 35 INSULATION MATERIALS MARKET SIZE, BY REGION, 2021 VS. 2026 (USD MILLION)

TABLE 101 R-VALUE, BY TYPE OF INSULATION

FIGURE 36 INSULATION MATERIAL MARKET SIZE, BY MATERIAL, 2021 VS 2026 (USD MILLION)

FIGURE 37 INSULATION MATERIAL MARKET SIZE, BY MATERIAL, 2021 VS 2026 (MILLION SQUARE METERS)

10.2 FIBERGLASS

FIGURE 38 FIBERGLASS INSULATION MATERIAL MARKET SIZE, BY REGION, 2021 VS 2026 (USD MILLION)

FIGURE 39 FIBERGLASS INSULATION MATERIAL MARKET SIZE, BY REGION, 2021 VS 2026 (MILLION SQUARE METERS)

10.3 MINERAL WOOL

FIGURE 40 MINERAL WOOL INSULATION MATERIAL MARKET SIZE, BY REGION, 2021 VS 2026 (USD MILLION)

FIGURE 41 MINERAL WOOL INSULATION MATERIAL MARKET SIZE, BY REGION, 2021 VS 2021 (MILLION SQUARE METERS)

10.4 OTHERS

FIGURE 42 OTHERS INSULATION MATERIAL MARKET SIZE, BY REGION, 2021 VS 2026 (USD MILLION)

FIGURE 43 OTHERS INSULATION MATERIAL MARKET SIZE, BY REGION, 2021 VS 2026 (MILLION SQUARE METERS)

11 COMPETITIVE LANDSCAPE (Page No. - 157)

11.1 OVERVIEW

FIGURE 44 LEADING PLAYERS FAVOR INVESTMENT & EXPANSION STRATEGY BETWEEN 2017 AND 2021

11.2 MARKET SHARE ANALYSIS

FIGURE 45 POLYSTYRENE FOAM: CAPACITY SHARE ANALYSIS IN 2020

TABLE 102 POLYSTYRENE FOAM MARKET: DEGREE OF COMPETITION

FIGURE 46 POLYOLEFIN FOAM: MARKET SHARE ANALYSIS IN 2020

TABLE 103 POLYOLEFIN FOAM MARKET: DEGREE OF COMPETITION

11.3 REVENUE ANALYSIS OF KEY PLAYERS IN PAST FIVE YEARS

11.4 COMPANY EVALUATION QUADRANT MATRIX, 2020

11.4.1 STAR

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE

11.4.4 PARTICIPANTS

FIGURE 47 FOAM MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

11.5 STRENGTH OF PRODUCT PORTFOLIO

11.6 BUSINESS STRATEGY EXCELLENCE

11.7 COMPETITIVE SCENARIO

11.7.1 MARKET EVALUATION FRAMEWORK

11.7.2 MARKET EVALUATION MATRIX

TABLE 104 COMPANY PRODUCT FOOTPRINT

TABLE 105 COMPANY REGION FOOTPRINT

TABLE 106 COMPANY INDUSTRY FOOTPRINT

11.8 STRATEGIC DEVELOPMENTS

11.8.1 MERGERS & ACQUISITIONS

TABLE 107 MERGERS & ACQUISITIONS, 2017–2021

11.8.2 INVESTMENTS & EXPANSIONS

TABLE 108 INVESTMENTS & EXPANSIONS, 2017–2021

11.8.3 NEW PRODUCT LAUNCHES

TABLE 109 NEW PRODUCT LAUNCHES, 2017–2021

11.8.4 JOINT VENTURES, AGREEMENTS & PARTNERSHIPS

TABLE 110 JOINT VENTURES, AGREEMENTS & PARTNERSHIPS, 2017–2021

12 COMPANY PROFILES (Page No. - 172)

12.1 KEY COMPANIES

(Business Overview, Products/Solutions Offered, Recent Developments, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win)*

12.1.1 ARMACELL INTERNATIONAL S.A.

TABLE 111 ARMACELL INTERNATIONAL S.A.: BUSINESS OVERVIEW

FIGURE 48 ARMACELL INTERNATIONAL S.A.: COMPANY SNAPSHOT

TABLE 112 ARMACELL INTERNATIONAL S.A.: NEW PRODUCT LAUNCH

TABLE 113 ARMACELL INTERNATIONAL S.A.: DEALS

12.1.2 BASF SE

TABLE 114 BASF SE: BUSINESS OVERVIEW

FIGURE 49 BASF SE: COMPANY SNAPSHOT

TABLE 115 BASF SE: DEALS

TABLE 116 BASF SE: OTHER DEVELOPMENTS

12.1.3 COVESTRO AG

TABLE 117 COVESTRO AG: BUSINESS OVERVIEW

FIGURE 50 COVESTRO AG: COMPANY SNAPSHOT

TABLE 118 COVESTRO AG: OTHER DEVELOPMENTS

12.1.4 THE DOW CHEMICAL COMPANY

TABLE 119 THE DOW CHEMICAL COMPANY: BUSINESS OVERVIEW

FIGURE 51 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

12.1.5 HUNTSMAN CORPORATION

TABLE 120 HUNTSMAN CORPORATION: BUSINESS OVERVIEW

FIGURE 52 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

TABLE 121 HUNTSMAN CORPORATION: DEALS

TABLE 122 HUNTSMAN CORPORATION: OTHER DEVELOPMENTS

12.1.6 JSP CORPORATION

TABLE 123 JSP CORPORATION: BUSINESS OVERVIEW

FIGURE 53 JSP CORPORATION: COMPANY SNAPSHOT

TABLE 124 JSP CORPORATION: OTHER DEVELOPMENTS

12.1.7 RECTICEL NV/SA

TABLE 125 RECTICEL NV: BUSINESS OVERVIEW

FIGURE 54 RECTICEL NV: COMPANY SNAPSHOT

TABLE 126 RECTICEL NV: OTHER DEVELOPMENTS

12.1.8 ROGERS CORPORATION

TABLE 127 ROGERS CORPORATION: BUSINESS OVERVIEW

FIGURE 55 ROGERS CORPORATION: COMPANY SNAPSHOT

12.1.9 SEALED AIR CORPORATION

TABLE 128 SEALED AIR CORPORATION: BUSINESS OVERVIEW

FIGURE 56 SEALED AIR CORPORATION: COMPANY SNAPSHOT

TABLE 129 SEALED AIR: DEALS

12.1.10 ZOTEFOAMS PLC

TABLE 130 ZOTEFOAMS PLC: BUSINESS OVERVIEW

FIGURE 57 ZOTEFOAMS PLC: COMPANY SNAPSHOT

TABLE 131 ZOTEFOAMS PLC: DEALS

TABLE 132 ZOTEFOAMS PLC: NEW PRODUCT LAUNCH

TABLE 133 ZOTEFOAMS PLC: OTHER DEVELOPMENTS

12.2 OTHER PLAYERS

12.2.1 ACH FOAM TECHNOLOGIES, INC.

TABLE 134 ACH FOAM TECHNOLOGIES: BUSINESS OVERVIEW

12.2.2 COMPAGNIE DE SAINT-GOBAIN S.A.

TABLE 135 COMPAGNIE DE SAINT-GOBAIN S.A.: BUSINESS OVERVIEW

12.2.3 EUROFOAM GROUP

TABLE 136 EUROFOAM GROUP : BUSINESS OVERVIEW

12.2.4 FOAMPARTNER

TABLE 137 FOAMPARTNER : BUSINESS OVERVIEW

12.2.5 FOAMCRAFT, INC.

TABLE 138 FOAMCRAFT, INC.: BUSINESS OVERVIEW

12.2.6 HANWHA TOTAL PETROCHEMICAL

TABLE 139 HANWHA TOTAL PETROCHEMICAL: BUSINESS OVERVIEW

12.2.7 KANEKA CORPORATION

TABLE 140 KANEKA CORPORATION: BUSINESS OVERVIEW

TABLE 141 KANEKA CORPORATION: OTHER DEVELOPMENTS

12.2.8 LOYAL GROUP

TABLE 142 LOYAL GROUP: BUSINESS OVERVIEW

12.2.9 MITSUI CHEMICALS, INC.

TABLE 143 MITSUI CHEMICALS: BUSINESS OVERVIEW

12.2.10 POLYMER TECHNOLOGIES, INC.

TABLE 144 POLYMER TECHNOLOGIES, INC.: BUSINESS OVERVIEW

12.2.11 TORAY INDUSTRIES, INC.

TABLE 145 TORAY INDUSTRIES: BUSINESS OVERVIEW

12.2.12 VERSALIS S.P.A.

TABLE 146 VERSALIS S.P.A: BUSINESS OVERVIEW

12.2.13 LG CHEM

TABLE 147 LG CHEM: BUSINESS OVERVIEW

12.2.14 SYNTHOS S.A.

TABLE 148 SYNTHOS S.A.: BUSINESS OVERVIEW

12.2.15 SIBUR

TABLE 149 SIBUR: BUSINESS OVERVIEW

*Business Overview, Products/Solutions Offered, Recent Developments, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 222)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This research study involves the extensive use of both primary and secondary data sources. Various factors affecting the industry, including the regulatory landscape; competitive scenario; historical data; current market trends; upcoming technologies; and market drivers, restraints, opportunities, and challenges, have been researched and analyzed in this report.

Foam Market Secondary Research

Secondary sources include annual reports, press releases, and investor presentations of companies; directories and databases such as D&B, Bloomberg, Chemical Weekly, and Factiva; white papers and articles from recognized authors; and publications and databases from associations, such as the Molecular Diversity Preservation International and Multidisciplinary Digital Publishing Institute (MDPI), European Phenolic Foam Association (EPFA), and British Plastics Federation (BPF). Secondary research has also been used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders has also been prepared using secondary research.

Foam Market Primary Research

In the primary research process, various sources from both the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include CEOs, vice presidents, marketing and sales directors, business development managers, technology and innovation directors of foam manufacturing companies, and suppliers and distributors. The primary sources from the demand side include industry experts such as directors of end-use industries and related key opinion leaders.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Foam Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the foam market in various end-use industries in each region. The research methodology used to estimate the market size includes the following steps:

- The key players in the market have been identified in the respective regions through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined through secondary sources and verified through primary sources.

- All possible parameters that affect the market and submarkets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data. The data has been consolidated, supplemented with detailed inputs and analysis from the MNM data repository, and presented in this report.

Foam Market Size: Top-Down Approach

Foam Market Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and sub-segments. Data triangulation and market breakdown procedures have been used wherever applicable to complete the overall market engineering process and to arrive at the exact statistics for all the segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market has been validated using both the top-down and bottom-up approaches; it has then been verified through primary interviews. Hence, for every data segment, there are three sources-the top-down approach, the bottom-up approach, and expert interviews. The data was assumed to be correct only when the values arrived at from the three sources matched.

Foam Market Objectives of the Study

- To define, describe, and forecast the size of the foam market, in terms of both value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To forecast the market size by foam type and end-use industry

- To forecast the market size with respect to five main regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America

- To strategically analyze foam market with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments in the market, such as new product development, mergers & acquisitions, investment & expansion, and joint ventures, agreements & partnerships

- To strategically profile the key players and comprehensively analyze their market shares and core competencies1

Note: Core competencies of companies are determined in terms of the key developments, and key strategies adopted by them to sustain in the market.

Foam Market Report Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Foam Market Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Foam Market Regional Analysis

- Further breakdown of the foam market, by country

Foam Market Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Foam Market