Transportation Management System Market

Transportation Management System Market by Solutions (Planning & Execution, Order Management, Analytics & Reporting, Routing & Tracking), Transportation Mode (Roadways, Railways, Airways, Maritime), and End User - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

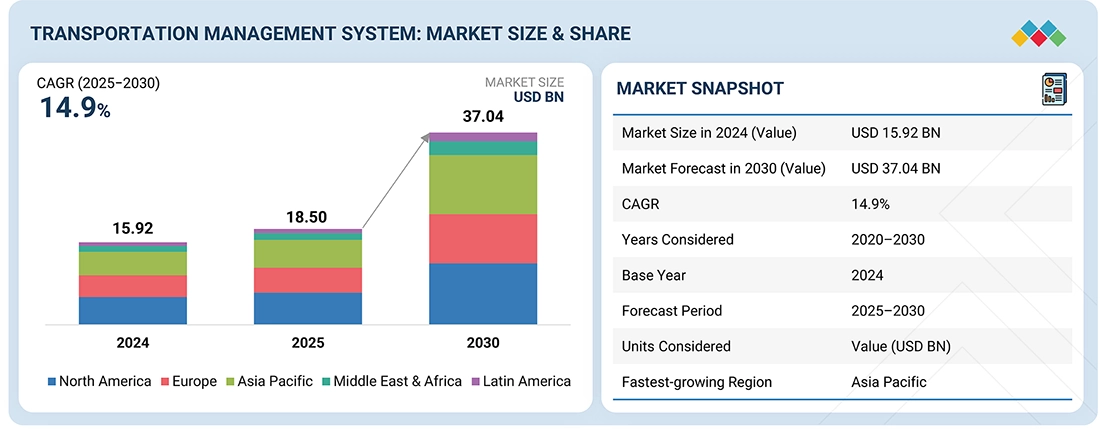

The transportation management system market is forecasted to reach USD 37.04 billion by 2030, up from USD 18.50 billion in 2025, with a CAGR of 14.9% from 2025 to 2030. The TMS market is fueled by changing consumer expectations, global trade growth, and the increasing need for operational efficiency. The rise in e-commerce has driven demand for faster, more reliable deliveries, making route optimization, fleet utilization, and last-mile efficiency essential. Global supply chains add complexity, requiring TMS solutions to streamline cross-border logistics, ensure compliance, and improve risk management. Simultaneously, companies face growing pressure to cut costs and achieve sustainability goals, with TMS helping to reduce mileage, fuel consumption, and emissions. The incorporation of advanced technologies such as AI, IoT, and predictive analytics further enhances TMS by increasing visibility, automating decision-making, and providing data-driven insights. Overall, these factors make TMS a strategic essential for businesses looking to stay competitive in an increasingly fast-paced and interconnected logistics environment.

KEY TAKEAWAYS

- The North America transportation management system market dominated, with a share of 33.7% in 2024.

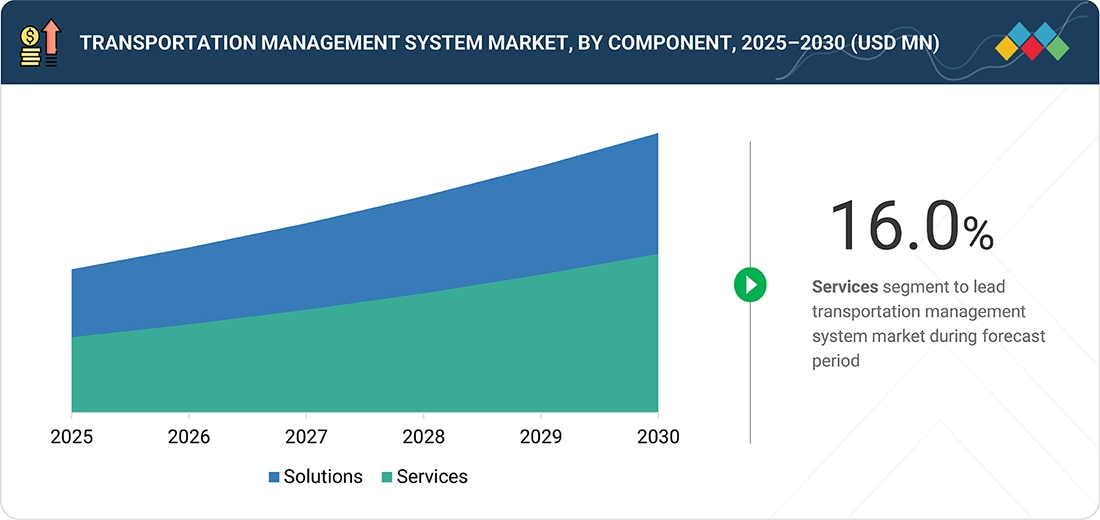

- By component, the services segment is expected to register the highest CAGR of 16.0%.

- By transportation mode, the Roadways segment is expected to dominate the market.

- Oracle, SAP, and C.H. Robinson were identified as Star players in the transportation management system market because they deliver enterprise-grade, end-to-end transportation planning, execution and visibility, deep logistics and ERP integration, advanced optimization and analytics, global carrier networks, and proven scalability for complex, high-volume shippers and 3PLs.

- VTradEx, Shipwell, and Tesisquare have have distinguished themselves among startups and SMEs by offering cloud-native, modular TMS with real-time shipment visibility, API-first integrations, AI-driven routing/optimization, freight marketplace/connectivity, and collaborative supply-chain orchestration that accelerates digitalization for shippers and carriers.

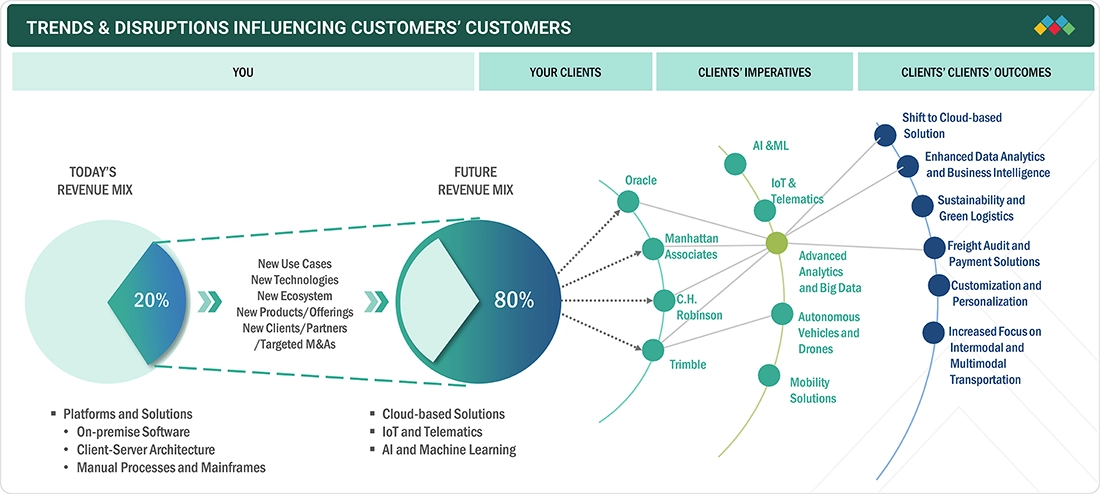

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The transportation management system market is undergoing significant transformation, driven by emerging trends and disruptions that directly influence the business outcomes of customers’ customers. For 3PLs, the drive for cost-efficient operations, real-time visibility, and value-added logistics services directly influences their ability to deliver on-time, scalable, and cost-effective solutions. This pushes them to adopt advanced transportation management systems (TMS) that provide better optimization and transparency. For shippers, imperatives such as efficient multimodal transport, end-to-end visibility, and regulatory compliance align with their customers’ demands for timely product availability, transparent fulfillment, and lower logistics costs. These pressures make TMS adoption critical for streamlining supply chains and ensuring both compliance and sustainability. For freight forwarders, challenges around cross-border trade, multimodal coordination, and shipment tracking translate into their clients’ expectations of smooth customs clearance, cargo safety, and affordable global transport. This compels them to invest in TMS solutions that handle complex documentation, ensure compliance, and offer end-to-end visibility. Collectively, these imperatives show that buying decisions in the TMS market are driven not only by operational efficiency needs but also by the cascading demands of clients’ clients for reliability, transparency, cost control, and sustainability.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Modernization of transport infrastructure leading to adoption of integrated multimodal logistics

-

Supply chain diversification to fuel market expansion

Level

-

Data migration challenges undermine TMS adoption and market growth

-

Synchronizing TMS with warehouse operations in real time

Level

-

Smart city and urban logistics integration

-

Advanced reverse-logistics orchestration

Level

-

Trade tensions and tariff volatility suppress market momentum

-

Bridging EDI and API workflows for seamless TMS integration

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Modernization of transport infrastructure leading to adoption of integrated multimodal logistics

Upgraded transport infrastructure is transforming logistics corridors worldwide, accelerating the adoption of transportation management systems (TMS). At major ports, advanced digital gate control systems are streamlining check-ins, reducing vessel turnaround times by up to 30%, and increasing utilization rates. Inland container depots now use automated stacking cranes and RFID technology, integrated with TMS platforms, to provide real-time container status updates, improve load sequencing, and reduce congestion. Modern rail corridors feature enhanced axle-load capacities, allowing up to 25% more cargo per trip, while advanced highway networks support longer, heavier trucks for efficient freight movement. These infrastructure upgrades generate large streams of operational data like gate-in/gate-out times, axle weights, and real-time vehicle availability. Smart TMS solutions process this data to coordinate multimodal transfers seamlessly. By leveraging digital logistics and automated workflows, TMS enables users to optimize intermodal dispatch, automate customs processes, and improve asset utilization—ultimately lowering logistics costs and reducing dwell times. As both public and private sectors invest in future-ready logistics networks, TMS solutions that utilize real-time data become essential drivers for efficient, resilient, and scalable global supply chains. The Transportation Management System market is set for strong growth, fueled by digital innovation and infrastructure upgrades.

Restraint: Fragmented Industry Standards & Protocols

The transportation management system (TMS) market faces challenges due to fragmented standards across freight documentation, telematics, and regulatory filings, which undermine the economies of scale that make TMS adoption attractive. Carriers often use proprietary EDI message variants, while regions such as Europe prefer XML declarations and emerging markets prioritize API-first JSON schemas. This lack of uniform protocols compels TMS vendors to continuously invest in adapter development, including rewriting parsers, updating certification processes, and validating new partner requirements each time there is a change. Support engineers dedicate significant hours to troubleshooting integration mismatches, such as reconciling carrier SCAC code lists with customs HS code standards, which inflates vendor operating costs. These expenses are frequently transferred to customers through higher subscription or customization fees, posing a particular challenge for shippers and 3PLs with thin margins. For smaller regional fleets, the complexity of managing multiple interface standards can reduce the return on investment from automation and delay network effects. Ultimately, protocol fragmentation slows TMS adoption and restricts market growth by increasing costs and limiting scalability for logistics providers of all sizes.

Opportunity: Push for Sustainability and Green Logistics

As global regulatory requirements tighten, the adoption of advanced transportation management systems (TMS) is becoming crucial for shippers and logistics providers. Since January 2024, the European Union’s Emissions Trading System has required verified carbon emissions reporting for all cargo and passenger vessels over 5,000 gross tons visiting EU ports. This development forces shippers to gather, monitor, and annually report their emissions, with regulatory coverage expected to increase from 40% in 2024 to full compliance by 2026. These environmental mandates are boosting demand for strong carbon accounting and reporting features within TMS solutions. Leading TMS vendors are now adding standardized emissions-tracking modules aligned with globally recognized frameworks like the GLEC Framework and ISO 14083 to support regulatory compliance and emissions transparency. These improvements help companies reach Scope 3 emissions goals and show their commitment to sustainable logistics practices. However, the growing complexity of regulations increases the need for automated data integration from carriers, reliable validation methods, and accurate multimodal data across road, rail, sea, and air transport. As the transportation industry moves toward cleaner operations, TMS platforms built for environmental compliance are set to become the core of sustainable, resilient, and future-ready supply chains.

Challenge: Trade tensions and tariff volatility suppress market momentum

Ongoing retaliatory tariffs among leading global economies like the US, China, and the European Union continue to disrupt cross-border freight flows, directly affecting revenue streams that fund transportation management system investments. As tariffs increase and duties fluctuate, shippers are forced to reroute shipments through less optimal paths or cut back on international order volumes, leading to demand fragmentation that complicates TMS planning and forecasting. Recent reports from the World Trade Organization reveal that global trade growth slowed to below 1% in 2023, marking the weakest performance since the 2008–09 crisis. Major shipping hubs such as Los Angeles and Shanghai have seen significant declines in container activity. This slowdown lessens the urgency to adopt advanced TMS modules like dynamic routing, multimodal optimization, and real-time visibility, which are typically high-growth segments of the TMS market. Additionally, uncertainty about future trade policies causes organizations to delay software investments, extend payback periods, and focus more on tactical cost-cutting measures. Consequently, reciprocal tariffs and trade slowdowns challenge both volume-driven and innovation-driven growth factors in the global TMS market. To adapt to these changing conditions, TMS providers need to offer flexible, resilient solutions that help logistics companies navigate ongoing volatility in worldwide supply chains.

Transportation Management System Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

A global technology provider unified various supply chain systems with Oracle Cloud SCM to address pandemic-driven demand increases while preparing for future growth. They integrated supply chain planning, inventory management, and transportation to improve visibility across departments and boost collaboration through better forecasting features. | Achieved nearly 100% improvement in forecast accuracy, automated 90% of orders saving 20,000 annual hours, saved USD 2 million in freight costs on single order through system integration, reduced IT maintenance costs, improved employee work-life balance scores, and gained scenario planning capabilities for better demand management and supply chain resilience |

|

Major US food retailer with over 460 stores unified three separate transportation systems into Manhattan TMS to address fragmented routing, inconsistent delivery times, and operational inefficiencies. Implemented a single platform to optimize inbound and outbound orders, maximize cube utilization, reduce empty miles, and enhance service levels across four-state regional operations. | Reduced empty miles by 8% and total miles by 7.7%, improved cube utilization by 7%, filled available capacity with backhauls reducing inbound costs, achieved 25% reduction in idle time with significant fuel cost savings, decreased deadhead miles by 8%, and consolidated five systems into one platform improving operational efficiency |

|

A rapidly growing power equipment manufacturer integrated C.H. Robinson's Navisphere TMS with SAP ERP to standardize global operations across acquisitions, manage a complex supply chain serving thousands of customers, and optimize multi-modal transportation, including ocean, air, customs brokerage, and trucking services, to support unprecedented business growth. | Reduced containerized freight from LA Long Beach to Wisconsin by 33%, saved multimillions on global freight spend, achieved real-time shipment visibility across multiple languages and regions, automated vendor communications reducing team workload, gained flexibility for expedited shipments, and standardized operations across business lines and geographies enabling scalable growth management |

|

A global consumer packaged goods leader with 17 years of partnership leveraged Blue Yonder TMS for transportation optimization across a large North American CPG network, focusing on reducing costs and improving operations. Implemented transportation management and visibility solutions to optimize a complex global transportation network while managing market condition shifts and carrier rate negotiations in real-time. | Achieved USD 14 million annual savings in transportation costs, optimized carrier selection based on specific parameters and changing market conditions, gained real-time rate negotiation capabilities, improved transportation network visibility and collaboration, enhanced decision-making through constraint-based planning, and strengthened competitive advantage in global consumer packaged goods market through supply chain excellence |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The current market ecosystem for the transportation management system (TMS) market is highly dynamic and segmented into specialized roles that reflect the complexity of modern logistics. The ecosystem includes platform providers who form the foundation by offering enterprise-level software powering end-to-end logistics operations. System integrators enable seamless connectivity between TMS platforms and broader enterprise systems, supporting implementation, customization, and strategic data integration. Multi-enterprise collaboration platforms focus on enhancing supply chain transparency and connecting multiple stakeholders. Solution and service providers offer logistics execution, consulting, and specialized modules for shippers and carriers. The ecosystem is also shaped by regulatory bodies and standards organizations that establish guidelines for data security, compliance, and interoperability to ensure safe, transparent, and efficient operations across the global TMS landscape.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Transportation Management System Market, By Offering

The solutions segment is experiencing rapid growth, driven by increasing digital transformation and changing logistics needs. Modern TMS offerings feature advanced functions, including real-time shipment tracking, AI-powered route optimization, and easy integration with ERP and WMS platforms. Major innovations such as cloud-native frameworks, mobile access, and predictive analytics are giving businesses valuable insights and better supply chain visibility. The combination of IoT sensors, sophisticated data analytics, and automation tools is supporting smarter decision-making, higher operational efficiency, and lower transportation costs. Growing e-commerce activity, rising customer expectations for speed and transparency, and a stronger focus on sustainability are also boosting demand for modern TMS solutions. As companies aim to improve delivery reliability and gain strategic advantages, these innovative solutions are changing logistics operations and speeding up adoption across the transportation and supply chain industry.

Transportation Management System Market, By Transportation Mode

Global commercial road transportation has experienced substantial growth, placing significant strain on existing transport infrastructure and creating an urgent demand for advanced transportation management systems (TMS) that enable precise monitoring and efficient management of vehicle movement to ensure smooth and timely carrier flows. The widespread adoption of TMS highlights its critical role in reducing congestion and enhancing carrier efficiency through sophisticated real-time tracking, route optimization, and streamlined load management solutions. Moreover, the integration of artificial intelligence, telematics, and IoT-based technologies within TMS platforms is revolutionizing fleet operations by providing logistics providers and shippers with granular visibility, predictive analytics, and automated decision-support, all essential for improving road transport reliability and cost efficiency. The growing use of electric and connected vehicles further accelerates the digitalization of road-based logistics, enabling data-driven performance enhancements and supporting sustainability initiatives. Additionally, the rise of autonomous and connected vehicle technologies fuels increased demand for TMS solutions tailored to the unique challenges of road transport. As of 2025, road transportation commands approximately 45% to 50% of the TMS market share, driven by rapid e-commerce expansion, evolving consumer expectations for faster deliveries, and government investments in smart transport infrastructure. Collectively, these factors position road transportation as the leading segment within the TMS market, facilitating operational efficiency and management of growing global traffic volumes.

Transportation Management System Market, By End User

The third-party logistics (3PL) provider segment is expected to be the largest contributor to the TMS market because of its vital role in simplifying and optimizing complex supply chains for many different clients. Acting as supply chain coordinators, 3PLs use TMS platforms to handle high transaction volumes and manage multi-modal shipments across global networks. Their operations need advanced features like real-time freight tracking, dynamic routing, automated carrier selection, and seamless integration with shippers’ ERP and warehouse systems. Industry leaders such as C.H. Robinson have demonstrated the transformative power of TMS through technology-enabled managed transportation services, offering shippers flexible, scalable, and data-driven logistics solutions. Likewise, WWEX Group and Uber Freight utilize TMS-powered digital brokerage platforms to improve shipment transparency, boost carrier engagement, and provide better customer experiences. The strategic role of 3PLs in managing end-to-end logistics, along with their adoption of advanced TMS solutions, positions them as the largest and most influential end-user group in today’s TMS market.

REGION

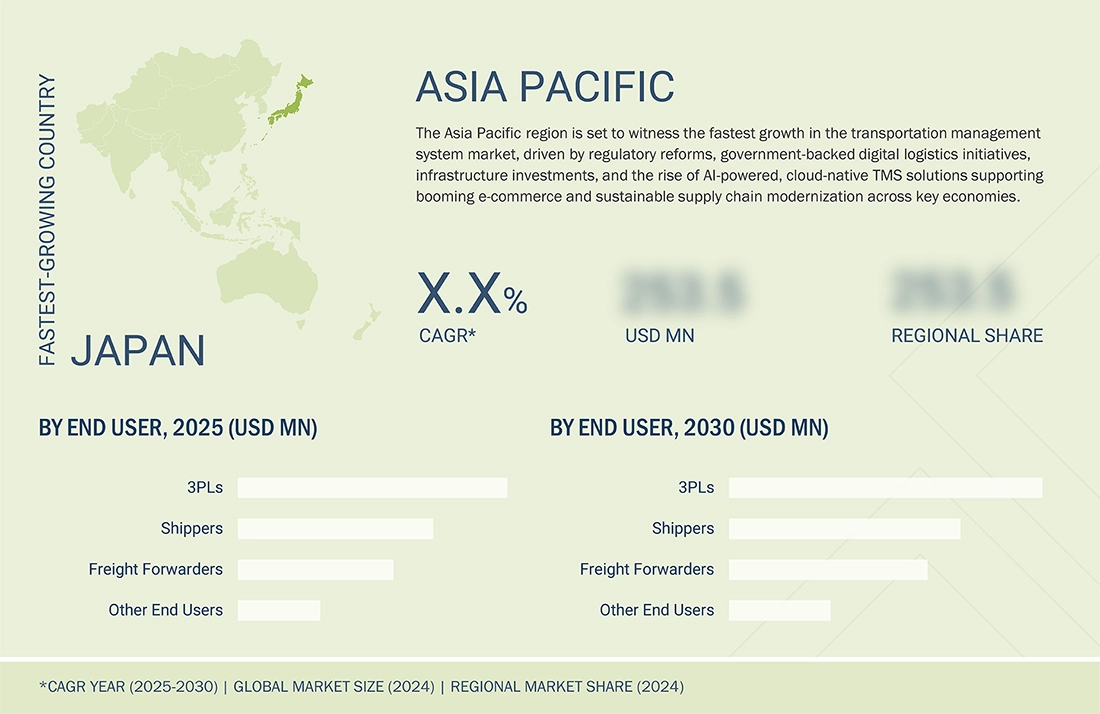

Asia Pacific to be fastest-growing region in global parking management market during forecast period

The Asia Pacific region is rapidly solidifying its position as the global growth leader in the transportation management system (TMS) market, driven by a perfect convergence of regulatory advancements, ambitious government initiatives, and local innovation in digital logistics solutions. Major economies such as China, India, Japan, and Australia are prioritizing logistics modernization through progressive data transparency laws, environmental mandates, and smart supply chain incentives. Regulatory breakthroughs like Singapore’s advanced environmental regulations and Vietnam’s digital energy management reforms are directly supporting logistics providers in optimizing fleet operations and reducing emissions. Across the region, governments are actively investing in digital transport corridors, next-generation road and rail infrastructure, and technology subsidies to fast-track TMS adoption. The business landscape is further energized by a surge in domestic M&A activity, with local TMS vendors in India and Japan launching AI-powered, cloud-native platforms tailored for the region’s booming e-commerce and urban logistics needs. These developments, underscored by robust partnerships between regional technology firms and logistics operators, are not only accelerating digital transformation but also positioning Asia Pacific as the fastest-expanding TMS market globally, driven by an environment conducive to innovation, connectivity, and supply chain sustainability.

Transportation Management System Market: COMPANY EVALUATION MATRIX

In the transportation management system market matrix, Oracle (Star) leads with a strong market presence and a broad product portfolio, offering solutions and services across roadways, railways, airways, and maritime transportation modes. Körber AG (Emerging Leader) is gaining traction in the Transportation Management System sector by providing innovative, scalable TMS solutions. Its platforms deliver real-time visibility, advanced analytics, and seamless ERP/WMS integration, enabling smarter logistics, improved efficiency, and optimized supply chains.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 15.92 Billion |

| Market Forecast in 2030 (Value) | USD 37.04 Billion |

| Growth Rate | CAGR of 14.9% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million/Billion |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa, and Latin America |

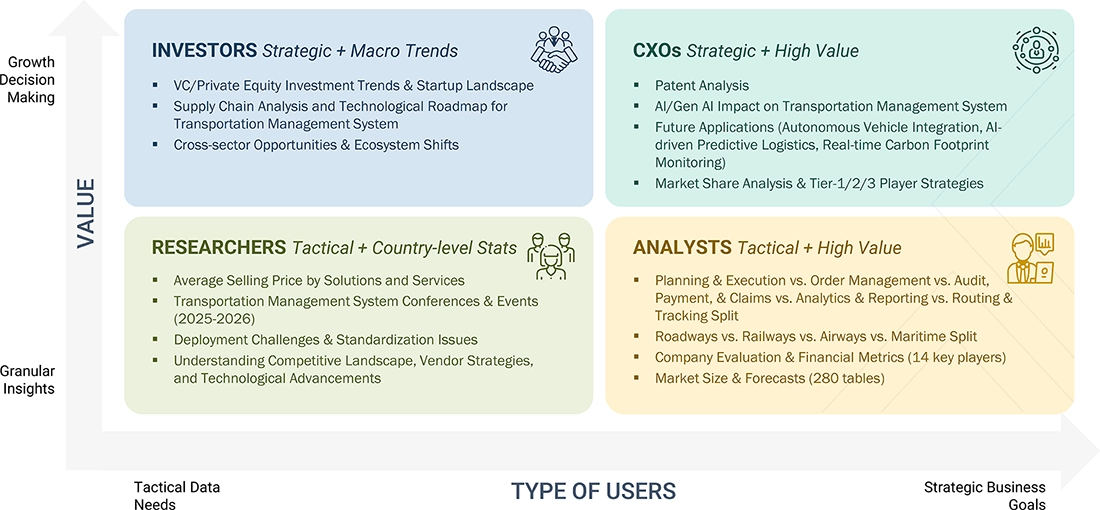

WHAT IS IN IT FOR YOU: Transportation Management System Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading North American TMS Vendor |

• Further breakdown of the North American Transportation Management System market • Further breakdown of the European Transportation Management System market |

• Identified key growth drivers and adoption trends unique to each geography • Distinguished end-user priorities across Industries. |

| TMS Vendor based in Asia Pacific |

• Customized analysis of e-commerce, 3PL, and retail verticals across Asia Pacific markets • Dedicated study on TMS adoption trends in Asia Pacific’s growing e-commerce ecosystem |

• Aligned insights with the client’s core customer segments and operations • Identified high-potential e-commerce and 3PL opportunities in Asia Pacific • Enhanced strategic planning with region-specific adoption and competitive intelligence |

RECENT DEVELOPMENTS

- April 2025 : C.H. Robinson introduced C.H.. Robinson Financial, a new digital payment platform developed in partnership with Triumph Financial. This program offers carriers immediate cash flow and near-instant invoice payments through Triumph’s LoadPay digital account and factoring, integrated with C.H. Robinson’s TMS. The initiative tackles industry-wide payment delays, improves carrier liquidity, and streamlines back-office operations, setting a new standard for speed and efficiency in freight payment solutions.

- May 2025 : WiseTech Global entered into a binding agreement to acquire US-based E2open for an enterprise value of USD 2.1 billion. The acquisition strengthens WiseTech’s vision to become the operating system for global trade and logistics by integrating E2open’s vast multi-enterprise supply chain network and cloud-based platform into the CargoWise ecosystem. This move will expand WiseTech’s product suite, addressable market, and deepen its presence in North America, facilitating the creation of a global, connected logistics marketplace.

- March 2025 : Descartes Systems Group announced the acquisition of 3GTMS for approximately USD 115 million. The deal expands Descartes’ cloud-based TMS offerings in North America, specifically in optimizing domestic over-the-road shipments. Integrating 3GTMS adds advanced planning, rating, and routing tools to Descartes’ existing platform, enhancing value for shippers, brokers, and 3PLs managing complex supply chain operations.

- April 2025 : Descartes expanded its TMS ecosystem through a strategic partnership with Parade, embedding “CoDriver AI” capabilities into freight brokerage operations. This collaboration empowers brokers with AI-driven carrier engagement, predictive analytics, and operational efficiencies, further differentiating Descartes’ TMS offerings amid rising market expectations for intelligent automation and real-time decision support.

- September 2024 : Körber AG acquired MercuryGate, enhancing its multimodal TMS capabilities and expanding its end-to-end supply chain execution suite. This strategic move improves operational efficiency, visibility, and issue resolution, positioning Körber as a leading global TMS provider and underlining its commitment to digital transformation and customer-focused innovation.

Table of Contents

Methodology

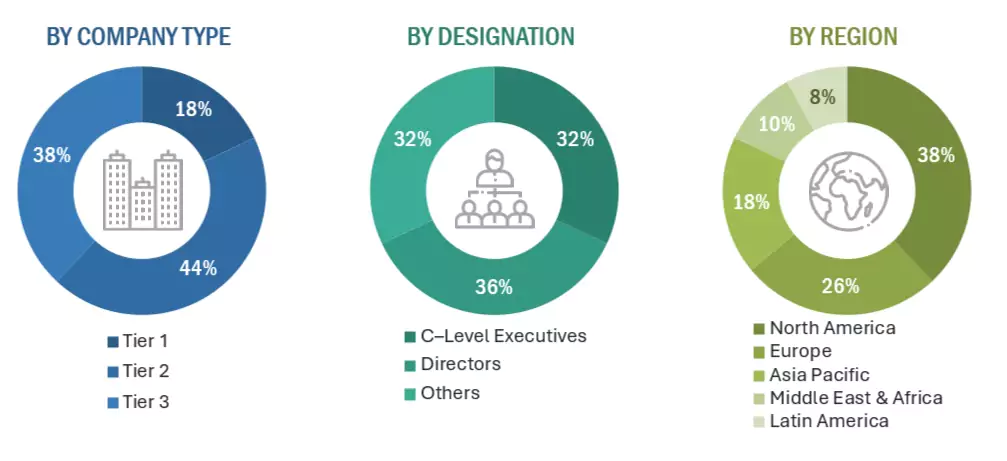

The research study involved four major activities in estimating the transportation management system market size. Exhaustive secondary research was done to collect important information about the market and peer markets. The next step was to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. The top-down and bottom-up approaches were used to estimate the market size. The market breakdown and data triangulation were adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

The market size of the companies offering transportation management system solutions to various end users was determined based on the secondary data available through paid and unpaid sources, and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to identify and collect information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources.

Secondary research was mainly used to obtain critical information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the transportation management system market.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from software and services, market breakups, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use transportation management system, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their current usage of transportation management system hardware, solutions and services, which is expected to affect the overall transportation management system market growth.

NNote 1: Tier 1 companies have revenues of more than USD 10 billion; tier 2 companies’ revenue ranges from USD

1 billion to USD 10 billion; and tier 3 companies’ revenue ranges from USD 500 million to USD 1 billion

Source: Secondary Literature, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches were used along with multiple data triangulation methods to estimate and validate the size of the transportation management system market, as well as other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- MarketsandMarkets focuses on top-line investments and spending in the ecosystems. Significant developments in the critical market area were considered.

- The recent and upcoming developments in the transportation management system market that include investments, R&D activities, product launches, collaborations, mergers & acquisitions, and partnerships were tracked and the market size was projected based on these developments and other critical parameters.

- Multiple discussions were conducted with key opinion leaders to learn about the diverse types of authentications and brand protection offerings used and the applications for which they are used to analyze the breakdown of the scope of work carried out by major companies.

- The market was segmented based on technology types concerning applications, the types of which are to be used and deriving the size of the global application market.

- The overall market was segmented into various market segments.

- The estimates were validated at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets.

Transportation Management System Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the transportation management system market was split into several segments and sub-segments. Data triangulation and market breakdown procedures were used, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The data was triangulated by studying various factors and trends from the demand and supply sides.

The transportation management system market size was validated using top-down and bottom-up approaches.

Market Definition

Transportation management systems (TMS) are crucial tools for businesses to choose the most cost-efficient and effective carrier and mode of shipment. A strong TMS can optimize multi-leg carrier routes and provide visibility into every stage of the supply chain. It also offers global trade management functionality, including information on trade and tariffs, and potential delays due to customs and other regulations.

Stakeholders

- TMS vendors

- Technology partners

- Consulting firms

- Resellers and distributors of TMS

- Enterprise users

- Technology providers

- System integrators

- Support service providers

- Consulting service providers

- Logistics service providers

- Government and standardization bodies

Report Objectives

- To determine and forecast the global transportation management system market by offering, solutions, and services, transportation mode, end user, vertical, and region from 2025 to 2030, and analyze the various macroeconomic and microeconomic factors affecting market growth.

- To forecast the size of the market segments concerning five central regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the transportation management system market

- To analyze each submarket concerning individual growth trends, prospects, and contributions to the overall transportation management system market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the transportation management system market

- To profile the key market players, provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and illustrate the market’s competitive landscape

- To track and analyze competitive developments in the market, such as mergers and acquisitions, product development, partnerships and collaborations, and research and development (R&D) activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

- Further break-up of the North American market into countries contributing 75% to the regional market size

- Further break-up of the Latin American market into countries contributing 75% to the regional market size

- Further break-up of the Middle East African market into countries contributing 75% to the regional market size

- Further break-up of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

What is transportation management system?

Transportation management system (TMS) is a software solution that facilitates the efficient planning, execution, and optimization of transportation logistics. It encompasses various functionalities such as route planning, shipment tracking, carrier selection, freight audit, and payment. TMS aims to streamline transportation operations, improve resource utilization, enhance visibility across the supply chain, and reduce costs. By leveraging real-time data and analytics, TMS enables businesses to make informed decisions, optimize delivery routes, and ensure timely and accurate deliveries.

What will be the projected market size of the transportation management system market?

The transportation management system market size is projected to grow from USD 18.50 billion in 2025 to USD 37.04 billion by 2030 at a CAGR of 14.9% during the forecast period.

What are the major drivers in the transportation management system market?

The major drivers in the TMS market are the increasing complexity of supply chains and logistics networks, which necessitate efficient management solutions. The rise of e-commerce is also a significant driver, requiring streamlined transportation operations to meet growing consumer demands.

Who are the key players operating in the transportation management system market?

The key vendors operating in the transportation management system market include Oracle (US), SAP (Germany), Manhattan Associates (US), C.H. Robinson (US), Trimble (US), Wisetech Global (Australia), Descartes (Canada), Generix Group (France), Körber AG (Germany), Blue Yonder (US), Uber Freight (US), Alpega Group (Belgium), WWEX Group (US), and Infor (US).

What are the opportunities for new market entrants in the transportation management system market?

New market entrants in the transportation management system market have several opportunities to capitalize on. They can differentiate themselves by offering innovative solutions that leverage emerging technologies such as artificial intelligence, machine learning, and blockchain to address evolving industry needs. Additionally, there is a growing demand for TMS solutions tailored to specific industry verticals or niche markets, presenting opportunities for specialization and customization. Furthermore, as businesses increasingly prioritize sustainability and green logistics, there is a need for TMS solutions that support environmentally friendly transportation practices, creating opportunities for new entrants to differentiate themselves in the market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Transportation Management System Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Transportation Management System Market