Blockchain Supply Chain Market by Offering (Platform, Services), Type (Public, Private, and Hybrid and Consortium), Provider, Application (Asset Tracking, Smart Contracts), Enterprise Size, Vertical (FMGC, Healthcare), and Region - Global Forecast to 2026

Updated on : April 25, 2023

Blockchain Supply Chain Market Forecast & Report Summary, Global Size

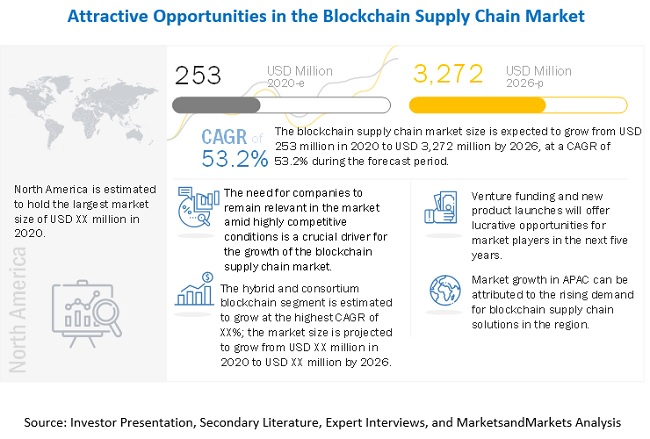

The global Blockchain Supply Chain Market size was worth approximately $253 million in 2020 and is poised to generate a revenue around $3,272 million by the end of 2026, presenting a CAGR of 53.2% during the forecast period.

The new research study consists of a market industry trends analysis and also includes pricing analysis, patent analysis, conference and webinar materials, key stakeholders and market buying behaviour. The major factors fueling the blockchain supply chain market include Increasing popularity of blockchain technology in retail and SCM, growing need for supply chain transparency and rising demand for enhanced security of supply chain transactions. Moreover, Growing need for automating supply chain activities and eliminating middlemen and rising government initiatives would provide lucrative opportunities for blockchain supply chain vendors.

To know about the assumptions considered for the study, Request for Free Sample Report

Blockchain Supply Chain Market Growth Dynamics

Driver: Increasing popularity of blockchain technology in retail and SCM

The retail and SCM industry witnesses several transactions each day, along with the exchange of information on a daily basis. The information may include authentication process information, procurement data, sales, fees, certifications, approvals, and disbursements. The major challenges faced by companies operating in the supply chain industry include reduced costs, enhanced speed, and continuous tracking of products’ movement and quality. Various stakeholders in the SCM industry have started adopting blockchain technology to improve the transparency and efficiency in business operations and enhance the overall experience of the final delivery phase. The integration of blockchain technology with an SCM system prevents data manipulation, which is expected to be one of the biggest driving factors for the overall growth of the blockchain market. This technology further enables the recording of transactions on distributed ledgers, thus offering increased transparency, fraud prevention, and improved efficiency to various agencies.

Restraint: Uncertain regulatory status and standards

With technological advancements, regulatory bodies need to understand what the current regulations lack and how these regulations can impact the overall technology-enabled applications. Uncertainties in regulations remain a concern in the blockchain supply chain market. At present, the lack of regulations is expected to be one of the biggest restraining factors for the adoption of blockchain technology, especially for SCM in many industry verticals. Healthcare institutions across the globe are working closely to find a common set of standards for blockchain technology, however, the regulatory acceptance by healthcare institutions is one of the biggest challenges in transforming supply chain systems. The distributed ledger technology is still at a nascent stage, which raises a number of questions related to the wide range of applications, security, and authenticity for regulators and policymakers both at the national and international levels. Owing to issues such as standardization and interoperability, the regulatory status of blockchain technology remains uncertain.

Opportunity: Growing need for automating supply chain activities and eliminating middlemen

The supply chain ecosystem includes various services, such as legal, insurance, settlement, transport management, route planning, normative compliance, fleet management, delivery schedules, and connectivity with stakeholders. These processes require middlemen. Blockchain technology equips supply chains with an automated process for storing the data in the digital format, which is extremely difficult to tamper with. By applying blockchain technology in supply chain activities, the need to appoint middlemen for transaction validations or negotiations would be eliminated. Moreover, the blockchain technology synchronizes all the transaction data across networks, so that each participant validates the work of other participants. It ultimately automates supply chain transactions and encourages a direct relationship between stakeholders, thereby eliminating the need for any middlemen. The added advantage of the blockchain technology is that, even with so many transactions and their data to handle, each transaction can be accurately backtracked to its point of origin.

Challenge: Managing the increasing data volume

A huge amount of energy and computing power is required for validating blocks and storing ledgers in the blockchain technology. In the case of Bitcoin technology, networks are large and public, which can process around 450 trillion transactions per second. These numbers of transactions per second are small when compared with the required transactions workload projected for supply chains. Furthermore, supply chains mainly rely on permissioned blockchain, due to confidentiality issues. The capabilities of the permissioned blockchain are still few than those of centralized databases that are being used by supply chain organizations at present. This raises significant hesitations about the scope of the data elements that the permissioned blockchain can capture. It would be challenging to increase the capacity of the permissioned blockchain for keeping up with the increasing pace of big data.

SMEs segment to grow at a higher CAGR during the forecast period

Rather than investing in on-premises networking solutions, SMEs prefer cloud-based solutions, which are more flexible and fall within the budget. The adoption of the pay-as-you-go model by SMEs to flexibly manage the IT infrastructure as per their requirements is projected to drive the adoption of blockchain supply chain. Also, the need for efficient customer data protection and cost-cutting, as well as attaining a competitive advantage, enables quick response and timely decisions that are projected to drive the growth of the blockchain supply chain market in SMEs.

FMCG vertical to hold the largest market size during the forecast period

In the FMGC segment, delivering the right product at the right time and quantity is very critical. Also, quick delivery of perishable goods is a major task for any food and beverage distributor. Hence, real-time supply chain visibility becomes absolutely essential for successful FMCG supply chain execution and unplanned cost avoidance. Blockchain supply chain platform and services provide FMCG companies with real-time supply chain visibility, BI, and reduced operating cost. The uses of blockchain in the supply chain for FMCG include anti-counterfeiting, advertising, and consumer data management. Anti-counterfeiting blockchain solutions track and trace products through barcodes assigned to products in the supply chain process, ensuring customers receive authentic products.

To know about the assumptions considered for the study, download the pdf brochure

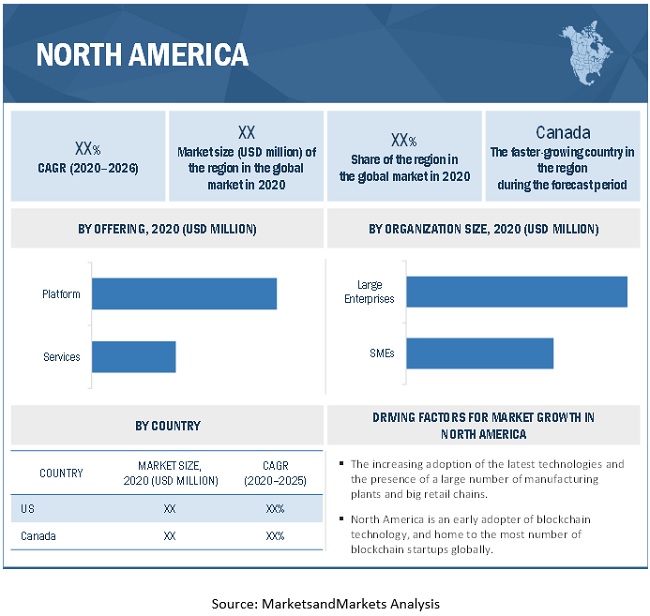

North America to hold the largest market size during the forecast period

With the technological advancement and the rising focus on making supply chain functions, such as logistics, warehousing, fulfillment, production, and transportation management more efficient, the need for a blockchain supply chain is being fueled in the region. The increasing adoption of the latest technologies and the presence of a large number of manufacturing plants and big retail chains are expected to drive the adoption of blockchain supply chain in the region. The presence of stringent regulations and trade agreements related to the supply chain across the region is also a driver of the blockchain supply chain here.

Asia Pacific is expected to contribute to the fastest-growing region with the highest CAGR during the forecast period as it is getting technologically equipped with the early adoption of new technologies. The latest trends of widespread adoption of trucking, containerization, and computerization resulting in scaled shipping and delivery of raw materials, Work In Progress (WIP), and finished goods around the world and effectively improving cost, quality, and delivery of supply chain are also a driver for blockchain supply chain software and services. The increased shift of APAC enterprises toward leaner and agile supply chains with end-to-end visibility by the adoption of the latest technologies is also one of the biggest drivers of blockchain supply chain software and services in the region.

Key Market Players

Major vendors in the global blockchain supply chain market include IBM (US), SAP SE (Germany), Oracle (US), Guardtime (Estonia), and Interbit (Canada)

Oracle is one of the leading providers of a wide array of technologies. The company operates in three business areas: cloud and license, hardware, and services. It offers middleware software, Oracle databases, cloud infrastructure, application software, and hardware systems, including networking products, computer servers, and storage-related services. It has a broad portfolio of SCM applications that enable organizations to improve outcomes for operational efficiency, while ensuring cost savings. Oracle offers a comprehensive and broad portfolio of cloud solutions for business functions, such as enterprise resource planning, human capital management, customer experience, and SCM. The Oracle SCM offerings enable organizations to efficiently organize and improve their supply chains. These offerings include Oracle product lifecycle management cloud, Oracle supply chain planning cloud, Oracle inventory management cloud, Oracle order management cloud, Oracle order manufacturing cloud, and Oracle logistics cloud. Oracle’s geographic operations are spread across Europe, the MEA, APAC, North America, and South America. Some of its notable subsidiaries include Oracle International Corporation (US), Oracle Global Holdings, Inc. (US), Oracle America, Inc. (US), Oracle Technology Company (Ireland), Oracle Systems Corporation (US), and OCAPAC Holding Company (Ireland).

Scope of the Report

|

Report Metrics |

Attributes |

|

Revenue Forecast in 2026 |

$3,272 million |

|

Market Size Value in 2020 |

$253 million |

|

Growth Rate |

53.2% |

|

Key Market Growth Drivers |

Increasing popularity of blockchain technology in retail and SCM |

|

Key Market Opportunities |

Growing need for automating supply chain activities and eliminating middlemen |

|

Market size available for years |

2014–2026 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2026 |

|

Forecast units |

Value (USD) |

|

Market Segmentation |

Offering (platform and Services), type, providers, application, organization size, end user, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

IBM (US), Microsoft (US), SAP (Germany), AWS (US), Oracle (US), Huawei (China), Guardtime (Estonia), TIBCO Software (US), Bitfury (The Netherlands), Interbit (Canada), Auxesis Group (India), VeChain (China), Chainvine (UK), Digital Treasury Corporation (China), Datex Corporation (US), OpenXcell (US), Algorythmix (India), BlockVerify (UK), and Applied Blockchain (UK). |

This research report categorizes the blockchain supply chain market to forecast revenues and analyze trends in each of the following subsegments:

Based on Offering:

- Platform

-

Services

- Technology Advisory and Consulting

- Deployment and Integration

- Support and Maintenance

Based on Type:

- Public

- Private

- Hybrid and Consortium

Based on Providers:

- Application Providers

- Middleware Providers

- Infrastructure Providers

Based on Application:

- Asset Tracking

- Counterfeit Detection

- Payment and Settlement

- Smart contracts

- Risk and Compliance Management

- Others (Inventory Control and Reward Management)

Based on Organization Size:

- SMEs

- Large enterprises

Based on Verticals:

- FMCG

- Retail and eCommerce

- Healthcare

- Manufacturing

- Transportation and Logistics

- Oil, Mining, and Gas

- Others (Construction, Agriculture, and Automobile)

Based on Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In June 2019, MIMOS collaborated with Oracle to leverage blockchain technology for greater transparency and trust.

- In October 2018, Oracle Blockchain Applications Cloud was launched to help customers increase trust and provide agility in transactions across their business networks.

- In September 2018, in order to fight the growing problem of counterfeit drugs in India, NITI Aayog and Oracle signed a Statement of Intent (SoI) to pilot a real drug supply-chain using blockchain distributed ledger and IoT software.

Frequently Asked Questions (FAQ):

How big is the Blockchain Supply Chain Market?

What is growth rate of the Blockchain Supply Chain Market?

What are the key trends affecting the global Blockchain Supply Chain Market?

Who are the key players in Blockchain Supply Chain Market?

What is the future of Blockchain Supply Chain industry?

What is the market demand for Blockchain Supply Chain?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 STUDY OBJECTIVES

1.4.1 MARKET DEFINITION

1.4.2 INCLUSIONS AND EXCLUSIONS

1.5 MARKET SCOPE

1.5.1 MARKET SEGMENTATION

1.5.2 YEARS CONSIDERED FOR THE STUDY

1.6 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2014–2020

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 6 BLOCKCHAIN SUPPLY CHAIN MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE FROM THE PLATFORM/SERVICES OF VENDORS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: ILLUSTRATIVE EXAMPLE OF AMAZON WEB SERVICES

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2, BOTTOM UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM PLATFORM AND SERVICES

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3, TOP DOWN (DEMAND SIDE)

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 11 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 12 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 13 GLOBAL BLOCKCHAIN SUPPLY CHAIN MARKET TO WITNESS HIGH GROWTH DURING THE FORECAST PERIOD

FIGURE 14 LEADING SEGMENTS IN THE MARKET IN 2020

FIGURE 15 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN THE BLOCKCHAIN SUPPLY CHAIN MARKET

FIGURE 16 HIGH ADOPTION OF THE BLOCKCHAIN TECHNOLOGY ACROSS APPLICATION AREAS TO PROVIDE SIGNIFICANT OPPORTUNITIES FOR MARKET GROWTH

4.2 MARKET, BY TYPE AND PROVIDER

FIGURE 17 PRIVATE BLOCKCHAIN SEGMENT AND APPLICATION SEGMENT TO HOLD THE HIGHEST MARKET SHARES IN 2020

4.3 MARKET, BY REGION

FIGURE 18 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.4 MARKET: INVESTMENT SCENARIO

FIGURE 19 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS OVER THE NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: BLOCKCHAIN SUPPLY CHAIN MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing popularity of blockchain technology in retail and SCM

5.2.1.2 Growing need for supply chain transparency

5.2.1.3 Rising demand for enhanced security of supply chain transactions

5.2.2 RESTRAINTS

5.2.2.1 Uncertain regulatory status and standards

5.2.3 OPPORTUNITIES

5.2.3.1 Growing need for automating supply chain activities and eliminating middlemen

5.2.3.2 Rising government initiatives

5.2.4 CHALLENGES

5.2.4.1 Managing the increasing data volume

5.2.4.2 Lack of the technical knowledge

5.2.4.3 Shortage of supply and demand shocks during COVID-19 outbreak

5.3 COVID-19 DRIVEN MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.3.3 CUMULATIVE GROWTH ANALYSIS

TABLE 3 COVID-19 IMPACT: BLOCKCHAIN SUPPLY CHAIN MARKET

5.4 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN: MARKET

5.5 ECOSYSTEM: MARKET

FIGURE 22 ECOSYSTEM: MARKET

TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

5.6 AVERAGE SELLING PRICE/PRICING MODEL OF BLOCKCHAIN SUPPLY CHAIN PLAYERS 2019-2020

FIGURE 23 2019-2020 AVERAGE SELLING PRICE MODEL OF MARKET

5.7 BLOCKCHAIN TECHNOLOGY ANALYSIS

5.7.1 BLOCKCHAIN SUPPLY CHAIN MARKET: TOP TRENDS

5.7.1.1 Integration of blockchain technology with the Internet of Things

5.7.1.2 Smart contracts

5.8 USE CASES

5.8.1 TO CHECK THE AUTHENTICITY, PROVENANCE, AND ORIGIN OF PRODUCTS BY TRACKING THE GLOBAL FLOW OF GOODS, BY BIGCHAINDB

5.8.2 USE CASE 2: TO REDUCE THE WASTAGE OF FOOD BY IMPROVING FOOD SAFETY AND TRACEABILITY, AND TO HELP ITS ONLINE AND OFFLINE CONSUMERS ACROSS THE GLOBE, BY IBM

5.8.3 USE CASE 3: TO LEVERAGE INNOVATIVE TECHNOLOGIES SUCH AS BLOCKCHAIN, AI AND IOT TO TRANSFORM SUPPLY CHAIN OPERATIONS IN THE SHIPPING INDUSTRY, BY ORACLE

5.8.4 USE CASE 4: BLOCKCHAIN HELPS RCS GLOBAL TRACE RESPONSIBLY PRODUCED RAW MATERIALS, BY IBM

5.9 REVENUE SHIFT – YC/YCC SHIFT FOR MARKET

FIGURE 24 YC/YCC SHIFT: BLOCKCHAIN SUPPLY CHAIN MARKET

5.10 PATENT ANALYSIS

FIGURE 25 BLOCKCHAIN PATENT APPLICATIONS PER YEAR

FIGURE 26 TOP BLOCKCHAIN APPLICATION AREAS

TABLE 5 BLOCKCHAIN SUPPLY CHAIN PATENT ANALYSIS

5.11 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 PORTERS 5 FORCES IMPACT ON THE MARKET

FIGURE 27 PORTER’S FIVE FORCES ANALYSIS: MARKET

5.11.1 THREAT FROM NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 INTENSITY OF COMPETITION RIVALRY

6 BLOCKCHAIN SUPPLY CHAIN MARKET, BY OFFERING (Page No. - 70)

6.1 INTRODUCTION

6.1.1 OFFERING: MARKET DRIVERS

6.1.2 OFFERING: COVID-19 IMPACT

FIGURE 28 PLATFORM SEGMENT TO HOLD A SIGNIFICANT MARKET SIZE DURING THE FORECAST PERIOD

TABLE 7 MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 8 MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

6.2 PLATFORM

TABLE 9 PLATFORM: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 10 PLATFORM: MARKET SIZE IN SOFTWARE, BY REGION, 2019–2026 (USD MILLION)

6.3 SERVICES

FIGURE 29 DEPLOYMENT AND INTEGRATION SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 11 SERVICES: BLOCKCHAIN SUPPLY CHAIN MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 12 SERVICES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 13 SERVICES: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 14 SERVICES: MARKET SIZE, BY TYPE, 2019 -2026 (USD MILLION)

6.3.1 TECHNOLOGY ADVISORY AND CONSULTING

TABLE 15 TECHNOLOGY ADVISORY AND CONSULTING MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 16 TECHNOLOGY ADVISORY AND CONSULTING MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.2 DEPLOYMENT AND INTEGRATION

TABLE 17 DEPLOYMENT AND INTEGRATION MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 18 DEPLOYMENT AND INTEGRATION MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.3 SUPPORT AND MAINTENANCE

TABLE 19 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 20 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7 BLOCKCHAIN SUPPLY CHAIN MARKET, BY TYPE (Page No. - 79)

7.1 INTRODUCTION

7.1.1 TYPE: MARKET DRIVERS

7.1.2 TYPE: COVID-19 IMPACT

FIGURE 30 HYBRID AND CONSORTIUM SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 21 MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 22 MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

7.2 PUBLIC

TABLE 23 PUBLIC: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 24 PUBLIC: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.3 PRIVATE

TABLE 25 PRIVATE:MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 26 PRIVATE: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.4 HYBRID AND CONSORTIUM

TABLE 27 HYBRID AND CONSORTIUM: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 28 HYBRID AND CONSORTIUM: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8 BLOCKCHAIN SUPPLY CHAIN MARKET, BY PROVIDER (Page No. - 85)

8.1 INTRODUCTION

8.1.1 PROVIDER: MARKET DRIVERS

8.1.2 PROVIDER: COVID-19 IMPACT

FIGURE 31 APPLICATION PROVIDER SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 29 MARKET SIZE, BY PROVIDER TYPE, 2014–2019 (USD MILLION)

TABLE 30 MARKET SIZE, BY PROVIDER TYPE, 2019–2026 (USD MILLION)

8.2 APPLICATION PROVIDERS

TABLE 31 APPLICATION PROVIDERS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 32 APPLICATION PROVIDERS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.3 MIDDLEWARE PROVIDERS

TABLE 33 MIDDLEWARE PROVIDERS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 34 MIDDLEWARE PROVIDERS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.4 INFRASTRUCTURE PROVIDERS

TABLE 35 INFRASTRUCTURE PROVIDERS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 36 INFRASTRUCTURE PROVIDERS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9 BLOCKCHAIN SUPPLY CHAIN MARKET, BY APPLICATION (Page No. - 91)

9.1 INTRODUCTION

9.1.1 APPLICATION: MARKET DRIVERS

9.1.2 APPLICATION: COVID-19 IMPACT

FIGURE 32 COUNTERFEIT DETECTION SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 37 MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 38 MARKET SIZE, BY APPLICATION, - 2019–2026 (USD MILLION)

9.2 ASSET TRACKING

TABLE 39 ASSET TRACKING: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 40 ASSET TRACKING: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.3 COUNTERFEIT DETECTION

TABLE 41 COUNTERFEIT DETECTION: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 42 COUNTERFEIT DETECTION: BLOCKCHAIN SUPPLY CHAIN MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.4 PAYMENT AND SETTLEMENT

TABLE 43 PAYMENT AND SETTLEMENT: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 44 PAYMENT AND SETTLEMENT: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.5 SMART CONTRACTS

TABLE 45 SMART CONTRACTS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 46 SMART CONTRACTS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.6 RISK AND COMPLIANCE MANAGEMENT

TABLE 47 RISK AND COMPLIANCE MANAGEMENT: MARKET SIZE, 2014–2019 (USD MILLION)

TABLE 48 RISK AND COMPLIANCE MANAGEMENT: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.7 OTHER APPLICATIONS

TABLE 49 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 50 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10 BLOCKCHAIN SUPPLY CHAIN MARKET, BY ORGANIZATION SIZE (Page No. - 101)

10.1 INTRODUCTION

FIGURE 33 LARGE ENTERPRISES SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

TABLE 51 MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 52 MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

10.2 SMALL AND MEDIUM-SIZED ENTERPRISES

10.2.1 SMALL- AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

10.2.2 SMALL- AND MEDIUM-SIZED ENTERPRISES: COVID-19 IMPACT

TABLE 53 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 54 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10.3 LARGE ENTERPRISES

10.3.1 LARGE ENTERPRISES: MARKET DRIVERS

10.3.2 LARGE ENTERPRISES: COVID-19 IMPACT

TABLE 55 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 56 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

11 BLOCKCHAIN SUPPLY CHAIN MARKET ANALYSIS, BY END USER (Page No. - 106)

11.1 INTRODUCTION

TABLE 57 MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 58 MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

FIGURE 34 RETAIL AND ECOMMERCE END USER TO ACCOUNT FOR THE LARGEST MARKET SIZE IN 2020

11.2 FAST-MOVING CONSUMER GOODS

11.2.1 FAST-MOVING CONSUMER GOODS: MARKET DRIVERS

11.2.2 FAST-MOVING CONSUMER GOODS: COVID-19 IMPACT

TABLE 59 FAST-MOVING CONSUMER GOODS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 60 FAST-MOVING CONSUMER GOODS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

11.3 RETAIL AND ECOMMERCE

11.3.1 RETAIL AND ECOMMERCE: MARKET DRIVERS

11.3.2 RETAIL AND ECOMMERCE: COVID-19 IMPACT

TABLE 61 RETAIL AND ECOMMERCE: BLOCKCHAIN SUPPLY CHAIN MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 62 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

11.4 HEALTHCARE

11.4.1 HEALTHCARE: MARKET DRIVERS

11.4.2 HEALTHCARE: COVID-19 IMPACT

TABLE 63 HEALTHCARE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 64 HEALTHCARE: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

11.5 MANUFACTURING

11.5.1 MANUFACTURING: MARKET DRIVERS

11.5.2 MANUFACTURING: COVID-19 IMPACT

TABLE 65 MANUFACTURING: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 66 MANUFACTURING: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

11.6 TRANSPORTATION AND LOGISTICS

11.6.1 TRANSPORTATION AND LOGISTICS: BLOCKCHAIN SUPPLY CHAIN MARKET DRIVERS

11.6.2 TRANSPORTATION AND LOGISTICS: COVID-19 IMPACT

TABLE 67 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 68 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

11.7 OIL, MINING, AND GAS

11.7.1 OIL, MINING, AND GAS: MARKET DRIVERS

11.7.2 OIL, MINING, AND GAS: COVID-19 IMPACT

TABLE 69 OIL, MINING, AND GAS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 70 OIL, MINING, AND GAS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

11.8 OTHER END USERS

TABLE 71 OTHER END USERS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 72 OTHER END USERS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

12 BLOCKCHAIN SUPPLY CHAIN MARKET, BY REGION (Page No. - 119)

12.1 INTRODUCTION

TABLE 73 MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 74 MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: MARKET DRIVERS

12.2.2 NORTH AMERICA: COVID-19 IMPACT

12.2.3 NORTH AMERICA: REGULATIONS

FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

TABLE 75 NORTH AMERICA: BLOCKCHAIN SUPPLY CHAIN MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY PROVIDER, 2014–2019 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY PROVIDER, 2019–2026 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

12.2.4 UNITED STATES

TABLE 91 UNITED STATES: BLOCKCHAIN SUPPLY CHAIN MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 92 UNITED STATES: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 93 UNITED STATES: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 94 UNITED STATES: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 95 UNITED STATES: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 96 UNITED STATES: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 97 UNITED STATES: MARKET SIZE, BY PROVIDER, 2014–2019 (USD MILLION)

TABLE 98 UNITED STATES: MARKET SIZE, BY PROVIDER, 2019–2026 (USD MILLION)

TABLE 99 UNITED STATES: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 100 UNITED STATES: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 101 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 102 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 103 UNITED STATES: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 104 UNITED STATES: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

12.2.5 CANADA

12.3 EUROPE

12.3.1 EUROPE: BLOCKCHAIN SUPPLY CHAIN MARKET DRIVERS

12.3.2 EUROPE: COVID-19 IMPACT

12.3.3 EUROPE: TARIFFS AND REGULATIONS

TABLE 105 EUROPE: MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 106 EUROPE: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 107 EUROPE: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 108 EUROPE: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 109 EUROPE: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 110 EUROPE: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY PROVIDER, 2014–2019 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY PROVIDER, 2019–2026 (USD MILLION)

TABLE 113 EUROPE: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 117 EUROPE: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

12.3.4 UNITED KINGDOM

TABLE 121 UNITED KINGDOM: BLOCKCHAIN SUPPLY CHAIN MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 122 UNITED KINGDOM: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 123 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 124 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 125 UNITED KINGDOM: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 126 UNITED KINGDOM: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 127 UNITED KINGDOM: MARKET SIZE, BY PROVIDER, 2014–2019 (USD MILLION)

TABLE 128 UNITED KINGDOM: MARKET SIZE, BY PROVIDER, 2019–2026 (USD MILLION)

TABLE 129 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 130 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 131 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 132 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 133 UNITED KINGDOM: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 134 UNITED KINGDOM: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

12.3.5 GERMANY

12.3.6 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: BLOCKCHAIN SUPPLY CHAIN MARKET DRIVERS

12.4.2 ASIA PACIFIC: COVID-19 IMPACT

12.4.3 ASIA PACIFIC: REGULATIONS

FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 135 ASIA PACIFIC: MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET SIZE, BY PROVIDER, 2014–2019 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET SIZE, BY PROVIDER, 2019–2026 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

12.4.4 CHINA

TABLE 151 CHINA: BLOCKCHAIN SUPPLY CHAIN MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 152 CHINA: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 153 CHINA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 154 CHINA: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 155 CHINA: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 156 CHINA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 157 CHINA: MARKET SIZE, BY PROVIDER, 2014–2019 (USD MILLION)

TABLE 158 CHINA: MARKET SIZE, BY PROVIDER, 2019–2026 (USD MILLION)

TABLE 159 CHINA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 160 CHINA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 161 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 162 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 163 CHINA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 164 CHINA: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

12.4.5 JAPAN

12.4.6 INDIA

12.4.7 REST OF ASIA PACIFIC

12.5 MIDDLE EAST AND AFRICA

12.5.1 MIDDLE EAST AND AFRICA: BLOCKCHAIN SUPPLY CHAIN MARKET DRIVERS

12.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

12.5.3 MIDDLE EAST AND AFRICA: REGULATIONS

TABLE 165 MIDDLE EAST AND AFRICA: MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 166 MIDDLE EAST AND AFRICA: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 167 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 168 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 169 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 170 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 171 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROVIDER, 2014–2019 (USD MILLION)

TABLE 172 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROVIDER, 2019–2026 (USD MILLION)

TABLE 173 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 174 MIDDLE EAST AND AFRICA: BLOCKCHAIN SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 175 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 176 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 177 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 178 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

TABLE 179 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SUBREGION, 2014–2019 (USD MILLION)

TABLE 180 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SUBREGION, 2019–2026 (USD MILLION)

12.5.4 MIDDLE EAST

TABLE 181 MIDDLE EAST: BLOCKCHAIN SUPPLY CHAIN MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 182 MIDDLE EAST: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 183 MIDDLE EAST: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 184 MIDDLE EAST: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 185 MIDDLE EAST: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 186 MIDDLE EAST: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 187 MIDDLE EAST: MARKET SIZE, BY PROVIDER, 2014–2019 (USD MILLION)

TABLE 188 MIDDLE EAST: MARKET SIZE, BY PROVIDER, 2019–2026 (USD MILLION)

TABLE 189 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 190 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 191 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 192 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 193 MIDDLE EAST: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 194 MIDDLE EAST: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

12.5.5 AFRICA

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: BLOCKCHAIN SUPPLY CHAIN MARKET DRIVERS

12.6.2 LATIN AMERICA: COVID-19 IMPACT

12.6.3 LATIN AMERICA: REGULATIONS

TABLE 195 LATIN AMERICA: MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 198 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 199 LATIN AMERICA: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET SIZE, BY PROVIDER, 2014–2019 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET SIZE, BY PROVIDER, 2019–2026 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 206 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 207 LATIN AMERICA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

12.6.4 BRAZIL

TABLE 211 BRAZIL: BLOCKCHAIN SUPPLY CHAIN MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 212 BRAZIL: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 213 BRAZIL: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 214 BRAZIL: MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 215 BRAZIL: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 216 BRAZIL: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 217 BRAZIL: MARKET SIZE, BY PROVIDER, 2014–2019 (USD MILLION)

TABLE 218 BRAZIL: MARKET SIZE, BY PROVIDER, 2019–2026 (USD MILLION)

TABLE 219 BRAZIL: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 220 BRAZIL: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 221 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 222 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 223 BRAZIL: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 224 BRAZIL: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

12.6.5 MEXICO

12.6.6 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE (Page No. - 191)

13.1 INTRODUCTION

13.2 MARKET EVALUATION FRAMEWORK

FIGURE 37 BLOCKCHAIN SUPPLY CHAIN: MARKET EVALUATION FRAMEWORK

13.3 REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 38 BLOCKCHAIN SUPPLY CHAIN MARKET: REVENUE ANALYSIS

13.4 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

TABLE 225 MARKET: DEGREE OF COMPETITION

13.5 HISTORICAL REVENUE ANALYSIS

FIGURE 39 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

13.6 RANKING OF KEY PLAYERS IN THE MARKET, 2020

FIGURE 40 KEY PLAYERS RANKING, 2020

13.7 COMPANY EVALUATION MATRIX

13.7.1 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

TABLE 226 EVALUATION CRITERIA

TABLE 227 COMPANY PRODUCT FOOTPRINT

13.7.2 STAR

13.7.3 PERVASIVE

13.7.4 EMERGING LEADERS

13.7.5 PARTICIPANTS

FIGURE 41 BLOCKCHAIN SUPPLY CHAIN MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

13.8 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 42 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE MARKET

13.9 BUSINESS STRATEGY EXCELLENCE

FIGURE 43 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE MARKET

13.10 STARTUP/SME EVALUATION MATRIX, 2020

13.10.1 PROGRESSIVE COMPANIES

13.10.2 RESPONSIVE COMPANIES

13.10.3 DYNAMIC COMPANIES

13.10.4 STARTING BLOCKS

FIGURE 44 BLOCKCHAIN SUPPLY CHAIN MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

14 COMPANY PROFILES (Page No. - 202)

(Business Overview, Solutions & Services, Key Insights, Recent Developments, Response to COVID-19, MnM View)*

14.1 MAJOR PLAYERS

14.1.1 IBM

TABLE 228 IBM: BUSINESS OVERVIEW

FIGURE 45 IBM: COMPANY SNAPSHOT

TABLE 229 IBM: SOLUTIONS OFFERED

TABLE 230 IBM: MARKET: PRODUCT LAUNCHES

TABLE 231 IBM: MARKET: DEALS

14.1.2 MICROSOFT

FIGURE 46 MICROSOFT: COMPANY SNAPSHOT

TABLE 232 MICROSOFT: BUSINESS OVERVIEW

TABLE 233 MICROSOFT: SOLUTIONS OFFERED:

TABLE 234 MICROSOFT: BLOCKCHAIN SUPPLY CHAIN MARKET: PRODUCT LAUNCHES

TABLE 235 MICROSOFT: MARKET: DEALS

14.1.3 SAP SE

TABLE 236 SAP: BUSINESS OVERVIEW

FIGURE 47 SAP SE: COMPANY SNAPSHOT

TABLE 237 SAP: SOLUTIONS AND SERVICES OFFERED

TABLE 238 SAP: MARKET: DEALS

14.1.4 AMAZON WEB SERVICES

TABLE 239 AWS: BUSINESS OVERVIEW

FIGURE 48 AMAZON WEB SERVICES: COMPANY SNAPSHOT

TABLE 240 SAP: SOLUTIONS AND SERVICES OFFERED

14.1.5 ORACLE

TABLE 241 ORACLE: BUSINESS OVERVIEW

FIGURE 49 ORACLE: COMPANY SNAPSHOT

TABLE 242 ORACLE: SERVICES OFFERED

TABLE 243 ORACLE: BLOCKCHAIN SUPPLY CHAIN MARKET: PRODUCT LAUNCHES

TABLE 244 ORACLE: MARKET: DEALS

TABLE 245 ORACLE: MARKET: OTHERS

14.1.6 HUAWEI

TABLE 246 HUAWEI: BUSINESS OVERVIEW

FIGURE 50 HUAWEI: COMPANY SNAPSHOT

TABLE 247 HUAWEI: SERVICES OFFERED

TABLE 248 HUAWEI: MARKET: PRODUCT LAUNCHES

14.1.7 GUARDTIME

TABLE 249 GUARDTIME: BUSINESS OVERVIEW

TABLE 250 GUARDTIME: SOLUTIONS AND SERVICES OFFERED

TABLE 251 GUARDTIME: BLOCKCHAIN SUPPLY CHAIN MARKET: PRODUCT LAUNCHES

TABLE 252 GUARDTIME: MARKET: DEALS

14.1.8 TIBCO SOFTWARE

TABLE 253 TIBCO SOFTWARE: BUSINESS OVERVIEW

TABLE 254 TIBCO SOFTWARE: SOLUTIONS OFFERED

14.1.9 BITFURY

TABLE 255 BITFURY: BUSINESS OVERVIEW

TABLE 256 BITFURY: SOLUTIONS OFFERED

TABLE 257 BITFURY: MARKET: PRODUCT LAUNCHES

TABLE 258 BITFURY: MARKET: DEALS

TABLE 259 BITFURY: BLOCKCHAIN SUPPLY CHAIN MARKET: OTHERS

14.1.10 INTERBIT

TABLE 260 INTERBIT: BUSINESS OVERVIEW

TABLE 261 INTERBIT: SOLUTIONS AND SERVICES OFFERED

TABLE 262 INTERBIT: MARKET: PRODUCT LAUNCHES

14.1.11 AUXESIS GROUP

14.1.12 VECHAIN FOUNDATION

14.1.13 CHAINVINE

14.1.14 DIGITAL TREASURY CORPORATION

14.1.15 DATEX CORPORATION

14.1.16 OPENXCELL

14.1.17 ALGORYTHMIX

14.1.18 BLOCKVERIFY

14.1.19 APPLIED BLOCKCHAIN

*Details on Business Overview, Solutions & Services, Key Insights, Recent Developments, Response to COVID-19, MnM View might not be captured in case of unlisted companies.

14.2 RIGHT TO WIN

TABLE 263 RIGHT TO WIN

14.3 STARTUP COMPANY PROFILES

14.3.1 TRANSCHAIN

14.3.2 OMNICHAIN

14.3.3 OWNEST

14.3.4 TRACEPARENCY

14.3.5 PEERLEDGER

14.3.6 OARO

14.3.7 RECORDSKEEPER

15 ADJACENT/RELATED MARKETS (Page No. - 247)

15.1 INTRODUCTION

15.2 HEALTHCARE SUPPLY CHAIN MANAGEMENT MARKET

15.2.1 MARKET DEFINITION

TABLE 264 HEALTHCARE SUPPLY CHAIN MANAGEMENT MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 265 HEALTHCARE SUPPLY CHAIN MANAGEMENT MARKET FOR MANUFACTURERS, BY REGION, 2018–2025 (USD MILLION)

TABLE 266 HEALTHCARE SUPPLY CHAIN MANAGEMENT MARKET FOR DISTRIBUTORS,BY REGION, 2018–2025 (USD MILLION)

TABLE 267 HEALTHCARE SUPPLY CHAIN MANAGEMENT MARKET FOR PROVIDERS, BY REGION, 2018–2025 (USD MILLION)

15.3 SUPPLY CHAIN ANALYTICS MARKET

15.3.1 MARKET DEFINITION

TABLE 268 SERVICES: SUPPLY CHAIN ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 269 SERVICES: SUPPLY CHAIN ANALYTICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 270 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 271 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 272 MANAGED SERVICES MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 273 MANAGED SERVICES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 274 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 275 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

15.4 CLOUD SUPPLY CHAIN MANAGEMENT MARKET

15.4.1 MARKET DEFINITION

TABLE 276 CLOUD SUPPLY CHAIN MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2014–2021 (USD MILLION)

TABLE 277 SMALL AND MEDIUM ENTERPRISES: CLOUD SUPPLY CHAIN MANAGEMENT MARKET SIZE, BY REGION, 2014–2021 (USD MILLION)

TABLE 278 LARGE ENTERPRISES: CLOUD SUPPLY CHAIN MANAGEMENT MARKET SIZE, BY REGION, 2014–2021 (USD MILLION)

16 APPENDIX (Page No. - 253)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

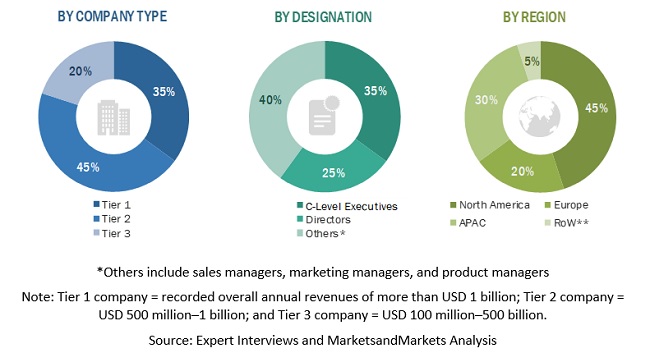

The study involved four major activities to estimate the current size of the blockchain supply chain market. An exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the size of the segments and subsegments of the market.

Secondary Research

The market for companies offering blockchain supply chain offerings was arrived at based on the secondary data available through paid and unpaid sources, by analyzing product portfolios of the major companies in the ecosystem, and rating companies based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; and white papers, journals, and certified publications. Secondary sources were used to identify and collect useful information for this extensive, technical, and commercial study on the global blockchain supply chain market.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, related key executives from blockchain supply chain vendors, blockchain supply chain solution providers, industry associations, independent SCM consultants, and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, revenue collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, deployment, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), and the installation teams of end users using blockchain supply chain solutions, were interviewed to understand the buyer’s perspective on the suppliers, and solution and service providers, and their current use of solutions.

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the blockchain supply chain market. These methods were also used extensively to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the blockchain supply chain market by offering (platform and services), type, provider, application, organization size, end user, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to five main regions: North America, Europe, Middle East and Africa (MEA), Asia Pacific (APAC), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as mergers and acquisitions, product developments, and Research and Development (R&D) activities, in the market

- To analyze the impact of the COVID-19 outbreak on the growth of the market

COVID 19 IMPACT

The lockdowns imposed as a result of the COVID-19 outbreak has shut down economies and is impacting every aspect of the supply chain in North America. This has also caused various industries to move their normal manufacturing processes to manufacture essential medical supplies, PPE kits, etc. According to a survey by the Supply Chain Media among 143 supply chain decision-makers in Europe, the COVID-19 pandemic is having a clear impact on the supply chains of virtually all European manufacturers, wholesalers, and retailers. Although 78% of them are experiencing a negative short-term impact, 17% are noticing positive effects, and only 5% say they are not affected in any way. COVID-19 finally forced many companies and entire industries to rethink and transform their global supply chain model. For example, according to a report by the Economist Intelligence Unit (EIU), over-reliance on Asian, and especially Chinese suppliers and clients was already a major concern for MEA before the COVID-19 disruption in 2020, and after the outbreak, MEA businesses are planning to diversify supply chains as well as refocus on local production where possible. The COVID-19 pandemic has resulted in an increased demand for eCommerce. To successfully operate in pandemic technologies, such as AI and Machine Learning (ML), are beginning to drive innovation strategies of the business which has further fueled the increase in the adoption of blockchain supply chain solutions across SMEs. Blockchain is being used for proper distribution of COVID-19 vaccine to keep a proper track of maintenance as well as storage of vaccine for distribution.

Blockchain Supply Chain Market Dynamics

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of APAC into countries in blockchain supply chain market size

- Further breakup of Latin America into countries in market size

- Further breakup of MEA into countries in market size

- Further breakup of Europe into countries in market size

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Blockchain Supply Chain Market