Biopsy Devices Market by Product (Core Needle Biopsy, Aspiration Biopsy, Vacuum Assisted Biopsy), Application (Breast Biopsy, Lung Biopsy, Prostate Biopsy), Guidance (Stereotactic, Ultrasound), End User (Hospital) & Region - Global Forecast to 2028

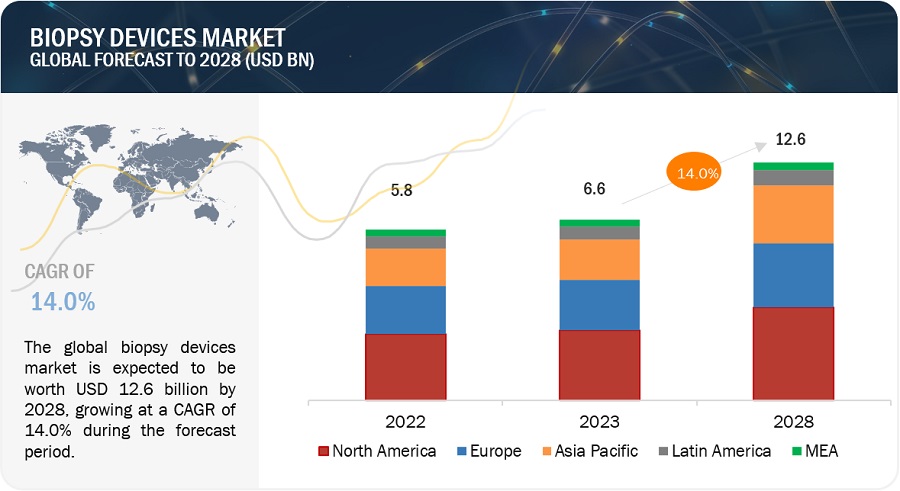

The global biopsy devices market in terms of revenue was estimated to be worth $6.6 billion in 2023 and is poised to reach $12.6 billion by 2028, growing at a CAGR of 14.0% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The increasing patient population, rising prevalence of target diseases, and rising focus on accurate procedures are expected to drive the market during the forecast period.

Global Biopsy Devices Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

e- Estimated; p- Projected

Biopsy devices Market Dynamics

Driver: Rising prevalence of cancer

Globally, there has been a significant increase in the number of people suffering from cancer. According to the GLOBOCAN’s estimates, the number of people suffering from cancer is expected to increase to 19.3 million by 2025 from 19.3 million in 2020. Cancer is the second leading cause of death in the US and accounts for nearly 1 in every 4 deaths. According to the American Cancer Society, in the US, 1,688,780 new cancer cases (excluding carcinoma in situ of any site) are expected to be diagnosed in 2017, and the total number of cancer-related deaths is expected to be 600,920 in the same year; this figure corresponds to ~1,650 deaths per day.

The incidence rates of cancer remain highest in the more-developed regions; however, the mortality is relatively higher in the less-developed countries due to limited access to treatment facilities and lack of awareness regarding the benefits of early detection. According to the GLOBOCAN 2012, about 56.8% of all new cancer cases and 10 million of all cancer deaths in 2020 occurred worldwide. GLOBOCAN predicts that the number of cancer cases will increase to 28.4 million in 2040. The mortality ratio was the highest in China (70.2%), followed by India (69.1%). These proportions are expected to increase further by 2025. The increasing number of cancer patients will lead to an increase in the number of biopsy procedures to diagnose malignant and benign cancer which is expected to drive the growth of market.

In 2022, the geriatric population affected with cancer accounted for 47.5% of cancer cases; this percentage is expected to reach 54.6% in 2030. The rapid growth in the geriatric population and the growing prevalence of cancer in this population is expected to increase the demand for biopsy procedures subsequently. The global shift towards an aging population is poised to exert a significant impact on cancer control efforts worldwide, given the higher incidence of cancer among elderly individuals. The pace of population aging is accelerating, with a current count of more than 703 million individuals worldwide aged 65 and above, constituting 9.1% of the global populace. This demographic transformation underscores the increasing importance of addressing cancer as a critical public health concern, particularly in the context of an aging society. By the year 2050, it is projected that the incidence of cancer among individuals aged 85 and above will experience a fourfold rise. ( Source:ons.org)

Restraint: Risk of infections

Biopsy procedures assist radiologists and surgeons in examining abnormalities at a particular site. However, patients can be infected during these procedures as they involve cuts and incisions for removing tissue samples. According to an article published in The Journal of Urology 2014 (Official Journal of the American Urology Association), the incidence of severe post-prostate biopsy infections is on the rise in Sweden. As per this study, the incidence of urinary tract infections was approximately 2%, which increased to 6% after 30 days of biopsy and 1% were hospitalized. The high risk of infections post biopsy procedures can hinder the growth of this market.

Opportunity: Technological Advancements

Continued innovation in biopsy device technology, such as improved imaging capabilities, robotics, and precision-guided biopsy tools, offers opportunities for more accurate and less invasive procedures. Advanced imaging techniques such as ultrasound, magnetic resonance imaging (MRI), and computed tomography (CT) scans have become integral in guiding biopsy procedures. For instance, real-time ultrasound imaging allows healthcare professionals to precisely target and extract tissue samples, minimizing the risk of complications.

- Medtronic has introduced the StealthStation iO navigation system, a cutting-edge image-guided surgery platform suitable for a range of procedures, including image-guided biopsy. Leveraging artificial intelligence (AI), the StealthStation iO system enhances the precision and effectiveness of image-guided surgical interventions, significantly improving their accuracy and efficiency.

- Hologic, a prominent provider of women's health and imaging solutions, unveiled its latest offering, the Affirm Breast Biopsy System, in September 2022. This advanced system is designed for minimally invasive breast biopsies and leverages 3D tomosynthesis for precise needle placement guidance. The Affirm system incorporates several innovative elements, such as an intelligent needle guide that automatically retracts upon tissue acquisition, thereby mitigating the potential for patient discomfort and procedural complications

The growth of liquid biopsy technologies, which enable the detection of cancer-related biomarkers in blood or other bodily fluids, presents significant growth potential for non-invasive cancer diagnosis and monitoring. Several companies are actively engaged in advancing liquid biopsy technologies. For instance, TrovaGene is in the process of developing a novel liquid biopsy test aimed at early colorectal cancer detection, while Natera is working on a liquid biopsy test for the early detection of ovarian cancer. These advancements have the capacity to enhance the precision, safety, and effectiveness of liquid biopsy tests. The realm of liquid biopsy is marked by continuous innovation, with new breakthroughs regularly emerging. This dynamic environment presents an exciting opportunity for those involved in the field, and I eagerly anticipate witnessing the future developments in liquid biopsy technology.

Challenge: Underdeveloped healthcare infrastructure and dearth of resources in developing countries

With the growing awareness about different types of cancers, the demand for biopsy procedures in developing countries is expected to increase in the coming years. Due to limited healthcare resources and underdeveloped infrastructure, alternative strategies for diagnosis of breast cancer are widely used in the region. Mortality caused due to breast cancer is also higher in low- and middle-income countries as compared to high-income countries. This is mainly due to the lack of early detection in these countries.

Although the incidence of cervical cancer has been increasing, the screening coverage in this region is very low. In Sub-Saharan Africa, it has been estimated that only 5% of the women at risk are screened for cancer. Likewise, in India, guidelines for population-based screening programs for cervical cancer have been established based on visual inspection tests. Despite these guidelines, the screening coverage in this country is very low. Various factors such as lack of trained practitioners, inadequate laboratory supplies, inappropriate physical access to treatment, and ethical and religious beliefs are negatively impacting the diagnosis of this condition. Inadequate healthcare resources and underdeveloped healthcare infrastructure thus present challenges to the growth of the market in developing countries.

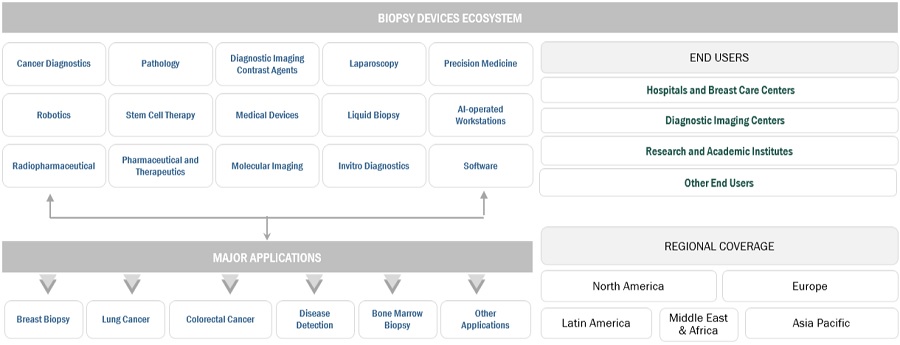

Market Ecosystem

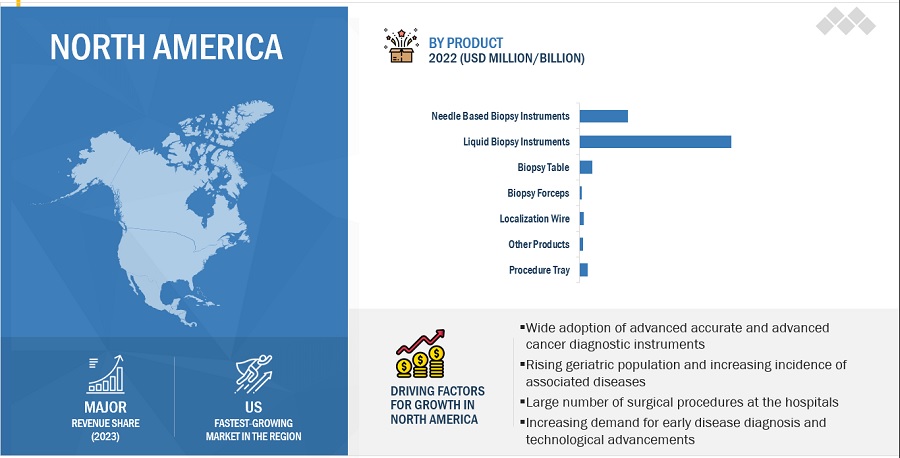

By product, the Needle based biopsy instruments segment accounted for the largest share of the biopsy devices industry in 2022

Based on technology, the global biopsy devices market is segmented into needle-based biopsy instruments, localization wire, procedure tray, biopsy forceps, biopsy tables and others. In 2022, the needle-based biopsy instruments segment accounted for the largest market share. Needle biopsies are minimally invasive procedures that can be performed quickly and with relatively low patient discomfort, making them preferable for both patients and healthcare providers. Secondly, the rising incidence of cancer and the need for early diagnosis have increased the demand for tissue sampling, particularly for lesions that are difficult to access through traditional means.

By application, the breast biopsy applications segment of the biopsy devices industry to register significant growth in the near future

Based on application, the biopsy devices market is divided into breast, bone marrow, colorectal, lung, prostate and other applications. Major share of the segment is attributed to the increasing number of cancer cases and the growing use of biopsy devices for diagnosis purpose.

By end user, the hospitals and breast care centers segment accounted for the largest share of the biopsy devices industry in 2022

On the basis of end user, the biopsy devices market has been segmented into hospitals and breast care centers, diagnostic imaging centers; research and academic institutes; and other end users. However, the diagnostic imaging center segment is estimated to grow at the highest CAGR during the forecast period.

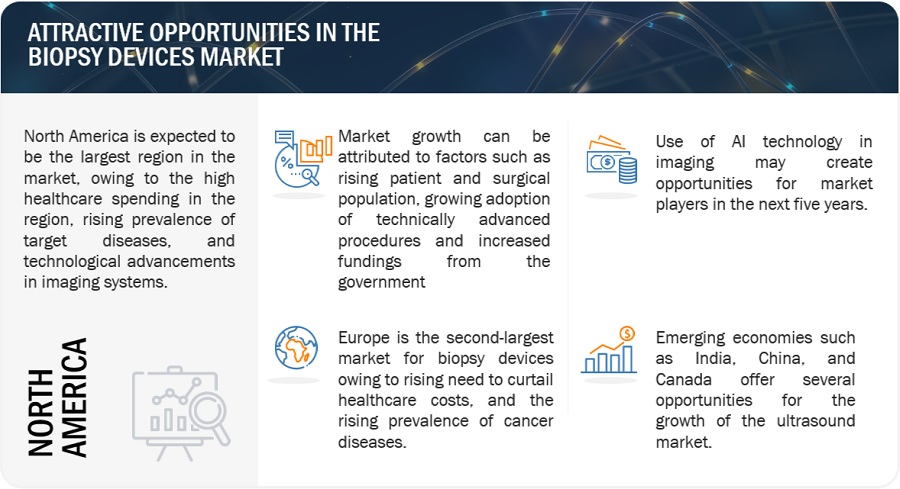

By region, North America is expected to be the largest market of the biopsy devices industry during the forecast period

North America, comprising the US and Canada, accounted for the largest market share of the biopsy devices industry in 2022. The faster growth of the biopsy devices imaging market in North America can be attributed to its technological leadership, robust healthcare infrastructure, high market demand driven by prevalent chronic diseases and an aging population, ample financial resources for advanced medical equipment investment, established regulatory frameworks ensuring safety and quality, active research collaboration, insurance coverage for advanced diagnostics, patient expectations for comprehensive care, and a competitive market environment fostering innovation.

To know about the assumptions considered for the study, download the pdf brochure

As of 2022, prominent players in the biopsy devices market are Becton, Dickinson and Company (US), Cook Group Incorporated (US), Devicor Medical Products, Inc., (Leica Biosystems) (Germany), Hologic, Inc. (US), Argon Medical Devices (US), B. Braun Melsungen AG (Germany), Cardinal Health, Inc. (US), Olympus Corporation (Japan), Boston Scientific Corporation (US), FUJIFILM Holdings Corporation (Japan), INRAD, Inc. (US), and Medtronic plc (Ireland)

Scope of the Biopsy Devices Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$6.6 billion |

|

Estimated Value by 2028 |

$12.6 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 14.0% |

|

Market Driver |

Rising prevalence of cancer |

|

Market Opportunity |

Technological Advancements |

This report has segmented the global biopsy devices market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Needle Based Biopsy Instruments

- Liquid Biopsy Instruments

- Localization Wire

- Biopsy Forceps

- Procedure Tray

- Biopsy Table

- Other Biopsy Products

By Guidance Technique

-

Image Guided Biopsy

- Ultrasound Guided Biopsy

- Stereotactic Guided Biopsy

- MRI Guided Biopsy

- Other Biopsy

-

Non-Image Guided Biopsy

- Liquid Biopsy

- General Biopsy

By Application

- Breast Cancer

- Lung Cancer

- Kidney Cancer

- Prostate Cancer

- Bone Marrow Biopsy

- Other Applications

By End User

- Hospitals and Breast Care Centers

- Diagnostic Imaging Centers

- Research and Academic Institutes

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

Recent Developments of Biopsy Devices Industry

- In December 2022, Olympus entered into a definitive agreement, subsequently finalizing the acquisition of all outstanding shares of Odin Medical Ltd., a cloud-AI endoscopy company based in the UK. This acquisition was conducted through Olympus' UK subsidiary, Keymed (Medical & Industrial Equipment) Ltd.

- In November 2021, B. Braun and REVA Medical announced the strategic partnership for the distribution of Fantom Encore - a bioresorbable scaffold for coronary interventions, manufactured with REVA's patented material Tyrocore. B. Braun will start active distribution of the products in Germany and Switzerland in November 2021, with additional countries to follow afterwards.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global biopsy devices market?

The global biopsy devices market boasts a total revenue value of $12.6 billion by 2028.

What is the estimated growth rate (CAGR) of the global biopsy devices market?

The global biopsy devices market has an estimated compound annual growth rate (CAGR) of 14.0% and a revenue size in the region of $6.6 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current size of the biopsy devices market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial biopsy devices market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

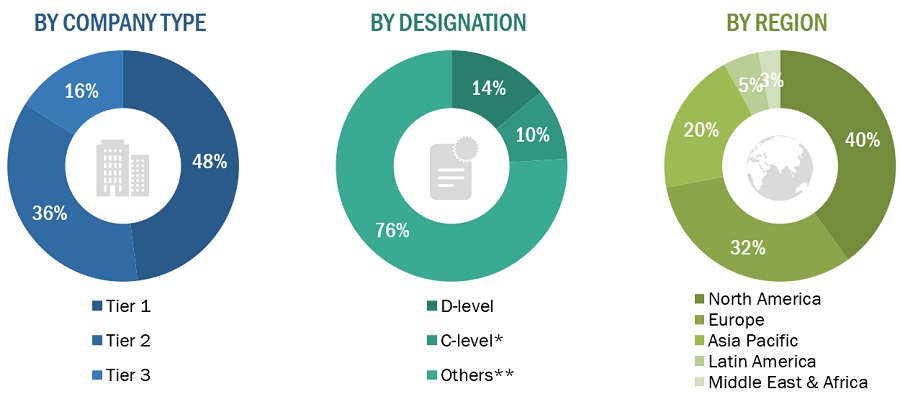

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the biopsy devices market. The primary sources from the demand side include hospitals, clinics, research labs, and pharmaceutical and biotechnology companies. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The tiers of the companies are defined based on their total revenue. As of 2022: Tier 1 => USD 1 billion, Tier 2 = USD 200-500 million to USD 1 billion, and Tier 3 =< USD 200 million

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

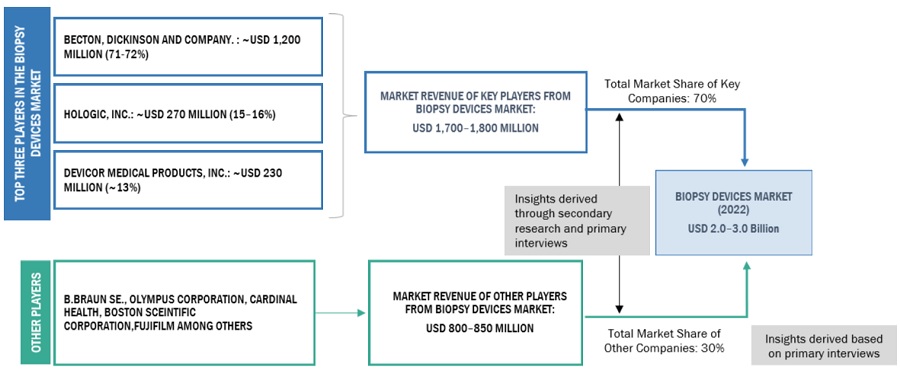

In this report, the biopsy devices market’s size was determined using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the market business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

Segmental revenues were calculated based on the revenue mapping of major solution/service providers to calculate the global market value. This process involved the following steps:

- Generating a list of major global players operating in the biopsy devices market.

- Mapping annual revenues generated by major global players from the product segment (or nearest reported business unit/product category)

- Revenue mapping of major players to cover a major share of the global market share, as of 2022

- Extrapolating the global value of the biopsy devices market industry

Bottom-up approach

In this report, the size of the global biopsy devices market was determined using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the biopsy devices business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and marketing executives.

Approach 1: Company revenue estimation approach

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/product providers. This process involved the following steps:

- Generating a list of major global players operating in the biopsy devices market

- Mapping the annual revenues generated by major global players from the biopsy devices segment (or the nearest reported business unit/product category)

- Mapping the revenues of major players to cover at least 80–85% of the global market share as of 2022

- Extrapolating the global value of the biopsy devices industry

Market Size Estimation For Biopsy Devices: Approach 1 (Company Revenue Estimation)

To know about the assumptions considered for the study, Request for Free Sample Report

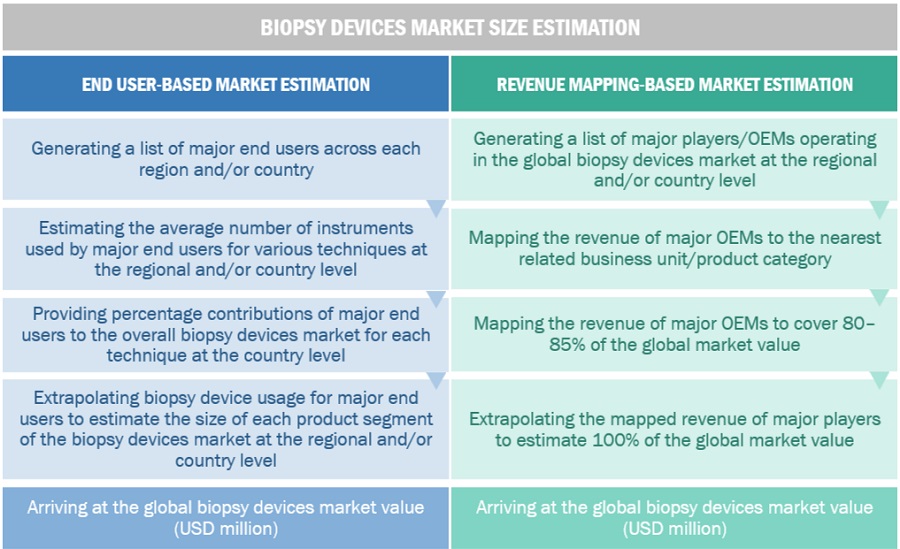

Approach 2: Customer-based market estimation

During preliminary secondary research, the total sales revenue of biopsy devices was estimated and validated at the regional and country level, triangulated, and validated to estimate the global market value. This process involved the following steps:

- Generating a list of major customer facilities across each region and country

- Identifying the average number of biopsy devices product supplies used by major customer facilities across each product type at the regional/country level, annually

- Identifying the percentage contribution of major customer facilities to the overall biopsy devices expenditure and usage at the regional/country level, annually

- Extrapolating the annual usage patterns for various products across major customer facilities to estimate the size of each product segment at the regional/country level, annually

- Identifying the percentage contributions of individual market segments and subsegments to the overall biopsy devices market at the regional/country level

Biopsy Devices Market Size Estimation: Bottom-Up Approach

Source: MarketsandMarkets Analysis

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global biopsy devices market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the biopsy devices market was validated using top-down and bottom-up approaches.

Market Definition

Biopsy devices encompass a diverse range of medical instruments designed for the precise collection and extraction of tissue samples from the human body for diagnostic and research purposes. These devices play a pivotal role in modern healthcare, aiding in the detection, characterization, and monitoring of various medical conditions, especially cancer. They come in various forms, including needle-based biopsy tools, endoscopic devices, and surgical instruments, each tailored to specific clinical scenarios and anatomical locations. Over the years, biopsy device technologies have evolved significantly, with a focus on enhancing accuracy, reducing patient discomfort, and improving diagnostic yield. These innovations, combined with increasing cancer incidence rates and the need for early disease detection, have driven the growth of the biopsy devices market, making it an integral component of the broader healthcare landscape. As healthcare continues to advance, biopsy devices continue to be at the forefront of diagnostic and therapeutic interventions, contributing to improved patient outcomes and the advancement of medical knowledge.

Key Stakeholders

- Biopsy devices product manufacturers

- Original equipment manufacturers (OEMs)

- Suppliers, distributors, and channel partners

- Healthcare service providers

- Hospitals and academic medical centers

- Radiologists

- Research laboratories

- Health insurance providers

- Government bodies/organizations

- Regulatory bodies

- Medical research institutes

- Business research and consulting service providers

- Venture capitalists and other public-private funding agencies

- Market research and consulting firms

Objectives of the Study

- To define, describe, and forecast the biopsy devices market based on product, guidance technique, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to four regions, namely, North America, Europe, the Asia Pacific, Latin America, Middle East and Africa

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To benchmark players within the market using a proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of market share and product footprint

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the present global biopsy devices market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Geographic Analysis

- Further breakdown of the Rest of Europe biopsy devices market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal, among others

- Further breakdown of the Rest of Asia Pacific biopsy devices market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

- Further breakdown of the Rest of Latin America (RoLATAM), which comprises Argentina, Chile, Peru, Colombia, and Cuba

- Further breakdown of the RoW market into Latin America and MEA regions

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Biopsy Devices Market